Harris & Ewing Children at water fountain, Washington, DC 1922

Before I get going, let me recommend two wonderful articles I put in today’s Daily Links list at The Automatic Earth. Which is updated every day around 8am Eastern Time, located at the top of every TAE page, and in more elaborate form, at bottom of the day’s essay; they are links to the things we ourselves read at a daily basis.

The first article is a piece by Umair Haque called The Rupture, in which he tries to put on words what is changing in our lives and our world, and how what we see happen today differs from what we once expected, or what most still expect but can no longer obtain. How our dream of eternal progress and growth has been shattered.

Please don’t miss either of the two pieces, you’ll find them more than worth your time.

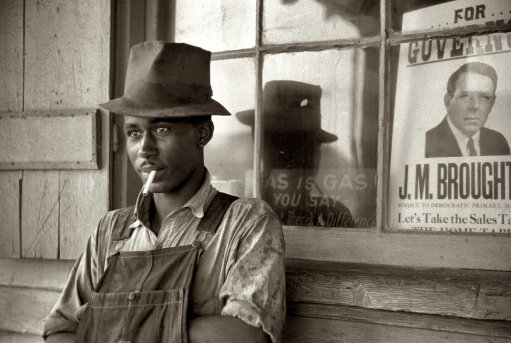

The future isn’t one of unalloyed, golden progress anymore. Tomorrow is a tale of decline, degeneration, decay. Rupture. The future isn’t flying cars and food pills and a smarthome and a stable career and comfortable prosperity for every family anymore. Rupture.

The future looks more like this. A story of a burning planet, of imploding middle classes, of lost generations, of empty decades, of mass unemployment, of the rule of law breaking, of democracy cracking, of nations splintering, of tribes warring, of broken dreams, of Greater Depressions, of unending Stagnations, of human possibility itself shattering into a million million pieces. Rupture. The future isn’t the steady, forward march of human advancement anymore.

The second, h/t Stockman, is from Peter St. Onge at Mises, in which he presents what I find a lovely take on the Scotland referendum issue. St. Onge, who, like yours truly, was living in Montréal during the last Québec referendum in 1995, draws parallels between the two votes, and suggests two nice lines of thought: 1) smaller countries tend to be richer, and 2) smaller countries tend not to get involved with truly awful ideas – like war-.

Is Scotland Big Enough To Go it Alone?

Even on physical area Scotland’s no slouch: about the size of Holland or Ireland, and three times the size of Jamaica. The fact that Ireland, Norway, and Jamaica are all considered sustainably-sized countries argues for the separatists here. So small is possible. But is it a good idea? The answer, perhaps surprisingly, is resoundingly “Yes!” Statistically speaking, at least.

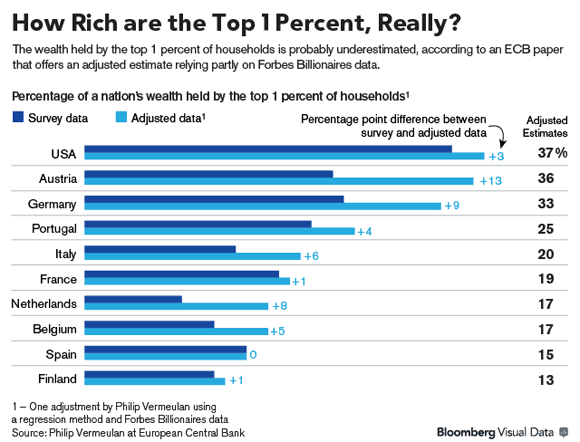

Why? Because according to numbers from the World Bank Development Indicators, among the 45 sovereign countries in Europe, small countries are nearly twice as wealthy as large countries. The gap between biggest 10 and smallest 10 ranges between 84% (for all of Europe) to 79% (for only Western Europe).

[..] Even among linguistic siblings the differences are stark: Germany is poorer than the small German-speaking states (Switzerland, Austria, Luxembourg, and Liechtenstein), France is poorer than the small French-speaking states (Belgium, Andorra, Luxembourg, and Switzerland again and, of course, Monaco). Even Ireland, for centuries ravaged by the warmongering English, is today richer than their former masters in the United Kingdom, a country 15 times larger.

Why would this be? There are two reasons. First, smaller countries are often more responsive to their people. The smaller the country the stronger the policy feedback loop. Meaning truly awful ideas tend to get corrected earlier. Had Mao Tse Tung been working with an apartment complex instead of a country of nearly a billion people, his wacky ideas wouldn’t have killed millions. Second, small countries just don’t have the money to engage in truly crazy ideas.

When it comes to the going going gone European economy – or economies -, all we can really say is that Europe only goes through the motions by now, because that’s all that it’s got left. Essentially, the old continent now scrambles to find ways to borrow money without adding debt.

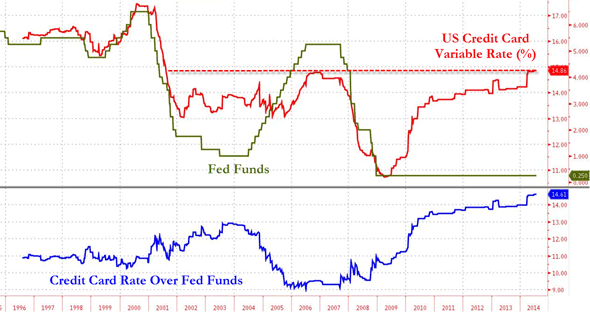

And that idea, absurd as it is, apparently seems attractive to the ‘leadership’, edged on by ultra low interest rates. If Draghi can solemnly declare that the ECB funds rate is now 0.05%, they all start concocting plans to borrow. Because without borrowing, without added debt, they know they’re, for lack of a better term, screwed. Whereas at 0.05%, would could go wrong?

And that’s how you get to these, for lack of a better term, kinds of weird things:

Show Us The Money: EU Seeks Billions Of Euros To Revive Economy

The European Union sought ways on Saturday to marshal billions of euros into its sluggish economy without getting deeper into debt [..] EU finance ministers tasked the European Commission, the EU executive, and the European Investment Bank (EIB) to draw up a list of projects that would create growth and decide how to finance them.

