Library of Congress Crowds of people waving at President Kennedy’s motorcade, Dallas, Texas Nov. 22 1963

Still think it’s a lot of fuzz over a Pacific deal that excludes China.

• Donald Trump To Withdraw From TPP On First Day In Office (G.)

Donald Trump has issued a video outlining his policy plans for his first 100 days in office and vowing to issue a note of intent to withdraw from the Trans-Pacific Partnership “from day one”. In the brief clip posted to YouTube on Monday, the president-elect said that “our transition team is working very smoothly, efficiently, and effectively”, contradicting a wealth of media reports telling of chaos in Trump Tower as Trump struggles to build a team. He said that he was going to issue a note of intent to withdraw from the TPP trade deal, calling it “a potential disaster for our country”. Instead he said he would “negotiate fair bilateral trade deals that bring jobs and industry back”.

Hours before Trump’s announcement, Japan’s prime minister, Shinzo Abe, warned that the TPP would be “meaningless” without US participation. Speaking to reporters in Buenos Aires on Monday, Abe conceded that other TPP countries had not discussed how to rescue the agreement if Trump carried out his promise to withdraw. Abe, a vocal supporter of the 12-nation agreement, appears to have failed in his recent attempts to coax Trump out of his “America first”, protectionism. The TPP, which excludes China, is thought to have been high on Abe’s agenda when he became the first foreign leader to meet the president-elect in New York last week.

While details of their 90-minute meeting have not been released, Abe would have used the time to try to persuade Trump to go back on his campaign threat to pull the US out of TPP on day one of his presidency. “The TPP would be meaningless without the United States,” Abe said, after Japan and other TPP countries had discussed the agreement on the sidelines of the Apec summit in Lima at the weekend. He added that the pact could not be renegotiated. “This would disturb the fundamental balance of benefits,” he said.

Dollar liquidity is under severe strain. There’s only one reserve currency. And letting this push up the value of the USD without limit will hurt the US in the end.

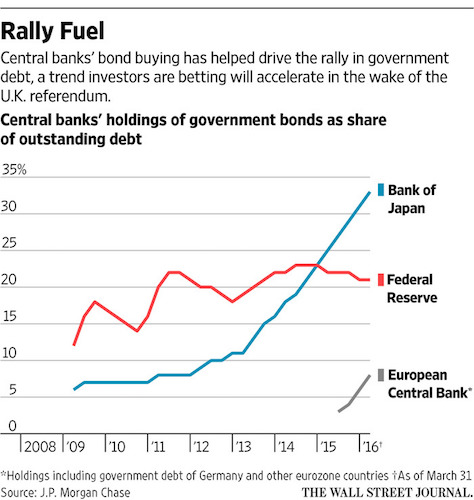

• Fed Should Allow “Elephant Size Quantitative Eurodollar Easing” (BBG)

As Donald Trump threatens to turn away from the rest of the world, the Fed will find itself under increasing pressure to extend a helping hand outwards. That’s the prognosis from Credit Suisse Director of U.S. Economics Zoltan Pozsar, who contends that the U.S. central bank needs to take a much more activist approach to ensuring adequate availability of the world’s reserve currency in light of recent regulatory changes that have raised bank funding costs and constrained sources of dollar funding. The liquidity financial institutions can draw upon has been drained by new rules that require banks to hold vast buffers of easy-to-sell assets, on the one hand, and a larger-than-expected exodus from prime money-market funds linked to financial reforms implemented in October, on the other.

That’s induced a pick-up in bank funding costs that looks to be permanent, the analyst said. That means that when foreign banks need dollars, they’re increasingly forced to procure them through currency swaps from U.S. banks and asset managers — who are themselves balance-sheet constrained. The cost of converting local currency payments in euros and yen into dollars is now at its most expensive since 2012, as implied by persistently negative cross-currency basis swap rates. The net result is an “existential trilemma” for the Federal Reserve, as it is forced to choose between two of the following three objectives: shoring up banks’ balance sheets, stabilizing costs for onshore and offshore dollar borrowing, and an independent monetary policy.

