Lewis Wickes Hine Child labor at Gorenflo Canning Co., Biloxi, Mississippi 1911

Obama meets with Biden and Yellen. Hadn’t happened since Truman?!

• What in the World’s Going on with Banks this Week? (WS)

Just about every major banker and finance minister in the world is meeting in Washington, D.C., this week, following two rushed, secretive meetings of the Federal Reserve and another instantaneous and rare meeting between the Fed Chair and the president of the United States. These and other emergency bank meetings around the world cause one to wonder what is going down. Let’s start with a bullet list of the week’s big-bank events:

• The Federal Reserve Board of Governors just held an “expedited special meeting” on Monday in closed-door session.

• The White House made an immediate announcement that the president was going to meet with Fed Chair Janet Yellen right after Monday’s special meeting and that Vice President Biden would be joining them.

• The Federal Reserve very shortly posted an announcement of another expedited closed-door meeting for Tuesday for the specific purpose of “bank supervision.”

• A G-20 meeting of finance ministers and central-bank heads starts in Washington, D.C., on Tuesday, too, and continues through Wednesday.

• Then on Thursday the World Bank and the International Monetary Fund meet in Washington.

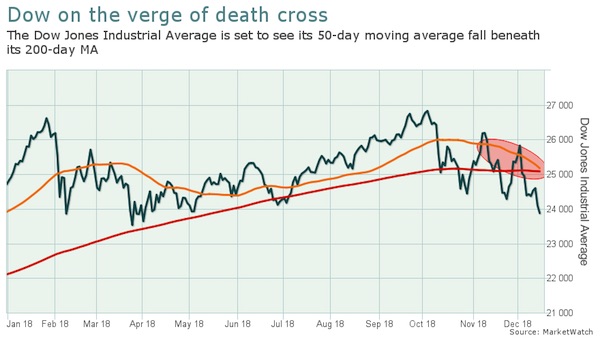

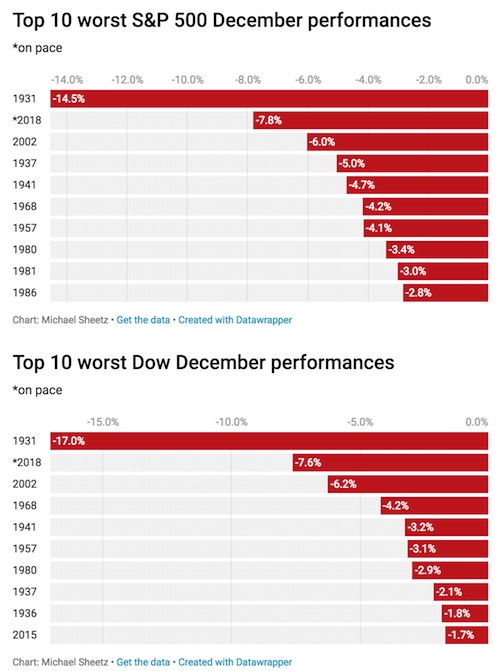

• The Federal Reserve Bank of Atlanta just revised US GDP growth for the first quarter to the precipice of recession at 0.1%.

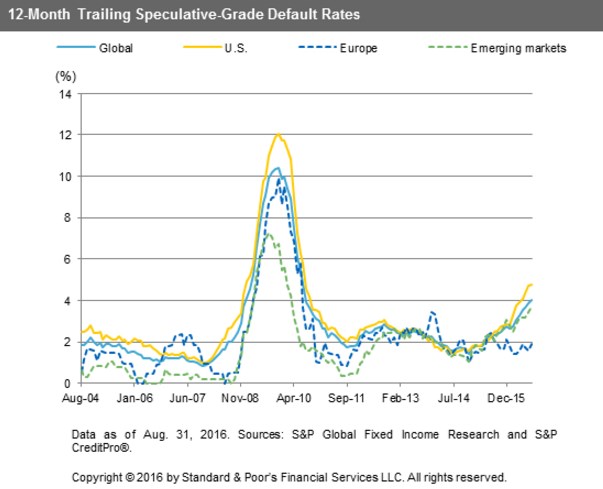

• US banks are expected this coming week to report their worst quarter financially since the start of the Great Recession.

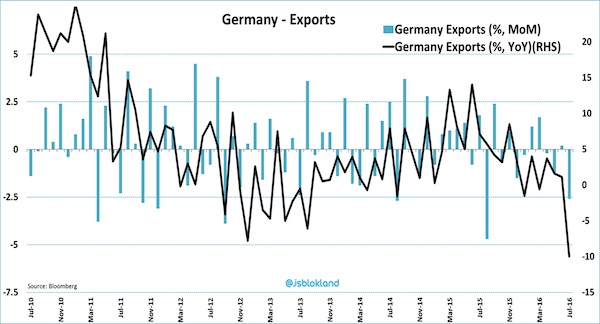

• The press stated that the German government will sue the European Central Bank if it launches a more aggressive and populist form of quantitative easing, often called “helicopter money.”

• The European Union’s new “bail-in” procedures for failing banks were employed for the first time with Austrian bank Heta Asset Resolution AG.

• Italy’s minister of finance called an emergency meeting of Italian bankers to engage “last resort” measures for dealing with €360 billion of bad loans in banks that have only €50 billion in capital.

It is rare for presidents to meet with the chair of the Federal Reserve. The last time President Obama met with Janet Yellen was in November of 2014, a year and a half ago. It is even more rare for the vice president of the United States to join them. In fact, I’ve heard but haven’t verified that it has never happened in a suddenly called meeting with the Fed before. For security reasons, the president and vice president don’t regularly attend the same events. There are, of course, many planning sessions or emergency meetings where they do get together, but not with the head of the Federal Reserve. Emergency meetings where the VP is included in the planning session would include situations related to dire national security in case the VP winds up having to take over.

In fact the meeting with the prez and vice prez is so rare that the White House is bending over backwards to assure the entire nation that the president is not meeting with Yellen to try to influence the Fed, which is required to act independently of politics (so they say). According to the White House, President Obama is meeting with the Fed chair and Biden to discuss the nation’s “longer-term economic outlook,” even though Yellen just told the entire nation that the economy was strong and had arrived nearly back at “full health.” The president says they will be “comparing notes.” Do their notes about the nation’s outlook disagree?

