Harris&Ewing War-bond rally on Penn. Avenue, Washington DC 1918

But wasn’t reform supposed to be crucial to growth itself? Pretty sure it still is. They should be careful not to start contradicting themselves.

• China Picks Growth Over Reform At Annual Congress (AFR)

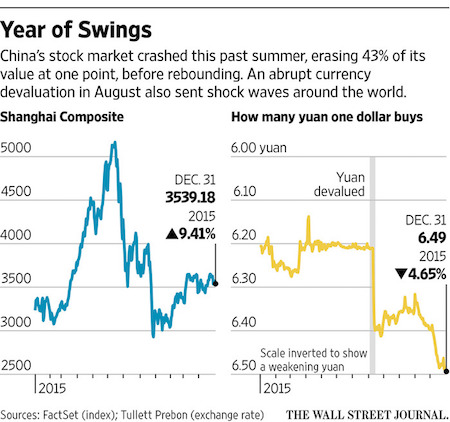

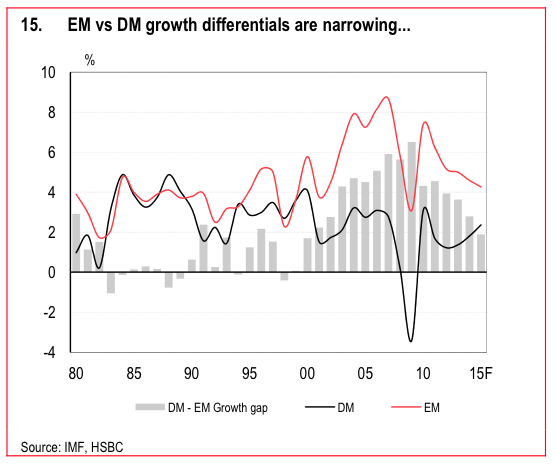

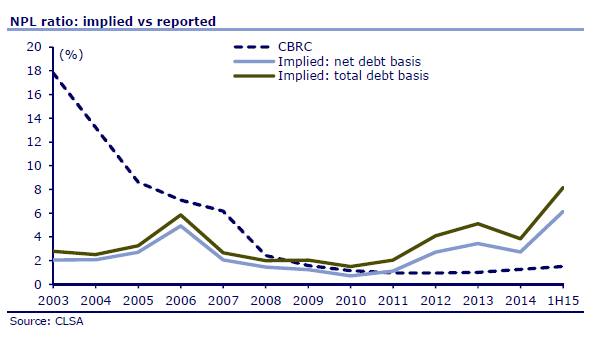

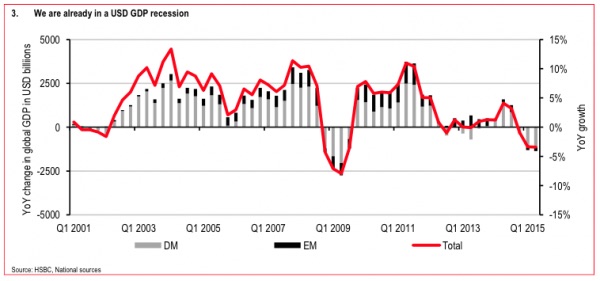

China will put development above structural reform over the next five years, as it outlined an ambitious economic growth target higher than economists and international agencies are forecasting. While announcing only modest tax cuts and a smaller than expected increase in fiscal spending, the government indicated it stands ready to roll out out other stimulus measures to meet targeted growth of 6.5% between 2016 and 2020. “We must remain committed to economic development as our central task … and respond effectively to challenges so as to ensure that China’s economy, like a gigantic ship, breaks the waves and goes the distance,” said Premier Li Keqiang during his opening address to the National People’s Congress on Saturday.

In outlining the three main priorities for its 13th Five Year Plan, Mr Li said development ranked ahead of structural reform and efforts to recalibrate China’s economy to be more reliant on consumption rather than investment. “Development is of primary importance to China and is the key to solving every problem we face,” he said. Mr Li’s determination for China to grow its way out of trouble will see a budgeted fiscal deficit of 3% of GDP in 2016, up from 2.3% last year. While this was lower than many had expected, it does not account for off-budget items, which are likely to see China post an actual fiscal deficit of 3.5% in 2015 and could see that figure top 4% this year. “The majority of the increase in the fiscal deficit will be used for a cut in taxes and charges in order to reduce the burden on enterprises,” Mr Li said.

