DPC Clam seller in Mulberry Bend, NYC 1904

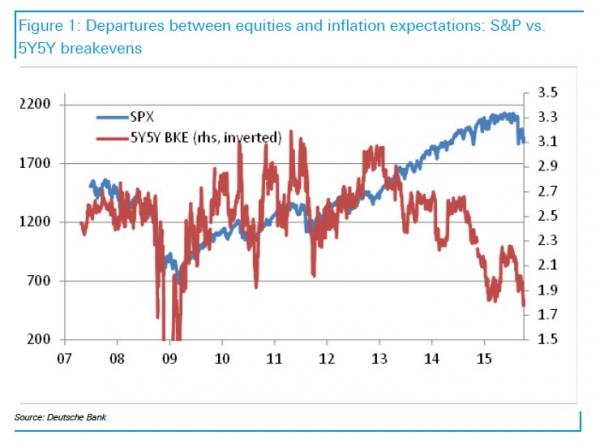

A long time coming. Key: derivatives exposure. Something’s bound to push Deutsche eerily close to the edge. What will Berlin do?

• Deutsche Bank’s Woes May Be ‘Insurmountable’ (BBG)

Deutsche Bank is stuck in a vicious circle as co-CEO John Cryan seeks to overhaul an impaired business that needs more capital, which the bank would struggle to raise if it tried to tap investors, according to Berenberg. The Frankfurt-based lender’s biggest problem is excessive leverage, Berenberg’s James Chappell wrote Monday in a note that said the bank faces “insurmountable headwinds.” He cut his rating to sell from hold and reduced his target price for the stock to €9 per share, the lowest among more than 30 analysts tracked by Bloomberg and about 40% below current levels. While Cryan, 55, has scrapped dividends, earmarked businesses for sale and pledged to eliminate thousands of jobs, Deutsche Bank earnings have been undermined by €12.6 billion in costs linked to past misconduct.

Efforts to sell assets may be hampered by illiquid credit markets, while Cryan will also struggle to boost capital as the investment-banking industry is in “structural decline,” Chappell wrote “It’s hard to see how Deutsche Bank can escape this vicious circle without raising more capital,” Chappell wrote. “The CEO has eschewed this route for now, in the hope that self-help can break this loop, but with risk being re-priced again, it is hard to see Deutsche Bank succeeding.” Shares in Deutsche Bank have dropped 35% this year. The company trades at about 39% of tangible book value, the lowest ratio among the top global banks, according to Bloomberg data. That means they are worth less than investors would expect to receive if the firm liquidated assets.

Credit Suisse, which last year raised capital to help restructure its businesses, is trading at 65%. Eleven analysts recommend selling Deutsche Bank shares, while 21 have a hold rating and six suggest buying the stock, according to Bloomberg data. The lender’s average 12-month price target is about €18, with analysts at Goldman Sachs forecasting shares to reach €23.80. Cryan has already signaled that Deutsche Bank may post another loss this year, hurt by restructuring costs and charges ties to past misconduct. Chappell cut his estimate for Deutsche Bank’s earnings-per-share by about 35% for 2017 and 2018. He predicts the lender will earn about €2 per share in 2018.

Talking their books? Sell in May?

• Wall Street Banks See A Painful Summer For Stocks Ahead (MW)

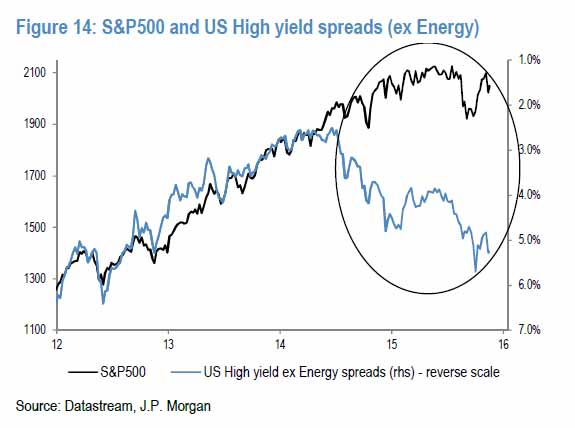

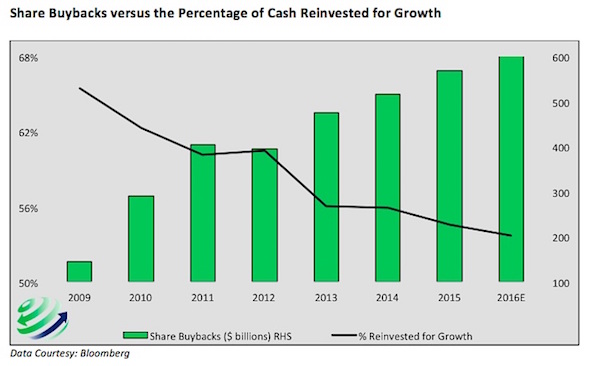

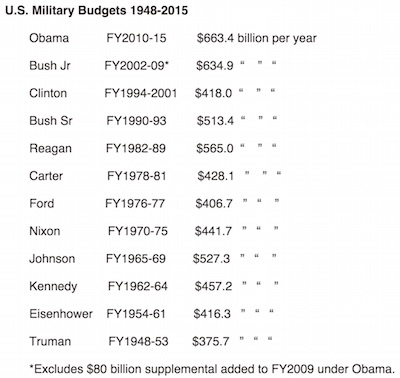

If you gathered a group of stock analysts in a room, odds are each analysts would have a different view on the market. So when analysts from three big investment banks are on the same page, it might pay to listen. Bank of America Merrill Lynch, Goldman Sachs and J.P. Morgan are all urging investors to rotate out of equities because they see a painful summer ahead. “An increasing number of trends worry us as we head into summer,” said Savita Subramanian, an equity and quantitative strategist at Bank of America Merrill Lynch. The fact that corporate buybacks are near an all-time high while the number of companies projected to post losses has also risen is a huge red flag for Subramanian.

