DPC Belle Isle Park Aquarium, Detroit 1905

John Hempton doesn’t leave much of the NYT story standing.

• Some Comments On The NYT Story About Donald Trump’s Tax Returns (Hempton)

The New York Times has published a story (including extracts) about Donald Trump’s tax returns over two decades ago. The money-quote is this: “Donald J. Trump declared a $916 million loss on his 1995 income tax returns, a tax deduction so substantial it could have allowed him to legally avoid paying any federal income taxes for up to 18 years…” According to the NYT the losses came … through mismanagement of three Atlantic City casinos, his ill-fated foray into the airline business and his ill-timed purchase of the Plaza Hotel in Manhattan. There is an issue here. Donald Trump did not repay all the debt associated with those investments.

Either the loss is a real loss and the Donald was really was out of pocket by $916 million (in which case he has legitimate NOLs) or the loss was passed on to someone else by The Donald defaulting on debt – in which case Donald Trump should be assessed for income from debt forgiveness. After all if the debt is forgiven it is not Donald Trump’s loss. The loss is borne by the person who lent Donald money and did not get it back. That – clearly stated by example – is why most income tax systems assess debt forgiveness as income. I do not know whether Donald Trump had the wherewithal in 1995 to bear $916 million of losses personally. But I doubt it. (If he did his financial career is different from what is popularly accepted.)

So the alternative is the debt was forgiven in some way. But then the story the New York Times is running is wrong – because the $916 million of losses would not have survived the debt forgiveness and hence would have wiped out his NOLs and thus he would not be allowed to shelter his income for the next 18 years. Unless that is there is an avoidance scheme the New York Times has not worked out. Those schemes go by the name of “debt parking”. Here is how debt parking works. Suppose the debtor (in this case The Donald) is going to get his debt cancelled for (say) 1c in the dollar. When he gets the debt wiped out the debtor (ie The Donald) will have to report assessable income equal to the debt wiped out (in this case 99% of $916 million).

The alternative though is for the debtor to set up a dummy party. The dummy party might be his wife or children or some company or trust set up by them or more likely some completely opaque offshore trust. And that dummy party goes and buys the debt for say 1.1 cents in the dollar. Then they just sit there. They don’t force the debtor (ie The Donald) to repay. They don’t make a profit or loss on the debt. And because the debtor never has his debt forgiven he never gets the assessment on debt forgiveness and he gets to keep his NOLs even though the losses did not come out of his pocket. Every tax system worth its salt has some rules on “effective debt forgiveness” to prevent debt parking. And – from my experience which is now over twenty years old – none of them work entirely.

Now if Donald really has all those tax losses its pretty clear that the debt must be parked somewhere. There is a vehicle out there (say an offshore trust or other undisclosed related party effectively controlled by Donald Trump) – which owns over $900 million in debt and is not bothering to collect it. I do not have the time or energy to find that vehicle. But it is there. Now that this blog has gone public journalists are going to look for it. There is a Pulitzer prize for whoever finds it. Just give me a nod at the acceptance ceremony.

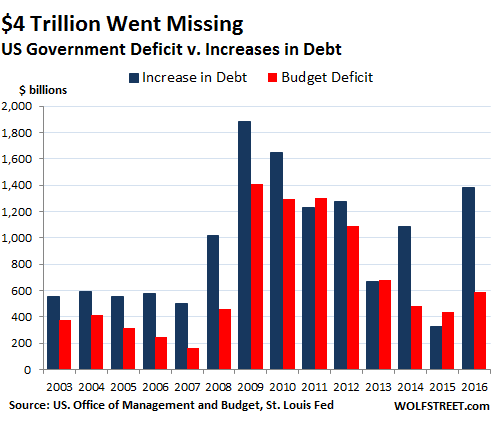

“What happened to the $4 trillion that the government borrowed but never officially spent since 2013? Where did this money go?”

