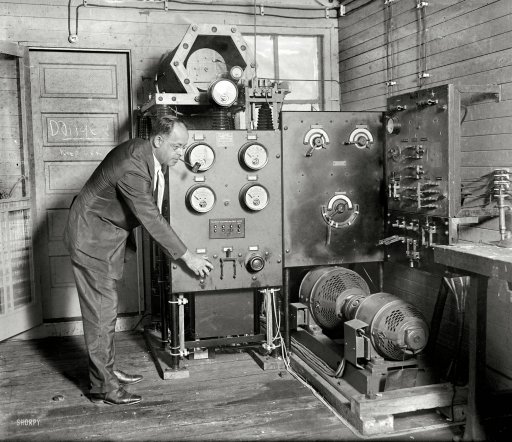

Harris&Ewing US Weather Bureau kiosque, Pennsylvania Avenue, Washington, DC 1921

As I said yesterday before the communique was out.

• Markets At Risk As G20 Proves Investor Hopes Were “Pure Fantasy” (ZH)

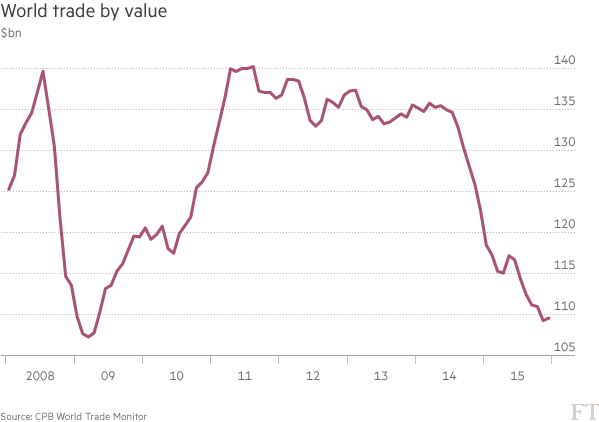

Anyone hoping this week’s G-20 meeting would yield some manner of “Shanghai Accord” to revive sluggish global growth, pull the global economy out of the deflationary doldrums and calm jittery markets that have seen harrowing bouts of volatility in the first two months of the year are disappointed on Saturday. The joint communique issued by policymakers at the end of the two-day summit is bland and generic, with officials parroting vacuous promises to avoid competitive currency devaluations and maintain monetary policies aimed at supporting economic activity and price stability. Officials pledged to “consult closely” on FX markets, a reference presumably to China’s “surprise” August 11 deval and the PBoC’s move in December to adopt a trade weighted basket as a reference point for the RMB, a move that telegraphed lots of downside for the currency.

The statement also “acknowledges” the fact that geopolitical risks abound and as Bloomberg noted this morning, “officials added a potential ‘Brexit’ to its long worry list in the communique.” “That’s a win for Chancellor of the Exchequer George Osborne, who had sought to rally international finance chiefs behind the campaign to keep Britain in the European Union,” Bloomberg goes on to point out. “Downside risks and vulnerabilities have risen,” due to volatile capital flows and slumping commodities but – and this was a critical passage – “monetary policy alone cannot lead to balanced growth.” What?! We thought counter-cyclical Keynesian tinkering was the magic elixir. A cure-all that smooths business cycles and creates demand out of thin air.

Now you’re telling us it “can’t lead to balanced growth” and implicitly that Paul Krugman is a snake oil salesman? This can’t be. “The global recovery continues, but it remains uneven and falls short of our ambition for strong, sustainable and balanced growth,” the statment continues, in a rather dour assessment of the economic landscape. “While recognising these challenges, we nevertheless judge that the magnitude of recent market volatility has not reflected the underlying fundamentals of the global economy,” officials added. Right. If markets were “reflecting the underlying fundamentals” of this global deflationary trainwreck, things would probably be even more volatile.

Predictably, everyone called on fiscal policy to save the day, in what amounts to a tacit admission that central banks have failed. “Countries will use fiscal policy flexibly to strengthen growth, job creation and confidence, while enhancing resilience and ensuring debt as a share of GDP is on a sustainable path,” the statement reads. So countries will somehow adopt expansionary fiscal policies without resorting to deficit financing via debt sales. So, magic. Got it. Long story short, there is no “Shanghai Accord” akin to the 1985 Plaza Accord between the United States, France, West Germany, Japan, and the United Kingdom, which agreed to weaken the USD to shore up America’s trade deficit and boost economic growth. All we have here is a generic statement and empty promises.

Even Buiter agrees.

