G. G. Bain The new Queensboro (59th Street) Bridge over the East River, NYC 1909

“The Pride of Europe”, just another story.

• Who Will Dare Say Out Loud ‘Emperor Has No Clothes’? (Irish Times)

In a normal democracy, urgent questions are asked when the prime minister says things that are wildly untrue. Was he lying or deluded? Which of these possibilities is more alarming? If he was lying, had he never heard of Google? If he genuinely didn’t know what the Government has been up to, why is he in government? But we don’t bother to ask these questions about St Enda’s extraordinary epistle to the Athenians last week, when he urged Greece to follow Ireland : “in Ireland’s case we did not increase income tax; we did not increase VAT; we did not increase PRSI”. Each of these claims is flatly wrong: all three taxes were very substantially increased, both by the present and previous governments But this truth is utterly irrelevant. Why? Because we all know that the Taoiseach wasn’t making a statement about reality.

He was telling a story. At some point in our lives – usually when we’re three or four – we all ask the question: “Daddy, did this really happen or is it a makey-up story?” And once we know which is which, we’re okay with it. And by now, we’re more or less okay with the fact that Ireland’s primary presence on the European stage is as a makey-up story. We don’t live in a country; we live in a narrative, a tale with no more truth content than Cinderella and considerably less than “The Emperor’s New Clothes”. Our current story is called, according to the Minister for Foreign Affairs Charlie Flanagan, “the pride of Europe”. Of course this doesn’t mean that Europe is proud that we’ve almost doubled consistent child poverty, or that we keep centenarians for days on hospital trollies or that basic services like clinics for sufferers of rheumatic diseases are simply disappearing or that we’ve been left with unpayable public debt.

It surely doesn’t mean that Europe is proud that little Ireland was forced to bear the cost of a bank bailout put last week by Patrick Honohan, governor of the Central Bank, at €100 billion and rising. At the level of reality, it doesn’t actually mean anything at all. But that doesn’t mean that it’s a harmless fiction. “The Pride of Europe” is a makey-up story that is intended to take the place of the realities it displaces. It’s not a stand-alone narrative. It has an evil twin: Greece. It belongs to a particular genre of fiction: the morality tale. Ireland is the pride of Europe because it is the anti-Greece. We are good because we play along with the bigger stories of the euro zone crisis. Greece is evil because it stopped doing so.

Read more …

Nice take: “By going through the sham negotiations with The Institutions, Syriza gave Greeks enough time to protect what savings and cash they had..”

• A New Mode of Warfare (Michael Hudson)

By going through the sham negotiations with The Institutions, Syriza gave Greeks enough time to protect what savings and cash they had – by converting these bank deposits into euro notes, automobiles and “hard assets” (even boats). Businesses borrowed from local banks where they could, and moved their money into eurozone banks or even better, into dollar and sterling assets. Their intention is to pay back the banks in depreciated drachma, pocketing a 30% capital gain. What commentators miss is that Syriza (at least its left) wants to be transformative. It wants to free Greece from the post-military oligarchy that evades taxes and monopolizes the economy. And it wants to transform Europe, away from ECB austerity to create a real central bank. In the process, it demands a clean slate of past bad debts.

It wants to reject the IMF’s austerity philosophy and refusal to take responsibility for its bad 2010-12 bailout. This larger, transformative picture is at the center of Syriza-left plans. I’m in Germany now, and have heard from Germans that the Greeks are lazy and don’t pay taxes. There is little recognition that what they call “the Greeks” are really the oligarchs. They have gained control of the old coalition Pasok/New Democracy parties, avoided paying taxes, avoided being prosecuted (New Democracy refused to act on the “Lagarde List” of tax evaders with nearly €50 billion in Swiss bank accounts), orchestrated insider dealings to privatize infrastructure at corrupt prices, and used their banks as vehicles for capital flight and insider lending. This has turned the banks into vehicles for the oligarchy.

They are not public institutions serving the economy, but have starved Greek business for credit. So one casualty apart from the credibility of the eurozone, the ECB and the IMF will be these banks. Syriza is positioning itself to provide a public option – public banks that will promote the economy, and a national Treasury that will spend government money INTO the economy, not drain it to pay the Troika for having bailed out French and other banks back in 2010-1.

The European popular press is as bad as the U.S. press in describing matters. It warns of “hyperinflation” if a central bank monetizes as much as one euro of government spending in the way that the U.S. Fed does, or the bank of England or any other real central bank. The reality is that nearly all hyperinflations stem from a collapse of foreign exchange as a result of having to pay debt service. That was what caused Germany’s hyperinflation in the 1920s, not domestic German spending. It is what caused the Argentinean and other Latin American hyperinflations in the 1980s, and Chile’s hyperinflation earlier.

Read more …

Might have to try The Hague.

• Greece Threatens Top Court Action To Block Grexit (AEP)

Greece has threatened to seek a court injunction against the EU institutions, both to block the country’s expulsion from the euro and to halt asphyxiation of the banking system. “The Greek government will make use of all our legal rights,” said the finance minister, Yanis Varoufakis. “We are taking advice and will certainly consider an injunction at the European Court of Justice. The EU treaties make no provision for euro exit and we refuse to accept it. Our membership is not negotiable,“ he told the Telegraph. The defiant stand came as Europe’s major powers warned in the bluntest terms that Greece will be forced out of monetary union if voters reject austerity demands in a shock referendum on Sunday.

