NPC Communist Party Young Communist League, Washington, DC 1925

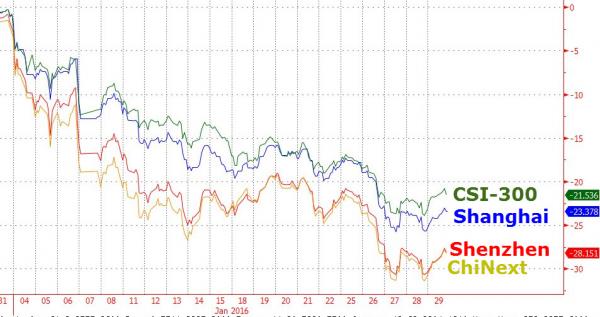

Yeah, the New Year break has an impact, but even on an annual basis exports fell 13.1%.

• China Exports Crash 25.4%, Imports Down 13.8% (ZH)

Worse than expected is an understatement. Things are not getting better in China as Exports crashed 25.4% YoY (the 3rd largest drop in history), almost double the 14.5% expectation and Imports tumbled 13.8%, the 16th month of YoY decline – the longest ever. Altogether this sent the trade surplus down to $32.6bn (missing expectations of $51bn) to 11-month lows.

So much for that whole "devalue yourself to export growth" idea…

As Bloomberg notes,

China’s exports in yuan terms fell 20.6% year on year in February, down from a 6.6% drop in January, and missing expectations of an 11.3% fall. Imports were down 8.0%, an improvement from January’s 14.4% drop. The trade surplus came in at 209.5 billion yuan ($32 billion), down from 406.2 billion yuan.

The Chinese New Year holiday, which fell at the start of February in 2016 and in the middle of February in 2015, distorts the data in unpredictable ways. Holiday effects mean the outsize drop in February exports overstates the weakness in China’s factory sector. Even so, looking at a year-to-date figure for the first two months of the year, the picture is only slightly less gloomy. In the year through February, exports are down 13.1%.

The policy response has already been announced. The National People’s Congress set a target for 13% growth in money supply in 2016, up from 12% in 2015, and a 3% of GDP fiscal deficit, up from 2.3%. In other words: more lending and more public spending to provide a boost to demand. In the short term, that shores up confidence in the growth outlook. Medium term, of course, there is a price to be paid.

Stocks are mounting a modest rebound on this terrible data (moar stimulus hopes) but after $1 trillion of new credit in 2 months, is there seriously anyone left who thinks moar will help?

“The depreciation of the RMB can therefore only be avoided by stepping back from the commitment to a more open capital account..”

• Conflicting China Policy Objectives Put Reform at Risk (Moody’s)

Moody’s Investors Service says that China’s (Aa3, negative) policy makers appear to have set themselves three main policy objectives: maintaining reasonably high rates of GDP growth, reforming and rebalancing the economy, and ensuring financial and economic — and thereby social — stability. The Government Work Report delivered to the National People’s Congress on 5 March made explicit reference to each of these policy objectives. “However, against the backdrop of China’s slower economic growth, capital outflows and rising corporate stress, it will be increasingly difficult for these policy objectives to be achieved in unison,” says Michael Taylor, a Moody’s Managing Director and Chief Credit Officer for Asia Pacific.

“With the government having now given a strong commitment to a growth target of between 6.5%-7.0%, it seems unavoidable that one of the other policy objectives will assume lesser priority. The most likely near-term casualty is reform momentum.” “We believe that achieving even the lower end of the growth target for 2016 is likely to require further substantial monetary and fiscal stimulus, as evidenced by the 50-basis-point cut to the required reserve ratio in February and the government’s announcement of a 3% fiscal deficit for this year”, adds Taylor. “This level of policy support is likely to frustrate the government’s ability to achieve at least one of its other objectives.” Moody’s analysis is contained in its just-released report titled “China Credit: Conflicts Between Policy Objectives Raise Risk That Momentum on Reform Will Slow”.

Moody’s report points out that it will be difficult even to implement two of the three objectives at any one time. If the authorities choose to prioritize reform while trying to maintain a growth target of in excess of 6.5%, the consequence will be to sacrifice some degree of financial stability, and accept a larger level of RMB depreciation, more widespread defaults, and perhaps even some failures in the banking system. Alternatively, a combination of growth and stability is also achievable, at least for some time, but such a strategy will leave unaddressed the deep imbalances in China’s economy, such as elevated system leverage and excess capacity. The risk is that the support necessary to achieve 6.5% growth instead postpones the restructuring of the SOE sector by creating artificially favorable demand and maintaining accommodative financing conditions for loss-making, as well as viable SOEs.

In addition, the implementation of the accommodative monetary policy needed to support growth would lead to further downward pressure on the RMB and would likely delay much-needed deleveraging. The depreciation of the RMB can therefore only be avoided by stepping back from the commitment to a more open capital account, thereby substantially slowing the pace at which this and related reforms, such as more market-based credit allocation, would be enacted.

Where would imports numbers be without this?

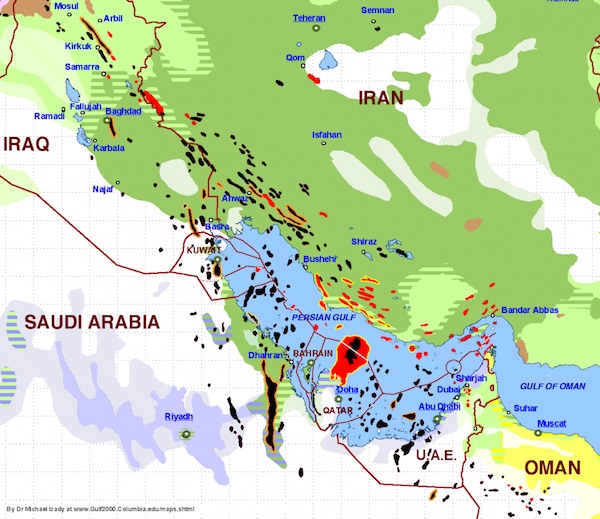

• Despite Slowdown, China’s Oil Imports Surge (WSJ)

China imported 31.80 million metric tons of crude oil in February, equivalent to 8.0 million barrels a day, preliminary data from the General Administration of Customs showed Tuesday. Imports were 24.5% higher than the 25.55 million tons of crude shipped in during the month a year earlier and was up about 19% from 26.69 million tons in January. BMI Research analyst Peter Lee said the rise was likely due to robust crude imports in the beginning of February by local refineries in preparation for expected higher demand during the Lunar New Year holiday. Despite its economic slowdown, China remains a strong importer of crude, driven by the rise of independent refineries. Government efforts to fill the strategic petroleum reserves are also pushing China to import more foreign crude as domestic production is likely to slide by 1.5% this year, according to research firm ICIS.

