Irving Underhill City Bank-Farmers Trust Building, William & Beaver streets, NYC 1931

It’s been a while, but Nicole Foss is back at the Automatic Earth -which makes me very happy-, and for good measure, she starts out with a very long article. So long in fact that we have decided to turn it into a 4-part series, if only just to show you that we do care about your health and well-being, as well as your families and social lives. The other 3 parts will follow in the next few days, and at the end we will publish the entire piece in one post.

Here’s Nicole:

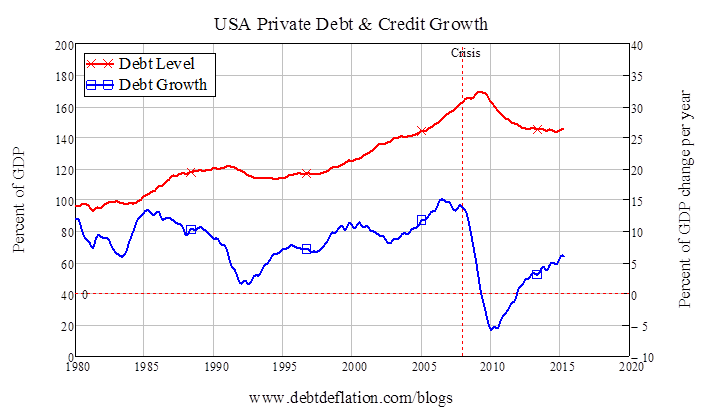

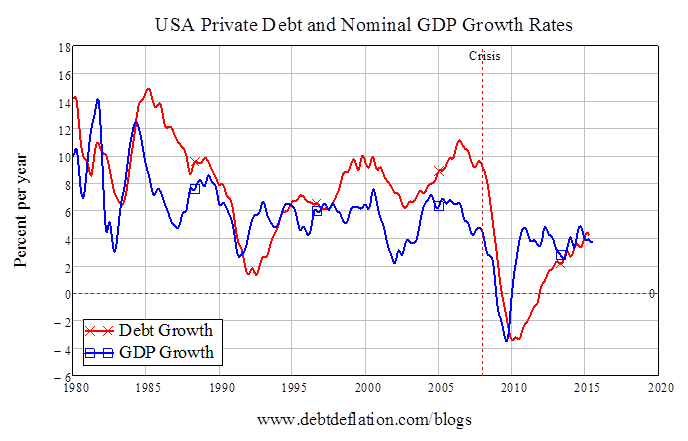

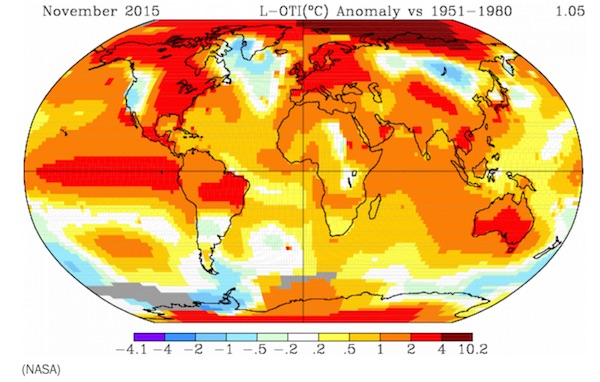

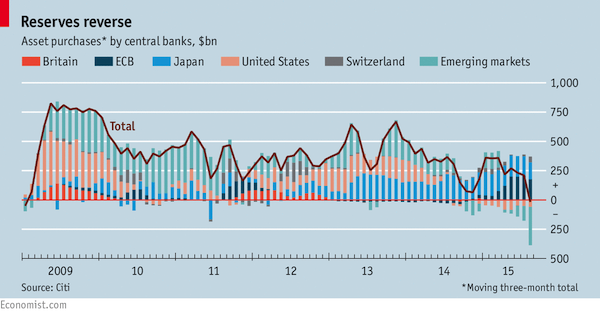

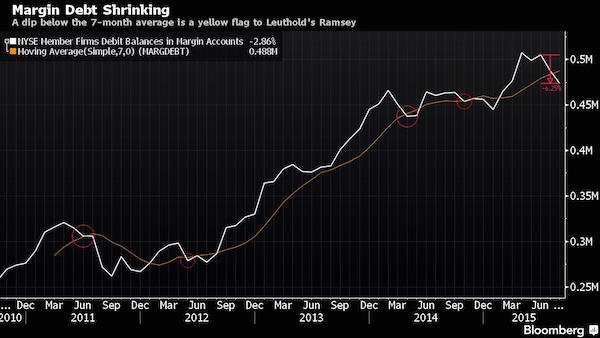

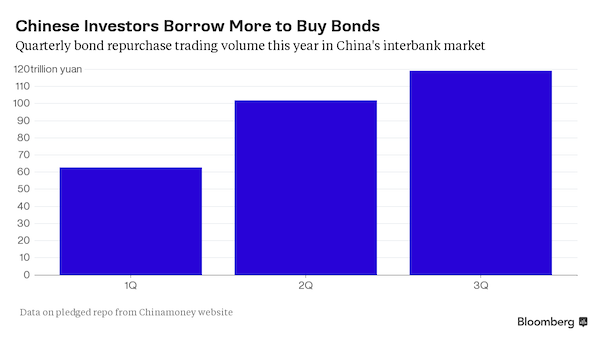

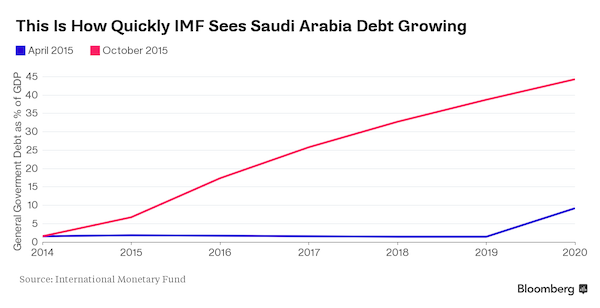

Nicole Foss: As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence. But that in turn requires a plethora of willing and able borrowers to maintain demand for new credit money, lenders who are not too risk-averse to make new loans, and (apparently effective) mechanisms for diluting risk to the point where it can (apparently safely) be ignored. As the peak of a credit bubble is reached, all these necessary factors first become problematic and then cease to be available at all. Past a certain point, there are hard limits to financial expansions, and the global economy is set to hit one imminently.

Borrowers are increasingly maxed out and afraid they will not be able to service existing loans, let alone new ones. Many families already have more than enough ‘stuff’ for their available storage capacity in any case, and are looking to downsize and simplify their cluttered