Rembrandt van Rijn Portrait of his father 1628-29

Tucker Nixon (Must see)

https://twitter.com/i/status/1616322813794680832

Our Birthright

Mike Rowe We’re at war with the things we need

Mike Rowe reacts to prescriptions out of Davos pic.twitter.com/iWzEoBqnKH

— Wittgenstein (@backtolife_2023) January 19, 2023

MSM Pfizer

https://twitter.com/i/status/1616157050912014337

Watters

UPenn took in millions from China.

UPenn paid President Biden more than $900,000, & the university employed at least 10 people at the Penn Biden Center who later became senior Biden administration officials.

This level of access & opportunity raises questions. @jesseprimetime pic.twitter.com/b4rHv3sRbB

— Rep. James Comer (@RepJamesComer) January 19, 2023

“We pray to the Lord so that he enlightens those madmen and helps them understand that any desire to destroy Russia will mean the end of the world..”

• Russian Orthodox Church Issues Apocalyptic Warning (RT)

Any attempts to destroy Russia could spell disaster for the entire world, the head of the Russian Orthodox Church, Patriarch Kirill, warned on Thursday. Speaking after a religious service marking the Orthodox Christian holiday of Epiphany, the primate claimed that both the international community and Russia are facing “very huge threats.” According to Patriarch Kirill, the root of the problem is that some “madmen” believe that Russia, which “has powerful weapons and is populated by extremely strong people… who had never given in to an enemy and had always emerged victorious, could be defeated under the current circumstances.” Neither would it be possible to “impose on them certain values that cannot even be called values, so that they would be like everyone else and obey those who have the power to control most of the world,” he noted.

“We pray to the Lord so that he enlightens those madmen and helps them understand that any desire to destroy Russia will mean the end of the world,” he added. The Patriarch’s remarks echo a statement by former Russian president Dmitry Medvedev on Thursday, who warned the countries that want to see Moscow defeated in Ukraine that nuclear powers such as Russia had “never lost a major conflict on which their fate depended.” Should such a nation lose a conventional war, such an outcome could trigger a nuclear conflict, he added. Earlier this month, the head of the Russian Church appealed to both Moscow and Kiev’s forces to establish a truce in the run-up to and during Orthodox Christmas on January 7 to give the faithful a chance to attend religious services. Hours later, the proposal was supported by Russian President Vladimir Putin, who ordered Moscow’s troops to stand down for 36 hours. The ceasefire, however, was rejected by Kiev, with Ukrainian officials dismissing the offer as “hypocrisy” and a military ruse.

“Europeans hate their elites. The spoilt elites may tell their peoples: ‘Let them eat cake’. But they have forgotten that what the people want is bread.”

• Going, Going, Gone: Fiddling While the West Burns (Batiushka)

Let us not forget that the conflict in the Ukraine is about the struggle of the United States to maintain its dinosaur’s status as the world’s last superpower. More exactly, it is about America’s attempt to destroy China as a rival. For since China, allied with Russia, is unbeatable, China has to be attacked through Eurasian Russia. In this crazed neocon video-game fantasy, the USA has overlooked Western Europe. In one sense that is understandable, since its leaders are just a pack of mindless Pavlovian dogs, intent on copying their master in Washington – and a pile of dollars greatly helps their salivating capacity for imitation. However, the US mistake is as usual to look only at its puppets. This was the same mistake as in Baghdad and Kabul, or for that matter in Tehran and Saigon, not to mention in Manila and a host of capitals in Latin America. Appoint an English-speaking yes-man, give him a Swiss bank account full of dollars and a US passport, ensure he has control over the capital and its TV and radio station and then you will control the whole country. Only Hamid Karzai didn’t and you won’t either.