• US Government Deficit Numbers are a BIG Lie (WS)

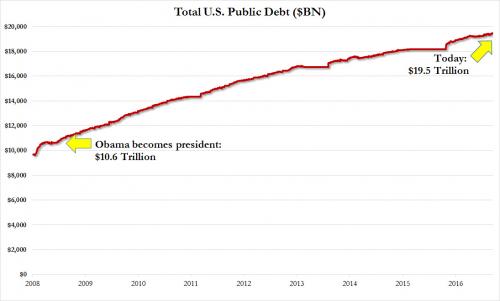

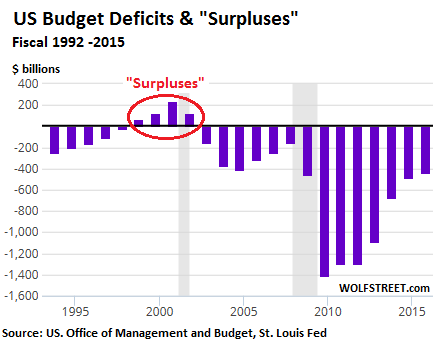

Remember when the US government had “surpluses” in the years 1998-2001? Well, yes, according to the Office of Management and Budget, those four years produced a combined $559 billion in “surpluses”: So did the debt fall by that amount? Nope. The debt continued to rise each year, as the government continued to borrow more and more money though it had a “surplus”: over the four years of “surpluses,” the government added $394 billion to its debt, as the scary chart below shows. But that was then and this is now. Now, the hole through which money disappears has gotten a lot bigger. In Fiscal 2016, the government ran a deficit of $590 billion, per the latest estimate of the Office of Management and Budget. Last year, the deficit was $438 billion. So combined over $1.0 trillion.

But it borrowed an additional $1.7 trillion to pay for $1.0 trillion in deficit spending. What happened to the $700 billion that it borrowed and that were not officially spent? It disappeared. Is it just a timing difference that averages out over the years? Nope. Since 2003, the government deficits published by the Office of Management and Budget amounted to $9.26 trillion. So the Treasury should have had to borrow that much to make up the difference. But over the same period, the national debt rose by $13.3 trillion. Meaning, $4.04 trillion had gone up in smoke. This chart shows the official deficits (red columns) and the increase in outstanding debt (blue columns) each year:

The $4 trillion was borrowed and the bonds were issued and the amounts are still outstanding, but the proceeds from the bond sales went out the door, off the books! We’ve all heard the stories of how the Pentagon’s books are sordid fiction [..] But that’s a different – and additional – matter. [..] With the missing $4 trillion, I’m talking about money that the government borrowed but never spent officially, that it never acknowledged even existed. This $4 trillion is on top of all the internal shenanigans at various departments, including the Department of Defense. What happened to the $700 billion in real money that the government borrowed over the past two fiscal years but never officially spent? What happened to the $4 trillion that the government borrowed but never officially spent since 2013? Where did this money go?

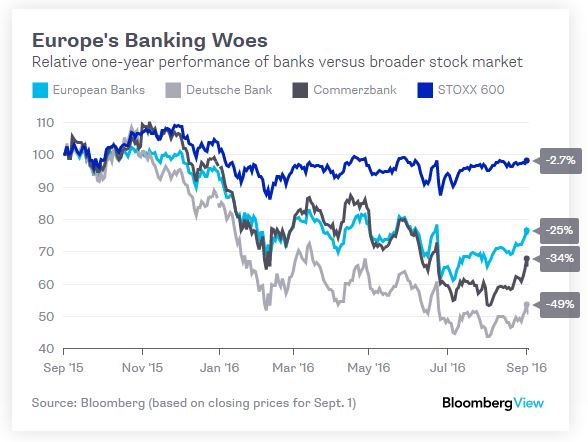

6 out of the 13 charged were/are Deutsche execs. And yes, it’s derivatives again, i.e. attempts to hide losses from the books. Same practice, and same time period, as Goldman’s dealings with the then Greek government.

• Six (Ex-)Deutsche Bank Executives Charged in Monte dei Paschi Probe (BBG)

Six current and former managers of Deutsche Bank – including ex-asset and wealth management head Michele Faissola – along with former executives at Nomura Holdings and Banca Monte dei Paschi di Siena were charged in Milan for colluding to falsify the accounts of Italy’s third-biggest bank and manipulate the market. A judge in Milan approved a request by prosecutors to try 13 bankers on charges over separate derivative transactions Paschi arranged with the securities firms, said a lawyer involved in the case, who attended the closed-door hearing Saturday, where the decision was announced.

