NPC KKK services, Capital Horse Show grounds, Arlington 1938

Spell ‘recovery’.

• 70 Million Americans Are Teetering On The Edge Of Financial Ruin (MarketWatch)

In the past few years, the job market has vastly improved and home prices have rebounded — yet Americans are becoming even more irresponsible when it comes to saving for emergencies. According to a survey of 1,000 adults released by Bankrate.com on Tuesday, nearly one in three (29%) American adults (that’s roughly 70 million) have no emergency savings at all – the highest percentage since Bankrate began doing this survey five years ago. What’s more, only 22% of Americans have at least six months of emergency savings (that’s what advisers recommend) – the lowest level since Bankrate began doing the survey. These findings mirror others – all of which paint an abysmal picture of Americans’ ability to withstand an emergency. For example, a survey released in March by national nonprofit NeighborWorks America also found that roughly one third (34%) of Americans don’t have emergency savings.

Greg McBride, the chief financial analyst for Bankrate.com, says these low savings reflect that households haven’t seen their incomes ramp up and thus “household budgets are tight.” Plus, he adds “people don’t pay themselves first – they wait until the end of the month to save what’s left over and then nothing is left over.” The problem with this lack of savings is that emergencies can and do happen, and when they do, you may be forced into an expensive solution like credit cards or personal loans – and in extreme cases having to declare bankruptcy. Indeed, half of Americans had experienced an unforeseen expense in the past year, according to a 2014 survey by American Express; of those, 44% had a health care-related unforeseen expense and 46% had one related to their car – both of which tend to be things you can’t avoid paying.

Thus, advisers recommend that most Americans have at least six months worth of income in their emergency fund — and more if they have children or other dependents. To build this up, “start an automatic transfer to a savings account and set a task to revisit and increase the amount in a month,” says Robert Schmansky, the founder and a financial adviser at Clear Financial Advisors. “See how much you can increase the amount until it becomes noticeable and then stop.” Scott Cole, the founder of Cole Financial Planning, says to put the money in an FDIC-insured, high-yield savings account. Schmansky says that you want this account to be separate from your checking account “to prevent frivolous withdrawals.” He adds that while it’s important to find a good rate, it’s “equally important” that the money is accessible and the bank has “a long history of paying higher than market rates” as “too many banks in the past that started out as high yield payers dropped those rates after some time.”

She’s going to blow up the whole thing. Unless someone else is first.

• Marine Le Pen: Just Call Me Madame Frexit (Bloomberg)

Marine Le Pen, a frontrunner in France’s 2017 presidential election, says a Greek exit from the euro is inevitable. And if it’s up to her, France won’t be far behind. “We’ve won a few months’ respite but the problem will come back,” Le Pen said of Greece in an interview at her National Front party headquarters in Nanterre, near Paris, on Tuesday. “Today we’re talking about Grexit, tomorrow it will be Brexit, and the day after tomorrow it will be Frexit.” Le Pen, 46, is leading first-round presidential election polls in France, ahead of President Francois Hollande, ex-leader Nicolas Sarkozy and Prime Minister Manuel Valls. She’s the only one of the four calling for France to exit the euro, banking on people’s exasperation with the Greek crisis and Britain’s proposed referendum on the European Union to win over voters.

“I’ll be Madame Frexit if the European Union doesn’t give us back our monetary, legislative, territorial and budget sovereignty,” Le Pen said. She’s calling for an orderly breakup of the common currency, with France and Germany sitting around the table to dismantle the 15-year-old monetary union. Since she took over from her father as head of the National Front in 2011, Marine Le Pen has done her best to push the anti-immigration party into the French political mainstream. She came third in the 2012 presidential race and currently has two members in the country’s National Assembly for the first time since 1997. The combination of tepid economic growth and high unemployment at home, together with hundreds of thousands of African and Middle Eastern immigrants seeking jobs or asylum in Europe, has given Le Pen increased traction.

Even German Chancellor Angela Merkel has expressed concern about the level of support Le Pen will receive in 2017 and how that power might weigh on French economic policy. “She knows perfectly well that if France leaves, there’s no more euro,” Le Pen said. Although Le Pen hasn’t given a full, detailed plan of how she would lead her country out of the euro, she says she doesn’t believe France would be shut out of the borrowing market or rejected by investors as a result.

Good to see that there are still some people awake.

• The Delphi Declaration On Greece And Europe (Paul Craig Roberts)

The Delphi Conference on the European/Russian crisis created by Washington issued a declaration repudiating the EU attack on the Greek nation. The Delphi Declaration asks the European peoples, especially the Germans, to do the right thing and object to the plunder of Greece by the One%. This appeal to good will is likely to fall on deaf ears even though the pillage of Greece will create a precedent that can then be applied to Italy, Spain, France, and even Germany.

THE DELPHI DECLARATION: European governments, European institutions and the IMF, acting in close alliance, if not under direct control of big international banks and other financial institutions, are now exercising a maximum of pressure, including open threats, blackmailing and a slander and terror communication campaign against the recently elected Greek government and against the Greek people. They are asking from the elected government of Greece to continue the “bail-out” program and the supposed “reforms” imposed on this country in May 2010, in theory to “help” and “save” it.

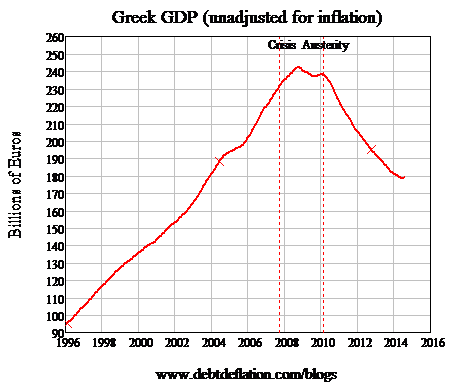

As a result of this program, Greece has experienced by far the biggest economic, social and political catastrophe in the history of Western Europe since 1945.It has lost 27% of its GDP, more than the material losses of France or Germany during the 1st World War. The living standards have fallen sharply, the social welfare system all but destroyed, Greeks have seen social rights won during one century of struggles taken back. Whole social strata were completely destroyed, more and more Greeks are falling from their balconies to end a life of misery and desperation, every talented person who can leaves from the country. Democracy, under the rule of a “Troika”, acting as collective economic assassin, a kind of Kafka’s “Court”, has been transformed into a sheer formality in the very same country where it was born!

