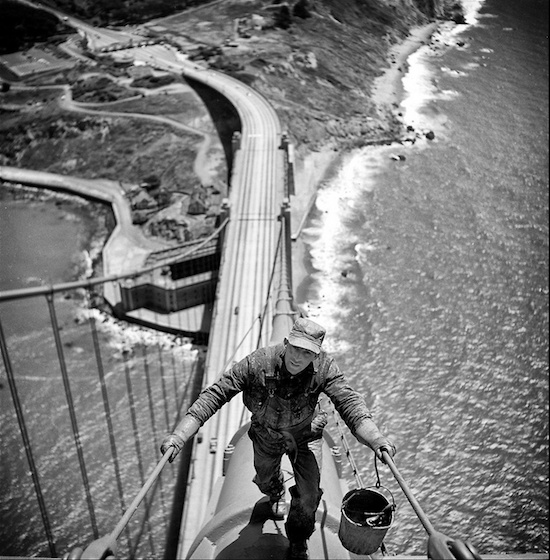

Harris&Ewing Safest driver of Washington DC, 32 Years Without Crash 1936

It’s Jackson Hole week, and we’re going to hear a lot of fairy tales and otherwise invented-from-scratch material. Since it may not always be easy to distinguish between pure mud and actual information, let’s destroy a few fantasy piñatas right here and now. So when Yellen and Draghi speak on Friday, you’ll be able to tell a few things apart. It’ll be hard enough, the speech writers and spin doctors won’t get much sleep this week.

But in the end, it’s all terribly simple. Central bank governors, finance ministers, government leaders and media have built up an image of ‘mere’ economic cycles and recovery and promises, boosted stock markets to new records, and gotten everybody’s hopes up. And now they won’t be able to deliver on those promises. Still, they can play along for a while longer. And they will.

There’s not a major central banker who can raise interest rates without risking severe damage to their economies. Simply because those economies wouldn’t look half as promising as they do today without the highly manipulative actions of ultra low rates and ultra loose credit. Without that pair, it’s going to be the crumbling walls of Jericho. In every single formerly rich nation.

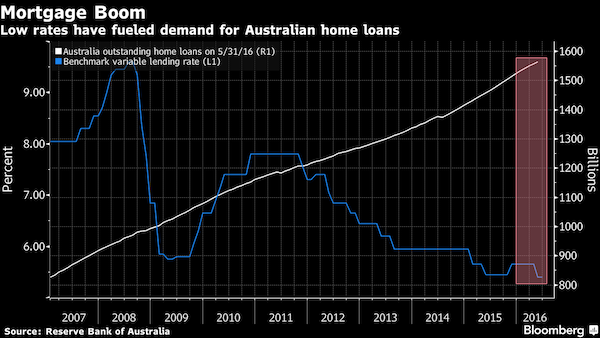

There is no escape velocity – and there won’t be -, there are only stories and fantasies. Where do you think housing would be where you live if mortgage rates were 2-3 times higher – as in normal – than they are now?

At the same time, the enormous distortion of the economies caused by ultra low rates and ultra loose credit cannot last forever. Because fixed income, pensions, will be bled so dry grandmas will start thirsting for blood before they keel over because of a lack of care. And because markets need the mechanism of price discovery, lest the only companies left to invest in will be the weaker ones (since every single one will be weak).

They have to, but they can’t. They must, but they don’t dare. So much for forward guidance, it doesn’t mean a thing when central bankers are stuck in a trap of their own BS spin.

Don’t Hike Alone Is Jackson Hole Bear Warning for Central Banks

The message from [Yellen] and fellow central banking superstars is loose monetary policy still has a while to run. Yellen continues to caution that labor markets are slack enough to merit low interest rates, while European Central Bank President Mario Draghi and Bank of Japan Governor Haruhiko Kuroda may even deploy more stimulus before the end of the year to battle low inflation. Yellen and Draghi will both address the Federal Reserve Bank of Kansas City’s conference in Jackson Hole on August 22.

Their behavior makes it tougher for others to take the initiative. A case in point: Bank of England Governor Mark Carney. After warning in June that investors may not appreciate the risk of higher rates, he said last week the U.K. won’t rush to act amid overseas threats of expansion and the weakness of wages. When the pack picks up the speed away from stimulus will therefore depend on Yellen, Draghi and Kuroda. If economic growth or inflation accelerates more than anticipated they may even push ahead faster …

Both the Fed and the Bank of England, if the forward guidance they so abundantly advertize would have actual meaning, would, given the targets they set in the past, have to raise rates. But they can’t, and this ‘having to do it in concert’ idea is a welcome distraction. There are others.

To justify not raising rates despite earlier guidance targets, Yellen uses the overloaded on part-time US jobs market, and the ‘broken record’ wages that just won’t move up no matter how great the economy is supposedly doing. Carney uses wages and an opaque story about disappointing exports. And then, obviously, they use each other as lightning rods.

They can also quite safely hide behind the ECB and the Bank of Japan, both of which oversee economies that are by most standards doing so poorly that a rate hike by either would be seen as suicidal.

Not that they’re in the same boat: the ECB, a.k.a. Berlin, hasn’t loosened credit enough over the past 7 years to achieve the short term upticks the US and UK have shown (and which both claim are not short term). Japan, on the other hand, has stimulated so much it has reached the end of the road in ‘stimuland’. Japan’s PM Shinzo Abenomics can look forward only to frightening statistics, and BOJ boss Kuroda will soon either move to Paraguay or be humbly requested to commit harakiri.

Carney’s case is a tad peculiar. Only this weekend he declared his willingness to risk a complete collapse of Britain’s economy just to show his never tried and certainly never proven theories are right:

Interest Rates Will Rise Before Real Pay Stops Falling, Says Carney

The governor of the Bank of England has warned interest rates might start to rise before workers see a sustained real-terms pick up in their pay. Signalling further pain for households, Mark Carney said it was possible that borrowing costs – on hold at 0.5% for more than five years – would increase before wage growth catches up with inflation. “We have to have the confidence that real wages are going to be growing sustainably [before rates go up]. We don’t have to wait for the fact of that turn to do so,” Carney said.

That’s at least sort of funny, because it’s exactly what Abe said about Abenomics before it started to fall apart entirely: that if only the Japanese had faith and confidence that it would work, it magically would. Looking at his mindset, you can expect him to repeat until his dying day that if only they had believed!

But that still doesn’t make Carney’s line any less crazy, of course. What he proposes is to make everyone in Britain pay more for everything, mortgages, services, you name it, without getting paid more so they can afford it. “We have to have the confidence”.

