Dorothea Lange Saturday afternoon, Pittsboro, North Carolina Jul 1939

No doubt the plans are being laid out in secret.

• Father Of The Euro Fears EU Superstate By The Back Door (AEP)

The euro’s founding father has warned that Europe’s latest plan for an EMU-wide finance ministry is a dangerous attempt to smuggle through political union, and breaches the basic tenets of modern democracy. Professor Otmar Issing, the chief architect of monetary union through its early years, said it would be “dangerous” to transfer control over tax and spending to the EU federal level before full political union has been established first on democratic foundations. Such a quantum leap in the constitutional structure of Europe – effectively the creation of an EU superstate, with a parliament comparable in power to the US Congress – is unthinkable in the current political atmosphere. It would require referenda across Europe, and a two-thirds majority in both houses of the German parliament.

“The chances of political union are close to zero,” he said, speaking at the Ambrosetti forum of world policymakers on Lake Como. If Europe were to jump the gun and force the pace of integration, this would lead to a rogue plenipotentiary with unbridled powers over sensitive issues of national life. “It is hard to see how it could be given democratic accountability,” he said. Prof Issing, a towering figure in the pre-EMU Bundesbank and the ECB’s first chief economist, said control of budgets must for now be left to national government and sovereign parliaments that are genuinely answerable to their own peoples. “Political union cannot be obtained in the European Union by the back door. It is a violation of the principle of no taxation without representation, and represents a wrong and dangerous approach,” he said.

Prof Issing was making a clear allusion to the American Revolution and the events that led up to the English Civil War in the 1640s, two great struggles triggered by a monarchical assault on the parliamentary power of the purse. The early democracies of Europe were all rooted in legislative control over spending. The proposals for an EMU finance ministry emerged in a paper by the heads of the Commission, Council, Parliament, Eurogroup, and ECB in June, a document known as the “Five Presidents Report”. It will start with an advisory European fiscal board and a strategic investment fund with enhanced powers, clearly a finance ministry in embryo. It will graduate towards a “euro area Treasury” from 2017 onwards, anchored in the EU treaties.

The report says that the new machinery will be established on a “lasting, fair and democratically legitimate basis”, and is in many ways a soul-searching admission that the EMU project has gone badly wrong, leading to bitter divisions. Yet critics warn that the EU is once again putting the cart before the horse. They point to the same fundamental errors that have led to perma-crisis in monetary union and spawned populist revolts across much of the EU. Prof Issing has always been open to an authentic United States of Europe similar to the US federal democracy. What he objects to is a deformed halfway house where supra-national bodies take decisions behind closed doors. The euro may survive “for a period” under its current structure, but it will break apart if the principles of monetary union are permanently violated. “Pacta sunt servanda (Agreements must be kept),” said Prof Issing.

Something tells me it’s going to take many meetings. And the outcome will be a huge disappointment. Perhaps we passed peak humanity a while ago and didn’t notice.

• UN Agencies ‘Broke And Failing’ In Face Of Ever-Growing Refugee Crisis (Guardian)

The UN’s humanitarian agencies are on the verge of bankruptcy and unable to meet the basic needs of millions of people because of the size of the refugee crisis in the Middle East, Africa and Europe, senior figures within the UN have told the Guardian. The deteriorating conditions in Lebanon and Jordan, particularly the lack of food and healthcare, have become intolerable for many of the 4 million people who have fled Syria, driving fresh waves of refugees north-west towards Europe and aggravating the current crisis. Speaking to the Guardian, the UN high commissioner for refugees, António Guterres, said: “If you look at those displaced by conflict per day, in 2010 it was 11,000; last year there were 42,000.

This means a dramatic increase in need, from shelter to water and sanitation, food, medical assistance, education. “The budgets cannot be compared with the growth in need. Our income in 2015 will be around 10% less than in 2014. The global humanitarian community is not broken – as a whole they are more effective than ever before. But we are financially broke.” Recent months have seen severe cuts to food rations for Syrian refugees in Lebanon and Jordan as well as for Somali and Sudanese refugees in Kenya. Darfuris living in camps in Chad have been warned that their rations may end completely at the end of the year. UN-run healthcare services have also been closed across a large part of Iraq, leaving millions of internally displaced people without access to healthcare.

Guterres warned that the damage being done by these cuts would be impossible to reverse. “We know that we are not doing enough, we are failing the basic needs of people. “The situation is beyond irreparable. If you look at the number of children who will see their lives so dramatically impacted by malnutrition and lack of psychosocial support, you will see this is already happening.”

