Lewis Wickes Hine ‘Hot dogs’ for fans waiting for gates to open at Ebbets Field 1920

Inherent in the system design.

• Americans Throw Out $165 Billion Worth Of Food Every Year (MarketWatch)

Americans are concerned about wasting food — yet they just can’t seem to stop throwing it out. Some 76% of households say they throw away leftovers at least once a month, while 53% throw them away every week, according to a survey released Wednesday of 1,000 consumers by market research firm TNS Global on behalf of the American Chemistry Council. (The latter is a trade organization for the U.S. plastics industry and so has a vested interest in people using its products to preserve food.) Despite throwing out food, 70% of people say they are bothered by the amount of food wasted in the U.S. Respondents estimated wasting $640 in household food each year — but U.S. government figures estimate people waste closer to $900.

Previous reports suggest even more people throw out unwanted or expired food. Over 90% of Americans may be prematurely tossing food because they misinterpret expiration dates, according to a separate 2013 study released by Harvard Law School’s Food Law and Policy Clinic and the Natural Resources Defense Council, or NRDC, a nonprofit environmental action group. Phrases like “sell by,” “use by,” and “best before” are poorly regulated and often misinterpreted, the report found: “It is time for a well-intended but wildly ineffective food date labeling system to get a makeover.”

Faulty expiration-date rules are confusing at best and, according to another report released this month by Johns Hopkins Bloomberg School of Public Health, the desire to only eat the freshest food and food safety concerns are the two main reasons for throwing it out. “Sell by” dates are actually for stores to know how much shelf life products have. They are not meant to indicate the food is bad. “Best before” and “use by” dates are for consumers, but they are manufacturers’ estimates as to when food reaches its peak. For most food, manufacturers are free to determine the shelf life for their own products.

A different angle from mine, but the same conclusion.

• Europe, A Big Phony (Costas Iordanidis)

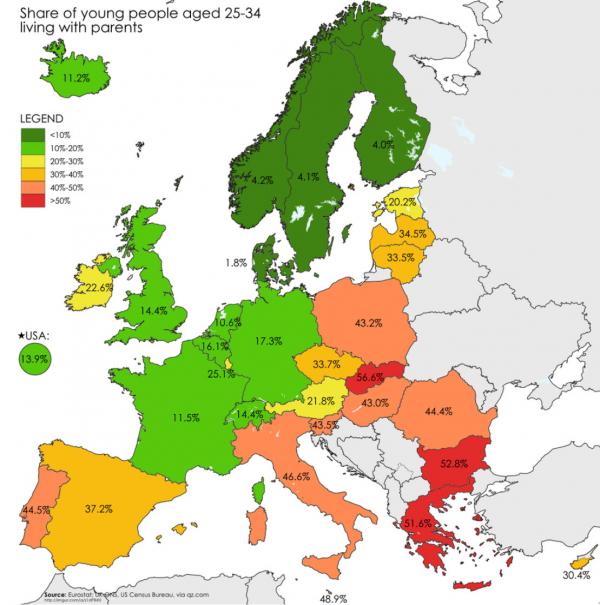

On September 11, 2001, the US was the target of an unprecedented terrorist attack. But the country quickly regained its composure. The Americans reacted in the way they felt was the most appropriate, as a unified country ready to defend its vital interests. On September 15, 2008, Lehman Brothers, the fourth-largest investment bank in the US went bankrupt, but the United States bounced back, some way or another, proving itself to be a country with a sovereign currency and strong leadership. Later, cities in California defaulted one after the other, similarly to other US states which had also gone bankrupt in the past. The issue of exiting the dollar was never raised.

Of course the US is a unified country, with a single, sovereign currency, the most powerful and advanced war machine ever to exist in the history of mankind, while the European Union is a big phony. The bloc’s biggest achievement, the euro, was never a sovereign currency in any country, not even in Germany, although it was developed based on the latter’s fears and old ghosts. Greece went bankrupt in 2010 and the country which accounts for just 2% of the eurozone’s GDP created major panic. Europe’s gigantic bureaucracy was deemed insufficient to devise a plan for dealing with the problem. And so Germany called for the IMF to intervene.

Europe looks down on Alexis Tsipras’s government, and not unjustly, for its obsessions, amateurism and hard to justify delays – it was the same, although to a lesser extent, with previous Greek governments. But what is emerging from Brussels right now is positively morbid. How can a eurozone country and government leaders publicly state that proposals submitted by the Greek administration form a “basis” for discussion and have the IMF take it all back a few days later. Tsipras may well be leading a group of unruly and at times rude associates, but the eurozone leadership’s image is not far from that of a group which changes its mind depending on the whims of one of the three institutions. By the way, Antonis Samaras’s government was brought down because of the IMF’s obsessions.