Greeks are experiencing now the same feeling of insecurity about all basic conditions of its life, that French have experienced in 1940, Germans in 1945, Soviets in 1991. In the same time, the two problems which this program was supposed to address, the Greek sovereign debt and competitiveness of the Greek economy have, both, sharply deteriorated. Now, European institutions and governments are refusing even the most reasonable, elementary, minor concession to the Athens government, they refuse even the slightest face-saving formula, if it could be. They want a total surrender of SYRIZA, they want its humiliation, its destruction. By denying to the Greek people any peaceful and democratic way out of its social and national tragedy, they are pushing Greece into chaos, if not civil war.

By the way, even now, an undeclared social civil war of “low intensity” is waged inside this country, especially against the unprotected, the ill, the young and the very old, the weaker and the unlucky. Is this the Europe we want our children to live? We want to express our total, unconditional solidarity with the struggle of the Greek people for its dignity, its national and social salvation, for its liberation from the unacceptable neocolonial rule “Troika” is trying to impose on a European country. We denounce the illegal and unacceptable agreements successive Greek governments have been obliged, under threat and blackmail, to sign, in violation of all European treaties, of the Charter of UN and of the Greek constitution.

IMF has already said no.

• Berlin Insists Greek Parliament Approves All Reforms By Monday (FT)

Greece’s parliament will have only a few days to pass all the economic reforms Athens promises its creditors to unlock desperately need bailout aid, putting intense pressue on prime minister Alexis Tsipras to build domestic political support for controversial concessions. Berlin has insisted on full and immediate legislative approval of measures that may be agreed at a meeting of eurozone finance ministers on Wednesday even though officials now concede a deal may come too late for Athens to meet a €1.5bn debt repayment to the IMF due on June 30. People briefed on Berlin’s thinking said months of fraught negotiations since the radical anti-austerity government came to power have undermined trust in Greece’s ability to fuflill its promises.

German officials want Greek parliamentary approval before an extension of its bailout programme is presented to the Bundestag before it expires on Tuesday. Greek authorities have already begun preparations for a hasty and potentially rancorous parliamentary debate over the weekend amidst growing signs Mr Tsipras’ new reform plan – which would be presented to eurozone leaders on Thursday — faces fierce resistance at home. A handful of more radical members of Mr Tsipras’ governing Syriza party have already vowed to mutiny over the proposal, and thousands of Greek pensioners took to the streets of Athens on Tuesday evening to decry the plans. “We have nothing, no money, we cannot live like this anymore,” shouted Thomas Yanakakis, 63, with tears in his eyes. “Enough is enough. Everyone must take to the streets now to stop this.”

Well, unless you’re into SM.

• Europe Is Destroying Greece’s Economy For No Reason At All (WaPo)

The real question is why Europe is forcing Greece to do any more austerity at all. It’s already done so much that, before this latest showdown, it actually had a budget surplus before interest payments. And that’s all it should shoot for, really: the point at which it doesn’t need any more bailouts from Europe. Anything more than that, though, would just inflict unnecessary — and self-defeating! — harm to the economy. When interest rates are zero, like they are now, budget cuts of 3% of GDP would, by Paul Krugman’s calculation, make the economy shrink something like 7.5%. So even though you have less debt, your debt burden isn’t much better since you have less money to pay it back.

There’s only one reason to make Greece do more austerity, and it makes no sense at all. That’s to try to make it pay back what it owes. Indeed, one European official said that the entire point of this was that they “want to get our money back some day.” The problem, though, is everybody knows Greece will never do that. Its debt should have been written down in 2010, but it wasn’t because it was “bailed out” to the extent that it was given money to then give to French and German banks. The longer Europe pretends this new debt will be paid back, the longer Greece’s depression will go on. Now, it’s true that Europe has lowered the interest rates and extended the maturities on Greece’s debt so far out that, for now at least, it’s like a lot of it doesn’t exist.

But eventually it will, and at that point they’ll either need to extend-and-pretend some more or hope that Greece has returned to growth. Until then, Greece will be stuck in its economic Groundhog Day. It keeps trying to resist these pointless budget cuts that just keep it in a perpetual state of high unemployment, but then gives in at the last minute. On second thought, history is just repeating itself as tragedy over and over again.

What I hear from Athens is that this is not quite accurate, it’s what happened 3 years ago.

• Greek Public Stops Paying Off Personal Debts As Uncertainty Grows (FT)

Margarita sits cross-legged on a shiny parquet floor in a small Athens apartment, surrounded by piles of cardboard boxes. Within them are her family’s possessions. “I never expected to set up house in my late parents’ place,” the 42-year-old says. Her husband George, a banker made redundant three years ago, is overseeing workers installing security shutters in the two-bedroom, one-balcony space, while her 16-year-old daughter Christina brews coffee in a cramped kitchen. The Athenian family, who asked for their surname not to be used, moved to a downtown residential district from a villa in the northern suburbs to avoid defaulting on their mortgage. “We restructured it twice, thanks to my old colleagues at the bank but we still couldn’t keep up with the payments,” says George, now a struggling investment consultant.

“Things were looking pretty bleak but then we found a tenant so we could move out.” The family still owes a year’s worth of school fees at the private international school their daughter attended, which George admits is not a priority. He is no longer embarrassed by his inability to pay, he says, because so many other parents are in the same situation. Such strategic defaults have become a way of life among Greece’s formerly affluent middle-class. Many borrowed heavily as local banks competed to offer consumer loans at accessible interest rates after Greece joined the euro in 2001. When the crisis struck they resisted changes to their lifestyle, convinced that it was only a blip on a continuous upward path to income levels matching those of Italy and Spain.

But they have since been forced to make harsh adjustments. With their own savings depleted and the country’s immediate future so uncertain — will Greece default on its debts and leave the euro? — many have simply stopped making payments altogether, virtually freezing economic activity. Tax revenues for May, for example, fell €1bn short of the budget target, with so many Greek citizens balking at filing returns. That has put more pressure on the country’s leftwing government as it desperately scrapes up cash to pay wages and salaries and foreign creditors. The government, itself, has contributed to the chain of non-payment by freezing payments due to suppliers. That has had a knock-on effect, stifling the small businesses that dominate the economy and building up a mountain of arrears that will take months, if not years, to settle.