“What is at stake is whether or not Greeks want to stay in the eurozone or want to take the risk of leaving,” said French president Francois Hollande. Sigmar Gabriel, Germany’s vice-chancellor and Social Democrat leader, said the Greek people should have no illusions about the fateful choice before them. “It must be crystal clear what is at stake. At the core, it is a yes or no to remaining in the eurozone,” he said. Chancellor Angela Merkel – standing next to him after an emergency meeting of party leaders – was more oblique, but the message was much the same. She praised hard-liners in her own party and insisted that the eurozone cannot yield to any one country. “If principles are not upheld, the euro will fail,” she said.

The refusal to hold out an olive branch to Greece more or less guarantees that it will not repay a €1.6bn loan to the IMF on Tuesday, potentially setting off a domino effect of cross-default clauses and the biggest sovereign bankruptcy in history. Any request for an injunction against EU bodies at the European Court would be an unprecedented development, further complicating the crisis. Greek officials said they are seriously considering suing the ECB itself for freezing emergency liquidity for the Greek banks at €89bn. It turned down a request from Athens for a €6bn increase to keep pace with deposit flight. This effectively pulls the plug on the Greek banking system. Syriza claims that this is a prima facie breach of the ECB’s legal duty to maintain financial stability.

“How can they justify setting off a run on the Greek banking system?” said one official. Mr Varoufakis said Greece has enough liquidity to keep going until the referendum but acknowledged that capital controls introduced over the weekend were making life difficult for Greek companies. Money is being rationed by an emergency payments committee made up of the key agencies and the banks. “We are having to prioritize spending,” he said. The one-week closure of the Greek banks and the drastic escalation of the crisis over the weekend caught investors by surprise. Most had assumed that a deal was in the works.

Read more …

The mind of a psychopath.

• Alexis Tsipras Must Be Stopped: The Underlying Message Of Europe’s Leaders (G.)

One day before Greece’s bailout ends and the country’s financial lifeline melts away, Europe’s big guns have lined up one after another to tell the Greeks unequivocally that voting no in Sunday’s referendum means saying goodbye to the euro. There was no mistaking the gravity of the situation now facing both Greece and Europe on Monday. Leaders were by turns ashen-faced, resigned, desperate and pleading with Athens to think again and pull back from the abyss. There were also bitter attacks on Alexis Tsipras, the young Greek prime minister whose brinkmanship has gone further than anyone believed possible and left the eurozone’s leaders reeling. One measure of the seriousness of the situation could be gleaned from the leaders’ schedules.

In Berlin, Brussels, Paris and London, a chancellor, two presidents and a prime minister convened various meetings of cabinet, party leaders and top officials devoted solely to Greece. The French president, François Hollande, was to the fore. “It’s the Greek people’s right to say what they want their future to be,” he said. “It’s about whether the Greeks want to stay in the eurozone or take the risk of leaving.” Athens insists that this is not what is at stake in the highly complicated question the Greek government has drafted for the referendum, but Berlin, Paris and Brussels made plain that the 5 July vote will mean either staying in the euro on their tough terms or returning to the drachma.

In what was arguably the biggest speech of his career, the president of the European commission, Jean-Claude Juncker, appeared before a packed press hall in Brussels against a giant backdrop of the Greek and EU flags. He was impassioned, bitter and disingenuous in appealing to the Greek people to vote yes to the euro and his bailout terms, arguing that he and the creditors – rather than the Syriza government – had the best interests of Greeks at heart. Tsipras had lied to his people, deceived and betrayed Europe’s negotiators and distorted the bailout terms that were shredded when the negotiations collapsed and the referendum was called, he said.

“I feel betrayed. The Greek people are very close to my heart. I know their hardship … they have to know the truth,” he said. “I’d like to ask the Greek people to vote yes … no would mean that Greece is saying no to Europe.” In a country where an estimated 11,000 people have killed themselves during the hardship wrought by austerity, Juncker offered unfortunate advice. “I say to the Greeks, don’t commit suicide because you’re afraid of dying,” he said.

Read more …

Great piece.

• Where Is My European Union? (Alex Andreou)

Last winter, I stood outside the Opera House in the centre of Athens looking at the posters in the window. I was approached by a well-dressed and immaculately groomed elderly lady. I moved to the side. I thought she wanted to pass. She didn’t. She asked me for a few euros because she was hungry. I took her to dinner and, in generous and unsolicited exchange, she told me her story. Her name was Magda and she was in her mid-seventies. She had worked as a teacher all her life. Her husband had been a college professor and died “mercifully long before we were reduced to this state”, as she put it. They paid their tax, national insurance and pension contributions straight out of the salary, like most people.

They never cheated the state. They never took risks. They saved. They lived modestly in a two bedroom flat. In the first year of the crisis her widow’s pension top-up stopped. In the second and third her own pension was slashed in half. Downsizing was not an option – house prices had collapsed and there were no buyers. In the third year things got worse. “First, I sold my jewellery. Except this ring”, she said, stroking her wedding ring with her thumb. “Then, I sold the pictures and rugs. Then the good crockery and silver. Then most of the furniture. Now there is nothing left that anyone wants. Last month the super came and removed the radiators from my flat, because I hadn’t paid for communal fuel in so long. I feel so ashamed.”