lives. Many businesses are already struggling to sell goods and services, and so are unwilling to borrow in order to expand their activities. Without willingness to borrow, demand for new loans will fall substantially. As risk factors loom, lenders become far more risk-averse, often very quickly losing trust in the solvency of of their counterparties. As we saw in 2008, the transition from embracing risky prospects to avoiding them like the plague can be very rapid, changing the rules of the game very abruptly.

Mechanisms for spreading risk to the point of ‘dilution to nothingness’, such as securitization, seen as effective and reliable during monetary expansions, cease to be seen as such as expansion morphs into contraction. The securitized instruments previously created then cease to be perceived as holding value, leading to them being repriced at pennies on the dollar once price discovery occurs, and the destruction of that value is highly deflationary. The continued existence of risk becomes increasingly evident, and the realisation that that risk could be catastrophic begins to dawn.

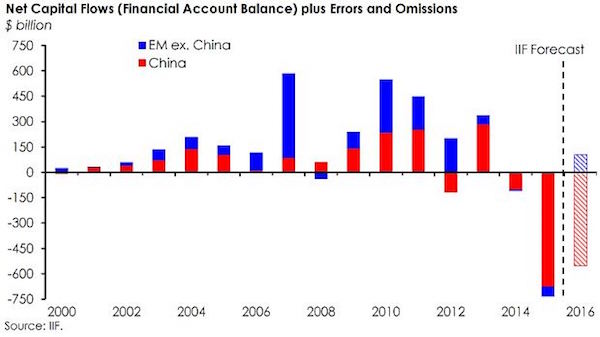

Natural limits for both borrowing and lending threaten the capacity to prolong the credit boom any further, meaning that even if central authorities are prepared to pay almost any price to do so, it ceases to be possible to kick the can further down the road. Negative interest rates and the war on cash are symptoms of such a limit being reached. As confidence evaporates, so does liquidity. This is where we find ourselves at the moment — on the cusp of phase two of the credit crunch, sliding into the same unavoidable constellation of conditions we saw in 2008, but on a much larger scale.

