Vincent van Gogh Sunflowers 1887

Funniest video in a while.

• It’s Beginning to Look a Lot Like Pravda (CTH)

Interesting short segment from Sky News interviewing the smiling U.K. Health Minister Gillian Keegan about the intense U.K. response to the Omicron variant and the new restrictions announced by government officials. Great Britain is preparing for hundreds-of-thousands of Omicron cases. Video prompted to 05:42 just watch for around 45 seconds. No commentary from me needed. WATCH:

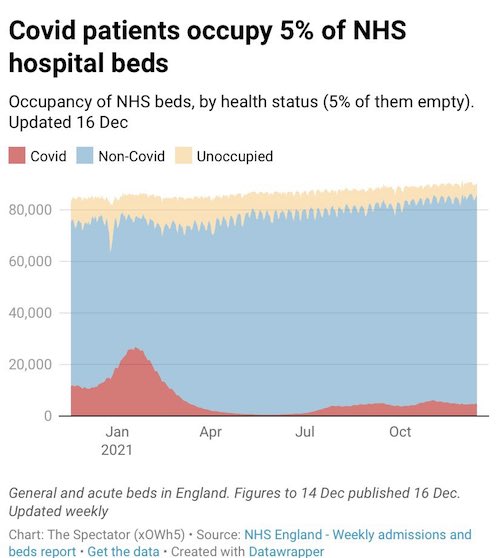

No omicron to speak of, infections falling fast, but let’s ruin Christmas regardless.

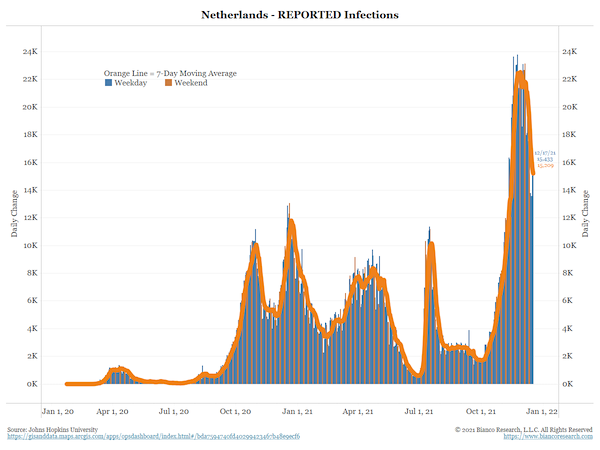

• Netherlands To Enter Lockdown As Nations Across Europe Tighten Curbs (G.)

Nations across Europe moved to reimpose tougher measures to stem a new wave of Covid infections spurred by the highly transmissible Omicron variant, with the Netherlands leading the way by imposing a nationwide lockdown. All non-essential stores, bars and restaurants in the Netherlands will be closed until 14 January starting Sunday, caretaker prime minister Mark Rutte said at a hastily arranged press conference Saturday night. Schools and universities will shut until 9 January, he said. In what is surely to prove a major disappointment, the lockdown terms also rein in private holiday celebrations. Residents only will be permitted two visitors except for Christmas and New Year’s, when four will be allowed, according to Rutte.

“The Netherlands is going into lockdown again from tomorrow,” he said, adding that the move was “unavoidable because of the fifth wave caused by the Omicron variant that is bearing down on us.” It wasn’t just the Dutch seeking to slow the spread of Omicron. Alarmed ministers in France, Cyprus and Austria tightened travel restrictions. Paris canceled its New Year’s Eve fireworks. Denmark has closed theatres, concert halls, amusement parks and museums. Ireland imposed an 8 pm curfew on pubs and bars and limited attendance at indoor and outdoor events. London mayor Sadiq Khan underscored the official concern about the climbing cases and their potential to overwhelm the health care system by declaring a major incident Saturday, a move that allows local councils in Britain’s capital to coordinate work more closely with emergency services.