“We have given a mandate to the Commission and the EIB to swiftly present an initial report on practical measures that can be taken, on profitable investment projects that are justifiable,” Italy’s economy minister, Pier Carlo Padoan, said.

To finance them, the ministers discussed four ideas: an Italian paper on new financing tools for companies, a Franco-German proposal on how to boost private investments, a Polish proposal on creating a joint EU fund worth €700 billion ($907 billion) and a call from incoming European Commission President Jean-Claude Juncker for a €300 billion investment program to revive the European economy.

The European Central Bank’s plan to resurrect a market for asset-backed securities would be another financing tool. “We don’t have a magic wand but we need growth,we need to stimulate demand without taking on debt,” France’s finance minister, Michel Sapin, told reporters. “We need the right mix of public and private money.”

That is a real desperate statement, “We don’t have a magic wand but we need growth”, only it’s not presented as such. It’s presented as just another difficulty that those smart boys who floated to the top will solve for you, you being the much less smart ‘peuple’. The problem, though, is not just that they can’t generate growth, and it’s not just that they don’t have a magic wand, the problem is they’re so desperate they’re more then willing to lie outright to their voters until the cows come home, and then sacrifice them on the altar of their own blind ambitions. It’s all just words, and then you die.

Investment is the new buzz word among ministers, overriding the German mantra of budget cuts. [..] German Finance Minister Wolfgang Schaeuble strongly supports the search for investment, but this week rebuffed calls for Berlin to spend more to boost the euro zone economy…

In a speech to the EU finance ministers in Milan on Thursday, ECB President Mario Draghi described business investment as “one of the great casualties” of the financial crisis, saying it has fallen 20% since 2008. “We will not see a sustainable recovery unless this changes,” he said.

Poland wants a ‘European Fund for Investments’ that would be able to finance, through leveraging its own capital, €700 billion worth of investment. The fund could be a special-purpose vehicle under the umbrella of the European Investment Bank, the EU bank owned by European governments.

Italy’s proposal is a pan-European market, where smaller companies can raise capital, building on its “minibond” legislation in 2012 that allows unlisted companies to issue. That could be part of a EU capital-market union, building on the eurozone’s banking union, but that will need to closely involve London, the leading financial center in Europe.

Did you catch that? “Leveraging its own capital”. That means going to the casino, having $1 in your pocket and putting $1000 on red. That’s what that means. We need growth, and we don’t have a magic wand, but we know a casino. It’s 2014, and when I hear European officials mention terms like “special-purpose vehicle”, I get chills down my spine.

These guys have no idea what they’re doing, but they do it anyway. Because they can. And because there’s nothing else in sight that would let them keep their jobs. They’s rather take your money and put it down at the crap table, than lose their own jobs and cushy plush positions. That is all this is really about.

Europe sees plummeting investments, refuses to wonder why that is happening, and goes to the slot machines to achieve growth, whatever it may mean and however long it may last. Even 5 minutes is deemed acceptable.

And lo and behold, from the deep burrows of highly indebted nothingness, they pretend they’ve found $1.3 trillion. Which they don’t have. But hey, we need growth, right?

ECB Cash Boost May Near $1.3 Trillion, Ex-Official Says

Banks are likely to take close to €1 trillion ($1.3 trillion) in cash auctions at the European Central Bank that begin this year, former Executive Board member Jose Manuel Gonzalez-Paramo said. “I would not be surprised if we see between €700 billion and €900 billion,” in the so-called TLTRO (Targeted Long Term Refinance Operation ) operations that start on Sept. 18, said Gonzalez-Paramo [..]

“The banks are quite happy to request this money, and they are willing to lend. The take-up in Spain could be big.” [..] After a rate cut this month, the TLTRO offer, which is tied to banks’ lending performance, became even more attractive as the funds are lent for four years at the rate prevailing on auction day plus 10 basis points.

The first of two initial operations is alloted on Sept. 18, the second on Dec. 11, and thereafter banks can bid in quarterly operations until June 2016. “You see demand for credit increasing in the case of Spain,” Gonzalez-Paramo said in a Sept. 11 interview in Milan. The ECB’s latest rate cut is “positive, in terms of making the TLTROs more of a success, because now the takeup I think is assured to be on the high side.”

If by now you’re thinking this is absolute gibberish, don’t think there’s anything wrong with you. It is gibberish. Europe’s in a deep debt hole, and all this stuff will achieve is to dig it in deeper. It’s just that to acknowledge that would cost all these primate clowns their coveted seats high up there in the most coveted trees.

The TLTROs are the first shot in a volley of stimulus driven by ECB President Mario Draghi this year. In addition to the liquidity support, the ECB will also start buying asset-backed securities and covered bonds. Draghi said yesterday that the aim is to return the central bank’s balance sheet to the early-2012 level of about €3 trillion.

Right. The central bank balance sheet. It’s how Japan, China and the US keep their economies ‘presentable’ despite the mountains of debt they’re buried in, so why not Europe? Well, maybe because Germany, they only country left that’s not gone full retard Keynes, doesn’t want it.

But Germany may soon be moved out of position by a ‘clever’ redifining of terms, by Mario Draghi, jockeying for position to become Italy’s next best duce, in what can only be described as pure semantics.

Draghi Says ABS Plan Will Proceed Without Government Guarantees

Mario Draghi said his plan to purchase higher quality asset-backed securities will proceed even if support from EU leaders to extend it to riskier debt isn’t forthcoming. “The program is primarily oriented to the purchase of senior tranches; only if it’s going to be extended to mezzanine tranches is there going to be a need for guarantees,” he said at a press conference …

Translation: the ECB doesn’t need permission for what is still considered good assets. But they are actively thinking about moving into toilet paper. Why? Because that’s all there’s left. But they need governments (yes, that would be taxpayers) to guarantee losses on soiled toilet paper.

“It’s going to be much more effective at facilitating credit expansion with also the mezzanine component, and for that we’ll need a guarantee.” To boost slowing euro-area inflation and spur credit, the ECB said this month it will buy ABS and covered bonds in the latest of a series of stimulus measures that included rate cuts and cheap loans to banks. Draghi pledged to buy senior tranches of “simple” and “transparent” ABS, adding that lower-ranking mezzanine tranches could also be part of the purchase plan provided public guarantees were in place.