Commodities trading.

• Europe Debates Migrant Quota Buyout Plan (FT)

European Commission officials are debating a proposal that would allow some EU countries to pay money in order to opt out of a mandatory quota system for accepting refugees, in a plan that could ease a stand-off between eastern and western members over how to relieve Europe’s migrant crisis. Some eastern states have balked at being forced to accept mandatory numbers, under a plan to divide 160,000 migrants across the region to be announced on Wednesday by commission president Jean-Claude Juncker. They argue that voluntary targets allow member states to provide better care to people looking to settle in Europe. “We are ready to share the burden and take responsibility, but only if we have control over the situation,” said Poland’s minister for Europe, Rafal Trzaskowski.

Over the summer a harrowing exodus of people from the Middle East, Africa and Afghanistan has leapt to the top of Europe’s political agenda, and led to a quadrupling of the EU’s resettlement target from 40,000 people in July. Commission officials and eastern diplomats stressed that the plan would only allow countries to take temporary “time-outs” from any expanded quota regime, in exchange for payments to a fund supporting refugees. “It creates an opportunity for voluntary decision making,” said an eastern EU official. “If they do it with penalties, then that is a bad idea. But if there is a system where you contribute financially to helping the problem in a different way, then that is much more palatable.”EU officials stressed that any opt-out would also have to be justified by “objective reasons” — for example Poland’s desire to have contingency plans in place to accept large numbers of refugees from Ukraine if the conflict there worsens.

Month, year, decade, you name it.

• Get Ready For A Real Lousy Month In The Stock Market (MarketWatch)

Investor sentiment has suffered with the recent correction and is not likely to improve in the short term, setting stocks up for a volatile September as international concerns overshadow domestic ones. Stocks took a big hit last week with the Dow Jones dropping 3.3%, the S&P 500 shedding 3.4%, and the Nasdaq falling 3%. International factors are feeding market volatility more than any other domestic factor, according to Brad McMillan, chief investment officer at Commonwealth Financial. McMillan said that Germany’s weak manufacturing orders report likely had more to do with Friday’s selloff than the jobs report’s effect on a September rate increase from the Federal Reserve.

What could affect the Fed’s decision is a continued stock market selloff. McMillan said if investors come back from the Labor Day holiday and decide to take risk off the table, the S&P 500 could break down through 1,870 as low as 1,790. If that happens, then the likelihood for a September rate increase falls below 50%, he said. “We’ve got another month or so before confidence bounces back,” McMillan said. “A lot of damage has been done to sentiment.” Others believe the correction still has a ways to go, with one indicator showing that investor sentiment has fallen to “panic” levels. Citi Research’s Tobias Levkovich said his Panic/Euphoria model, which brings together such indicators as short-interest ratios, margin debt, compiled bullishness data, and put/call ratios, broke into “panic” territory for the first time since late 2012.

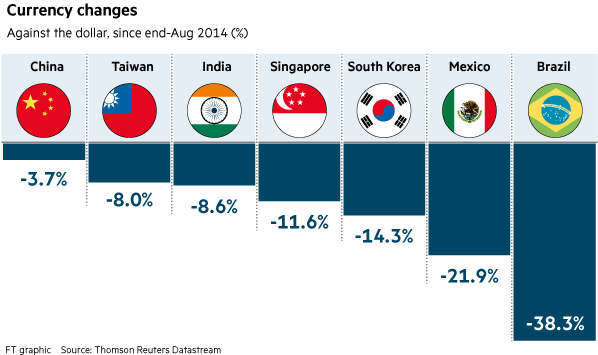

“..the dollar value of foreign currency reserves held by all developing nations ballooned by almost $7 trillion in just one decade to a peak of some $8.05 trillion by the middle of last year.” It was $1.05 trillion 10 years ago….