Irish prime minister Micheal Martin captured the sense of the continent in an address to the nation, saying the new restrictions were needed to protect lives and livelihoods from the resurgent virus. “None of this is easy,” Martin said Friday night. “We are all exhausted with Covid and the restrictions it requires. The twists and turns, the disappointments and the frustrations take a heavy toll on everyone. But it is the reality that we are dealing with.”

Trick of the trade.

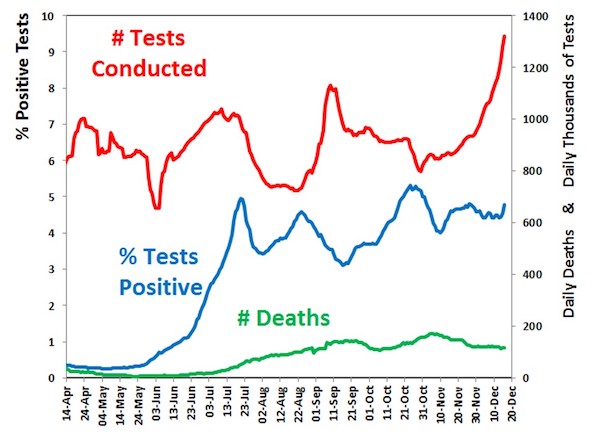

• Omicron Surge is Mostly Due to Ramping Up Testing (DS)

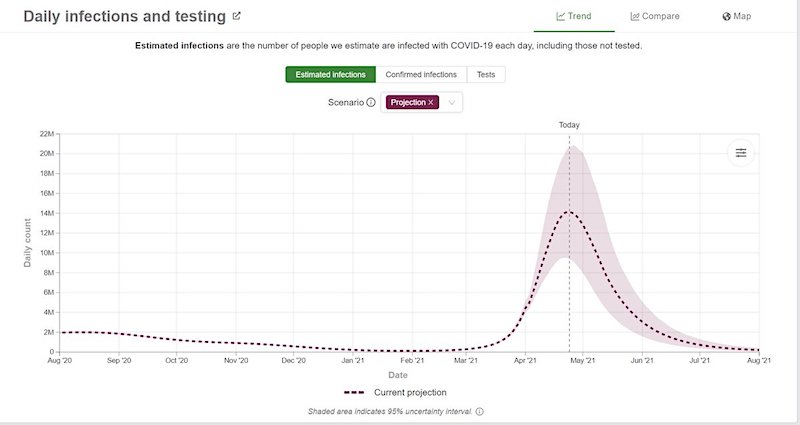

Reported infections in the U.K. have suddenly spiked in the last three days, up from 59,610 on Tuesday to 78,610 on Wednesday, 88,376 on Thursday and 93,045 on Friday. Looking at the data regionally, the spike is currently much more pronounced in London, the South East, the East of England, the East Midlands and the North West than it is in the North East, Yorkshire and the Humber, the South West and the West Midlands. It’s not clear at this point if it is going to continue to rise, though the last three days’ counts don’t appear to indicate continued sharp growth. It is also so far largely an artefact of massively increased testing, as the graph below with data for the U.K. up to December 16th shows. Similar is true for Scotland. Positive tests have spiked.

But positivity is up only a little due to the large increase in testing. How significant is it that the spike began on Monday December 13th, the day after Boris Johnson’s Sunday press conference when he warned everyone about Omicron and told them to get their booster jab? There was a huge surge in demand for booster doses starting that Monday and continuing throughout the week. Could the fact that this surge coincided with a similar surge in both testing and positive tests be more than coincidence? Perhaps people got tested before getting their booster, or just because of the dire warning of a new threat.

We would normally expect a spike in winter viral illness at this point in December, so there is nothing particularly unusual about it. In this regard, it’s worth noting that the Covid deaths trend for the U.K. is currently very similar to normal winter flu deaths at this time of year. However, the recent announcement of the Omicron variant raises the question of the role it might be playing in the surge.