Western Europe, the EU and the UK, with a few other bits and pieces, is also inhabited by 500 million people (the other 50 odd million belong to the elite). Some, especially from the elites, live in the capitals. The vast majority do not live there and generally despise those who do live in the capitals. Ask a Frenchman what he thinks of ‘les sales parisiens’ (filthy Parisians), ask a Romanian what he thinks of the elite in Bucharest, a Pole what he thinks of those in Warsaw or an Englishman what he thinks of Londoners. If you don’t believe me, ask Macron in France. Alternatively, ask any Frenchman what he thinks of France’s real rulers – the grossly overpaid super-elite in Brussels. The English hated them so much, they had Brexit. A lot of Germans, who by a huge majority never wanted to give up the Deutschmark, got quite jealous of that, even though the incompetent and perfidious British elite totally mishandled the Brexit negotiation process.

If in Western Europe, the vast majority don’t like their leaders, they will eventually – even the passive British – get rid of them and they will appoint leaders whom Washington does not like, Le Pen, Farage etc. Remember Orban? He is already in power, as is Erdogan (though he is in Turkey). The Ukrainian conflict is already reshaping Europe’s totally outdated (1945) security architecture and forcing a reconfiguration. The realignment will not be in Washington’s favour. Demonstrations against NATO are already starting in various European countries. But what is more likely to topple the US puppet elite is strikes and protests. Europeans hate their elites. The spoilt elites may tell their peoples: ‘Let them eat cake’. But they have forgotten that what the people want is bread.

Once Western Europe, including even the UK, has gone, the end of the short unipolar era will be here. The domino effect, from Kiev to Dublin, is surely only a matter of time. Remember the fall of the Berlin Wall in November 1989? Within twenty-five months the whole of the Soviet Eastern European Empire fell, one country after another, until in December 1991, the Soviet Union itself fell. Berlin to Vladivostok. Well, the time is now up for the American Empire in its turn. It will also fall, and for the same reasons. The SU (Soviet Union) went. So will its reverse, the US (United States). Red stars, white stars, they have both had their time. Keep your eyes on Western Europe.

Could have fooled me….

• World Economic Forum Wants You to Trust Them (ET)

One of the central themes of the World Economic Forum summit this week is “restoring trust”; this initiative comes at a moment when progressive corporate organizations such as the WEF are being scrutinized for violating U.S. antitrust laws. A WEF panel discussion called “Disrupting Distrust” featured speakers from Mastercard, the United Way, and Consumers International, as well as communications consultant Richard Edelman. It proceeded under the slogan: “Trust is at the heart of meaningful multi-stakeholder cooperation … Yet levels of distrust are higher than ever.” The panel was hosted by Kathleen Kingsbury, an opinion editor at The New York Times.

The discussion opened with a report from Edelman’s Annual Edelman Trust Barometer, which found that trust in government had declined substantially, leaving corporations as the most trusted institutions in society. Edelman also warned of a “growing mass class divide” in public opinion. The divergence of public opinion started in 2013 in the United States, France, and the United Kingdom, he said, and it has now “metastasized” to three-quarters of the countries in the world. Helena Leurent, director of Consumers International, said “economic pain” is the top issue causing mistrust. “The consumer is embattled,” she said, citing dramatic increases in food and fuel prices over the past two years. “The cost of living is the body blow.” “I find a lot of irony in this,” Joel Griffith, research fellow at The Heritage Foundation, told The Epoch Times.

“The energy crisis that we’re facing now across the world is a problem that by and large has been caused by the 50-plus world leaders that are gathered there, because almost in lockstep these world leaders, from [President Joe] Biden, to the European Union leaders, to our counterpart in Canada, have declared a long-term war on fossil fuels,” Griffith said. “They’ve created this energy crisis, they’ve created the inflation crisis, created the rising price trajectory, and they are not acknowledging responsibility.” Another topic on the trust agenda was what Edelman called the “battle for truth.” Rather than what had previously been the “Moses model,” in which truth is handed down from higher institutions to the masses, Edelman said, “now trust is local, in my employer and in my company and my CEO.” Speaking for The New York Times, Kingsbury said that “in journalism, we struggle with an issue of a lack of trust … particularly in our expertise.”

Tucker WEF

https://twitter.com/i/status/1615896188573700096

“the relationship between the number of posts from Russian foreign influence accounts that users are exposed to and voting for Donald Trump is near zero..”

