Dorothea Lange Family of 4 from Taos Junction, resettled at Bosque Farms, NM Dec 1935

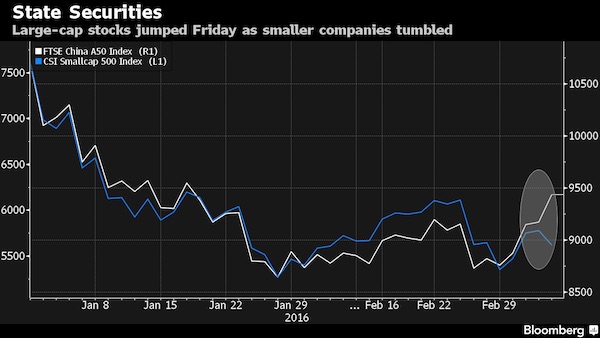

The Nikkei lost 2.98% overnight, European exchanges continue their fall, hundreds of trucks carrying European produce are turned back at the Russian border, and high yield bond funds saw record high outflows in the past week. And in that world, China reports it highest trade balance surplus ever, a ‘fact’ that’s duly parroted by ‘news’ services around the globe.

Meanwhile, the WHO declares the Ebola outbreak an ‘international public health emergency’ and Barack Obama goes on national TV to announce he’s ordered targeted airstrikes in Iraq, ostensibly to prevent a massacre. Is this the US trying to clean up some of the mess and the vacuum it’s left behind?

Don’t bet on it, creating messes, vacuums and chaos is an integral part of American foreign policy. Perhaps seeing ISIS militants take over Iraq’s biggest hydroelectric dam earlier in the week was the proverbial straw. There’s a Pentagon report that says “a failure at the dam could send a 65-foot wave across parts of northern Iraq.”

Talking about Obama, journalist Greg Palast, who knows a thing or two about vulture funds, writes one of the most damning articles about the president that I’ve seen in a while. Palast contends that it would be very easy for Obama to halt Argentina’s default – and the credit event it would result in – by simply invoking one single clause from the US Constitution.

In fact, George W. did just that, and used it against the very same hedge fund that now threatens Argentina. Moreover, the very same judge who rules over the present case was warned over the “Separation of Powers” clause 30 years ago. But Obama hasn’t moved an inch.

How Barack Obama Could End Argentina Debt Crisis

The “vulture” financier now threatening to devour Argentina can be stopped dead by a simple note to the courts from Barack Obama. But the president, while officially supporting Argentina, has not done this one thing that could save Buenos Aires from default. Obama could prevent vulture hedge-fund billionaire Paul Singer from collecting a single penny from Argentina by invoking the long-established authority granted presidents by the US constitution’s “Separation of Powers” clause.

Under the principle known as “comity”, Obama only need inform US federal judge Thomas Griesa that Singer’s suit interferes with the president’s sole authority to conduct foreign policy. Case dismissed. Indeed, President George W Bush invoked this power against the very same hedge fund now threatening Argentina. Bush blocked Singer’s seizure of Congo-Brazzaville’s US property, despite the fact that the hedge fund chief is one of the largest, and most influential, contributors to Republican candidates.

Notably, an appeals court warned this very judge, 30 years ago, to heed the directive of a president invoking his foreign policy powers. In the Singer case, the US state department did inform Judge Griesa that the Obama administration agreed with Argentina’s legal arguments; but the president never invoked the magical, vulture-stopping clause. Obama’s devastating hesitation is no surprise. It repeats the president’s capitulation to Singer the last time they went mano a mano.

It was 2009. Singer, through a brilliantly complex financial manoeuvre, took control of Delphi Automotive, the sole supplier of most of the auto parts needed by General Motors and Chrysler. Both auto firms were already in bankruptcy. Singer and co-investors demanded the US Treasury pay them billions, including $350m (£200m) in cash immediately, or – as the Singer consortium threatened – “we’ll shut you down”. They would cut off GM’s parts. Literally.

GM and Chrysler, with no more than a couple of days’ worth of parts to hand, would have shut down, permanently; forced into liquidation. Obama’s negotiator, Treasury deputy Steven Rattner, called the vulture funds’ demand “extortion” – a characterisation of Singer repeated last week by Argentina President Cristina Fernández de Kirchner. But while Fernández declared “I cannot as president submit the country to such extortion,” Obama submitted within days. Ultimately, the US Treasury quietly paid the Singer consortium a cool $12.9 billion in cash and subsidies from the US Treasury’s auto bailout fund.

I recommend you read the rest of Palast’s piece as well, there are still people in the world who know how to do investigative journalism. Here’s one more paragraph:

In the case of Argentina, Obama certainly has reason to act. The US State Department warned the judge that adopting Singer’s legal theories would imperil sovereign bailout agreements worldwide. Indeed, it is reported that, in 2012, Singer joined fellow billionaire vulture investor Kenneth Dart in shaking down the Greek government for a huge payout during the euro crisis by threatening to create a mass default of banks across Europe.

Best remember who your friends are. Argentina has filed a complaint against the US with the International Court Of Justice, but it may be of little use, since the US doesn’t recognize its jurisdiction (it’s too afraid some former Washington hotshots would be called to stand trial for, among other things, war crimes).

Mario Draghi yesterday reiterated his intention to prepare for launching QE, but that may not just be impossible, it may be too late as well, since even Germany is rumored to be near a recession. What global central banks have pulled out of their hats so far has already resulted in such a distorted marketplace that German and Dutch 10-year bonds yield 1% or less, and the German 2-year even briefly went negative yesterday. Draghi QE would only exacerbate the very situation that has led to this distortion, and we must hope at least some heads are clear enough to recognize that.

But don’t bet on that either. Draghi may have to save his native country first, and urgently:

The ECBs Next Problem: Saving Italy

Since Matteo Renzi grabbed the Italian premiership in February, Rome has fallen off the radar of most crisis watchers. Renzi’s promise to institute sweeping reforms to business and labour markets appeared to be more than hot air following the appointment of Pier Carol Padoan as finance minister. The heavy-hitting former chief economist of the OECD appeared to give the youthful Renzi the intellectual ballast and political clout needed to push through an ambitious agenda.

This narrative was allied to figures showing Italy was already close to achieving a balanced budget and its banks were in better shape than many of France’s famous names. Maybe it is too soon to judge, but figures showing the country has fallen back into recession will dent the new government’s plans along with its image.

Fathom Consulting, run by former Bank of England economist Danny Gabay, warns that Rome may rank as another of Europe’s Black Swans. It has flirted with disaster before and always pulled back. Without an ECB rescue, in the form of large-scale quantitative easing, maybe a full-blown run on its debt is inevitable, possibly next year.

