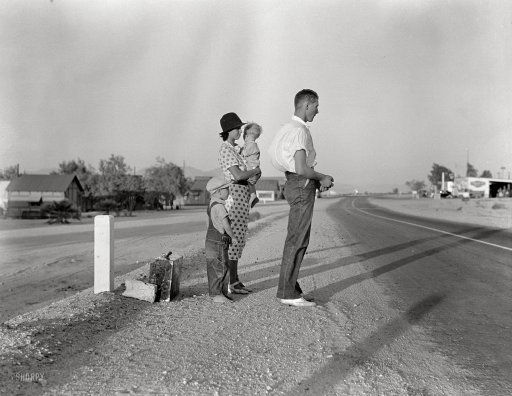

AP Refugee carries child in freezing waves off Lesbos 2016

Great start to the year.

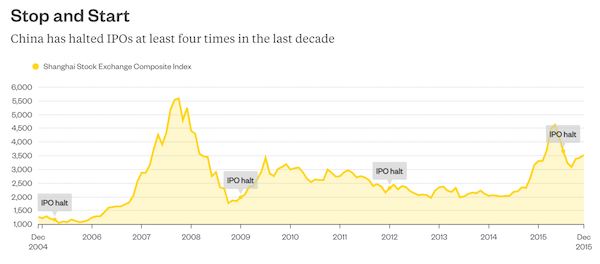

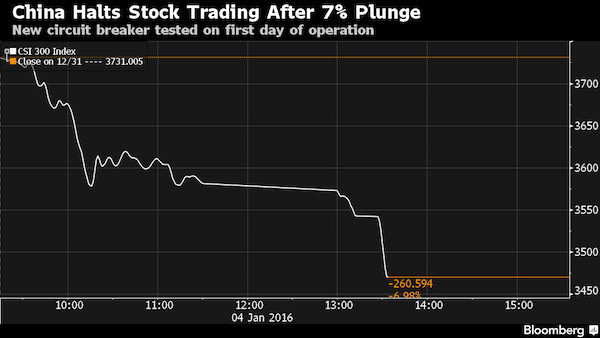

• China Halts Stock Trading After 7% Rout Triggers Circuit Breaker (BBG)

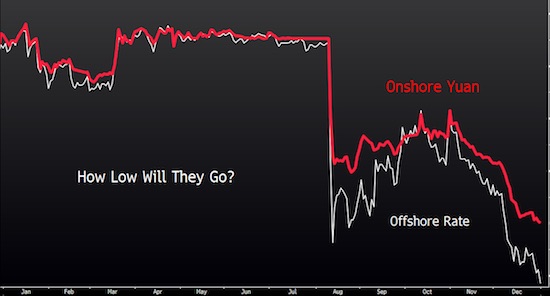

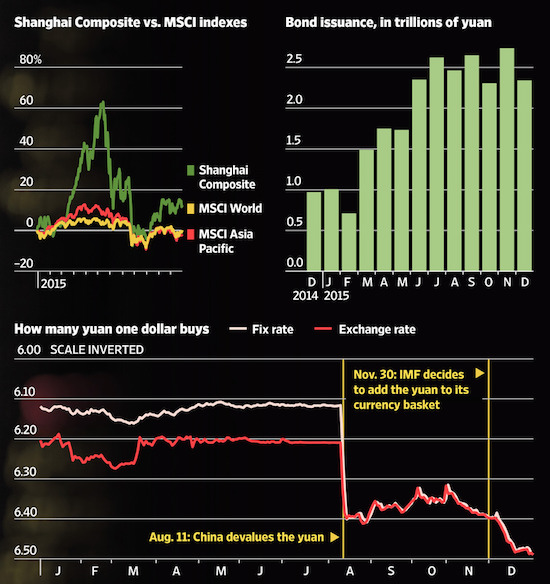

China halted trading in stocks, futures and options after a selloff triggered circuit breakers designed to limit swings in one of the world’s most volatile equity markets. Trading was halted at about 1:34 p.m. local time on Monday after the CSI 300 Index dropped 7%, according to data compiled by Bloomberg. An earlier 15-minute halt at the 5% level failed to stop the retreat, with shares extending losses as soon as the market re-opened. The selloff, the worst-ever start to a year for Chinese shares, came on the first day the circuit breakers took effect. The $7.1 trillion stock market is starting the year on a down note after data showed manufacturing contracted for a fifth straight month and investors anticipated the end of a ban on share sales by major stakeholders.