In any case, this is where things stand right now. Wednesday night saw yet another impasse. Even if we assume that the negotiations are successfully completed on Thursday, the damage done to the notion of the euro is very serious. One way or another, the wall put up by Russia excludes any EU economic expansion to the east. Meanwhile, Germany’s dangerous expansion is being averted for the third time – only this time due to the euro. We Greeks, but also our partners, should stop pretending. The current dynamic lies outside Europe.

Nuclear.

• Greek Problems Mask The Rising Risks In Italy And France (Satyajit Das)

According to John Maynard Keynes “the expected never happens; it is the unexpected always”. Obsessed with the problems of Greece and the European periphery, financial markets are ignoring the rising risks of the core, especially Italy and France. Italy and France face mounting problems of high debt, slow growth, unemployment, poor public finances, lack of competitiveness and an inability to undertake necessary adjustments. Reductions in energy prices combined with low borrowing costs and a weaker euro, engineered by the ECB, cannot hide deep-seated and unresolved problems forever. Italian total real economy debt (government, household and business) is about 259% of gross domestic product, up 55% since 2007. France’s equivalent debt is about 280% of GDP, up 66% since 2007.

This ignores unfunded pension and healthcare obligations as well as contingent commitments to eurozone bailouts. Italy is running a budget deficit of 2.9%. Government debt is around €2.1tn, or 132% of GDP. French public debt is just above €2tn, or 95% of GDP. The current budget deficit is 4.2% of GDP. France’s budget has not been balanced in any single year since 1974. Italy’s economy has shrunk about 10% since 2007, as the country endured a triple-dip recession. Italy’s unemployment is more than 12%, with youth unemployment about 44%. French GDP growth is anaemic, with unemployment above 10% and youth unemployment of more than 25% Trade performance is lacklustre. Italy’s current account surplus of 1.9% reflects deterioration of the domestic economy rather than export prowess.

France’s current account deficit is about 0.9% of GDP, reflecting a declining share of the global export market. Italy and France’s problems are structural, rather than attributable to the eurozone debt crisis. High wages, inflexible labour markets, generous welfare benefits, large public sectors and restrictive trade practices are major issues. In the World Economic Forum’s competitiveness rankings, Italy and France ranked 49th and 23rd respectively, well behind Germany (fourth) and Britain (10th). In World Bank studies, Italy and France rank 56th and 31st in terms of ease of doing business. Transparency International ranks Italy 69 out of 175 countries in perceived levels of public corruption, comparable to Romania, Greece and Bulgaria.

The lack of competitiveness is exacerbated by the single currency. Italy and France faced a 15-25% overvalued currency until the recent decline in the euro. Denied the historically preferred option of devaluation of the lira or franc to improve international competitiveness, both countries have relied increasingly in recent times on debt-funded public spending to maintain economic activity and living standards.

Cameron’s a side show in Europe, can’t get any attention.

• Britain Would Not Survive A Vote For Brexit (FT)

Promising a referendum on Britain’s place in Europe was always a rash gamble — a tactical swerve blind to the strategic consequences. The stakes have risen. The rest of Europe does not want to see the Brits depart, but the EU would muddle on. For the UK, the choice has become existential. If Britain leaves Europe, Scotland will leave Britain. The union of the United Kingdom would not long survive Brexit. The referendum was offered to appease troublesome eurosceptics in David Cameron’s Conservative party. Some hope. There are signs the prime minister has begun to appreciate what is at stake. Never mind talk that he may be remembered as the leader who split his own party, or as the architect of Britain’s retreat from its own continent.

History will be even less kind if it records that a device to quell a Tory rebellion about Europe led to the unravelling of England’s union with Scotland. Mr Cameron’s government has lowered its sights accordingly. When Philip Hammond toured European capitals before the May election 25 of his 27 counterparts told the British foreign secretary that they would not rewrite the basic texts of the EU to accommodate British exceptionalism. Angela Merkel, the German chancellor, is particularly insistent that the Union’s organising “acquis” is sacrosanct. So the prime minister’s pre-election promise of “full-on treaty change” has made way for a more modest set of demands.

Mr Cameron has struck an emollient pose in his own post-election journey around EU chancelleries. What has emerged is a careful choreography for the negotiating process. As he explained it to Ms Merkel, the plan is to avoid undue acrimony and, for the most part, to keep the nitty gritty of negotiations low key and under wraps. The prime minister will stick to generalities at this week’s Brussels summit. His favourite refrain speaks of a “reformed Europe”, whatever that means. He wants an opt-out from the (never defined) treaty aspiration of ever closer union of the peoples of Europe, safeguards for the City of London against eurozone caucusing, and a motherhood-and-apple-pie declaration that Europe is about competition rather than regulation. Finally, he is asking for leeway to restrict in-work benefits paid to workers from the rest of the EU.

