NPC Grand Palace shoe shining parlor, Washington DC 1921

Titans of finance gather and sulk.

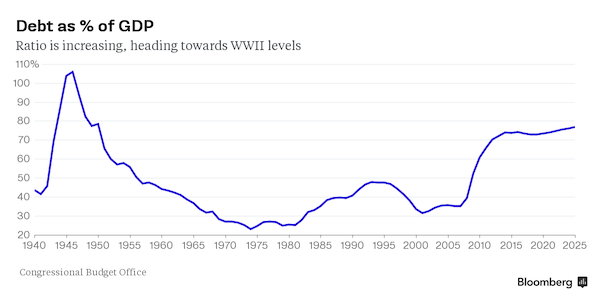

• “How Do You Have Capitalism Without Any Cost Of Capital?” (BBG)

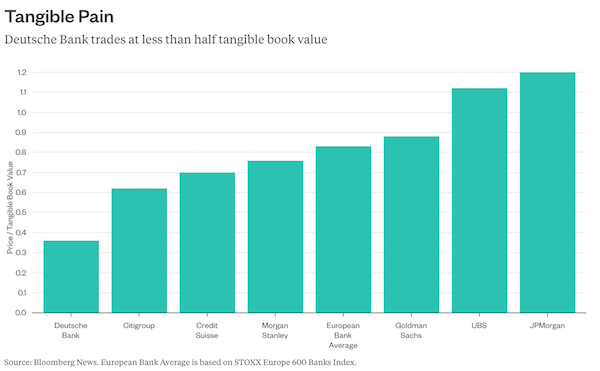

Mary Callahan Erdoes, one of JPMorgan Chase’s most senior executives, summed up her industry’s mood like this: “There is no excitement,” she told throngs of bankers gathered in Washington. “There is a lot of handwringing.” Again and again, speakers at the Institute of International Finance’s three-day meeting in Washington, which wrapped up Saturday, bemoaned the inability of central banks to rev up economic growth, as well as the drag of tougher regulations and the looming impact of Brexit. Concerns over Deutsche Bank’s mounting legal costs deepened the gloom. Slow growth is leaving companies little reason to expand, fueling the public’s frustration and giving rise to extreme political views and nationalism, said Erdoes, 49, who runs JPMorgan’s asset-management operations.

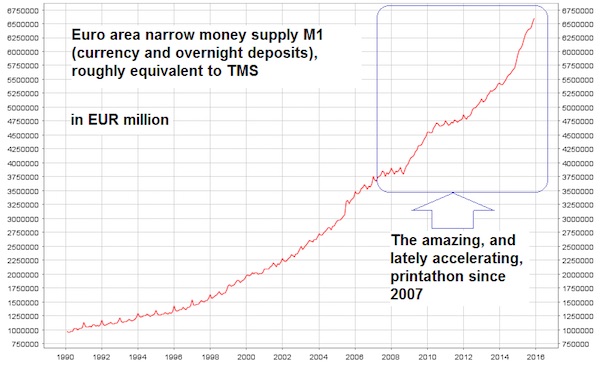

Low interest rates – instead of better fiscal stimulus – are taking a toll on the entire system, she said. “We had a very smart economist at JPMorgan ask me the following question: How do you have capitalism without any cost of capital? And therein lies the problem.” [..] Goldman Sachs President Gary Cohn called the world’s central banks an “ineffective cartel,” as actions in Europe and Japan lead to negative rates and hamstring other policy makers. The outlook for low growth is long-term, he said. “I don’t see this changing,” Cohn said Friday. “We keep saying we’re getting closer to the end, but I don’t think we’re getting closer to the end.”

I’m not sure how one writes an article like this and completely fails to mention that for millions of Americans, it’s not a matter of bad saving habits, but of spending everything on the basics.

• 7 in 10 Americans Have Less Than $1,000 In Savings (MF)

The U.S. is often referred to as the land of economic opportunity. Apparently, it’s also the land of consumption and “spend everything you’ve got.” We don’t have to look far for confirmation that Americans are generally poor savers. Every month the St. Louis Federal Reserve releases data on personal household savings rates. In July 2016, the personal savings rate was just 5.7%. Comparatively, personal savings rates in the U.S. 50 years ago were double where they are today, and nearly all developed countries have a higher personal savings rate than the United States. In other words, Americans are saving less of their income than they should be — the recommendation is to save between 10% and 15% of your annual income — and they’re being forced to do more with less in terms of investing.