Chinese policy makers, who went to unprecedented lengths to prop up stock prices during a summer rout, are trying to prevent financial-market volatility from weighing on economy set to grow at its weakest annual pace since 1990. “Stay short, or go home,” said Mikey Hsia at Sunrise Brokers. “That’s all you can do.” The halts took effect as anticipated, without any technical issues, Hsia said. About 595 billion yuan ($89.9 billion) of shares changed hands on mainland exchanges before the suspension, versus a full-day average of about 1 trillion yuan over the past year, according to data compiled by Bloomberg.

Under the circuit breaker rules finalized last month, a move of 5% in the CSI 300 triggers a 15-minute halt for stocks, options and index futures, while a move of 7% closes the market for the rest of the day. The CSI 300, comprised of large-capitalization companies listed in Shanghai and Shenzhen, fell as much as 7.02% before trading was suspended. Chinese shares listed in Hong Kong, where there is no circuit breaker, extended losses after the halt on mainland exchanges. The Hang Seng China Enterprises Index retreated 4.1% at 2:12 p.m. local time. “Investors are using Hong Kong to hedge their positions,” said Castor Pang at Core-Pacific Yamaichi. “The circuit breaker may increase selling pressure further.”

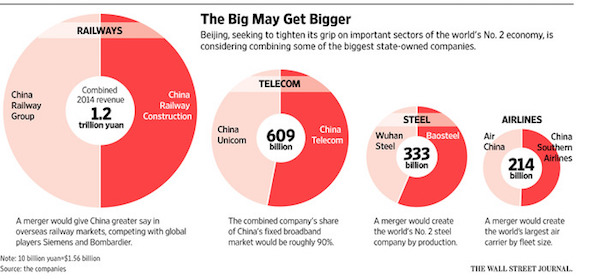

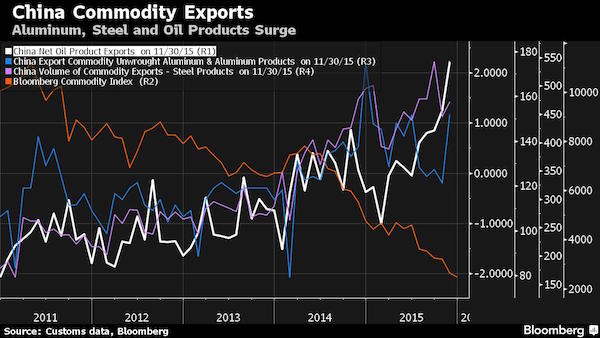

China needs a big clean-up.

• China Factories Struggle As Weak Exports Drag Industry In Asia (Reuters)

China’s factory activity shrank for a 10th straight month in December as surveys across Asia showed industry struggling with slack demand even as the policy cupboard is looking increasingly bare of fresh stimulus. Uncertainty over the economic outlook was exacerbated by a flare up in tensions between Saudi Arabia and Iran, that has sent investors scurrying from stocks to safe havens such as the Japanese yen. Japan’s Nikkei fell over 2% and Shanghai lost more than 3%. The Caixin/Markit China Manufacturing Purchasing Managers’ Index (PMI) slipped to 48.2 in December, below market forecasts of 49.0 and down from November’s 48.6. That was the lowest reading since September and well below the 50-point level which demarcates contraction from expansion.

It followed a fractional increase in the official PMI to 49.7. There was a faint stirring of hope as PMIs in South Korea and Taiwan both edged above the 50 mark, though more thanks to a pick up in domestic demand than any revival in exports. Weighed down by weak demand at home and abroad, factory overcapacity and cooling investment, China is expected to post its weakest economic growth in 25 years in 2015, with the rate of expansion slipping to around 7% from 7.3% in 2014. “Absent vibrant external demand, we think it’s a consensus view that China’s GDP growth is poised to slow further to ‘about’ 6.5% in 2016,” ING said in a research note. The drag from industry comes as China makes gradual progress in its transformation to a more service-driven economy.