This will result in 500 billion yuan ($103 billion) of tax cuts this year, as China replaces sales tax with a Value Added Tax. China set an economic growth target of between 6.5% and 7% for 2016. While this is well down on the double-digit growth rates of last decade, Mr Li put it in context by saying each 1 percentage point of growth today was the same as 2.5 percentage points 10 years ago, as the economy was now significantly larger. He also said each 1 percentage point of growth created 1.9 million new jobs. However, he conceded the country would face “more and tougher challenges” for economic development this year and must be prepared to “fight a battle” as international trade was weak and geopolitical risks were rising. But he said the economy was resilient and there was ample room for growth.

[..] On structural reform, Mr Li said the issue of so called “zombie enterprises” – companies that are effectively bankrupt but still operating – would be addressed “proactively yet prudently”. Beijing has outlined plans for 1.8 million steel and coal workers to lose their jobs over the next five years and has set up a 100 billion yuan ($20 billion) fund for compensating employees and restructuring companies. However, Mr Li outlined few details on how this would be achieved, suggesting it would be more gentle than the brutal restructure of State Owned Enterprises in the late 1990s, which saw an estimated 25 million workers lose their jobs.

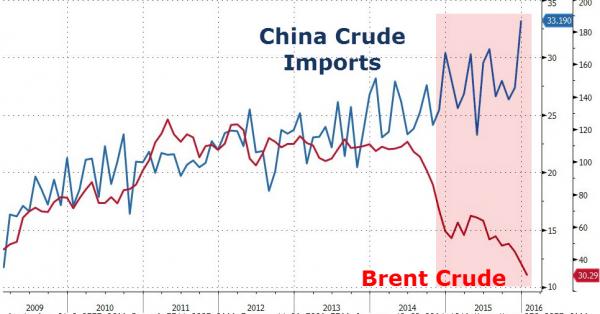

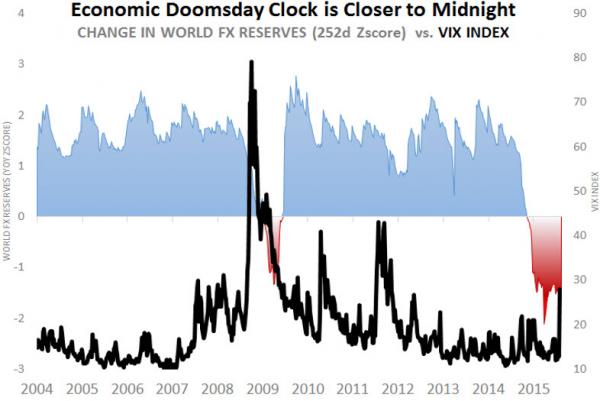

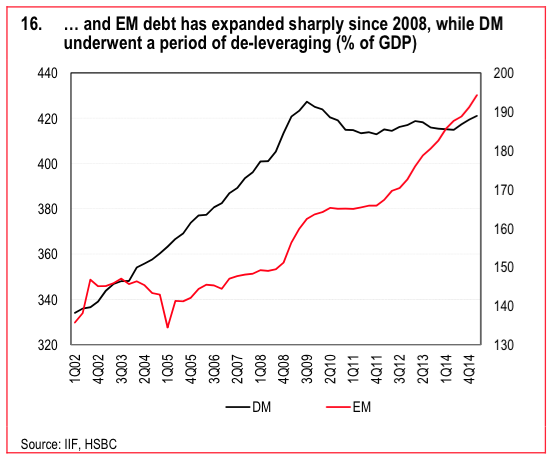

“China accounted for a quarter of the world’s economic growth in 2014, Xy said..” Tyler Durden wryly observes: “And accounted for 40% of all global new debt issuance since 2008..”

• Hard Landing Fallacy “No Way” In China: Regulator (Xinhua)

The hard landing fallacy on China’s economy will “no way” occur in China, a senior economic official said Sunday. The Chinese economy is so resilient with relatively strong abilities to resist risks, Xu Shaoshi, who heads the National Development and Reform Commission, said on the sidelines of the annual parliamentary session. “We are capable of keeping economic growth at rates within a reasonable range,” Xu said. “We are confident of achieving that end.” China set the growth target at a range of 6.5% to 7% this year, and an average annual growth of above 6.5% for the next five years.

It had seen, for a quarter of a century, the slowest expansion of 6.9% in 2015, amid its structural adjustment and a fragile global recovery. China’s economic growth remains relatively fast among world major economies. The 6.9% growth was hard won given the sluggish global recovery, Xu said. China accounted for a quarter of the world’s economic growth in 2014, Xu said, citing data from the World Bank and China’s National Bureau of Statistics.

We respectfully disagree.