And nobody should.

• Greece: A Deal Nobody Believes In (Paul Mason)

The deal Greece wants in Brussels has three parts: budget, debt and public investment. In the flurry of last-minute negotiations, conducted under threat of a bank run and capital controls, the media has been obsessed with the first. The Greek newspaper Kathimerini carried the full Greek proposal on the budget for 2015-17, designed by Syriza’s negotiators to achieve the surplus target the IMF/ECB and EU have imposed. It is, as one of the ministers presenting it told me, “terrible”. To avoid cutting services and pensions further, Syriza is preparing to hit businesses, consumers and employees with a mixture of tax and higher contributions to their pensions. It will also raise the retirement age to 67 over the next 10 years, and severely limit incentives to early retirement.

The proposal meets the top line targets of the lenders but last night they were still haggling over the precise structure of VAT, pensions and “product market reform” – which is the codeword for the IMF’s obsession with Greek pharmacies and bakeries. While the proposal has caused outrage among the Greek conservatives who were only last week calling for a deal, and outrage among Syriza’s left-wing voters, and the 5,000 communist-led pensioners who staged a march last night, the real problem is bigger. Everything we’ve seen so far suggests it will not work. The lenders, as one senior participant in the talks put it to me, “do not do macroeconomics”. The models used in the EU’s negotiations assume that if you whack an €8bn tax rise on to an economy in recession it will at the very least only shrink by €8bn, and may even grow.

But the experience of Greek austerity – and this tax package is simply left austerity – shows you have to consider the “multiplier effects”. The IMF has already said its own model on this was flawed, and that the macroeconomic effect of cutting one euro could be not 50 cents but more like €1.50. The reason the IMF and EU are trying to tinker with stuff like VAT and bakeries is because they suspect that a switch from harsh spending cuts to harsh, redistributive tax rises will have the same overall impact: the economy will shrink and the debt will get larger. But a redistributive programme is all Syriza can sell to the people who voted for it. When they drew up this proposal the Greeks did so in the knowledge that it would need tens of billions of debt relief and tens of billions of structural funding from the EU to cushion the blow.

But the lenders are resisting. When it comes to debt, as one participant described it to me, the lenders are “each at war with the other”. The IMF wants debt write-offs; the ECB wants no debt write-offs. The proposal being discussed is to swap €27bn of debt Greece owes to the ECB into a programme called the ESM, where redemptions are decades away and interest rates low. It would mean paying the ECB out of a fund owned by national governments. I understand that, without some clear indication that debt relief is on the agenda, the Greeks cannot sign. Likewise, they are determined there should be an agreement to release structural funds for development projects from the European Commission.

Red lines vs red ink.

• Troika’s Red Ink Tells Its Own Story (Guardian)

The red ink told its own story. Greece’s creditors looked at the plan submitted by Alexis Tsipras to end his country’s debt crisis and found it wanting. Like a teacher dealing with an obtuse pupil, the message in the revised document sent back to the Greeks was simple: this is a shoddy piece of work. Do it again. Without question, this makes life tough for the Greek prime minister, who thought the concessions offered on Monday were as much as he could deliver politically. Tsipras bridled at the demands from the troika to cross all his red lines and that means the crisis is back on again.

Athens should not have been entirely surprised by the response given that the IMF – one third of the troika – thinks a repair job on the public finances should be structured so that 80% of the improvement comes through spending cuts and 20% from tax increases. The plan put forward by Tsipras was skewed in the other direction. Of the €7.9bn (£5.6bn) that the Greek government said the plan would raise, 92% came from tax increases. In the unlikely event that the extra revenues were collected in full, the IMF believes the one-off levy on bigger businesses coupled with the increases in corporation tax would hinder growth. It thinks the Greek plan will only add up if there are immediate cuts in pensions and higher VAT on restaurants and medical supplies.

Olivier Blanchard, the IMF’s chief economist, explained its reasoning earlier this month. Greece’s creditors, he said, were prepared to accept that the state of the economy meant it was now impossible to meet the target of running a 3% primary budget surplus (revenues minus spending, excluding debt interest payments) in 2015, and that a lower 1% goal would now be acceptable to creditors. “We believe that even the lower new target cannot be credibly achieved without a comprehensive reform of the VAT – involving a widening of its base – and a further adjustment of pensions”, Blanchard said in a blogpost.

