Pablo Picasso Marie-Thérèse Walter 1937

From what I understand Zebley will be sworn in for the Intelligence Committe part, the last part, but not the Judiciary Committee, the first 3 hours. Hints at them knowing at least some of what’s going to be asked.

• Mueller In Last-Minute Request For Aide To Be With Him During Testimony (NBC)

One of former special counsel Robert Mueller’s longtime aides will appear alongside him during his highly-anticipated testimony before the House Judiciary Committee, a spokesperson said Tuesday, but is not expected to be sworn in. Mueller’s team made a last-minute request that Aaron Zebley be sworn in and testify with him during his scheduled hearings before Congress on Wednesday, a congressional source familiar with the request told NBC News. Mueller is slated to testify on his report into Russian interference in the 2016 election and the country’s influence on President Donald Trump for three hours before the House Judiciary Committee, take a break, then appear for at least two additional hours before the House Intelligence Committee.

For the first hearing, Zebley will sit alongside Mueller as his counsel, according to the Judiciary Committee spokesperson. The committee, however, is not updating its guidance to include Zebley as a witness. This means that Zebley will not be sworn in. Mueller can confer with him as he is questioned by the panel, according to committee rules, but cannot answer questions. The ranking Republican on the Judiciary Committee, Rep. Doug Collins of Georgia, said Tuesday that GOP members had “not gotten assurances from the House Democrats on the committee that he [Zebley] will not speak.”

“He’s not supposed to speak in that role to anyone on the committee or asked questions. And we’re asking, and, frankly, that that be confirmed before the hearing. So we don’t have to waste time with it tomorrow,” Collins said. Jim Popkin, Mueller’s spokesperson, disputed the idea that Zebley’s presence at the hearings amounted to an 11th-hour addition. “Aaron Zebley was the Deputy Special Counsel and had day-to-day oversight of the investigations conducted by the Office,” Popkin said in a statement Tuesday. “He will accompany Special Counsel Mueller to the Wednesday hearings, as was discussed with the committees more than a week ago.”

Mueller’s people asked Barr for guidance on what he can talk about. Wonder how many times they will refer to that guidance when not answering questions. Sort of like taking the fifth.

• Questions for Mueller (Aaron Maté)

”For two years, Democrats have waited on Robert Mueller to deliver a death blow to the Trump presidency,” The New York Times observed on July 20. “On Wednesday, in back-to-back hearings with the former special counsel, that wish could face its final make-or-break moment.” The very fact that Democrats had to subpoena Mueller in order to create this final moment should in fact be the final reminder of what a mistake it was for Democrats to have waited on him. If Mueller had incriminating information yet to share, or had been stymied from doing his work, or if Attorney General William Barr had somehow misrepresented his findings, then it stands to reason that Mueller would be welcoming the opportunity to appear before Congress, not resisting it.

The reality is that Mueller’s investigation did not indict anyone on the Trump campaign for collusion with Russia, or even for anything related to the 2016 election. Mueller’s report found no evidence of a Trump-Russia conspiracy, and even undermined the case for it. That said, there are unresolved matters that Mueller’s testimony could help clarify. Mueller claimed to have established that the Russian government conducted “a sweeping and systematic” interference campaign in order to elect Trump, yet the contents of his report don’t support that allegation. The Mueller report repeatedly excludes countervailing information in order to suggest, misleadingly, that the Trump campaign had suspect “links” and “ties” to people connected with Russia. And Mueller and other intelligence officials involved in the Russia probe made questionable investigative decisions that are worthy of scrutiny.

Horowitz has to finish his report first before Durham can do anything. Today’s hearings are far from the last thing on the topic.

• Robert Mueller, The ‘Magician Of Omission’ On Russia (Solomon)

While most of the political world focused its attention elsewhere, special prosecutor John Durham’s team quietly reached out this summer to a lawyer representing European academic Joseph Mifsud, one of the earliest and most mysterious figures in the now closed Russia-collusion case. An investigator told Swiss attorney Stephan Roh that Durham’s team wanted to interview Mifsud, or at the very least review a recorded deposition the professor gave in summer 2018 about his role in the drama involving Donald Trump, Russia and the 2016 election. The contact, confirmed by multiple sources and contemporaneous email, sent an unmistakable message:

Durham, the U.S. attorney handpicked by Attorney General William Barr to determine whether the FBI committed abuses during the Russia investigation, is taking a second look at one of the noteworthy figures and the conclusions of former special counsel Robert Mueller’s final report. The evidence I reviewed suggests Mueller’s handiwork may be exposed for glaring omissions that, when brought to public light, leave key questions unanswered, especially about how the FBI’s unprecedented probe of the Trump campaign started. Durham is focused on determining whether any government or private figures who came in contact with the Trump campaign in 2016 “were engaged in improper surveillance,” a U.S. official told me when asked about the Mifsud overture.