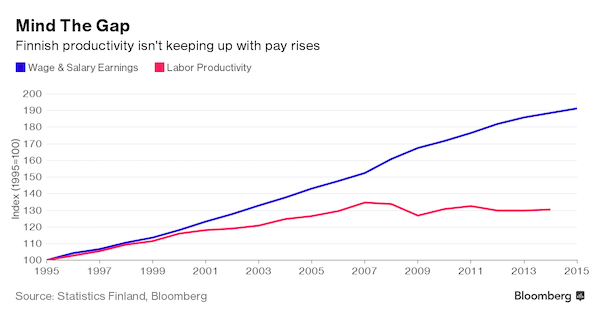

Inflation has outpaced wage growth for the vast majority of the period since 2008, bringing a prolonged period of falling real pay and living standards for UK workers. Last week the Bank’s rate-setting Monetary Policy Committee slashed its forecast for pay growth by half to 1.25% by the end of 2014, as wage rises have failed to materialise despite rapidly rising employment. With inflation expected to be just below the 2% target by the end of 2014, average real pay is expected to fall for the rest of the year, with rises not expected until 2015. Markets are forecasting a first rate rise in early 2015, and the pound has strengthened in recent weeks as investors bet that Threadneedle Street will be the first major central bank to raise rates.

Carney said he would be “comfortable” being the first to move. “We will do what we need to do.” Hinting at the growing division among MPC members over the appropriate timing of the first hike, Carney said: “In terms of our broader message, and where the committee is united and has the same view, is that as the expansion continues, rates are going to go up,” he said. “People might have different views on the exact timing, but it will happen and people should plan accordingly. Second, our best judgment of the path is that it will be limited and gradual, a new normal if you will.”

Carney, no matter what he says, isn’t “comfortable being the first to move”. He just finds himself with a big sweaty – but undoubtedly well pedicured – foot in his mouth. He’s looking for a way out, and covering his donkey with lines like “as the expansion continues, rates are going to go up”, so if there’s no expansion, he’s off the hook.

But that contradicts his earlier “forward guidance”, and it head-on collides with the insane loose credit-induced housing boom he himself created and now realizes he must stop, lest three quarters of the nation end up underwater.

As for that so-called “inflation”, British CPI was announced to be 1.6% today. Way below anyone’s target. Should that make him more, or less, likely to raise rates? One could argue either way, but he could certainly make a case for not raising them on account of it, and so he will. But it’s all hot air.

Because inflation cannot be measured – just – by looking at rising prices. Inflation is the money/credit supply – which recent policies have raised to stupendous levels – multiplied by the velocity of money, better known as consumer spending. Given the rise in credit, one can only surmise, looking at low CPI numbers, that spending is dropping rapidly. Despite all that credit pumping. But then, with stagnant wages, and a nation already swamped in debt, who would expect anything else?

British MPs are on to Carney’s behind-wiggling too, but they’re seeking a political reason behind it.

Bank Of England’s Mark Carney Accused Of Delaying Rate Hike Ahead Of General Election

A second MP has attacked Bank of England Governor Mark Carney, claiming the Canadian is “clearly” attempting to delay rate rises until after the next general election. Treasury Select Committee member John Mann’s intervention comes in the wake of accusations from Conservative MP Mark Field of a “clear bargain” between Carney and Chancellor George Osborne to keep rates low until the country goes to the polls next May. A dovish inflation report from the Bank last week meanwhile dampened prospects for an interest rate rise this year. Mann said: “It is abundantly clear that Mark Carney is attempting to delay interest rate increases until after the election when they rise immediately.”

Mann previously clashed in public with Carney in November last year when he accused him of being “in danger of being too close to the Chancellor and acting as a politician rather than a Governor”. Carney responded that he was “more than mildly offended” by the thrust of Mann’s comments. The Bank of England – operationally independent since 1997 – and the Treasury deny any kind of backroom deals between Osborne and Carney, following Field’s claims. The Bank said there “was no agreement between the Governor and the Chancellor over Bank rate and never has been”. One insider added: “The idea is absolutely mad. The monetary policy committee guards its independence fiercely.”

Right. Independence. Only a fool would believe in that, and regardless, Carney still doesn’t need pressure from politicians to make up his mind. He has nowhere to turn, whatever he does is going to work out terribly wrong. All he’s got is the ‘official’ 3.2% GDP growth for the UK. That looks good. For now. So he might as well go for the rate hike in an ‘after me the flood’ move.

But then, there’s Jackson Hole. And all those other hugely important people who want a say.

For Interest Rates, Low Is the New Status Quo

It’s time to get used to near-zero savings-account interest rates and 10-year bond yields that don’t get much higher than 3%. Yes, the Federal Reserve is preparing to raise rates as soon as next spring. But even that won’t produce the interest-rate “normalization” that many assume to be on the way.

That overdue reversion to the mean of recent decades—pined for by retirees and other risk-averse savers, feared by holders of higher-yielding bonds—isn’t coming. Blame it on the persistent sources of fragility in the global economy: banks that remain reluctant to lend to Main Street, a looming debt crisis in China, and the alarming prospect that deflation will come to Europe’s shores and return to Japan’s. All that will keep inflation reined in and make the Fed extremely hesitant to do follow-up rate hikes after its first one breaks an almost decadelong drought.

In other words, whatever or whoever may be wrong, it’s not the central bankers. It’s global fragility , China, Europe, Japan. If not for that all that reality, theories would look just great, thank you.

Scott Mather, deputy CIO at bond fund manager Pacific Investment, says the eventual resting point for rates will be much lower and “the Fed will take a lot longer to get there than in previous cycles. And a chief reason for that is all the overhangs that we have.” The initial move, certain to be a mere quarter of a percentage point, will have only the slightest impact on money-market rates, since banks will still be borrowing short-term money at not much more than 0%.

Yet because of underlying economic weakness, even this modest credit tightening could temper growth and reflexively give the Fed pause. It isn’t hard to imagine that first increase being followed by a six-month or even yearlong hiatus. That’s a far cry from past periods of policy normalization, when signs of economic recovery would send the Fed off on a multiyear campaign of repeated interest-rate increases.

The bond market seems to know this. Even as forecasts for Fed rate increases have come forward in response to better U.S. employment data, the 10-year Treasury yield is at a 14-month low beneath 2.4%. Pimco’s Mr. Mather thinks the 10-year yield won’t get much higher than 3%. But it is very difficult for economists to abandon their old normalization models.

Translation: Bond markets don’t believe there will be a recovery, or at least not one that looks anything like what we’ve been told for 7 years is just around the corner.