Not so smart money: “More than $60 billion of fresh capital found its way into Chinese startup and take-private deals in 2015, compared with $13.9 billion during 2014..”

• China’s Tech Sector Likely Faces Tougher Sledding in 2016 (WSJ)

Investors who poured billions into China’s homegrown technology companies scored big during 2015. But increasingly it looks like the easy money has been made and this year could prove tougher as China’s tech companies face high expectations from investors. Many Chinese privately held startups rewarded investors, as valuations more than doubled during 2015 and a wave of management buyout offers buoyed investors in U.S.-listed Chinese tech companies. More than $60 billion of fresh capital found its way into Chinese startup and take-private deals in 2015, compared with $13.9 billion during 2014 according to data from CB Insights and Dealogic. Investors marked up their holdings in Chinese privately held startups during the year even as they put lower price tags on some of their Silicon Valley investments.

Most investors aren’t required to publicly disclose their valuations of startup holdings, which are often valued based on their most recent round of fundraising. But mutual fund Fidelity Blue Chip Growth Fund, which has marked down some of its Silicon Valley startup investments, instead increased the value ascribed to its January investment in the $15 billion Chinese shopping app Meituan.com by more than 20% through the end of November. Investors have seen their bet on Chinese ride-hailing company Didi Kuaidi Joint Co. nearly triple from a $6 billion valuation in February to $16 billion in September.

The higher valuations and cash-burning of many startups are giving some investors pause. In recent months, some have become more cautious about putting fresh cash into big startups, as China’s rocky domestic stock market put local initial public offerings on hold. “The huge swings in the public markets have spilled over into the later-stage venture investment market,” says Richard Ji, founder of All-Stars Investment, an investor in Chinese startups like $46 billion smartphone maker Xiaomi Corp. and ride-sharing company Didi Kuaidi Joint Co. “Valuations overall have softened and companies are offering better terms to investors.”

Smashing US exports, emerging and commodities currencies in the process.

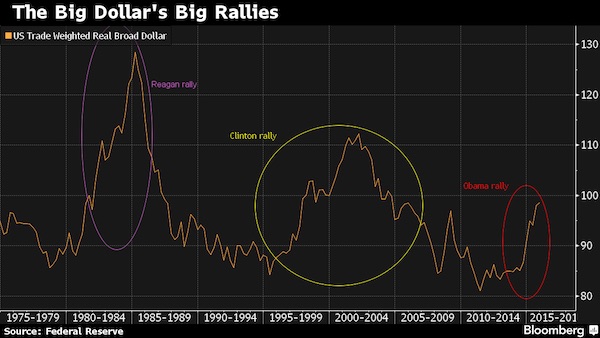

• Obama Dollar Rally Is Forecast to Join Clinton, Reagan Upturns (BBG)

The dollar has an opportunity to make history. After three straight years of gains, strategists are forecasting the U.S. currency will be a world beater again in 2016, strengthening against seven of 10 developed-world peers by the end of the year, according to the median estimate in a Bloomberg survey. That outlook is backed by the Federal Reserve’s stated intent to continue raising interest rates while peers in the rest of the world keep them flat or lower. The rally that started during President Barack Obama’s second term is poised to join a category defined by only the biggest, most durable periods of dollar strength since the currency’s peg to gold ended in 1971.

Of the two other rallies that share that distinction, during the terms of Presidents Ronald Reagan and Bill Clinton, neither stopped at four years. “This is the third big dollar rally we’ve had,” said Marc Chandler, global head of currency strategy in New York at Brown Brothers Harriman & Co. “The Obama dollar rally, I think, is being fueled by the divergence in monetary policy.” The U.S. currency will end 2016 higher against its major counterparts except the Canadian dollar, British pound and the Norwegian krone, posting its biggest gains against the New Zealand and Australian dollars and the Swiss franc, according to forecasts compiled by Bloomberg.

“UK shares have steadily risen for more than 70 months..”

• Global Stock Markets Overvalued And Unprepared For Return Of Risk (Telegraph)

Investors face a rude awakening in 2016 as the return of risk brings an end to the era of unparalleled financial excess. Central bankers actions to save creditors by reducing borrowing costs to near zero created a Dorian Gray style economy that pursued returns without consequences. We are about to unveil the reality of those decisions after six years in a world devoid of financial responsibility.