According to the Chinese government’s forecast, the country’s reliance on foreign crude will likely rise to 62% this year. However, many analysts have said that as China moves to a more consumption and services-oriented economy, China’s oil demand will likely continue on a downtrend. Investment firm CLSA estimates that China’s crude imports will rise about 6% this year, lower than the 8.8% growth in the previous year when China shipped in a total of 336 million tons. The firm also expects the country’s oil demand to reach 2.5% this year. “A low single-digit growth might be the new norm for China’s oil demand,” said Nelson Wang, a CLSA China energy analyst. Refined oil product imports totaled 2.64 million tons, while exports totaled 2.99 million tons, the data showed.

Here comes deflation.

• China’s Velocity Of Money Is Now The Lowest In The Entire World (ZH)

[..] here, courtesy of Macquarie’s Viktor Shvets, is the best encapsulation of the predicament the world finds itself in. From volume 52 of “What Caught My Eye”

Rising leverage levels (whilst positive initially) eventually turn to “poison”, as incremental benefit diminishes and in order to maintain growth rates, economies require an ever increasing infusion of credit and ever declining cost of capital.

Although not perfect there is a well-defined relationship between the overall level of debt and velocity of money. Each economy is different (both in term of structure and efficiency) and therefore the degree of tolerance to rising debt levels and associated volatility also differs; nevertheless, as a generalization, the higher debt levels and the faster pace of debt accumulation tends to coincide with lower (and declining) velocity of money.

Then, after showing the declining velocity of money in all developed markets as leverage exploded higher, Shvets focuses on China:

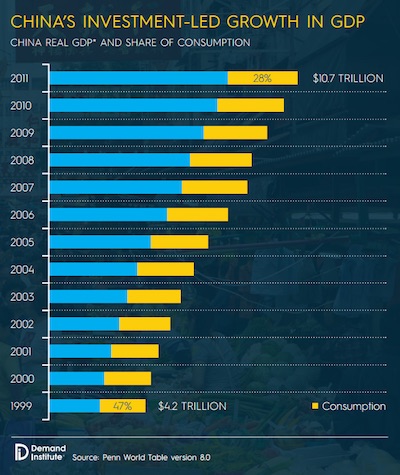

The massive rise in China’s financial leverage is in a class of its own. As China embarked on a highly capital intensive growth strategy, its debt levels accelerated, driving velocity of money down. As can be seen below, China’s estimated debt burden has increased from US$1.5 trillion in 2000 to US$5.8 trillion in 2007 and exploded to over US$28 trillion by 2014 (and should have reached US$30-31 trillion in 2015).

The punchline: China’s velocity of money is now the lowest in the entire world, a world in which China provided 40% of the entire credit impulse since 2008!

In the last seven years, China has accounted for around ~40% of entire global incremental debt creation. Such a rapid accumulation of debt in less than a decade, when combined with the capital-intensive nature of the economy and a less sophisticated financial sector, drove China’s velocity of money to one of the lowest levels globally (~0.5x, i.e. below that of Japan).

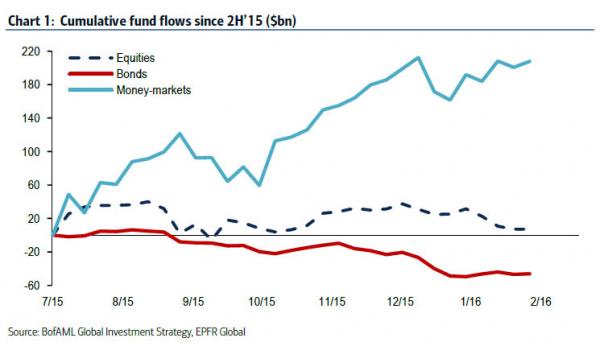

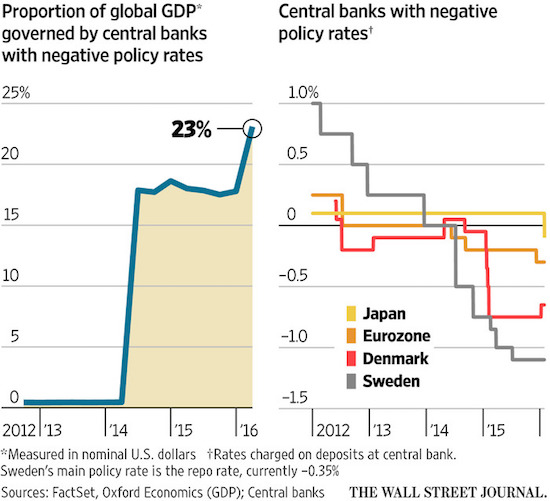

And while we agree with the BIS and all those others who suddenly had an epiphany and confirmed what we have been saying for years about China’s debt load, the question remains: just who will propel the global debt-creation growth dynamo if China is taken out of the picture, and if 25% of the world is covered in debt-demand destroying NIRP?

We hope to get some answers just as soon as the massive short squeeze acorss global markets, the biggest in history, is over.