• China Says Cuts In Overcapacity Won’t Cause Massive Layoffs (Reuters)

China’s plans to reduce industrial overcapacity are unlikely to result in large-scale layoffs, the country’s top economic planner said on Sunday. Xu Shaoshi, head of the National Development and Reform Commission (NDRC), told reporters at a briefing that economic growth will create more jobs and help offset the impact of capacity cuts. China aims to keep its economy growing by at least 6.5% over the next five years while pushing hard to create more jobs and restructure inefficient industries, Premier Li Keqiang said on Saturday.

“There was plenty of talk about “painful rebalancing”, the need to reform inefficient state owned enterprises and to cut overcapacity – but for many, this speech will look a lot like business as usual: a commitment to growth at all costs..”

• China PM Predicts ‘Battle’ For Growth (BBC)

China’s National People’s Congress has set the country’s growth target for 2016 at a lower range of 6.5%-7%. Premier Li Keqiang made the announcement in his opening speech, warning of a “difficult battle” ahead. The annual meeting in Beijing sets out to determine both the economic and political agenda for the country. It comes at a time when China struggles with slowing economic growth and a shift away from overreliance on manufacturing and heavy industry. The congress is also expected to approve a new five-year plan, a legacy of the communist command economy. “China will face more and tougher problems and challenges in its development this year, so we must be fully prepared to fight a difficult battle,” Mr Li told delegates on Saturday.

Last year, China’s goal was “about 7%”. The economy actually grew by 6.9% – the lowest expansion in 25 years. Mr Li also said that China was targeting consumer inflation at “around 3%” and unemployment “within 4.5%”. Meanwhile, the country’s defence spending will be raised by 7.6%, the state-run Xinhua news agency reports, citing a budget report. China’s congress is a highly choreographed, largely rubber stamp affair, but Premier Li’s opening address can at least be gleaned for clues about the overall direction of policy, the BBC’s John Sudworth in Beijing reports. There was plenty of talk about “painful rebalancing”, the need to reform inefficient state owned enterprises and to cut overcapacity – but for many, this speech will look a lot like business as usual: a commitment to growth at all costs, our correspondent adds.

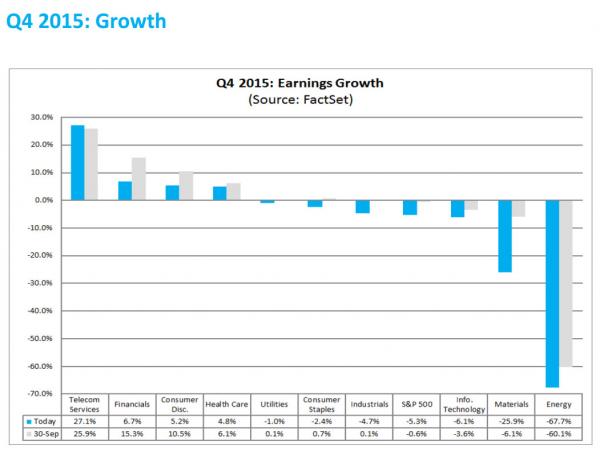

Ugly.

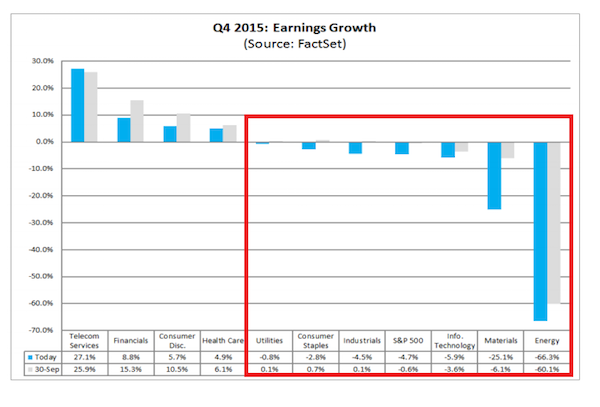

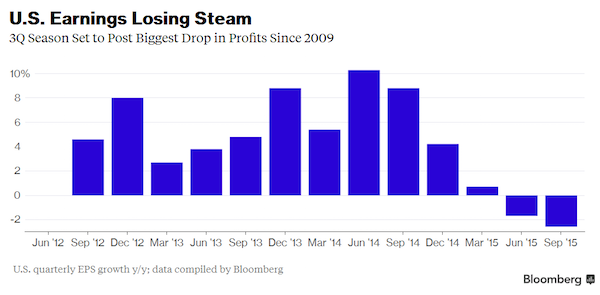

• US Weekly Earnings Drop Most On Record (ZH)

The headline jobs number was certainly good, beating expectations and well higher than last month’s disappointing (and upward revised) 182K print. However, a quick look below the headline reveals an amazing statistic: while we already noted that average hourly earnings posted only their first decline since December 2014, and just the 6th in the past decade, declining by -0.1%, what is the real surprise is that average weekly hours worked also dropped substantially by 0.2 from 34.6 to 34.4. This, naturally, is the denominator in the average hourly earnings calculation, and for it drop drop with the average also sliding, means that weekly earnings must have dropped.