[..] The realisation of losses is something that many in the cosseted world of investment will never have experienced. The collapse in high-yield bond prices is already causing paralysis. Third Avenue Management, a $800m high-yield mutual fund, was forced to halt redemptions in order to run down the fund in an orderly fashion as investors clamoured for the exit. The holders of certain bonds in Portuguese bank Novo Banco reacted with fury when they were informed they faced losses last week under a recapitalisation plan. The fact that an investor in the debt of a Portuguese bank is surprised that losses are even a possibility is laughable, if it wasn’t also deeply troubling. The return of risk will turn many of the investment decisions made during the past six years on their head.

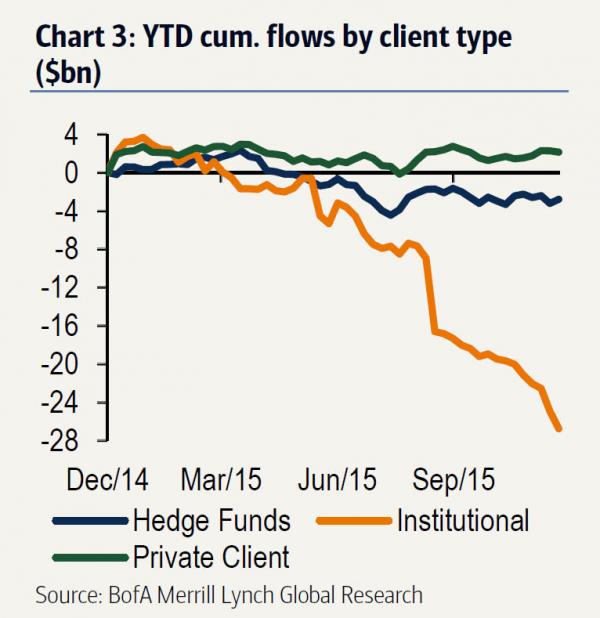

Out will go unprofitable companies that relied on constant support from shareholders for stellar growth. In will come companies with solid profit track records that can generate enough cash to fund themselves. The lofty valuations in the technology sector are looking particularly exposed. When the world economy stumbled in 2008 it was only concerted action that pulled it back from the brink. The situation now is very different with the US pursuing monetary tightening, and China devaluing its currency to arrest the decline. Emerging markets have been crippled by a currency collapse and the drop in commodity prices has undermined the budgets of Canada, Norway, Australia, Venezuala and Saudi Arabia. The flow of funds out of developed Western equity markets is becoming alarming.

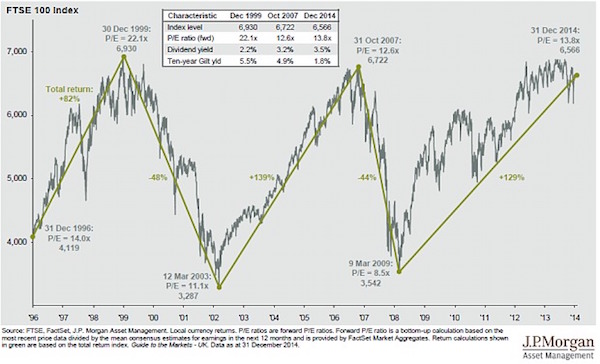

We enter 2016 as the bull run in the FTSE 100 is looking particularly long in the tooth. UK shares have steadily risen for more than 70 months. The goldilocks scenario of cheap debt and low wages is coming to and end and placing corporate profits under pressure. The Institute of Directors has already warned UK profits may be past their peak. This leaves investors in the FTSE 100 exposed with shares trading on 16 times forecast earnings, a premium to the long run average of 15. Even more worrying when you consider earnings have to increase by 14pc in 2016 to achieve that rating, if earnings remain flat in the year ahead the market is trading on more than 20 times earnings.

