Pablo Picasso Portrait of Daniel-Henry Kahnweiler 1910

But the pending Mexico government change could change that.

• Delaying NAFTA Deal Is Actually A Win-Win-Win (R.)

Delaying a revamped North American Free Trade Agreement is actually a win-win-win. Canada and the United States will keep talking despite missing a Friday deadline to conclude trade talks. Negotiators will need to move quickly to avoid the risk of fresh demands from the next Mexican government. But getting a deal that all sides can sell is more important. The mood was tense on Friday as U.S. President Donald Trump acknowledged having told Bloomberg he wasn’t going to make any concessions to his northern neighbor. The United States had already shut the Canadians out of talks for weeks while it negotiated with the Mexican government.

On Monday, Trump hailed a U.S.-Mexico deal on certain NAFTA provisions and threatened auto tariffs on Canada if it didn’t capitulate by the end of the week. Ottawa and Washington also appeared to remain far apart on certain issues. Trump has slammed Canadian tariffs of up to 270 percent on dairy imports. Canada objects to the U.S. demand to eliminate dispute panels for anti-dumping complaints. That’s why it’s encouraging that both sides will continue negotiations next week. The Friday deadline was set because of the 90-day notice period Congress needs before a deal can be concluded. Meeting it would enable Mexican President Enrique Peña Nieto to sign the pact before he leaves office at the end of November.

But the parties have some wiggle room because the deal text doesn’t have to be released until the end of September. Trump gave notice to Congress on Friday that a trade pact with Mexico would be concluded by the end of November, and Canada could join “if it is willing.” Yet Trump’s threat to do a deal with Mexico alone rings hollow because Congress has signaled it would reject a bilateral deal.

In-deep on Trichet and all his arrogance.

• The Bank That Nearly Broke Europe (Tooze)

The ECB often deals with critics by pointing to its limited mandate. But in responding to this crisis, Trichet far overstepped those bounds. His aim was nothing less than regime change. He was trying to use the crisis to force the completion of the still-incomplete constitution of the single currency zone—on conservative terms. He wanted Europe’s politicians to agree to binding fiscal rules, to establish a bond market stabilisation fund independent of the ECB, a fund that would keep the ECB forever clear of any obligation to stand behind public debt. Until the politicians fell into line, he would support the market only in extremis. Playing with fire, the ECB unleashed a conflagration.

When in the spring of 2011 Greece’s centre-left Pasok government suggested that it might be safer to write down or restructure some of its debt, Trichet did not just stonewall—he sought to silence the debate by threatening that if Athens publicly broached the issue, the ECB would cut off the funding lifeline to its banks. In the name of protecting the reputation of Europe’s sovereign borrowers, Trichet made himself into an intransigent defender of creditor interest.

And when market pressure was not enough, Trichet did not hesitate to step across the boundary that notionally separated the central bank from national governments; he issued instructions to the governments of Ireland, Spain and Italy, demanding spending cuts, tax increases and changes to labour law that reached deep into their internal affairs. Trichet used the ECB’s “independence,” and the threat of the bond market, to dictate terms to elected governments.

No such tough medicine was dished out to Europe’s banks, which should, like their American counterparts, have been forced to recapitalise in 2008-2009, even if that meant shareholders had to suffer. When the debts of Ireland’s banks threatened to tip its government over the edge, Trichet still refused point blank to countenance “bailing in” their private creditors to sharing the pain.

Russia provocation. Which set of warmongers did it? US or Kiev?

• Rebel Leader Alexander Zakharchenko Killed In Explosion In Ukraine (G.)

The leader of a Kremlin-backed separatist republic in war-torn eastern Ukraine has been killed in a blast that tore through a cafe close to his official residence in Donetsk. Alexander Zakharchenko, 42, was named prime minister of the so-called Donetsk People’s Republic (DNR) in November 2014. The DNR’s official news agency confirmed his death and said the republic’s finance minister, Alexander Timofeev, was injured when the explosive device went off in the Separ café in the centre of Donetsk. The bomb was planted in a nearby vehicle, Ukrainian media reported.

Zakharchenko is the latest in a series of separatist leaders to have been assassinated during the ongoing conflict in eastern Ukraine, where more than 10,000 people have died since fighting broke between Kremlin-backed separatists and pro-Ukrainian government forces in 2014, according to UN figures. More than 1.5 million people have been displaced by the fighting. Vladimir Putin called the killing a “dastardly” act that aimed to destabilise the fragile peace in the region and the Russian president expressed his condolences to Zakharchenko’s family.