Read more …

Clinton and Cameron: monsters under the bed.

• The “Independent” Fed Is About to Become Partisan (JR)

Late last night it was revealed that President Obama has summoned Janet Yellen to the White House today. There’s nothing unusual in itself about the president meeting with the Chair of the Federal Reserve over lunch to discuss policy. Bush 43, for example, frequently met with Alan Greenspan to discuss the economy. But this meeting is different… This isn’t a casual lunch. It’s a high-profile, last-minute meeting Obama orchestrated. The last time something like this happened was in 1951, when Harry Truman summoned the entire Federal Reserve Board of Governors to the White House. Since this is something that hasn’t happened in almost 70 years, today’s meeting is a fairly extraordinary event. Why did Obama order the meeting? There are a few factors to consider… Number one, Obama does not want the Fed to raise rates.

If the Fed remains on its path of interest rate hikes this year, it would give the Republicans the strongest chance at the White House in this fall’s election. That’s because rate hikes would likely lead to recession, and that would bode poorly for the Democrats. Obama is deeply concerned about his legacy, which the Republicans would like to reverse. So the best chance the Democrats have in the upcoming presidential election is if rates stay low. Janet Yellen herself is a Democrat, with a background as a labor economist and a career at U.C. Berkeley. She’s not necessarily hostile to Obama’s message. By bringing her to the White House, Obama is sending Yellen a highly visible public message. Don’t raise rates. You can consider this meeting more like an implied threat. There are two openings on the Fed’s Board of Governors. Obama could nominate two of Yellen’s biggest policy opponents if he wanted to play hardball with her.

Those two opponents could fight Yellen at every turn and threaten her control. Or, Obama could no nothing if she confirms and let her maintain control of the board. He’s very cleverly held the vacancies open, which he can use as leverage to influence Yellen’s course of action. He can nominate her worst opponents if she doesn’t follow his wishes. There’s also another factor at play: The Democrats are as afraid of Bernie Sanders as Republicans are of Donald Trump. Sanders has won seven straight primaries and caucuses. One of his biggest weapons is his bashing of the big banks, Wall Street and his criticism of Hillary Clinton for being in their pocket. Sanders has demanded that Hillary release the transcripts of her three speeches to Goldman Sachs, for which she received $675,000. She has refused to release those transcripts. That’s the Achilles heel of the Clinton campaign, and Sanders is making the most of it.

Read more …

No credibility.

• IMF Cuts World Growth Forecast, Warns Over Brexit (AFP)

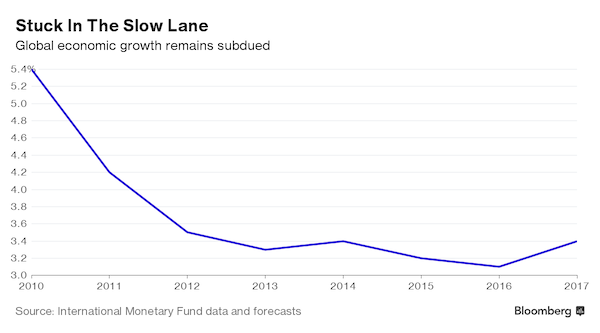

The IMF said Tuesday that the global economy faces wide-ranging threats from weak growth and rising protectionism, warning of possible “severe” damage should Britain quit the EU. The Fund cut its global forecast for the third straight quarter, saying economic activity has been “too slow for too long,” and stressed the need for immediate action by the world’s economic powers to shore up growth. It said intensifying financial and political risks around the world, from volatile financial markets to the Syria conflict to global warming, had left the economy “increasingly fragile” and vulnerable to recession. The IMF raised concerns over “fraying” unity in the European Union under pressure from the migration crisis and the “Brexit” possibility.

And it pointed to the contractions in large emerging market economies, most notably Brazil, where the economic downturn has been accompanied by deep political crisis that has President Dilma Rousseff facing impeachment. Seeing a broad fall in trade and investment, the IMF cut its forecast for world growth this year to a sluggish 3.2%, 0.2 percentage points down from its January outlook and down from the 3.8% pace expected last July. That reflects a glummer view of growth in both developed and emerging economies, with the forecasts for Japan and oil-dependent Russia and Nigeria all sharply lowered. Growth expectations for most leading economies were pared back by 0.2 percentage points. The outlook for the United States – hit by the impact of the strong dollar – was trimmed to 2.4% this year, from 2.6% in January.

Only the pictures in China and developing eastern Europe were better. But at a slightly upgraded pace of 6.5% growth, China was still on track for a significant slowdown from last year. The growth downgrade was expected but the tone of the IMF message was more dire than in recent months. It came as an increasing number of countries are approaching the IMF and World Bank for financial support. Last week Angola, its finances devastated by the crash in oil prices, asked the IMF for a three-year bailout program. And the World Bank said requests for loan support had reached levels seen only during financial crises. IMF chief economist Maurice Obstfeld said there was a risk of a full stall in global growth without efforts to boost investment and demand. “The weaker is growth, the greater the chance that the preceding risks, if some materialize, pull the world economy below stalling speed,” he said.

Read more …

It’s too late for helicopter money. It would evaporate before touching the ground.

• Don’t Trust Ben Bernanke On Helicopter Money (Steve Keen)

Ben Bernanke earned the sobriquet “Helicopter Ben” for his observations in a 2002 speech that “the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost”, that the existence of this technology means that “sufficient injections of money will ultimately always reverse a deflation”, and that using this technology to finance a tax cut is “essentially equivalent to Milton Friedman’s famous “helicopter drop” of money.” But just because he’s called “Helicopter Ben” doesn’t mean that he knows how “Helicopter Money” would actually work.

