Edmund Melzl The Buddhas of Bamiyan in Afghanistan 1958

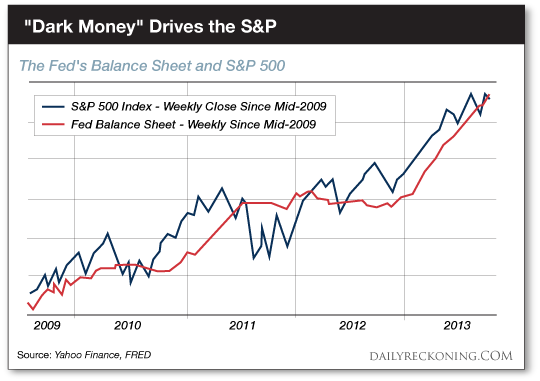

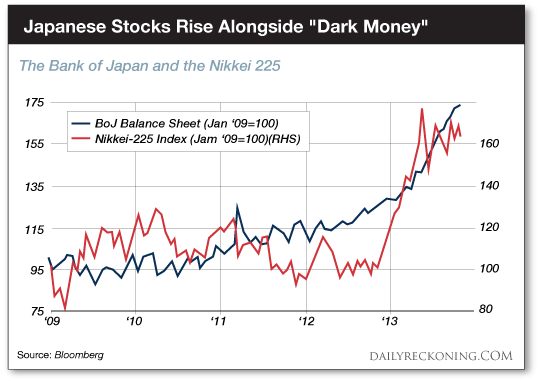

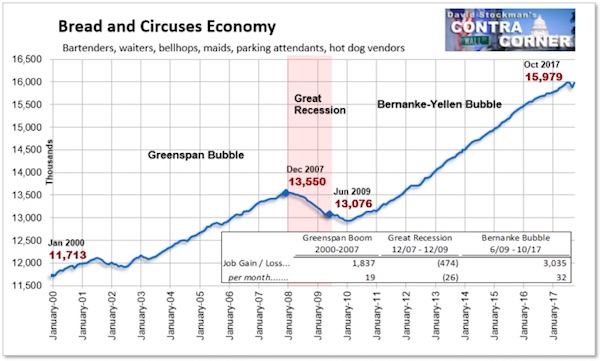

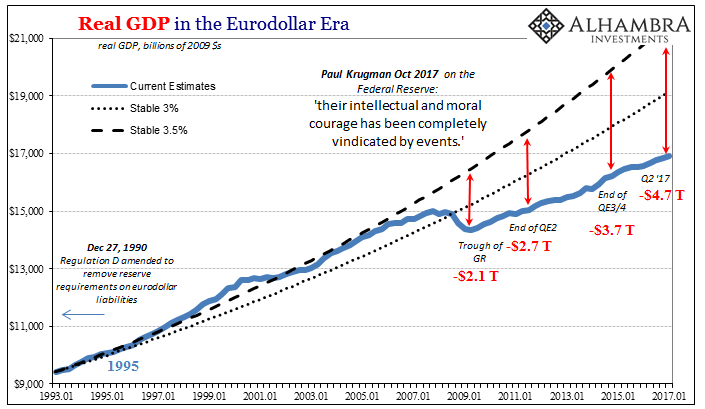

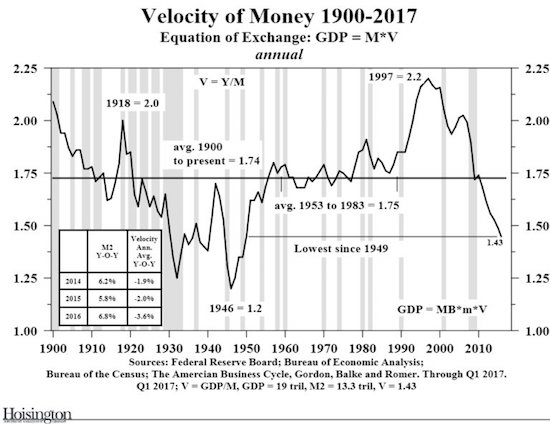

“How can anyone claim the Fed under Yellen or Bernanke performed even minimally well?”

• Political Economics (Snider)

The political winds are changing, and the parties themselves are being realigned in different directions (which is not something new; there have been several re-alignments throughout American history even though the two major parties have been entrenched since the 1850’s when Republicans first appeared). Who the next Fed Chair is could tell us something about how far along we are in this evolution. What Krugman wants, meaning, it is safe to assume, what all those like him want, is simple: success. He believes that the central bank has given us exactly that, therefore it is stupid to upset what works.

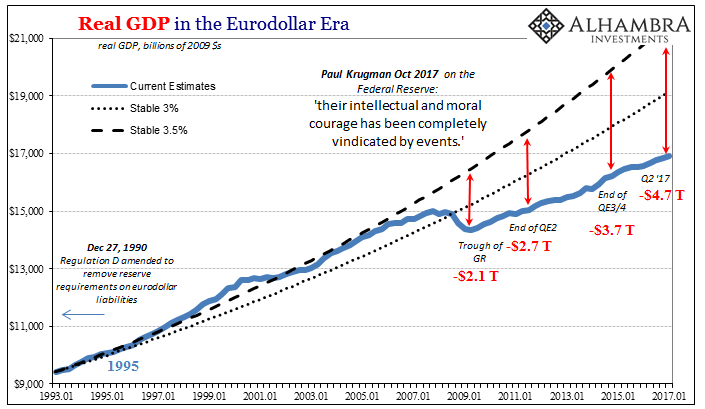

“In particular, both Bernanke and Yellen responded effectively to a once-in-three-generations economic crisis despite constant heckling from back-seat drivers in Congress and on the political right in general. And their intellectual and moral courage has been completely vindicated by events.” This is right here is the very central point of political difference that is pulling the world slowly apart. Krugman offers no evidence for his assertion, that the Fed has performed admirably and successfully, he just states it as if it was so (a common tactic in the mainstream, the fallacy of authority). Whenever challenged on this contention, the argument will always go back to “jobs saved.”