Not if Twitter has any say in it…

• Ivermectin Prophylaxis For Covid-19 Reduces Infection, Mortality Rates (RG)

Background: Ivermectin has demonstrated different mechanisms of actions that could potentially protect from both COVID-19 infection and COVID-19-related comorbidities. Based on the existing literature and safety profile of ivermectin, a citywide program of prophylactic use of ivermectin for COVID-19 was implemented in Itajai, a Southern city in Brazil in the state of Santa Catarina. The objective of this analysis is to evaluate the effects of the use of ivermectin for prevention of COVID-19 infection, risk of dying and mortality, compared to non-users.

Materials and methods: This is a retrospective analysis of registry data from the medical based citywide COVID-19 prevention with ivermectin program, between July 2020 to December of 2020. The whole population of Itajaí was invited for a medical visit to compile demographic and medical parameters. In the absence of contraindications, ivermectin was offered as an optional treatment for 2 days every 15 days at a dose of 0.2mg/kg/day. Patients’ preferences and medical autonomy were preserved. Ivermectin users were compared with the comorbidity-matched population of non-users for COVID-19 by age, sex, COVID-19 infection rate, and COVID-19 mortality rate. Results in terms of mortality were adjusted for all relevant variables and Propensity Score Matching (PSM) was calculated.

Results: A total of 220,517 subjects were included in the analysis; 133,051 (60.3%) ivermectin users and 87,466 (39.7%) non-users. COVID-19 infection occurred in 4,311 (3.2%) treated subjects, and 3,034 (3.5%) non-treated subjects. This evidence showed a 7% reduction in COVID-19 infection rate with use of ivermectin: COVID-19 infection rate ratio (Risk ratio (RR) of 0.93; 95% confidence interval (CI), 0.89 – 0.98; p = 0.003). A total of 62 deaths (1.4% mortality rate) occurred among users and 79 deaths (2.6% mortality rate) among non-users, showing a 48% reduction in mortality rate (RR, 0,52; 95%CI, 0.37 – 0.72; p = 0.0001). Risk of dying from COVID-19 among ivermectin users was 45% lower than non-users (RR, 0.55; 95%CI, 0.40 – 0.77; p = 0.0004).

Conclusion: Prophylactic use of ivermectin showed significantly reduced COVID-19 infection rate, mortality rate and chance of dying from COVID-19 on a calculated population-level analysis, which controlled for all relevant confounding variables.

Prophylactic ivermectin works (new study just published): "Risk of dying from COVID-19 among ivermectin users was 45% lower than non-users" https://t.co/BMIFSRIKhB

— Vaccine Truth (@VaccineTruth2) December 18, 2021

“..or we can take every little mutation and every little change and try to make it into a crisis so we can frighten people and control their lives more..”

• Pandemic Could Be Solved Quickly If Politics Thrown Out: Dr. Ben Carson (ET)

“We’ve been having tunnel vision” dealing with the COVID-19 pandemic, Dr. Ben Carson told EpochTV’s “American Thought Leaders” program. “Let’s throw the politics out. We could solve this problem pretty quickly,” he stated in an interview that will premiere on Dec. 18 at 7 p.m. New York time. “Let’s open this thing up to all the different mechanisms,” said Carson, a renowned neurosurgeon who was awarded the Presidential Medal of Freedom—the highest civilian award in the nation—in 2008 for his work. He retired in 2013 and ran for the presidency in 2016, before serving as the secretary of Housing and Urban Development during the Trump administration.

“Let’s look around the world at things that work. Let’s look at the fact that on the western coast of Africa, there’s almost no COVID. And let’s ask ourselves, why is that? And then you see, it’s because they take antimalarials, particularly hydroxychloroquine. Let’s study that. Let’s see what’s going on there. “Let’s listen to these physician groups who’ve had incredible success with ivermectin. Let’s look at the results with monoclonal antibodies. Let’s look at all of these things. Let’s put them all in our armamentarium so that we don’t have a one-size-fits-all system.” The U.S. Food and Drug Administration (FDA) at one time had authorized hydroxychloroquine for treating certain COVID-19 patients but quickly revoked the emergency use authorization (EUA) in June 2020, claiming no data showed its effectiveness.

