Herbert Ponting Scott’s Terra Nova Expedition, Antarctica 1911

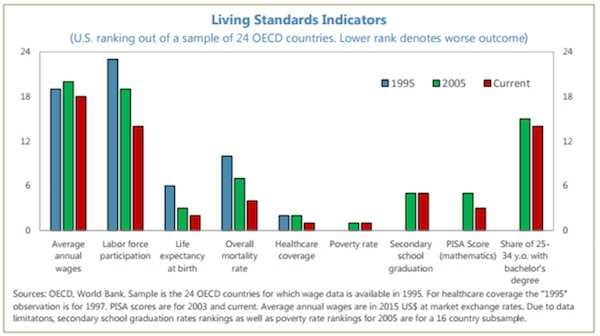

Something must be terribly wrong with the world. A few days ago Elizabeth Warren agreed with Trump on China, now Bernie Sanders agrees with him about Amazon. What’s happening?

Bernie Sanders Agrees With Trump: Amazon Has Too Much Power

Independent Vermont senator and 2016 presidential hopeful Bernie Sanders echoed President Donald Trump in expressing concern about retail giant Amazon. Sanders said that he felt Amazon had gotten too big on CNN’s “State of the Union” Sunday, and added that Amazon’s place in society should be examined.

“And I think this is, look, this is an issue that has got to be looked at. What we are seeing all over this country is the decline in retail. We’re seeing this incredibly large company getting involved in almost every area of commerce. And I think it is important to take a look at the power and influence that Amazon has,” said Sanders.

A backlash against Facebook, a backlash against Amazon. Are these things connected? Actually, yes, they are connected. But not in a way that either Trump or Sanders has clued in to. Someone who has, a for now lone voice, is David Stockman. Here’s what he wrote last week.

The Donald’s Blind Squirrel Nails An Acorn

It is said that even a blind squirrel occasionally finds an acorn, and so it goes with the Donald. Banging on his Twitter keyboard in the morning darkness, he drilled Jeff Bezos a new one – or at least that’s what most people would call having their net worth lightened by about $2 billion:

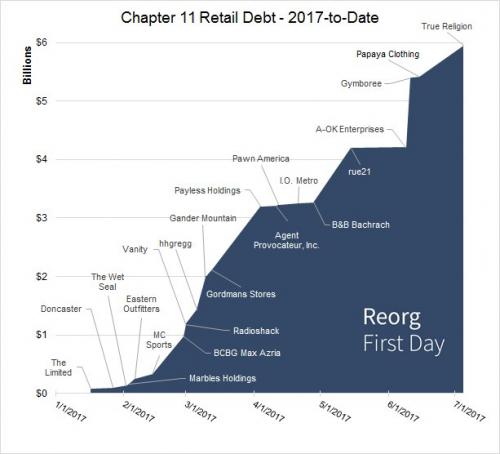

“I have stated my concerns with Amazon long before the Election. Unlike others, they pay little or no taxes to state & local governments, use our Postal System as their Delivery Boy (causing tremendous loss to the U.S.), and are putting many thousands of retailers out of business!” You can’t get more accurate than that. Amazon is a monstrous predator enabled by the state, but Amazon’s outrageous postal subsidy – a $1.46 gift card from the USPS stabled on each box – isn’t the half of it.