“There cannot be a deal without a substantial reference and specific steps on the issue of debt..”

• Greek Syriza Official Says Lenders’ Proposals ‘Blackmail’ (Reuters)

A senior official of Greece’s ruling Syriza party attacked the latest proposals from international lenders as “blackmail” on Thursday, highlighting the deep divisions between Athens and its creditors as wrangling continued over a bailout deal. “The lenders’ demand to bring annihilating measures back to the table shows that the blackmail against Greece is reaching a climax,” Nikos Filis, the ruling Syriza party’s parliamentary spokesman told Mega TV. He said the Greek side was maintaining its insistence on debt relief as part of any accord, in comments that were echoed by Labour Minister Panos Skourletis. “There cannot be a deal without a substantial reference and specific steps on the issue of debt,” Skourletis said in an interview with state broadcaster ERT.

“Speculation the EU was seeking political alternatives to Mr Tsipras’s Leftist Syriza government were heightened after leader of Greece’s centrist opposition party, To Potami also met with Brussels officials on Wednesday.”

• Last-Ditch Greek Rescue Hopes; Tsipras Faces Austerity Ultimatum (Telegraph)

Greece’s eurozone future was thrown into fresh turmoil on Wednesday night as talks broke down after creditor powers demanded further austerity measures to release the funds the country needs to avoid a debt default. Dashing tentative hopes that an agreement could be struck at European Union leaders summit on Thursday, a meeting of finance ministers was suspended after only an hour as Prime Minister Tsipras was summoned for further late night talks with his bail-out chiefs. Earlier in the day, Greece’s three lending institutions rejected Athens’ €8bn reform plans, despite widely hailing it as a positive step forward only days ago. Greece now faces an imminent debt default and expiration of its bail-out June 30.

In a five-page set of counter proposals, creditors instead demanded Athens’ Leftist government carry out more spending cuts, abolish exemptions on VAT and implement a root and branch overhaul of its pensions system. The breakdown came after Athens seemed to renege on its previous commitments to end tax privileges for its islands and phase out supplementary pensions for the poorest. But the government was quick to reject the new demands, attacking them as “absurd” and sure to bring “Armageddon” to the beleaguered economy . Having been hauled back to Brussels on Wednesday morning, a wounded Mr Tsipras released an ambiguous statement suggesting ulterior motives behind lenders’ fresh demands.

“The repeated rejection of equivalent measures by certain institutions never occurred before — neither in Ireland nor in Portugal,” he said. “This curious stance may conceal one of two possibilities: either they don’t want an agreement or they are serving specific interest groups in Greece.” Mr Tsipras spent Wednesday holed up in more than seven hours of talks with European Commission president Jean-Claude Juncker, IMF managing director Christine Lagarde, and ECB chief Mario Draghi, as the sides sought to thrash out their differences.

[..] Speculation the EU was seeking political alternatives to Mr Tsipras’s Leftist Syriza government were heightened after leader of Greece’s centrist opposition party, To Potami also met with Brussels officials on Wednesday. After a meeting with EU economics chief Pierre Moscovici, party leader Stavros Theodorakis said the country should “cut down on expenditures and excessive spending in the public sector, so that we can save money without imposing further taxes”. To Potami holds 17 seats in the Greek parliament, a margin which could be crucial in any vote to pass a deal through should it emerge from the fractious round of talks.

The troika keeps leaking to the press, and nobody protests that.

• Greece Debt Crisis Talks End In Renewed Deadlock (Guardian)

Gruelling negotiations between Greece and its creditors broke up without agreement on Wednesday evening as lenders warned the country that it must accept more austerity if it is to avoid defaulting on its debts. A third meeting of eurozone finance ministers in less than a week was called to a halt amid fresh deadlock over an agreement on greater spending cuts in Athens in exchange for rescue funds. The finance ministers will reassemble on Thursday in a bid to achieve an elusive breakthrough, as Greece strives to meet next Tuesday’s deadline for a €1.6bn payment to the IMF. A deal could not be reached at the finance minister’s gathering despite six hours of talks earlier in the day between Alexis Tsipras, the Greek PM, and the heads of the IMF, ECB and EC. Tsipras met the creditors again on Wednesday night.

The meeting ended in the early hours of Thursday with Greece “remaining firm on its position” according to a Greek government official. Tsipras was dressed down at the creditors’ meeting on Wednesday morning, despite having presented new budget proposals on Monday that were generally welcomed as constructive. However, by the time he met the creditors on Wednesday he was being asked to toughen his plans. Tsipras sounded bitter and wounded after the creditors, led by Christine Lagarde of the International Monetary Fund, raised a host of problems with the 11-page policy document he had tabled. A revised version of the Greek proposals, littered with corrections entered in red type by the creditors, was soon leaked to the media.

