Jack Delano Freight train on the Chicago & North Western, Chicago to Clinton, Iowa Jan 1943

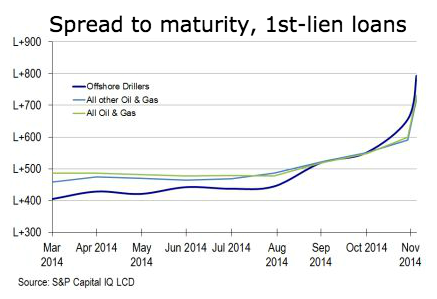

That’s one ugly graph. Look at the difference between whites and the rest.

• Americans Are 40% Poorer Than Before The Recession (MarketWatch)

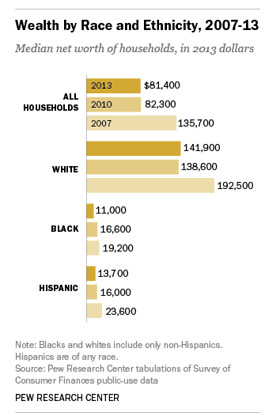

The Great Recession is officially over, but Americans are still 40% poorer today than they were in 2007, the year before the global financial crisis. The net worth of American families – the difference between the values of their assets, including homes and investments, and liabilities – fell to $81,400 in 2013, down slightly from $82,300 in 2010, but a long way off the $135,700 in 2007, according to a new report released on Friday by the nonprofit think-tank Pew Research Center in Washington, D.C. “The Great Recession, fueled by the crises in the housing and financial markets, was universally hard on the net worth of American families,” the report found.

There is also a dramatic disparity in net worth between races. The median net worth of white households was $141,900 in 2013, down 26% since 2007. It declined by 42% to $13,700 over the same period for Hispanic households and fell by 43% to $11,000 for African-American households. One theory for the wealth gap: White households are more likely than other ethnicities to own stocks directly or indirectly through retirement accounts, the Pew report said. The wealth of most Americans has stood still. In November 2014, the average weekly wage was $853 versus $833 for November 2013, according to the Bureau of Labor Statistics. But things are improving somewhat when it comes to housing.

Nationwide, only 8% of borrowers have homes that are underwater as of October 2014, down from a peak of 35%, or 18 million homes, in February 2011, according to Black Knight Financial Services in Jacksonville, Fla., which tracks mortgage performance. But 8% still impacts 4 million homes. Stagnant wages and rising property prices don’t bode well for first-time buyers without wealthy parents. The homeownership rate for non-Hispanic white households fell to 73.9% in 2013 from 75.3% in 2010, Pew found, and fell to 47.4% in 2013 from 50.6% in 2010 for minorities. It takes an average of 12.5 years to save up a 20% down payment – the usual requirement by banks – with a personal savings rate of 5.6%, according to real-estate firm RealtyTrac.

Read more …

This is how Cameron has built his recovery model.

• UK Low-Paid And Zero-Hours Jobs Surge Dramatically (Observer)

New figures have revealed the dramatic spread of low-paid, insecure and casual work across the British economy since the financial crash of 2008. In that year, one in 20 men and one in 16 women worked in the casualised labour market. Now, one in 12 of both men and women are in precarious employment, which includes zero-hours contracts (ZHCs), agency work, variable hours and fixed-term contracts, according to new TUC data. According to the analysis, in 2008 there were 655,000 men in the casualised labour market. That number has risen by 61.8% to 1.06 million. The casualised female workforce has increased by 35.6%, from 795,000 in 2008 to 1.08 million in 2014. The TUC is also publishing research showing that since 2008, only one in 40 new jobs has been full-time. Over the same period, 60% of net jobs added have been self-employed and 36% have been part-time.

Employers argue that casual work often leads to a permanent post. According to the Work Foundation, however, only 44% of zero-hours contract jobs last for two years or more and 25% have lasted for five years or more. A survey by the Chartered Institute of Personnel Development estimated that there are more than a million zero-hours contract workers – 3.1% of the UK workforce – four times the estimate of the Office for National Statistics in 2012. The business secretary, Vince Cable, has proposed that those on zero-hours contracts should have the right to request a fixed-term contract. Labour has proposed that an employee on a ZHC has the right to request permanent work after 12 months.

In its report, Women and Casualisation: Women’s Experiences of Job Insecurity, the TUC makes a number of recommendations to tackle precarious employment, including written contracts for those on zero- or short-hours contracts guaranteeing work patterns; payment for the time that a casual worker is on call; better enforcement of the minimum wage; better enforcement of statutory rights, such as the right to permanent work after four years; and more help from larger employers on childcare. “For many women, ‘flexibility’ has become synonymous with being at the beck and call of employers,” said the TUC general secretary, Frances O’Grady. “Job insecurity isn’t just something that affects women in industries like retail and social care; it is a problem across the labour market.”

Read more …

Heed this.

• Global Credit Markets Have Proclaimed An End To The Recovery (Alhambra)

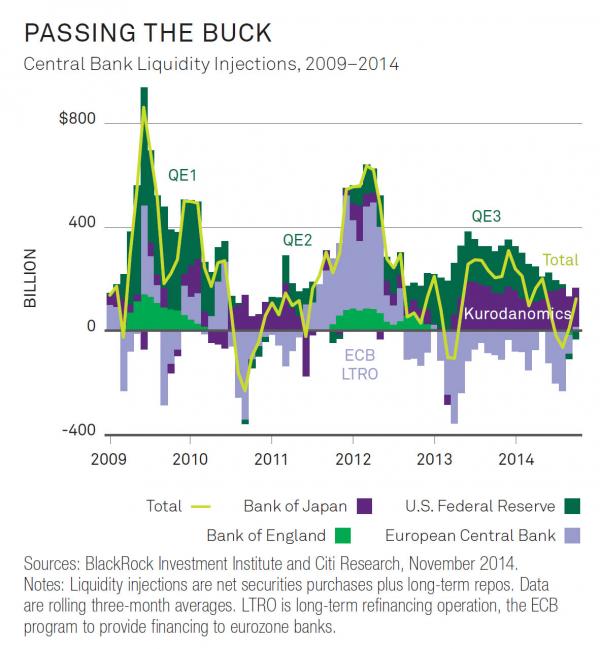

The amount of credit market fireworks this week is only surpassed by those of October 15. Everywhere you look, credit markets are not just growing bearish but, as I said earlier in the week, bearish in comparison with past crisis periods. The past few days have surpassed even that observation, making credit now a fast-moving indicator of still nothing good. For most people that makes sense of Europe. The currency bloc that has been strangled by the common euro is living up to that sense of monetary reality. All that talk of recovery only eight months ago has been washed away in a tide of remarkable fear. What was perhaps only unease or mild nervousness as late as September has turned in the past few weeks to what can only be described as growing desperation. Just this week, the German bund curve at the longer end has dropped 10-15 bps all the way out. The 15-year bund is now under 1%!