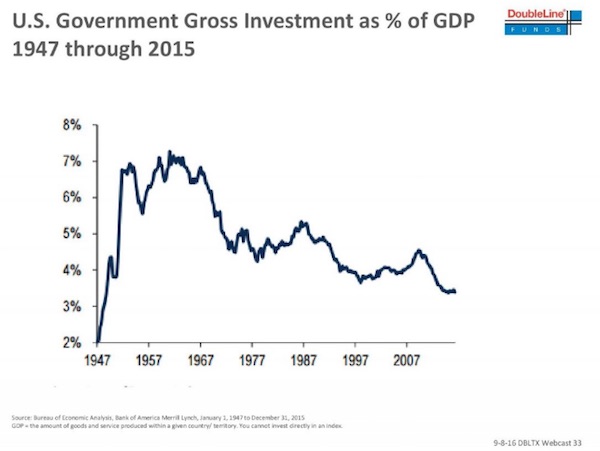

His column “What tools does the Fed have left? Part 3: Helicopter money” discusses both the nuts and bolts of actually implementing a “Helicopter Drop” (or as he more accurately describes it, “an expansionary fiscal policy—an increase in public spending or a tax cut—financed by a permanent increase in the money stock”) and also discusses how such a policy might affect the real economy. While his discussion of the nuts and bolts is realistic, his discussion of how it would work is fantasy. The nuts and bolts are straightforward (and Bernanke has a good practical suggestion for how to implement it too, which I’ll discuss at the end of this post). “Helicopter money” (or as he excitingly renames it, “a Money-Financed Fiscal Program, or MFFP”) is a direct injection of money from the government into people’s bank accounts, which is financed by a loan from the Federal Reserve to the Treasury. This differs from the standard way that Government spending is financed, which is by issuing Treasury Bonds that are then bought by the public.

The standard method doesn’t put additional money into circulation in the economy, because the increase in some private sector bank accounts caused by the government spending—a tax rebate, for example—is completely offset by the fall in other private sector bank accounts as they buy the Treasury Bonds that financed the tax rebate. But with “MFFP”, the tax rebate is financed by new money created by the Federal Reserve “at essentially no cost”. It thus directly increases the money supply, and this is where Friedman’s “Helicopter” analogy comes from. In the private sector economy, the money supply is increased when private banks lend to the public. Money created by private bank lending also goes by the nickname of “inside money”, since it is created by institutions that are “inside” the private sector—private banks.

Government-created money, which is what a tax rebate financed by a direct loan from the Federal Reserve to the Treasury would be, is “outside money”, because it comes from outside the private sector. Friedman’s analogy likened it to a helicopter flying over an economy and dropping new dollar bills from the sky. So how does “Helicopter Money” differ in impact from the standard way of financing government spending? Here’s where Bernanke passes from the practical nuts and bolts to the fantasy world of mainstream economics. According to Ben, the Helicopter flies, so to speak, because it causes “a temporary increase in expected inflation,” and because it “does not increase future tax burdens.”

Read more …

Best friends?!

• Bundesbank’s Weidmann Rebukes Draghi Critics In Berlin (FT)

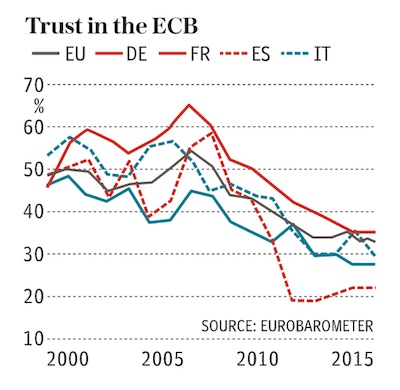

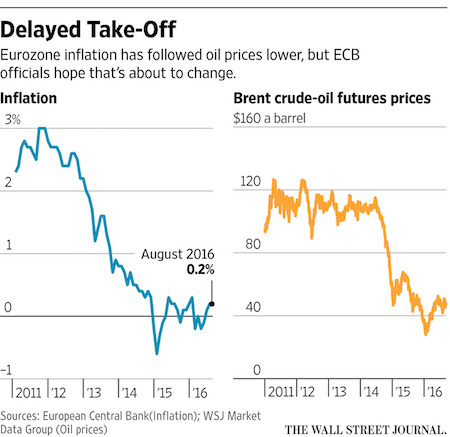

Bundesbank president Jens Weidmann has rebuked German politicians for attempting to pressure European Central Bank chief Mario Draghi over his easy money policies, suggesting their criticism was interfering with the bank’s independence. “It’s not unusual for politicians to have opinions on monetary policy, but we are independent,” Mr Weidmann told the Financial Times last Thursday. “The ECB has to deliver on its price stability mandate and thus an expansionary monetary policy stance is appropriate at this juncture regardless of different views about specific measures.” The head of Germany’s central bank and his counterpart at the ECB have often been at odds over how to respond to the threat of falling prices, with Mr Weidmann frequently raising objections to measures tabled by Mr Draghi.

But they have emerged as unlikely allies at a time when monetary policymakers around the world are facing mounting criticism over record-low interest rates, including the decision by some central banks – among them the ECB – to cut rates below zero and into negative territory to counter the threat of a vicious bout of deflation. The policy has been deeply unpopular in Germany, prompting criticism from senior politicians, led by finance minister Wolfgang Schäuble, that the central bank’s low interest rates are expropriating savings from the German public and fuelling the rise of rightwing populism.

While the ECB targets inflation of just below 2%, the latest reading was minus 0.1%. Mr Weidmann also said the German debate on the ECB is focused too narrowly on the consequences of low interest rates for savers. “The debate does not focus enough on the broader macroeconomic consequences of monetary policy. People are not just savers: they’re also employees, taxpayers, and debtors, as such benefiting from the low level of interest rates,” he explained. The Bundesbank built its reputation on its independence from politics, frequently falling out with German lawmakers in the 1970s and 1980s over the central bank’s use of high interest rates to tackle inflation. But Mr Weidmann faces a more sensitive challenge: defending an EU institution from criticism from within Germany at a time of acute unease fuelled by the refugee crisis.

Read more …

Riddle me this.