“The repeated rejection of equivalent measures by certain institutions never occurred before, neither in [bailout countries] Ireland nor Portugal,” said Tsipras. “This odd stance seems to indicate that either there is no interest in an agreement or that special interests are being backed.” Both sides are in a race to cut a deal before five years of bailouts worth €240bn (£171bn) lapse next Tuesday, the same day that Greece must repay the IMF. The Tuesday deadline is doubly pressing because the ECB, which is keeping the Greek banking system on life support, has indicated that it will not support banks if the bailout programme expires without a new agreement in place. Without ECB’s support Greek banks are expected to buckle, which would force the Tsipras government to impose capital controls and threaten the country’s exit from the eurozone.

“This strange position maybe hides two things: either they do not want an agreement or they are serving specific interests in Greece,” Tsipras said.”

• Greece Rejects Creditors’ Counter-Proposals (AFP)

Greece rejected Wednesday “counter proposals” from creditors that were issued in response to Athens’ latest budgetary plan, in light of the IMF’s position, a government source said. Questioned about whether “this counter proposal” – containing even bigger VAT tax hikes and public spending cutbacks – had been rejected by the radical left Greek government, the source replied: “Yes.” Creditors are calling for early retirement to be abolished and an increase in the retirement age from 62 to 67 by 2022, and not 2025, according to plans published on a leftist website and confirmed by the source. They are sticking to a demand for a rate of 23% for VAT, or value-added tax, for restaurants, instead of 13% at the moment. Athens is fearful over the impact on its valuable tourism sector.

Creditors also propose to increase the level of corporation tax to 28%, instead of the Greek plan to raise it to 29% from 2016 onwards. The current level is 26%. And they want defence expenditure to be slashed by 400 million euros instead of the proposed 200 million euros. Creditors also seek the removal of special VAT rates for residents of the Aegean islands. Earlier Wednesday, Greek Prime Minister Alexis Tsipras launched a scathing attack on the IMF for rejecting Greek reform proposals before arriving in Brussels, denting hopes of a final deal. The leftist leader hit out at the “strange position” of the creditors just minutes before going into an eleventh-hour meeting with key lenders including IMF chief Christine Lagarde and the European Union.

“This strange position maybe hides two things: either they do not want an agreement or they are serving specific interests in Greece,” Tsipras said. “The repeated rejection of equivalent measures by certain institutions never occurred before – neither in Ireland nor Portugal,” he tweeted, referring to previous bailouts in those two countries. The EU-IMF creditors were due to present Tsipras with their own “common position” in response to the last-ditch list of reform proposals submitted by Athens on Sunday, sources said. The Greek plans aimed to raise some VAT rates and hike business taxes, increase employee and employer pension contributions, and narrow the country’s budgetary gap.

The worst kind of journalism. Greek brinkmanship is the first sign. But not mentioning that the ECB itself went public about capital controls risk, and then provided ELA, is quite another yet. It’s an ugly game.

• How Draghi Shifted ECB Crisis Tactic Amid Greek Brinkmanship (Bloomberg)

Mario Draghi can’t afford to play by the same crisis rules as the European Central Bank did in the past. With Ireland in 2010 and Cyprus in 2013, a threat to withhold aid for lenders forced each country to agree to international bailouts. This time, Greece’s appetite for brinkmanship has so far left the ECB president dependent on Europe’s politicians to deliver the ultimatums, while policy makers have reluctantly kept Greek banks afloat. Through weekly, and now almost daily, doses of liquidity, ECB support for those institutions has given Greece’s government room to negotiate a bailout with creditors until the eleventh hour without imposing capital controls. That’s riled sticklers for rules on the ECB Governing Council, but such pliancy is a price Draghi may have paid to keep the euro intact.

“What strikes me is the patience which the ECB has found in all of this,” said Holger Schmieding, chief economist at Berenberg Bank in London. “This was too much of a political decision for the ECB. Ireland didn’t look like falling out of the euro, and Cyprus was much more marginal. So sometimes you discover a flexibility that you weren’t aware of before.” So-called Emergency Liquidity Assistance for banks has been part of the ECB’s toolkit since its foundation. It was intended to allow authorities to tide over solvent lenders who could neither raise funding in markets nor had collateral for regular ECB tenders. The measure was never meant to save whole countries. That’s what it’s now doing.

