DPC Oyster luggers along Mississippi, New Orleans 1906

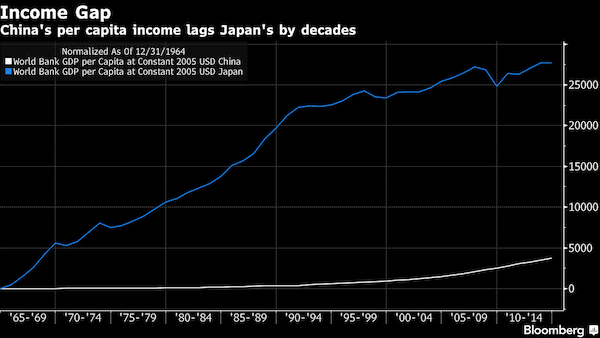

“In Japan, core machinery orders in November fell 14.4%..”

• Asia Stocks Extend Losses, Japan’s Nikkei Falls 3.67% (CNBC)

[..] major Asian stock markets continued their downward slide, following a massive sell-off on Wall Street overnight, pressured by concerns over a global economic slowdown and low oil prices. After a late sell-off Wednesday afternoon, the Chinese markets opened in negative territory before trimming losses, with the Shanghai composite down some 1.05%, while the Shenzhen composite was flat. At market open, Shanghai was down 2.73% and Shenzhen saw losses of 3.37%. Hong Kong’s Hang Seng index was down 1.51%. Offering some sign of stability in a generally volatile market, the People’s Bank of China (PBOC) set Thursday’s yuan mid-point rate at 6.5616, compared with Wednesday’s fix of 6.5630. The dollar-yuan pair was nearly flat at 6.5777.

Japan’s Nikkei 225 erased all of Wednesday’s 2.88% gain and plunged 3.95%, weighed by commodities and machinery sectors, which were all down between 3 and 4%. Earlier, it fell as low as 4% before paring back some of the losses. South Korea’s Kospi traded down 1.45%. Down Under, the ASX 200 dropped 1.61%, with energy and financials sectors sharply down. All sectors were in the red except for gold, which saw an uptick of 3.71%. In Japan, core machinery orders in November fell 14.4% from the previous month, according to official data, down for the first time in three months. The data is regarded as an indicator of capital spending and fell more than market expectations for a 7.9% decline.

Read more …

Or is it just price discovery?

• Oil and US Stocks Tumble Over Fears For Global Economy (Guardian)

US stocks fell heavily on Wednesday, with the Standard & Poor’s 500 falling 2.5% to take the index below 1,900 points for the first time since September, due to growing concerns about the falling oil price, which dipped below $30 a barrel for the first time in nearly 12 years. The S&P 500, which closed at 1,890 points, suffered its worst day since September and has fallen by 10% since its November peak taking it into “correction” territory, something that has not happened since August 2014. The Dow Jones industrial average dropped by 364 points, or 2.2%, to 16,151, and the Nasdaq composite dropped 159 points, or 3.4%, to 4,526. This deepened the New York stock exchange’s already worst start to a year on record.

Wednesday’s stock market declines were triggered by new figures showing US gasoline stockpiles had increased to record high, which caused Brent crude prices to fall as low as $29.96, their lowest level since April 2004, before settling at $30.31, a 1.8% fall. The oil price has fallen by 73% since a peak of $115 reached in the summer of 2014. Industry data showed that US gasoline inventories soared by 8.4m barrels and stocks of diesel and heating oil increased by more than 6m barrels – confirming the forecasts of many analysts that a huge oversupply of oil could keep prices low during most of 2016. Analysts said that growing fears of a weakening outlook for the global economy, made worse by falling oil prices, was behind the steep falls. Some oil analysts this week predicted that the price could fall as low as $10.

In recent days several analysts have warned that the global economy could suffer a repeat of the 2008 crash if the knock-on effects of a contraction in Chinese output pushes down commodity prices further and sparks panic selling on stock and bond markets. [..] Earlier in the day China’s stock market fell more than 2% after officials played down the significance of better-than-expected trade figures for December, saying exports could sink further before they find a floor.

Read more …

Looms?!

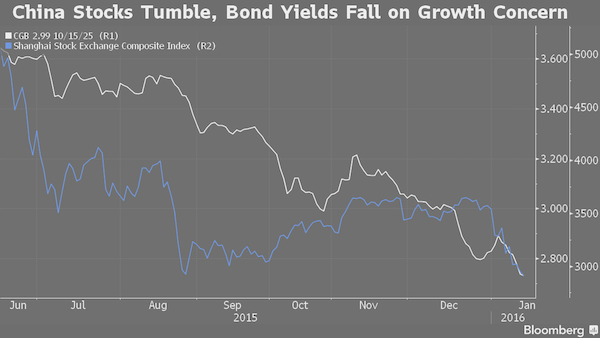

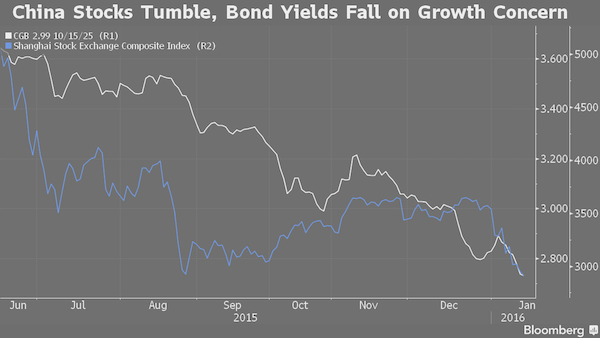

• China Bear Market Looms as PBOC Fails to Stop Flight to Safety (BBG)

Chinese stocks headed for a bear market while government bond yields fell to a record as central bank cash injections and a stable yuan fixing failed to shore up confidence in the world’s second-largest economy. The Shanghai Composite Index sank as much as 2.8%, falling more than 20% from its December high and sinking below its closing low during the depths of a $5 trillion rout in August. Investors poured money into government bonds after the People’s Bank of China added the most cash through open-market operations since February 2015, sending the yield on 10-year notes down to 2.7%. While the central bank kept its yuan reference rate little changed for a fifth day, the currency dropped 0.5% in offshore trading and Hong Kong’s dollar declined to the weakest since March 2015.