And drop they did: as the chart below clearly shows, based on the data which showed a whopping tumble in average weekly earnings from 878.15 to just 872.04, at -0.7%, this was the biggest monthly drop in the entire series history!

The drop confirms that the jump in earnings observed in January, and which led many to prematurely conclude that wage growth has finally arrived, was nothing but a headfake driven by the increase in minimum wages across various states, which has now been fully digested, and as a result wage growth is once again what it was before: non-existent. Finally, it goes without saying that in the middle of a ‘recovery’ this is not really supposed to happen.

Long article by Gross, worth a read.

• Sunshine, Lollipops and… (Bill Gross)

Our Sun – a rather tiny star in the galaxial scheme of things – seems inexhaustible. But 5 billion years from now, it will swallow, instead of nurture the Earth as it burns itself out – first contracting, then expanding like a flaming candle turned firecracker. Not to worry though. We won’t be around. It’s not that we are beyond worrying; it’s that our lives are much shorter and we needn’t think much about it. In the nearer term, there is global warming/climate change, and other such down to Earth problems as paying the bills and getting kids into the right colleges. Still – there are presumably inexhaustible things that deserve our attention in the here and now. One of them is finance-based capitalism and our assumption that the risk/ reward historically inherent in it will be sufficient to drive economic growth forward.

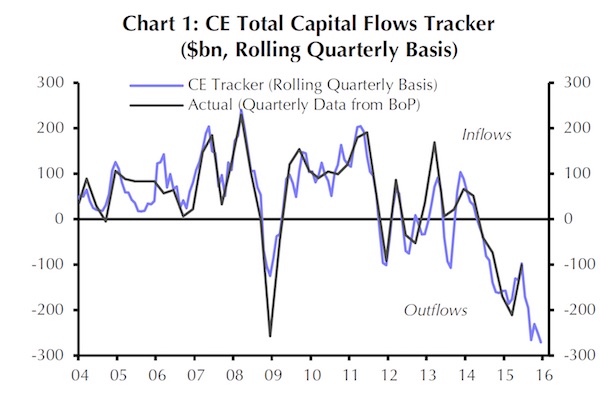

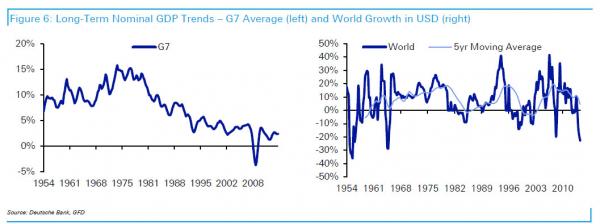

Unlike the Sun, whose fate and lifespan can be scientifically determined, there is little evidence that anything could ever change what has been until now a flawed, yet the best economic system conceivable. Capitalistic initiative married to an ever expanding supply of available credit has facilitated economic prosperity much like the Sun has been the supply center for energy/ food and life’s sustenance. But now with quantitative easing and negative interest rates, the concept of nurturing credit seems to have morphed into something destructive as opposed to growth enhancing. Our global, credit based economic system appears to be in the process of devolving from a production oriented model to one which recycles finance for the benefit of financiers. Making money on money seems to be the system’s flickering objective.

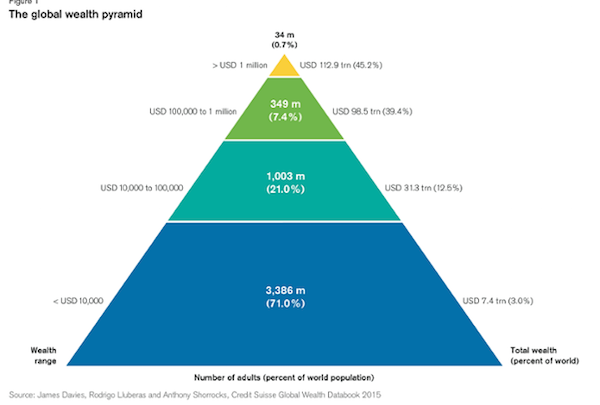

Our global financed-based economy is becoming increasingly dormant, not because people don’t want to work or technology isn’t producing better things, but because finance itself is burning out like our future Sun. What readers should know is that the global economy has been powered by credit – its expansion in the U.S. alone since the early 1970’s has been 58 fold – that is, we now have $58 trillion of official credit outstanding whereas in 1970 we only had $1 trillion. Staggering, is it not? But now, this expansion appears to be reaching an ending of sorts, at least in its current form. Private sector savers are growing leery of debt piled upon debt and government regulators have begun to build fences against further rampant creation.

