Lewis Wickes Hine Workers in Maryland packing company 1909

Not a fan of the Union.

• Marc Faber: Brexit Would Be Best Thing To Happen in Britain’s History (CNBC)

As investors wring their hands over the impact of Britain’s potential withdrawal from the European Union, otherwise known as “Brexit,” one of the market’s biggest bears delivered a surprising message. “I happen to think that a Brexit would be bullish for global economic growth,” Marc Faber told CNBC’s “Trading Nation” on Wednesday. “It would give other countries incentive to leave the badly organized EU.” The editor and publisher of The Gloom, Boom & Doom Report emphasized that a vote on June 23 by Britain to leave the EU would be an ideal course of action for the country. Additionally, Faber expressed the belief that small countries like Croatia, Estonia and Malta would also prosper as independent nations versus being a part of a larger system.

Currently, the EU has 28 members that operate within a single market with the goal of encouraging the free movement of goods and services. British Prime Minister David Cameron has expressed disdain for leaving the bloc, explaining in a piece for The Telegraph that doing so would “be the gamble of the century.” However, that’s a risk that Faber says Britain should be willing to take and noted that the EU is an “empire that is hugely bureaucratic.” Faber further reasoned that a Brexit would not be a disaster. “On the contrary, it would be the best thing for Britain that would ever happen!” Faber defended his case by citing Switzerland, which is not a member of the EU nor the European Economic Area, but instead operates in the “single” market. That enables the Swiss to have rights in the U.K., but theoretically allows them to operate independently of both groups.

“The level of debt coming due over the next 12 months is 755pc of the country’s external receipts..”

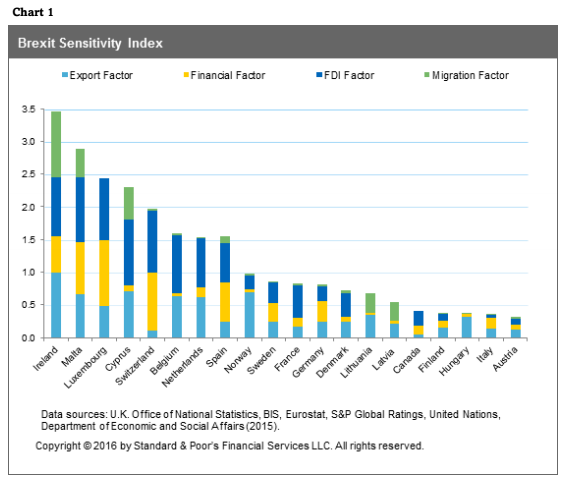

• Brexit Might Trigger Run On Britain’s Record Financial Debts, S&P Warns (AEP)

Britain is the world’s most vulnerable state on a key measure of short-term debt and credit markets might suddenly seize up if voters opt for Brexit, Standard & Poor’s has warned. The US credit rating agency is crystal clear that Britain will be stripped of its coveted AAA status immediately and may face a double-barrelled downgrade if the country takes a leap in dark, jeopardizing its trading and financial ties to its biggest market. “We are categorical about this,” said Moritz Kraemer, the agency’s head of sovereign ratings. “There is no clear ‘Plan B’ in the UK and we are not going to wait until we find out what the British position actually is. We could potentially see a two-notch downgrade,” he told The Daily Telegraph.

Mr Kraemer said the British financial system is extremely dependent on external financing. This is the Achilles Heel for an economy that relies so heavily on the City of London, and has a current account deficit above 5pc of GDP – the highest in Britain’s peace-time history. The level of debt coming due over the next 12 months is 755pc of the country’s external receipts, the highest for all 131 sovereign states rated by S&P. This compares to 318pc for the US and 316pc for France, the next two states most exposed. Much of this short-term debt is owed by banks operating in the City, some of them American, Japanese, European, or Mid-East institutions.