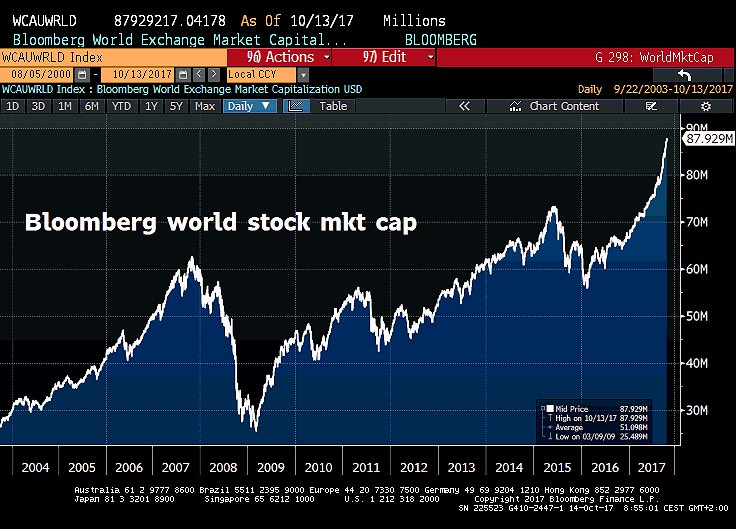

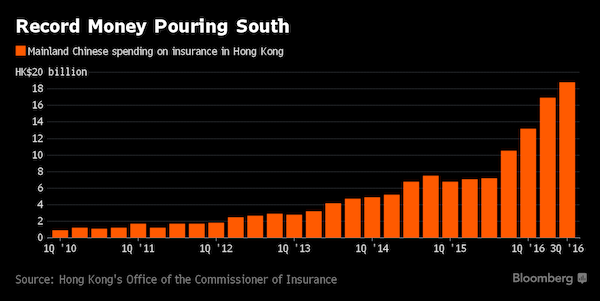

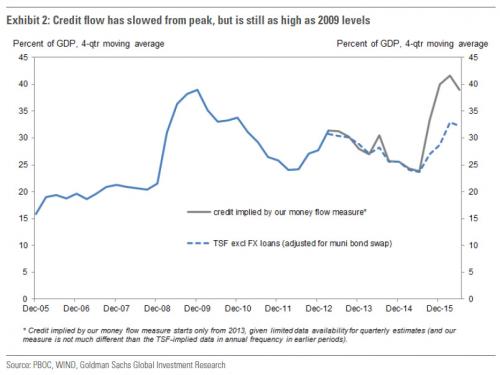

• China Rail Freight Volume Plunges 10.5%, and The Economy Still Grows 6.9%? (WS)

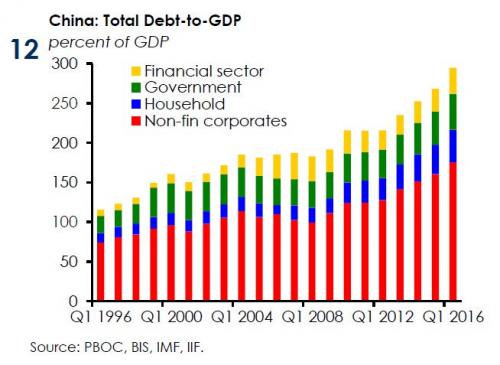

Rail freight volumes are an indicator of China’s goods-producing and goods-consuming economy, not just manufacturing, construction, agriculture, and the like, but also consumer goods. Thus they’re also an indication of consumer spending on goods. Alas, rail freight volume is collapsing: the first quarter this year puts volume for the whole year on track to revisit levels not seen since 2007. While China’s economy was strong, rail freight volumes were soaring. For example, in 2010, when China was pump-priming its economy, rail freight volume jumped 10.8% from a year earlier. In 2011, it rose 6.9%. It had soared 44% from 2005 to 2011! But 2011 was the peak. In 2012, volume in trillion ton-kilometers declined one notch and in 2013 stagnated. But in 2014, volume skidded 5.8%.

And in 2015, volume plunged 10.5% to 3.4 billion tons, according to Caixin, citing figures from the National Railway Administration. It was the largest annual decline ever booked in China. It was a year that the People’s Daily, the official paper of the Communist Party, described in this elegant manner: “Dragged by a housing slowdown, softening domestic demand, and unsteady exports, China’s economy expanded 6.9% year on year in 2015, the weakest reading in around a quarter of a century.” Which is precisely where things stop making sense: rail freight volume plunges 10.5% in 2015, and the economy still increases 6.9%? I mean, come on. At the time, Caixin said that China’s central planners aimed to increase rail freight volumes to 4.2 billion tons by 2020. This would assume an average annual growth rate of 4.3%.

So these declines are not part of the planned transition to a consumption-based economy. They’re totally against that plan or any other plan. They’re very inconvenient for the rosy scenario! Then came the first quarter of 2016. Rail freight volume plunged 9.4% year-over-year to 788 million tons, according to data from China Railway Corporation, cited today by the People’s Daily. At this rate, rail freight volume for 2016 will be down 20% from 2014, which had already been a down year! At this rate, volume in 2016 will end up where it had been in 2007! China — hobbled by soggy domestic demand, perhaps even soggier demand overseas, rampant factory overcapacity, cooling investment, an insurmountable mountain of bad debt, and a million other domestic problems — may be trying to transition from a manufacturing-based economy to an economy based on consumption.

But even consumer goods must be transported, even those purchased online! Only services don’t require much transportation. But we doubt that service sales have jumped in two years to the extent that they would even halfway make up for the crashing demand for goods transported by rail. The World Bank just figured that China’s economy would grow 6.7% in 2016, the IMF pegs it at 6.5%, both kowtowing to the GDP declarations issued by the Chinese government. Whose Kool-Aid have they been drinking? This would make 2016 another year when rail freight plunges by a dismal 10% or so while economic growth soars nearly 7% – which would make China one of the fastest growing economies in the world. So something in this convoluted, government-imposed math doesn’t add up here.

Read more …

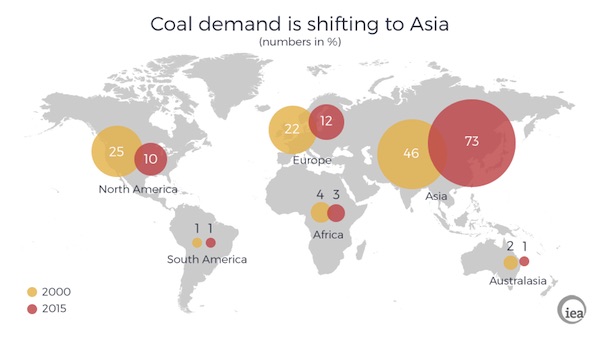

Demand destruction and debt deflation.

