George N. Barnard Federal picket post near Atlanta, Georgia 1864

They said it would be 7%, and 7% it is…

• China GDP Tumbles To Lowest In 6 Years Amid Dismal Data (Zero Hedge)

A month ago we warned "Beijing, you have a big problem," and showed 10 charts to expose the reality hiding behind a stock market rally up over 100% in the last year. Tonight we get confirmation that all is not well – China GDP fell to 7.0% (its lowest in 6 years) with QoQ GDP missing expectations at +1.3% (vs 1.4%). Then retail sales rose 10.2% YoY – the slowest pace in 9 years (missing expectations of 10.9%). Fixed Asset Investment rose 13.5% – the lowest since Dec 2000 (missing expectations). And finally Industrial Production massively disappointed, rising only 5.6% YoY (weakest since Dec 2008). Finally, as a gentle reminder to the PBOC-front-runners, a month ago Beijing said there was no such thing as China QE (and no, the weather is not to blame.. but the smog?). [..] all this leading us to the most important chart of all: home prices in China, which are crashing…

… at a pace faster than in what happened to US housing in the immediate aftermath of the Lehman collapse!

And the reason why this is such a problem for China is that unlike the US where the bulk of household wealth is in financial assets (i.e., the market), in China it is the reverse:

nearly three quarters of all household assets are in real estate: real estate which is deflating, if not crashing, at an unprecedented pace.

Finally, here is a chart which leaves even us speechless. If indeed Chinese rail freight is indicative of underlying economic trends, then the hard landing is already here.

To keep people from revolting, Beijing allows for the reality of major real estate losses to be hidden by virtual stock market gains.

• China Walks $264 Billion Tightrope as Margin Debt Powers Stocks (Bloomberg)

Confident that China’s stock market rally still has legs, Jiang Lin recently began borrowing money from her brokerage to buy more shares. Her newly-opened margin finance account with state-owned China Investment Securities Co. has allowed Jiang, a 29-year-old marketing executive in Beijing, to double up her bets on the vertigo-inducing rally in Chinese share prices. “It’s worth the risk,” said Jiang, while admitting she doesn’t fully understand how margin finance works because she hasn’t had her broker explain it to her. Investors such as Jiang are part of a $264 billion dilemma facing the country’s securities regulator, the China Securities Regulatory Commission, after the Shanghai Composite Index climbed on Monday to a seven-year high.

Should it tighten its rules governing margin finance and risk triggering a crash, or continue tinkering with regulations and see stock purchases on credit rise to potentially perilous levels? Traders are betting that the regulator will shy away from any serious steps to curb an explosion of margin finance, which fueled a 93% one-year surge in Shanghai’s benchmark gauge. Securities firms’ outstanding loans to investors for stock purchases were a record 1.64 trillion yuan ($264 billion) as of April 10, up 50% in less than three months, despite bans imposed by the CSRC in January and April on lending to new clients by four Chinese brokerages. China’s margin finance now stands at about double the amount outstanding on the New York Stock Exchange, after adjusting for the relative size of the two markets.

“Regulators are aware of the risk of rising margin debt but they can’t afford to puncture the equities bubble with very draconian measures,” said Lu Wenjie, a Shanghai-based analyst at UBS. “They want to pelt the mice without smashing the china.” With growth faltering and real estate prices heading lower, China is wary of adding a stock market crash to its economic problems, according to Mole Hau at BNP Paribas. There’s also a political dimension because equity markets are dominated by small retail investors, some of whom may face ruin if a market slump prompts brokers to call in loans. Individual investors make up about 90% of equity trading in China, according to the CSRC.

The biggest money-printing wager ever is starting to spread its desolation.

• Hong Kong’s Peg to Instability (Pesek)

For years, any call for Hong Kong to scrap its peg to the U.S. dollar was deflected with a single word: stability. The city’s monetary authority has consistently treated the 32-year-old link as the linchpin to the economy’s international credibility. But with Chinese money now swamping the city, the opposite may be true. China this week announced limits on mainland visitors to Hong Kong, who have been a longstanding source of tension in the city. But the flow of money from the mainland shows no sign of slowing. Politically-connected Chinese tycoons, who have a longstanding habit of squirreling their money abroad (the better to hide it from authorities in Beijing), are increasingly turning to Hong Kong’s stock and property markets.

As Louis-Vincent Gave of fund manager GaveKal puts it: “In its troubled marriage with China, it looks very much as if Hong Kong is about to get more money and less mainlanders.” And this is likely only to increase tensions in Hong Kong. Although last year’s enormous protests in the city were presented in the international press as a call for democracy, they were as much about income inequality fueled by money from the mainland. As of 2011, Hong Kong’s Gini coefficient, a measure of inequality, was 0.537. That was the highest since record-keeping began in 1971 and puts Hong Kong well above the 0.4 level analysts associate with social unrest. It’s no coincidence that record protests flared up at the same time as residential home prices surged by 13%.

