Amedeo Modigliani Jeanne Hebuterne 1919

Build Back Better

https://twitter.com/i/status/1351507371386949639

Could be good news. But I’m a bit reluctant to attach too much meaning to 6 vs 18 infections among 50,777 people. Once you apply normal procedures like margin of error to this, then what are you left with? What would a bookmaker make of it?

• Israel: 60% Drop In Hospitalizations For Age 60+ 3 Weeks After 1st Shot (ToI)

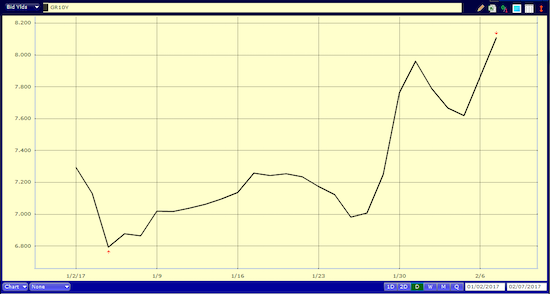

Vaccines are quickly averting serious cases of COVID-19 among the most vulnerable members of society, an Israeli healthcare provider has indicated. The full effects of Pfizer’s vaccine are only slated to kick in around a month after the first shot, but data from Israel, home to the world’s fastest vaccination drive, has already shown that there is a stark drop in infections even before this point. Attracting widespread international interest by sharing early data, Maccabi Healthcare Services reported earlier this month that it has seen a 60 percent reduction in coronavirus infections three weeks after the first shot is administered. But it wasn’t clear if the benefits were being felt equally by those who have a propensity to mild infection and those who would be likely to take COVID-19 badly.

Now, Maccabi is starting to answer the question that hospitals and health ministers around the world are anxiously asking, amid fears of health service meltdowns: How quickly will COVID-19 wards start to see the benefits of vaccination? The decrease in hospital admissions is swift after vaccination, Maccabi suggests in its latest data, finding that hospitalizations start to fall sharply from Day 18 after people receive the first shot. Galia Rahav, head of infectious diseases at Israel’s largest hospital, Sheba Medical Center, described the data as “very important.” By Day 23, which is 2 days after the second shot, there is a 60% drop in hospitalizations among vaccinated people aged 60-plus, Maccabi revealed after monitoring 50,777 patients. It compared their hospitalization rate at that point with their hospitalization rate soon after receiving the vaccine, using 7-day moving averages.

“This is very important data,” Rahav, who is unconnected to the study, told The Times of Israel. “It has an impact because amid high infection rates and the spread of variants it’s hard to see from general figures how vaccination is influencing things. “By giving an insight into hospitalizations among just those elderly people who were vaccinated, this data is valuable.” However, she cautioned that some of the drop may be due to a tendency of newly vaccinated people to adhere to lockdown rules, which causes a drop in infection and hospitalization.The new data also supports Maccabi’s earlier claim of a 60% infection rate drop after three weeks, reporting that it saw the same drop with a new sample comprising only the 60-plus age group. Maccabi’s graph gives a real picture of infection in Israel, showing that until Day 13, vaccinated over-60s had similar infection rates as the overall 60-plus population. Then, a gap opens, and by Day 23, there were 18 daily infections among the 50,777 overall, but just six among the vaccinated.

One dimension is not enough.

• Nevada District To Partially Reopen Schools As Student Suicides Surge (Hill)

The Clark County School District in Nevada is moving to partially reopen schools in response to a surge of student suicides, The New York Times reports. Eighteen students in the county took their own lives in the final nine months of 2020, the Times reports, leading the Clark County school board to approve returning some elementary school grades and struggling classes back to in-person learning despite the continuing spread of the coronavirus. “When we started to see the uptick in children taking their lives, we knew it wasn’t just the COVID numbers we need to look at anymore,” said Clark County superintendent Jesus Jara. “We have to find a way to put our hands on our kids, to see them, to look at them. They’ve got to start seeing some movement, some hope.”