• ‘Russiagate’ Is Dead, But Social Media Control Is Here To Stay (Livshitz)

Donald Trump’s time as president was dominated by years of mainstream news headlines declaring that his unexpected victory was attributable to Saint Petersburg’s Internet Research Agency (aka ‘The Russian IRA’). The company reportedly corralled online networks of bots and trolls that perpetuated pro-Trump propaganda in a bid to get the outsider elected at the Kremlin’s request. This narrative quickly became widely accepted among US liberals, and remains entrenched today – but a new study decisively shows it to be false. The paper, published in the respected academic journal Nature, investigates the exposure of Twitter users to alleged activity on the social media platform by the IRA during the 2016 US election, “and its relationship to attitudes and voting behavior.”

The study’s findings speak for themselves. For example, 70% of purported IRA-connected posts during that campaign were seen by just 1% of the network’s users, “who strongly identified as Republicans.” Coverage of these posts was moreover “eclipsed by content from domestic news media and politicians.” The academics also found “no evidence of a meaningful relationship” between exposure to these tweets, and “changes in attitudes, polarization, or voting behavior.” Alleged IRA posts seen on Twitter by users were “overshadowed – by an order of magnitude – by posts from national news media and politicians.” For every four IRA tweets published in the last month of the 2016 election campaign, 106 per day from national news media and 35 per day from US politicians were seen on average. In other words, 25 times and nine times more posts respectively.

The academics also probed whether there was any connection between exposure to alleged IRA posts and “changes in respondents’ positions on salient election issues” and political polarization, surveying them on “eight major policy issues salient during the election, and respondents’ self-reported political ideology.” They bluntly concluded that there were not “statistically significant relationships between exposure on any of the issue-based and polarization outcomes.”

Extensive data-based analyses were also conducted to “examine the relationship between exposure to Russian foreign influence accounts and vote choice.” Again, the conclusion couldn’t be more damning – “the relationship between the number of posts from Russian foreign influence accounts that users are exposed to and voting for Donald Trump is near zero (and not statistically significant).”

RFKjr

https://twitter.com/i/status/1615834413149065218

“..India’s purchases of Russian crude have increased year-by-year by a whopping factor of 33..”

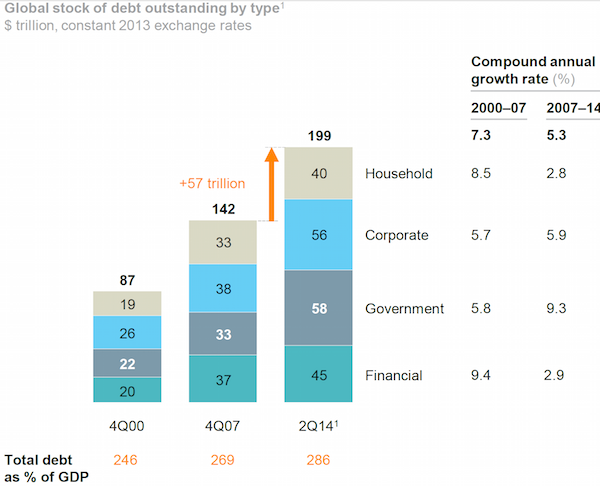

• Global South: Gold-Backed Currencies To Replace The US Dollar (Escobar)

First: One of the key take aways from the World Economic Forum annual shindig in Davos, Switzerland is when Saudi Finance Minister Mohammed al-Jadaan, on a panel on “Saudi Arabia’s Transformation,” made it clear that Riyadh “will consider trading in currencies other than the US dollar.”So is the petroyuan finally at hand? Possibly, but Al-Jadaan wisely opted for careful hedging: “We enjoy a very strategic relationship with China and we enjoy that same strategic relationship with other nations including the US and we want to develop that with Europe and other countries.”

