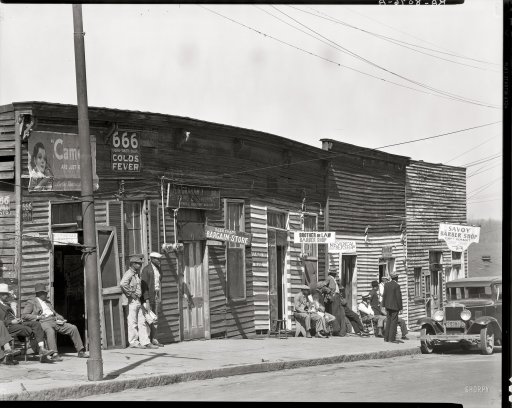

Walker Evans Vicksburg, Mississippi. “Vicksburg Negroes and shop fronts” 1936

Behold: an economy broken to the bone. No investement in manufacturing capacity equals no confidence in the future.

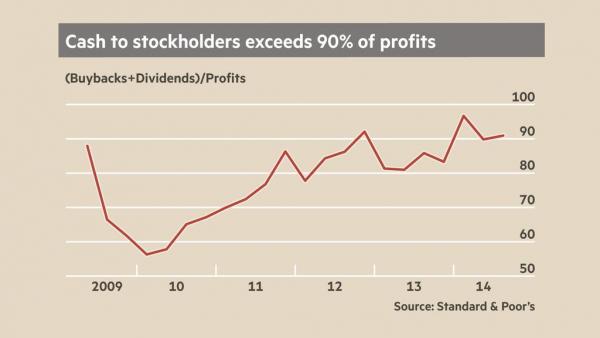

• US Firms Spend More on Buybacks Than Factories (WSJ)

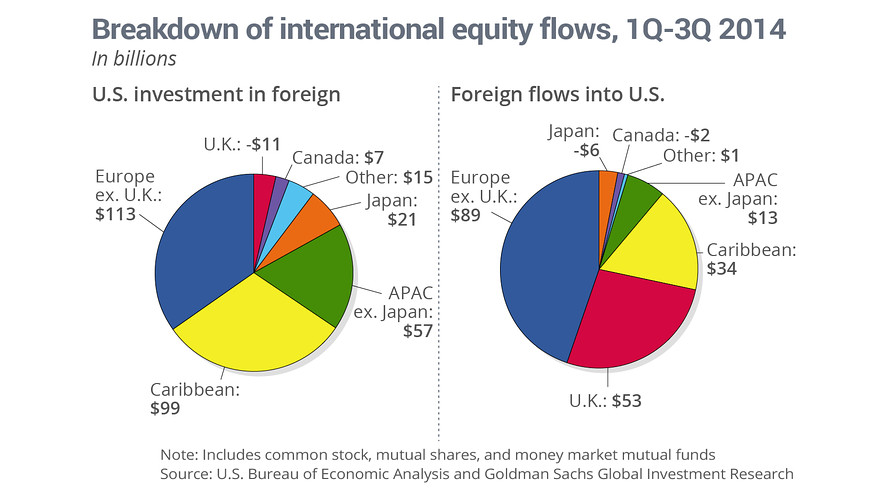

U.S. businesses, feeling heat from activist investors, are slashing long-term spending and returning billions of dollars to shareholders, a fundamental shift in the way they are deploying capital. Data show a broad array of companies have been plowing more cash into dividends and stock buybacks, while spending less on investments such as new factories and research and development. Activist investors have been pushing for such changes, but it isn’t just their target companies that are shifting gears. More businesses sitting on large piles of extra cash are deciding to satisfy investors by giving some of it back. Rock-bottom interest rates have made it cheap to borrow to buy back shares, which can boost a company’s stock price. And technology-driven productivity gains are enabling some businesses to do more with less.

As the trend picks up steam, so too has debate about whether activist investors—who take sizable stakes in companies, then agitate for changes they think will boost share prices—have caused companies to tilt too far toward short-term rewards. Laurence Fink, chief executive of BlackRock, the world’s largest money manager, argued as much in a March 31 letter to S&P 500 CEOs. “More and more corporate leaders have responded with actions that can deliver immediate returns to shareholders, such as buybacks or dividend increases, while underinvesting in innovation, skilled workforces or essential capital expenditures necessary to sustain long-term growth.”

An analysis conducted for The Wall Street Journal by S&P Capital IQ shows that companies in the S&P 500 index sharply increased their spending on dividends and buybacks to a median 36% of operating cash flow in 2013, from 18% in 2003. Over that same decade, those companies cut spending on plants and equipment to 29% of operating cash flow, from 33% in 2003. At S&P 500 companies targeted by activists, the spending cuts were more dramatic. Targeted companies reduced capital expenditures in the five years after activists bought their shares to 29% of operating cash flow, from 42% the year before, the Capital IQ analysis shows. Those companies boosted spending on dividends and buybacks to 37% of operating cash flow in the first year after being approached, from 22% in the year before.

Rent seeking.

• You’ve Met Hillarynomics. Now Meet Left-of-Hillarynomics. (Vox)

Conventional thinking holds that wealth should be invested and, through investment, put to productive use, with those investments creating job opportunities and higher wages. Alternatively, if few productive investment opportunities are available, the return on invested wealth should start falling. It ought to be a self-correcting cycle in which wealth cannot outpace incomes for long. But the return from capital remains high, and wages are stagnating. Something’s gone wrong. The problem, Stiglitz and his co-authors write, is that the rise in wealth isn’t coming from productive investments. It’s coming from what economists call rents — a metaphorical extension of the 18th-century practice of small farmers paying rent to landlords for the right to use the total inert asset of land.

