Edvard Munch Vampire 1893

Be wary of false flags. And ponder how much Canada is ahead of anybody else on immigration.

• Canadian PM Says Québec Mosque Shooting A ‘Terrorist Attack On Muslims’ (R.)

Six people were killed and eight wounded when gunmen opened fire at a Quebec City mosque during Sunday night prayers, in what Canadian Prime Minister Justin Trudeau called a “terrorist attack on Muslims”. Police said two suspects had been arrested, but gave no details about them or what prompted the attack. Initially, the mosque president said five people were killed and a witness said up to three gunmen had fired on about 40 people inside the Quebec City Islamic Cultural Centre. Police said only two people were involved in the attack. “Six people are confirmed dead – they range in age from 35 to about 70,” Quebec provincial police spokeswoman Christine Coulombe told reporters, adding eight people were wounded and 39 were unharmed.

The mosque’s president, Mohamed Yangui, who was not inside when the shooting occurred, said he got frantic calls from people at evening prayers. “Why is this happening here? This is barbaric,” he said. Prime Minister Justin Trudeau said in a statement: “We condemn this terrorist attack on Muslims in a center of worship and refuge”. “Muslim-Canadians are an important part of our national fabric, and these senseless acts have no place in our communities, cities and country.” The shooting came on the weekend that Trudeau said Canada would welcome refugees, after U.S. President Donald Trump suspended the U.S. refugee program and temporarily barred citizens from seven Muslim-majority countries from entering the United States on national security grounds.

A Canadian federal Liberal legislator, Greg Fergus, tweeted: “This is an act of terrorism – the result of years of sermonizing Muslims. Words matter and hateful speeches have consequences!” The premier of Quebec province, Philippe Couillard, said security would be increased at mosques in Quebec City and Montreal. “We are with you. You are home,” Couillard said, directing his comments at the province’s Muslim community. “You are welcome in your home. We are all Quebecers. We must continue together to build an open welcoming and peaceful society”.

Immigration Minister Ahmed Hussen was born in Somalia.

• Canada To Offer Temporary Residency To Travelers Stranded By US (R.)

Canada will offer temporary residency to any travelers stranded by U.S. President Donald Trump’s orders temporarily barring people from seven Muslim-majority countries, a senior official said on Sunday. Immigration Minister Ahmed Hussen told a news conference he did not know how many people might be eligible but said only a handful of passengers headed to the United States from Canada had been denied boarding. Trump’s decision on Friday, which also affects refugees, left many people uncertain of whether they could enter the United States. “Let me assure those who may be stranded in Canada that I will use my authority as minister to provide them with temporary residency if they need it,” Hussen said.

Liberal Prime Minister Justin Trudeau’s government has refrained from criticizing the United States, which takes 75% of Canadian exports, preferring instead to stress Canada is open to refugees. “Every country has the right to determine their policies,” said Hussen. The Canadian Council for Refugees and the Canadian Civil Liberties Association, or CCLA, called on Ottawa to withdraw from a Safe Third Country agreement with the United States, under which Canada returns asylum seekers crossing the border. “There’s a danger that the U.S. is doing blanket detentions and deportations … and not honoring asylum claims,” said CCLA Executive Director Sukanya Pillay. Such a move would be diplomatically insulting and Hussen said the pact would remain unchanged for now.

Many many lawsuits in the pipeline. Attorneys general are getting together to challenge this. Sharp edges are already being blunted.

• Trump Immigration Order Restricted By More US Judges (R.)

U.S. judges in at least four states blocked federal authorities from enforcing President Donald Trump’s executive order restricting immigration from seven Muslim-majority countries. Judges in Massachusetts, Virginia and Washington state, each home to major international airports, issued their rulings late Saturday or early Sunday, following an order on Saturday night by U.S. District Judge Ann Donnelly in New York’s Brooklyn borough. Donnelly had ruled in a lawsuit by two men from Iraq being held at John F. Kennedy International Airport. While none of the rulings struck down the executive order, the growing number of orders could complicate the administration’s effort to enforce it. Trump’s order on Friday halted immigration from Iran, Iraq, Libya, Somalia, Sudan, Syria and Yemen for 90 days, and stopped the resettlement of refugees for 120 days.