The best possible solution, according to Pozsar, is for the U.S. central bank to let its own balance sheet go: serving as a “dealer of last resort” by way of “elephant size quantitative eurodollar easing,” in other words, that it should allow the unlimited use of its dollar swap lines to prevent foreign banks’ dollar borrowing costs from getting too high in an environment of constrained bank balance sheets. “The tool to use is the Fed’s dollar swap lines but the aim would no longer be to backstop funding markets, but to police the range within which various cross currency bases trade,” Pozsar writes, arguing for the “fixed-price, full-allotment broadcast of eurodollars globally” by the U.S. central bank.

The flipside of a strong dollar. And of Trump’s America first.

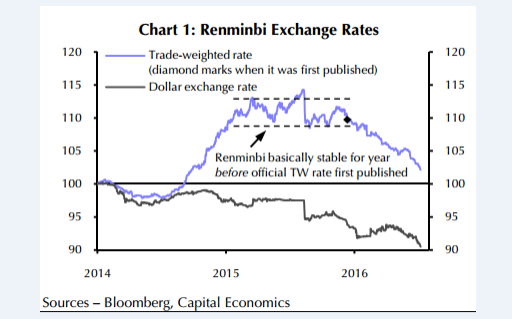

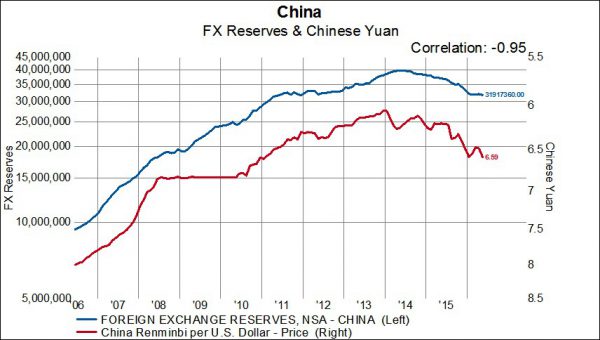

• China May Have To Float The Yuan If Tighter Capital Controls Fail (BBG)

Dollar strength and rising U.S. interest rates under President-elect Donald Trump would intensify pressure on capital outflows from China, forcing its policy makers to choose between tightening capital controls or a drastic floating of the currency in coming months. That’s according to Victor Shih, a University of California at San Diego professor who studies China’s government and finance and specializes in tracking politics at the most elite level. “Given the Chinese government’s consistent preference for control, we may see much more Draconian capital controls before a decision to float the currency can be made,” Shih said in an interview in Beijing. “The main objective is to avoid a panicky float.”

Federal Reserve Chair Janet Yellen has indicated a rate hike could be appropriate “relatively soon,” and investors anticipate Trump’s proposals to cut taxes and boost infrastructure will spur faster U.S. growth and inflation. At the same time, the record indebtedness of China’s companies limits the government’s ability to raise interest rates because doing so would increase the cost of repaying debt. China may face a stark choice between abandoning recent policy changes to tie the yuan more to a basket of currencies and letting it float more freely or stringent capital controls sometime in the next six to 18 months, said Shih. The Communist Party’s preference for control suggests economic reform is unlikely to accelerate, Shih said. He sees China following Russia toward slower growth and rising currency volatility.

More signs the euro is failing.

• Eurozone Nations Turn To Hedge Funds To Meet Borrowing Needs (R.)

Eurozone governments are increasingly relying on hedge funds to help them meet their borrowing needs, which risks leaving them vulnerable to a debt market sell-off driven by a class of investors dubbed “fast money” for their speculative approach. With banks playing a less active part in the sovereign debt market because of pressures on their balance sheets, several countries have turned to hedge funds to sell their targeted amount of bonds, according to data, officials and bankers. Hedge funds tend to look for quick returns on investments, which could increase the volatility of government bond markets as they face several tests of sentiment in coming months.

A populist revolt that propelled Donald Trump and the Brexit vote is sweeping the developed world and threatens to unseat established leaders in an Italian referendum next month, and Dutch, French and German elections in 2017. Any such political shocks, compounded by rising bond market volatility, could potentially trigger a sell-off – a risk that stirs painful memories of the region’s debt crisis in 2010-2012 when a bond rout led to several countries unable to pay their debts and raised fears the euro zone could unravel. Hedge funds have been particularly active in the market for long-dated bonds as they offer the higher risk and reward that they traditionally seek.