I don’t know why this encounter should have shocked me so deeply. Poverty and hunger is everywhere in Athens. Magda’s story is replicated thousands of times across Greece. It is certainly not because one life is worth more than another. And yet there is something peculiarly discordant and irreconcilable about the “nouveau pauvres”, just like like there is about the nouveau riches. Most likely it shocked me because I kept thinking how much she reminded me of my mother. And, still, I don’t know whether voting “yes” or “no” will make life better or worse for her. I don’t know what Magda would vote either. I can only guess. What I do know, is that the encounter was the beginning of the end of my love affair with the European project. Because, quite simply, it is no longer my European Union.

It is Amazon’s and Starbucks’. It is the politicians’ and the IMF’s. But it is not mine. If belonging to the largest and richest trading bloc in the world cannot provide dinner for a retired teacher like her, it has no reason to exist. If a European Union which produces €28,000 of annual GDP for every single one of its citizens cannot provide a safety net for her, then it is profoundly wicked. If this is not a union of partners, but a gang of big players and small players, who cut the weakest loose at the first sign of trouble, then it is nothing. Each one of us will have to engage in an internal battle before Sunday’s referendum. I will be thinking of you, Magda, when I vote. It seems as honest a basis to make a decision as any.

Read more …

“Europe’s common market exemplifies a situation that is unfavorable to a common currency…”

• Milton Friedman Predicted Euro Would Be A Disaster (Vox)

Milton Friedman might be best known today for his free-market political views. But some of his most important contributions to economics were in monetary policy. He explained the high inflation rates of the 1970s, and he was also an early and influential advocate of the system of floating exchange rates that we have today. So European policymakers would have done well to pay attention in 1997 when Friedman predicted that the euro would be a disaster. Eighteen years later, with Greece on the verge of a financial meltdown, his analysis looks prophetic:

Europe’s common market exemplifies a situation that is unfavorable to a common currency. It is composed of separate nations, whose residents speak different languages, have different customs, and have far greater loyalty and attachment to their own country than to the common market or to the idea of “Europe.” Despite being a free trade area, goods move less freely than in the United States, and so does capital.

The European Commission based in Brussels, indeed, spends a small fraction of the total spent by governments in the member countries. They, not the European Union’s bureaucracies, are the important political entities. Moreover, regulation of industrial and employment practices is more extensive than in the United States, and differs far more from country to country than from American state to American state. As a result, wages and prices in Europe are more rigid, and labor less mobile. In those circumstances, flexible exchange rates provide an extremely useful adjustment mechanism.

What Friedman means here is that if Greece still had the drachma, it could deal with its financial difficulties by devaluing the currency. A cheaper drachma would make Greek goods more attractive to foreigners, boosting exports and creating jobs. And a bit of inflation in Greece would help ease the country’s debt burden — not an ideal outcome, but better than the yearslong depression the country has suffered since the 2008 financial crisis. It’s much harder for an unemployed man in Greece to move to get a job in Germany than it is for somebody who loses his job in Pennsylvania to find work in Texas. So Greece’s unemployment rate has stayed disastrously high, even as other eurozone nations have enjoyed a robust recovery. Friedman concluded that the euro experiment would backfire:

The drive for the Euro has been motivated by politics not economics. The aim has been to link Germany and France so closely as to make a future European war impossible, and to set the stage for a federal United States of Europe. I believe that adoption of the Euro would have the opposite effect. It would exacerbate political tensions by converting divergent shocks that could have been readily accommodated by exchange rate changes into divisive political issues. Political unity can pave the way for monetary unity. Monetary unity imposed under unfavorable conditions will prove a barrier to the achievement of political unity.

Read more …

Now take that story to Washington, and tell them to wake up.

• The Awesome Gratuitousness of the Greek Crisis (Krugman)

Barry Eichengreen asks himself why his influential analysis, suggesting that the euro was irreversible now appears wrong. Surely in a direct, mechanical sense what we’re seeing is the process I warned about five years ago: Think of it this way: the Greek government cannot announce a policy of leaving the euro — and I’m sure it has no intention of doing that. But at this point it’s all too easy to imagine a default on debt, triggering a crisis of confidence, which forces the government to impose a banking holiday — and at that point the logic of hanging on to the common currency come hell or high water becomes a lot less compelling. But doesn’t the ultimate cause lie in wild irresponsibility on the part of the Greek government? I’ve been looking back at the numbers, readily available from the IMF, and what strikes me is how relatively mild Greek fiscal problems looked on the eve of crisis.

In 2007, Greece had public debt of slightly more than 100% of GDP — high, but not out of line with levels that many countries including, for example, the UK have carried for decades and even generations at a stretch. It had a budget deficit of about 7% of GDP. If we think that normal times involve 2% growth and 2% inflation, a deficit of 4% of GDP would be consistent with a stable debt/GDP ratio; so the fiscal gap was around 3 points, not trivial but hardly something that should have been impossible to close. Now, the IMF says that the structural deficit was much larger — but this reflects its estimate that the Greek economy was operating 10% above capacity, which I don’t believe for a minute.

