Jack Delano Row houses, Baltimore 1940

“Once you bring the rapid change in major benchmark prices and a change in the architecture of the global financial system together, you could end up with outcomes that are pretty painful, and certainly unknowable.”

• Liquidity Drought Could Spark Market Bloodbath, Warns IIF (Telegraph)

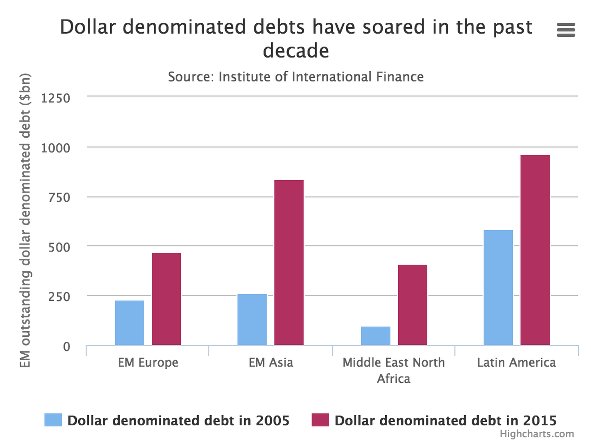

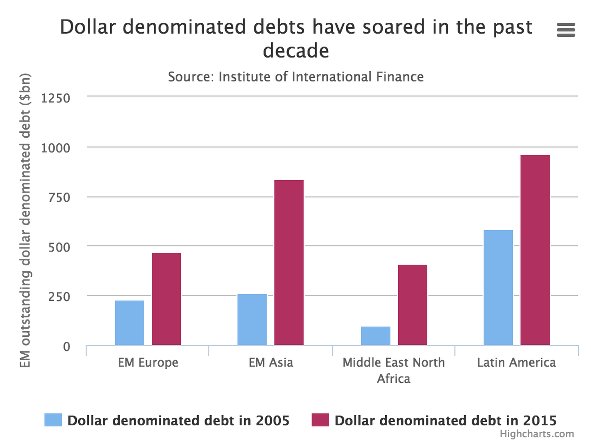

Investors face a “painful” adjustment in a world of evaporating liquidity and higher US interest rates that will trigger huge market swings with potentially catastrophic consequences, the Institute of International Finance has warned. Timothy Adams, the chief executive of the IIF, which represents the world’s biggest banks, described liquidity as the “top issue” at high level meetings of central bankers, chief executives and other financial institutions. He warned that the raft of regulation introduced in the wake of the 2008 crisis could potentially cause market gyrations larger than last October’s “flash crash” in US Treasuries. While Mr Adams supports tougher rules that have made the banks more resilient, he said a complex web of regulatory reform may have left banks less able to respond to the next crisis.

“There’s just less capacity for making markets,” he said. “Officials will say: we expect some volatility and this was part of this broader scheme of regulatory reform. But for the private sector there is this issue of: is the total effect of all of these various regulatory changes likely to produce outcomes larger than each individual regulatory reform and its consequences? “The cumulative unintended could end up being much larger than the one-off intended – we just don’t know.” Market liquidity, or the ease with which an investor can quickly buy or sell a security without moving its price, has evolved since the financial crisis. Investment banks, which traditionally supported liquidity in times of stress, have been shrinking their activities. Corporate bond inventories have fallen by 75pc in the US and 50pc in Europe since 2007, according to IIF data.

While much of this has been driven by banks unwinding large credit books, regulation has also discouraged them from holding large quantities of bonds that could help cushion violent swings in prices. Mr Adams said a “dramatic revolution” of the players and risks of market making had also pushed risk “out into the shadows” of non-bank lending. “We’ve rewired and re-engineered the global financial regulatory system and as a result we’re having profound impacts on institutional arrangements. At the same time we’ve had this rapid change in benchmark prices such as a 50pc drop in the price of oil, a rapid change in the dollar and other exchange rates and another drop in commodity prices,” he said. “Once you bring the rapid change in major benchmark prices and a change in the architecture of the global financial system together, you could end up with outcomes that are pretty painful, and certainly unknowable.”

Read more …

“..the very same investors who are buying today seem deeply concerned about their ability to get out tomorrow”

• “Nor Any Drop To Drink,” Citi Maps The Liquidity Paradox (Zero Hedge)

The lack of liquidity in corporate credit markets couldn’t come at a worse time. Yield-starved investors have been herded into corporate debt after central banks drove yields on risk-free assets into the ground, leaving market participants with little choice but to venture into IG and then into HY. Corporations have been more than happy to oblige by issuing record amounts of debt (the proceeds from which are plowed into buybacks) at what, to management teams, seem like bargain-basement borrowing costs, but what to investors look like great income-generating opportunities compared to the growing number of government bonds that actually have a negative carry. And so, with the entire financial universe suddenly fixated on liquidity (or a lack thereof), we bring you the following from Citi’s Matt King:

From the BIS to BlackRock, and Jamie Dimon to Jose Vinals, everyone seems to be talking about market liquidity. Chiefly they seem to be fretting about a lack of it. Primary markets might be wide open, thanks in large part to the largesse of central banks, but the very same investors who are buying today seem deeply concerned about their ability to get out tomorrow… We take issue with the widespread notion that the problem is solely due to regulators having raised the cost of dealer balance sheet, and could be ameliorated if only there were greater investment in e-trading or a rise in non-dealer-to-non-dealer activity.

To be sure, we see the growth in regulation – leverage ratio and net stable funding ratio (NSFR) in particular – as one of the main reasons why rates markets are now starting to be afflicted, and indeed we expect further declines in repo volumes to add to such pressures. But illiquidity is a growing concern even in markets like equities and FX, which use barely any balance sheet at all, and where e-trading is the already the norm rather than the exception. Instead, we argue that in addition to bank regulations, there is a broad-based problem insofar as the investor base across markets has developed a greater tendency to crowd into the same trades, to be the same way round at the same time.

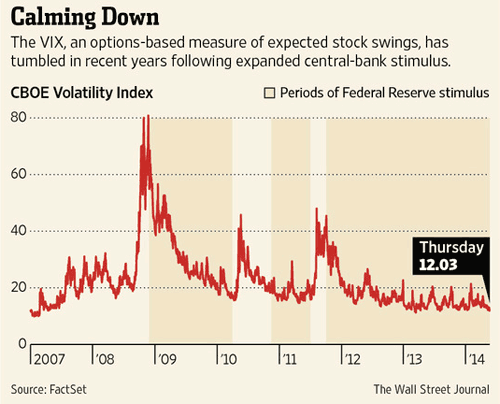

This “herding” effect leads to markets which trend strongly, often with low day-to-day volatility, but are prone to air pockets, and ultimately to abrupt corrections. E-trading if anything reinforces this tendency, by creating the illusion of lliquidity which evaporates under stress. To date, the air pockets and flash crashes represent little more than a curiosity, having mostly been resolved very quickly, and having had little or no obvious feed-through to longer-term market dynamics, never mind to the real economy.

