Dorothea Lange Salvation Army, San Francisco, California. Unemployed young men 1939

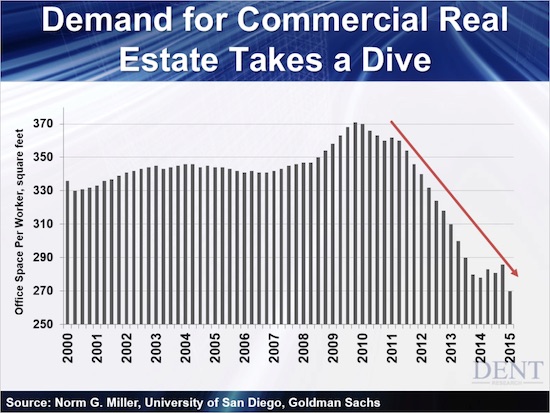

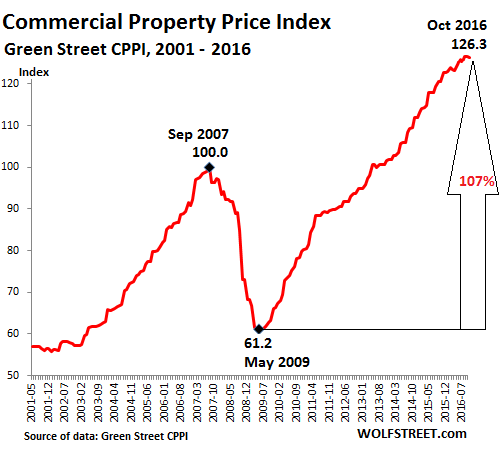

“The Green Street Commercial Property Price Index has soared 107% from the trough in May 2009 and now exceeds the peak of the totally crazy bubble in 2007 by 26%“.

• Who’ll Get Hit by Fallout of $11 Trillion US Commercial Property Bubble? (WS)

Warnings about the loans, bonds, and commercial-mortgage-backed securities (CMBS) tied to the vast $11-trillion commercial property sector in the US have been hailing down for months. Moody’s Investor Services just warned about the rising delinquency rate of some $360 billion in CMBS it rates. Delinquencies of 60+ days jumped from 4.6% last year to 5.6% in September. Fitch Ratings has been fretting about valuations in the sector, and CMBS, for months. “Valuation and lending trends are not sustainable in the medium term,” it said most recently in its November report. It pinpointed debt backed by apartment buildings as a particular trouble spot. But now it’s also fretting about construction loans, which “experienced the highest loss severity in the last crisis, and we expect a similar trend in the next downturn,” it said.

It’s worried about the banks, whose commercial real estate (CRE) lending has reached “record levels”: “All of the most concentrated banks – those with more than 300% of risk-based capital in CRE – have less than $50 billion in assets and most have assets below $10 billion. These smaller banks also have varying degrees of sophistication in their risk management practices.” Fitch laments that the “timing and severity of this softening is uncertain and depends on factors including interest rates and overall economic conditions.” Alas, since the report was released on Election Day, interest rates have alread jumped. This comes at the worst possible moment, at the peak of the most gigantic CRE price bubble the US has ever seen. The Green Street Commercial Property Price Index has soared 107% from the trough in May 2009 and now exceeds the peak of the totally crazy bubble in 2007 by 26%:

Let’s see if a normal economy can still work.

• US Mortgage Applications Crash 30% As Borrowing Rates Surge (ZH)

Dear Janet…In the last few months, as The Fed has jawboned a rate hike into markets, mortgage applications in America have collapsed 30% to 10-month lows – plunging over 9% in the last week as mortgage rates approach 4.00%.

We suspect the divergent surge in homebuilders is overdone…

“We don’t want the U.S. government purchasing companies in the United States, why would we want the Chinese Communist government purchasing companies in the United States?”

• Congressional Panel Urges Ban On China State Firms Buying US Companies (R.)