Translation: without toilet paper, no growth.

Draghi has said details of the ABS plan will be announced after the next monetary policy meeting on Oct. 2. While euro-area governments have expressed support for reviving securitization in the region, they’ve stopped short of pledging new fiscal backing for the ECB’s plan. “If I understand the program correctly, it’s non-discriminatory, it’s open to all countries and all financial institutions, so it could also open to Dutch banks,” Dutch finance minister Jeroen Dijsselbloem said at the same press conference. “Do I support additional guarantees from the government on these products? The answer would be no.”

Translation: Holland doesn’t want to buy used toilet paper.

If the central bank were to buy mezzanine tranches, it could mean banks have to hold lower provisions against the asset, increasing the amount of cash at their disposal. European regulators have required banks to treat ABS as relatively high-risk since the asset class was blamed for helping fuel the financial crisis. “In the meantime and independently, there will be some regulatory evolution in the way ABS are treated,” Draghi said. “The ABS program will be launched regardless of whether there are guarantees or not.”

But if Draghi buys the stuff, the banks who are loaded beyond their necks with the ‘asset’, can use it as collateral to borrow even more. And then house prices across Europe drop. And then all those rich people in Greece, Spain, Portugal etc. will have to make up the difference.

Sounds like a plan to me. All it takes is semantics: what you need is someone to change the definition of what a central bank, or pension fund, can buy, and you‘re off to the races. In the end, everything is just semantics. As long as Draghi is willing to buy worthless paper from banks, why would anyone think there’s a crisis at all?

For a while, it is indeed possible to transfer private debt to the public sector (and that’s what this is, obviously). You just call a spade a dinner table, and a cow a bathroom mirror. Semantics. But only the very thick amongst us will think that doesn’t make problems much worse down the road.

Draghi simply changes the definitions of what he can buy or not, and Angela Merkel lets it go until some clever kraut picks up on it and protests. Great basis for a strong and decisive economic policy. If and when Mario claims that someting, anything, is a ‘security’, it magically is. It’s the emperor’s new clothes all over again. And why does it work? Because the US, China and Japan do it too. All it really takes is access to your taxpayers’ wallets.

• Big Guns Fail To Halt Scottish Independence Bandwagon (Guardian)

The 307-year-old union between Scotland and England hangs by a thread as a fresh Guardian/ICM poll put the yes vote in next week’s referendum just two percentage points behind those supporting no. Despite an intense week of campaigning by pro-union politicians and repeated warnings from business, the poll out on Friday found support for the no campaign on 51% and with yes on 49%, once don’t knows were excluded. The Guardian/ICM poll is based on telephone interviews conducted between Tuesday and Thursday, the first such survey ICM has conducted during the campaign. Previous polls suggesting that the race for Scotland was too close to call have been based on internet-based surveys. The headline figures exclude the 17% of voters in Scotland who ICM found were still undecided a mere week before polling day, a substantial proportion that gives the pro-UK campaign hope that it could arrest September’s surge in support for independence.

Alex Salmond, the SNP leader and first minister, said he was now “more confident than ever” that Scotland would vote yes on 18 September. “Despite Westminster’s efforts we’ve seen a flourishing of national self-confidence,” he said. “It’s this revival in Scottish confidence that tells me we’ll make a great success of an independent Scotland.” At a rally with former prime minister Gordon Brown in Glasgow on Friday night, Labour leader Ed Miliband reached out to the 29% of Labour voters who told ICM they planned to vote yes next week. He said only a no vote could guarantee that Scotland had the money to protect the NHS. “With a vote for no, change is coming with more powers on tax and welfare for a stronger Scotland,” he said. “Change is coming faster with a devolution delivery plan beginning the day after the referendum. And better change, faster change, safer change is the message we will take on to the streets and the doorsteps in the last few days of the campaign.”

Free Nelson Mandela too!

• Europe Fears Scottish Independence Contagion (AFP)

The prospect of Scottish independence is raising fears in Europe that it could inflame other separatist movements at a time when the continent’s unity and even its borders are under threat, analysts say. While nationalists from Catalonia to Flanders will watch Scotland’s referendum with hope, Brussels is nervous about the possibility of a major European Union member like Britain falling apart. The fear of contagion spreads as far as the EU’s eastern frontier, where the Baltic countries worry that Moscow will back their ethnic Russian citizens who could then claim more autonomy. But while the EU might initially make life difficult for a new Scottish nation, it would most likely allow it to join the bloc eventually, experts said. “It is a very difficult situation for the EU if Scotland becomes independent, it really is,” Pablo Calderon Martinez, Spanish and European Studies fellow at King’s College London, told AFP.

The EU already has a lot on its plate as it tackles a stalled economy and high unemployment, and has insisted in recent days that the Scottish vote is an “internal matter.” But European Commission chief Jose Manuel Barroso made the position clear in 2012: any newly independent country emerging from an EU nation would no longer be part of the bloc, and would have to reapply for membership. Barroso outraged nationalists in February when he said it would be “extremely difficult” for Scotland to gain automatic membership, comparing it to Kosovo, which broke away from Serbia. European Council president Herman Van Rompuy meanwhile weighed in on Catalonia in December, saying he was “confident” Spain would remain “united and reliable.”

Never. Got that? Yes or no, there’s no way back.

• After Thursday, Britain Will Never Be The Same Again (Observer)

On Thursday, Scotland will take a decision of seismic consequence for the 307-year-old union. Tempered and tested by the Industrial Revolution, the empire, the carnage of war, the birth of the welfare state, it is a union that has been strengthened by the mutual inventiveness and talents of complementary identities. It has been pluralistic, democratic, multicultural, tolerant (mostly), enlightened (for the most part), liberal. As political unions go, it has been a remarkably successful one. But whatever the decision on Thursday, the result should act as a catalyst for change, a harbinger of constitutional shifts for the whole of Great Britain. The Scottish people set out on this journey alone – but they have unwittingly taken on board passengers from the rest of the union. When Gordon Brown – backed by the three Westminster party leaders – last week promised Scotland “nothing less than a modern form of home rule” if the vote is no, it signalled that the constitutional make-up of these islands is about to change irrevocably.