From ZIRP to NIRP

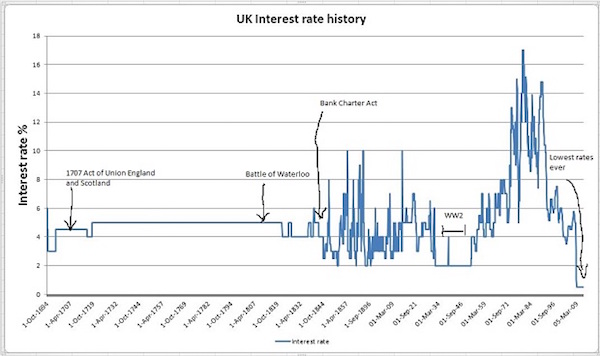

Interest rates have remained at extremely low levels, hardly distinguishable from zero, for the several years. This zero interest rate policy (ZIRP) is a reflection of both the extreme complacency as to risk during the rise into the peak of a major bubble, and increasingly acute pressure to keep the credit mountain growing through constant stimulation of demand for borrowing. The resulting search for yield in a world of artificially stimulated over-borrowing has lead to an extraordinary array of malinvestment across many sectors of the real economy. Ever more excess capacity is being built in a world facing a severe retrenchment in aggregate demand. It is this that is termed ‘recovery’, but rather than a recovery, it is a form of double jeopardy — an intensification of previous failed strategies in the hope that a different outcome will result. This is, of course, one definition of insanity.

Now that financial crisis conditions are developing again, policies are being implemented which amount to an even greater intensification of the old strategy. In many locations, notably those perceived to be safe havens, the benchmark is moving from a zero interest rate policy to a negative interest rate policy (NIRP), initially for bank reserves, but potentially for business clients (for instance in Holland and the UK). Individual savers would be next in line. Punishing savers, while effectively encouraging banks to lend to weaker, and therefore riskier, borrowers, creates incentives for both borrowers and lenders to continue the very behaviour that set the stage for financial crisis in the first place, while punishing the kind of responsibility that might have prevented it.

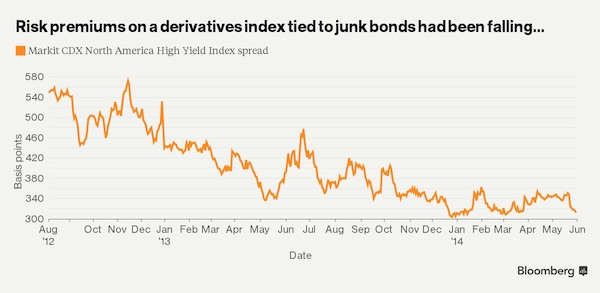

Risk is relative. During expansionary times, when risk perception is low almost across the board (despite actual risk steadily increasing), the risk premium that interest rates represent shows relatively little variation between different lenders, and little volatility. For instance, the interest rates on sovereign bonds across Europe, prior to financial crisis, were low and broadly similar for many years. In other words, credit spreads were very narrow during that time. Greece was able to borrow almost as easily and cheaply as Germany, as lenders bet that Europe’s strong economies would back the debt of its weaker parties. However, as collective psychology shifts from unity to fragmentation, risk perception increases dramatically, and risk distinctions of all kinds emerge, with widening credit spreads. We saw this happen in 2008, and it can be expected to be far more pronounced in the coming years, with credit spreads widening to record levels. Interest rate divergences create self-fulfilling prophecies as to relative default risk, against a backdrop of fear-driven high volatility.

Many risk distinctions can be made — government versus private debt, long versus short term, economic centre versus emerging markets, inside the European single currency versus outside, the European centre versus the troubled periphery, high grade bonds versus junk bonds etc. As the risk distinctions increase, the interest rate risk premiums diverge. Higher risk borrowers will pay higher premiums, in recognition of the higher default risk, but the higher premium raises the actual risk of default, leading to still higher premiums in a spiral of positive feedback. Increased risk perception thus drives actual risk, and may do so until the weak borrower is driven over the edge into insolvency. Similarly, borrowers perceived to be relative safe havens benefit from lower risk premiums, which in turn makes their debt burden easier to bear and lowers (or delays) their actual risk of default. This reduced risk of default is then reflected in even lower premiums. The risky become riskier and the relatively safe become relatively safer (which is not necessarily to say safe in absolute terms). Perception shapes reality, which feeds back into perception in a positive feedback loop.