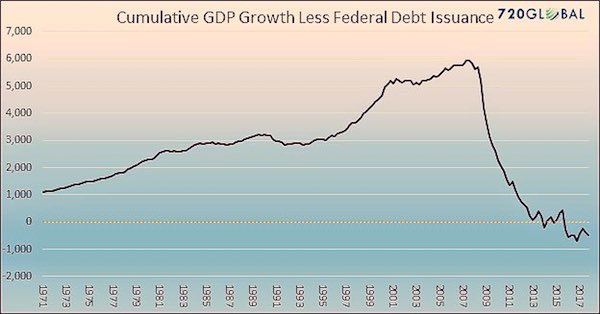

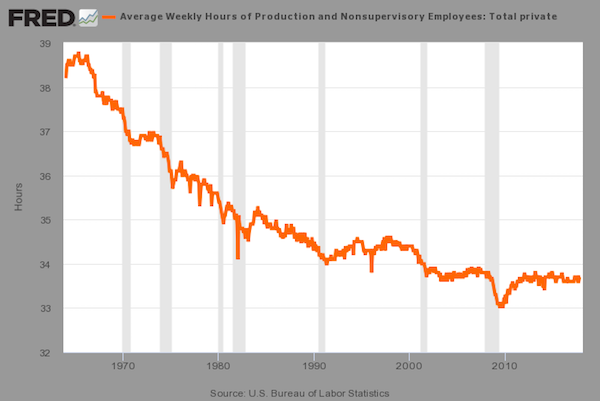

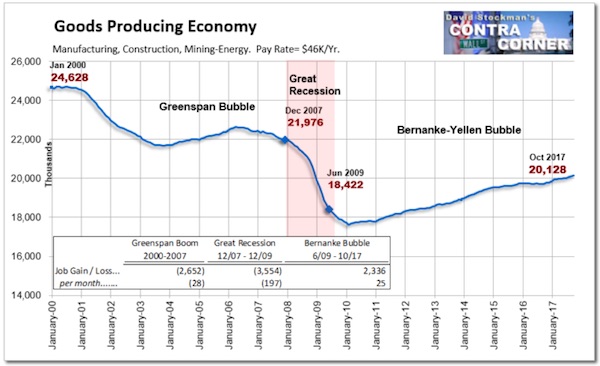

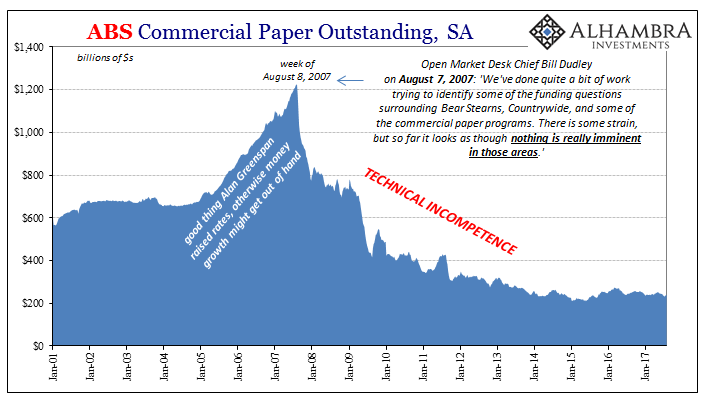

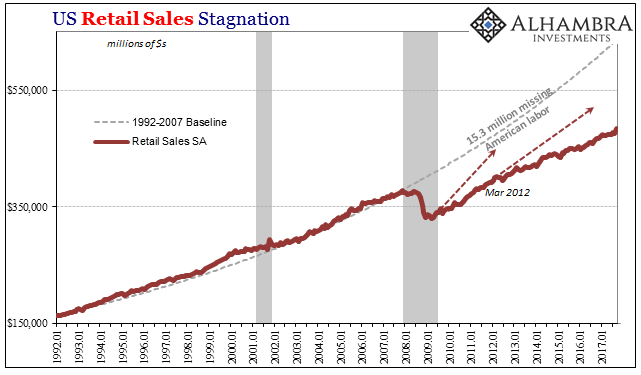

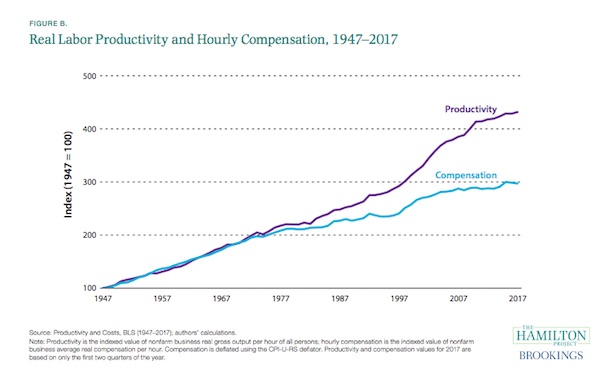

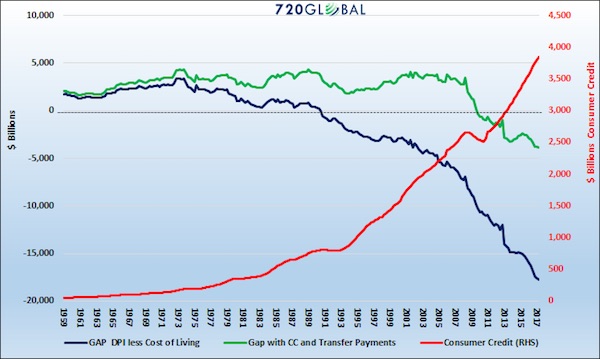

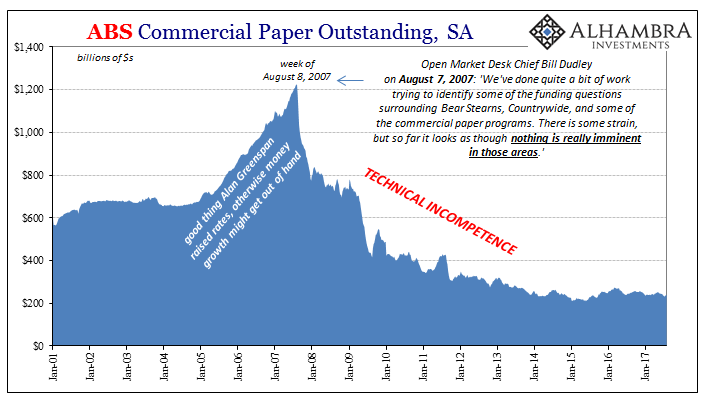

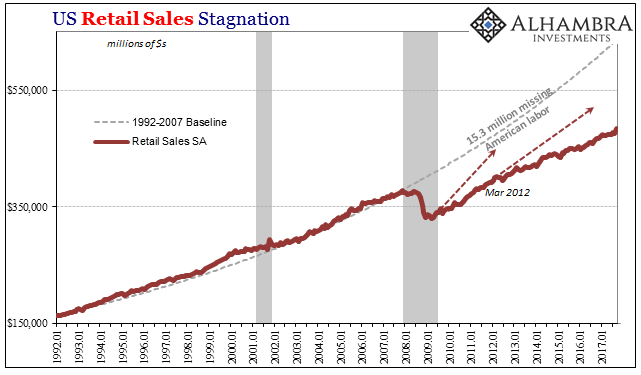

A worse counterfactual downside is not a rational standard for evaluation in any discipline or context. The only benchmark that should matter is recovery, as any economy facing recession, even an unusually severe one, has to make it back to the prior condition. On that score the Fed has utterly and unambiguously failed. One reason for it is the one thing Economists like Krugman never bring up; the 2008 panic. How can anyone claim the Fed under Yellen or Bernanke performed even minimally well? The very fact that the panic happened at all is a direct indictment on monetary policy and the people who were there during it (you had one job to do!).