Business-to-business payments have almost been paused, one Athens businessman says. “They are just rolling over postdated cheques”. For Greek banks, mortgage loans left unserviced by strategic defaulters have become a particular headache, especially since the Syriza-led government says it is committed to protecting low-income homeowners from foreclosures on their properties “There’s a real issue of moral hazard… Around 70% of restructured mortgage loans aren’t being serviced because people think foreclosures will only be applied to big villa owners”, one banker said.

When you cut an economy by 25%, pensions automatically weigh heavier.

• A -Last- Shield Against Poverty, Pensions Are Greece’s Top Priority (AP)

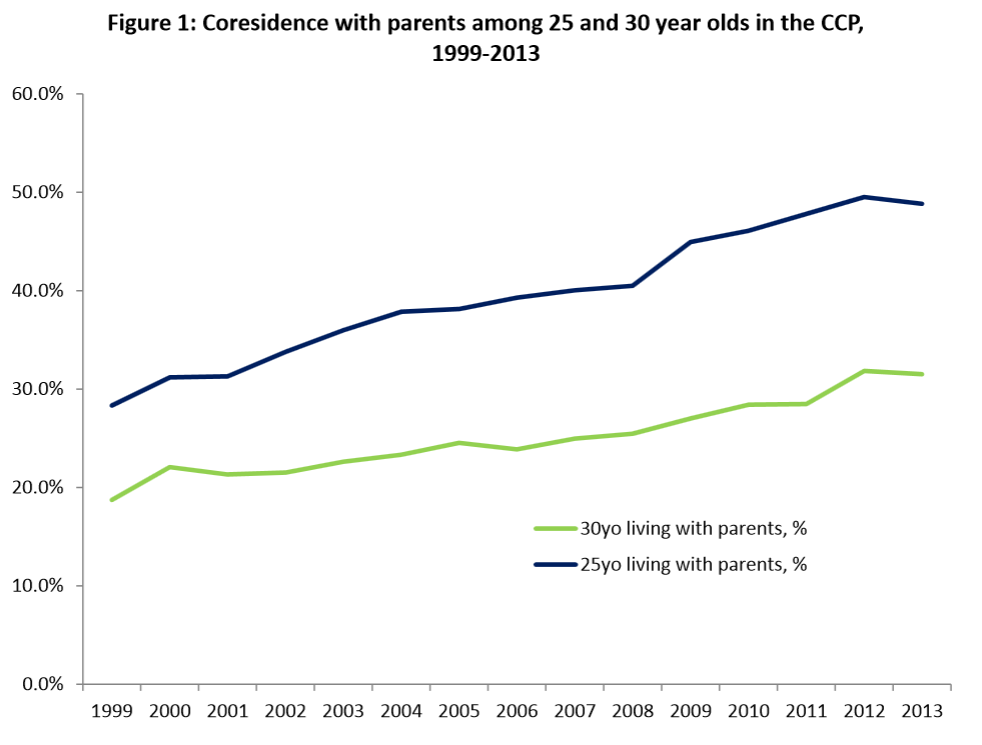

Unlike most eurozone members, Greece’s welfare system is relatively weak, with effectively no social housing or rent assistance programs, while the jobless only receive benefits and state health coverage for up to one year. Families are left to provide the safety net. Pensioner Assimina Griva, who helps run a community center for the retired in a hillside suburb of Athens, illustrates what many Greeks live. With her monthly pension of €600 she gives financial assistance to her son, who was laid off from the steel industry and otherwise depends on his wife’s salary of €400. “I help my child, and I keep €100 for the whole month,” says Griva. The problem, experts agree, is that the system is speeding toward insolvency.

State spending on pensions has risen from 11.7% of GDP before the financial crisis to 16.2% as the economy shrank. The average in the European Union is about 12%. The burden on the state is set to grow dramatically as the number of pensioners — currently 2.6 million out of a total population of 11 million — is set to keep rising. Greece has the sixth oldest population in the world, according to United Nations data. Over 20% of Greeks are aged 65 and over, a share the EU statistics agency expects to jump to 33% in 2060. Added to that is the impact of the financial crisis. High unemployment, undeclared labor, and arrears from struggling businesses have hammered state revenues.

A 2012 write-down of Greece’s privately-held national debt saw pension funds’ reserves lose more than half their value, as they were required by law to buy government bonds. “The pension system in Greece is not sustainable. But how could it be?” Finance Minister Yanis Varoufakis said at a business conference in Berlin this month. “We want to reform it … (But) pensions have already been cut by 40%. Forty%! Is cutting further a reform? I don’t think it is a reform. Any butcher can take a clever and start chopping things down. We need surgery.”

At last, the world press shows some signs of working neurons.

• This Is A Deal That Heaps More Misery On Greeks (Guardian)

For Greece, the small concessions the creditors now seem prepared to make on pensions and tax increases on the poor will at least allow Alexis Tsipras to save face with his electorate and overcome the difficulty of getting the proposals through his parliament. But he will also have seen off the threat of capital controls being imposed to stop any further outflow of money from Greece and a humiliating take-it-or-leave-it message from the creditors should the ECB have pulled the plug and stopped providing emergency liquidity assistance to the beleaguered Greek banking system. Yet the reality is also that the extra austerity will now be tougher for Greece to bear and the cost of restoring the economy will be much greater.

Just as the rest of the eurozone is showing small signs of recovery the Greek economy has gone back into recession, with GDP falling by 0.4% in the last three months of 2014 and by 0.2% in the first three months of 2015. The signs are that the decline has continued, with unemployment rising again to 26%. Many companies have gone out of business as activity stalled during the uncertainty surrounding the negotiations and banks’ non-performing loans now account for some 35% of their total lending. As a result, the effort required to restore health to the economy will be much greater. It is hard to imagine it now, but strong tourist receipts last year brought the first rise in Greek GDP after a five-year decline in which the economy had slid by 25% under the IMF-inspired austerity programme.