According to Jara, the 18 suicides in the nine months that schools have been closed is double the number of suicides recorded in the school district in the entire previous year. The youngest student to kill themselves was nine years old. The pandemic has had a devastating effect on students’ mental health, grades and attendance around the world and health and education experts have struggled with the best way to protect students – and the faculty, staff and family members who may be more vulnerable – while tending to their mental health and education. In Virginia’s largest school district, the number of F’s nearly doubled among middle school and high school students.

Anthony Fauci, the nation’s leading infectious disease expert, has called for schools to remain open if at all possible, saying there is a way for them to do so safely. The Times reports that Clark County, which includes the city of Las Vegas, invested in the GoGuardian Beacon alert system following the sixth student suicide. The system monitors student writing on iPads provided by the school district, looking for suicide risks. More than 31,000 alerts were made between the months of June and October.

“..they won’t answer why indoor religious services are strictly forbidden while other venues where people gather are just fine..”

• California Refuses To Disclose COVID19 Data Used To Drive Lockdowns (ZH)

California Governor Gavin Newsom (D) promised months ago that the state’s COVID-19 policy decisions would be driven by transparent data that would be shared with the public. Now, his administration is refusing to disclose key information used to determine when lockdown orders are implemented or rescinded – and has denied a public records request filed with the California Health and Human Services (CHHS) Agency on May 28 by the Center for American Liberty (CAL) seeking both the data and science behind the state’s lockdown decisions, according to Fox News. State health officials now say they rely on a ‘very complex set of measurements that would confuse and potentially mislead the public,’ AP reports.

In short, California says you’re too stupid to understand their rationale for mandating thousands of businesses into financial ruin through what appear to be arbitrary and unscientific decisions. To wit, at least two California judges have struck down the state’s draconian mandates over lack of scientific evidence to support lockdowns and restaurant restrictions. Not only that, according to SFGATE, there’s growing speculation that California’s ban on outdoor dining may have contributed to the state’s COVID-19 surge. Not the best of optics as as a GOP effort to recall Newsom continues to gain momentum. According to CAL executive director Mark Trammel, the Golden State won’t answer why, for example, they won’t answer why indoor religious services are strictly forbidden while other venues where people gather are just fine.

“If it’s safe enough to go to a marijuana dispensary or Macy’s or Costco that same standard should apply to parishioners in our congregation they should be able to sep in pews and wear a mask,” Trammel told Fox News in a recent interview. Dr. Lee Riley, chairman of UC Berkeley’s School of Public Health infectious disease division thinks the state’s lack of transparency is troubling. “There is more uncertainty created by NOT releasing the data that only the state has access to,” he told the Associated Press in an email.

Get your own variant!

• Covid-19 Variant In California May Explain Sharp Rise In Cases (F.)

The post-Thanksgiving, Christmas, and New Year’s surge of Covid-19 cases has been felt in nearly all 50 states, but perhaps none more so than California. More specifically, Southern California, and even more specifically, Los Angeles County, have been experiencing daily case counts never before seen in the past 11 months. Hospitals have been in surge mode since the week before Christmas, with ICU capacity down to 0% in many facilities. Reminiscent of New York City back in April 2020, refrigerated trucks for deceased bodies of those who succumbed to complications due to Covid-19 infections were seen outside of many hospitals, where morgues became full in recent weeks. Some hospitals have been using tents, hallways, and even hospital gift shops as patient care areas. Some hospitals were operating at 200% capacity.

Most have canceled non-emergency surgeries, procedures, and admissions. Death rates of hospitalized patients have risen, in part due to stresses on personnel and equipment availability, and in part due to the fact that only the very sickest patients would be provided an inpatient hospital bed. Initial thoughts that the relatively cooler weather, even for Southern California, combined with pandemic fatigue and complacency, all in the midst of holiday gatherings and travel, would explain the remarkable uptick in cases, hospitalizations, and deaths. By early January 2021, test positivity in Los Angeles County was in the 20% range, and one Angeleno was dying from Covid every six to eight minutes. But just as the U.K. has identified a more transmissible variant, termed B.1.1.7, South Africa has identified another highly transmissible variant, and a third variant has arisen in Japan and Brazil, California has found one of its own.