However, new data emerged this week from personal-finance news website GoBankingRates that shows just how dire Americans’ savings habits really are. Last year, GoBankingRates surveyed more than 5,000 Americans only to uncover that 62% of them had less than $1,000 in savings. Last month GoBankingRates again posed the question to Americans of how much they had in their savings account, only this time it asked 7,052 people. The result? Nearly seven in 10 Americans (69%) had less than $1,000 in their savings account. Breaking the survey data down a bit further, we find that 34% of Americans don’t have a dime in their savings account, while another 35% have less than $1,000. Of the remaining survey-takers, 11% have between $1,000 and $4,999, 4% have between $5,000 and $9,999, and 15% have more than $10,000.

Furthermore, even though lower-income adults struggle with saving money more than middle- and upper-income folks, no income group did particularly well. Some 29% of adults earning more than $150,000 a year, and 44% making between $100,000 and $149,999, had less than $1,000 in savings. Comparatively, 73% of the lowest income adults (those earnings $24,999 or less annually) had less than $1,000 in their savings account. There was even minimal difference between multiple generations of Americans. From seniors aged 65 and up to young millennials aged 18 to 24, between 62% and 72% of Americans had less than $1,000 in a savings account.

Great little piece by Wolf Richter.

• After Becoming Debt Slaves, Millennials Get Blamed for Lousy Economy (WS)

Over the past few days, the Diamond Producers Association launched its first new ad campaign in five years after watching retail sales of diamond jewelry slow down, as Millennials built on the habit pioneered by prior generations of delaying or not even thinking about marriage, and thus not being sufficiently enthusiastic about buying diamond engagement rings. The campaign, according to Adweek, is designed to motivate Millennials “to commemorate their ‘real,’ honest relationships with diamonds, even if marriage isn’t part of the equation.” Mother New York, the agency behind the campaign, spent months interviewing millennials, according to Quartz, and learned that they associated diamonds with a “fairytale love story that wasn’t relevant to them.”

So the premium jewelry industry, seeing future profits at risk, needs to do something about that. A year ago, it was Wall Street – specifically Goldman Sachs – that did a lot of hand-wringing about millennials. “They don’t trust the stock market,” Goldman Sachs determined in a survey. Only 18% thought that the stock market was “the best way to save for the future.” It’s a big deal for Wall Street because millennials are now the largest US generation. There are 75 million of them. They’re supposed to be the future source of big bonuses. Wall Street needs to figure out how to get to their money. The older ones have seen the market soar, collapse, re-soar, re-collapse, re-soar…. They’ve seen the Fed’s gyrations to re-inflate stocks. They grew up with scandals and manipulations, high-frequency trading, dark pools, and spoofing.

They’ve seen hard-working people get wiped out and wealthy people get bailed out. Maybe they’d rather not mess with that infernal machine. And today, the Los Angeles Times added more fuel. “They’re known for bouncing around jobs, delaying marriage, and holing up in their parents’ basements,” it mused. Everyone wants to know why millennials don’t follow the script. Brick-and-mortar retailers have been complaining about them for years, with increasing intensity, and a slew of specialty chains have gone bankrupt, a true fiasco for the industry, even as online retailers are laughing all the way to the bank. “For starters, millennials are not big spenders, at least not in the traditional sense,” the Times said. Yet most of them spend every dime they earn, those that have decent jobs. But much of that spending goes toward their student-loan burden and housing.

Trying to fit human behavior into triangles.

• S&P 500 Triangle Chart Pattern ‘Warns Of A Big Selloff’ (MW)

The S&P 500 is moving fast toward an impending breakout that could be bad news for investors. “And it’s gonna be big, by all accounts,” said Carter Braxton Worth, a technical analyst at research firm Cornerstone Macro. The S&P 500 has been trading within a “symmetrical triangle” on a number of time scales, as the index traced out a pattern of rising lows and falling highs. Since the upper and lower boundary lines are narrowing to a point, it’s just a matter of time before the S&P 500 breaks above or below one of them. “It is a circumstance where buyers and sellers are matched off so evenly that purchases being made by those who like a particular security are in the same order of magnitude as the selling being done by those who dislike the security,” Worth wrote in a note to clients.