U.S. lawmakers should take action to ban China’s state-owned firms from acquiring U.S. companies, a congressional panel charged with monitoring security and trade links between Washington and Beijing said on Wednesday. In its annual report to Congress, the U.S.-China Economic and Security Review Commission said the Chinese Communist Party has used state-backed enterprises as the primary economic tool to advance and achieve its national security objectives. The report recommended Congress prohibit U.S. acquisitions by such entities by changing the mandate of CFIUS, the U.S. government body that conducts security reviews of proposed acquisitions by foreign firms.

“The Commission recommends Congress amend the statute authorizing the Committee on Foreign Investment in the United States (CFIUS) to bar Chinese state-owned enterprises from acquiring or otherwise gaining effective control of U.S. companies,” the report said. CFIUS, led by the U.S. Treasury and with representatives from eight other agencies, including the departments of Defense, State and Homeland Security, now has veto power over acquisitions from foreign private and state-controlled firms if it finds that a deal would threaten U.S. national security or critical infrastructure. If enacted, the panel’s recommendation would essentially create a blanket ban on U.S. purchases by Chinese state-owned enterprises.

The panel’s report is purely advisory, but could carry extra weight this year because they come as President-elect Donald Trump’s transition team is formulating its trade and foreign policy agenda and vetting candidates for key economic and security positions. Congress also could be more receptive, after U.S. voter sentiment against job losses to China and Mexico helped Republicans retain control of both the House and the Senate in last week’s election. Trump strongly criticized China throughout the U.S. election campaign, grabbing headlines with his pledges to slap 45 percent tariffs on imported Chinese goods and to label the country a currency manipulator on his first day in office. “Chinese state owned enterprises are arms of the Chinese state,” Dennis Shea, chairman of the U.S.-China Economic and Security Review Commission, told a news conference. “We don’t want the U.S. government purchasing companies in the United States, why would we want the Chinese Communist government purchasing companies in the United States?”

Normalization?

• Foreign Central Banks Liquidate Record $375 Billion In US Paper (ZH)

One month ago, when we last looked at the Fed’s update of Treasuries held in custody, we noted something troubling: the number had dropped sharply, declining by over $22 billion in one week, one of the the biggest weekly declines since January 2015, pushing the total amount of custodial paper to $2.805 trillion, the lowest since 2012. One month later, we refresh this chart and find that in last week’s update, foreign central banks continued their relentless liquidation of US paper held in the Fed’s custody account, which tumbled by another $14 billion over the course of a week, pushing the total amount of custodial paper to $2.788 trillion, a new post-2012 low.

Today, to corroborate the disturbing weekly slide in the Fed’s custody data, we also got the latest monthly Treasury International Capital data for the month of September, which showed that the troubling trend presented one month ago, has accelerated to an unprecedented degree. Recall that a month ago, we reported that in the latest 12 months we have observed a not so stealthy, actually make that a massive $343 billion in Treasury selling by foreign central banks in the period July 2015- August 2016, something unprecedented in size. Fast forward to today when in the latest monthly update for the month of September, we find that what until a month ago was “merely” a record $346.4 billion in offshore central bank sales in the LTM period ending August 31 has – one month later – risen to a new all time high $374.7 billion, or well over a third of a trillion in Treasuries sold in the past 12 months.

Among the biggest sellers – on a market-price basis – not surprisingly was China, which in August “sold” $28 billion in US paper (the actual underlying number while different, as this particular series is adjusted for Mark to Market variations, will be similar), bringing its total to $1.157 trillion, the lowest amount of US paper held by Beijing since 2012.

It wasn’t just China: Saudi Arabia also continued to sell its TSY holdings, and in August its stated holdings (which again have to be adjusted for MTM), dropped from $93Bn to $89Bn, the lowest since the summer of 2014. This was the 8th consecutive month of Treasury sales by the Kingdom, which held $124 billion in TSYs in January, and has since sold nearly 30% of its US paper holdings.