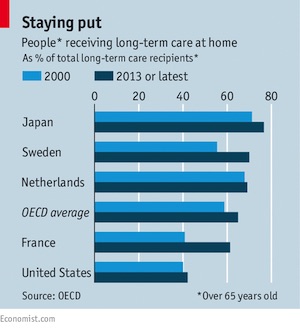

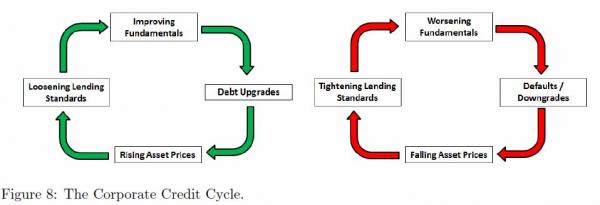

Furthermore, an interest-rate hike during an earnings recession never ends well, she said. “Since 1971, the Fed has begun tightening during a bona fide profits recession only three other times – 1976, 1983, and 1986; two out of those three instances saw stocks drop over the next twelve months. The S&P is just 1% off its Dec. 16 level when the Fed initially hiked,” said the strategist in a report. An earnings recession, like an economic contraction, is two consecutive quarters of negative year-on-year profit growth. First-quarter earnings fell 7.1% from a year earlier, marking four consecutive quarters of declines, according to FactSet. Subramanian also sees signs that capital is drying up with initial public offerings at an all-time low while commercial lending standards have tightened.

Schäuble says NEIN!

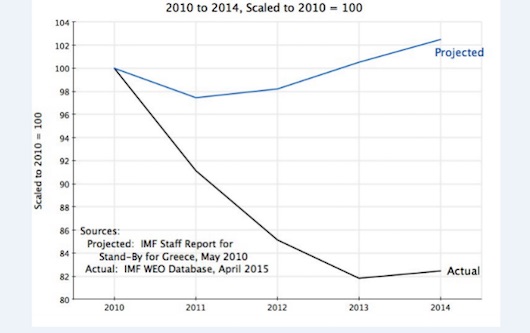

• IMF Wants Eurozone Debt Relief for Greece Until 2040 (WSJ)

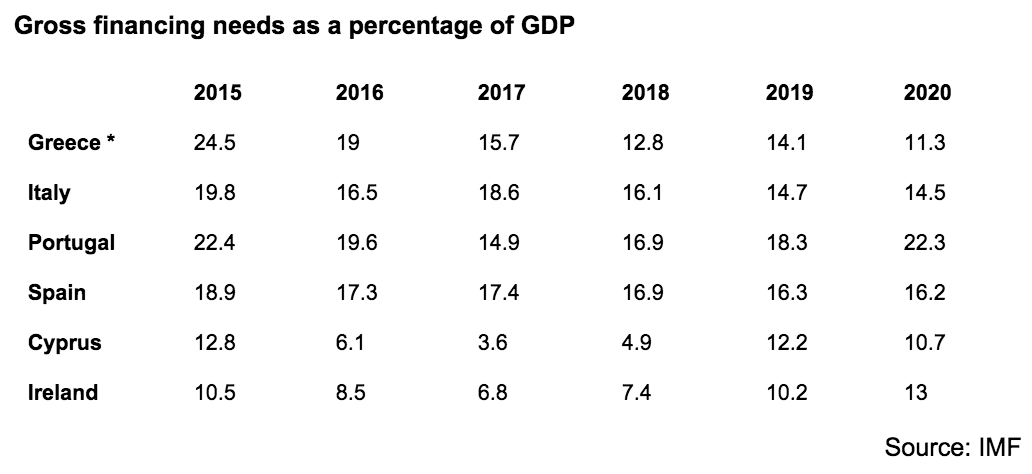

The IMF is pressing the eurozone to let Greece skip paying interest or principal on bailout loans until 2040, say officials familiar with the talks. The IMF wants the loans to Greece to fall due gradually in the following decades, and as late as 2080, according to the IMF’s proposal. The IMF’s proposal, presented to eurozone governments late last week, would keep Greece’s annual debt-service needs below 15% of its gross domestic product, under the IMF’s relatively pessimistic forecast for Greece’s long-term economic trajectory. The IMF’s demands go far beyond what Greece’s eurozone creditors have said they are willing to do to help Greece regain its financial health.

Eurozone governments, led by Germany, are reluctant to make such major concessions on their loans to Greece, which currently total just over €200 billion with around another €60 billion to come under the latest Greek bailout plan. But Germany, the eurozone’s dominant economic power, also wants the IMF to rejoin the Greek bailout as a lender. The IMF hasn’t yet signed up to the Greek program agreed last summer. German Chancellor Angela Merkel has long viewed the IMF as essential to the credibility of the Greek bailout. Her government promised Germany’s parliament, the Bundestag, last year that the IMF would join the new bailout program before Europe disburses further money to Athens.