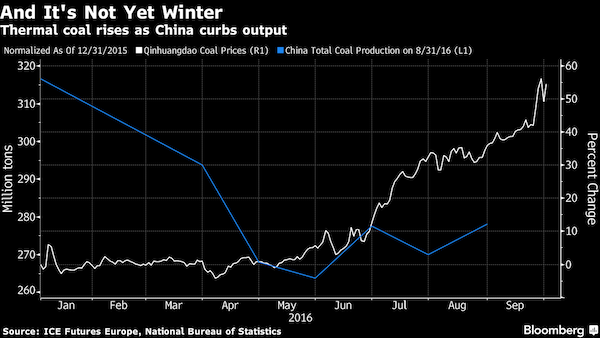

• Peabody, World’s Top Private Coal Miner, Files For Bankruptcy (Reuters)

Peabody Energy, the world’s largest privately owned coal producer, filed for U.S. bankruptcy protection on Wednesday in the wake of a sharp fall in coal prices that left it unable to service a recent debt-fueled expansion into Australia. The company listed both assets and liabilities in the range of $10 billion to $50 billion. Falling global coal demand, stricter environmental controls and a glut of natural gas have pushed big miners, including the second largest U.S. coal producer, Arch Coal, into bankruptcy protection over the past year.

Read more …

It’s cruel game that EU and IMF enjoy far too much.

• IMF Says Greek Debt ‘Highly Unsustainable’, Debt Relief ‘Essential’ (R.)

The IMF wants Greece’s European partners to grant Athens substantial relief on its debt which it sees remaining “highly unsustainable”, according to a draft IMF memorandum seen by Reuters. Earlier on Tuesday, Greece and inspectors from its EU/IMF lenders adjourned talks on a crucial bailout review, mainly due to a rift among the lenders over a projected fiscal gap by 2018 and over Athens’ resistance to unpopular reforms. They will resume the review after this week’s IMF spring meetings in Washington, where the lenders are also expected to discuss Greek reforms and debt., Greek Finance Minister Euclid Tsakalotos and German Finance Minister Wolfgang Schaeuble, who told Reuters on Tuesday that he saw no need for debt restructuring, will also be there.

“Despite generous concessional official financing and further reform plans … debt dynamics are projected to remain highly unsustainable,” the IMF draft said. “To restore debt sustainability, in addition to our reform efforts, decisive action by our European partners to grant further official debt relief will be essential.” EU institutions expect Greece to have a fiscal shorfall equivalent to 3% of economic output in 2018, while the IMF projects a 4.5% shortfall. The EU institutions also believe Athens can reach a primary surplus – the budget balance before debt-servicing costs – of 3.5% of GDP by 2018, as targeted in its latest financial bailout.

But the IMF’s draft Memorandum of Financial and Economic Policies (MFEP), which is compiled during the review, projected a primary deficit of 0.5% this year, a surplus of 0.25% in 2017 and a primary surplus of just 1.5% in 2018. It said these figures reflected reform fatigue after five years of adjustments and social pressures in Greece due to high unemployment, which rose to 24.4% in January. The draft projected an average rate of economic growth of 1.25% for the long term, which is lower than its previous forecast. The targets, which it called “ambitious, yet realistic”, could be underpinned by implementing measures that would save the equivalent of 2.5% of GDP by 2018, including reforms to its pension system, income tax, value-added tax and the public sector wage bill.

Read more …

If Cameron stays on, Brexit is here.

• Pro-EU Leaflets Spark ‘Return To Sender’ Revolt In Britain (AFP)

Britons who want to leave the EU in June’s referendum are sending the government’s pro-Europe leaflets back to Downing Street in a furious protest against a campaign critics have slammed as scaremongering. The “Post It Back” campaign on Facebook and Twitter has attracted support from hundreds of people who do not appreciate the taxpayer-funded, pro-European Union leaflets being delivered to their homes this week. Kirsty Stubbs posted a picture of her leaflet on Facebook defaced with slogans including “What scaremongering rubbish” and “Vote Leave!” before sending it back. Alex Armstrong sent his leaflet back to a freepost address for Prime Minister David Cameron’s Conservatives with an added special package in the hope of lumbering the party with a large bill for postage.

“Just sent back the propaganda leaflet to the freepost address with a suitably heavy attachment – a lump of concrete,” he wrote on Facebook. Others burnt their leaflets or said they would use them as toilet paper, coffee mats or cat litter. Eurosceptic MPs are also angry that Cameron’s government has spent over £9 million on the leaflets, which will eventually go to every home in Britain. They forced a debate on the issue in the House of Commons on Monday. “It is bad enough getting junk mail, but to have Juncker mail sent to us with our own taxes is the final straw,” said Liam Fox, a senior Conservative, punning on the name of European Commission head Jean-Claude Juncker. Another Conservative, Nigel Evans, spoke of his work as an election monitor and compared ministers’ campaign tactics to those in Zimbabwe.

“If in any of the countries I visit I witnessed the sort of spiv (racketeer) Robert Mugabe antics that I have seen carried out by this government, I would condemn the conduct of that election as not fair,” he said. More than 200,000 people have signed a petition on parliament’s website opposing the use of taxpayers’ money to pay for the “biased” leaflet, forcing MPs to schedule another debate on the issue for May 9. The glossy, 16-page leaflet makes a series of claims including that leaving the EU would “create years of uncertainty and potential disruption” and that EU membership “makes it easier to keep criminals and terrorists out of the UK”. The main pro and anti-EU campaigns will each be entitled to send a publicly-funded leaflet to all households or electors, worth up to £15 million each, in the run-up to the June 23 vote. But opponents say that by spending £9 million on this extra leaflet before the formal campaign period begins on Friday, the government is getting an unfair advantage.

