Pablo Picasso Les femmes d’Alger Version 0 1955

No markets, no discovery, just smoke.

• The Average Stock Is Enormously, Tremendously Overvalued (Katsenelson)

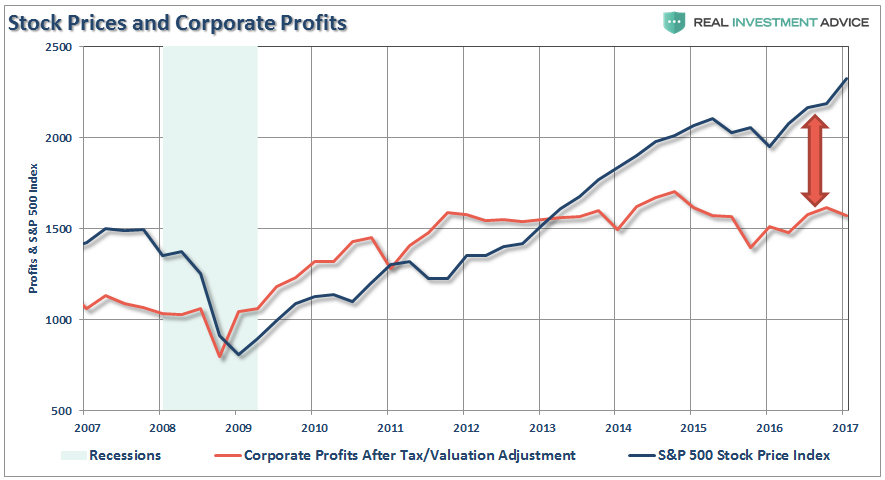

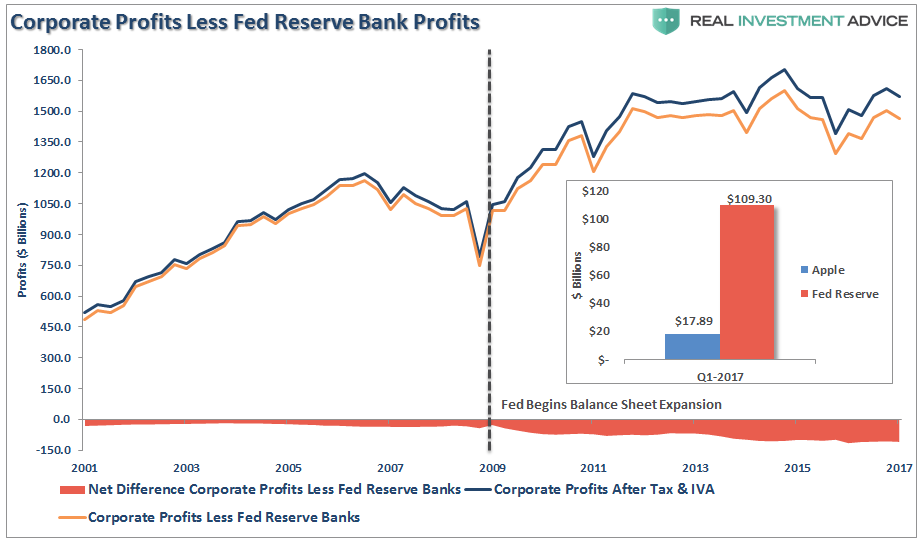

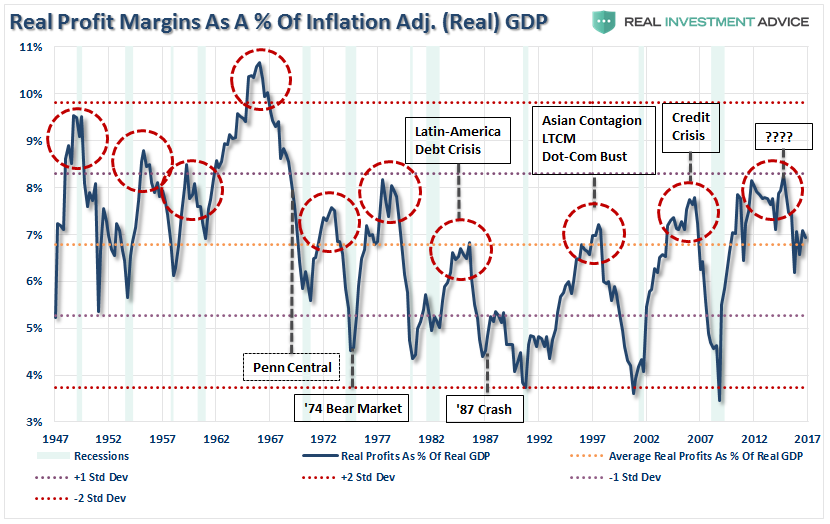

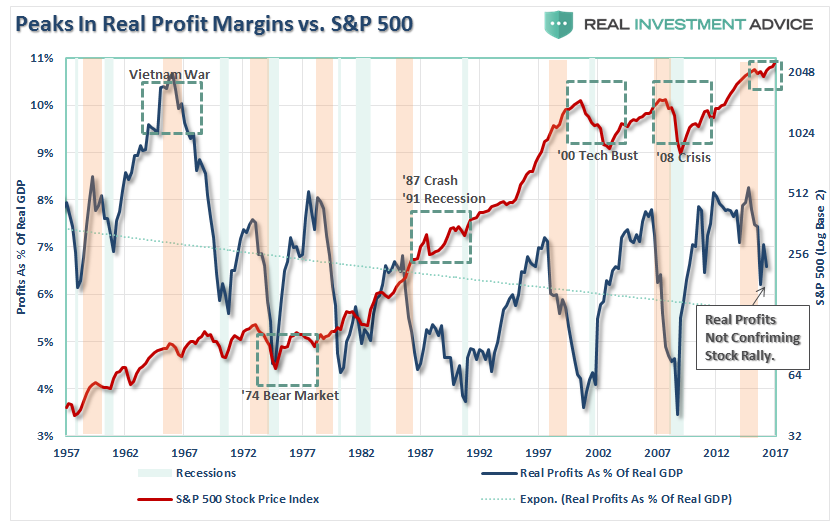

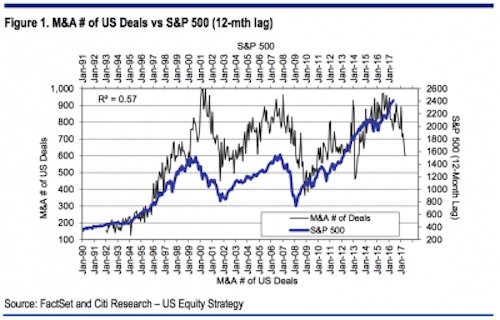

We are constantly looking for new stocks by running stock screens, endlessly reading (blogs, research, magazines, newspapers), looking at holdings of investors we respect, talking to our large network of professional investors, attending conferences, scouring through ideas published on value investor networks, and finally, looking with frustration at our large (and growing) watch list of companies we’d like to buy at a significant margin of safety. The median stock on our watch list has to decline by about 35–40% to be an attractive buy. But maybe we’re too subjective. Instead of just asking you to take our word for it, in this letter, we’ll show you a few charts that not only demonstrate our point, but also show the magnitude of the stock market’s overvaluation and, more importantly, put it into historical context.

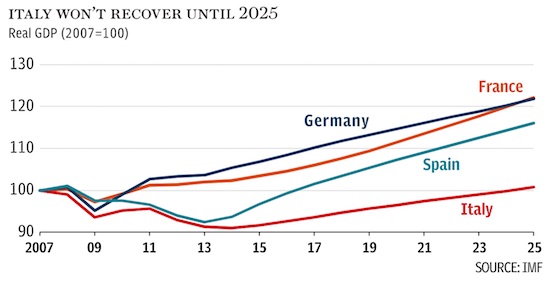

Each chart examines stock market valuation from a slightly differently perspective, but each arrives at the same conclusion: the average stock is overvalued somewhere between tremendously and enormously. If you don’t know whether “enormously” is greater than “tremendously” or vice versa, don’t worry, we don’t know either. But this is our point exactly: When an asset class is significantly overvalued and continues to get overvalued, quantifying its overvaluation brings little value. Let’s demonstrate this point by looking at a few charts. The first chart shows price-to-earnings of the S&P 500 in relation to its historical average. The average stock today is trading at 73% above its historical average valuation. There are only two other times in history that stocks were more expensive than they are today: just before the Great Depression hit and in the 1999 run-up to the dot-com bubble burst.