The new Republican president said these actions were needed “to protect the American people from terrorist attacks by foreign nationals admitted to the United States.” Condemnation of the order was swift and broad-based. Democratic politicians and civil rights groups weighed in, as well as U.S. allies who view the actions as discriminatory and divisive. Democratic attorneys general from California, New York and other states, meanwhile, were discussing whether to pursue their own legal challenges. The U.S. Department of Homeland Security on Sunday said it “will comply with judicial orders,” while enforcing Trump’s executive order in a manner that ensures those entering the United States “do not pose a threat to our country or the American people.”

Across the United States, lawyers worked overnight to help confused international travelers at airports. Activists and lawyers tracking the arrivals said some Border Patrol agents appeared to be disregarding the various court orders. “There is really no method to this madness,” Becca Heller, director of the New York-based International Refugee Assistance Project organization, told reporters on a conference call.

Homeland Security Secretary John Kelly has confirmed this.

• Priebus Says Trump’s Immigration Ban Doesn’t Include Green Card Holders (BBG)

The White House defended President Donald Trump’s executive order halting entry to the U.S. from seven predominantly Muslim Middle East countries after judges blocked parts of the plan. Republican lawmakers suggested the president’s action was too broad and potentially damaging to the U.S. Trump’s chief of staff said the immigration order doesn’t include holders of green cards, although those people could be subject to additional steps when they travel overseas. A federal judge in Boston became the latest to curb Trump’s immigration order, directing customs officials at the city’s Logan International Airport on Sunday to let passengers from the seven countries with valid visas disembark and go on their way. Trump told his almost 23 million Twitter followers on Sunday morning: “Our country needs strong borders and extreme vetting, NOW. Look what is happening all over Europe and, indeed, the world – a horrible mess!”

[..] The judges’ moves came at the end of a day when a number of students, refugees and dual citizens were stuck overseas or detained, and some businesses, including Google, warned employees from those countries not to risk leaving the U.S. Spontaneous protests erupted at a number of airports around the nation, and world leaders including London’s mayor and Canada’s prime minister joined U.S. lawmakers in crying foul. Although some U.S. visa and green-card holders were blocked from boarding flights to the U.S. on Saturday after the order was issued, “the executive order doesn’t affect green-card holders moving forward,” Reince Priebus, the White House chief of staff, said Sunday on NBC’s “Meet the Press” in what seemed to be an adjustment to the administration’s policy.

He added that green-card holders – legal permanent residents – may be subject to additional screening if they travel to one of the seven countries targeted by the order. Even U.S. citizens may be affected: “I would suspect that if you’re American citizen traveling back and forth to Libya you’re likely to be subjected to further questioning when you come into an airport.,” Priebus said.

As is Canada.

• Theresa May Confirms UK Exempt From Trump’s ‘Muslim Ban’ (Ind.)

Theresa May has confirmed most UK citizens will not be affected by Donald Trump’s “Muslim ban” in a frantic bid to prevent a broad backlash against the policy from damaging her government. Foreign Secretary Boris Johnson sought the clarification in anxious calls to senior figures in Mr Trump’s team, highlighting the political problems the ban was causing Ms May’s administration. The Prime Minister had finally told Mr Johnson and Home Secretary Amber Rudd to “make representations” to their US counterparts, after she initially refused to condemn the ban sparking an angry backlash from her own MPs and others. Her early reluctance to criticise it came after she was the first foreign leader to visit Mr Trump at the White House, where the pair were pictured holding hands and the President delighted Ms May by expressing a desire to sign a quick post-Brexit trade deal with the UK.

The clarification to Mr Trump’s plan to temporarily ban travellers coming into the US from a group of predominantly Muslim countries – Iraq, Iran, Libya, Somalia, Sudan, Syria and Yemen – confirms that the only people affected will be dual citizens of the UK and a listed country, going directly to the US from the listed country. But it is unclear if the move by ministers will be enough to quell anger over the ban, much of which was targeted at its discriminatory nature rather than the effect on Britons alone. As events unfolded on Sunday, Conservatives demanded Mr Trump be forbidden from addressing Parliament on his state visit, Labour and the Lib Dems called for the President to be banned from the country and champion athlete Sir Mo Farah launched an outspoken attack on the ban.