Even though there is intellectual appreciation that liftoff will be slower than in the past and implicit acknowledgment of former Treasury Secretary Lawrence Summers’s “secular stagnation” thesis, routine policy normalization is baked into base-case projections.

The Federal Open Market Committee’s own “blue dot” projections for the federal funds rate capture this. In June, its 16 members’ median forecast stood at 1.13% for the end of 2015, then sloped up to 2.5% at end-2016 and to 3.75% in the “long run” beyond that.

While that long-run forecast marked a modest reduction from March’s 4% median, it is far higher than the 2% or less that believers in the secular-stagnation thesis are now citing. This group, which includes Pimco, says the long-run “neutral fed funds” rate—a theoretical equilibrium for an economy running at full capacity—is now much lower because the economy’s ingrained growth capacity is weaker.

That last bit is just absolutely hogwash. Actually, it all is. There is no “fragility” in the global economy, there is nothing left that could lift it out of its misery. To call that fragility is like calling a boulder that’s about to land on your head a ‘nuisance’. Economists are completely useless when it comes to understanding the economy. All they have is theories and models and graphs and ideas of how things ‘should’ go.

Today’s leading – Keynesian – ideas in economics claim that loose credit and low interest rate ‘should’ lift any economy out of any hole it’s dug itself into. It doesn’t get sillier than that. And it certainly doesn’t work, other than in in tales fabricated by media and spin doctors.

As for “the Fed will take a lot longer to get there than in previous cycles”, all I got is: Cycles? Author Mike Casey himself states that “it is very difficult for economists to abandon their old normalization models.” Well, the first thing they should get rid of is the notion of cycles – well other than 70-year Kondratieff, perhaps -.

Cycles imply a move upward at some point. There’ll be no such thing in our formerly rich economies for a long time to come.

We might have arrived at an upward turn in the cycle if debt had been allowed, and forced, to be properly restructured. As things stand, however, the debt is still all or mostly there, and it has continued to bloat, swell and fester for 7 long years as well. And that could only be achieved by increasing debts at governments and central banks.

Altogether, we’re in a much worse situation than we were 7 years ago. We’re just getting better as we go along at hiding how bad it is.

Me, personally, I can’t wait for the first central banker to raise rates. Because it will be the best opportunity we will have for price discovery, for finding out what things really look like, and are worth, behind the veil of abundant credit that fogs our mirrors.

It’ll be very ugly when those rates go up, because there is nothing to catch our fall. But the only alternative is for our children to fall even deeper than they already must because of our illusionary media-induced visions of recovery and escape velocity and American Dreams.

One thing’s for sure already: for our kids, the American Dream will be nothing but a Hollywood driven illusion or video game. They will hardly understand that once their ancestors really believed it to be true, and for a short few decades seemed to achieve that dream.

A few last words on Ferguson. Everyone so far has done everything wrong over there that they could. Why the first black US president 10 days after it started still hasn’t shown his face is beyond me. Obama’s sending Eric Holder, and only tomorrow. As if people either know who Holder is, or care one damn bit.

Obama needs to watch out by now. because more people will be drawn towards Ferguson, police already said they arrested people from California and New York. And protests will spread as long as Ferguson is not handled in a proper and respectful way; the first ones were in St. Louis, New York, Seattle and Oakland last night.

This can get out of hand in a way that nobody, not even the most war party minded Americans, should look forward to. And it’s really easy: send Obama, make sure he can deliver a sure-fire way to assure an independent investigation, and deliver the guilty parties to justice. There are too many Fergusons in the US not to.

The by far best summary of the situation comes from John Oliver, a British comedian: “let’s totally demilitarize the police; and if and only if they can get through a month without killing a young black man can they get their toys back.”.

Oliver was a Daily Show correspondent for Jon Stewart until recently, the show that was elected the most trustworthy news program not long ago by Americans. So that Oliver should provide the best coverage of this topic, fits a pattern.

But come on, how sad is that?

Finally, the saddest thing I’ve seen in ages must be this:

Americans Eat Most Of Their Meals Alone

Americans eat most of their meals alone, new research finds, with families finding it more difficult to find time to eat together and a dramatic increase in the number of single-person households. The majority of meals (57%) are eaten by solo diners.

That depicts a nation in despair, and demise.

• Americans Eat Most Of Their Meals Alone (MarketWatch)

It may have taken more than half a century, but Miss Lonelyhearts from Alfred Hitchcock’s “Rear Window” finally has some company. Americans eat most of their meals alone, new research finds, with families finding it more difficult to find time to eat together and a dramatic increase in the number of single-person households. The majority of meals (57%) are eaten by solo diners, market researcher NPD Group found. Snacks have the highest percentage of lone diners (72%) followed by breakfast (61%) and lunch (55%). (Solo lunches include workers eating at their desk.) Although 34% of Americans spent dinner time alone, half of American families still choose to eat dinner with each other five times a week. Would this make Ward Cleaver proud — or not? “A generation ago, the ‘Leave it to Beaver’ television family ate dinner together,” says Warren Solochek, vice-president of client development for NPD’s food service practice. “Today, that traditional eating arrangement is much harder to achieve.”

Although this was the first time NPD carried out the survey, experts say the trend of a person cooking for just themselves or requesting tables for one will continue. Single-person households jumped from 17% in 2008 to 27% in 2012, according to the U.S. Census Bureau. “People are marrying later in life and starting families later in life,” says Andy Brennan, a lead analyst at research firm IBISWorld. “A lot of restaurants are accommodating single diners with more bar space. There isn’t the stigma there once was to dining alone.” Restaurants – still struggling after the Great Recession – are happy to cater to the new wave of single diners. Breakfast menus are the only growth area on fast-food and casual dining menus, studies show. “Breakfast sales rose over 5% to $27.4 billion last year at quick-service and fast-casual restaurants, according to analysis of BLS data by research firm Mintel. What’s more, fast-casual restaurants were the only segment to see traffic growth in the restaurant industry last year — increasing 7% in 2013 and 9% in 2012.

With the popularity of on-demand entertainment via DVRs and mobile devices, it’s no longer easy to blame the fall-off in family dinner time on TV, says Jonathan Wai, a psychologist at the Duke University Talent Identification Program. He sees it as part of a broader unravelling of the “social fabric” and cites the high number of hours worked by Americans and the fact that commutes are getting longer every year. The 40-hour work week in the U.S. is longer than the work week in many European countries. And around 2.2 million U.S. workers have a daily commute of at least an hour to and from work, according to the U.S. Census.