[..] The irrational, emotional defense for the ideology is what is driving political upheaval, including Donald Trump’s occupying the White House. To most people, Krugman’s ideas and assertions are nonsense. They don’t have to know anything about QE’s effect on the TBA market and dollar rolls, how exactly McDonald’s was borrowing from FRBNY, or what it was that AIG did that ultimately made the Federal Reserve profits. People know the Fed did a bunch of stuff that didn’t work because they can tell there is something very wrong with the economy.

Read more …

Short, long, smart, dumb.

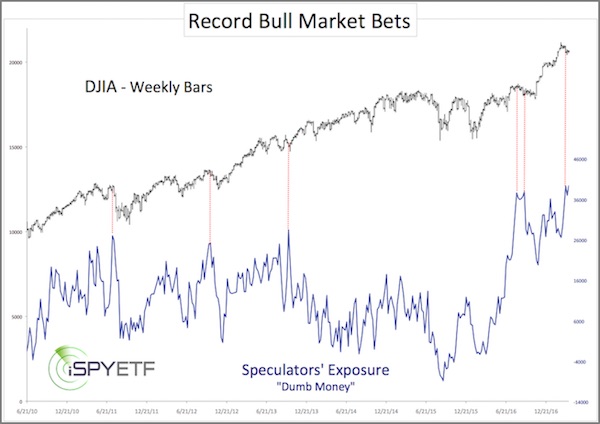

• Smart Money And Dumb Money Are Moving In Opposite Directions (MW)

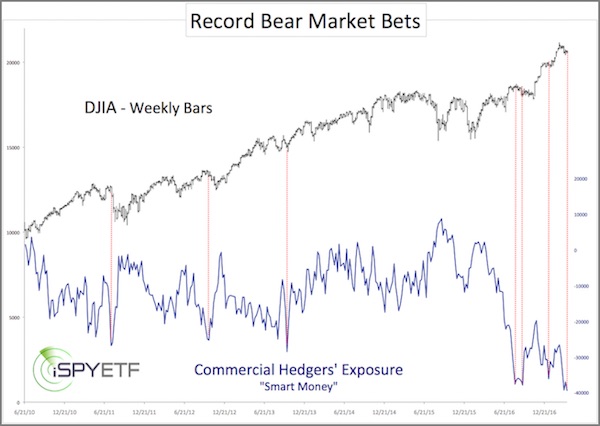

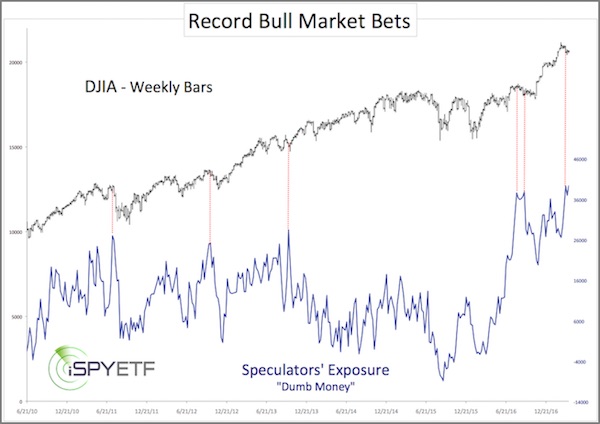

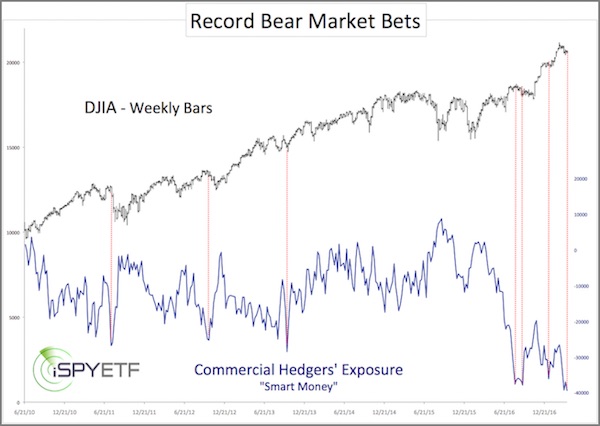

While all seems calm in the U.S. equity markets, with stocks continuing to hit all-time highs, an interesting trend has emerged beneath the surface. Combing through the latest Commitments of Traders report from the Commodity Futures Trading Commission (CFTC), we found that commercial traders (“smart money”) have a record number of short positions in the Dow Jones Industrial Average. At the same time, noncommercial traders (“dumb money”) have a record number of long positions. You may be thinking “one group thinks stocks will go up, and the other thinks stocks will go down. What’s the big deal?” Here’s the big deal. There’s a strong negative correlation between commercial traders’ short positions and the Dow Jones Industrial Average, as the below chart shows. When short positions increase, the DJIA usually falls … perfect timing!

The opposite also is true. When noncommercial traders increase their long positions, the market usually drops shortly thereafter. It seems they have a habit of buying the market at exactly the wrong time.