Second: The Central Banks of Iran and Russia are studying the adoption of a “stable coin” for foreign trade settlements, replacing the US dollar, the ruble and the rial. The crypto crowd is already up in arms, mulling the pros and cons of a gold-backed central bank digital currency (CBDC) for trade that will be in fact impervious to the weaponized US dollar. The really attractive issue here is that this gold-backed digital currency would be particularly effective in the Special Economic Zone (SEZ) of Astrakhan, in the Caspian Sea. Astrakhan is the key Russian port participating in the International North South Transportation Corridor (INTSC), with Russia processing cargo travelling across Iran in merchant ships all the way to West Asia, Africa, the Indian Ocean and South Asia.

The success of the INSTC – progressively tied to a gold-backed CBDC – will largely hinge on whether scores of Asian, West Asian and African nations refuse to apply US-dictated sanctions on both Russia and Iran. As it stands, exports are mostly energy and agricultural products; Iranian companies are the third largest importer of Russian grain. Next will be turbines, polymers, medical equipment, and car parts. Only the Russia-Iran section of the INSTC represents a $25 billion business. And then there’s the crucial energy angle of INSTC – whose main players are the Russia-Iran-India triad. India’s purchases of Russian crude have increased year-by-year by a whopping factor of 33. India is the world’s third largest importer of oil; in December, it received 1.2 million barrels from Russia, which for several months now is positioned ahead of Iraq and Saudi Arabia as Delhi’s top supplier.

He’s been in charge for 20 years already.

• Economist: Turkey Could Be On ‘Brink Of Dictatorship’ (K.)

Turkish President Recep Tayyip Erdogan, or rather his shadow, has made the cover of this week’s issue of the Economist in a decidedly unflattering way, as a leader that has taken his country “to the brink of disaster.” As the introduction to the financial paper’s report on the state of the country ahead of presidential and parliamentary elections states, “Mr Erdogan’s behavior as the election approaches could push what is today a deeply flawed democracy over the edge into a full-blown dictatorship.” The Economist says Erdogan’s now 20-year-old reign was initially beneficial to Turkey: he mended the economy, neutralized the country’s meddling generals and secured, in 2005, the formal opening of accession talks to the EU, while putting his islamist agenda, which had alarmed the long-dominant secularist heirs to Kemal Ataturk, the Turkish Republic’s founder, mostly to the side.

But, as the paper points out, “the longer Mr Erdogan has been in power, the more autocratic he has grown.” Moving on from Prime Minister to President, he turned that mostly ceremonial post into a really powerful one in the service of an autocracy. “Approaching his third decade in power, he sits in a vast palace snapping orders at courtiers too frightened to tell him when he is wrong. His increasingly eccentric beliefs swiftly become public policy,” the article says. Erdogan once likened democracy to a tram journey: when you reach your destination, you get off. His treatment of mayor of Istanbul, Ekrem Imamoglu, whom the Economist calls the “most plausible rival” for the presidency is indicative. A 2-year prison term and a ban from politics for calling election officials who had annulled his first election “idiots” have taken Imamoglu out of the presidential race if the conviction is not annulled or overturned and have cast doubt that the election will be fair or free, the Economist says.

Internationally, Erdogan could cause trouble for Greece and Cyprus by “foment[ing] fiercer territorial quarrels; he could “create further confusion and strife in Syria”; he could “allow the 5m migrants and refugees in Turkey to set sail for southern Europe.” And he could continue to block the accession of Finaland and Sweden into NATO. Yet, the Economist contends, Erdogan cannot afford to make a total break with the West, because he needs investments and he needs armaments. But, the article argues, it is time for a firmer stance by western powers, beginning with the US. “Mr Erdogan is a bully who sees timidity as a reason to press his advantage and toughness as an incentive to mend fences,” the Economist says.

“On Thursday the walls of the Élysée palace must tremble..”

• Over 1 Million Workers Hit French Streets Against Macron’s Pension Reform (ZH)

President Macron’s retirement and pension reform program has unleashed the expected mass demonstrations, strikes, and likely soon to be riots on the streets of France. The much anticipated reform bill headed through parliament will see the official retirement age rise by two years, from the age of 62 to 64. And just like that, it’s popping off… as French authorities brace for more chaos in the coming weeks. Previously, the unions promised the “mother of all battles”. As a result, public transport has seen significant disruptions in service, while many schools are already closed, amid some 200+ well-attended protests all across France on Thursday. Various forms of public transport were brought to a standstill in Paris, Toulouse, Marseille, Nantes and Nice, due to the strikes, and the Eiffel Tower was closed to visitors as well as the protests spread.

