René Magritte The Art of Conversation 1963

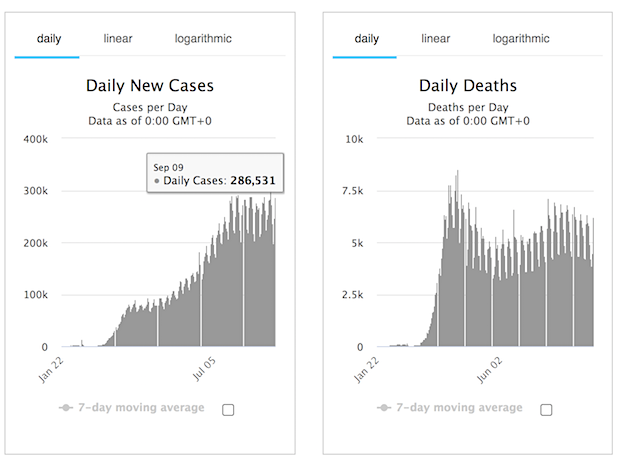

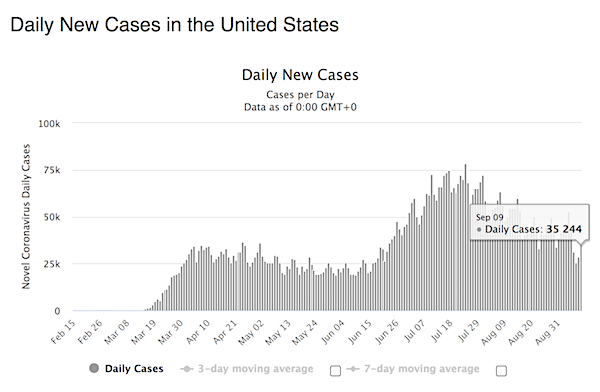

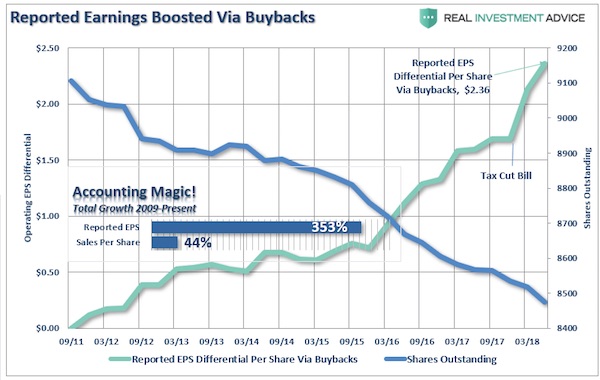

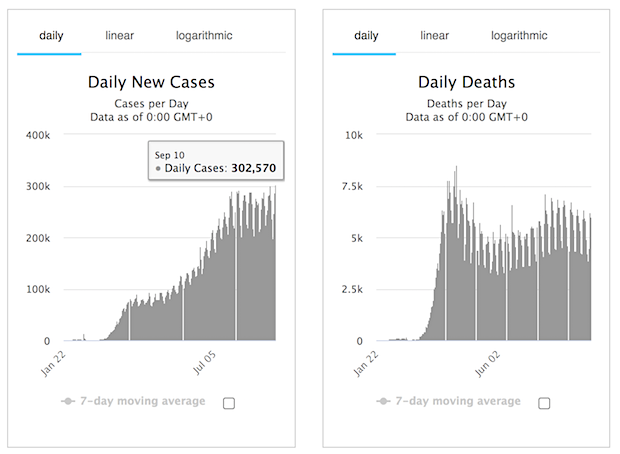

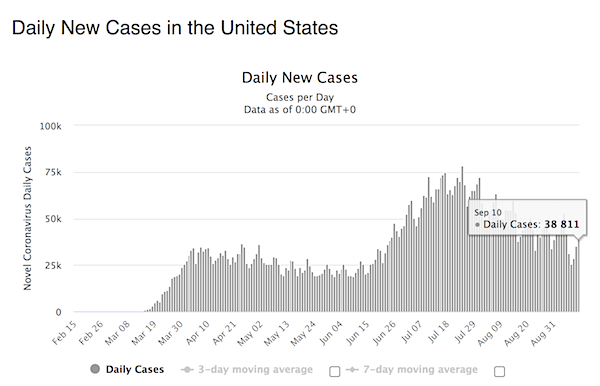

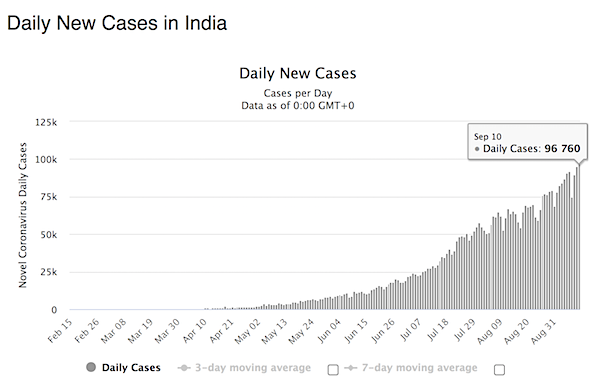

Not good: Global new daily cases set a new record. India adds about a third of that.