The Russian foreign ministry was quick to react, accusing the Ukrainian government of ordering the “terrorist attack”, although Putin’s later statement did not blame Kiev for the killing. The Ukrainian security service chief, Igor Guskov, said Zakharchenko’s death could have been the result of infighting between rival separatist factions or an operation by Russian special forces. Kiev has previously accused Russia of killing separatist figures who refuse to obey Kremlin orders.

Big mistake. Russia has no room to back down.

• US Ready To Boost Arms Supplies To Ukraine (G.)

Washington is ready to expand arms supplies to Ukraine in order to build up the country’s naval and air defence forces in the face of continuing Russian support for eastern separatists, according to the US special envoy for Ukraine. In an interview with the Guardian, Kurt Volker said there was still a substantial gap between the US and Russia over how a United Nations peacekeeping force could be deployed to end the four-year war, and predicted that Vladimir Putin would wait for presidential and parliamentary elections in Ukraine next year before reconsidering his negotiating position. However, Volker argued that time was not on Putin’s side. He insisted pro-western, anti-Russian sentiment was growing in Ukraine with every passing month.

And he made clear that the Trump administration was “absolutely” prepared to go further in supplying lethal weaponry to Ukrainian forces than the anti-tank missiles it delivered in April.= “They are losing soldiers every week defending their own country,” said Volker, a former US ambassador to Nato. “And so in that context it’s natural for Ukraine to build up its military, engage in self-defense, and it’s natural to seek assistance and is natural that other countries should help them. And of course they need lethal assistance because they’re being shot at.” He added: “We can have a conversation with Ukraine like we would with any other country about what do they need. I think that there’s going to be some discussion about naval capability because as you know their navy was basically taken by Russia. And so they need to rebuild a navy and they have very limited air capability as well. I think we’ll have to look at air defence.”

“..Mr. Trump slip-sliding towards Hubrisville like some ass-clown pol in a Coen Brothers’ movie..”

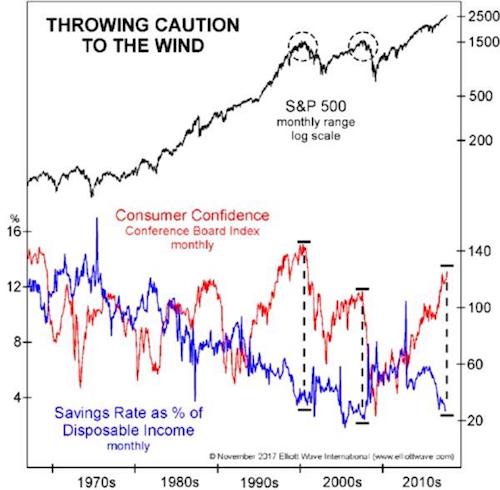

Radiating anger and, at times, actual malice, Mr. Trump presented exactly the lack of couth that drives his hypothetically more refined “blue” enemies up a tree. His rhetorical skills have not improved since 2016, but his demagogic self-confidence soars as he unwittingly launches himself into a one-man Space Force flying too close to the sun, claiming that he has magically made America great again, mission accomplished! Even the live audience of Hoosier clods appeared strangely restive and unconvinced after an hour of this bellowing, and one got a sense of Mr. Trump slip-sliding towards Hubrisville like some ass-clown pol in a Coen Brothers’ movie about to be run out of the grange hall on a rail.

His error: taking “ownership” of a financialized economy of hallucinated markets run by out-of-control algo robots into a twilight zone of default and insolvency. The “red” and “blue” constituencies at war with each other are essentially the losers and winners in this depraved system. When the hallucination dissolves, the winners will be the new losers and the old losers will be looking to string them up. That scenario remains to be played out as we say our official goodbyes to summer this holiday weekend and turn the corner into portentous autumn. On the “blue” side of things, mendacity rules as usual lately, especially in the Deep State septic abscess that the Russia probe has become.