The selloff is a setback for Chinese authorities, who have been intervening to support both stocks and the yuan after the worst start to a year for mainland markets in at least two decades. As policy makers in Beijing fight to prevent a vicious cycle of capital outflows and a weakening currency, the resulting financial-market volatility has undermined confidence in their ability to manage the deepest economic slowdown since 1990 “You can’t really find buyers in this environment,” said Ken Peng, a strategist at Citigroup Inc. in Hong Kong. “It’s a very, very fragile status quo China is trying to maintain.” The government faces a dilemma with the yuan, according to Samuel Chan at GF International.

On one hand, a weakening exchange rate would help boost exports and is arguably justified given declines in other emerging-market currencies against the dollar in recent months. The downside is that a depreciating yuan encourages capital outflows and makes it harder to keep domestic interest rates low. The monetary authority “doesn’t want the yuan to depreciate fast because it will push funds to leave China very quickly,” Chan said. The country saw capital outflows for 10 straight months through November, totaling $843 billion, according to an estimate from Bloomberg Intelligence. Foreign-exchange reserves, meanwhile, sank by a record $513 billion last year to $3.33 trillion, according to the central bank.

Read more …

Still sinking after all these years.

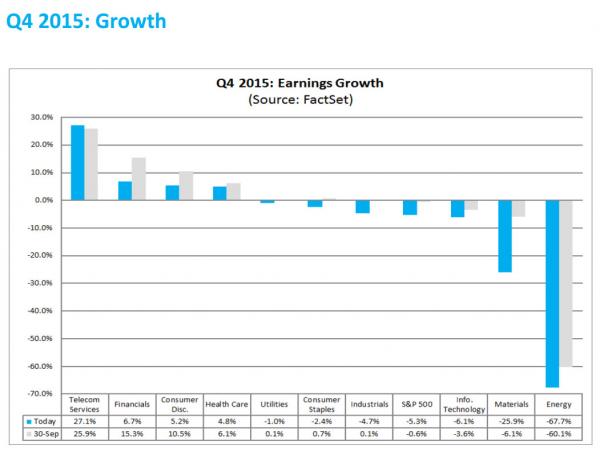

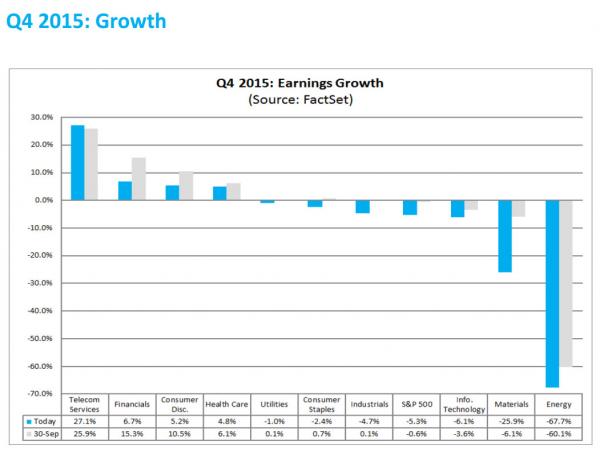

• Q4 Will Be Worst US Earnings Season Since Third Quarter Of 2009 (ZH)

Couple of things: first of all, any discussion whether the US market is in a profit (or revenue) recession must stop: the US entered a profit recession in Q3 when it posted two consecutive quarters of earnings declines. This was one quarter after the top-line of the S&P dropped for two consecutive quarters, and as of this moment the US is poised to have 4 consecutive quarters with declining revenues as of the end of 2015. Furthermore, as we showed on September 21, when Q4 was still expected to be a far stronger quarter than it ended up being, in the very best case, the US would go for 7 whole quarters without absolute earnings growth (and even longer without top-line growth).

Then, as always happens, optimism about the current quarter was crushed as we entered the current quarter, and whereas on September 30, 2015, Q4 earnings growth was supposed to be just a fraction negative, or -0.6%, as we have crossed the quarter, the full abyss has revealed itself and according to the latest Factset consensus data as of January 8, the current Q4 EPS drop is now expected to be a whopping -5%. And just to shut up the “it’s all energy” crowd, of the 10 industries in the S&P, only 4 are now expected to post earnings growth and even their growth is rapidly sliding and could well go negative over the next few weeks. It gets even worse. According to Bloomberg, on a share-weighted basis, S&P 500 profits are expected to have dropped by 7.2% in 4Q, while revenues are expected to fall by 3.1%.

This would represent the worst U.S. earnings season since 3Q 2009, and a third straight quarter of negative profit growth. It’s no longer simply a recession: as noted above, the Q4 EPS drop follows declines of 3.1% in Q3 and 1.7% in Q2. it is… whatever comes next. As Bloomberg adds, the main driving forces behind drop in U.S. earnings are the rise in the dollar index (thanks Fed) and the drop in average WTI oil prices. However, since more than half of all industries are about to see an EPS decline, one can’t blame either one or the other. So while we know what to expect from Q4, a better question may be what is coming next, and according to the penguin brigade, this time will be different, and the hockey stick which was expected originally to take place in Q4 2015 and then Q1 2016 has been pushed back to Q4 2016, when by some miracle, EPS is now expected to grow by just about 15%.

Read more …

WTI/Brent prices are just a story.