Is someone going to question Weismann at some point?

• Mueller Deputy Andrew Weissmann’s Offer To An Oligarch Could Hurt DOJ (Solomon)

At the time, pressure was building inside the DOJ and the FBI to find smoking-gun evidence against Trump in the Russia case because the Steele dossier — upon which the early surveillance warrants were based — was turning out to be an uncorroborated mess. (“There’s no big there there,” lead FBI agent Pete Strzok texted a few days before Weissmann’s overture.) Likewise, key evidence that the DOJ used to indict Firtash on corruption charges in 2014 was falling apart. Two central witnesses were in the process of recanting testimony, and a document the FBI portrayed as bribery evidence inside Firtash’s company was exposed as a hypothetical slide from an American consultant’s PowerPoint presentation, according to court records I reviewed.

In other words, the DOJ faced potential embarrassment in two high-profile cases when Weissmann made an unsolicited approach on June 4, 2017, that surprised even Firtash’s U.S. legal team. To some, the offer smacked of being desperately premature. Mueller was appointed just two weeks earlier, did not even have a full staff selected, and was still getting up to speed on the details of the investigation. So why rush to make a deal when the prosecution team still was being selected, some wondered. Second, Weissmann’s approach was audaciously aggressive, even for a prosecutor with his reputation.

According to a defense memo recounting Weissmann’s contacts, the prosecutor claimed the Mueller team could “resolve the Firtash case” in Chicago and neither the DOJ nor the Chicago U.S. Attorney’s Office “could interfere with or prevent a solution,” including withdrawing all charges. “The complete dropping of the proceedings … was doubtless on the table,” according to the defense memo.

“So we beat on, against the sun, borne back ceaselessly into hell.”

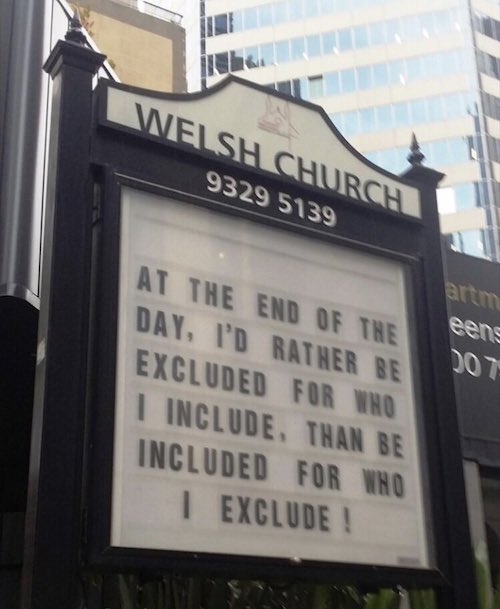

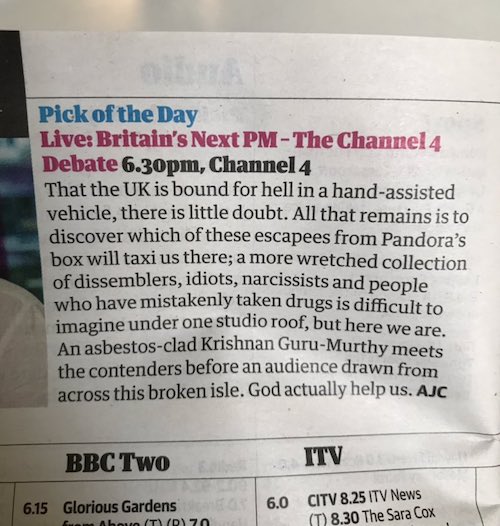

• The Clown Is Crowned As The Country Burns In Hell (G.)

Well, here we are then. Someone who could easily be rejected as a Guess Who character for looking too ridiculous is now to lead the country. A man whose DNA profile is the exact same as a Bernard Manning joke. A man who mentioned the 20 hustings he had taken part in, approximately 30 seconds after Conservative party chairman Brandon Lewis talked of the 16 hustings held. With 8,000 members of the Johnson family watching on – and Jeremy Hunt, looking for all the world like a sub who’s never gonna get off the bench and knows it – Boris Johnson was announced as the new leader of the Conservative party, and, in short order, the new prime minister. Elected by a staggering 0.2% of the nation, we can’t say it isn’t the will of the people.