Conspiracy or incompetence?

• ‘We Quarantined The Healthy And Exposed The Sick’ (JTN)

Citizens and public authorities fixated on society-wide lockdowns as a key measure to combat COVID-19 have failed to account for the devastating effects those measures can have on society as a whole, a Stanford professor of medicine says. Jay Bhattacharya, the director of Stanford’s Program on Medical Outcomes as well as the director of the school’s Center on the Demography and Economics of Health and Aging, said in an interview this week on the John Solomon Reports podcast that he found it “shocking” that, as countless countries earlier this year moved to shut down ahead of COVID-19, so many had forgotten to “think about both the cost and benefits” of such policies. “Country after country made the same decision with a couple of exceptions,” Bhattacharya said. “And I think that was a major problem.”

The professor said the global community largely abandoned the playbooks followed during earlier pandemics, instead “jump[ing] to a global lockdown.” Bhattacharya alluded to the policies in states such as New York and Pennsylvania that instructed nursing homes to accept COVID-19-positive patients, decisions which critics have claimed led to a significantly elevated death rate in nursing homes. “We essentially, in effect, exposed people who were at high risk in nursing homes, in assisted care facilities, elderly populations,” Bhattacharya said. “We essentially, in the early days of the epidemic, did the inverse of the right policy.” “We quarantined the healthy, and we exposed the sick,” he added.

The professor noted that the World Health Organization, early on in the pandemic, suggested that the death rate for the disease might be as high as 3.4%, significantly higher than that of seasonal influenza. Revised estimates have put that rate as low as 0.26%, though some studies have put it closer to 0.5%. Health institutions “were guided by models that were not based on actual data,” Bhattacharya said. “They were based on assumptions of worst cases.” He said such policy was a “worldwide phenomenon” and not limited to any one country. [..] “I can’t understand how so many people jumped to this mitigation strategy,” he added, “when there had been a playbook … to address the epidemic in ways that took into account both the cost and benefits of the policies.”

There are 28 million cases and counting. That’s 280,000 punctured lungs.

• One in 100 COVID19 Patients Suffer Punctured Lung (RT)

As many as one in every hundred patients hospitalized with Covid-19 suffer ‘punctured lung’ according to new research led by Cambridge University, further complicating treatment for those affected. Symptoms of a pneumothorax or ‘punctured lung’ include shortness of breath and sudden, stabbing chest pains that are exacerbated by taking deep breaths during the coughing fits associated with Covid-19. A punctured lung allows air to seep out and become trapped between the outside of the lung and the chest wall, eventually leading to the organ’s collapse under the accumulated pressure.

According to the new study, published in the European Respiratory Journal, tall young men or older patients with underlying lung disease were most at risk of suffering a punctured lung while undergoing treatment for severe Covid-19 infection (they are already considered at higher risk even before infection with the coronavirus). The Cambridge researchers behind the study used admissions data from the 16 hospitals and consulted colleagues across the UK who reported similar findings. “We started to see patients affected by a punctured lung, even among those who were not put on a ventilator,” says Professor Stefan Marciniak from the Cambridge Institute of Medical Research.

[..] even patients who would not fall into the aforementioned at-risk categories might suffer punctured lungs warned Marciniak, as many of the incidents of punctured lungs were diagnosed “by chance.” Almost two thirds of patients who suffered a punctured lung survived but the researchers recorded just a 42 percent survival rate for patients over 70. Men were three times more likely to suffer a punctured lung than women, possibly as a growing body of research indicates men are disproportionately affected by severe Covid-19 than women.

Would they really mind if Julian gets infected?

• UK Extradition Hearing For Julian Assange Postponed Over COVID19 Concerns (R.)

The London extradition hearing for WikiLeaks founder Julian Assange was postponed on Thursday because of concern that one of the lawyers involved might have been exposed to COVID-19. Assange is fighting extradition to the United States where he is wanted for conspiring to hack government computers and violating an espionage law over the release of confidential cables by WikiLeaks in 2010-2011. Judge Vanessa Baraitser adjourned the case until Monday after being told one of the lawyers representing the United States might have been exposed to the virus. The lawyer was being tested on Thursday with the result due on Friday, she said. “At the moment we would respectfully submit we have to go ahead on the assumption that she has COVID,” Edward Fitzgerald, Assange’s lawyer told London’s Old Bailey court where the hearings are taking place.