The California strain, known as Cal.20C, has been identified in 35-50% of recently diagnosed cases in Los Angeles. And as has been the case for the other variants across the world, all of which have crossed oceans and borders, the Cal.20C variant is more infectious than the prior forms of coronavirus, or SARS-CoV2. In addition, this and the previously identified variants are not necessarily more deadly, nor do they necessarily cause more significant illnesses. The variant, although named for the western-most state, has also been found in other states in the Southwest as well as the Northeast.

“You start looking at obviously, have to be a white person, obviously likely male, libertarians, anyone who loves freedom, liberty, maybe has an American flag outside their house..”

• Tulsi Gabbard: Domestic-Terrorism Bill Targets Almost Half The Country (NR)

Tulsi Gabbard, the former Democratic representative from Hawaii, on Friday expressed concern that a proposed measure to combat domestic terrorism could be used to undermine civil liberties. Gabbard’s comments came during an appearance on Fox News Primetime when host Brian Kilmeade asked her if she was “surprised they’re pushing forward with this extra surveillance on would-be domestic terror.” “It’s so dangerous as you guys have been talking about, this is an issue that all Democrats, Republicans, independents, Libertarians should be extremely concerned about, especially because we don’t have to guess about where this goes or how this ends,” Gabbard said. She continued:

“When you have people like former CIA Director John Brennan openly talking about how he’s spoken with or heard from appointees and nominees in the Biden administration who are already starting to look across our country for these types of movements similar to the insurgencies they’ve seen overseas, that in his words, he says make up this unholy alliance of religious extremists, racists, bigots, he lists a few others and at the end, even libertarians.” She said her concern lies in how officials will define the characteristics they are searching for in potential threats.

“What characteristics are we looking for as we are building this profile of a potential extremist, what are we talking about? Religious extremists, are we talking about Christians, evangelical Christians, what is a religious extremist? Is it somebody who is pro-life? Where do you take this?” Gabbard said. She said the proposed legislation could create “a very dangerous undermining of our civil liberties, our freedoms in our Constitution, and a targeting of almost half of the country.” “You start looking at obviously, have to be a white person, obviously likely male, libertarians, anyone who loves freedom, liberty, maybe has an American flag outside their house, or people who, you know, attended a Trump rally,” Gabbard said.

Tulsi Liberty

https://twitter.com/i/status/1353403241820635136

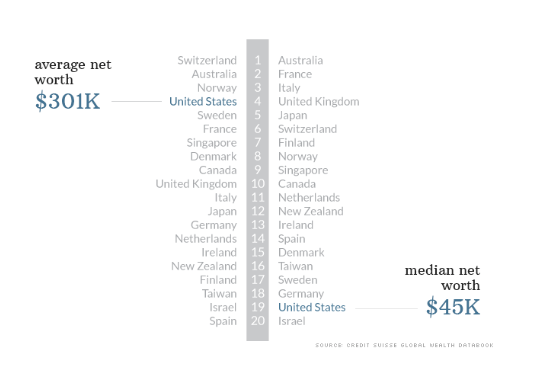

We’ll never know how much. Would it be an idea to just stop this? So a billionaire gets one vote, just like a plumber?

• Biden 2020 Run Backed By $145 Million In ‘Dark Money’ (ZH)

President Biden’s campaign received a record-breaking amount of anonymous donations to outside groups backing him, which means the public “will never have a full accounting of who helped him win the White House,” according to Bloomberg. In total, $145 million in so-called dark money donations, “a type of fundraising Democrats have decried for years,” backed the Biden campaign – and combined with his $1.5 billion record-breaking haul. Of note, Biden’s campaign called for banning certain types of nonprofits from spending money to influence elections, and that any organization spending over $10,000 to benefit a candidate register with the Federal Election Commission (FEC) and disclose its donors. They didn’t specifically call on their own supporters to do so, however.