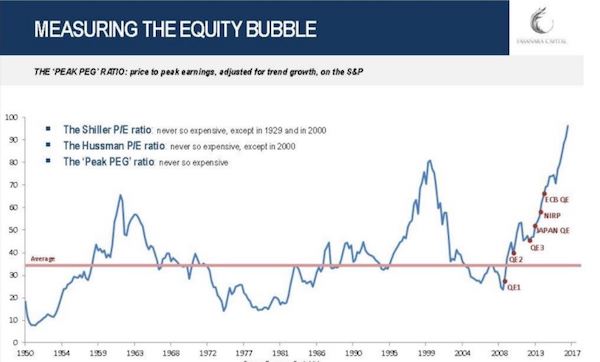

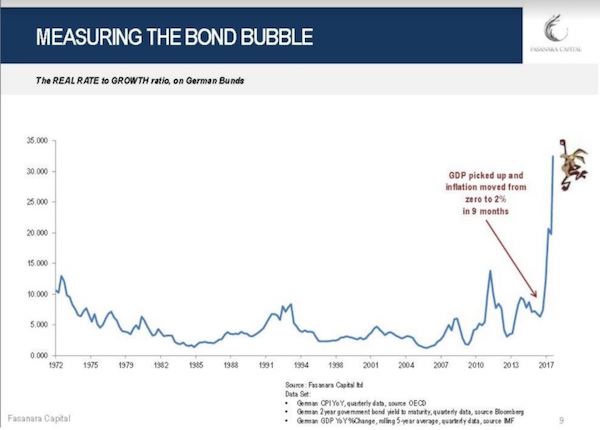

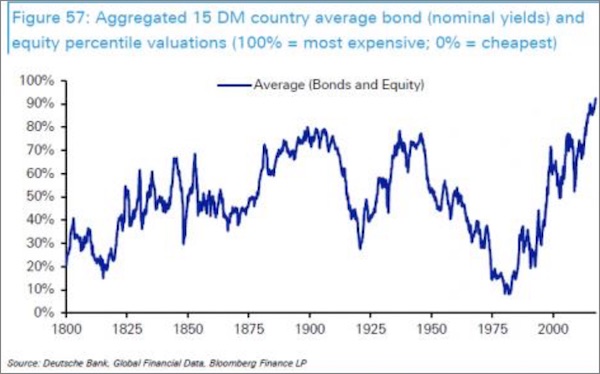

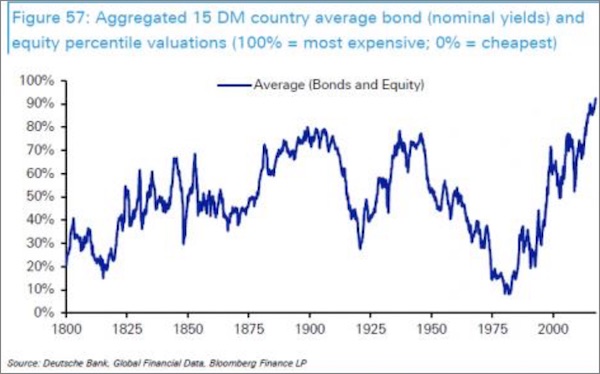

Given that the “smart money” usually wins this tug of war, let’s focus on the reasons behind their negative outlook for stocks. Here’s some of the reasons professional money managers may be growing cautious about stocks today. Findings from Goldman Sachs Asset Management (GSAM) show that by just about every measure, stocks are expensive today. But it’s not only U.S. stocks that are trading at all-time highs. This chart from Deutsche Bank shows that, in their own words, “we’re in a period of very elevated global asset prices — possibly the most elevated in history.”

Lofty valuations are likely a big factor in Warren Buffett’s and Seth Klarman’s reasoning for holding record levels of cash in their portfolios. In September, Buffett’s Berkshire Hathaway had $99.7 billion in cash on the sidelines. Klarman’s Baupost Group held 42% of its portfolio in cash, the largest single position. So U.S. stocks are expensive by most measures. But they have been expensive for quite some time. High valuations don’t mean a crash is imminent. They do, however, tell us something about future returns.

Read more …

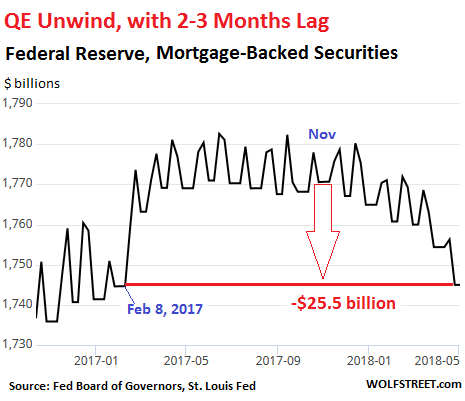

Absolutely nuts. But then, the Fed buys mortgage backed securities…

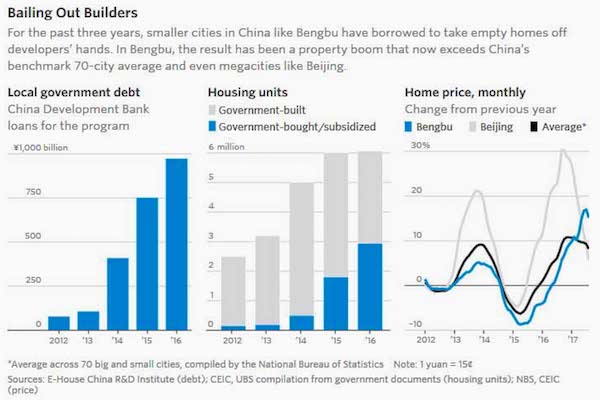

• Beijing Is The Covert Buyer Of A Quarter Of All Chinese Real Estate (ZH)

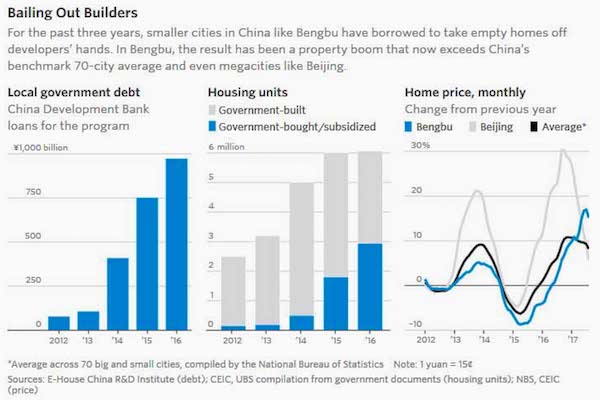

According to a fascinating new WSJ report, China’s housing downturn is likely far worse than meets the eye, as under Beijing’s direction more than 200 cities across China for the last three years have been buying surplus apartments from property developers and moving in families from condemned city blocks and nearby villages. China’s Housing Ministry, which is behind the purchases, said it plans to continue the program through 2020. The strategy, supported by central-government bank lending, has rescued housing developers and lifted the property market, As the WSJ notes, this latest backdoor bailout “It is a sharp illustration of China’s economy under President Xi Jinping and the economic challenges he will face as he renews his 5-year term at a twice-a-decade Communist Party Congress that opens on Wednesday.”

Rosealea Yao from Gavekal Dragonomics, who was also quoted above, wrote that “the government’s creativity in coming up with new ways of supporting the housing market is impressive—but it’s also an indication that it still depends on housing for growth.” While traditionally, China’s government used to build homes for families who lost theirs to development or decay, last year, local governments, from the northeast rust belt to the city of Bengbu with 3.7 million amid the croplands of central Anhui province, spent more than $100 billion to buy housing from developers or subsidize purchases, according to Gavekal Dragonomics. In other words, the reason why China no longer has ghost cities is because the government is buying them in just as concerning, “ghostly” transcations.

The underlying structure is yet another typically-Chinese ponzi scheme: “Underpinning the strategy is a cycle of debt. Cities borrow from state banks for purchases and subsidies, then sell more land to developers to repay the loans. As developers build more housing, they, too, accrue more debt, setting up the state to bail them out again. The burden on the state rises, as does the risk of collapse.” [..] Beijing is now the (covert) marginal buyer of a quarter of all Chinese real estate. That, in itself, is a mindblowing statistic. What is scarier, is that despite this implicit backstop, property sales are once again declining after 30 months of increases. One can only imagine the epic crash that would ensue at this moment, if – for some reason – the government bid were to be pulled, and just how spectacular the ensuing global depression would be as the rug is pulled from below the middle class of the world’s fastest growing economy.

Read more …

“..And even if a society does redistribute wealth, if it’s too small an amount, “a partial oligarchy will result..”