• Forex Reserves Unwind Could Reverse Global Bond Supercycle (Reuters)

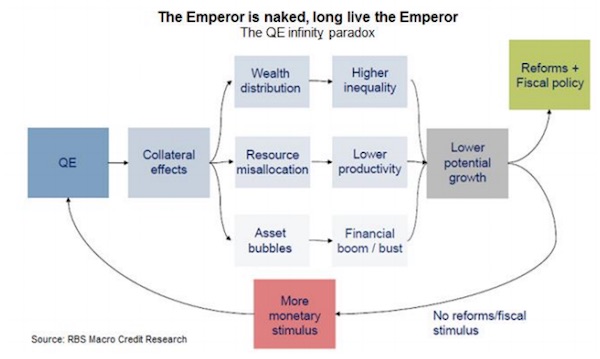

China’s summer shock may mark the end of an era of globalization that helped define world markets for more than a decade. Investor anxiety about the consequences is well-founded. Beijing’s integration into the global economy since 2002 reshaped the financial as well as economic landscape – mainly by the way China itself and the economies it supercharged with outsize demand for raw materials banked the hard cash windfalls they earned over the following 12 years. According to the IMF, the dollar value of foreign currency reserves held by all developing nations ballooned by almost $7 trillion in just one decade to a peak of some $8.05 trillion by the middle of last year.

While China was the main driver, accounting for about half of that increase, its economic boom created a commodity supercycle that flooded the coffers of resource-rich nations from across Asia to Russia, Brazil and the Gulf. As the vast bulk of this hard cash was banked in U.S. Treasury and other low risk, rich-country bonds, they were at least one critical factor in the halving of U.S. Treasury and other Group of Seven government borrowing costs over the same period. Alongside the disinflationary impact of China’s low cost labor on western goods imports and wages, this reserve stash helped extend what has now been a 20-year bull market in bonds.

What’s more, the drop in yields, by skewing relative returns between stocks and bonds and also the relative cost of capital for companies, also at least partly underwrote a post-credit crisis surge in equity prices to successive records. Reverse that bond buying, even at the margin, and world asset markets may have a major problem. That’s especially so at a time when the big other marginal bid for bonds, the U.S. Federal Reserve’s quantitative easing program, has ended and when western recoveries are pressuring the Fed and others to normalize near zero interest rates.

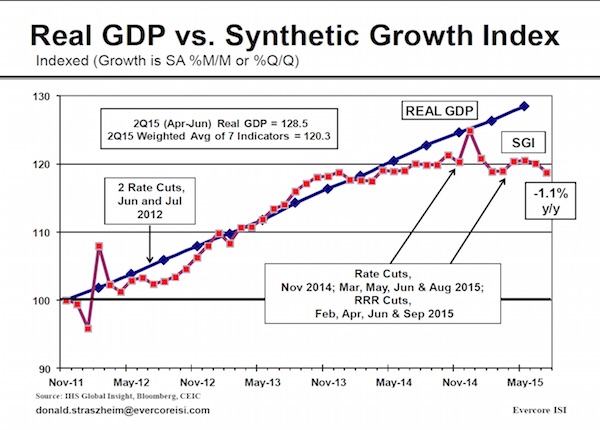

How much longer can China keep up the pretense?

• Capital Flight Now The Big Concern For Slowing China (FT)

Last month, Dalian Wanda, one of the most outward facing corporates in China, bought the organiser of the Ironman triathlons from a US private equity firm for $650 million. Meanwhile, Anbang Insurance, another company with similar global aspirations, looked less likely to succeed in its courtship of the Portuguese authorities in the hope of purchasing the remnants of a troubled financial conglomerate in Lisbon — precisely because the Chinese already have purchased so many assets there. At the same time, Chinese tourists continue to flood destinations like Japan, purchasing luxury goods which have become ever more inexpensive as a result of the steady appreciation of the Chinese currency, with the intention to sell them back home for a tidy profit.

It is hard to know what represents prudent diversification and what constitutes capital flight on the part of Chinese groups and wealthy travellers. But for those who track capital outflows from China, the distinction does not much matter. In the four quarters to the end of June, such outflows, (which do not include debt repayment) have totalled more than $500 billion according to data from Citigroup. China’s mountain of foreign reserves, once around $4 trillion, are now down to less than $3.7 trillion and are expected to drop further to $3.3 trillion by the end of the year, Citi calculates. Not long ago, it seems that the world was awash in cheap dollars. Many of those cheap dollars could be traced to the generous monetary policies of the Federal Reserve.

But many of them also came from the mainland as Chinese recycled their dollar earnings from the sale of exports abroad. Chinese capital flowed into everything from farms in Africa to ports in Sri Lanka and Pakistan, to dairies in New Zealand, energy firms in Canada and Treasuries in the US. More recently China started undertaking massive new, and expensive initiatives including the Asian Infrastructure Investment Bank, the New Development Bank, its Silk Route projects and a recapitalisation of the two policy banks that help recycle its reserves.