The benchmark 10-year has fallen all the way to an essentially meaningless 63 bps. That is an astounding drop of 44 bps going back to mid-September. You may recall mid-September for its break in this bearish action that started back in August. At the time I believed that minor reprieve was related to optimism over the ECB’s ABS plan and covered bond purchases that finally offered something specific apart from the usual bland platitudes of “promises.” Of course, since almost nobody even remembers that now, its total lack of efficacy has been made plain with the ECB looking far worse and even more (if that was possible) impotent for their trouble. So in the midst of what was forewarned as a major monetary “stimulus” credit market revulsion is severe; an exceptional result unlike anything of the past five years, especially the last three.

Read more …

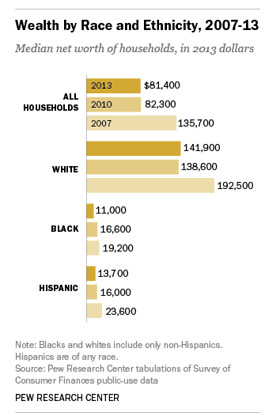

“.. it is not inconceivable that the price of a barrel of Brent could touch lows of around $30 ..” And that’s the Telegraph …

• Oil ‘Contango’ Fandango Over How Low Prices Will Finally Go (Telegraph)

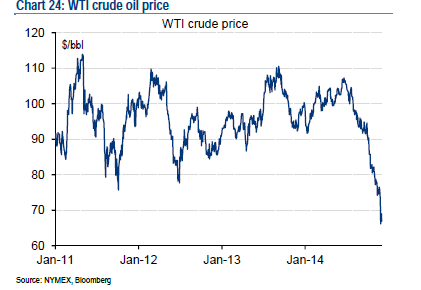

Contango, or not contango? This is perhaps the most important question facing oil markets right now. In the space of a week, the global three top energy organisations have downgraded their forecasts for the amount of oil they think the world will need next year to fuel the economy. These revisions are significant in the context of understanding why the price of oil has fallen so dramatically in such a short period of time — down 45% since June — and helping to predict accurately where it is likely to be heading in the future. One of the secrets to understanding what price oil will be trading at in six months’ time could be predicting contango. This word, rarely spoken outside oil trading circles, refers to the point at which spot delivery prices for crude are cheaper than the futures contracts being bought for offloading months in advance. When contango develops, the motive to buy oil usually returns soon after, if only for the reason of brokers profiting from the price spread attached to storing excess supply in tanks.

With Brent threatening to break its current $60 per barrel resistance level, oil traders are beginning to see the sort of deep contango that could put a floor under prices taking shape in the market. Even some members of the OPEC are now fixing their spot crude contract prices on the assumption that contango is already under way. Iraq’s state oil marketing company used that excuse this week as the reason why it cut its prices. “The widened contango in crude oil prices in Asia was the major reason behind the cut,” said the company. Of course, even more crude sloshing around in brim-full storage tanks is a sign that the fundamental link between supply and demand, which drives all markets, is currently broken when it comes to oil. World oil markets are now facing a demand shock of epic proportions, which makes predicting a floor to the price of crude increasingly difficult, unless producers unilaterally agree to deep cuts in output.

Given the glut of oil already in circulation on tankers without customers to unload to, it is not inconceivable that the price of a barrel of Brent could touch lows of around $30, last seen during the depths of the financial crisis in 2008. According to the International Energy Agency (IEA), growth in world demand for oil will next year again fall below the critical figure of 1m barrels per day (bpd), reaching 93.3m bpd in total. The agency has also warned of a 300m barrel increase that has built up in the storage tanks across Europe and North America. American estimates for demand are even more depressed, with the Energy Information Administration (EIA) — part of the US Department of Energy — this week reducing its forecast demand growth to just 880,000 bpd, or 92.8m bpd in total. Finally, OPEC itself shaved off 70,000 bpd to 92.26m bpd, of which it will account for a smaller share.

Read more …

Make it 10 times that.

• Oil Price Crash Means $87 Billion Of New European Projects Face Axe (Telegraph)

Dozens of new oil projects in the North Sea and Europe could be shelved as falling prices force international oil companies to tear up their investment plans. Global energy consultancy Wood Mackenzie has said that 32 potential European oil field developments containing 4.9bn barrels of oil equivalent are waiting for approval on more than $87bn (£55bn) of funding. These could be at risk should oil prices fall below $60 per barrel. Major projects and investment in the UK and across Continental and Mediterranean Europe could be at risk if prices stay below $80 per barrel, as over 70% of the pre-FID [final investment decision] reserves in each region have a break-even [price] in excess of $60 per barrel, James Webb, lead analyst at Wood Mackenzie, told The Sunday Telegraph. Whereas in Norway almost 80% of reserves require an oil price of less than $60 per barrel to break even, he said. Norway’s output is expected to increase by 50,000 barrels per day to average almost 1.9m bpd in 2014, despite the recent slump in prices.