While Greece didn’t ask for an increase in assistance on Wednesday, according to a person familiar with the matter, it has needed fresh approval for a higher ELA limit four times in the past week. Via the Greek central bank, the ECB is replacing money withdrawn by depositors fearful that the government can’t agree a deal with its creditors, allowing lenders to rack up an overdraft of almost €90 billion since February. ELA cash loaned against state-guaranteed bank bonds and government debt at its 2012 peak amounted to almost 63% of Greek GDP, far more than the equivalent measure in Ireland or Cyprus. Now, Draghi says total liquidity support to Greece amounts to €118 billion euros, or about 66% of GDP, the highest level of any country in the euro.

They smell power.

• To Potami Leader Warns Tsipras Over Bailout Reshuffle (FT)

Alexis Tsipras will need to reshuffle his governing coalition if he suffers significant defections over a new bailout agreement, the head of Greece’s largest pro-EU protest party has warned. Stavros Theodorakis, leader of centre-left To Potami, said he discussed the possibility of such a reshuffle with Mr Tsipras during meetings last week, and predicted there would be “a lot of objections” from the prime minister’s far-left Syriza party when the measures are put to a vote. “That is something that will be discussed, and Tsipras will face, after passing the agreement through parliament, after he sees which members of his party — or members of his government — did not vote for the agreement,” Mr Theodorakis said in an interview with the Financial Times.

“We do not want to wound the prime minister when he’s in the middle of these hard negotiations,” he added. “But I can say Syriza has a choice: either Syriza will change or it will be beaten.” Mr Theodorakis, a charismatic former television journalist, created To Potami — The River — from scratch ahead of January’s national elections and rode a wave of mainstream protests to secure 17 seats in parliament, the third largest in the 300-seat chamber. Because of his populist credentials, Mr Theodorakis was seen as a natural coalition partner for Mr Tsipras shortly after the election. But because of its overtly pro-EU stance, To Potami was bypassed by Mr Tsipras for the right-wing nationalist Independent Greeks party, which — like Syriza — vowed to reject Greece’s international bailout.

Talked about him yesterday. A tool.

• Martin Schulz, The Man Who Would Be Caliph (Neurope)

There is a French cartoon character, Iznogood, a vizier whose only goal in life is to become Caliph in place of the Caliph… telling everybody he wants to be “Caliph in place of the Caliph”. He is shaken by fits of anger when he realises his goal remains distant. In his comic-book hubris, Iznogood, with his goatee and permanent bad mood, never puts forth his qualities (if any) for the coveted job. He only stomps the ground in irritation and shouts: “I want to be Caliph. I’ve been here long enough”. Martin Schulz has been around for more than 20 years. He first entered the European Parliament in 1994, as a German Socialist MEP, never to leave it again. He has been speaker of the Parliament since 2012, but last year he missed the Caliphate: the presidency of the Commission.

The Commission job is the most prestigious in the EU institutions. The President of the Commission is (almost) the equivalent of a chief of state. One had only to see how Jose Manuel Barroso was blushing and beaming, satisfaction oozing from his pores, whenever he was called “Mr President”. So, Schulz wanted to become Caliph after Caliph Barroso. What were his qualifications for running the Commission and becoming Caliph? Well, first of all, again, he’s been around long enough. He also carries the aura of a martyr: a decade ago, Berlusconi, angered by Schulz’s criticism of him, suggested in a plenary that he, Schulz, would be perfect in the role of a Nazi camp guard, as an extra in a movie. Astonishment: what? Was Schulz already here 10 years ago? Of course he was…

How about his studies? Martin Schulz is a rare case for someone in his position. No studies. Schulz never finished school. He doesn’t even have his Abitur, that German diploma that is as hard to obtain as the one marking the baccalaureate in France. In his youth, he dreamed of becoming a football player, but, as he told the German tabloid Bild, he became an alcoholic instead. He was saved from alcohol by his brother and became a bookseller, and even had his own bookshop for a decade before entering the SPD, the German Social Democrat party. In order to ensure that he might get the presidency of the Commission, he fought hard to have the capitals accept the principle of consulting with the major political groups in the EU Parliament when they nominate the Commission President.

Sinn’s a tool AND a douche.

• IMF Must Help Europe With ‘Aggressive’ Athens: Sinn (CNBC)

Greece’s far-left government have proved “aggressive” in lengthy cash-for-reforms talks, the head of an influential German think tank told CNBC, adding that all of Athens’ bailout supervisors must share the strain of negotiating. “You have seen what kind of wording Greece used during the crisis to really change the mood in Europe and I think it’s fair to say they have been aggressive,” the president of the Ifo Institute for Economic Research, Hans Werner-Sinn, told CNBC on Wednesday. He added: “It is easier for the Europeans if the IMF (International Monetary Fund) shares in the burden of absorbing this attitude, rather than everything being imposed on the other European countries – this is a recipe for hassle and strife.”