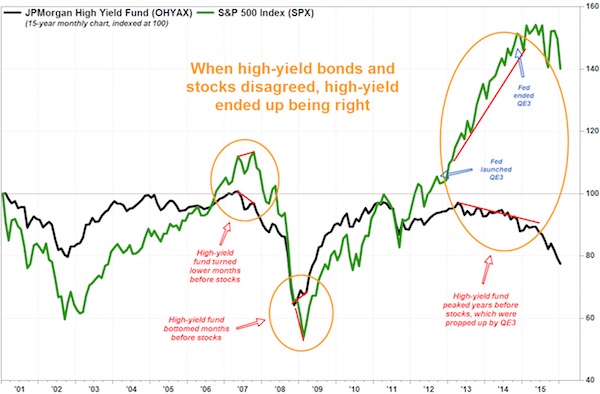

“Markets are therefore unhinged from any connection to fundamental economic and financial reality, meaning that they are capable of an extended period of spasmodic deadcat bounces that will have only one end result.”

• Central Banks Are Fixing To Ambush The Casino (David Stockman)

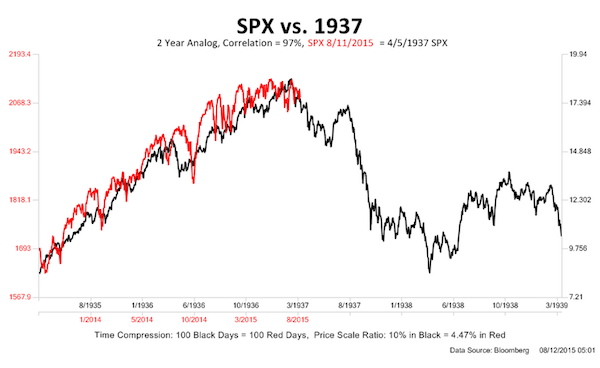

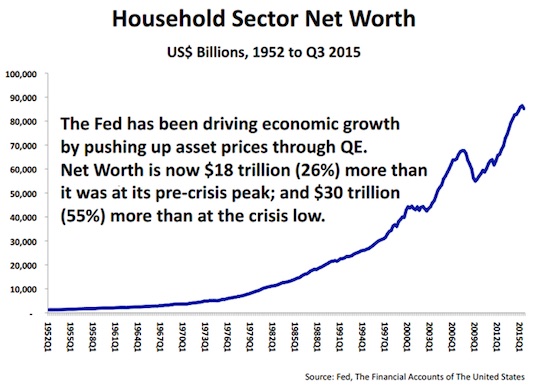

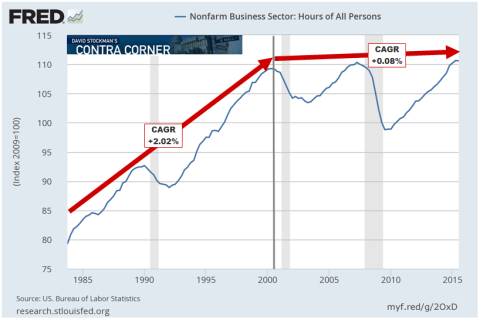

The casino is incorrigible. After a monumental short squeeze that has lifted the averages right into the jaws of danger, Goldman Sachs has the temerity to print the following: “Our model suggests SPX calls are more attractive than at any time over the past 20 years”. There must have been a mullets’ breeding frenzy awhile back because it’s hard to fathom how Goldman has any real customers left. Then again, its current preposterous call is just indicative of the horrible threat heading menacingly toward what remains of main street’s 401k investments. To wit, the Fed and other central banks have thoroughly falsified financial market prices and destroyed all of the ordinary mechanisms of financial discipline. Foremost among these are short sellers and a meaningfully positive cost of carry trades.

Markets are therefore unhinged from any connection to fundamental economic and financial reality, meaning that they are capable of an extended period of spasmodic deadcat bounces that will have only one end result. Namely, the naïve and desperate among main street investors who still, unaccountably, frequent the casino will presently be taken out back and shot yet another time. The market technicians are pleased to call this “distribution”. Would that someone on Wall Street man-up and amend the phrase to read ”distribution…….of losses to the mullets” and be done with the charade. The S&P 500 is heading through 1300 from above long before it ever again penetrates from below its old May 2015 high of 2130. And now that 97% of Q4 results are in, there is a single number that proves the case.

Reported LTM profits as of year-end 2015 stood at just $86.46 per S&P 500 share. That particular number is a flat-out bull killer. At a plausible PE multiple of 15X, it does indeed imply 1300 on the S&P 500 index. It also represents an 18% decline from peak S&P 500 reported earnings of $106 per share back in September 2014. And more importantly, it means that the robo-machines and hedge fund gamblers have traded the market back up to 23.1X earnings. That’s off the charts…….except for when recession has already arrived unannounced by the hockey stick factories of Wall Street. But here’s the thing with respect to the scarlet 23.1X numerals now painted on the casino’s front entrance. It comes at a time when the so-called historical average PE ratios are way too high for present realities. That is, in a world sliding into a prolonged deflationary decline, capitalization rates should be falling into the sub-basement of history.

The Troika’s back in Athens.

• Brussels Seeks Further Reform To Seal Greek Bailout (FT)

Eurozone finance ministers have moved to break a deadlock between Greece’s warring creditors by sending bailout negotiators back to Athens to agree a new set of economic reforms. Despite continued disagreement over how long the list of reforms must be, Jeroen Dijsselbloem, the Dutch finance minister who chaired the eurogroup meeting of his 16 counterparts, insisted there was “enough common ground” between the EU and the IMF to restart the negotiations. He said mission chiefs from the bailout monitors could arrive as early as Tuesday. “More work will have to be done in Athens,” Mr Dijsselbloem said after the Monday evening eurogroup meeting in Brussels. “It’s not going to be easy, we’re very much aware of that.”

Officials acknowledged that the IMF and the EU had not reached an agreement on how thorough the reforms must be, essentially putting off a final fight over the future of Greece’s third, €86bn rescue for at least another month. The IMF has hinted it is willing to walk away from the bailout if it deems the reforms inadequate, a move that would plunge Greece back into economic uncertainty. Without the IMF, a German-led group of creditor countries have said they would be unable to secure parliamentary approval for their participation in the EU’s rescue, potentially scuppering the deal. “An interim solution without the IMF would be very difficult for a number of countries, including my own,” Alex Stubb, the Finnish finance minister, said.