Stiglitz and his co-authors extend the idea to include a wider and more modern array of rents. A patent or a copyright, for example, can be a valuable financial commodity to own, even without being productive in the way a factory or tractor is. To see the distinction, imagine you have $300 million and can either invest it in a startup or use it to buy the rights to the Beatles’ songs. In the former case, you’re providing money that a company can then use to hire people, produce goods, and generally create wealth in the world. In the latter, you’re producing nothing; you’re just grabbing something that someone else produced and claiming the proceeds from it. “Rent-seeking,” as economists call it, is generally viewed as economically counterproductive. It’s especially counterproductive when it becomes so lucrative as to provide a more attractive outlet for people’s money than real investments.

The report’s authors argue that’s exactly what’s happening with Wall Street. Its growth has fueled a big rise in credit — credit that tends to go to those who already have wealth, often in the form of rents, exacerbating existing rent-based problems. Financiers have also identified novel ways to rent-seek. “Too big to fail” status, for example, can count as a rent. It increases the value of firms like Goldman Sachs or JPMorgan Chase not by making them more productive, but by providing an implicit government subsidy. Trading mortgage-backed securities for profit, similarly, does little to actually increase wealth but a lot to redirect it. That makes it attractive as a business activity for banks and hedge funds, redirecting their energies from profitable activities that create wealth.

Many of these rents are explicitly created by government policies. “Too big to fail” is an obvious example, but financial deregulation more broadly has made speculation vastly more profitable in recent decades, encouraging rent-seeking on the part of financial firms. Stiglitz and his co-authors also finger tax cuts for the wealthy as a culprit. [..] countries that slashed their top marginal tax rates the most in recent decades also saw the biggest increases in inequality before taxes. That might make sense if the tax cuts boosted growth, but that wasn’t really what happened. [..] the tax cuts gave top earners bigger incentive to extract rents for themselves, to bargain hard to increase their share of the company’s wages. In the 1950s, when the top marginal tax rate in the US was 91%, getting an extra $1 in income through rents only yielded $0.09 after taxes. Today, it means getting $0.60. That’s a sixfold increase — a huge increase in the incentive to find rents for oneself.

All the job protection our (grand-)parents fought for are gone.

• 40% of American Workers Now Have ‘Contingent’ Jobs (Forbes)

Tucked away in the pages of a new report by the U.S. General Accounting Office is a startling statistic: 40.4% of the U.S. workforce is now made up of contingent workers—that is, people who don’t have what we traditionally consider secure jobs. There is currently a lot of debate about how contingent workers should be defined. To arrive at the 40.4 %, which the workforce reached in 2010, the report counts the following types of workers as having the alternative work arrangements considered contingent. (The government did some rounding to arrive at its final number, so the numbers below add up to 40.2%).

Agency temps: (1.3%); On-call workers (people called to work when needed): (3.5%); Contract company workers (3.0%); Independent contractors who provide a product or service and find their own customers (12.9%); Self-employed workers such as shop and restaurant owners, etc. (3.3%); Standard part-time workers (16.2%). In contrast, in 2005, 30.6% of workers were contingent. The biggest growth has been among people with part time jobs. They made up just 11.9% of the labor force in 2005. That means there was a 36% increase in just five years. The report uses data from the Bureau of Labor Statistics. It begs an important question: Are traditional jobs—the foundation of our consumer economy–running their course and going the way of the typewriter and eight-track tape? And if so, what do we do about it?

This report is important because it’s the first time since the Great Recession that the U.S. government has taken stock of how many people are working without the protections that come with traditional, full-time W-2 jobs. It reinforces estimates of the independent workforce that have come from observers ranging from the Freelancers Union to Faith Popcorn and are in a similar ballpark. Many people in this workforce are struggling economically. In a note issued with the report, Senators Patty Murray (D-WA) and Kirsten Gillibrand (D-NY) write, “Because contingent work can be unstable, or may afford fewer protections depending on a worker’s particular employment arrangement, it tends to lead to lower earnings, fewer benefits, and a greater reliance on public assistance than standard work.”

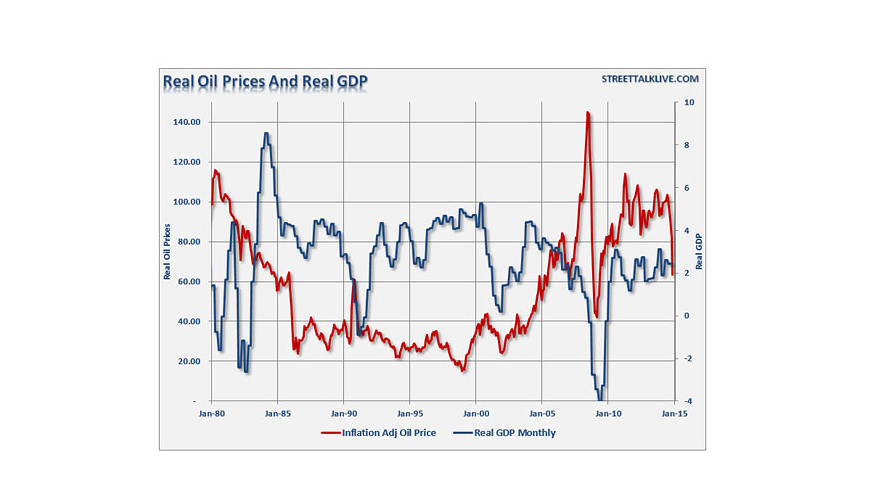

Sorry, technodreamers, but we will never power anything like our present economy on renewables. Ambrose has no clue.