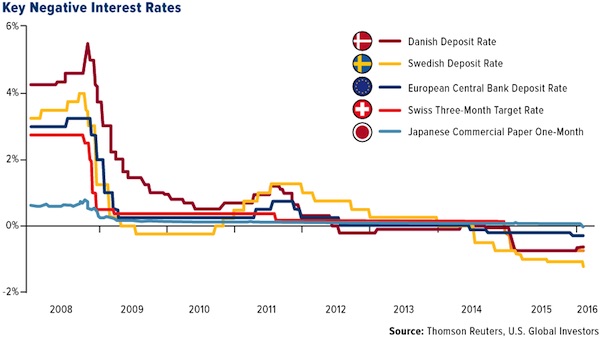

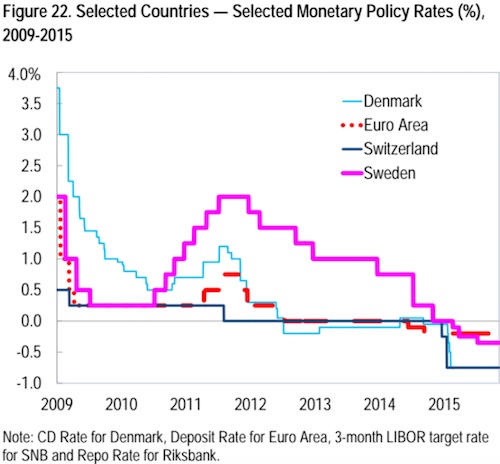

The process of diverging risk perception is already underway, and it is generally the states seen as relatively safe where negative interest rates are being proposed or implemented. Negative rates are already in place for bank reserves held with the ECB and in a number of European states from 2012 onwards, notably Scandinavia and Switzerland. The desire for capital preservation has led to a willingness among those with capital to accept paying for the privilege of keeping it in ‘safe havens’. Note that perception of safety and actual safety are not equivalent. States at the peak of a bubble may appear to be at low risk, but in fact the opposite is true. At the peak of a bubble, there is nowhere to go but down, as Iceland and Ireland discovered in phase one of the financial crisis, and many others will discover as we move into phase two. For now, however, the perception of low risk is sufficient for a flight to safety into negative interest rate environments.

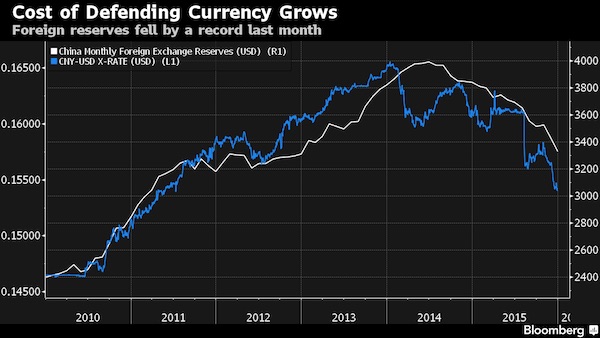

This situation serves a number of short term purposes for the states involved. Negative rates help to control destabilizing financial inflows at times when fear is increasingly driving large amounts of money across borders. A primary objective has been to reduce upward pressure on currencies outside the eurozone. The Swiss, Danish and Swedish currencies have all been experiencing currency appreciation, hence a desire to use negative interest rates to protect their exchange rate, and therefore the price of their exports, by encouraging foreigners to keep their money elsewhere. The Danish central bank’s sole mandate is to control the value of the currency against the euro. For a time, Switzerland pegged their currency directly to the euro, but found the cost of doing so to be prohibitive. For them, negative rates are a less costly attempt to weaken the currency without the need to defend a formal peg. In a world of competitive, beggar-thy-neighbour currency devaluations, negative interest rates are seen as a means to achieve or maintain an export advantage, and evidence of the growing currency war.

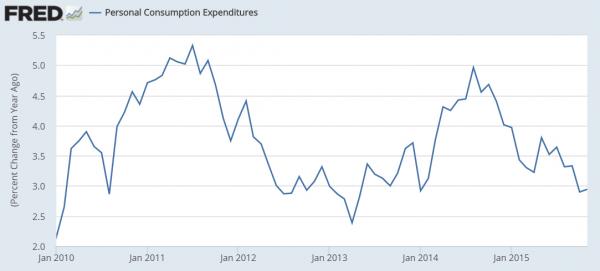

Negative rates are also intended to discourage saving and encourage both spending and investment. If savers must pay a penalty, spending or investment should, in theory, become more attractive propositions. The intention is to lead to more money actively circulating in the economy. Increasing the velocity of money in circulation should, in turn, provide price support in an environment where prices are flat to falling. (Mainstream commentators would describe this as as an attempt to increase ‘inflation’, by which they mean price increases, to the common target of 2%, but here at The Automatic Earth, we define inflation and deflation as an increase or decrease, respectively, in the money supply, not as an increase or decrease in prices.) The goal would be to stave off a scenario of falling prices where buyers would have an incentive to defer spending as they wait for lower prices in the future, starving the economy of circulating currency in the meantime. Expectations of falling prices create further downward price pressure, leading into a vicious circle of deepening economic depression. Preventing such expectations from taking hold in the first place is a major priority for central authorities.