His research suggests that the resolution of these standoffs is usually “aggressive,” with the index moving past the declining or rising trendlines “in a meaningful way.” Many technicians believe triangles represent continuation patterns, or periods of pause in a bigger trend, which means they should eventually be resolved in the direction of the preceding trend. In the S&P 500’s case, that would mean a big rally is coming. But Worth said that based on his interpretation of the charts, the S&P 500’s triangle looks more like a reversal pattern. “We believe the current formation is a setup for a move lower,” Worth said.

Hoping that just this once it’s different.

• The Bank of Mom and Dad is Australia’s Fastest-Growing Housing Lender (BBG)

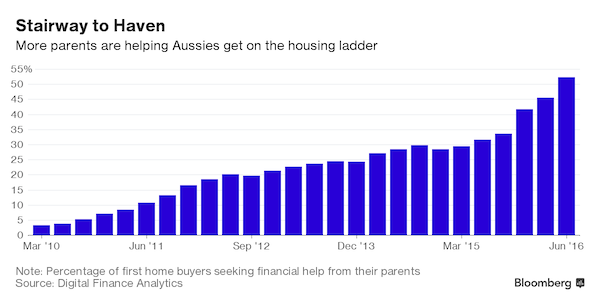

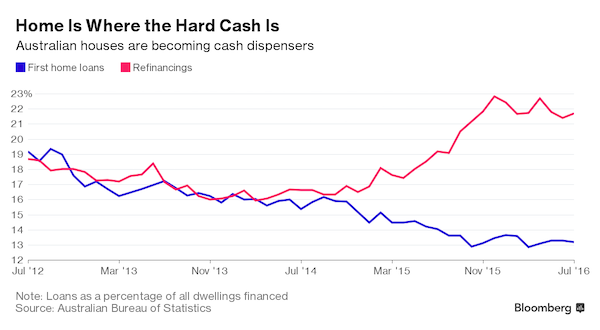

Beset by lending curbs and bubble-esque prices, first-time home buyers in Australia are turning to a rapidly growing source of finance: The Bank of Mom and Dad. More parents are taking advantage of record-low interest rates to refinance their properties and help their grown-up kids onto the housing ladder amid sky-rocketing house values. Digital Finance Analytics estimates the number of Aussies getting help from their parents has soared to more than half of first-home buyers from just 3% six years ago. Australia’s housing rally has favored baby-boomers and locked out youth, compounding an inter-generational shift of wealth.

As the number of bank loans to first-time buyers dwindles, the average slice of cash handed to them by parents has almost quadrupled in the past six years, DFA says. The downside: a market that the Reserve Bank of Australia is already wary of may get further inflated. First-time buyers are “being infected by the notion that property is about wealth building, rather than somewhere to live,” said Martin North, Principal at DFA. That “may be tested if interest rates rise later, or property prices fall from their current illogical stratospheric levels.” [..] The boom is turning some homes into cash dispensers. More than two thirds of owners that refinanced houses worth more than A$750,000 did so to extract capital for reasons including helping their kids. Near the start of 2010, the average helping hand from parents was about A$23,000; today, it’s more than A$80,000.

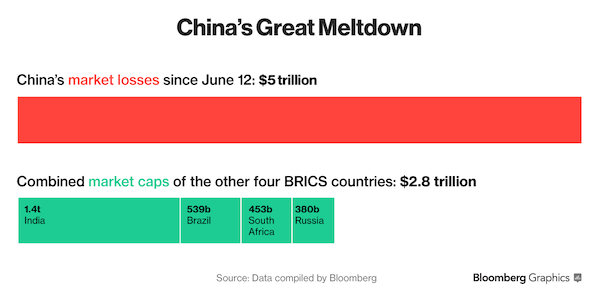

“..they don’t have a strong willingness to hold the yuan due to depreciation expectations..” Does that rhyme with the SDR basket thing?