• Fossil Industry Faces A Perfect Political And Technological Storm (AEP)

The political noose is tightening on the global fossil fuel industry. It is a fair bet that world leaders will agree this year to impose a draconian “tax” on carbon emissions that entirely changes the financial calculus for coal, oil, and gas, and may ultimately devalue much of their asset base to zero. The IMF has let off the first thunder-clap. An astonishing report – blandly titled “How Large Are Global Energy Subsidies” – alleges that the fossil nexus enjoys hidden support worth 6.5pc of world GDP. This will amount to $5.7 trillion in 2015, mostly due to environmental costs and damage to health, and mostly stemming from coal. The World Health Organisation – also on cue – has sharply revised up its estimates of early deaths from fine particulates and sulphur dioxide from coal plants.

The killer point is that this architecture of subsidy is a “drag on economic growth” as well as being a transfer from poor to rich. It pushes up tax rates and crowds out more productive investment. The world would be richer – and more dynamic – if the burning of fossils was priced properly. This is a deeply-threatening line of attack for those accustomed to arguing that solar or wind are a prohibitive luxury, while coal, oil, and gas remain the only realistic way to power the world economy. The annual subsidy bill for renewables is just $77bn, trivial by comparison. The British electricity group SSE is already adapting to the new mood. It will close its Ferrybridge coal-powered plant next year, citing the emerging political consensus that coal “has a limited role in the future”.

The IMF bases its analysis on the work Arthur Pigou, the early 20th Century economist who advocated taxes to ensure to stop investors keeping all the profit while dumping bad side-effects on the rest of society. The Fund has set off a storm of protest. Subsidies are not quite the same as costs. Oil veterans retort that they have been paying punitive taxes into the common welfare pool for a long time. But whether or not you agree with the IMF’s forensic accounting the publication of such claims by the world’s premier financial body is itself a striking fact. The IMF is political to its fingertips. It rarely deviates far from the thinking of the US Treasury.

It is becoming clearer last year’s sweeping deal on climate change between the US and China was an historical inflexion point, the beginning of the end for a century of fossil dominance. At a single stroke it defused the ‘North-South’ conflict that has bedevilled climate policy and that caused the collapse of the Copenhagen talks in 2009. Todd Stern, the chief US climate negotiator, said the chemistry is radically different today as sherpas prepare for the COPS 21 summit in Paris this December. “The two 800-pound gorillas are working together,” he said.

Glut.

• The Tanker Market Is Sending a Big Warning to Oil Bulls (Bloomberg)

Four months into oil’s rebound from a six-year low, the tanker market is sending a clear signal that the rally is under threat. A sudden surge in demand for supertankers drove benchmark charter rates 57% higher in the two weeks through May 20. OPEC will have almost half a billion barrels of oil in transit to buyers at the start of June, the most this year, while analysts say about 20 million barrels is being stored on ships in another indication the glut has yet to dissipate. OPEC is pumping the most oil in more than two years, determined to defend market share rather than prices. A record cut to the number of active U.S. drilling rigs and billions of dollars of spending reductions by companies since last year’s price plunge has yet to translate into a slump in barrels produced.

The world is producing about 1.9 million barrels a day more crude than it needs, according to Goldman Sachs “Supply of oil continues to build,” said Paddy Rodgers of Euronav, whose supertanker fleet can haul 56 million barrels of crude. “All of this oil needs to go somewhere,” he wrote in an e-mail May 19. Daily rates for supertankers on the industry’s benchmark route reached $83,412 on May 20, from $52,987 on May 6, according to the Baltic Exchange in London. While rates since retreated to $69,594, they’re still the highest for this time of year since at least 2008.

OPEC’s 12 members have will have 485 million barrels of oil in transit to buyers in the four weeks to June 6, the most since November, Roy Mason, founder of Oil Movements, monitoring the flows, said by e-mail Wednesday. Iraq, the group’s second-largest producer, plans to boost exports to a record 3.75 million barrels a day next month, according to shipping programs. Spare tanker capacity in the Middle East has seldom been tighter. The combined excess of ships competing for the region’s exports stood at 6% last week, the lowest for the time of year in Bloomberg surveys of shipbrokers that started in 2009. While that expanded to 12% this week, the monthly average was still the lowest on record for May.

Expect many, and bigger, swings.

• China Stocks Plunge 6.5%, Worst Selloff In 4 Months (CNBC)

It was a sea of red in China, with the key Shanghai Composite ending down 6.5% at a near one-week low, marking its biggest one-day loss since January 19 and breaking an eight-session winning streak. The CSI 300 index of the largest listed companies in Shanghai and Shenzhen tumbled 6.7%, while the start-up board ChiNext sank 5.4%. News that more Chinese brokerages are tightening margin lending rules seem to be the main cause of concern among retail investors, experts say. According to IG market strategist Bernard Aw, Guosen Securities increased the margin requirement for 908 counters while Southwest Securities reduced the amount of margin financing that traders can receive using collateral.

Separately, the Shanghai Securities News also reported that regulators have recently urged banks to submit data regarding money flows into the stock market, according to Reuters. Meanwhile, Hong Kong shares tracked their mainland peers to recede more than 2%, hitting a two-week low. Shares of Hong Kong-listed Evergrande Real Estate Group inched up 0.1% after announcing plans to raise around $600 million in a Hong Kong share offering. Sunac China Holdings plunged nearly 6% following news that it is terminating a takeover deal for troubled Chinese developer Kaisa.

“Once it’s government policy, you better pay attention.”

