Harris&Ewing “Street scene with snow, F STreet Washington, DC” 1918

The battle gets ugly.

• Iraq Sells Oil For $22 A Barrel, Calls For IMF Help (BBG)

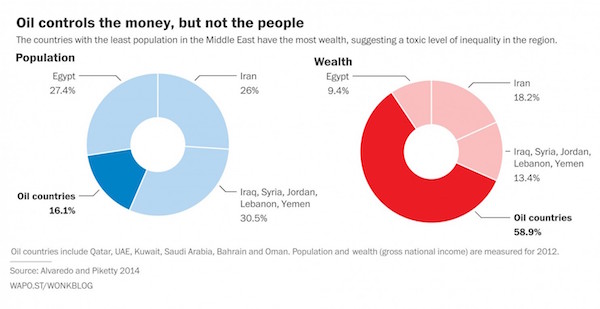

Prime Minister Haidar al-Abadi said the plunge in oil prices means Iraq needs IMF support to continue its fight against Islamic State, a battle he says his country is winning despite little support from its neighbors. “We’ve been anticipating there would be some drop of prices but this has taken us by surprise,” Abadi said of the oil collapse in an interview at the World Economic Forum in Davos, Switzerland. “We can defeat Daesh but with this fiscal problem, we need the support” of the IMF, he said. “We have to sustain the economy, we have to sustain our fight.” The conflict with Islamic State, which swept through swaths of northern Iraq in the summer of 2014, has destroyed economic infrastructure, disrupted trade and discouraged investment.

Iraq is now facing the “double shock” of war as well as the crude-oil price drop, and has “urgent” balance-of-payment and budget needs, the IMF said in January as it approved a staff-monitored program to pave the way for a possible loan. Under the program, Iraq will seek to reduce its non-oil primary deficit. “We have cut a lot of our expenditures, government expenditures,” Abadi said in the interview. But the war brings its own costs. “We are paying salaries for the uniformed armies, for our fighters” and their weapons, Abadi said in Davos. Speaking later in a panel session in the Swiss resort, Abadi said Iraqi oil sold on Thursday for $22 a barrel, and after paying costs the country is left with $13 per barrel.

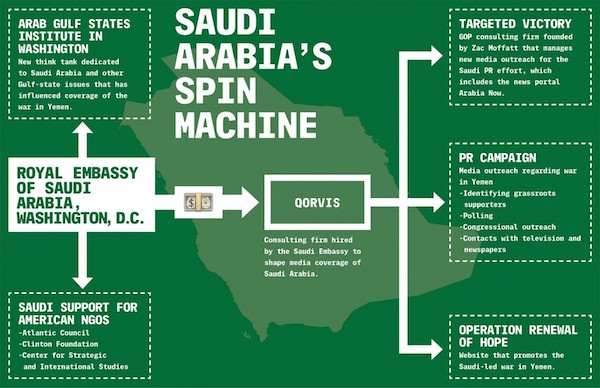

He called for neighbors to do more to help. The only country to have provided financial assistance is Kuwait, he said, which gave Iraq $200 million. “Daesh is on the retreat and it is collapsing but somebody is sending a life line to them,” Abadi said, citing victories for his forces in the key western city of Ramadi and using an Arabic acronym for Islamic State. “Neighbors are fighting for supremacy, using sectarianism.” Shiite Iran supports several of the biggest militias aiding Iraqi forces in the fight against Islamic State. Its rivalry with the Middle East’s biggest Sunni power, Saudi Arabia, has flared in recent weeks, complicating efforts to end conflicts in Iraq, Syria and Yemen. Iraq has managed to stop the advance of Islamic State in Iraq but if neighbors continue to inflame sectarianism, successes can be reversed, he said. “We are supposed to be in the same boat,” Abadi said. “In reality, we aren’t.”

“..42nd driller to file for bankruptcy in this commodity crunch..”