But we think ignoring them would be a mistake. Each has occurred against a largely benign economic backdrop, with little by way of a fundamental driver. And yet with each one, investors’ nervousness about the risk of illiquidity is likely to have been reinforced. When the time comes that investors do see a fundamental reason all to sell – most obviously because they start to doubt the extent of central banks’ support – their desire to be first through the exit is liable to be even greater.

Read more …

“Despite the abject failure of Japan’s approach, the rest of the world remains committed to using monetary policy to cure structural ailments.”

• Economic Policy Turned Inside Out (Stephen Roach)

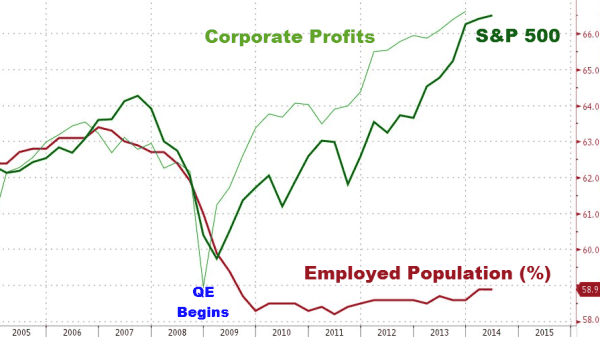

The world economy is in the grips of a dangerous delusion. As the great boom that began in the 1990s gave way to an even greater bust, policymakers resorted to the timeworn tricks of financial engineering in an effort to recapture the magic. In doing so, they turned an unbalanced global economy into the Petri dish of the greatest experiment in the modern history of economic policy. They were convinced that it was a controlled experiment. Nothing could be further from the truth. The rise and fall of post-World War II Japan heralded what was to come. The growth miracle of an ascendant Japanese economy was premised on an unsustainable suppression of the yen. When Europe and the United States challenged this mercantilist approach with the 1985 Plaza Accord, the Bank of Japan countered with aggressive monetary easing that fueled massive asset and credit bubbles.

The rest is history. The bubbles burst, quickly bringing down Japan’s unbalanced economy. With productivity having deteriorated considerably – a symptom that had been obscured by the bubbles – Japan was unable to engineer a meaningful recovery. In fact, it still struggles with imbalances today, owing to its inability or unwillingness to embrace badly needed structural reforms – the so-called “third arrow” of Prime Minister Shinzo Abe’s economic recovery strategy, known as “Abenomics.” Despite the abject failure of Japan’s approach, the rest of the world remains committed to using monetary policy to cure structural ailments. The die was cast in the form of a seminal 2002 paper by US Federal Reserve staff economists, which became the blueprint for America’s macroeconomic stabilization policy under Fed Chairs Alan Greenspan and Ben Bernanke.

The paper’s central premise was that Japan’s monetary and fiscal authorities had erred mainly by acting too timidly. Bubbles and structural imbalances were not seen as the problem. Instead, the paper’s authors argued that Japan’s “lost decades” of anemic growth and deflation could have been avoided had policymakers shifted to stimulus more quickly and with far greater force.

Read more …

They’ve voted without realizing the consequences.

• Most Greeks Want Euro Even With New Bailout Deal (Kathimerini)

The majority of Greeks want the country to stay in the eurozone should ongoing negotiations with foreign creditors fail, even if that means signing a new bailout deal, a new survey has found. Asked whether they want to keep the euro or return to the drachma, 66.5% said they preferred the common currency over 27% who would prefer a return to the nation’s old currency. A smaller majority, 55.5% over 35%, were in favor of euro membership if that entailed signing up to a new memorandum. The opinion poll by the research institute of the University of Macedonia was commissioned by Skai TV.

The survey also featured a breakdown by political party of those in favor of euro membership: 53.5% of SYRIZA voters want in, compared to 92.5 of New Democracy, 100% of To Potami and PASOK, 36.5 of Independent Greeks and 27.5% of Communist Party (KKE). Golden Dawn voters were evenly split, the poll said. On the prospect of a new memorandum as a prerequisite for euro membership, support among SYRIZA voters fell to 34 voters compared to 58% who would rather return to the drachma. Backing was at 95.5 among ND voters, 90 for PASOK, 83.5 for To Potami, 37.5 for Independent Greeks, 6 for KKE and 58.5 for GD.

Read more …

“I might not be right this year, but ultimately Greece will have to default..”