Read more …

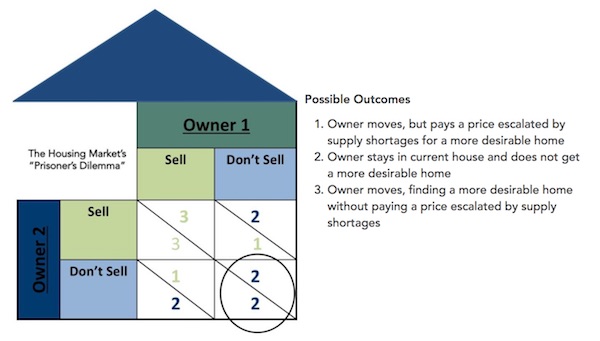

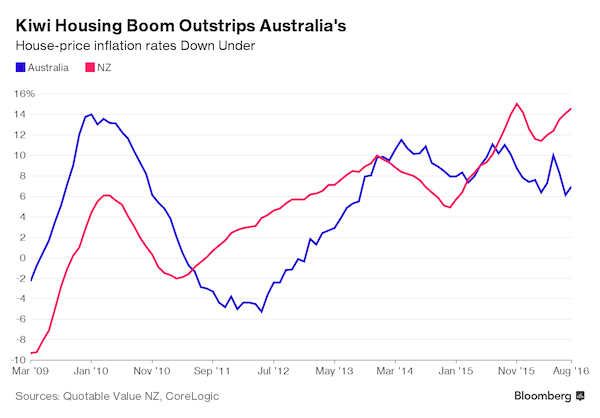

Housing bubbles save governments.

• Why Younger People Can’t Afford A House: Money Became Too Cheap (G.)

House prices have risen by 10% in the last year, the Halifax announced last week. Whoopeedoo. What that means is that the intergenerational wealth divide just rose by another 10% – and anyone born after 1985 is going to find it 10% harder to ever buy a home. There is perhaps no greater manifestation of the wealth gap in this country than who owns a house and who doesn’t, and yet it’s so unnecessary. Ignoring land prices for the moment, houses do not cost a lot of money to build – a quick search online shows you can buy the materials for a three-bed timber-framed house for less than £30,000; in China a 3D printer can build a basic home for less than £3,000 – and the building cost of the houses we already have has long since been paid. How can it be that, in the liberal, peaceful, educated society that is 21st-century Britain, a generation is priced out?

These are not times of war, nor are they, for the most part, periods of national emergency, so why should one couple be able to settle down and start a family and another not, by virtue of the fact that one was born 15 years earlier than the other? There has been a failure in both the media and government to properly diagnose the cause of high house prices. Until the causes – our systems of money and planning – are properly understood, we cannot hope to fix the problem. The standard solution is: “we need to build more”, but this is not a simple supply-and-demand issue. Between 1997 and 2007 the housing stock grew by 10%, but the population only grew by 5%. If house prices were a function of supply and demand, they should have fallen slightly over this period. They didn’t. They rose by more than 300%. The cause of house price rises is the unrestrained supply of something else: money.

Mortgage lending over the same period went up by 370%, thinktank Positive Money’s research shows. It was newly created debt that pushed up prices in a decade of extraordinarily loose lending, which gave birth to a national obsession. Houses were no longer places to live, but financial assets. Property owners became immensely wealthy without actually doing anything. And this great, unearned wealth saw the rise of a new rentier class: the buy-to-let landlord. When you have runaway inflation such as this, the Bank of England has a responsibility to quash it, usually by putting up interest rates. But – and here is the great sleight of hand – the Bank has seen fit not to include house prices in its measures of inflation. So, throughout the 90s and 00s, they could then “prove” inflation was low or moderate and interest rates meandered lower. Meanwhile, more and more mortgages were issued, and so more and more money was created, and it pushed up prices. The government didn’t mind.

Read more …

Hilarious.

• Iceland Shocked By Elite’s Love Of Offshore Holdings (AFP)

Cabinet ministers, bankers and CEOs: the offshore companies at the heart of the leaked Panama Papers have drawn large numbers of Iceland’s elite into a scandal that has already brought down the country’s premier. The documents from the Panama-based law firm Mossack Fonseca, obtained by the International Consortium of Investigative Journalists (ICIJ), revealed just how many Icelanders had holdings hidden away in tax havens.That number is astounding: some 600 Icelanders are named in the documents, in a country of just 320,000. That’s the highest per capita number for any country, according to Johannes Kristjansson, an independent Icelandic journalist who worked with the Consortium. In the streets of Reykjavik, people are disgusted.

“It’s a small clique, and even after the 2008 (financial) crisis they wouldn’t let go. It just confirms that money made during the boom years didn’t disappear into thin air,” a 50-year-old resident, Kolbrun Elfa Sigurdardottir, told AFP. “Who are the people who benefited from this system? We all want to know,” asked Alli Thor Olafsson, 32. The offshore companies are part of the legacy from the euphoria that was rampant in Iceland’s financial sector in the early 2000s when the country’s banks borrowed beyond their means to fund aggressive investments abroad, ultimately causing the 2008 collapse of the three main banks. According to Sigrun Davidsdottir, a journalist at public television RUV who has been investigating offshore holdings since the 2008 crisis, Iceland’s financial advisors were quick to suggest to all and sundry that their money should be placed offshore.

“During the heady years up to 2008, a source said to me that you just weren’t anyone unless you owned an offshore company,” she wrote on her blog. By now, the best-known case is that of ousted prime minister Sigmundur David Gunnlaugsson. In 2007, his then-future wife, Anna Sigurlaug Palsdottir, placed her inheritance from her wealthy businessman father in an offshore tax haven, the British Virgin Islands, via the Credit Suisse bank. Gunnlaugsson owned 50% of the offshore company, named Wintris, a fact he neglected to disclose as required in April 2009 when he was elected to parliament. He resigned last week after massive public protests. Offshore accounts were so well-known in Iceland that the expression “Tortola company” – referring to the most populated island in the British Virgin Islands – had been widespread in Icelandic media, though not the extent to which they were used and by whom.

Gunnlaugsson was definitely not the only government official to own an offshore company. Finance Minister Bjarni Benediktsson owns a company in the Seychelles, while Interior Minister Olof Nordal has one in Panama. Both have so far managed to hold onto their cabinet posts despite the scandal. A former central bank governor and ex-industry minister, Finnur Ingolfsson, the head of pharmaceutical group Alvogen, Robert Wessman, as well as journalist Eggert Skulason of the daily DV are all known to be on the Panama Papers list of offshore account holders.