• Goldman Warns China’s Outflows May Be Worse Than They Look (BBG)

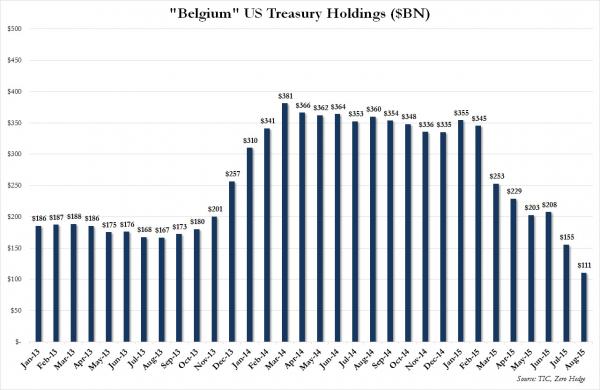

China’s currency outflows may be bigger than they look, with Goldman Sachs warning that a rising amount of capital is exiting the country in yuan rather than in dollars. While the nation’s foreign-exchange reserves have stabilized and lenders’ net foreign-exchange purchases for clients have fallen close to a one-year low, official data show that $27.7 billion in yuan payments left China in August. That’s compared with a monthly average of $4.4 billion in the five years through 2014. Such large cross-border moves can’t be explained by market-driven factors and need to be taken into account when measuring currency outflows, according to MK Tang, Hong Kong-based senior China economist at Goldman Sachs.

Any sign of increased capital outflows could disturb a recent calm in China’s foreign-exchange market, adding to pressure from a potential Federal Reserve interest-rate increase and denting the yuan’s image as the world’s newest global reserve currency. The yuan fell to a six-year low on Monday, adding to outflow pressures. “There is some window guidance from the central bank that limits companies’ dollar conversion onshore, so they need to move the money overseas in yuan,” said Harrison Hu, chief Greater China economist at RBS in Singapore. “But they don’t have a strong willingness to hold the yuan due to depreciation expectations, so they sell it to offshore banks. This pressures the offshore yuan’s exchange rate.”

[..] Goldman Sachs started including yuan funds in its analysis of outflows in July, after noting that cross-border movement of the currency masked actual pressures. The bank estimates that 56% and 87% of outflows took place through the offshore yuan market in July and August, respectively.

Do read the whole thing for a good history lesson.

• ‘Why Do They Hate Us So?’-A Western Scholar’s Reply to a Russian Student (SC)

In 2000 when Putin was elected president, he publically promoted security and economic cooperation with Europe and the United States. After 9/11, he offered real assistance to Washington. The United States accepted the Russian help, but continued its anti-Russian policies. Putin extended his hand to the west, but on the basis of five kopeks for five kopeks. This was a Soviet policy of the interwar years. It did not work then and it does not work now. In 2007 Putin spoke frankly at the Munich conference on Security Policy about overbearing US behaviour. The “colour revolutions” in Georgia and the Ukraine, for example, and the Anglo-American war of aggression against Iraq raised Russian concerns. US government officials did not appreciate Putin’s truth-telling which went against their standard narrative about «exceptionalist» America and altruistic foreign policies to promote «democracy».

Then in 2008 came the Georgian attack on South Ossetia and the successful Russian riposte which crushed the Georgian army. It’s been all down-hill since then. Libya, Syria, Ukraine, Yemen are all victims of US aggression or that of its vassals. The United States engineered and bankrolled a fascist coup d’état in Kiev and has attempted to do the same in Syria reverting to their “Afghan policy” of bankrolling, supplying and supporting a Wahhabi proxy war of aggression against Syria. Backing fascists on the one hand and Islamist terrorists on the other, the United States has plumbed the depths of malevolence. President Putin and Russian foreign minister Sergei Lavrov have made important concessions, to persuade the US government to avert catastrophe in the Middle East and Europe.