• American Oil Companies Are Starting To Scream “Mayday” (CNN)

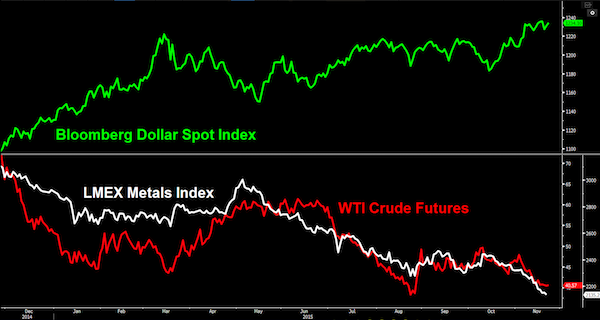

Last year, 42 North American drillers filed for bankruptcy, according to law firm Haynes and Boone. It’s only likely to get worse this year. Experts say there are a lot of parallels between today’s crisis and the last oil crash in 1986. Back then, 27% of exploration and production companies went bust. Defaults are skyrocketing again. In December, exploration and production company defaults topped 11%, up from just 0.5% the previous year, according to Fitch Ratings. That’s a 2,000%-plus jump. It’s just the beginning, says John La Forge, head of real assets strategy at Wells Fargo. If history repeats, people should prepare for the default rate to double in the next year or so. No wonder America’s biggest banks are setting aside a lot of money in anticipation that more energy companies will go belly up.

Energy companies borrowed a lot of money when oil was worth over $100 a barrel. The returns seemed almost guaranteed if they could get the oil out of the ground. But now oil is barely trading just above $30 a barrel and a growing number of companies can’t pay back their debts. “The fact that a price below $100 seemed inconceivable to so many is kind of astonishing,” says Mike Lynch, president of Strategic Energy and Economic Research. “A lot of people just threw money away thinking the price would never go down.” On the last day of 2015, Swift Energy, an “independent oil and gas company” headquartered in Houston, became the 42nd driller to file for bankruptcy in this commodity crunch. The company is trying to sort out over $1 billion in debt at a time when the firm’s earnings have declined over 70% in the past year.

Trimming costs and laying off workers can’t close that kind of gap. “In the 1980s, there was a bumper sticker that people in Texas had that said, ‘God give me one more boom and I promise not to screw it up,'” says Lynch. “People should have those bumper stickers ready again.” The last really big oil bust was in the late 1980s. The Saudis really controlled the price then, says La Forge. Now the Saudis (and other members of OPEC) are in a battle with the United States, which has become a major player again in energy production. No one wants to cut back on production and risk losing market share. “It will be the U.S. companies that go out of business,” predicts La Forge. OPEC countries don’t have a lot of smaller players like the United States does. It’s usually the government that controls oil drilling and production in OPEC nations.

La Forge predicts the governments can hold their position longer. As the smaller players run out of cash, they will get swallowed up by bigger ones. “The big boys and girls will snap up a lot of cheap assets,” predicts Lynch. There’s a lot of debate about whether oil prices have bottomed out. Crude oil hit its lowest price since 2003 this week. But even if prices have stabilized, the worst isn’t over for oil companies. “Some companies went under in 1986-’87 even when prices rebounded,” says La Forge. This week, Blackstone (BGB) CEO Stephen Schwarzman said his firm is finally taking a close look at bargains in the energy sector. One of the largest bankruptcies so far is Samson Resources of Oklahoma. In 2011, private equity firm KKR (KKR) bought it for over $7 billion. Now it’s struggling to deal with over $1 billion in debt that’s due this year alone.

Can’t read on shale without mention of default anymore.