Read more …

• Preserving Disorder in Ferguson (Bloomberg)

The rioting that erupted in Ferguson, Missouri, over the weekend calls to mind Chicago Mayor Richard Daley’s 1968 gaffe: “The policeman is not here to create disorder. The policeman is here to preserve disorder.” In Ferguson, the police are doing an outstanding job of that. That’s partly why Missouri Governor Jay Nixon was right to call in the National Guard today. Yet he must know that the move will not quell the anger among protesters, who are motivated not only by a sense of injustice over an unarmed teenager’s death but also out of frustration with a truculent police force. Only when political leaders do a better job of holding police accountable — an urgent necessity in Ferguson right now, and a priority nationwide — will tensions truly begin to ease. Last week, police in Ferguson seemed to take every opportunity to ratchet up tensions over the shooting death of 18-year-old Michael Brown.

They mishandled the release of information about the case, attempted to intimidate residents with displays of military power, and were unable to provide basic answers about chain-of-command decisions. When Nixon on Thursday finally appointed State Highway Police Captain Ron Johnson to lead the police response, an evening of calm ensued. Johnson not only pulled back the heavily artillery, but he also walked among the protesters. Unfortunately, this goodwill evaporated on Friday when the local Keystone Cops released a video — before releasing Brown’s initial autopsy report or a photo of the officer who shot him — of what appears to be Brown lifting some cigars from a local convenience store minutes before he was killed. The officer who shot Brown did not stop him in connection with the robbery, a fact the police failed to disclose until questioned about it later in the day.

Read more …

• John Oliver: Ferguson, MO and Police Militarization (HBO)

In the wake of the shooting of Michael Brown in Ferguson, MO, John Oliver explores the racial inequality in treatment by police as well as the increasing militarization of America’s local police forces.

“let’s totally demilitarize the police; and if and only if they can get through a month without killing a young black man can get their toys back.”

Read more …

• For Interest Rates, Low Is the New Status Quo (WSJ)

It’s time to get used to near-zero savings-account interest rates and 10-year bond yields that don’t get much higher than 3%. Yes, the Federal Reserve is preparing to raise rates as soon as next spring. But even that won’t produce the interest-rate “normalization” that many assume to be on the way. That overdue reversion to the mean of recent decades—pined for by retirees and other risk-averse savers, feared by holders of higher-yielding bonds—isn’t coming. Blame it on the persistent sources of fragility in the global economy: banks that remain reluctant to lend to Main Street, a looming debt crisis in China, and the alarming prospect that deflation will come to Europe’s shores and return to Japan’s. All that will keep inflation reined in and make the Fed extremely hesitant to do follow-up rate hikes after its first one breaks an almost decadelong drought.

Scott Mather, deputy chief investment officer at bond fund manager Pacific Investment, which has $2 trillion in assets under management, says the eventual resting point for rates will be much lower and “the Fed will take a lot longer to get there than in previous cycles. And a chief reason for that is all the overhangs that we have.” The initial move, certain to be a mere quarter of a percentage point, will have only the slightest impact on money-market rates, since banks will still be borrowing short-term money at not much more than 0%. Yet because of underlying economic weakness, even this modest credit tightening could temper growth and reflexively give the Fed pause. It isn’t hard to imagine that first increase being followed by a six-month or even yearlong hiatus. That’s a far cry from past periods of policy normalization, when signs of economic recovery would send the Fed off on a multiyear campaign of repeated interest-rate increases.

Read more …

• Don’t Hike Alone Is Jackson Hole Bear Warning for Central Banks (Bloomberg)

“Hiking alone is not recommended” goes the warning to walkers in Wyoming’s Grand Teton National Park. Central bankers should perhaps heed the same advice when it comes to interest rates as they fly this week to the Tetons and their annual symposium on monetary policy in Jackson Hole. Currency bulls rather than grizzly bears are the reason there is safety in numbers for them. The point is highlighted in recent research by Joachim Fels and Manoj Pradhan, economists at Morgan Stanley in London, who use a cycling rather than walking analogy to make it. Reviving a 2009 analysis, they note cyclists prefer not to ride solo because of wind drag and to instead stick to a group – or peloton – to reduce headwinds by as much as 40%. For those who try to go it alone in monetary policy, the work can be harder too. Raising rates before counterparts or signaling plans to do so often trigger higher exchange rates, which sap demand in their economies and often force them back into the pack.

“In cycling, the peloton is usually led and controlled by the strongest and largest teams,” Fels said in a report yesterday, citing a longer study he and Pradhan released on July 30. “It’s the same with the global monetary peloton where the easy policy stance of the Group of Three central banks sets the pace for the entire group.” For Tour de France winner Vincenzo Nibali, read Federal Reserve Chair Janet Yellen. The message from her and fellow central banking superstars is loose monetary policy still has a while to run. Yellen continues to caution that labor markets are slack enough to merit low interest rates, while European Central Bank President Mario Draghi and Bank of Japan Governor Haruhiko Kuroda may even deploy more stimulus before the end of the year to battle low inflation. Yellen and Draghi will both address the Federal Reserve Bank of Kansas City’s conference in Jackson Hole on August 22.

Their behavior makes it tougher for others to take the initiative. A case in point: Bank of England Governor Mark Carney. After warning in June that investors may not appreciate the risk of higher rates, he said last week the U.K. won’t rush to act amid overseas threats of expansion and the weakness of wages. Economists at Citigroup and Berenberg Bank were among those to revise their forecasts to show the U.K. central bank raising rates in the first quarter of 2015 rather than the last few months of this year. The pound responded by falling for a sixth week against the dollar, its longest run in four years. Carney isn’t alone. New Zealand also has tightened policy more slowly than its domestic economy would suggest, according to Morgan Stanley. The central banks of Sweden, South Korea, Mexico and Israel have all cut their benchmarks lately, while Canada and Australia have turned more dovish. Most noted currency strength or global economic conditions in explaining their decisions.

Read more …

Not one inch.

• How Independent Is The Independent Bank Of England? (Telegraph)

A CPI reading of 1.6% is below the City’s expectations, and makes it – for now, anyway – at little bit less likely that the Bank of England will raise interest rates this year or early in 2015. Cue relief and even a bit of jubilation in the Government; Danny Alexander has gone so far as to say that “subdued inflation is now becoming the norm as the economy recovers”. Ministers, it is clear, do not want rates to rise any time soon. Higher rates mean it’s more costly to borrow, and in an election season that will focus heavily on talk of the cost of living, no one seeking re-election wants anything that eats into household disposable income. (Yes, higher rates mean better returns for savers, but for unfortunate reasons best explored on another day, politicians tend to care more about borrowers than savers.) The decision on rates, of course, rests with the Bank of England. Since 1997, the Bank has had operational independence over monetary policy.