“That amount of dark money dwarfs the $28.4 million spent on behalf of his rival, former President Donald Trump. And it tops the previous record of $113 million in anonymous donations backing Republican presidential nominee Mitt Romney in 2012. Democrats have said they want to ban dark money as uniquely corrupting, since it allows supporters to quietly back a candidate without scrutiny. Yet in their effort to defeat Trump in 2020, they embraced it.” -Bloomberg. One such dark money recipient, Priorities USA Action Fund designated by Biden as his preferred vehicle for outside spending, backed Biden with $26 million originally (and anonymously) donated to its nonprofit arm, Priorities USA.

Priorities USA Chairman Guy Cecil deflected when asked about the funds, saying in a statement “We weren’t going to unilaterally disarm against Trump and the right- wing forces that enabled him.” Another entity funneling dark money to benefit Biden was the Future Forward PAC, which spent $104 million backing Biden. While they received tens of millions from known sources, such as $46.9 million from Facebook co-founder Dustin Moskovitz, $3 million from Twilio CEO Jeff Lawson, and $2.6 million from Alphabet’s Eric Schmidt – they received $61 million from Future Forward USA Action – none of which requires disclosure of sources.

“I don’t own the Senate seat, it doesn’t belong to me,” he added. “If I want to be back in the U.S Senate, I have to earn that every six years.”

• Rubio: Trump Impeachment Trial Is ‘Stupid’ (Hill)

Sen. Marco Rubio (R-Fla.) said Sunday that he would vote to dismiss the article of impeachment against former President Trump at the earliest opportunity, calling the upcoming Senate trial detrimental to national unity. “I think the trial is stupid,” Rubio said on “Fox News Sunday.” “We already have a flaming fire in this country,” he added, saying the trial would be “a bunch of gasoline.” “The first chance I get to vote to end this trial I’ll do it,” the Florida senator told Fox News’s Chris Wallace. Rubio went on to say that then-President Ford’s pardon of former President Nixon after his resignation was “in hindsight important” for “moving the country forward” despite widespread consensus that Nixon had committed criminal offenses. “I think [Trump is] entitled to due process,” Rubio added.

“The House doesn’t have much of a record of witnesses because they rammed it through very quickly … I think this is going to be very bad for the country.” Sen. Mitt Romney (R-Utah) earlier in the show pushed back on claims that convicting a former president was unconstitutional, saying the “preponderance of opinion” allowed for such a conviction. Romney was the only Republican to vote for conviction in the president’s early 2020 impeachment trial. Wallace went on to ask Rubio, who is up for reelection in 2022, about rumors that former White House adviser Ivanka Trump is considering a primary challenge for the Senate seat. “I don’t really get into the parlor games of Washington,” Rubio said. “I don’t own the Senate seat, it doesn’t belong to me,” he added. “If I want to be back in the U.S Senate, I have to earn that every six years.”

“Morale is low among the troops, who described having to stand guard for hours at a time in full gear with limited access to food and water..”

• Impeachment Trial To Keep National Guard Troops At Capitol (Pol.)

Former President Donald Trump’s upcoming Senate impeachment trial poses a security concern that federal law enforcement officials told lawmakers last week requires as many as 5,000 National Guard troops to remain in Washington through mid-March, according to four people familiar with the matter. The contingency force will help protect the Capitol from what was described as “impeachment security concerns,” including the possibility of mass demonstrations coinciding with the Senate’s trial, which is slated to begin the week of Feb. 8. Despite the threat, the citizen soldiers on the ground say they have been given little information about the extension and wonder why they are being forced to endure combat-like conditions in the nation’s capital without a clear mission.

“Quite frankly this is not a ‘combat zone,’ so combat conditions shouldn’t apply,” said one Guard member on the ground in D.C. who has deployed twice to Afghanistan. Several National Guard units have seen their deployments extended involuntarily, though a majority of Guardsmen remaining in Washington will do so on a volunteer basis. Around 7,000 troops will continue to provide riot security through the beginning of February, with that number decreasing slightly to 5,000 by the time Trump’s impeachment trial begins. “We are not going to allow any surprises again,” said one Guard member, referring to the widespread lack of preparedness for the insurrection on Jan. 6. There is also some concern over potential unrest surrounding March 4, the date some QAnon conspiracy theorists believe Trump will be inaugurated for the second time.