• Currency Wars Coming In Leaderless World: Citi’s Buiter (CNBC)

The global economy is bound to remain leaderless, as G-20 countries meeting in Shanghai on Friday are unlikely to produce anything more than a rhetorical statement, Citigroup’s chief economist Willem Buiter said. Buiter said Friday the global economy truly needs an agreement on exchange rates that will be defended through intervention, as well as expansion of supportive monetary policy, fiscal stimulus modulated according to countries’ needs, and “supply side reforms that sustain animal spirits in the corporate sector.” “You’re not going to get any of that in substance. There is no leadership in the global economy. And there is no willingness to forgo the short-run benefits of beggar-thy-neighbor exchange rate depreciation. Currency wars will be the reality of what we’ll see over the next few years,” he told CNBC’s “Squawk on the Street”.

Buiter and Citigroup analysts said in a note Wednesday the risk of the global economy falling into a recession is rising as fundamentals remain poor. “We are currently in a highly precarious environment for global growth and asset markets after two to three years of relative calm,” Citigroup said, noting that global growth was “unusually weak” in the fourth quarter at around 2 percent. Buiter said central banks are nearly out of ammo when it comes to using conventional and unconventional monetary policy as a means of stimulating demand. “If we have a further slowdown, it will have to be combined more with the fiscal policy, and the world just isn’t ready for that, institutionally, politically and any other way,” he said.

At the same time, the private and public sectors in most advanced economies have become highly leveraged, he noted. Citi is not expecting a U.S. recession, provided no surprises from abroad send the dollar sharply higher. But it does anticipate a further incremental slowing in the absence of a supportive Federal Reserve and as corporations ratchet up debt following a period of “unspectacular, mediocre” growth, he said. Markets have appropriately priced in the risk of recession following last year’s “excessive optimism,” he said. “Markets are ahead of the policymakers here for once,” he said. “People have now rediscovered that, yes, future earnings growth projections on which the stock valuations were based were unrealistic.”

While knowing that governments won’t.

• G-20 Wants Governments Doing More, and Central Banks Less (BBG)

Finance chiefs from the world’s top economies committed their governments to doing more to boost global growth amid mounting concerns over the potency of monetary policy. In a pledge that will prove easier to write than deliver and may disappoint investors looking for a coordinated stimulus plan, the Group of 20 said “we will use fiscal policy flexibly to strengthen growth, job creation and confidence.” After a two-day meeting in Shanghai, finance ministers and central bank governors also doubled down on a line from their last gathering that “monetary policy alone cannot lead to balanced growth.” For those few analysts calling for a 1985 Plaza Accord-type agreement to address exchange-rate tensions, there was no such luck: IMF Managing Director Christine Lagarde said there were no discussions about anything like that.

The G-20 members did reaffirm they will refrain from competitive devaluations, and – in new language – agreed to consult closely on currencies. An increasing sense monetary policy is reaching its limit permeated officials’ briefings during the meetings that ended Saturday. While central banks proved critical in avoiding a global slide into depression last decade, there is now no consensus among the world’s top economic guardians backing stepped-up monetary stimulus. That leaves focus on fiscal polices that are subject to domestic political constraints, and a structural-reform agenda the G-20 said will be gauged through a new indicator system. “Central bankers have done their bit in recent years to stabilize the world economy,” said Frederic Neumann at HSBC in Hong Kong.

“But as their tools are losing their effectiveness, only more aggressive fiscal policy and structural reforms will help to lift growth.” Among those publicly indicating a potentially reduced role for central banks was Lagarde, who said Friday the effects of monetary policies, even innovative ones, are diminishing. Bank of England Governor Mark Carney used a Shanghai speech ahead of the G-20 to voice skepticism over negative interest rates – now in place in continental Europe and Japan – and their ability to boost domestic demand.

“They’re paid to spin it in a positive manner..” “You can’t expect them to say anything else.”

• We’re In Recession And It’s Getting Worse: Ron Paul (CNBC)

Ron Paul wants to deliver a message to the market that he claims the Federal Reserve refuses to do itself. The former U.S. Republican congressman said this week that the Fed has been propping up markets, and the U.S. economy has already entered a recession despite what central bankers might say. “They’re paid to spin it in a positive manner,” the libertarian firebrand told CNBC’s “Futures Now” in an interview. He added: “You can’t expect them to say anything else.” Paul’s warning comes as a growing number on Wall Street have turned pessimistic on the economy. This week, Citigroup analysts cautioned in a note that the risk of the global economy sinking into a full-fledged recession is on the rise, amid a “tightening in financial conditions everywhere.”

Dragging down the economy is a massive load of personal and sovereign debt, Paul said. A 2015 analysis by the McKinsey Global Institute said that global debt had grown by $57 trillion in the last several years, while no major economy has successfully de-leveraged since 2007. According to Paul, the Fed has played a large role in that accumulation of debt by implementing artificially low interest rates for years. This has pushed individuals and companies to spend beyond their means, he added.