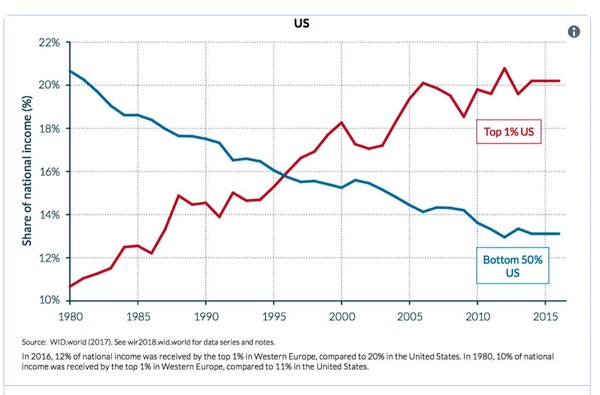

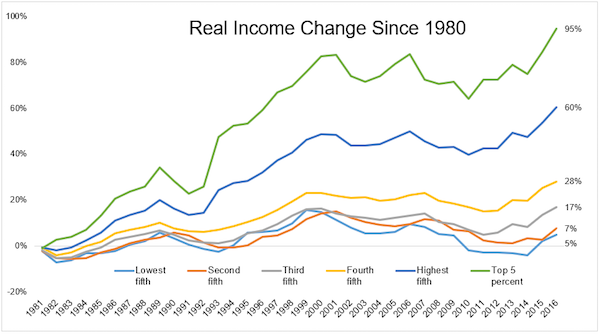

• The Mathematics of Inequality (TuftsNow)

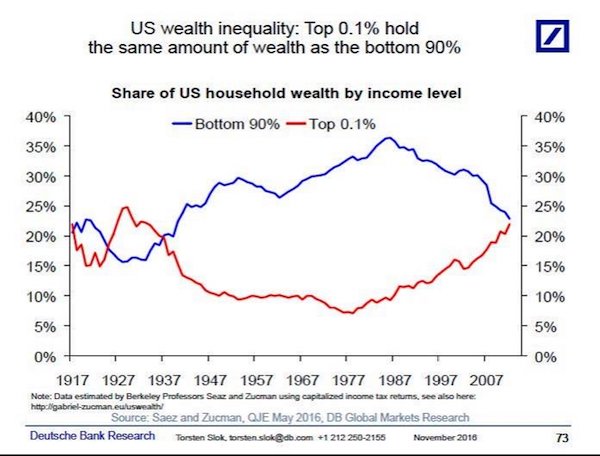

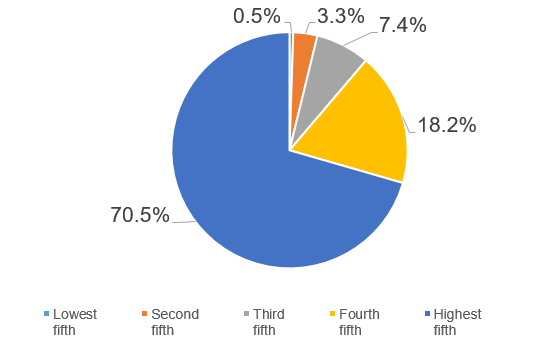

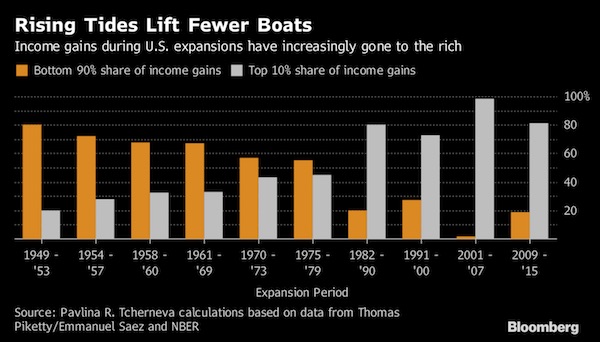

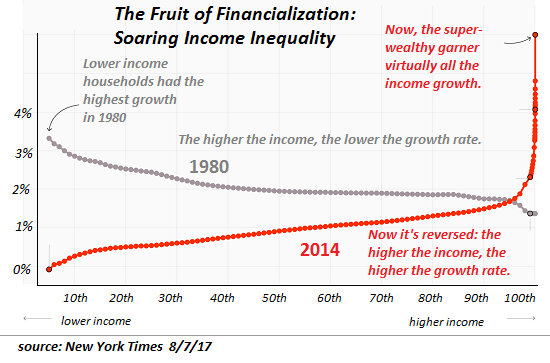

Seven years ago, the combined wealth of 388 billionaires equaled that of the poorest half of humanity, according to Oxfam International. This past January the equation was even more unbalanced: it took only eight billionaires, marking an unmistakable march toward increased concentration of wealth. Today that number has been reduced to five billionaires. Trying to understand such growing inequality is usually the purview of economists, but Bruce Boghosian, a professor of mathematics, thinks he has found another explanation—and a warning. Using a mathematical model devised to mimic a simplified version of the free market, he and colleagues are finding that, without redistribution, wealth becomes increasingly more concentrated, and inequality grows until almost all assets are held by an extremely small% of people.

“Our work refutes the idea that free markets, by virtually leaving people up to their own devices, will be fair,” he said. “Our model, which is able to explain the form of the actual wealth distribution with remarkable accuracy, also shows that free markets cannot be stable without redistribution mechanisms. The reality is precisely the opposite of what so-called ‘market fundamentalists’ would have us believe.” While economists use math for their models, they seek to show that an economy governed by supply and demand will result in a steady state or equilibrium, while Boghosian’s efforts “don’t try to engineer a supply-demand equilibrium, and we don’t find one,” he said. [..] The model tracks the data with remarkable accuracy, he said. He and his team will soon publish a paper on how it relates to U.S. wealth data from 1989 to 2013.

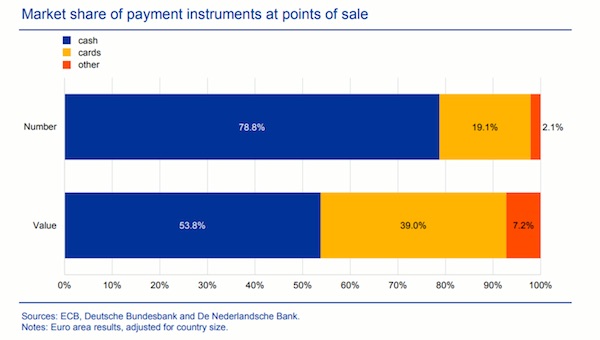

“We have also begun to apply it to wealth data from the ECB, and so far it seems to work very well for certain European countries as well,” he said [..] It turns out that when agents do well in early transactions, the odds are so increasingly stacked in their favor that—without redistribution from taxes or other wealth-transfer mechanisms—they will get more money, and keep accruing wealth inevitably. “Without redistribution of wealth, our market economy would not be stable,” said Boghosian. “One person would run away with all the wealth, and it would keep going until it came to complete oligarchy.” And even if a society does redistribute wealth, if it’s too small an amount, “a partial oligarchy will result,” Boghosian said.