“If that is the correct assumption … we shouldn’t really be here: COVID would be here in the courtroom and it’s not possible to tell how far it’s extended,” he added. The extradition hearings began for a week in February and were due to resume in May, but were then delayed until this week because of the coronavirus lockdown. Assange’s lawyers have argued he should be granted bail because he himself is at particular risk from COVID-19 as he has suffered from respiratory infections and has had heart problems. However, the judge has ordered him to be kept in jail because he is considered a flight risk, having skipped bail and fled to the Ecuadorean embassy in 2012 to avoid extradition to Sweden where he was wanted at the time to answer questions on alleged sex crimes. Those allegations have since been dropped.

Investigating the CIA? Not done.

• US Hinders Spanish Probe Into CIA Ties To Firm That Spied On Assange (ElPais)

There will be no judicial cooperation forthcoming from the United States unless a Spanish judge reveals his information sources in an investigation into alleged espionage against WikiLeaks founder Julian Assange while he was living in the Ecuadorean embassy in London. Judge José de la Mata of Spain’s High Court (Audiencia Nacional) has sent a request for judicial cooperation to US authorities as part of his probe into a Spanish private security company named UC Global S.L. and its owner David Morales, on allegations that this firm secretly recorded Assange’s private meetings with lawyers, politicians, relatives and journalists at the embassy, where he took refuge in 2012 to avoid separate legal proceedings against him in Sweden.

Morales was arrested a year ago and released pending trial. According to testimony from several protected witnesses and former UC Global workers who gave evidence in connection with the case, Morales provided the CIA with recordings, video material and reports detailing the activities of the 49-year-old Australian cyber-activist inside the diplomatic mission, where he lived until his eviction in April 2019. Judge De la Mata, who is heading the probe into UC Global, has asked US prosecutors for the IP (Internet Protocol) addresses of the computers or other networked devices that allegedly connected from American soil to a server held by the private security firm at its headquarters in the southern Spanish city of Jerez de la Frontera.

That server stored all the recordings made by cameras at the embassy, where UC Global was in charge of security, as well as reports drafted by company employees detailing each visit that Assange received, images of the visitors’ passports, and photographs of their cellphones and electronic devices. According to testimony by several ex-workers as well as e-mails used as evidence in the investigation, US intelligence services allegedly had access to this central server. US prosecutors have now sent a letter to María de las Heras, a liaison judge for Spain in the US, asking her to convey their demands to De la Mata. These include showing proof that the requested IP addresses are “relevant and substantial to the investigation.”

The document requests further details about the Spanish probe, including the sources of information for most of the assertions made in the request for judicial cooperation. The Spanish judge has been asked to answer a long list of questions regarding every aspect of his investigation, including who he believes that Morales was providing information to, or whether the judge thinks Morales was working for a foreign information service or as an agent for a foreign power – or whether it was simply a case of bribery. US prosecutors have asked for all this information to be relayed before October 16, otherwise “we will assume that Spanish authorities are not interested” and the request will be shelved.

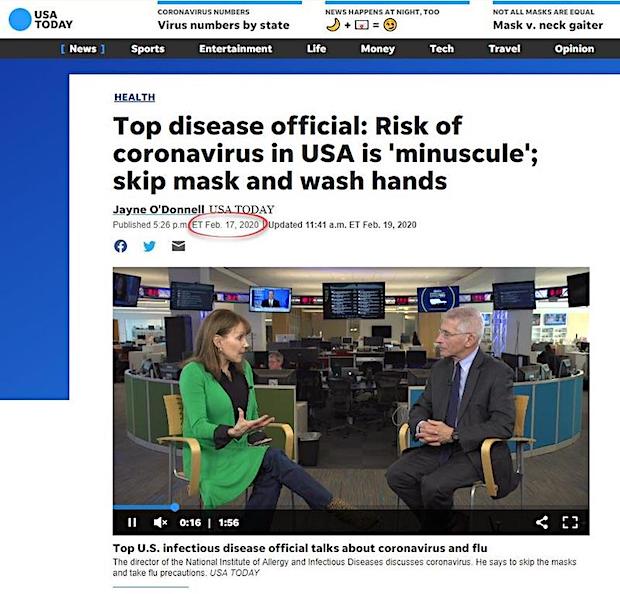

Woodward knew Trump said what he did after having been briefed by O’Brien. Who’s not a scientist. And that Trump right after talked to Fauci et al, who didn’t agree with the assessment.