Major international oil companies such as BP, Chevron and ConocoPhillips are already reviewing capital expenditure levels in the wake of a rout in global crude markets, which has wiped 45% off the price of a barrel of Brent since June. The benchmark closed out the week at just above $62 per barrel, close to a new five-and-a-half-year low, after the International Energy Agency slashed its forecast for demand growth next year by 230,000 barrels to 93.3m bpd. A sharp cutback in spending on new projects by oil majors could also threaten thousands of jobs in the UK s oil and gas sector offshore and hit hubs such as Aberdeen and Montrose, which serve the North Sea, hard. BP warned of thousands of potential redundancies last week, as it informed investors of $1bn of cuts it plans to make to adjust its business to the new lower price environment. The downward trend in oil prices is a growing source of concern for operators across Europe, said Mr Webb.

Read more …

Russia, Venezuela, Nigeria and Canada. Nice lise.

• Canadian Dollar At 54-Month Low As Oil Prices Collapse Below $60 (RT)

The Canadian dollar is taking spill with falling oil prices, and traded at a new low of 86.58 cents against the US dollar Friday. Canada has the world’s third largest proven oil reserves, and relies on oil and gas exports for 30% of GDP. The ‘Loonie’, as the currency is called in Canada, hit a 5-year low in October, and continues to sink along with oil prices, which have lost more than 43% from their June peak. Brent crude, the global benchmark, was trading at $62.95 per barrel. West Texas Intermediate (WTI) crude futures slipped to $59. The Canadian currency hit a high of $1.05 against the dollar in summer 2011, but has been stuck in a 5-year lull as investors sell off crude oil in the market. “Roughly speaking, if we start to think about oil prices below $50 a barrel for any significant period of time, you’re talking in all likelihood of a US dollar getting up to the CAN$1.20 to CAN$1.25 range,” Shaun Osborne, chief currency strategist at TD Securities is quoted by Reuters as saying.

As oil prices collapse, so are the currencies in high-cost oil producing nations, such as Canada, Norway, and Russia. Both Norway and Russia have complex oil drilling projects in frigid northern waters, which often necessitate ice breakers. Canadian heavy crude has fallen to near $40 a barrel. The blend trades lower than WTI because production and shipping costs in Canada are more expensive. Canada specializes in oil sands, which needs to be extracted from the ground and refined and processed into lighter crude. About one-third of Canada’s proven reserves are oil sands. Like the US shale boom, Canada’s oil sands have been a big boost to the economy since the 2008-2009 recession. Canada is the largest source of energy imports into the United States, the world’s second biggest oil consumer. Canadian energy stocks have taken a beating as crude has plunged into a bear market, as many investors are losing confidence in the expensive oil extraction methods.

Read more …

Vintage Farrell.

• Noah’s 12 Survival Tips (Paul B. Farrell)

Merry Christmas? No, just same ol’ happy-talkin’ Scrooges pushing the same ol’ tired message — spend, spend, spend, run up our holiday retail numbers. But I’ll bet your gut’s filled with dark storm warnings … crashing oil stocks threaten recovery, growth … China, EU, developing markets stalling … trading, commodities, exports falling … corporate profits mask low-skill jobs … wages flattening … interest rates, inflation too low … as the middle class keeps losing, superrich capitalists lobby for bigger perks … maybe economist Robert Gordon’s dismal forecast is right, America may already be collapsing into a 1% GDP by 2100.

Happy New Years? No, don’t count on it … all this is coming on top of America’s hard-right changing-of-the-guard … the victorious GOP is taking command of the ship … and they’re unconsciously threatening economic growth with their partisan dogma designed to undermine everything done by the president the past six years — health care, immigration, minority voting and women’s rights — while now aggressively undermining all climate initiatives with uncompromising science-denial plans guaranteed to further frustrate Main Street voters and sabotage America’s weak economic recovery.

But for the moment, Christmas spirit shines above all those storm warnings, above the accelerating climate disasters, a great spirit reminiscent of my days years ago overseas with the Marine Corps, often serving mass for Catholic chaplains. A great gift, a mystery, a privilege. A welcome respite from what’s ahead. Why? We just put up four Christmas trees lighting our home today, memories going back to celebrations in my home in small-town Pennsylvania, where that lit up my youth during holidays. Christmas is that kind of story time, filled with happy memories, like how we got our home, through Capt. Jerry Shields, chaplain of the First Marine Expeditionary Force. I fell in love with his Christmas list: “All I Really Need to Know I Learned From Noah’s Ark.” It was on the wall of our future home we first walked in years ago, lit up my eyes with a smile.

Chaplain Shields was the owner’s son. I looked, was hooked. The message, this home was waiting for you. Today the same spirit arises year after year, of serving mass for Marine chaplains. And also collecting Noah’s Ark memorabilia. After a double-take, they gave us a copy. We were sold on the house, put in an offer on the spot. Love it more with each passing Christmas, living here in God’s country. Noah’s spirit surrounds us every day, reminds of how to navigate successfully through good times and bad, always true to yourself. If you need to know how to survive the storm, Noah’s got the answer. Yes, the great ark-builder is one of history’s all-time survivors. He listened to the right voice, the one echoing within his soul, all souls. Trust it.

Read more …

“.. even with absurd assumptions (7%+ GDP growth for years at a time, low interest rates, etc.), it is simply not feasible for the US government to ‘grow’ its way out”.

• Paying Down The Debt Is Now Almost Mathematically Impossible (Simon Black)

Exactly 199 years ago, in 1815, a “temporary” committee was established in the US Senate called the Committee on Finance and Uniform National Currency. It was set up to address economic issues and the debt accrued by the US government after the War of 1812. Of course, because there’s nothing more permanent than a temporary government measure, the committee became a permanent one after just one year. It soon expanded its role from raising tariffs to having influence over taxation, banking, currency, and appropriations. In subsequent wars, notably the American Civil War, the Committee was quick to use its powers and introduced the union’s first income tax. They also detached the dollar from gold to help fund the war.

This was all an indication of things to come. Over the subsequent decades there was a sustained push to finally establish the country’s central bank that will control money and credit, as well as institute a permanent income tax to feed the expanding aspirations of government. They succeeded in 1913 when the Federal Reserve Act was passed and the 16th Amendment ratified, binding the country in the shackles of central banking and taxation of income. Over the century that followed, the US has gone from being the biggest creditor in the world to its biggest debtor. Decades of expanding government programs, waste, endless and costly wars, etc. have racked up such an enormous pile of debt that it has become almost impossible to pay it down. A lot of folks don’t realize that, since the end of World War II, the US government’s total tax revenue has been almost constant at roughly 17% of GDP.