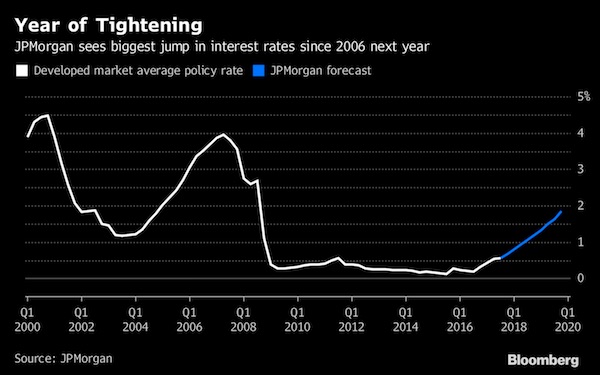

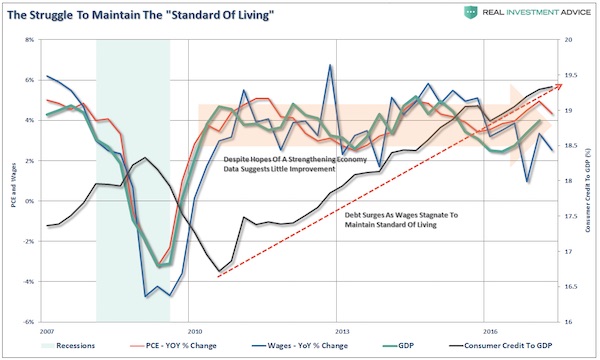

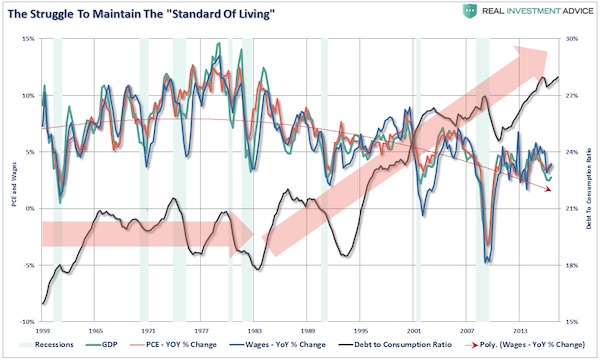

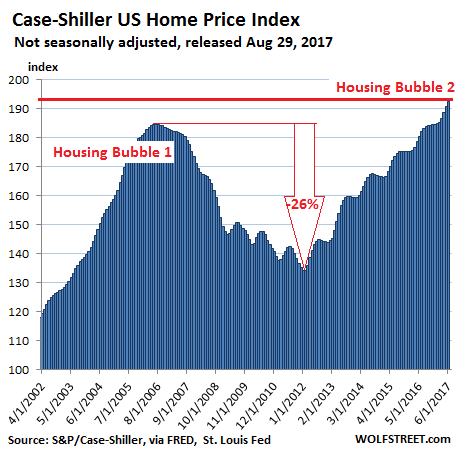

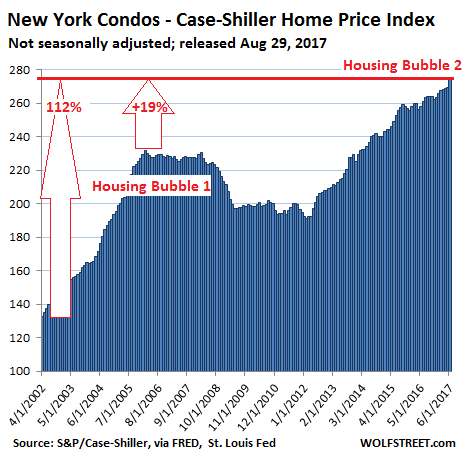

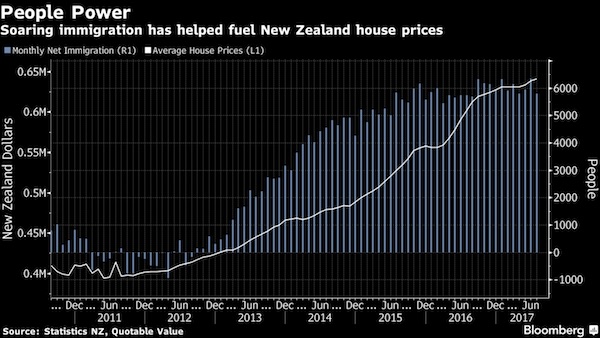

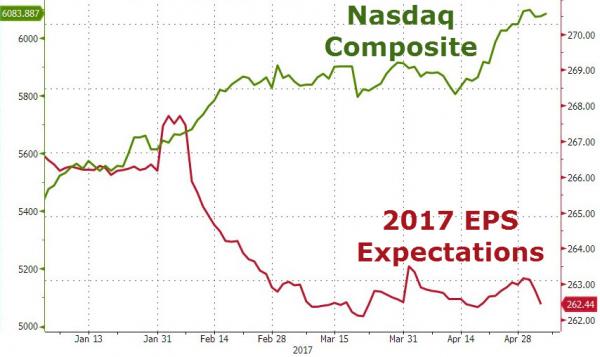

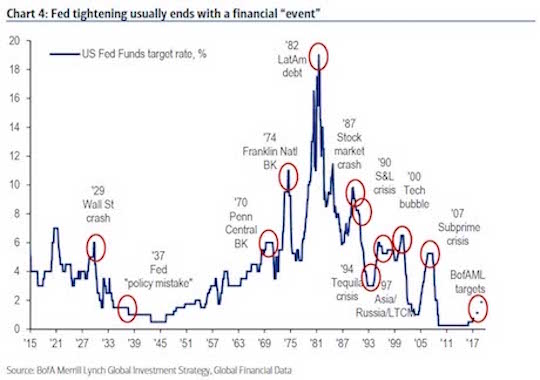

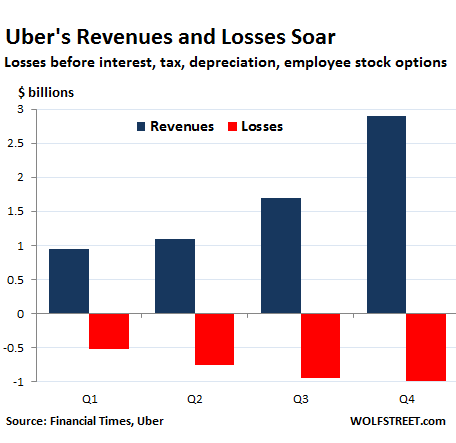

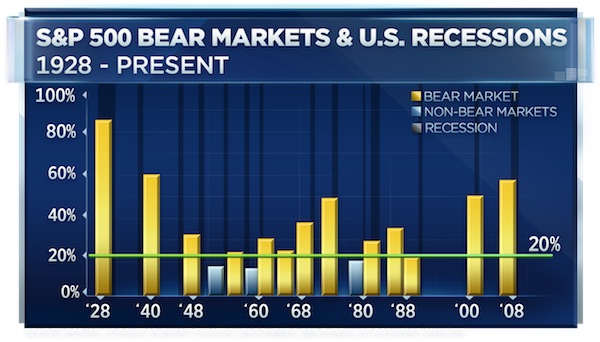

The real crime here is that Amazon has been exempted from making a profit, and the culprit is the Federal Reserve’s malignant regime of Bubble Finance. The latter has destroyed financial discipline entirely and turned the stock market into the greatest den of speculation in human history. That’s why Bezos can kill established businesses with impunity.