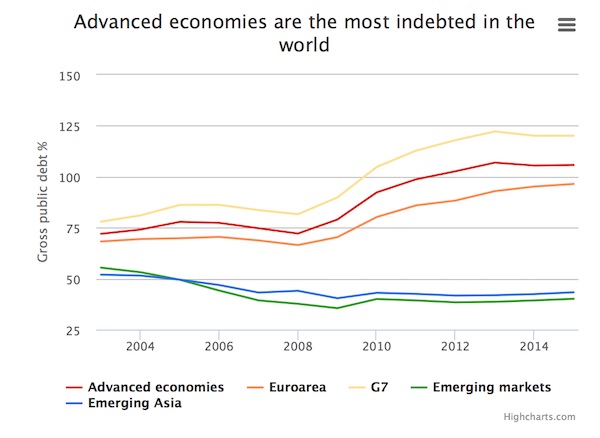

The recent reversal has wiped out much of that progress. Years of austerity loom. More bailout money, but also more hardship and no – or very slow – growth. In itself that is not a recipe for social and political tranquillity. The creditor institutions, the old troika of the IMF, the ECB and the European commission, will be as visible as ever. So actually, not much advance on the status quo of the last few years. This gets us back to the perennial elephant in the room whenever Greece is discussed. The truth is, there won’t be sustainable growth again until the huge debt overhang (180% of GDP) is dealt with decisively. Greece would need to grow by at least 4% a year to service its current debt. If forced down that road, nothing can be seen ahead for the Greek people but continuous belt-tightening and misery.

“Einstein had a definition for this – insanity..”

• Creditors’ Economic Plan For Greece Is Illiterate And Doomed To Fail (Guardian)

One of the insights gleaned during the Great Depression was that it does not make a lot of sense for governments to try to balance budgets during a severe downturn, because tax increases and spending cuts reduce demand. That deepens the slump, leaving an even bigger hole in the public finances. In Greece, though, it as if the clock has been turned back to the pre-FDR days when Herbert Hoover was US president. Weak growth means that Athens continues to miss the deficit targets the troika sets for it. The troika responds by insisting on additional savings to put the budget back on track. Paul Krugman posted a chart last week based on IMF data that illustrates what happened to the underlying public finances of the eurozone members in 2014.

This measure of budgetary discipline looks at the primary budget surplus – the gap between revenues and spending excluding debt interest payments – adjusted for the state of the economic cycle. Measured in this way, Greece ran a surplus of more than 5% of GDP last year, comfortably higher than any other eurozone country. It is, however, not enough for the troika. In order to avoid a debt default and a run on its banks that would threaten its continued membership of the single currency, Greece has now had to table proposals that will suck an additional €8bn out of the economy in the next 18 months. Consumer spending will be hit by an increase in VAT and higher pension contributions, while investment will be dampened by a one-off levy and an increase in corporation tax.

Greece has a number of severe economic problems. It suffers from a lack of demand, and a five-year slump has pushed it into deflation. Falling prices have added to the real, inflation-adjusted burden of the government’s debt, which currently stands at 175% of GDP. A fresh dose of austerity will make all these problems worse. One way for Greece to get out of its mess would be for it to leave the euro, devalue its currency and renege on all or part of its debt. That is not an option if it stays in the single currency, which the public wants. Another way out would be for the creditors to cut Greece some slack. That would involve immediate debt relief and more realistic targets. The troika, though, will continue with policies that have failed before in the hope that they will succeed this time. Einstein had a definition for this – insanity.

“..the single currency’s most troublesome state will remain inside the euro as long as Greek nuisance value (GNV), both political and economic, is held to be lower inside the system (I) than it would be outside (O)..”

• Whatever Happens To Greece, It Will End In Contagion (MarketWatch)

Acres of column inches have been expended on Greece and the future. Here are eight succinct truths to guide observers through the next few days.

1. There will be no quick and easy end to the Greek affair. Unstable disequilibria can last a long time. For four centuries, Greece was part of the Ottoman Empire. Tonight’s unhappy meeting of eurozone leaders will not be the last time they gather to consider an intractable imbroglio.

2. Greece holds a lot of the cards. No doubt some kind of deal will be done to prevent — for the moment at least — full-scale ejection from the euro EURUSD, +0.3761% bloc.

As I wrote four months ago, the single currency’s most troublesome state will remain inside the euro as long as Greek nuisance value (GNV), both political and economic, is held to be lower inside the system (I) than it would be outside (O). For the time being, GNV-I is — just — less than GNV-O. All sorts of Greek maneuvering — whether talks with President Vladimir Putin or speculation about a Greek exit bringing down the euro “house of cards” — are useful ploys to stoke up European fears of GNV-O.

3. The funds that are now leaving Greek banks to the tune of €1 billion a day, whether being taken abroad or simply kept under the mattress, are all effectively liabilities of the European Central Bank, to be paid ultimately (if things go wrong) by European taxpayers. The ECB, as an unelected body run by technocrats, cannot by itself pull the plug on Greece and declare the banks insolvent. The Greek government has no great wish to bring in exchange controls (although soon it may be forced to) since withdrawn euros represent a negotiating tool against its creditors and a store of value that many Greeks can use to hedge against a return of the drachma.

4. The IMF is unlikely to get its money back on time. An internal IMF assessment two years ago ruled that the Fund’s exceptional loan to Greece in 2010 was made on far-too-optimistic assumptions about the country’s debt sustainability and ability to carry out adjustment, breaching the IMF’s own rules. U.S. taxpayers will lose money. So please forget any idea that Congress will agree on IMF governance and voting reforms any time in the next few years.

5. Angela Merkel, the German chancellor, will be a big loser. The pressure is on her to hold the euro area together and maintain Germany’s European credentials without damaging the pocketbooks of German taxpayers and turning the euro into an overt transfer union. This is an impossible task. Her biggest adversaries are likely to be within her own coalition with the Social Democratic Party, which, however unfairly, will publicly blame her for any unsavory outcome. Shaming Merkel over Greek debt may be unscrupulous, but if it delivers the SPD a chance of winning the 2017 election, then the party will seize it.