Negative rates in the historical record are symptomatic of times of crisis when conventional policies have failed, and as such are rare. Their use is a measure of desperation:

First, a policy rate likely would be set to a negative value only when economic conditions are so weak that the central bank has previously reduced its policy rate to zero. Identifying creditworthy borrowers during such periods is unusually challenging. How strongly should banks during such a period be encouraged to expand lending?

However strongly banks are ‘encouraged’ to lend, willing borrowers and lenders are set to become ‘endangered species’:

The goal of such rates is to force banks to lend their excess reserves. The assumption is that such lending will boost aggregate demand and help struggling economies recover. Using the same central bank logic as in 2008, the solution to a debt problem is to add on more debt. Yet, there is an old adage: you can bring a horse to water but you cannot make him drink! With the world economy sinking into recession, few banks have credit-worthy customers and many banks are having difficulties collecting on existing loans.

Italy’s non-performing loans have gone from about 5 percent in 2010 to over 15 percent today. The shale oil bust has left many US banks with over a trillion dollars of highly risky energy loans on their books. The very low interest rate environment in Japan and the EU has done little to spur demand in an environment full of malinvestments and growing government constraints.

Doing more of the same simply elevates the already enormous risk that a new financial crisis is right around the corner:

Banks rely on rates to make returns. As the former Bank of England rate-setter Charlie Bean has written in a recent paper for The Economic Journal, pension funds will struggle to make adequate returns, while fund managers will borrow a lot more to make profits. Mr Bean says: “All of this makes a leveraged ‘search for yield’ of the sort that marked the prelude to the crisis more likely.” This is not comforting but it is highly plausible: barely a decade on from the crash, we may be about to repeat it. This comes from tasking central bankers with keeping the world economy growing, even while governments have cut spending.

Experiences with Negative Interest Rates

The existing low interest rate environment has already caused asset price bubbles to inflate further, placing assets such as real estate ever more beyond the reach of ordinary people at the same time as hampering those same people attempting to build sufficient savings for a deposit. Negative interest rates provide an increased incentive for this to continue. In locations where the rates are already negative, the asset bubble effect has worsened. For instance, in Denmark negative interest rates have added considerable impetus to the housing bubble in Copenhagen, resulting in an ever larger pool over over-leveraged property owners exposed to the risks of a property price collapse and debt default:

Where do you invest your money when rates are below zero? The Danish experience says equities and the property market. The benchmark index of Denmark’s 20 most-traded stocks has soared more than 100 percent since the second quarter of 2012, which is just before the central bank resorted to negative rates. That’s more than twice the stock-price gains of the Stoxx Europe 600 and Dow Jones Industrial Average over the period. Danish house prices have jumped so much that Danske Bank A/S, Denmark’s biggest lender, says Copenhagen is fast becoming Scandinavia’s riskiest property market.

Considering that risky property markets are the norm in Scandinavia, Copenhagen represents an extreme situation:

“Property prices in Copenhagen have risen 40–60 percent since the middle of 2012, when the central bank first resorted to negative interest rates to defend the krone’s peg to the euro.”

This should come as no surprise: recall that there are documented cases where Danish borrowers are paid to take on debt and buy houses “In Denmark You Are Now Paid To Take Out A Mortgage”, so between rewarding debtors and punishing savers, this outcome is hardly shocking. Yet it is the negative rates that have made this unprecedented surge in home prices feel relatively benign on broader price levels, since the source of housing funds is not savings but cash, usually cash belonging to the bank.

The Swedish property market is similarly reaching for the sky. Like Japan at the peak of it’s bubble in the late 1980s, Sweden has intergenerational mortgages, with an average term of 140 years! Recent regulatory attempts to rein in the ballooning debt by reducing the maximum term to a ‘mere’ 105 years have been met with protest:

Swedish banks were quoted in the local press as opposing the move. “It isn’t good for the finances of households as it will make mortgages more expensive and the terms not as good. And it isn’t good for financial stability,” the head of Swedish Bankers’ Association was reported to say.

Apart from stimulating further leverage in an already over-leveraged market, negative interest rates do not appear to be stimulating actual economic activity:

If negative rates don’t spur growth — Danish inflation since 2012 has been negligible and GDP growth anemic — what are they good for?….Danish businesses have barely increased their investments, adding less than 6 percent in the 12 quarters since Denmark’s policy rate turned negative for the first time. At a growth rate of 5 percent over the period, private consumption has been similarly muted. Why is that? Simply put, a weak economy makes interest rates a less powerful tool than central bankers would like.