But Mario thinks it’s a good idea to chastise his fellow countrymen, especially new PM Renzi, first. Perhaps his dreams of one day becoming Prime Minister himself have something to do with that.

Draghi Takes Aim at Italy as Recession Scars Euro Area

Mario Draghi says Italy can only blame itself for its third recession since 2008. The day after data showed the euro-area’s third-biggest economy unexpectedly contracted last quarter, the European Central Bank president singled out his country’s lack of structural reform and the disincentive for investment it engenders. [..] “I keep on saying the same thing, really – I mean, of reforms in the labor market, in the product markets, in the competition, in the judiciary, and so on and so forth [..] “These would be the reforms which actually have shown to have a short-term benefit.”

The ECB president’s comments on his homeland are blunter than normal, adding to the contrast with countries such as Spain that have engaged in more structural adjustments. “Draghi made a strong call for structural reforms, noting that there is now ample evidence to suggest that countries that have reformed their economies are showing a stronger economic performance than the rest of the euro zone,” said Riccardo Barbieri [at Mizuho]. “This sounds like a strong rebuttal of the approach taken by Italy’s new prime minister.”

Still, as Wolf Richter states, things are not as easy as an IMF style reform or two here and there. Italy has a hidden pile of debt to suppliers it would rather see go bankrupt.

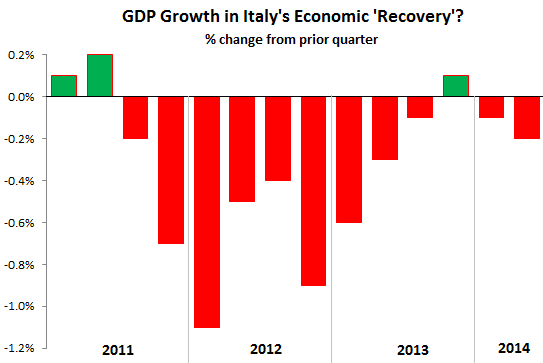

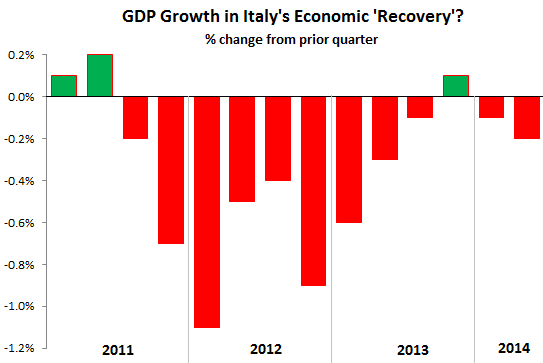

Italy’s Unrecovery: GDP Negative In 11 Of Last 12 Quarters

In the second quarter, Italy’s economy contracted 0.2% from the first quarter, which surprised economists who’d expected, somehow, more growth now that the Italian economy – in parallel with the grander Eurozone economy – is recovering so nicely. However, reality is not playing along. Crummy exports and a refusal by businesses to pile on inventories were blamed.

Not blamed, of course, was the Italian government, which refuses to pay its suppliers. The arrears, according to the most recent data by the Bank of Italy, amounted to €75 billion ($102 billion). Italy could just issue more bonds to fund what it owes, but that would show to the rest of the world that its debt is actually much higher than the current pretenses. So no way.

Successive politicians have promised for years to pay it, only to push the date when payment would be considered seriously out further and further. So far, no one has forced the government to pay its bills, and so they don’t get paid. The past dues have been sucked out of the working capital of businesses. They strangle the private sector, lead to layoffs, and wreak general havoc in an already very fragile economy. Based on the government’s failure to comply with Europe’s Late Payments Directive, which requires governments to cut payment delays to a maximum of 60 days, the European Commission commenced an infringement procedure against Italy. But that too may just be decoration. The way it looks, it may never be paid.

The (in)famous Martin Armstrong, in his own unique style, takes things a step further:

Italy’s Recession Means ‘The End Of Democracy’

Italy has entered that phase of zero-point growth. Italy’s people have been beaten by Europe and no longer expect recovery. But then, yesterday, the Statistical Office of the economic data for the second quarter of 2014 released economic numbers that froze a dumb look even on the faces of the hardcore pessimists. For the second time this year, Italy experienced a slump of its GDP by 0.3% year on year. The economic data is so bad, not seen for 14 years, that everyone no matter what side of the political fence is whispering or shouting the same world – “Recession!”

The advantage of Italy and its legendary corruption has been its equally inefficient government that has allowed the people to just ignore it and get along with life in the real world of the underground economy. When you look at the numbers at the gross level, one cannot imagine how Italy has functioned economically. However, looking closer one sees the vibrant underground economy that has allowed the people to make their own living and still prices, taxes and debt per capita are much lower than everywhere else in Europe[..] The solution for Italy? The politician’s dream. Brussels wants to take away the right of the Italian people to vote on anything meaningful.

The Senate in Italy was rather unique. All legislation had to go through the Senate which was elected by the people and had the power to dismiss the government. This was actually a very good idea. However, it prevents tyranny from Brussels and this is the real problem. Renzi has succeeded against the resistance of the deputies. The Senate, the second chamber of Parliament, today or at the latest on Friday will decide to self-disempowerment. [..]

Italy is where the Republic was born in 509 BC that sparked a contagion that spread with the overthrow of monarchy giving birth to Democracy in Athens in 508 BC. The land that had inspired the American Revolution against monarchy is now itself surrendering the last vestige of democratic process yield to the growing tyranny of Brussels under the pretense of saving the Euro.

I’ve said it often: the only thing that would actually benefit Italy is for it to leave the Eurozone. But with people like Draghi, Monti and Renzi, plus the very extensive cabal that has held the reins for ages, that will not happen. The country will have to default, and see extensive rioting in the streets, before something fundamental will change. Until then, an ongoing parade of technocrats and bureaucrats will be elected to rule the ruins of the dramatically tragic, and dramatically beautiful, nation.

Whether the old style Senate was as great as Armstrong makes it out to be, I’m not so sure, there’s too many pictures on my retina of 95 year old life long senators soaked in ties to much less than squeaky clean segments of Italian society. Italy needs a truly fresh start, and while it’s hard to see how it will get there, it won’t get it inside the eurozone. As for democracy, Beppe Grillo’s M5S was the single largest party in the last general elections, and the system still manages to ignore him.

As for American democracy, you tell me. Who amongst ordinary Americans is happy with what the US does in Ukraine? The only voice I’ve seen consistently make sense on the topic is Ron Paul. That’s not much. Who wants to see the US go back into Iraq, as Obama has decided it will?

And who’s happy to see the President not use the powers very evidently at his disposition, to call a halt to an attack on yet another sovereign nation, this one from behind desks and courtrooms in New York and Washington? Shouldn’t the President be the one to decide on foreign policy, and is President Obama still the one making those decisions? Is he the one who went looking for a new cold war?