6. Karl Otto Pöhl, the former Bundesbank president who died in December, was right when he said, a few days after the May 2010 bailout, that it was decided to save (roughly in that order) rich Greeks, and French and German banks. The Bundesbank’s qualms over the ECB’s purchases of the bonds of Greece and other peripheral countries, publicly though impotently voiced at the time, were never likely to derail the action. But we will hear more of them now that taxpayers in Germany and other creditor countries start to weigh up the bill.

Behind the curtains.

• Tsipras: Angel Of Mercy Or Trusty Of Central Bankers’ Debt Prison? (Stockman)

Draghi and his posse of financial dimwits have created what amounts to a hideous financial scam – a disgrace to any notion of central banking which existed before 2008. Had he not announced he would massively monetize euro sovereign debt in July 2012, Greece would have been bankrupt long ago, and the peripheral borrowers like Italy, Spain and Portugal would have had their day of fiscal reckoning, too. The eurozone would have blown sky high, and the ECB would be no more. Likewise, were not the ECB now supplying $125 billion of funding to the Greek banking system—or actually more than its current level of fast vanishing deposits – the latter would have crashed and burned months ago, thereby triggering a crisis which would have eventually destroyed the euro.

Ironically, the angel of mercy now hovers in the form of Greece’s intrepid prime minister, Alexis Tsipras. Too be sure, his left-wing statist economics is a complete abomination that would cause the Greek people catastrophic suffering if were ever to be implemented. But he is absolutely correct on the matter of political self-governance: “We have no right to bury the European democracy in the land where it was born.” That’s the essence of the issue. If Greece’s democracy is to survive, it must be cut loose from the destructive regime of superstate dictation from Brussels and monetary falsification from Frankfurt. Ironically, going back to the Drachma would put Greece’s politicians right were they were before they were betrayed by the false monetary regime of eurozone central banking.

They would be forced to run a primary surplus because they would not be able to borrow on world markets after a massive default on the debt forced upon them by the eurozone, ECB and IMF. But the mix of taxing the rich, cutting the pensioners, catching the tax cheats, selling state assets, shrinking the bureaucracy and squeezing the crony capitalist leeches which feed on the Greek state would be up to them, not the inspectors and pompous bureaucrats from the IMF and European superstate. More importantly, faced with a honest bond market and real bond vigilantes, the Greek state would rediscover the requisites of sustainable fiscal governance. If they should ever again choose to run large fiscal deficits in the future, they would have to deal with an altogether different kind of committee. Namely, the pricing committee of their bond underwriters syndicate.

If the bond vigilantes needed a 15% yield to buy the state’s debt based on the facts and fiscal prospects at hand, there would not ensue months and years of can-kicking, phony restructuring plans and promises and endless PR maneuvers and leaks to the financial press. Greece’s politicians would be required to either hit the bid or cut the pension checks the very next day. Tsipras is now confronted with this kind of hard choice in an altogether different venue. If he sells out Greece one more time to the paymasters of his country’s crushing debt, it will be only a matter of time before another Greek prime minister will be forced to walk the same plank on which he now totters. By doing what’s right for Greek democracy, by contrast, he would prove to be an angel of mercy. There is no way that the euro and ECB could survive a Greexit, nor could worlwide Keynesian central banking survive the blow of their demise.

Emerging markets.

• Debt Default Risk Not Just A Greece Story (FT)

Gripped by the prospect of default in Greece? You may be looking in the wrong direction. The southern European nation may have the world’s highest debt burden, equal to 175% of its economy or gross domestic product, but according to credit rating agencies that does not make Greece the riskiest borrower for bond investors. That title is held by Ukraine, presently engaged in fighting a war with pro-Russian separatists as well as battling creditors over $15bn of debt the country says it cannot afford to service. The difference between Greece and Ukraine is reflected in the prices at which the sovereign debt of the two countries trades. Prices for Greek bonds have crashed over the past year as investors took fright at the political success of the anti-austerity Syriza party, yet they remain above 50 cents in the euro – considered a benchmark default level.

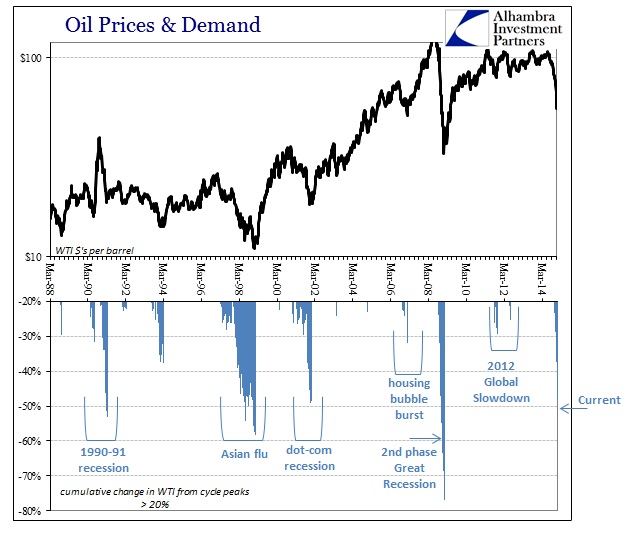

Ukraine’s equivalent bonds trade below 50 cents in the dollar, suggesting a far higher risk of a default. Indeed, this week, Ukraine was declared a “credit event”, triggering insurance payouts in the credit derivatives market. According to credit rating agency Standard & Poor’s, default is all but certain. All told, 11 countries, including Greece, are currently at serious risk of defaulting according to global credit rating agency Moody’s. Around the world the euphoric credit boom in emerging markets driven by low interest rates in the US, Europe and Japan now appears vulnerable, piling on the pressure for borrowers. A weakening trend in EM sovereign credit that began in 2013 has continued this year thanks to the slowdown in Chinese economic growth, weakness in commodity prices and higher US dollar borrowing costs, according to UBS.

Interesting two-week old piece.