(The problem here is the way standard methods for estimating potential output cause any large slump to propagate back into a reinterpretation of history, interpreting the past as an unsustainable boom.) So yes, Greece was overspending, but not by all that much. It was over indebted, but again not by all that much. How did this turn into a catastrophe that among other things saw debt soar to 170% of GDP despite savage austerity? The euro straitjacket, plus inadequately expansionary monetary policy within the eurozone, are the obvious culprits. But that, surely, is the deep question here. If Europe as currently organized can turn medium-sized fiscal failings into this kind of nightmare, the system is fundamentally unworkable.

Read more …

The EU was the original mistake.

• Krugman’s Right: The Euro Was The Original Mistake, Vote No (Tim Worstall)

It’s not exactly a secret that Paul Krugman hasn’t been a great fan of the euro over the years. In fact, most economists haven’t been great fans of it: it has always been the political classes urging it on. So, the question now becomes, with the situation in Greece, what should be done next? And the answer is almost certainly to encourage a no vote at the upcoming referendum. That would seal the idea that Greece just will not continue within the eurozone and at that point we would almost certainly see signs of life in the Greek economy once again. And that is actually the aim of whatever policy is followed now. The heck with European unity and all that jazz: the task is to get some growth back into that Greek economy, get people back to work. Seriously, a 50% youth unemployment rate is evidence of little else than all out economic war. So, let’s stop doing that and go and do something useful and sensible instead. Here’s the opening of Krugman’s column:

It has been obvious for some time that the creation of the euro was a terrible mistake. Europe never had the preconditions for a successful single currency — above all, the kind of fiscal and banking union that, for example, ensures that when a housing bubble in Florida bursts, Washington automatically protects seniors against any threat to their medical care or their bank deposits.

Yep, entirely so, and many economists (and others, like myself) have been saying this all along. It doesn’t and didn’t matter how much people praised this idea of ever more Europe, the currency, as designed, was simply not going to work over the area it was planned to introduce it over. And it’s worth noting that there really were many economists who were saying this. Here’s a quite gorgeous paper from the European Commission. It’s from 2009, and it’s a look back at what American economists were saying about the euro from 1989 to 2002. The tone is most fun: they’re dancing along, tooting their horns, shouting that well, the Yankees didn’t think it would work! And yet here we are in 2009 and we’ve still got our lovely euro!

The euro: It can’t happen, It’s a bad idea, It won’t last.

– US economists on the EMU, 1989 – 2002

Schadenfreude on those celebrating their own schadenfreude is so much fun, isn’t it? We should note that Krugman was on the right side in all of this. And he also asks the right question: well, what should be done next?

Read more …

Now make that stick.

• Stiglitz: Troika Caused Greek Recession, Has “Criminial Responsibility” (Time)

A few years ago, when Greece was still at the start of its slide into an economic depression, the Nobel prize-winning economist Joseph Stiglitz remembers discussing the crisis with Greek officials. What they wanted was a stimulus package to boost growth and create jobs, and Stiglitz, who had just produced an influential report for the United Nations on how to deal with the global financial crisis, agreed that this would be the best way forward. Instead, Greece’s foreign creditors imposed a strict program of austerity. The Greek economy has shrunk by about 25% since 2010. The cost-cutting was an enormous mistake, Stiglitz says, and it’s time for the creditors to admit it.

“They have criminal responsibility,” he says of the so-called troika of financial institutions that bailed out the Greek economy in 2010 “It’s a kind of criminal responsibility for causing a major recession,” Stiglitz tells TIME in a phone interview. Along with a growing number of the world’s most influential economists, Stiglitz has begun to urge the troika to forgive Greece’s debt – estimated to be worth close to $300 billion in bailouts – and to offer the stimulus money that two successive Greek governments have been requesting. Failure to do so, Stiglitz argues, would not only worsen the recession in Greece – already deeper and more prolonged than the Great Depression in the U.S. – it would also wreck the credibility of Europe’s common currency, the euro, and put the global economy at risk of contagion.

So far Greece’s creditors have downplayed those risks. In recent years they have repeatedly insisted that European banks and global markets do not face any serious fallout from Greece abandoning the euro, as they have had plenty of time to insulate themselves from such an outcome. But Stiglitz, who served as the chief economist of the World Bank from 1997 to 2000, says no such firewall of protection can exist in a globalized economy, where the connections between events and institutions are often impossible to predict. “We don’t know all the linkings,” he says.

Many countries in Eastern Europe, for instance, are still heavily reliant on Greek banks, and if those banks collapse the European Union faces the risk of a chain reaction of financial turmoil that could easily spread to the rest of the global economy. “There is a lack of transparency in financial markets that makes it impossible to know exactly what the consequences are,” says Stiglitz. “Anybody who says they do obviously doesn’t know what they’re talking about.”

Read more …

On Europe’s democracy.

• Europe’s Attack On Greek Democracy (Joseph Stiglitz)

The rising crescendo of bickering and acrimony within Europe might seem to outsiders to be the inevitable result of the bitter endgame playing out between Greece and its creditors. In fact, European leaders are finally beginning to reveal the true nature of the ongoing debt dispute, and the answer is not pleasant: it is about power and democracy much more than money and economics. Of course, the economics behind the program that the “troika” foisted on Greece five years ago has been abysmal, resulting in a 25% decline in the country’s GDP. I can think of no depression, ever, that has been so deliberate and had such catastrophic consequences: Greece’s rate of youth unemployment, for example, now exceeds 60%.