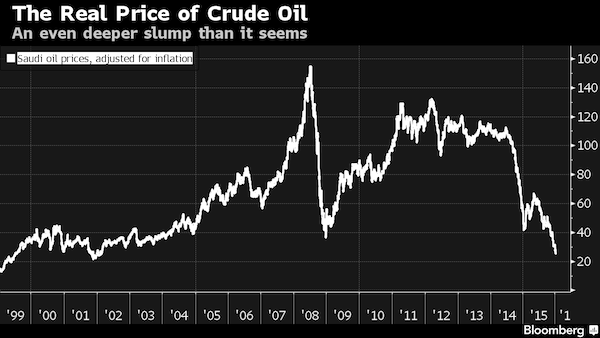

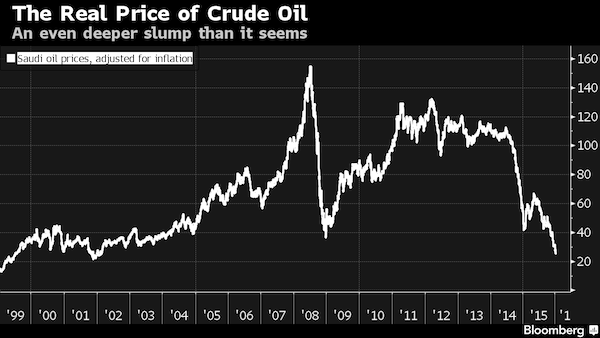

• The Real Price of Oil Is Far Lower Than You Realize (BBG)

While oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is even deeper. West Texas Intermediate futures, the U.S. benchmark, sank below $30 a barrel on Tuesday for the first time since 2003. Actual barrels of Saudi Arabian crude shipped to Asia are even cheaper, at $26 – the lowest since early 2002 once inflation is factored in and near levels seen before the turn of the millennium. Slumping oil prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking.

Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Turner, former chairman of the U.K. Financial Services Authority, said. The nation’s economic expansion faltered last year to the slowest pace in a quarter of a century. “You see a big destruction in the income of the oil and commodity producers,” Turner said. “That is having a major effect on their expenditure across the world.” The benefit for consumers from historically low oil prices is being blunted by changes in fuel taxation and a reduction in subsidies, according to Paul Horsnell at Standard Chartered in London. “But it certainly shows that current prices are very low by any description,” he said.

Read more …

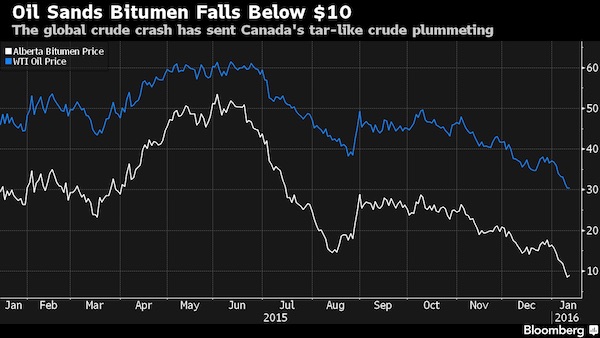

“..$8.35 on Tuesday, down from as much as $80 less than two years ago.”

• Crude At $10 Is Already A Reality For Canadian Oil-Sands Miners (BBG)

Think oil in the $20s is bad? In Canada they’d be happy to sell it for $10. Canadian oil sands producers are feeling pain as bitumen – the thick, sticky substance at the center of the heated debate over TransCanada’s Keystone XL pipeline – hit a low of $8.35 on Tuesday, down from as much as $80 less than two years ago. Producers are all losing money at current prices, First Energy Capital’s Martin King said Tuesday at a conference in Calgary. Which doesn’t mean they’ll stop. Since most of the spending for bitumen extraction comes upfront, and thus is a sunk cost, production will continue and grow. Canada will need more pipeline capacity to transport bitumen out of Alberta by 2019, King said.

Bitumen is another victim of a global glut of petroleum, which has sunk U.S. benchmark prices into the $20s from more than $100 only 18 months ago. It’s cheaper than most other types of crude, because it has to be diluted with more-expensive lighter petroleum, and then transported thousands of miles from Alberta to refineries in the U.S. For much of the past decade, oil companies fought environmentalists to get the pipeline approved so they could blend more of the tar-like petroleum and feed it to an oil-starved world. TransCanada is mounting a $15 billion appeal against President Barack Obama’s rejection of Keystone XL crossing into the U.S. – while simultaneously planning natural gas pipelines from Alberta to Canada’s east coast to carry diluted bitumen. Environmentalists are hoping oil economics finish off what their pipeline protests started.

Read more …

Inventories are overflowing. How predictable.

• Tanker Rates Tumble As Last Pillar Of Strength In Oil Market Crashes (ZH)

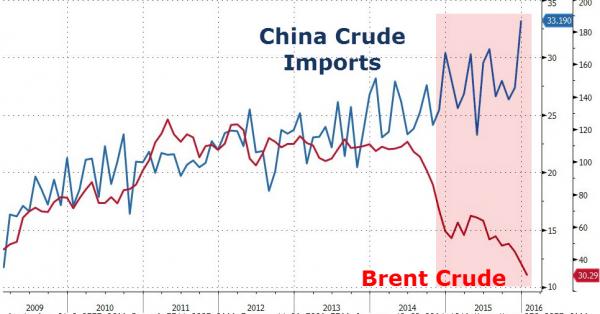

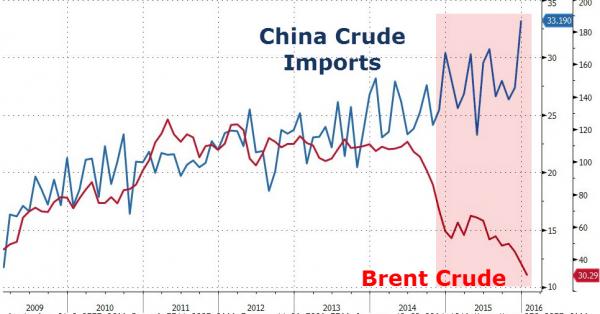

If there was one silver-lining in the oil complex, it was the demand for VLCCs (as huge floating storage facilities or as China scooped up ‘cheap’ oil to refill their reserves) which drove tanker rates to record highs. Now, as Bloomberg notes so eloquently, it appears the party is over! Daily rates for benchmark Saudi Arabia-Japan VLCC cargoes have crashed 53% year-to-date to $50,955 (as it appears China’s record crude imports have ceased). In fact the rate crashed 12% today for the 12th straight daily decline from over $100,000 just a month ago…

China imported a record amount of crude last year as oil’s lowest annual average price in more than a decade spurred stockpiling and boosted demand from independent refiners. China’s crude imports last month was equivalent to 7.85 million barrels a day, 6% higher than the previous record of 7.4 million in April, Bloomberg calculations show.