[..] Now, thousands of Guard members will remain in Washington far longer than they initially expected when they packed their suitcases for what they believed to be a short-term mission on Jan. 6. The rank-and-file have so far been given no official justifications, threat reports or any explanation for the extended mission, said two Guard members — nor have they seen any violence thus far. “There is no defined situation, or mission statement. … This is very unusual for any military mission,” said one member, who has deployed twice to Afghanistan. “We are usually given a situation, with defined mission perimeters, and at least a tentative plan on how to execute those objectives.”

[..] Morale is low among the troops, who described having to stand guard for hours at a time in full gear with limited access to food and water, waiting for hours to be transported to and from their hotels, and very little sleep. Many are washing socks and cold-weather undergarments in hotel bathroom sinks because they do not have access to laundry facilities. Some have been forced to purchase their own food out of pocket to supplement the sparse meals they have been provided, which do not provide enough calories to sustain the long days. Even meals ready to eat are hard to come by due to logistical and transportation issues. “Even if they do arrive all on time, the calories are just not there for the amount of work we put in and time we’re spending on our feet, in the cold, in full gear,” one Guard member said.

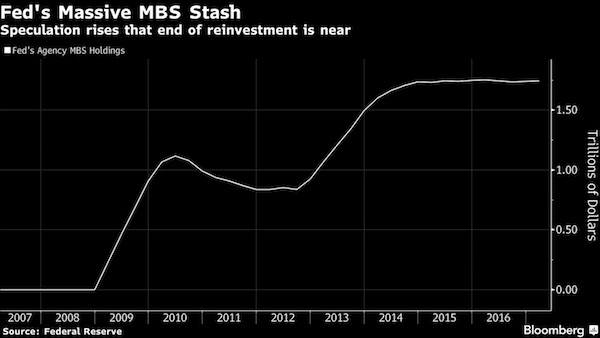

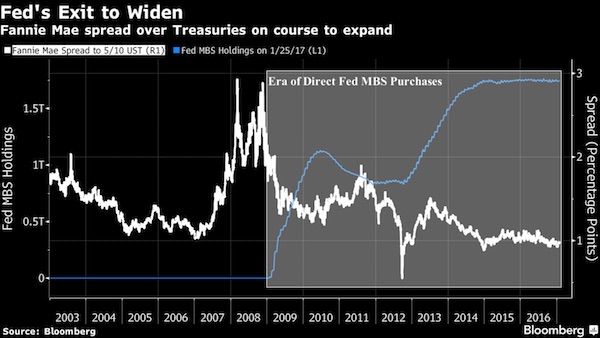

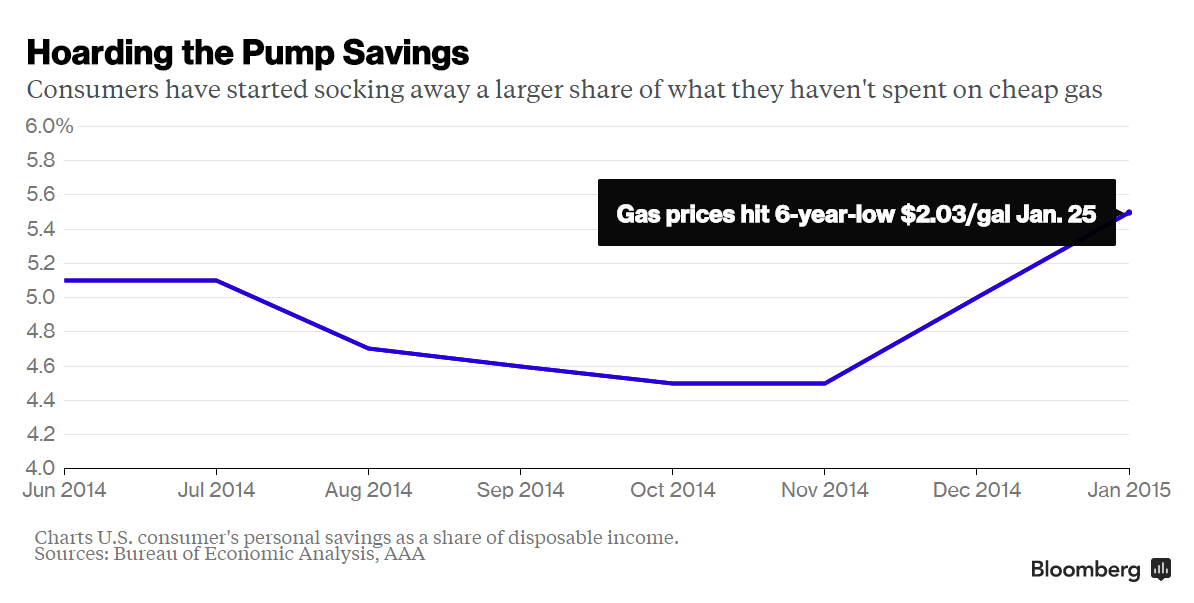

Western stimulus money being transferred out of originating countries because their interest rates are too low.

• UN Agency: China Surpassed US In Foreign Direct Investments In 2020 (Hill)

A United Nations trade agency reported that China surpassed the U.S. as the largest recipient of foreign direct investments (FDI) in 2020. The UN Conference on Trade and Developments (UNCTAD) concluded that China became the largest FDI receiver last year over the U.S., with flows increasing by 4 percent to $163 billion, Bloomberg News reported. Most countries saw decreases due to the coronavirus pandemic, including the U.S., which saw its flow drop by 49 percent to $134 billion, according to UNCTAD’s Investment Trends Monitor. The U.S.’s decrease was seen in wholesale trade, financial services and manufacturing. China’s return to positive GDP growth and targeted investment facilitation program assisted in the country’s FDI levels, the agency noted in a release.