Read more …

Well that’s clear enough.

• New Zealand’s New Prime Minister Brands Capitalism A ‘Blatant Failure’ (Ind.)

New Zealand’s new prime minister called capitalism a “blatant failure”, before citing levels of homelessness and low wages as evidence that “the market has failed” her country’s poor. Jacinda Ardern, who is to become the nation’s youngest leader since 1856, said measures used to gauge economic success “have to change” to take into account “people’s ability to actually have a meaningful life”. The 37-year-old will take office next month after the populist New Zealand First party agreed to form a centre-left coalition with her Labour Party. They will be supported by the liberal Greens. New Zealanders had been waiting since 23 September to find out who would govern their country after national elections ended without a clear winner. Ms Ardern has pledged her government will increase the minimum wage, write child poverty reduction targets into law, and build thousands of affordable homes.

In her first full interview since becoming prime minister-elect, she told current affairs programme The Nation that capitalism had “failed our people”. “If you have hundreds of thousands of children living in homes without enough to survive, that’s a blatant failure,” she said. “What else could you describe it as?” Incumbent prime minister Bill English, whose National Party has held power for nine years, has said his party grew the economy and produced increasing budget surpluses which benefited the nation. But Ms Ardern said: “When you have a market economy, it all comes down to whether or not you acknowledge where the market has failed and where intervention is required. Has it failed our people in recent times? Yes. “How can you claim you’ve been successful when you have growth roughly three per cent, but you’ve got the worst homelessness in the developed world?”

Read more …

He won by a landslide. An even more far-right and anti-EU party also won. More problems in the heart of the Union.

• Euroskeptic Billionaire on Route to Czech Election Victory (BBG)

A Czech billionaire looks set to win parliamentary elections Saturday, overcoming traditional political parties on a pledge to run the state like a business, fight Muslim immigration and oppose deeper integration with the European Union. Andrej Babis, who has drawn comparisons to Donald Trump and Silvio Berlusconi, had a wide lead in opinion polls before two days of voting started Friday. With a chemical, food and media empire employing 34,000 in 18 countries, the Slovak-born businessman – and second-richest Czech – increased his popularity while serving as finance minister before he was fired by his coalition partner, Prime Minister Bohuslav Sobotka. Taking credit for the EU’s lowest unemployment, one of its fastest rates of economic growth, and a budget surplus, Babis has portrayed himself as a competent manager struggling against traditional parties.

That’s lifted his ANO party’s support, while his attacks against Muslim immigration and criticism of the EU have helped fuel the rise of anti-establishment political forces similar to Germany’s AfD and Austria’s Freedom Party. It’s also raised concern that a Babis victory may add another source of tension within the EU, which has clashed with Poland and Hungary over democratic values. “Babis has managed to take advantage of the crisis of traditional parties and offer something new,” Josef Mlejnek, a political scientist at Charles University in Prague, said by phone. “He has depicted his rivals as an incompetent, corrupt bunch and he is presenting himself as the only one who can get things in order.” [..] Sobotka dismissed Babis in May in a conflict over his past business dealings.

The premier’s Social Democrats later teamed up with the opposition to strip the billionaire of his parliamentary immunity from prosecution to make way for an investigation into fraud allegations. Police have since charged Babis, 63, in the case of a 50 million-koruna ($2.3 million) in EU subsidies transferred to his Stork Nest recreation complex. Babis denies wrongdoing and says the allegations are an attempt to sideline him from politics. Despite the scandal, he’s held on to support siphoned from both the Social Democrats and other traditional parties. He has boasted of streamlining government operations and, via a law requiring retailers to link their cash registers to the Finance Ministry, boosting budget revenue and cracking down on tax evasion. At the same time, he’s railed against EU “meddling,” a stance that resonates with voters in the bloc’s most euroskeptic member.

Read more …

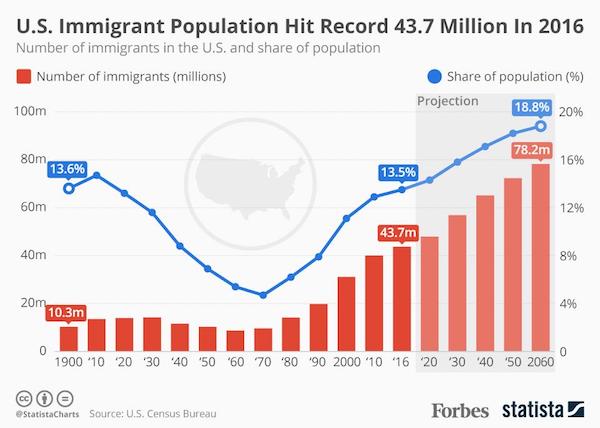

What about the time when almost all Americans were immigrants?

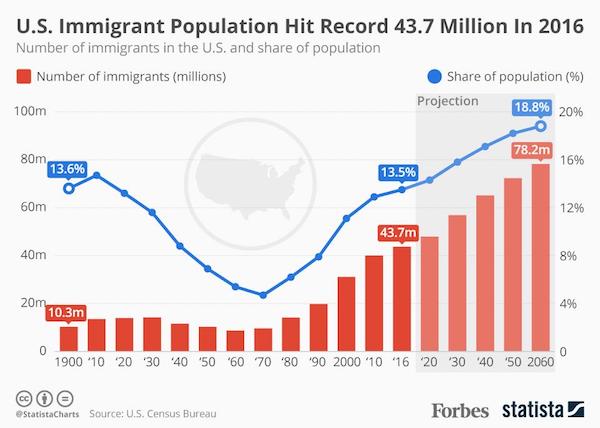

• US Immigrant Population Climbed To Record 43.7 Million In 2016 (F.)

According to new data released by the U.S. Census Bureau, the nation’s immigrant population, both legal and illegal, climbed to a record 43.7 million in July 2016. That’s an increase of half a million since 2015 and 12.6 million since the turn of the century. Immigrants now comprise 13.5% of the U.S. population, roughly one out of eight residents, the highest share in 106 years. The all-time highest immigrant share of the U.S. population was 14.7%, recorded in 1910 when the country had 13.5 million immigrants. According to the Census Bureau, that will be eclipsed by 2030 when the immigrant share reaches 15.8% or 56.9 million people. Up to 2050, the influx is expected to continue its upward trajectory, with the number of immigrants projected to reach 72.3 million and account for an 18.2% share of the population.

Currently, Mexico has the highest share of America’s foreign-born population by far with over 11.5 million people. Despite also being the top sending nation with a grand total of 1.1 million new arrivals between 2010 and 2016, the Mexican-born population has not grown in the past six years due to return migration and natural mortality. During the same time frame, the sending countries with the highest increases were Saudi Arabia (122%), Nepal (86%) and Afghanistan (74%). Out of all states, Texas recorded the greatest numeric increase in immigrants (587,889) between 2010 and 2016, ahead of Florida (578,468) and California (527,234).