The FDA hasn’t approved or issued an EUA for ivermectin to treat COVID-19, citing the same reasons. Using hydroxychloroquine or ivermectin to treat COVID-19 patients has been highly controversial. Some studies show, and some doctors claim, that hydroxychloroquine or ivermectin can effectively treat COVID-19 patients. A vaccine confidence insight report (pdf) from the Centers for Disease Control and Prevention (CDC) labeled such claims as misinformation or disinformation. “COVID is a virus. Viruses mutate. That’s what they do. And they will continue to mutate,” Carson said. Carson pointed out that fortunately, most of the time, viruses become a little weaker with each mutation. “We can admit that and deal with it, or we can take every little mutation and every little change and try to make it into a crisis so we can frighten people and control their lives more,” Carson said.

But there’s only one Science.

• Ex-FDA Officials, Medical Experts Flog Feds For Politicizing Covid (JTN)

The federal agencies in charge of COVID-19 response are taking hits from former officials and high-profile medical professors for “sidelining experts,” not conducting basic research, and mischaracterizing evidence related to vaccines and masks for young people. The Biden administration is getting a pass for “extreme political pressure” that “appropriately” prompted outrage against its predecessor, two FDA alumni wrote in The Washington Post Thursday. Former Office of Vaccines Research and Review Deputy Director Philip Krause and former acting Chief Scientist Luciana Borio protested three recent actions authorizing boosters for people as young as 16.

“Before last month, the standard practice was for the agencies to convene standing outside advisory committees, whose members inspect the relevant data, debate it and vote,” they wrote. Earlier debates and votes suggest that “at least some experts would probably have voiced opposition,” and the refusal to hear them out “could hurt the credibility of these agencies.” They criticized the FDA’s “unpersuasive” explanation that authorizing boosters for 16- and 17-year-olds “does not raise questions that would benefit from additional discussion by committee members.” Exigency is “the exact circumstance when expert discussion and interpretation of the data can make the biggest difference,” the duo wrote.

Krause left the FDA in apparent protest of the White House sidestepping the agency to promise booster shots across the board. He soon joined a public letter warning “there could be risks if boosters are widely introduced too soon, or too frequently,” with implications for “vaccine acceptance.” The White House is “acting seriously reckless,” University of California San Francisco medical professor Vinay Prasad tweeted, echoing Krause’s argument. “If the last administration did this, all experts would be outraged. Principles only matter when they are inconvenient.”

Johns Hopkins University medical professor Marty Makary, who agrees boosters can harm low-risk groups, blasted the feds for too much “speculation” and too little research on the Omicron variant, just their latest pandemic failure. “In fact, most of our COVID findings have come from Israel and scientists abroad,” he wrote in a New York Post op-ed Dec. 8 decrying “turtle-speed bureaucracy.” It’s baffling that the National Institutes of Health or CDC has not “mobilize[d] any of their 7,000-plus scientists” to quickly answer how antibodies from vaccines and natural immunity respond to Omicron, said Makary, editor-in-chief of MedPage Today. There’s not even a “real-time data dashboard” on Omicron cases.

“Perhaps [Anthony] Fauci could have done fewer media interviews and university lectures … and instead personally overseen an NIH Omicron-antibody-binding experiment,” he said. Makary blasted the CDC for consistently releasing “tardy and incomplete data, missing key information on risk stratification, the role of obesity and a breakdown of child deaths by comorbidity as we imposed blanket restrictions on 72 million children.”

Who cares what Pfizer says?

• Pfizer Says Pandemic Could Extend Through 2023 (K.)

Pfizer Inc said on Friday the Covid-19 pandemic could extend through next year and announced plans to develop a three-dose vaccine regimen for children ages 2 to 16, a move that could delay its authorisation. The US pharmaceutical company made its comments as European countries geared up for further travel and social restrictions and a study warned that the rapidly spreading Omicron coronavirus variant was five times more likely to reinfect people than its predecessor, Delta. Pfizer executives said the company believed that by 2024, the disease should be endemic around the globe, meaning it would no longer be a pandemic. The company projected that “Covid will transition to an endemic state potentially by 2024.”