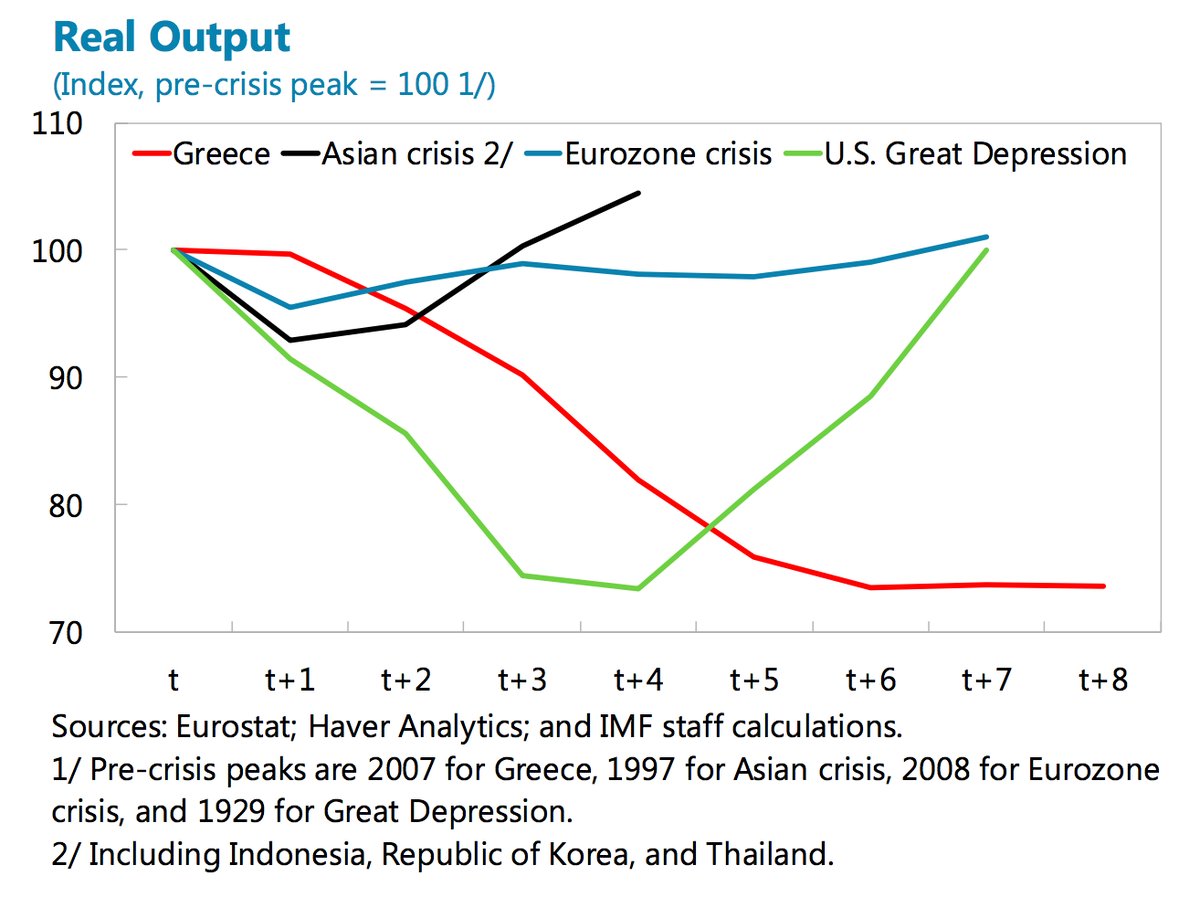

• Deal Or No Deal, Greece Still Faces Bankruptcy (CNBC)

Despite hopes that Greece and its lenders will come to some agreement in May, not everyone is convinced that a deal – which could unleash a last tranche of much-needed bailout aid – can resolve the country’s looming debt problem. Talks over reforms Greece has to make in return for aid continued this weekend after months of wrangling which have led to growing fears that the country could default, or even exit the euro zone – a scenario dubbed a “Grexit.” “I think the end of the road is still bankruptcy for Greece,” Steen Jakobsen, chief economist at Saxo Bank, told CNBC Monday. “Whether it becomes a Grexit is a different story but I think they’re just playing for time.” He added that the Greek problem likely had two solutions.

“(Firstly) by defaulting, which I think will happen in the bankruptcy case. Or you can grow yourself out of it,” Jakobsen said. “But in no shape or form is Greece willing or able to enact a program that is going to set growth in motion.” The comments come after several days of technical talks between Greece and the so-called Brussels Group, made up of the bodies overseeing Greece’s bailout program, the IMF, ECB and European Commission. On Monday, Greece’s Labour Minister Panos Skourletis told Mega TV that the country had chosen to meet its debt payments and reach an agreement with its lenders, Reuters reported. An agreement with lenders on reforms could see Greece receive a vital last tranche of bailout aid worth €7.2 billion that it desperately needs to make loan repayments to the IMF and ECB in the next few months.

The next key date for Greece and its lenders is the Eurogroup meeting of euro zone finance ministers on May 11, and Greece’s Prime Minister Alexis Tsipas hopes a deal can be reached by then. But comments by Labour Minister Skourletis reflected the stumbling blocks between Greece and its lenders over reforms. He said the IMF was unyielding on its demands for labour reforms, including pensions cuts, mass layoffs and resisting a plan by the leftist-led government to raise the minimum wage, Reuters reported. The Greek government, led by the leftist Syriza party, wants to relax austerity measures to ease financial pressure on the public, but its lenders insist that it must cut spending and adhere to austerity measures.

As discussions drag on, time is running out. Greece has a loan repayment of €744 million due to the IMF on May 12 and more repayments totaling over €1 billion in June. Against this backdrop of pressing repayments, Jakobsen said he believed that Greece would still have to default. “I might not be right this year, but ultimately Greece will have to default because the burden on the economy and corporations in Greece is so large that it’s impossible to sustain without deep-rooted reform, which certainly Syriza is not standing for,” he said.

Read more …

“..the euro and austerity are indissolubly linked..”

• France’s Far-Right Leader: EU Is Mocking Greece (CNBC)

France’s far-right Front National party leader, Marine Le Pen, has said that the tense talks over the debt deal with Greece has revealed the “real face” of European Union which has “brushed aside” the wishes of the Greek people. Le Pen, who described herself as a “ferocious” opponent to the EU, described the group as a “Euro dictatorship” and insisted that it was up to the Greek government to take responsibility of its future. “I think that Greece, by saying that it will not quit the euro, in reality it’s making promises that it cannot keep. For the simple reason that the euro and austerity are indissolubly linked,” Le Pen told CNBC.

Greece has been in talks with its euro zone creditors for months, as the country is running out of cash and needs a last tranche of bailout aid in order to meet debt repayments and to pay its domestic wages and pension bill this month. Greek Prime Minister Alexis Tsipras has reshuffled the team which is handling its fraught bailout negotiations, widely seen as a way to push outspoken Greek Finance Minister Yanis Varoufakis to the sidelines. “It (the EU) mocks and brushes aside the popular wish expressed in the Greek elections and it seeks to impose a policy of austerity, the continuity of policy of austerity which the Greek people no longer want. And confronted with the choice, who will win? Democracy or Euro-Dictatorship? It’s up to the Greek government to take up its responsibilities,” she said.

Read more …

Just two weeks ago, the IMF was playing the good cop part.

• IMF Takes Hard Line On Aid As Greek Surplus Turns To Deficit (FT)

Greece is so far off course on its $172bn bailout programme that it faces losing vital International Monetary Fund support unless European lenders write off significant amounts of its sovereign debt, the fund has warned Athens’ eurozone creditors. The warning, delivered to eurozone finance ministers by Poul Thomsen, head of the IMF’s European department, raises the prospect that it may hold back its portion of a €7.2bn tranche of bailout aid that Greece is desperately attempting to secure to avoid bankruptcy. Half of the €7.2bn, which is the subject of intense negotiations between Athens and its creditors in Brussels-based talks that resumed on Monday, is due to come from the IMF. Without the funds, Greece is expected to run out of cash this month.

Eurozone creditors, who hold the vast bulk of Greek debt, are adamantly opposed to debt relief. But IMF support is crucial both for its funds and to sustain political backing for the Greece bailout, particularly in Germany. According to two officials present at a contentious meeting of eurozone finance ministers in Riga last month, Mr Thomsen said initial data the IMF had received from Greek authorities showed Athens was on track to run a primary budget deficit of as much as 1.5% of gross domestic product this year.