Euclid Tsakalotos, the Greek finance minister, acknowledged the talks would restart “despite certain differences”, which he hoped could be overcome in the negotiations. “I’m sure sensible people when they get across the table will come to sensible conclusions,” Mr Tsakalotos said as he left the eurogroup meeting. Under the terms of the new bailout, Greece must pass measures designed to take government finances to a primary budget surplus of 3.5% of economic output by 2018. A country’s primary balance is its revenues minus expenses excluding debt payments.

The IMF and the EU are at loggerheads over both the stringency of the new reform measures and how many of them must be adopted to hit the 3.5% target. Officials said the differences would only be sorted out at a later date. The IMF believes the reform measures on the table are insufficient and has pushed for more concrete and deeper cuts. Athens has caved in to an ultimatum from its creditors and agreed to rush through long-resisted economic reforms in return for a third bailout. Further reading Mr Dijsselbloem appeared to side with the IMF’s tough line, saying “the package of measures needs to become even more solid, needs to go even deeper than what’s been put on the table so far” — though when pressed whether he backed the IMF’s view, he insisted, “I’m not in anyone’s camp.”

The big words are back.

• Greece Clears Bailout Hurdle With Debt Relief Pledge (AFP)

Greece cleared a crucial hurdle in its massive bailout programme on Monday as eurozone ministers promised to consider debt relief to Athens, which is already under pressure from the refugee crisis. Bailout monitors from the EU and IMF will return to Greece as soon as Tuesday in an effort to complete a long-delayed review of the programme that could unlock rescue cash, European Economic Affairs Commissioner Pierre Moscovici said. “I am very happy that mission chiefs are going to Athens as soon as tomorrow,” Moscovici said after a meeting of the eurozone’s 19 finance ministers in Brussels, taking place in parallel to an EU-Turkey summit on the refugee crisis. Greek Prime Minister Alexis Tsipras secured Greece’s third bailout, worth a staggering 86 billion euros ($95 billion), last July after six months of bruising negotiations that shook the EU and nearly saw Athens thrown out of the single currency.

Along with its debt crisis the Greek state is now overwhelmed by the arrival of around a million migrants in a year. As refugees trek across Europe seeking new lives in Germany and elsewhere, the fresh crisis has increased the pressure on Athens’ eurozone partners to soften their demands of Greek austerity. Eurogroup chief Jeroen Dijsselbloem, who last year was one of Greece’s harshest critics, said eurozone ministers would now address debt relief, meeting a key demand of the Greek government that has been resisted by its pro-austerity partners. The EU forecasts that Greece’s debt will soar to 185% of GDP in 2016 – a level generally understood to be unsustainable. “We have a longstanding promise that if the Greek government fulfils its commitments … we will do what is necessary to make debt service manageable,” said Dijsselbloem. “Today… we made explicit that the discussion is on our table,” the Dutch finance minister said.

They have absolutely no idea where their policies will lead. That’s a very thin premise to throw trillions around on.

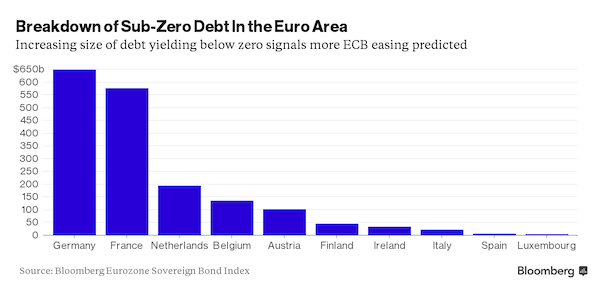

• ECB Solutions Create More Problems (CNBC)

What a difference a few weeks make. Market sentiment seems to have improved and the fears of imminent recession now appear a touch hasty. But the question of where markets head next continues to depend on policymakers’ ability to deliver bold and decisive action. Step forward “Super” Mario Draghi, the President of the ECB, who is widely expected to tinker with the euro zone’s financial plumbing this week in the face of weaker-than-expected inflation and six weeks of volatility weighing on business sentiment. Once again, with the market already pricing aggressive action, there’s a risk of disappointment just as there was in December 2015. Analyst expectations include a 10-20 basis point cut in the deposit rate, taking it further in to negative territory, an increase of €10 -20 billion in monthly asset purchases, more longer-term cash available for borrowing and even a further extension in the maturity of the programme.

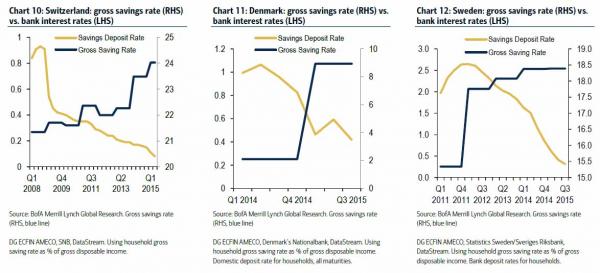

The problem for the ECB is that all the available options come with complications. The most immediate of those hazards applies to negative deposit rates and the impact on bank profitability and consumer behaviour, as the Bank for International Settlements highlighted this past weekend. The BIS warned that it was impossible to predict how borrowers or savers would react to the increasing possibility of negative rates for an extended period of time. A negative deposit rate means that ordinary banks have to actually pay the ECB to deposit money, rather than receiving money as they would in a normal environment. The hope is that, instead of paying up, the banks will decide to lend the money instead. If they don’t lend, they have the choice of passing on the costs to depositors or suffer what is an effect tax on their business. And that’s at a time when profits are tough to come by.

A further complication is that it’s not just the euro zone that has resorted to negative rates, Switzerland, Denmark, Sweden and most recently Japan are all applying this monetary policy tool. Mohamed el-Erian told CNBC last week that the ‘system is not equipped to deal with negative rates all across the world.’ So while broader sentiment in the market recovers, I think it’s worth asking why the Stoxx Europe banks Index is still down 15% this year. Is this a sign that investors are growing increasingly concerned that the ECB has reached its limits and policy may now be doing more harm than good? And more importantly how cautious are the ECB?