Suddenly, though, the question has shifted from what China will do with all the capital that flowed in and its arguably excessive reserves to whether it has enough money and adequate reserves at all. “It is neither the sell-off in Chinese stocks nor weakness in the currency that matters most,” notes George Saravelos, a currency strategist in London with Deutsche Bank. “It is what is happening to China’s FX reserves and what this means for global liquidity. The People’s Bank of China’s actions are equivalent to an unwind of QE or, in other words, Quantitative Tightening.”

Shanghai down another 2.52% today.

• China Freezes Outbound Investment Quotas as Outflows Hurt Yuan (Bloomberg)

China refrained from granting new quotas for residents to invest in overseas markets for a fifth month in August, the longest halt in six years, as authorities seek to stem weakness in the yuan. The State Administration of Foreign Exchange, which has approved 132 local institutions to put as much as $89.99 billion in offshore assets via its Qualified Domestic Institutional Investor program, hasn’t granted new allocations since March. Quotas for overseas investors to access domestic capital markets rose $16.4 billion to $140.3 billion in the period, data from the regulator show. The yuan traded 1.5% weaker outside of China than inside the country on Monday, indicating depreciation pressure.

China is trying to open its capital account enough for the yuan to win reserve status from the International Monetary Fund, while trying to curb an exodus of funds from an economy expanding at the slowest pace since 1990. Chinese investors are seeking to diversify in overseas assets after the Shanghai Composite Index of shares tumbled 39% from this year’s peak on June 12. The yuan slumped 3.6% in Shanghai and 4.9% in Hong Kong in the past 12 months. “Interest is there but whether the money can leave in the short term is the problem,” said Thomas Kwan, Hong Kong-based chief investment officer at Harvest Global Investments Ltd., whose Chinese unit offers QDII funds. “To avoid triggering excessive yuan outflows, I don’t think regulators would grant additional QDII quotas in the short term.”

Stand up act. Very funny people, the Chinese.

• China Revises Down 2014 GDP To 7.3% From 7.4% (CNBC, Reuters)

China’s National Bureau of Statistics on Monday revised down 2014 gross domestic product (GDP) growth to 7.3% from a previously reported 7.4%. This growth revision comes on the back of comments by China’s Finance Minister Lou Jiwei over the weekend that GDP growth will remain around 7% in 2015, as predicted earlier in the year, and the new economic normal may last for four to five years. A lower GDP number for 2014 should also make year-on-year comparisons for economic growth in 2015 more favorable. GDP stood at 63.6 trillion yuan ($10.00 trillion) last year, down by 32.4 billion yuan from the initial estimate, Reuters reported, citing the statistics bureau.

“China revises growth data every year, but it’s usually upwards. In that regard, it is unusual that the revision was downwards,” said Dariusz Kowalczyk, senior economist and strategist at Credit Agricole. “Rationally speaking, a 0.1% revision isn’t a big deal – and it doesn’t tell us much about the Chinese economy, but when it comes to sentiment, this is a negative development,” he said. The government will not particularly care about quarterly economic fluctuations and maintain steady macro-economic policy, Lou said, according to a statement late Saturday on the People’s Bank of China website. China is headed for its slowest economic expansion in 25 years in 2015 and mainland markets have slumped 40% since mid-June, sending global financial markets skittering.

“Like a zoo,” Mr. Hadad said. “Like we are dogs.”

• As Europe Grasps for Answers, More Migrants Flood Its Borders (NY Times)

Along Hungary’s border with Serbia, the scene was anything but smooth. “While Europe rejoiced in happy images from Austria and Greece yesterday, refugees crossing into Hungary right now see a very different picture: riot police and a cold, hard ground to sleep on,” Barbora Cernusakova, an Amnesty International researcher, said in a statement released by the group. The new camp in Roszke was being called a “reception center” by Hungarian officials, though the police on the scene referred to it as an “alien holding center.” Both migrants and relief groups were reporting harsh treatment and a hostile reception from the border authorities. On the Serbian side, officials temporarily blocked at least some trains headed north, amid numerous reports of the police demanding bribes to allow the migrants to pass.