Democracy in America, you tell me. A few last words from Greg Palast:

Singer has certainly earned his vulture feathers. His attack on Congo-Brazzaville in effect snatched the value of the debt relief paid for by US and British taxpayers and, says Oxfam, undermined the nation’s ability to fight a cholera epidemic.

[..] since taking on Argentina, Singer has unlocked his billion-dollar bank account, becoming the biggest donor to New York Republican causes. He is a founder of Restore Our Future, a billionaire boys club, channeling the funds of Bill Koch and other Richie Rich-kid Republicans into a fearsome war-chest dedicated to vicious political attack ads. And Singer recently gave $1 million to Karl Rove’s Crossroads operation, another political attack machine.

In other words, there’s a price for crossing Singer. And, unlike the president of Argentina, Obama appears unwilling to pay it.

• How Obama Could End Argentina Debt Crisis, And Why He Doesn’t (Greg Palast)

The “vulture” financier now threatening to devour Argentina can be stopped dead by a simple note to the courts from Barack Obama. But the president, while officially supporting Argentina, has not done this one thing that could save Buenos Aires from default. Obama could prevent vulture hedge-fund billionaire Paul Singer from collecting a single penny from Argentina by invoking the long-established authority granted presidents by the US constitution’s “Separation of Powers” clause. Under the principle known as “comity”, Obama only need inform US federal judge Thomas Griesa that Singer’s suit interferes with the president’s sole authority to conduct foreign policy. Case dismissed. Indeed, President George W Bush invoked this power against the very same hedge fund now threatening Argentina. Bush blocked Singer’s seizure of Congo-Brazzaville’s US property, despite the fact that the hedge fund chief is one of the largest, and most influential, contributors to Republican candidates.

Notably, an appeals court warned this very judge, 30 years ago, to heed the directive of a president invoking his foreign policy powers. In the Singer case, the US state department did inform Judge Griesa that the Obama administration agreed with Argentina’s legal arguments; but the president never invoked the magical, vulture-stopping clause. Obama’s devastating hesitation is no surprise. It repeats the president’s capitulation to Singer the last time they went mano a mano. It was 2009. Singer, through a brilliantly complex financial manoeuvre, took control of Delphi Automotive, the sole supplier of most of the auto parts needed by General Motors and Chrysler. Both auto firms were already in bankruptcy. Singer and co-investors demanded the US Treasury pay them billions, including $350m (£200m) in cash immediately, or – as the Singer consortium threatened – “we’ll shut you down”. They would cut off GM’s parts. Literally.

GM and Chrysler, with no more than a couple of days’ worth of parts to hand, would have shut down, permanently;forced into liquidation. Obama’s negotiator, Treasury deputy Steven Rattner, called the vulture funds’ demand “extortion” – a characterisation of Singer repeated last week by Argentina President Cristina Fernández de Kirchner. But while Fernández declared “I cannot as president submit the country to such extortion,” Obama submitted within days. Ultimately, the US Treasury quietly paid the Singer consortium a cool $12.9bn in cash and subsidies from the US Treasury’s auto bailout fund.

Read more …

• Argentina Files Legal Action Against US Over Debt Default (Reuters)

Argentina has asked the International Court Of Justice (ICJ) in The Hague to take action against the United States over an alleged breach of its sovereignty as it defaulted on its debt. Argentina defaulted last week after losing a long legal battle with hedge funds that rejected the terms of debt restructurings in 2005 and 2010. A statement issued by the ICJ, the United Nation’s highest court for disputes between nations, said Argentina’s request had been sent to the US government. It added that no action will be taken in the proceedings “unless and until” Washington accepts the court’s jurisdiction.

The US has recognised the court’s jurisdiction in the past, but it was not immediately clear if it would do so in Argentina’s case. The default came after Argentina failed last week to strike a deal with the main holdouts among investors, hedge funds NML Capital and Aurelius Capital Management. Buenos Aires maintains it has not defaulted because it made a required interest payment on one of its bonds due in 2033, but a judge in the US district court in Manhattan blocked that deposit in June, saying it violated an earlier ruling. Argentina said in its application to the court that the United States had “committed violations of Argentinian sovereignty and immunities and other related violations as a result of judicial decisions adopted by US tribunals.”

Read more …

Any questions?

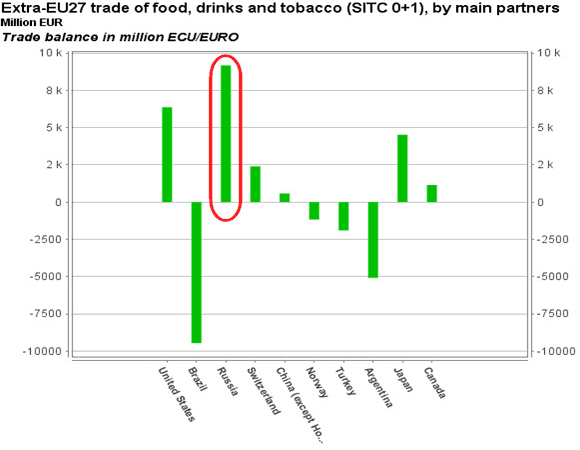

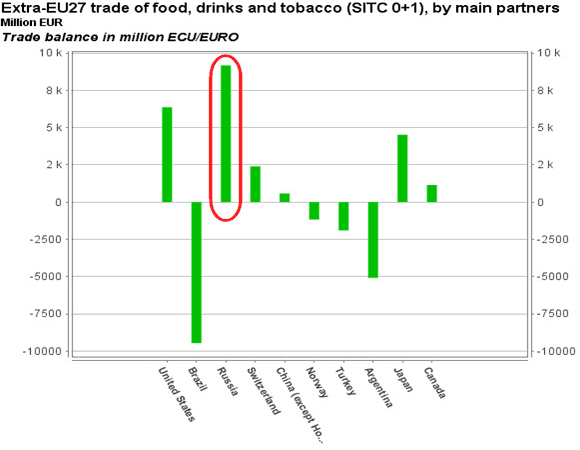

• Checkers Vs Chess: Why Europe Implodes On ‘Russian’ Sanctions (Zero Hedge)

The West’s leaders are full of lawyers, Putin is ex-KGB. If ever there was an example of him playing chess while the West plays checkers, the following chart is it. Despite Western protestations that its sanctions will hurt Russia more than Europe this morning, one look at Europe’s huge net trade balance with Russia for food and it’s clear who is really going to feel the pain. As Martin Armstrong noted previously, “Putin has responded to [Western] sanctions as any really smart chess-player would – you get the supporters of your adversary to jump-ship.” What better way to crack the ‘stop-Putin’ alliance than to force Europe into trade deficits and squeeze their economies (especially Germany)?