Eyewitness: “97% of the Indian economy is cash-based. With 88% of all outstanding currency no longer usable, the economy is coming to a standstill.”

• Panic In India As Gold Price Skyrockets After Currency Ban (AM)

I went to convert my banned banknotes into new ones. The largest amount one can have converted is Rs 4,000 ($60), until further notice. There was a huge rush of people at the bank. Arguments were erupting, as people refused to stand in queues and the banks gave no explanation of what needed to be done. Fights were breaking out. Amid the chaos I finally learned that there were three queues I had to go through in a sequence. I had to get a form from one counter, which I had to fill in with my name and address, my ID card details, the serial numbers of all the bills I wanted to exchange, and my cell-phone number. At the second counter, I then had to present the completed form along with a photocopy of my ID card. I had to sign on the photocopy which an official then stamped.

With my banknotes, the form and the photocopy of my ID card, I then went to the next queue to get my currency converted at a third counter. The whole process took about two hours. For most people in the busier parts of the cities, it took much longer.Anyone who thinks that a country which wastes two hours of every citizen’s life to convert his own $60 can ever hope to be an economic power is drinking too much Kool-Aid and cannot do primary level math. Forget any possibility of removing unaccounted for money or reducing corruption, what Modi is doing is a recipe for the destruction of whatever legitimate economy there is. That same afternoon, I went to the post office with a friend who wanted to get his money converted. After waiting a long time there, we found out that the post office had run out of cash.

Since then most ATMs have had limited amounts of cash available and banks keep running out of cash as well. The queues have continued to grow. People start lining up late into the night waiting for banks to open and still have to go back home with no cash. What started with two hours of queuing is becoming an endless slog now. Half of India’s citizens do not have a bank account and around 25% do not even have an ID card. These are the country’s poorest people, who have no way of converting their money – even if they learn how to do it, which is already a nigh insurmountable hurdle. Also, those who are old, disabled or sick have no choice but to suffer, for without personally visiting a bank branch office, one cannot convert one’s banknotes. 97% of the Indian economy is cash-based. With 88% of all outstanding currency no longer usable, the economy is coming to a standstill.

The daily-wage laborer, who leads a hand-to-mouth existence in a country with GDP per capita of a mere $1,600, no longer has work, as his employer has no cash to pay his wages. His life is in utter chaos. He is not as smart as Modi — despite the fact that Modi has no real life experience except as a bully and perhaps in his early days as a tea-seller at a train-station. He has no clue where his life is headed from here. These people are going hungry, and some have begun to raid food shops. People are dying for lack of treatment at hospitals. Old people are dying in the endless queues. Some are killing themselves, as they are unable to comprehend the situation and simply don’t know what to do. There are now hundreds of such stories in the media.

There are now voices that claim Modi used the measure to deprive oppositon parties of their campaign cash. Elections coming up in a key state.

• Modi May Need Six More Months to Replace India’s Junk Banknotes (BBG)

For Indians expecting respite from the government’s clampdown on cash, here’s a reality check: it probably won’t come soon. Prime Minister Narendra Modi’s administration may need until May 2017 to replenish the stock of now worthless bills, according to Saumitra Chaudhuri, an economist who advised Modi’s predecessor. The government on Nov. 8 banned 500 ($7.5) and 1,000 rupee notes in a surprise move against graft and tax evasion. Delays in replacing the currency risk prolonging the pain in the $2 trillion economy, where about 98 percent of consumer payments are made in cash. Deutsche Bank predicts the crunch could easily shave off a half-point from India’s growth in October-December, which could imperil its position as the world’s fastest-growing major market.