Executive Board Member Benoit Cœuré noted in a speech on 2 March that the ECB is well aware of the issue but pointed out that ‘many (banks) have overcome negative central bank rates and the ECB’s commitment to price stability has actually supported banking profitability. A green light for more action there, I think. No one has been more reticent about further stimulus than the Bundesbank President Jens Weidmann, who told me this month that the ECB was not a miracle-worker. And more is needed for euro zone policymakers. Yet even the German central banker drew a distinction between longer-term risks and support for the economy in the short term.

Right on the US doorstep.

• Ontario Plans To Trial Universal Basic Income (Ind.)

Ontario has announced it could soon be sending a monthly cheque to its residents as it plans to launch an experiment testing the basic income concept. While officials in the Canadian province are yet to release any specific details of the project – including how much will be given to residents who participate – the finance ministry has published a report confirming the government’s intention to roll out the experiment. The general concept of basic income involves a government handing out a flat-rate income to every single citizen within a country, either by replacing existing benefits or to top them up. Proponents of the idea say it would save on welfare administration costs, reduce the poverty traps of traditional welfare states, be fair to people who have jobs, and give people more autonomy in general.

In Britain, the think tank Royal Society for the encouragement of Arts, Manufactures and Commerce has proposed a system of universal income that would give a basic amount to fit, working-age people that it believes would still give a strong incentive to these people to work. It suggests providing an income of £3,692 for all qualifying citizens between 25 and 65, or £308 per month. “As Ontario’s economy grows, the government remains committed to leaving no one behind. Maintaining an effective social safety net is one part of the government’s broader efforts to reduce poverty and ensure inclusion in communities and the economy,” Ontario’s budget statement said.

It added: “The pilot project will test a growing view at home and abroad that basic income could build on the success of minimum wage policies and increases in child benefits by providing more consistent and predictable support in the context of today’s dynamic labour market. “The pilot would also test whether a basic income would provide a more efficient way of delivering income support, strengthen the attachment to the labour force, and achieve savings in other areas such as health care and housing supports. The government will work with communities, researchers and other stakeholders in 2016 to determine how best to implement a Basic Income pilot.”

Interesting.

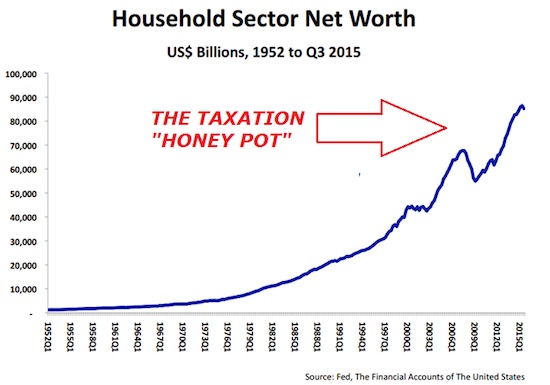

• Canada Prepares To Fight Inequality (BBG)

[..] Canada is about to embark on an experiment whose outcome ought to matter deeply to U.S. Democrats and Republicans alike as they consider how to respond to Donald Trump’s angry coalition of the downwardly mobile. At issue is this: How far can a market-oriented country, if it were temporarily freed from short-term concerns about politics and budget deficits, push the fight against inequality – without sparking public alienation, a decline in work, a rash of tax avoidance, an exodus of talent or wealth, or some other unpleasant consequence? In other words, what are the practical limits of the inequality agenda? And how much can be done within those limits to satisfy, or at least mollify, the furies of economic insecurity?

Canada is perhaps the ideal setting for that experiment. Despite its image as a North American outpost of Scandinavian social values, the country has experienced a divergence in high and middle incomes similar to the U.S.’s, if not quite as severe. Unlike the U.S., Canada has already done the obvious things to remedy that: Its residents enjoy universal health care, reasonably generous social programs, paid family leave, a relatively high minimum wage, and college tuition that averages less than $5,000 a year. Yet that hasn’t been enough to reverse the trend (interrupted by the recession) toward ever-greater inequality. So the lingering question for progressives in both countries is this: What more is there to do? The short answer: quite a bit. In December, the Liberal government increased the tax rate on income above Canadian $200,000 ($150,800) and cut taxes on the middle class.

The Liberals have said their budget, to be introduced later this month, will introduce benefits to low- and middle-income families of C$6,400 a year ($4,825) for each child under 6, and slightly less for children ages 6 to 17. They also promise to reduce contribution limits for tax-free savings accounts and prevent single-income couples from splitting that income for tax purposes, reversing policies that disproportionately benefit the wealthy; increase monthly payments to low-income seniors (think of top-up payments to Social Security); fund the construction of more affordable housing; and make it easier for workers to form unions. In case that’s not enough, Prime Minster Justin Trudeau has asked Duclos to develop a national poverty-reduction strategy. Duclos has even mused publicly about introducing a guaranteed minimum income.

“..if there is just a little more trouble in banking and financial markets before November 8, we can’t even be certain of holding the general election.”

• Mistakes Were Made (Jim Kunstler)

[..] the US Department of Justice did nothing under six-plus years of Attorney General Eric Holder to prosecute criminal misconduct in banking. And then President Obama, who is ultimately responsible, did absolutely nothing to prompt that Attorney General into action or replace him with somebody who would act. Obama’s lame excuse back in the days when informed people were still wondering about this, was that the bankers had done nothing patently illegal enough to warrant investigation — a claim that was absurd on its face. Obama didn’t do any better with the regulating agencies that are supposed to make criminal referrals to the Department of Justice, especially the Securities and Exchange Commission (SEC) charged with keeping financial markets honest.

There was nothing that difficult about those criminal matters now fading in the nation’s memory: for instance, the bundled bonds (CDOs) of “non-performing” mortgages designed to pay off the issuers handsomely when they failed. A child of ten could have unpacked the Goldman Sachs Timberwolf bond caper. Eventually Goldman and others were slapped with mere fines that could be (and were) written off as the cost of doing business. What a difference it would have made if Lloyd Blankfein and a few hundred other bank executives were personally held accountable and sent to cool their heels in federal prison. As the politicians are fond of saying, make no mistake: this was Barack Obama’s failure to act. Likewise, regarding the Citizens United Supreme Court’s decision that equated arrant corporate bribery of public officials with “free speech;”

Mr. Obama (a constitutional lawyer by training) had a range of remedies at his disposal, foremostly working with the then-majority Democratic congressional leadership to legislate a new and clearer definition of so-far-alleged corporate “personhood,” its duties, obligations, and responsibilities to the public interest — and its limits! Not only did Mr. Obama fail to act then, but nobody in his own party even coughed into his-or-her sleeve when he so failed. And now, of course, nobody remembers any of that. The effects of all this fundamental dishonesty have thundered through our national life to the degree that American society is now divided into the swindlers and the swindled, loosing the monster of collective Id known as Trump on the public. This is what comes of attempting to divorce truth from reality, which has been the principal business of American life for several decades now. When truth and reality become de-linked, a society literally doesn’t know what it is doing.

