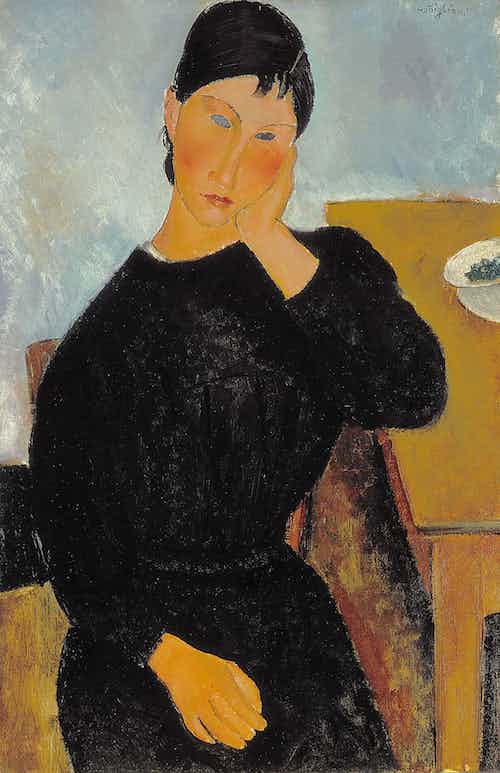

Amedeo Modigliani Elvira Resting at a Table 1919

Many of you are undoubtedly familiar with Naomi Klein’s 2007 book “The Shock Doctrine: The Rise of Disaster Capitalism”, in which she describes how neoliberalism, as developed by Milton Friedman and his Chicago School, wreaks often very brutal and bloody havoc upon societies under the guise of ‘crisis as an opportunity for change’, first in Latin America and later also in Eastern Europe.

One of the most prominent actors in the book, the man behind the term ‘shock therapy’ for economies, is Jeffrey Sachs, a Harvard prodigy. In an interview at the time, Klein had this to say:

Q: You mention the shift from shock therapy to shock-and-awe, but there are also attempts to soften the image of neoliberalism. Jeffrey Sachs, the economist who pioneered shock therapy, wrote his latest book on The End of Poverty. Is there any more to this than a rebranding exercise?

A: A lot of people are under the impression that Jeffrey Sachs has renounced his past as a shock therapist and is doing penance now. But if you read The End of Poverty more closely he continues to defend these policies, but simply says there should be a greater cushion for the people at the bottom. The real legacy of neoliberalism is the story of the income gap. It destroyed the tools that narrowed the gap between rich and poor.

The very people who opened up this violent divide might now be saying that we have to do something for the people at the very bottom, but they still have nothing to say for the people in the middle who’ve lost everything. This is really just a charity model. Jeffrey Sachs says he defines poverty as those whose lives are at risk, the people living on a dollar a day, the same people discussed in the Millennium Development Goals. Of course that needs to be addressed, but let us be clear that we’re talking here about noblesse oblige, that’s all.

[..] Leszek Balcerowicz, the former finance minister who worked with Jeffrey Sachs to impose shock therapy in Poland in 1989, said that the ideology advances in moments of extraordinary politics. He listed these moments of extraordinary politics as ends of war and moments of extreme political transition.

Around the same time, Alexander Cockburn said in a review of the book:

“Shock therapy” neoliberalism really isn’t most closely associated with Milton Friedman, but rather with Jeffrey Sachs, to whom Klein does certainly give many useful pages, even though Friedman remains the dark star of her story. Sachs first introduced shock therapy in Bolivia in the early 1990s. Then he went into Poland, Russia, etc, with the same shock therapy model. Sachs’ catchy phrase then was that “you can’t leap over an abyss step-by-step,” or words to that effect. This is really where contemporary neoliberalism took shape.

I’ve thought for all these years that Jeffrey Sachs, when out there campaigning for the end of poverty and other ostensibly grandiose goals with the likes of Angeline Jolie, should have at least provided a very public and detailed apology for his past endeavors. I’ve never seen one.

Which meant I was very surprised to see his name pop up as a prominent adviser to Yanis Varoufakis during the latter’s time as Greek finance minister, as Yanis describes it in his 2017 book Adults in the Room. Even more surprising than to see Larry Summers in a similar role in the same book.

The mother of all surprises in this regard, however, was to see Varoufakis’ DiEM25 movement announce Naomi Klein as a member of its Advisory Panel yesterday, a panel which also includes the likes of Julian Assange. Because while he’s not on that panel, Jeffrey Sachs has done public presentations for DiEM25. Bien étonné de se trouver ensemble, as the French put it. Strange bedfellows. Maybe Naomi should explain.