This is how Chaudhuri reached his conclusion, which he published in a blog post on the Economic Times’ website: Extrapolating from central bank data, he estimates that Modi’s move sucked out about 16.6 billion notes of the 500-denomination, and 6.7 billion 1,000-rupee bills. That means more than 23 billion notes totaling 15 trillion rupees. Modi intends to replace these with new 2,000-rupee and 500-rupee bills. However, Bharatiya Reserve Bank Note Mudran Pvt., which prints the higher denomination currency, has a stated capacity of just 1.3 billion notes a month. That’s with working double shifts. Raise this to triple shifts and it becomes 2 billion bills, which means it will need until the end of 2016 to replenish in value the 1,000-rupee notes.

Security Printing & Minting Corporation of India Ltd., whose capacity Chaudhuri estimates at 1 billion pieces a month, will need several more months to meet the 500-rupee target, even if it joins forces with BRBNM, he said. “Ergo, currency shortages will remain with us for many months and economic contraction will rule this period,” he wrote. “At the end of the period, confidence will be at new lows and recovery will take time.” In what could make matters worse, the presses – busy with the new bills – have almost completely stopped printing 100-rupee notes, Bloomberg Quint reported Wednesday citing central bank sources it didn’t name. These bills are the bread-and-butter of India’s $780 billion informal economy, which employs more than 90 percent of the workforce.

“..at the next NATO summit, in the spring of 2017, and Secretary General Jens Stoltenberg had planned to extend a hearty welcome to the new US president, Hillary Clinton.” “..even the female English pronouns “she” and “her” had crept into internal written correspondence..”

• NATO Prepares for Trump Presidency (Spiegel)

Everything had been so perfectly planned. Construction of the new NATO headquarters building near the Brussels Airport, a giant glass-and-steel structure to house the world’s most powerful military alliance in the future, will have cost more than €1 billion ($1.07 billion) by the time it opens next year. The mammoth building was supposed to be officially dedicated at the next NATO summit, in the spring of 2017, and Secretary General Jens Stoltenberg had planned to extend a hearty welcome to the new US president, Hillary Clinton. At least that’s how officials at NATO headquarters planned it. Anything else seemed unthinkable. So unthinkable that even the female English pronouns “she” and “her” had crept into internal written correspondence to refer to the future occupant of the White House.

But there will be no female president. Instead of Clinton, a reliable partner and good, old acquaintance in many trans-Atlantic circles, Donald Trump will be coming to Brussels – the same man who described the alliance as “obsolete” in his campaign. If he even comes, that is. Fearing that Trump won’t even attend the NATO summit, only a few weeks after his inauguration, the alliance has postponed the event. A meeting of NATO leaders without the presence of the American president, after all, would be a signal of its decline. Now organizers are envisioning a date next summer, in the hope that, by then, Trump will have recognized that the United States will also need NATO in the future. There are enormous doubts that this will happen. Consternation over the election of Donald Trump as the next US president is especially great within the Brussels alliance.

[..] In their most favorable scenario, the NATO strategists assumed that the new US president would only strictly insist that the Europeans spend more money on their security. During the campaign, after all, Trump left no doubt that he intends to radically change burden sharing within the Western alliance. One of Trump’s closest advisers, General Mike Flynn, the former head of US military intelligence, told SPIEGEL in an interview in July that, when it comes to money, Trump will pay little attention to the carefully tended harmony in the alliance. “We have to have these alliances going forward and see who’s going to pay for them,” Flynn said. He added that “NATO as a political alliance does need to be relooked at in terms of everything, (including) resourcing and capabilities,” soon after Trump’s administration takes office.

At the 2014 NATO summit in Wales, the member states agreed to a goal of spending 2% of their national GDP on defense. But few countries are currently meeting that goal. Germany, the second-strongest economy in the alliance, next to the United States, spends only 1.19% of its GDP on defense. Trump is now threatening to make the mutual defense commitment under Article 5 dependent on fulfilling this goal, or even to increase the%age. For Germany, 2% would already signify a dramatic increase in the defense budget, from about €34 billion today to roughly €65 billion. In any case, NATO officials are preparing themselves for growing demands on the Europeans. “Europe has no other choice: It has to strengthen the European column in NATO,” says EU foreign policy expert Alexander Graf Lambsdorff, a member of the pro-business Free Democratic Party.