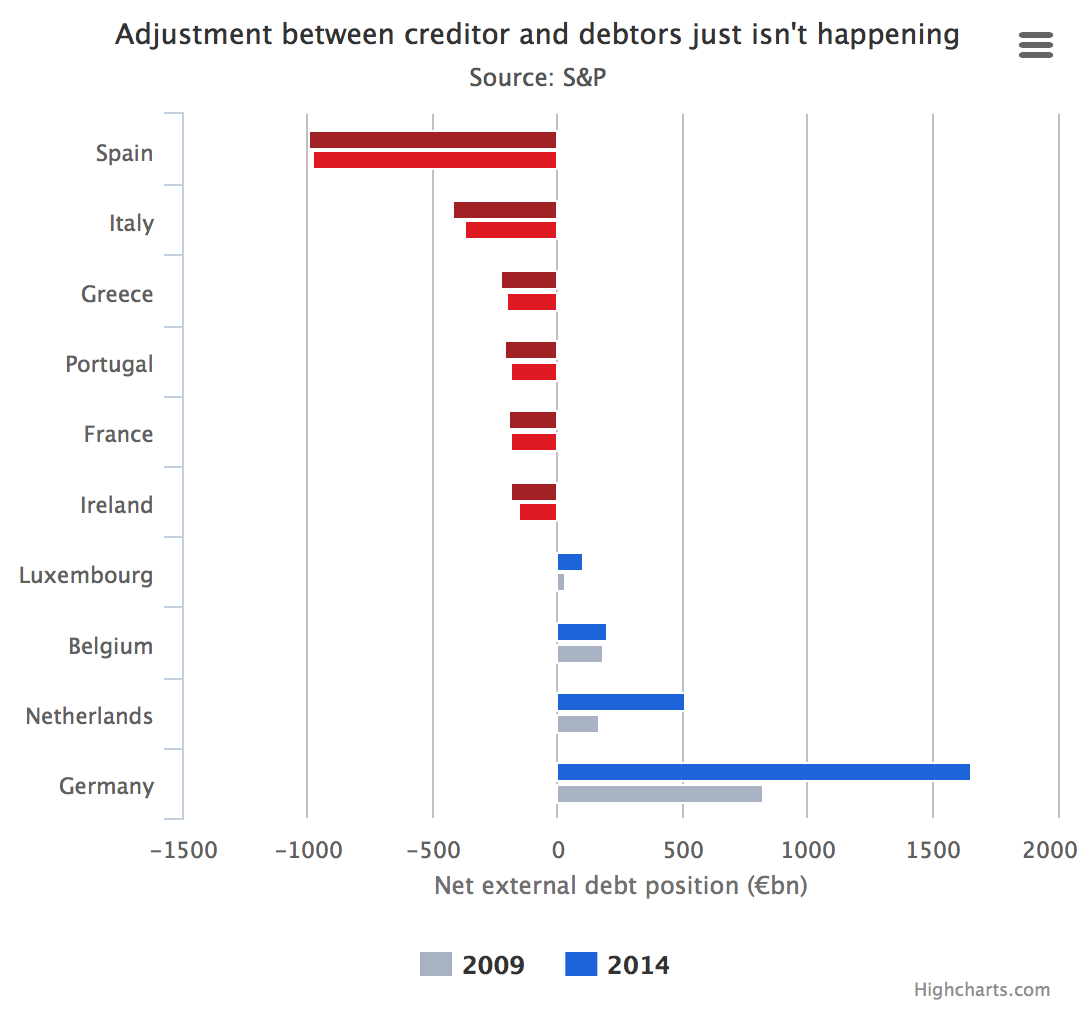

As Germany gets more debt relief than anyone else.

• ECB Grants Debt Relief To All Eurozone Nations Except Greece (Vox)

It looks like Greece may get some debt relief. There is as yet no certainty about this because some German politicians continue to conduct rear-guard battles to prevent it. What is certain, however, is that all Eurozone countries, with the exception of Greece, have been enjoying debt relief since early 2015. That may seem surprising to the outsider. Some explanation is necessary here. As part of its new policy of ‘quantitative easing’ (QE), the ECB has been buying government bonds of the Eurozone countries since March 2015. Since the start of this new policy, the ECB has bought about €645 billion in government bonds. And it has announced that it will continue to do so, at an accelerated monthly rate, until at least March 2017 (Draghi and Constâncio 2015). By then, it will have bought an estimated €1,500 billion of government bonds.

The ECB’s intention is to pump money in the economy. In so doing, it hopes to lift the Eurozone economy out of stagnation. I have no problems with this. On the contrary, I have been an advocate of such a policy. What I do have problems with is the fact that Greece is excluded from this QE programme. The ECB does not buy Greek government bonds. As a result, the ECB excludes Greece from the debt relief that it grants to the other countries of the Eurozone. How is this possible? When the ECB buys government bonds from a Eurozone country, it is as if these bonds cease to exist. Although the bonds remain on the balance sheet of the ECB (in fact, most of these are recorded on the balance sheets of the national central banks), they have no economic significance anymore.