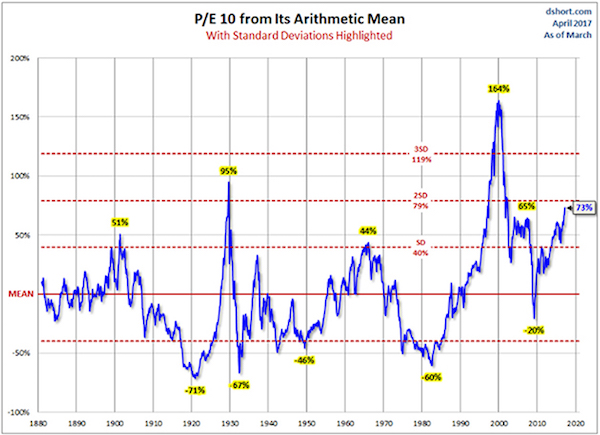

We know how the history played in both cases—consequently stocks declined, a lot. Based on over a century of history, we are fairly sure that, this time too, stock valuations will at some point mean revert and stock markets will decline. After all, price-to-earnings behaves like a pendulum that swings around the mean, and today that pendulum has swung far above the mean. What we don’t know is how this journey will look in the interim. Before the inevitable decline, will price-to-earnings revisit the pre-Great Depression level of 95% above average, or will it maybe say hello to the pre-dot-com crash level of 164% above average? Or will another injection of QE steroids send stocks valuations to new, never-before-seen highs? Nobody knows. One chart is not enough. Let’s take a look at another one called the Buffett Indicator. Think of this chart as a price-to-sales ratio for the whole economy, that is, the market value of all equities divided by GDP. The higher the price-to-sales ratio, the more expensive stocks are.

What does this say about where the S&P is?

• 72% Of US Businesses Are Not Profitable (Simon Black)

Total Household Wealth is exactly what it sounds like– the total net worth of every person in the United States, from Bill Gates down to the youngest newborn baby. So when you add up all the 330+ million folks in the Land of the Free and tally up their combined net worth, the total is $94 trillion. The thing is that the VAST majority of that wealth, especially the incredible growth over the last 8 years, has been from increases in just two asset classes: real estate and the stock market. In fact, stocks and real estate alone account for roughly 2/3 of the wealth increase since 2009. I’ll come back to that in a moment. Now, simultaneously, we see plenty of other interesting data, also published by the Federal Reserve and US federal government. Both the Fed and Census Bureau, for example, tell us that over 80% of businesses in the US are “nonemployer” companies, i.e. businesses which only employ one person (the owner), and often provide his/her primary source of income.

Yet according to the Federal Reserve, only 35% of these small businesses are profitable. Most are operating at a loss. In other words, only 35% of the companies which make up 80% of American businesses are profitable. You’re probably already doing the arithmetic– this means that a whopping 72% of all US businesses are NOT profitable. That hardly sounds like record wealth to me. Shifting gears, there’s the little factoid that an astounding 40% of young Americans are living with their parents– the highest%age in the last 75 years. And who can blame them considering student debt in the Land of the Free also hit a record $1.4 trillion three months ago, more than double the amount since the Great Recession. Speaking of record debt, US credit card debt passed a record $1 trillion, and total US consumer credit hit a record $3.8 trillion last month. Again, all of this hardly seems like ‘wealth’ to me.

Then there’s the issue of wages, which have remained essentially flat since the 2009 Great Recession if you adjust for inflation. According to the US Department of Labor, inflation-adjusted wages, aka “real hourly compensation” in the US fell an annualized 0.9% last quarter, and fell a dismal 5.6% in the previous quarter. Adjusted for inflation, the average American isn’t making any more money. Once again, this is a pitiful excuse for ‘wealth.’ American businesses aren’t more productive either. The same Labor Department report shows that productivity in the Land of the Free was flat in the first quarter of this year. And productivity actually declined in 2016– something that hasn’t happened in at least the last 50 years. Not to mention total economic growth in the Land of the Free has been pretty pitiful, logging a pathetic 1.6% last year. And GDP growth in the first quarter of 2017 was just 1.2% on an annualized basis. The US economy has exceed hasn’t surpassed 3% growth in more than 10-years.

Oversaturated with debt.