The casino allows him to run a pernicious business model based on “price to destroy”, rather than price for profit and a return on capital. Needless to say, under a regime of sound money and honest capital markets Amazon would be a far more benign economic creature. That’s because no real investors would value AMZN’s money-loosing e-Commerce business at $540 billion – nor even a small fraction of that after 25-years of profitless growth.

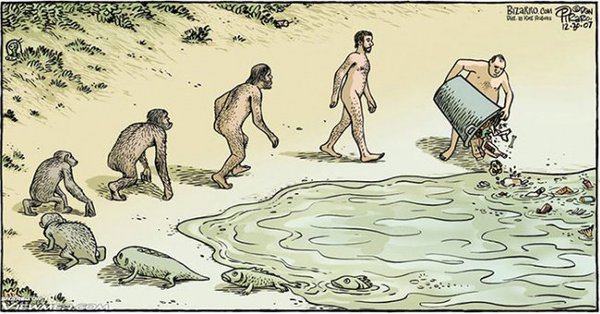

The bubble economy, the everything bubble, that we have been forced into, with QE, ultra-low rates, central banks buying trillions in what at least used to be assets, and massive buybacks that allow companies to raise their ‘value’ into the stratosphere, has enabled a company like Amazon to kill off its competition, which consists of many thousands of retailers, that do have to run a profit.