Prior to the Omicron variant, top US disease doctor Anthony Fauci forecast the pandemic would end in 2022 in the United States. Announcing plans to develop a three-dose regimen for ages 2 to 16, Chief Scientific Officer Mikael Dolsten told a conference call that results of three doses among people older than 16 showed that approach offered greater protection. “Therefore, we have decided to modify each of the pediatric studies to incorporate a third dose to the series and seek licensure for a three-dose series rather than a two-dose series as originally anticipated,” the company said.

Pfizer developed its Covid-19 vaccine with Germany’s BioNTech SE. The companies have been developing a version of their vaccine tailored to combat the Omicron variant, but have not decided whether it will be needed. They expect to start a clinical trial for the updated vaccine in January, the Pfizer executives said. The risk of reinfection with the Omicron variant is 5.4 times higher and it shows no sign of being milder than the Delta variant, a study by Imperial College London found, as cases soar across Europe and threaten year-end festivities. Past infection may offer as little as 19% protection against reinfection by the new variant, Imperial College said, noting that the study of hundreds of thousands of cases, including 1,846 confirmed as Omicron, had not been peer reviewed.

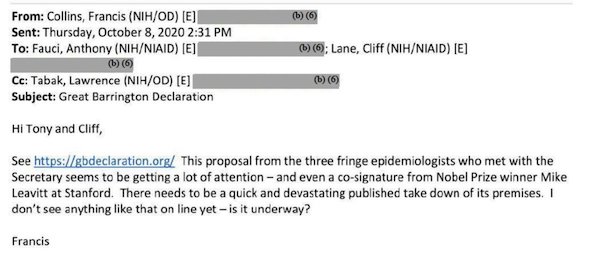

‘three fringe epidemiologists’

• Fauci, Collins Colluded To Smear Experts Who Called For End To Lockdowns (DM)

Dr. Anthony Fauci and the head of the National Institute of Health (NIH) colluded on a way to discredit an alternative plan to deal with COVID from a group of experts, released emails reveal. The emails, some of which were tweeted out on Saturday by Phil Magness, senior research faculty and interim research and education director at the American Institute for Economic Research (AIER), show Fauci and Francis Collins attempting to coordinate a ‘devastating takedown’ of the Great Barrington Declaration. AIER, a libertarian think tank, sponsored the declaration, which largely abandons lockdowns in favor of a herd immunity strategy that allows life to return to normal.

In an October 8 email from Collins to Fauci, the head of the NIH calls the GBD the work of ‘three fringe epidemiologists’ that ‘seems to be getting a lot of attention.’ Collins adds that ‘there needs to be a quick and devastating published takedown of its premises. I don’t see anything like that online yet – is it underway?’ Later in the day, Fauci sends Collins a Wired op-ed that refutes the notion of herd immunity stopping the pandemic. Collins then sends Fauci an op-ed in The Nation also trashing the GBD.

A few days later, Collins emails Fauci a Washington Post op-ed he’s quoted in headlined ‘Proposal to hasten herd immunity to the coronavirus grabs White House attention but appalls top scientists.’ Collins – working under former President Donald Trump at the time – said ‘my quotes are accurate but will not be appreciated in the [White House].’ Fauci responds: ‘They are too busy with other things to worry about this. What you said was entirely correct.’ Later, Gregg Gonsalves – the writer of The Nation op-ed – sends Collins an email thanking him with a subject line that includes saying legendary AIDS activist Larry Kramer ‘would be proud.’ Collins responds with a smiley face.