Each national treasury will pay interest on these bonds, but the central banks will refund these interest payments at the end of the year to the same national treasuries. This means that as long as the government bonds remain on the balance sheets of the national central banks, the national governments do not pay interest anymore on the part of its debt held on the books of the central bank. All these governments enjoy debt relief. How large is the debt relief enjoyed by the governments of the Eurozone? Table 1 gives the answer. It shows the cumulative purchases of government bonds by the ECB since March 2015 until the end of April 2016.

As long as these bonds are held on the balance sheets of the ECB or the national central banks, governments do not have to pay interest on these bonds. The ECB has announced that when these bonds come to maturity, it will buy an equivalent amount of bonds in the secondary market. We observe that the total debt relief granted by the ECB until now (April 2016) to the Eurozone countries amounts to €645 billion. We also note the absence of Greece and the fact that the greatest adversary of debt relief for Greece, Germany, enjoys the largest debt relief from the ECB.

What bubbles can do.

• Canada Terrified Of Popping Foreign-Buyer Housing Bubble (CBC)

There’s a bidding war for government action on Canada’s soaring housing market, but as fingers point to foreign buyers as a reason for escalating prices, governments at all three levels are not yet motivated to cool the market down. Young Canadians complain home ownership is increasingly beyond their reach. Governments fear rules to put a lid on stratospheric prices — expected to show another strong increase in today’s real estate data for April — could have an an economic impact far beyond the first-time buyer market. The difficulty governments face is that while Canadian manufacturing and exports fall, while oil and resources crash, the property market has become the spark plug of the economy. The proverbial engine of growth is firing on a single cylinder.

Efforts to tabulate exactly how much foreign money is entering the market are unlikely to be definitive. The debate over whether it is five, 14 or 66% of sales, to quote some of the estimates in a recent Maclean’s article, will not be easily resolved. Family members can be placeholders for overseas investors. Layers of corporate ownership can do something similar [..] And that may be just the way a lot of those who benefit from the real estate market want to keep it. The fact is the foreign contribution to rising prices is only accelerating a global phenomenon that would have happened in Canada anyway. The real issue is land, hence the real estate truism: “They ain’t makin’ any more of it.” As populations grow, prime land close to where people want to live inevitably gets bid up in value.

Compared to the rest of the world, Canada has been living in a bubble. Ours is a huge country with a small population, so for decades Canadians have imagined it their God-given right to sprawl out over the best agricultural land surrounding our cities, offering everyone a suburban backyard and a picket fence. The end of that seemingly endless sprawl just happened to coincide with historically low interest rates and large parts of a global population having risen from poverty to be at least as rich as Canadians. No longer the poor and hungry, many now have a healthy down payment. The very difficult question facing municipal, provincial and federal governments is exactly how they should respond if the new data on foreign ownership shows overseas money is significantly distorting Canadian markets.

If everything becomes speculation, then so do people.

• New Zealand Housing Crisis Forces Hundreds To Live In Tents And Garages (G.)

Hundreds of families in Auckland are living in cars, garages and even a shipping container as a housing crisis fuelled by rising property prices forces low-income workers out of private rental accommodation. Charity groups have warned that, as the southern hemisphere winter approaches, most of the premises have no electricity, sewage or cooking facilities. “This is not people who haven’t been trying. They have been trying very hard and still they’re failing,” said Campbell Roberts of The Salvation Army, who has worked in South Auckland for 25 years. “A few years ago people in this situation were largely unemployed or on very low-incomes. But consistently now we are finding people coming to us who are in work, and have their life together in other ways, but housing is alluding them.”

Auckland’s housing market is one of the most expensive in the world, with property prices increasing 77.5% over the last five years (this growth has now slowed), and the average house price fetching over NZ$940,000 (£440,000), according to CoreLogic, New Zealand. Combined with low interest rates, rising migration, near full occupancy of state housing in South Auckland, and minimal wage rises, the pressure on many low to middle income earners has become too much to bear. Some families are now forced to choose between having a permanent roof over their heads, or feeding themselves and their children. Jenny Salesa, a Labour MP in the South Auckland suburb of Otara, says Maori and Pacific peoples are overwhelmingly bearing the brunt of Auckland’s housing crisis, and she has people coming to her office every day begging for help.

“People are living in garages with ten family members and paying close to NZ$400 for the privilege,” said Salesa. “People are ashamed their lives have come to this, and they try to hide. But you can tell which garages are occupied – there are curtains on the windows, small attempts to make it a home. And on the weekends, in the park, there can be up to fifty cars grouped together, with people sleeping in them.” Salesa estimates nearly 50% of people asking for her help in finding a home are in paid employment, and many families have two parents working and are still unable to make ends meet.

$200 billion of which is in mortgage-backed securities?!

• Chinese Investors Have Spent $300 Billion On US Property (R.)

Chinese investment in the U.S. real estate market has surpassed $300 billion and is growing despite China’s economic weakness and increased currency controls, the authors of a new report said on Monday. Between 2010 and 2015 Chinese buyers bought $93 billion in residential real estate, nearly $208 billion of mortgage-backed securities, and roughly $17 billion of commercial real estate, including office towers and hotels, according to the report by the Rosen Consulting Group and the Asia Society. Despite those eye-popping numbers, foreign direct investment from China still only makes up 10% of all foreign direct investment put into the United States. However, the report is significant as the first independent study to prove Chinese investors rank among the top in every real estate sector.