To no avail, five kopeks for five kopeks is not an offer the United States understands. Assymetrical advantages is what Washington expects. One cannot reproach the Russian government for trying to negotiate with the United States, but this policy has not worked in the Ukraine or Syria. Russian support of the legitimate government in Damascus has exposed the US-led war of aggression and exposed its strategy of supporting Al-Qaeda, Daesh, and their various Wahhabi iterations against the Syrian government. US Russophobia is redoubled by Putin’s exposure of American support for Islamist fundamentalists and by Russia’s successful, up to now, thwarting of US aggression. Who does Putin think he is? From my observations, I would reply that President Putin is a plain-spoken Russian statesman, with the support of the Russian people behind him.

For five kopeks against five kopeks, he will work with the United States and its vassals, no matter how malevolent they have been, if they adopt less destructive policies. Unfortunately, recent events suggest that the United States has no intention of doing so. After one hundred years of almost uninterrupted western hostility, no one should be under any illusions. So then, the question is “Why do they hate us so?” Because President Putin wants to build a strong, prosperous, independent Russian state in a multi-polar world. Because the Russian people cannot be bullied and will defend their country tenaciously. “Go tell all in foreign lands that Russia lives!» Prince Aleksandr Nevskii declared in the 13th century: «Those who come to us in peace will be welcome as a guest. But those who come to us sword in hand will die by the sword! On that Russia stands and forever will we stand!”

Yeah, Daniel Hannan has lots of stuff wrong with him. But Britain must have this conversation regardless of that. I picked this piece up on Twitter, with this accompanying comment: “No aspect of Brexit is Remain voters’ fault in any way, or to any extent at all.” I don’t know if that was meant sarcastically, but I would certainly hope so. Without that conversation things can only get worse. Remainers must try harder to understand why Brexit happened. If nothing else, I would think they’re at least ‘guilty’ of not seeing it coming. And perhaps also of seeing Brexit as the problem, not a mere symptom.

• Remainers, Brexit, Racism and a Self-Fulfilling Prophecy (Hannan)

Shortly after the EU referendum, several thousand young people marched through London demanding a rerun. I happened to be sitting next to three of them on a train as I travelled into the capital that morning. They evidently recognised me right away as an Evil Tory Leaver, but we were past Clapham Junction before one of them plucked up the courage to talk to me. “Are you Daniel Hannan? I just wanted to say that what you’ve done is terrible. We’re not a racist country. You’ve taken away our future.” “Is that so? Out of interest, can you tell me who the President of the European Commission is?” “No. What’s that got to do with it?” “Can you name a single European Commissioner, come to that? Do you know what our budget contribution will be this year? Or what the difference is between a Directive and a Regulation?”

She was affronted by the questions. So were her two friends with their “I [heart] EU” placards. They weren’t interested in details. For them, it was about values. Are you a decent, internationalist, compassionate person? Or are you a selfish bigot? Let’s leave aside the fact that no one would ever vote on any ballot paper for a “selfish bigot” option. Their determination to approach the issue in terms of character, rather than cost-benefit, explains why they were so upset – and why, even now, some Remain voters struggle to accept the outcome. In my experience, the 48% who voted Remain fall into two categories. There are those who were making a judgement as to where Britain’s best options lay. They could see that the is EU flawed.

They were well aware of the corruption, the lack of democracy, the slow growth. But they took the view that, on balance, the disruption of leaving would outweigh the gains. These people, by and large, now want to make a success of things, and are keen to maximise our opportunities. Then there were those like my companions on South West Trains, for whom the issue was not financial but somehow moral. For them, the EU wasn’t the grubby and self-interested body that exists in reality; rather, it was a symbol of something better and purer, an embodiment of the dream of peace among nations. They never heard, because they never wanted to hear, the democratic or economic arguments against membership. As far as they were concerned, the only possible reason for voting Leave was chauvinism.

“Euro Area Looks to Help on Debt” sounds like the epitomy of cynicism. The Eurogroup withheld €1.7 billion, to Greece’s surprise, because it wanted to assess A) whether a June payment was fully used to pay off third parties, and B) whether the government had squeezed its people enough (reforms). The delay is convenient for Brussels because it also delays debt restructuring talks once again, for the umpteenth time. And without those talks, the IMF won’t commit. Rinse and repeat.