Read more …

All files should be transferred to a Wiki-style open source server.

• Swiss Banker Whistleblower: CIA Behind Panama Papers (CNBC)

Bradley Birkenfeld is the most significant financial whistleblower of all time, so you might think he’d be cheering on the disclosures in the new Panama Papers leaks. But today, Birkenfeld is raising questions about the source of the information that is shaking political regimes around the world. Birkenfeld, an American citizen, was a banker working at UBS in Switzerland when he approached the U.S. government with information on massive amounts of tax evasion by Americans with secret accounts in Switzerland. By the end of his whistleblowing career, Birkenfeld had served more than two years in a U.S. federal prison, been awarded $104 million by the IRS for his information and shattered the foundations of more than a century of Swiss banking secrecy.

In an exclusive interview Tuesday from Munich, Birkenfeld said he doesn’t think the source of the 11 million documents stolen from a Panamanian law firm should automatically be considered a whistleblower like himself. Instead, he said, the hacking of the Panama City-based firm, called Mossack Fonseca, could have been done by a U.S. intelligence agency. “The CIA I’m sure is behind this, in my opinion,” Birkenfeld said. Birkenfeld pointed to the fact that the political uproar created by the disclosures have mainly impacted countries with tense relationships with the United States. “The very fact that we see all these names surface that are the direct quote-unquote enemies of the United States, Russia, China, Pakistan, Argentina and we don’t see one U.S. name. Why is that?” Birkenfeld said. “Quite frankly, my feeling is that this is certainly an intelligence agency operation.”

Asked why the U.S. would leak information that has also been damaging to U.K. Prime Minister David Cameron, a major American ally, Birkenfeld said the British leader was likely collateral damage in a larger intelligence operation. “If you’ve got NSA and CIA spying on foreign governments they can certainly get into a law firm like this,” Birkenfeld said. “But they selectively bring the information to the public domain that doesn’t hurt the U.S. in any shape or form. That’s wrong. And there’s something seriously sinister here behind this.” Birkenfeld also said that during his time as a Swiss banker, Mossack Fonseca was known as one piece of the vast offshore maze used by bankers and lawyers to hide money from tax authorities. But he also said that the firm that is at the center of the global scandal was also seen as a relatively small player in the overall offshore tax evasion business.

Read more …

Ha!

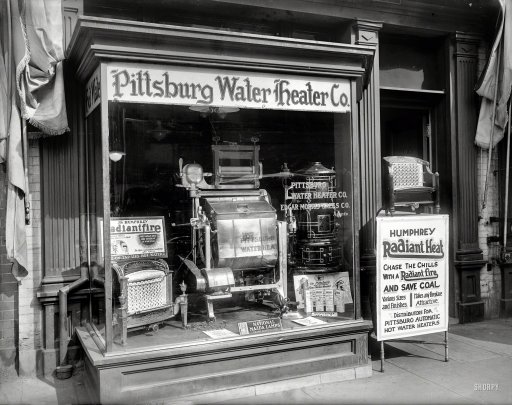

• Australia Issues The Most Hideous Banknote In History (SMH)

The new $5 note continues Australia’s proud history of monetary innovation. When the British founded the convict colony of NSW in 1788, Governor Arthur Phillip embarked on a unique social experiment. He would establish a society without money, as having it around would only give the convicts something else to steal. Rum became the currency of choice, with the pound making way for the pint and the shilling swapped for the shot. In 1814, Governor Lachlan Macquarie decided he could not run a colony on a currency prone to spillage and evaporation. He bought 40,000 Spanish pieces of eight, the currency more pirates prefer, and cut the centre out of each piece, creating two coins, the holey dollar and the dump. In a moment of Scottish fiscal genius, Macquarie declared the two new coins would have a combined value of one-and-a-quarter pieces of eight, generating a tidy profit for his government.

Australia’s first banknote was printed by the Bank of NSW in 1817. The bank, established by convicted criminals, was commonly known as the Convict’s Bank and is now known as Westpac. In 1988, Australia celebrated its bicentenary by revolutionising banknote design, issuing the world’s first polymer note, the brainchild of Australia’s CSIRO. The organisation was so good at the science of making money that this is now the only science the Australian government will let it do. And now, with the new $5 note, Australia is again leading the world in banknote design. The Reserve Bank is proud to announce it has designed, possibly, the most hideous banknote in history. This is the start of a campaign to make our currency so nauseatingly unappealing that people will switch to electronic payments (saving the Australian government printing costs).

The new wattle motif, designed to look like anthrax spores, will stop old people sending money by mail (saving the Australian government postage costs). The government must have retained the designer of Australia’s 1984 Olympic uniforms to come up with a startling combination of off-pink and bilious yellow, before giving the Reserve Bank’s gibbon the keys to the inkjet. Blind people will love the new banknote for its revolutionary tactile features, but mainly because they won’t be able to see it. The worst thing about the new $5 note, however, is that it dispenses with one of the greatest Australians ever, Catherine Helen Spence – who was commemorated in 2001 for the note issued to celebrate the centenary of federation.

Spence was the first Australian woman novelist to write about Australian issues, the mother of the Australian foster care system, the leading campaigner for proportional representation in government, a hero of the women’s suffrage movement, and Australia’s first female political candidate. And those are but a few of her achievements. Spence has been forced to make way for a lump of neo-brutalist architecture – our Parliament House –topped by a giant Australian flag. A non-Australian, the Queen retains pride of place on the new note.

Read more …

Canada, US, Australia and more.

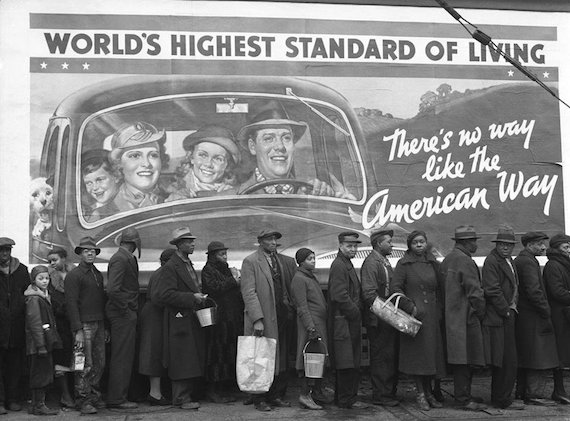

• Canadian First Nation Suicide Epidemic Has Been Generations In The Making (G.)