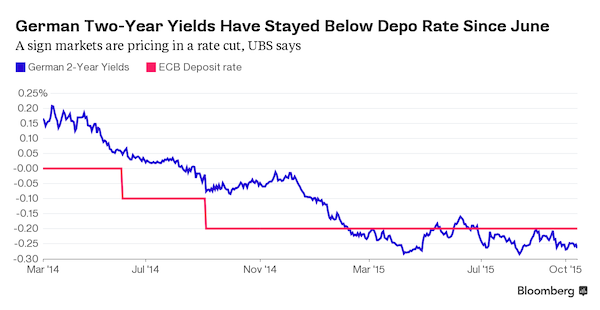

In addition, the return offered on savings/investment whether it be on deposit at a bank, in Treasuries/Bunds, or at extremely low equity risk premiums, is inadequate relative to historical as well as mathematically defined durational risk. The negative interest rates dominating 40% of the Euroland bond market and now migrating to Japan like a Zika like contagion, are an enigma to almost all global investors. Why would someone lend money to a borrower with the certainty of getting less money back at a future date? Several years ago even the most Einsteinian-like economists would not have imagined such a state but now it seems an everyday occurrence, as central banks plumb deeper and deeper depths like drilling rigs expecting to strike oil, if only yields could be lowered another 10, 20, 50 basis points.

Some kind of currency will appear. Maybe the Swedes will start using dollars.

• Sweden Begins 5 Year Countdown Until It Eliminates Cash (ZH)

How much louder can the “ban cash” calls get? Recall it was just last year when we catalogued the growing cacophony of crazies for whom banning physical currency is the only way to ensure that depositors can’t simply reassert their economic autonomy under a low or zero rate regime.. Put simply, if interest rates get too low, depositors will simply take their money out the bank and put it in the mattress or the safe where, to quote WSJ from last week, “interest rates are always low no matter what central bankers do. Most recently, Larry Summers called for the abolition of the $100 bill in the US and in Europe the €500 note is to go the way of the dinosaurs. Perhaps the most telling sign that citizens are starting to panic is that in Japan, they’re selling out of safes. Literally.

“It shows a vague sense of unease,” one Japanese lawmaker who brought up the soaring safe sales in parliament on Monday remarked. Now, the excuse given for banning big bills is that it combats crime. And maybe it does. But in the end the rationale is simple: if there are no more physical banknotes, people have no economic autonomy. Let’s say consumer spending is stagnating. No problem, take rates to -20%. We bet they’ll start spending then – either that or see their deposits haircut by 20%. In short, no cash means no effective lower bound and with no lower bound, the economy can be completely centrally planned – for all intents and purposes. Consumers not spending? No problem. Just tax their excess account balance. Economy overheating? Again, no problem. Raise the interest paid on account holdings to encourage people to stop spending.

So with Citi, Harvard, Denmark and Peter Bofinger, member of the German Council Of Economic Experts, all onboard, we’re surprised to hear that Sweden (already one of the leaders in the cashless society movement) is looking to phase out a series of new bank notes it just introduced last year and moved ever closer to the cashless utopia. “Last year Sweden introduced a series of new banknotes replacing its old kronor notes. But figures suggest these too could be gone from circulation in half a decade if the development towards a cashless society continues,” The Local reports,” continuing that “cash transactions today represent no more than 2% of the value of all payments made in Sweden, [and that estimate] will drop to below 0.5% within the next five years. Some welcome the trend – credit card providers, for instances – others have reservations.

“It is happening at a furious rate. And it’s important to many older people to be able to use cash. I mean, today it is legal tender and you have to be able to use it until parliament decides otherwise,” Christina Tallberg, chairwoman of Swedish pensioners’ organization PRO, told Swedish Radio on Friday. Well, until parliament or perhaps more appropriately, until The Riksbank and Stefan Ingves decides it. Because at -0.55, it’s a “how much lower can you go type scenario.” Well, if you go kronor-less, that question ceases to make sense. The “problem” simply goes away. “Sometimes you have to learn new things. It’s a little awkward for a transitional period, but I think it’s going to be so simple that you pretty soon realize that this is a lot easier and better than having cash,” said working environment ombudsman Krister Colde of the Commercial Employees’ Union (Handels). Famous last words Krister.