Photos on social media from the new camp showed the police with dogs guarding a desolate compound surrounded by high fences. Omar Hadad, 24, from Dara’a, Syria, had been at a nearby camp along the border before he was shifted on Sunday to one west of Budapest, in the town of Bicske. “The Hungarian police came into the camp and they beat me with batons,” he said of his time in the holding center near the Serbian border. He peeled off his socks to show a bruised foot and leg. Journalists were not allowed into the Bicske camp, but the migrants could come out or speak across the entrance gate. Several other migrants rushed toward Mr. Hadad when they saw him displaying his wounds.

“Here, here, look,” said Salam Barajakly, a student from Damascus who began counting off the wounds and scars on his arms, legs and neck that he said he had gotten on the journey to Hungary, some by accident, some from the police, some from crawling under razor-wire fences. Two men held out smartphones showing videos of the camp where they had been held near the Serbian border. Hundreds of people squatted in the dust while the police tossed sandwiches and bottles of water to them over a barbed-wire fence. “Like a zoo,” Mr. Hadad said. “Like we are dogs.”

And that’s just the Catholics. But let’s see the response.

• Pope Francis Calls On European Parishes To House Up To 500,000 Refugees (WaPo)

In a statement that could have far-reaching implications, Pope Francis called on all Catholic parishes and monasteries in Europe to each house one refugee family that has fled “death from war and hunger.” “Every parish, every religious community, every monastery, every sanctuary of Europe, take in one family,” the pope said during his customary Sunday address, the news agency Agence France-Presse reported. He also said the Vatican will welcome two families of refugees. There are about 122,000 Catholic parishes in Europe, according to a study conducted by Georgetown University and published in June. If each of them housed one refugee family consisting of three to four people, about 360,000 to 500,000 refugees could be accommodated in the coming months.

It is unclear, however, whether all parishes will accede to the pope’s wish. In addition, housing refugees in parishes would have little bearing on the strict policies in countries such as France that have left desperate refugees — fleeing conflict and persecution — with limited options when they make their way to European shores. Addressing thousands of people in St. Peter’s Square on Sunday, Francis provided few details about his call to accommodate refugees, many of whom are not Catholics. The pope called his idea a “concrete gesture” ahead of a “year of mercy” that starts in December. The announcement, nevertheless, could relieve some of the countries that have taken in a large share of the refugees who have recently arrived in Europe, such as Germany or Sweden.

If all of Germany’s 12,000 parishes responded favorably to the pope’s demand, they alone could house a total of more than 30,000 refugees, according to Reuters. However, Germany expects about 800,000 refugees to apply for asylum in the country by the end of the year. The pope’s push resembles other, smaller initiatives already popular in the country. Some Germans have invited refugees to stay in their homes for free as authorities confront increasing difficulties in their bid to provide adequate apartments and reception centers. Many refugees are still housed in tent camps, and it is unclear whether alternative housing can be provided before winter arrives, as WorldViews reported earlier.

“They all knew about it … but they just let it go.”

• ‘If This Is Your Idea Of Europe, You Can Keep It’ (CNBC)

“If this is your idea of Europe, keep it for yourself.” Thus spoke an irate Matteo Renzi, Italy’s Prime Minister, during an E.U. Council meeting last June as his East European colleagues refused any obligation to accept some of the thousands of Middle Eastern and African refugees lucky enough to reach alive the Greek and the Italian shores. More than two months later, there is still no unified E.U. policy on how to resettle the growing waves of refugees overwhelming Italy, Greece, Serbia and Hungary. In the middle of all that, some European leaders say they are defending Europe’s Christian values with barbed wires and overcrowded railway cars stuffed with suffocating people – the chilling images reminiscent of the darkest chapters in European history.

Viktor Orbán, Hungary’s Prime Minister, and a self-proclaimed defender of the “Christian Europe,” is justifying such acts by saying that “Europeans are scared because they see that their leaders have completely lost control of the situation.” Along with hundreds of thousands of refugees during the recent Balkan wars, and close to a million of refugees and displaced people from Ukraine’s eastern provinces, this latest human tragedy is emblematic of E.U.’s inability to respond to any major challenges – to say nothing of its inability to anticipate such extraordinary events. And that is not for lack of institutional infrastructure. The E.U. Commission has people in charge of everything – economic, social and foreign policy issues, including even the “specialists” writing the rules and procedures for cheese manufacturing.