• Trump: If Woodward Found My COVID19 Quotes Dangerous, Why Sit On Them? (RT)

Donald Trump is hitting back at Bob Woodward’s claims that he downplayed the deadliness of Covid-19, saying if the veteran reporter really felt his approach to the pandemic was “dangerous” he should have made it public sooner. “Bob Woodward had my quotes for many months. If he thought they were so bad or dangerous, why didn’t he immediately report them in an effort to save lives?” the president tweeted on Thursday. Audio from Woodward’s interview with Trump discussing the coronavirus was recorded in February. It has now been released just a few weeks before Woodward’s book ‘Rage’ goes on sale — and there are reportedly more tapes soon to drop. Trump questioned whether Woodward had an “obligation” to come forward if he really felt his thoughts on the virus were so bad. “Didn’t he have an obligation to do so? No, because he knew they were good and proper answers. Calm, no panic!” he tweeted.

In the released audio, the president admits Covid-19 is “deadly” and worse than the flu. He also says he will “always play it down” so he doesn’t create public panic. Weeks after the audio was recorded, Trump publicly compared Covid-19 to the common flu. He also made public comments suggesting that the virus would eventually just “go away.” At a Wednesday press conference, the president slammed Woodward’s book and audio as a “political hit job.” While Woodward’s work is being celebrated by Trump critics, parts of his book have been disputed by Dr. Anthony Fauci, who works on the White House coronavirus task force. Fauci claims he does “not recall” uttering several negative quotes about the president attributed to him in the book — and said Trump “didn’t really say anything different” about the pandemic in private than he did in public.

Or the other way around, depending on your affiliation.

• Senate Democrats Block GOP Relief Bill (Hill)

Senate Democrats blocked a GOP coronavirus bill on Thursday amid a deep stalemate over the next relief package. Senators voted 52-47 on the roughly $500 billion Republican bill, which marked the first coronavirus-related legislation the chamber has voted on since it passed a $484 billion package in April. The vote handed a symbolic victory to Senate Majority Leader Mitch McConnell (R-Ky.), who spent weeks haggling with Republicans and the White House over the contours of the pared-down GOP bill as he sought to overcome deep divisions over the path forward. GOP leadership worked behind the scenes to lock down 51 votes, a U-turn from last month when McConnell predicted that up to 20 GOP senators wouldn’t vote for any additional legislation.

GOP Sen. Rand Paul (Ky.) was the only Republican to vote against the bill on Thursday. But it failed to get the 60 votes needed to overcome Thursday’s procedural hurdle as congressional Democratic leadership and the White House remain at a standoff over a fifth coronavirus package. The brinkmanship was on full display ahead of Thursday’s vote, with McConnell and Senate Minority Leader Charles Schumer (D-N.Y.) trading barbs on the Senate floor. [..] there’s no sign that congressional Democrats or the White House is willing to break the stalemate.

Mnuchin, Meadows, Schumer and House Speaker Nancy Pelosi (D-Calif.) remain far apart not only on the price tag but also on significant policy issues including unemployment insurance and more money for state and local governments. Republicans unveiled a $1.1 trillion bill in late July, and Mnuchin has suggested the White House could go as high as $1.5 trillion. But he’s also suggested this week that his focus is shifting to an end-of-the-month deadline to fund the government. There are no talks currently scheduled between the foursome.

That record’s definitely broken.

• Schiff’s Latest ‘Whistleblower’ Probed By House Intel, IG, Fired From DHS (ZH)

On Wednesday, Rep. Adam Schiff (D-CA) has unveiled a new whistleblower – former DHS intelligence official Brian Murphy, who claims that Trump administration officials at the White House and Department of Homeland Security suppressed intelligence reports that Russia is interfering in the 2020 election, and ‘altered intelligence’ related to comments made by President Trump. “We’ve received a whistleblower complaint alleging DHS suppressed intel reports on Russian election interference, altered intel to match false Trump claims and made false statements to Congress,” Schiff tweeted, adding “We will investigate.” Except, Schiff did investigate – his whistleblower – for allegedly ‘providing incomplete and potentially misleading information to Committee staff,’ according to the New York Times.

Not only that, Murphy was fired from his job as the head of DHS’s intelligence branch and reassigned after he compiled reports about protesters and journalists reporting on the Trump administration’s response to the riots in Portland, Oregon in July. “Brian Murphy, the acting under secretary for intelligence and analysis, was reassigned to a new position in the department after his office disseminated to the law enforcement community “open-source intelligence reports” containing Twitter posts of journalists, noting they had published leaked unclassified documents, according to an administration official familiar with the matter. It was not clear what Mr. Murphy’s new position would be.” -New York Times As a result of Murphy’s actions, acting DHS Secretary Chad Wolf asked the Inspector General to investigate.

“Sullivan’s court appointed amicus response brief is due [today]..”