By the start of 2015, prices had more than doubled since 2009, spurred in part by money flowing in from China. To their credit, locals officials tightened rules in February to keep homeownership from rising further out of the reach of local residents. But those efforts will likely soon be overwhelmed by tidal waves of mainland cash. It’s safe to expect higher living costs in a city already plagued by a scandalous rich-poor divide. If Hong Kong authorities want to cool down their overheating economy, they should start by addressing its undervalued currency. That’s a key reason why Hong Kong’s inflation is growing 4.6% compared with 1.4% in China and 0.4% in South Korea. It has also forced the Hong Kong Monetary Authority into an increasingly uncomfortable position.

Since August, it has been forced to defend its conversation rate to the U.S. currency by selling off massive amounts of Hong Kong dollars. But those efforts have allowed mainlanders to get a cheaper conversion rate than if the Hong Kong dollar traded freely. Unsurprisingly, they’ve been rushing to take advantage of it, by pouring more money into the city. Hong Kong’s peg, in other words, has outlived its usefulness. But Hong Kong authorities have been reluctant to scrap the peg, because they see it as the source of their credibility with western investors. Chinese President Xi Jinping – who has ultimate authority over Hong Kong – might have his own reasons for feeling risk-averse, given the magnitude of economic challenges facing China at the moment.

“..George Osborne’s scheme to boost the housing market as one of the “most stupid economic ideas” of the past 30 years..” (Hello, Auckland!)

• ‘Timebomb’ UK Economy To Explode After Election – Albert Edwards (Guardian)

The UK economy is a ticking time bomb set to explode after the general election, according to a leading City commentator who has warned of a fresh crisis for the pound. Albert Edwards, who heads the global strategy team at investment bank Société Générale and is well known for downbeat views, chides the coalition for a legacy of “grotesquely wide deficits” in both the public sector finances and on the UK’s current account – its overall trading position with the rest of the world. In a note for the bank, Edwards wrote: “As the UK general election rapidly approaches, we take a look at the UK economic situation. We say what we see, and after five years of the Conservative and Liberal Democrat coalition government, the UK economy looks like a ’ticking time bomb’waiting to explode after the election.”

Edwards says his commentary is apolitical and notes he previously heaped scathing criticism on the UK economic situation under Labour in 2008. The difference with his latest critique, he says, is that this time the UK compares particularly badly with other economies. He added: “At least back then [January 2008] the UK was not alone in reaping the sour fruits of economic mismanagement – the US and the eurozone periphery were all sailing in similarly unstable, leaky boats. But now the UK economy stands alone, up to its eyeballs in macro manure. Eventually the stench will fill the nostrils of currency markets with the inevitable result – another sterling crisis.”

Edwards, who has previously taken aim at chancellor George Osborne’s scheme to boost the housing market as one of the “most stupid economic ideas” of the past 30 years, says a push to cut the deficit has failed. To the extent the UK economy has recovered, it is not because the public sector deficit cutting has worked as the government claim, but because, for the last three years, the government has quietly abandoned all pretence at fiscal cuts, kicking the can into the next parliament,” he says. He is not alone in his concern over the UK’s large current account deficit, which reflects the gap between money paid out by the UK and money brought in, and was the widest for more than 60 years in 2014. It emerged last week that the Bank of England is worried the gap could cause financial markets to turn against the British economy in a time of stress.

Emerging markets are about to be obliviated.

• IMF Fears ‘Cascade’ Of Woes As Fed Crunch Nears (AEP)

The United States is poised to raise rates much more sharply than markets expect, risking a potential storm for global asset prices and a dollar shock for much of the developing world, the International Monetary Fund has warned. The IMF fears a “cascade of disruptive adjustments” as the US Federal Reserve finally pulls the trigger for the first time in eight years, ending an era of cheap and abundant dollar liquidity for the international system. The Fed’s long-feared inflexion point is doubly treacherous because investors seem ill-prepared for what lies ahead, and levels of dollar debt outside the US have reached an unprecedented extreme. The Fund said future contracts are pricing in a “much slower” pace of monetary tightening than the Fed itself is forecasting.

The crunch comes as the world economy remains becalmed in 2015 with stodgy growth of 3.5pc, held back by another set of brutal downgrades for Russia and string of countries in Latin America. Emerging markets face a fifth consecutive year of slippage as they exhaust the low-hanging fruit from catch-up growth and hit their structural limits. The IMF’s World Economic Outlook forecast that rich economies will clock up respectable growth of 2.4pc this year after 1.8pc in 2014 as fiscal austerity fades and quantitative easing lifts the eurozone off the reefs, but there will be no return to the glory days of the pre-Lehman era. “Potential growth in advanced economies was already declining before the crisis. Ageing, together with a slowdown in total productivity, were at work. The crisis made it worse,” said Olivier Blanchard, the IMF’s chief economist.