Central bank independence is a relatively novel feature of British political life that has become part of the orthodoxy, accepted by just about everybody as a Good Thing. It means no more political interference, no more ministers keeping rates artificially low before elections and generally skewing the economy for political purposes. But just how independent is the independent Bank of England? Some people have their doubts about the Bank under its current governor, Mark Carney. Mark Field, the Conservative MP for the City and Westminster, makes a habit of saying in public things that other politicians only mutter privately. Today, he’s suggested that Mr Carney is setting rates for reasons that are not wholly economic. The Governor is under a “political imperative” to delay an increase until after the election, Mr Field suggests: “From the moment Mark Carney became governor in July 2013, it was pretty clear forward guidance was an indication rates would not rise this side of the election – for all the talk of Bank of England independence, there was a clear bargain between him and George Osborne.”

Read more …

• For Markets, Any Re-Escalation Is Simply Pent Up De-Escalation (Zero Hedge)

A quick reminder of how geopolitics governs markets: on Friday, the market plunged 0.005% over fears Ukraine and Russia may be about to go at it all out after a fake report Ukraine shelled a Russian military convoy. On Monday, the same “market” soared just under 1% as the news that had caused the “crash” was refuted. That has been the dominant rinse, repeat theme for the past month and will continue to be well after Yellen’s Friday speech at Jackson Hole (although one does wonder why she is not speaking on Wednesday when the symposium begins). Not surprisingly, with only modest re-escalation news overnight (that Russia is preparing further retaliatory sanctions against the West), which is simply “pent up de-escalation” in the eyes of Keynesian algos, futures are again up a solid 0.2% and rising, and the way the rampy USDJPY is being manipulated before its pre-market blast off, we may well see the S&P hit 1980, if not a new all time high before 9:30am, let alone during today’s cash session.

In any event, whatever you do, don’t you dare suggest that algos should care one bit about Ferguson and its implications for US society. Taking a closer look at the geopolitical stories, as DB summarizes, no bad news is certainly viewed as good news for now. Following the four-way diplomatic talks in Berlin on Sunday, Russian Foreign Minister Sergei Lavrov yesterday told the press that the talks have failed to produce positive results in establishing a ceasefire and (starting) a political process. According to Reuters, Lavrov accused Ukraine for changing their demands over what it would take to establish a truce between government troops and pro-Russian insurgents. The good news though is that some progress was made on allowing the delivery of Russian humanitarian aid to eastern Ukraine. Lavrov said that “all questions” regarding the humanitarian convoy had been removed and agreement had been reached with Ukraine and the International Committee of the Red Cross (ICRC).

Bloomberg news overnight said that the ICRC expects to work out the details of a safe-passage plan for the convoy into Ukraine “soon”. The four-way talk is expected to resume again sometime this week but we don’t have specific timing on that yet. Despite the ongoing volatility, it is interesting to see the strong performance in Russian equities over the past week. The MICEX index has rallied every single day for the past 7 trading sessions and is currently about 7% off its early August lows. One wonders which Russian oligarchs are selling into the latest liftathon.

Read more …

• Robert Shiller Wonders Why Stocks Are ‘Very Expensive’ (MarketWatch)

“The United States stock market looks very expensive right now.” And with that, Yale professor Robert Shiller is at it again, telling us to worry. He’s got plenty of company these days among those who fear this bull market can’t possibly keep going. Shiller’s particularly uncomfortable about the CAPE ratio (cyclically adjusted price-earnings), a stock-price measure that he helped create. He said something similar in June. (Just Google Robert Shiller bubble for more instances of his bubble theories.) Otherwise known as the Shiller P/E, the ratio basically takes average inflation-adjusted earnings for the S&P 500 over the previous 10 years. In Shiller’s New York Times article from Saturday, he notes that when he touched on this topic over a year ago, that ratio stood around 23, far above its 20th-century average of 15.21. It now stands at 25, a level that since 1881 has only been surpassed in three other periods — the years surrounding 1929, 1999 and 2007. And we all know what came next after the market peaks in those years.

Shiller says the CAPE was never intended to indicate timing on when to buy and sell, and that the market could remain at these valuations for years. But given that this is an “unusual period,” investors should be asking questions, he says. His question: Given that the ratio shows valuations have been elevated for years, are there legitimate factors that could keep stock prices high for decades longer? He points that his own questionnaire surveys show investors are getting more worried. Other than that, unfortunately there is no “slam-dunk” explanation for these high valuations, says Shiller. “I suspect the real answers lie largely in the realm of sociology and social psychology — in phenomena like irrational exuberance, which, eventually, has always faded before,” says the Nobel-Prize winner. “If the mood changes again, stock market investments may disappoint us.”

Read more …

Keep your eye on him. He’s not kidding.

• George Soros Is Not The Only Big Investor Playing Defense (MarketWatch)

George Soros isn’t the only big-shot investor who seems to be suffering from a bit of a backache. The question is whether it’s just a twinge or something more serious. Soros, whose astounding long-term success as a trader has reportedly been shaped at least in small part by his reactions to physical discomfort, raised eyebrows when a regulatory filing on Thursday showed he had significanty upped his holdings of puts on the SPDR S&P 500 ETF. As you may recall, Soros reported that he held nearly 11.3 million puts on the ETF as of June 30, a position with a market value of more than $2.2 billion. That was a 605% rise from the end of the first quarter and made the stake his largest single position, constituting nearly 17% of his total portfolio. That is the biggest such put position Soros has had since 2008, noted Raul Moreno, chief executive of iBillionaire, an index that tracks investment choices by big investors, including the likes of Soros, Warren Buffett and Carl Icahn.

So in a portfolio that’s around 80% long equities, the position appears clearly to be a hedge rather than an outright bet on a market fall, Moreno said. Still, the size of the position would seem to indicate Soros had grown more worried about the potential for a pullback, Moreno said in a phone interview. Maz Jadallah, founder of AlphaClone, a research firm that collects, aggregates and clones data from 13F filings, emphasized that while the shift indicates Soros believes the risk of a pullback has increased, it shouldn’t be read to indicate he is betting on one. In fact, the data shows Soros’s long exposure increased by 9% over the second quarter, a time when the S&P 500 rose 5%. Michael Vachon, the spokesman for Soros Fund Management, said the increase in put holdings was “not a story.”

Read more …

Run, Forrest, run!

• Fed Says SEC Money-Market Rule Could Spark, Not Reduce, Runs (MarketWatch)

A new Securities and Exchange Commission rule designed to reduce runs in the money-market mutual-fund industry could instead spark them, the New York Federal Reserve said Monday. At issue is part of the new SEC rule giving funds the ability to limit outflows — through gates or restrictions to redemptions — when liquidity runs short. New York Fed economists, in a blog post, said that a study of academic literature concludes these gates may ultimately just make investors run sooner.