It’s a money scheme that allows many of the most ‘valuable’ tech companies to elbow their way into our lives, in ways that may seem beneficial to us at first, but in reality will only leave us behind with much less choice, far less competition, and many, many fewer jobs. Once it’s done someone will mention ‘scorched earth’. But for now they are everybody’s darlings; they are, don’t you know, the tech giants, the brainchildren of the best that the best among us have to offer.

They don’t all work the exact same way, which may make it harder to recognize what they have in common. For some it’s easier to see than for others. It’s also difficult to list them all. Here’s a few: Apple, Amazon, Facebook, Google (Alphabet), Tesla, Uber, Airbnb, Monsanto. Let’s go through the list.

Apple ? Yes, Apple too. But they make real things! Yes, but just as Apple CEO Tim Cook seeks to distance his company from the likes of Facebook on morals and ethics, he can’t deny that Apple sells a zillion phones to a large extent because everybody uses them to look at Facebook and Alphabet apps until their faces are blue. If data ethics are the only problem Cook sees, he’s in trouble.

Silicon Valley infighting shows that the industry does have an idea what is going wrong, in ways that should have already led to many more pronounced worries and investigations.

Silicon Valley Rivals Take Shots At Facebook

Mr. Cook, who has long sought to differentiate Apple on privacy matters, contrasted its focus on selling devices with Facebook and Google’s ad-based businesses that are built on user data. Asked what he would do if he were Facebook CEO Mark Zuckerberg, Mr. Cook replied: “I wouldn’t be in this situation.”

[..] Days earlier, François Chollet, an artificial intelligence engineer at Google, sought to draw a line between his company and Facebook. He tweeted that Google products like search and Gmail help users “to do more, to know more.” Facebook’s newsfeed, he wrote, “manipulates your worldview and seeks to maximally waste your time.”

[..] In January, Salesforce.com CEO Marc Benioff, whose company sells business software services, said that the addictive nature of social media means it should be regulated like a health issue.“I think that you do it exactly the same way that you regulated the cigarette industry,” Mr. Benioff told CNBC when asked how Facebook should be regulated. Some of the most cutting rebukes have come from people who know Facebook well.

In November, Sean Parker, the founding president of Facebook, said that Facebook executives, including himself, were “exploiting a vulnerability in human psychology” by designing a platform built on social validation. Mr. Parker didn’t respond to a request for comment.

Facebook generally hasn’t responded to the criticism, but it did after sharp comments from its former vice president of growth, Chamath Palihapitiya. “The short-term, dopamine-driven feedback loops that we have created are destroying how society works,” Mr. Palihapitiya said at a talk at Stanford University in November.

I would expect to hear a lot more of that sort of thing. Big Tech is changing the world in more ways than one. And spying on people Facebook-style is merely one of a long list of them. So yes, Apple certainly also belongs in that list. Facebook doesn’t build the devices people use to see what their friends had for breakfast, Apple does that. Moreover, Apple profits hugely from stock buybacks, so it fits in Stockman’s bubble finance definition of Amazon, too.

The failure of politics to investigate, and act against, those dopamine-driven feedback loops which exploit a vulnerability in human psychology in order to maximally waste your time and sell you product after product that you never (knew you) wanted is downright bizarre. Politicians only started talking about Facebook when a topic connected to Trump and Russia was linked to it.

Amazon: Trump can’t act fast enough on the tax situation and the US Postal deal. Not that that will solve the issue. Amazon, like all the companies on my list, can only be cut down to size if and when the everything bubble is. They are, after all, its children.

The most pernicious aspect of the Amazon ‘business model’, which all these firms share, and all are able to live by thanks to the central banks and the “greatest den of speculation in human history” they have created, is the prospect of world domination in their respective fields. They all hold in front of speculators the promise that they can crush all competition, or nearly all. Scorched earth, flat earth.