It is startling that the troika has refused to accept responsibility for any of this or admit how bad its forecasts and models have been. But what is even more surprising is that Europe’s leaders have not even learned. The troika is still demanding that Greece achieve a primary budget surplus (excluding interest payments) of 3.5% of GDP by 2018. Economists around the world have condemned that target as punitive, because aiming for it will inevitably result in a deeper downturn. Indeed, even if Greece’s debt is restructured beyond anything imaginable, the country will remain in depression if voters there commit to the troika’s target in the snap referendum to be held this weekend.

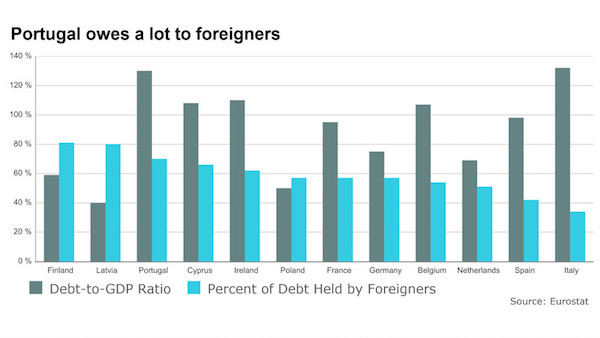

In terms of transforming a large primary deficit into a surplus, few countries have accomplished anything like what the Greeks have achieved in the last five years. And, though the cost in terms of human suffering has been extremely high, the Greek government’s recent proposals went a long way toward meeting its creditors’ demands. We should be clear: almost none of the huge amount of money loaned to Greece has actually gone there. It has gone to pay out private-sector creditors – including German and French banks. Greece has gotten but a pittance, but it has paid a high price to preserve these countries’ banking systems. The IMF and the other “official” creditors do not need the money that is being demanded. Under a business-as-usual scenario, the money received would most likely just be lent out again to Greece.

But, again, it’s not about the money. It’s about using “deadlines” to force Greece to knuckle under, and to accept the unacceptable – not only austerity measures, but other regressive and punitive policies. But why would Europe do this? Why are European Union leaders resisting the referendum and refusing even to extend by a few days the June 30 deadline for Greece’s next payment to the IMF? Isn’t Europe all about democracy? In January, Greece’s citizens voted for a government committed to ending austerity. If the government were simply fulfilling its campaign promises, it would already have rejected the proposal. But it wanted to give Greeks a chance to weigh in on this issue, so critical for their country’s future wellbeing.

Read more …

Numbers are rising, but timing is way off.

• As Crisis Deepens, Eurozone Critics Are Vocal (WSJ)

With Greece on the brink of leaving the eurozone and global financial markets panicked by that prospect, eurozone policy makers can’t have expected favorable reviews Monday for their recent efforts. So they won’t have been surprised as a queue of academics formed to detail their failings. The ECB’s decision not to expand the emergency liquidity assistance given to Greek banks came in for particularly harsh criticism, as long-time critics of the policies pursued by the Troika in which it is joined by the IMF and EC lined up to claim vindication. The most stinging attack on the ECB came from Charles Wyplosz, professor of international economics at the Graduate Institute, Geneva and a respected commentator on eurozone economic policy.

In a posting on the VoxEU blog run by the Centre for Economic Policy Research, Mr. Wyplosz argued the ECB had acted from political motives, and not for the first time. “No other central bank in the world tells its government what reforms it should conduct, nor how sharp should fiscal consolidating be,” he wrote. Mr. Wyplosz argued that one of the ECB’s key roles is to act as a lender of last resort to the eurozone’s banks, and in failing to do that it was “pushing Greece out of the eurozone.” “Politicians may debate about the wisdom of making Greece leave,” he wrote. “As non-elected officials, the people who sit on the Governing Board of the Eurosystem have no such mandate.”

Writing for Foreign Policy, the London School of Economics’ Philippe Legrain also saw the ECB’s decision as a “political move” in the service of “brutal power politics” that seeks to bypass democracy. “There is a chance that a resounding No vote in the referendum will bring the creditors to their senses,” Mr. Legrain wrote. “But if it doesn’t, default on the 3.5 billion euros due to the ECB on July 20 and leaving the euro is better than debt bondage.” Some U.S. observers joined the fray, penning unflattering assessments of the Troika’s track record. Writing for The Conversation, the University of California’s Barry Eichengreen was criticial of the Greek government’s decision to call a referendum as “a transparent effort to evade responsibility.”

But he had a harsher judgement to deliver. “Still, this incompetence pales in comparison with that of the European Commission, the ECB and the IMF,” Mr. Eichengreen wrote, arguing their key mistake was to deny a debt restructuring in 2010, and once again earlier this year.

Read more …

Already has.