I have said multiple times that I am a fan of Yanis, and his departure as finance minister has been a huge loss to Greece, because he was their best, and perhaps their only, chance at salvation from economic disaster, but I’m still not at all convinced about DiEM25 and its intentions (and I don’t mean to say they don’t mean well).

For one, because I think the EU is so throughly rotten to the core it cannot be reformed; its fatal flaws have been continually baked into the cake for decades. Whereas DiEM25 think they can get people elected in various countries across Europe and get Brussels to change direction and become democratic. It was never built to be democratic.

But all this before was merely a build-up to an article Sachs penned for Project Syndicate this week in which he claims to know precisely what Germany and Europe need. He doesn’t.

A New Grand Coalition for Germany – and Europe

With America AWOL and China ascendant, this is a critical time for Germany and the European Union to provide the world with vision, stability, and global leadership. And that imperative extends to Germany’s Christian Democrats.

Friends of Germany and Europe around the world have been breathing a sigh of relief at the newfound willingness of Germany’s Christian Democrats and Social Democrats (SPD) to discuss reprising their grand coalition government. The world needs a strong and forward-looking Germany in a dynamic European Union. A new grand coalition working alongside French President Emmanuel Macron’s government would make that possible.

We have all seen, in Greece, in Italy, in Libya, what leadership Germany has provided. In economics and with regards to the refugee crisis. It has been an unmitigated economic disaster everywhere but in Germany itself (and Holland). And that is no coincidence. It illustrates exactly what is so wrong with the EU. Germany has the power to squeeze the poorer and smaller countries into submission with impunity, and it does just that.

The last thing the EU needs is more such German ‘leadership’. In fact, it needs a whole lot less of that. It needs to find a way to diminish German influence. But to get there, it would require for Berlin to voluntarily step back, and that is not going to happen. Merkel can veto anything she likes, and there’s nothing anyone can do about it.

[..] The world and Europe need an outward-looking Germany that offers more institutional and financial innovation, so that Europe can be a true counterpart to the US and China on global affairs. I say this as someone who believes firmly in Europe’s commitment and pioneering statecraft when it comes to sustainable development, the core requirement of our time.

Not only does Sachs not understand that making Germany some superior power in Europe is the exact wrong way to go, he doesn’t understand sustainable development either. It’s as exasperating as it is predictable.

Economic growth that is socially inclusive and environmentally sustainable is a very European idea, one that has now been embraced globally in the United Nations’ 2030 Agenda and its 17 Sustainable Development Goals, as well as in the 2015 Paris climate agreement. Europe’s experience with social democracy and Christian democracy made this global vision possible. But now that its agenda has been adopted worldwide, Europe’s leadership in fulfilling it has become essential.

A grand coalition government in Germany must help put Europe in a position to lead. French President Emmanuel Macron has offered some important ideas: a European finance minister; Eurobonds to finance a new European investment program; more emphasis on innovation; a financial transactions tax to fund increased aid to Africa, where Europe has a strategic interest in long-term development; and tax harmonization more generally, before the US triggers a global race to the bottom on taxing corporations and the rich.

There is so much wrong in those few lines we could write a book about it. First of all, and let’s bold this once again, there is no such thing as sustainable growth. It’s a lie.

If we want to do something that can actually save our planet, we have to decouple economic growth from environmental sustainability. We can and will not grow our way out of the disaster we have created with -our blind focus on- growth. This is the most dangerous nonsense story there is out there. We have to pick one of the two, we can’t have both. It’s EITHER growth OR a livable planet. Here’s what I wrote on December 16 2016:

Heal the Planet for Profit

If you ever wondered what the odds are of mankind surviving, let alone ‘defeating’, climate change, look no further than the essay the Guardian published this week, written by Michael Bloomberg and Mark Carney. It proves beyond a moonlight shadow of a doubt that the odds are infinitesimally close to absolute zero (Kelvin, no Hobbes).

Yes, Bloomberg is the media tycoon and former mayor of New York (which he famously turned into a 100% clean and recyclable city). And since central bankers are as we all know without exception experts on climate change, as much as they are on full-contact crochet, it makes perfect sense that Bank of England governor Carney adds his two -trillion- cents.

Conveniently, you don’t even have to read the piece, the headline tells you all you need and then some: “How To Make A Profit From Defeating Climate Change” really nails it. The entire mindset on display in just a few words. If that’s what they went for, kudo’s are due.