“Legacies of both the financial and the euro area crises — weak banks and high levels of public, corporate and household debt — are still weighing on growth. Low growth in turn makes deleveraging a slow process.” The world will remain stuck in a low-growth trap until 2020, and perhaps beyond. The Fund called for a blast of infrastructure spending by Germany and others with fiscal leeway to help break out of the impasse. The report said markets may have been lulled into a complacency by the lowest bond yields in history and a strange lack of volatility, seemingly based on trust that central banks will always come to the rescue. Any evidence that the fault lines of the global financial system are about to be tested could “trigger turmoil”, it warned. “Emerging market economies are particularly exposed: they could face a reversal in capital flows, particularly if US long-term interest rates increase rapidly, as they did during May-August 2013,” it said.

“The total inventory of Treasuries readily available to market makers today is $1.7 trillion, down from $2.7 trillion at its peak in 2007.”

• Prudential Chief Echoes Dimon Saying Liquidity Is Top Worry (Bloomberg)

Prudential Investment Management CEO David Hunt says the No. 1 concern among bond buyers globally is liquidity and its rapid disappearance. “The biggest worry of the buy side around the world is that there has been a dramatic decline in liquidity from the sell side for many fixed income products,” said Hunt, 53, who heads Prudential’s investment management unit, which had $934 billion in assets at the end of 2014. “I think it’s a big risk and is one of the unintended consequences” of regulators trying to prevent another financial crisis, he said. While the size of the U.S. bond market has swelled 23% since the end of 2007 through the end of last year, trading has fallen 28% in the period, Securities Industry & Financial Markets Association data show.

Regulators, seeking to reduce risk, have made it less attractive for banks to hold an inventory of tradable bonds. JPMorgan CEO Jamie Dimon warned in a report last week the next financial crisis could be exacerbated by a shortage of U.S. Treasuries. “If we had a major political event or something that caused rates to spike and traders needed to get out of the current position they have, and there was a lot of people that wanted to do that, I think it would be quite difficult,” Hunt, in Tokyo last week for various management meetings, said. The liquidity drain in bond markets spans Treasuries to corporate notes, Dimon said in a letter to shareholders dated April 8.

“Liquidity can be even more important in a stressed time because investors need to sell quickly, and without liquidity, prices can gap, fear can grow and illiquidity can quickly spread,” he wrote. “The likely explanation for the lower depth in almost all bond markets is that inventories of market-makers’ positions are dramatically lower than in the past.” Inventories are lower, Dimon said, because of multiple new rules that affect market making, including “far higher” capital requirements. The total inventory of Treasuries readily available to market makers today is $1.7 trillion, according to JPMorgan, down from $2.7 trillion at its peak in 2007.

“..the German establishment convinced large sectors of the German working class that they are bailing out their southern European neighbors who are too lazy, too corrupt or too disorganized to run a modern successful economy. ”

• Syriza Against the Machine (Tom Voulomanos)

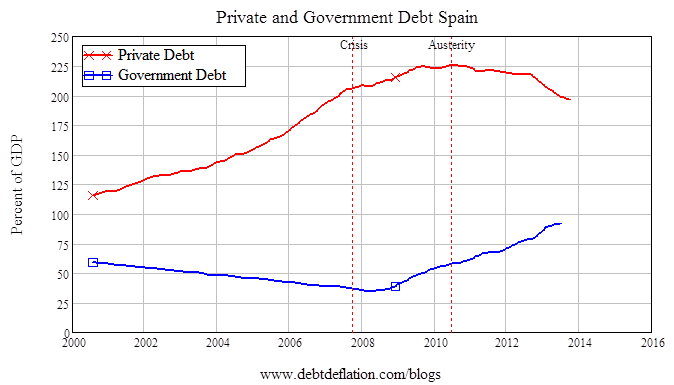

It was obvious that the European establishment was not happy with the election of Syriza and it wanted to nib this problem in the bud before other countries, like Spain, Ireland, Portugal, or Italy get any ideas or even worse, before a European wide movement takes shape against the neo-liberal structure of the EU and begins discussing and agitating for alternatives. Unlike what the citizens of Europe may have thought they were getting into, the EU is not a democratic confederation of peoples, but an economic space completely under the control of the European establishment namely, the Financial and Corporate elite, the traditional European oligarchs, the neo-liberal politicians (no matter what meaningless party label they use) and unelected technocrats in their service.

Of course, the German state is the hegemon of this establishment, but its interests more or less converge with the interests of the European ruling class. This is the true architecture of the European Union. Syriza is a disturbance to this order that must be quashed. In order to fully appreciate the current impasse between Syriza and its creditors, it must be seen outside the narrow nationalist paradigm of Germans vs Greeks and be seen for what it truly is, a class war. The German state is simply the most powerful guarantor of the privileges of this European establishment, after the US of course. As such, the German establishment convinced large sectors of the German working class that they have common interests and that they are bailing out their southern European neighbors who are too lazy, too corrupt or too disorganized to run a modern successful economy.

