William Henry Jackson North from Brink Wood, Pen Mar Park, Maryland 1906

“The German structural imbalance in trade with the rest of the EU and the US underscores the economic heterogeneity within the EU — ergo, this is a multilateral deal in bilateral dress.”

• Trump Trade Chief Navarro Accuses Germany Of Abusing Euro For Own Gain (Tel.)

Sterling completed its best January against the dollar in six years after Donald Trump and a key adviser renewed an attack on countries that “exploit” their weak currencies. The value of the pound climbed as high as $1.2593 against the dollar after the US president heavily criticised China and Japan for “play[ing] the money market”. His comments followed a meeting with pharmaceutical executives in which he pledged to bring back drug manufacturing to the US. The rise in sterling’s value on Tuesday rounded off its best January performance against the dollar since 2011 and its first positive start to the year in half a decade. It came as Mr Trump’s trade chief put the US on a collision course with Germany after he accused Berlin of using a “grossly undervalued” euro to “exploit” the US and the rest of the EU.

Peter Navarro, who heads the US president’s new National Trade Council, described the single currency as an “implicit Deutsche Mark” that gave Germany a competitive advantage over its trade partners. The economics professor also said Germany was the main obstacle to a trade deal between the US and European bloc as he dismissed a revival of TTIP talks. “A big obstacle to viewing TTIP as a bilateral deal is Germany, which continues to exploit other countries in the EU as well as the US with an ‘implicit Deutsche Mark’ that is grossly undervalued,” Mr Navarro said. “The German structural imbalance in trade with the rest of the EU and the US underscores the economic heterogeneity within the EU — ergo, this is a multilateral deal in bilateral dress.”

Mr Trump has highlighted a preference for “one-on-one” trade deals. He pulled the US out of the TPP with 11 Pacific Rim nations on his first full day in office. Mr Navarro told the Financial Times the UK’s decision to leave the EU had “killed” a similar trade deal between the US and Europe. Mr Trump has signalled that the US will engage in trade talks with the UK. Angela Merkel, Germany’s chancellor, said the country had no influence over the euro exchange rate. “I neither want to nor can I do something to change the situation,” she told reporters in Stockholm. Mario Draghi, the ECB’s president, has warned that the country’s persistent current account surplus has contributed to imbalances and hindered growth in the eurozone. Analysis by the OECD suggests the euro is trading below its “fair value”. Data published by the think-tank shows the the euro is the most undervalued currency among the dollar’s major peers.

To repeat for a 1000th time: inflation numbers are meaningless unless money velocity is considered. And velocity is certainly not rising in southern Europe. That in turn would mean if it is rising in Germany – something I haven’t seen any proof of but let’s say it is -, what we see here is a huge threat to the eurozone. Because what is good for Germany is not good for others, and the others will have had enough of it.

• ECB Has An Inflation Problem … Called Germany (Pol.)

The eurozone has reached its inflation target for the first time in four years, but ECB chief Mario Draghi has no time to rest on his laurels: He must now brace for renewed attacks on his easy-money policy in Germany. Overall inflation for the 19 countries that use the euro in January came in at a preliminary 1.8% – within a whisper of the ECB’s official target of “below, but close to, 2%,” but core inflation, which strips out volatile food and energy prices, was unchanged from December at 0.9%, making any immediate change in policy unlikely. However, with German elections looming this September, and top-selling tabloid Bild featuring a “horror curve” showing that despite the spike in inflation –which was even higher in Germany, at 1.9% in January – savers are still earning nothing thanks to the policy of negative rates to spur spending elsewhere in the eurozone, Draghi’s problems are more political than economic.

“Someone has to put a stop to Draghi,” said Jörg Meuthen from the far-right, Euroskeptic Alternative for Germany (AfD), which has high hopes of entering the Bundestag (lower house of parliament) for the first time in September. The party is keen to play on the collective German memory of hyperinflation in the first decades of the 20th century. Other inflation hawks, including mainstream figure like Bavarian Finance Minister Markus Söder, are frustrated with Draghi’s insistence that he cannot tailor monetary policy for the eurozone to the needs of the Germany economy, which is growing much more robustly than neighboring countries who still need the ECB’s support.