“When things get out of kilter from artificially low interest rates…the only correction is the liquidation of the debt, but that is not permissible,” Paul said. Now, Paul warned that the government may be losing control of markets, which will lead to more volatility in stocks. “Everything is designed to keep the stock market alive. At the same time, the employment numbers when you look at them closely aren’t all that great,” he said. In January, the U.S. economy added 151,000 jobs, missing economist expectations and falling well short from the previous month. From here, Paul said growth will continue to deteriorate. “I think that the conditions will get a lot worse,” he said. “The slope is going to be down, for economic growth and prosperity.”

Lame defense that breaks down confidence instead of building it up.

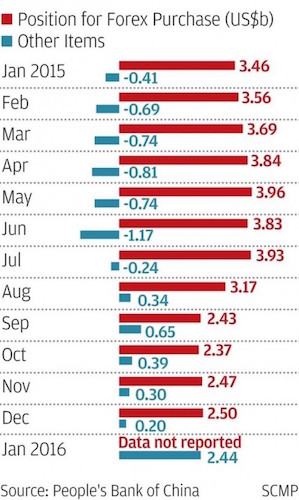

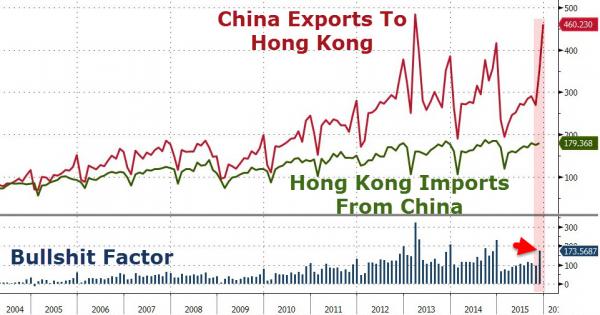

• PBoC Defends Halting Publication Of Sensitive Financial Data (SCMP)

China’s central bank has defended the removal of sensitive data from a regular financial report used by the market to assess the flow of capital in and out of the country. The People’s Bank of China said in a statement that the figures were no longer published as they were misleading and not an accurate reflection of capital flows. The removal of the data comes as huge amounts of cash is flowing out of China as the nation’s economy slows and its currency weakens. China’s foreign exchange reserves fell by a record US$108 billion in December and US$99.4 billion in January. The absence of the regular figures in the report was first reported by the South China Morning Post last week. Analysts had complained that sudden lack of clear information made it hard for markets to draw a clear picture of the financial positions in China’s banking system.

Figures on the “position for forex purchase” for all financial institutions, including the central bank, were regularly published in the PBOC’s monthly report on the “Sources and Uses of Credit Funds of Financial Institutions”. The December reading in yuan was 26.6 trillion yuan. But the data was missing in the central bank’s latest report. The central bank did publish figures for its own purchases of foreign exchange. A central bank statement issued before the start of a G20 finance ministers and central bank leaders meeting in Shanghai said the figures on “commercial banks foreign exchange transactions do not necessarily affect the central bank’s foreign exchange position, nor necessarily reflect capital flows”. The data has “little resemblance to its original meaning and cannot reflect the real condition of capital flows”, the statement said.

The indicator was useful to measure capital flows when almost all foreign exchange at commercial banks was purchased in yuan, but particularly after China joined the World Trade Organisation in 2001 the correlation between foreign exchange and yuan positions at commercial banks was no longer clear, the central bank said. The data removed from the report used to be closely monitored by analysts and the media as a guide to capital flows in and out of China. Chen Xingdong, chief economist at BNP Paribas in Beijing, said: “If China’s capital flows were not so closely watched, the tweak may not stir debate, but as China’s capital flow situation is such a hot issue the central bank’s adjustment is put under the spotlight. China’s central bank has to improve its communications” with the market, he said.

[..] Christopher Balding, an associate professor at Peking University HSBC Business School, said the change in published data was relatively small, but still made it more complicated to track China’s capital flows. “Rather than censoring or redacting, it is better to say obfuscating or making [it] more difficult to track,” said Balding. It showed the central bank was unaware “how sceptical people are of these types of surprises and Chinese data”, he said. The problems with central bank data were similar to figures released by other Chinese government agencies, according to Balding. “They are constantly redefining key data to mean different things, most of the time without telling anyone…you never know if you are making the correct comparison.”

Great way to create confidence.