The charges deal another blow to Deutsche Bank, which is seeking to reassure investors and clients that it will be able to withstand pending U.S. penalties over the bank’s sale of mortgage-backed securities and its dealings with some Russian clients. Monte Paschi, the world’s oldest bank, restated its accounts and has been forced to tap investors twice to replenish capital amid a surge in bad loans and losses on derivatives. It’s now attempting to convince investors to buy billions of soured debt before a fresh stock sale. Deutsche Bank’s shares have slumped 49% in Frankfurt this year, swinging wildly last week on news that hedge-fund clients withdrew some funds. Monte Paschi has dropped 84% this year amid concern it will struggle to restore profitability and strengthen its finances.

The charges culminate a three-year investigation by prosecutors that showed Monte Paschi used the transactions to hide losses, leading to a misrepresentation of its accounts between 2008 and 2012. The deals came to light in January 2013, when Bloomberg News reported that Monte Paschi used derivatives struck with Deutsche Bank to mask losses from an earlier derivative contract dubbed Santorini.

Between refugees and banks, Merkel has sure screwed up.

• ‘Merkel Cannot Afford To Bail Out Deutsche Bank’ (R.)

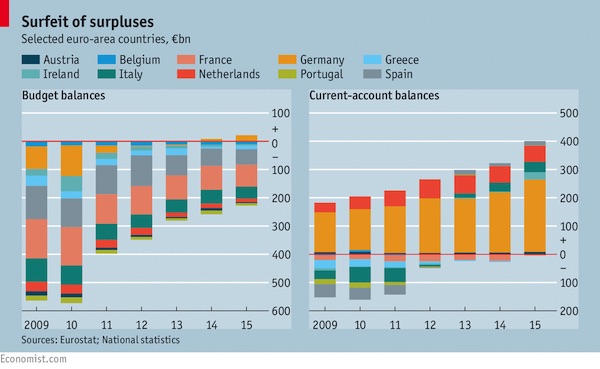

German Chancellor Angela Merkel cannot afford to bail out Deutsche Bank given the hard line Berlin has taken against state aid in other European nations and the risk of a political backlash at home, German media wrote on Saturday. The government denied a newspaper report on Wednesday that it was working on a rescue plan for Germany’s biggest bank, as its shares went into a tailspin fueled by a demand for up to $14 billion from U.S. authorities for misselling mortgage-backed securities before the financial crisis. Germany, which has insisted Italy and others accept tough conditions in tackling their problem lenders, can ill afford to be seen to go soft on its flagship bank, the Frankfurter Allgemeine wrote. “Of course Chancellor Merkel doesn’t want to give Deutsche Bank any state aid,” it wrote in a front-page editorial.

“She cannot afford it from the point of view of foreign policy because Berlin is taking a hard line in the Italian bank rescue.” The Sueddeutsche Zeitung wrote that Merkel would be breaking a promise to taxpayers if she were to bail the bank out, which could spell disaster for her re-election bid next year as the anti-immigration AfD party gains ground. The AfD is already benefiting from a backlash against Merkel’s open-door refugee policy, making huge gains in two regional elections last month and hitting an all-time high of 16% support in an opinion poll last week. “A state aid package would drive voters into the arms of the AfD,” the Sueddeutsche wrote in an editorial. “Domestic political considerations make it unlikely that Berlin would play this joker. Even more unlikely is that the European Commission would agree. The political risk would be simply too high.”

Before the end of March 2017, she said this morning.

• Theresa May To Propose ‘Great Repeal’ Bill To Unwind EU Laws (G.)

Theresa May will set Brexit in motion on Sunday , unveiling plans for a ‘great repeal bill’ to enshrine all EU regulations in UK law as soon as Brexit takes effect. In opening speeches at Conservative party conference in Birmingham, May and the Brexit secretary, David Davis, will announce the government’s plan to repeal the 1972 European Communities Act, the law that binds EU law to the British statute book, and new legislation to transpose EU legislation into British law, in its entirety, That law will only come into force on the day Britain leaves the EU, with future governments then able to unpick those laws as desired. The bill is set to be brought forward in the next parliamentary session, but will not take effect until after the formal two-year process of leaving the EU, which begins when the government triggers article 50.