• Greece Gets Fresh Loan Payout as Euro Area Looks to Help on Debt (BBG)

The euro area authorized a €1.1 billion payment to Greece and signaled a further €1.7 billion would follow this month, saying the region’s most indebted nation has made progress in overhauling its economy. The green light, given by euro-area finance ministers on Monday in Luxembourg, removes a hurdle on Greece’s path to debt relief on which Prime Minister Alexis Tsipras has staked part of his political future. The country had to fulfill 15 conditions on matters such as selling state assets and improving bank governance to get the first payout.

It “was unanimously decided that Greece had completed the 15 milestones, so we can proceed to the €1.1 billion disbursement,” Greek Finance Minister Euclid Tsakalotos told reporters after the meeting, saying the talks produced a “very good” outcome for his country. The delay in getting an endorsement for the remaining sum, which is tied to the clearing of arrears, is merely “technical,” he said. Greece, in its third bailout since 2010, is struggling to right an economy that is poised to undergo its eighth annual contraction in the past nine years. A second review of the country’s rescue program will pave the way for a possible restructuring of Greece’s debt, which the IMF says is a necessary condition for its future involvement.

This feels like a military coup, a chapter straight out of the Shock Doctrine. Stocks go up because people’s lives go down.

Glenn Greenwald on Twitter: “Brazil’s lower House- in the face of negative growth- just voted to amend the Constitution to ban spending increases for 20 years..” “This extreme austerity in Brazil – enabled by impeachment- is being imposed in world’s 7th largest economy, 5th most populous country (200m). ”

Nomi Prins on Twitter: “Brazil’s coup was about advancing western speculative market access & squashing domestic population needs – for decades…bastards.”

• Brazil Votes To Amend Constitution, Ban Spending Increases For 20 Years (BBG)

The Ibovespa rose to a two-year high and the real gained as commodities advanced and as expectations mounted that lawmakers will approve a bill to cap spending, a key measure in President Michel Temer’s plan to trim a budget deficit and rebuild confidence in Brazil. The benchmark equity index rose 0.9% and the currency climbed 0.5% Monday in Sao Paulo. [..] Brazilian stocks have gained 75% in dollar terms this year and the real has strengthened 24%, the best performances in the world, on bets that a new government would be able to pull the country out of its worst recession in a century.

Temer, who formally replaced impeached former President Dilma Rousseff in August, said the administration should have enough votes to drive through a budget bill Monday that’s seen as a vital first step toward his economic reforms. The proposal to amend the Constitution to set limits on government spending for as long as 20 years must be approved by at least three-fifths of both chambers of Congress. “The market is very optimistic over this legislation,” said Paulo Figueiredo, an economist at FN Capital in Petropolis, Brazil. “New bets on local assets depend a lot on the signals that will come from this vote.”

Bubble?!

• Global Clean Energy Investment Dropped 43% in Worst Quarter Since 2013 (BBG)

Global investment in clean energy fell to the lowest in more than three years as demand for new renewable energy sources slumped in China, Japan and Europe. Third-quarter spending was $42.4 billion, down 43% from the same period last year and the lowest since the $41.8 billion reported in the first quarter of 2013, Bloomberg New Energy Finance said in a report Monday. Financing for large solar and wind energy plants sank as governments cut incentives for clean energy and costs declined, said Michael Liebreich at the London-based research company. Total investment for this year is on track to be “well below” last year’s record of $348.5 billion, according to New Energy Finance.

The third-quarter numbers “are worryingly low even compared to the subdued trend we saw” in the first two quarters, Liebreich said in a statement. “Key markets such as China and Japan are pausing for a deep breath.” Part of the reason for the steep decline in the quarter was a slowdown following strong spending in the first half of the year on offshore wind. Investors poured $20.1 billion into European offshore wind farms in the first and second quarters, “a runaway record,” according to Abraham Louw, an analyst for energy economics with New Energy Finance. That was followed by a “summer lull,” with $2.4 billion in spending in the third quarter.

So much for that.