It’s quite extraordinary, isn’t it, when the new leader of the country opens his inaugural speech with: “There may be people here who wonder quite what they have done!” – having to address the fact that many people in the room are coming to terms with the fact they’ve got shit on their shoe. “Do you look daunted?!” he boomed, “You don’t look remotely daunted to me!” Which was met with a Spectoresque wall of silence, a number of faces as white as Elizabeth I’s, and a solitary cry of: “No!”.

[..] I don’t really know what to say myself. I don’t understand how a man can lie his way about bananas and condoms to high office. I don’t understand how a man whose entire prep for anything seems to consist of drawing a cock and balls – but in Latin! – on a sheet of paper, ends up in high office. I don’t understand how a man can be recorded offering to facilitate the assault of a journalist and reach high office. I don’t understand how a man can be fired twice for cavalierly making stuff up and reach high office. I don’t understand how a man whose entire personality is a job-lot sold off from a closing down joke shop can reach high office. A racist, an inveterate liar, a man who makes Machiavelli look misunderstood and Pinocchio button-nosed. It’s 33C outside in London. You can’t tell whether people are crying or sweating. We can’t do anything until we get a say – which, this time, we did not. So we beat on, against the sun, borne back ceaselessly into hell.

There will not be a recovery. The only thing they can so is prolong the agony.

• Deutsche Bank’s Problem Derivatives Cloud Recovery (R.)

Deutsche Bank’s turnaround strategy rests in large part on shedding 288 billion euros of unwanted assets. Three bank insiders said it will take years, tying up capital that could have generated income of 500 million euros ($557 million) a year. The opportunity cost of holding the assets, which has not been previously reported, underscores the challenges facing Chief Executive Christian Sewing as he attempts to turn around the bank and restore confidence among investors who have seen the value of their shares decline by 75% in the past four years. Sewing said earlier this month that Deutsche, Germany’s largest lender, would set up a bad bank to house the assets, which include equity, credit and interest-rate derivatives.

The bank said it wants to offload most of its derivatives by 2020. Executives managing the book can either sell positions or allow them to gradually wind down over time, depending on which is more profitable. The bank is planning an auction of its short-dated equity derivatives book, having already received “significant expressions of interest,” the sources familiar with the matter said. However, its long-dated interest rate and credit derivatives are expected to be much harder to offload, the sources said. Deutsche Bank has held on-and-off talks with potential buyers of some of those assets over the past two years, three people said. The sales did not happen because the prices offered would have resulted in hundreds of millions of euros in losses for the bank, they said.

What, laundering as well?

• Deutsche Bank Flagged Epstein’s Overseas Transactions To US Watchdog (CNBC)

Deutsche Bank notified U.S. financial watchdogs about suspicious transactions by accused child sex trafficker Jeffrey Epstein — a customer of the bank — according to a new report Tuesday. The transactions, which involved Epstein moving money out of the United States, were flagged after Deutsche Bank discovered them while looking for indications that the wealthy financier was using his money for sex trafficking, The New York Times reported. Epstein had been a client of Deutsche Bank’s private banking division since at least 2013, five years after he pleaded guilty to prostitution-related charges involving a teenage girl filed by Florida state prosecutors, the Times noted.

That guilty plea led to Epstein — a former friend of Presidents Donald Trump and Bill Clinton — being required to register as a sex offender. According to the new article, an anti-money laundering compliance officer in Deutsche Bank’s office in New York and Florida raised concerns about the bank’s relationship with Epstein in 2015 and 2016. Those officers also reportedly put together a suspicious activity report on potentially illegal activity in an Epstein account at the time, which had moved money outside of the U.S. The Times said it was not clear if that report was ever filed with the financial crimes division of the U.S. Treasury Department. But the latest suspicious transactions were reported this year, according to the article.

But but.

• Berkeley First US City To Ban Natural Gas (G.)

Berkeley this week became the first city in the United States to ban natural, fossil gas hook-ups in new buildings. The landmark ordinance was passed into law on Tuesday, after being approved unanimously by the city council the previous week amid resounding public support. Although Berkeley may be pushing the vanguard, the city is hardly alone. Governments across the US and Europe are looking at strategies to phase out gas. In California alone, dozens of cities and counties are considering eliminating fossil fuel hook-ups to power stoves and heat homes in new buildings, while California state agencies pencil out new rules and regulations that would slash emissions. Natural gas, it seems, has become the new climate crisis frontline. Berkeley’s ordinance, which goes into effect on 1 January, will ban gas hook-ups in new multi-family construction, with some allowances for first-floor retail and certain types of large structures.