The European media made sure that simple facts were not known to the public of the northern European states. They were not told that the loans to Greece were not for bailing out Greeks but for bailing out European banks, as these loans simply financed debt repayments. With each loan, the debt increased further, forcing more loans on condition that the country privatizes its resources, destroys its social state, throws people into unemployment and poverty. All of which shrink the economy decreasing the country’s ability to service its debt and pay its creditors, forcing it to borrow even more conditional bailout money, further increasing its debt and accelerating austerity and so on and so forth; a vicious cycle that is leading to the third worldization of the European periphery countries. This was the EU against which Syriza campaigned and won.

Nice twist. I’m thinking Obama likes Yanis’ style.

• Greek Finance Minister to Meet With Obama (WSJ)

Greece’s finance minister Yanis Varoufakis is due to meet President Barack Obama in Washington Thursday, according to a senior finance minister. “Mr. Varoufakis is going to attend celebrations for the Greek Independence Day at the White House, where he will have a private meeting with the U.S. president,” the official said Tuesday. The meeting comes as Greece’s Syriza-led government has been locked in negotiations with its international creditors since coming to power in late January, with progress so far being very slow. Greece needs a deal to secure billions of euros in bailout aid to avoid defaulting on its debts by this summer and potentially tumbling out of the euro.

But the overhauls that creditors want, including further pension cuts and tax increases, in a country reeling from years of drastic austerity, could split or bring down the government of left-wing Prime Minister Alexis Tsipras, which was elected in January on an antiausterity ticket. The Greek finance minister, as well as Bank of Greece Governor Yannis Stournaras will be in Washington to attend the spring meetings of the World Bank Group and the International Monetary Fund. Earlier Thursday, Mr. Varoufakis is scheduled to speak at a conference organized by the Brookings Institution think tank. His German counterpart Wolfgang Schäuble is also going to speak at the same conference on Thursday. The Greek Finance Minister is also expected to meet the European Central Bank’s President Mario Draghi.

Well, that’s would I would say if I were them…

• Greece Confident Of Reaching Agreement Before 24 April Deadline (Guardian)

Greece has vigorously rebutted speculation that it will declare a debt default and plunge out of the eurozone if it fails to strike a deal with lenders to keep its bankrupt economy afloat. Acknowledging that the Syriza-led anti-austerity government had faced the “teething problems” of any administration new to power, the minister tasked with overseeing the country’s international economic relations expressed confidence that a deal with creditors would be reached even if negotiations went to the wire. “I can assure you we are working flat out for the good scenario,” said deputy foreign minister Euclid Tsakalotos. “I am absolutely confident an agreement will be reached on 24 April. Deals are always done five or three or one minute before midnight, it’s not unusual that they should go right to the brink.”

In what is widely seen as a make-or-break date for the debt-stricken nation, eurozone finance ministers have said they will pass judgment on the reform package Athens has been told to submit next week when they gather in the Latvian capital, Riga, on 24 April. With the country facing a series of debt repayments in May and June – when its existing bailout agreement ends – and the Greek economy forced to survive on emergency funding from the European Central Bank, failure to endorse the proposals could spell disaster for the continent’s most indebted state.

The reform-for-cash deal, an interim accord before Greece signs up to an anticipated third bailout later this year, would unlock €7.2bn (£5.2bn) in financial assistance withheld since August as Athens has argued with creditors at the EU, ECB and IMF over the extent of austerity measures required to release aid. In the 10 weeks since prime minister Alexis Tsipras assumed power, the state of the economy has become ever more perilous as the government has struggled to meet debt obligations and keep up with public sector pensions and salaries while surviving on ever-waning reserves of credit.

“..nearly 75% of those receiving some form of public assistance come from working families..” “..bad jobs may be a bigger problem than no jobs..”

• More Than Half Of US Welfare Spending Goes To Working Families (Zero Hedge)

We’ve talked quite a bit over the past several months about wage growth or, more appropriately, a lack thereof. The problem in the US is that for the 80% of workers the BLS classifies as “non-supervisory” (i.e. Hillary Clinton’s “everyday Americans”), higher pay is proving to be a rather elusive concept. The same cannot be said for America’s bosses however, who have seen their wages grow at a healthy pace. We’ve also argued that this doesn’t bode well for the US economic “recovery” (which we’ve only been waiting on for six years) because when three quarters of workers are suffering under stagnant wages and when the engine that drives three quarters of economic output (consumer spending) is almost perfectly correlated (0.93) with wage growth, you have a recipe for lackluster GDP prints and if the Atlanta Fed’s nowcast is any indication, that’s just what we can expect going forward.