The refugee crisis is not a sudden emergency. It is a disaster that has brewed over the past three years. The U.N. confirmed last Friday that it repeatedly warned the E.U. Commission of the coming influx of refugees from war-torn areas of Africa and Middle-East. This horrendous case of ineptitude and mismanagement will remind some of the European “shock” at “discovering” in 2009 that many euro area countries had been violating for years the monetary union’s fiscal rules, and that some of them had totally lost control of their banking systems. How was it possible that nobody knew about that? Jean-Claude Trichet, the former President of the ECB had the answer: “They all knew about it … but they just let it go.”

Can you then blame an angry German Chancellor Angela Merkel for roiling the markets with incendiary statements and imposing debilitating austerity policies to punish the fiscal transgression and banks’ mismanagement in a number of euro area countries? Yes, you can. As a key euro area member, Germany had the responsibility to help enforce the fiscal and financial treaty obligations binding the countries where the euro serves as a legal tender. Anger and vindictiveness are no substitutes for anticipating problems and applying proper policies.

Amen. Even a failed Canadian politician can oversee this.

• The Refugee Crisis Isn’t a ‘European Problem’ (Michael Ignatieff)

Those of us outside Europe are watching the unbelievable images of the Keleti train station in Budapest, the corpse of a toddler washed up on a Turkish beach, the desperate Syrian families chancing their lives on the night trip to the Greek islands — and we keep being told this is a European problem. The Syrian civil war has created more than four million refugees. The United States has taken in about 1,500 of them. The United States and its allies are at war with the Islamic State in Syria — fine, everyone agrees they are a threat — but don’t we have some responsibility toward the refugees fleeing the combat? If we’ve been arming Syrian rebels, shouldn’t we also be helping the people trying to get out of their way? If we’ve failed to broker peace in Syria, can’t we help the people who can’t wait for peace any longer?

It’s not just the United States that keeps pretending the refugee catastrophe is a European problem. Look at countries that pride themselves on being havens for the homeless. Canada, where I come from? As few as 1,074 Syrians, as of August. Australia? No more than 2,200. Brazil? Fewer than 2,000, as of May. The worst are the petro states. As of last count by Amnesty International, how many Syrian refugees have the Gulf States and Saudi Arabia taken in? Zero. Many of them have been funneling arms into Syria for years, and what have they done to give new homes to the four million people trying to flee? Nothing. The brunt of the crisis has fallen on the Turks, the Egyptians, the Jordanians, the Iraqis and the Lebanese.

Funding appeals by the United Nations High Commissioner for Refugees have failed to meet their targets. The squalor in the refugee camps has become unendurable. Now the refugees have decided, en masse, that if the international community won’t help them, if neither Russia nor the United States is going to force the war to an end, they won’t wait any longer. They are coming our way. And we are surprised? Blaming the Europeans is an alibi and the rest of our excuses — like the refugees don’t have the right papers — are sickening. Political leadership from outside Europe could reverse the paralysis and mutual recrimination inside Europe. The United Nations system to register refugees is overwhelmed. Countries like Hungary say they can’t resettle them all on their own. The obvious solution is for Canada, Australia, the United States, Brazil and other countries to announce that they are willing to send processing teams to Budapest, Athens and the other major entry points to register refugees and process them for admission.

Countries will set their own targets, but for the United States and Canada, for example, a minimum of 25,000 Syrian refugees is a good place to start. (The United States’ recent promise to take in 5,000 to 8,000 Syrian refugees next year is still far too small.) Churches, mosques, community groups and families could agree to sponsor and resettle refugees. Most of the burdened countries — Hungary, Greece, Turkey, Italy — would accept help in a heartbeat. Once these states take a lead, other countries — including those wretched autocrats in the Gulf States — could be shamed into doing their part.

Somewhat plausible.

• Refugee Flow Linked To Turkish Policy Shift (Kath.)

A sharp increase in the influx of migrants and refugees, mostly from Syria, into Greece is due in part to a shift in Turkey’s geopolitical tactics, according to diplomatic sources. These officials link the wave of migrants into the eastern Aegean to political pressures in neighboring Turkey, which is bracing for snap elections in November, and to a recent decision by Ankara to join the US in bombing Islamic State targets in Syria. The analyses of several officials indicate that the influx from neighboring Turkey is taking place as Turkish officials look the other way or actively promote the exodus. According to one Greek official, security fears are a key reason for Turkey’s encouragement of migrant flows.