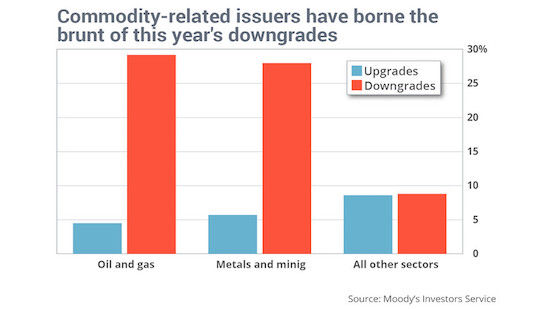

The boom years left the US oil industry deep in debt. The 60 leading US independent oil and gas companies have total net debt of $206bn, from about $100bn at the end of 2006. As of September, about a dozen had debts that were more than 20 times their earnings before interest, tax, depreciation and amortisation. Worries about the health of these companies have been rising. A Bank of America Merrill Lynch index of high-yield energy bonds, which includes many indebted oil companies, has an average yield of more than 19%. Almost a third of the 155 US oil and gas companies covered by Standard & Poor’s are rated B-minus or below, meaning they are at high risk of default.

The agency this month revised down its expectations of future oil prices, meaning that many of those companies’ ratings are likely to be cut even further. Credit ratings for the more financially secure investment grade companies are also likely to be lowered this time. Some companies under financial strain will be able to survive by selling assets. Private capital funds raised $57bn last year to invest in energy, according to Preqin, an alternative assets research service, and most of that money is still looking for a home. Companies with low-quality assets or excessive debts will not make it. Tom Watters of S&P expects “a lot more defaults this year”. Bankruptcies, a cash squeeze and poor returns on investment mean companies will continue to cut their capital spending.

The number of rigs drilling oil wells in the US has dropped 68% from the peak in October 2014 to 510 this week, and it is likely to fall further. So far, the impact on US oil production has been minimal. Output in October was down 4% from April, as hard-pressed companies squeeze as much revenue as possible out of their assets. Saudi Arabia’s strategy of allowing oil prices to fall to curb competing sources of production appears to be succeeding But Harold Hamm, chief executive of Continental Resources, one of the pioneers of the shale boom, says the downturn in activity is likely to intensify. “We’re seeing capex being slashed to almost nothing,” he says. “At low prices, people aren’t going to keep producing.” He expects US oil production to fall sharply this year, and says people may be surprised by how fast it goes.

Poor banks.

• Squeezed Primary Dealers Quit European Government Bond Markets (Reuters)

A rise in the number of banks giving up primary dealer roles in European government bond markets threatens to further reduce liquidity and eventually make it more expensive for some countries to borrow money. Increased regulation and lower margins have seen five banks exit various countries in the last three months. Others look set to follow, further eroding the infrastructure through which governments raise debt. While these problems are for now masked by the European Central Bank buying €60 billion of debt every month to try to stimulate the euro zone economy, countries may feel the effects more sharply when the ECB scheme ends in March 2017. Since 2012, most euro zone governments have lost one or two banks as primary dealers, while Belgium – one of the bloc’s most indebted states – is down five.

Primary dealers are integral to government bond markets, buying new issues at auctions to service demand from investors and to maintain secondary trading activity. Without their support, countries would find it harder to sell debt, forcing them to offer investors higher interest rates. Over the last quarter alone, Credit Suisse pulled out of most European countries, ING quit Ireland, Commerzbank left Italy, and Belgium did not re-appoint Deutsche Bank as a primary dealer and dropped Nordea as a recognised dealer. In that time, only Danske Bank has added to its primary dealer roles in the bloc’s main markets. But even Danske is worried. “I’ve never seen it so bad,” said Soeren Moerch, head of fixed income trading at Danske Markets.

“When further banks reduce their willingness to be a primary dealer then liquidity will go even lower…we could have more failed auctions and we could see a big washout in the market.” Acting as a dealer has become increasingly expensive for banks under new regulations because of the amount of capital it requires, while trading profits that once made up for the initial spend have diminished in an era of ultra-low rates. “Shareholders would be shocked if they knew the scale of the costs that some businesses are taking,” said one banker who has worked at several major investment houses with primary dealer functions. The decline in dealers comes as many of the world’s largest financial firms, such as Morgan Stanley and Deutsche Bank, launch strategic reviews that are likely to impact their fixed income operations.