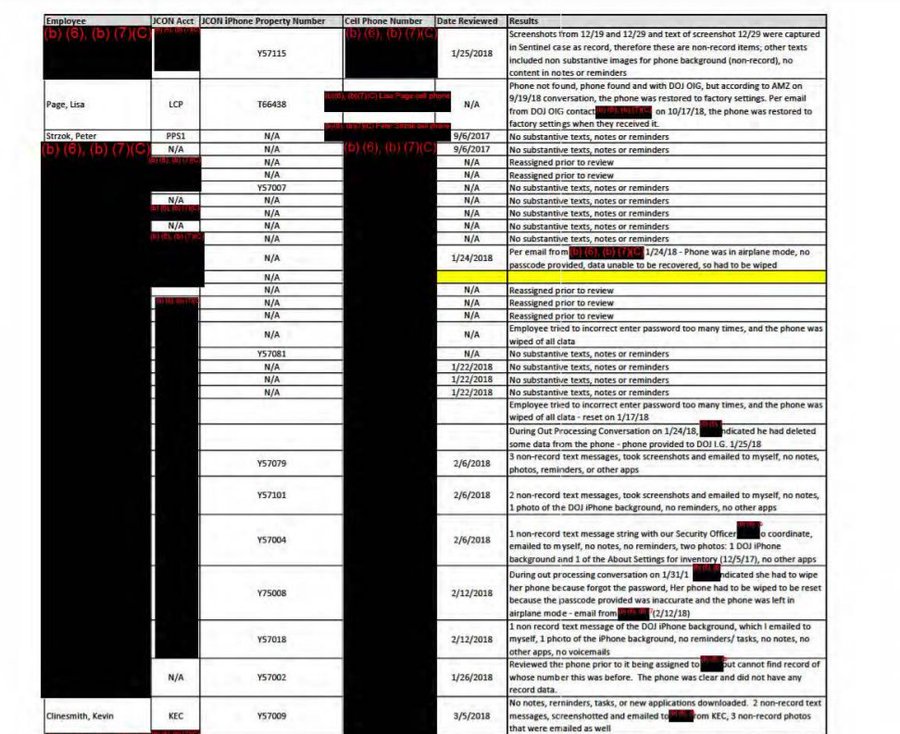

• Sidney Powell On Weissmann/Mueller Special Counsel Destroying Evidence (CT)

Michael Flynn defense attorney Sidney Powell appears for an interview with Liz MacDonald to discuss the developments in the Flynn case (note: Sullivan’s court appointed amicus response brief is due tomorrow), and the background information recently highlighted. As you review this interview, retain the 30,000/ft perspective. Ms. Powell also discusses the Weissmann/Mueller special counsel erasing evidence by wiping phones and hiding evidence of their corrupt activity. Additionally, Liz Mac circles back to the 2017 FISA report by Rosemary Collyer to support the most recent 2019 opinion filed by the FISA court showing the NSA database search abuse is ongoing.

(1) We know to a demonstrable certainty the special counsel took apart the FBI investigative file of Washington Field Office Supervisory Special Agent Brian Dugan in order to protect their corrupt investigation and the collaborative effort of the Senate Intelligence Committee. And Durham/Aldenberg knows that we know. (2) We also know with a high degree of certainty the special counsel created a missing Woods File for the Carter Page application when the IG started sniffing around and announced his intent to review the four FISA applications. And Durham/Aldenberg knows that we have strong, very strong, evidence pointing in that direction. (3) And now today we discover the same special counsel team destroyed their iPhones in an effort to cover their tracks. These three events all happened within an almost identical time-frame. C‘mon man… this is not coincidental.

“At least 27 phones used by the Mueller team were wiped before they could be checked for records.”

• DOJ Records Show Members Of Mueller Team Wiped Phones During Trump Probe (Fox)

Newly released records from the Department of Justice show that the cell phones of multiple people on then-Special Counsel Robert Mueller’s investigative team were “wiped” for various reasons during the probe. The records show at least several dozen phones were wiped of information because of forgotten passcodes, irreparable screen damage, loss of the device, intentional deletion or other reasons — and came before the DOJ’s Office of Inspector General (OIG) could review the devices. The documents show that Mueller deputy Andrew Weissman “accidentally wiped” his phone twice after entering the wrong passcode too many times in March 2018. Lawyer James Quarles’ phone “wiped itself” without his intervention, the records say. The documents were released after a lawsuit from the conservative watchdog group Judicial Watch.

[..] The records indicate Attorney Greg Andres phone was also wiped due to a forgotten passcode. And they say the phones of both Mueller deputy Kyle Freeny and Rush Atkinson were wiped accidentally after they entered the wrong passcode too many times. The records say that a phone belonging to FBI lawyer Lisa Page – whose anti-Trump texts with FBI agent Peter Strzok were of interest to investigators — was restored to factory settings when the inspector general’s office received it. Other officials, whose names are redacted, claim to have unintentionally restored their phone to its factory settings, deleting all records of communication. Next to the name of one redacted person, the record says: “Phone was in airplane mode, no passcode provided, data unable to be recovered so had to be wiped.”