The reasons behind the decision are multifold. Energy use in buildings accounts for about 25% of greenhouse gas emissions in California. If the state is to meet its goal of 100% zero-carbon energy by 2045, the gas will have to go. For decades, gas was considered among the preferred energy sources for buildings and embraced as a bridge from dirtier fossil fuels to a green energy future. “There’s been a lingering perception that burning gas was cleaner than electricity, which might have been true 20 years ago when electricity came from burning coal,” said Pierre Delforge, a senior scientist with the Natural Resources Defense Council . “When we look at electrification policies, we need to think about what the grid will look like in 10 or 20 years, not what it looked like yesterday.”

Not the Onion.

• Libra Scams Are Already Popping Up On Facebook (F.)

As Facebook faces skepticism from regulators that it can handle launching its cryptocurrency Libra, a raft of fake accounts and scams purporting to sell Libra have cropped up on its own platform, according to the Washington Post. At least a dozen fake pages and websites on Facebook and Instagram claim to be associated with Facebook’s Libra, which has yet to be officially launched. One video offered a discount on Libra coins that have been distributed to early investors. Another linked to a realistic-looking fake website called “buylibracoins.com.” The website remains online. The scams even spread to YouTube and Twitter, according to the Washington Post. Facebook says Libra will allow people to send money to each other without a traditional middleman, such as a bank.

A digital wallet, called Calibra, will also be available as a stand-alone app on Facebook Messenger and WhatsApp. A Facebook spokesperson told Forbes that it “removes ads and Pages that violate our policies when we become aware of them, and we are constantly working to improve detection of scams on our platforms.” Key Background: In 2018, Facebook banned advertisements involving cryptocurrency or initial coin offerings to combat the proliferation of scams and bogus ICOs cropping up as the price of Bitcoin soared. Over the last few months, Facebook has been softening the ban in the run up to the announcement of Libra—and it appears scammers are taking advantage. Libra scams may not help Facebook convince lawmakers and regulators that it can protect user privacy and prevent the digital currency from being used in criminal activity.

I’ll believe it when I see it. Because Big Tech=CIA.

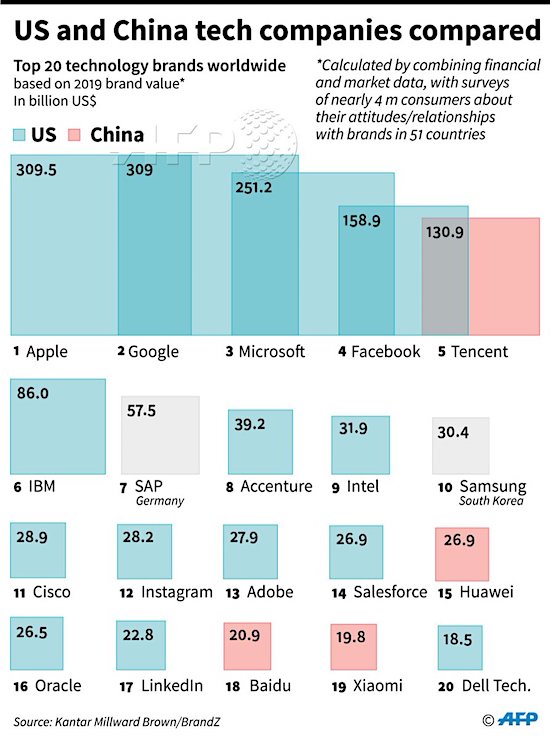

• Big Tech Faces Broad US Justice Department Antitrust Probe (R.)

The U.S. Justice Department said on Tuesday it was opening a broad investigation of major digital technology firms into whether they engage in anticompetitive practices, the strongest sign the Trump administration is stepping up its scrutiny of Big Tech. The review will look into “whether and how market-leading online platforms have achieved market power and are engaging in practices that have reduced competition, stifled innovation, or otherwise harmed consumers,” the Justice Department said in a statement. The Justice Department did not identify specific companies but said the review would consider concerns raised about “search, social media, and some retail services online” — an apparent reference to Alphabet Inc, Amazon.com Inc and Facebook Inc, and potentially Apple Inc.