The risk that the euro zone could slide back into recession, having barely recovered from its long-running debt crisis, could exacerbate the withdrawal by prompting banks to retreat into their home markets. “It is a negative trend. The opposite that we saw in the first 10 years of the euro,” said Sergio Capaldi at Intesa SanPaolo. “For smaller countries…the fact that there are less players is something that could have a negative affect on market liquidity and borrowing costs.”

Squeezed them for all they’re worth.

• US Banks Cut Off Mexican Clients as Regulatory Pressure Increases (WSJ)

U.S. banks are cutting off a growing number of customers in Mexico, deciding that business south of the border might not be worth the risks in the wake of mounting regulatory warnings. At issue are correspondent-banking relationships that allow Mexican banks to facilitate cross-border transactions and meet their clients’ needs for dealing in dollars—in effect, giving them access to the U.S. financial system. The global firms that provide those services are increasingly wary of dealing with Mexican banks as well as their customers, according to U.S. bankers and people familiar with the matter.

The moves are consistent with a broader shift across the industry, in which banks around the world are retreating from emerging markets as regulators ramp up their scrutiny and punishment of possible money laundering. For many banks, the money they can earn in such countries isn’t worth the cost of compliance or the penalties if they step across the line. U.S. financial regulators have long warned about the risks in Mexico of money laundering tied to the drug trade. The urgency spiked more than a year ago, when the Financial Crimes Enforcement Network, a unit of the Treasury Department, sent notices warning banks of the risk that drug cartels were laundering money through correspondent accounts, people familiar with the advisories said. Earlier, the Office of the Comptroller of the Currency sent a cautionary note to some big U.S. banks about their Mexico banking activities.

But the pain Mexican firms are experiencing is relatively new. The fallout is affecting Mexican banks of various sizes such as Grupo Elektra’s Banco Azteca, Grupo Financiero Banorte and Monex Grupo Financiero, and their customers, the people said. Regulators have consistently said they don’t direct banks to cut ties with specific countries or a large swath of customers. But the advisories, which had nonpublic components that haven’t been previously reported, were interpreted by several big banks as a fresh signal that they do business in Mexico at their own peril, according to people familiar with the matter. “All they know is that sanctions are big and revenues are small,” said Luis Niño de Rivera, vice chairman of Banco Azteca, based in Mexico City. “It’s simple arithmetic: ‘I make a million dollars and they’re going to fine me a billion? I won’t do that.’”

A field of pretense.

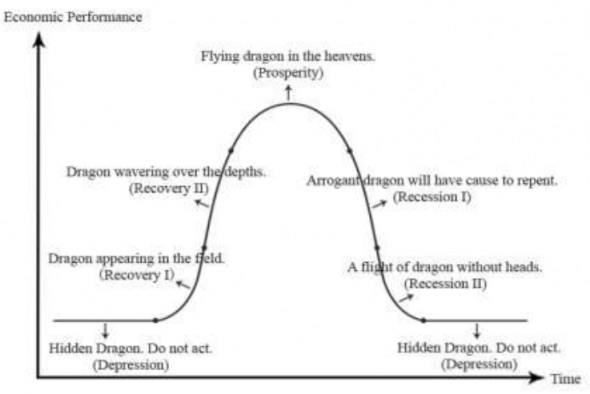

• Ideological Divisions Undermine Economics (Economist)

Dismal may not be the most desirable of modifiers, but economists love it when people call their discipline a science. They consider themselves the most rigorous of social scientists. Yet whereas their peers in the natural sciences can edit genes and spot new planets, economists cannot reliably predict, let alone prevent, recessions or other economic events. Indeed, some claim that economics is based not so much on empirical observation and rational analysis as on ideology. In October Russell Roberts, a research fellow at Stanford University’s Hoover Institution, tweeted that if told an economist’s view on one issue, he could confidently predict his or her position on any number of other questions. Prominent bloggers on economics have since furiously defended the profession, citing cases when economists changed their minds in response to new facts, rather than hewing stubbornly to dogma.