Read more …

Ban? What ban?

• Russia’s Import Ban Means Big Business For Latin America (RT)

Russia’s 1-year ban on food products from the EU, US, Canada, and Norway will force Russia to increase food imports from Latin America, specifically Ecuador, Brazil, Chile, and Argentina. Russia will ban meat, dairy, fruit, and vegetable imports from countries that have imposed sanctions on Russia over the Ukraine conflict, which opens the door to Russia’s partners on the other side of the world.

Russia will have to fill an 8% gap in its total agricultural imports that it sources from the EU, USA, Canada, Australia, and Norway. The Netherlands, Germany and Poland are currently Russia’s biggest food suppliers in the EU. Meat and dairy products from Ecuador, Chile and Uruguay may appear on Russian supermarket shelves as early as September, said Julia Trofimova, a at Rosselkhoznadzor, Russia’s consumer watchdog. On Wednesday the three countries confirmed they are ready to start supplying Russia with agricultural goods and Moscow will soon hold meetings with ambassadors from Brazil and Argentina.

Read more …

“NML Capital, a subsidiary of the hedge fund Elliot Management, headed by Paul Singer, spent $48m on bonds in 2008; thanks to Griesa’s ruling, NML Capital should now receive $832m – a return of more than 1,600%.”

• Argentina Default? Griesafault Is Much More Accurate (Stiglitz/Guzman)

On 30 July Argentina’s creditors did not receive their semi-annual payment on the bonds that were restructured after the country’s last default in 2001. Argentina had deposited $539m (£320m) in the Bank of New York Mellon a few days before. But the bank could not transfer the funds to the creditors: US federal judge Thomas Griesa had ordered that Argentina could not pay the creditors who had accepted its restructuring until it fully paid – including past interest – those who had rejected it. It was the first time in history that a country was willing and able to pay its creditors, but was blocked by a judge from doing so. The media called it a default by Argentina, but the Twitter hashtag #Griesafault was much more accurate. Argentina has fulfilled its obligations to its citizens and to the creditors who accepted its restructuring. Griesa’s ruling, however, encourages usurious behaviour, threatens the functioning of international financial markets, and defies a basic tenet of modern capitalism: insolvent debtors need a fresh start.

Sovereign defaults are common events with many causes. For Argentina, the path to its 2001 default started with the ballooning of its sovereign debt in the 1990s, which occurred alongside neoliberal “Washington Consensus” economic reforms that creditors believed would enrich the country. The experiment failed, and the country suffered a deep economic and social crisis, with a recession that lasted from 1998 to 2002. By the end, a record-high 57.5% of Argentinians were in poverty, and the unemployment rate skyrocketed to 20.8%. Argentina restructured its debt in two rounds of negotiations, in 2005 and 2010. More than 92% of creditors accepted the new deal, and received exchanged bonds and GDP-indexed bonds. It worked out well for both Argentina and those who accepted the restructuring. The economy soared, so the GDP-indexed bonds paid off handsomely.

But so-called vulture investors saw an opportunity to make even larger profits. The vultures were neither long-term investors in Argentina nor the optimists who believed that Washington Consensus policies would work. They were simply speculators who swooped in after the 2001 default and bought up bonds for a fraction of their face value from panicky investors. They then sued Argentina to obtain 100% of that value. NML Capital, a subsidiary of the hedge fund Elliot Management, headed by Paul Singer, spent $48m on bonds in 2008; thanks to Griesa’s ruling, NML Capital should now receive $832m – a return of more than 1,600%.

Read more …

Wow!

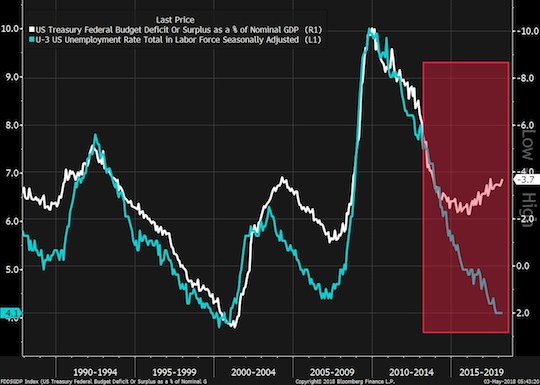

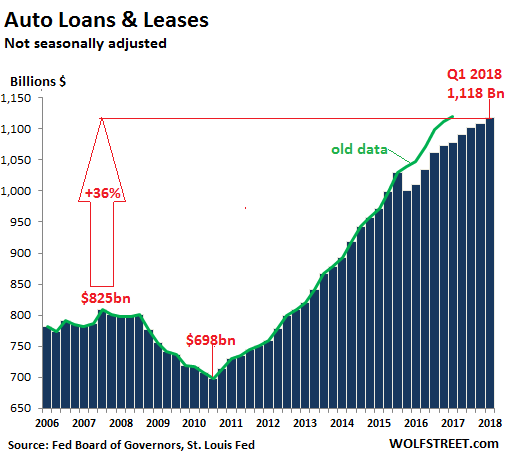

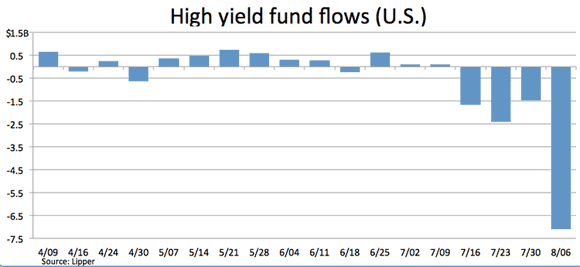

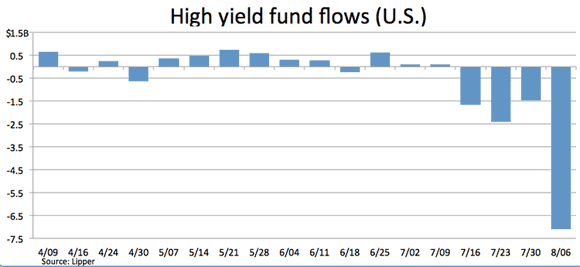

• US High Yield Bond Funds See Shocking, Record $7.1B Cash Outflow

Retail-cash outflows from high-yield funds ballooned to a shocking, record $7.07 billion in the week ended Aug. 6, with ETFs representing just 18% of the sum, or roughly $1.28 billion, according to Lipper. The huge redemption blows out past the prior record outflow of $4.63 billion in June 2013. With four straight weeks of outflows from the asset class totaling $12.6 billion, the four-week trailing average expands to negative $3.15 billion per week, from $1.4 billion last week. This reading is also a record, eclipsing a prior record at $2.8 billion, also in June 2013.