“..as Lincoln put it, a perpetual story of “a rebirth of freedom”..”

• A Clarifying Moment in American History (Eliot A. Cohen)

In an epic week beginning with a dark and divisive inaugural speech, extraordinary attacks on a free press, a visit to the CIA that dishonored a monument to anonymous heroes who paid the ultimate price, and now an attempt to ban selected groups of Muslims (including interpreters who served with our forces in Iraq and those with green cards, though not those from countries with Trump hotels, or from really indispensable states like Saudi Arabia), he has lived down to expectations. Precisely because the problem is one of temperament and character, it will not get better. It will get worse, as power intoxicates Trump and those around him. It will probably end in calamity—substantial domestic protest and violence, a breakdown of international economic relationships, the collapse of major alliances, or perhaps one or more new wars (even with China) on top of the ones we already have.

It will not be surprising in the slightest if his term ends not in four or in eight years, but sooner, with impeachment or removal under the 25th Amendment. The sooner Americans get used to these likelihoods, the better. The question is, what should Americans do about it? To friends still thinking of serving as political appointees in this administration, beware: When you sell your soul to the Devil, he prefers to collect his purchase on the installment plan. Trump’s disregard for either Secretary of Defense Mattis or Secretary-designate Tillerson in his disastrous policy salvos this week, in favor of his White House advisers, tells you all you need to know about who is really in charge. To be associated with these people is going to be, for all but the strongest characters, an exercise in moral self-destruction.

For the community of conservative thinkers and experts, and more importantly, conservative politicians, this is a testing time. Either you stand up for your principles and for what you know is decent behavior, or you go down, if not now, then years from now, as a coward or opportunist. Your reputation will never recover, nor should it. Rifts are opening up among friends that will not be healed. The conservative movement of Ronald Reagan and Jack Kemp, of William F. Buckley and Irving Kristol, was always heterogeneous, but it more or less hung together. No more. New currents of thought, new alliances, new political configurations will emerge. The biggest split will be between those who draw a line and the power-sick—whose longing to have access to power, or influence it, or indeed to wield it themselves—causes them to fatally compromise their values.

For many more it will be a split between those obsessed with anxiety, hatred, and resentment, and those who can hear Lincoln’s call to the better angels of our nature, whose America is not replete with carnage, but a city on a hill. This is one of those clarifying moments in American history, and like most such, it came upon us unawares, although historians in later years will be able to trace the deep and the contingent causes that brought us to this day. There is nothing to fear in this fact; rather, patriots should embrace it. The story of the United States is, as Lincoln put it, a perpetual story of “a rebirth of freedom” and not just its inheritance from the founding generation.

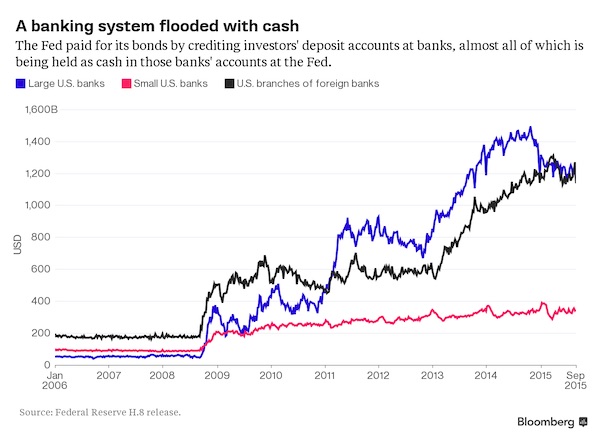

Isn’t it simply the result of having the reserve currency, though?

• US Became A Dumping Ground For The World. No More (CNBC)

America’s shift toward bilateral trade deals shows a total loss of faith in the ability of multilateral forums (G7 … G20) and U.N. agencies (IMF, etc.) to rebalance the world economy through effective international policy coordination. That was long time coming – a sad coda to the global economic (political) and financial order created at the Bretton Woods Conference in July 1944. It is at that time that the economic policy coordination was enshrined as one of the fundamental principles in the IMF’s Articles of Agreement, enjoining both surplus and deficit countries to balance out their external trade positions. What followed – to this day – has been an unending comedy of errors, recriminations and hypocrisy as policy coordination and rules of a sustainable free trade were shunned in pursuit of self-serving national interests.