[..] The announcement comes a day before the Federal Trade Commission is set to announce a $5 billion penalty to Facebook for failing to properly protect user privacy. Senator Richard Blumenthal, a Democrat, said the Justice Department “must now be bold and fearless in stopping Big Tech’s misuse of its monopolistic power. Too long absent and apathetic, enforcers now must prevent privacy abuse, anticompetitive tactics, innovation roadblocks, and other hallmarks of excessive market power.” In June, Reuters reported the Trump administration was gearing up to investigate whether Amazon, Apple, Facebook and Alphabet’s Google misuse their massive market power, setting up what could be an unprecedented, wide-ranging probe of some of the world’s largest companies.

The FBI tried to steal the black boxes, but Malaysian secret service had already ‘smuggled’ agents into the Donbass ahead of other countries. Oh, and literally everybody has been caught lying. What a story this is becoming,

• MH17 Evidence Tampering Revealed by Malaysia (John Helmer)

A new documentary from Max van der Werff, the leading independent investigator of the Malaysia Airlines Flight MH17 disaster, has revealed breakthrough evidence of tampering and forging of prosecution materials; suppression of Ukrainian Air Force radar tapes; and lying by the Dutch, Ukrainian, US and Australian governments. An attempt by agents of the FBI to take possession of the black boxes of the downed aircraft is also revealed by a Malaysian National Security Council official for the first time. The sources of the breakthrough are Malaysian — Prime Minister of Malaysia Mohamad Mahathir; Colonel Mohamad Sakri, the officer in charge of the MH17 investigation for the Prime Minister’s Department and Malaysia’s National Security Council following the crash on July 17, 2014; and a forensic analysis by Malaysia’s OG IT Forensic Services of Ukrainian Secret Service (SBU) telephone tapes which Dutch prosecutors have announced as genuine.

The 298 casualties of MH17 included 192 Dutch; 44 Malaysians; 27 Australians; 15 Indonesians. The nationality counts vary because the airline manifest does not identify dual nationals of Australia, the UK, and the US. The new film throws the full weight of the Malaysian Government, one of the five members of the Joint Investigation Team (JIT), against the published findings and the recent indictment of Russian suspects reported by the Dutch officials in charge of the JIT; in addition to Malaysia and The Netherlands, the members of the JIT are Australia, Ukraine and Belgium. Malaysia’s exclusion from the JIT at the outset, and Belgium’s inclusion (4 Belgian nationals were listed on the MH17 passenger manifest), have never been explained.

The film reveals the Malaysian Government’s evidence for judging the JIT’s witness testimony, photographs, video clips, and telephone tapes to have been manipulated by the Ukrainian Security Service (SBU), and to be inadmissible in a criminal prosecution in a Malaysian or other national or international court. For the first time also, the Malaysian Government reveals how it got in the way of attempts the US was organizing during the first week after the crash to launch a NATO military attack on eastern Ukraine. The cover story for that was to rescue the plane, passenger bodies, and evidence of what had caused the crash. In fact, the operation was aimed at defeating the separatist movements in the Donbass, and to move against Russian-held Crimea. The new film reveals that a secret Malaysian military operation took custody of the MH17 black boxes on July 22, preventing the US and Ukraine from seizing them. The Malaysian operation, revealed in the film by the Malaysian Army colonel who led it, eliminated the evidence for the camouflage story, reinforcing the German Government’s opposition to the armed attack, and forcing the Dutch to call off the invasion on July 27.

Not the first time he’s said it, but this time it’s directly to the FAA.

• Ralph Nader Says Boeing 737 Max Should Never Fly Again (CNBC)

Consumer advocate Ralph Nader on Tuesday urged the Federal Aviation Administration to permanently ground Boeing’s 737 Max jet. “The plane cannot be refixed,” said Nader, whose grandniece was killed in a March crash of a 737 Max jet in Ethiopia. “It has to be recalled” and permanently taken out of service, he said. Regulators worldwide ordered airlines to ground their 737 Max planes in mid-March after the crash in Ethiopia and one in Indonesia that occurred within five months of one another, killing a total of 346 people. Since then, Boeing has been preparing to get the Max back in the air. Airlines have canceled thousands of flights due to the grounding and are planning to do so until at least November, a move that Boeing said it took a $4.9 billion charge for in its second quarter.

But the planemaker needs to “take their losses” on the jet, Nader said in an interview with CNBC’s “Squawk on the Street.” Crash investigators have pointed to an issue with the jets’ software, for which Boeing said it has developed a fix, as the cause behind the two fatal crashes. But once a software upgrade is submitted to the FAA, it will likely take at least another month before the planes are back in operation. On the software fix, Nader said it shouldn’t be trusted since executives are “stuck in their bad decision” and are “ignoring preventable aerodynamic design.” “It’s a new plane; they can’t say it’s just a little bit changed,” he said. “It needs full certification.”