China has exploited a plunge in crude prices by easing rules to allow private refiners, known as teapots, to import crude and by boosting shipments to fill emergency stockpiles. The nation’s overseas purchases may rise to 370 million metric tons this year, surpassing estimated U.S. imports of about 363 million tons, according to Li Li, a research director with ICIS China, an industry researcher. But given the crash in tanker rates – and implicitly demand – that “boom” appears to be over.

Read more …

What neighbors can the US beggar?

• Currency Swings Sap US Corporate Profits by Most in Four Years (BBG)

Volatility in the $5.3-trillion-a-day foreign exchange market is dragging down U.S. corporate earnings by the most since 2011, according to a report from FiREapps. Currency fluctuations eroded earnings for the average North American company by 12 cents per share in the third quarter, according to the Scottsdale, Arizona-based firm, which advises businesses and makes software to help reduce the effect of foreign-exchange swings. That’s the most in data going back at least four years, and is up from an average 3 cents per share in the second quarter. “This is the worst I’ve seen it,” FiREapps chief executive officer Wolfgang Koestersaid in a telephone interview. “Investors and analysts are taking a very close look at corporate results impacted by foreign exchange and recognize how material they are.”

A JPMorgan measure of currency volatility averaged 10.1 % during the third quarter, up from 6.3 % 12 months earlier. Last year, some of the biggest price swings came from unscheduled events, such as China’s August devaluation of the yuan, Switzerland’s decision to scrap its currency cap and plummeting commodity prices. Companies in North America lost at least $19.3 billion to foreign-exchange headwinds in the third quarter of 2015, FiREapps data showed. The losses grew by about 14 % from the second quarter. Of the 850 North American corporations that Fireapps analyzed, 353 cited the negative impact of currencies in their earnings, more than double the previous quarter. “That is the largest number of companies talking about currency impact that we’ve ever seen,” Koester said.

China’s yuan is garnering more attention from corporations amid concern that growth in the world’s second-largest economy is slowing, according to FiREapps. Yet North American firms remain most concerned about the effects of the euro, Brazilian real and Canadian dollar on their results. The currencies have fallen 8.3 %, 34 % and 16 % against the greenback over the past 12 months. The stronger U.S. dollar means higher, less-competitive prices for U.S. businesses seeking to sell their products overseas. Companies also take a hit when they account for revenue denominated in weaker overseas currencies, unless they hedged their exposure.

Read more …

That is a very big number.

• African Exports To China Fell By 40% In 2015 (BBC)

African exports to China fell by almost 40% in 2015, China’s customs office says. China is Africa’s biggest single trading partner and its demand for African commodities has fuelled the continent’s recent economic growth. The decline in exports reflects the recent slowdown in China’s economy. This has, in turn, put African economies under pressure and in part accounts for the falling value of many African currencies. Presenting China’s trade figures for last year, customs spokesman Huang Songping told journalists that African exports to China totalled $67bn (£46.3bn), which was 38% down on the figure for 2014.

BBC Africa Business Report editor Matthew Davies says that as China’s economy heads for what many analysts say will be a hard landing, its need for African oil, metals and minerals has fallen rapidly, taking commodity prices lower. There is also less money coming from China to Africa, with direct investment from China into the continent falling by 40% in the first six months of 2015, he says. Meanwhile, Africa’s demand for Chinese goods is rising. In 2015 China sent $102bn worth of goods to the continent, an increase of 3.6%. Last year, South Africa hosted a China-Africa summit during which President Xi Jinping announced $60bn of aid and loans, symbolising the country’s growing role on the continent.

Read more …

And for now that’s still largely due to China.

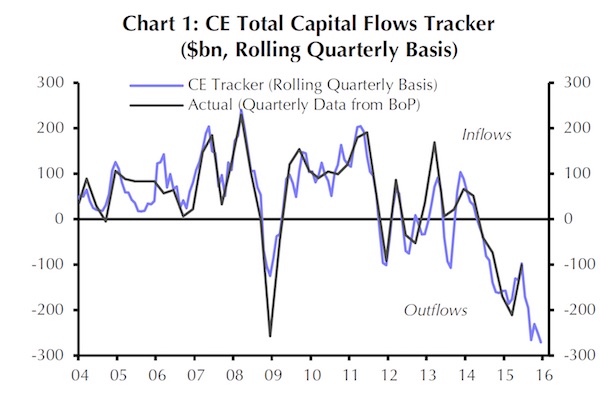

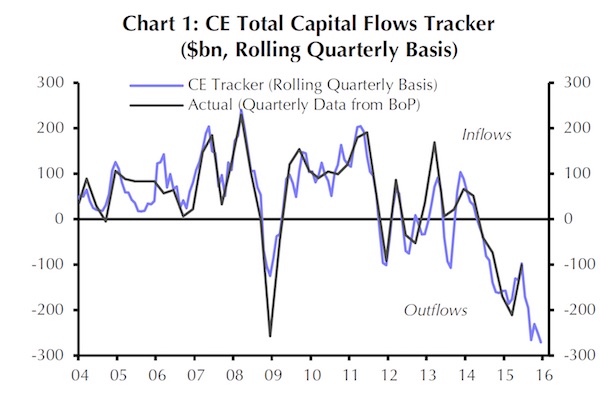

• Money Leaving Emerging Markets Faster Than Ever Amid China Slump (BBG)

Investors pulled more money from emerging markets in the three months through December than ever before as investors dumped riskier assets in China amid concern the country’s currency will weaken further, according to Capital Economics. Capital outflows from developing nations reached $270 billion last quarter, exceeding withdrawals during the financial crisis of 2008, led by an exodus from China as investors pulled a record $159 billion from the country just in December, Capital Economics’ economist William Jackson said in a report. Excluding outflows from the world’s second-largest economy, emerging markets would have seen inflows in the quarter, he said.