“Turkey is facilitating or at least is not hampering the movement of illegal immigrants toward Greece, thinking that in this way it will limit the risk of a possible new terrorist attack on its territory as a reprisal for the military operations it has carried out on Syrian soil,” the official said. Another diplomat said Turkey wants to create a “dead zone” on its border with Syria that would allow the Turkish military to freely move against jihadists and Syrian Kurds. “This is why it is encouraging, or at least not obstructing, the movement of refugees from camps near the Syrian border to the Aegean and Greece,” he said.

Hungary is largely a nation of former refugees.

• Hungarian Official Admits Campaign To Generate Hate Against Migrants (EurActiv)

A Hungarian official indirectly admitted that the poster campaign ordered by the government last summer to discourage immigrants from coming into the country was aimed at generating hate towards them. Anti-immigration posters put up by the Hungarian government have sparked political controversy since June, featuring slogans such as “If you come to Hungary, you cannot take away Hungarians’ jobs”, and “If you come to Hungary, you have to respect our culture!”

Strangely enough, the posters can hardly be understood by migrants, because they are written in Hungarian. The posters – widely ridiculed on social media – were part of a larger anti-immigration campaign driven by Prime Minister Viktor Orban in response to a surge in asylum seekers. The campaign included a public questionnaire linking migration to terrorism and blaming EU policies for the influx of refugees.

But now a Hungarian official has admitted that the posters were in fact aimed at instigating hate against the migrants. Gergely Prohle, substitute state secretary of EU affairs in the Ministry of Human Resources, started by saying that the radical football hooligans did not become radical due to the country’s poster campaign. Then he added that Hungarian society displayed vast solidarity with the refugees, and if the poster campaign did have the desired effects on our society this would not be so.

Next year?!

• Merkel Seeks $6.7 Billion for Refugees NEXT YEAR! (Bloomberg)

German Chancellor Angela Merkel’s government announced plans to spend an extra €6 billion on refugees next year as thousands more migrants poured into the country over the weekend. Merkel’s governing coalition said on Monday that Germany will add 3 billion euros in spending to the 2016 federal budget and provide another €3 billion to states and municipalities to tackle the region’s biggest refugee crisis since World War II. Germany and Austria plan to end emergency measures that allowed the passage of thousands of migrants over the weekend from Hungary without registering in that country. That decision came after talks between Merkel, Austrian Chancellor Werner Faymann and Hungarian Prime Minister Viktor Orban, Faymann said in a statement on Sunday.

The countries late on Friday suspended European Union rules that require migrants to register and stay in the EU country where they first enter. The refugees, many coming from war-torn Syria, traveled on trains to Munich’s main station and were then sent to shelters around the country as German citizens volunteered in mass numbers to help the newcomers. Merkel’s government is considering putting excess 2015 tax revenue in a fund that would help cover the refugee costs next year, according to a person familiar with the plans, who asked not to be identified discussing private deliberations. In her weekly podcast, Merkel said the government would stick to its balanced budget goal even as it spends more on refugees.

Reuters said “Migration crisis”. But that sounds too nonsensical.

• Greece Asks EU For Humanitarian Aid To Cope With Refugee Crisis (Reuters)

Greece asked the European Union on Monday for humanitarian aid to help it cope with what it called “a volatile situation” following the large flow of migrants and refugees from the Middle East and Africa onto its shores. It requested the EU activate its civil protection mechanism, the bloc’s crisis-response body, to provide staff, medical and pharmaceutical supplies, clothes and equipment, the Interior Ministry said. Greece is struggling to cope with the thousands of people fleeing poverty and war in countries such as Syria for Europe. Tensions have flared on eastern islands including Kos and Lesbos where most refugees land due to their proximity to Turkey.

On Monday morning, a Greek ferry unloaded 2,500 migrants at the port of Piraeus, bringing the total number of people moved to the mainland since last Monday to more than 15,000. Thousands more are waiting to be identified and ferried to Athens to continue their trip to other European countries. “The First Response Service requested that the EU civil protection mechanism is activated in order to substantially strengthen the efforts undertaken by the First Reception Service to manage a volatile situation,” the ministry said. “The satisfaction of the said request is expected to be of critical assistance to the work of the First Response System, which, under current conditions, is extremely difficult.”

The EU’s civil protection mechanism coordinates the bloc’s humanitarian aid efforts, channeling aid and sending special teams with equipment to disaster areas. It has previously helped Greece fight forest fires. European Commission First Vice President Frans Timmermans and Migration Commissioner Dimitris Avramopoulos have already promised Athens €33 million to help it tackle the crisis.

Refugees as an election issue, Alexis? You sure?