In theory, the liabilities are matched by assets and therefore simply ‘net out’ if stress forces banks to shrink their operations, but crises have a nasty habit of revealing skeletons in the cupboard. “If there is no currency and maturity mismatch, then there is no big issue. But we don’t know that for sure,” Mr Kraemer said. “These sums are very large and have to be rolled over constantly. Nobody has ever hesitated in the past because it was always assumed that Britain is a safe haven and there is no risk,” he said.

Bernard Connolly was never a fan of the EU. He sees Germany take over if Britain remains in the Union.

• Heavy Cost Of UK’s Access To The Single Market In Europe (Connolly)

We are told that Britain’s net contribution to the EU budget, about 0.5pc of our GDP after the rebate (our gross contribution is much bigger; what we “get back” is EU payments to universities and interest groups as part of the EU’s subversion strategy) is the entry fee we must pay for “access” to the EU single market. Why do numerous other countries, with equal access to the single market, receive substantial net payments from the EU – that is, from us and a few other countries? Jean-Claude Juncker has said that France gets away with breaking the budgetary rules “because it’s France”. Britain is gleefully given the rough end of the stick by our partners “because it’s Britain”.

What access brings to Britain is the enormous cost of single market regulations imposed on all firms, not just the very small minority of exporters to the EU. It also brings higher prices in the shops because we are forced to apply the EU’s common external tariff to imports from third countries. Importantly, it brings a massive deficit with the EU on trade in goods and services – reducing the amount we can spend without borrowing from abroad by close to a massive 4pc of our GDP. But we do borrow. The trade deficit with the EU is the biggest single contributor to Britain’s unsustainable current-account position.

We do not yet have much net debt to the rest of the world. But if the current account deficit continues at anything like its present rate it will not be long before we build up foreign debt that leaves us with four choices: default; an economic depression like that in Greece; substantial sterling depreciation; and total political submission to Germany in the hope of getting permanent transfers from that country. The last option is far-fetched beyond science fiction. The first and second are obviously unthinkable for a country such as Britain, at least if we restore control over our own affairs by leaving the EU. That leaves just sterling depreciation, and the sooner it happens the less disruptive it will be. The more Leave thrives in the opinion polls, the better it is for the prospect of avoiding default and depression.

Why the eurozone should fall. Everything moves towards the center. Design flaw, intentional or not, can’t be fixed.

• Germans Get Richer While Southern Europe Lags (R.)

The wealth disparity in the euro zone is increasing, with rising property prices helping Germans get richer while southern European countries lag behind, a study has found. While the gap between northern countries, such as the Netherlands, and southern states like Portugal has long been a feature of the euro bloc, the study by an arm of German fund manager Flossbach von Storch shows it is getting ever wider. Taking a basket of items including property, stocks, art and expensive wine, the research concluded that wealth in Germany and Austria jumped more than 7% at the end of 2015 compared to a year earlier.

That was roughly twice the growth rate of Italy and Spain, while Greeks saw their wealth drop by more than 4%. Property prices, which, for example, jumped by more than 6% in Germany, are the biggest driver of wealth. This difference leads to political tension in the 19-member euro zone, while weak property prices in southern countries hit their banks, which hold homes and commercial property as security for loans. “Until 2006 when the bubble burst, countries in the south were really taking off. Now they are in a Japan-like situation,” said Thomas Mayer, founder of the research institute that carried out the study.

Inevitable.

• Bill Gross Says Negative Rates Are Like ‘Supernova’ That Will Explode (BBG)

Bill Gross, the manager of the $1.4 billion Janus Global Unconstrained Bond Fund, warned central bank policies that pushed trillions of dollars into bonds with negative interest rates will eventually backfire violently. “Global yields lowest in 500 years of recorded history,” Gross, 72, wrote Thursday on the Janus Twitter site. “$10 trillion of neg. rate bonds. This is a supernova that will explode one day.” A supernova is a star at the end of its life that suddenly increases greatly in brightness because of a catastrophic explosion that ejects most of its mass. Gross has argued for some time that the economy is at the end of a decades-long cycle of expanding credit that has culminated in negative interest rates, a situation he said is unsustainable.