Department of Justice official Bruce Ohr, twice demoted but still on the payroll, went into a closed congressional hearing and apparently threw everybody but his mother under the bus, laying out an evidence trail of stupendous, flagrant corruption in that perfidious scheme to un-do the election results of 2016. Most amazingly, it was revealed that Mr. Ohr had not been called to testify by special counsel Robert Mueller nor by the federal prosecutor John Huber, who is charged with investigating the FBI / DOJ irregularities surrounding the Russia probe. It is amazing because Mr. Ohr is precisely the pivotal figure in what now looks like an obvious conspiracy to politically weaponize the agencies against the Golden Golem. An awful lot of people have some ‘splainin’ to do on that one, starting with the Attorney General and his deputy. Who will put it to them?

Planning another invasion?!

• Saudi Arabia Hints At Plan To Turn Qatar Into An Island (AFP)

A Saudi official hinted Friday the kingdom was moving forward with a plan to dig a canal that would turn the neighbouring Qatari peninsula into an island, amid a diplomatic feud between the Gulf nations. “I am impatiently waiting for details on the implementation of the Salwa island project, a great, historic project that will change the geography of the region,” Saud al-Qahtani, a senior adviser to Crown Prince Mohammed bin Salman, said on Twitter. The plan, which would physically separate the Qatari peninsula from the Saudi mainland, is the latest stress point in a highly fractious 14-month long dispute between the two states.

Saudi Arabia, the United Arab Emirates, Bahrain and Egypt cut diplomatic and trade ties with Qatar in June 2017, accusing it of supporting terrorism and being too close to Riyadh’s archrival, Iran — charges Doha denies. In April, the pro-government Sabq news website reported government plans to build a channel -– 60 kilometres (38 miles) long and 200 metres wide –- stretching across the kingdom’s border with Qatar. Part of the canal, which would cost up to 2.8 billion riyals ($750 million), would be reserved for a planned nuclear waste facility, it said. Five unnamed companies that specialise in digging canals had been invited to bid for the project and the winner will be announced in September, Makkah newspaper reported in June.

Corruption rules.

• Brazil’s Top Electoral Court Votes Down Lula Candidacy (AFP)

A majority of Brazil’s top electoral court shot down late Friday the candidacy of popular leftist Luiz Inacio Lula da Silva in the country’s upcoming presidential vote, telling the jailed former leader he cannot participate in October’s critical election. The vote punctuated a gripping case that has roiled the country for months, with Lula, 72, remaining the top contender among Brazilians to lead Latin America’s largest economy — despite sitting behind bars since April for accepting a bribe. In an extraordinary session the Superior Electoral Court dashed Lula’s hopes after hours of debate, with the judges voting an overwhelming 6-1 against him.

Shortly thereafter, the former president’s Workers’ Party (PT) vowed to “fight with all means” to secure candidacy for the leftist icon. “We will present all appeals before the courts for the recognition of the rights of Lula provided by law and international treaties ratified by Brazil,” said the party in a statement. “We will defend Lula in the streets, with the people, because he is a candidate of hope.” Lula’s case was a last-minute addition to the court session. The result was expected, but the vote of Judge Edson Fachin, the second to speak, had momentarily rekindled suspense. He relied on Lula’s recent backing from the UN Human Rights Committee, which ruled that the former leader cannot be disqualified from the elections as his legal appeals are ongoing.

With full deadlock.

• Brexit: Entering The Final Phase (RTE)

As we head into September, the assessment of EU officials and diplomats is that August has come and gone with little to show for it. Yes, there has been the publication of over 50 technical notices on a no-deal Brexit, and a flurry of trips to European capitals by Theresa May, Foreign Secretary Jeremy Hunt, and Business Secretary Greg Clark. But there has been no movement from London on the key issues, because the paralysis in the House of Commons still holds. “Objectively in the British system nothing has changed,” says one EU diplomat. “They’re still deeply divided.” As Fleet Street was trumpeting a change of heart on Brexit, the Japanese electronic giant Panasonic quietly announced it was shifting its European headquarters from the UK to the Netherlands.

In a statement the company blamed “potential fiscal obstacles by the application of different rules and regulations between the UK and EU.” So where do things stand? There are just under seven weeks before the European Council in October. In that time Theresa May will have to conclude the Withdrawal Agreement, and reach agreement on a political declaration on the future relationship that will sit alongside the divorce treaty. On the Withdrawal Treaty there are three outstanding issues. The first is on governance – how the EU and UK will resolve their differences in the future. The second is on Geographical Indicators – will the UK respect some 3,000 sensitive EU products such as Champagne and Feta cheese and not start producing their own under those names.