With Euroskeptic populists challenging the established order in elections this year in Germany, France and the Netherlands, the ECB will come under increasing pressure to explain why it is doing what it’s doing, said Anatoli Annenkov, economist at Société Générale. While he assumes a slow recovery in core inflation, “we had years and years of downside surprises and now that it is going up, we might also see upside surprises,” he said. Beyond Brexit and fears of protectionist policies from the new U.S. administration, the ECB is bracing for internal pressure from the largest economy in the eurozone. In his most recent press conference, Draghi attempted to project unity among the ECB’s governing council in support of the €2.3 trillion bond-buying program designed to stimulate the eurozone economy.

But that façade crumbled just days later when German executive board member Sabine Lautenschläger suggested it might be time to bring the policy to an end. “All preconditions for a stable rise in inflation exist. I am thus optimistic that we can soon turn to the question of an exit,” she said in a speech last week. Her former boss, Bundesbank President Jens Weidmann, has also signaled that the ECB should let economic data — rather than its previous commitment to keeping quantitative easing running until the end of 2017 — dictate its policy in the coming months.

Really? Japan would try and deny this?

• Japan Rejects Trump Accusation Of Devaluing Yen In Currency War (G.)

Japan has rejected Donald Trump’s claims that Tokyo was deliberately weakening the yen to gain an unfair trade advantage over the US. Trump told a meeting of pharmaceutical companies on Tuesday that Japan, along with China and Germany, were guilty of “global freeloading” for using regulation and currency devaluation in their trade dealings with the US. The president’s trade adviser, Peter Navarro, also accused Germany of using a “grossly undervalued” euro to gain an unfair advantage over the US and other EU countries. In unusually frank comments, Japan’s chief cabinet secretary, Yoshihide Suga, said Trump’s criticism “completely misses the mark”. Suga added that the Bank of Japan’s pursuit of monetary easing was intended to boost inflation, not weaken the yen against the dollar.

Japan’s policy was in line with G7 and G20 agreements, he said, adding that Tokyo would continue to respond to “one-sided” currency moves by other countries. Vowing to end the emasculation of US trade, Trump’s said: “You look at what China’s doing, you look at what Japan has done over the years. … they play the money market, they play the devaluation market and we sit there like a bunch of dummies.” According to a transcript of Tuesday’s meeting, Trump said other countries “live on devaluation”. Trump’s outburst, which suggests he could backtrack on his wish to see higher US interest rates, came at the end of the worst January for the dollar for three decades. But that follows a huge rise in the dollar on the back of his election win in November when promises of a huge stimulus for the US economy sent the greenback to 14-year highs.

Said many times before: Tusk got his job solely because of his Putin-bashing as PM of Poland.

• EU Chair Tusk Labels Trump A ‘Threat’ As Europeans Debate US Ties (R.)

Donald Trump has joined Russia, China and radical Islam as a threat to the European Union, EU leaders were told on Tuesday by the man chairing a summit where they will debate relations with the United States. European Council President Donald Tusk, a conservative former premier of Poland, wrote to EU national leaders to lay out themes for discussion when they meet in Malta on Friday to discuss the future of their Union as Britain prepares to leave. In vivid language that reflects deep concern in Europe at the new U.S. president’s support for Brexit, as well as his ban on refugees and people from several Muslim countries, Tusk called on Europeans to rally against eurosceptic nationalists at home and take “spectacular steps” to deepen the continent’s integration.

Saying the EU faced the biggest challenges of its 60-year history, Tusk named an “assertive China”, “Russia’s aggressive policy” toward its neighbors and “radical Islam” fuelling anarchy in the Middle East and Africa as key external threats. These, “as well as worrying declarations by the new American administration, all make our future highly unpredictable,” he said. Laying out issues leaders may address in a 60th anniversary declaration at Rome in March, Tusk said the EU unity built after World War Two and the Cold War was needed “to avoid another historic catastrophe”. He also said Americans should not weaken Transatlantic ties fundamental to “global order and peace”.