In other words, even though the actual tax rates themselves rise and fall, the government’s ‘slice’ of the economic pie is almost always the same – 17%. I’ve worked out a mathematical model which shows that, even with absurd assumptions (7%+ GDP growth for years at a time, low interest rates, etc.), it is simply not feasible for the US government to ‘grow’ its way out. Default has become the only option. And that could mean a number of things. They could default on their creditors (other governments like China who loaned money to the US government). But this would spark a global financial and banking crisis. They could default on the Federal Reserve, which owns trillions of dollars of US debt. But this would create an epic currency crisis for the US dollar. They could also default on their obligations to their citizens—primarily to future beneficiaries of Social Security (who collectively own trillions of dollars of US debt).

Read more …

But she didn’t win.

• Elizabeth Warren, Obama’s Left-Side Headache (Bloomberg)

If the #cromnibus debate is a sign of what’s to come, President Obama may wish he had given Elizabeth Warren the Consumer Financial Protection Bureau post she wanted. From trade to taxes, President Barack Obama is looking for areas to cut deals with the new congressional Republican majority and burnish his legacy. Judging by the budget debate this week, at least one obstacle to bipartisanship will be the progressives in his own party, who will have a more influential voice in a slimmed-down caucus when Congress returns in January. House Democratic Leader Nancy Pelosi gave the White House palpitations Thursday when she railed against the $1.1 trillion government spending bill that the president supported, delaying the vote for hours and increasing the risk of a second government shutdown in as many years. Obama needed to make personal calls to House Democrats to shore up support, and sent his chief of staff, Denis McDonough, to the Capitol to do the same.

The announcement on Friday that Senator Sherrod Brown of Ohio will serve as the top Democrat on the Banking Committee, released in the midst of the spending fight that had been held up by a debate over derivatives, foreshadowed more resistance. The pro-labor senator’s news release came complete with statements of support from leaders of credit unions and homeless and housing advocates, rather than Wall Street titans. Blowback was coming from the outside, too. Americans for Financial Reform–a liberal advocacy group–was the first to alert Pelosi’s office to a provision in the spending measure that loosened a banking regulation imposed by the 2010 Dodd-Frank financial reform law. That sparked an anti-Wall Street narrative and led to other liberal groups, like Progressive Change Campaign Committee, asking their members to contact lawmakers and register their opposition. The group also sought to raise money off the dispute.

Read more …

Just another ugly moment in American politics.

• US Senate Passes $1.1 Trillion Spending Bill Averting Shutdown (Bloomberg)

The Senate passed a $1.1 trillion bill to fund most of the U.S. government through September and avert a shutdown after defeating an effort by Ted Cruz that previewed a potential 2015 Republican fight over immigration. The 56-40 vote during an uncommon Saturday session follows House passage of the spending bill on Dec. 11 and sends the measure to President Barack Obama for his signature. Cruz of Texas, like a number of House Republicans, had sought to use the measure, H.R. 83, to block funding of Obama’s actions allowing millions of undocumented immigrants to stay in the U.S. The bill also drew “no” votes from Democrats who opposed language easing bank rules and allowing larger financial contributions to political parties.The measure was “poisoned by special favors flagrantly contrary to the public interest,” Democratic Senator Richard Blumenthal of Connecticut, who voted against the bill, said in a statement.

The vote ended a weeks-long drama over immigration, government spending and banking rules as Senate Democrats prepare to turn the majority over to Republicans in January. Republicans also will have an expanded House majority, and this month’s fight previewed the party’s plans to try to roll back government regulations in 2015. While Republican leaders insisted they wouldn’t allow a government shutdown like the one in October 2013 that stemmed from an effort to defund Obamacare, Congress was just a few hours from a lapse in government funding Dec. 11 when lawmakers passed a stopgap measure to give the Senate time to act.

Read more …

Empty and hollow.

• Lima Marathon Climate Change Talks Reach Agreement (Guardian)

Negotiators adopted a course of action on Sunday that would for the first time commit every country to cutting the greenhouse gas emissions that drive climate change. The decision reached at United Nations climate talks on Sunday was seen as a significant first step towards reaching a global climate change deal in Paris at the end of next year – although negotiators acknowledged much of the hard work remained ahead. It is also far from clear that the actions sketched out on Sunday would be enough to limit warming to the internationally agreed limit of 2C above pre-industrial levels – or to protect poor countries from climate change. “I think this is good, and I think this moves us forward,” Manuel Pulgar-Vidal, Peru’s environment minister and the chair of the talks, said.

The deal struck early Sunday – now officially known as the Lima Call for Climate Action – would for the first time require all countries, rising economies as well as rich countries, to take action on climate change. That represents a break from one of the defining principles of the last 20 years of climate talks – that wealthy countries should carry the burden of cutting carbon dioxide emissions. Now for the first time, China, whose emissions have overtaken the US since climate talks began as well as India, Brazil and other rising economies have agreed they will need to cut their own emissions as well. As agreed, countries would come up with their own emissions reductions targets, with a suggested deadline of 31 March 2015. The United Nations would then weigh up those pledges and determine whether the collective action was enough to limit warming to 2C above pre-industrial levels, the internationally agreed goal.

Read more …

We can’t help but reset that carbon imbalance, out of the ground and into the air.

• Germany To Remain Oil, Gas and Coal Powered For Next 70 Years (RT)

Germany’s plan to phase out nuclear energy and switch to renewables by 2022 is unrealistic as the country is doomed to remain dependent on fossil fuels like oil and gas for the next 70 years, energy expert Matthias Dornfeldt told RT. Renewables can’t replace fossil fuels overnight because there’s not enough infrastructure, said Dornfeldt in an interview with RT. He believes the 21st century will be the century of gas, as the 20th century was the century of oil. “We are going to be dependent on oil as well as on gas, as I see, for the next 50, 60, 70 years”, he said, adding there is “a huge impact of fossil fuels on the national economy in Germany.” His comments echo a Wednesday study by the Federal Institute for Geosciences and Natural Resources (BGR) that said Germany would remain dependent on fossil fuels for decades.