Ed Miliband goes further: writing for this paper today, he suggests that were he to become prime minister the union would undergo fundamental change. “Scotland’s example will lead the way in changing the way we are governed in England too, with the devolution we need to local government from Cornwall to Cumbria.” Few, if any, people were talking about devolved powers to Cumbria or Cornwall two weeks ago. It is a sign that, regardless of the outcome on Thursday, the first minister, Alex Salmond, has already won a significant victory. The decision by the three main Westminster parties – spooked by a poll showing the yes campaign in the lead – to make significant promises of more devolved power revealed how remote they are from the political and cultural winds swirling in Scotland. Cameron, Miliband and Clegg had 18 months but they waited until the last 10 days to spell out just how profound devolution could be. It wasn’t a terrific advertisement for how well the union is working.

Love it.

• Is Scotland Big Enough To Go it Alone? (Mises.org)

As Scotland goes to the polls to decide on its separation from the United Kingdom, the tone of the campaign is, again, high on passion and, again, secessionists are inching toward the magical 50% line. But don’t uncork the single malt quite yet: as of today (September 2, 2014), bookies in London still put the odds at 4-to-1 against the non-binding referendum. But it remains a real possibility. One core debate is whether Scotland is too small and too insignificant to go it alone. During the Quebec referendum there was a nearly-identical debate, with secessionists arguing that Quebec has more people than Switzerland and more land than France, while federalists preferred to compare Quebec to the US or the “rest-of-Canada” (ROC, in a term from the day).

In a curious coincidence, 2014 Scotland and 1994 Quebec have nearly the same population: about 5–6 million. About the same as Denmark or Norway, and half-a-million more than Ireland. Even on physical area Scotland’s no slouch: about the size of Holland or Ireland, and three times the size of Jamaica. The fact that Ireland, Norway, and Jamaica are all considered sustainably-sized countries argues for the separatists here. So small is possible. But is it a good idea? The answer, perhaps surprisingly, is resoundingly “Yes!” Statistically speaking, at least. Why? Because according to numbers from the World Bank Development Indicators, among the 45 sovereign countries in Europe, small countries are nearly twice as wealthy as large countries. The gap between biggest-10 and smallest-10 ranges between 84% (for all of Europe) to 79% (for only Western Europe).

This is a huge difference: To put it in perspective, even a 79% change in wealth is about the gap between Russia and Denmark. That’s massive considering the historical and cultural similarities especially within Western Europe. Even among linguistic siblings the differences are stark: Germany is poorer than the small German-speaking states (Switzerland, Austria, Luxembourg, and Liechtenstein), France is poorer than the small French-speaking states (Belgium, Andorra, Luxembourg, and Switzerland again and, of course, Monaco). Even Ireland, for centuries ravaged by the warmongering English, is today richer than their former masters in the United Kingdom, a country 15 times larger. Why would this be? There are two reasons. First, smaller countries are often more responsive to their people. The smaller the country the stronger the policy feedback loop. Meaning truly awful ideas tend to get corrected earlier.

Had Mao Tse Tung been working with an apartment complex instead of a country of nearly a billion-people, his wacky ideas wouldn’t have killed millions. Second, small countries just don’t have the money to engage in truly crazy ideas. Like Wars on Terror or world-wide daisy-chains of military bases. An independent Scotland, or Vermont, is unlikely to invade Iraq. It takes a big country to do truly insane things. Of course there are many short-term issues for the Scots to consider, from tax and subsidy splits, to defense contractors relocating to England. And, of course, the deep historico-cultural issues that an America of Franco-British descent should best sit out. Still, as an economist, what we can say is that Scotland’s big enough to “survive” on its own, and indeed is very likely to become richer out of the secession. Nearer to the small-is-rich Ireland than the big-but-poor Britain left behind.

• Fate of United Kingdom Hangs In Balance After New Scotland Polls (Reuters)

The fate of the United Kingdom remained unclear five days before a historic referendum on Scottish independence as three new polls on Saturday showed a slight lead for supporters of the union, but one saying the separatist campaign was pulling ahead. On the final weekend of campaigning, tens of thousands of supporters of both sides took to the streets of the capital Edinburgh and Scotland’s largest city, Glasgow. Rival leaders worked across the country to convince undecided voters. At stake is not just the future of Scotland, but that of the United Kingdom, forged by the union with England 307 years ago. The battle also took a bitter turn on Saturday when a senior nationalist warned businesses such as oil major BP that they could face punishment for voicing concern over the impact of a secession.

The economic future of Scotland has become one the most fiercely debated issues in the final weeks of impassioned debate. Nationalists accuse British Prime Minister David Cameron of coordinating a scare campaign by business leaders aimed at spooking voters, while unionists say separation is fraught with financial and economic uncertainty. But former Scottish Nationalist Party deputy leader Jim Sillars went much further than separatist leader Alex Salmond, warning that BP’s operations in Scotland might face nationalisation if Scots voted for secession on Thursday. “This referendum is about power, and when we get a ‘Yes’ majority we will use that power for a day of reckoning with BP and the banks,” Sillars, a nationalist rival of Salmond’s, was quoted by Scottish media as saying.

Word.

• ‘Cool’ London Is Dead, And The Rich Kids Are To Blame (Telegraph)

I have seen the future – and the future is Paris and Geneva. The future is a clean, dull city populated by clean, dull rich people and clean, dull old people. The future is joyless Michelin starred restaurants and shops selling £3,000 chandeliers. In the 1990s, we accidentally stumbled upon the formula for a perfect city. Exactly halfway between East and West, serious history, attractive (but not chocolate-boxy), English-speaking, and a capital for the creative industries and financial services. Better still, years of decline and depopulation had left vast central swathes of the city very affordable. So, the cool kids piled in. And, suddenly, a rather grey, down-at-heel capital, a place that had never quite quite recovered from losing an Empire (and winning a war) began to swing again. Back then we all lived in central London, because we all could. It was normal to leave university and get a flat with your mates in Marylebone or Maida Vale or Primrose Hill or Notting Hill. Not because we were rich, but because London was cheap.