It also shows Chinese investors have stamina and can withstand short-term market events, said Arthur Margon, a co-author of the report and a partner at Rosen Consulting Group, which specializes in real estate. “There are strong signals that there will be continued, maybe even increasing appetite,” said Margon, during an event at New York’s Asia Society. How long the good times will last depends on both the U.S. and Chinese economies. Rosen’s team projects the United States will move out of its economic recovery and into a minor slowdown within 18 to 24 months, during which time China’s slowdown may worsen. China’s President Xi Jinping said Monday that he will push supply-side reforms and focus on increasing the middle-class, underscoring the pressure the country faces to reverse growth rates that are the lowest in 25 years.

The narrative of the service economy falls flat.

• China’s Economy Is Past The Point Of No Return (Chang)

After a near-disastrous start to the year and a one-month recovery in March, the Chinese economy looks like it’s now headed in the wrong direction again. The first indications from April show the country was unable to sustain upward momentum. Even before the first dreadful numbers for last month were released, Anne Stevenson-Yang of J Capital Research termed the uptick the “Dead Panda Bounce.” The economy is essentially moribund as there is not much that can stop the ongoing slide. A contraction is certain, and a severe adjustment downward—in common parlance, a crash—looks likely. At the moment, China appears healthy. The official National Bureau of Statistics reported that growth in the first calendar quarter of this year was 6.7%.

That is just a smidgen off 6.9%, the figure for all of last year. Moreover, the quarterly result cleared the bottom of the range of Premier Li Keqiang’s growth target for this year, 6.5%. The first-quarter 6.7% was too good to be true, however. And there are two reasons why we should be particularly alarmed. First, China’s statisticians appear to be just making the numbers up. For the first time since 2010, when it began providing quarter-on-quarter data, NBS did not release a quarter-on-quarter figure alongside the year-on-year one. And when NBS got around to releasing the quarter-on-quarter number, it did not match the year-on-year figure it had previously reported. NBS’s 1.1% quarter-on-quarter figure for Q1, when annualized, produces only 4.5% growth for the year.

That’s a long distance from the 6.7% year-on-year growth that NBS reported for the quarter. Even China’s own technocrats do not believe their own numbers. Fraser Howie, the coauthor of the acclaimed Red Capitalism, notes that the chief of a large European insurance company, who had just been in meetings with the People’s Bank of China, said that even the Chinese officials were joking and laughing in derision when they talked about official reports showing 6% growth. Second, the central government simply turned on the money taps, flooding the economy with “gobs of new debt,” as the Wall Street Journal labeled the deluge. The surge in lending was one for the record books. Credit growth in Q1 was more than twice that in the previous quarter.

China created almost $1 trillion in new credit during the quarter, the largest quarterly increase in history. [..] The Ministry of Finance also did its part to refloat the economy. Its figures show that in March, the central government’s revenue increased 7.1% while spending soared 20.1%. All that money produced good results—for one month. In April, the downturn continued. Exports, in dollar terms, fell 1.8% from the same month last year, and imports tumbled 10.9%. Both underperformed consensus estimates. A Reuters poll, for instance, predicted that exports would decline only 0.1%, while imports would fall 5%. Exports have now dropped in nine of the last ten months, and imports, considered a vital sign of domestic demand, have fallen for eighteen straight months.

Iron ore, steel, housing…

• Money Trail Shows China Sticking To ‘Original Sin’ (R.)

When it comes to reducing its dependence on debt, China’s actions matter more than its words. Last week the state-owned People’s Daily newspaper quoted an unnamed “authoritative figure” saying that the country’s high leverage was the “original sin”. Yet official data released over the weekend confirm debt is still rising while infrastructure and property investment are increasing at a rapid pace. Until the numbers show otherwise, it’s safe to assume Beijing is still focused on growth. On the surface, recent credit data suggests that China’s economy has entered debt rehab. New total social financing (TSF), a widely used barometer of investment, was 751 billion yuan ($115 billion) in April, down sharply from 2.3 trillion yuan in March. New loans fell to 564 billion yuan from 1.3 trillion yuan in the previous month.

This appeared to confirm speculation that the interview, published in People’s Daily on May 9, had signaled a high-level shift in policy. Yet a closer look at the numbers shows the story remains much as before. The TSF numbers don’t include a monthly record of one trillion yuan of new local government bonds, most of which were issued as part of a scheme to swap bank loans for longer-term securities. Add these back in and UBS calculates that overall credit in China grew 17% year on year. That’s far too high for an economy where nominal GDP is growing at about half that pace. Moreover, the new money is still pouring into the same areas that gave China years of lop-sided growth. Property prices have risen sharply in prime cities such as Shanghai and Shenzhen.

Construction starts were 21.4% higher measured by floor space in the first four months of 2016 than a year ago, China’s National Bureau of Statistics said on May 14. Even though infrastructure spending slowed slightly, it still increased by 21% year on year in April, with investment in utilities growing at an even faster pace, according to UBS. Meanwhile, private sector firms complain of a shortage of credit. To rebalance China’s economy, Beijing needs to direct capital to areas that can generate better returns. For now, the numbers show no sign of that happening. Then again, renouncing original sins was never going to be easy.