• UBS Has Some Very Bad News For The Global Economy (ZH)

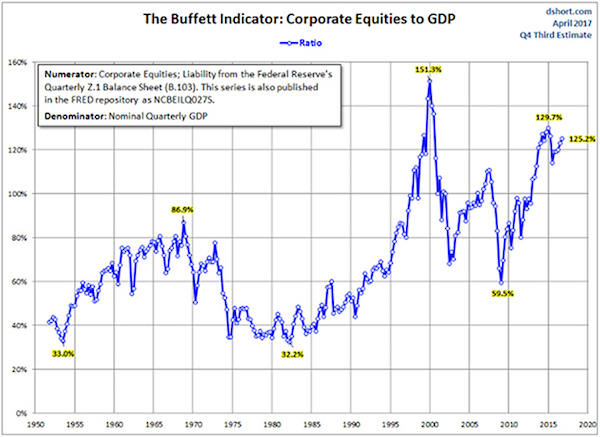

[..] fast forwarding just over three months later, where are we now? To answer that question, overnight UBS released its much anticipated update on the current state of the global credit impulse, and it’s nothing short of a disaster. As Kapteyn writes in what may have been the most eagerly awaited report in recent UBS history, “we have been inundated with questions about the chart below, first published in March. Yes, the global credit impulse is still falling. And yes, it matters because the correlation of this global credit impulse with global domestic demand is 0.61.” But it’s what follows next that should send shivers down the spine of anyone still clutching to the failed “recovery” narrative:

From peak to trough the deceleration in global credit growth is now approaching that during the global financial crisis (-6% of global GDP), even if the dispersion of the decline is much narrower. Currently 55% of the countries in our sample have experienced a -0.3 standard deviation deterioration in their credit impulse (median over 12 months) compared to 77% of countries in Dec ’09 when the median decline was -1.4 stdev.” Here is what the stunning collapse in the credit impulse looks like as of today:

While we urge all readers to get in touch with their friendly UBS sales coverage for the full report, here is a quick primer from UBS on what the current data is telling us, not so much about China where the credit impulse slowdown was discussed previously, but about the world’s biggest economy. From UBS: The credit impulse in the US has also turned down, seemingly on the back of a sharp drop in demand for C&I loans. The slowdown is more visible in the bank loan data than the Flow of Funds data we are using to calculate the credit impulse (the FoF is 3x as broad and includes non-bank credit as well). But the slowdown is nonetheless at odds with confidence being expressed about investment and future borrowing plans.

The US credit impulse was running at 0.7% GDP back in September 2016 and by March had fallen to -0.53% GDP (recovering somewhat in April based on bank loan data). Why does this matter? Because as UBS shows in the chart below, in the US the correlation between activity and the impulse is very strong, and the lack of credit growth could constrain an acceleration in GDP from weak Q1 levels (the credit impulse suggests domestic demand growth should be close to 1% rather than the 2+% which consensus is currently tracking).

Yawn.

• Fed To Raise Interest Rates, Give More Detail On Balance Sheet Winddown (R.)

The U.S. Federal Reserve is widely expected to raise its benchmark interest rate this week due to a tightening labor market and may also provide more detail on its plans to shrink the mammoth bond portfolio it amassed to nurse the economic recovery. The central bank is scheduled to release its decision at 2 p.m EDT on Wednesday at the conclusion of its two-day policy meeting. Fed Chair Janet Yellen is due to hold a press conference at 2:30 pm EDT. “The expectation of a rate hike…is widely held, and has been reinforced by the most recent round of Fed communications,” said Michael Feroli, an economist with J.P. Morgan. Economists polled by Reuters overwhelmingly see the Fed raising its benchmark rate to a target range of 1.00 to 1.25% this week.

The Fed embarked on its first tightening cycle in more than a decade in December 2015. A quarter%age point interest rate rise on Wednesday would be the second nudge upwards this year following a similar move in March. Since then, the unemployment rate has fallen to a 16-year low of 4.3% and economic growth appears to have reaccelerated following a lackluster first quarter. However, other indicators of the economy’s health have been more mixed. The Fed’s preferred measure of underlying inflation has retreated to 1.5% from 1.8% earlier in 2017 and investors are growing increasingly doubtful policymakers will be able to stick to their anticipated pace of tightening of three interest rate rises this year and next.

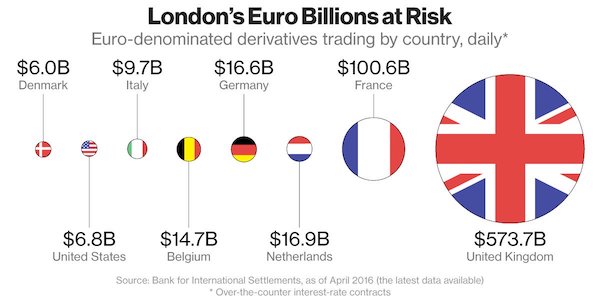

There’s money in derivatives yet.