Adam Ozimek, an economist at Moody’s Analytics, pointed to Narayana Kocherlakota, president of the Federal Reserve Bank of Minneapolis from 2009 to 2015, who flipped from hawkishness to dovishness when reality failed to affirm his warnings of a looming surge in inflation. Tyler Cowen, an economist at George Mason, published a list of issues on which his opinion has shifted (he is no longer sure that income from capital is best left untaxed). Paul Krugman chimed in. He changed his view on the minimum wage after research found that increases up to a certain point reduced employment only marginally (this newspaper had a similar change of heart). Economists, to be fair, are constrained in ways that many scientists are not. They cannot brew up endless recessions in test tubes to work out what causes what, for instance.

Yet the same restriction applies to many hard sciences, too: geologists did not need to recreate the Earth in the lab to get a handle on plate tectonics. The essence of science is agreeing on a shared approach for generating widely accepted knowledge. Science, wrote Paul Romer, an economist, in a paper* published last year, leads to broad consensus. Politics does not. Nor, it seems, does economics. In a paper on macroeconomics published in 2006, Gregory Mankiw of Harvard University declared: “A new consensus has emerged about the best way to understand economic fluctuations.” But after the financial crisis prompted a wrenching recession, disagreement about the causes and cures raged. “Schlock economics” was how Robert Lucas, a Nobel-prize-winning economist, described Barack Obama’s plan for a big stimulus to revive the American economy. Mr Krugman, another Nobel-winner, reckoned Mr Lucas and his sort were responsible for a “dark age of macroeconomics”.

Nice details.

• A Greek Conspiracy: How The ECB Crushed Varoufakis’ Plans (Häring)

A central bank governor in Athens conspires with the President of the Republic to sabotage the negotiation strategy of his government to weaken it in its negotiations with the European Central Bank. After the government has capitulated, this governor, who is a close friend of the new finance minister and boss of the finance ministers wife, and the President of the Republic travel together to the ECB to collect their praise and rewards. This is not an invention, this is now documented. On 19 January the German Central Bank in Frankfurt informed the media that the Greek President Prokopis Pavlopoulos visited the ECB and met with ECB-President Mario Draghi, and that he was accompanied by the President of the Greek central Bank, Yanis Stournaras.

Remember. When the Syriza-led government in Athens was in tense negotiations with the European institutions, the ECB excerted pressure by cutting Greek banks off the regular financing operations with the ECB. They could get euros only via Emergency Liquidty Assistance from the Greek central bank and the ECB placed a strict limit on these. Finance minister Yanis Varoufakis worked on emergency plans to keep the payment system going in case the ECB would cut off the euro supply completely. It has already been reported and discussed that a close aide of Stournaras sabotaged the government during this time by sending a memo to a financial journalist, which was very critical with the governments negotiation tactics and blamed it for the troubles of the banks, which the ECB had intensified, if not provoked.

A few days ago, Stournaras himself exposed a conspiracy. He bragged that he had convened former prime ministers and talked to the President of the Republic to raise a wall blocking Varoufakis emergency plan. In retrospect it looks as if Alexis Tsipras might have signed his capitulation to Stournaras and the ECB already in April 2015, when he replaced Varoufakis as chief negotiator by Euklid Tsakalotos, who would later become finance minister after Varoufakis resigned. In this case the nightly negotiating marathon in July, after which Tsipras publicly signed his capitulation, might just have been a show to demonstrate that he fought bravely to the end. Why would I suspect that? Because I learned in a Handelsblatt-Interview with Tsakalotos published on 15 January 2016 that he is a close friend of Stournaras. Looking around a bit more, I learned that Tsakalotos wife is ‘Director Advisor’ to the Bank of Greece.