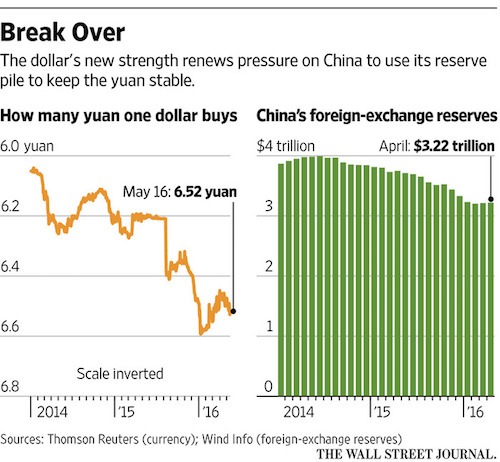

“It can choose to keep the yuan stable either against the dollar OR the basket. ”

• China Challenged to Keep Yuan Stable as Dollar Rises (WSJ)

Having had it easy for a few months, the Chinese central bank is now coming under renewed pressure to steady the yuan and prevent money from leaving China’s shores. The culprit is the dollar. The greenback’s weakness in the past two months had given the People’s Bank of China some breathing room to stabilize the yuan, reducing the Chinese appetite for foreign assets along the way. But since the end of April, the yuan has depreciated 0.6% against the dollar, eroding the 1% gain the Chinese currency made over the previous two months. The yuan’s renewed weakness puts the PBOC back in a familiar juggling act: Its mandate to support growth requires it to pump credit into the economy, which tends to weaken the yuan. But it must make sure it doesn’t weaken the currency so much that it worsens the flood of money exiting China.

Growing concern about China’s economic outlook also weighs on the yuan. Late Monday, China’s state broadcaster showed footage of President Xi Jinping emphasizing at a top-level meeting the urgency of implementing restructuring steps to put the economy on a stronger footing. Some economists and officials within China, including those at the government think tank China Academy of Social Sciences, have urged the central bank to let the market steer the yuan lower as China’s slowdown deepens. But for officials at the People’s Bank a bigger worry, at least for now, is the potential for ordinary Chinese to exchange their yuan assets for foreign currencies and take them out of the country. The central bank is also wary of causing the kind of market gyrations that have twice in the past year resulted from its exchange-rate maneuvering.

Most recently, in early January, an unexpected move by the People’s Bank to guide the yuan sharply weaker against the dollar triggered a global market selloff. The central bank “wants yuan stability in order to minimize the shocks to the weak economic momentum,” said Chi Lo, China economist at BNP Paribas Investment Partners, the asset-management arm of the Paris-based bank. To do that, it is trying to shift investors’ focus on the yuan’s movements against the dollar to its value against a broader group of currencies. When the dollar declines, the central bank can keep the yuan largely flat or even slightly stronger against the greenback, while it still weakens against the basket of 13 currencies. But when the dollar advances, the central bank needs to guide the yuan weaker against it to safeguard the economy and keep the yuan stable against the basket. The upshot: It can choose to keep the yuan stable either against the dollar or the basket.

..an excerpt from Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud, published on May 17 by The New Press.

• The Great Foreclosure Fraud (Dayen)

All whistleblowers are a little bit crazy. They obsess over things most people overlook. They see grand conspiracies where others see only shadows. In this case, these whistleblowers, armed with only a few websites and a hunger for the truth, found that the mortgage industry fundamentally ruptured a centuries-old system of U.S. property law; that millions of documents generated to foreclose on people’s homes were phony; and that all those purchasing a mortgage in America were taking a gamble that they would be tossed onto the street with nothing, even if they made every payment and played by the rules. Virtually everyone to whom they presented this information reacted the same way: “That can’t be true.” Right up until the day the banks admitted it.

These three—Lisa Epstein, Michael Redman, and Lynn Szymoniak— unearthed another layer of the mystery, too. After they exposed foreclosure fraud and forced the nation’s leading mortgage companies to stop repossessing homes, they saw firsthand the unwillingness of our government to deliver any consequences. In fact, walk into any courtroom today and you will see the same false documents, the same ones Lisa, Michael, and Lynn exposed, used to foreclose on homeowners. As America searches for understanding amid the perversity of the financial crisis, they should know that there were a few determined people, far from the corridors of power, who tried to write an alternative history, one where the perpetrators of fraud get rounded up and put away.

But the same democracy that allows ordinary Americans to collaborate and organize and build a movement allows their deep-pocketed opponents to use the tools of entrenched power to counteract it. And we have to reckon with the fact that, in our current system of justice, who you are matters more than what you did. Michael Redman, one of these whistleblowers, sat next to me one night as he told me his story, and said over and over again, “I don’t believe your book. I lived through it, and I don’t believe it.” I will forgive readers their skepticism, as even a protagonist in the tale shares it. It is unbelievable. That doesn’t make it untrue.

Think if the numbers get big enough we’ll all get smart one day?

• Climate Change Puts 1.3 Billion People, $158 Trillion At Risk: World Bank (G.)

The global community is badly prepared for a rapid increase in climate change-related natural disasters that by 2050 will put 1.3 billion people at risk, according to the World Bank. Urging better planning of cities before it was too late, a report published on Monday from a Bank-run body that focuses on disaster mitigation, said assets worth $158tn – double the total annual output of the global economy – would be in jeopardy by 2050 without preventative action. The Global Facility for Disaster Reduction and Recovery said total damages from disasters had ballooned in recent decades but warned that worse could be in store as a result of a combination of global warming, an expanding population and the vulnerability of people crammed into slums in low-lying, fast-growing cities that are already overcrowded.