With that goes the collective sense of purpose, replaced with bromides and platitudes such as Trump’s “make America great again,” and Hillary’s “In America, every family should feel like they belong.” Unbeknownst to the cable news hustlers, events are in the driver’s seat, not the personalities of the puppets and muppets in the spotlight. Come July, there may not be anything that could be called the Republican Party. And Hillary is the first leading contender for the highest office with a possible indictment looming over her. Yes, it’s really there percolating on the FBI’s front burner. Even if the machinery of justice trips over itself again on that, imagine how the questions behind it will color the final battle for the general election. We also fail to appreciate how, if there is just a little more trouble in banking and financial markets before November 8, we can’t even be certain of holding the general election.

Back to the pre-Nazi era.

• Germany Once Again Finds Itself In An Age Of Dislocation (MW)

“Germany is not an island. No country is in the same degree woven actively or passively into the world’s destiny. Germany’s geographical position, its lack of natural borders, condemn it to this role. The Germans, more than anyone, must think politically and economically well beyond their borders. Everything that happens afar sweeps through to the heart of Germany.” So wrote Oswald Spengler, a German writer-philosopher of the Weimar republic and the early-Nazi period, whose gloomy 1920s and 1930s prognostications made him a symbol of that age of dislocation. I first became aware of Spengler’s writings during the build-up to German unification. A mass exodus from East Germany into the Federal Republic from autumn 1989 onwards, a product of relaxation of Soviet control over eastern Europe and the realization that Marxism-Leninism was a bust, brought 300,000 people into the western part of the country.

Reunification followed in October 1990. During 1989, the population rose by 800,000 as a result of immigration from the eastern part of the country and the developing world. Germany was again at the epicenter of far-reaching geopolitical and migration upheavals. It’s not so different today. Germany took more than a million immigrants last year, with more on the way. Soviet uncertainties have been replaced by Russian ones. The European Union will either be dismantled or head for more centralization. Soul searching under Chancellor Angela Merkel has reached Spenglerian proportions. Here are four examples of how Spengler’s painful tales of wrenching interdependence are striking home.

• Real-life events have eclipsed Germany’s vision of leading the EU into a fresh wave of liberal democracy, efficient markets and economic prosperity. The euro has sown European division. Populist anti-European parties are on the march. If Britain leaves the EU — the vote in June is still astonishingly wide open — then no nation will be more negatively affected than Germany.

• Assembling enormous annual current account surpluses — a product of an undervalued currency and concentrating German resources on exports and savings — will not safeguard Germany’s future. The country has built up unrepayable claims on foreign countries that will be written off.

• Germany’s need for European solidarity over the migration crisis — which Merkel has made worse by overdoing the welcome — has exposed it to blackmail. Turkey, shifting daily to more authoritarianism, is asking for ever more money to keep refugees on Turkish soil. Greece, facing thousands hemmed in between the hemorrhaging south and an increasingly sealed-off north, is suffering a national emergency. So no one can press Athens into completing IMF-ordained reforms.

• To revive euro-area inflation, the European Central Bank will almost certainly cut negative interest rates further on March 10. The Bundesbank will acquiesce. This will have counterproductive consequences. The euro will be weak, exacerbating the German current account surplus; and European banks’ profitability (especially in peripheral countries) will come under fresh pressure, delaying recovery.

But nothing is done about this.

• Merkel Ally Fuchs: Syria, Libya Key To Solving Migrant Crisis (CNBC)

Germany is seeking a longer-term solution to the migrant crisis, a key ally of Chancellor Angela Merkel told CNBC, as European Union (EU) leaders came to a tentative deal with Turkey to stem the flow of people into Europe. Michael Fuchs, vice chairman of Merkel’s central-right party, the Christian Democratic Union, told CNBC’s “Squawk Box” that a solution to the crisis needed to be found at the source of the human influx. “We need to have a solution which is including Syria and also Libya because both countries are still filled with refugees which are trying to enter either via Turkey into Europe or directly from Libya into Italy,” Fuchs said. But he admitted that working with migrants’ home countries could be difficult. “One of the problems is, for instance in Libya, to whom to talk. There are three different groups fighting each other: who to talk to? They don’t have a foreign minister to talk to,” Fuchs said.

The comments came after the European Union and Turkey agreed on Monday night local time the outlines of a deal designed to stem the tide of migrants that has flowed into Europe over the past six months. Turkey agreed to take back migrants who crossed into Europe from its soil. In return, the EU may increase the €3 billion of aid already set for Turkey to deal with the migrant crisis; it could also ease visa requirements for Turks traveling to Europe, as well as potentially expedite Turkey’s talks to join the EU. Speaking in Hong Kong, where he was set to deliver a speech at the Asia Society, Fuchs underlined the need for a speedy resolution to the issue. “We have over a million refugees already in Germany, which is quite a lot,” he said. Those figures are likely related to the number of asylum seekers in the country. “We have to find solutions because it cannot be double or three times more, because then it’s coming to a difficult situation.”

What a mess this is becoming.

• Turkey Makes Last-Minute Demands Over Migrants (FT)

Turkey has made a host of last-minute funding and political demands that threaten to derail a controversial EU-Turkey deal to dramatically reduce migrant flows to Europe. Ahead of crunch summit between EU leaders and the Turkish prime minister on Monday, Ankara has called for a an increase to the €3bn in aid previously promised by Brussels, faster access to Schengen visas for Turkish citizens and accelerated progress in its EU membership bid. Although talks remain fluid, the wishlist represents the new price demanded by Ankara to help the EU handle the migrant crisis by facilitating the systematic return of non-Syrian migrants from Greek islands to Turkey. A deal of some kind is still expected at the end of the summit. But four diplomats involved in the talks said that Turkey’s revised demands would be extremely challenging and could blow apart a fragile EU consensus on the sweeteners offered to Ankara.