• Statement By The President Of SYRIZA On The Refugees (Alexis Tsipras)

Europe is experiencing an unprecedented humanitarian crisis as a result of the refugees that are fleeing war and violence in our region. Greece is at the forefront of this crisis. Yesterday’s picture of three-year old Ailan, dead in the Aegean Sea, on the coast of Bodrum, was a powerful punch in the gut for all of us. And particularly for Europe. A Europe that has responded with initial indifference, nonsensical repression and now awkwardness in the face of a global drama caused by erratic foreign policy and the West’s military interventions.

Yesterday’s horrific picture that shocked the world unfortunately demonstrates the tremendous irresponsibility and great shame of the political forces and especially of New Democracy, which from the outset sought to exploit the problem for petty gains; stoking the most extreme populist instincts, the very ones Golden Dawn is manipulating as well to gain more votes. For now, I will ignore New Democracy’s inability to manage this – even rudimentarily – as a government, and will concentrate on its criticism of open borders. What exactly were they demanding from the Greek government? To use Greek coast guard ships to sink the inflatable boats carrying refugees? And to turn the Aegean into a watery grave for thousands of children like Ailan? Even populism and trying to win votes must have some limits.

Stop making sense?!

• Tsipras Vows Battle To Improve Bailout After Greek Election (Reuters)

Former prime minister Alexis Tsipras promised on Sunday to fight to improve the terms of Greece’s latest bailout as he tried to shore up a rapidly collapsing lead in opinion polls, two weeks before a snap election. In a campaign speech in the northern town of Thessaloniki, Tsipras offered no new policy ideas but pledged thousands of new jobs and an attack on corruption. He defended his record of battling Greece’s creditors in his seven months in office, even though he was eventually forced to capitulate to their demands to secure the €86 billion rescue package, Greece’s third in a protracted debt crisis that at times has threatened its future in the euro.

“The battle to improve it is far from over,” Tsipras said, referring to the bailout. He said he would seek to win some form of debt relief and press Greek demands to restore collective bargaining powers for workers, a move the creditors oppose. Tsipras resigned last month to make way for the election, hoping to secure a stronger mandate. But having started out as the clear frontrunner, his leftist SYRIZA party’s poll lead has now all but disappeared, making for an unexpectedly close contest against the conservative New Democracy party. The prospect of a fractured result after the September 20 vote has stoked fears of yet more turmoil in a country hit by years of instability and recession, and raised the prospect of Greece having to go to the polls again.

A sad state. Beyond repair.

• On The State Of The European Union (Yanis Varoufakis)

In a session entitled ‘Old and New Conflicts and Challenges in the EU’, featuring also Peter Sutherland (FT), Mario Monti and Otmar Issing, I used the unwillingness of the Eurogroup, and the troika, even to consider a document prepared by my (then) ministry (entitled “A Policy Framework for Greece’s Fiscal Consolidation, Recover and Growth“) as a case in point of how Europe has lost its integrity and is in the process of losing its soul (judging by the scandalous failure to address the refugee crisis).

Hats off to the Greek people.

• Greek Crisis Prompts A Rethink On Food Waste (AFP)

With little end to their economic misery in sight, Greeks are finding inventive ways to feed the poor while also fighting waste – a movement that is chipping away at traditional attitudes to food. Three years ago, Xenia Papastavrou came up with a simple idea: take unsold food from shops and restaurants that was headed for the bin, and use it to feed the growing number of Greeks going hungry as the financial crisis took hold. “In June, they gave us 3,000 kilos of melons; in August we got 7,200 cartons of milk,” the 39-year-old told AFP at her office behind Athens’ central market. Boroume (“We Can”), the organization she founded, matches donated foodstuffs with charities in need – whether vegetables, bread or “even these 12 tiropita (cheese pies), which weren’t sold at the bakery.”

These days the food routed through Boroume provides an average of 2,500 meals a day across Greece, from Athens to Thessaloniki in the north. “Greece is a country that throws a lot away,” explained Papastavrou from behind a computer screen covered with data tables and the addresses of charities. In Greek tavernas, if the plates aren’t piled with huge pyramids of food, a meal between friends can be considered a failure, she added. “There isn’t really a mentality of paying attention to this,” she said. “Here, it’s: ‘I’ve paid for it, so I can do what I want with it.'” But years of hardship have started to change habits in a country where official figures show a quarter of the population is at risk of poverty.