Under existing bailout targets, Athens was supposed to run a primary surplus — government receipts net of spending, excluding interest payments on sovereign debt — of 3% of GDP in 2015.

With the large surplus now turning into a sizeable deficit, Greece’s debt levels would begin to spike again. This would force either Athens to take drastic austerity measures or eurozone bailout lenders to agree to debt write-offs to get Athens’ debt back on a sustainable path, the IMF believes. Officials said Mr Thomsen specifically mentioned the need for debt relief during the three-hour meeting. “The IMF thinks the gap between the two realities is very large right now,” said one senior official involved in the talks. He noted that both Athens, which was resisting new economic reforms, and eurozone creditors would probably fight the IMF on the issue.

Read more …

“The IMF is the most inflexible side … the most extreme voices of the Brussels Group..”

• Pension, Labor Disputes Dog Greek Talks As Cash Dwindles (Reuters)

Wide differences over pension and labor reforms continued to dog intensive negotiations between Greece’s leftist government and its international creditors despite progress in other areas as the country’s cash position becomes increasingly critical. Government spokesman Gabriel Sakellaridis sounded the alarm on Monday, saying that while Athens intended to meet all its payment obligations, including nearly 1 billion euros to the IMF in May, it needed fresh funds before the end of the month. “Liquidity is a pressing issue,” Sakellaridis told a news conference. “The Greek government is not waiting until the end of May for a liquidity injection. It expects this liquidity to be offered to the Greek economy as soon as possible.”

Labor Minister Panos Skourletis said the IMF, Greece’s second biggest creditor after euro zone governments, was insisting on tough policy conditions for an interim deal to unlock frozen bailout aid. The global lender was unyielding in demands for pensions cuts, rules to ease mass layoffs of private sector workers and opposition to a government plan to raise the minimum wage, Skourletis told Mega TV. “They are asking us to not touch anything (of the austerity measures) that have ruined Greek people’s lives in the last five years,” he said. “The IMF is the most inflexible side … the most extreme voices of the Brussels Group,” the minister said. “But there are also calmer voices.” Greece faces repayments to the IMF totaling 970 million euros by May 12. It has been borrowing from municipalities and government entities to meet obligations.

Intensive talks on an interim deal between a reshuffled Greek negotiating team and representatives of the European Commission, the European Central Bank and the IMF, renamed the “Brussels Group”, have been under way since last Thursday. A European Commission spokesman said the negotiators worked through the weekend. Talks were “constructive” but work remains, he said, declining to give details. The aim is to achieve a technical-level accord that would enable euro zone finance ministers to declare when they meet on May 11 that there is a prospect of concluding the bailout review successfully. That could give the ECB grounds to permit Greek banks to buy more short-term treasury bills, easing the government’s cash crunch.

Read more …

A very suggestive headline from the Guardian.

• Greece Vows To Pay Debts As It Awaits Handout From Creditors (Guardian)

Greece has vowed to honour heavy debt repayments over the coming weeks but says it is counting on international creditors to release billions of euros in rescue funds before the end of the month as crisis talks between the two sides grind on. But as the European commission described discussions over the long weekend as constructive, albeit with more work to be done, one Greek minister criticised the International Monetary Fund’s “extreme” demands for austerity cuts. Greece’s creditors are demanding reforms in exchange for bailout money, but the government of the prime minister, Alexis Tsipras, recently elected on an anti-austerity ticket, has said it will resist significant changes to pensions or the labour market.

On Monday, the Greek labour minister, Panos Skourletis, singled out the IMF as “inflexible” and “extreme”, saying the creditor was demanding pension cuts and opposing a government plan to raise the minimum wage. “They are asking us to not touch anything [of the austerity measures] that have ruined Greek people’s lives in the last five years,” Skourletis told Mega TV. “The IMF is the most inflexible side … the most extreme voices of the Brussels group” of creditors, he said. “But there are also calmer voices.” Greece owes money to the Brussels Group – the IMF, European commission and ECB – following its two bailouts in 2010 and 2012.

A further €7.2bn (£5.3bn) in bailout money is still to be paid out and fears are growing that without it Greece will default on its debts, potentially precipitating the country’s exit from the euro. The most pressing of its obligations are payments to the IMF totalling almost €1bn by 12 May. But Skourletis tried to sound a note of reassurance that payments would be met. “The country has chosen to pay its obligations and reach an agreement [with lenders]. We are trying to have the money,” he said.

Read more …

The IMF wants Europe to provide debt relief. And get paid in full itself.

• Pressure Grows In Greek Talks (Kathimerini)

As negotiations continue at the technical level in Brussels, Greek government officials have significant meetings planned on Tuesday in European capitals in a bid to tackle the country’s looming cash crunch even as the IMF raises the pressure. The IMF reportedly suggested that it would pull out of Greece’s loan program if steps are not taken to lighten the country’s huge debt burden. Of the €7.2 billion installment in pending aid that Greece has been seeking to secure from creditors, €3.5 billion is an IMF tranche. A report in Monday’s Financial Times said that IMF official Poul Thomsen warned eurozone finance ministers at a summit in Riga last month that Greece would post a primary deficit of up to 1.5% of gross domestic product.

This contrasts sharply with a target set by creditors of 3% of GDP which Greece wants to reduce to 1.5% of GDP. Billions of euros in measures would be required to plug the gap. But, according to the report, Thomsen underlined the need for debt relief. Shortly after reports that the IMF has upped the pressure in debt talks, Tsipras “discussed matters relating to the current negotiations” with the Fund’s chief Christine Lagarde, his office said. The development comes as Greece aims to seek a liquidity boost from another of its creditors, the European Central Bank. Deputy Prime Minister Yiannis Dragasakis is to meet with ECB President Mario Draghi in Frankfurt on Tuesday afternoon along with Euclid Tsakalotos, the alternate foreign minister who has been tasked with “coordinating” Greece’s negotiating team.

The visit comes just a day before the ECB’s governing council is to decide on whether to extend more emergency liquidity to Greece even as speculation mounts that the ECB will up pressure on Greece by increasing the haircut on collateral that is accepted in exchange for funding. Athens has a much more optimistic plan in mind: It aims to push the ECB to raise the ceiling on the amount of treasury bills Greece is allowed to issue. As Dragasakis and Tsakalotos meet with Draghi in Frankfurt, Greece’s Finance Minister Yanis Varoufakis is due in Paris Tuesday morning for talks with his French counterpart Michel Sapin. He is then to fly to Brussels for talks with European Economic and Monetary Affairs Commissioner Pierre Moscovici.