A deal with Turkey is crucial for reducing the flow of people entering Europe, according to EU officials. This has overridden concerns about the country s asylum system and human rights record. Turkish prime minister Ahmet Davutoglu said that the proposed deal demonstrated how indispensable the EU is for Turkey and Turkey for the EU. Speaking before the meeting, Mr Davutoglu added: “The whole future of Europe is on the table”. Last week Mr Davutoglu privately signalled to EU negotiators that Turkey would be willing to accept the systematic return of non-Syrian migrants to Turkey. In the final stages of the negotiation, however, Turkey made clear it would expect its EU agreement on migration to be improved. This includes moving forward a recommendation to grant visa privileges to Turkish citizens, which was expected in the autumn.

Turkey has yet to meet some of the most difficult conditions for visa access, including the recognition of Cyprus. Ankara also wants an increase in the EU’s proposed €3bn in funding, so that it covers municipal infrastructure costs as well as health, education and material support for Syrian refugees in Turkey. On top of these concessions, Turkey wants to speed up the already fast-tracked process of opening several new chapters in its EU membership bid. Cyprus in particular is also loath to make further concessions to Ankara in membership talks. One diplomat said the additional demands could make for a’ train wreck’. Another compared the haggling to a Turkish bazaar. According to draft conclusions for the meetings, EU leaders will declare that the western Balkans route used by more than 1m people to enter Europe has been “closed”, despite opposition from Berlin over such wording.

In Berlin’s view, the statement cannot say the Balkan route is closed when hundreds of people are still arriving via the Balkans in Germany every day. The dispute illustrates the split at the highest levels of the EU over how to cope with the migration crisis. While some such as European Council president Donald Tusk have advocated tough rhetoric to deter people from making the trip, other leaders such as German Chancellor Angela Merkel have called for a softer approach. Leaders will also discuss whether to push on with a plan to resettle refugees directly from Turkey into the EU. Turkey, which hosts 2.5m Syrian refugees, has long argued that such an agreement is vital if it is to cut down on the number of people heading to Greece. Ms Merkel, who has been the most vocal proponent of this plan, held late-night talks with the Turkish prime minister in Brussels on Sunday night. Despite pressure from Berlin, other member states have been unwilling to back such a scheme.

ALL refugees will be forced back to Turkey. Imagine what scenes that will cause on the Greek islands.

• EU And Turkey Close In On Refugee Deal (BBC)

The EU and Turkey say they have agreed the broad principles of a plan to ease the migration crisis at a summit in Brussels, but delayed a final decision. European Council President Donald Tusk said all irregular migrants arriving in Greece from Turkey would be returned. For each Syrian returned, Turkey wants the EU to accept a recognised Syrian refugee, and offer more funding and progress on EU integration. Talks on the plan will continue ahead of an EU meeting on 17-18 March. Europe is facing its biggest refugee crisis since World War Two. Most migrants come via Turkey, which is already sheltering more than 2.7 million refugees from the civil war in neighbouring Syria. Turkey tabled new proposals ahead of the EU summit on Monday, and there was uncertainty on whether any agreement would be possible.

However, European Council President Donald Tusk said leaders had made a “breakthrough”, and he was hopeful of concluding a deal next week. He said the progress sent “a very clear message that the days of irregular migration to Europe are over”. In a statement, EU leaders said they broadly supported a deal that included:

• the return of all new irregular migrants crossing from Turkey to the Greek islands with the costs covered by the EU

• the resettlement of one Syrian from Turkey to the EU for every Syrian readmitted by Turkey from Greece

• speeding up of plans to allow Turks visa-free travel in Europe, with a view to lifting visa requirements by June 2016

• speeding up the payment of €3bn promised in October, and a decision on additional funding to help Turkey deal with the crisis. Turkey reportedly asked for EU aid to be increased to €6bn.

• preparations for a decision on the opening of new chapters in talks on EU membership for TurkeySpeaking at a news conference after the summit, Turkish PM Ahmet Davutoglu said Turkey had made a “bold decision to accept all irregular illegal migrants… based on the assumption that for every one Syrian readmitted by Turkey from the Greek islands another Syrian will be resettled by Europe.” But he said it was important to see the refugee deal as a package, to include progress on Turkish integration within the EU. The BBC’s Chris Morris in Brussels says that, although this new initiative is bold, it could spark fierce argument and its implementation will not be easy. But, he says, the EU clearly needs Turkey’s co-operation if it is to begin coping with the migration crisis. German Chancellor Angela Merkel said the proposals could be a major step forward if realised, stressing that “irregular migration” needed to be turned into “regular migration”.

Faustian deal.

• EU Defies International Law To Push Back Refugees To Turkey (Mason)

It is waging war on an ethnic minority, its riot police just stormed the offices of a major newspaper, its secret service faces allegations of arming Isis, its military shot down a Russian bomber and yet Turkey wants to join the European Union. The country s swift descent into despotism poses yet another existential problem for the west. The sight of Europe’s leaders kowtowing to Turkey’s president, Recep Tayyip Erdogan, in the hope he would switch off the flood of refugees to Greece, was sickening. After the Turkish courts authorised police to seize the Zaman newspaper, tear-gassing its employees and sacking the editors, the new bosses immediately placed Erdogan’s smiling picture on the front page. He has a lot to smile about.

Erdogan’s mass support in Turkey is real. To the conservative heartlands, where Islam was suppressed for decades by one secular military regime after another, he initially seemed to have achieved an ideal stasis. The liberal, networked, progressive part of Turkey would leave the reactionary, religious, patriarchal part in peace, and vice versa. The Kurds would renounce guerilla warfare in favour of parliamentary opposition. Erdogan would lead the country towards EU accession, at a pace slow enough to allow the obvious failings in democracy to be ignored. But it has all gone wrong, and for the same fundamental reason that Assad’s regime in Syria collapsed: the unwillingness of educated youth to be ruled by simpletons running a “benign” police state.