“The disintegration of the EU will not lead to the restoration of some mythical, full sovereignty of its member states, but to their real and factual dependence on the great superpowers: the United States, Russia and China,” Tusk wrote to the EU leaders. “Only together can we be fully independent.” Senior officials discussed a possible EU response to Trump at a meeting in Brussels on Monday where some governments stressed that Europeans should not be hasty to alienate a key ally, diplomats said. “We don’t want to get fired,” one senior EU diplomat said in reference to Trump’s reality TV catchphrase. Another said that because the full U.S. administration was not yet in place, Europeans should be cautious: “No government in Europe can respond in a coherent manner to this series of orders and tweets,” the diplomat said.

“Goldman Sachs has a unique vested interest in repealing chunks of Dodd-Frank while making sure that the Glass-Steagall Act is not reinstated.”

• Donald Trump Has a Goldman Sachs Problem: Derivatives (Martens)

Following a plunge of over 200 points in the Dow Jones Industrial Average yesterday, Trump pivoted to something he thought would please his financial backers on Wall Street. He called the Dodd-Frank financial reform legislation passed in 2010 by the Obama administration a “disaster” and promised to “do a big number” on it soon. The Dow closed down 122 points — now wary of Trump’s fire-ready-aim leadership on complex matters. The legitimate fear across Wall Street right now is that Trump’s zero-vetting approach to rule-by-Executive-Order could leave Wall Street in the same chaotic state as the airports experienced from his ham-fisted approach to immigration. But it’s not just Trump that Wall Street needs to fear: it’s Goldman Sachs as well. Trump has stuffed his administration with so many Goldman Sachs progeny that his administration is now regularly referred to as Government Sachs.

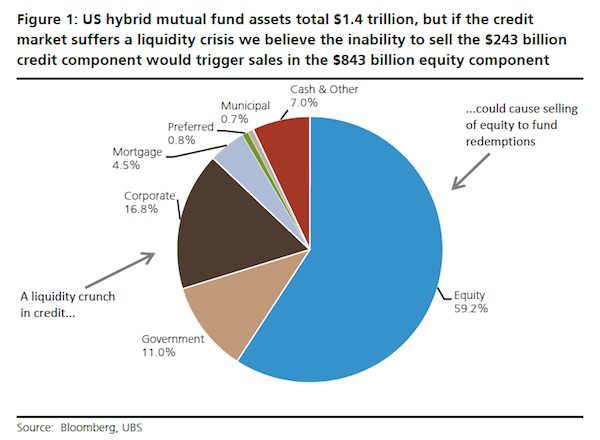

Goldman Sachs has a unique vested interest in repealing chunks of Dodd-Frank while making sure that the Glass-Steagall Act is not reinstated. That’s because when it comes to derivatives, Goldman Sachs is keeping a lot of secrets. The Office of the Comptroller of the Currency (OCC) is the regulator of national banks. Each quarter it publishes a report on the derivative holdings of the biggest Wall Street banks and their holding companies. Its most recent report shows that as of September 30, 2016 Goldman Sachs Bank USA (a taxpayer-backstopped, FDIC insured bank where it holds its derivatives) had “credit exposure to risk-based capital” of 433%. That figure was more than double that of JPMorgan Chase (216%) and six times that of Bank of America (68%).

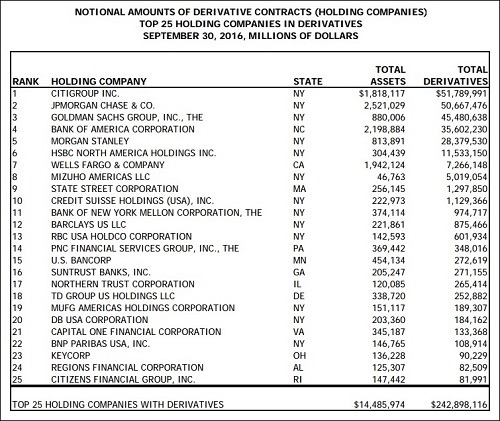

There’s another big problem with Goldman Sachs: it has a miniscule asset base compared to the big guns on Wall Street but it’s attempting to play in the big leagues in terms of derivatives. As the chart above shows, Goldman Sachs is the third largest holder of derivatives on Wall Street with $45.48 trillion in notionals (face amount). (As of 2015, the entire GDP of the United States was only $18 trillion.) But Goldman only has $880 billion in assets. That ratio compares to JPMorgan Chase with $2.5 trillion in assets and $50.6 trillion in derivatives and Citigroup with $1.8 trillion in assets and $51.78 trillion in derivatives. The amount of these derivatives is insane on all levels but, clearly, Goldman stands out starkly in its ratios.