Rather than spurring economic growth, low rates are promoting asset bubbles as investors reach for higher yields while punishing individual savers and industries that rely on interest rates, such as bank and insurance companies, according to Gross. He said in a June 2 note that the era of 7.5% annualized investment gains is history and that investors should eventually take positions to protect principal or profit from market declines. Returns will be low, risk will be high and at some point the ‘Intelligent Investor’ must decide that we are in a new era with conditions that demand a different approach,” he wrote. “Negative durations? Voiding or shorting corporate credit? Buying instead of selling volatility? Staying liquid with large amounts of cash? These are all potential ‘negative’ carry positions that at some point may capture capital gains or at a minimum preserve principal.”

You can neither purchase nor borrow growth. When China reaches this phase, watch out.

• It Took The US $10 In New Debt To Create $1 Of Growth In Q1 (ZH)

today we had a chance to update the total US credit following the release of the Fed’s Flow of Funds (Z.1) statement, which is usually parsed for its tracking of changes to household wealth. And while it showed that in the first quarter the net worth of US residents, mostly the wealthy ones as the bulk of financial assets is held by a small fraction of the total population, rose by $837 billion to $88 trillion mostly as a result of a change in real estate holdings, we were more interest in the aggregate picture. It wasn’t pretty.

As a reminder, according to the latest BEA revision, nominal Q1 GDP was $18.23 trillion, an increase of just $65 billion from the previous quarter or an annualized 0.7% rate, the question is how much credit had to be created to generate this growth. Well, according to the Z.1, total credit rose to a new record high $64.1 trillion. This was an increase of $645 billion from the previos quarter. It means that in the first quarter, it “cost” $10 in new debt to generate just $1 in new economic growth!

And here are the two other key charts: the first, showing total credit (debt and loans) vs GDP growth since 1950. The trend is hardly anyone’s friend, except for those who create the debt out of thin air to pocket the ever lower cash flows associated with it (and await the next inevitable bailout):

More importantly, on a leverage ratio basis, the US economy is now at a level of 352% total credit/GDP, the highest since Q1 2013, and a level which has been relatively flat since it peaked at 380% just before the crash. One way to read this chart perhaps is that the “carrying debt capacity” of the US economy is roughly 380% at which point something “unexpected” happens. At the current rate of surging credit relative to slowing GDP, the US economy should be there in the not too distant future.

This supposes people merely switch their money somewhere else, but some may simply need it fr other purposes.

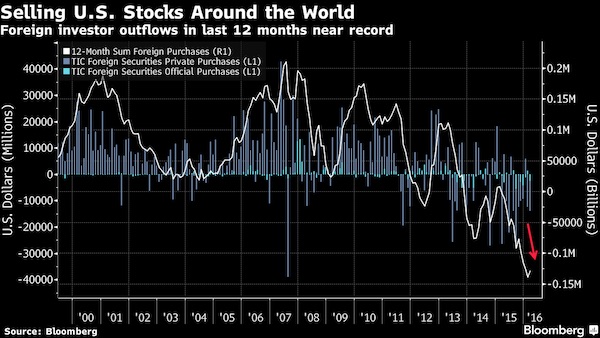

• Global Investors Are Fleeing US Stocks at a Record Pace (BBG)

The most determined seller of U.S. stocks may not be in the U.S. at all. Investors outside the country dumped $128 billion in American shares over the past year, data from the U.S. Treasury International Capital System show. Despite the higher quality of companies in the U.S., long-term investors may be drawn to the faster pace of growth in other economies, said Stewart Warther, an equity strategist at BNP Paribas.

There’s those nasty pesky withholding taxes again.