The Attawapiskat First Nation, or the people of the parting rocks, as they are known in their indigenous Swampy Cree language, number roughly 2,000 souls. They live on a small Indian reserve 600 miles north of the Canadian capital of Ottawa, at the mouth of James Bay’s Attawapiskat River. This subarctic First Nation declared a state of emergency after 11 community members tried to take their own lives Saturday night. Since last September, more than 100 Attawapiskat people have attempted suicide in what local MP Charlie Angus has described as a “rolling nightmare” of a winter. The ghastly toll reveals a grim reality with which a nation in the midst of a process of truth and reconciliation now must reckon.

Suicide does not merely roll in like a hurricane to uproot homes and families, and drown out neighborhoods before receding from where it came. No, this has been an emergency generations in the making, tacitly supported by a Canada fully willing to mine natural resources, proselytize and brutalize generations of children in residential schools, and then leave with basic housing, education systems and healthcare in a state of disrepair. In 2011, Attawapiskat declared a state of emergency due to a “severe housing shortage”. In 2014, the community opened the first proper elementary school to serve Attawapiskat’s children in 14 years. At the same time, the De Beers mining company pulled $392m worth of diamonds out of their Victor Lake mine on lands taken from the Attawapiskat First Nation through an extension of Treaty 9 in 1930.

This is how First Nations live in the Bantustans of Canada’s north. Broke and broken people with little to no opportunities live in cold, run-down homes and suffer from generations of sexual, physical and psychological abuse. They look on as hundreds of millions of dollars worth of resources are mined from their ancestral homelands. This is not an emergency – a catastrophe for which Canada was unprepared and never saw coming. No, this is and always has been part of the design and devastation that colonization wrought. In order to take the land, Canadian settlers needed to eliminate First Nations and their prior and legitimate political claims to territories. In the late 19th and early 20th centuries, infectious diseases and state-supported starvation gave way to the institutional violence of Indian reserves and residential schools, where more than 150,000 First Nations children were taken from 1876 to 1996.

Read more …

No more Schengen.

• Brussels Gives Greece Two Weeks To Tighten Borders (Kath.)

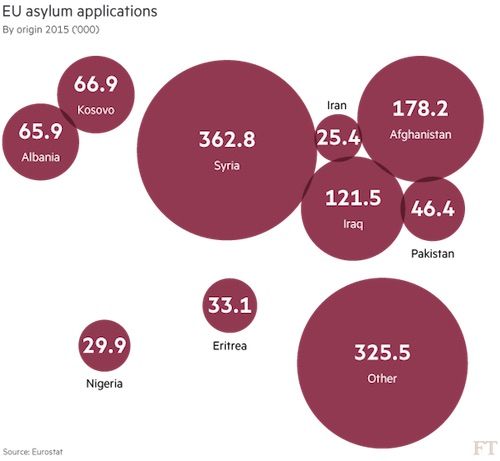

The European Commission on Tuesday gave Greece two weeks to determine how it plans to tighten control of its borders, noting that although progress has been made, the process of registering thousands of migrants streaming through the country remained inadequate. The Commission criticized an action plan submitted by Athens, noting that it lacked “detailed time frames” for fixing problems. It also demanded guarantees that EU funding for migration will be used properly. “The Commission requests that Greece provide the additional elements and clarifications by 26 April,” it said in a statement which acknowledged Athens had made “significant progress.” If Greece fails to take remedial action, Brussels could authorize other EU member-states to extend border controls in the Schengen passport-free area for up to two years instead of the normal six months. Such a scenario would effectively suspend Greece’s participation in the Schengen zone.

Read more …

Can’t stop this.

• Refugees Become Smugglers Following EU-Turkey Deal (MEE)

Refugees and migrants in Greece have begun joining smuggling networks in growing numbers in a desperate bid to earn enough cash to pay for their own journeys north since an agreement between the EU and Turkey has made it more difficult for people to make it to places like Germany. In Idomeni, the northern border between Greece and Macedonia where more than 11,000 people have been stuck for weeks, the smugglers have been out in full force since the controversial deal officially – slated as a major blow to smuggling rings in Turkey and Europe – began to be implemented and the first migrants sent back. In contrast to the stated aim of cutting down on smuggling, smugglers can be seen in parking lots of hotels and abandoned gas stations, nor are the locals working alone.

In their bid to earn enough cash to make it north, some of the refugees and migrants stranded in Greece have started working as “fixers” for the smugglers, while smaller groups, mostly from Afghanistan, have started to self-organise and develop their own smuggling routes through parts of the Balkans. While the development is not altogether new, and some new arrivals have long stayed on with smugglers, the practice appears to be accelerating and is happening more in the open than ever before. [..] Despite the dangers, growing numbers of people feel they have no choice as border closures and barbed wire fences have made paying smugglers even more expensive. Karam, a Syrian refugee who paid smugglers to get to Germany last year and has now returned to Greece as a volunteer, says that prices have gone up and that he only paid $2,700 to make it all the way to Germany, significantly less than the journey would cost today.

“When I travelled to Germany, the smugglers did not see us as people but as commodities. We were often in risky situations during the trip and they didn’t care much. The only thing important to them was to transfer us as quickly as possible and return back for a new tour of people. I suppose they treat people even worse now,” said Karam. “I think that today, in this situation, I would apply to stay in Greece.”

Read more …

And the beat goes on and on.

• Greek Coast Guard Rescues 120 Refugees Off Lesvos, Samos (Kath.)

Greek coast guard officers rescued 120 refugees and migrants in three separate incidents off Lesvos and Samos, authorities said on Wednesday morning. Officials said that between Tuesday and Wednesday morning there had been 101 arrivals on the Aegean islands. There are currently 3,644 people at the Lesvos hotspot, 1,827 in Chios and 516 on Samos, according to authorities.

Read more …