• Europe’s Dream Is Dying In Greece (Gideon Rachman)

The shuttered banks of Greece represent a profound failure for the EU. The current crisis is not just a reflection of the failings of the modern Greek state, it is also about the failure of a European dream of unity, peace and prosperity. Over the past 30 years Europe has embraced its own version of the “end of history”. It became known as the European Union. The idea was that European nations could consign the tragedies of war, fascism and occupation to the past. By joining the EU, they could jointly embrace a better future based on democracy, the rule of law and the repudiation of nationalism. As Lord Patten, a former EU commissioner, once boasted, the success of the union ensured that Europeans now spent their time “arguing about fish quotas or budgets, rather than murdering one another”.

When the Greek colonels were overthrown in 1974, Greece became the pioneer of a new model for Europe — in which the restoration of democracy at a national level was secured by a simultaneous application to join the European Economic Community (as it then was).

Greece became the 10th member of the European club in 1981. Its early membership of an EU that now numbers 28 countries is a rebuke to those who now claim it has always been a peripheral member. The model first established in Greece — democratic consolidation, secured by European integration — was rolled out across the continent over the next three decades. Spain and Portugal, which had also cast off authoritarian regimes in the 1970s, joined the EEC in 1986.

After the fall of the Berlin Wall, almost all the countries of the former Soviet bloc followed the Greek model of linking democratic change at home to a successful application to join the EU. For the EU itself, Greek-style enlargement became its most powerful tool for spreading stability and democracy across the continent. As one Polish politician put it to me shortly before his country joined the EU: “Imagine there is a big river running through Europe. On one side is Moscow. On the other side is Brussels. We know which side of the river we need to be on.” That powerful idea — that the EU represented good government and secure democracy — has continued to resonate in modern Europe. It is why Ukrainian demonstrators were waving the EU flag when they overthrew the corrupt government of Viktor Yanukovich in 2014.

The danger now is that, just as Greece was once a trailblazer in linking a democratic transition to the European project, so it may become an emblem of a new and dangerous process: the disintegration of the EU. The current crisis could easily lead to the country leaving the euro and eventually the union itself. That would undermine the fundamental EU proposition: that joining the European club is the best guarantee of future prosperity and stability. Even if an angry and impoverished Greece ultimately remains inside the tent, the link between the EU and prosperity will have been ruptured. For the horrible truth is dawning that it is not just that the EU has failed to deliver on its promises of prosperity and unity. By locking Greece and other EU countries into a failed economic experiment — the euro — it is now actively destroying wealth, stability and European solidarity.

Read more …

Mason’s growing.

• Will Syriza’s Last Desperate Gamble Pay Off? (Paul Mason)

But Syriza is different. Syriza is a coalition whose colours are red for socialism, green for ecology and purple for feminism. But it is primarily red. It was born out of Eurocommunism – when the communist parties of the west declared loyalty to parliamentary democracy instead of Moscow. Its most influential activists are aged 50 and above: people who have read all three volumes of Karl Marx’s Capital, plus the Grundrisse, Theories of Surplus Value and Friedrich Engels’ Anti-Dühring. A lot of them are MPs now, or special advisers: you’ll find them in greying huddles in their old haunts – the radical bars and cafes of Exarchia and Plaka. How this generation of Greek leftwingers broke out of isolation is of more than academic interest.

They have managed – for the first time in modern history – to form a government that defied the global finance system, and to do so with flair. Their strength was that they understood the significance of the youth revolts of 2008 and 2011. Some pitched their own tents in Syntagma Square and were tear-gassed out of it. But in the process, the party built something more official and resilient. Their weakness, it turns out, starts with Nicos Poulantzas. Poulantzas was a Greek intellectual of the new left who famously clashed with Ed Miliband’s father, Ralph, in 1969 over the nature of the capitalist state. Miliband said the state was “capitalist” because personally controlled by the business elite. Poulantzas said the state was structurally capitalist – independent of the will of individuals.

Poulantzas evolved a dual strategy for the Greek left in the 1970s: first, to encircle the state with social movements, which were not to be controlled by any party but allowed to become expressions of popular democracy. And at the same time, to enter the state, democratise it and use it to pursue social justice. Poulantzas killed himself in 1979, but his ideas guided the precursor organisation to Syriza. Not many people remember now, but the party’s predecessor, Synaspismos, joined a short-lived coalition government with the conservatives in 1988, and a national government thereafter. In the runup to its election victory, Syriza got a chance to execute the Poulantzas strategy of the march through the state: it won the Euro elections and the vital prefecture of Attica, where its candidate was protest veteran Rena Dourou. Then it won state power – but that has turned out differently.

Read more …

“.. large swaths of the continent have fallen under the rule of institutions that find it almost impossible to deal with democracy.”

• A Fight Between The Greeks And Europe’s Cruel Capitalism (Chakrabortty)

The incompatibles here are about as big as you get: the Greek people on one side, busted economics on the other. The irony is that if anyone was going to marry those incompatibles it was Tsipras. Despite it all, Syriza remains committed to the single currency, in a country that before the crisis ranked as among the most euro-enthusiastic of all the members. As in other European countries where national poverty is still recalled by grandparents, the Greek elite treats membership of the single currency almost as a badge of first-world status. When he was still an academic, Yanis Varoufakis, the finance minister, spent years figuring out ways to make European monetary union viable.