And it felt fantastic. Here was a city whose fortunes were reviving and, as 20-somethings, ready to make our mark on the world, we really were bang in the middle of things. Two decades on and you can play a nostalgic little game where you remind yourself what groups London’s inner neighbourhoods were known for 20 years ago. Hampstead: intellectuals; Islington: media trendies; Camden: bohemians, goths and punks; Fulham: thick poshos who couldn’t afford Chelsea; Notting Hill: cool kids; Chelsea: rich people. Now, every single one of these is just rich people. If you want to own a house (or often just a flat) in these places, you need a six figure salary or you can forget it. And, for anyone normal, that means working in finance. As for the bits of London that always were rich – Mayfair, Chelsea and Kensington, they’ve moved up to the next level. Ultra-prime central London is fast becoming a ghost-town where absentee investors park their wealth. As some wag put it, houses in Mayfair are now bitcoins for oligarchs.

So, what does this have to do with Paris and Geneva? The answer is that both are places where the rich have socially cleansed the centres. Inner Paris is a fairytale for wealthy people in their fifties (and outer Paris looks like Stalingrad with ethnic strife) while Geneva has dispensed with the poor altogether. As a result, both cities are safe, pretty and rather boring places to live – and soon London will be too. Why? Because the financiers who can afford inner London neighbourhoods are not cool. Visit Canary Wharf at on any weekday lunchtime and watch the braying, pink-shirted bankers disporting themselves. Not cool. Peruse the shops at Canary Wharf. From Gap to Tiffany’s, they’re all chains stores and you could be anywhere wealthy, safe and dull in the world. Rich people like making money and spending it on dull, expensive things. That’s what they do – and they’re very good it. But being a high-end cog in the machine is not cool.

Never’s a bit much, perhaps.

• America’s Poor Have Never Been Deeper In Debt (Zero Hedge)

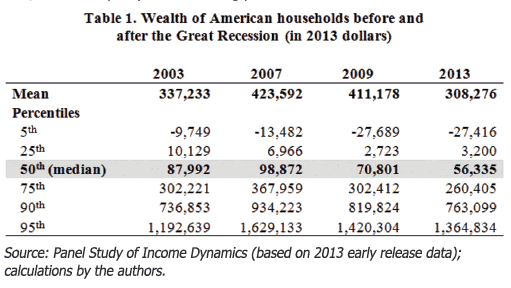

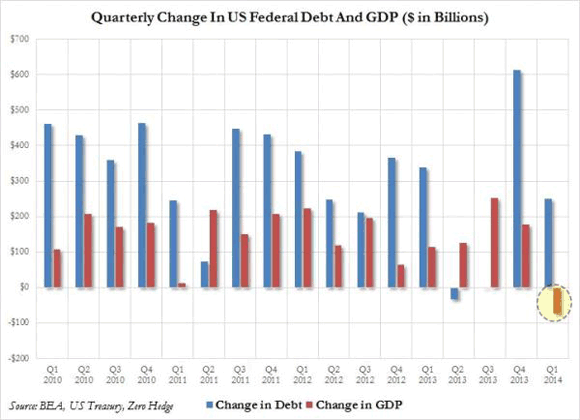

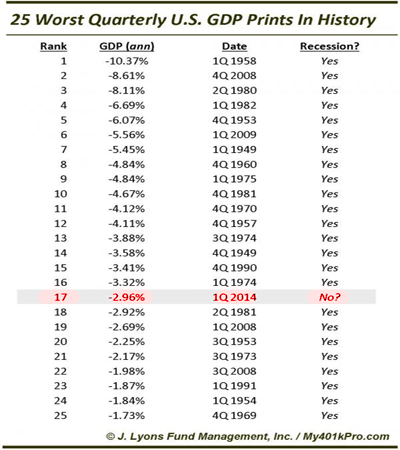

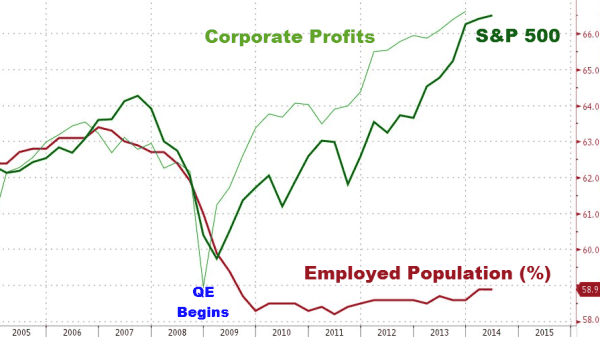

Ever since the Lehman bankruptcy, one of the main reasons given by the perpetual apologists about why i) the so-called “recovery” has been the worst in US history and ii) the Fed has been “forced” to conduct 6 years of wealth transferring policies, boosting the stock market to all time highs and creating a record wealth split in US society between the super rich and everyone else (one that surpasses even that seen during the roaring 20s) is that the US consumer, scarred by the economic crash, has been rushing to deleverage and dump as much debt as possible. There are two problems with that story:

First, as we first pointed out in 2012, US households are not deleveraging, they are defaulting, a huge difference which goes to motive and intent, and shows that instead of actively paying down debt households are instead loading up on as much debt as they can, which at some point they simply stop servicing (for a detailed analysis of this disturbing trend, read our series on the student loan bubble).