Another consequence of forcing America’s workforce to subsist on low paying jobs with little hope of pay hikes is that it puts extra pressure on the welfare state because if you can’t make ends meet on what you make you can either make more (which, as it turns out, is easier said than done) or turn to the government for assistance. According to a new report from UC Berkeley, nearly 75% of those receiving some form of public assistance come from working families, confirming that when it comes to straining the public purse, bad jobs may be a bigger problem than no jobs. From UC Berkeley:

Even as the economy has at last begun to expand at a more rapid pace, growth in wages and benefits for most American workers has continued its decades-long stagnation. Real hourly wages of the median American worker were just 5% higher in 2013 than they were in 1979, while the wages of the bottom decile of earners were 5% lower in 2013 than in 1979. Trends since the early 2000s are even more pronounced. Inflation-adjusted wage growth from 2003 to 2013 was either flat or negative for the entire bottom 70% of the wage distribution. Compounding the problem of stagnating wages is the decline in employer provided health insurance, with the share of non-elderly Americans receiving insurance from an employer falling from 67% in 2003 to 58.4% in 2013.

Stagnating wages and decreased benefits are a problem not only for low-wage workers who increasingly cannot make ends meet, but also for the federal government as well as the 50 state governments that finance the public assistance programs many of these workers and their families turn to. Nearly three-quarters (73%) of enrollees in America’s major public support programs are members of working families; the taxpayers bear a significant portion of the hidden costs of low-wage work in America…

“The closer your job is to the actual oil well, the more in jeopardy you are of losing that job..”

• American Oil Layoffs Hit 100,000 and Counting (WSJ)

Thousands of oil-field workers are in the same shoes or, more accurately, steel-toed boots. Since crude prices began tumbling last year, energy companies have announced plans to lay off more than 100,000 workers around the world. At least 91,000 layoffs have already materialized, with the majority coming in oil-field-services and drilling companies, according to research by Graves, a Houston consulting firm. Now the cutbacks are slowly showing up in federal employment data. Direct employment in oil and gas extraction, which had grown by more than 50,000 jobs since 2007, has fallen by about 3,000 jobs since it peaked in October at 201,500, according to the Bureau of Labor Statistics; 12,000 jobs have disappeared from the larger category of energy support since it reached 337,600 jobs in September. And the layoffs are continuing. Last week alone, the Texas Workforce Commission said it received notices of close to 400 layoffs from energy-related companies.

Among them, FTS International, a privately owned oil-field-services business, said it was laying off 194 workers, while Lufkin, a subsidiary of GE that makes oil-field equipment, said it was cutting 149 workers, adding to the 426 workers it has cut since the year began. While layoffs in the industry have hit office workers and high-skilled employees such as geologists and petroleum engineers, it is the roughnecks who are feeling the brunt of the cuts. “The closer your job is to the actual oil well, the more in jeopardy you are of losing that job,” said Tim Cook, oil and gas recruiter and president of PathFinder Staffing in Houston. “Each time an oil rig gets shut down, all the jobs at the work site are gone. They disappear.” The number of working U.S. oil and gas rigs has dropped 46% so far this year to 988, the lowest level in more than five years, according to data from Baker Hughes, an oil-field-services company that is merging with industry giant Halliburton.

It’s not just oil, it’s commodoties in general. And much comes from poor countries, not Saudi Arabia.

• Oil-Rich Nations Sell Off Petrodollar Assets at Record Pace (Bloomberg)

In the heady days of the commodity boom, oil-rich nations accumulated billions of dollars in reserves they invested in U.S. debt and other securities. They also occasionally bought trophy assets, such as Manhattan skyscrapers, luxury homes in London or Paris Saint-Germain Football Club. Now that oil prices have dropped by half to $50 a barrel, Saudi Arabia and other commodity-rich nations are fast drawing down those “petrodollar” reserves. Some nations, such as Angola, are burning through their savings at a record pace, removing a source of liquidity from global markets. If oil and other commodity prices remain depressed, the trend will cut demand for everything from European government debt to U.S. real estate as producing nations seek to fill holes in their domestic budgets.

“This is the first time in 20 years that OPEC nations will be sucking liquidity out of the market rather than adding to it through investments,” said David Spegel, head of emerging markets sovereign credit research at BNP Paribas. Saudi Arabia, the world’s largest oil producer, is the prime example of the swiftness and magnitude of the selloff: its foreign exchange reserves fell by $20.2 billion in February, the biggest monthly drop in at least 15 years, according to data from the Saudi Arabian Monetary Agency. That’s almost double the drop after the financial crisis in early 2009, when oil prices plunged and Riyadh consumed $11.6 billion of its reserves in a single month. The IMF commodity index, a broad basket of natural resources from iron ore and oil to bananas and copper, fell in January to its lowest since mid-2009.