“The possibility of a fee or any other measure that is costly enough to counter investors’ strong incentives to run amid a crisis will give investors a strong incentive to run preemptively to avoid such measures.”

A spokeswoman for the SEC. said the agency had no comment on the blog post. One SEC. commissioner, who ultimately voted against the rule, raised concerns about a rush to redemption in the debate. Fed officials do like other parts of the SEC rule, especially the fluctuation in net asset values of shares for some of the funds instead of a fixed value of $1 a share. Boston Fed President Eric Rosengren last week called that part of the new rule a “meaningful improvement.”

Read more …

Yes, it is.

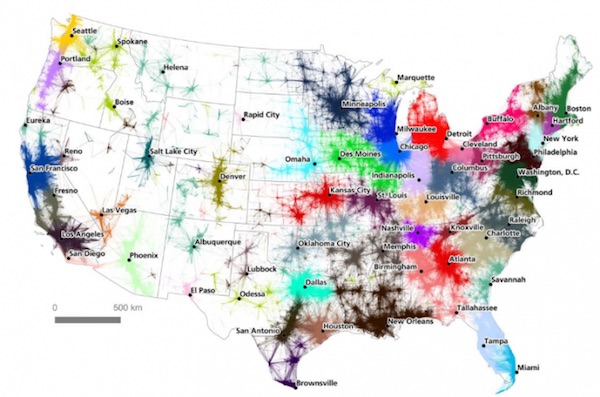

• Is Rising Unrest In China A Threat To The Economy? (CNBC)

Incidents of unrest in China are increasing, and analysts told CNBC the country’s one-party government may be getting more concerned about the broader impact on social and economic stability. Protests are illegal in China, an authoritarian state where freedom of speech is limited. “[The government] places arbitrary curbs on expression, association, assembly and religion; prohibits independent labor unions and human rights organizations; and maintains Party control over all jurisdictions,” according to Human Right Watch’s 2014 World Report. Yet, according to official police statistics, the number of annual protests rose to 87,000 in 2005 from approximately 8,700 in 1993. Currently, there are 300-500 protests in China each day, with anywhere from ten to tens of thousands of participants, the 2014 World Report said.

Protests ranged from farmers contesting land grabs to environmental protests organized by the middle classes and deadly ethnic minority riots. “Most of these protests have involved farmers pushed off their land and sometimes poorer people in urban areas kicked out of their houses to make way for development,” said James Miles, China editor at The Economist. “Often these protests have involved the weakest, poorest, most marginalized sectors of Chinese society. They are poorly organized and their grievances are localized – so a protest might flare up in one particular location, but not spread like wildfire across the country,” he added. But more recent large-scale environmental protests by the middle class, long viewed as a crucial government support, have caused for alarm among authorities, he said. “The way in which these demonstrations have rapidly formed using social media has clearly unnerved authorities and made them wonder about how quickly middle class unrest could spread,” Miles told CNBC.

Read more …

Just the start.

• Abandoned Homes Swell Bad Debt in China’s Wenzhou (Bloomberg)

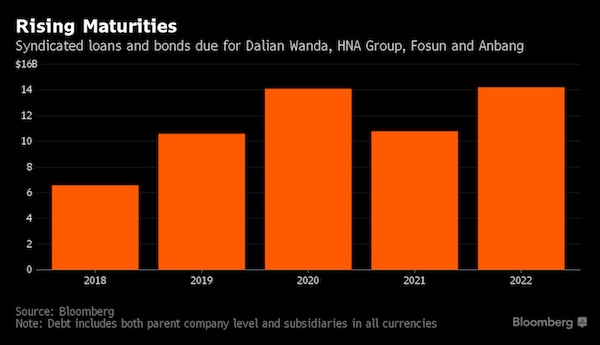

Falling property prices in China’s eastern city of Wenzhou triggered 6.4 billion yuan ($1 billion) of bad loans as buyers abandoned homes and stopped making mortgage payments, the Economy & Nation Weekly reported. Purchasers of 1,107 properties halted payments as prices dropped for 34 straight months, the Xinhua News Agency-affiliated magazine said yesterday on its website, citing data from the local banking regulator. A press officer at the Wenzhou branch of the China Banking Regulatory Commission declined today to confirm the data. China’s slumping property market is a drag on the world’s second-biggest economy and banks’ profits, with lenders’ soured loans increasing for almost three years. New-home prices fell last month in 64 of 70 cities tracked by the government.

In Wenzhou, about 56% of the homes were abandoned due to falling values and most were high-end apartments, according to the report. Homes were also abandoned by borrowers left with liabilities after making guarantees for companies in financial trouble, the report said. Real-estate lending accounts for 26% of outstanding bank loans in Wenzhou, 8%age points higher than the national level, according to the report, which didn’t specify a time period for the data. The city’s economy expanded 6.8% in the first half, according to the local government, compared with a 7.4% expansion nationwide. China’s economy is forecast to expand 7.4% for the full year, the slowest pace since 1990.

Read more …

• China to Cut ‘Overly High’ Income of State-Owned Firm Executives (Bloomberg)

Chinese President Xi Jinping plans to regulate income distribution in state-owned companies, cutting the top salaries, as part of the nation’s anti-extravagance and anti-corruption campaigns. “Unreasonably high income will be adjusted,” and top managers can’t have excessive spending beyond what’s stipulated by government regulations or companies’ financial policies, according to a statement posted on the central government’s website, citing Xi. Leaders of central-government-controlled enterprises should actively support the changes, Xi was cited as saying in a meeting of the Communist Party’s reform group yesterday.

Xi started a broad campaign to cut corruption and excessive spending by government officials after he took over as head of the ruling Communist Party in November 2012. In the wake of the campaign, growth in retail sales dropped to a three-year low in April. Yesterday’s meeting also discussed plans to build a few influential media groups, and changes to the national examination and enrollment systems. In another meeting yesterday, Xi urged innovation to promote development, according to a statement posted on the central government’s website.

Read more …

Subprime China.