Spain, Italy, Belgium and France have sought to lock in record-low borrowing rates this year with 50-year bond issues for €3-5 billion. Each of them reported a historically high allocation of 13-17% to hedge funds. By contrast, just three years ago, Spain, Italy and Belgium were selling only 4-7% of their syndicated bond sales to that community of investors.

Trump should penalize buybacks, make sure the money is used productively.

• Goldman: How Corporations Will Spend Their Huge Piles of Overseas Cash (BBG)

Companies in the S&P 500 Index will spend most of their sizable cash hoard buying back stock next year, analysts at Goldman Sachs write in a new note. If so, it would be only the second time in the past 20 years that buybacks have accounted for the largest share of cash usage. Much of this, Goldman says, would be due to the enacting of plans President-elect Donald Trump proposed on the campaign trail, such as a tax holiday for overseas income and changes to the corporate tax code. “A significant portion of returning funds will be directed to buybacks based on the pattern of the tax holiday in 2004,” the team, led by Chief U.S. Equity Strategist David Kostin, write. They estimate that $150 billion (or 20% of total buybacks) will be driven by repatriated overseas cash.

They predict buybacks 30% higher than last year, compared to just 5% higher without the repatriation impact. Other areas that will see a boost include capital expenditures, research and development, as well and mergers and acquisitions. Here’s a broader look at how the analysts see firms allocating their cash in 2017. Other Wall Street banks have started looking at the potential impacts of repatriation as well. A new note from Morgan Stanley analysts Todd Castagno and Snehaja Mogre says that this is one of the top questions they are receiving from clients, and that most are overestimating how much cash will be brought back from overseas.

“The often cited $2.5 trillion statistic [of cash for repatriation] represents accumulated foreign earnings that companies have declared permanently reinvested abroad for GAAP accounting purposes,” they write. “We estimate that only 40% of this amount, or roughly $1 trillion, is available in the form of cash and marketable securities. Thus, the other $1.5 trillion has been reinvested to support foreign operations and exists in the form of other operating assets, such as inventory, property, equipment, intangibles and goodwill.” The note did not provide more detail on how much of that available cash the analysts expect to be used for buying back stock.

Can America still reverse this, or is it too late? “You haven’t just lost the industrial capacity, you have lost the skill-base as well, you don’t have the engineers and designers anymore.”

• Why Free Trade Doesn’t Work for the Workers – Steve Keen (ET)

Once you have transferred all your capacity offshore, it’s very hard to reverse the process. You haven’t just lost the industrial capacity, you have lost the skill-base as well, you don’t have the engineers and designers anymore. They used to build news versions every year; now they are gone. What [Trump] can do on the fiscal front is his plan to invest in infrastructure. If he goes into this massive program as he has talked about and insists on a made-in-America policy, which he will do, that will provide the financing for the reindustrialization to occur. I’m not worried about a potential deficit because he has the world reserve currency in his hands and the Fed can print as much of it as necessary.

Then, if you produce all the infrastructure components onshore, you don’t even need trade tariffs. In my opinion, this wouldn’t be a trade barrier under WTO rules, but this could be the first dispute he has with the WTO. Because there is demand by the government and the components have to be manufactured onshore, capital needs to be invested and workers trained for the job. On top, you have the increases in productivity through infrastructure, another positive.

Epoch Times: What about tariffs? Mr. Keen: It’s not going to be peaceful, and there will be repercussions for American companies. Trump is used to playing hardball, and now he will have to negotiate with bureaucrats and their corporate backers. There will be attempts to control what Trump does through the WTO and it will be interesting to see how successful those attempts will be.

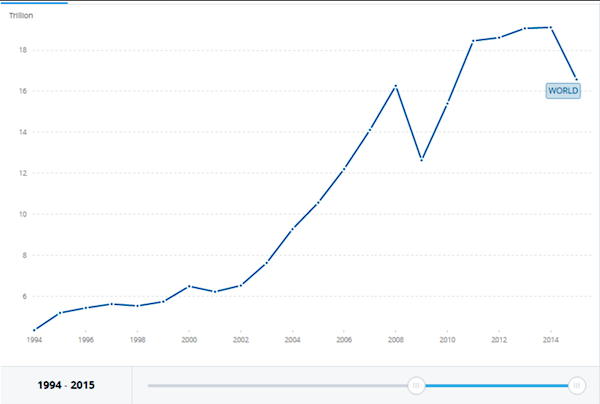

World Merchandise Exports in trillions of dollars. (World Bank)

“Mommy is all about feelings and Daddy’s role is action and that is another reason that Hillary lost and Trump won.”