Global trade again. Plummeting exports and imports across Asia.

• Singapore’s Recession Risk Rises As October Exports Show 12% Decline (R.)

Singapore’s exports in October shrank more than expected as sales to major markets fell, with those to Europe contracting sharply and raising risks of a recession in the trade-dependent economy. Non-oil domestic exports (NODX) skidded 12% last month from a year earlier, the trade agency International Enterprise Singapore said in a statement on Thursday, far worse than the median forecast of a 3.5% decline in a Reuters poll. In September, overseas shipments slumped a revised 5% on-year though the decline in sales to China slowed. On a month-on-month, seasonally adjusted basis, exports decreased 3.7% in October, missing a forecast of a 1% slide in the survey. Exports to the EU contracted 28.6% last month from a year earlier, compared with 9.9% growth in September. Contraction in sales of pharmaceuticals, non-electric engines & motors, as well as personal computers led the decline in October.

It’s not even a black swan. I’ve warned of this risk for a long time. Without constructing bubble upon bubble, and without the shadow system that finances them, China has a long way to fall.

• China Civil War Is the Real Black Swan (RV)

TL Tsim has studied the Chinese political scene since the 1980s, with a background in journalism, including the South China Morning Post and Hong Kong Economic Journal before starting his own consultancy. In an interview with Real Vision TV he said the greatest misconception among its people is that Chinese dynasties are super stable structures that last a long time. That’s not really the case, he argued, because none of them lasted longer than the Habsburgs in Austria, who ruled for over 800 years. The last one in China – the Qing dynasty – lasted 260 years, which is much shorter in comparison. People also underestimate the length of the civil wars between Chinese dynasties, which can last for 150 years, he adds. “That is something most Chinese people do not understand. And it has a bearing on the way we go forward,” Tsim said.

“In spite of all of the intelligence, the learning, and the experience of the Chinese people over 5,000 years, they have not come up with a system of government which can deal with the effective and peaceful transfer of power. In the West, you do it through the ballot box. So Brexit is Brexit. You accept it. But in China, the fight goes on.” The shortest dynasty of any size and power in Chinese history was the Yuan dynasty, which lasted just less than 100 years, Tsim said. “This government, this administration, the Chinese Communist Party, came to power in 1949. And so it’s been around for 67 years. “We don’t know when something like the Russian collapse, the implosion of the former Soviet Union might take place. We don’t know whether this is going to be the Yugoslavian model, when the country broke up into six or seven parts. So to speculate on the timing of it is something I do not do.“

But it is not idle to speculate on how this is going to happen. The most likely scenario is a power struggle over-spilling into a coup d’etat and then over-spilling into civil war. That would be the trajectory.” The real concern for Tsim – and he said for the Chinese leaders as well– is that if you look at the breakup of the former Soviet Union, the problem was internal, arising out of disagreements within the center of the party itself. [..] “And sadly, I think we’re not going to see a Yugoslavian model either, because there they did have a civil war. But the civil war– the war was small, in terms of size and scale, and didn’t last very long. That is not the Chinese model either. The Chinese model is a bitter, long-standing civil war– very destructive, very divisive. This is the real black swan.”

I know many people won’t like to, but I would recommend reading at least part of this very long expose. How racist is Trump? And how do you know?

• You Are Still Crying Wolf (Scott Alexander)

Back in October 2015, I wrote that the media narrative of Trump as “the white power candidate” and “the first openly white supremacist candidate to have a shot at the Presidency in the modern era” were being fabricated out of thin air. I said that “the media narrative that Trump is doing some kind of special appeal-to-white-voters voodoo is unsupported by any polling data”, and predicted that: “If Trump were the Republican nominee, he could probably count on equal or greater support from minorities as Romney or McCain before him.” Well, guess what? The votes are in, and Trump got greater support from minorities than Romney or McCain before him. You can read the Washington Post article, Trump Got More Votes From People Of Color Than Romney Did, or look at the raw data.