• How Xi Jinping Is Bringing China’s Media To Heel (Guardian)

It was an astonishing admission from one of the Communist party’s key mouthpieces: with China’s economic star fading, its leaders now urgently needed to strengthen their hold on the media in order to maintain control. “It is necessary for the media to restore people’s trust in the Party,” an editorial in the China Daily argued this week in the wake of a high-profile presidential tour of the country’s top news outlets in which Xi Jinping demanded “absolute loyalty” from their journalists. “The nation’s media outlets are essential to political stability.” China’s government-run media has long been a propaganda tool of the Party with Chairman Mao once famously declaring: “Revolution relies on pens and guns.”

But as Xi Jinping enters his third year as president experts say he is seeking to cement that grip even further, doubling down on the Party’s control of organisations such as state broadcaster CCTV, official news agency Xinhua, and Beijing’s flagship newspaper, the People’s Daily. “They must love the party, protect the party, and closely align themselves with the party leadership in thought, politics and action,” Xi told newsroom staff during a highly choreographed tour of the three outlets last Friday after which he set out his blueprint for the media. In case Xi’s message had been missed, an editorial in the People’s Daily informed news reporters their key role was not as speakers of truth to power but “disseminators of the Party’s policies and propositions”. “Guiding public opinion for the Party is crucial to governance of the country,” the newspaper said.

‘Lord King’. How odd that sounds.

• Mervyn King: New Financial Crisis Is ‘Certain’ Without Reform Of Banks (PA)

Another financial crisis is “certain” and will come sooner rather than later, the former Bank of England governor has warned. Mervyn King, who headed the bank between 2003 and 2013, believes the world economy will soon face another crash as regulators have failed to reform banking. He has also claimed that the 2008 crisis was the fault of the financial system, not individual greedy bankers, in his new book, The End Of Alchemy: Money, Banking And The Future Of The Global Economy, serialised in The Telegraph. “Without reform of the financial system, another crisis is certain, and the failure … to tackle the disequilibrium in the world economy makes it likely that it will come sooner rather than later,” Lord King wrote.

He added that global central banks were caught in a “prisoner’s dilemma” – unable to raise interest rates for fear of stifling the economic recovery, the newspaper reported. A remark from a Chinese colleague who said the west had not got the hang of money and banking was the inspiration for his book. Lord King, 67, said without understanding what caused the crash, politicians and bankers would be unable to prevent another, and lays the blame at the door of a broken financial system. He said: “The crisis was a failure of a system, and the ideas that underpinned it, not of individual policymakers or bankers, incompetent and greedy though some of them undoubtedly were.” Spending imbalances both within and between countries led to the crisis in 2008 and he believes a current disequilibrium will lead to the next.

To solve the problem, Lord King suggests raising productivity and boldly reforming the banking system. He said: “Only a fundamental rethink of how we, as a society, organise our system of money and banking will prevent a repetition of the crisis that we experienced in 2008.” Lord King was in charge of the Bank of England when the credit crunch struck in 2007, leading to the collapse of Northern Rock and numerous other British lenders, including RBS, and has been criticised for failing to see the global financial crisis coming.

Private debt. Warrants far more attention than it gets. See Steve Keen.

• Hidden Debt That No One Is Talking About -And It Involves You- (SMH)

There’s a paradox when it comes to debt in Australia. We have endless debate about the magnitude of the government’s borrowings, even though they are comparatively low by global standards. Meanwhile, the level of household debt gets relatively little attention even though it’s among the highest in the world. In the past two decades the debt owed by households has risen from about 80% of combined income to more than 180%. A fresh surge in borrowing driven by the recent boom in house prices, coupled with slow wage growth, has pushed the debt-to-income ratio to new heights. When economist Kieran Davies last year compared countries using another measure – the ratio of household debt to gross domestic product – he found Australia’s to be the world’s highest, just above Denmark, Switzerland and the Netherlands.

Australians’ household debts may be manageable now, but higher interest rates would stretch many people. Even so, I think Australia’s household debt story gets less scrutiny than it deserves, considering the risks. About 85% of household borrowings – which include mortgages, credit cards, overdrafts and personal loans – are owed to Australian lenders, mostly banks. The Reserve Bank pointed out recently that a small but fast-growing proportion is owed to Australian governments – mostly university-related HECS/HELP debt – and to overseas banks and governments, which is mostly owed by recent migrants. Household surveys by research firm Digital Finance Analytics have found more than one in 10 owner-occupiers would have difficulty meeting their mortgage repayments if interest rates were to rise by just 1 percentage point from their current historic lows.