“This appears to reflect a growing skepticism in the markets that the People’s Bank can keep the renminbi steady,” Jackson said in the note, which was published Wednesday. “Given the fresh sell-off in EM financial markets and growing concerns about the level of the renminbi, it seems highly likely that total capital outflows will have increased” in January, he said. Investor skepticism increased last year as a surprise devaluation of China’s yuan roiled global markets and triggered a $5 trillion rout in the nation’s equity markets, casting doubt on the government’s ability to contain the selloff and support growth.

Chinese leaders have since then stepped up efforts to restrict capital outflows and prop up share prices despite pledges to give markets greater sway and allow money to flow freely across the nation’s borders within five years. The yuan traded in the mainland market declined 4.4% in 2015, the most since 1994. Outflows from emerging markets rose to a record $113 billion in December, Capital Economics said. Over 2015, investors pulled $770 billion from developing nations, compared with $230 billion a year earlier.

Read more …

“For local investors, there’s nothing to buy..”

• China Bond Yield Sinks To Record Low As Central Bank Injects $24 Billion (BBG)

China’s government bonds advanced, pushing the 10-year yield to a record low, as the central bank stepped up cash injections and volatile stock and currency markets drove demand for safety. The offshore yuan traded in Hong Kong declined for the first time in six days on speculation a narrowing gap with the Shanghai rate will dissuade the People’s Bank of China from stepping into the market, while Chinese equities slid below the lowest levels of last year’s market selloff. “For local investors, there’s nothing to buy,” said Li Liuyang at Bank of Tokyo-Mitsubishi. “Equities are not performing well, so bonds become the natural investment target. The PBOC increased reverse repo offerings partly because it may be taking some preemptive measures before next month’s Lunar New Year holidays.”

The yield on debt due October 2025 fell as much as three basis points to 2.70%, the least for a benchmark 10-year note in ChinaBond data going back to September 2007. The previous low was 2.72% in January 2009, during the global financial crisis. The PBOC conducted 160 billion yuan ($24 billion) of seven-day reverse-repo agreements in its open-market operations on Thursday, up from 70 billion yuan a week ago. That’s the biggest one-day reverse repo offerings since February 2015, data compiled by Bloomberg show. The PBOC injected a net 40 billion yuan this week, taking its total additions to 230 billion yuan so far this month. “The PBOC wants to keep liquidity abundant onshore to bolster the economy,” said Nathan Chow at DBS Group. “It’s also trying to calm the currency market as the yuan declined significantly last week and caused high volatility. But in the long run, the yuan will depreciate as the fundamentals are still weak.”

Read more …

Fake invoices. It’s as simple as that.

• China’s Better-Than-Expected Trade Numbers Raise Questions (WSJ)

China’s better-than-expected trade figures in December have sparked questions over whether trade flows have been inflated by investors evading capital controls and the extent of incentives being offered by government agencies to prop up exports. China reported Wednesday that exports in December declined 1.4% year on year. This was much better than the 8% drop expected by economists in a WSJ survey and compared with a 6.8% decline in November, allowing Beijing to end the trading year on a stronger note. Imports fell by 7.6% last month, better than the expected 11% decline, compared with an 8.7% drop in November. The December trade figures also were helped by favorable comparisons with year-earlier figures, economists said.

Of particular note was a 64.5% jump in China’s imports from Hong Kong, the strongest pace in three years, analysts said. This compared with a 6.2% decline for the January-November period. ”It really looks like capital flight,” said Oliver Barron with investment bank North Square Blue Oak. “This has artificially inflated the total import data.” China in recent months has struggled to adjust to massive capital outflows as Chinese investors seek better returns overseas. China saw its foreign exchange hoard drop 13.3% in 2015, or by $500 billion, to $3.3 trillion by the end of December. Under Beijing’s strict capital controls, consumers are only allowed to purchase $50,000 worth of U.S. dollars each calendar year. But manipulated foreign trade deals offer a way around tightening restrictions, say economists.

In an effort to stem the outflow, Beijing’s foreign exchange regulator announced stricter supervision starting January 1 to screen suspicious individual accounts and crack down on organized capital flight, according to an online statement. Bank customers also have reported more difficulty recently exchanging yuan into dollars, with some forced to wait four days to complete a transaction that normally takes one. And China has cracked down on illegal foreign-exchange networks, including a bust announced in November in Jinhua, a city of five million people in eastern Zhejiang province, allegedly involving eight gangs operating from over two dozen “criminal dens” that reportedly handled up to $64 billion in unauthorized transactions, according to state media and a detailed police report.

The official People’s Daily newspaper said 69 people had been criminally charged and another 203 people had been given administrative sanctions. ”Regulators have been trying really hard to close the loopholes,” said Steve Wang with Reorient Financial, adding that the market seems skeptical of Wednesday’s trade figures. The Shanghai Composite Index fell 2.4%. “I don’t think Hong Kong has been buying or selling any more from China. The December data is a huge question mark,” he added. An example of how a Chinese company might move capital abroad using trade deals would be to import 1 million widgets at $2 apiece from a Hong Kong partner or subsidiary company, paying the $2 million, analysts said. It then exports the same widgets at $1 apiece, receiving $1 million from the Hong Kong entity. The goods are back where they started, but $1 million has now moved offshore.

Read more …

“..the surprise gains may harken back to past instances of phony invoicing and other rules skirted to escape currency restrictions.”