Greece is engulfed in debt to both the ECB and the IMF and needs urgent aid to save it from defaulting on a €1.6 billion debt at the end of the month. However, it has fought against creditors’ demands for further economic, social and political cuts and reforms. “The IMF is skeptical about the Greek proposals as I understand. They say the Greeks promised to increase their taxes, but they have not been very good in raising taxes in the past. So it’s more credible if they promise to cut wages or government employees or pensions and that is the issue about they are discussing,” Sinn told CNBC.

In addition to his role at Ifo, Sinn is an adviser to the Germany economy ministry and a professor of economics and public finance at the University of Munich. He is due to retire from Ifo in March 2016. The veteran economist has previously advocated the benefits for Greece of leaving the euro zone and he reiterated this view on Tuesday. “A ‘Grexit’ is a rescue strategy for Greece because the Greek people will, with the drachma (the Greek currency prior to the adoption of the euro) devaluation, then have more demand for their own products. The imported products will become more expensive and they will go to their farmers, for example,” Sinn told CNBC.

Someone’s going to spin this into a recovery.

• US Credit Card Debt Grew At 11.5% In April, Fastest In Years (Forbes)

EDITOR’S NOTE: Forbes launched Secrets From An Ex-Banker: How To Crush Credit Card Debt, our latest eBook. Written by a former banker, this book reveals tips and tricks to get you out of credit card debt within three years.

Secrets From An Ex-Banker: An eBook From Forbes If running from the collection agencies isn’t your exercise of choice, read this book for tips and tricks on how to crush credit card debt. We are a nation addicted to credit card debt. Americans have amassed $857 billion of it. As we begin to forget the 2008 financial crisis, banks have once again started aggressively marketing credit cards. I receive mail every week promising me bonus points, extra cash back and a lifetime of plastic-induced happiness. The marketing is working. In April, credit card debt grew at 11.5%, its fastest pace in years.

Credit cards can be remarkably useful and lucrative spending tools, when used responsibly. If you pay your balance in full and on time every month, you are receiving an interest free loan, often with some airline miles on top. However, over 40% of Americans are not able to pay their balance in full. Instead, they are borrowing money at interest rates that are usually well above 15%. That means the typical family is paying over $1,500 of interest every year. In a world where middle class families feel increasingly squeezed, this is too much money to be lost to interest.

Why do credit cards have this power over us? Why does the average household have more than $10,000 of credit card debt at interest rates well above 15%? And how can we break the cycle and get out of debt? Today I am publishing a Forbes eBook, “Secrets from An Ex-Banker: How To Crush Credit Card Debt.” This book uses my nearly 15 years of insider experience as a credit card executive to help you become debt-free forever. I helped introduce credit cards to the Russian market with Citibank. I ran the UK consumer credit card franchise of Barclays. But now I am focused on using my knowledge of how the industry works to help people avoid the tricks, traps and pitfalls of credit card debt.

And there ain’t none left.

• Three Words Count in Bonds: Liquidity, Liquidity, Liquidity (Bloomberg)

There are three things that matter in the bond market these days: liquidity, liquidity and liquidity. How – or whether – investors can trade without having prices move against them has become a major worry as bonds globally tanked in the past few months. As a result, liquidity, or the lack of it, is skewing markets in new and surprising ways. Spain, for instance, must pay more to borrow money than Italy for 30 years, even though Spain is considered safer by credit raters. Why? The Italian bond market is twice as big as the Spanish one — and, therefore, more liquid. The same thing is happening around the world. Bonds in smaller, less-traded markets like Finland, Singapore and Canada are starting to fall out of favor.

And with the Federal Reserve preparing to raise U.S. interest rates, investors want to know they can sell in a hurry if debt markets turn volatile. “Liquidity is our number-one criteria in country selection,” said Olivier de Larouziere at Natixis Asset Management. Concern liquidity is drying up has intensified as the global bond rout that erupted in April erased more than a half a trillion dollars from sovereign debt and triggered swings some have likened to a once-in-a-generation event. Aberdeen Asset Management Plc has already said it arranged $500 million in credit lines to fund potential withdrawals. In the U.S., regulators will meet with Wall Street firms to discuss how they can prevent post-crisis regulations and central bank policies from sparking a meltdown when the next selloff occurs.