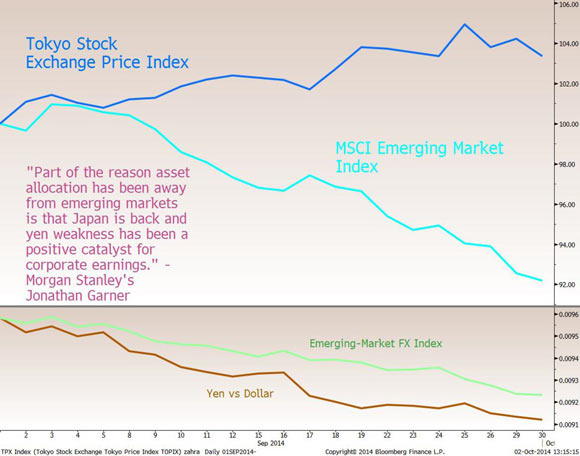

• Yen Drops to 12-Year Low as Yellen Builds Case for Fed Rate Rise (Bloomberg)

The yen fell to a 12-year low versus the dollar as the Federal Reserve prepares to raise interest rates, sharpening the contrast with the Bank of Japan’s unprecedented monetary stimulus. Japan’s currency led declines among 16 major peers this week as signs of U.S. economy strengthening revived the greenback’s rally. The yen’s 30% drop since 2012 is driving record profits at Japan’s biggest companies, helping the nation’s stocks toward their longest rally since 1988. BOJ Governor Haruhiko Kuroda repeated this week that he’ll adjust monetary policy if needed to meet his inflation target.

“The dollar will appreciate relative to the yen because Japanese government policy is to depreciate the yen,” Daniel Fuss at Loomis Sayles said in an interview in Tokyo Wednesday. “Once it’s government policy, you better pay attention.” The Japanese currency has depreciated by 2.1% versus the greenback since May 21, the day before Fed Chair Janet Yellen said she expects to raise interest rates this year for the first time since 2006. Until last week, the yen had been trading in a range of just two yen around 120 per dollar this quarter. The yen’s weakness came as the BOJ pursued policies including unprecedented debt purchases, seeking to revive an economy that spent more than a decade battling deflation.

The fine print: the original Guardian headline is: “US to urge Greece to end brinkmanship with creditors at G7 meeting”, accusing Greece of brinkmanship. But that’s not what Lew said, even in the article.

• US To Urge Greece, Creditors To End Brinkmanship At G7 Meeting (Guardian)

The US Treasury secretary has said he will use the G7 finance ministers’ meeting to press Greece and its European creditors to end their brinkmanship and forge a rescue deal. With the Syriza-led coalition scrambling to secure an agreement, which will release the final €7.2bn (£5.1bn) tranche of bailout cash and prevent it defaulting on a looming payment to the International Monetary Fund (IMF), Jack Lew urged both sides in the ongoing Greek debt crisis to “treat every deadline as the last”. Washington has looked on with varying degrees of frustration and alarm throughout the long-running saga, which has seen Greece bailed out twice by a total of €240bn.

On a day when share prices soared on rumours of a breakthrough in the debt talks, before German officials scotched talk of “progress”, Lew warned both sides against complacency. Speaking to students at the London School of Economics before flying to Dresden for the G7 summit, which will take place on Thursday and Friday, he said: “No one should have a false sense of confidence that they know what the result of a crisis in Greece would be.” He stressed that he believed all parties were negotiating in good faith, with neither deliberately aiming at a Greek default. However, Lew said he feared an “accident”, with the high-stakes negotiations ending in crisis. “It is profoundly in the interests of the US and European economies for the accident to be avoided,” Lew said, speaking to students at the London School of Economics. “Brinksmanship is a dangerous thing”.

Dangerous. The troika could stop this, but won’t.

• Greek Bank Losses Show Predicament Amid Record Deposit Outflows (Bloomberg)

Greek banks, forced into a central bank liquidity lifeline, are poised to report sustained losses as they grapple with record deposit outflows and an economy that plunged into double-dip recession. National Bank of Greece, the country’s biggest lender by assets, and Alpha Bank report first-quarter earnings Thursday. Piraeus Bank on Wednesday said its first-quarter loss was €69 million, as deposits shrank by 15% to €46.5 billion, with a further €1.9 billion of private deposit outflows through mid-May. “We expect the Greek banks to remain loss-making this quarter” on more expensive funding from the ECB and higher provisions for souring loans, Euroxx Securities analyst Maria Kanellopoulou said.

The prolonged uncertainty on Greece’s support program “will inevitably weigh on banks’ asset quality, with a fresh rise in new non-performing loans.” Greek lenders have lost access to capital markets and the ECB’s normal financing operations amid a standoff between the country’s anti-austerity coalition and its creditors over the terms of the current bailout. Lenders rely on more than €80 billion of Emergency Liquidity Assistance extended by the Bank of Greece to stay afloat, a more expensive source of funding, while they are forced to participate in liquidity-draining auctions of government treasury bills rather than let the country default.

“Tsipras added that there is “absolutely no risk to salaries and pensions, nor to bank deposits.”

• Athens, Creditors Offer Conflicting Views On Negotiations (Kathimerini)

Prime Minister Alexis Tsipras said Wednesday that a deal with creditors was “close” and government officials said an agreement was being drafted but representatives of the country’s creditors made it quite clear that they do not share such optimism. In comments after a meeting at the Finance Ministry, Tsipras said a deal with creditors was “close” and that “very soon we will be able to present more details.” He stressed the need for “calm and determination,” noting that Greece would come under additional pressure in the final stretch of negotiations. He also referred to “conflicting views between institutions” and to “countries with different approaches.” Tsipras added that there is “absolutely no risk to salaries and pensions, nor to bank deposits.”