• EU Plans to Force Relocation of Euro Clearing After Brexit (BBG)

Firms that clear euro-denominated derivatives may be forced to relocate to the European Union from London after Brexit under EU proposals to be rolled out on Tuesday, according to a person with knowledge of the matter. Under the European Commission’s plans for overhauling supervision of clearinghouses that are based outside the bloc, firms deemed systemically important to the EU financial system could be required to accept direct oversight by the bloc’s authorities, the person said, asking not to be named because the proposals aren’t yet public. Firms could also be forced to move their euro clearing operations to a location inside the EU, the person said.

This so-called location requirement has spurred warnings from the industry of skyrocketing costs, and has helped to turn clearing into a political football as the EU and U.K. prepare for divorce negotiations. In a June 8 letter to Valdis Dombrovskis, the EU’s financial-services policy chief, the International Swaps and Derivatives Association said a survey of data from 11 banks showed that requiring euro-denominated interest-rate derivatives to be cleared by an EU-based clearinghouse would boost initial margin by as much as 20%. The proposals to be published on Tuesday are largely in line with initial plans floated last month by the commission, the EU’s executive arm.

Central banks and shunned economists seem to be the only ones who understand this.

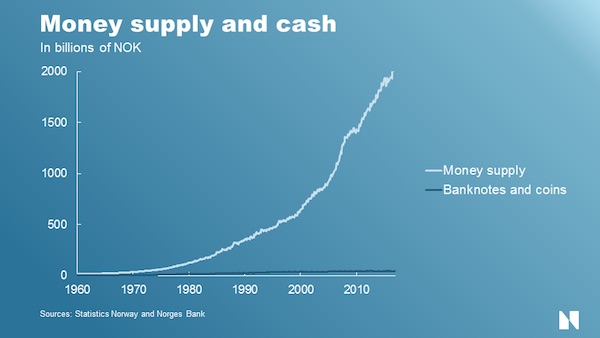

• Norway Central Bank Explains How Money Is Created (Norges Bank)

Today, there are two forms of central bank money. One of the forms is common knowledge – banknotes and coins. The other, bank reserves at Norges Bank, is less well known. The sum total of banknotes and coins and bank reserves at Norges Bank is about NOK 85 billion.[5] But the total money supply is much larger than this. Customer deposits in banks are also money. These deposits, referred to as deposit money, total more than NOK 2 trillion in Norway. This money is created by banks, not by Norges Bank. Chart 1 shows the money supply and the supply of banknotes and coins in Norway since 1960. In Norway, the money supply mainly comprises deposit money in banks.[6] In the early 1960s, banknotes and coins accounted for a fifth of the money supply. Current accounts and cheques were already becoming commonplace.

Since then, banks’ deposit money has increased dramatically, and today, banknotes and coins make up less than 2.5% of the money supply. In other words, virtually all the money we use has been created by banks. So how do banks create money? The answer to that question comes as quite a surprise to most people. When you borrow from a bank, the bank credits your bank account. The deposit – the money – is created by the bank the moment it issues the loan. The bank does not transfer the money from someone else’s bank account or from a vault full of money. The money lent to you by the bank has been created by the bank itself – out of nothing: fiat – let it become. The money created by the bank does not disappear when it leaves your account. If you use it to make a payment, it is just transferred to the recipient’s account.

The money is only removed from circulation when someone uses their deposits to repay a bank, as when we make a loan repayment.[7] The money supply is therefore only reduced when banks’ claims on the rest of the economy decrease. Banks also fund lending by raising loans themselves instead of creating money in the form of deposits. In order to reduce risk, banks also use other forms of investment in addition to lending.[8] Nevertheless, the money supply is growing at almost at the same pace as total bank credit. To sum up: banks create money out of nothing and withdraw it when loans are repaid. Growth in total bank credit is normally matched by growth in the money supply.[9] This does not sound encouraging. Is money an illusion? Why is today’s privately issued deposit money often perceived to be as safe as money issued by the central bank?

Flying pigs would have been even nicer.