The full-year reading is now deeply in the red, at $5.9 billion, with 43% of the withdrawal tied to ETFs. One year ago at this time outflows were $3.9 billion, with 15% linked to the ETF segment. In addition to the huge outflow, the change due to market conditions was negative $1.24 billion, also the greatest negative move dating to June 2013. The change this past week is nearly negative 1% against total assets, which stood at $176.3 billion at the end of the observation period, with 19% tied to ETFs, or $34.1 billion. Total assets are up $6.5 billion in the year to date, reflecting a gain of roughly 4% this year.

Read more …

• ECB Ready To Pump Cash Into Eurozone As Fears Rise Over Recovery (Guardian)

The European Central Bank is accelerating plans to unleash fresh growth-boosting measures as the eurozone’s recovery loses steam and the risk increases of a geopolitical shock from the Ukraine crisis. Mario Draghi, president of the ECB, said that the Bank had “intensified preparatory work” on quantitative easing as a potential new weapon in its battle against deflation and economic stagnation. He revealed that the eurozone’s policymakers were closer to using QE – which would inject cash into the eurozone by acquiring assets such as bonds from financial institutions – amid worrying signs that weak growth in the 18-member currency bloc is slowing further still. “The recovery remains weak, fragile and uneven. In recent weeks, the data shows growth momentum is slowing down. It is quite clear that if geopolitical risks materialise, the next two quarters will show lower growth.”

Recovery in the region is barely established, with GDP increasing by only 0.2% in the first quarter of the year. Speaking at a press conference in Frankfurt, Draghi said sanctions and counter sanctions between the west and Russia were among the biggest risks facing the eurozone economy, with the potential to drive energy prices higher and depress exports. He stressed it was too early to say what the precise impact sanctions would have on the region. “We are just at the beginning. We are still assessing what impact sanctions might have on the economy. “Geopolitical risks are heightened. And some of them, like the situation in Ukraine and Russia will have a greater impact on the euro area than they … have on other parts of the world.” Earlier, the ECB’s governing council left rates on hold at its July policy meeting, as expected.

Read more …

• Germany Close To Recession As ECB Admits Recovery Is Weak (AEP)

German bonds yields plunged to a historic low and two-year rates briefly fell below zero on Thursday on fears of widening recession in the eurozone, and a flight to safety as Russian troops massed on the Ukrainian border. Yields on 10-year Bunds dropped to 1.06% after a blizzard of fresh data showed that recovery has stalled across most of the currency bloc, with even Germany now uncomfortably close to recession. Commerzbank warned that the German economy may have contracted by 0.2% in the second quarter and is far too weak to pull southern Europe out of the doldrums. Industrial output fell 1.5% over the three months. The DAX index of equities in Frankfurt has dropped 10% over the past month and is threatening to break through the psychological floor of 9,000.

Mario Draghi, head of the ECB, said the recovery remained “weak, fragile and uneven”, with a marked slowdown in recent weeks on escalating geopolitical worries over Russia and the Middle East. He said the ECB, which on Thursday held benchmark interest rates at 0.15%, “stands ready” to inject money through purchases of asset-backed securities and quantitative easing if needed, but would not take further action yet even though inflation had fallen to 0.4%. The debt markets are pricing in 0.5% inflation in Germany and Italy over the next five years through so-called “break-even” rates, evidence that investors think the ECB is falling far behind the curve. Mr Draghi insisted that a string of measures unveiled in June were starting to work and should be enough to stave off deflation.

The ECB ignored pleas from leading economists for pre-emptive action to bolster the eurozone’s defences before an external shock hit and before the US Federal Reserve tightened monetary policy, an inflection point that risks sending tremors through the global system, according to a paper by the Chicago Fed. Hopes for a swift rebound in Germany are fading. The economics ministry said new orders in manufacturing fell 3.2% in June, with orders from the rest of the eurozone collapsing by 10.4%. “What this shows is that Europe is nowhere close to recovery. Monetary policy has run out of traction,” said Steen Jakobsen from Saxo Bank.

Read more …

• Draghi Takes Aim at Italy as Recession Scars Euro Area (Bloomberg)

Mario Draghi says Italy can only blame itself for its third recession since 2008. The day after data showed the euro-area’s third-biggest economy unexpectedly contracted last quarter, the European Central Bank president singled out his country’s lack of structural reform and the disincentive for investment it engenders. That followed an opening statement that lamented the region’s “uneven” recovery. “I keep on saying the same thing, really – I mean, of reforms in the labor market, in the product markets, in the competition, in the judiciary, and so on and so forth,” Draghi, the former Bank of Italy governor, said in Frankfurt yesterday after keeping ECB interest rates unchanged at record lows. “These would be the reforms which actually have and have shown to have a short-term benefit.”

The comments may increase pressure on Italian Prime Minister Matteo Renzi to turn around an economy with youth unemployment above 40% and a recession that threatens the 18-nation currency bloc’s nascent revival. The ECB president’s comments on his homeland are blunter than normal, adding to the contrast with countries such as Spain that have engaged in more structural adjustments. “Draghi made a strong call for structural reforms, noting that there is now ample evidence to suggest that countries that have reformed their economies are showing a stronger economic performance than the rest of the euro zone,” said Riccardo Barbieri, the London-based chief European economist at Mizuho International Plc. “This sounds like a strong rebuttal of the approach taken by Italy’s new prime minister.”

Read more …

• Without ECB Rescue, ‘Full-Blown Run On Italian Debt Is Inevitable’ (Guardian)

Since Matteo Renzi grabbed the Italian premiership in February, Rome has fallen off the radar of most crisis watchers. Renzi’s promise to institute sweeping reforms to business and labour markets appeared to be more than hot air following the appointment of Pier Carol Padoan as finance minister. The heavy-hitting former chief economist of the Organisation of Economic Co-operation and Development (OECD) appeared to give the youthful Renzi the intellectual ballast and political clout needed to push through an ambitious agenda. This narrative was allied to figures showing Italy was already close to achieving a balanced budget and its banks were in better shape than many of France’s famous names. Maybe it is too soon to judge, but figures showing the country has fallen back into recession will dent the new government’s plans along with its image.

Fathom Consulting, run by former Bank of England economist Danny Gabay, warns that Rome may rank as another of Europe’s Black Swans. It has flirted with disaster before and always pulled back. Without a European Central Bank (ECB) rescue, in the form of large-scale quantitative easing, maybe a full-blown run on its debt is inevitable, possibly next year. Mario Draghi, the ECB president, is expected to tell his audience today that he is waiting to see how his previous attempts at offering cheap credit are faring before considering QE. Interest rates will be kept on hold alongside further monetary easing. The view from Draghi’s Frankfurt base is that Italy is one of Europe’s children and must be parented with an iron rod. Any hand-outs or relaxation in tough fiscal constraints will be spent by Rome on the equivalent of sweets and sugary drinks, is his view. And he is not alone. The Germans, Dutch and Brussels elite think the same way.