Fun in Oz.

• Confused By The Economic Modelling? That’s The Whole Idea (SMH)

Politics is about trust. Prime Minister Malcolm Turnbull has been claiming for weeks that Labor’s plans for negative gearing would smash house prices. “The 70% of Australians who own houses will see the value of their single most important asset smashed to fulfil an ideological crusade,” he told parliament. His Attorney-General George Brandis has made it sound even worse. “There is one thing we know about the negative-gearing debate,” he told us. “If the Labor Party were to implement its policy, the value of most Australians’ homes would collapse”. His assistant treasurer Kelly O’Dwyer briefly said the opposite. Labor’s policy would “increase the cost of housing for all Australians; for those people who currently own a home and for those people who would like to get into the housing market”.

And then his treasurer Scott Morrison latched on to a “credible report” that said Labor’s policy would have “a significant impact on property values”. He latched on too quickly. The report, by BIS Shrapnel, said no such thing. Prices would continue to rise in all but two of the next 10 years under the scenario it modelled, just as they would if negative gearing was maintained. After a decade, they would have climbed 15%. That’s less than with full negative gearing, but its still an increase. The report explained that house prices are typically “sticky in a downwards direction,” unable to fall lower than the cost of construction plus a markup. When new attempts at negative gearing were temporarily suspended between 1985 and 1987 real estate prices continued to climb.

While new investors would be less keen to buy if Labor’s policy stopped them negatively gearing, existing investors would be also less keen to sell, because they could only continue to negative gear if they hung on to the properties they had. Prices wouldn’t be smashed. It’s all there in the report Morrison lauded as credible (because it said rents would rise), but appeared not to properly read. Certainly his eyes appeared to glaze over the howling error on page one. The report said Australia’s national income would average $190 billion over the next ten years when it meant $1.9 trillion. And they appeared not to be troubled by its suggestion that a measure that raised around $2 billion per year would shrink the economy by $19 billion per year.

That’s $9 of economic damage for every $1 collected, a sum so big as to be way out of the ballpark of anything his department has ever modelled. When Treasury modelled a range of taxes for its tax discussion paper, it found the worst of them, stamp duty, did 70 cents of economic damage for each dollar collected. Yet first thing Thursday morning on AM Morrison described as “credible” a report that found removing negative gearing would create multiples of the biggest damage his department could find The Grattan Institute’s John Daley says the finding doesn’t even pass the giggle test. Try it for yourself. Attempt to say: “a tax that raises $2 billion will shrink the economy by $19 billion” without laughing.�

5 years later.

• Mutations, DNA Damage Seen In Fukushima Forests (AFP)

Conservation group Greenpeace warned on Friday that the environmental impact of the Fukushima nuclear crisis five years ago on nearby forests is just beginning to be seen and will remain a source of contamination for years to come. The March 11, 2011 magnitude 9.0 undersea earthquake off Japan’s northeastern coast sparked a massive tsunami that swamped cooling systems and triggered reactor meltdowns at the Fukushima Daiichi nuclear plant. Radiation spread over a wide area and forced tens of thousands of people from their homes – many of whom will likely never return – in the worst nuclear accident since Chernobyl in 1986. As the fifth anniversary of the disaster approaches, Greenpeace said signs of mutations in trees and DNA-damaged worms were beginning to appear, while “vast stocks of radiation” mean that forests cannot be decontaminated.

In a report, Greenpeace cited “apparent increases in growth mutations of fir trees… heritable mutations in pale blue grass butterfly populations” as well as “DNA-damaged worms in highly contaminated areas”, it said. The report came as the government intends to lift many evacuation orders in villages around the Fukushima plant by March 2017, if its massive decontamination effort progresses as it hopes. For now, only residential areas are being cleaned in the short-term, and the worst-hit parts of the countryside are being omitted, a recommendation made by the International Atomic Energy Agency. But such selective efforts will confine returnees to a relatively small area of their old hometowns, while the strategy could lead to re-contamination as woodlands will act as a radiation reservoir, with pollutants washed out by rains, Greenpeace warned.

Shame on Europe and the US.

• Zaman Newspaper: Defiant Last Edition As Turkey Police Raid (BBC)

Turkey’s biggest newspaper, Zaman, has condemned its takeover by the authorities in a defiant last edition published just before police raided it. Saturday’s edition said Turkey’s press had experienced “one of the darkest days in its history”.