The GBD – authored by previous DailyMail.com contributor Jay Bhattacharya of Stanford University, Sunetra Gupta of the University of Oxford and Martin Kulldorff of Harvard University, calls for individuals at significantly lower risk of dying from COVID-19 – as well as those at higher risk who so wish – to be allowed ‘to resume their normal lives.’ That would mean allowing people in low risk groups to go to offices, hang out in bars and restaurants and go to sporting and entertainment events. The centerpiece of the declaration, according to Dr. Bhattacharya, is a call for increased focused protection of the vulnerable older population, who are more than a thousand times more likely to die from COVID infection than the young. The declaration makes no mention of social distancing, masks, tracing, or long-term Covid cases but suggests that increased infection of those at lower risks would build herd immunity.

Dr. Paul Alexander names a few more ‘fringe epidemiologists’.

• Time To Take Away The Hall Pass We Gave Doctors And Scientists (Alexander)

Had it not been for the likes of McCullough, Fareed, Zelenko, Tenenbaum, Oskoui, Urso, Littell, Malone, Vanden Bossche, Yeadon, Ryan Cole, Kulvinder Gill, Francis Christian, Trozzi, Phillips, Palmer, Hodkinson, Bhattacharya, Heneghan, Kulldorff, Bridle, Mallard, Bernstein, Risch etc. to me, take the whole lot of the million doctors and fire them all…every one damn of them, they have caused this by being silent and being on the take…yes, I know many from CDC and NIH and even FDA who told me they cant speak out because of fear of losing their appointment and grant…yes, this be about money…grift and graft…they have all benefitted and of course the top dog Bourla of Pfizer with his buddy Fauci…imagine this grifter Bourla saying we are criminals because we question the efficacy and safety of the vaccines…this piece of untermensche s***….

The Canadian and UK and American doctor, yes Kuntsler, have shown themselves to be among the most dweeb, pusillanimous, weak, cowardly, craven, money hungry, grifters, stiff necked idiots and fools…money whores to the pharma…selling out the good populations for benefit to yourself…you sick twisted set of doctors…you dont see it yet but your gravitas id now DOA…and you did it to you. you had it all and now are worth nothing. you helped destroy your careers, your name, EBM, research, all of it…you did this…you joined a devious scheme and history will recall and remind you always of what you did. you are utterly corrupt and I tell you in your face here…corrupt untermensche.

Yes it the doctors we used to revere and admire, that have lost all credibility along with the entire research establishment, the medical publication process, the journal editors, all of them were and are on the take in some manner…their silence got them something and we will come to learn in time…fire these bastards, all of them. These losers oh I meant doctors and scientists in the US and Canada and UK etc…sucking on the teats of NIH grants and CIHR grants…losers the whole bunch of them should hang heads in shame…abject failures….it is their disastrous unscientific illogical and specious policies that have harmed populations…children hung themselves and it was this Trump was fighting against and Atlas…I know I was there. Atlas did many things to stem the tide of the massive deaths in the nursing homes and deserves big credit…I know, I was there.

Brought to you by Pfizer. Bought for you by Pfizer.

• The Scientists Hunting For The Next Variant Of Concern (ZH)

America has some of the most advanced medical research capabilities in the world. So why is it that a small group of labs in South Africa seems to be a step ahead of everybody else when it comes to sniffing out new variants? The group first gained notoriety for discovering the beta variant and alerting the world to its presence. But most people probably became familiar with Alex Sigal, Tulio de Oliveira and their work at a gene-sequencing laboratory in the South African port city of Durban when they announced the discovery of the omicron variant, the latest “variant of concern” while Americans were enjoying their Thanksgiving dinner. What is it that makes their lab so successful? Well, it looks like Bloomberg has finally found the answer in a profile of the Africa Health Research Institute, as it’s formally known.

South African scientists became experts at combating viruses almost by necessity, They have been hard at work fighting AIDS, Turburculosis and other viruses – work that has made them a magnet for the world’s best epidemiologists. Because of this, Sigal’s lab has become a kind of training ground for scientists across the continent. It was the first to test omicron against blood plasma from people who’d received two doses of the Pfizer jab. They also developed a theory claiming that immunodepressed people might be breeding grounds for mutants since they’re so vulnerable. One reason for its success with finding new variants: South Africa has set up a network of seven genomic surveillance labs with one at the National Institute for Communicable Diseases and six at academic institutions. Sigal works with Tulio de Oliveira, the Brazilian head of the gene-sequencing laboratory Krisp.