Although the index has recovered a little since then, it still is down more than 40% from a record high set in early 2011. A concomitant drop in foreign reserves, revealed in data from national central banks and the IMF, is affecting nations from oil producer Oman to copper-rich Chile and cotton-growing Burkina Faso. Reserves are dropping faster than during the last commodity price plunge in 2008 and 2009. In Angola, reserves dropped last year by $5.5 billion, the biggest annual decline since records started 20 years ago. For Nigeria, foreign reserves fell in February by $2.9 billion, the biggest monthly drop since comparable data started in 2010. Algeria, one of the world’s top natural gas exporters, saw its funds fall by $11.6 billion in January, the largest monthly drop in a quarter of century. At that rate, it will empty the reserves in 15 months.

Welcome to reality. From a Goldman report today: “Australia is getting “older, fatter and forgetful”.

• Australia Gets First-Time Negative Yield At Sale Of Inflation Linked Bonds (AFR)

Australia sold inflation-linked notes at an average yield below zero for the first time, as gains in crude oil and a drop in the local currency underscored the allure of debt offering protection versus consumer-price gains. The government sold $200 million ($US152 million) of 1% indexed bonds due in November 2018 at an average yield of minus 0.076% on Tuesday, the Australian Office of Financial Management said on its website. With the yield on similar conventional debt at around 1.74% and the principal adjusted for consumer-price gains, the result signals bets inflation will accelerate from the 1.7% annual pace recorded in the fourth quarter of 2014.

The Australian dollar has weakened 7% this year, adding to the potential for higher prices on imported goods. Crude oil has rebounded over the past month, undermining prospects that last year’s decline in fuel prices will have a lasting impact on inflation. “The headline rate may go up because of oil prices going up or the Australian dollar coming down,” said Roger Bridges, the chief global strategist for interest rates and currencies at Nikko Asset Management Australia in Sydney. “The nominal yield has gone to a level way below what people think inflation’s going to be. It makes real assets look attractive.” The company bought some of the bonds, Bridges said. It oversees the equivalent of $US18.3 billion. Ten-year break-even rates show expectations for 2.21%, which is higher than Australian yields on bonds due in as long as seven years.

“..one of the few advanced economies that hasn’t had a major house price correction in the past 45 years..”

• New Zealand Central Bank Calls For Housing Capital Gains Tax (NZ Herald)

The Reserve Bank has urged the government to take another look at a tax on investment in housing, allow increased high-density development and cut red tape for planning consents to address an over-heated Auckland property market. Deputy governor Grant Spencer said in a speech to the Rotorua Chamber of Commerce that housing market imbalances “are presenting an increasing risk to financial and economic stability” in New Zealand, one of the few advanced economies that hasn’t had a major house price correction in the past 45 years. He said there was “considerable scope” to streamline approval processes for residential developments and a need for a more integrated approach to planning and funding of new infrastructure, some of which may be delivered via amendments to the Resource Management Act.

“The proposed RMA reforms have the potential to significantly improve the planning and resource consenting processes,” he said. The government and Auckland Council could also focus on increasing designated areas for high-density housing, because building more apartments was “the best prospect for substantially increasing the supply of dwellings over the next one or two years,” Spencer said. Annual house price inflation in Auckland reached almost 17% last month and the central bank has estimated the city faces a shortfall of between 15,000 and 20,000 properties to meet population growth as the country experiences record migration. Spencer said today there were “practical difficulties” in attempting to use migration policy to mitigate Auckland’s overheated housing market and with inflation so tame, there was little scope for monetary policy to provide assistance. However, there were measures that could counter the growth in investor and credit based demand for housing, he said.

Castro’s speech before an audience that included Obama. Do read the entire thing.

The ideals of Simón Bolívar on the creation of a “Grand American Homeland” were a source of inspiration to epic campaigns for independence.In 1800, there was the idea of adding Cuba to the North American Union to mark the southern boundary of the extensive empire. The 19thcentury witnessed the emergence of such doctrines as the Manifest Destiny, with the purpose of dominating the Americas and the world, and the notion of the ‘ripe fruit’, meaning Cuba’s inevitable gravitation to the American Union, which looked down on the rise and evolution of a genuine rationale conducive to emancipation. Later on, through wars, conquests and interventions that expansionist and dominating force stripped Our America of part of its territory and expanded as far as the Rio Grande.

After long and failing struggles, José Martí organized the “necessary war”, and created the Cuban Revolutionary Party to lead that war and to eventually found a Republic “with all and for the good of all” with the purpose of achieving “the full dignity of man.” With an accurate and early definition of the features of his times, Martí committed to the duty “of timely preventing the United States from spreading through the Antilles as Cuba gains its independence, and from overpowering with that additional strength our lands of America.” To him, Our America was that of the Creole and the original peoples, the black and the mulatto, the mixed-race and working America that must join the cause of the oppressed and the destitute. Presently, beyond geography, this ideal is coming to fruition.