According to sources, Tsipras was advised to make the statement by aides fearing that jitters were creeping back into the markets and could prompt a new wave of deposit outflows. Tsipras chose to make the statement flanked by Finance Minister Yanis Varoufakis to underline the government’s backing for the latter, who has come under fire over his confusing statements about the content of a potential deal. Earlier in the day, the ECB decided not to raise the ceiling on emergency liquidity to Greece. A Greek government official commented that the Bank of Greece had not requested an increase to emergency liquidity as the current ceiling of €80.2 billion is regarded as adequate “following a stabilization of deposit outflows.”

In an interview with Die Zeit on Wednesday, German Finance Minister Wolfgang Schaeuble said it was down to Greece to decide on whether to introduce capital controls. He defended the decision by Greece’s creditors to link loans to further reforms, despite the country’s tightening liquidity problems. “That is the philosophy of the rescue program. The new government is saying: we want to keep the euro but we don’t want the program any more. That doesn’t fit together,” he said. Earlier, on a stopover in London on his way to a meeting of Group of Seven finance ministers in Dresden, US Treasury Secretary Jack Lew called on Greece’s creditors “show enough flexibility so if the Greeks are prepared to take the kind of steps they need to take, they find a pathway to resolving this without there being an unnecessary crisis.”

It’s easy to forget that all Syriza has been able and allowed to do so far is to negotiate with creditors, and that everything else has been forced onto the backburner.

• Romantic Notions Meet Reality (Alexis Papachelas)

Before the elections, there was a considerable number of people who totally disagreed with the ideas and program put forward by SYRIZA, but they expected that the leftist party would, at least, provide a breath of fresh air as it climbed to power. They believed that SYRIZA would do away with the highly partisan tactics of its socialist and conservative predecessors and move on to adopt more meritocratic practices. They expected that SYRIZA would install young, independent people in key government posts, making use of the best talents that the country has to offer. They hoped that SYRIZA officials would man the state apparatus after poring over the CVs of thousands of job-seekers in the private sector. And they anticipated a growth-oriented strategy that would enable people to try their luck without running into unnecessary or artificial obstacles, and without having to pay bribes here and there.

It was only natural that a large section of voters would expect all that. Because, regretably, and despite the crisis, the old political system failed to change the way things work in this country. Unfortunately, the expectations of all those voters with romantic notions of what to expect have not been fulfilled. The state mechanism has mostly been manned by friends and political cronies of the ruling party. Key posts have been entrusted to well-connected representatives of the good old system. The way SYRIZA has dealt with the so-called oligarchs seems very selective. It does not seem to have allowed the domestic institutions to carry out their work in a fair and transparent manner. In fact, it smacks of an attempt to install a new oligarchy – only, this time, one that is pro-SYRIZA.

So, no breath of fresh air. The question, of course, is why? The answer is that SYRIZA has strong ties with groups that depend exclusively on the state for their survival. The healthy private sector which does not rely on the generosity of the state for its well-being has no political representation in Alexis Tsipras’s party. The truth is, even the country’s conservative parties have failed in that respect. It’s hard to say how long SYRIZA will manage to stay in power. Any prediction would be risky these days. That said, those who looked forward to some creative big bang, as it were, spawned by SYRIZA’s victory are beginning to feel disappointed. That does not mean to say that the party will not be able to consolidate itself as the dominant political player. It does mean, however, that the dreamers will have to wait. Or move to a more cynical, same-old view of things.

A moment of clarity from Ye Olde Paul.

• Grexit and the Morning After (Krugman)

We just had another electoral earthquake in the euro area: Podemos-backed candidates have won local elections in Madrid and Barcelona. And I hope that the IFKAT — the institutions formerly known as the troika — are paying attention. The essence of the Greek situation is that the actual parameters of a short-run deal are clear and unavoidable: Greece can’t run a primary budget deficit, because nobody will lend it new money, and it won’t (and basically can’t) run a large primary surplus, because you can’t squeeze even more blood from that stone. So you would think that an agreement for Greece to run a modest primary surplus over the next few years would be easy to reach — that is what will happen, so why not make it official?

But now the IMF is playing bad cop, declaring that it cannot release funds until Syriza toes the line on pensions and labor market reform. The latter is dubious economics — the IMF’s own research doesn’t support enthusiasm about structural reforms, especially in the labor market. The former probably recognizes a real problem — Greece probably can’t deliver what it has promised pensioners — but why should this be an issue over and above the general question of the primary surplus. What I would urge everyone to do is ask what happens if Greece is in fact pushed out of the euro. (Yes, Grexit — ugly word, but we’re stuck with it.) It would surely be ugly in Greece, at least at first.

Right now the core euro countries believe that the rest of the euro area can handle it, which might be true. Bear in mind, however, that the supposed firewall of ECB support has never actually been tested. If markets lose faith and the time for ECB purchases of Spanish or Italian bonds arises, will it really happen? But the bigger question is what happens a year or two after Grexit, where the real risk to the euro is not that Greece will fail but that it will succeed. Suppose that a greatly devalued new drachma brings a flood of British beer-drinkers to the Ionian Sea, and Greece starts to recover. This would greatly encourage challengers to austerity and internal devaluation elsewhere.

Think about it. Just the other day the Very Serious Europeans were hailing Spain as a great success story, a vindication of the whole program. Evidently the Spanish people don’t agree. And if the anti-establishment forces have a recovering Greece to point to, the discrediting of the establishment will accelerate. One conclusion, I guess, is that Germany should try to sabotage Greece post-exit. But I hope that will be considered unacceptable. So think about it, IFKATs: are you really sure you want to start going down this road?

Has been for years. The plunge will be historic.