There’s another highly disturbing aspect of Goldman’s derivatives. Dodd-Frank legislation mandated that derivatives at the big Wall Street banks move into the sunshine by moving out of over-the-counter contracts whose details are known only to the buyer and seller and onto some type of centrally cleared platform. Dodd-Frank was signed into law on July 21, 2010. It’s almost six years later and yet the OCC’s report of September 30, 2016 shows that of the total derivatives held by Goldman Sachs only 24% are centrally cleared versus 76% at Goldman that remain over-the-counter. Again, that’s a far higher %age of over-the-counter contracts than at its peer banks on Wall Street.

5 weeks.

• Theresa May to Trigger Brexit on March 9 (DM)

Theresa May has set a target date of launching the formal Brexit process on March 9. The Government is aiming to push through its EU Bill through Parliament by March 7, which would allow the Prime Minister to trigger Article 50 at a summit of European leaders on March 9 and 10. MPs will start debating the crucial Brexit legislation today and fiery clashes are expected in the commons chamber as the SNP, Lib Dems and dozens of Labour MPs say they will defy June’s vote to leave the EU and vote against triggering Article 50. Ministers told the House of Lords yesterday that it hopes to have the European Union (Notification of Withdrawal) Bill approved by March 7. The following day – March 8 – is the Budget, before Mrs May travels to Brussels for the long-awaited Brexit showdown with her EU counterparts.

The PM has promised to trigger Article 50, the formal mechanism for quitting the EU, by the end of March. But she does not want to get off on the wrong foot with EU leaders by clashing with the 60th anniversary of the Treaty of Rome, which effectively gave birth to the EU. She could tell her European counterparts of her timetable at a meeting in Malta on Friday. The timetable could be knocked off course if the Lords initiate what is known as parliamentary ‘ping-pong’ by sending the bill back to the Commons with a series of amendments. And in a sign of the trouble ahead for Mrs May, a senior Tory told the Independent: ‘What we are seeing now is a huge raft of amendments being tabled. ‘There are cross party talks going on about this. It’s not going to be plain sailing for the Prime Minster.’

How much chaos is Britain capable of?

• UK MPs Set For Vote On Triggering Brexit Talks With EU (BBC)

MPs are to vote later on whether to give Theresa May the power to get Brexit negotiations under way. The government is expected to win, with most Conservative and Labour MPs set to back its European Union Bill. But Labour leader Jeremy Corbyn faces a rebellion by some on his side, while the SNP and Liberal Democrats are also promising to oppose ministers. The vote, which will follow two days of parliamentary debate, is expected at about 19:00 GMT. On Monday, politicians made impassioned speeches for and against the bill, which, if passed, will allow Mrs May to trigger Article 50 of the Lisbon Treaty by her own deadline of 31 March. This would get formal Brexit negotiations with the EU started, with the UK expected to leave the 28-member group in 2019.

Brexit Secretary David Davis said MPs had to implement a decision made by the people in last June’s referendum, which the Leave campaign won by 51.9% to 48.1%. Doing otherwise would be viewed “dimly”, he warned. Mr Corbyn has imposed a three-line whip – the strongest possible sanction – on his MPs to back the bill, which is only two lines long. Shadow Brexit secretary Sir Keir Starmer called the vote a “difficult decision” for Labour – most of whose MPs supported Remain in the referendum – but it had to “accept the result”. Two shadow ministers have quit Labour’s front bench in order to oppose the bill, while MPs Stephen Timms and Lyn Brown told the Commons they would also vote against it. A government source said up to 30 Labour MPs were expected to defy Mr Corbyn.

Cameron and Osborne worked on this for years.