Police raided Zaman’s Istanbul offices hours after a court ruling placed it under state control, but managers were still able to get the edition to print. Police later fired tear gas to disperse Zaman supporters. Water cannon was also used as about 500 people gathered in front of Zaman’s headquarters on Saturday. They chanted “Free press cannot be silenced!” A number of the journalists returned to work, but some of them tweeted that:

• they had lost access to internal servers and were not able to file articles

• they were not able to access their email accounts

• the newspaper’s editor-in-chief Abdulhamit Bilici and a leading columnist had been firedOne reporter, Abdullah Bozturk, said attempts were also under way to wipe the newspaper’s entire online archive. The European Union’s response has been to issue weak statements of concern, the BBC’s Mark Lowen says. It is accused of acting softly on Turkey as it needs the country’s support in managing the refugee crisis. The paper is closely linked to the Hizmet movement of influential US-based cleric Fethullah Gulen, which Turkey says is a “terrorist” group aiming to overthrow President Recep Tayyip Erdogan’s government. Mr Gulen was once an ally of Mr Erdogan but the two fell out. Many Hizmet supporters have been arrested.

The court ruled on Friday that Zaman, which has a circulation of some 650,000, should now be run by administrators. No explanation was given. Turkish Prime Minister Ahmet Davutoglu said the move was “legal, not political”. “It is out of the question for neither me nor any of my colleagues to interfere in this process,” he said in a television interview. The government in Ankara has come under increasing international criticism over its treatment of journalists. The EU’s diplomatic service said that Turkey “needs to respect and promote high democratic standards and practices, including freedom of the media”, while the US described the move as “troubling”.

They should find other allies, this is nuts. Erdogan is (mass-)murdering Kurds and closing down the press. And we’re helping him do it?!

• “EU ’Must’ Hand Turkey €7 Billion Per Year To Keep Out Refugees” (Reuters)

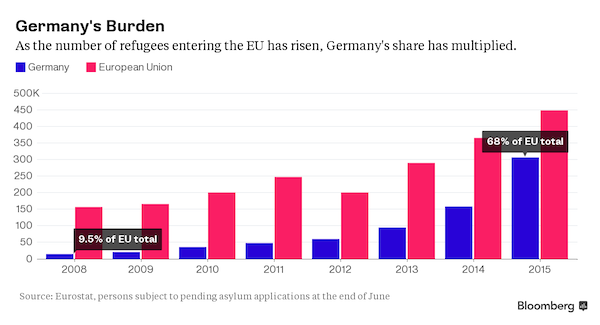

The EU may need to more than double financial aid already pledged to Turkey to help it keep millions of Syrian refugees on its soil, Germany’s EU Commissioner Guenther Oettinger was quoted as saying on Saturday. The European Commission on Friday announced the first payouts from a €3 billion ($3.3 billion) fund to help Turkey pay for the needs of some 2.5 million refugees. “Europe should hold out the prospect of further financial support to Turkey also beyond 2017,” Oettinger told German magazine Der Spiegel. “Taking over full costs of the services that Turkey is providing by accommodating and caring for the refugees, the bill could easily add up to six or seven billion euros per year,” said Oettinger, a senior member of Chancellor Angela Merkel’s center-right party Christian Democratic Union (CDU).

Austrian Chancellor Werner Faymann proposed a new EU fund to finance the additional costs. “In the migrant crisis, we need joint European solutions,” Faymann told the magazine. “Therefore I suggest a fund in which each EU member state pays in, similar to the bank bailout. The money should be used to cover the costs of providing for the asylum seekers.” European Council President Donald Tusk, who on Friday held talks with Turkish President Tayyip Erdogan, will chair an emergency EU summit with Turkey on Monday aimed at strengthening cooperation to stem the flow of migrants to Europe.

Emptier words were never spoken.

• Merkel Pressures Greece to Step Up Refugee Aid (BBG)

German Chancellor Angela Merkel boosted pressure on the Greek government to step up its capacity for sheltering refugees, pledging that the European Union will assist the country with the task. Greece fell short of its aim of setting up shelter for 50,000 asylum seekers fleeing Syria and the Middle East by the end of 2015, Merkel said in an interview with Bild am Sonntag. “The backlog needs to be made up posthaste,” Merkel told the German newspaper. “I know from my talks with Greek Prime Minister Alexis Tsipras that he wants that too, but that that he needs our help to do it.”