Read more …

There won’t be much left.

• After 54 Years America Deserves To Know Everything (PP)

President of the United States Dwight Eisenhower, a five-star general in the Army before his presidency, upon departing the White House in January 1961, issued a bone-chilling warning about the dangers of the Deep State to President John F. Kennedy before Kennedy took office. Eisenhower warned Kennedy that the “military industrial complex created an imperative for development… It was compelled to create a permanent armaments industry.” Kennedy stood up against the military-industrial complex. Did that lead to Kennedy’s assassination? Did Kennedy’s assassination trigger the Deep State’s birth of a baby vampire squid with tentacles spread throughout many industries? We did have the Warren Commission, but did that commission provide any reasonable explanation as to how President Kennedy was assassinated?

Given what we know today, it’s likely that the truth has been withheld from the American public and the world. For example, doubt remains widespread about the Warren Commission’s conclusions since several trajectory analyses show that one bullet could not have caused all the damage that occurred. Are the CIA and the Deep State colluding to keep this information secret? In one set of recently declassified CIA documents, the American people learned that JFK’s assassination led to the CIA creating the highly derogatory term “conspiracy theory” and “conspiracy theorists”. This was the beginning of Deep State psychological operations used to malign, slander, discredit, and undermine the credibility of anyone who dared to voice dissent towards the government. The CIA called this branch the Clandestine Services unit and its aim was to ruin anyone who wanted to take on the establishment and the military industrial complex.

The military-industrial complex has garnered far too much power in Washington since World War II, and it now presents the biggest threat to democracy and liberty in America. And it has only gotten bigger since George W. Bush entered office and declared “a war on terror”. Just take a look at the stock prices of military-industrial complex participants — they have skyrocketed over 1000% (e.g. Northrop Grumman). The presence of a Deep State became very clear and even more pronounced during the 2016 presidential election cycle, which unearthed Washington’s culture of pay-to-play and cover-ups. This led to the December 2016 proclamation to America by President-elect Trump that he was going to “drain the swamp.” In response, Senate minority leader Chuck Schumer went on The Rachel Maddow Show in January 2017 and delivered the following warning to President Trump: “Let me tell you: You take on the intelligence community—they have six ways from Sunday at getting back at you,”

Read more …

“The revolution to come out of this frozen swamp of irresponsibility will be the messiest and most incoherent in world history.”

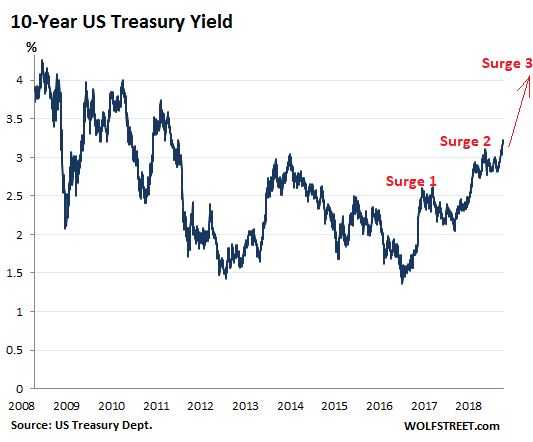

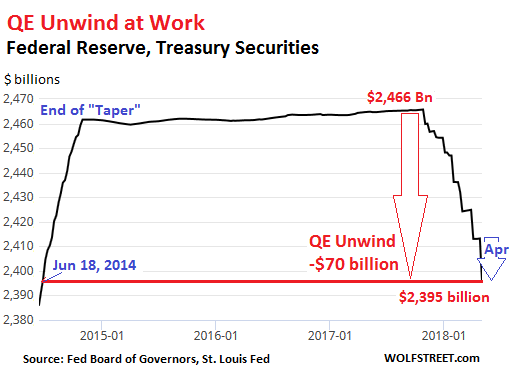

• Into the Cold and Dark (Jim Kunstler)

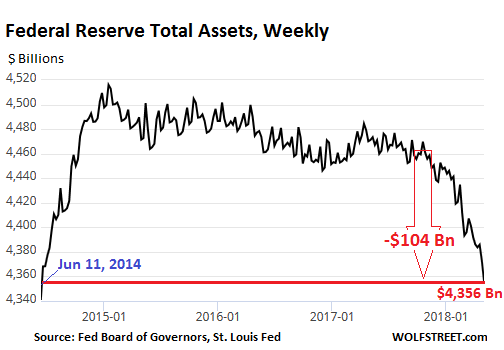

Many, including yours truly, have expected the distortions and perversions on the money side of life to express themselves in money itself: the dollar. So far, it has only wobbled down about ten percent. This is due perhaps to the calibrated disinformation known as “forward guidance” issued by this country’s central bank, the Federal Reserve, which has been threatening — pretty idly so far — to raise interest rates and shrink down its vault of hoarded securities — a lot of it janky paper left over from the misadventures of 2007-2009. I guess the lesson is that when you have a pervasively false and corrupt financial system, it is always subject to a little additional accounting fraud — until it’s not.

And the next thing you know, you’re sitting in the rubble of what used to be your civilization. The ever more immiserated schnooks who make up the former middle-class know that their lives are crumbling, and may feel that they’re subject to the utterly overwhelming forces of a cruel destiny generated by a leviathan state that hates and despises them. And of course that is exactly why they turned to the Golden Golem of Greatness for salvation. Alas, Mr. Trump has not constructed a coherent strategy for defeating the colossus of fakery that drives the nation ever-deeper toward the cold and dark. He has a talent for distraction and disruption, though, and so far that gave cover to a whole lot of other people in power who have been able to stand around with their hands in their pockets doing nothing about the sinking state of the nation.

Now, the vaudeville act is coming to a spectacular conclusion as the trappings of Halloween go back in the closet and the pulsating, LED-studded Santas go up on the rooftops. Every ceremony of American life seems drained of meaning now, including the machinations of government over the budget and taxes. The revolution to come out of this frozen swamp of irresponsibility will be the messiest and most incoherent in world history. Nobody will have any idea what is going on outside the geo-storm of failure. About the only thing one can say for sure is that the American life which emerges from this maelstrom will not look a whole lot like what we’re living in today. I remain serenely convinced that when it finally passes, the air will be fresh again and the sun will shine, and a lot more people will know what is real and what is not.

Read more …

Pay attention.

• Google’s Plan To Revolutionise Cities Is A Takeover In All But Name (O.)

Last June Volume, a leading magazine on architecture and design, published an article on the GoogleUrbanism project. Conceived at a renowned design institute in Moscow, the project charts a plausible urban future based on cities acting as important sites for “data extractivism” – the conversion of data harvested from individuals into artificial intelligence technologies, allowing companies such as Alphabet, Google’s parent company, to act as providers of sophisticated and comprehensive services. The cities themselves, the project insisted, would get a share of revenue from the data. Cities surely wouldn’t mind but what about Alphabet? The company does take cities seriously. Its executives have floated the idea of taking some struggling city – Detroit? – and reinventing it around Alphabet services, with no annoying regulations blocking this march of progress.