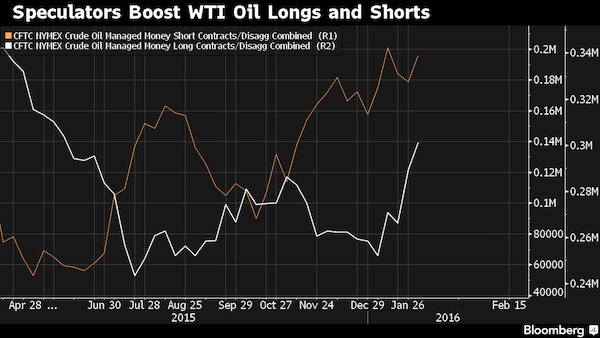

• Russia’s Rosneft Boss Sechin Says No To OPEC Oil Cut/Freeze (R.)

Igor Sechin, Russia’s most influential oil executive and the head of Kremlin energy champion Rosneft, said his company will not cut or freeze oil production as part of a possible agreement with OPEC. His comments underline how difficult it is for Russia to get its oil companies to freeze or cut output as part of a potential deal with OPEC designed to support oil prices. President Vladimir Putin told an energy congress on Monday that Russia was ready to join the proposed OPEC cap, but did not provide any details. “Why should we do it?” Sechin, known for his anti-OPEC position, told Reuters in Istanbul on Monday evening, when asked if Rosneft, which accounts for 40% of Russia’s total crude oil output, might cap its own output.

Sechin said he doubted that some OPEC countries, such as Iran, Saudi Arabia and Venezuela would cut their output either, saying that an increase in oil prices above $50 per barrel would make shale oil projects in the United States profitable. There have been several attempts in the past for Russia and OPEC to join forces to stabilize oil markets. Those efforts have never come to pass however. Oil prices surged on Monday after Putin’s comments amid hopes that a two-year price slide could be halted.

Uglee!!!

• Britain’s Nuclear Cover-Up (NYT)

Last month, the British government signed off on what might be the most controversial and least promising plan for a nuclear power station in a generation. Why did it do this? Because the project isn’t just about energy: It’s also a stealth initiative to bolster Britain’s nuclear deterrent. For years, the British government has been promoting a plan to build two so-called European Pressurized Reactors (EPR) at Hinkley Point C, in southwest England. It estimates that the facility will produce about 7% of the nation’s total electricity from 2025, the year it is expected to be completed. The EPR’s designer, Areva, claims that the reactor is reliable, efficient and so safe that it could withstand a collision with an airliner.

But the project is staggeringly expensive: It will cost more than $22 billion to build and bring online. And it isn’t clear that the EPR technology is viable. No working version of the reactor exists. The two EPR projects that are furthest along — one in Finland, the other in France — are many years behind schedule, have hemorrhaged billions of dollars and are beset by major safety issues. The first casting of certain components for the Hinkley Point C reactors left serious metallurgical flaws in the pressure vessel that holds the reactor core. In 2014, the Cambridge University nuclear engineer Tony Roulstone declared the EPR design “unconstructable.”

The lead builder of the EPR, the French utility company Electricité de France, faced a mutiny this year: Its unions fought the Hinkley Point project, fearing it might bring down the company. E.D.F.’s chief financial officer has resigned, arguing that it would put too much strain on the company’s balance sheet. But the British government continues to act as though it wants the Hinkley project to proceed at almost any price. In return for covering about one-third of the costs, the Chinese state-run company China General Nuclear Power Corporation will take about one-third ownership in the project. (A subsidiary of E.D.F. owns the rest.) The British government has also provisionally agreed to let China build a yet-untested Chinese-designed reactor in Bradwell-on-Sea, northeast of London, later.

[..] The British government has [..] guaranteed that investors in the Hinkley project will get $115 per megawatt-hour over 35 years. This is approximately twice the price of electricity today [..]. If the market price of electricity falls below that rate, a government company is contractually bound to cover the difference — with the extra cost passed on to consumers. Price forecasts have dropped since the deal was struck: This summer the government, revising estimates, said differential payments owed under the contract could reach nearly $37 billion. If the Hinkley plan seems outrageous, that’s because it only makes sense if one considers its connection to Britain’s military projects — especially Trident, a roving fleet of armed nuclear submarines, which is outdated and needs upgrading.