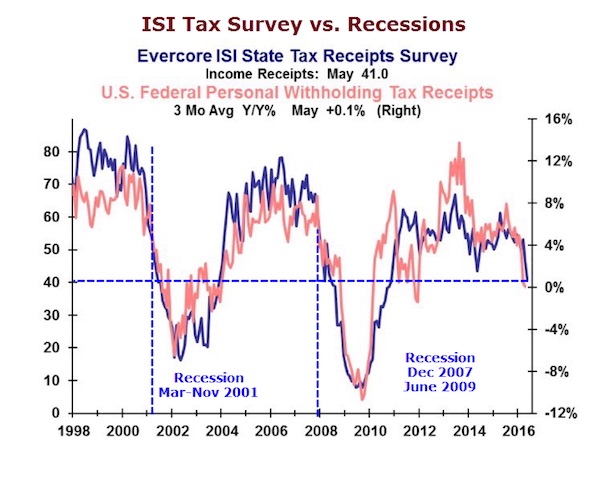

• US Tax Receipts Signaling Recession? (Mish)

US federal personal tax receipts receipts are falling fast. So is the Evercore ISI State Tax Survey. The last two times the survey plunged this much, the US was already in recession. Is it different this time?

Boy oh boy.

• Ready, Set, Crash – Could New Zealand Be Next To Fall? (NZ Herland)

“We’ve almost got the perfect storm,” says veteran fund manager Brian Gaynor as he reels off the many reasons New Zealand house prices and debt levels are soaring to precipitous heights. There are many ingredients. But right now, New Zealand seems to have them all: not enough building, restrictions on development, surging migration, baby boomer savings, low interest rates and banks that are all too happy to lend for property investment. “When you get the perfect storm like we did in the 1980s with the sharemarket, you see things just go up and up. People start to believe they will never fall,” he says.

“People didn’t believe the sharemarket would fall in the 80s. I’d come in from a trip to Australia and the guy at customs wouldn’t let me in unless I gave him sharemarket tips. It was just euphoria. Everyone was talking about the sharemarket. Now everyone is talking about the property market.” New Zealand’s gross debt is a whopping half trillion dollars; housing now accounts for $218 billion of that. As of April that housing debt was growing at an annualised rate of 8.3% – and that rate is accelerating. The median price of an Auckland house has almost doubled since the bottom of the last cycle in 2009, in the depths of the global financial crisis. The boom has now spilt over into the regions, with places like Hamilton and Tauranga surging 26 and 23% respectively in the past 12 months.

We should think about how scary this is.

• Pity Poor China: There’s No Easy Fix to the S-Curve (CH Smith)

The fundamental context of China’s economy is that it has traced out an S-Curve – as did previous fast-developing nations such as Japan and South Korea. The S-Curve can be likened to a rocket’s trajectory: first, there’s an ignition phase, as the fuel of financialization, cheap labor and untapped productive capacity is ignited. The boost phase lasts as long as credit-fueled production and consumption expand rapidly. In the boost phase, investors and financial authorities can do no wrong. The high growth rate of credit and production overwhelms all other factors, as the virtuous cycle of expanding profits and production increases wages which then support further expansion of credit and consumption which then supports more production, and so on.

A vast tide of foreign investment fuels an equally vast expansion of fixed capital assets such as factories and new homes. But then the fuel of financialization is consumed, and the previously fast-growing economy slows to stall speed. Depending on how much leverage, corruption and wealth has piled up in the boost phase, this phase may last a few years. This is the top of the S-Curve. As the economy weakens, everything that worked in the boost phase no longer works: expanding credit no longer boosts growth, inflating yet another real estate bubble no longer generates a widespread wealth effect, and every effort to shift from being an export-dependent economy to a self-supporting consumer economy fails to achieve liftoff.

Study western media to see how it’s done?!

• China’s Propaganda Department Not Good Enough At Propaganda (AFP)

hina’s propaganda department, tasked with controlling the media and arts, has been given a slap on the wrist for not being good enough at shaping public opinion, according to a report on a government website. The Central Commission for Discipline Inspection (CCDI) posted an article on its website Wednesday that described findings from its two-month-long probe of the ruling Communist party’s propaganda department, which began in February. Leaders in the department did not feel a sufficient sense of responsibility for undertaking ideological work, the piece cited CCDI member and investigation spokesman Wang Huaichen as saying. Art was not directed clearly enough towards socialist aims and political thought not emphasised enough in universities, he was quoted as saying.