All of this might have looked counter-intuitive several decades ago, but today, when institutions such as the World Bank preach the virtues of privately run cities and bigwigs in Silicon Valley aspire to build sea-based micronations liberated from conventional bureaucracy, it does not seem so far-fetched. Alphabet already operates many urban services: city maps, real-time traffic information, free wifi (in New York), self-driving cars. In 2015 it launched a dedicated city unit, Sidewalk Labs, run by Daniel Doctoroff, former deputy mayor of New York and a veteran of Wall Street. Doctoroff’s background hints at what the actual Google Urbanism – as opposed to its theoretical formulations – portends: using Alphabet’s data prowess to build profitable alliances with other powerful forces behind contemporary cities, from property developers to institutional investors.

On this view, Google Urbanism is anything but revolutionary. Yes, it thrives on data and sensors, but they only play a secondary role in determining what gets built, why, and at what cost. One might as well call it Blackstone Urbanism – in homage to one of the largest financial players in the property market. [..] Alphabet’s weapons are impressive. Cheap, modular buildings to be assembled quickly; sensors monitoring air quality and building conditions; adaptive traffic lights prioritising pedestrians and cyclists; parking systems directing cars to available slots. Not to mention delivery robots, advanced energy grids, automated waste sorting, and, of course, ubiquitous self-driving cars.

Alphabet essentially wants to be the default platform for other municipal services. Cities, it says, have always been platforms; now they are simply going digital. “The world’s great cities are all hubs of growth and innovation because they leveraged platforms put in place by visionary leaders,” states the proposal. “Rome had aqueducts, London the Underground, Manhattan the street grid.” Toronto, led by its own visionary leaders, will have Alphabet. Amid all this platformaphoria, one could easily forget that the street grid is not typically the property of a private entity, capable of excluding some and indulging others. Would we want Trump Inc to own it? Probably not. So why hurry to give its digital equivalent to Alphabet?

Read more …

Sort of the opposite of what Google wants.

• Put Drivers In Control (NEF)

Last weekend, Jeremy Corbyn raised an intriguing possibility. “Imagine an Uber,” he said, “run co-operatively by their drivers, collectively controlling their futures, agreeing their own pay and conditions, with profits shared or re-invested.” Many have since dismissed this idea as wishful thinking. First, there is Uber’s undoubted popularity among its users – hundreds of thousands of people signed a petition protesting against Transport for London’s decision not to renew Uber’s licence. Then there is its market dominance, which only ever seems to intensify. How can any rival hope to compete in the increasingly monopolistic world of private hire? Finally there is the factor which underpins both its popularity and its dominance. And that’s its price point. When Uber came on the scene, it undercut other taxi services by a huge margin.

And it appeared to do so by spending vast amounts of venture capital in a bid to achieve global dominance of the market. Any co-operative, driver-owned alternative to Uber has to be competitive on price or it will never break through Uber’s grip on the market. How can they do that without spending vast amounts of capital? Where would that money come from? None of these arguments holds water. At the New Economics Foundation we recently called for ‘Khan’s Cars’, a mutually owned taxi platform for London which would give drivers real control over their working lives while still providing people with the cheap and convenient transport they need. We believe a driver-owned alternative could genuinely compete with Uber on price and convenience, especially if supported by the Mayor of London.

In fact, Uber isn’t as cheap as it seems. The company’s use of surge pricing, which inflates prices during periods of high demand, allows it to present cheaper prices at other times. Partly as a result of this, Uber makes a profit in the UK – suggesting the basic pricing model is financially viable without vast capital resources. So the gap to close isn’t as wide as it may look at first glance. Furthermore, Uber takes between 20-25% of the fares it charges. Khan’s Cars could reduce that %age since it will not have shareholders looking to extract profit.

Read more …

Delusionary.

• “Success, Greeks No Longer Seek Food In Garbage Bins” (KTG)

“There are no people seeking food in the garbage bins as in 2014,” Culture Minister Elena Kountoura said adding that citizens congratulate the government for its social policies. People are congratulating the government because “in 2014 there were people struggling to have a meal on their table. It is a success that people do not eat from the garbage anymore, “Kountoura from junior coalition partner Independent Greeks claimed speaking to private Skai TV on Saturday morning. “Despite the difficulties, people manage it.” “At least, Greeks are now living in dignity,” she said further adding “we brought growth.” She claimed further that “no minister cuts pensions, no minister introduces taxes.” The Culture Minister said further that “we have ten difficult months ahead” until the Greek program ends in August 2018. She said that also this year was an unprecedented success for the tourism industry saying that “90% of the capacity” was fully booked.

PS no taxes, no pension cuts? I propose, Minister Kountoura to take a fresh look into the 2015 bailout agreement and the additional agreement the coalition government signed last May in order to enable the conclusion of the second review. As for the meals from garbage bins… well… I wonder why neighbors still leave bags with food on the street, bags that quickly disappear. Probably they didn’t hear of the growth and the government success story.

Read more …

“Their daughter had just died and they were left there. They had nothing. No visit from a psychiatrist. The mother was silent. They were in shock and the children were saying ‘my sister died – she died just here.’”

• 5 Year Old Syrian Girl Dies In ‘Concentration Camp’ Funded By UK Taxpayers (RT)

British aid money is propping up a European migrant camp routinely likened to a prison. In just one appalling example, a Syrian girl who survived war, smugglers and the Aegean Sea, died last week in a cold, damp tent in Moria, on the Greek island of Lesbos. She was five. The girl, her parents and her five siblings had been offered a freezing tent in the squalid camp when they arrived in search of safety a week earlier. Her body was discovered last Sunday by her father and pregnant mother, who just hours before were denied extra blankets to keep their daughter warm and given just paracetamol to treat her medical issues. “I crawled inside and the blankets on the floor were wet, it was so cold and dirty and damp,” Daliah, a volunteer and former protection team employee who visited the family, told RT UK.

Their daughter had just died and they were left there. They had nothing. No visit from a psychiatrist. The mother was silent. They were in shock and the children were saying ‘my sister died – she died just here.’ “There was a volunteer there in tears. He told me they just pulled her out like a dog and took her away. There was no dignity.” Following her “unexplained” death, her tiny body was buried without an Islamic funeral and without her mother being present. “She became nothing but a number – she didn’t even get her last respect,” Daliah said. The child, whose parents did not wish to be identified, is yet another victim of the migration crisis Europe has mishandled and misjudged. With grotesque irony, European Union ministers who advocate saving refugees from war zones enjoy worldwide praise for funding camps like these.

The grave of a five-year-old girl who died on Lesbos © Zoie O’Brien / RT

Read more …