• Surging China-Hong Kong Trade Raises Doubts Over Recovery (BBG)

China exports to Hong Kong rose 10.8% from a year earlier for the biggest gain in more than a year, making the city the biggest destination for shipments last month and spurring renewed skepticism over data reliability and the broader recovery in the nation’s outbound trade. Exports to Hong Kong rose to $46 billion last month, according to General Administration of Customs data released Wednesday. That was the highest value in almost three years and the biggest amount for any December period in the last 10 years, customs data show. Imports from Hong Kong surged 65%, the most in three years, to $2.16 billion. Economists said the surprise gains may harken back to past instances of phony invoicing and other rules skirted to escape currency restrictions.

China’s government said in 2013 some data on trade with Hong Kong were inflated by arbitrage transactions intended to avoid rules, an acknowledgment that export and import figures were overstated. The increase in exports to Hong Kong and China’s imports from the city probably indicate “fake invoicing,” said Iris Pang at Natixis in Hong Kong. Invoicing of China trade should be larger in December because of the wider gap between the onshore yuan and the offshore yuan traded in Hong Kong, she said. China’s exports to the Special Administrative Region of more than 7 million people eclipsed the $35 billion tallies last month for both the U.S. and the EU, the data show. Exports to Brazil, Canada, Malaysia, Russia all dropped more than 10%.

The imports gain “points to potential renewed fake trade activities,” said Larry Hu at Macquarie. When the yuan rose in 2013, exports to Hong Kong were inflated artificially, he said, and “now it’s just the opposite.” China’s total exports rose 2.3% in yuan terms from a year earlier, the customs said, after a 3.7% drop in November. Imports extended declines to 14 months. The recovery in exports in December may prove to be a temporary one due to a seasonal increase at the end of the year, and it doesn’t represent a trend, a spokesman for customs said after the Wednesday briefing. A weak yuan will help exports, but that effect will gradually fade, the spokesman told reporters in Beijing. Morgan Stanley economists led by Zhang Yin in Hong Kong also said in a note Wednesday that the higher-than-expected trade growth may have been affected by currency arbitrage. Overall external demand remained weak, as shown by anemic export data reported by South Korea and Taiwan, he said.

Read more …

State firms buying/holding lousy paper.

• The Quiet Side of China’s Market Intervention (WSJ)

As Chinese markets tanked last week, China Inc. appeared to be rallying to their support. At least 75 Chinese companies issued statements during the past week and a half, saying their biggest shareholders would be holding on to their stakes in order to protect investor interests. Officially, the companies were acting spontaneously. But privately, people close to Chinese regulators as well as some of the companies themselves said they were prompted to release the statements by exchange officials, who had called and asked them to issue expressions of support. In many cases, the statements contained similar or nearly identical language. The behind-the-scenes activity reflects the secretive, unofficial side to Chinese regulators’ attempts to bolster the country’s sagging stock markets.

The regulators’ varied arsenal includes tactics such as phone calls from exchange officials to big holders of shares, urging them not to sell, as well as pumping hundreds of billions of yuan into the markets through government-affiliated funds. The hand of the regulators was most apparent over the summer, when a 43% plunge in the Shanghai Composite Index over slightly more than two months was accompanied by dozens of declarations by brokerages and fund managers abjuring stock sales, as well as huge purchases of shares in bellwether Chinese stocks by a shadowy group of firms known as the “national team.” Brokers, company executives and people close to Chinese regulators say tactics have become more subtle during the current market downturn: The national team hasn’t been making the high-profile buys of half a year ago, and regulators have been less overt in their requests for cooperation.

An executive at one environmental technology firm listed on the Shenzhen exchange said that in July, the bourse sent a letter demanding the company release a statement saying its controlling shareholders wouldn’t unload stock. Last week, the exchange was more low key, he said, phoning up and urging the company to release another statement to set an example for other firms. But the flurry of companies declaring their support for the market in recent days shows that Chinese regulators still haven’t given up on behind-the-scenes efforts to guide the direction of stocks. “We issued the statement because the [Shenzhen] exchange encouraged listed firms to maintain shareholdings,” said an executive at LED device-maker Shenzhen Jufei who requested anonymity. “You can think of this as a concerted effort by listed firms to voluntarily stabilize the market.”

Read more …

The popularity of T-Bills is guaranteed.

• As China Dumps Treasuries, Other Buyers Expected To Step In (BBG)

It might be easy to conclude China’s unprecedented retreat from Treasuries is bad news for America. After all, as the biggest overseas creditor to the U.S., China has bankrolled hundreds of billions of dollars in deficit spending, particularly since the financial crisis. And that voracious appetite for Treasuries in recent years has been key in keeping America’s funding costs in check, even as the market for U.S. government debt ballooned to a record $13.2 trillion. Yet for many debt investors, there’s little reason for alarm. While there’s no denying that China’s selling may dent demand for Treasuries in the near term, the fact the nation is raising hundreds of billions of dollars to support its flagging economy and stem capital flight is raising deeper questions about whether global growth itself is at risk.

That’s likely to bolster the haven appeal of U.S. debt over the long haul, State Street Corp. and BlackRock Inc. say. Any let up in Chinese demand is being met with record buying by domestic mutual funds, which has helped to contain U.S. borrowing costs. “You have China running down reserves and Treasuries are a big portion of reserves, but even with that we still think the weight of support” will boost demand for U.S. debt, said Lee Ferridge, the head of macro strategy for North America at State Street, which oversees $2.4 trillion. The question is “if China slows, where does growth come from. That’s what’s been worrying a lot of people coming into 2016.”

Read more …

And then the TBTFs will need rescue again?!