Predictably, surplus countries refused to adjust (i.e., to reduce their surpluses by running stronger domestic demand to boost imports), extolled their “economic virtue” and continued to live off their trade partners. But deficit countries had no choice; they had to adjust (i.e., to reduce their deficits by shrinking their domestic demand and cutting down their imports) because they ran out of money and had to submit to foreign lenders demanding strict conditions with respect to the timing and magnitude of their trade adjustment. And here is the world we ended up with. Germany is currently running the world’s largest trade surplus of $300 billion. China is not very far behind with a $264 billion surplus. Japan’s $200 billion surplus is rapidly catching up with its large Asian neighbor, and a group of smaller export-driven East Asian countries is showing a steadily rising surplus of $300 billion.

These countries account for 40% of world GDP, but their combined trade surpluses of $1 trillion represent about 80% of the world’s total. In other words, nearly half of the world economy is a drag on the rest of the global demand, output and employment. Do you still wonder why the world economy is stuck in a hopelessly slow lane? With its systematic half-a-trillion dollars of quasi structural trade deficits, the U.S. accounts for 40% of the world’s total (trade deficits) and bears the brunt of what some would call beggar-thy-neighbor trade policies. In a more polished diplomatic “G something” language, you could also call that a “collateral damage” of uncoordinated global economic policies. Damage it is. Over the last two years, these trade deficits have taken an entire percentage point out of America’s sluggish economic growth.

Think also of the huge downward pressure on output and employment these deficits exerted, and continue to exert, in our import-competing industries. And think of this, too. While the surplus countries keep accumulating reserves and net foreign assets by recycling the money we pay for our imports, our trade deficits got us to a huge net foreign debt of $7.8 trillion during the first three quarters of last year – a $1 trillion increase from the same period in 2015. People carping about imaginary trade wars say that this is nothing to worry about. They believe that China, Japan and the rest of “dynamic Asia” will keep lending us the money we pay for their imports, and that they will be happy to hold $2.7 trillion of our IOUs – 46% of the total held by foreign investors – as they did at the end of last November. These, of course, are fairy tales. America’s trade problems are urgent and vitally important policy issues.

I know people hate him, but he’s interesting.

• The Persuasion Filter and Immigration (Adams)

[..] my starting point is the understanding that human brains did not evolve to show us reality. We aren’t that smart. Instead, our brains create little movies in our heads, and yours can be completely different from mine. We see that situation now. Half the country thinks President Trump is well on his way to becoming a Hitler-like dictator. But many other Americans think Trump is an effective business person with good intentions. They can’t both be right. I use the word “filter” to describe an optional way of looking at the world. A good filter is one that makes you happy and does a good job of predicting what happens next. Let’s use that standard to compare the Hitler Filter to what I call the Persuasion Filter. The Hitler filter clearly isn’t making people happy. The people watching that movie are protesting in the streets.

Meanwhile, the people who see Trump as a good negotiator looking out for the country are quite happy with the job he has done so far. The Persuasion Filter says Trump opens with a big first offer and negotiates back to something reasonable. If you don’t recognize the method, it looks crazy, random, and racist. But what about predictions? The Persuasion Filter predicting Trump would become president when the Hitler Filter thought he had no chance. Now we have another chance to test the predictive power of the Persuasion Filter. If Trump is a Master Persuader, as I have been telling you for over a year, he just solved his biggest problem with immigration and you didn’t notice. The biggest problem is that his supporters on the right want more immigration control than he can (or should) deliver while his many critics on the left want far less.

Normally when you negotiate there is only one party on the other side. But in this case, Trump is negotiating two extremes in two different directions. It’s the toughest possible situation. Best case scenario is that 40% of the country want you dead when it’s all over. Not good. So what does a President Trump do when he is in an impossible situation? According to the Hitler Filter, he does more Hitler stuff, such as being more extreme than anyone expected with his recent immigration declarations. That filter accurately predicted that he would be “worse” once elected. Sure enough, his temporary immigration ban is more extreme than most people expected. If things never get worse from this point on, we would have to question the Hitler Filter. But if things get worse still, the Hitler Filter is looking good.