Eight major unions had designated Thursday the “first day of strikes and protests” – with promises of many more to come. France’s education ministry said that over 40% of primary school teachers, as well as one-third of high school teachers are participating in the strikes, forcing many to close their doors for the day, and possibly weeks ahead. French rail authority SNCF reported a “severe disruption” across the country, with metro lines in the capital having to implement partial closures. “On some rail lines, as few as one in 10 services were operating, while the Paris metro was running a skeleton service,” BBC reported. A reported over one million people total are believed to have participated in Thursday’s protests and strikes, according to the unions, which plan to keep up the intense pressure until Macron’s bill is defeated.

Likely the demonstrations will get more and more radical and violent, as French protests tend to go… All the country’s unions – including so-called “reformist” unions that the government had hoped to win to its side – have condemned the measure, as have the left-wing and far-right oppositions in the National Assembly. “On Thursday the walls of the Élysée palace must tremble,” Communist Party leader Fabien Roussel said on Tuesday.In many places, crowds clashed with police, who deployed riot control measures including tear gas and batons, as they struggled to clear streets against vastly superior numbers.

“It looks bad — but the FBI got Hillary out of a worse legal tar pit.”

• How A Corrupt FBI Could Save Joe Biden In Classified-Docs Scandal (Bovard)

The White House is being whipsawed by the discovery of secret documents from President Joe Biden’s vice presidency recklessly stored around his garage, his Delaware house and his rented Washington office. The appointment of a special counsel to investigate Biden’s classified-document violations could imperil the president’s survival. But Biden may be saved by the charades the FBI concocted to rescue Hillary Clinton. But breaking news Tuesday night revealed the investigation may already be turning into a farce. Amazingly, the Justice Department is permitting Biden’s personal lawyers to control the evidence — without the FBI. Federal law penalizes the removal or mishandling of classified documents via “gross negligence” by up to 10 years in prison.

The number of clearly marked confidential documents discovered on Biden’s turfs is up to 20 — all of which were supposedly “inadvertently misplaced” (for at least six years), per White House Press Secretary Karine Jean-Pierre. It looks bad — but the FBI got Hillary out of a worse legal tar pit. Clinton’s presidential campaign was roiled by the disclosure she’d used an insecure private email server to handle top-secret documents while she was secretary of state from 2009 to 2013. In 2015, the FBI Counterintelligence Division opened a criminal investigation of the “potential unauthorized storage of classified information on an unauthorized system.” The FBI treated Clinton and her coterie like royalty worthy of endless deference, according to a 2018 report by the Justice Department inspector general.

The FBI agreed to destroy the laptops of top Clinton aides after a limited examination of their contents (including a promise not to examine any post-Jan. 31, 2015, emails or content). When BleachBit software and hammers were used to destroy email evidence under congressional subpoena, the FBI treated it as a harmless error. The IG criticized federal investigators for relying on “rapport building” with Team Hillary instead of using subpoenas to compel the discovery of key evidence. The IG recommended possible disciplinary penalties for five FBI employees who sent blatant anti-Trump texts (some of those agents later staffed special counsel Robert Mueller’s investigation of President Donald Trump). FBI investigators shrugged off every brazen deceit they encountered.

The IG report quoted an unnamed FBI agent responding to a fellow agent’s question on how an interview went with a witness who worked with the Clintons at their Chappaqua residence: “Awesome. Lied his ass off. Went from never inside the scif [sensitive compartmented information facility for classified documents] at res [residence], to looked in when it was being constructed, to removed the trash twice, to troubleshot the secure fax with HRC a couple times, to everytime there was a secure fax i did it with HRC. Ridic.” The agency waited until the end of the investigation in July 2016 to question Clinton and refused to videotape that crucial interview. Bizarrely, the FBI planned to absolve her “absent a confession” by Clinton during the interview, the IG report noted.