• China Banks On First-Time Buyers To Prop Up Housing (CNBC)

Jiang Lu is the proud owner of a 450 square foot apartment in the Chinese capital of Beijing. The 28-year-old web editor invested her entire life savings and took advantage of easier mortgages in China to buy her new 250,000 dollar home. “It is very easy to get a mortgage. Any bank will give one to you,” she said. “Without one, I wouldn’t even think about buying.” Jiang is one of the first time buyers Chinese authorities hope will help prop up China’s flagging property market. In Beijing and many other cities across China, the housing market is starting to weaken. New home prices dropped in July for the third month in a row with 64 out of 70 cities surveyed showing month-on-month declines. Based on data from the National Bureau of Statistics on Monday, the average price of new homes slid 0.9% from June, slipping faster than June’s 0.5% drop. “The acceleration in home price declines is probably due to more projects offering discounts and slower sales in July,” Bank of America Merrill Lynch analysts said in a research note.

Housing sales in China have dropped this year in total value by 10.5% compared to last year, according to official data. China’s home prices have been skyrocketing for years, with the government encouraging development and offering few other ways for regular citizens to invest their cash. Concerned that prices were becoming out of reach for average citizens, policymakers began to put in restrictions in 2010 to stop speculators. After several false starts, the market appears to be cooling finally but there are now fears the market could fall too fast and trigger a hard landing. With property so important to China’s growth, accounting for an estimated 20-percent of GDP, some economists worry about the impact a housing downturn could have on China’s economy and the rest of the world. The country’s real estate market drives global growth with construction fueling prices in commodities.

Read more …

The lunatics take over. And no-one sees the difference.

• Tycoon Palmer: China Wants to Take Over Australia Resources (Bloomberg)

Australian mining magnate Clive Palmer, whose political party effectively holds the balance of power in the Senate, accused China of trying to take over the nation’s resources — earning a rebuke from Prime Minister Tony Abbott’s government. “They want to take over our ports and get our resources for free,” Palmer said on Australian Broadcasting Corp. television late yesterday. Palmer also labeled a unit of China’s state-owned Citic Pacific Ltd., his partner in the world’s biggest magnetite iron ore mine in Western Australia, as “mongrels”. Abbott’s government attacked Palmer’s comments as “hugely damaging”, and stressed the importance of Australia’s relationship with its biggest trading partner. The Australian Industry Group condemned Palmer’s comments as “ill-considered and inappropriate.”

Palmer is embroiled in legal battles with Citic Pacific, which has alleged he used funds from a joint account to help finance his political campaign. His nascent Palmer United Party has three senators in Parliament’s upper house, making it an influential force that Abbott’s government must win over to pass legislation should it be opposed by Labor and the Greens. On the ABC’s Q&A show last night, Palmer denied Citic’s allegations, calling them “Chinese mongrels.” “I’m saying that because they are communists, they shoot their own people, they haven’t got a justice system and they want to take over this country,” Palmer said.

Read more …

Next goal for US.

• Bulgaria Halts South Stream Gas Pipeline Project For Second Time (RT)

All operations on Russia’s Gazprom-led project South Stream have been suspended, as they do not meet the requirements of the European Commission, Bulgaria’s Ministry of Economy and Energy said on its website. “Minister of Economy and Energy Vasil Shtonov has ordered Bulgaria’s Energy Holding to halt any actions in regards of the project,” the ministry said. This specifically means entering into new contracts. There has been mounting pressure from the EU to put the project on hold, and now the European Commission will be consulted each step of the way to make sure it complies with EU law. European ‘anti-monopoly’ laws prohibits the same company to both own and operate the pipeline. However, Gazprom and Bulgaria had previously struck a bilateral agreement regarding that aspect of the project.

This is the second time Bulgaria has called for a suspension of the South Stream project. In early June, the country’s Prime Minister Plamen Oresharski ordered the initial halt. Bulgaria is the first country traversed by the pipeline on land, after a section that runs beneath the Black Sea from Russia. The branch that begins in Bulgaria is planned to continue through Serbia, Hungary, Slovenia and Austria. Other participating countries have confirmed their commitment to the South Stream’s construction. Gazprom’s $45 billion South Stream project, slated to open in 2018 and deliver 64 billion cubic meters of natural gas to Europe, is a strategy by Russia meant to bypass politically unstable Ukraine as a transit country, and help ensure the reliability of gas supplies to Europe.

Read more …

And Russia’s aid will never be delivered?!

• East Ukraine Under Massive Artillery Fire (Itar-Tass)

The Ukrainian army’s artillery delivered massive artillery strikes on large populated areas and industrial enterprises in the Donetsk and Luhansk Regions in east Ukraine on Tuesday. The Ukrainian military’s howitzers and multiple launch rocket systems shelled residential quarters in Donetsk, Horlivka, Yenakiyevo and Makeyevka The Donetsk city council said that artillery shells had exploded in a residential neighborhood near the airport and destroyed a local school while local residents were hiding in basements and bomb shelters The shelling started on Monday evening and continued until Tuesday morning. Water supply has been disrupted in the area. Donetsk People’s Republic PM Alexander Zakharchenko earlier said that the Ukrainian army’s shelling had destroyed electricity transmission lines supplying power to water filtration stations.

“Teams have been dispatched to restore water supply to populated areas and there are plans to use reserve water reservoirs,” Zakharchenko said, adding that “facilities were located on the territory occupied by the Ukrainian army,” which complicated restoration efforts. The situation in the Donetsk Region is close to critical due to incessant shelling. In addition to the absence of water, local residents are experiencing food shortages. Food stocks in stores are running out while supplies have almost stopped. The prices of available food products have jumped almost 50%.

Local residents have to stand in line to get bread, milk and drinking water, eye-witnesses said. The Samsonovskaya-Zapadnaya coalmine in the Luhansk Region has halted work over artillery shelling, the press office of the Metinvest company reported on Tuesday. “The mine’s work has been suspended. Specialists are restoring power supply to switch to a regime of maintaining the mine’s vital systems. The operations headquarters and the special commission are assessing the scope of damage,” the press office said. The Ukrainian army’s shelling has also halted production at the Yenakiyevo metallurgical plant, the Yenakiyevo coke and chemical enterprise and the Khartsyz pipe factory.

Read more …

“As long as they’re betting on a military solution, and as long as the authorities in Kiev are using military victories over their own people to shore up their position in Kiev, I don’t think there’s any point to what we’re trying to do now,” Lavrov said.

• Red Cross Makes Progress on Russian Aid Convoy to Ukraine (BW)

The Red Cross is making progress on details of a safe-passage plan for a Russian aid convoy intended for southeast Ukraine, after four-way talks on a halt to the fighting reached an impasse in Berlin. The crisis, in which Ukrainian troops have been battling pro-Russian separatists for months, can only be stemmed once the government in Kiev calls off its army as part of an unconditional cease-fire, Russian Foreign Minister Sergei Lavrov said yesterday in the German capital. Ukraine says it will declare a truce if the pro-Russian rebels lay down their arms and Russia stops supplying them with weapons. Galina Balzamova, a spokeswoman for the International Committee of the Red Cross, said today she expects agreement “in the very near future” on security guarantees for the Geneva-based agency to accompany the Russian aid trucks, though she said she couldn’t give a specific time. The ICRC says it’s “extremely concerned” about the humanitarian crisis in eastern Ukraine.