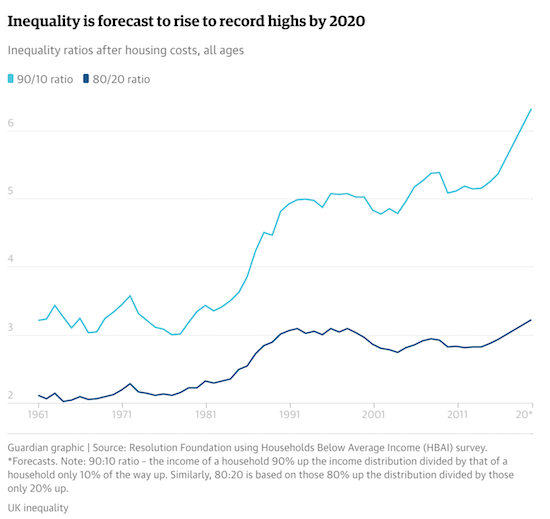

• UK Faces Return To Inequality Of Thatcher Years (G.)

Pressure on the government to help struggling Britons has intensified after a leading thinktank warned that falling living standards for the poor threatened the biggest rise in inequality since Margaret Thatcher was prime minister. The Resolution Foundation said Theresa May would need to make good on her pledge to support “just about managing” households as it released a report showing that rising inflation and an end to recent strong jobs growth would hit the least well-off hardest. Its warnings chime with other forecasts for a squeeze on family budgets on the back of sluggish wage growth, welfare cuts, rising global oil prices and the pound’s sharp fall since the Brexit vote. The drop in sterling has made imports more expensive and there are already signs that is being passed on to consumers, with inflation hitting its highest level for more than two years in December.

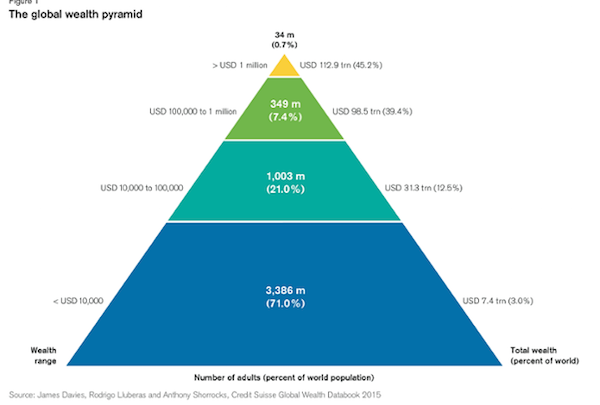

The Resolution Foundation’s study found that the current parliament would be the worst for living standards for the poorest half of households since comparable records began in the mid-1960s and the worst since the early years of Thatcher’s 1979-90 premiership for inequality. Since its sharp increase in the early 1980s – a period of high unemployment, factory closures and a cut in the top rate of tax from 83% to 60% – inequality has broadly remained flat. But the Resolution Foundation forecast that between 2015 and the next general election in 2020 incomes for the poorest half of households will fall by 2%. That compares with a rise of 4% during the last parliament and 1% between 2005 and 2010 – the five-year period that included the deepest recession since the 1930s.

Torsten Bell, director of the Resolution Foundation, said: “Britain has enjoyed a welcome mini-boom in living standards in recent years. But that boom is slowing rapidly as inflation rises, productivity flatlines and employment growth slows. “The squeeze in the wake of the financial crisis tended to hit richer households the most. But this time around it’s low- and middle-income families with kids who are set to be worst affected. “This could leave Britain with the worst of both worlds on living standards – the weak income growth of the last parliament and rising inequality from the time Margaret Thatcher was in Downing Street.

Curious piece, sources ‘a tad‘ shaky, but it could still well be right.

• Trump Wants Assad to Stay in Power (AHT)