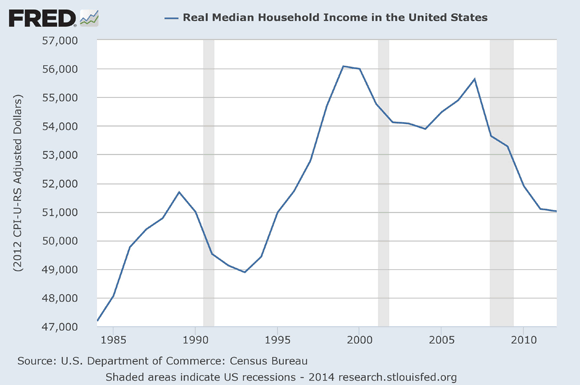

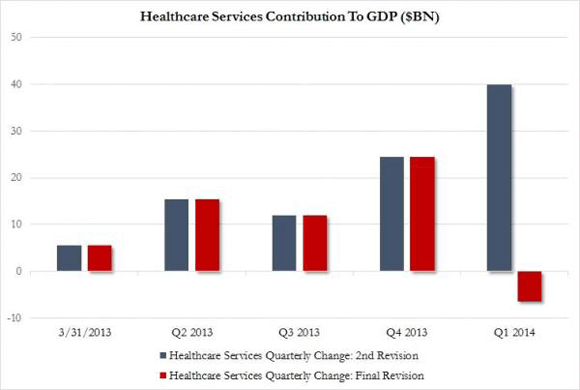

Second, when it comes to the poorest quartile of US society, some 14 million people, it is dead wrong. In fact, as the Fed’s triennial Survey of Consumer Finances, released last week showed, America’s poorest have never been more in debt! As usual, the full story is one of nuances. As Bloomberg reports, as a result of the first point – mass defaults – US household debt has indeed declined on an average basis. Indeed, average debt burden for all families stood at about 105% of pretax income in 2013, down from about 125% in 2010 and the lowest level since the 2001 survey. Of course, since economists are unable to grasp the difference between default and deleveraging, one look at the chart above gives them reason for hope. As Bloomberg summarizes:

The improved finances, along with more recent signs that consumers are feeling comfortable about borrowing again, has given some economists cause for optimism: The more progress households make in getting out from under their debts, the logic goes, the greater the chances that renewed spending will boost growth.

In reality, the “improved finances”, namely those tens of trillions in financial assets that have been artificially reflated courtesy of the Fed’s monetary policies, have benefited the tiniest sliver of US society – about 1% or less depending on whose calculations one uses. Everyone else, the bulk of US society, was forced to simply stop paying down their credit card and thus “delever.”

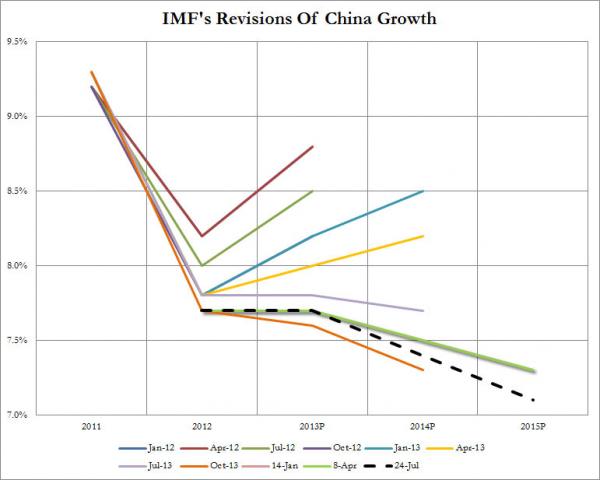

• Chinese Growth Slows Most Since Lehman; Electric Output Shrinks (Zero Hedge)

While China may have mastered the art of goalseeking GDP, always coming within 0.1% of the consensus estimate, usually to the upside, even if the bogey has seen dramatic declines in the past few years, dropping from double digit annualized growth to just 7.5% currently and the projections hockey stick long gone… it may need to expand its goalseek template to include the other far more important measure of Chinese economic activity, such as Industrial production, retail sales, fixed investment, and even more importantly – such key output indicators as Cement, Steel and Electricity, because based on numbers released overnight, the Q2 Chinese recovery is now history (as the credit impulse of the most recent PBOC generosity has faded, something we have discussed in the past), and the economy has ground to the biggest crawl it has experienced since the Lehman crash.

What’s worse, and what we predicted would happen when we observed the collapse in Chinese commodity prices ten days ago, capex, i.e. fixed investment, grew at the slowest pace in the 21st century: the number of 16.5% was the lowest since 2001, and suggests that the commodity deflation problem is only going to get worse from here. As JPM summarized earlier today, pretty much every economic data release was a disaster, missing consensus significantly, and suggesting GDP is now trending at an unprecedented sub-7%.

Read her!

• This Changes Everything: Capitalism vs. the Climate (Naomi Klein)

I denied climate change for longer than I care to admit. I knew it was happening, sure. But I stayed pretty hazy on the details and only skimmed most news stories. I told myself the science was too complicated and the environmentalists were dealing with it. And I continued to behave as if there was nothing wrong with the shiny card in my wallet attesting to my “elite” frequent-flyer status. A great many of us engage in this kind of denial. We look for a split second and then we look away. Or maybe we do really look, but then we forget. We engage in this odd form of on-again-off-again ecological amnesia for perfectly rational reasons. We deny because we fear that letting in the full reality of this crisis will change everything. And we are right. If we continue on our current path of allowing emissions to rise year after year, major cities will drown, ancient cultures will be swallowed by the seas; our children will spend much of their lives fleeing and recovering from vicious storms and extreme droughts. Yet we continue all the same.

What is wrong with us? I think the answer is far more simple than many have led us to believe: we have not done the things needed to cut emissions because those things fundamentally conflict with deregulated capitalism, the reigning ideology for the entire period we have struggled to find a way out of this crisis. We are stuck, because the actions that would give us the best chance of averting catastrophe – and benefit the vast majority – are threatening to an elite minority with a stranglehold over our economy, political process and media. That problem might not have been insurmountable had it presented itself at another point in our history.

But it is our collective misfortune that governments and scientists began talking seriously about radical cuts to greenhouse gas emissions in 1988 – the exact year that marked the dawning of “globalisation”. The numbers are striking: in the 1990s, as the market integration project ramped up, global emissions were going up an average of 1% a year; by the 2000s, with “emerging markets” such as China fully integrated into the world economy, emissions growth had sped up disastrously, reaching 3.4% a year. That rapid growth rate has continued, interrupted only briefly, in 2009, by the world financial crisis. What the climate needs now is a contraction in humanity’s use of resources; what our economic model demands is unfettered expansion. Only one of these sets of rules can be changed, and it’s not the laws of nature.

• Naomi Klein: Richard Branson Cheats On Climate Change Pledge (Guardian)

Richard Branson has failed to deliver on his much-vaunted pledge to spend $3bn (£1.8bn) over a decade to develop a low carbon fuel. Seven years into the pledge, Branson has paid out only a small fraction of the promised money – “well under $300m” – according to a new book by the writer and activist, Naomi Klein. The British entrepreneur famously promised to divert a share of the profits from his Virgin airlines empire to find a cleaner fuel, after a 2006 private meeting with Al Gore. Branson went on to found a $25m Earth prize for a technology that could safely suck 1bn tons of carbon a year from the atmosphere. In 2009, he set up the Carbon War Room, an NGO which works on business solutions for climate change. But by Klein’s estimate, Branson’s “firm commitment” of $3bn failed to materialise.