Read more …

“.. it also provides Greece with some bargaining power when they negotiate the primary surplus for this year and next.”

• Greek Talks Drag On as New EU Data Set to Underscore Crisis (Bloomberg)

Greece’s talks with international creditors dragged on as the European Commission prepares new forecasts that are expected to underscore the scale of the crisis facing the country’s government. While officials on all sides have reported progress, six days of talks have yet to provide the breakthrough Greece needs to guarantee the flow of liquidity to its banks. The prolonged cash squeeze is threatening the country’s fragile recovery, with a person familiar with the talks saying that the Commission is likely to slash its growth and budget estimates when it releases new figures on Tuesday. The fiscal noose is tightening after weeks of brinkmanship and Prime Minister Alexis Tsipras needs to show European officials that he’s willing to find a compromise if he’s to head off the risk of capital controls.

At the same time, the weakening economic outlook may give his negotiating team more leeway to argue that Greece can’t meet the budget targets demanded by its creditors. “Greek economic conditions are deteriorating quite fast,” said Frederik Ducrozet at Credit Agricole in Paris. “It’s negative in terms of the fiscal revenues and the backdrop for the negotiations. But it also provides Greece with some bargaining power when they negotiate the primary surplus for this year and next.” In a sign that leaders are stepping up the drive for an agreement, Greek Deputy Prime Minister Yannis Dragasakis will meet ECB President Mario Draghi in Frankfurt on Tuesday. In Paris, Finance Minister Yanis Varoufakis will have a meeting with his French counterpart Michel Sapin.

European Commission President Jean-Claude Juncker dismissed the notion of a Greek exit from the euro and said Tsipras had to take into account the other countries in the currency. “Grexit isn’t an option,” Juncker said in a televised speech in Leuven, Belgium. In February, the Commission forecast economic growth of 2.5% this year and a primary budget surplus at 4.8% of gross domestic product. Greece argues that such a surplus target is unachievable and says a goal of 1.5% is more realistic. Greece’s banks need some signs of progress in the Brussels talks, as the ECB keeps the liquidity they need for survival on a tight leash. A breakdown could prompt the ECB to raise the haircut it demands on Greek collateral as soon as May 6, a decision which would risk pushing the country further toward financial chaos.

Read more …

What a douche: “..the government of Mr. Samaras was doing the right things, [and] those who were contesting these right things won the elections..” ‘Right things’=misery.

• Juncker: If Greece Leaves, Anglo-Saxons Will Try To Break Up Eurozone (EurActiv)

European Commission President Jean Claude Juncker said that if Greece left the single currency area, the “Anglo-Saxon world” would try everything to break it up. Speaking at the Catholic University of Leuven on May 4, Juncker made it clear that a ‘Grexit’ was not an option, because it would be an existential threat to the 19-member economic and monetary union. Juncker, who chose French to deliver his 40-minute speech at the Flemish university, said: “The world wants to know which way we are going. We should make sure that everyone understands that the economic and monetary union is irreversible, that the euro is a currency that is here to stay, which is not going to be abolished or suspended. “

Juncker added that he had discussed the issue the same day with former Greek Prime Minister Antonis Samaras, who was also present at the event. “Grexit is not an option. If Greece would accept it, if the others would accept it, that the country would exit the zone of security and prosperity constituted by the eurozone, we would be exposed to huge danger, because the Anglo-Saxon world would do everything to try to decompose, at a regular rhythm, by (the) sale, apartment by apartment, of the eurozone,” he said. Later, in the Q&A session, Juncker returned to the issue, speaking this time in English.

“We have to know that Greece was misbehaving in the past, that the government of Mr. Samaras was doing the right things, that those who were contesting these right things won the elections. Now they are confronted with their election promises, and we have to deal with that,” he said, referring of the leftist government of Alexis Tsipras. “My concern is not the Greek government. My concern is the Greek people. We don’t have the right to deal with the Greek people as if they were the neglected part of Europe. The Greek people have great dignity. This is a great nation, although being from time to time a weak state, and we have to show solidarity with the Greeks. And the [present] Greek government has to know that at the level of the eurozone, we have to deal with 19 democracies, not only with one, not only with Greek democracy,” he said.

One of the questions referred to the UK, and the push of the present government to renegotiate its status in the EU. “I want a fair deal with Britain, but Britain is not in a situation to impose its exclusive agenda to all the other member states of Europe”, Juncker said. “I’m a strong defender of the freedom of movement of workers”, he continued, alluding to the rhetoric against workers from the Eastern European countries in the UK . He added: “This is a basic principle of the EU laid down in the Treaty of Rome. So the British are kindly invited to present a list of their requests, we’ll take this under exam, with friendly attention, and then we will see. I don’t want Britain to leave the EU, but I don’t want the EU to follow an exclusive British commandership.”

Read more …

Hunger and healthcare. That’s the real Greek crisis.

• Greece Plan Health Booklets For The Uninsured (Kathimerini)

Health Minister Panayiotis Kouroublis on Monday unveiled a plan aimed at helping some 2.5 million uninsured citizens gain access to free healthcare. Under Kouroublis’s plan, which is expected to be enforced by next month, millions of uninsured citizens will be able to apply for health booklets at Citizens’ Information Centers (KEPs). Greeks and immigrants who are legally resident in Greece will be eligible, as will children and pregnant women irrespective of their legal status. Apart from free access to medical assistance and drugs, uninsured patients will also be able to undergo health tests at state hospitals.

Alternate Administrative Reform Minister Giorgos Katrougalos, who also attended Monday’s press conference, said the new reform was a crucial one “that we have to do, whatever the cost.” Kouroublis said Greece’s crisis had created deep inequalities in society which a leftist government cannot accept. The government’s plan is to be put up for public consultation until May 11. Then, once the best of the proposed improvements have been applied, a biministerial decision will be signed, paving the way for the legislation to be implemented. Although existing Greek law allows uninsured citizens access to health services free of charge, many hospital units and public services interpret the legislation in varying ways and so the law is not always enforced.

Read more …

The bankrupt casino that buys the west.