“The analysts note that the Chinese economy will be closing the gap with the US and could finally outperform it by the end of the decade.”

But doesn’t China’s growth come from globalization?

• Say Goodbye To Globalization, ‘The Age Of Disorder’ Is Coming – Deutsche (RT)

The four-decade era of globalization may be coming to an end, and we could be entering “The Age of Disorder,” which will reshape both economies and politics, Deutsche Bank analysts have said in a new research note. One of the key characteristics of the new era will be the reversal of unfettered globalization, a team of analysts led by strategist Jim Reid predicted. While we saw “the best combined asset price growth of any era in history, with equity and bond returns very strong across the board” since 1980, “the Age of Disorder” is likely to break this trend. Deteriorating US-China relations is another theme (out of eight) that will define the next distinct era of modern times, “which is hastened, but not caused by, the pandemic.” The analysts note that the Chinese economy will be closing the gap with the US and could finally outperform it by the end of the decade.

“A clash of cultures and interests therefore beckons, especially as China grows closer to being the largest economy in the world,” the report says. Fortunately, this economic standoff is unlikely to trigger a real military conflict between the two states, as usually happens when a rising power tries to challenge the ruling one. Economic war – with tariffs, sanctions, and attacks in the technology sphere – will go on instead, the analysts believe. No matter who wins the 2020 presidential election in the US, the rift between the two superpowers will grow. While the coronavirus crisis has already put the European economy at a crossroads, Deutsche Bank says that the next decade may become “a make-or-break decade for Europe.” Among other factors defining the future are higher debt and helicopter money (distributing cash to the public) becoming mainstream – policies which are likely to spike inflation.

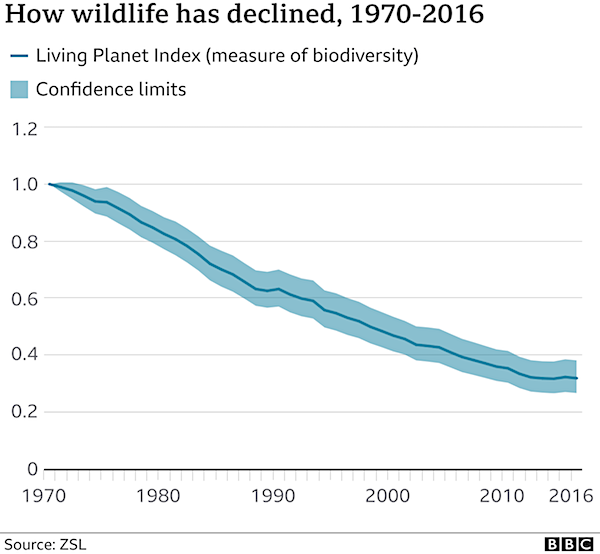

Inequality may even get worse in the post-Covid-19 world, before a backlash and reversal takes place, the bank says. Inequality is closely connected with the intergenerational gap, but the analysts expect that the number of younger voters will exceed those born before 1980 by the end of the decade. This could lead to major policy changes in many spheres – from taxes to climate.

Doctors and pharmacists always tend to play “hard to understand”. And so do central bankers.

• Trouble Mounts For The ECB And Christine Lagarde (NaYM)

Today is ECB ( European Central Bank ) day where we get the results of their latest deliberations. We may get a minor move but essentially it is one for what we have come to call open mouth operations. This is more than a little awkward when the President has already established a reputation for putting her Hermes shod foot in her mouth. Who can forget this from March 12th? “Lagarde: We are not here to close spreads, there are other tools and other actors to deal with these issues.” If you are ever not sure of the date just take a look at a chart of the Italian government bond market as it is the time when the benchmark ten-year yield doubled. As many put it the ECB had gone from “Whatever it takes” to “Whatever.”

This issue has continued and these days President Lagarde reads from a script written for her which begs the issue of whether the questions from the press corps are known in advance? It also begs the issue of who is actually in charge? This is all very different from when prompted by an admiring Financial Time representative she was able to describe herself as a “wise owl” like her brooch. Whoever was in charge got her to change her tune substantially on CNBC later and got a correcting footnote in the minutes. “I am fully committed to avoid any fragmentation in a difficult moment for the euro area. High spreads due to the coronavirus impair the transmission of monetary policy. We will use the flexibility embedded in the asset purchase programme, including within the public sector purchase programme. The package approved today can be used flexibly to avoid dislocations in bond markets, and we are ready to use the necessary determination and strength.”