Thousands of refugees are stranded in Greece. Merkel in the Bild interview blamed the humanitarian crisis on other European states that tightened their borders against the influx, blocking passage north, where most asylum seekers have sought shelter in more accommodating countries such as Germany. The chancellor has said the blocked borders endanger Europe’s system of passport-free travel, known as Schengen. “Today we have a different situation, because Austria and the Balkan nations made unilateral decisions at their national borders that have unfortunately placed a burden on our partner and Schengen member Greece,” Merkel told Bild. The EU’s 28 leaders and the Turkish government will discuss the refugee crisis in Brussels on Monday.

Well put.

• Open Letter To Vienna From Austrian Expatriates In Greece (Observer)

This is the full text of a letter written by prominent émigrés to ministers in protest over the country’s role in border closures against refugees

Open letter to the Austrian government Austrians living and working in Greece, who feel deeply connected with this country, appeal to the Austrian government to take a more responsible position in dealing with the refugee crisis. Instead of putting on blinkers, pretending that by closing the borders the problem will go away, the situation has to be tackled head-on at a European level. The Austrian government needs to understand that individual, national approaches fail to produce results, also because solitary advances contradict the basic tenets of the European programme, which is meant to serve as the foundation for a new generation. Despite the temporary ceasefire, the war in Syria continues unabated, forcing the frightened civilian population, trapped between the fighting fronts, to keep seeking refuge by fleeing their country.

While the neighbours of Syria bear the brunt of the pressure, the callous reaction of the Austrian government, one of the richest countries in the world (ranked 11), puts us to shame. Austrian politicians have claimed that our country has accepted more refugees than most others. But a glance at the facts from Europe’s south proves this statement to be fatally wrong, misrepresenting the data. Pushing solutions to the refugee crisis that rely on increasing the pressure on Greece is counterproductive, unrealistic and irresponsible. The Austrian Minister of the Interior maintains that “that will put an end to perilous journeys across the Mediterranean.” No, Mrs Minister, it won’t!

Dozens of boats continue to arrive on Greece’s shores on a daily basis, often carrying over three thousand desperate people a day. The unspeakable horror of the war, hopelessness in the adjacent countries and the desire to reunite with family members are a strong motivation for those who have nothing to lose to risk the journey towards European destinations. What could stop them? Coast guards? Warships? Walls? Barbed wire fences? None of these measures will have any effect, unless the acts of war are put to an end. Otherwise, traumatised, terrorised people will continue to do anything to escape their misery.

The Europeans, who cannot see eye to eye among each other and do not even seem to share the most basic values, are busying themselves reinforcing their ominous fortress. As much as they try, it is not going to prevent war refugees from attempting to save their lives. Many more will come, hoping to make it somehow, at all cost, as hope dies last. Europe has no choice but to face the catastrophic situation in the war-torn countries of the near and Middle East responsibly and make every effort to help these people rebuild their lives. This will require foresight, wisdom and the will to convince the doubters (and the constituencies). Otherwise, we will be faced with a generation growing up in war-torn nations in who cannot but feel deepest frustration and animosity towards Europe and its “values”.

Nobody cares. All they care about is that refugees stop coming.

• EU Refugee Crisis Leaves 10,000 Children Missing, Europol Says (BBG)

More than 10,000 child refugees have disappeared after arriving in Europe, according to crime-fighting agency Europol, as the region faces its worst migrant crisis since World War II. “This is something European police services and governments should be worried about,” Europol Chief Rob Wainwright said in an interview Saturday with French newspaper Le Figaro. “Not all are exploited for criminal purposes – illegal labor or sexual slavery. Some have left shelters to reunite with their families, but we have no proof of that.” Of the 1.2 million refugees who arrived in the European Union last year, a quarter were minors, and 85,000 were unaccompanied by an adult, Wainwright said.

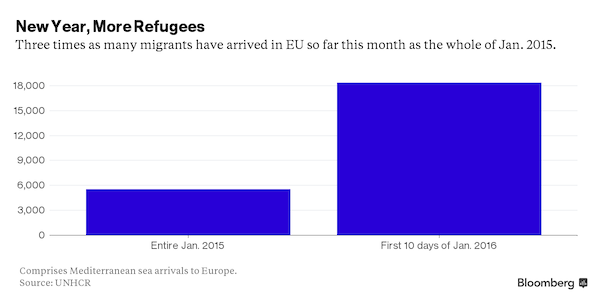

More than 135,000 asylum seekers have made their way to Europe this year, compared with about 376,000 in October and November, according to UNHCR, the United Nations refugee agency. European leaders are struggling to develop an alternative for the patchwork of unilateral border controls imposed by national governments to stem the flow of migrants fleeing war and poverty. The European Commission, the EU’s executive arm, proposed on Friday to lift internal border border checks and restore passport-free travel by the end of the year.