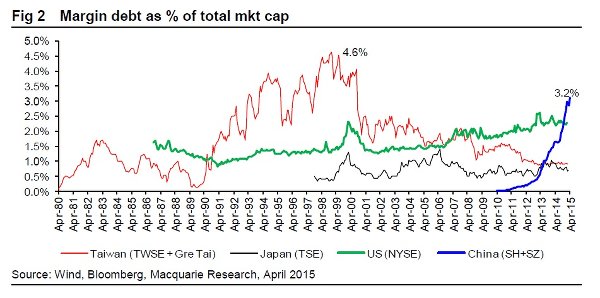

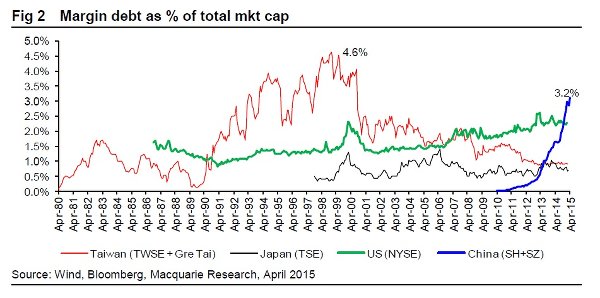

• China’s Crazy Stock Market, Charted (Bloomberg)

The Financial Times reports that every one of the 29 IPOs that took place in Shanghai and Shenzhen last month have risen by the daily limit each day since. Meanwhile, the Shanghai Composite Index is up a delirious 39% so far this year, while the CSI 300 Index has gained 35%. For many Chinese investors, that is some tantalizing price action. Openings of Chinese brokerage accounts have surged in recent months as has the take-up of margin accounts which offer investors the ability to borrow against their stock portfolios.

How high could the whole thing go, you ask? The Macquarie analysts estimate that, at an extreme, investors could borrow RMB 85.7 for every RMB 100 of collateral in their portfolios. That suggests the theoretical ability to increase margin finance loans from the current 1.7 trillion yuan to as much as 9.4 trillion yuan, or 461% higher than the current level. While it’s doubtful that would ever happen (banks, after all, do not have unlimited lending capacity and the government has already instituted some curbs on margin lending) even a moderate increase in margin borrowings could be meaningful. At 3.2% of total market cap, China’s margin debt has already eclipsed bubble-era Japan as well as pre-Asian Financial Crisis Korea.

Read more …

“The central bank nominally has a “strict separation” between supervisory and monetary-policy operations.”

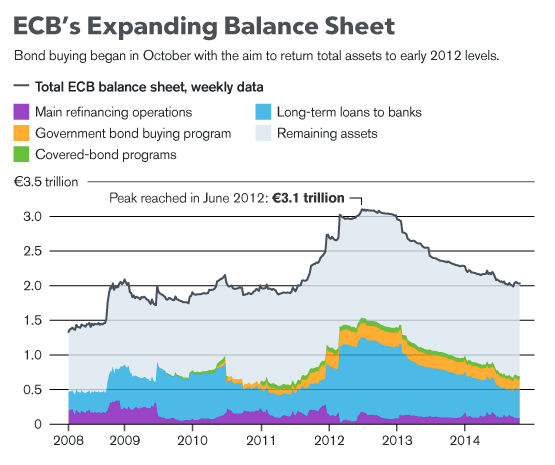

• ECB Said to Consider Delegating Powers to Ease Oversight Burden (Bloomberg)

The ECB is considering delegating more power to its supervisory arm to avoid monetary-policy makers becoming entangled in low-level details, said people familiar with the matter. Since assuming oversight of the euro area’s largest lenders in November, ECB officials have come to the conclusion that the legal requirement for each decision to be seen by the 25-member Governing Council isn’t sustainable, the people said, asking not to be named as the deliberations aren’t public. An ECB spokesman declined to comment. The discussions highlight the Frankfurt-based institution’s struggle to incorporate fresh responsibilities after 16 years of focusing on price stability. They may also provide ammunition to critics of the current set-up who want the Single Supervisory Mechanism to be split off entirely.

The SSM expects to take around 6,000 decisions a year across 19 countries on topics including capital plans and approval of bank management – all of which must pass through the Governing Council. One option being considered is ‘umbrella decisions’ that can cover multiple cases, two of the people said. Officials may make adjustments after a planned review of procedures due by the end of this year. The ECB was given responsibility for banking supervision by European Union leaders in 2012, as the first pillar of a Banking Union to mitigate future financial crises. Under the leadership of France’s Daniele Nouy, the SSM has aggressively pursued its mandate, scrutinizing bank balance sheets in an unprecedented review last year and pushing for higher capital levels.

Even so, the watchdog’s powers are effectively limited by the EU regulation written as the SSM was hastily constructed. That document must comply with Article 129 of the EU’s basic treaty, which states that the decision-making bodies of the ECB are the Governing Council and the Executive Board. It’s unlikely that the ECB will seek to change the treaty or even amend the SSM regulation, two of the people said. Instead, lawyers are examining how the rules can be adjusted to fit with existing laws, they said. SSM officials are anxious to avoid conflicts with the monetary-policy side of the ECB and have erred on the side of legal prudence with regard to the running of the institution, one of the people said. The central bank nominally has a “strict separation” between supervisory and monetary-policy operations.

Read more …

Not chasing the bottom is so yesterday.

• Australia Cuts Benchmark Interest Rate to Record Low 2% (AP)

Australia’s central bank on Tuesday cut its benchmark interest rate to a record low of 2% in a bid to jolt the nation’s economy which is weighed by falling commodity prices and weakening demand from China. The Reserve Bank of Australia’s quarter percentage point rate cut was the first in three months. Before the last cut in February, the interest rate had been steady at 2.5% since August 2013. Economists largely anticipated the move, although some thought the bank would hold off until after the government released its budget next week for the fiscal year beginning July 1. Resource-rich Australia managed to avoid a recession during the global financial crisis thanks to a decade-long mining boom.

But with the economy weakening in China, which is Australia’s largest export market, prices for commodities such as iron ore and coal have dropped. RBA Governor Glenn Stevens said in a statement the global economy was expanding at a moderate pace, but commodity prices have declined over the past year, in some cases sharply. “Looking ahead, the key drag on private demand is likely to be weakness in business capital expenditure in both the mining and non-mining sectors over the coming year,” Stevens said. Public spending is also expected to be subdued. The economy was therefore likely to be operating with a degree of spare capacity for some time yet.

The central bank forecast inflation to remain within the target range of between 2 and 3% over the next one to two years, even with a lower exchange rate. “Low interest rates are acting to support borrowing and spending, and credit is recording moderate growth overall, with stronger lending to businesses of late,” Stevens said. The Australian dollar has declined sharply against a rising U.S. dollar over the past year, though less so against a basket of currencies. “Further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices,” Stevens said.

Read more …

Good!