• Qatar Spends $8 Million To Airlift 4,000 Cows (BBG)

Call it the biggest bovine airlift in history. The showdown between Qatar and its neighbors has disrupted trade, split families and threatened to alter long-standing geopolitical alliances. It’s also prompted one Qatari businessman to fly 4,000 cows to the Gulf desert in an act of resistance and opportunity to fill the void left by a collapse in the supply of fresh milk. It will take as many as 60 flights for Qatar Airways to deliver the 590-kilogram beasts that Moutaz Al Khayyat, chairman of Power International Holding, bought in Australia and the U.S. “This is the time to work for Qatar,” he said. Led by Saudi Arabia, Qatar stands accused of supporting Islamic militants, charges the sheikhdom has repeatedly denied.

The isolation that started on June 5 has forced the world’s richest country by capita to open new trade routes to import food, building materials and equipment for its natural gas industry. The central bank said domestic and international transactions were running normally. Turkish dairy goods have been flown in, and Iranian fruit and vegetables are on the way. There’s also a campaign to buy home-grown produce. Signs with colors of the Qatari flag have been placed next to dairy products in stores. One sign dangling from the ceiling said: “Together for the support of local products.” “It’s a message of defiance, that we don’t need others,” said Umm Issa, 40, a government employee perusing the shelves of a supermarket before taking a carton of Turkish milk to try. “Our government has made sure we have no shortages and we are grateful for that. We have no fear. No one will die of hunger.”

“..they had no idea what to do about it, except maybe try to escape the moment-by-moment pain of their ruined lives with powerful drugs. And then, a champion presented himself..”

• Things To Come (Jim Kunstler)

As our politicos creep deeper into a legalistic wilderness hunting for phantoms of Russian collusion, nobody pays attention to the most dangerous force in American life: the unraveling financialization of the economy. Financialization is what happens when the people-in-charge “create” colossal sums of “money” out of nothing — by issuing loans, a.k.a. debt — and then cream off stupendous profits from the asset bubbles, interest rate arbitrages, and other opportunities for swindling that the artificial wealth presents. It was a kind of magic trick that produced monuments of concentrated personal wealth for a few and left the rest of the population drowning in obligations from a stolen future. The future is now upon us. Financialization expressed itself in other interesting ways, for instance the amazing renovation of New York City (Brooklyn especially).

It didn’t happen just because Generation X was repulsed by the boring suburbs it grew up in and longed for a life of artisanal cocktails. It happened because financialization concentrated immense wealth geographically in the very few places where its activities took place — not just New York but San Francisco, Washington, and Boston — and could support luxuries like craft food and brews. Quite a bit of that wealth was extracted from asset-stripping the rest of America where financialization was absent, kind of a national distress sale of the fly-over places and the people in them. That dynamic, of course, produced the phenomenon of President Donald Trump, the distilled essence of all the economic distress “out there” and the rage it entailed.

The people of Ohio, Indiana, and Wisconsin were left holding a big bag of nothing and they certainly noticed what had been done to them, though they had no idea what to do about it, except maybe try to escape the moment-by-moment pain of their ruined lives with powerful drugs. And then, a champion presented himself, and promised to bring back the dimly remembered wonder years of post-war well-being — even though the world had changed utterly — and the poor suckers fell for it. Not to mention the fact that his opponent — the avaricious Hillary, with her hundreds of millions in ill-gotten wealth — was a very avatar of the financialization that had turned their lives to shit. And then the woman called them “a basket of deplorables” for noticing what had happened to them.

The permafrost is not all that perma.

• Multi-Million Dollar Upgrade Planned To ‘Failsafe’ Arctic Seed Vault (G.)

The Global Seed Vault, built in the Arctic as an impregnable deep freeze for the world’s most precious food seeds, is to undergo a multi-million dollar upgrade after water from melting permafrost flooded its access tunnel. No seeds were damaged but the incident undermined the original belief that the vault would be a “failsafe” facility, securing the world’s food supply forever. Now the Norwegian government, which owns the vault, has committed $4.4m (NOK37m) to improvements. The vault is buried 130m inside a mountain in the Svalbard archipelago and contains almost a million packets of seeds, each a variety of an important food crop. The vault was opened in 2008, sunk deep into the permafrost, and was expected to provide protection against “the challenge of natural or man-made disasters” and “to stand the test of time”.

But the vault’s planners had not anticipated the extreme warm weather seen recently at the end of the world’s hottest ever recorded year. “The background to the technical improvements is that the permafrost has not established itself as planned,” said a government statement. “A group will investigate potential solutions to counter the increased water volumes resulting from a wetter and warmer climate on Svalbard.” One option could be to replace the access tunnel, which slopes down towards the vault’s main door, carrying water towards the seeds. A new upward sloping tunnel would take water away from the vault.