Compare to the Persuasion Filter. This filter says Trump always opens with an extreme first offer so he has room to negotiate to the middle. The temporary ban fits that model perfectly. On the immigration topic alone, both the Hitler Filter and the Persuasion Filter predict that we get to exactly the point we are at today. Let’s call that a tie in terms of predictive power. The hard part is predicting what happens next. The Persuasion Filter says Trump is negotiating with his critics on the extreme right at the same time as he is negotiating with his critics on the left. He needed one “opening offer” that would set up both sides for the next level of persuasion. And he found it. You just saw it.

Devolved: Scotland, Wales and Northern Ireland. What a mess this is going to be.

• Theresa May To Warn Devolved Nations: You Have No Veto On Brexit (G.)

Theresa May is set for a bracing final round of Brexit talks with the leaders of the devolved nations before the likely triggering of article 50, with the prime minister warning her counterparts from Scotland, Wales and Northern Ireland that they can have no veto over the process. May is to see the other leaders in Cardiff on Monday at a meeting of the joint ministerial committee (JMC), the forum for soliciting views from around the UK on the process of leaving the UK. While the first ministers of Scotland and Wales, Nicola Sturgeon and Carwyn Jones, have stressed they cannot accept a hard Brexit without membership of or full access to the EU’s single market, May is set to tell them this will not be possible.

“We will not agree on everything, but that doesn’t mean we will shy away from the necessary conversations and I hope we will have further constructive discussions,” May said in comments released ahead of the meeting. Last week’s supreme court judgment on the need for MPs to vote on triggering article 50 “made clear beyond doubt that relations with the EU are a matter for the UK government and UK parliament”, May said. While the main element of the ruling was to oblige May to put the article 50 process, which will trigger departure from the EU, as a bill to parliament – a subsidiary element of the judge’s decision was that the devolved governments could not veto the process.

Line of the day: “..We don’t need these kinds of tensions at this time of a geopolitical Jurassic Park..”

• UK and EU Heading For Economic Cold War – Italian Foreign Minister (G.)

A senior Italian official has warned that the UK and the European Union are heading into an “economic cold war” over Brexit that could wreak havoc on the west and weaken the continent. Mario Giro, Italy’s deputy foreign minister, said that while many countries in the EU had said the UK’s vote to leave the EU represented a loss to the union, there were more hardliners in the EU against the UK than it appeared. “When we are among the 27 [countries within the EU, not including the UK], the hardliners are more numerous than it appears. I cannot quote a country in particular at the moment. We will see it at the beginning of the negotiation,” Giro said in an interview with the Guardian.

He added: “We are hearing more and more that there are people – economic interests – who are thinking they can inherit some economic position, thinking that they can take away from the UK some of the position of the City of London. Not Italy, of course, because we are not in that position. And this will be an economic war. Let’s say an economic cold war, and we are not in favour of it.” The statement followed remarks this month by the British prime minister, Theresa May, in which she said the UK was prepared for a “hard Brexit” if she could not negotiate a reasonable agreement with the EU over Britain’s departure. She said attempts by other EU countries to wreak vengeance on the UK would be an “act of calamitous self-harm” because the UK in turn would be prepared to radically cut taxes to attract businesses.

Italian officials have always said their top priority in Brexit negotiations would be to guarantee the rights of hundreds of thousands of Italians who lived in the UK. Giro suggested that a coming “battle of interests” – which he described as a competition between economic interests, not necessarily individual states – could have terrible consequences. “This will be a disgrace. To enter into a new era of hard competition on big money questions involving companies, this is very bad for the western world. We don’t need these kinds of tensions at this time of a geopolitical Jurassic Park,” he said, meaning that it was a world where every interest was out for itself.

Creative destruction.

• Eurozone ‘Destruction’ Necessary For Countries To Thrive Again – Stark (Tel.)

The eurozone must break up if its members are to thrive again, according to a former ECB official. Jürgen Stark, who served on the ECB’s executive board during the financial crisis, said it was time to “think the unthinkable” and work towards a “reset” of Europe that pulled power away from Brussels. The former vice-president of Germany’s Bundesbank said the creation of a two-speed eurozone, with France and Germany at its core, would help to ensure the smaller bloc’s survival. “We have to think the unthinkable. And it is already unthinkable to think about the restart of Europe, which means we have to be creative. But in order to be creative, you have to destruct [sic] something.” Mr Stark said countries such as Italy, which has seen its economy stagnate since the crisis, would be better off outside the single currency area.