Read more …

• Italy’s Unrecovery: GDP Negative In 11 Of Last 12 Quarters (WolfStreet)

In the second quarter, Italy’s economy contracted 0.2% from the first quarter, which surprised economists who’d expected, somehow, more growth now that the Italian economy – in parallel with the grander Eurozone economy – is recovering so nicely. However, reality is not playing along. Crummy exports and a refusal by businesses to pile on inventories were blamed. Not blamed, of course, was the Italian government, which refuses to pay its suppliers. The arrears, according to the most recent data by the Bank of Italy, amounted to €75 billion ($102 billion). Italy could just issue more bonds to fund what it owes, but that would show to the rest of the world that its debt is actually much higher than the current pretenses. So no way.

Successive politicians have promised for years to pay it, only to push the date when payment would be considered seriously out further and further. So far, no one has forced the government to pay its bills, and so they don’t get paid. The past dues have been sucked out of the working capital of businesses. They strangle the private sector, lead to layoffs, and wreak general havoc in an already very fragile economy. Based on the government’s failure to comply with Europe’s Late Payments Directive, which requires governments to cut payment delays to a maximum of 60 days, the European Commission commenced an infringement procedure against Italy. But that too may just be decoration. The way it looks, it may never be paid. Meanwhile, businesses are suffocating. And it shows: over the last 12 quarters, 11 quarters were contractions, with the sole errant quarter being Q1 2014, when the economy booked a tiny growth of 0.1% from the prior quarter and gave rise to an avalanche of hope, now obviated by events.

Read more …

• Italy’s Recession Means ‘The End Of Democracy’ (Martin Armstrong)

Italy has entered that phase of zero-point growth. Italy’s people have been beaten by Europe and no longer expect recovery. But then, yesterday, the Statistical Office of the economic data for the second quarter of 2014 released economic numbers that froze a dumb look even on the faces of the hardcore pessimists. For the second time this year, Italy experienced a slump of its gross domestic product by 0.3% year on year. The economic data is so bad, to the point it has not been seen for 14 years, that everyone no matter what side of the political fence is whispering or shouting the same world – “Recession!”

The advantage of Italy and its legendary corruption has been its equally inefficient government that has allowed the people to just ignore it and get along with life in the real world of the underground economy. When you look at the numbers at the gross level, one cannot imagine how Italy has functioned economically. However, looking closer one sees the vibrant underground economy that has allowed the people to make their own living and still prices, taxes and debt per capita are much lower than everywhere else in Europe, Italy’s real problem – it joined the Euro which did not benefit the Italians and only increased their national debt in “real terms” as the Euro rallied to excessively high levels in this wave of deflation. The solution for Italy? The politician’s dream. Brussels wants to take away the right of the Italian people to vote on anything meaningful. Prime Minister Matteo Renzi had hoped to celebrate his “epochal success” in the parliamentary reform in practice.

The Senate in Italy was rather unique. All legislation had to go through the Senate which was elected by the people and had the power to dismiss the government. This was actually a very good idea. However, it prevents tyranny from Brussels and this is the real problem. Renzi has succeeded against the resistance of the deputies. The Senate, the second chamber of Parliament, today or at the latest on Friday will decide to self-disempowerment. [..] Italy is where the Republic was born in 509BC that sparked a contagion that spread with the overthrow of monarchy giving birth to Democracy in Athens in 508BC. The land that had inspired the American Revolution against monarchy is now itself surrendering the last vestige of democratic process yield to the growing tyranny of Brussels under the pretense of saving the Euro.

Read more …

And that’s just the Fed polling.

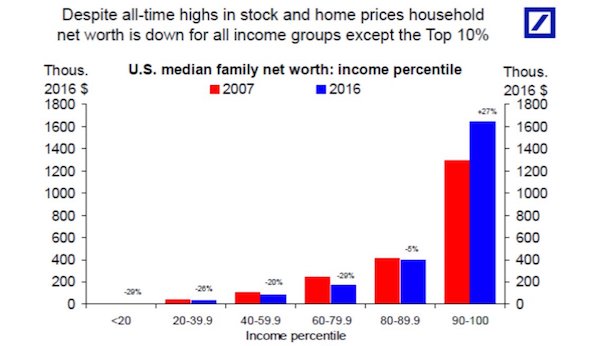

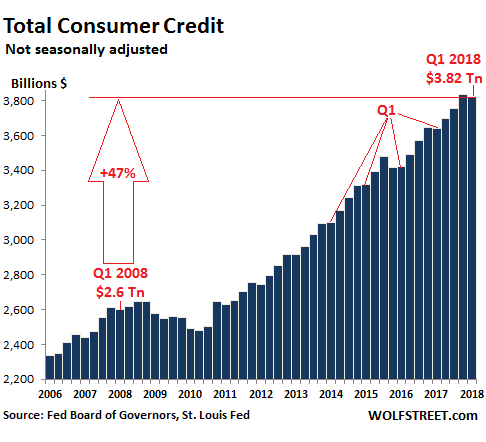

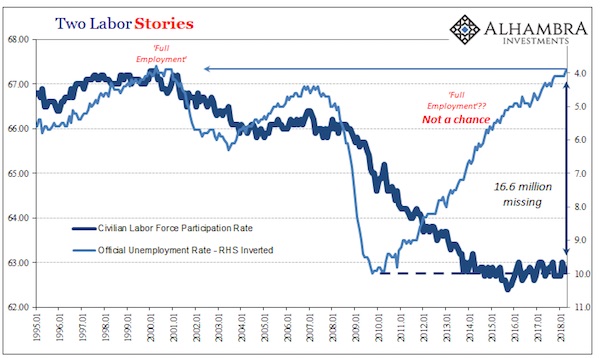

• Fed Survey Finds 4 in 10 Americans in Financial Stress in 2013 (Bloomberg)

Almost four in 10 Americans were suffering financial stress in September 2013 and more than a third said they were worse off than they were five years earlier, a new Federal Reserve report on U.S. household finances showed today. One-fourth of respondents reported they were “just getting by” financially and another 13% said they were struggling to do so, the Fed said. Thirty-four% were worse off financially than in 2008, 34% were about the same, and 30% were better off, according to the report. “The survey found that many households were faring well, but that sizable fractions of the population were at the same time displaying signs of financial stress,” researchers wrote. “For some, perceived credit availability remains low.”