“If you’re very busy worrying about the economy and your job, you don’t care very much what the exact rate is on your car loan,” says Torsten Slok, Deutsche Bank’s chief international economist in New York.

Fuelling inequality and profligacy while punishing responsible behaviour is politically unpopular, and the consequences, when they eventually manifest, will be even more so. Unfortunately, at the peak of a bubble, it is only continued financial irresponsibility that can keep a credit expansion going and therefore keep the financial system from abruptly crashing. The only things keeping the system ‘running on fumes’ as it currently is, are financial sleight-of-hand, disingenuous bribery and outright fraud. The price to pay is that the systemic risks continue to grow, and with it the scale of the impacts that can be expected when the risk is eventually realised. Politicians desperately wish to avoid those consequences occurring in their term of office, hence they postpone the inevitable at any cost for as long as physically possible.

The Zero Lower Bound and the Problem of Physical Cash

Central bankers attempting to stimulate the circulation of money in the economy through the use of negative interest rates have a number of problems. For starters, setting a low official rate does not necessarily mean that low rates will prevail in the economy, particularly in times of crisis:

The experience of the global financial crisis taught us that the type of shocks which can drive policy interest rates to the lower bound are also shocks which produce severe impairments to the monetary policy transmission mechanism. Suppose, for example, that the interbank market freezes and prevents a smooth transmission of the policy interest rate throughout the banking sector and financial markets at large. In this case, any cut in the policy rate may be almost completely ineffective in terms of influencing the macroeconomy and prices.

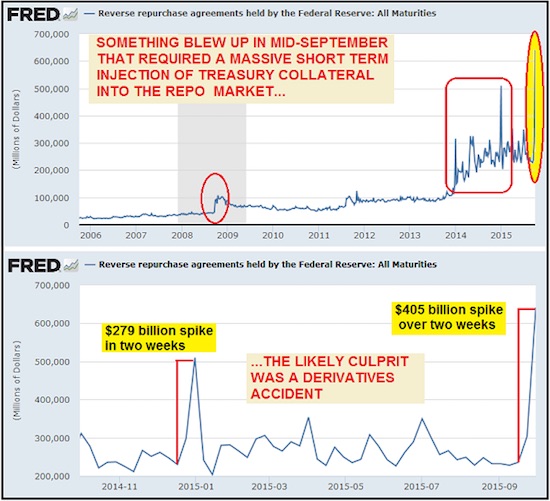

This is exactly what we saw in 2008, when interbank lending seized up due to the collapse of confidence in the banking sector. We have not seen this happen again yet, but it inevitably will as crisis conditions resume, and when it does it will illustrate vividly the limits of central bank power to control financial parameters. At that point, interest rates are very likely to spike in practice, with banks not trusting each other to repay even very short term loans, since they know what toxic debt is on their own books and rationally assume their potential counterparties are no better. Widening credit spreads would also lead to much higher rates on any debt perceived to be risky, which, increasingly, would be all debt with the exception of government bonds in the jurisdictions perceived to be safest. Low rates on high grade debt would not translate into low rates economy-wide. Given the extent of private debt, and the consequent vulnerability to higher interest rates across the developed world, an interest rate spike following the NIRP period would be financially devastating.

The major issue with negative rates in the shorter term is the ability to escape from the banking system into physical cash. Instead of causing people to spend, a penalty on holding savings in a banks creates an incentive for them to withdraw their funds and hold cash under their own control, thereby avoiding both the penalty and the increasing risk associated with the banking system:

Western banking systems are highly illiquid, meaning that they have very low cash equivalents as a percentage of customer deposits….Solvency in many Western banking systems is also highly questionable, with many loaded up on the debts of their bankrupt governments. Banks also play clever accounting games to hide the true nature of their capital inadequacy. We live in a world where questionably solvent, highly illiquid banks are backed by under capitalized insurance funds like the FDIC, which in turn are backed by insolvent governments and borderline insolvent central banks. This is hardly a risk-free proposition. Yet your reward for taking the risk of holding your money in a precarious banking system is a rate of return that is substantially lower than the official rate of inflation.

In other words, negative rates encourage an arbitrage situation favouring cash. In an environment of few good investment opportunities, increasing recognition of risk and a rising level of fear, a desire for large scale cash withdrawal is highly plausible:

From a portfolio choice perspective, cash is, under normal circumstances, a strictly dominated asset, because it is subject to the same inflation risk as bonds but, in contrast to bonds, it yields zero return. It has also long been known that this relationship would be reversed if the return on bonds were negative. In that case, an investor would be certain of earning a profit by borrowing at negative rates and investing the proceedings in cash. Ignoring storage and transportation costs, there is therefore a zero lower bound (ZLB) on nominal interest rates.