Globally, flows fell by 42 percent to $859 billion due to the coronavirus pandemic, compared to $1.5 trillion in 2019. The global foreign direct investment reached its lowest level since the 1990s, including 30 percent lower than investments after the 2008-2009 financial crisis. North American flows dropped by 46 percent to $166 billion, but Europe saw declines of about 66 percent to negative $4 billion. The decreases were found to be concentrated in developed countries, where flows dropped 69 percent. Meanwhile, developing countries accounted for 72 percent of the global FDI, the highest percentage recorded.

And there’s Sully.

• Boeing 737 Max Cleared To Fly Again ‘Too Early’ (BBC)

A former senior manager at Boeing’s 737 plant in Seattle has raised new concerns over the safety of the company’s 737 Max. The aircraft, which was grounded after two accidents in which 346 people died, has already been cleared to resume flights in North America and Brazil, and is expected to gain approval in Europe this week. But in a new report, Ed Pierson claims that further investigation of electrical issues and production quality problems at the 737 factory is badly needed. Regulators in the US and Europe insist their reviews have been thorough, and that the 737 Max aircraft is now safe. In his report, Mr Pierson claims that regulators and investigators have largely ignored factors, which he believes, may have played a direct role in the accidents. He explicitly links them to conditions at the company’s factory in Renton, near Seattle at the time. Boeing says this is unfounded.

Lion Air flight JT610 crashed into the sea off Indonesia in October 2018. Five months later, Ethiopian Airlines flight ET302 came down minutes after take-off from the Ethiopian capital Addis Ababa. Investigators believe both accidents were triggered by the failure of a single sensor. It sent inaccurate data to a piece of flight control software, called MCAS. This automated system then repeatedly forced the nose of the aircraft downwards, when the pilots were trying to gain height. Ultimately each aircraft was pushed into an unrecoverable dive. Efforts to make the 737 Max safe have focused on redesigning the MCAS software, and ensuring it can no longer be triggered by a single sensor failure.