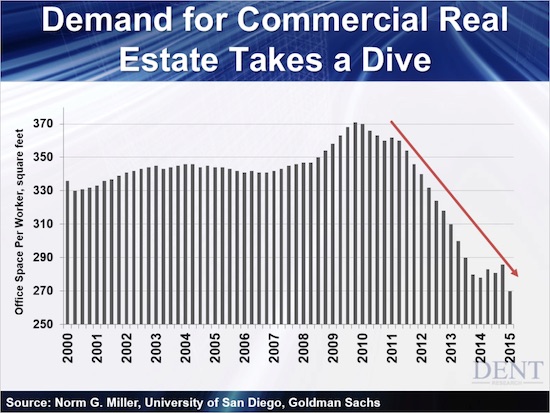

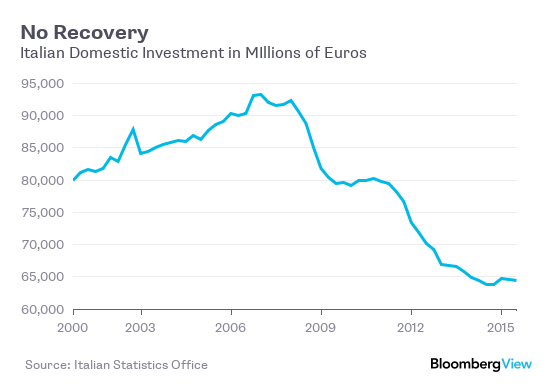

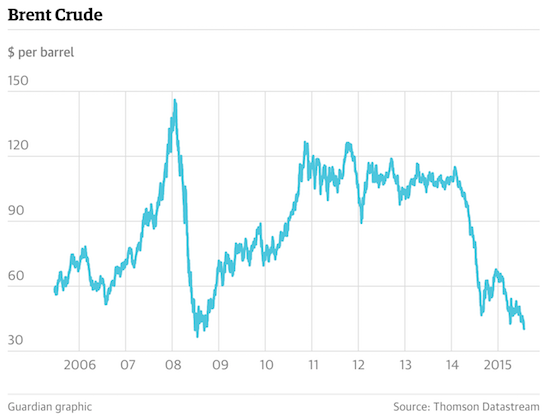

Scary graph of the day.

• Reserve Bank of Australia Index of Commodity Prices (RBA)

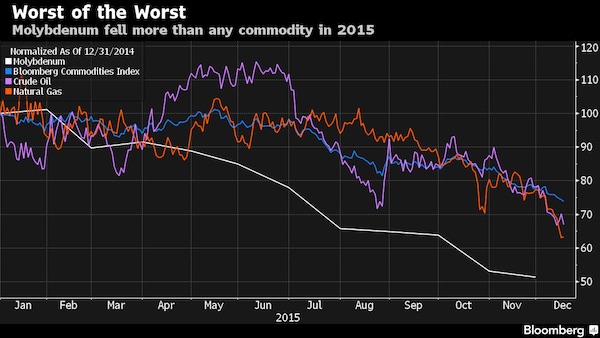

Preliminary estimates for December indicate that the index declined by 4.9% (on a monthly average basis) in SDR terms, after declining by 3.1% in November (revised). The decline was led by the prices of iron ore and oil. The base metals subindex declined slightly in the month while the rural subindex was little changed. In Australian dollar terms, the index declined by 6.0% in December. Over the past year, the index has fallen by 23.3% in SDR terms, led by declines in the prices of bulk commodities. The index has fallen by 17.1% in Australian dollar terms over the past year. Consistent with previous releases, preliminary estimates for iron ore, coking coal and thermal coal export prices are being used for the most recent months, based on market information. Using spot prices for these commodities, the index declined by 5.3% in December in SDR terms, to be 25.6% lower over the past year.

John provides a slew of examples I have no space for here.

• As Hedge Funds Go, So Goes The World (John Rubino)

How do you make money in a world where history is meaningless? The answer, for a growing number of big fund managers, is that you don’t. Hedge funds, generally the most aggressive species of money manager, do a lot of “black box” trading in which bets are placed on previously-identified patterns and relationships on the assumption that those patterns will repeat in the future. But with governments randomly buying stocks and bonds and bailing out/subsidizing everything in sight, old relationships are distorted and strategies that worked in the past begin to fail, as do the money managers who rely on them.