This is the Wikipedia entry: “Heather Denise Gibson is a Scottish economist currently serving as Director-Advisor to the Bank of Greece (since 2011). She is the spouse of Euclid Tsakalotos, current Greek Minister of Finance.” At the time she entered, Stournaras was serving as Director General of a think tank of the Bank of Greece. The friendship of the trio goes back decades to their time together at a British university. They even wrote a book together in 1992. Thus: The former chief negotiator of the Greek government is and was a close friend of the central bank governor and the central bank governor was the boss of his wife. The governor of the Bank of Greece, which is part of the Eurosystem of central banks, gets his orders from the ECB, i.e. the opposing side in the negotiations. He actively sabotaged the negotiation strategy of his government. If this does not look like an inappropriate association for a chief negotiator, I don’t know what would.

Someone grabbed Cameron by the nuts?

• Britain ‘Poised To Open Door To Thousands Of Migrant Children’ (Guardian)

David Cameron is considering plans to admit thousands of unaccompanied migrant children into the UK within weeks, as pressure grows on ministers to provide a haven for large numbers of young people who have fled their war-torn homelands without their parents. Amid growing expectation that an announcement is imminent, Downing Street said ministers were looking seriously at calls from charities, led by Save the Children, for the UK to admit at least 3,000 unaccompanied young people who have arrived in Europe from countries including Syria and Afghanistan, and who are judged to be at serious risk of falling prey to people traffickers. Government sources said such a humanitarian gesture would be in addition to the 20,000 refugees the UK has already agreed to accept, mainly from camps on the borders of Syria, by 2020.

Following a visit to refugee camps in Calais and Dunkirk on Saturday, Labour leader Jeremy Corbyn called on Cameron to offer children not just a refuge in the UK but proper homes and education, equivalent to the welcome received by those rescued from the Nazis and brought to the UK in 1939. “We must reach out the hand of humanity to the victims of war and brutal repression,” he said. “Along with other EU states, Britain needs to accept its share of refugees from the conflicts on Europe’s borders, including the horrific civil war in Syria. “We have to do more. As a matter of urgency, David Cameron should act to give refuge to unaccompanied refugee children now in Europe – as we did with Jewish Kindertransport children escaping from Nazi tyranny in the 1930s.

And the government must provide the resources needed for those areas accepting refugees – including in housing and education – rather than dumping them in some of Britain’s poorest communities.” Signs that the prime minister may act came after a week in which concern has risen in European capitals, and among aid agencies and charities, about the high number of migrants still pouring into the EU just as cold weather bites along the routes many are taking through the Balkans and central and eastern Europe. With one week of January to go, about 37,000 migrants and refugees have already arrived in the EU by land or sea, roughly 10 times the equivalent total for the month last year. The number of Mediterranean deaths stands at 158 this year.

It’s a free for all now.

• Germany Scolds Austria For Greek Schengen Threats (AFP)