• Reporting Rule Adds $3 Trillion Of Leases To Balance Sheets Globally (FT)

Companies around the world will be forced to add close to $3tn of leasing commitments to their balance sheets under new rules from US and international regulators — significantly increasing the debt that must be reported by airlines and retailers. A new financial reporting standard — the culmination of decades of debate over “off-balance sheet” financing — will affect more than one in two public companies globally. Worst hit will be retail, hotel and airline companies that lease property and planes over long periods but, under current accounting standards, do not have to include them in yearly reports of assets and liabilities. In these sectors, future payments of off-balance sheet leases equate to almost 30% of total assets on average, according to the International Accounting Standards Board, which collaborated with the US Financial Accounting Standards Board on the new rule.

Hans Hoogervorst, IASB chairman, said: “The new Standard will provide much-needed transparency on companies’ lease assets and liabilities, meaning that off-balance-sheet lease financing is no longer lurking in the shadows”. As a result of the accounting change, net debt reported by UK supermarket chain Tesco would increase from £8.6bn at the end of August to £17.6bn, estimated Richard Clarke, an analyst from Bernstein. However, while the new standard would make Tesco look more indebted, Mr Clarke added that the assets associated with the leases would also come on to the company’s balance sheet, so “the net effect would be neutral.” Investors warned that the new standards could affect some groups’ banking covenants and debt-based agreements with lenders, but said they would make it easier to compare companies that uses leases with those that prefer to borrow and buy.

Vincent Papa, director financial reporting policy at the Chartered Financial Analysts Institute, which has been pushing for these changes since the 1970s, said: “Putting obligations on balance sheets enables better risk assessment. It is a big improvement to financial reporting.” For some airlines, the value of off-balance- sheet leases can be more than the value of assets on the balance sheets, the IASB noted. It also pointed out that a number of retailers that had gone into liquidation had lease commitments that were many times their reported balance sheet debt. [..] In 2005, the SEC calculated that US companies had about $1.25 trillion of leasing commitments that were not included in assets or liabilities on balance sheets. Six years later, the Equipment Leasing and Finance Foundation in the US said that “Capitalising operating leases will add an estimated $2 trillion and 11% more reported debt to the balance sheets of US-based corporations…and could result in a permanent reduction of $96bn in equity of US companies. ”

Read more …

“..used so widely that its residues are commonly found in British bread.”

• EU Scientists In Bitter Row Over Safety Of Monsanto’s Round-Up (Guardian)

A bitter row has broken out over the allegedly carcinogenic qualities of a widely-used weedkiller, ahead of an EU decision on whether to continue to allow its use. At issue is a call by the European Food and Safety Authority (Efsa) to disregard an opinion by the WHO’s International Agency for Research on Cancer (IARC) on the health effects of Glyphosate. Glyphosate was developed by Monsanto for use with its GM crops. The herbicide makes the company $5bn (£3.5bn) a year, and is used so widely that its residues are commonly found in British bread. But while an analysis by the IARC last year found it is probably carcinogenic to humans, Efsa decided last month that it probably was not. That paves the way for the herbicide to be relicensed by an EU working group later this year, potentially in the next few weeks.

Within days of Efsa’s announcement, 96 prominent scientists – including most of the IARC team – had fired off a letter to the EU health commissioner, Vytenis Andriukaitis, warning that the basis of Efsa’s research was “not credible because it is not supported by the evidence”. “Accordingly, we urge you and the European commission to disregard the flawed Efsa finding,” the scientists said. In a reply last month, which the Guardian has seen, Andriukaitis told the scientists that he found their diverging opinions on glyphosate “disconcerting”. But the European Parliament and EU ministers had agreed to give Efsa a pivotal role in assessing pesticide substances, he noted. “These are legal obligations,” the commissioner said. “I am not able to accommodate your request to simply disregard the Efsa conclusion.”

Read more …

What’s Monsanto’s role in this?

• Thousands Of Farmer Suicides Prompt India Crop Insurance Scheme (Guardian)

India’s government has approved a $1.3bn insurance scheme for farmers to protect against crop failures, saying it was intended to put a halt to a spate of suicides. Two successive years of drought have battered the country’s already struggling rural heartland, with farmer suicides in rural areas regularly hitting the headlines. More than 300,000 farmers have killed themselves in India since 1995. Under the new scheme, farmers will pay premiums of as little as 1.5% of the value of their crops, allowing them to reclaim their full value in case of natural damage, the government said. “The scheme will be a protection shield against instances of farmer suicides because of crop failures or damage because of nature,” home minister Rajnath Singh said on Wednesday after the cabinet approved the scheme.

The Prime Minister Crop Insurance Scheme is also an attempt by Narendra Modi’s government to woo the country’s powerful farming community after being beaten in two recent state elections. “This scheme not just retains the best features of past policies but also rectifies all previous shortcomings… This is a historic day,” Modi said in a tweet. Previous crop insurance schemes have been criticised by the agricultural community as being too complex or for having caps that prevented them from recouping the full commercial value in the case of damage. Take-up of existing schemes by farmers is as low as 23%, the agriculture minister Radha Mohan Singh said, adding that he hoped to increase coverage to 50%. The heavily subsidised scheme will come into effect in April, a major crop-sowing season.

Read more …

Priorities.

• Greece Said To Propose Return Trips For Illegal Migrants (AP)

A senior Greek official has said the government will ask Europe’s border protection agency Frontex to help set up a sea deportation route to send migrants who reach the country illegally back to Turkey. The official told AP the plan would involve chartering boats on Lesvos and other Greek islands to send back migrants who were not considered eligible for asylum in the EU. The official spoke on condition of anonymity because Athens hasn’t yet formally raised the issue with other European governments. More than 850,000 migrants and refugees reached Greece in 2015 on their route through the Balkans to central Europe. But the EU is seeking to toughen and better organize procedures for asylum placements, while Balkan countries outside the EU have also imposed stricter transit policies.

Read more …

NIMBY.