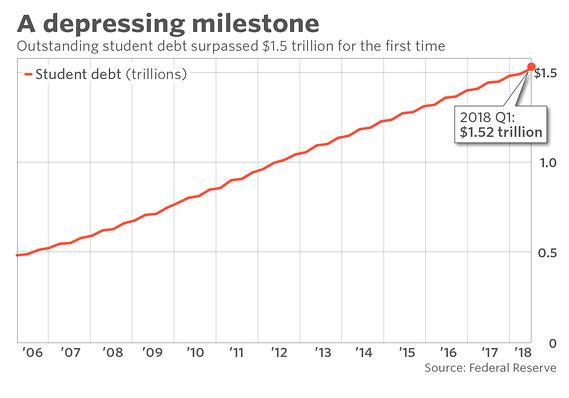

One-third of those who applied for credit were denied or given less credit than they requested, the survey showed. Twenty-four% reported having education debt of some kind, with an average unpaid balance of $27,840. The central bank said its Report on the Economic Well-Being of U.S. Households is a snapshot of financial and economic well-being of U.S. households to help monitor their recovery from the recession and “identify perceived risks to their financial stability.” It aimed to gather household data not readily available from other sources.

Read more …

HELOCs will make a big comeback in the news.

• Default Risk Rises on 20% of Boom-Era Home-Equity Loans (Bloomberg)

As much as 20% of home equity lines of credit worth $79 billion are at increased risk of default as their payments jump a decade after the loans were made during the U.S. housing boom, according to TransUnion Corp. Borrowers face rate shocks as payments on the credit lines, known as HELOCs, switch from interest-only to include principal, causing monthly bills to surge more than 50%, according to a report today by the Chicago-based credit information company. The 20% of borrowers most in danger of default are property owners with low credit scores, high debt-to-income ratios and limited home equity, said Ezra Becker, TransUnion’s vice president of research.

Maturing home equity lines, which allow borrowers to use the value of their home as collateral on loans for personal spending, are the last wave of resetting debt from the era of high property values and easy credit before the 2008 financial crisis. The three biggest home equity lenders – Bank of America, Wells Fargo, JPMorgan Chase – held 36% of the $691.5 billion debt as of the first quarter, according to Federal Reserve data. [..] About $23 billion in HELOCs will have payment increases this year as the interest-only phase ends, rising to a projected peak of $56 billion in 2017, according to a June report by the Treasury Department’s Office of the Comptroller of the Currency.

Read more …

Haha!

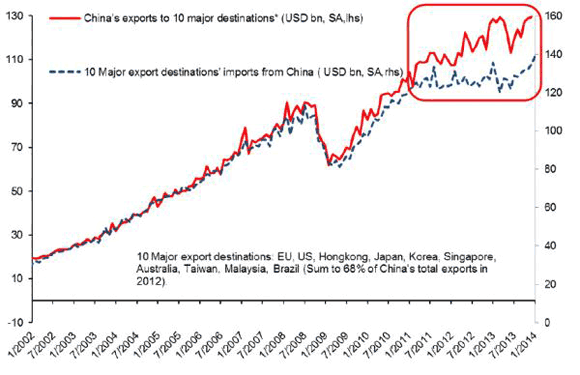

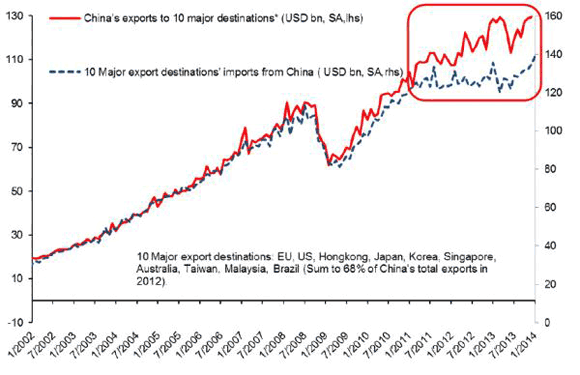

• China Trade Balance At Highest Ever – EVER! (Zero Hedge)

Filed in the “are you kidding us” folder… Chinese exports rose an astounding 14.5% YoY in July (the biggest surge since April 2013 and double the 7.0% YoY expectations). Chinese imports plunged 1.6% to 4-month lows, dramatically missing expectations of a 2.6% YoY gain. These miracles of goalseek.xls and fake trade invoicing left the Chinese Trade Balance for July at $47.3 Billion – its highest ever (ever) and almost double the $27.4bn expectations. In the midst of collapsing European economies, plunging Russia, and stumbling ‘hard’ US macro data, the Chinese government would have us believe the world (net) bought the most stuff ever from them in July… Yes, your eyes are not deceiving you…

It would appear – as we noted previously, that China is up to its old tricks… China’s exports have been overstated by Chinese data…

We cannot show just how crazy this data is because US and more importantly Hong Kong imports from China data is not updated to end July yet… but it is noteworthy that the hub of fake invoicing – Hong Kong – saw a 13.3% YoY jump – its most in 16 months… after being totally flat for 4 months

Read more …

“One figure stands out: the $343 billion these nonbank lenders owe in interest and principal repayments this quarter alone.”

• China’s $343 Billion Q3 Payments Due in the Shadows (Bloomberg)

China’s “trust companies” are a growth industry, notable not for imparting stability to the $9.2 trillion economy, but for the red flags they raise. One figure stands out: the $343 billion these nonbank lenders owe in interest and principal repayments this quarter alone. This topic may not sound very exciting to those far removed from the mechanics of China Inc. and President Xi Jinping’s efforts to rein in credit and investment bubbles. But these nonbank lenders are at the core of the shadow-banking industry that makes China’s financial system both opaque and fragile. The greater the repayment requirements, the greater the risk of a miss and the turmoil that might follow. That’s why the latest report from Hu Yifan of Haitong International Securities, titled “Day of Reckoning for China Trusts,” is so troubling. From now through 2015, Hu says, such repayments will be at elevated levels.

The odds of missed payments and headline-making credit events is increasing as data suggest government stimulus measures are gaining less traction than in years past. “The brisk development of trust funds is leading to a dead-end,” Hu says. The “uncertainties surrounding their regulatory requirements have led to an accumulation and concentration of risk in this sector.” And even as Chinese regulators try to curb trust-company indebtedness, they find new ways to expand. This “liquidity binge,” Hu says, is fueling excessive leverage and risk in real estate, infrastructure and mining. “Current payment difficulties of trust fund companies are only the tip of the iceberg,” he warns. Here, the reference is to the part of the problem we can see. What’s worrying outside observers, including the IMF, is what we can’t. At the top of any wish list for economists in Washington is discerning China’s true debt profile – national, local and financial.