America didn’t get what it expected, but perhaps it got what it deserved, good and hard. Daddy’s in the house and he busted straight into the nursery and now the little ones are squalling in horror. Mommy was discovered to be a grifting old jade who ran the household into a slum and she’s been turned out to solemnly await the judgment of the courts, nowhere to run, nowhere to hide. The kids on campus have gone temporarily insane over this domestic situation and some wonder if they’ll ever get over it. Trump as The USA’s Daddy? Well, yeah. Might he turn out to be a good daddy? A lot of people worry that he can’t be. Look how he behaved on the campaign trail: no behavioral boundaries… uccchhh. He even lurches as he walks, like Frankenstein.

Not very reassuring — though it appears that somehow he raised up a litter of high-functioning kids of his own. Not a tattoo or an earplug among them. No apparent gender confusion. All holding rather responsible positions in the family business. Go figure…. Judging from the internal recriminations among Democratic Party partisans playing out in the newspapers, it’s as if they all woke up simultaneously from a hypnotic trance realizing what an absolute dud they put up for election in Hillary Clinton — and even beyond that obvious matter, how deeply absurd Democratic ideology had become with its annoying victimology narrative, the incessant yammer about “diversity” and “inclusion,” as if pixie dust were the sovereign remedy for a national nervous breakdown. But can they move on from there?

I’m not so sure. For all practical purposes, both traditional parties have blown themselves up. The Democratic Party morphed from the party of thinking people to the party of the thought police, and for that alone they deserve to be flushed down the soil pipe of history where the feckless Whigs went before them. The Republicans have floundered in their own Special Olympics of the Mind for decades, too, so it’s understandable that they have fallen hostage to such a rank outsider as Trump, so cavalier with the party’s dumb-ass shibboleths. It remains to be seen whether the party becomes a vengeful, hybrid monster with an orange head, or a bridge back to reality. I give the latter outcome a low percentage chance.

Mommy is all about feelings and Daddy’s role is action and that is another reason that Hillary lost and Trump won. We’ve heard enough about people’s feelings and it just doesn’t matter anymore. You’re offended? Suck an egg. Someone appropriated your culture? Go shit in your sombrero. What matters is how we’re going to contend with the winding down of Modernity — the techno-industrial orgy that is losing its resource and money mojo. The politics of sacred victimhood has got to yield to the politics of staying alive.

“Trump senior adviser Kellyanne Conway, who arranged the meeting, said afterward that it was “very cordial, candid and honest.”

• Top Network Executives, Anchors Meet With Donald Trump (CNN)

Executives and anchors from the country’s five biggest television networks met with President-elect Donald Trump at Trump Tower on Monday afternoon. And they got an earful. Trump vented about media coverage, according to sources who spoke on the condition of anonymity. He was highly critical of CNN and other news organizations. But while Trump showed disdain for the news media, he also answered questions; listened to the journalists’ arguments about the importance of access; and committed to making improvements. A source in the room told CNNMoney that there was “real progress” made with regards to media access to Trump and his administration. One specific topic was the importance of the “press pool,” a small group of journalists that traditionally travels with the president.

The hour-long meeting was off the record, meaning the participants agreed not to talk about the substance of the conversations. But Trump senior adviser Kellyanne Conway, who arranged the meeting, said afterward that it was “very cordial, candid and honest.” While there was “no need to mend fences,” she said, “from my own perspective, it is great to hit the reset button, it was a long, hard-fought campaign.” Some of the attendees were struck by Trump’s anti-media posture. During the meeting, Trump revived some of the specific arguments he made weeks before winning the presidency. According to Politico, among Trump’s complaints, even as he asked for a “cordial” relationship, was that NBC had used unflattering pictures of him. But one of the participants told CNNMoney that Trump also asked for a positive relationship between his White House and the media.