In an interview in which the prime minister repeated her decision not to hold a general election before 2020, May told the Sunday Times: “We will introduce, in the next Queen’s speech, a ‘great repeal’ bill that will remove the European Communities Act from the statute book. “This marks the first stage in the UK becoming a sovereign and independent country once again. It will return power and authority to the elected institutions of our country. It means that the authority of EU law in Britain will end.” The prime minister has rejected calls from some Eurosceptic quarters to immediately repeal the 1972 act, saying the country needed “maximum security, stability and certainty for workers, consumers, and businesses, as well as for our international allies”.

A nice read, but it misses out entirely on the fact that stupefication starts in universities -if not before-, not afterwards.

• Stupefied: How Organisations Enshrine Collective Stupidity (Aeon)

Each summer, thousands of the best and brightest graduates join the workforce. Their well-above-average raw intelligence will have been carefully crafted through years at the world’s best universities. After emerging from their selective undergraduate programmes and competitive graduate schools, these new recruits hope that their jobs will give them ample opportunity to put their intellectual gifts to work. But they are in for an unpleasant surprise. Smart young things joining the workforce soon discover that, although they have been selected for their intelligence, they are not expected to use it. They will be assigned routine tasks that they will consider stupid. If they happen to make the mistake of actually using their intelligence, they will be met with pained groans from colleagues and polite warnings from their bosses.

After a few years of experience, they will find that the people who get ahead are the stellar practitioners of corporate mindlessness. One well-known firm that Mats Alvesson and I studied for our book The Stupidity Paradox (2016) said it employed only the best and the brightest. When these smart new recruits arrived in the office, they expected great intellectual challenges. However, they quickly found themselves working long hours on ‘boring’ and ‘pointless’ routine work. After a few years of dull tasks, they hoped that they’d move on to more interesting things. But this did not happen. As they rose through the ranks, these ambitious young consultants realised that what was most important was not coming up with a well-thought-through solution. It was keeping clients happy with impressive PowerPoint shows.

Those who did insist on carefully thinking through their client’s problems often found their ideas unwelcome. If they persisted in using their brains, they were often politely told that the office might not be the place for them. [..] For more than a decade, we’ve been studying dozens of organisations such as this management consultancy, employing people with high IQs and impressive educations. We have spoken with hundreds of people working for engineering firms, government departments, universities, banks, the media and pharmaceutical companies. We started out thinking it is likely to be the smartest who got ahead. But we discovered this wasn’t the case.

To repeat once again: the EU is a criminal organization.

• How Brussels Is Obstructing The Prosecution Of Corruption Cases In Greece (IE)

For a good eight years now, politicians, pundits and ordinary citizens have been quarreling over the merits (or lack thereof) of economic policies imposed on Greece by its lenders, notably the EU Commission. Was austerity beneficial or catastrophic? Did “reforms” help or hamper employment and growth? But while such issues are inherently contentious, the third and latest bailout agreement also provides for far less controversial policies. “Upgrade the fight against corruption”! “Strengthen the independence of institutions”! “De-politicise” the state! Insulate “financial crime and corruption investigations from political intervention”! All these are straight quotes from the third bailout agreement. Who would object to any of that?

Well, the EU, via its main institutions, does. Even the author of the bailout agreement, the EU Commission, seems to be quite allergic to all of the above, at least when it involves its own people. From the Commission’s spokespersons to the president of Eurogroup himself, a crowd of EU officials have been, at least twice in the recent months, actively and proactively doing their best to stop Greek judges from delivering on their job description: prosecuting corruption cases and financial crime. In August 2016, EU Commission spokesman Margaritis Schinas reiterated the need for Greece “to depoliticise” its administration. Schinas was referring to the controversial prosecution of the former head of the Greek statistics authority Andreas Georgiou.