“Italy was accustomed to this ongoing devaluation of the lira from the mid-Seventies until the late Nineties. Maybe they need devaluation and their own currency in order to become more competitive again,” he said. Speaking at an event organised by ETF Securities, Mr Stark said current accommodative ECB policy meant countries were likely to “muddle through” in the coming years and move closer “by coincidence”. However, he said the eurozone’s problems would resurface, regardless of the political landscape. “In the long run, in the context of a European reset, one has to discuss the issue of whether it is still appropriate to keep these countries with different economic structures and different economic performances together. There is no convergence anymore. “We have had divergence rather than convergence… from the very beginning.”

Mr Stark said Belgium, France, Luxembourg, the Netherlands and Germany “plus Austria and Finland” could form the core of a system with “staggered integration” for other countries such as Italy and Greece. While he described Marine Le Pen’s victory in French elections this year as “unlikely” due to the country’s voting system, Mr Stark said the Front National leader’s victory would also be the catalyst of a eurozone split. Mr Stark, who resigned from the ECB in 2011, said he “blamed” the central bank for allowing countries to drag their heels on reforms. “As long as the ECB gives a signal in its operations to governments that ‘we are the backstop’ and ‘we will prevent country ‘a’ or country ‘b’ from becoming insolvent’ – there will be no structural reforms,” he said.

A correlation vs causation problem. Where the US was very strong, China is not.

• The Dollar Will Die With a Whimper, Not a Bang (Rickards)

[..] the dollar and sterling seesawed over the 20 years following the First World War, with one taking the lead from the other as the leading reserve currency and in turn giving back the lead. In fact, the period from 1919–1939 was really one in which the world had two major reserve currencies — dollars and sterling — operating side by side. Finally, in 1939, England suspended gold shipments in order to fight the Second World War and the role of sterling as a reliable store of value was greatly diminished apart from the U.K.’s special trading zone of Australia, Canada and other Commonwealth nations. The 1944 Bretton Woods conference was merely recognition of a process of dollar reserve dominance that had started in 1914. The significance of the process by which the dollar replaced sterling over a 30-year period has huge implications for you today.

Slippage in the dollar’s role as the leading global reserve currency is not necessarily something that would happen overnight, but is more likely to be a slow, steady process. Signs of this are already visible. In 2000, dollar assets were about 70% of global reserves. Today, the comparable figure is about 62%. If this trend continues, one could easily see the dollar fall below 50% in the not-too-distant future. It is equally obvious that a major creditor nation is emerging to challenge the U.S. today just as the U.S. emerged to challenge the U.K. in 1914. That power is China. The U.S. had massive gold inflows from 1914-1944. Although China’s gold purchases may have fallen off recently, it has been experiencing massive gold inflows. Gold reserves at the People’s Bank of China increased to 1,842 tonnes at the end of 2016, according to the China Gold Association. That’s up 11% from the 1,658 tonnes it held in June, 2015.

But China has acquired thousands of metric tonnes since without reporting these acquisitions to the IMF or World Gold Council. Based on available data on imports and the output of Chinese mines, actual Chinese government and private gold holdings are likely much higher. It’s hard to pinpoint because China operates through secret channels and does not officially report its gold holdings except at rare intervals. China’s gold acquisition is not the result of a formal gold standard, but is happening by stealth acquisitions on the market. They’re using intelligence and military assets, covert operations and market manipulation. But the result is the same. Gold’s been flowing to China in recent years, just as gold flowed to the U.S. before Bretton Woods.

Get your shades out. The future’s so bright.