• All The British Parties Are Eurosceptic Now (Münchau)

The aftermath of the British elections is one of the most pressing issues on the minds of EU policy makers. It ranks some distance behind a breakdown of the Minsk II ceasefire agreement in Ukraine, but some way ahead of a sudden Greek exit from the eurozone. Yet British voters do not return these attentions. Astonishingly, given the importance of this Thursday’s elections for Britain’s future in the EU, Europe has played hardly any role in the debate. What I can predict with some degree of confidence is that the outcome of these elections will have a profound effect on Britain’s future membership of the EU. The trouble is that the effect is hard to calculate – no matter who wins. A British exit from the EU is possible under virtually any election outcome.

David Cameron has promised an in-out referendum in 2017 if the Conservative party wins. If, instead, the Tories form a coalition with the more pro-European Liberal Democrats, the odds of a referendum are less clear. It would depend on the outcome of coalition negotiations that have yet to take place. The Labour party is viewed as, on the whole, more pro-EU than the Conservatives. That is true, but misleading. Labour has not chosen to raise the EU as a central election issue either. Of the 83 pages of the Labour party’s manifesto, the EU occupies little more than a single page – on page 76. That section consists of a very odd compilation of statements and proposals. I get the sense that I am spending more time summarising them than they spent writing them.

The short passage asks for less austerity and more budget discipline at the same time. It wants a “red card mechanism” to allow national parliaments to veto EU legislation. The overarching goal is “to change the EU in the best interests of Britain” and “to protect our national interest”. There is no mention of the EU’s interest, something that the social democratic parties of continental Europe nowadays commit to as well. Naturally, Labour rules out joining the euro. If you were reading this without knowing anything about the party and its history, you might conclude that there was a greater degree of overlap between Labour’s manifesto and that of the National Front in France, than with centre-left parties elsewhere in the EU.

To a continental European, this reads like a profoundly eurosceptic programme. If you ask people in Britain and the rest of the EU whether they support reform of the EU, the majority would say yes. But they mean opposite things by these assertions. What Labour has in common with the Conservatives, but not with social democrats and socialists in continental Europe, is support for returning certain EU powers to national parliaments.

Read more …

Brand doesn’t remember Tony Blair.

• Russell Brand Has Endorsed Labour – And The Tories Should Be Worried (Guardian)

He has nearly 10 million Twitter followers; his YouTube interview with Ed Miliband received well over a million hits and counting; he is listened to by hundreds of thousands of disillusioned Britons, particularly young people who have been repeatedly kicked over the last few years. Russell Brand matters. And however much bluff and bluster the Tories now pull – maybe more playground abuse from David Cameron, who called Brand a “joke” – his endorsement of Labour in England and Wales will worry them. More people have registered to vote than ever before: between the middle of March and the deadline to register, nearly 2.3 million registered, over 700,000 of them 24 years old or younger. In countless marginal seats, disillusioned voters who were either going to plump for a protest party or not vote at all could well decide whether we are ruled by David Cameron, George Osborne and Iain Duncan Smith for another half a decade.

Naturally, Brand’s endorsement is being portrayed as a giant U-turn, and sure enough, he has abandoned his “no vote” stance. But Brand has been on a very public political journey, previously indicating his support for voting for Scottish independence and Syriza in Greece. He has been supportive of the Greens, and still calls on the people of Brighton Pavilion to return Caroline Lucas to parliament. And it isn’t quite as big a U-turn as you might think. Brand has thrown his support behind grassroots struggles, particularly over housing. He believes that change “comes from below, movements putting pressure on governments”, but if those in power are resolutely hostile, then there are limitations to what such pressure can achieve.

He’s not advocating a vote for Labour because he’s become a born-again Milibandite, but because he believes Labour are far more amenable to pressure than Tories who will happily shred the welfare state, the NHS, social housing and workers’ rights. When Ed Miliband met Brand, the comedian-cum-activist explained, he made it clear he “welcomes and wants pressure from below”. Brand is sometimes bizarrely portrayed as the cause of voter disengagement: obviously, it’s our political and media elites who are responsible for that. But actually he is a symptom. He achieved such traction because he summed up how millions of people already felt. He has won the ear of a section of the population that practically no other public figure has.

Read more …

She should resign over this.

• Intelligence Scandal Puts Merkel in a Tight Place (Spiegel)

July 14, 2013 was an overcast day. The German chancellor was reclining in a red armchair across from two television hosts with the country’s primary public broadcaster. With Berlin’s Spree River flowing behind her, Angela Merkel gave her traditional summer television interview. The discussion focused in part on the unbridled drive of America’s NSA intelligence service to collect as much information as possible. Edward Snowden’s initial revelations had been published just one month earlier, but by the time of the interview, the chancellor had already dispatched her interior minister to Washington. Having taken action to confront the issue, Merkel was in high spirits. Merkel’s interviewers wanted to know exactly what data had been targeted in Germany.

Reports had been making the rounds, they reminded her, of “economic espionage.” Merkel sat quietly. “So, on that,” she said, “the German interior minister was clearly told that there is no industrial espionage against German companies.” Only a few hundred meters away from the red armchair, though, more was known. In Merkel’s Chancellery, staff had long been aware that the information provided by the United States wasn’t true. By 2010 at the latest, the Chancellery had received indications that the NSA had attempted to spy on European firms, including EADS, the European aerospace and defense company that is partly owned by German shareholders. They also knew that the Americans were seeking to join forces with Germany’s foreign intelligence agency, the Bundesnachrichtendienst (BND), in their spying efforts.

It would be astonishing if Merkel herself had not known about these occurrences long before she sat down for the interview. Indeed, she would look even worse had she not known. Officially, the chancellor is in charge of oversight of foreign intelligence and Merkel has an entire department in the Chancellery responsible for formulating the BND’s assignments, managing them and, most importantly, keeping an eye on the agency. But the Chancellery wasn’t just sloppy in exercising this oversight. It failed completely. As such, the scandal surrounding NSA spying, and the evident cooperation between the BND and the NSA, is an affair for Chancellor Merkel, as well. An online report by SPIEGEL triggered the latest intelligence service scandal a week ago Thursday.

SPIEGEL reported that the NSA had made massive efforts to target and spy on German and European targets using BND facilities. Despite having had indications for years, the Chancellery had essentially done nothing to stop it. The scope of the affair became increasingly apparent over the past week. It now appears that the NSA, via its cooperation with the BND, didn’t just spy on companies, but also on politicians and institutions in Europe. The conclusion can be drawn from search criteria the Americans supplied to their German partners. The German Federal Prosecutor’s Office is now reviewing whether there is “initial evidence for a criminal offense that would fall under our jurisdiction.” Within the federal public prosecutor’s jurisdiction is the prosecution of crimes relating to espionage and treason.