Zero is the lower bound for nominal interest rates if one would want to avoid creating such an incentive structure, but in a contractionary environment, zero is not low enough to make borrowing and lending attractive. This is because, while the nominal rate might be zero, the real rate (the nominal rate minus negative inflation) can remain high, or perhaps very high, depending on how contractionary the financial landscape becomes. As Keynes observed, attempting to stimulate demand for money by lowering interest rates amounts to ‘pushing on a piece of string‘. Central authorities find themselves caught in the liquidity trap, where monetary policy ceases to be effective:

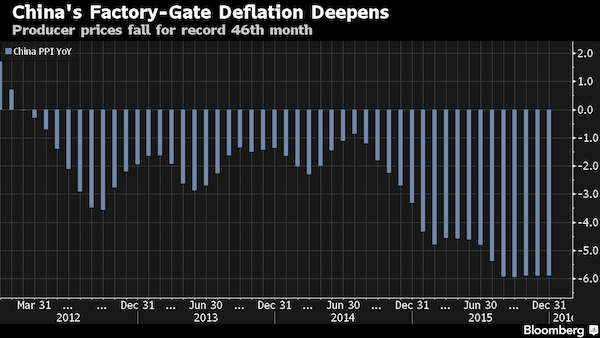

Many big economies are now experiencing ‘deflation’, where prices are falling. In the euro zone, for instance, the main interest rate is at 0.05% but the “real” (or adjusted for inflation) interest rate is considerably higher, at 0.65%, because euro-area inflation has dropped into negative territory at -0.6%. If deflation gets worse then real interest rates will rise even more, choking off recovery rather than giving it a lift.

If nominal rates are sufficiently negative to compensate for the contractionary environment, real rates could, in theory, be low enough to stimulate the velocity of money, but the more negative the nominal rate, the greater the incentive to withdraw physical cash. Hoarded cash would reduce, instead of increase, the velocity of money. In practice, lowering rates can be moderately reflationary, provided there remains sufficient economic optimism for people to see the move in a positive light. However, sending rates into negative territory at a time pessimism is dominant can easily be interpreted as a sign of desperation, and therefore as confirmation of a negative outlook. Under such circumstances, the incentives to regard the banking system as risky, to withdraw physical cash and to hoard it for a rainy day increase substantially. Not only does the money supply fail to grow, as new loans are not made, but the velocity of money falls as money is hoarded, thereby aggravating a deflationary spiral:

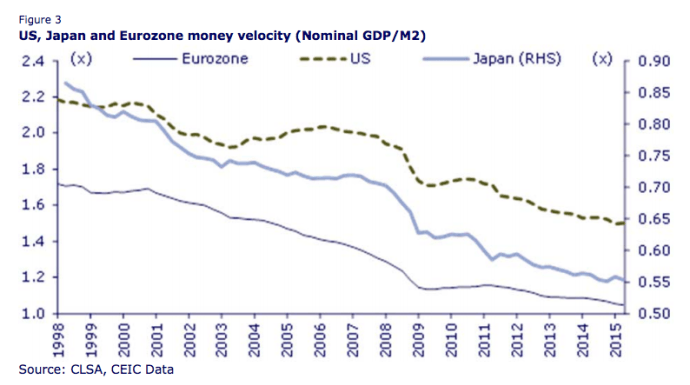

A decline in the velocity of money increases deflationary pressure. Each dollar (or yen or euro) generates less and less economic activity, so policymakers must pump more money into the system to generate growth. As consumers watch prices decline, they defer purchases, reducing consumption and slowing growth. Deflation also lifts real interest rates, which drives currency values higher. In today’s mercantilist, beggar-thy-neighbour world of global trade, a strong currency is a headwind to exports. Obviously, this is not the desired outcome of policymakers. But as central banks grasp for new, stimulative tools, they end up pushing on an ever-lengthening piece of string.

Japan has been in the economic doldrums, with pessimism dominant, for over 25 years, and the population has become highly sceptical of stimulation measures intended to lead to recovery. The negative interest rates introduced there (described as ‘economic kamikaze’) have had a very different effect than in Scandinavia, which is still more or less at the peak of its bubble and therefore much more optimistic. Unfortunately, lowering interest rates in times of collective pessimism has a poor record of acting to increase spending and stimulate the economy, as Japan has discovered since their bubble burst in 1989:

For about a quarter of a century the Japanese have proved to be fanatical savers, and no matter how low the Bank of Japan cuts rates, they simply cannot be persuaded to spend their money, or even invest it in the stock market. They fear losing their jobs; they fear a further fall in shares or property values; they have no confidence in the investment opportunities in front of them. So pathological has this psychology grown that they would rather see the value of their savings fall than spend the cash. That draining of confidence after the collapse of the 1980s “bubble” economy has depressed Japanese growth for decades.