Trump made big gains among blacks. He made big gains among Latinos. He made big gains among Asians. The only major racial group where he didn’t get a gain of greater than 5% was white people. I want to repeat that: the group where Trump’s message resonated least over what we would predict from a generic Republican was the white population. Nor was there some surge in white turnout. I don’t think we have official numbers yet, but by eyeballing what data we have it looks very much like whites turned out in equal or lesser numbers this year than in 2012, 2008, and so on. The media responded to all of this freely available data with articles like White Flight From Reality: Inside The Racist Panic That Fueled Donald Trump’s Victory and Make No Mistake: Donald Trump’s Win Represents A Racist “Whitelash”.

I stick to my thesis from October 2015. There is no evidence that Donald Trump is more racist than any past Republican candidate (or any other 70 year old white guy, for that matter). All this stuff about how he’s “the candidate of the KKK” and “the vanguard of a new white supremacist movement” is made up. It’s a catastrophic distraction from the dozens of other undeniable problems with Trump that could have convinced voters to abandon him. That it came to dominate the election cycle should be considered a horrifying indictment of our political discourse, in the same way that it would be a horrifying indictment of our political discourse if the entire Republican campaign had been based around the theory that Hillary Clinton was a secret Satanist. Yes, calling Romney a racist was crying wolf. But you are still crying wolf.

But today’s headlines are all about unemployment reaching 11-year lows. Makes you wonder, doesn’t it?!

• One In Three UK Working Families Struggle To Pay Energy Bills (G.)

One in three working families struggle to pay their energy bills, it has been claimed, as pressure mounts on suppliers to do more to help poorer households move on to the cheapest deals. 29% of families do not put on the heating even when the house is cold, said comparison website uSwitch, while two-thirds fear cutting their energy use to save money will affect their family’s health. “It’s appalling that even families in work are struggling to pay their energy bills,” said uSwitch’s energy expert, Claire Osborne. “Suppliers must play their part by doing all they can to help their customers move to their best deal.” The energy regulator, Ofgem, backed calls for suppliers to alert customers to cost-saving schemes such as the warm home discount (WHD).

The initiative forces firms with more than 250,000 customers to offer a £140 discount to low-income pensioners and other vulnerable groups, though it has been criticised for long delays in delivering the reduction. “We want suppliers to engage more actively with customers, particularly those on standard variable tariffs, to help them get a better deal,” said an Ofgem spokesperson. This week the business minister criticised energy companies amid claims they were profiteering from deals that do not offer good value. “Customers who are loyal to their energy supplier should be treated well, not taken for a ride, and it’s high time the big companies recognised this,” Greg Clark said. “I have made clear to the big firms that this can’t go on and they must treat customers properly or be made to do so.”

I’ll keep saying that a basic income for only parts of a society -as the pilot is set up- is doomed to fail.

• Canadian Province To Give Every Citizen $1,320 Basic Income (Ind.)

A Canadian province is to run a pilot project aimed at providing every citizen a minimum basic income of $1,320 a month. The provincial government of Ontario confirmed it is holding public consultations on the $25m (£15m) project over the next two months, which could replace social assistance payments administered by the province for people aged 18 to 65. People with disabilities will receive $500 more under the scheme, and individuals who earn less than $22,000 (£13,000) a year after tax will have their incomes topped up to reach that threshold. The pilot report was submitted by Conservative ex-senator Hugh Segal, who suggested the project should be tested on three distinct sites: in the north, south and among the indigenous community of Ontario.