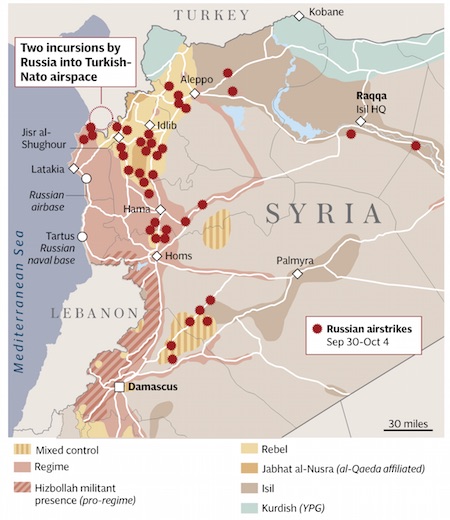

A Syrian diplomatic source underlined that the visit by 130 US figures, including three former secretaries and congresspersons, is a “good omen” in the relations between Damascus and Washington. According to the source, Rep. Tulsi Gabbard who had last week said that she met with Syrian President Bashar Assad during a recent trip to the war-torn country, stressed during the meeting that “affairs are going on in a way that an unprecedented opening is seen in the relations between the two sides in different fields”. Referring to three existing scenarios on Syria, she said that the first option is continued war which doesn’t benefit any sides and the US administration will likely oppose it; the second option is the victory of dissidents which is opposed by Trump and he even dismisses interactions with them.

The third option is Assad’s continued ruling over Syria as the best person to manage the country provided that certain considerations will receive attention in the formation of the government, the Syrian source said. According to the source, Gabbard has indirectly spoken about a US plan to pave the ground for Trump’s showoff by annihilation of the ISIS in Raqqa like what was done by former US President Barack Obama. “Raqqa city is a political card important for the world since it is considered as the ISIS’s first base; meantime, ending the war is Raqqa militarily is easy since there are no tunnels and tall buildings in there which facilitates any military measure to annihilate terrorism,” the Syrian diplomatic source said. Back from a weeklong trip to Syria [she] defended her meeting with the war-torn country’s president, saying there’s no possibility of a viable peace agreement unless Bashar Assad is part of the conversation.

Rep. Tulsi Gabbard of Hawaii said she originally had no intention of sitting down with Assad, according to a statement issued by her office detailing her travels. But she changed her mind when the opportunity arose. “I think we should be ready to meet with anyone if there’s a chance it can help bring about an end to this war, which is causing the Syrian people so much suffering,” Gabbard said. Gabbard said that the U.S. has “waged wars of regime change” in Iraq, Libya and Syria. Yet each has resulted “in unimaginable suffering, devastating loss of life, and the strengthening of groups like al-Qaeda” and the Islamic State group, she said. “My visit to Syria has made it abundantly clear,” Gabbard said. “Our counterproductive regime change war does not serve America’s interest, and it certainly isn’t in the interest of the Syrian people.”

Germany moving soldiers and equipment through Europe is scary enough. The purpose makes it worse.

• Germany Sends Tanks To Lithuania For NATO Mission (R.)

Germany began sending tanks and other equipment to Lithuania on Tuesday as part of a NATO mission to beef up the defense of eastern Europe and send a signal of resolve to Russia, which has denounced the build-up as an act of aggression. The German army command said it was sending about 200 vehicles, including 30 tanks, by train to Lithuania along with 450 troops, the first of whom arrived last week. The transports would continue until late February. Seven decades after the end of World War Two, the movement of German troops to eastern Europe, even on a NATO mission, remains a sensitive issue both in Germany and the region. On Monday the U.S. military deployed thousands of soldiers and heavy weaponry to Poland, the Baltic states and southeastern Europe in its biggest build-up since the Cold War.

The movements are part of a strategy agreed by NATO leaders last July to reassure member states that were once part of the Soviet bloc and have been alarmed by Russia’s seizure of the Crimean peninsula from Ukraine in 2014. The 28-nation Western alliance decided to move four battalions totaling 3,000 to 4,000 troops into northeastern Europe on a rotating basis to display its readiness to defend eastern members against any Russian aggression. The deployments focus on Poland and the Baltic states of Estonia, Latvia and Lithuania, which fear Moscow could try to destabilize them by cyber attacks, territorial incursions or other means. Russia denies such intentions and has described NATO’s behavior as aggressive and threatening.

Good luck with that. A state may be beneficial, but not the ones we see around us.

“Ronald Reagan claimed the nine most terrifying in the English language were: “I’m from the government and I’m here to help.” He said it was a joke; it turned out to be a prophecy.”

• We Need The State Now More Than Ever. But Our Belief In It Has Gone (G.)