“Updated versions of the protocol list the same 15 adverse events. None of the conditions were included in the actual surveys.”

• CDC Knowingly Left Serious Adverse Events Off Post-Vaccination Surveys (ET)

The U.S. Centers for Disease Control and Prevention (CDC) didn’t include serious adverse events like heart inflammation on post-vaccination surveys even though the agency knew the issues could be linked to COVID-19 vaccines, documents show. Even before the surveys were rolled out in December 2020 after the first vaccines were authorized, the CDC knew that myocarditis—a form of heart inflammation since confirmed as being caused by the Pfizer and Moderna shots—and other serious adverse events were of “special interest” when it came to the vaccines, according to a newly disclosed version of the protocol for the survey system. The Nov. 19, 2020, protocol for V-safe, the survey system, lists myocarditis, stroke, death, and a dozen “prespecified medical conditions.”

The protocol was obtained by the Informed Consent Action Network (ICAN), a nonprofit that seeks transparency around health information. All of the conditions can cause severe symptoms. V-safe is a system of surveys that was introduced during the COVID-19 pandemic to monitor vaccine safety. It was developed and is managed by the CDC. Updated versions of the protocol list the same 15 adverse events. None of the conditions were included in the actual surveys. Respondents could check boxes if they experienced certain symptoms, but only 10 lower-level problems such as fever and nausea were listed as options.

“It’s deeply troubling that the CDC would construct V-safe in a manner that does not permit it to be able to easily assess the rate of harm from adverse events the CDC had already identified as potentially being caused by these products,” Aaron Siri, a lawyer representing ICAN, told The Epoch Times. “This calls into question what the CDC was really trying to accomplish with V-safe. Was it trying to assess the actual safety of these products? Or was it trying to design a system that would be more likely to affirm its previous public pronouncements regarding the safety of these products?”

“We’ve never had a situation where the federal government at very high levels is coordinating or coercing social media to do its bidding in terms of censoring people.”

• How the CDC Became the Speech Police (Soave)

Anthony Fauci, the federal government’s most prominent authority on COVID-19, had his final White House press conference two days before Thanksgiving 2022. The event served as a send-off for the longserving director of the National Institute of Allergy and Infectious Diseases, who was finally stepping down after nearly four decades on the job.Ashish Jha, the Biden administration’s coronavirus response coordinator, hailed Fauci as “the most important, consequential public servant in the United States in the last half century.” White House Press Secretary Karine Jean-Pierre described him as a near-constant “source of information and facts” for all Americans throughout the pandemic.

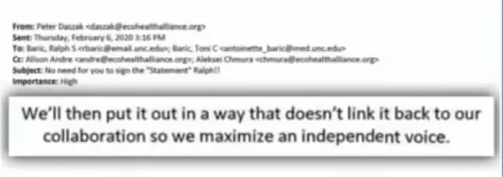

Indeed, the U.S. public’s understanding of COVID-19—its virality, how to prevent its spread, and even where it comes from—was largely controlled by Fauci and bureaucrats like him, to a greater degree than most people realize. The federal government shaped the rules of online discussion in unprecedented and unnerving ways. This has become much more obvious over the past few months, following Elon Musk’s acquisition of Twitter. Musk granted several independent journalists access to internal messages between the government and the platform’s moderators, which demonstrate concerted efforts by various federal agencies—including the FBI, the Centers for Disease Control and Prevention (CDC), and even the White House—to convince Twitter to restrict speech. These disclosures, which have become known as the Twitter Files, are eye-opening.

But Twitter was hardly the only object of federal pressure. According to a trove of confidential documents obtained by Reason, health advisers at the CDC had significant input on pandemic-era social media policies at Facebook as well. They were consulted frequently, at times daily. They were actively involved in the affairs of content moderators, providing constant and ever-evolving guidance. They requested frequent updates about which topics were trending on the platforms, and they recommended what kinds of content should be deemed false or misleading. “Here are two issues we are seeing a great deal of misinfo on that we wanted to flag for you all,” reads one note from a CDC official. Another email with sample Facebook posts attached begins: “BOLO for a small but growing area of misinfo.”