That these problems originated in the same relentless quest for profit that they now claim will help us get rid of them, is likely a step too far for them; must have been a class they missed. “We destroyed it for profit” apparently does not in their eyes contradict “we’ll fix it for profit too”. Not one bit. It does, though. It’s indeed the very core of what is going wrong.

Jeffrey Sachs can now be added to the list of deluded ‘experts’ on the topic. The COP21 Paris agreement, which I re-dubbed CON21, is full of, and directed by, such people. I always think Trump was very right to withdraw from it, even if it was for all the wrong reasons.

CON21 is a CON. The recent CON23 in Bonn is too. It’s a scheme meant to get to your money under the guise of going green. If they can convince you that you can prosper of off saving the planet, you’ll give them anything, because it’ll make you feel good about yourself.

This is me from December 12 2015:

CON21

Protesters and other well-intended folk, from what I can see, are falling into the trap set for them: they are the frame to the picture in a political photo-op. They allow the ‘leaders’ to emanate the image that yes, there are protests and disagreements as everyone would expect, but that’s just a sign that people’s interests are properly presented, so all’s well. COP21 is not a major event, that’s only what politicians and media make of it. In reality, it’s a mere showcase in which the protesters have been co-opted.

They’re not in the director’s chair, they’re not even actors, they’re just extras. I fully agree, and more than fully sympathize, with the notion of saving this planet before it’s too late. But I wouldn’t want to rely on a bunch of sociopaths to make it happen. There are children drowning every single day in the sea between Turkey and Greece, and the very same world leaders who are gathered in Paris are letting that happen. They have for a long time, without lifting a finger. And they’ve done worse -if that is possible-.

[..] you guys are targeting a conference in Paris on climate change that features the exact same leaders that let babies drown with impunity. Drowned babies, climate change and warfare, these things all come from the same source. And you’re appealing to that very same source to stop climate change.

What on earth makes you think the leaders you appeal to would care about the climate when they can’t be bothered for a minute with people, and the conditions they live in, if they’re lucky enough to live at all? Why are you not instead protesting the preventable drownings of innocent children? Or is it that you think the climate is more important than human life? That perhaps one is a bigger issue than the other?

[..] The current economic model depends on our profligate use of energy. A new economic model, then, you say? Good luck with that. The current one has left all political power with those who profit most from it. And besides, that’s a whole other problem, and a whole other issue to protest.

If you’re serious about wanting to save the planet, and I have no doubt you are, then I think you need to refocus. COP21 is not your thing, it’s not your stage. It’s your leaders’ stage, and your leaders are not your friends. They don’t even represent you either. The decisions that you want made will not be made there.

But let’s return to Sachs and his -other- lofty goals: “..a European finance minister; Eurobonds to finance a new European investment program; more emphasis on innovation; a financial transactions tax to fund increased aid to Africa, where Europe has a strategic interest in long-term development; and tax harmonization more generally..”

We all know Europeans don’t want things that infringe even further on their country’s sovereignty. If they were offered the opportunity to vote on them they would defeat them in massive numbers. Which is precisely why they are not offered that opportunity. The only way to push through such measures is by stealth and against the will of the people.

Which already has, and will much further and worse, divide the EU. It’s not even the plans themselves, it’s the notion of the ever increasing erosion of what people have to say about their own lives. The Czech Republic, Hungary, Poland and Slovakia are flaring off bright red warning signs about sovereignty, and they are completely ignored.

If the EU insists on continuing that way, it will be the cause of chaos and violence and right wing resurgence, not the solution to all that. Europe needs to take a step back and reflect upon itself before taking even one single step forward towards more centralization. But centralization is what Brussels is all about, it’s what it was built on.

The EU will never be viable if Germany in the end calls all the important shots. So a new Grand Coalition in Berlin, and its sympathetic stance towards Macron’s grandiosity, is not ‘needed’, it’s Europe’s biggest danger. But yeah, you’re right, it fits right in with Jeffrey Sachs’ neoliberalist dreams.

And there’s more centralization, globalism, neoliberalism and ‘green growth’ where that came from:

Contrary to the Germans who oppose such ideas, a European finance minister and Eurobonds would not and should not lead to fiscal profligacy, but rather to a revival of investment-led green growth in Europe. China has proposed the Belt and Road Initiative to build green infrastructure linking Southeast Asia and Central Asia with Europe.

This is the time for Europe to offer the same bold vision, creating a partnership with China to renovate Eurasia’s infrastructure for a low-carbon future. If Europe plays its cards right, Europe’s (and China’s) scientific and technical excellence would flourish under such a vision. If not, we will all be driving Chinese electric vehicles charged by Chinese photovoltaic cells in the future, while Germany’s automotive industry will become a historical footnote.