A former Svalbard coal miner, Arne Kristoffersen, told the Guardian most coal mines on the islands had upward sloping entrance tunnels: “For me it is obvious to build an entrance tunnel upwards, so the water can run out. I am really surprised they made such a stupid construction.” Hege Njaa Aschim, the Norwegian government’s spokeswoman for the vault, said: “The construction was planned like that because it was practical as a way to go inside and it should not be a problem because of the permafrost keeping it safe. But we see now, when the permafrost is not established, maybe we should do something else with the tunnel, so that is why we have this project now.”

Hollow threats.

• EU To Open Case Against Poland, Hungary, Czech Republic Over Refugees (R.)

The European Union’s executive will decide on Tuesday to open legal cases against three eastern members for failing to take in asylum-seekers to relieve states on the front lines of the bloc’s migration crisis, sources said. The European Commission would agree at a regular meeting to send so-called letters of formal notice to Poland and Hungary, three diplomats and EU officials told Reuters. Two others said the Czech Republic was also on the list. This would mark a sharp escalation of the internal EU disputes over migration. Such letters are the first step in the so-called infringement procedures the Commission can open against EU states for failing to meet their legal obligations. The eastern allies Poland and Hungary have vowed not to budge. Their staunch opposition to accepting asylum-seekers, and criticism of Brussels for trying to enforce the scheme, are popular among their nationalist-minded, eurosceptic voters.

Speaking in Hungary’s parliament earlier on Monday, Prime Minister Viktor Orban said: “We will not give in to blackmail from Brussels and we reject the mandatory relocation quota.” A spokeswoman in Brussels did not confirm or deny the executive would go ahead with the legal cases, but referred to an interview that Commission head Jean-Claude Juncker gave to the German weekly Der Spiegel last week. “Those that do not take part have to assume that they will be faced with infringement procedures,” he was quoted as saying. Poland and Hungary have refused to take in a single person under a plan agreed in 2015 to relocate 160,000 asylum-seekers from Italy and Greece, which had been overwhelmed by mass influx of people from the Middle East and Africa. Poland’s Interior Minister Mariusz Blaszczak was quoted as saying on Monday by the state news agency PAP: “We believe that the relocation methods attract more waves of immigration to Europe, they are ineffective.”

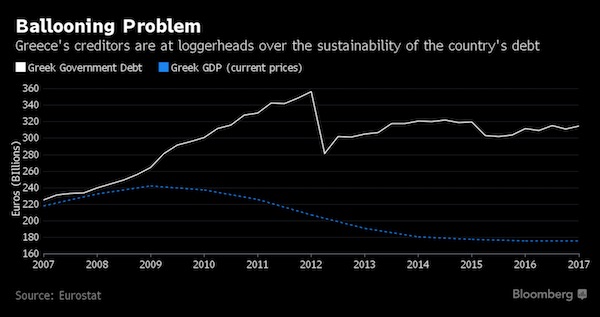

Not going to happen, it would solve many of Greece’s problems, and Germany is not done with it yet.

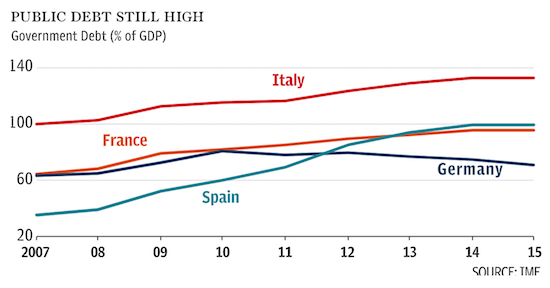

• ECB Unlikely to Include Greece in QE in Coming Months (BBG)

The ECB is unlikely to include Greek bonds in its asset-purchase program for the foreseeable future, a person familiar with the matter said, as European creditors aren’t prepared to offer substantially easier repayment terms on bailout loans to improve the nation’s debt outlook. Euro-area finance ministers will meet in Luxembourg on June 15 to discuss debt-relief measures that the ECB has said are needed before it will consider purchasing Greek bonds. The so-called Eurogroup is expected to complete a review of Athens’s rescue program that would allow for the disbursement of at least €7.4 billion in aid needed for a similar amount of bond repayments in July. An agreement among the ministers will likely allow the IMF – whose participation in the rescue program is a requirement for many nations – to commit in principle to a conditional loan, said the person.