The revolts that swept Turkey’s cities in June 2013 were triggered by the inability of Erdogan and his old-man’s form of Islam to tolerate the basic microfreedoms that the younger generation want: the right to drink alcohol on campus, the right to uncensored social media, the right to protest peacefully about the same things European kids protest about in the case of Gezi Park, the bulldozing of green space for a shopping mall. Since then, Erdogan has overcome all obstacles. The protest was suppressed by the simple method of firing US-made tear gas canisters into the crowd and laying waste to the urban areas of the Kurdish minority, who had joined the struggle.

Then Erdogan got himself made president. And having narrowly lost his parliamentary majority in June 2015, he regained it late last year after a campaign that left the offices of the pro-Kurdish HDP party burned out in several cities. Simultaneously, the Turkish military provoked an end to a three-year ceasefire with the Kurdish PKK, unleashing the army into the Kurdish towns of southern Turkey on a scale that has left some the mirror image of burned-out Syrian towns just across the border.

The UN should speak out a lot louder and clearer. It’s UN laws that are being violated here.

• Europe Must Share Refugee Burden With Turkey, Says UNHCR Chief (Reuters)

The United Nations refugee chief said on Monday he was “very concerned” about what solution European leaders were debating and called for countries to share the burden with Turkey by taking in hundreds of thousands of Syrian refugees. Filippo Grandi, UN High Commissioner for Refugees, told an event at the Geneva Graduate Institute: “In the joint action plan, the most important thing is to help Turkey bear the burden, responsibility by taking people … not in the thousands or tens of thousands but in the hundreds of thousands.” Turkey offered the European Union greater help on Monday to stem a flood of migrants into Europe but raised the stakes by demanding more money, accelerated membership talks and faster visa-free travel for its citizens in return.

“The world has gone very silent on what’s happening in Turkey, and that’s saddening and also short-sighted. If the war in Turkey continues like this, you’re also going to have refugees from Turkey.”

• EU Making ‘Big Mistake’ in Turkey Deal, Kurdish Leader Warns (BBG)

The EEU is making an historic mistake in its haste to conclude a refugee deal with Turkey, overlooking human rights violations that risk plunging the bloc’s largest membership candidate into civil war, said Selahattin Demirtas, leader of the nation’s most prominent pro-Kurdish party. The EU is turning a blind eye to an opposition crackdown in Turkey that’s polarizing society and complicating efforts to find a political solution to the nation’s Kurdish conflict, Demirtas said in an impromptu interview en route to Brussels. European leaders are expected to ink an agreement with Turkey on Monday that will offer faster EU membership negotiations and visa-free travel in exchange for stopping refugees from crossing the country to enter Europe. “The EU is trying so hard not to upset Erdogan, and that’s a big mistake,” Demirtas said.

“The world has gone very silent on what’s happening in Turkey, and that’s saddening and also short-sighted. If the war in Turkey continues like this, you’re also going to have refugees from Turkey.” Demirtas’s own experience show how fast things are changing. Less than a year ago, he was celebrating a momentous electoral result that marked him as a rising political star, dealing a blow to Erdogan’s attempts to concentrate more power in his office. But on Sunday night, sitting alone on the front row of a Turkish Airlines flight, Demirtas had a possible jail sentence on his mind. Erdogan has called on parliament to strip HDP lawmakers of their immunity to try them for their links to the Kurdish PKK, considered a terrorist group by Turkey, the U.S. and EU. PKK gunmen resumed their 30-year-old insurgency after the collapse of the political peace process last year.

Turkish Prime Minister Ahmet Davutoglu said on Sunday that parliament would take up the subject after budget talks. “There’s a very high risk it will happen,” said Demirtas, with a copy of “Remaking Society” by decentralization advocate Murray Bookchin perched on his armrest. “I don’t see this as a big risk for me personally. But for the country, it is.” Demirtas was speaking two days after Turkish government trustees took over one of Turkey’s primary opposition newspapers in a dramatic raid that sparked clashes between protesters and police. The seizure reflects a broader intolerance of dissent that has also undermined the HDP, who are now largely excluded from mainstream media coverage. “Of course this affects us,” Demirtas said. “We were a party on the rise, and now we can only try to protect our position.”

“..A friend of mine says that we stopped being human as soon as we became citizens ourselves..”

• Crisis-Hit Greeks Put Own Woes Aside To Help Refugees (AFP)

Their own wages and pensions have been slashed by the debt crisis, but thousands of Greeks are putting their economic woes aside to help desperate refugees trapped in the country by the Balkan border blockade. People old and young, from couples with babies to pensioners and teenagers, came to Athens’ Syntagma Square on Sunday loaded with bottles of water, medicine, pasta, nappies and clothes. Panayiotis, a 32-year-old accountant, was just one of those determined to help. “Greek people know what it is to be a refugee,” said Panayiotis, a volunteer with the Red Cross at the Sunday donation organized by a social solidarity network.

“My grandmother came from Turkey in the 1920s. She had to leave everything there and she arrived in Thessaloniki with nothing. A lot of people in Greece have grandparents who experienced this exodus. This is maybe why we are helping those people,” he said. With Greek state services overwhelmed by the arrival of around a million people in a year – most en route to countries in northern Europe – the support of volunteers and private donations has been invaluable in helping aid groups manage the crisis. Like Panayiotis, many donors say they are motivated by the suffering of family relatives who became refugees themselves in the 20th century when Turkey progressively expelled a sizeable Greek minority from Istanbul and Asia Minor.

Giorgos and his wife have came to Syntagma Square with bags of food and clothes after seeing television images of migrants stuck at Idomeni on the Greek side of the Greek border with Former Yugoslav Republic of Macedonia (FYROM) where over 13,000 people are camping in miserable conditions waiting to cross. FYROM is only allowing a few hundred people through every day, while thousands more continue to arrive from Turkey. “The only thing we want is to help those people. We saw them on TV in Idomeni. A friend of mine says that we stopped being human as soon as we became citizens ourselves,” said the 70-year-old pensioner.