[..] Jay Bhattacharya and Martin Kulldorff, professors of medicine at Stanford University and Harvard University, respectively, have claimed that social media platforms repeatedly muzzled their opposition to lockdowns, mask requirements, and vaccine mandates. The New Civil Liberties Alliance, a public interest law firm that has joined the lawsuit, thinks the federal government’s campaign to squelch contrarian coronavirus content was so vast as to effectively violate the First Amendment. “What’s at stake is the future of free speech in the technological age,” says Jenin Younes, the group’s litigation counsel. “We’ve never had a situation where the federal government at very high levels is coordinating or coercing social media to do its bidding in terms of censoring people.”

“..many adverse events will go unrecorded, and this becomes more likely the longer the delay between treatment and the associated adverse reaction.”

• Safety Signals for Heart, Blood, Reproduction in Yellow Card Vaccine Data (DS)

The strength of the C-19VYC reporting scheme is that it is capable of generating an enormous amount of valuable information about adverse reactions to the experimental COVID-19 vaccines. Reports of suspected adverse reactions can be submitted not only by physicians but also by the recipients of the vaccines themselves, providing valuable feedback to the MHRA based on first-hand experience. This inclusive aspect of the C-19VYC reporting scheme has proved very successful, with nearly half a million adverse event reports submitted, roughly one for every hundred recipients of the COVID-19 vaccines in the U.K. Despite this strength in terms of quantity of data, the C-19VYC reporting scheme has a number of serious weaknesses related to the nature of the data collected.

These weaknesses place limits on the scheme’s ability both to detect and to measure safety signals. The first problem is that the scheme does not identify or include a control group of individuals, who have not taken the vaccine, against which to compare those who have. Other major weaknesses are that reporting is passive rather than planned and takes place at a single point in time. Thus, reporting relies on the sufferer of the adverse reactions or his or her physician making the connection between the vaccine treatment and the adverse reaction. As a consequence, many adverse events will go unrecorded, and this becomes more likely the longer the delay between treatment and the associated adverse reaction. Reporting rates of adverse reactions are also likely to represent only a fraction of actual cases because physicians or recipients may have too little time to fill out the onerous paperwork, may not have knowledge of the Yellow Card scheme, or may be unwilling to countenance the idea of harms resulting from a medication in which they have placed trust.

As well as being low, reporting rates are expected to vary substantially between different sectors of the population. Experience shows that females post roughly three times more adverse event reports than males, and the reporting rate for adverse reactions varies with age, dropping off in the elderly population where adverse reactions may be obscured by multiple forms of pre-existing chronic illnesses. In addition, reporting rates are likely to vary with the severity of the adverse reaction. Individuals are far more likely to have the motivation and tenacity to file a report if their adverse reaction is severe than if it is mild. On the other hand, if the adverse event results in death, grieving friends or relatives may be too preoccupied to file a C-19VYC report.

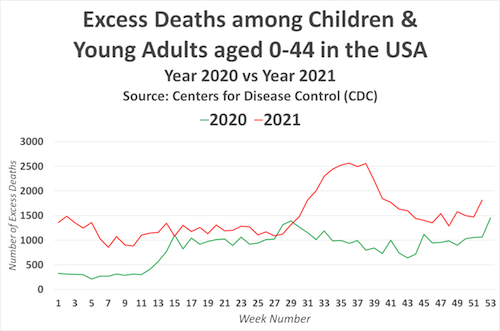

“..nearly half a million children and young adults died within a year of his fateful announcement with over 118,000 of those deaths suspected to be due to the Covid-19 vaccine..”

• Fauci Lied; 120,000 US Children Died (Exp.)