But the extent and wording of debt-relief commitments probably won’t convince the Governing Council of the ECB to buy Greek bonds. And while the government of Prime Minister Alexis Tsipras is relying on quantitative easing to aid Greece’s return to the public debt market, the ECB won’t factor fiscal consequences into its policy-making decisions and excessive emphasis on QE inclusion would be misguided, according to the person. [..] The ECB’s quantitative easing is scheduled to continue until December 2017, with economists saying purchases will be gradually tapered throughout 2018. This would leave little time for purchases of Greek bonds before the program’s end.

Meanwhile, France, which is trying to bridge differences on the debt issue, has proposed automatically reducing loan repayments when Greece misses growth targets, according to two people with knowledge of the talks. European officials see the proposal as a step in the right direction but doubt it will be enough to convince the ECB to include Greece in its bond purchase program if the IMF maintains its position that the country’s debt is unsustainable. Other euro-area member states so far have opposed France’s proposal, the people said.

Is Macron going to stand up to Merkel and Schäuble? I’m not convinced.

• Greek Debt Deal ‘Not Far’ Says New French Finance Minister (AFP)

A deal on debt relief for Greece is “not far,” France’s new finance minister Bruno Le Maire said Monday ahead of crunch eurozone talks on the issue on Thursday. “I am optimistic that we will have a good solution. We are not far from agreement,” Le Maire said ahead of a meeting with Greek PM Alexis Tsipras. “We are really doing our best to find an agreement,” he had said earlier after seeing his Greek counterpart Euclid Tsakalotos. “It’s difficult. It’s complicated,” he said. At the June 15 meeting, Le Maire said he planned to propose a “mechanism” of “flexibility” to lessen Greek debt repayment based on its economic growth. “It’s a mechanism which should allow us to revise certain (debt) parameters based on Greek growth,” he told reporters.

The issue of debt relief for Greece has sharply divided its international creditors, the EU and the IMF, for months in the latest round of talks. The impasse has held up a tranche of bailout cash which Greece needs to repay loans in July, and Athens says its fragile recovery has also been impaired. Tsipras has said he will ask EU leaders to resolve the issue at the end of June if no solution is forthcoming on Thursday. “Piling drama on the problem helps no one,” he said on Monday. The Europeans expect Greece’s economy to grow strongly and its government to bring in large surpluses in revenue in the coming years, allowing it to pay down its debts. But the IMF is less optimistic, arguing there must be further relief for Athens before it can label its debt sustainable and justify loaning Greece any more cash.

New French President Emmanuel Macron last month called Tsipras after his election, saying he was in favour of “finding a deal soon to alleviate the weight of Greece’s debt over time.” Macron’s position puts him at odds with Germany where Greek debt relief – following three different bailouts with public money for the country since 2010 – is seen as a vote loser ahead of general elections in September. Macron explained his thinking about Greece in an interview to the Mediapart website two days before his election. “I am in principle in favour of a concerted restructuring of Greek debt and in keeping Greece in the eurozone. Why? Because the current system is unsustainable,” he said.

Wonder what the older, religious people on Lesbos must be thinking by now. It once was a quiet place.

• One Dead As 6.3-Magnitude Earthquake Rocks Greek Islands Lesbos, Chios (AFP)

A woman died and 10 people were hurt on Monday when a 6.3-magnitude earthquake struck the Greek islands of Lesbos and Chios and the Aegean coast of western Turkey, officials said. The middle-aged victim had been trapped for around seven hours in the ruins of her home in the Lesbos village of Vrisa, the area that bore the brunt of the strong quake and where several homes collapsed. “Our fellow citizen who was trapped in the house that collapsed in Vrisa was pulled out dead,” Lesbos mayor Spyros Galinos said in a tweet. The earthquake also struck the Aegean coast of western Turkey after 1200 GMT.

Video footage shot by a Vrisa resident on a cellphone showed masonry from several single and two-level homes clogging the streets. “It’s a difficult situation, we are facing a disaster,” Christiana Kalogirou, governor of the north Aegean region, told Greek state TV station ERT, adding: “Some 10 people are injured.” “The army is bringing in tents so people can spend the night,” she said, adding that the south of Lesbos had taken the brunt of the quake. The tremor, felt as far as Athens and Izmir in Turkey, damaged at least three churches and shops in south Lesbos, local owners said, while rock slides blocked some roads.