The participant said that a New York Post account – which had a source describing it as Trump giving the assembled members of the media a “dressing down” like a “firing squad” – was overstated. Conway herself has also criticized the Post report. [..] NBC’s Chuck Todd and Lester Holt; CNN’s Wolf Blitzer and Erin Burnett; CBS’s Norah O’Donnell, Charlie Rose, John Dickerson, and Gayle King; and ABC’s George Stephanopoulos, David Muir and Martha Raddatz were some of the anchors seen entering Trump Tower shortly before 1 p.m. Several executives from the network news divisions were also spotted on the way into Trump Tower, including ABC News president James Goldston; CNN president Jeff Zucker; Fox News co-presidents Bill Shine and Jack Abernethy; NBC News president Deborah Turness; MSNBC president Phil Griffin; and CBS News vice president Chris Isham.

“But if I get hit by a bus, or a drone, or dropped off an airplane tomorrow, you know what? It doesn’t actually matter that much to me, because I believe in the decisions that I’ve already made.”

• Trump Is ‘Just The President’ – Snowden (AFP)

Former US National Security Agency contractor Edward Snowden on Monday downplayed the importance of President-elect Donald Trump and again defended his decision to leak documents showing massive surveillance of US citizens’ communications. “Donald Trump is just the president. It’s an important position. But it’s one of many,” Snowden told an internet conference in Stockholm, speaking via a video link from Russia, where he has been living as a fugitive. The 33-year-old is wanted in the United States to face trial on charges brought under the tough Espionage Act after he leaked thousands of classified documents in 2013 revealing the vast US surveillance of private data put in place after the September 11, 2001 attacks.

He said he was not worried about the Trump administration stepping up efforts to arrest him and stood by his decision to leak the classified material. “I don’t care,” he said. “The reality here is that yes, Donald Trump has appointed a new director of the CIA who uses me as a specific example to say that, look, dissidents should be put to death. “But if I get hit by a bus, or a drone, or dropped off an airplane tomorrow, you know what? It doesn’t actually matter that much to me, because I believe in the decisions that I’ve already made.”

Just a president-to-be having some fun.

• Nigel Farage Would Be Great UK Ambassador To US – Trump (G.)

US president-elect Donald Trump has suggested that Nigel Farage, controversial leader of the United Kingdom Independence party, should be the UK’s ambassador to the US. “Many people would like to see @Nigel_Farage represent Great Britain as their Ambassador to the United States,” Trump tweeted on Monday evening. “He would do a great job!” In a brief call with BBC Breakfast, Farage said he had been awake since 2am UK time when the tweet was first posted. The Ukip leader said he was flattered by the tweet, calling it “a bolt from the blue” and said he did not see himself as a typical diplomatic figure “but this is not the normal course of events”. But a Downing Street spokesman said: “There is no vacancy. We already have an excellent ambassador to the US.”

Farage, a member of the European parliament and on-again-off-again leader of Ukip for a decade, recently suggested he could launch an eighth bid to become an MP. Seven previous attempts were unsuccessful. It is unprecedented for an incoming US president to ask a world leader to appoint an opposing party leader as ambassador, and the statement puts British prime minister Theresa May in a difficult position. The role of UK ambassador to the US is among the most prestigious in the diplomatic service. Sir Kim Darroch, formerly the UK’s national security adviser and permanent representative to the European Union (EU), took over the role in January this year. The Ukip leader has previously said it was “obvious” that Darroch should resign his post, calling him part of the “old regime”.

But he told Sky News at that time he did not see himself as Darroch’s replacement: “I don’t think I will be the ambassadorial type. Whatever talents or flaws I have got I don’t think diplomacy is at the top of my list of skills.”

Bringing Blair back would be the end of Labour.

• Richard Branson To Bankroll Secret Blairite Campaign To Stop Brexit (Ind.)