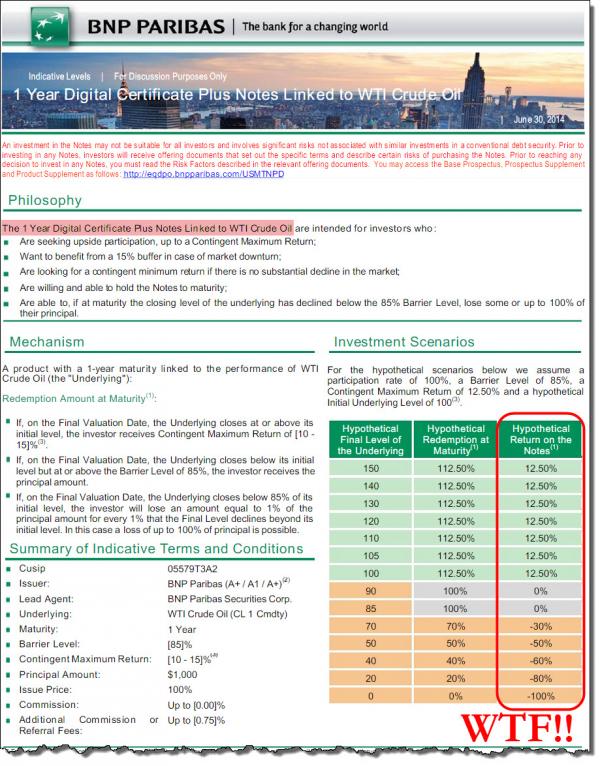

• A Derivatives Bomb Exploded In The First Week Of June (IRD)

(June 9): I believe the illogical movement in 10yr Treasury yields reflects the fact the Fed is losing control of its tight grip on the bond market and longer term interest rates. Note that German bunds have also experienced a similar spike up in interest rates and volatilty. In the context of my view that there was a derivatives accident somewhere in the global banking system in the last two weeks, it could well have been an OTC interest rate swap bomb that detonated. As of the latest OCC quarterly report on bank derivatives activity (Q4 2014), JP Morgan held $63.7 trillion notional amount of derivatives, $40 trillion of which were various interest rate derivatives.

If you look at the ratio of interest rate derivatives to total holdings for the top 4 U.S. banks, they all own roughly same proportion of interest rate derivatives as % of total holdings. Deutsche Bank is reported to have about a $73 trillion derivatives book. If we assume that ratio of interest rate derivatives is likely similar to JP Morgan’s, it means that DB’s potential derivatives exposure to interest rates is around $46 trillion. Interestingly, the price of the 10yr moved abruptly higher after the Fed ended QE. This is the opposite of what many of us would have expected. It wasn’t until early February that 10yr bond price began to decline (yields move higher). The 10yr bond price also crashed through its 200 day moving average – an ominous technical signal. Both of these events happened within the last week.

Again, I believe that this action in the bond market is pointing to the fact that the Fed is losing control of the markets. I also believe that the catalyst for this loss of control is a big derivatives accident of some sort in the last two weeks. Another clear indication that something has melted down “behind the scenes” recently is an ominous market call by self-made hedge fund billionaire Paul Singer, founder and CEO of Elliott Management. In his latest letter to investors, released the last week of May, he stated that the best trade in a generation is to short “long term claims on paper money.

Too late.

• Beware Bond-Liquidity Traps When Hunting Yield, Pimco Says (Bloomberg)

Investors risk falling into liquidity traps as they seek to boost yields depressed by the ECB’s €1.1 trillion bond-buying program, according to Pimco. The search for yield has caused investors to buy riskier and less frequently traded bonds, which may be hard to sell quickly, said Mike Amey at Pimco, which oversees about $1.59 trillion of assets. Overall bond trading has slumped since the global financial crisis because banks have cut inventories to preserve capital in response to tighter regulations. “If you want to find some yield-enhancing assets, then make sure you’re paid for tighter liquidity,” said Amey, a speaker at Euromoney’s Global Borrowers & Investors Forum in London, which starts Tuesday. “If you’re going to take a liquidity premium, be prepared to hold the asset for years.”

One measure of bond-market liquidity is down 10% in the past year and 90% since 2006, RBS said in March. In the U.S., less than 5% of the market changes hands each month, down from about 20% in 2007, according to a November report by the Bank for International Settlements. “My biggest worry for the market going forward is liquidity,” said Kris Kowal at DuPont Capital Management, which oversees $30.8 billion of assets. Investors are “trading illiquidity for a bit more yield, and I don’t think that’s the right approach at this stage in Europe’s economic cycle.”

Structured securities and loans are among the most illiquid assets, said Wilmington, Delaware-based Kowal, who is also speaking at the Euromoney conference. Investors who need liquidity should hold cash or highly traded government bonds, Amey said. The ECB’s quantitative easing will continue to provide liquidity for the time being, said David Zahn, head of European fixed income at Franklin Templeton Investments, which manages about $890 billion of assets. Still, he is ensuring that his funds have enough liquidity to meet redemptions and to act on new opportunities.

Why does the right have to be the only side that gets it right?

• TTIP Is A Corporatist Scam And Not A Real Free Trade Deal: Ukip (Independent)

A proposed deal between the United States and European Union is a “corporatist scam”, Ukip’s MP has said. Douglas Carswell said that TTIP, which stands for the Transatlantic Trade and Investment Partnership, was not what its proponents made it out to be. “Ukip [is] making clear we are the most staunchly free trade party in the UK,” he tweeted. “TTIP is not free trade. It’s a corporatist scam.” Tellingly, the message was retweeted by Conservative MP Zac Goldsmith, a leading contender for his party’s nomination for Mayor of London. TTIP’s proponents say it is a free trade deal that would benefit both the United States and European Union.

One controversial aspect of drafts of the deal would be to establish a quasi-judicial trade court to which the two blocs would be subject. This could allow large corporations to ‘sue’ national governments for enacting any policy that potentially harmed their profits. Critics say that this would erode democracy and increase corporate power. The deal is also controversial because of the secret way in which it is been negotiated, with press and campaigners relying heavily on leaks to determine its direction. A Ukip spokesperson told the Independent that the party feared the destruction of public services by the deal.

“Ukip is a party that believes that free trade between people is the surest way to greater prosperity,” he said. “However the TTIP agreement is not a free trade deal, but one that favours big multinational corporates over the interests of smaller businesses, and most importantly the democratic right of people to set policy through elections. “TTIP as it currently stands could hand the NHS lock, stock, and barrel to huge corporations against the wishes of the British people.”