Martin North, the principal of Digital Finance Analytics, says it’s not just low-income households that are exposed. “My reading is that overall the market is OK but there are some significant pockets of stress even in this low-interest rate environment,” he said. “But those pockets are not necessarily where you would expect the risk to be, it’s not just western Sydney for example. Some quite affluent people who have taken out very large mortgages are more leveraged and therefore more exposed if interest rates were to rise.” One striking trend going largely under the radar is the dramatic shift in customers using short-term loans from so called “payday lenders” following regulatory changes in 2013 and advances in information technology. In the past, payday loans were typically used by those on very low incomes in financial crisis. But a growing share of these loans – now called “small amount credit contracts” – are being taken out by those in higher income groups.

High time to scrutinize the lenders.

• North Sea Firms Are ‘Sleepwalking Into Disaster’ As Insolvencies Loom (Tel.)

The North Sea industry is “sleepwalking” into a wave of insolvencies in the coming months as the full brunt of the collapse in the price of crude causes the finances of many companies to buckle, some of the City’s top restructuring lawyers have said. The majority of North Sea firms have so far endured a punishing 70pc oil price decline since 2014 by relying on loans which were approved based on market hedges secured one to two years before the market crash. But with hedge positions now unwinding firms will be exposed to the full brunt of the oil collapse and the increasingly stressed loan facilities keeping them afloat will be stretched to breaking point. Lenders may have offered firms a stay of execution last year in anticipation of a market recovery, but hopes for significantly higher crude prices are now dashed.

Within weeks, big North Sea lenders will begin a review of the loans that have propped up many Aim-listed explorers through the 18-month oil price rout, prompting a swath of insolvencies later this year.. Stephen Phillips, head of restructuring at Orrick, Herrington & Sutcliffe, said: “There’s a sense that the North Sea may be sleepwalking into a disaster zone.” Simon Tysoe a partner at Latham & Watkins, said half a dozen North Sea explorers were being actively discussed by banks and lenders as firms which will go into restructuring and possibly insolvency. North Sea bankruptcies have been rare in the past but the severity of the current downturn has already forced Iona Energy and First Oil Expro, two smaller oil companies, to call in administrators.

Now larger Aim-listed firms look at risk, which will also leave project partners and oilfield service firms vulnerable as the financial contagion spreads through the embattled sector. Mr Tysoe said: “Most oil companies have in fact not been selling their oil at $30 a barrel, they’ve been selling their oil at prices like $75 a barrel, notwithstanding the spot price of oil, because they’ve had financial hedges in place.” “The impact of this collapse is going to look very bad. In oilfield services, the position is significantly worse. The question is: when will lenders pull the trigger?”

How much did the banks lose?

• European Oil Majors Tally $19 Billion In Losses (MW)

How much has Big Oil in Europe lost in the last quarter? Try $19 billion — or slightly more than Iceland’s entire economy. The culprit is of course an unrelenting decline in crude and Brent prices through the period, when the contracts slid 18% and 24%, respectively. That sparked a round of significant impairment charges, project delays and reduced exploration among Europe’s major energy companies, with the majority of the Stoxx Europe 600’s oil and gas producers reporting losses in the one-billion dollar territory. “It’s been a mixed bag for oil company results — most have been pressured by weaker oil prices,” said Jason Kenney, head of pan-European oil equity research at Banco Santander, in emailed comments.

“Many have had to write down assets given the new oil price environment. The key to weathering the storm is disinvestment in our view — cutting costs, lowering capex, deferring spend, divesting peripheral businesses, offloading capital commitments, restructuring operations, and generally squeezing more from current operations for hopefully a lot less,” he added. Earnings from Europe’s oil majors have trickled out through February and were rounded off with a set of downbeat fourth-quarter numbers from Italian oil giant Eni on Friday. Eni said its quarterly loss more than tripled to 8.5 billion euros ($9.4 billion) in the final three months of the year, bringing the total tally of losses among the European oil majors to $19.3 billion..

Does Belgium jail people for fraud? How about bankers?

• Citigroup Faces Fraud Suit Claiming $1.1 Billion in Losses (BBG)

Citigroup Inc. was sued for fraud by investors and creditors of a bankrupt Mexican oil services firm over claims they were harmed by a loan scheme that also led the bank to cut 2013 profit by $235 million and fire at least a dozen people. Citigroup’s loans led to the 2014 collapse of the Mexican firm Oceanografia, and caused Dutch lender Rabobank, with investors and creditors, to lose at least $1.1 billion, according to the lawsuit filed Friday in Miami federal court. Rabobank and other investors separately filed a negligence suit in Delaware state court against auditor KPMG. Citigroup’s Mexican subsidiary, Banamex, made short-term loans to Oceanografia, which did work for state-run Petroleos Mexicanos, or Pemex. In turn, Pemex repaid the bank.