Some investors aren’t waiting to find out. In Spain, where a slump in repurchase agreements and trading of bills sent government-debt turnover in April to lows not seen since at least 2012, they’re starting to demand a bigger premium to own the securities, data compiled by Bloomberg show. Yields on 10-year Spanish bonds reached 2.54 percent on June 16, and rose to the highest versus Italian securities since the end of 2013. Spain’s 30-year bonds are also yielding more than comparable Italian debt. For much of the past year, the relationship was reversed as investors preferred Spain. Part of the shift has to do with the rising cost of trading as liquidity dries up. The difference in yields for buyers and sellers of Spain’s 10-year notes — known as the bid-ask spread — is almost double that in Italy, the data show.

Strong contender for weirdest story of the year.

• Toyota’s Drug Problem, and Japan’s (Pesek)

Toyota has a drug problem. The company and CEO Akio Toyoda are dealing with the fallout from a bizarre case surrounding his newly promoted head of global public relations, Julie Hamp. It all started on June 18, when Hamp, an American who moved to Japan earlier this year, was arrested for allegedly having a controlled drug sent to her from Michigan. The powerful painkiller oxycodone is a relatively common prescription drug in the U.S., but is designated as a narcotic in Japan, where users need permission to import it. Japanese authorities could have chosen to confiscate the 57 pills sent to Hamp and schooled her on local regulations. Instead, they decided to make an example of her in ways that could damage corporate Japan’s efforts to attract foreign talent and diversify its boardrooms.

The day after Hamp’s arrest, Toyoda called a press conference to defend the company’s highest-ranking female executive ever. He launched into a spirited defense, declaring that Hamp hasn’t intentionally broken any laws. Those words came back to haunt Toyoda this week, on Tuesday, when police raided the company’s Toyota City headquarters and its Tokyo and Nagoya offices. The coordinated raids smacked of retribution by the police for Toyoda’s standing by a foreigner over local authorities. What’s even more troubling is that the police made the case public at all. Hamp was forced to do a perp walk on live television. (It led the news on national broadcaster NHK.)

But it’s safe to say the police wouldn’t even have told the media if a male Japanese Toyota executive were allegedly involved in similar lawbreaking. (Japanese law enforcement has never even attempted to arrest officials at Tokyo Electric Power Company for negligent oversight of nuclear reactors at Fukushima, or managers at Takata for selling the company’s faulty airbags.)

Meanwhile, the thrust of the media coverage about Hamp’s ordeal has been cringeworthy. Rather than treat it as an unfortunate aberration, the media have used it as an excuse to pillory companies for trying to attract foreign executives to Japan in the first place. Toyoda’s June 19 press conference was a case in point, filled with insinuating questions: What medical condition does Hamp have that requires pain medication? Why does Hamp live alone? (The answer to that one is that her family hasn’t yet arrived from the U.S.) What is Toyota’s basis for trusting this woman so much? Might this be a harbinger of future problems as diversity efforts increase?

Interesting take.

• How WikiLeaks Could Help Precipitate The Fall Of The Saudi Empire (RT)

Whistleblower group WikiLeaks has released a flurry of official documents lifting the lid on Saudi Arabia’s covert diplomatic apparatus. Not just another scandal, these revelations could bring Saudi Arabia to its knees. While WikiLeaks has seldom shied away from controversy it might just have outdone itself this June as it exposed Saudi Arabia’s grand media scheme to the public, shining a light onto state officials’ unscrupulous dealings as they worked and plotted to silence the truth and manipulate realities to suit their goals. And though many among the public will not be surprised at learning that one of the world’s most violent and repressive governments has actively worked to control the world’s media narrative by applying political and financial pressure upon international news organizations and foreign governments to both forward its agenda and shield its institutions from any political or judicial fallouts.

The sheer depth and breadth of this grand deception will certainly send a few heads spinning. Aided by Al Akhbar, a prominent Lebanese-based newspaper which has remained stubbornly independent despite aggravated pressures, WikiLeaks released last Friday 60,000 classified documents out of a reported half a million leaked diplomatic cables from the Kingdom of Saudi Arabia. Speaking on the content disclosed by WikiLeaks, Kristinn Hrafnsson, a spokesman for the group said “We are seeing how the oil money is being used to increase (the) influence of Saudi Arabia which is substantial of course – this is an ally of the US and the UK. And since this spring it has been waging war in neighboring Yemen.”

While most allies of the kingdom, Britain and the US at the head of the line, have attempted to play down the revelations, arguing the veracity of the leaked documents while redirecting the public’s attention onto other, less sensitive matters, it is pretty evident the kingdom is fast losing its cool. For a country which almost solely relies on control to exist, losing only just a nugget of power can be daunting; especially when the very fabric of the state stands to be obliterated by the very truths which are now being unveiled.