News propaganda was not targeted or effective enough, especially in the field of new media, where the department had failed to fully implement the principle of “the party controlling the media”, the post cited him as saying. Wang called upon the department to make propaganda appear more valid by enhancing its attractiveness and appeal, it said. The Communist party tolerates no opposition to its rule and newspapers, websites, and broadcast media are strictly controlled. An army of censors patrols social media and many Western news websites are blocked. President Xi Jinping reminded top state media outlets to “strictly adhere to the orders of the Chinese Communist Party” during a series of high-profile visits to their headquarters in February.

How Hillary stands out against the US Marine Corps. Click the link to read a young man’s sense of duty and honor. Perhaps a bit overcharged, but what Clinton tries to get away with drags down the entire nation. She’s not the only one to flaunt the rules, but if the commander-in-chief -supposing she’s elected- does this, what does that tell everyone else? I can’t see the military and the FBI accepting it. Maybe the higher-ups would, but you don’t want widespread unrest in the ranks.

• How Mishandling Classified Info Affects People Not Named Clinton (USA T.)

Clinton is the antithesis of that young captain, someone with no honor, little courage and commitment only to her endless ambition. This has nothing to do with gender, party affiliation, ideology or policy. It is a question of character — not just hers, but ours. Electing Clinton would mean abandoning holding people accountable for grievous errors of integrity and responsibility. What we already know about her security infractions should disqualify her for any government position that deals in information critical to mission success, domestic or foreign. But beyond that, her responses to being found out — dismissing its importance, claiming ignorance, blaming others — indict her beyond anything the investigation can reveal. Those elements reveal her character. And the saddest thing is that so many in America seem not to care.

The downfall of the tech religion?!

• They Died of Progress (Greer)

[..] the unspeakable has become the inescapable in today’s world. It’s become a running joke on the internet that the word “upgrade” inevitably means poorer service, fewer benefits, and more annoyances for those who have to deal with the new and allegedly improved product. The same logic can be applied equally well across the entire landscape of modern technology. What’s new, innovative, revolutionary, game-changing, and so on through the usual litany of overheated adjectives, isn’t necessarily an improvement. It can be, and very often is, a disaster. Examples could be drawn from an astonishingly broad range of contemporary sources, but I have a particular set of examples in mind.

To make sense of those examples, it’s going to be necessary to talk about military affairs. As with most things in today’s America, the collective conversation of our time provides two and only two acceptable ways to discuss those, and neither of them have anything actually useful to say. The first of them, common among the current crop of American pseudoconservatives, consists of mindless cheerleading; the second, common among the current crop of pseudoliberals all over the industrial world, consists of moralizing platitudes. I don’t particularly want to address the moralizing platitudes just now, other than to say that yes, war is ghastly; no, it’s not going away; and it’s not particularly edifying to watch members of the privileged classes in the countries currently on top of the international order insist piously that war ought to be abandoned forever, just in time to keep their own nations from being displaced from positions they won and kept at gunpoint not that many decades ago.

The cheerleading is another matter, and requires a more detailed analysis. It’s common among the pseudoconservative right these days to insist that the United States is by definition the world’s most powerful nation, with so overwhelming a preponderance of military might that every other nation will inevitably have to bow to our will or get steamrollered. That sort of thinking backstops the mania for foreign intervention that guides neoconservatives such as Hillary Clinton on their merry way, overthrowing governments and destabilizing nations under the fond delusion that the blowback from these little adventures can never actually touch the United States.

In America these days, a great deal of this sort of cheerleading focuses on high-tech weapons systems—inevitably, since so much of contemporary American pop culture has become gizmocentric to the point of self-parody. Visit a website that deals with public affairs from a right-of-center viewpoint, and odds are you’ll find a flurry of articles praising the glories of this or that military technology with the sort of moist-palmed rapture that teenage boys used to direct to girlie-mag centerfolds. The identical attitude can be found in a dizzying array of venues these days, very much including Pentagon press releases and the bombastic speeches of politicians who are safely insulated from the realities of war. There’s only one small difficulty here, which is that much of the hardware in question doesn’t work.