Next comes her promise to unify the ECB Governing Council and have it singing from the same hymn sheet, unlike the term of her predecessor Mario Draghi. This has been crumbling over the past day or two as we have received reports of better economic expectations from some ECB members. This has been solidified by this in Eurofi magazine today. “Now that we have moved past the impact phase of the shock, we can shift our attention toward the recovery phase. Recently, forward looking confidence indicators look robust, while high frequency data suggest that mobility is recovering. These developments solidify the confidence in our baseline projection with a more favorable balance-of-risks. However, even if no further setbacks materialize economic activity will only approach pre-corona levels at the end of 2022.”

That is from Klass Knot the head of the DNB or Netherlands central bank and any doubts about his view are further expunged below. “Relying too heavily on monetary policy to get the job done might have contributed to perceptions of a “central bank put” in the recovery from the euro area debt crisis, where the ECB bore all of the downside risk to the economy.” Might?!

Sleeping by the side of the road with little children, while cars rush by. The local stores won’t sell them anything, including water.

• Misery In Moria Is Europe’s Migration Policy (Howden)

Five years ago, when the refugee camp at Moria was still just a bad idea, a local army officer was asked to assess the site. Surveying the hillside of olive groves, Stavros Miroyiannis warned the authorities they were going to “build a favela.” If they had to choose this site, he said, they should at least plan the camp as they would a village. They ignored him on both counts. Miroyiannis would go on to put his own advice into practice a few kilometers away as the camp manager at Lesvos’ much smaller and more humane Kara Tepe camp. Meanwhile, Moria, which burned to the ground this week, came to resemble a detention camp and function like the slum he predicted. And yet, while the ashes of Moria are still smoldering, the one certainty is that it will be rebuilt.

Moria, in all its miserable, dehumanizing squalor, was designed to be that way. It was not a mistake. The camp was the product of political calculations in Brussels and European capitals and that calculus has not changed. It is fireproof. When thousands, and then tens of thousands, of asylum seekers began to arrive by sea on Greece’s islands in 2015, the European Union’s strategic response was the creation of so-called “hot spots.” Moria was the largest and most notorious of these, and its architecture and evolution most graphically demonstrated its true intention. Its concrete terraces, nested fences and razor wire amounted to an anti-shelter. It was not meant to receive and give shelter, it was a spectacle intended to deter future asylum seekers.

Moria became the emblem of an EU deterrence policy in which the warehousing of asylum seekers in humiliating circumstances was the point. Any other approach was and is seen as creating a “pull factor” that will attract another 2015-style surge of arrivals. Migration experts have spent the last five years explaining to policymakers why this is not true but the base assumption has proven to be impervious to evidence. The European deterrence consensus is concealed behind technocratic jargon like “managed migration” but it is really evidence that the Continent prefers to pay the poor to contain the poorest. Europe’s leaders no longer care whether human warehouse fees are paid to Turkey or to Greece, or spent on a lower cost per capita basis in Jordan or Lebanon. The deal that underpins the consensus was the EU-Turkey statement unveiled in 2016.

That agreement foresaw Turkey preventing the departure for Europe of the vast majority of asylum seekers in return for billions of euros in financial assistance. The terms transformed refugees and migrants into a commodity that could be leveraged by the unpredictable and autocratic regime of Turkish President Recep Tayyip Erdogan When the deal collapsed six months ago, it quickly became apparent that there were no new ideas on the EU side. All diplomatic efforts have dwelt on renegotiating the old deal with some minor tweaks. Meanwhile, the dreadful logic of its original terms has reached its inevitable, damaging conclusion: People trying to access asylum in Europe are cast not as “people like us” but an invading horde — weapons in an asymmetric war.

He is from Iraq. He lost his 2yo brother in the wavy Aegean sea, 9 months ago when he was trying to reach the coast of #Lesbos #Greece

His tent in #Moria got burned.

After all these, he keeps studying English. Sitting in the middle of nowhere. @BILD pic.twitter.com/EBJT8GXAND— Liana Spyropoulou (@LSpyropoulou) September 10, 2020

“We must be tough with the Turkish government and not with the Turkish people who deserve more than the Erdogan government..”

• Macron: ‘Turkey Is No Longer A Partner In East Mediterranean’ (RT)

The Turkish Foreign Ministry said on Thursday that the French president’s critical comments on the standoff in the eastern Mediterranean are a sign “of his own weakness and despair.” Macron “has again made an arrogant… statement,” the ministry in Ankara said after the French president urged European leaders earlier in the day to stand up to Turkey’s “unacceptable provocations.” He hosted an emergency summit in Corsica with seven leaders of EU countries that border the Mediterranean Sea at a time when Ankara seeks to expand its energy resources and influence in the eastern Mediterranean. The meeting came amid fears of an open conflict with Turkey stemming from tensions over offshore oil and gas drilling. Ankara has already lashed out at France and the EU for siding with Greece and Cyprus in the dispute.