For Ed Pierson, this does not go nearly far enough. A US Navy veteran, who had a senior role on the 737 production line from 2015-2018, he was a star witness during congressional hearings into the disasters involving the Max. He told lawmakers he had become so concerned about conditions at the factory, he had told his bosses that he was hesitant about taking his own family on a Boeing plane. [..] Mr Pierson’s concerns are supported by the celebrated aviation safety campaigner Captain Chesley Sullenberger. Best known as “Sully”, one of the pilots who safely ditched a crippled and engineless Airbus plane in the Hudson river off Manhattan in 2009, he too believes that modifications to the Max do not go far enough. He believes changes are needed to warning systems aboard the plane, which were carried over from a previous version of the 737 and are “not up to modern standards”.

One member of the Five Eyes defies the others.

• Australia Says ‘Inevitable’ That Facebook & Google Will Pay For Content (RT)

Australia’s treasurer has advised the tech giants to accept that their platforms will have to start paying for content, amid threats from Facebook and Google to limit services in the country if such a policy is enacted. Canberra is finalizing legislation that would require the internet behemoths to obtain licenses to use content created by Australian news outlets. Both companies have warned that they would retaliate over the revenue-sharing scheme, with Google saying last week that it would remove its search engine from Australia, and Facebook declaring that it would strip news from the feeds of all Australian users. On Sunday, Treasurer Josh Frydenberg pushed back on the ultimatums, signaling that the Australian government wouldn’t reverse course.

“My view is that it is inevitable that the digital giants will be paying for original content,” he said, suggesting that Australia was leading the way in what would soon become a worldwide norm. He also admonished Facebook and Google for their hostility towards the proposed regulation, describing their threats to pull out of Australia as a “big disservice.” Google has been particularly unreceptive to the proposed legislation. Earlier this month, it was revealed that the Silicon Valley giant has been experimenting with blacklisting some Australian news sites from its search results, apparently as a future strategy to avoid having to pay for hosting the content. The move shocked Australian media outlets, which accused Google of carrying out a flagrant show of force to stop the revenue-sharing code from becoming law.

A spokesman for Nine, the corporate owners of the Sydney Morning Herald, described the tech behemoth’s “experiment” as a “chilling illustration of their extraordinary market power.” The proposed law was drafted last July following an inquiry by the Australian Competition and Consumer Commission (ACCC). The commission concluded that a large proportion of the country’s media are reliant on referrals from Google and Facebook, despite the fact that news outlets have little or no influence over the powerhouse corporations.

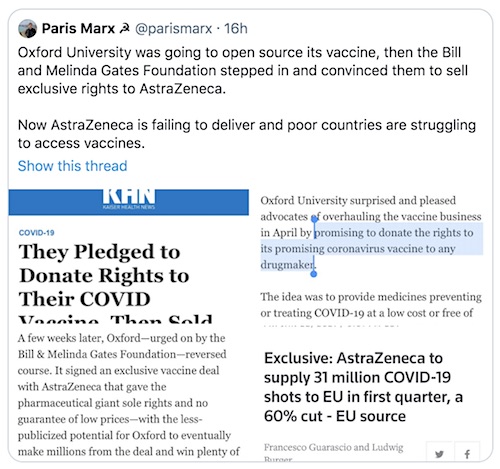

They’re US intelligence pure and simple.

• Facebook Feeds Private Messages of Its Users Directly to the FBI (TFTP)

Deferring all responsibility for the planning of the raid on the capitol, Facebook chief operating officer Sheryl Sandberg had stated shortly after the incident that the protests were largely organized off Facebook. However, she was not telling the truth, and likely knew that large portions of the pro-Trump protests were talked about and organized on Facebook. But was Facebook wiped off the internet like Parler? No, no it was not. Here’s why. This week, Facebook began furnishing the Federal Bureau of Investigation with data on Trump supporters who discussed the events at the capitol on their platform — up to and including their private messages. Through this action the social media giant is acting as a de facto intelligence collecting arm of the US government.