Read more …

Thad can be wonderfully angry.

• Frankly My Dear, I Don’t Give a Damn (Thad Beversdorf)

I find it shocking how often I have people tell me the Constitution is out of date and is no longer relevant or necessary. Then there are the vast majority of people that think about the Constitution the same way they think about religion; it makes us feel good to believe in it and we’ll even worship it on a holiday or two. The reality is that those who seem to get very worked up to the point that they are willing to act in defense of the Constitution even against the highest levels of government make up a very small minority of Americans. This is a real problem. You see if people gave a damn the government couldn’t get away with negating the Constitution.

But the vast majority of people just don’t give a damn and so the government very easily provides ridiculous and false legal sounding arguments to explain away why they have become a higher law than the Constitution. Now I’ve tried to understand why it is that we Americans are so damn apathetic about everything the government and government officials do. Let me give a couple examples for which our apathy just boggles my mind. We know they took us into wars on false pretenses resulting in the wrongful deaths of thousands of American soldiers and hundreds of thousands of innocent civilians and yet we’ve prosecuted no one.

Hell they’ve admitted to hacking into millions of our home webcams and downloading videos and pictures of us in our most private moments and maintaining those downloads on government servers and then sharing these files with foreign governments. But because today’s American is simply a shell of a citizen none of the criminal atrocities creates even a stir from us. Sure we all read about these atrocities and we are angered in the moment but it passes rather quickly and we fall back into our self induced ignorant bliss. Only two things can get Americans to formidably rise up. The first is a very direct and immediate impediment to our comfort. For example try cutting back on the monthly social welfare checks. You’ll have riots. The second way is if the mainstream media relentlessly instructs us to be upset about a particular issue. Outside of that there is absolutely nothing the new American won’t move past like water off a duck’s back.

Read more …

“The first thing I would do as Prime Minister is evacuate all the children that are in the contaminated areas.”

• Fukushima’s “Caldrons of Hell”: 300 Tons of Highly Radioactive Water Daily (GR)

Yauemon Sato, the ninth-generation chief of a sake brewery operating here since 1790 [and president of electric power company Aizu Denryoku] likens the crippled reactors at the Fukushima No. 1 nuclear power plant to “caldrons of hell.” In a recent interview with The Asahi Shimbun, Sato said the nuclear disaster “continues to recur every day”… Excerpts from the interview follow: Question: What drives you to be so active, including in the use of renewable energy?

Sato: You know the caldron of hell? You will be sent to hell and will be boiled in that caldron if you do evil. And there are four such caldrons in Fukushima… And the disaster has yet to end. It continues to recur every day. More than 300 tons of water, contaminated with intense levels of radioactive substances, are being generated every day… Hiroaki Koide, professor at Kyoto Univ. Research Reactor Institute (retired), Apr 24, 2015:

11:30 – The Prime Minister [said Fukushima] had been brought to a close. My reaction on hearing his words was, ‘Stop kidding.’ Reality is, though 4 years have passed, the accident has not yet been brought to a close at all.

15:15 – What is the situation within the core? How much has melted? Where is the fuel exactly? We do not know… This is an accident of a severity that cannot be imagined anywhere else… As you can see, we are facing a very, very difficult situation. The only choice that we have open to us is to somehow keep the situation from getting worse.

30:30 – We are in a very terrible situation, I would even call it a crisis.

55:30 – The Japanese government has issued a declaration that this is an emergency situation. As a result, normal laws do not have to be followed. What they are saying is that, in these very high radiation exposure level areas, they have basically abandoned people to live there. They’ve actually thrown them away to live there… The Cs-137 that’s fallen onto Japanese land in the Tohoku and Kanto regions, so much so that this area should all be put under the radiation control area designation [the Kanto region includes Tokyo and is home to over 40 million people].

1:01:00 – I really do want to impress upon you that the accident effects are continuing.

1:02:00 – Bahrain’s Ambassador to Japan: If you were the Prime Minister of Japan, what are you going to do with this very complicated situation?… Koide: When you have an emergency legally declared, regular laws are put on hold. What that means is people can be thrown away into areas where normally people should not be… The first thing I would do as Prime Minister is evacuate all the children that are in the contaminated areas.

Read more …

It would be good if the Windsors adopt that baby, set up a college fund etc. Who am I kidding?

• The Other Royal Baby Was Born on the High Seas (Daily Beast)

She’s not a princess. We don’t even know her name. But the image of this child swaddled in a hazmat suit has brought tears of joy and pain to millions of Italians. Around the time Prince William and the Duchess of Cambridge, then in the early stages of labor, hopped into their armored Land Rover and headed to the Lindo Wing of St. Mary’s Hospital in London on Saturday morning, another pregnant woman started her own journey towards motherhood. We know well the minute details of the royal princess’s birth; but we believe the second baby girl born over the weekend has a story worth telling, too. She was delivered onboard the Italian Navy’s patrol boat Bettica after her mother was rescued from a rubber dinghy with hundreds of other migrants several hours after they left the Libyan coastline.

The Italian Navy says the young mother was already in labor when smugglers forced her onto the rubber boat on the Libyan coast. In the absence of an easel or trumpet like the ones brought out for the royal princess, after the migrant baby girl was born the Italian Navy doctors swaddled her in a disposable hazmat suit (used to try to protect the wearer from dangerous chemicals and infections) and tweeted her picture as a sign of hope. The Italian press have dubbed her “rose petal.” We don’t yet know the migrant mother’s name, her nationality or why she felt that crossing the perilous Mediterranean Sea to Europe was worth such a risk for her and her unborn child. She arrived in Pozzallo, Sicily, on the Bettica on Monday along with 654 people who were saved from four sinking vessels over the weekend.

The mother will be processed and questioned, and both she and her infant daughter will be given basic medical care and a checkup before being moved to a refugee camp somewhere in Italy. If they are lucky, they will get to spend a few nights in a hospital. Unlike the Duchess of Cambridge who left St. Mary’s ten hours after giving birth, a hospital stay probably sounds like a luxury for the migrant mother after all she has been through. We don’t know if the baby’s father was with her, or if he was one of the ten men who died over the weekend during which 6,771 migrants were saved from the sea.

The migrant baby doesn’t have a name yet, either. But the Italian press have dubbed her “rose petal.” She is one of now thousands of babies and children who survived the crossing this year so far. Italy’s branch of Save The Children says there has been a 60% increase in minors and pregnant women arriving by sea over last year. Of course that means that of the estimated 1,750 people who have died making the deadly crossing since the beginning of the year, many are likely to be children and hopeful mothers, too.

Read more …