Richard Branson’s Virgin Group is to help bankroll a campaign set up in secret by Blairite former ministers and advisers to derail Brexit, The Independent can reveal. An email seen by The Independent highlights the scale of backing the group has already secured. It shows the campaign has been months in the planning and claims “substantial progress” has already been made, including the identification of “an excellent potential CEO”. The memo was written by Alan Milburn, who was one of Tony Blair’s closest cabinet allies. It reveals the group has heavy financial, political and corporate backing and is receiving advice and support from a host of high-level business and communications organisations. High-profile MPs including former Deputy Prime Minister Nick Clegg and Labour MP Chuka Umunna are believed to have had contact with the group, as have celebrities such as Bob Geldof.

Freuds, a leading public relations agency that was founded by Matthew Freud, a close friend of both Mr Blair and David Cameron, is understood to have been commissioned to manage the strategy and marketing of the campaign. The email says: “We have been beavering away over the last few months to get a Europe campaign up and running. I’m pleased to say that substantial progress has been made.” “I have met the Freuds team several times and we are making good progress. “I have been in discussions with an excellent potential CEO to lead the campaign. “Virgin … are keen to help … Since we last spoke [they] have offered a further £25k, plus bigger office space, help with legal advice and a possible secondment. “I have held discussions with Stronger In, Chuka Umunna, a new organisation called Common Ground, Bob Geldof and a number of senior politicians across the party spectrum.”

Catchy headline and all, but hardly what the report in question is about.

• Brexit Vote Wiped $1.5 Trillion Off UK Household Wealth In 2016 (G.)

The UK saw $1.5tn (£1.2tn) wiped off its wealth during 2016 after the Brexit vote sent the pound tumbling and the stock market into reverse, according to a survey by Credit Suisse. A fall in values at the top-end of the property market also contributed to about 400,000 Britons losing their status as dollar millionaires and one of the biggest drops in wealth among the major economies. But the UK remained third for the number of ultra-high-net-worth individuals, who own more than £50m in assets, behind the US and China. And the UK’s top 1% of richest people also continued to own 24% of the nation’s wealth, the report said.

Across the globe, the richest 1% own more wealth than the rest of the world put together, continuing the dominance seen in last year’s report. A recovering in the global stock markets in recent weeks is also likely to reverse some of the losses suffered by pension savers and wealthy individuals. Oxfam said the huge gap between rich and poor was “undermining economies, destabilising societies and holding back the fight against poverty”.

The findings from the Credit Suisse Research Institute’s seventh annual global wealth report that found the overall growth in global wealth remained flat in 2016, following a trend that emerged in 2013 and contrasting sharply with the double-digit growth rates witnessed before the global financial crisis of 2008. Michael O’Sullivan, chief investment officer in Credit Suisse’s wealth management arm: “The impact of the Brexit vote is widely thought of in terms of GDP but the impact on household wealth bears watching. “Since the Brexit vote, UK household wealth has fallen by $1.5tn. Wealth per adult has already dropped by $33,000 to $289,000 since the end of June. In fact, in US dollar terms, 406,000 people in the UK are no longer millionaires.”

“Merkel is isolated given she represents the status quo while the pace of change in Europe is accelerating”

• Merkel’s ‘Days Are Numbered’, Warns France’s Le Pen (CNBC)

German Chancellor Angela Merkel’s “days are numbered,” according to the leader of France’s right-wing National Front party, Marine Le Pen. Merkel confirmed on Sunday she would run for a fourth term in 2017, however, Le Pen says the German leader does not fit the mood of the times. Speaking to CNBC on Monday, the National Front’s presidential candidate claims Merkel is isolated given she represents the status quo while the pace of change in Europe is accelerating. Turning to another international relationship, Le Pen said it would be natural for France to retain relations with Russia given the close history of the two countries. Arguing she sees no reason why we cannot live in a multi-polar world, she lambasted the U.S. for taking the world into the Cold War, saying it put France and Europe at great risk, given they were caught in the middle.

The numbers look a bit shaky, but the trend is glaringly obvious. The Troika is dismantling what until just a few years ago was an absolute world class health system.

• Greek Doctors Continue To Emigrate In Large Numbers (Kath.)