Oil, natural gas, coal and lignite account for 80% of German energy consumption. Germany’s game plan to switch to renewables known as Energiewende, and the recently approved National Action Plan for Energy Efficiency looking very unrealistic, the report added. Following the 2011 disaster at the Fukushima nuclear power plant in Japan, Angela Merkel’s government made a commitment to phase out nuclear power by 2022 and get 80% of its energy from renewable sources by 2050. The country will need new energy infrastructure, including new power plants, transmission lines and additional energy storage.

Although some scientists look at the government’s attempts to cut emissions with skepticism, it hopes to reverse this with the Action Plan on Climate Protection it passed earlier in December. The plan suggests a goal to reduce greenhouse gas emissions by 40% compared to 1990 levels by 2020. Germany is still on a long way from achieving its target. Even oil production in Germany, which is small compared with the big international producers, contributes more to power generation than all of domestic photovoltaic equipment put together, the BGR study says. In 2014 the share of renewables in Germany’s energy mix grew 5% from the year before.

Read more …

What’ll be left after a real test?

• Assets Collapse, Loans Go Bad: UK Banks Brace For Serious Stress Test (Observer)

House prices fall by an unprecedented 35% and base rates jump above 4%, putting pressure on household finances already feeling the pain of falling real incomes. Unemployment doubles to 12% and inflation rockets in an economy being buffeted by a sharp drop in the value of the pound. In the worst slump in almost a century, Britain’s big banks are struggling to fund themselves on the international financial markets as they face the prospect of a wave of homebuyers and big companies defaulting on their debts. This bleak scenario is the stress test the Bank of England is running on seven banks and one building society to assess their financial strength, with the results to be released at 7am on Tuesday. These are the first tests to be run concurrently on lenders and are likely to become an annual event, incorporating lessons learned from the 2008 crisis, when banks such as Royal Bank of Scotland were exposed as running on wafer-thin capital ratios and unable to withstand the storm.

Analysts at Morgan Stanley said: “Annual stress tests form the third leg of the Bank of England’s approach to regulating bank capital.” The other two involve looking at the risks attached to assets and the leverage ratio method of assessing capital strength. Although the tests are based on hypothetical scenarios, the results could have implications for the banks taking part. Dividend payouts to shareholders could be at risk or banks could be forced to pull out of businesses. Institutions could be forced to raise more capital. The Co-op Bank has already warned it might fail while Lloyds Banking Group’s hopes to pay a dividend for the first time since 2008 could be scuppered. This comes only weeks after stress tests conducted by the European Banking Authority , which the four UK banks involved – Barclays, HSBC and bailed-out Royal Bank of Scotland and Lloyds Banking Group – all passed. Those four are now being included in the Bank of England’s test along with Co-operative Bank, Nationwide building society, Santander UK and Standard Chartered.

Some of the scenarios are the same as those tested by EBA, such as a “market tantrum” in Brazil, India, Indonesia, South Africa and Turkey, but the UK-specific test is tougher. Threadneedle Street’s approach is also different because the regulator takes accounts of efforts banks would make to improve capital positions once the crisis is under way. But the Bank has said it could exercise discretion and come down hard on a bank even though technically it managed to struggle over the line in terms of capital strength.

Read more …

“Of course, there is a plan B [in the case of Russia being shut off from the SWIFT bank system], but in my personal opinion it would mean war ..”

• The New European ‘Arc Of Instability’ (Escobar)

The European Council on Foreign Relations and Berlin think-tank Friedrich Ebert Stiftung have just reached more or less the same conclusion. If the dangerous stand-off between the EU and Russia over Ukraine is not solved, the EU could face, up to 2030, a military build-up in eastern Europe; a new arms race with NATO as a protagonist; and a semi-permanent “zone of instability” from the Baltic to the Balkans and the Black Sea. What these two think-tanks don’t – and won’t – ever acknowledge is that a new European “arc of instability” – from the Baltic to the Black Sea, as myself and other independent analysts have stressed – is exactly what the Empire of Chaos and its weaponized arm – NATO – are working on to prevent closer Eurasia integration.

By the way, the Pentagon excels in fabricating “arcs of instability.” The previous one was – and remains – massive, stretching from the Maghreb to Xinjiang in western China across the Middle East and Central Asia. Moscow has totally identified the plot; Foreign Minister Sergey Lavrov, once again, has made it crystal clear, in detail. And crucially, some influential sectors in Germany also did, as in members of the cultural elite destroying the notion of a new war in Europe: “Not in our name.” The same applies to those that always preach more transatlantic cooperation, extol the US’s “defining” role in Germany, and effusively praise Germany as the most American country in Europe; that’s the case of the Frankfurter Allgemeine newspaper – which stands for the core of the political and economic establishment in Germany.

It’s still in an embryonic stage, and has not yet made Chancellor Angela Merkel see the light; but a reverse reengineering of Atlanticist relations is already in progress in Germany. Meanwhile, the proverbial group of extremist US senators, plus the notorious poodles/vassals of Britain and Poland, haven’t stopped lobbying to shut Russia off from SWIFT – just as they did with Iran. This would be nothing but yet another declaration of (economic) war – or the economic counterpoint to NATO hysteria. In fairness, a great deal of the EU – especially Germany – knows this is madness.

Germany’s top financial paper Handelsblatt recently published a key interview with head of VTB-Bank Andrei Kostin, which has still not been translated into any major English-language paper. Kostin went straight to the point: “Of course, there is a plan B [in the case of Russia being shut off from the SWIFT bank system], but in my personal opinion it would mean war – if this type of sanction will be introduced. America and Europe did that against Iran but with Iran at that time there were no diplomatic relations, only military containment…if Russian banks’ access to SWIFT will be prohibited, the US ambassador to Moscow should leave the same day. Diplomatic relations must be finished. Banking is the most vulnerable part of the Russian economy because the system is based so strongly on the dollar and the euro.”

Read more …

Weidmann is Europe’s only hope at the banking level.