In contrast, when Syed Farook, otherwise known as the San Bernardino mass shooter, wouldn’t unlock his iPhone for the feds, Apple refused to create a backdoor for them to access it acting as an actual private company supporting the privacy rights of its customers. But Facebook is more than willing to open up its data mining services for their friends in the federal government — because, as we have stated numerous times, Facebook is not private. As TFTP reported in 2018, Facebook announced that it partnered with the arm of the government-funded Atlantic Council, known as the Digital Forensic Research Lab that was brought on to help the social media behemoth with “real-time insights and updates on emerging threats and disinformation campaigns from around the world.”

The Atlantic Council is the group that NATO uses to whitewash wars and foster hatred toward Russia, which in turn allows them to continue to justify themselves. It’s funded by arms manufacturers like Raytheon, Lockheed Martin, and Boeing. It is also funded by billionaire oligarchs like the Ukraine’s Victor Pinchuk and Saudi billionaire Bahaa Hariri. The list goes on. The highly unethical HSBC group — who has been caught numerous times laundering money for cartels and terrorists — is listed as one of their top donors. They are also funded by the pharmaceutical industry, Google, Goldman Sachs and others. However, the funding that comes from the United States, the US Army, and the Airforce directly negates the “private” aspect of the partnership. The “think tank” Facebook partnered with to make decisions on who they censor is directly funded by multiple state actors — including the United States — which voids any and all claims that Facebook is a wholly “private actor.”

It’s scary stuff, and it makes you wonder how it links to all the talk of erasing gender-specific words etc.

• Toxic Chemicals Threaten Humanity’s Ability To Reproduce (IC)

Shanna Swan is the senior author of a 2017 study that documented a dramatic drop in sperm counts in Western countries over the past half-century. That meta-analysis of 185 studies involving 42,935 men found that total sperm count fell 59 percent between 1973 and 2011. Swan, a reproductive epidemiologist, pointed to the role of environmental chemicals in that trend. Now she has written “Count Down: How Our Modern World Is Threatening Sperm Counts, Altering Male and Female Reproductive Development, and Imperiling the Future of the Human Race,” a book that ties industrial chemicals in everyday products to a wide range of changes taking place in recent years, including increasing numbers of babies being born with smaller penises; higher rates of erectile dysfunction; declining fertility; eroding sex differences in some animal species; and potentially even behaviors that are thought of as gender-typical.

Your study showed that baby boys who had been exposed to four different phthalates at the end of the first trimester in the womb had a shorter anogenital distance, or AGD. Can you explain what AGD is and why it’s important? Nobody is going to like that term, so you could use taint or gooch instead. But basically it’s the distance between the anus and the beginning of the genitals. And scientists have recognized its importance for a long time. I have a paper from 1912 that looks at AGD and showed that they were nearly 100 percent longer in males than in females. Our work has shown that chemicals, including the diethylhexyl phthalate, shorten the AGD in males.

You’ve also linked phthalate exposure to a lack of interest in sex. Yes, we found a relationship between women’s phthalate levels and their sexual satisfaction. And researchers in China found that workers with higher levels of bisphenol A, commonly known as BPA, in their blood were more likely to have sexual problems, including decreased desire. Of course, phthalates, which are added to plastics, food, cosmetics, and other products, aren’t the only problem. You write about lots of chemicals that interfere with the hormonal system and reproduction, including the pesticide atrazine, which you’ve linked to lower sperm quality, and glyphosate, which you’ve recently shown decreases AGD in rats and perhaps also in humans.

It’s worth pointing out that all of these chemicals we’re talking about are still in use in the U.S., while some other countries have banned them. Anyway, tell me about the relationship between endocrine disrupting chemicals and how children play? Sexually dimorphic play is controversial. Some people say it’s all socially determined. And it undoubtedly does have social determinants, but it also has physiological determinants. And we showed that in two studies. We asked mothers of young children to tell us how their children play. It’s pretty simple: How often do they play with guns? Play with dolls? Play dress-up? Play with tea sets, etc. And it turns out that when boys are exposed to the same chemicals that affect AGD, they play in a less male-typical manner.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.