• Australia Property Boom Is On Borrowed Time (Business Spectator)

The stage is set for Australian property to finally feel the pain so evident across other sectors of the economy. A series of headwinds – combined with tighter lending standards – ensures that the investor property boom is now on borrowed time. Yesterday, Westpac decided to cut the lucrative interest rate discounts offered to new housing investors – following similar action from its major rivals last week – as regulatory pressure from the Australian Prudential Regulation Authority begins to take effect. The implication of this shift in regulatory policy will be modest at first but could soon snowball into a much weaker period for Australian property. Rarely can a housing downturn be so easily identified.

Nevertheless, right now, prices continue to rise at a rapid pace in Sydney and to a lesser extent Melbourne. By comparison, conditions in the other capitals remain more modest. Real dwelling prices – that is prices adjusted for inflation – have increased by 30% since the beginning of 2013 in Sydney and by 15% in Melbourne. In the other capitals, price growth has better reflected income growth. But the tide is clearly turning and the outlook for the property sector needs to be viewed against the broader economic backdrop. The Reserve Bank, for example, was recently forced to cut their economic outlook for the fourth time in the past five quarters. We are currently stuck in the middle of an ‘income recession’ due to the sharp fall in commodity prices.

In the next few years, higher taxes will hit the market at the very top – since high income earners obviously purchase expensive housing – but also towards the bottom – since investors often favour cheap rental properties. Alternatively, higher taxes could make negative gearing more attractive. Meanwhile, the Federal Government has taken clear and decisive steps to reign in foreign investment in established property, while maintaining the existing arrangements for new construction. We also cannot ignore the possibility that the Western Australia economic bust has significant spill over effects for the broader economy and financial system.

But will it stick? Does RICO apply to FIFA?

• US Treats FIFA Like the Mafia (Bloomberg)

It wasn’t exactly extraordinary rendition. But when Swiss police arrested seven officials of FIFA, the international football federation, for extradition to the U.S., there were some echoes of the secret terrorism arrests. Soccer is a global game, and it matters more to almost everyone than to Americans. So why is the U.S. acting as the international sheriff and grabbing up non-U.S. citizens to try them domestically for corrupting the sport worldwide? And more to the point, why is this legal? It turns out the legal basis for the FIFA prosecutions isn’t all that simple or straightforward – and therein lies a tale of politics and sports. The prosecutions are being brought under RICO, the Racketeer Influenced and Corrupt Organizations Act of 1970, which was designed to prosecute crime syndicates that had taken over otherwise lawful organizations.

Roughly speaking, the law works by allowing the government to prove that a defendant participated in a criminal organization and also committed at least two criminal acts under other specified laws, including bribery and wire fraud. If the government can prove that, the defendant is guilty of racketeering, and qualifies for stiff sentences, the seizure of assets and potential civil-liability lawsuits. The first and most obvious problem raised by the FIFA arrests is whether the RICO law applies outside the U.S., or “extraterritorially” as lawyers like to say. Generally, as the Supreme Court has recently emphasized, laws passed by Congress don’t apply outside the U.S. unless Congress affirmatively says so. RICO on its face says nothing about applying beyond U.S. borders. So you’d think that RICO can’t reach conduct that occurred abroad, and much of the alleged FIFA criminal conduct appears to have done so.

But in 2014, the U.S. Court of Appeals for the Second Circuit held that RICO could apply extraterritorially – if and only if the separate criminal acts required by the law, known as “predicate acts,” violated statutes that themselves apply outside U.S. borders. The court gave as an example the law that criminalizes killing an American national outside the U.S. That law clearly applies abroad, the court pointed out. And it may function to define one of the predicate offenses under RICO. Thus, RICO can apply abroad. To convict the FIFA defendants, therefore, the Department of Justice will have to prove either that they committed crimes within the U.S. or that they committed predicate crimes covered by RICO that reach beyond U.S. borders.

Bet you didn’t know.

• You’ll Be Sorry When The Robot McJournalists Take Over (Irish Times)

If you consume much of your daily news diet online, you’re probably already acquainted with the work of “robot journalists”, you just don’t know it yet. We’re not talking here about Wall-E running around with a reporter’s notebook chasing stories on Amal Clooney (well, not yet), but about the algorithms used by organisations such as Forbes, AP and Fortune to produce millions of stories AP relies on a content generation package called Wordsmith to produce some of its quarterly-earnings business stories and will soon be using it for sports coverage too. You’ve never heard of Wordsmith but you’re probably familiar with its work: it produced 300 million stories last year and is aiming for one billion this year. A rival company, Narrative Science, provides content to Forbes, Fortune and others.

“We sort of flip the traditional content creation model on its head,” Robbie Allen, creator of Wordsmith told the New York Times. “Instead of one story with a million page views, we’ll have a million stories with one page view each.” The cheerleaders for this new technology – who includes some journalists (New York magazine declared that “the stories that today’s robots can write are, frankly, the kinds of stories that humans hate writing anyway”) – claim that it will free journalists up to do more meaningful pieces, while algorithms churn out rewrites of press releases, mine longer texts for insights, or produce entirely personalised packages of content tailored for individuals. That’s nonsense. As always, “freeing people up” invariably means “liberating them of their jobs”.

But leaving aside the prospect of fewer people in employment, the notion that algorithms may end up taking over even the quotidian aspects of content production is depressing, and not just for journalists. [..] it’s you, the reader, who will suffer. Algorithms may be good at crunching numbers and putting them in some kind of context, but journalists are good at noticing things no one else has. They’re good at asking annoying questions. They’re nosy and persistent and willing to challenge authority to dig out a story. They’re good at provoking irritation, devastation, laughter or controversy. Wildly efficient robot journalists may offer hope to an industry beset by falling advertising rates and disappearing readers. The world will have fewer human journalists as a result, which may not be altogether a bad thing. But the question is: does it really need a billion more pieces of McJournalism?