For a sixth consecutive year, Greece has been unable to stem the flow of doctors leaving the country. The numbers emigrating during 2016 have been high again, with most opting for work in other European countries. The only difference this year is that there has been a slight dip in those leaving for the UK, which may be due to Brexit. Overall, the Athens Medical Association (ISA) issued a total of 1,018 certificates between January 1 and October 24 allowing Greek doctors to practice abroad. During the whole of 2015, ISA issued 1,521 such documents, which was slightly higher than the 1,380 it produced in 2014 and 1,488 in 2013. The year which saw the highest level of emigration among Greek doctors was in 2013, when ISA issued 1,808 certificates. In total, between 2010 and this year, ISA has readied paperwork for more than 9,300 medical professionals looking to leave Greece.

[..] While Greek doctors pursue their futures abroad, the Greek National Health System (ESY) is buckling due to the shortage of medical staff. According to the Federation of Greek Hospital Doctors’ Unions (OENGE), Greece lacks some 6,000 specialized doctors. The vast majority of doctors hired over the last few years were on fixed-term contracts, which is not a very attractive proposition for those in the medical field. According to the Health Ministry, ESY employs 1,464 auxiliary doctors at the moment. “The medical world has been seriously affected by the crisis over the last few years,” ISA president Giorgos Patoulis told Kathimerini. “The proliferation of mostly young doctors and the low rate at which they are absorbed into the public or private sector creates serious challenges for them in finding work and drives wages down.

“In combination with the government’s failure to set out a sustainable and effective health policy, this has caused an unprecedented migratory wave. This leaves us facing a paradox: Even though there is a plethora of young doctors who are unemployed, the health system is getting old and collapsing due to a lack of personnel.”

Seems a tad quirky, but there’s more than meets the initial eye.

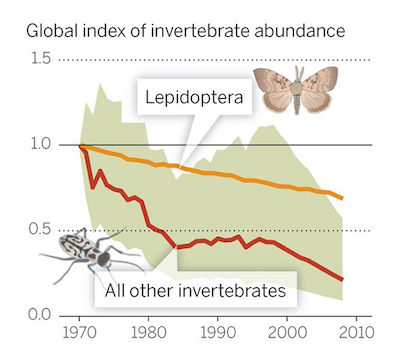

• Why Don’t We Grieve For Extinct Species? (G.)

In early 2010, artist, activist and mother, Persephone Pearl, headed to the Bristol Museum. Like many concerned about the fate of the planet, she was in despair over the failed climate talks in Copenhagen that winter. She sat on a bench and looked at a stuffed animal behind glass: a thylacine. Before then, she’d never heard of the marsupial carnivore that went extinct in 1936. “Here was this beautiful mysterious lost creature locked in a glass case,” she said. “It struck me suddenly as unbearably undignified. And I had this sudden vision of smashing the glass, lifting the body out, carrying the thylacine out into the fields, stroking its body, speaking to it, washing it with my tears, and burying it by a river so that it could return to the earth.”

[..] .. grief doesn’t occur only when we lose loved ones. Ask anyone who has seen a local forest they once played in as a child demolished for another cookie-cutter development or has watched as fewer bees and butterflies show up in their garden each summer. Or ask any conservationist who has to witness year-after-year as the species they work with slowly vanish, ask any marine biologist about coral reefs or any Arctic biologist about sea ice. Grief can extend far beyond our human parochialism. “We realised that there was a hunger for a way of grieving ecological loss through ritual,” said Porter who in 2011 directed a Funeral for Lost Species through her group, Feral Theatre. This was an outdoor theatrical performance in a churchyard that included various traditional forms of mourning and tilted between somber and whimsical.

Porter believes many people are simply “stuck in a kind of denial” when it comes to extinction, biodiversity loss and environmental crises. “If we face it honestly and fully we have to face our own collective shadow, our out-of-control destructive urges and acts. These are terrible, terrifying things to face alone,” she said. Part of this denial is also due to our growing disconnect from nature. “Many humans now solely interact with domesticated animals and plants. Some have no experience whatsoever of intact forest, field, and aquatic community. The total loss of other community members, their families, and life affirming ways then is an utterly distant abstraction,” Hollingsworth said. “Yet in grief, as in love, humans are wired for intimacy. “

A thylacine, or Tasmanian tiger, in captivity sometime in the 1920s. The thylacine was killed off by European settlers in Australia who erroneously viewed it as a sheep killer. Photograph: Popperfoto