“With climate change and rising numbers of people in urban areas rapidly driving up future risks, there’s a real danger the world is woefully unprepared for what lies ahead,” said John Roome, the World Bank Group’s senior director for climate change. “Unless we change our approach to future planning for cities and coastal areas that takes into account potential disasters, we run the real risk of locking in decisions that will lead to drastic increases in future losses.” The facility’s report cited case studies showing that densely populated coastal cities are sinking at a time when sea levels are rising. It added that the annual cost of natural disasters in 136 coastal cities could increase from $6bn in 2010 to $1tn in 2070. The report said that the number of deaths and the monetary losses from natural disasters varied from year to year, but the upward trend was pronounced.

Total annual damage – averaged over a 10-year period – had risen tenfold from 1976–1985 to 2005–2014, from $14bn to more than $140bn. The average number of people affected each year had risen over the same period from around 60 million people to more than 170 million.

The hope of the Irish.

• Will Brexit Make Ireland A Nation Once Again? Don’t Write It Off (McWilliams)

If Britain leaves the EU, it could start a domino effect – at the end of which is a united Ireland Here’s a scenario that might not be too far-fetched. It is not, by any stretch of the imagination, one that would be welcomed here; but it could happen. What will happen if Britain votes to leave the European Union in five weeks’ time? What happens to Northern Ireland? The DUP is campaigning for Brexit, but Brexit may loosen the UK so much that the DUP could be signing its own death warrant. Here is the possible scenario that will unfold if there’s a break-up of the UK. The English lead the British out of Europe. The Scottish then go to the polls again, wanting to stay in Europe. They have to leave the UK to stay in the EU, and by a small margin they vote to stay in Europe but leave the English. Not unfeasible.

The rump UK becomes an entity involving a eurosceptic England, a modestly pro-European but compliant Wales and an ever-divided Northern Ireland. However it is a Northern Ireland shorn of its fraternal brothers, the Scots – in a union with the ambivalent English. There has never been the same cultural affinity between the English and the Northern Unionists. The cultural glue of Protestant Northern Ireland within the UK is Scotland. I have some experience of this. My grandparents were Scottish. My wife is from Belfast. My children were born in the Ulster Hospital (where the missus and me were the only couple at the pre-natal classes not in his-and-hers matching Rangers tracksuits). Unlike many Southerners, my bonds with that part of the world are strong. Ethnically, without Scotland, the union of Northern Ireland and a multicultural but nationalistic little England is not particularly coherent.

All the while, the demographic forces are on the side of nationalism. As I write, I am looking at demographics in Northern Ireland from the 2011 census. The most interesting statistic shows the proportion of Catholics and Protestants in various age groups. Of the elderly, those over-90 in the North, 64% are Protestant and 25% are Catholic. A total of 9% had no declared religion. This reflects the religious status quo when these people were born, in the 1920s, and more or less reflects the realities of the Treaty. When you look at those children and babies born since 2008, the picture changes dramatically. This corresponding figure is 31% Protestant and 44% Catholic. In one (admittedly long) lifetime, the Catholic population in the youngest cohort has nearly doubled, while the Protestant cohort has more than halved. Even given the fact that 23% of parents of infants declared themselves as having no religion, we seem to be en route to a united Ireland.

I have the idea that making this a left vs right issue is not helpful. And while Paul Mason realizes what’s wrong in Brussels, he doesn’t seem to grasp there’ll be no second chance for a very long time. He says it himself: “..in Britain I can replace the government, whereas in the EU, I cannot.”, but still wants to stay in EU because of Boris Johnson. Where’s the logic?

• The Leftwing Case For Brexit -One Day- (Mason)

The leftwing case for Brexit is strategic and clear. The EU is not – and cannot become – a democracy. Instead, it provides the most hospitable ecosystem in the developed world for rentier monopoly corporations, tax-dodging elites and organised crime. It has an executive so powerful it could crush the leftwing government of Greece; a legislature so weak that it cannot effectively determine laws or control its own civil service. A judiciary that, in the Laval and Viking judgments, subordinated workers’ right to strike to an employer’s right do business freely. Its central bank is committed, by treaty, to favour deflation and stagnation over growth. State aid to stricken industries is prohibited.

The austerity we deride in Britain as a political choice is, in fact, written into the EU treaty as a non-negotiable obligation. So are the economic principles of the Thatcher era. A Corbyn-led Labour government would have to implement its manifesto in defiance of EU law. And the situation is getting worse. Europe’s leaders still do not know whether they will let Greece go bankrupt in June; they still have no workable plan to distribute the refugees Germany accepted last summer, and having signed a morally bankrupt deal with Turkey to return the refugees, there is now the prospect of that deal’s collapse.

That means, if the reported demand by an unnamed Belgian minister to “push back or sink” migrant boats in the Aegean is activated, the hands of every citizen of the EU will be metaphorically on the tiller of the ship that does it. You may argue that Britain treats migrants just as badly. The difference is that in Britain I can replace the government, whereas in the EU, I cannot. That’s the principled leftwing case for Brexit. Now here’s the practical reason to ignore it. In two words: Boris Johnson.

More threats?

• As Brexit Vote Looms, US Banks Review Their European Commitments (R.)