T�h�i�s� �w�e�e�k� �G�r�e�e�c�e� �s�l�a�m�m�e�d� �a� �F�i�n�a�n�c�i�a�l� �T�i�m�e�s� �r�e�p�o�r�t� �s�a�y�i�n�g� �s�e�v�e�r�a�l� �E�u�r�o�p�e�a�n� �m�i�n�i�s�t�e�r�s� �a�n�d� �s�e�n�i�o�r� �E�U� �o�f�f�i�c�i�a�l�s� �b�e�l�i�e�v�e�d� �t�h�r�e�a�t�e�n�i�n�g� �s�u�s�p�e�n�s�i�o�n� �f�r�o�m� �S�c�h�e�n�g�e�n� �c�o�u�l�d� �p�e�r�s�u�a�d�e� �G�r�e�e�c�e� �t�o� �p�r�o�t�e�c�t� �i�t�s� �b�o�r�d�e�r�s� �m�o�r�e� �e�f�f�e�c�t�i�v�e�l�y�.� J�u�n�i�o�r� �i�n�t�e�r�i�o�r� �m�i�n�i�s�t�e�r� �f�o�r� �m�i�g�r�a�t�i�o�n� �Y�i�a�n�n�i�s� �M�o�u�z�a�l�a�s� �s�a�i�d� �t�h�e� �r�e�p�o�r�t� �c�o�n�t�a�i�n�e�d� �”�f�a�l�s�e�h�o�o�d�s� �a�n�d� �d�i�s�t�o�r�t�i�o�n�s�”� �b�u�t� �M�i�k�l�-�L�e�i�t�n�e�r� �s�a�i�d� �t�e�m�p�o�r�a�r�y� �e�x�c�l�u�s�i�o�n� �w�a�s� �a� �r�e�a�l� �p�o�s�s�i�b�i�l�i�t�y�.� “�I�f� �t�h�e� �A�t�h�e�n�s� �g�o�v�e�r�n�m�e�n�t� �d�o�e�s� �n�o�t� �f�i�n�a�l�l�y� �d�o� �m�o�r�e� �t�o� �s�e�c�u�r�e� �t�h�e� �(�E�U�’�s�)� �e�x�t�e�r�n�a�l� �b�o�r�d�e�r�s� �t�h�e�n� �o�n�e� �m�u�s�t� �o�p�e�n�l�y� �d�i�s�c�u�s�s� �G�r�e�e�c�e�’�s� �t�e�m�p�o�r�a�r�y� �e�x�c�l�u�s�i�o�n� �f�r�o�m� �t�h�e� �S�c�h�e�n�g�e�n� �z�o�n�e�,�”� �M�i�k�l�-�L�e�i�t�n�e�r� �s�a�i�d� �i�n� �a�n� �i�n�t�e�r�v�i�e�w� �w�i�t�h� �G�e�r�m�a�n� �d�a�i�l�y� �D�i�e� �W�e�l�t�.� “�I�t� �i�s� �a� �m�y�t�h� �t�h�a�t� �t�h�e� �G�r�e�c�o�-�T�u�r�k�i�s�h� �b�o�r�d�e�r� �c�a�n�n�o�t� �b�e� �c�o�n�t�r�o�l�l�e�d�,�”� �M�i�k�l�-�L�e�i�t�n�e�r� �s�a�i�d�.�

“�W�h�e�n� �a� �S�c�h�e�n�g�e�n� �s�i�g�n�a�t�o�r�y� �d�o�e�s� �n�o�t� �p�e�r�m�a�n�e�n�t�l�y� �f�u�l�f�i�l� �i�t�s� �o�b�l�i�g�a�t�i�o�n�s� �a�n�d� �o�n�l�y� �h�e�s�i�t�a�t�i�n�g�l�y� �a�c�c�e�p�t�s� �a�i�d� �t�h�e�n� �w�e� �s�h�o�u�l�d� �n�o�t� �r�u�l�e� �o�u�t� �t�h�a�t� �p�o�s�s�i�b�i�l�i�t�y�,�”� �s�h�e� �a�d�d�e�d�.� “�T�h�e� �p�a�t�i�e�n�c�e� �o�f� �m�a�n�y� �E�u�r�o�p�e�a�n�s� �h�a�s� �r�e�a�c�h�e�d� �i�t�s� �l�i�m�i�t� �.�.�.� �W�e� �h�a�v�e� �t�a�l�k�e�d� �a� �l�o�t�,� �n�o�w� �w�e� �m�u�s�t� �a�c�t�.� �I�t� �i�s� �a�b�o�u�t� �p�r�o�t�e�c�t�i�n�g� �s�t�a�b�i�l�i�t�y�,� �o�r�d�e�r� �a�n�d� �s�e�c�u�r�i�t�y� �i�n� �E�u�r�o�p�e�.�”� G�e�r�m�a�n�y�’�s� �S�t�e�i�n�m�e�i�e�r� �c�r�i�t�i�c�i�s�e�d� �V�i�e�n�n�a�’�s� �w�a�r�n�i�n�g� �h�o�w�e�v�e�r�.� “�T�h�e�r�e� �w�o�n�’�t� �b�e� �a�n�y� �s�o�l�u�t�i�o�n� �t�o� �t�h�e� �r�e�f�u�g�e�e� �c�r�i�s�i�s� �i�f� �s�o�l�i�d�a�r�i�t�y� �d�i�s�a�p�p�e�a�r�s�,�”� �h�e� �s�a�i�d�.� “�O�n� �t�h�e� �c�o�n�t�r�a�r�y�,� �w�e� �m�u�s�t� �w�o�r�k� �t�o�g�e�t�h�e�r� �a�n�d� �c�o�n�c�e�n�t�r�a�t�e� �a�l�l� �o�u�r� �e�f�f�o�r�t�s� �t�o� �f�i�g�h�t� �a�g�a�i�n�s�t� �t�h�e� �c�a�u�s�e�s� �t�h�a�t� �a�r�e� �p�u�s�h�i�n�g� �t�h�e� �r�e�f�u�g�e�e�s� �i�n�t�o� �f�l�i�g�h�t�,� �t�o� �r�e�i�n�f�o�r�c�e� �t�h�e� �E�U�’�s� �o�u�t�e�r� �b�o�r�d�e�r�s� �a�n�d� �t�o� �a�c�h�i�e�v�e� �a� �f�a�i�r� �r�e�d�i�s�t�r�i�b�u�t�i�o�n� �(�o�f� �a�s�y�l�u�m� �s�e�e�k�e�r�s�)� �w�i�t�h�i�n� �E�u�r�o�p�e�.�”�

Chance of Schengen survival below zero.

• EU Leaders Consider Two-Year Suspension Of Schengen Rules (Telegraph)

The Schengen system of free movement could be suspended for two years under emergency measures to be discussed by European ministers on Monday, as the French Prime Minister warned the crisis could bring down the entire European Union. Manuel Valls said that the “very idea of Europe” will be torn apart until the flows of migrants expected to surge in spring are turned away. On Monday, interior ministers from the EU will meet in Amsterdam to discuss emergency measures to allow states to reintroduce national border controls for two years. The powers are allowed under the Schengen rules, but would amount to an unprecedented abandonment of the 30-year old agreement that allows passport-free travel across 26 states. The measure could be brought in from May, when a six-month period of passport checks introduced by Germany expires.

The European Commission would have to agree that there are “persistent serious deficiencies” in the Schengen zone’s external border to activate it. “This possibility exists, it is there and the Commission is prepared to use it if need be,” said Natasha Bertaud, a spokesman for Jean-Claude Juncker. Greece has been blamed by states for failing to identify and register hundreds of thousands of people flowing over its borders. Other states that have introduced emergency controls are Sweden, Austria, France, Denmark and Norway, which is not in the EU but is in Schengen. “We’re not currently in that situation,” Ms Bertaud added. “But interior ministers will on Monday in Amsterdam have the opportunity to discuss and it’s on the agenda what steps should be taken or will need to be taken once we near the end of the maximum period in May.”

In a further blow, Mr Valls said that France would keep its state of emergency, which has included border checks, until the Islamic State of Iraq and Levant network is destroyed. “It is a total and global war that we are facing with terrorism,” he said. He warned that without proper border controls to turn away refugees, the 60-year old European project could disintegrate. “It’s Europe that could die, not the Schengen area. If Europe can’t protect its own borders, it’s the very idea of Europe that could be thrown into doubt. It could disappear, of course – the European project, not Europe itself, not our values, but the concept we have of Europe, that the founding fathers had of Europe.