In Kiev, military spokesman Andriy Lysenko said yesterday that separatists shelled a column of civilian vehicles in the Luhansk region, killing “dozens of people.” There was no independent confirmation. Government troops have been shelled 10 times since yesterday, the Defense Ministry said on its Facebook page. Government forces are fighting rebels in Yasynuvata in the Donetsk region in eastern Ukraine and blockading Ilovaysk to the east of Donetsk, the ministry said. Meanwhile, paratroopers and infantry are battling to keep control of the villages of Novosvitlivka and Khryashchuvate in the neighboring Luhansk region.

Ukraine’s central bank raised its overnight refinancing rate to 17.5% today from 15% as it seeks to support the hryvnia. The Ukrainian currency fell 0.9% to 13.15 per dollar today, taking its decline for the month to 6.7%. Russia’s benchmark Micex stock index gained for an eighth day today, rising 0.8% at 12:47 p.m. in Moscow. “As long as they’re betting on a military solution, and as long as the authorities in Kiev are using military victories over their own people to shore up their position in Kiev, I don’t think there’s any point to what we’re trying to do now,” Lavrov said. He said no resolution was reached in the talks with his Ukrainian, German and French counterparts. No date has been set for a resumption.

Read more …

Must read.

• Occupation Forces (International Man)

When I was growing up in Berlin, after the war (World War II), we lived in the American sector and the American soldiers were everywhere—on the streets, in the cafes. No one wanted them there, but whenever we made disparaging remarks, our own authorities tell us we must not do this. They tell us the Americans can do what they like and we just have to accept it. So, we stop using the words, “Yankee” and “American.” They are the occupying forces, just like the Romans were at one time, so, amongst ourselves, we refer to them as “the Romans.” So, we talk freely in the cafes about the “Romans” and the American soldiers don’t know that we mean them.

The snippet above was from taken from a conversation I had recently in a café with Klaus, a German who is now in his late sixties. He had a long career as a pilot for the German air force and had been stationed in many countries. In spite of his own career as an “occupier,” he never got over the resentment he had for the occupation of his homeland by American troops. (Berlin was occupied from 1945 to 1994.) The US is unique in the world with regard to occupation. It has been estimated that the US has over 325,000 military personnel in over 1,000 overseas military bases in more than 150 countries, but statistics are widely conflicting. Generally, the American troops arrive to deal with some sort of conflict (either invited or uninvited), but unlike most other armies, they tend to remain for a long time beyond the stated “need.”

There are those who praise this policy, stating that the US “keeps the world safe for democracy;” however, the US is known (at least to us outsiders) as a country that typically routs elected governments, installs corrupt and ineffectual puppet leaders, and seeks to control the occupied country as a satellite state. There are three major downsides to this policy:

1. Occupation Forces Are Always Resented Most Americans, during the Cold War, perceived the Russian forces in Berlin to be hated by the Berliners, but assumed that Berliners were grateful to have American occupiers to “keep them safe.” The truth, as Klaus states, was that all occupiers were hated, not just the Russians. Long after the war was over and it was time for Berlin to return to normal, the Russians and Americans maintained a standoff in Berlin that did not end for another forty-nine years. Only in 1994 did Germans “get their city back.” Not surprisingly, many Germans, even today, feel that neither the Russians nor the Americans can be trusted, as they are seen as “empire builders” who play out their ambitions in foreign lands. Although today, there is a fair bit of cooperation between the governments of the US and Germany, the German people themselves have, even recently, expressed their distrust by asking that the Bundesbank demand the return of their $141 billion in gold from the US Federal Reserve, and have additionally railed against NSA spies in Germany.

2. Occupation Is Extremely Costly Two thousand years ago, the Romans created an empire by training its own people as troops, then invading other countries, stripping them of their wealth. They then left troops behind in each country as occupiers to maintain Roman control. Unfortunately, after the initial pillaging, there was little ongoing wealth to be taken, and the occupations became expensive liabilities. Eventually, the once-wealthy Rome sank into debt and relied more and more on mercenary troops—troops that had no real loyalties to Rome and would eventually turn on Rome, when the money ran out. The US is now in a similar state. There is no more military draft in the US, and the majority of soldiers occupying the 150 countries are mercenaries (or, in today’s nomenclature, “defense contractors”). As the US is technically bankrupt, it is only a question of time before the cheques stop coming. As in Rome, it can be expected that the mercenaries will drop their “loyalty” with little or no warning at some point.

3. A Government that Believes in Occupation as a Policy is a Danger to its Citizens The US Government clearly believes in the concept of occupation, as it is actually increasing the number of countries where it has troops in occupation. In addition, in the last decade, the US has been dramatically ramping up its preparedness for war at home. Not since World War II has the US spent so much money building tanks, buying bullets, and training troops to get ready for a major conflict. However, this time, it is not for a war overseas, but at home. The armaments are being deployed to localised law enforcement departments and the Department of Homeland Security (DHS), which is charged solely with domestic enforcement. Similarly, the training of police officers and other authorities has changed dramatically from the traditional “Protect and Serve” policy to one of riot control and combatting “domestic terrorism.” Of the three downsides to occupation, this is the one that should concern American citizens most greatly, as, for the first time since 1865, the American continent itself is planned to be the occupied territory.

Read more …

Remember how many flights were cancelled a few years ago?

• Iceland Tells Airlines Volcano Under Glacier May Erupt (Bloomberg)

Iceland warned airlines that there may be an eruption at one of the island’s largest volcanoes located underneath Vatnajokull, Europe’s biggest glacier. The alert level at Bardarbunga was raised to “orange,” indicating “heightened or escalating unrest with increased potential of eruption,” the Reykjavik-based Met Office said in a statement on its website. Over 250 tremors have been measured in the area since midnight. The agency said there are still no visible indications of an eruption. The volcano is 25 kilometers (15.5 miles) wide and rises about 1,900 meters above sea level. Bardarbunga, which last erupted in 1996, can spew both ash and molten lava. Ash from Iceland’s Grimsvotn volcano forced flight cancellations in Scotland, northern England and Germany in May 2011. An eruption of the Eyjafjallajokull volcano in April 2010 caused the cancellation of more than 100,000 flights on concern glass-like particles formed from lava might melt in aircraft engines and clog turbines.

Read more …