“So the sceptics might be right: Branson’s various climate adventures may indeed prove to have all been a spectacle, a Virgin production, with everyone’s favourite bearded billionaire playing the part of planetary saviour to build his brand, land on late night TV, fend off regulators, and feel good about doing bad,” Klein writes in This Changes Everything, Capitalism vs The Climate. Klein uses Branson and other so-called green billionaires – such as the former New York mayor, Michael Bloomberg – as case studies for her argument that it is unrealistic to rely on business to find solutions to climate change. Branson routed a first pay-out of his $3bn commitment, about $130m, through a new Virgin investment company into corn ethanol. The fuel has now been widely discredited as a greener alternative to fossil fuels, because of its climate change impacts and for driving up the cost of food.

Virgin went on to look at other biofuels, at one point exploring a project to develop jet fuel from eucalyptus trees. “But the rest of its investments are a grab bag of vaguely green-hued projects, from water desalination to energy efficient lighting, to an in-car monitoring system to help drivers conserve gas,” Klein writes. By last year, the total of those investments, in corn ethanol and elsewhere, amounted to about $230m, she estimates. Branson made an additional small investment in an algae fuel company, Solazyme. But Branson still puts the total spend at well under $300m – just a tenth of his $3bn pledge.

Where’s my Trojan Horse?

• Luhansk To Start Distributing Russian Aid Monday, Trucks Return Home (RT)

The last truck from Russia’s second humanitarian aid convoy to the Eastern Ukrainian city of Lugansk has returned home after delivering its cargo. All vehicles had reached the Ukrainian-Russian border without incidents and the last of them crossed the border in the direction of Russia at around 6:30 pm local time. Early on Saturday, a convoy of 245 trucks colored in white paint crossed the border and headed to Lugansk to bring much needed relief supplies to the residents of the war-torn city. The 2,000 tons of Russian humanitarian aid include food, power generators, water purification systems, medicine and blankets. The convoy was welcomed by the population of Lugansk as people lined up on the sides of the roads and waved Russian flags. After unloading in Lugansk, the trucks made their way back to Russia’s Rostov region, which is bordering Ukraine.

The second Russian convoy has arrived just in time as the city almost ran out of first batch of humanitarian aid delivered on August 22, Valery Potapov, deputy prime minister of the self-proclaimed People’s Republic of Donetsk, said. “The supplies from the first convoy have almost ended. We still have a small amount of canned meat, but we had to use our own stock to provide people with sugar and cereal,” Potapov told RIA-Novosti news agency. The handout of the aid to the people will begin in Lugansk on Monday, he said. Potapov added that its “more or less calm [in Lugansk] because of the so-called the cease-fire” and “people began returning (to their homes) en masse”, which makes it difficult to predict how long the aid will last.

Meanwhile, Ukraine claimed that the second Russian humanitarian aid convoy entered the country illegally. Ukrainian border officials were not allowed to inspect the cargo, Col. Andrey Lysenko, spokesman for Ukraine’s National Security Council, said. But Russia’s Federal Security Service has denied the claims, saying that it offered full cooperation to the Ukrainian side. “We repeatedly suggested that Ukrainian border guards and customs officers take part in inspections of a humanitarian convoy that was passing through border and customs control at the Donetsk border-crossing point, but the Ukrainian side rejected the offer,” Nikolay Sinitsyn, a spokesman for the FSB’s border department in the southern Russian Rostov region, said.

Modern democracy.

• Ukraine’s Party of Regions Refuses to Participate in Rada Elections (RIA)

The Ukrainian Party of Regions is not planning to take part in the elections to the country’s parliament, Verkhovna Rada, scheduled for October 26, the Ukrainian Party of Regions deputy Mykhailo Chechetov told RIA Novosti. “The Party of Regions made a decision not to participate in the elections. That is why if the elections will still take place and Donbas will not vote, than, in the given circumstances we will be saying that the level of legitimacy [of the elections] does not meet the people’s expectations,” Chechetov said.

On August 27, Ukrainian President Petro Poroshenko signed a decree, dissolving the country’s parliament and setting new elections for October 26. Following his election on May 25 Poroshenko has repeatedly highlighted the need to hold early parliamentary elections, saying the current composition fails to represent the interests of Ukrainian society. A

• Enron Buster Is Back at Justice and Taking Aim at Real People (Bloomberg)

Lawmakers, in what has become something of a Washington ritual, criticized the Justice Department this week for not holding individual bankers to account for the financial crisis. So, the Justice Department has given the job to Godzilla. Leslie Caldwell, the prosecutor who led the government’s prosecution of Enron Corp., took over the Justice Department’s Criminal Division in June after a decade in private practice. Among her priorities, she says, is focusing on the individual actors behind corporate wrongdoing. “Certainly, there are cases where you also want to prosecute the company,” Caldwell said in an interview last week. “But I think you get the best outcome – really across the board in terms of deterrence, in terms of the message to the public – when you prosecute individuals.” Caldwell’s predecessor was accused by lawmakers and the public of not doing enough to convict Wall Street bankers who securitized and sold low-quality mortgages, helping precipitate the financial crisis of 2008.

The government has won multibillion-dollar settlements from some of the world’s largest banks, only to see their shares rise and their executives win higher bonuses. Caldwell herself has been accused of getting the balance wrong between corporate and individual accountability. To hear critics tell it, it was an overzealous prosecution overseen by Caldwell that brought down accounting firm Arthur Andersen. Under Caldwell, the Justice Department’s Enron task force generated dozens of prosecutions. Early in that probe, federal prosecutors won an indictment of Arthur Andersen for shredding massive amounts of Enron-related paperwork — a move that led to the firm’s collapse and the loss of tens of thousands of jobs. When Caldwell returned to Justice in June, an editorial in Investor’s Business Daily declared: “The Justice Department Unleashes a Godzilla on business.”

Uglier still.