Ahead of the Med-7 Summit, Macron said that “Turkey is no longer a partner in the Mediterranean region.” He made it clear that the meeting was summoned to clarify “red lines” if a “fruitful dialogue” with Turkey was to restart. The EU states should avoid an escalation, but that does not mean they should be passive in disputes with Ankara, Macron said. “We must be tough with the Turkish government and not with the Turkish people who deserve more than the Erdogan government,” the French leader was quoted as saying. “All unilateral actions of Turkey, such as the Turkish-Libyan memorandum, without respecting the rights of Greece, are unacceptable.”

Apart from the Foreign Ministry in Ankara, Turkey’s ruling party did not leave Macron’s comments unnoticed either, accusing him of extending his country’s “long history of colonialism.” Omer Celik, spokesman for the Justice and Development (AK) Party, described the French leader’s statement as an “old and immoral game” of colonialists. “They offered a false show of love to exploit the people, but targeted patriotic leaders,” he tweeted.

“The cattle brands on their faces tell a story more tragic than anything produced by Hollywood. These are slaves: human beings bought and sold for their labor.”

• The Plot Against Libya: An Obama-Biden-Clinton Criminal Conspiracy (Draitser)

The scorching desert sun streams through narrow slats in the tiny window. A mouse scurries across the cracked concrete floor, the scuttling of its tiny feet drowned out by the sound of distant voices speaking in Arabic. Their chatter is in a western Libyan dialect distinctive from the eastern dialect favored in Benghazi. Somewhere off in the distance, beyond the shimmering desert horizon, is Tripoli, the jewel of Africa now reduced to perpetual war. But here, in this cell in a dank old warehouse in Bani Walid, there are no smugglers, no rapists, no thieves or murderers. There are simply Africans captured by traffickers as they made their way from Nigeria, Cameroon, Chad, Eritrea, or other disparate parts of the continent seeking a life free of war and poverty, the rotten fruit of Anglo-American and European colonialism.

The cattle brands on their faces tell a story more tragic than anything produced by Hollywood. These are slaves: human beings bought and sold for their labor. Some are bound for construction sites while others for the fields. All face the certainty of forced servitude, a waking nightmare that has become their daily reality. This is Libya, the real Libya. The Libya that has been constructed from the ashes of the US-NATO war that deposed Muammar Gaddafi and the government of the Libyan Arab Jamahiriya. The Libya now fractured into warring factions, each backed by a variety of international actors whose interest in the country is anything but humanitarian. But this Libya was built not by Donald Trump and his gang of degenerate fascist ghouls.

No, it was the great humanitarian Barack Obama, along with Hillary Clinton, Joe Biden, Susan Rice, Samantha Power and their harmonious peace circle of liberal interventionists who wrought this devastation. With bright-eyed speeches about freedom and self-determination, the First Black President, along with his NATO comrades in France and Britain, unleashed the dogs of war on an African nation seen by much of the world as a paragon of economic and social development. But this is no mere journalistic exercise to document just one of the innumerable crimes carried out in the name of the American people. No, this is us, the antiwar left in the United States, peering through the cracks in the imperial artifice – crumbling as it is from internal rot and political decay – to shine a light through the gloom named Trump and directly into the heart of darkness. There are truths that must be made plain lest they be buried like so many bodies in the desert sand.

To understand the depth of criminality involved in the US-NATO war on Libya, we must unravel a complex story involving actors from both the US and Europe who quite literally conspired to bring about this war, while simultaneously exposing the unconstitutional, imperial presidency as embodied by Mr. Hope and Change himself. In doing so, a picture emerges that is strikingly at odds with the dominant narrative about good intentions and bad dictators. For although Gaddafi was presented as the villain par excellence in this story told by the Empire’s scribes in corporate media, it is in fact Barack Obama, Hillary Clinton, Joe Biden, former French President Nicholas Sarkozy, French philosopher-cum-neocolonial adventurist Bernard Henri-Levy, and former UK Prime Minister David Cameron, who are the real malevolent forces. It was they, not Gaddafi, who waged a blatantly illegal war on false pretenses and for their own aggrandizement. It was they, not Gaddafi, who conspired to plunge Libya into chaos and civil war from which it is yet to emerge. It was they who beat the war drums while proclaiming peace on earth and good will to men.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Trump 9/11

Two days after the 9/11 attack @realDonaldTrump was at Ground Zero with hundreds of workers that he paid of his own pocket to help find and identify victims.

This was much before he was even thinking of running for @POTUS.

He's been a patriot to the country he loves for ever. pic.twitter.com/svywb8AXee

— Joel Fischer (@JFNYC1) September 10, 2020

Support the Automatic Earth in virustime.