• Bundesbank Chief Attacks EU For Dragging Feet Over French Deficit (Telegraph)

The head of the German central bank has criticised the EU’s decision to give France extra time to sort out its budget, hinting at a disagreement between Europe’s two most powerful economies. Jens Weidmann, the Bundesbank president, told a French newspaper that he feared last month’s decision to give France more time to spell out plans to fix its budget deficit risked giving the impression that EU rules are up for negotiation. It came a day after Fitch downgraded France’s credit rating from AA+ to AA, citing its failure to get a grip on its deficit. “Fitch’s medium-term growth forecasts are somewhat weaker and budget deficits wider than official projections,” the ratings agency said. At the end of November, the European Commission gave France an extra three months to implement reforms to shrink its budget deficit.

The country has been on course to run a deficit of 4.3% of GDP in 2015, well above the 3% EU target. By extending the deadline, the EU has saved Paris from humiliating sanctions, at least for the time being. “I would have hoped for clearer decisions,” Mr Weidmann told Le Figaro. “It would be unfortunate if the impression set in that rules are in the end up for negotiation and that budgetary consolidation can be perpetually put off by national governments.” Mr Weidmann added that bending the rules to give France, among others, more time to fix their budgets could put the EU rules’ credibility at risk. “France announced that it will not reach the agreed deficit goal in 2015 and has clearly put back the envisaged correction of its excessive deficit. For me, that does not strengthen the credibility of EU rules,” he said.

Read more …

“Cheney’s blunt talk is a win-win in Washington. His black-and-white views of the world give him a bigger bullhorn that those who see gray ..”

• A Viewer’s Guide to Dick Cheney (Bloomberg)

Dick Cheney is making a rare appearance Sunday on NBC’s Meet the Press to discuss the Senate Intelligence Committee’s CIA torture report. It’s an unnecessary one, really. The former vice president slipped into media chairs to trash the investigation’s findings even before the first public reports emerged on its shocking details. So here are five things you need to know as you watch:

1. He thinks the Senate report is “full of crap” and a “crock.” Cheney wasn’t a mealy-mouthed politician during his years as a top administration official. He’s further embraced that reputation since leaving the VP post. “I get to say exactly what I think,” he told Charlie Rose in June. His reaction to the Democrat-led Senate panel report has been no exception. The New York Times captured his “crock” comment. In a Fox interview that aired Wednesday, he asserted it was “full of crap,” adding: “It’s a terrible piece of work.”

2. But he hasn’t read it. Cheney acknowledged he hasn’t perused the committee’s 6,700-page investigation, or even its declassified 500-page executive summary. In fairness, he doesn’t need to. He’s in it. Cheney’s name comes up 44 times in the report. From a footnote one can glean that not only did Cheney not want to read about the his former colleague’s work, he didn’t want anyone else to either–ever. “In 2006, Vice President Cheney expressed reservations about any public release of information regarding the CIA program,” it states.

3. He said they knew. He has taken pains in both post-release interviews to refute the idea that President George W. Bush was kept in the dark about the interrogation techniques. “I think he knew everything he wanted to know and needed to know,” he said in the Fox interview. Another search through the footnotes backs him up: “March 4, 2005, Briefing for Vice President Cheney: CIA Detention and Interrogation Program.” That followed cited briefings in 2003, 2004, and before one in 2006. The president received similar backgrounders. Of course, there were also some things that Cheney, Bush and other high-ranking officials didn’t want to know.

According to the report: “A proposed phone call to the Vice President Cheney to [redacted name] solidify support for CIA operations in Country [unnamed] was complicated by the fact that Vice President Cheney had not been told about the locations of the CIA detention facilities. The CIA wrote that there was a “primary need” to “eliminate any possibility that [unnamed person] could explicitly or implicitly refer to the existence of a black site in [the country]” during the call with the vice president. There are no indications that the call occurred.”

4. He uses Meet the Press as a big platform. Although Cheney has become a fixture on Fox, he’s turned to the NBC program to make bold statements over the years. He chose MTP as his first television appearance after the terrorist attacks on Sept. 1, 2001. Host Tim Russert did the show from the presidential retreat Camp David that Sunday. Cheney’s closing line to the American people that day: “There are those in the world who hate us and will do everything they can to impose pain, and we can’t let them win.”

5. Why is anyone is still listening to Cheney, six years after he left office? Cheney’s blunt talk is a win-win in Washington. His black-and-white views of the world give him a bigger bullhorn that those who see gray, so he is viewed as the ultimate spokesman for the Republican Party’s hawk division. The fact that he outrages liberals and delights conservatives also means he can be a ratings and website bonanza for those news outlets that score one of his occasional public moments. Kudos to MTP.

Read more …

The war party rules.

• US Congress Readies New Sanctions On Russia (Reuters)

U.S. lawmakers were expected on Friday to approve new sanctions on Russian weapons companies and investors in the country’s high-tech oil projects, putting more U.S. pressure on President Vladimir Putin for interference in eastern Ukraine. Late on Thursday, the Senate and House of Representatives unanimously passed the Ukraine Freedom Support Act. A House panel made a small change and sent the bill back to the Senate for a last vote expected as soon as late Friday. President Barack Obama has said he opposes further sanctions on Russia unless Europe is on board. The bill, which will be sent to Obama to sign, requires him to apply sanctions on Russian state-owned arms exporter Rosoboronexport and other defense companies Congress says contribute to instability in Ukraine, Georgia and Syria. It requires Obama to penalize global companies that make large investments in crude oil drilling projects in deep waters and the Arctic.

The penalties go beyond U.S. and EU sanctions imposed in September on the world’s largest oil companies such as Exxon Mobil and BP. The legislation would also provide $350 million in military assistance to Ukraine from 2015 to 2017, and other aid for energy to the country, which has been threatened by cutoffs in natural gas supply from Russia. Republicans, who control the House and will have a majority in the Senate from January, have criticized Obama’s reaction to Russian interference in Ukraine as inadequate. “The hesitant U.S. response to Russia’s continued invasion of Ukraine threatens to escalate this conflict even further,” said Senator Bob Corker, a Tennessee Republican, incoming chairman of the foreign relations committee. The unanimous support for the bill showed a “firm commitment to Ukrainian sovereignty and to making sure Putin pays for his assault on freedom and security in Europe,” said Corker, who co-authored the bill with Democratic Senator Robert Menendez, the current head of the panel.