One hundred and seventeen years ago, on April 11, 1898, the President of the United States of America requested Congressional consent for military intervention in the independence war already won with rivers of Cuban blood, and that legislative body issued a deceitful Joint Resolution recognizing the independence of the Island “de facto and de jure”. Thus, they entered as allies and seized the country as an occupying force. Subsequently, an appendix was forcibly added to Cuba’s Constitution, the Platt Amendment that deprived it of sovereignty, authorized the powerful neighbor to interfere in the internal affairs, and gave rise to Guantánamo Naval Base, which still holds part of our territory without legal right. It was in that period that the Northern capital invaded the country, and there were two military interventions and support for cruel dictatorships.

I will not get caught up in the Hillary over-attention-hype nonsense. Let’s leave it at this portrait.

• The Making of Hillary Clinton (Cockburn And St. Clair)

If any one person gave Hillary her start in liberal Democratic politics, it was Marian Wright Edelman who took Hillary with her when she started the Children’s Defense Fund. The two were inseparable for the next twenty-five years. In her autobiography, published in 2003, Hillary lists the 400 people who have most influenced her. Marion Wright Edelman doesn’t make the cut. Neither to forget nor to forgive. Peter Edelman was one of three Clinton appointees at the Department of Health and Human Services who quit when Clinton signed the Welfare reform bill, which was about as far from any “defense” of children as one could possibly imagine. Hillary was on Mondale’s staff for the summer of ’71, investigating worker abuses in the sugarcane plantations of southern Florida, as close to slavery as anywhere in the U.S.A.

Life’s ironies: Hillary raised not a cheep of protest when one of the prime plantation families, the Fanjuls, called in their chips (laid down in the form of big campaign contributions to Clinton) and insisted that Clinton tell Vice President Gore to abandon his calls for the Everglades to be restored, thus taking water Fanjul was appropriating for his operation. From 1971 on, Bill and Hillary were a political couple. In 1972, they went down to Texas and spent some months working for the McGovern campaign, swiftly becoming disillusioned with what they regarded as an exercise in futile ultraliberalism. They planned to rescue the Democratic Party from this fate by the strategy they have followed ever since: the pro-corporate, hawkish neoliberal recipes that have become institutionalized in the Democratic Leadership Council, of which Bill Clinton and Al Gore were founding members. In 1973, Bill and Hillary went off on a European vacation, during which they laid out their 20-year project designed to culminate with Bill’s election as president.

Inflamed with this vision, Bill proposed marriage in front of Wordsworth’s cottage in the Lake District. Hillary declined, the first of twelve similar refusals over the next year. Bill went off to Fayetteville, Arkansas, to seek political office. Hillary, for whom Arkansas remained an unappetizing prospect, eagerly accepted, in December ’73, majority counsel John Doar’s invitation to work for the House committee preparing the impeachment of Richard Nixon. She spent the next months listening to Nixon’s tapes. Her main assignment was to prepare an organizational chart of the Nixon White House. It bore an eerie resemblance to the twilit labyrinth of the Clinton White House 18 years later. Hillary had an offer to become the in-house counsel of the Children’s Defense Fund and seemed set to become a high-flying public interest Washington lawyer. There was one impediment. She failed the D.C. bar exam. She passed the Arkansas bar exam. In August of 1974, she finally moved to Little Rock and married Bill in 1975.

Brussels risks being accused of genocide.

• 400 Believed To Have Drowned Off Libya After Migrant Boat Capsizes (Guardian)

Survivors of a capsized migrant boat off Libya have told the aid group Save the Children that around 400 people are believed to have drowned. Even before the survivors were interviewed, Italy’s coast guard said it assumed that there were many dead given the size of the ship and that nine bodies had been found. The coast guard had helped rescue some 144 people on Monday and immediately launched an air and sea search operation in hopes of finding others. No other survivors or bodies have been recovered. On Tuesday, Save the Children said its interviews with survivors who arrived in Reggio Calabria indicated there may have been 400 others who drowned.

The UN refugee agency said the toll was likely given the size of the ship. The deaths, if confirmed, would add to the skyrocketing numbers of migrants lost at sea. The International Organization of Migration estimates that up to 3,072 migrants are believed to have died in the Mediterranean in 2014, compared to an estimate of 700 in 2013. But the IOM says even those estimates could be low. Overall, since the year 2000, IOM estimates that over 22,000 migrants have lost their lives trying to reach Europe. Earlier Tuesday, the European Union’s top migration official said the EU must quickly adapt to the growing numbers of migrants trying to reach its shores, as new figures showed that more than 7,000 migrants have been plucked from the Mediterranean in the last four days.