“There’s a lot of technical capacity in South Africa to do genomic sequencing of pathogens because we’ve built up that expertise over many years for HIV and TB,” said Richard Lessells, a Scottish infectious diseases specialist at Krisp. “Very early on in the pandemic, we recognized that genomic sequencing and genomic surveillance was going to be very important.” Since the discovery of omicron, many of the scientists working in the lab have been dealing with sleepless nights. “I’ve been working to get the Pfizer vaccine efficacy study ready,” said Sigal, who becomes animated when he watches a time-lapse video of the omicron variant attacking cells. “I worked through the night.” Put another way: the more variants they “discover”, the more prestige and funding they will be rewarded with.

“..CDC data show 240MM people with at least one shot – about 72.5% of the population. But it also says only 203MM have been fully vaccinated, or 61.3%..”

• CDC Data Missed Millions Of Unvaccinated Americans (ZH)

What a surprise – the CDC and states across the country have been over-counting the number of American adults who have been fully vaccinated. Here’s how Bloomberg explains this accident (because what kind of person would do this on purpose?): “in collating reams of data on vaccinations, the US has counted too many shots as first doses when they are instead second doses or booster shots.” Here’s the tell: CDC data show 240MM people with at least one shot – about 72.5% of the population. But it also says only 203MM have been fully vaccinated, or 61.3%, an 11-percentage-point difference that is far larger than in other developed countries. So, either Americans are so lazy – or perhaps don’t want to endure another series of adverse reactions – that they won’t show up to get their second dose, or there’s something wrong with these numbers.

And it might not surprise you to learn that a number of state and local officials believes it’s the latter. “State and local officials say it’s improbable that 37MM Americans got one shot without completing their inoculations. Instead, they say, the government has regularly and incorrectly counted booster shots and second doses as first doses.” Their conclusion is that both fully vaccinated and completely unvaccinated are officially undercounted. As for the precise number miscounted, that’s unknown, but revisions in data from three states – Illinois, Pennsylvania and West Virginia – found enough over-counting of first shots to suggest that there are plenty of unvaccinated people nationally who’ve mistakenly been counted as having received a dose.

One of the biggest gaps identified was in Pennsylvania, where CDC estimates of first doses for the elderly exceed the state of Pennsylvania’s estimate by about 850,000. If changes are made to the national data on the scale of Pennsylvania’s revisions, this would mean increasing the number of Americans who are unvaccinated by more than 10MM. “The truth is, we have no idea,” said Clay Marsh, West Virginia’s Covid czar.

“..Schaffner took to CNN to express his horror at Americans having fun at football games, complaining that they were “breathing too vigorously.”

• CNN Doctor: Wear Masks At Home And Take Tests On Christmas Morning (SN)

A resident doctor on CNN told viewers Thursday that they should all be wearing masks at home around other family members and everyone should wake up on Christmas morning and rather than open presents, take COVID tests. Dr. William Schaffner also said that these restrictions should apply to everyone, even those people who are double and triple vaccinated. “I recommend that we hang our stockings with care,” Schaffner stated, adding “We have to be careful because we are all going to get together, we should all be vaccinated and preferentially boosted. We should wear our masks if we are uncertain.”

“Another thing we could do is we could all get tested the morning of our getting together,” Schaffner further urged, before sharing a heartwarming story of how his own family did that for Thanksgiving. “We were all negative. It worked out just fine,” the doctor declared. Earlier in the year, Schaffner took to CNN to express his horror at Americans having fun at football games, complaining that they were “breathing too vigorously.” Schaffner declared “People are cheering and enthusiastic, exhaling with vigor; if there are people infected, they can infect people around them … Nobody was wearing a mask … I’d be very surprised if we didn’t have outbreaks.”

London Dec 18

Paris Dec 18

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.