The bill authorizes Obama to penalize the top Russian natural gas producer Gazprom if he determines it is withholding significant natural gas supplies from NATO members or from Ukraine, Georgia and Moldova. Lawmakers dropped a measure that would have designated Ukraine, Georgia and Moldova as non-NATO allies of Washington. Obama on Thursday said slapping fresh sanctions on Russia without a similar move by Europe would be counterproductive. In Kiev on Friday, Ukraine’s defense minister called for a doubling of the military budget to buy weapons abroad and better equip the army to fight Russian-backed separatists in the east.

Read more …

The ‘Ukraine Freedom Support Act’, no less.

• Russian Anger Over New US Sanctions And Lethal Military Aid For Ukraine (AFP)

Russia responded angrily on Saturday to news that US senators had passed a bill calling for fresh sanctions against Moscow and the supply of lethal military aid to Ukraine. “Undoubtedly, we will not be able to leave this without a response,” deputy foreign minister Sergei Ryabkov told Interfax news agency ahead of a meeting between the Russian and US foreign ministers. The Senate bill – dubbed the Ukraine Freedom Support Act – must still be approved by the White House, which has so far been reluctant to provide direct military assistance to Ukraine for fear of being drawn into a proxy war with Russia. Ryabkov blamed “anti-Russian moods” in the United States for the bill passed on Friday, which calls for additional sanctions against Russia and the delivery of up to $350 million (280 million euros’) worth of US military hardware to Ukraine.

The eight-month conflict between government forces and pro-Russian separatists has left at least 4,634 dead and 10,243 wounded, while displacing more than 1.1 million people, according to new figures released by the United Nations. It also threatens fresh sanctions against Russia, whose economy is crumbling under previous rounds of Western sanctions and a collapse in oil prices. Kiev lawmakers have hailed the bill as a “historic decision”. They have long been pressing the West to provide military support to their beleaguered army, but have so far received only non-lethal equipment. US Secretary of State John Kerry is set to meet Russian Foreign Minister Sergei Lavrov in Rome against the backdrop of the hardening US stance. Ryabkov said that “the main focus at their 17th meeting this year would be on the Middle East.” There was confusion over the timing of the meeting, however, with the US state department saying it was scheduled for Monday, while the Russian embassy press office in Rome told AFP the meeting would be Sunday.

Read more …

“We should not wait until Ukraine is armed and becomes really dangerous ..”

• ‘If US Sends Weapons To Ukraine, Russia Should Send Troops’ (RT)

A leftist Russian MP has said the US Senate’s decision to arm the Kiev regime should prompt ‘adequate measures’ from Russia, such as deploying military force on Ukrainian territory before the threat becomes too high. “The decision of the US Senate is extremely dangerous. If it is supported by the House of Representatives and signed by their president, Russia must reply with adequate measures,” Mikhail Yemelyanov of the Fair Russia party told reporters on Friday. “It is quite possible that we should return to the decision by our Upper House and give the Russian president an opportunity to use military force on Ukrainian territory preemptively. We should not wait until Ukraine is armed and becomes really dangerous,” the lawmaker stated. Yemelyanov also noted that in his opinion the US Senate’s decision to arm Ukraine had revealed that Washington wasn’t interested in the de-escalation of the Ukrainian conflict.

He then said that US actions gave him the impression they was seeking to turn Ukraine into some sort of an “international militant targeting the Russian Federation.” “In a few years Ukraine will turn into a poor and hungry country with an anti-Russian government that will teach its population to hate Russia. They will be armed to the teeth and Ukraine and US reluctance to recognize the Russian Federation within its current borders would always provoke conflicts,” the MP said. The US Senate on Thursday passed the so called “Ukraine Freedom Support Act” allowing for the provision of lethal and non-lethal aid to Ukraine and imposing additional sanctions against Russia. The bill was passed by a unanimous vote, according to one of its main sponsors – Republican Senator Bob Corker. The motion is yet to be passed by the US House of Representatives. The bill was opposed by US President Barack Obama, who spoke before the White House Export Council on Thursday and said that the move would be counterproductive and create divisions with Washington’s European allies.

On March 1 this year, the Upper House of the Russian Parliament – the Federation Council – approved a resolution allowing the president to use military force on the territory of Ukraine “until the normalization of the social and political situation in that country.” The resolution was adopted in accordance with the first part of Article 102 of the constitution of the Russian Federation. However, on June 25 the Federation Council voted to repeal the legislation following a request from Vladimir Putin. The Russian president instigated the move from a desire to discharge tensions in view of the three-party talks on a peaceful settlement in the East and South-East of Ukraine.

Read more …

“Only 10 members – five from each party – opposed this reckless resolution. [..] We should thank those 10 members who were able to resist the war propaganda.”

• A New Cold War with Russia? (Ron Paul)

Last week the U.S. House voted overwhelmingly in favor of an anti-Russia resolution so full of war propaganda that it rivals the rhetoric from the chilliest era of the Cold War. Ironically, much of the bill condemns Russia for doing exactly what the U.S. government has been doing for years in Syria and Ukraine! For example, one of the reasons to condemn Russia in the resolution is the claim that Russia is imposing economic sanctions on Ukraine. But how many rounds of sanctions has the U.S. government imposed on Russia for much of the past year? I guess sanctions are only bad when used by countries Washington doesn’t like. The resolution condemns Russia for selling weapons to the Assad government in Syria. But the U.S. has been providing weapons to the rebels in Syria for several years, with many going to terrorist groups like al-Qaeda and ISIS that the U.S. is currently bombing!