“The unprecedented influx of migrants at our borders, and in particular refugees, is unfortunately the new norm, and we will need to adjust our responses accordingly,” the EU’s commissioner for migration, Dimitris Avramopoulos, told lawmakers in Brussels. More than 280,000 people entered the European Union illegally last year. Many came from Syria, Eritrea and Somalia and made the perilous sea journey from conflict-torn Libya.

Abe’s last steps.

• Nuclear Reactors in Japan Remain Closed by Judge’s Order (NY Times)

Fukui Prefecture, with 13 commercial nuclear reactors clustered along a short, rugged coastline, has earned the area a reputation as a political stronghold for the atomic power industry. Nuclear-friendly politicians dominate most of Fukui’s government offices, and the region is nicknamed Genpatsu Ginza, or Nuclear Alley. Fukui has now emerged as a battleground for the Japanese government’s effort to rebuild the nuclear industry and reverse the economic impact of the reactor shutdowns. On Tuesday, a local judge blocked the latest attempt to get atomic power back on the grid, issuing an injunction forbidding the restarting of two nuclear reactors at the Takahama power plant in the region.

The nuclear industry has been in a state of paralysis since the meltdowns at the Fukushima Daiichi nuclear plant four years ago. None of the 48 usable reactors in Japan are back online. Business groups say that delays in returning at least some plants to service are wrecking their bottom line. The price of electricity has increased by 20% or more, reflecting the cost of importing more oil and natural gas to make up for the lost nuclear power. That translates to the equivalent of several tens of billions of dollars a year in added expenses for households and companies, according to government estimates.

It is a potential stumbling block for Prime Minister Shinzo Abe’s efforts to rekindle economic growth, which have focused on increasing corporate profits and consumer spending. Because of the increased use of fossil fuels, Japan’s carbon emissions have also risen in the four years since the country began taking its reactors offline. The decline in oil prices, which have fallen about 50% since June, has taken some of the pressure off the economy. But the government nonetheless sees a revival of nuclear power as critical to supporting growth and slowing an exodus of Japanese industry to lower-cost countries.

History and perspective.

• The Inequality Bubble Accelerates, Worse Than ‘29, Even 1789 (Paul B. Farrell)

A couple years ago a Credit Suisse Global Wealth Report gave us a snapshot of just where this explosive inequality bubble is headed, reminding us of something far worse than the 1929 Crash, but of the 1790s when inequality triggered the French Revolution, and 17,000 lost their heads under the guillotine. The Credit Suisse data reveals that just 1% own 46% of the world, while two-thirds of the world’s people have less than $10,000. Forbes also reports that just 67 billionaires already own half of Planet Earth’s assets. Credit Suisse predicts a world with 11 trillionaires in a couple generations, as the rich get richer and the gap widens. Can this trend continue? Or will it trigger a revolutionary economic guillotine?

Nobel economist Joseph Stiglitz, author of “The Price of Inequality,” is not as optimistic as Credit Suisse: “America likes to think of itself as a land of opportunity.” But today the “numbers show that the American Dream is a myth … the gap’s widening … the clear trend is one of concentration of income and wealth at the top, the hollowing out of the middle, and increasing poverty at the bottom.” History is warning us: Inequality is a recipe for disaster, rebellions, revolutions and wars. Not in two generations. Much, much sooner, a reminder of the Pentagon’s famous 2003 prediction: “As the planet’s carrying capacity shrinks, an ancient pattern of desperate, all-out wars over food, water, and energy supplies will emerge … warfare will define human life on the planet by 2020.” Yes, much sooner than two generations.

Early warnings of a crash are dismissed over and over (“a temporary correction”). They gradually numb us about the big one. Time after time we forget history’s lessons. Until finally a big surprise catches us totally off-guard. Financial historian Niall Ferguson put it this way: Before the crash, our world seems almost stationary, deceptively so, balanced, at a set point. So that when the crash finally hits, as inevitably it will, everyone seems surprised. And our brains keep telling us it’s not time for a crash. Till then, life just goes along quietly, hypnotizing us, making us vulnerable, till shockers like Bear Stearns or Lehman Brothers upset the balance. Then, says Ferguson, the crash is “accelerating suddenly, like a sports car … like a thief in the night.”

It hits, shocks us wide awake. In our denial, we may keep telling ourselves it’s just another short-term correction in a hot bull market. Until suddenly, it’s accelerating Mack truck hits. Angry masses, let resentment build, fuming inside. Their Treasury was bankrupt. High interest on national debt consumed half their tax revenues. Why? Earlier wars, a decedent aristocracy, an incompetent King Louis XVI. The anger so intense that during the 1792-93 “Reign of Terror” even the King was guillotined, along with 17,000, many who were innocent, as inequality ripped apart the France nation. Why? The aristocracy, intellectuals and the rich were oblivious of the needs of the masses, much like our leaders today.