Lovely from Dmitry.

• The Money Cult (Dmitry Orlov)

are there any unintended consequences of negative interest rates? Unintended consequences are hard to think about, and most people get a headache even trying. How can it be that clean, plentiful nuclear energy will eventually pollute the whole planet with long-lived radionuclides, resulting sky-high cancer rates? How can it be that wonderful genetically modified seeds will render us sickly and infertile in just a few generations? And how can it be that ingenious mobile computing technology has turned our children into zombies who are constantly twiddling their smartphones as they sleepwalk through life? It s hard to think about any of this without taking some happy pills; and how can it be that taking those happy pills has… you get the idea.

The unintended consequence of negative interest rates is that they destroy money. This is true in an entirely trivial sense: if you deposit x dollars at -p% annual, then a year later you will only have x(1-p) dollars because xp dollars has been destroyed. (In case you prefer to count on your fingers and toes, if you deposit $10 at -10% annual, then a year later you will only have $9 because $1 has been destroyed.) But what I mean is something slightly more profound: negative interest rates erode the very concept of money. To get at the reason for this, we have to ask a slightly more profound question: What is money? I think that money is the cult of the god Mammon.�

“Despite its intention to process all cases, Greece lacks the manpower to deal with the volume of applications. It says it needs more help from EU institutions. As many as 6,656 people applied for asylum in March and April this year, up from 1,899 in those months last year. Even if it could hire more people, they would need to be highly qualified legal experts, government officials say.”

• In Greek Refugee Camps, Wait For Asylum Fuels Unrest (R.)

Tents were set on fire, punches were thrown, children cried through the night and families were forced to flee the burning detention camp and sleep in open fields. The tension is palpable on Greece’s islands, where about 8,000 asylum seekers feel stranded by a European Union deal with Turkey to stem the arrival of refugees and other migrants on European shores from Syria, Iraq, Afghanistan and beyond. The deal, hailed a success by its European architects, prevents migrants from going beyond Greece – or even its islands – in their search for a new home in Europe, until their asylum claims are processed and those rejected are sent back to Turkey, from where they arrived. But some European officials say the assessment has been slow, and the wait long for those confined to often overcrowded camps.

In June, the most violent month yet, dozens were injured in clashes on three islands, police said. Videos in Greek media showed clouds of smoke rising over the centers on three occasions. In clashes on Lesvos the night of June 1-2, families with young children had to flee and spend the night in nearby fields or Mytilene town, several kilometers away, Amnesty International said. Many returned to burned down tents and destroyed belongings. Women told Amnesty they “live in constant fear” in camps where fights break out in food queues. Journalists are barred from entering the camps on the islands. But humanitarian organizations and police officials on the ground speak of people on edge. “They’re reacting. They want to leave the islands,” said a police official for the northern Aegean region which includes the islands of Lesvos, Samos and Chios where rival migrant groups brawled. “We’re bracing for all eventualities.”

We will never know how many people drown unnoticed. If a tree falls in a forest…

• 3,000 Migrants Rescued Off Italian Coast; Two Bodies Found (R.)

More than 3,000 boat migrants have been rescued in the Mediterranean over the past two days and two bodies have been recovered, Italy’s coastguard said on Thursday. The coastguard coordinated rescues of migrants from 15 different boats on Thursday, bringing 1,950 people to safety. Two bodies were recovered from a rubber boat. Some 1,100 migrants were rescued at sea on Wednesday. The coastguard had no details about the nationalities of the migrants, nor about the two deaths.

All the rescues took place between Italy and Libya, where people-smugglers operate with impunity amid the chaos of civil war. Britain’s HMS Enterprise and Germany’s FGS Frankfurt, patrolling the area as part of the European Union’s anti-people-smuggling operation, together rescued migrants from seven boats, a coastguard spokesman said. A Doctors without Borders vessel, the Dignity 1, rescued almost 500 from four boats, while the Phoenix, run by humanitarian group Migrant Offshore Aid Station, took 243 people from two boats.