In a yet new twist in the “Greek Statistics” saga, Greece’s Supreme Court had reopened a criminal case against Georgiou for allegedly inflating the government’s budget data between 2010 and 2015 and thus overstretching the need for additional austerity measures. Mr. Georgiou had been appointed head of ELSTAT, the statistical authority, in 2010 in an attempt by the government and the country’s lenders to restore credibility to Greek statistics. The revelation in late 2009 that the fiscal deficit had been grossly underestimated had largely triggered the start of the euro crisis. Since Georgiou took over, the quality of Greece’s reported data was hailed by the country’s lenders and Eurostat as “reliable” and “accurately reported”, but contested by other ELSTAT board members, including academics and statisticians.

This led to a nasty and lengthy spat between the two sides and to the eventual prosecution of Mr. Georgiou despite huge political pressure (by Greek and international political actors) to dismiss the case. The case’s reopening provoked the immediate and angry reaction of Brussels. In an interview with Bloomberg TV, Jeroen Dijsselbloem said that the prosecution of Mr. Georgiou was “a big mistake”. Head of Eurostat, Marianne Thyssen, told reporters that Georgiou effectively had no case to answer. Brussels retaliated by threatening Greece to postpone the reimbursement of the next installment

Turley will never be an EU member. And if Merkel tries to push through visa-free travel, she’ll blow up the EU AND her own country.

• Erdogan Says Turkey In ‘Endgame’ Over EU Membership (AFP)

President Recep Tayyip Erdogan on Saturday warned that Turkey had reached the “end of the game” over its decades-long EU membership bid, saying it was time for Brussels once and for all to make clear if it wanted Ankara as a member. In a hard-hitting speech marking the opening session of parliament, Erdogan also told Brussels it needed to allow Turks visa-free travel to the bloc by October, as per a previous agreement to decrease migrant flows. Relations between the EU and Turkey have strained in the wake of the July 15 failed coup, with EU officials among the most vocal critics of the relentless crackdown against the alleged plotters and supporters “If the EU is going to make Turkey a full member, we are ready. But they should know that we have came to the end of the game,” Erdogan said in a televised speech in Ankara.

“There is no need to beat around the bush or engage in diplomatic acrobatics. “It’s their (the EU’s) choice to continue the path with or without Turkey. They should not hold us responsible,” he added. Erdogan said that October would be an important month in Turkey’s relations with the European Union and that “it is necessary” that visa-free travel for Turks to the Schengen Area comes into force this month. Under a March deal, Turks were to gain visa-free travel in exchange for Ankara helping reduce the flow of migrants to Europe. However the visa plan as stumbled over Turkey’s anti-terror laws. Turkey’s bid to join the EU dates back to the 1960s with formal talks starting in 2005. So far, only 16 chapters of the 35 chapter accession process have been opened for Turkey.

Afraid he himself will be sued. But then, so are many Americans.

• Erdogan Slams US Congress Over Saudi 9/11 Law (AFP)

Turkish President Recep Tayyip Erdogan condemned Saturday a US Congress vote to override Barack Obama’s veto of a bill allowing 9/11 victims to sue Saudi Arabia, saying he expected the move to be reversed as soon as possible. Relations between Ankara and Riyadh have tightened considerably in the past months as they pursue joint interests in Syria. Erdogan had just the day earlier hosted Saudi Crown Prince Mohammed bin Nayef for talks at his palace. “The allowing by the US Congress of lawsuits to be opened against Saudi Arabia over the 9/11 attacks is unfortunate,” Erdogan said in a speech for the opening of parliament.

“It’s against the principle of individual criminal responsibility for crimes. We expect this false step to be reversed as soon as possible,” he added. Families of 9/11 victims have campaigned for the law, convinced the Saudi government had a hand in the attacks that killed almost 3,000 people. Fifteen of the 19 hijackers were Saudi citizens, but no link to the government has been proven. The Saudi government denies any ties to the plotters. Obama called the vote a “dangerous precedent” while Saudi Arabia warned it risked having “disastrous consequences”.

Western Europe has utterly failed to see how different eastern European, formerly Soviet-block, nations are from them.