Long term risk.

• Will Seizure of Russian Assets Hasten Dollar Decline? (Ron Paul)

While much of the world focused last week on whether or not the Federal Reserve was going to raise interest rates, or whether the Greek debt crisis would bring Europe to a crisis, the Permanent Court of Arbitration in The Hague awarded a $50 billion judgment to shareholders of the former oil company Yukos in their case against the Russian government. The governments of Belgium and France moved immediately to freeze Russian state assets in their countries, naturally provoking the anger of the Russian government.[..] The US government is desperately trying to cling to the notion of a unipolar world, with the United States at its center dictating foreign affairs and monetary policy while its client states dutifully carry out instructions.

But the world order is not unipolar, and the existence of Russia and China is a stark reminder of that. For decades, the United States has benefited as the creator and defender of the world’s reserve currency, the dollar. This has enabled Americans to live beyond their means as foreign goods are imported to the US while increasingly-worthless dollars are sent abroad. But is it any wonder after 70-plus years of a depreciating dollar that the rest of the world is rebelling against this massive transfer of wealth? The Europeans tried to form their own competitor to the dollar, and the resulting euro is collapsing around them as you read this.

But the European Union was never considered much of a threat by the United States, existing as it does within Washington’s orbit. Russia and China, on the other hand, pose a far more credible threat to the dollar, as they have both the means and the motivation to form a gold-backed alternative monetary system to compete against the dollar. That is what the US government fears, and that is why President Obama and his Western allies are risking a cataclysmic war by goading Russia with these politically-motivated asset seizures. Having run out of carrots, the US is resorting to the stick. The US government knows that Russia will not blithely accept Washington’s dictates, yet it still reacts like a petulant child flying into a tantrum whenever Russia dares to exert its sovereignty.

The existence of a country that won’t kowtow to Washington’s demands is an unforgivable sin, to be punished with economic sanctions, attempting to freeze Russia out of world financial markets; veiled threats to strip Russia’s hosting of the 2018 World Cup; and now the seizure of Russian state assets. Thus far the Russian response has been incredibly restrained, but that may not last forever. Continued economic pressure from the West may very well necessitate a Sino-Russian monetary arrangement that will eventually dethrone the dollar. The end result of this needless bullying by the United States will hasten the one thing Washington fears the most: a world monetary system in which the US has no say and the dollar is relegated to playing second fiddle.

Golden rule: If they can do it, they will.

• Espionnage Élysée – NSA Spied On French Governments, Presidents (Wikileaks)

Today, 23 June 2015, WikiLeaks began publishing “Espionnage Élysée”, a collection of TOP SECRET intelligence reports and technical documents from the US National Security Agency (NSA) concerning targeting and signals intelligence intercepts of the communications of high-level officials from successive French governments over the last ten years. The top secret documents derive from directly targeted NSA surveillance of the communications of French Presidents Francois Hollande (2012–present), Nicolas Sarkozy (2007–2012), and Jacques Chirac (1995–2007), as well as French cabinet ministers and the French Ambassador to the United States.

The documents also contain the “selectors” from the target list, detailing the cell phone numbers of numerous officials in the Elysee up to and including the direct cell phone of the President. Prominent within the top secret cache of documents are intelligence summaries of conversations between French government officials concerning some of the most pressing issues facing France and the international community, including the global financial crisis, the Greek debt crisis, the leadership and future of the European Union, the relationship between the Hollande administration and the German government of Angela Merkel, French efforts to determine the make-up of the executive staff of the United Nations, French involvement in the conflict in Palestine and a dispute between the French and US governments over US spying on France.

A founding member state of the European Union and one of the five permanent members of the UN Security Council, France is formally a close ally of the United States, and plays a key role in a number of US-associated international institutions, including the Group of 7 (G7), NATO and the World Trade Organization (WTO). The revelation of the extent of US spying against French leaders and diplomats echoes a previous disclosure in the German press concerning US spying on the communications of German Chancellor Angela Merkel and other German officials. That disclosure provoked a political scandal in Germany, eventuating in an official inquiry into German intelligence co-operation with the United States, which is still ongoing.

And nothing will be done. Or they risk exposure of what France itself does.

• Hollande Calls Emergency Meeting After U.S. Spying Reports (Bloomberg)

French President Francois Hollande has called a high-level emergency meeting for 9 a.m. on Wednesday after WikiLeaks reported that the U.S. had spied on him and two of his predecessors. The meeting with the defense, interior, foreign and justice ministers will “evaluate the nature” of the report posted on the WikiLeaks website, said an official in Hollande’s office who asked not to be identified. WikiLeaks, which has published unauthorized documents since it started in 2006, reported that the NSA spied on Hollande, Nicolas Sarkozy and Jacques Chirac from 2006 to 2012, listening in on discussions about the euro debt crisis and French relations with German Chancellor Angela Merkel, including secret meetings of French government ministers about the possibility of Greece leaving the euro area.

The NSA also eavesdropped on French complaints about U.S. spying, WikiLeaks said. “We are not targeting and will not target the communications of President Hollande,” said Ned Price, a spokesman for the U.S. National Security Council, which advises the White House on its foreign policy. “We do not conduct any foreign intelligence surveillance activities unless there is a specific and validated national security purpose.” Sarkozy’s office didn’t respond to requests for comment. Agence France-Presse reported that his office had said the spying as reported was “unacceptable in general, and certainly between allies.” WikiLeaks has been releasing documents about U.S. wiretapping since 2010, detailing how the NSA spied on world leaders including Brazilian President Dilma Rousseff.

You betcha.

• World’s Big Economies Are About to Feel the Impact of China Slowdown (Bloomberg)

Emerging markets and commodity suppliers have grappled with reduced demand from China as a property downturn weighed on the world’s second-largest economy. U.S., Japanese and German exporters did better, supplying capital goods like machines that China still demanded. That may soon change, according to a study of global exposure to China by UBS Group AG economists Donna Kwok, Wang Tao and Jennifer Zhong. “As the multiyear Chinese property downshift continues to unfold beyond this year, we may see a longer-term decline in China’s appetite for foreign industrial imports,” the analysts wrote in a report June 22. “Commodity, reprocessing, and developed country exporters alike should brace themselves for the impact of weakening China demand this year, irrespective of whether U.S. or EU imports pick up.”