Facebook: their place in the list is obvious. What is it, 2.5 billion users? And what they don’t have is divvied up between them and Google when they buy up apps like Instagram. Officially competitors, but they have the exact same goals. And, like me, you may think: what’s the problem, just ban them from collecting all that data. Facebook has no reason to know, at least not one that serves us, where you were last Friday, and with whom. And just in case you missed that bit, they do.

But there their connection to the intelligence world comes in. Their platforms are better than anything the NSA has ever been able to develop. So we can say we don’t want Zuckerberg and Alphabet spying on us, but our own spies do want to do just that. That makes any kind of backlash much harder to succeed. And it doesn’t matter if you delete your Facebook account, they’ll find you anyway. Friend of a friend. We all have friends who are on Facebook, rinse and repeat.

The only hope there is, with Facebook as with the other companies, is for investors and speculators to dump their holdings in massive numbers. And that will only happen when the central bank Ponzi collapses. And it will, but by then we have a whole new set of problems.

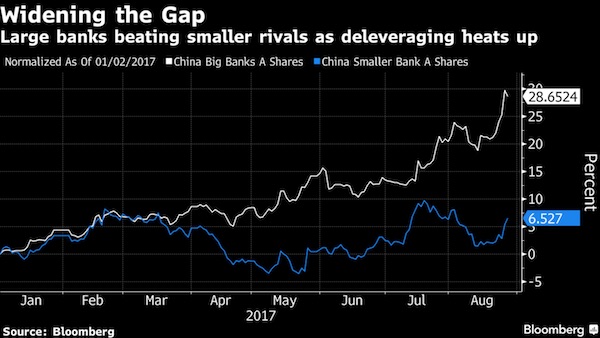

Google: largely the same set of issues that Facebook has. Its tentacles are everywhere. Former CEO Eric Schmidt’s connections to the Pentagon should be really all you need to know. The EU may have issued all sorts of complaints and fines on competition grounds, but that makes no difference.

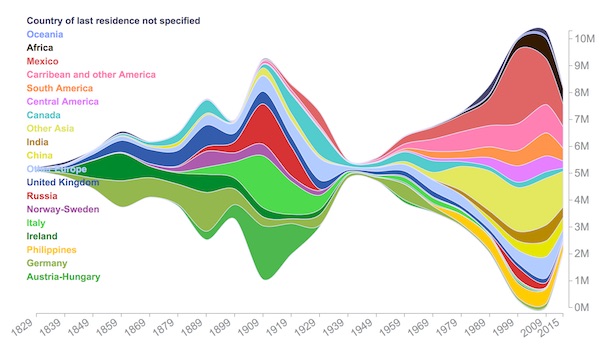

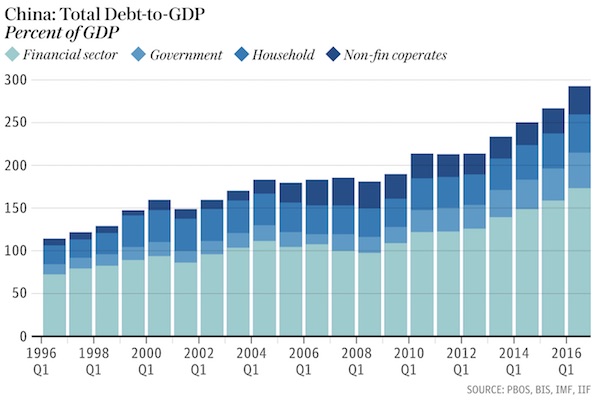

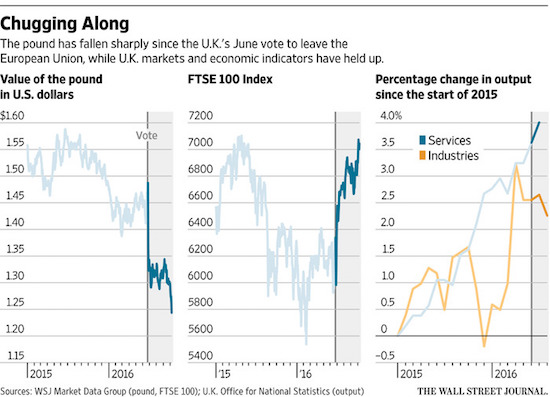

The one country with an effective response to Google and Facebook is China, that has largely banned both and built its own versions of their products. Which allows Beijing to ban people from boarding planes, buying homes etc., if their ‘social credit’ is deemed too low. If you want to be scared about where Big Tech’s powers can lead, look no further.