Go to site to watch video.

• Julian Assange: TPP Isn’t About Trade, But Corporate Control (Democracy Now)

As negotiations continue, WikiLeaks has published leaked chapters of the secret Trans-Pacific Partnership — a global trade deal between the United States and 11 other countries. The TPP would cover 40% of the global economy, but details have been concealed from the public. A recently disclosed “Investment Chapter” highlights the intent of U.S.-led negotiators to create a tribunal where corporations can sue governments if their laws interfere with a company’s claimed future profits. WikiLeaks founder Julian Assange warns the plan could chill the adoption of health and environmental regulations.

Julian Assange: ..it’s the largest-ever international economic treaty that has ever been negotiated, very considerably larger than NAFTA. It is mostly not about trade. Only five of the 29 chapters are about traditional trade. The others are about regulating the Internet and what Internet—Internet service providers have to collect information. They have to hand it over to companies under certain circumstances. It’s about regulating labor, what labor conditions can be applied, regulating, whether you can favor local industry, regulating the hospital healthcare system, privatization of hospitals. So, essentially, every aspect of the modern economy, even banking services, are in the TPP.

And so, that is erecting and embedding new, ultramodern neoliberal structure in U.S. law and in the laws of the other countries that are participating, and is putting it in a treaty form. And by putting it in a treaty form, that means—with 14 countries involved, means it’s very, very hard to overturn. So if there’s a desire, democratic desire, in the United States to go down a different path—for example, to introduce more public transport—then you can’t easily change the TPP treaty, because you have to go back and get agreement of the other nations involved. Now, looking at that example, what if the government or a state government decides it wants to build a hospital somewhere, and there’s a private hospital, has been erected nearby?

Well, the TPP gives the constructor of the private hospital the right to sue the government over the expected—the loss in expected future profits. This is expected future profits. This is not an actual loss that has been sustained, where there’s desire to be compensated; this is a claim about the future. And we know from similar instruments where governments can be sued over free trade treaties that that is used to construct a chilling effect on environmental and health regulation law. For example, Togo, Australia, Uruguay are all being sued by tobacco companies, Philip Morris the leading one, to prevent them from introducing health warnings on the cigarette packets.

But that’s against our life philosophy?!

• The Cheapest Way To Help the Homeless: Give Them Homes (Mother Jones)

Santa Clara County is perhaps best known as the home of Silicon Valley. It also has one of the country’s highest rates of homelessness and its third largest chronically homeless population. An extensive new study of the county’s homelessness crisis, published yesterday, finds that the most cost-effective way to address the problem is to provide people with homes. Those findings echo a similar approach that’s been successfully adopted in Utah, the subject of Mother Jones’ April/May cover story. The study was conducted by county officials who teamed up with Economic Roundtable, a nonprofit public policy research organization, and Destination: Home, an agency that works to house the homeless.

Researchers dug into 25 million records to create a detailed picture of the demographics and needs of the more than 104,000 people who were homeless in the county between 2007 and 2012. They found that much of the public costs of homelessness stemmed from a small segment of this population who were persistently homeless, around 2,800 people. Close to half of all county expenditures were spent on just five% of the homeless population, who came into frequent contact with police, hospitals, and other service agencies, racking up an average of $100,000 in costs per person annually. Those costs quickly add up—overall, Santa Clara communities spend $520 million in homeless services every year.

The study also highlights solutions. The researchers examined Destination: Home’s program, which has housed more than 800 people in the past five years. The study looked at more than 400 of these housing recipients, a fifth of whom were part of the most expensive cohort. Before receiving housing, they each averaged nearly $62,500 in public costs annually. Housing them cost less than $20,000 per person—an annual savings of more than $42,000.

Fifty shades of dry.

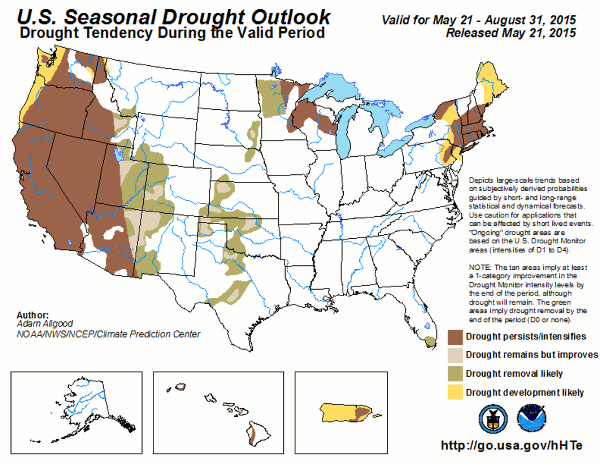

• US Droughts Set To Be Worst In 1000 Years (OnEarth)

The National Oceanic and Atmospheric Administration’s seasonal outlook is out, and this summer is going to be a dry one. The massive drought consuming the West will likely continue and even intensify in most places (sorry Nevada, that forecast covers the entire Silver State.) But it won’t be alone: The upper Midwest and Northeast will be parched, too. As for the lower Midwest, a few states could get some relief, but…I wouldn’t let those green lawns go to your head. Scientific models predict that as the climate warms, we’ll see more droughts, and according to the video below, they’ll also last longer than in the past. So Americans, start swinging your partner round and round, shaking your moneymaker, or electric-sliding (if you must)—because we may need to come up with a national rain dance.