Areas with high levels of poverty and food insecurity should be chosen for the test project, Mr Segal recommended. “It is in fact the precinct of rational people when looking to encourage work and community engagement and give people a floor beneath which they’re not allowed to fall,” he said. “We can do this for seniors without having to add any more bureaucrats or civil servants, we respect their freedom to choose, we give them the money, they decide what’s important. Why would we treat other poor people differently? “What Ontario is doing is saying let’s have a pilot project, let’s calculate the costs, let’s calculate the positive and the nudge effects behaviourally.” Mr Segal confirmed that participation in the project, which is due to launch in spring 2017, will be voluntary and promised “no one would be financially worse off as a result of the pilot”.

he can defend it all he wants, but defending the past shows you are blind to the present.

• Obama Defends Globalization On Germany Visit (BBC)

US President Barack Obama has made a strong defence of globalisation as he arrived in Germany on his final visit to Europe before leaving office. In a joint article, Mr Obama and German Chancellor Angela Merkel said that with the global economy developing faster than ever, co-operation was vital. Mr Obama arrived in Germany from Athens where he had warned of threats to modern democracy. He is seeking to calm unease following the election of Donald Trump. In the article in the business magazine, Wirtschaftswoche (in German), he and Mrs Merkel made a strong case for international trade in contrast to Mr Trump’s more protectionist stance. “There will be no return to a world before globalisation,” they wrote. “We owe it to our companies and our citizens, indeed to the entire world community, to broaden and deepen our co-operation.”

The two leaders voiced support for the proposed Trans-Atlantic Trade and Investment Partnership (TTIP) between the US and the EU. By contrast, Mr Trump is a fierce critic of global free trade agreements and welcomed the UK’s decision in June to leave the EU. In Athens, Mr Obama acknowledged that globalisation had created a “sense of injustice” and a “course correction” was needed to address growing inequality. “When we see people, global elites, wealthy corporations seemingly living by a different set of rules, avoiding taxes, manipulating loopholes… this feeds a profound sense of injustice,” he told Greek leaders. Mr Obama’s visit to Greece was marked by street protests by leftist groups which denounced US “imperialism”. Police used tear gas against about 2,500 demonstrators who had tried to reach the city centre on Tuesday. The US president will stay in Germany until Friday and then head to Peru.

But the words were again empty.

• Athens Clings To Obama’s Words As Focus Shifts To Berlin (Kath.)

Greece on Wednesday hailed the support expressed by outgoing US President Barack Obama for debt relief for the country even as the latter arrived in Berlin for talks with German Chancellor Angela Merkel, whose country has consistently resisted restructuring Greece’s debt burden. Government spokesman Dimitris Tzanakopoulos expressed “satisfaction” with Obama’s references to the crucial issues of debt, the refugee crisis and Cyprus. “The US president made clear that austerity cannot lead to economic prosperity,” he said. Asked why an intervention by Obama in favor of Greek debt relief now that he is on his way out of the presidency should make a difference, Tzanakopoulos said that the situation in Europe is now very different and there is a shift against austerity.

“There is a very good possibility that by the end of the year we will have very positive developments as regards the Greek debt,” Tzanakopoulos said, noting that Athens was on course for a Eurogroup meeting on December 5. The spokesman described Obama’s visit as “an event of global significance” while sources indicated that the outgoing president had been “very friendly” to Prime Minister Alexis Tsipras. Earlier in the day, Obama delivered a stirring speech at the Stavros Niarchos Foundation Cultural Center, exalting the virtues of democracy and ancient Greece’s contribution to the modern world. “I came here with gratitude for all that Greece – ‘this small, great world’ – has given to humanity through the ages,” Obama said, referring to Aeschylus, Euripides, Herodotus, Thucydides, Socrates and Aristotle.

Obama took advantage of the speech to highlight the democratic values he sought to honor while in office and implicitly prodded his Republic successor Donald Trump to do the same. He also emphasized his respect for Greece’s efforts to respond to Europe’s refugee crisis despite its own problems. “Because our democracies are inclusive, we’re able to welcome people and refugees in need to our countries. And nowhere have we seen that compassion more evident than here in Greece,” he said.