Time and time again throughout 2021, Dr. Anthony Fauci, stood at the podium, the bright lights of the cameras blinding him as he faced the nation. With a steady hand, he held up a vial of the Pfizer Covid-19 vaccine, promising it would be the key to protecting America and its children from the “deadly” Covid-19 disease supposedly ravaging the country. But little did the public know, the truth about the Covid vaccine’s safety had been buried deep within Fauci’s own lies and deceit and confidential U.S. Government and Pfizer documents. Fauci used propaganda, lies and manipulation to coerce parents into getting their children vaccinated.

But the weight of the lives lost has quickly come crashing down on him and the nation, as a secret Centers for Disease Control (CDC) report has revealed that nearly half a million children and young adults died within a year of his fateful announcement with over 118,000 of those deaths suspected to be due to the Covid-19 vaccine’s dangerous side effects. The CDC report should spark widespread outrage and be on the front page of every single major newspaper. But instead, it has been and will continue to be met with a deafening silence. Despite the staggering death toll the report will be buried and swept under the carpet.

The mainstream media, consumed with working overtime to distract the public with propaganda on the war in Ukraine, alleged climate change and the cost of living crisis, has paid and will pay no attention to the devastating consequences of Dr. Anthony Fauci’s deception. The public wil continue to be kept in the dark, and the U.S. Government will move quickly to cover up its own involvement in the tragedy. With Dr Fauci quietly announcing his “retirement” in August 2022. It’s all business as usual and simply just another day at the office. But it is also a shocking failure of transparency and accountability, and the people of the United States should be forever haunted by the lives lost due to the Covid-19 vaccine scandal.

“If Elon Musk successfully purchases Twitter, it could result in World War 3 and the destruction of our planet..”

• Twitter Files Show Authoritarian “Cult Of Identity” Controls The Media (Gurri)

Only yesterday, Elon Musk was a hero to progressives. He had made the electric car sexy and organized a migration to Mars to save humanity from the coming ecological apocalypse. Musk voted for Barack Obama twice and for Biden once. When he offered to purchase Twitter on April 14 of last year, he clearly believed he was reconnecting progressivism to its liberal roots. “For Twitter to deserve public trust it must be politically neutral, which effectively means upsetting the far right and the far left equally,” he said. Famously, Musk characterized himself as “a free speech absolutist.” But elites took that for a declaration of war and changed their tightly synchronized minds about the man. Twitter in the hands of Musk was “dangerous to our democracy,” said Democratic senator Elizabeth Warren.

“If Elon Musk successfully purchases Twitter, it could result in World War 3 and the destruction of our planet,” wrote David Leavitt. The White House expressed newfound concern about “the power of large social media platforms … over our everyday lives … tech platforms must be held accountable for the harm they cause.” Before Musk’s takeover, Twitter management had gone on record stating, “We do not shadow ban [i.e., secretly block users]. And we certainly don’t shadow ban based on political viewpoints or ideology.” Thanks to Twitter’s internal emails and messages released by Musk, we now know both claims were false. “Twitter employees build blacklists, prevent disfavored tweets from trending, and actively limit the visibility of entire accounts or even trending topics—all in secret, without informing users,” wrote journalist Bari Weiss. The targets were offenders against elite orthodoxy—a conservative activist, a right-wing talk show host, and a Covid-dissenting doctor, among others.

In December, Musk invited Weiss, Matt Taibbi, and Michael Shellenberger to examine the company’s internal Slack messages and emails. Taibbi and Weiss are fierce critics of establishment media; Shellenberger is a strong anti-establishment voice on energy and homeless policy. All are, in Weiss’ phrase, “politically homeless,” neither right nor left, but tend to write about aspects of the struggle between the elites and the public. Taibbi, Weiss, and Shellenberger are clear thinkers and good writers but two traits, in my opinion, separate them from the pack: independence and integrity. Musk could have bought himself a passel of hired hacks who would have churned out whatever spin he wished. With these three authors, he gave up control over the Twitter Files output in exchange for their ironclad credibility.

Lavrov

https://twitter.com/i/status/1616066295719677954

GoreWEF

https://twitter.com/i/status/1615808847544999941

https://twitter.com/i/status/1616132119549329408

Fetch

https://twitter.com/i/status/1615833809077010432

https://twitter.com/i/status/1613580927946592258

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.