Fear is a very sharp driver of behaviour — easily capable of over-riding incentives designed to promote spending and investment:

When people are fearful they tend to save; and when they become especially fearful then they save even more, even if the returns on their savings are extremely low. Much the same goes for businesses, and there are increasing reports of them “hoarding” their profits rather than reinvesting them in their business, such is the great “uncertainty” around the world economy. Brexit obviously only added to the fears and misgivings about the future.

Deflation is so difficult to overcome precisely because of its strong psychological component. When the balance of collective psychology tips from optimism, hope and greed to pessimism and fear, everything is perceived differently. Measures intended to restore confidence end up being interpreted as desperation, and therefore get little or no traction. As such initiatives fail, their failure becomes conformation of a negative bias, which increases the power of that bias, causing more stimulus initiatives to fail. The resulting positive feedback loop creates and maintains a vicious circle, both economically and socially:

There is a strong argument that when rates go negative it squeezes the speed at which money circulates through the economy, commonly referred to by economists as the velocity of money. We are already seeing this happen in Japan where citizens are clamouring for ¥10,000 bills (and home safes to store them in). People are taking their money out of the banking system to stuff it under their metaphorical mattresses. This may sound extreme, but whether paper money is stashed in home safes or moved into transaction substitutes or other stores of value like gold, the point is it’s not circulating in the economy. The empirical data support this view — the velocity of money has declined precipitously as policymakers have moved aggressively to reduce rates.

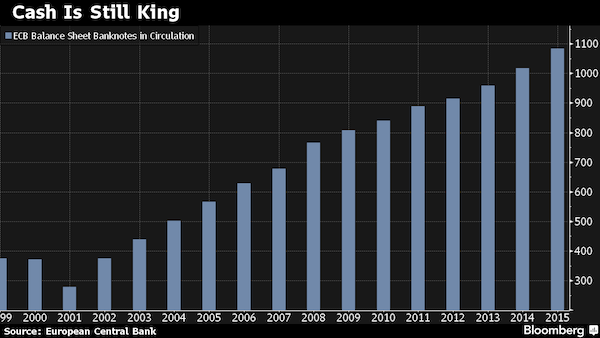

Physical cash under one’s own control is increasingly seen as one of the primary escape routes for ordinary people fearing the resumption of the 2008 liquidity crunch, and its popularity as a store of value is increasing steadily, with demand for cash rising more rapidly than GDP in a wide range of countries:

While cash’s use is in continual decline, claims that it is set to disappear entirely may be premature, according to the Bank of England….The Bank estimates that 21pc to 27pc of everyday transactions last year were in cash, down from between 34pc and 45pc at the turn of the millennium. Yet simultaneously the demand for banknotes has risen faster than the total amount of spending in the economy, a trend that has only become more pronounced since the mid-1990s. The same phenomenon has been seen internationally, in the US, eurozone, Australia and Canada….

….The prevalence of hoarding has also firmed up the demand for physical money. Hoarders are those who “choose to save their money in a safety deposit box, or under the mattress, or even buried in the garden, rather than placing it in a bank account”, the Bank said. At a time when savings rates have not turned negative, and deposits are guaranteed by the government, this kind of activity seems to defy economic theory. “For such action to be considered as rational, those that are hoarding cash must be gaining a non-financial benefit,” the Bank said. And that benefit must exceed the returns and security offered by putting that hoarded cash in a bank deposit account. A Bank survey conducted last year found that 18pc of people said they hoarded cash largely “to provide comfort against potential emergencies”.

This would suggest that a minimum of £3bn is hoarded in the UK, or around £345 a person. A government survey conducted in 2012 suggested that the total number might be higher, at £5bn….

…..But Bank staff believe that its survey results understate the extent of hoarding, as “the sensitivity of the subject” most likely affects the truthfulness of hoarders. “Based on anecdotal evidence, a small number of people are thought to hoard large values of cash.” The Bank said: “As an illustrative example, if one in every thousand adults in the United Kingdom were to hoard as much as £100,000, this would account for around £5bn — nearly 10pc of notes in circulation.” While there may be newer and more convenient methods of payment available, this strong preference for cash as a safety net means that it is likely to endure, unless steps are taken to discourage its use.