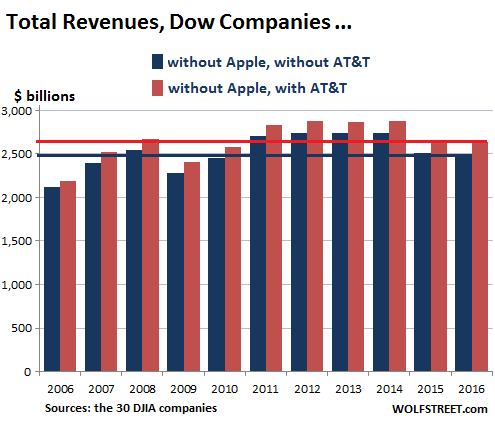

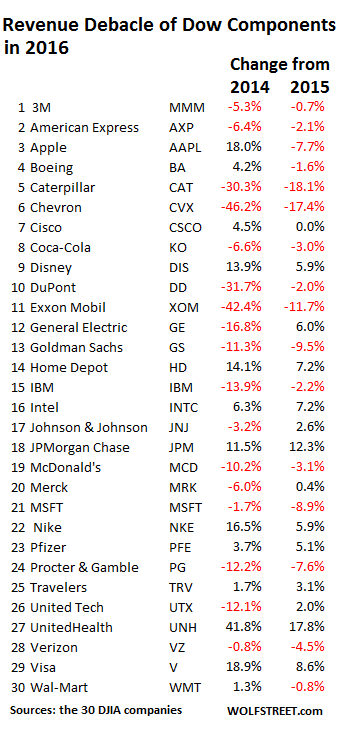

• Dow Companies Report Worst Revenues since 2010, Dow Rises to 20,000 (WS)

The Dow-20,000 hats have come out of the drawer after an agonizingly long wait that had commenced in early December with the Dow Jones Industrial Average tantalizingly close to the sacred number before the selling started all over again. What a ride it has been. From the beginning of 2011 through January 27, 2017, so a little more than six years, the DJIA has soared 73%, from 11,577 to 20,094. Glorious!! But when it comes to revenues of the 30 Dow component companies – a reality that is harder to doctor than ex-bad-items adjusted earnings-per-share hyped by Wall Street – the picture turns morose. The 30 Dow component companies represent the leaders of their industries. They’re among the largest, most valuable, most iconic American companies. And they’re periodically booted out to accommodate a changed world.

[..] Ah-ha, you say. It’s all the oil bust’s fault. Without the oil companies that have been ravaged by the oil bust, revenues are fine. OK, maybe not fine. Revenues without the oil bust companies are up 13% since 2011. That’s an average annual growth rate of 2.5%, barely above the rate of inflation! But the DJIA hit 20,000 with the oil majors in the average. So in looking at the relationship between aggregate revenues and stock price movements, we need to leave them in the mix. And reality looks even worse. Apple, whose revenues have skyrocketed by over 1,000% since 2006, from $19.3 billion to $216 billion, became a Dow component in 2015, replacing AT&T. And its revenues weren’t part of the 30 Dow components until 2015. So here’s what the aggregate revenues of the Dow components look like without Apple (blue columns) and without Apple but with AT&T (brown columns). A pure stagnation fest:

In both scenarios, revenues in 2016 were lower than they had been in 2008. Only 2009 and 2010 were lower. So in terms of revenues, 2016 was for the Dow components ex-Apple the worst year since 2010! And this despite the five-year binge in acquisitions! So how have the last two years been? Don’t even ask. Of the 30 companies in the Dow, 16 sported declining revenues in 2016. And 17 sported declining revenues over the two-year span since 2014! Only two of them are oil companies! This table shows that inglorious list in all its beauty:

Deliberate torture in a sort of good cop bad cop routine.

• Eurozone Bailout Fund Says Greek Public Debt Is ‘Manageable’ (R.)

Greece’s public debt can be manageable, the eurozone bailout fund said on Sunday, responding to a leaked report by the IMF that the country’s debt will explode to 275% of GDP by 2060. A spokesman for the bailout fund, the European Stability Mechanism (ESM), said the path for Greek public finances agreed between Athens and the eurozone was credible and backed by contingency measures in case of unforeseen events. “We believe that Greece’s debt burden can be manageable, if the agreed reforms are fully implemented, thanks to the ESM’s exceptionally favorable loan conditions over the long term and the recently adopted short-term debt relief measures,” the ESM said. In the document, seen by the Financial Times, the IMF calculated that Greece’s debt load would reach 170% of gross domestic product by 2020 and 164% by 2022.