Tesla: Elon Musk has built a fantasy (and maybe I should put Paypal in this list too) on what everyone thinks must be done to ‘save the planet’ (yeah, build cars…) by grossly overstating the number of cars he can build, and financing his growth on not only speculation, but also on spectacular amounts of government subsidies (politicians want to save the planet, too).

And now he needs additional financing again. He will probably get it, again, but the Amazon backlash might have people take another look. One fine day… Fits David Stockman’s complaint to a t(ee), doesn’t have to make a profit. Musk has perfected that model.

Uber and Airbnb: why anyone anywhere would want to send money generated in their community, by renting out cars and apartments in that same community, to a bunch of people in Silicon Valley, is beyond me. Someone should set this up as an international effort that makes it easy for a community, a city etc., to provide this kind of service and make the profits benefit their own cities.

But like Amazon, they are free to run any competition into the ground because no profits are required until they have conquered the world. And then they can go nuts. It may look like a business model, but it isn’t. It’s a soon to be orphaned bubble child..

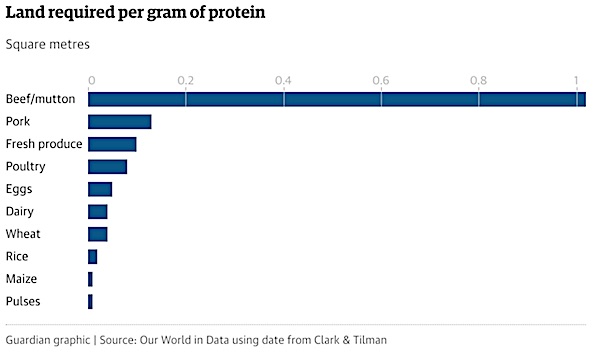

Monsanto: less obvious perhaps as an entry in the Big Tech list, but very much warranting a spot. And of course it stands for the entire chemical-seeds field. From Agent Orange to your children’s dinner plate. Monsanto has more lawyers and lobbyists on its payroll than it has scientists, but then its lofty goals outdo even those of Google or Amazon.

Facebook may focus on your addiction to human contact, but Bayer, DuPont, Syngenta et al have decided to make your food so addicted to their chemicals that they will in the future profit from every bite served on your table. How they will grow that food long term without any insects, bees or birds left is unclear, but they don’t seem to care much. As for profits? Monsanto seeks to rule the world, and for now care as little about profits as they do about insects.

Zuckerberg may claim that he only wants to improve Facebook’s service, but when that is done through for instance the 2012 so-called Transmission of Anger experiment in which the company tried to alter their users’ emotional states -and succeeded-, by manipulating their friends’ postings, that claim becomes pure ridicule. Selling off user data to scores of developers doesn’t help either. But do you see Congress tackling him in any serious way next week? Neither do I.

Because there’s one huge catch to the scenario that David Stockman -and I- painted, of the whole tech bubble collapsing when the financial bubble does. It is the links tech companies have built to intelligence. A group of Google employees wrote a letter to their CEO Sundar Pichai to protest the company’s involvement in “weaponized AI”, in the shape of Project Maven, a military surveillance engine to-be.

These people undoubtedly mean well, but they’re far too late. They will have to leave the “don’t be evil” company to actually not be evil. Because it’s not a big step from weaponized AI to killer robots. Microsoft is also part of the project, and Amazon is. If you work there and don’t want to be evil, you know what to do.

Yeah, it’s about our safety, and security, and political and military and economic power. But it’s also about spying on people, in even worse ways than Facebook does. So even as the central bank bubble, and the tech bubble, go poof, some of these companies may be saved by their military ties.

That sound you hear is George Orwell turning in his grave.