Whatever insults the northern European press might hurl, Syriza’s leading policymakers are euro-believers who have been forced into disillusionment. Last week the government offered a compromise deal to Greece’s creditors. It was “austerian” and “recessionary” – those words came from Varoufakis, the man who wrote it. Yet it was not austere enough for the creditors, who reportedly quibbled over Syriza’s plans to tax the rich. That was the final rupture. Less idealistic people than Tsipras and Varoufakis might have guessed at this outcome. Since the euro crisis broke out in 2010, large swaths of the continent have fallen under the rule of institutions that find it almost impossible to deal with democracy.

Most important are the ECB– unelected and almost totally unaccountable – and Juncker’s European commission: neither directly nor even indirectly answerable to the Greeks, Portuguese, Irish and Spanish who have lost jobs, wages and benefits at its command. The informal Eurogroup meeting of eurozone finance ministers is about as close to democracy as the system gets. As Fritz Scharpf, former head of the Max Planck institute for the Study of Societies in Cologne, puts it: “The regime that has been established to rescue an over-extended and ill-designed monetary union is in fact jeopardising … democratic self-government in Europe.”

Read more …

Useful, but a bit all over the place. Translations get worse.

• A European Tyranny? (Jacques Sapir)

The reaction of the Eurogroup which convened in Brussels on Saturday has consisted indeed in an action joining the most glaring illegality with the will to impose one’s views onto a sovereign State. In taking the decision to hold a reunion in the absence of a representative of the Greek state the Eurogroup has decided to exclude de facto Greece from the Euro. This constitutes evidently an abuse of power. We must here be reminded of several points which are not without consequences from the standpoint of the law as well as from the one of politics.

• There is no procedure presently in existence allowing to exclude a country from the Economic and Monetary Union (the real name of the « Eurozone »). If there can be separation, it can only occur in a common accord and on a friendly basis.

• The Eurogroup has no legal existence. It is only a « club » operating under cover of the European Commission and the European Council. This means that if the Eurogroup has committed an illegal action – and this seems to be the case – the responsibility for it is incumbent upon both of these institutions. The Greek government would therefore have grounds to attack the Commission and the Council both before the European Court of Justice as well as before the International Court in The Hague. Indeed, the European Union is at base an international organization. The rule in any international organization is the one of unanimity. True, the Treaty of Lisbon has foreseen mechanisms of a qualified majority, but these mechanisms do not apply to the Euro nor to the questions of fundamental relationships between the states.

• The coup de force – for this is what it is – which has been committed the Eurogroup, does not concern Greece alone. Other member countries of the European Union, think of Great Britain or Austria, could also sue before the European as well as the International court the de facto decision taken by the Eurogroup. In effect, the European Union rests on rules of law which apply to all. Any decision to violate these rules against one particular country constitutes a threat against all the members of the European Union.

We must therefore be clear. The decision taken by the Eurogroup could well signify, in time, the death of the EU. Either the European leaders, taking measure of the abuse of power which has been perpetrated, will decide to annul it or, if they persevere in this direction, they must expect an insurgency of the peoples, but also of the leaders of some of the states against the EU. One cannot see well how states which have just recovered their sovereignty, such as Hungary, the Czech Republic or Slovakia, could accept such practices.

Read more …

Parallell currency seems certain. How about today?

• The Road To Grexit And Beyond (Wolfgang Münchau)

When a shock you predicted actually happens, it still feels like a shock. Alexis Tsipras was right to walk away. But it was a momentous decision nevertheless when the Greek prime minister rejected an offer that would have allowed it to pay its debt to the IMF and the ECB. What I am struggling to understand is why he suddenly decided to call a referendum on whether to accept a bailout for next Sunday. There might be some super-smart strategy behind this beyond my capacity to comprehend. The problem with the referendum is that the offer on which the Greek people are asked to vote is no longer on the table. And the programme to which it relates expires tomorrow at midnight. Why should the Greeks vote Yes to a package the creditors themselves no longer support?

By far the biggest tactical error committed over the weekend, however, was the rejection by eurozone finance ministers of a five-day extension of the Greek bailout programme to beyond the referendum. With that decision, they foreclosed the only way to keep the show on the road. They have unwittingly strengthened the political argument of the Greek prime minister. He will now be able to say: first the creditors wanted to destroy the Greek economy with their austerity programme. And now they are hoping to destroy Greek democracy. To see where all this might be going, it is instructive to go through the various scenarios, eliminate the implausible and see what is left. If the Greek referendum on Sunday goes ahead and concludes in a No vote, Grexit probably beckons.

If the result is a Yes, there will be initial confusion. A vote to accept the bailout may be interpreted as a vote in favour of remaining in the eurozone. In that case I would expect the Greek government — whoever that may be after a Yes vote — to maintain the regime of capital controls and introduce a parallel currency, denominated in euros. A parallel currency scenario could split into three directions: Grexit within a short time; a regime where Greece defaults but maintains the capital controls indefinitely; and a scheme where the controls are eventually lifted and Greece remains in the eurozone. The latter would require a resolution for the Greek banks. That would be the ideal scenario but it is hard to do. Since the eurozone lacks a true banking union, the only route to bank recapitalisation would be through another round of negotiations between Greece and its creditors.

Read more …

Big risk.