Citigroup CEO Michael Corbat said in February 2014 that $400 million of accounts receivable from Oceanografia were fraudulent. He said the bank was working with Mexican authorities and would find out “who perpetrated this despicable crime.” Rabobank and the investors claim Citigroup conspired with Oceanografia to accept falsified work estimates even as the oil services firm became increasingly dependent on cash advances to survive. Those Citigroup loans propped up Oceanografia, while Pemex repaid the bank with millions of dollars in interest, according to the complaint. “Intentional misconduct on the part of Wall Street banks – including Citigroup specifically – is far from unfamiliar,” according to the complaint. “Yet again, greed and dishonesty have victimized blameless businesses and investors.”

Things weren’t always like this.

• How Land Barons, Industrialists And Bankers Corrupted Economics (Kent)

The Corruption of Economics by Mason Gaffney and Fred Harrison, while free online, is hardly known; as of December 2015 only three New Zealand university libraries and the Auckland Public Library held copies. Yet in it is a very important story. Fred Harrison describes the phenomenon of Henry George, the San Francisco journalist who took the world by storm with his book Progress and Poverty in 1879, in which he argues that the benefits of land ownership must be shared by all and that a single tax is needed to fund government – a land tax. The factors of production are land, capital and labour. Untax labour and tax land was the cry. Poverty could be beaten. Social justice was possible! Of Henry George influential economic historian John Kenneth Galbraith writes,

“In his time and even into the 1920s and 1930s Henry George was the most widely read of American economic writers both at home and in Europe. He was, indeed, one of the most widely read of Americans. Progress and Poverty… in various editions and reprintings… had a circulation in the millions.” Unlike many writers, Henry George didn’t stop there. He took his message of hope everywhere he could travel – across America and to England, New Zealand, Australia, Scotland and Ireland. He turned political. Seven years after his book came out in remote California, in 1886 he narrowly missed out on being elected Mayor of New York, outpolling Teddy Roosevelt. During the 1890s George, Henry George was the third most famous American, after Mark Twain and Thomas Edison. Ten years after Progress and Poverty he was influencing a radical wing of the British Liberal Party.

He was read by semi-literate workers from Birmingham, Alabama to Liverpool, England. His Single Tax was understood by peasants in the remotest crofts of Scotland and Ireland. Gaffney’s section of the book outlines how certain rich land barons, industrialists and bankers funded influential universities in America and proceeded to change the direction of their economics departments. He names names at every turn, wading through presidents and funders of many prestigious universities. In particular, Gaffney, an economist himself, names the economists bought to discredit his theories, their debates with George and their papers written over many decades.

“George’s ideas were carried worldwide by such towering figures as Lloyd George in England, Leo Tolstoy and Alexander Kerensky in Russia, Sun Yat-sen in China, hundreds of local and state and a few power national politicians in both Canada and the USA, Billy Hughes in Australia, Rolland O’Regan in New Zealand, Chaim Weizmann in Palestine, Francisco Madero in Mexico, and many others in Denmark, South Africa and around the world. In England Lloyd George’s budget speech of 1909 reads in part as though written by Henry George himself. Some of Winston Churchill’s speeches were written by Georgist ghosts.” When he died there were 100,000 at his funeral.

The wealthy and influential just couldn’t let the dangerous ideas spread. Their privileged position was gravely threatened. Henry George must be stopped. But the strategy had to be subtle. What better route than by using their money to influence the supposed fount of all knowledge, the universities? That would then indoctrinate journalists and the general public. Nice one! The story explains how, for their wealthy paymasters, academics corrupted the language to subsume it under capital. They redefined rent, and created a jargon to confuse public debate. Harrison says, ‘For a century they have taken people down blind alleys with abstract models and algebraic equations. Economics became detached from the real world in the course of the twentieth century.’ Yes, the wealthy paid money to buy scholars to pervert the science.

Gaffney’s rich, whimsical language is a joy to read. He writes to Harrison, ‘Systematic, universal brainwashing is the crime, tendentious mental conditioning calculated to mislead students, to impoverish their mental ability, to bend their minds to the service of a system that funnels power and wealth to a parasitic minority.’

“..we’re talking about a legislature … that says we don’t care about y’all.”

• Alabama Lawmakers To Cities: We Won’t Let You Raise The Minimum Wage (CSM)

While major demonstrations have led to a $15 minimum wage in San Francisco, Seattle, New York Los Angeles, and 10 other cities in the past year, Birmingham’s plans to boost local wages have been thwarted by state legislation. The city council of Birmingham, Ala., voted 7 to 0 (with one abstention) to become the first city in the deep South to enact a minimum wage above the current federal level of $7.25. The ordinance planned an increase to $8.50 per hour by July 2016, with a second increase to $10.10 set for July 2017. But the Alabama legislature this past week fired back, passing a bill that prevents cities and counties from mandating their own benefits, including minimum wage, vacation time, or set work schedules. The bill passed easily in both houses and Gov. Robert Bentley signed it into law on Thursday.