Until we know for sure, if we even can, the IMF can do little more than urge China to address its “web of vulnerabilities” inherent in its credit-and-investment-fueled growth. Hu’s iceberg comment has me thinking back to Bill Gross’s oft-quoted China analogy about “mystery meat.” “Nobody knows what’s there and there’s a little bit of bologna,” the bond-fund manager said in a Feb. 4 Bloomberg Television interview. “So we’re just going to have to wonder going forward through this year as to the potential problems in China and other emerging markets.” Make that next year, too. The lack of transparency that pervades Beijing makes it harder to know which of Xi’s planned reforms are being carried out and which aren’t. China’s grow-fast-at-any-cost ethos, rampant corruption and the lack of a free press conspire to make second-biggest economy more of a black box than investors like Gross and policy makers at the IMF would prefer.

Read more …

23 months inventory …

• China Home Glut Worsens as Developers Won’t Sell at Lower Prices (Bloomberg)

The biggest immediate risk facing China’s economy is about to get worse. A reluctance among some developers to sell units at prices lower than they could fetch just months ago threatens to cause a swelling in unsold properties. The worsening glut would extend a slide in construction that’s already put a drag on the world’s second-largest economy, and counter policy makers’ efforts to stimulate the real-estate industry with loosened rules. In Nanjing, eastern China, nine housing projects originally planned for sale in the first half of 2014 were held for later this year, consulting firm Everyday Network Co. says. The number of homes added to the market in July in 21 major cities dropped 25% from June, according to Centaline Group, parent of China’s biggest real-estate brokerage.

“The completed apartments will be in the marketplace sooner or later, and potential buyers will continue to expect prices to fall,” said Hua Changchun, China economist at Nomura Holdings Inc. in Hong Kong. “The property-market weakness hasn’t changed, despite the policy adjustments.” July economic data due over the next week, starting with tomorrow’s trade numbers, will give a sense of how well growth is holding up after accelerating to 7.5% in the second quarter from a year earlier. The statistics bureau releases inflation figures Aug. 9, followed by industrial production, fixed-asset investment and retail sales on Aug. 13. The central bank reports lending and money-supply figures by the middle of August.

China’s broadest measure of new credit rose in June to the highest level for the month since 2009, underscoring the role of debt in supporting expansion. Home-price data for cities are due from the statistics bureau on Aug. 18, after June prices fell from the previous month in 55 of 70 cities tracked by the government. China’s home sales slumped 9.2% in the first half of this year from a year earlier, following a full-year 26.6% increase in 2013, while new-property construction plunged 16.4%. Developers are responding with sales delays and discounts as well as incentives including no-down-payment purchases and buyback guarantees. Developers’ sales delays in the first half were “very widespread” because prospects were poor given weak demand and tight credit conditions, said Donald Yu, a Shenzhen-based analyst at Guotai Junan Securities Co. “Will the increased supply lead to declines in prices in the second half? That for sure will happen.”

Read more …

But we’ll do it anyway.

• Mining the Bottom of the Ocean Is as Destructive as it Sounds (Vice)

Have you ever wondered how much the ocean floor is worth? The answer is in the trillions. Metals and materials are the foundation of our life, but with seven billion people occupying the earth, supplies are rapidly dwindling. So mining industries have set their sights miles deep under the sea. It’s estimated there are billions of tonnes worth of valuable metals and minerals on the seabed. However, marine biologists and researchers have raised concerns that those doing deep sea mining don’t appreciate the delicate and fragile ecosystem of the deep-ocean, and how their actions could affect it. Andrew Thurber, a researcher at the College of Earth, Ocean and Atmospheric Sciences at Oregon State University, talked to me about the issue. Thurber’s review on the deep sea’s relationship to us on land and our duty to protect it was recently published in Biogeosciences, a journal of the European Geosciences Union.

In their report, Thurber and his colleagues pointed out the many important uses of the deep sea. The deep sea is used as a dumping ground to absorb waste; it contains many life forms, some of which are being looked at for new medicines; and it serves as an environment for fish to breed. I asked Thurber about the implications of deep sea mining. “It’s really not different from clear-cutting a forest of redwoods, except instead of majestic trees there are many small organisms that, together and en masse, gain their importance to the planet,” he said. “We also know that many of the services that are provided by this habitat are connected.”

Read more …

What else would you expect?

• Massive Toxic Tailings Pond Spill Floods Canadian Waterways (eNews)

A middle-of-the-night breach of the tailings pond for an open-pit copper and gold mine in British Columbia sent a massive volume of toxic waste into several nearby waterways on Monday, leading authorities to issue a water-use ban. Slurry from Mount Polley Mine near Likely, B.C. breached the earthen dam around 3:45 am on Monday, with hundreds of millions of gallons — equivalent to 2,000 Olympic-sized swimming pools, according to Canada’s Global News — gushing into Quesnel Lake, Cariboo Creek, Hazeltine Creek and Polley Lake. An estimated 300 homes, plus visitors and campers, are affected by the ban on drinking and bathing in the area’s water.

Chief Anne Louie of the Williams Lake Indian band told the National Post the breach was a “massive environmental disaster.” With salmon runs currently making their way to their spawning grounds, “Our people are at the river side wondering if their vital food source is safe to eat,” said Garry John, aboriginal activist and member of the board of directors of the Council of Canadians, in a press release.

Read more …

Not the last word on this.

• WHO Declares Ebola Outbreak ‘International Public Health Emergency’ (DW)

The World Health Organization says the Ebola epidemic in West Africa constitutes a public health emergency of international proportions. More than 900 people have died since the virus broke out earlier this year. In a press conference on Friday, the WHO said the Ebola epidemic required an extraordinary response to stop its spread. “Countries affected to date simply do not have the capacity to manage an outbreak of this size and complexity on their own,” said WHO Director General Dr. Margaret Chan. She called on the international community to provide urgent support to countries affected by the crippling virus. The WHO previously declared similar emergencies for polio in May, and for the swine flu pandemic in 2009. The agency had convened an expert committee this week for an emergency session to assess the severity of the ongoing Ebola epidemic in West Africa. The virus was first identified in Guinea in March, before it spread to Sierra Leone and Liberia. All three countries have already implemented states of emergency.

The WHO has described the current outbreak as unprecedented. So far, it has killed 932 people and infected more than 1,700, with the death rate hovering around 50%. Medical charity Doctors Without Borders has warned that the virus is “out of control,” while US health authorities acknowledges on Thursday that the pathogen’s spread outside Africa was inevitable. The first European Ebola victim, Spanish Roman Catholic priest, Miguel Pajares, was flown out of Liberia on Thursday. Authorities said the 75-year-old’s condition was stable. Meanwhile two Americans who are being treated in Atlanta, Georgia, after being infected in Liberia are showing signs of improvement. Ebola was first discovered in 1976 in what is now the Democratic Republic of Congo. The virus causes severe fever, headaches, vomiting and bleeding, and is spread via bodily fluids.

Read more …