• Greek BofA Strategist Sees Humanitarian Disaster Looming (Bloomberg)

Athanasios Vamvakidis, Bank of America’s head of European currency strategy, is in a difficult spot: He advises clients from London on how to make money – or at least minimize losses – as his homeland unravels. His view: Greek banks will soon exhaust cash supplies, leading to shortages of imports including medicine unless the ECB expands assistance, he said in an interview. A July 5 referendum on austerity measures probably will usher in August elections and a potential new government. Then “the earliest Greece will get any new funding is September or later – in the meantime, the economy will collapse,” Vamvakidis said. “On a personal level, this is a very bad situation. And the worst is still ahead of us.”

To prevent a crisis, the ECB will have to boost the Emergency Liquidity Assistance program long beforehand, continuing to ensure Greek lenders have enough cash on hand, the strategist said. “Otherwise, you’ll have a humanitarian disaster,” he said. “People will start to be affected when they can’t withdraw their paychecks, when you start to see shortages because Greece imports many of its products. For instance medications are imported, some food items are imported.” Greece imposed emergency capital controls for its financial system early Monday, closing banks and financial markets after the announcement of the referendum fueled concern the country will exit the euro. Over the weekend, citizens lined up at ATMs to withdraw savings. They are now limited to €60 in daily withdrawals.

The referendum probably will result in a “yes” vote to proposed reforms as most Greeks want to remain part of the euro, Vamvakidis said. A “no” vote could result in bank failures as the ECB closes its emergency liquidity facility, he said. Without more ECB help, “banks will run out of money soon,” he said. “Within the limits, we will need more euro notes in Greece.”

Read more …

Greece 2 or Detroit 2?

• Puerto Rico Has No Easy Path Out of Debt Crisis (WSJ)

Its economy has been mired in recession for years. The public is fed up with austerity. Investors want big premiums to lend to a government deep in debt, with no ability to devalue its currency. Greece? Try Puerto Rico, the U.S. commonwealth whose long-simmering debt crisis—its $72 billion debt equals nearly 70% of its economic output, far more than any U.S. state—is about to come to a boil. The commonwealth’s governor, Alejandro García Padilla, is expected to lay out in a speech on Monday next steps that could include calls for significant concessions from the island’s creditors, according to people familiar with the matter. The change in course for the central government comes months after it commissioned former IMF officials to draft a long-term plan for the commonwealth’s finances, which is expected to offer a grim assessment.

Credit-rating companies this week expect the island’s electricity provider, which has borrowed $9 billion, to miss a payment to creditors, in what would be one of the largest municipal defaults ever. Things don’t get better after that. Analysts believe the central government will run out of cash as soon as July, which could lead to a government shutdown, employee furloughs and other emergency measures. “This is going to be painful for the next two to three years,” said Rep. Pedro Pierluisi, the island’s Democratic representative in the U.S. House, in an interview. “The government is facing serious cash-flow issues.” Many analysts have concluded the island has more debt than it can afford to repay given its listless economy.

“It’s a Sisyphean task,” said Richard Ravitch, the former New York lieutenant governor who steered New York City’s financial restructuring in the 1970s and is currently advising Detroit. So how did the U.S. end up with its own version of Greece? Puerto Rico’s problems date to the end of the Cold War, when the U.S. began closing military bases on the island, whose residents have American citizenship but don’t pay federal tax on their local income. The expiration of corporate tax breaks in 2006 prompted an exodus of pharmaceutical and other manufacturers, nudging the island into a deep recession. As the economy has worsened, migration to the U.S. mainland has accelerated, further shrinking the tax base. Puerto Rico’s population has fallen 4.7% since 2010 to 3.5 million, a period when the U.S. overall grew 3%.

Read more …

Grandmas on quaaludes.

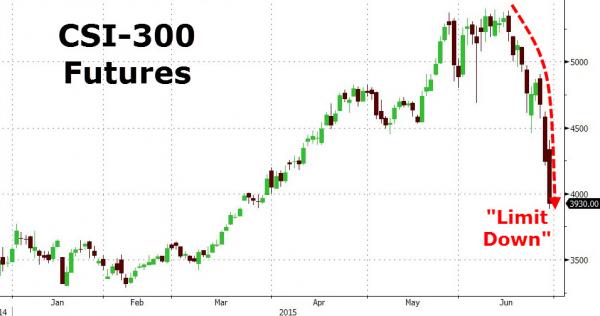

• China’s Stocks Post Biggest Gain Since 2009 as Volatility Soars (Bloomberg)

Chinese stocks rallied, sparking the benchmark index’s biggest intraday swing since 1992, on speculation the government will take steps to prevent bear-market losses from deepening. The Shanghai Composite Index rose for the first in four days, jumping 5.5% to 4,277.22 at the close, the most since March 2009. The gauge swung 432 points from the highs and lows, propelling a volatility measure to a seven-year peak. An industry group representing brokerages called on investors and fund managers to take responsibility to stabilize the market after a weekend interest-rate cut failed to stem a rout.

“After the recent correction, investors might think stocks are oversold and hope regulators will introduce further measures to support the market,” said Shen Zhengyang, an analyst at Northeast Securities Co. in Shanghai. “The fund industry association’s remarks on stocks might also have boosted investor confidence.” Speculation is growing that policy makers are preparing support measures after the Shanghai Composite plunged more than 20% from a June 12 peak amid surging valuations and concern record high levels of borrowing to buy stocks were unsustainable.

Read more …