• Tighter Border Checks Leave Migrants Trapped In Greece (AP)

As twilight falls outside the Hellenikon shelter – a former Olympic field hockey venue currently housing about 280 people – Iranian men play volleyball, a red line on the ground serving as a notional net. Inside, migrants are coming to terms with their bleak future. “I can’t go back to Somalia,” said English teacher Ali Heydar Aki, who hoped to settle in Europe and then bring his family. “I have sold half my house” to fund the trip. While it’s unclear exactly how many are stuck in Greece, a comparison of arrivals there and in FYROM since late November leaves about 38,000 people unaccounted for. Greek immigration minister Ioannis Mouzalas’ best guess is “a few thousand.” “But (that’s) a calculation based on experience, not something else,” he said.

Syed Mohammad Jamil, head of the Pakistani-Hellenic Cultural Society, says about 4,000 Pakistanis could be stuck in Greece, mostly still on the islands, and about as many Bangladeshis. “Every day we get … phone calls from people in tears asking for help,” he said. “We can’t help – send them where? Germany, Spain, Italy, England? We can’t.” All now face two legal options: To seek asylum in Greece – which has 25% unemployment and a crumbling welfare system – or volunteer for repatriation. Greek authorities have recorded an increase in both since FYROM tightened controls. Karim Benazza, a Moroccan hotel worker in his 20s, has signed up to go home on Jan. 18.

“This is all I do now, smoke and smoke, but no money, no food,” he said, lighting a cigarette outside the International Organization for Migration building. “There is nothing for us in Greece, and the Macedonian border is closed.” Daniel Esdras, IOM office head in Greece, sees a steep increase in voluntary repatriations, which the IOM organizes. About 800 people registered in December and 260 have been sent home. “It’s one thing to return in handcuffs … and quite another to go as a normal passenger with some money in your pocket, because we give them each €400,” Esdras said.

Read more …

5,700 children in 12 days.

• Refugee Influx To Greece Continues Unabated Through Winter (Reuters)

More than 1,000 migrants and refugees arrived at Greece’s biggest port of Piraeus near Athens on Wednesday as the influx of people fleeing conflict zones for Europe continued unabated into the winter months. More than 1 million refugees and migrants braved the seas in 2015 seeking sanctuary in Europe, nearly five times more than in the previous year, according to the United Nations’ refugee agency. Most entered through Greece’s outlying islands. So far this year, 31% of arrivals to Europe have been children, said medical aid group Medecins Sans Frontieres, which has been treating arrivals to the Greek islands. About 5,700 children crossed the narrow but dangerous sea passage between Greece and Turkey in just 12 days aboard rickety, overcrowded boats, it said.

“I leave my home, my country [because] there was violence, it was not safe,” said 18-year-old Idris, who left his home and family behind in Afghanistan three months ago, traveling alone through Turkey and hoping to reach Germany to study. As others disembarked from the ferry on Wednesday, volunteers passed out hot tea and fruit to help them get through the next leg of their journey, an eight-hour bus ride from Athens to Greece’s northern border with Former Yugoslav Republic of Macedonia [FYROM]. The ferry picked up a total of 1,238 migrants and refugees from the Eastern Aegean islands of Lesvos and Chios. Among those was 25-year-old Salam, from the Syrian city of Homs, who said he had lived in a number of different cities before the fighting led him and his friends to flee. “[They killed] women and children and men,” said Salam, who also hopes to reach Germany. [It was] very very very bad in Syria.”

Read more …

How blind is this? “Work must also step up on “returning those who have no right to international protection.” There are people who have no right to protection? Who gets to decide?

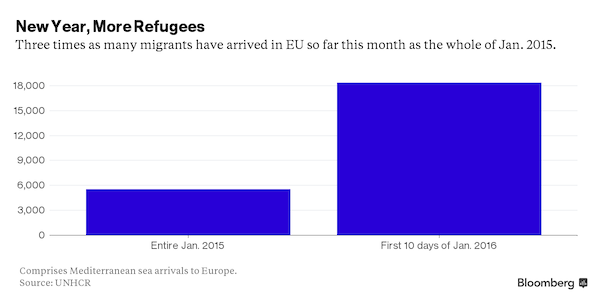

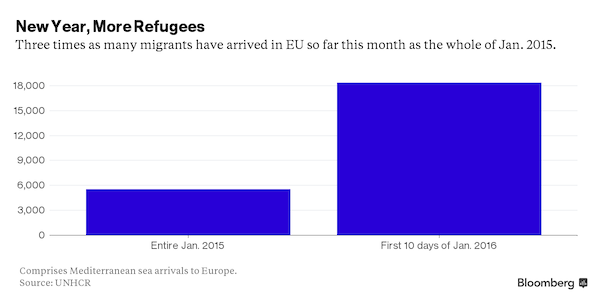

• Europe Sees No Let Up in Refugee Crisis as January Arrivals Soar (BBG)

The number of refugees entering Europe in the first 10 days of 2016 is already three times the level in all of January 2015, signaling no let up in the pressure facing the region’s leaders amid the biggest wave of migration since World War II. The number of migrants crossing the Mediterranean Sea to the European Union from Turkey, the Middle East and North Africa reached 18,384 through Jan. 10, according to the United Nations Refugee Agency. That compares with 5,550 in January last year. “This year, these weeks, the coming months must be dedicated to delivering clear results in terms of regaining controls of flows and of our borders,” EC Vice President Frans Timmermans told reporters in Brussels on Wednesday after discussing the latest situation with EU commissioners.

Turmoil in Syria and across the Arab world triggered an influx of more than 1 million people arriving in the EU last year. Faced with migration in such unprecedented numbers, governments have reintroduced internal border checks, tried – and failed – to share refugees between one another and have been forced to defend their policies amid anger at violence allegedly perpetrated by the recent arrivals.

The number of refugees entering the EU increased month-on-month from January 2015 until hitting a peak of 221,374 in October, according to the agency. The level fell back to 118,445 last month as bad weather deterred people from making the journey. Almost a third of those arriving are children. So far this year 49 people have either died or are missing having attempted to cross into Europe. EU countries need to work together to tackle the “root causes” of the refugee influx, Timmermans said. Work must also step up on “returning those who have no right to international protection.”

Read more …