Supporters argued that a “patchwork” of varying wages would devastate businesses, cost jobs, and send the regional economy into a slump. “We want businesses to expand and create more jobs – not cut entry-level jobs because a patchwork of local minimum wages causes operating costs to rise,” said State Sen. Jabo Waggoner (R) after the bill’s passage. Critics of the new law countered that higher wages lift families out of poverty and inject new spending into the regional economy. “We’re talking about the bare survival of people,” said Sen. Rodger Smitherman (D), reported the Montgomery Advertiser. “And we’re talking about a legislature … that says we don’t care about y’all.” “When you lift a person on the bottom, everybody above them is lifted up,” he added.

No space here for the whole thing, but very much worth the time.

• The Donald – The Good And Bad Of It (David Stockman)

[..] Once upon a time, by contrast, the GOP actually stood for free markets, fiscal rectitude, hard money and minimalist government. Calvin Coolidge did a pretty good job of it. And even the unfairly besmirched Warren G. Harding got us out of the foreign intervention business—-a path that the great Dwight D. Eisenhower pretty consistently hewed to under the far more challenging conditions of the cold war. But these were sons of America’s old school interior – Massachusetts, Ohio and Kansas. As temporary sojourners in Washington, they remained incredulous and chary of grand state missions either at home or abroad. Harding called it returning to “normalcy”. Coolidge said Washington’s business was to get out of the way.

And Ike actually shrank the Warfare state by one-third, ended Truman’s wars and started no new ones, resisted much of the Dulles’ brother’s interventionist agenda, balanced the budget and froze the New Deal as hard in place at he had the votes to achieve. Today’s Republican crowd bears no resemblance. They live in the capital, fully embrace its projects and pretensions and visit the provinces as sparingly as possible. And that’s why The Donald has them so rattled, even petrified. To be sure, there is much that is ugly, superficial and stupid about Donald Trump’s campaign platform, if you can call it that, or loose cannon oratory to be more exact. More on that below, but at the heart of his appeal are two propositions which strike terror in the hearts of the Imperial City’s GOP operatives.

To wit, he is loudly self-funding his own campaign and bombastically insisting that America is getting a bad deal everywhere in the world. The first of these propositions explicitly tells the legions of K-Street lobbies to take a hike, thereby posing a mortal threat to the fund raising rackets which are the GOPs lifeblood. And while the “bad deal” abroad is superficially about NAFTA and our $500 billion trade deficit with China, it is really an attack on the American Imperium The American people are sick and tired of the Lindsay Graham/John McCain/George Bush/neocon wars of intervention and occupation; and they resent the massive fiscal burdens of our outmoded but still far-flung alliances, forward bases and apparatus of security assistance and economic aid. They especially have no patience for the continued huge cost of our commitments to cold war relics like NATO, the stationing of troops in South Korea and the defense treaty with the incorrigible Japanese, who still blatantly rig their trade rules against American exports.

In short, The Donald is tapping a nationalist/isolationist impulse that runs deep among a weary and economically precarious main street public. He is clever enough to articulate it in the bombast of what sounds like a crude trade protectionism. Yet if Pat Buchanan were to re-write his speech, it would be more erudite and explicit about the folly of the American Imperium, but the message would be the same. That’s why the War Party is so desperate, and why its last great hope is the bantam weight Senator from Florida. In truth, Marco Rubio is an obnoxious kid who wants to be President so he can play with guns, planes, ships and bombs. He is a pure creature of the Imperial City, even if at his young age he has idled there only since 2010.

Yet down to the last nuance of his insipid neocon worldview and monotonous recitation of the American Exceptionalism catechism, he might as well have been born in Washington of GS-16 parents, not Cuban refugees, raised as a Congressional page, and apprenticed to the Speaker of the US House rather than serving as the same in the backwaters of Tallahassee. What Marco Rubio is all about is Warfare State republicanism. When he talks about restoring American Greatness it is through the agency of Imperial Washington. He has no kinship with Harding, Coolidge or Eisenhower. None of them were intent on searching the earth for monsters to destroy, as does Rubio in every single speech.

Traffic violations?! Gives a whole new meaning to ‘two strikes you’re out’.