• Hungary Votes On Government’s Rejection Of EU Refugee Quotas (AP)

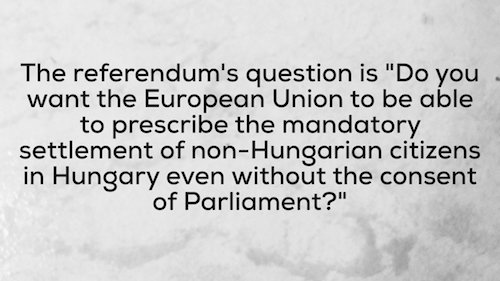

Hungarians were voting Sunday in a referendum called by Prime Minister Viktor Orban’s government to seek support for its opposition to any future, mandatory EU quotas for accepting relocated asylum seekers. The government’s position is expected to find wide support among voters, though there was uncertainty whether turnout would exceed the 50% plus-one-vote threshold needed for the referendum to be valid. The referendum asks: “Do you want the European Union to be able to prescribe the mandatory settlement of non-Hungarian citizens in Hungary even without the consent of Parliament?” Orban has argued that “No” votes favor Hungary’s sovereignty and independence. If that position secures a majority of ballots, Hungary’s parliament would pass legislation to bolster the referendum’s goal whether or not turnout was sufficient for a valid election, he said.

Orban also said he would resign if the “Yes” votes won, but the vow was seen mostly as a ploy to boost turnout by drawing his critics to the polls. “The most important issue next week is for me to go to Brussels, hold negotiations and try with the help of this result — if the result if appropriate— achieve for it not to be mandatory to take in the kind of people in Hungary we don’t want to,” Orban said after casting his vote in an elementary school in the Buda hills. Orban, who wants individual EU member nations to have more power in the bloc’s decision-making process, said he hopes the anti-quota referendums would be held in other countries. “We are proud that we are the first” he said. “Unfortunately, we are the only ones in the European Union who managed to have a (referendum) on the migrant issue. I would be happy to see other countries to follow.”

“..Greece has plenty of uninhabited islands, and big foreign debt. So if you have ‘hotspots’ in Greek islands, this would be a sort of payment of foreign debt..”

• Czech President Calls For Deportation Of Economic Migrants (Pol.)

Czech President Milos Zeman has called for economic migrants arriving in Europe to be deported to “empty places” in North Africa or “uninhabited Greek islands.” “I am for deportation of all economic migrants,” Zeman said. “Of course I respect the cruelty of civil war in Syria, Iraq, and so on. But we do not speak about those people, we speak about economic migrants.” “We are in Greece, and Greece has plenty of uninhabited islands, and big foreign debt. So if you have ‘hotspots’ in Greek islands, this would be a sort of payment of foreign debt,” Zeman told the FT in an interview published on Sunday. He added that he is “sure there is a strong connection between the wave of migrants and the wave of jihadis … And those people who deny this connection are wrong.” The Czech president has been condemned for making Islamophobic remarks in the past.

It was Germany that last year declared Dublin null and void. They will say that was only temporaray, but regulations like this are not light switches that selected parties can flick on and off when it suits them.

Greece is already little more than a greatly impoverished holding pen for the unwanted, and it threatens to fall much deeper into the trap. That’s why the Automatic Earth effort to support the poorest people is not just still needed, but more now than ever. We will soon start a new campaign to that end. In the meantime, please do continue to donate through our Paypal widget in amounts ending in $.99 or $.37.

• Germany Interior Minister Urges Athens To Implement Dublin Rules (Kath.)

Germany Interior Minister Thomas de Maiziere has repeated his call for Greece to implement the so-called Dublin regulations, which state that migrants must seek asylum in the EU member-state they first arrived in. Due to deficiencies in Greece’s asylum processing system and the large number of migrants and refugees arriving in the country, Berlin has suspended deportations back to Greece since 2011. “The EU has since then provided financial and other support for Greek efforts, and given a lot of money to improve these conditions,” de Maiziere told Kathimerini. “That is why I would like to see the Dublin Convention implemented again,” he said. The German minister said Berlin recognized the burden shouldered by Greece in recent years. “But we still need a strategy to restore the legal situation,” he said, adding that the issue would be discussed at a meeting of interior ministers in October.