The third, and biggest, obstacle is the Irish backstop. The most recent proposal from London to replace to the European Commission’s draft legal text on the backstop dates back to 7 June. It suggested a Temporary Customs Arrangement (TCA) and a UK-wide backstop that would expire around the end of 2020, when a new trade arrangement would – presumably – take effect. London’s subsequent qualification of the TCA was that the Chequers White Paper would definitively rule out the need for the backstop. That solution is not definitive enough for Dublin or the other member states. A backstop is still needed in the Withdrawal Agreement. So, the deadlock remains.

One of the world’s best healthcare systems has been gutted.

• The Terrible Human Cost Of Greece’s Bailouts (Coppola)

Some people justify Greece’s terrible depression and severe fiscal austerity on the grounds that they are necessary to “reform” the Greek economy. Others even argue that Greeks “deserve” poverty and deprivation. They had a massive party at other people’s expense, after all. Now, it’s payback time. I have heard a lot of this recently. So I am grateful to the medical journal The Lancet for providing me with some ammunition to fire at those who want to play “blame the Greeks”, or who believe that the austerity inflicted on Greek was both mild and necessary, or who simply can’t see the humans behind the numbers. The Lancet has published an analysis of changes in life expectancy in Greece during the recent crisis. It is heavy on numbers and light on anecdote, but even so, it makes grim reading.

Greek mortality has worsened significantly since the beginning of the century. In 2000, the death rate per 100,000 people was 944.5. By 2016, it had risen to 1174.9, with most of the increase taking place from 2010 onwards. Greece’s mortality increase stands in stark contrast to global death rates, which fell during this time. Even in Western Europe, where death rates rose slightly overall, no other country experienced a deterioration on this scale. Cyprus, Greece’s close neighbour, also experienced some worsening of mortality rates around the time of its financial crisis and recession, but not on the scale of Greece. Among the countries included in the study, Greece’s case appears to be exceptional.

But what is causing these additional deaths? The report says it varies with age: “…adverse effects of medical treatment, self-harm, and several types of cancer stood out as consistently increasing in Greece across all ages… Within specific age groups, other causes are apparent, with rapid increases in deaths due to neonatal haemolytic disease and neonatal sepsis in children younger than 5 years, and prominent increases in self-harm among adolescents and young adults. Greek adults aged 15–49 years had increased mortality due to HIV, several treatable neoplasms, all types of cirrhosis, neurological disorders (eg, multiple sclerosis, motor neuron disease), chronic kidney disease, and most types of cardiovascular disease except for ischaemic heart disease and stroke.”

Let me translate this piece of medical jargon into plain English: • Newborn babies are dying of completely treatable conditions. • Adolescents and young adults are killing themselves. • Adolescents and adults are dying of diseases associated with poor diet, alcohol abuse and smoking, and of treatable illnesses.

That’s the entire EU.

• India Introduces Free Health Care – For Its 500 Million Poorest People (NW)

The Indian government will pay for health care for around 500 million of its poorest citizens, with Prime Minister Narendra Modi declaring that the country can reach its potential only with a healthy population. During a speech to mark the country’s independence day on Wednesday, Modi said, “It is essential to ensure that we free the poor of India from the clutches of poverty due to which they cannot afford health care,” The Times of India reported. The National Health Protection Mission—also known as “Modicare”—will give impoverished families health insurance coverage of up to $7,100 every year. This may not seem a lot by American standards, but in a country where the annual per capita income is just over $1,900, it will make a massive difference to those who cannot afford private treatment.

Public hospitals in India offer free, but less sophisticated, care. The system is strained to the point of collapse, with hospitals struggling to secure enough beds and staff to care for the sick. The lack of access for rural communities—where 66 percent of Indians live—forces people to travel many hours to reach urban facilities if they want treatment. This means the private medical sector cares for the majority of India’s patients and charges them accordingly. When the project was announced in February, then-Finance Minister Arun Jaitley declared it the “world’s biggest government-funded health care program.” According to the mission’s chief executive officer, Indu Bhushan, “This is going to be a game changer.” Medical costs are one of the primary causes of poverty in India. Around 63 million Indians fall into poverty each year because of health care bills, and 70% of all charges are paid directly by patients.