• Switzerland Votes On Expelling Foreigners For Minor Offences (Guardian)

Switzerland votes in a referendum Sunday on whether foreigner citizens who commit two minor offences, like traffic violations, in the space of 10 years should be automatically deported. The referendum asks whether any foreign national found guilty of two lower-level infractions, including fighting, money laundering, giving false testimony and indecent exposure, should be expelled. The vote comes at a time when many European countries are hardening their attitudes to migrants after more than a million arrived on the continent last year. A quarter of the people living in Switzerland have a foreign passport, the majority of them from European countries.

More than half of Swiss voters backed strengthening rules to automatically expel foreign nationals convicted of violent or sexual crimes in a referendum on the same topic six years ago. But the populist right-wing Swiss People’s Party (SVP), which won the biggest share of the vote in parliamentary elections last October, has accused parliament of dragging its feet on writing the text into law and watering it down when it did so last March. Known for its virulent campaigns against immigration, the European Union and Islam, the party has proposed tougher rules, calling for “a real deportation of criminal foreigners”. The initiative faces stiff opposition, including from the government, parliament and all the other major political parties, who have warned it circumvents the “fundamental rules” of democracy.

If passed, it would dramatically increase the number of offences that could get foreign nationals automatically kicked out of Switzerland, including misdemeanours usually punishable with fines or short prison sentences. It would also remove a judge’s right to refrain from deportation in cases where it would cause the foreign national “serious personal hardship”. More than 50,000 people including hundreds of celebrities have signed a petition against the proposals. [..] Opponents warn that if the text passes, people born to foreign parents in Switzerland risk being deported to countries they have never lived in, for petty offences.

Getting worse fast.

• Double Crisis Deepens Despair In Greece’s ‘Warehouse Of Souls’ (Guardian)

There are more than 25,000 refugees and migrants stuck in Greece, police sources have told the Observer. The borders leading out have closed down one by one, leaving the country in danger of becoming what the Greek prime minister, Alexis Tsipras, described last week as a “warehouse of souls”. Tsipras has threatened to block future EU agreements and has withdrawn the Greek ambassador to Austria from Vienna in protest at the lack of support being offered by other nations during the refugee crisis. Austria is accepting only 80 migrants a day. The Hungarian prime minister, Viktor Orbán, plans to hold a referendum on compulsory migrant quotas. Macedonia, Croatia, Serbia and Slovenia are refusing to accept Afghans and other refugees deemed not to be from conflict zones and are accepting a maximum of 580 migrants a day. The German chancellor, Angela Merkel, appears to be staking everything on a crucial EU-Turkey summit, scheduled to take place on 7 March.

[..] The convergence of two crises – the refugee influx and the debt drama that has plagued the country for the past six years – has caused the rhetoric of catastrophe to be ratcheted up in Athens and abroad. After the announcement by the European commission on Friday that, in the wake of border closures, it had been forced to put together a humanitarian aid plan for Greece, there is an inescapable sense of impending doom. “It was difficult for the government to manage Greece’s own domestic economic crisis,” said Dirk Reinermann, project manager for southern Europe at the World Bank. “The new exogenous challenge of having to deal with refugees and migrants is such that the overall task at hand borders on the impossible.” While EU diplomats spoke of the nightmare scenario of seeing hundreds of thousands of people trapped in the country by May, analysts predicted that Europe’s southern flank could soon become embroiled in scenes of chaos and immense social hardship.

“It’s going to get a lot worse before it gets better,” said Thanos Dokos, who heads Eliamep, a leading Greek thinktank. He told the Observer: “We are at risk of seeing an economy without any hope of recovery, and the country being flooded by people who have no intention of staying in camps but instead [will be] making their way to borders where there will be no shelter or facilities to host them.” Anger at the influx has mounted on Aegean islands close to the Turkish coast, where tourism has been hard hit. In an interview, Constantine Michalos, president of the Athens chamber of commerce and industry, said pre-bookings in Kos, Rhodes and Lesbos, the islands that have borne the brunt of the refugee and migrant arrivals, were down by 60%.

[..] Dimitra Koutsavli is working for Doctors of the World – Greece. The organisation is having constantly to move its operations to follow the ever-changing makeshift camps opening and closing on political orders across the country. She said she had never seen the situation as bad in Athens as over the past few days. “The situation here is worsening. Refugees are all over the city, in squares, in the port. According to our emergency mission in Piraeus port on Friday, we saw thousands of refugees there, among them many children.” To say that Greeks think the rest of Europe could do more is an understatement. There were peaceful protests in Athens and Piraeus last week by Greeks and refugees, and on Saturday there was a protest by 300 people outside the Austrian embassy in Athens. Not many of those in Victoria Square went to the demonstration. “It’s for Europe to decide if it can help us. We just say, ‘Please open the borders.’ We don’t want to sit here,” said Sharzai..