That’s not good news for a world economy increasingly reliant on China. China quadrupled the number of countries to which it was the biggest export market in the decade to 2014, the UBS analysts wrote. In the same period, the U.S. almost halved the number of countries for which it held the same title. In terms of exports as a share of GDP, nearly all countries UBS covers saw their China exposure rise; some doubled – Japan, South Korea, U.S., Brazil, Canada, Chile – while some tripled – Germany, the EU – and some even quadrupled, like Australia. For commodity exporters including South Africa, Australia, Indonesia and Brazil, the impact of a slowing China has been predictably negative.

Just to show you who’s really in power.

• Shell Fights To Prevent The Release Of Arctic Drilling Audit (Greenpeace)

Shell is fighting to prevent the public release of an audit of their Arctic drilling operations. Last week, in response to Greenpeace’s Freedom of Information Act (FOIA) request, Shell argued to government regulators that the entire document is “confidential business information” and should be kept from public disclosure. The problem is that – in order to comment on Shell’s Exploration Plan – the public should have had access to this document months ago. The deadline for that passed on 1 May yet the government department in charge – Bureau of Safety and Environmental Enforcement (BSEE) – has had the first part of Shell’s audit since November 2014. With Shell’s fleet already heading north to Alaska the failure to disclose is becoming more serious every day.

After Shell’s disastrous 2012 attempt at drilling in the Arctic Ocean — which ended with one of their drilling rigs beached on an Alaskan island and eight felony charges related to violations on the other rig — Secretary of the Interior Ken Salazar ordered a review of Shell’s operations to find out what went wrong, including an audit of Shell’s Safety and Environmental Management Systems (SEMS). The audit was designed to ensure “that the management and oversight shortcomings identified with respect to all aspects of the company’s 2012 operation have been addressed and that the company’s management structure and systems are appropriately tailored to Shell’s Arctic exploration program” – before the firm was to drill again in the Arctic.

The audit was meant to be a full third party assessment – but Shell paid for the audit and was allowed to handpick the auditor (Houston-based Endeavor Management). A SEMS audit assesses the management and operational systems put in place on offshore oil rigs to protect worker safety and the environment, such as analysing potential hazards and operating procedures. The auditor will typically review documents and systems as well as conduct interviews and site visits. It was also disclosed that the audit would be split into two parts. Stage 1 would take place in Shell’s Anchorage, AK office, and Stage 2 would take place on board the drillship Noble Discoverer once it was operating in the waters of the Alaskan Outer Continental Shelf.

The in-office portion of the audit was completed in 2014 and the audit report was provided to BSEE towards the end of that year. However, this document has never been made public and Greenpeace submitted a FOIA request for its release. Despite the promise that the audit would be a requirement “before” Shell was allowed to return to the Arctic, Stage 2 has yet to be completed and will presumably happen this summer while Shell is drilling.

Sanctions?

• Russia Surpasses Saudi Arabia as China’s Biggest Oil Supplier (Bloomberg)

Russia surpassed Saudi Arabia to become China’s top crude supplier as the fight for market share in the world’s second-largest oil consumer intensifies. China imported a record 3.92 million metric tons from its northern neighbor in May, according to data emailed by the Beijing-based General Administration of Customs. That’s equivalent to 927,000 barrels a day, a 20% increase from the previous month. Saudi sales slumped 42% from April to 3.05 million tons. China is becoming a key market for global oil exporters as surging output from shale fields from Texas to North Dakota allows the U.S., the biggest crude consumer, to rely less on overseas supplies. The Asian nation will account for more than 11% of world demand this year, the Paris-based International Energy Agency predicted this month.

“This is a clear sign of how spoilt Asia is for choice these days, with Middle Eastern crude now having to compete with oil from other regions,” Amrita Sen at Energy Aspects said in an e-mail. “Russia is increasingly looking east and the various deals made between Rosneft and China are likely to see more Russian crude head to China permanently.” Russia is China’s top crude supplier for the first time since October 2005 as it seeks new markets for its crude amid western sanctions over its dispute with Ukraine. Rosneft in 2013 agreed to supply 365 million tons over 25 years to China National under a $270 billion deal. The same year, the company agreed an $85 billion, 10-year deal with China Petrochemical. Russia isn’t the only crude shipper to overtake Saudi Arabia last month. Angola sold 3.26 million tons to China, 14% more from April, rising two places to take second spot.

As we always predicted.

• Cellulosic Ethanol is Going Backwards (Robert Rapier)

In last month’s article Where are the Unicorns?, I discussed the fact that the commercial cellulosic ethanol plants that were announced with great fanfare over the past couple of years are obviously running at a small fraction of their nameplate capacity. In fact, April was a record month for cellulosic ethanol production according to the EPA’s database that tracks this information, but that meant that at least 8 months into the learning curves for these plants actual production for that month was only about 6% of nameplate capacity. May’s numbers are now in, and the situation has gotten worse. After reporting 288,685 gallons of cellulosic ethanol in April, May’s numbers only amounted to 114,018 gallons.

This is only about 2.4% of the nameplate capacity of the announced commercial cellulosic ethanol plants. If we use year-to-date numbers, the annualized capacity is still less than 3% of nameplate capacity for facilities that cost hundreds of millions of dollars to build. Let that soak in. POET alone spent $275 million, with U.S. taxpayers footing more than $100 million of that bill. Abengoa reportedly received $229 million from taxpayers for its project. For this (plus however much that was spent by INEOS), the combined plants are running at an annualized capacity of 1.7 million gallons of ethanol, which would sell on the spot market today for $2.6 million.

We can conclude from this that the three companies with announced commercial cellulosic ethanol facilities – INEOS, POET, and Abengoa – are finding the going much tougher than expected. I believe that the costs to produce their cellulosic ethanol are higher than the price they will receive for the ethanol. This is the sort of monthly cash drain that led to the shutdown of everyone else that ever tried to produce cellulosic ethanol commercially.