We don’t need more vehicles, whatever they run on, we need less, because we need to use less energy. Of any kind. We must not drive differently, in different cars using a different energy source, we must drive less. Much less. This shouldn’t be that hard, because our cities and societies are designed to be as wasteful as possible.

What we need is not green growth, but green shrinkage. We cannot grow our way into a sustainable planet or economic system. It is a fallacy. And it is time people like Jeffrey Sachs and Mike Bloomberg and Mark Carney (and Merkel and Macron etc. etc.) stop spreading such nonsense. If even Lloyd Blankfein supports the Paris Agreement, we should be suspicious, not feel grateful or validated in our warped views.

A European finance minister would, moreover, finally end Europe’s self-inflicted agony in the aftermath of the 2008 financial crisis. As difficult as it is to believe, Greece’s crisis continues to this day, at Great Depression scale, ten years after the onset of the crisis. This is because Europe has been unable, and Germany unwilling, to clean up the financial mess (including Greece’s unpayable debts) in a fair and forward-looking manner (akin to the 1953 London Agreement on German External Debts, as Germany’s friends have repeatedly reminded it).

If Germany won’t help to lead on this issue, Europe as a whole will face a prolonged crisis with severe social, economic, and political repercussions. In three weeks, Macron will convene world leaders in Paris on the second anniversary of the climate accord. France should certainly take a bow here, but so should Germany. During Germany’s G20 Presidency, Merkel kept 19 of the 20 members of the G20 firmly committed to the Paris agreement, despite US President Donald Trump’s disgraceful attempt to wreck it.

Yes, the corruption of US politics (especially campaign funding by the oil and gas industry) threatened the global consensus on climate change. But Germany stood firm. The new coalition should also ensure that the country’s Energiewende (“energy transition”) delivers on the 2020 targets set by previous governments. These achievable and important commitments should not be a bargaining chip in coalition talks.

Oh, c’mon, Jeffrey. You really want anyone to believe that European politics is less corrupt than American? What do you think handed Monsanto its 5-year glyphosate extension this week? Why do you think the entire Volkswagen board is still at liberty? Thing is, all this is about money.

It’s just that Merkel thinks there’s more of it to be made supporting CON21, while Trump, who’s 180º wrong on on the entire topic, thinks otherwise. But they’re both equally focused on money, not polar bears or penguins or elephants. Trump is right for believing green growth is a load of humbug, he’s just right for all the wrong reasons. While Merkel is trying to sell you a CON. Take your pick.

A CDU/CSU-SPD alliance, working with France and the rest of Europe, could and should do much more on climate change. Most important, Europe needs a comprehensive energy plan to decarbonize fully by 2050. This will require a zero-carbon smart power grid that extends across the continent and taps into the wind and solar power not only of southern Europe but also of North Africa and the eastern Mediterranean.

Once again, Eurobonds, a green partnership with China, and unity within Europe could make all the difference. Such an alliance would also enable a new foreign policy for Europe, one that promotes peace and sustainable development, underpinned by new security arrangements that do not depend so heavily on the US.

“Decarbonize fully by 2050”. Our entire societies have been built on carbon. Every single bit of it. Sachs simply doesn’t understand the world he lives in. He envisions bigger where only smaller could possibly help. We can decarbonize, but it will mean the end of our way of life. No amount of solar panels or wind turbines can change that. That are made with and from carbon.

It’s all just snake oil. We want to save the planet, and the life upon it, but we’re not willing to pay the price and bear the consequences. So we make up a narrative that feels good and run with it.

I have a tonic here that will cure all your ills, ladies and gentlemen. Only ten dollars. I know it sounds expensive, and it’s a full month’s wages, but just you think of the benefits. Think of your children!

Europe, a magnet for hundreds of millions of would-be economic migrants, could, should, and I believe would regain control of its borders, allowing it to strengthen and enforce necessary limits on migration. The political terms of a new grand coalition government, it would seem, are clear. The SPD should hold out for ministerial leadership on economic and financial policy, while the CDU/CSU holds the chancellorship.

That would be a true coalition, not one that could bury the SPD politically or deny it the means to push for a truly green, inclusive, EU-wide, sustainable development agenda. With Merkel and SPD leader Martin Schulz in the lead, the German government would be in excellent, responsible, and experienced hands. Germany’s friends and admirers, and all supporters of global sustainable development, are hoping for this breakthrough.

Long story short, Jeffrey Sachs still promotes disaster.