The resolution condemns what it claims is a Russian invasion of Ukraine (for which it offers no proof) and Russian violation of Ukrainian sovereignty. But it was the U.S., by backing a coup against the democratically elected Yanukovich government in February, that first violated that country’s sovereignty. And as far as a military presence in Ukraine, it is the U.S. that has openly sent in special forces and other military advisors to assist the government there. How many times have top U.S. military and CIA officials visited Kiev to offer advice and probably a lot more? The resolution condemns Russia for what it claims are attempts to “illicitly acquire information” about the U.S. government. But we learned from the Snowden revelations that the NSA is spying on most rest of the world, including our allies! How can the U.S. claim the moral authority to condemn such actions in others?

The resolution attacks Russian state-funded media, claiming that they “distort public opinion.” At the same time the bill demands that the thousands of U.S. state-funded media outlets step up their programming to that part of the world! It also seeks “appropriate responses” to Russian media influence in the rest of the world. That should be understood to mean that U.S. diplomats would exert pressure on foreign countries to shut down television networks like RT. The resolution condemns what it claims is Russia’s provision of weapons to the Russian-speaking eastern part of Ukraine, which seeks closer ties with Russia, while demanding that the U.S. government start providing weapons to its proxies on the other side. As I have said, this is one of the worst pieces of legislation I can remember. And trust me, I have seen some pretty bad bills. It is nothing but war propaganda and it will likely lead to all sorts of unintended consequences.

Only 10 members – five from each party – opposed this reckless resolution. Probably most of those who voted in favor did not bother to read the bill. Others who read it and still voted in favor may have calculated that the bill would not come up in the Senate. So they could vote yes and please the hawks in their districts — and more importantly remain in good graces of the hawks who run foreign policy in Washington — without having to worry about the consequences if the bill became law. Whatever the case, we must keep an eye on those members of Congress who vote to take us closer to war with Russia. We should thank those 10 members who were able to resist the war propaganda. The hawks in Washington believe that last month’s election gave them free rein to start more wars. Now more than ever they must be challenged!

Read more …

” .. is that the only kind of torture? Is it not torture to go to a wedding in Pakistan and watch as your family is blown up by a US drone? Is it not torture to have your village water treatment plant bombed by NATO planes seeking to overthrow Gaddafi? Is it not torture for parents of the 500,000 Iraqi children who were killed by US sanctions?”

• Do McCain and Obama Really Oppose Torture? (Ron Paul)

The Senate Intelligence Committee released its long-awaited report on CIA torture of detainees and the reaction has been strong. While some still maintain that torture is justified, the emerging details of the program have left most of the country disgusted and ashamed. Many in the current Administration blame the Bush people for this dark chapter, claiming that President Obama finally put an end to what his predecessor started. Senator John McCain, an advocate for war and an interventionist foreign policy, has nevertheless been one of the strongest voices opposing torture. He has recalled his time as an abused prisoner of war in Vietnam to argue the importance of facing up to the recent behavior of the US government and making necessary corrections. He said he knows from personal experience that torture does not produce good intelligence, as the victims will say whatever they believe their captors want to hear to gain some relief from their agony.

Torture is morally wrong and it doesn’t work, he maintains. I believe the Senator is sincere and that his intentions are good when it comes to the torture outlined in the report. I also believe that President Obama is sincere when he denounces the practices outlined by the Senate Committee. But I think both President Obama and Senator McCain are being disingenuous and selective in their opposition to torture. It is one thing to argue that people should not have their feet broken and be forced to stand cuffed to a wall, to oppose rectal force-feeding, and to condemn water-boarding a detainee 50 or 100 times. Most of us reject this kind of torture for both moral and practical reasons.

But is that the only kind of torture? Is it not torture to go to a wedding in Pakistan and watch as your family is blown up by a US drone? Is it not torture to have your village water treatment plant bombed by NATO planes seeking to overthrow Gaddafi? Is it not torture for parents of the 500,000 Iraqi children who were killed by US sanctions? Is endorsing pre-emptive war, knowing that thousands of civilians are sure to be “collateral damage,” not support for torture? Both Senator McCain and President Obama take the moral high ground with regard to CIA torture, but both are enthusiastic supporters of past and current US military interventions that have the same effect on millions. It is one thing to oppose horrific practices that leave perhaps dozens killed or maimed. But what about practices that do the same for tens of thousands or millions? A consistent anti-torture position would also reject sanctions, “humanitarian” interventions, regime change, and preemptive war. Anything less is missing the whole point.

Read more …

It should be for many nations. But many were (are?) involved.

• CIA Torture Is Reason For France To Exit NATO – Le Pen (RT)

The shocking revelations of CIA torture techniques give France a reason to exit NATO, National Front party leader Marine Le Pen said on Saturday. The report on the CIA’s former interrogation practices has drawn wide criticism since its release. “If indeed everyone is outraged by the tortures used by the US then, let’s leave NATO,” Le Pen said during an interview with Europe 1 radio channel. She wrote the same statement on her Twitter account. The US Senate Intelligence Committee’s CIA “torture report,” which details the CIA’s use of torture on prisoners in the wake of 9/11, was released by the Senate on Tuesday. After four years of research at a cost of over $40 million, the findings unveiled the “enhanced interrogation techniques,” or EITs, used within the walls of covert, overseas prisons by the CIA.

The report raised serious questions over controversial tactics which included sleep deprivation, waterboarding, rectal feeding, and others. Dianne Feinstein, the committee chair, admitted that the techniques were “torture,” though the word was never used in the report. The findings also revealed that the CIA’s treatment breached the body’s legal mandate, as investigators said they found evidence of the intelligence agency’s systematic deception of Congress. Despite the methods used, the agency failed to gather information that foiled subsequent threats to US national security, the report found. Since the report’s release, prominent human rights groups have demanded to prosecute the responsible US officials listed in the document.

Despite widespread criticism and a wave of outrage sparked by the results of the Senate investigation, the Department of Justice (DOJ) said on Wednesday that it will not be pursuing charges against those involved in the interrogations. UN special rapporteur for torture Juan Mendez told RT that the report will likely create momentum that will lead to justice. He insisted that countries complicit in the CIA torture need to carry out their own investigations. “We have lived without prosecutions now for several years, but the experience shows that when truth telling is done honestly and sincerely, it generates a debate and the debate then generates a momentum towards justice,” he said in an interview on Thursday.

Read more …