If Britain votes to leave the European Union in June, some U.S. banks could give up parts of their business in the bloc altogether. The option is an extreme scenario under consideration by some Wall Street firms if the terms of an exit, currently a matter of speculation, leave financial services companies in Britain unable under their current set-ups to do business inside the EU, according to discussions Reuters had with several U.S. banks and their lawyers. The scenarios being studied by taskforces at U.S. banks underscore the extent to which the London operations of non-European banks are linked to business on the continent. In particular focus are the banks’ market operations, as trading of most European securities is regulated at the EU level but conducted by many investment banks mainly out of London.

The five largest U.S. banks employ 40,000 people in London, more than in the rest of Europe combined, taking advantage of the EU “passporting” regime that allows them to offer services across the bloc out of their British hubs. Having to reorganize business in order to set up new continental European outposts — which U.S. banks say is a worst-case scenario that they are being forced to consider — would be so costly that it would make some rethink their commitment to the bloc altogether. “The costs may lead some banking groups to reassess how important Europe is in the context of their global business and what sort of presence they wish to maintain post-Brexit,” said Edward Chan, a partner at the law firm Linklaters, which has been advising banks on contingency arrangements.

Blame EU, not Greece.

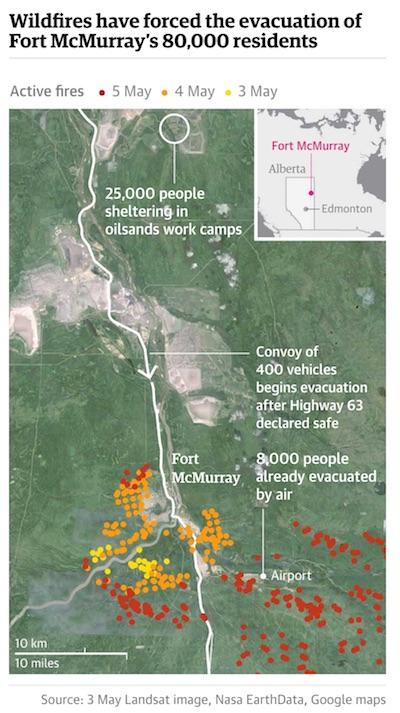

• UN Urges Greece To Stop Detaining Migrant Children (R.)

A top United Nations official urged Greece on Monday to stop detaining refugee and migrant children, some of whom are locked up in police cells for weeks, and to develop child protection services instead. The U.N. Special Rapporteur on the human rights of migrants, Francois Crepeau, said he had met unaccompanied children held in police stations for more than two weeks without access to the outdoors, and “traumatised and distressed” by the experience. Others were with their families in overcrowded detention centres, where inter-communal frictions and contradictory information created “an unacceptable level of confusion, frustration, violence and fear”, he said. “Children should not be detained – period,” said Crepeau, on a fact-finding mission in Greece from May 12 to 16.

“Detention should only be ordered when people present a risk, a danger, a threat to the public and it has to be a documented threat, it cannot simply be a hunch.” Crepeau said children and families should be offered alternatives to detention. He urged authorities to develop a “substantial and effective” guardianship system for unaccompanied minors and increase the shelter capacity for them. More than a million migrants, many fleeing the Syrian war, have arrived in Europe through Greece since last year. More than 150,000 have arrived in 2016 so far, 38% of them children, according to U.N. refugee agency data. Greece, in its sixth year of economic crisis, has struggled to cope with the numbers.

International charity Save the Children says an estimated 2,000 unaccompanied children who travelled alone to Europe or lost their families on the way are stranded in Greece and only 477 shelter spaces are available across the country. (Unaccompanied minors) are put in … protective custody and the only place there is space (for them) is the cell in police stations and that’s where we find them quite often,” Crepeau said. “Spending 16 days (in a police cell) is way too long. What is needed is specialised body of competent professionals who can take care of unaccompanied minors.”

What a surprise.

• Syrians Returned To Turkey In EU Deal ‘Have No Access To Lawyers’ (G.)

The first Syrians to be returned by plane under the EU-Turkey deal have been detained in a remote camp for the past three weeks with no access to lawyers, casting further doubts over EU claims that they are being sent back to a safe third country. With hundreds more likely to be expelled in similar fashion in the coming weeks, the returnees have warned that those following in their wake face arbitrary detention, an inscrutable asylum process, and substandard living conditions. Their claims undermine the legitimacy of the EU-Turkey migration deal, under which it is likely most Syrians landing on Greek islands will be returned to Turkey, on the assumption that they can live without restrictions once there.

Turkey has said they will be released soon. But a group of 12 Syrians returned by plane on 27 April who were contacted by telephone said they had simply been detained without clear legal recourse since they arrived in a remote detention centre in southern Turkey called Düziçi. The fate of two other Syrians deported along with hundreds of non-Syrians earlier in April is unknown.

“You can’t imagine how bad a situation we are in right now,” said one Syrian mother detained with her children, who now wants to return to Syria because she sees no alternative. “My children and I are suffering, the food is not edible. I’m forcing my children to eat because I don’t have any money to buy anything, but they refuse because there are bugs in it.” The detainees have also been denied access to lawyers and specialised medical care, she alleged. Like all the interviewed detainees, the Syrian asked to remain anonymous for fear of reprisals, but said she now wanted to return to Syria because she felt that even a war-zone would be better for her family than the refugee detention centres in Greece and Turkey.