History revised: no asteroid.

• Fossil Fuel Burning Nearly Wiped Out Life On Earth 250m Years Ago (Monbiot)

In the media, if not scientific literature, global catastrophes have long been associated with asteroid strikes. But as the dating of rocks has improved, the links have vanished. Even the famous meteorite impact at Chicxulub in Mexico, widely blamed for the destruction of the dinosaurs, was out of sync by more than 100,000 years. The story that emerges repeatedly from the fossil record is mass extinction caused by three deadly impacts, occurring simultaneously: global warming, the acidification of the oceans and the loss of oxygen from seawater. All these effects are caused by large amounts of carbon dioxide entering the atmosphere. When seawater absorbs CO2, its acidity increases. As temperatures rise, circulation in the oceans stalls, preventing oxygen from reaching the depths.

The great outgassings of the past were caused by volcanic activity that were orders of magnitude greater than the eruptions we sometimes witness today. The dinosaurs appear to have been wiped out by the formation of the Deccan Traps in India: an outpouring on such a scale that one river of lava flowed for 1,500km. But that event was dwarfed by a far greater one, 190m years earlier, that wiped out 96% of marine life as well as most of the species on land. What was the cause? It now appears that it might have been the burning of fossil fuel. Before I explainthis extraordinary contention, it’s worth taking a moment to consider what mass extinction means.

This catastrophe, at the end of the Permian period about 252m years ago, wiped out not just species within the world’s ecosystems but the ecosystems themselves. Forests and coral reefs vanished from the fossil record for some 10 million years. When, eventually, they were reconstituted, it was with a different collection of species which evolved to fill the ecological vacuum. Much of the world’s surface was reduced to bare rubble. Were such an extinction to take place today, it would be likely to eliminate almost all the living systems that sustain us. When plants are stripped from the land, the soil soon follows.

Blackberry founder decides Artic ownership?

• A 19th Century Shipwreck Could Give Canada Control of the Arctic (Bloomberg)

Jim Balsillie, the former co-CEO of Research In Motion, the company behind the BlackBerry, believes rituals are scenes we perform so our lives might take the shape we need them to take. It’s a symbolic act, and symbols matter to him. Directly beneath the hole in the ice, visible on the seafloor, is the biggest symbol of all: the HMS Erebus, one of two British navy ships lost during Sir John Franklin’s doomed 1845 quest to find the Northwest Passage through the Arctic. The whereabouts of the Erebus frustrated hundreds of searchers for more than 150 years, costing several their lives. Balsillie helped finance and coordinate the successful hunt for the ship, rediscovered in September 2014.

On a personal level, the search for the Erebus was a way for him to take more control over his life after his unceremonious exit from RIM, which left him angry, drained, and disoriented. But it’s much more than an archeological artifact. It represents an opportunity for Canada to take more control of the Arctic. Exploring the Erebus, Balsillie hopes, will draw the collective attention of Canadians northward to a neglected region with billions in potential resources. And by conducting a complex operation in the waters, Canadian military and civilian officials say they are demonstrating their sovereignty over the Northwest Passage. The Queen Maud Gulf, where the Erebus sits, is part of the southern branch of the Northwest Passage.

The route is a fabled link between the Atlantic and Pacific that for centuries proved a dangerous magnet for seekers of knowledge, fortune, and glory. Since 2007, as a result of climate change, the passage has become navigable by smaller ships for a couple of months during most summers. An open route can cut thousands of miles off of trips between the west coast of the Americas and Europe. The two alternative routes are the Panama Canal and the Northern Sea Route, which runs from the Bering Strait and over the Russian Arctic. In 2013 the MS Nordic Orion, a Norwegian freighter, made the first cargo transit of the Northwest Passage. That trip, which carried coal from Vancouver to Norway, hasn’t been repeated. But it raised an unanswered question in maritime law: Who really controls the waters of the route and the rest of Canada’s Arctic archipelago, which consists of more than 30,000 islands?

She’s a beauty.

• The Tiny House Powered Only by Wind and Sun (Atlantic)

In theory, I support the tiny-house lifestyle. I would enjoy the opportunity to live on a lonesome plain somewhere, with only the stars and many insects for company. I’m sure I could find a way to de-clutter my life such that the floor of my room/house was not always covered by 100 pairs of yoga pants. I would emerge from the experience a stronger, more reflective person who, if tiny house documentaries are to be believed, is also an expert in knitting and roof repair. The problem would lie in the construction of said house. If I were in charge of hooking up my own water lines, for example, I would be dead of dysentery by now.

Enter the Ecocapsule, a new kind of micro-house powered entirely by solar and wind energy. The capsule, made by a Slovakian company called Nice Architects, comes pre-made and ready to house two adults. Its kitchenette spouts running water, the toilet flushes, and the shower flows hot. It is 14.6 feet long and 7.4 feet wide. Nice Architects will start taking pre-orders in the fall of this year, and it expects to start delivering the first units in the beginning of 2016. They’re unveiling the Ecocapsule publicly for the first time this week at the Pioneers festival in Vienna. The company suggest the Ecocapsule can be used as a portable hotel, a research station, or even a charging hub for electric vehicles.

The designers, for whom English is not a first language, also write in the release that the “capsule can be used as a urban dwelling for singles in the high-rent, high-income areas like NY or Silicone valley. It can be placed on the rooftop or vacant parking lot.” (Hear that, Google employees? Enjoy dealing with your new, pod-dwelling roof squatters!) Okay, so maybe that last one is wishful thinking. But if it works as described, the capsule might just be the perfect tiny house for those who yearn to live on the edge of an ethereal cliff but don’t want to learn how to build a composting toilet.