We’re often told that the state and the market have entirely different roles. But meet any number of the people paying the price for Britain’s crash, and you’ll see that they play almost identical parts using similar language and similar bureaucracy. And far from protecting low-paid workers from the depredations of the market, the state wants to hurl more people into it under the pretence that they are shirkers. None of this fits with how social democrats view the state. Having attended my fair share of Labour and other leftwing political meetings, I know that a staple feature is that some grey-haired man in a jumper will leap up towards the end and launch into a good-hearted defence of the state. Public investment, social security, industrial strategy: all will circle back to the state; all will be met with murmurs of approval. And all are a million miles away from the experiences I regularly hear while reporting.

[..] At the end of 2015, a team of academics held a series of two-day discussions with small groups of members of the public across Europe. They were asked only one big question: what should the government do for your children’s generation? Of all the countries, the British were easily the most pessimistic about what could be done – behind even Slovenia. The British liked the NHS and pensions, but thought both would be gone in a generation. They didn’t talk about the good things that could be done by government. Trade unions came up just once in the entire two days. “I found it quite shocking,” recalls Peter Taylor-Gooby, of the University of Kent. “Of all the groups we interviewed, the British had this mood of resigned, reluctant individualism.”

Thirty years ago, Ronald Reagan claimed the nine most terrifying in the English language were: “I’m from the government and I’m here to help.” He said it was a joke; it turned out to be a prophecy. Three decades of both right and left privatising, outsourcing and deregulating have shrunk the public imagination about what their representatives in government can achieve. Put that alongside the shattering of the working class, the smashing of trade unions, and the diminishment of so many other social institutions. The need for the state and collective action hasn’t diminished, but the public belief in it has gone. The state is now either invisible or hostile. This has happened without the pundits and politicians noticing, but its consequences could shape politics for decades.

Editorial in Kathemerini bytThe new British ambassador in Athens, who wastes not one word on what has happened to Greece courtesy of the EU. Not one word! No compassion for the people of Greece, no understanding, not consolation, no hope. Not one word on what Britain intends to do to help Greece. No, the UK wants Greek help. She either doesn’t know what’s going on, or she chooses to blindly ignore it. In both cases, she should not be where she is. She talks about Britain only, as if Britain is the main victim here. Me, me, me. Well, f**king stay home then. Athens now has this dimwit and Victoria Nuland lackey Geoffrey Platt as US ambassador.

• The UK and Greece after Brexit (Kate Smith)

As the new British ambassador in Athens, I begin my mission in Greece at a challenging time. I’ve been struck by the anxiety and even sadness expressed by many Greeks about Britain’s withdrawal from the European Union. Much of that is based in uncertainty about what this means for the future of Europe, and for the relationship between the United Kingdom and Greece. That’s understandable. And that was why Prime Minister Theresa May’s speech last week sought to provide as much clarity as possible for our partners about what the United Kingdom is seeking from the forthcoming negotiations and beyond. Above all, we intend to remain the best friend and neighbor possible to our European partners. We are not seeking to undermine the European Union. Indeed it is in the best interests of the UK that the EU should succeed.

A prosperous, stable Greece is a critical element in that, and I believe Greece has a strong interest in the specific outcomes to which the prime minister committed the UK government to pursue on 23 January. First – the prime minister said repeatedly in her speech that our cooperation with all European partners on defense, security and foreign policy, including intelligence sharing, will continue. The security of our citizens is not negotiable. With Greece, that means the highly valued collaboration we have with partners in the Greek armed forces, police, coast guard and customs on migration, counterterrorism, and organized crime will remain a priority. Second, our aim of a bold and ambitious free-trade agreement, which gives British and European companies the maximum freedom to trade across our markets, can only be of benefit to Greece.

The United Kingdom is the second biggest export market for Greece’s pharmaceutical products, and third largest for agricultural products; while the freedom for the British financial and professional services to continue to trade across borders will benefit both the City of London and the Greek shipping sector, one of its most important customers. Third: There is much concern about the status of EU nationals in the UK after Brexit. Britain values very highly the contribution of Greeks who live and work and study in the UK – for example the hugely talented Greek clinical staff in, for example, the National Health Service – as well as the 10,000 Greek students in our universities. The rights and benefits of current students, and those starting in academic year 17/18, are secure to the end of their courses. And we want to guarantee the rights of all EU citizens already living in Britain, as well as the rights of British nationals in other member-states, as early as we can. Greece’s support on this would be very welcome.