• NSA, GCHQ Have Secret Access To German Telecom Networks: Spiegel (RT)

US and UK intelligence services have secret access points for German telecom companies’ internal networks, Der Spiegel reports, citing slides created in the NSA’s ‘Treasure Map’ program used to get near-real-time visualization of the global internet. The latest scandal continues to evolve around the US’ NSA and the British GCHQ, both of which appear to be able to eavesdrop on German giants such as Deutsche Telekom, Netcologne, Stellar, Cetel and IABG network operators, according to Der Spiegel’s report based on material disclosed by Edward Snowden. The Treasure Map program, dubbed “the Google Earth of the Internet,” allows the agencies to expose the data about the network structure and map individual routers as well as subscribers’ computers, smartphones and tablets. The German telecoms had “access points” for technical supervision inside their networks, marked as red dots on such a map, shown on one of the leaked undated slides, Spiegel reports, warning it could be used for planning sophisticated cyber-attacks.

The Treasure map, first mentioned by the New York Times last year, provides “a near real-time, interactive map of the global Internet,” offering a “300,000 foot view of the Internet,” as it gathers Wi-Fi network and geolocation data as well as up to 50 million unique Internet provider addresses. The Federal Office for Information Security (BSI) spokesman told the DPA news agency that the Federal Office for the Protection of the Telekom has been informed, and that the authorities are analyzing the situation. One of the companies, Stellar, meanwhile voiced fury over US and British spying. “A cyber-attack of this kind clearly violates German law,” said one if its heads. Deutsche Telekom and Netcologne said they had not identified any data breaches but Deutsche Telekom’s IT security chief Thomas Tschersich said, that the “access of foreign secret services to our network would be totally unacceptable.” “We are looking into any indication of a possible manipulation. We have also alerted the authorities,” he stated.

Every age has a story it tells about the end of the world. And every age’s story about the end of the world tells us something; not about how the world will end; but about how that age already is. We call those stories eschatologies. I want to tell you a story, too, in this little essay. Of an eschatology. Our eschatology. Remember our collective vision of the future? Imagine the Jetsons. Imagine high modernism. Imagine Mad Men. The perfect suits, the immaculate hair, the endless cocktails, the towering city, the secret affairs, the endless desire. The gleaming seduction of a better tomorrow. What is the future? We thought—no, we believed, with all our might—that the world would inexorably be moved, by our might. In a single direction. The direction of human progress. We were true believers in a faith. That the right, true, and inescapable trajectory of mankind was forward. It was an idea born in the high industrial age. The machine. The factory. The gear. The sudden, furious birth of plenty.

Like a supernova going off in the heart of a human world that hadn’t changed for millennia. Suddenly, we had more than we could imagine. And we thought: this was the future. The right, noble, just, future. Maybe Nietzsche was right. God was dead. But who needed God? We had forged this wondrous future. Through the sweat of our brows and the might of our faith. And so how was it anything less than destined? Fuck Providence. We were something bigger than providence. We were destiny. This was how the future was meant to be. And so this was how the future would surely always be. And then. Something went wrong. It’s hard to say how. But. The future broke. Rupture. The Rupture is the future slowing, stopping, winding down. Fracturing; splitting apart; coming undone. It is the future ending, collapsing, breaking. Once, we subscribed to a naive view of historical progress. That humanity marched forwards into a place we called the “future”. The future stopped happening. For most of us. We got left behind by it.

The future isn’t one of unalloyed, golden progress anymore. Tomorrow is a tale of decline, degeneration, decay. Rupture. The future isn’t flying cars and food pills and a smarthome and a stable career and comfortable prosperity for every family anymore. Rupture. The future looks more like this. A story of a burning planet, of imploding middle classes, of lost generations, of empty decades, of mass unemployment, of the rule of law breaking, of democracy cracking, of nations splintering, of tribes warring, of broken dreams, of Greater Depressions, of unending Stagnations, of human possibility itself shattering into a million million pieces. Rupture. The future isn’t the steady, forward march of human advancement anymore. What is “declining”? Constitutional democracy, opportunity, mobility, material prosperity, law, equity, fairness, a sense of meaning in life…hope for the future. Rupture.

Quite a tale.

• California Solar Projects Plan Undergoing Major Overhaul (SFGate)

With billions of dollars in federal stimulus money in hand, the Obama administration set out five years ago on a grand experiment in the California desert. The goal: Open public lands to renewable-energy development to wean the nation from fossil fuels. The results haven’t been pretty, a fact the administration has tacitly acknowledged by devising a new plan, expected to be released this month, to find better places to put industrial-scale solar farms in the California desert. Quoting songwriter Joni Mitchell in a speech describing the new approach, Interior Secretary Sally Jewell said, “You don’t know what you’ve got till it’s gone.” The solar plants were rushed through the environmental approval process. Miles of unspoiled desert lands were scraped and bulldozed to make way for sprawling arrays of solar panels.

Desert tortoises required mass relocation, and kit fox burrows were destroyed. Surprise troves of American Indian artifacts found in the Mojave Desert were moved to a San Diego warehouse, where they remain. And once it was built, the largest solar plant of its kind in the world – the Ivanpah installation in the Mojave – began igniting birds and monarch butterflies that fly through intensely concentrated, reflected sunbeams aimed at 40-story “power towers,” according to a confidential report by federal wildlife officials. Owned by BrightSource of Oakland, with investment partners Google of Mountain View and NRG Energy of Houston, the 5.4-square-mile, $2.2 billion facility was built with a $1.6 billion federal loan and went online last fall.

BrightSource underestimated how much natural gas it would need to run the Ivanpah plant when the sun doesn’t shine. And scientists now say desert soils contain vast stores of carbon that are unleashed by construction of solar facilities. Research at UC Riverside’s Center for Conservation Biology indicates that carbon-dioxide-emissions savings from many solar plants “will be compromised, or even negated, by the loss of stores of inorganic and organic carbon sequestered by desert native ecosystems.” Within the next few weeks, state and federal agencies plan to release the mammoth Desert Renewable Energy Conservation Plan, nearly five years in the making, that many hope will correct mistakes made when stimulus dollars and California’s quest to slash carbon emissions set off a solar land rush in the Mojave.