“Whoever says ‘we will relieve your debts’ is doing Greece a disservice..”

• Schaeuble Crushes Greek Debt Relief Hopes that Obama May Have Sowed (GR)

U.S. President Barack Obama’s visit to Greece raised fresh hopes for debt relief that German Finance Minister Wolfgang Schaeuble rushed to quash. He said late on Tuesday that granting Greece its debt relief would not be helping the country, describing such a move as a “disservice.” A German Finance Ministry spokesman confirmed that Schaeuble had indeed made this statement, but that it was not in direct response to Obama’s visit to Greece. “Whoever says ‘we will relieve your debts’ is doing Greece a disservice,” said Schaeuble, according to the report by the daily newspaper, Passauer Neue Presse. His comments are not surprising bearing in mind that Germany has long supported the notion that no immediate debt relief is needed for Greece as this would discourage structural reforms.

“We have noted that President Obama has pointed to the importance of debt relief. The euro group agreed in May on a timetable on exactly that subject, regarding measures for the short term, and later in 2018 for mid-term measures,” said German government spokesman Steffen Seibert at a news conference. He added that Obama’s visit had not changed Germany’s position on the matter, during a government news conference. Seibert added that Obama’s view that austerity on its own does not create growth is a viewpoint that reflects that of the German government, adding that two things needed for long-term growth are a sustainable budget and the need for structural reforms.

Think Obama went to see them?

• Share of Greek Children At Risk Of Poverty Rises To 37.8% (Kath.)

More than a third, or 37.8%, of children aged up to 17 in Greece were at risk of poverty and social exclusion in 2015, compared to 28.7% in 2010, according to a report published by the European Statistics Agency (Eurostat). This means that they were living in households with at least one of the following characteristics: at-risk-of-poverty after social transfers (income poverty), severely materially deprived or with very low work intensity. The increase, which took the total number of children at risk of poverty and social exclusion in Greece to 710,000, is the largest in the European Union since 2010. After Greece, Cyprus was the country with the highest rise since 2010, with 7.1%.

At the same time, the EU average dropped from 27.5% in 2010 to 26.9% in 2015, which corresponds to the alarming figure of approximately 25.26 million children. Greece was third in the EU in the total number of children faced with such a predicament, behind Romania at 46.8% and Bulgaria at 43.7%. Hungary was fourth at 36.1%, ahead of Spain at 34.4% and Italy at 33.5%. The lowest rates were recorded in the Scandinavian countries, with Sweden at 14%, ahead of Finland and Denmark, with 14.9% and 15.7% respectively.

At some point you may want to wonder if it’s a bug or a feature of the system.

• Drowning Deaths In Mediterranean Already 20% Higher Than All Of Last Year (G.)

About 240 people are suspected to have drowned this week in four separate incidents in the Mediterranean, raising the total annual death toll to an unprecedented 4,500. Deaths in the Mediterranean are now nearly 20% higher than last year’s total of 3,771, which was the previous annual record. About 130 asylum seekers are missing after a rubber boat capsized on Sunday night, while another 100 are thought to have drowned on Tuesday night in a separate incident, the UN refugee agency said. Up to 10 people died in two further tragedies in recent days, bringing the death toll this week to at least 240.

In the accident on Sunday 15 survivors were left in the water for 10 hours, clinging on to a piece of a capsized boat, before being rescued by an oil tanker. Nine are still in hospital, Iosto Ibba, a spokesman for UNHCR, said in a phone call. Migration between Turkey and Greece has lessened significantly since March, after Turkey agreed to re-admit people deported from Greece. But crossings between Libya and Italy continue unabated. More than 165,000 people have reached Italy so far this year from north Africa, and the final annual total is likely to surpass the previous record of 170,000.