But it would become explosive thereafter and grow to 275% of GDP by 2060, the paper quoted the report as saying. The spokesman said, however, that the eurozone had promised to offer Greece additional debt relief if Athens delivers on all its reform promises. “As a result, we see no reason for an alarmistic assessment of Greece’s debt situation”. The IMF has long been calling for substantial eurozone debt relief for Athens, but Germany, which faces elections this year, has been strongly opposed to such a move until after 2018, when Greece is to finish all its promised reforms. The IMF assessment of Greek debt developments may make it impossible for the Fund to join the current bailout for Greece, now shouldered only by eurozone governments, because the fund’s policy is to enter programs which in the end allow a country to cope on its own. Eurozone governments want the IMF on board, but do not seem to be ready to provide the debt relief to Greece that is necessary for the Fund to join.

Incursions into Greek air space have become ‘normal’. Now this. Brussels better act. Or Greece will, at some point. It puts Theresa May’s fast trip to Ankara to sell more weaponry in a bleak light.

• Turkish Gunboat With Army Chief Sails Into Greek Waters; High Alert (K.)

The Greek military was on high alert on Sunday after a Turkish gunboat carrying Chief of General Staff Hulusi Akar sailed into Greek waters and around the Imia islets at around 10.30 a.m. The Turkish gunboat was escorted by several assault craft carrying commandos, which also circled the islets that brought Greece and Turkey to the brink of war 21 years ago, almost to the day. Greek authorities responded to what is being viewed as Turkish provocation with warnings and dispatched the Hellenic Navy’s Krataios gunboat, which escorted the Turkish flotilla out of Greece’s territorial waters. Diplomatic officials believe the incident to be a response to a Greek Supreme Court ruling last week rejecting a request from Ankara for the extradition of eight Turkish servicemen accused of taking part in failed coup last summer. Turkish military authorities released photographs showing Akar on the gunboat, with Imia in the background.

Bless their souls.

• Greek Fishermen Who Brave The Seas To Rescue Refugees Now Need Saving (NBC)

At the height of the refugee crisis in Sept. 2015, the 63-year-old Marmarinos and the rest of the village’s fishermen gave up working to spend months saving families from the rough, cold waters. Many of them were seeking safety from the bombs falling on Syria. “Mothers, pregnant women, children,” Marmarinos recalled. “So many children, all in the waters, wet, in a horrible situation.” Pideris, 40, says the fishermen risked their own lives “because it was the humane thing to do.” He said refugees and migrants “would fall overboard, they didn’t know how to navigate, boats were left adrift, they’d lose their engines, they’d break apart and the sea would fill with people.” But today, it’s Pideris and Marmarinos who need help after a winter storm on January 9 dropped nearly two feet of snow in their village. The boat canopies couldn’t take the weight and capsized while tied up in the harbor.

The boats are the pair’s sole sources of income. Pideris said he was in shock. “I’ve been in danger at sea, fishing and helping refugees, and my boat sinks in the safety of the harbor,” he said. “My brain stopped. My heart stopped. I was the living dead.” Both vessels sat in the corrosive sea water for three days, until the roads cleared enough to bring in a crane. The electronics and engines on both vessels were destroyed and require thousands of dollars in repairs. The mayor of Lesbos says money from a humanitarian award — the Olof Palme prize, which given to the islanders for embracing migrants – will go toward the cost of repairs. Marmarinos says he’s proud “because I offered help and I see it’s coming back to me … Even if no one helped I’d still be proud and if it happens again, I’d do the same.” Marmarinos and Pideris hope to be fishing again by early next month.

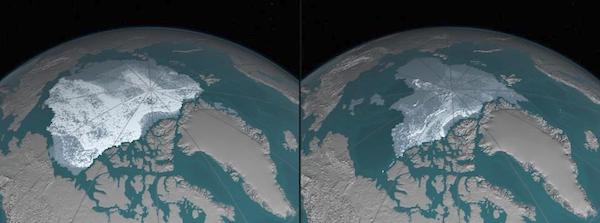

I think that’s the clearest picture of what has happened to Arctic sea ice that I’ve seen.

• NASA – 30 Years Of Before And After Images Around The World (F.)

The Arctic’s sea ice has been in decline for decades as pictured above comparing September 1984 to September 2016. The total area of persistent (4 years or older) ice has declined from 718,000 square miles to 42,000 square miles in the time period above. In the above images blue/grey ice is younger whereas white ice is older.