[..] Why should regular people care about the travails of the leveraged speculating community? Because these guys are generally considered to be the finance world’s best and brightest, and if they can’t figure out what’s going on, no one can. And if no one can, then risky assets are no longer worth the attendant stress. In response, a system that had previously embraced leverage and “alternative” asset classes will go risk-off in a heartbeat, and all those richly-priced growth stocks and trophy buildings and corporate bonds will find air pockets under their prices. And since pretty much everything else now depends on high asset prices, things will get ugly in the real world.

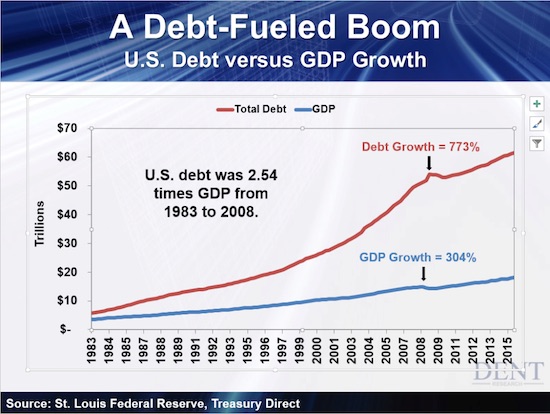

A case can be made that such a contagion is already underway but is being hidden from Americans by the recent strength of the dollar. According to Deutsche Bank, when measured in dollars the rest off the world is now deeply in recession and falling fast. In other words, Main Street is vulnerable to leveraged trading algorithms and Brazilian bonds because it’s not just exotica that is overleveraged. Virtually all governments have to refinance trillions of short-term debt each year. Corporations have borrowed record amounts of money in this expansion (and wasted much of it on share buy-backs). Pension funds (the last remaining leg of the middle-class stool for millions of Americans) are grossly underfunded and will have to slash benefits if their portfolios decline from here.

Risk-off, in short, is no longer just a temporary swing of the pendulum, guaranteed to reverse in a year or two. As amazing as this sounds, we’ve borrowed so much money that as hedge funds go, so goes the world.

Desperation writ large.

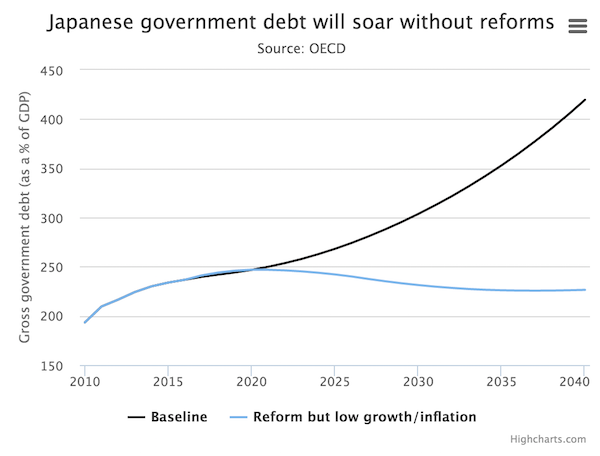

• Japan Central Bank Turns Activist Investor To Revive Economy (Reuters)

Japan’s central bank, which dominates the domestic bond market, has begun to call the shots in the equity market as well – to the point where asset managers are looking to design investment funds with the Bank of Japan in mind. The bank has blazed a trail in global central banking by becoming something of an activist investor in pursuit of economic revival, using its influence as a mainly indirect owner of shares to support firms that spend more cash at home. The bank, which owns about $54 billion in exchange-traded funds (ETFs), is ramping up its purchases but has yet to give any detailed investment criteria, beyond a preference for firms with growing capital expenditure and investment in its staff.

“We’re willing and considering to add such a product,” said Kohei Sasaki at Mitsubishi UFJ Kokusai Asset Management. “We’ve already contacted index vendors on this matter.” Bank of Japan Governor Haruhiko Kuroda and Prime Minister Shinzo Abe have been calling on companies to raise capital expenditure and wages to spur the economy, after repeated monetary and fiscal stimulus over the past three years failed to lift it out of a funk of weak consumption and deflation. So far, their pleas have failed to prod companies into action, despite many of them making record profits on the back of the central bank’s zero interest rates and a weak yen.

Losing patience, Kuroda said last month the bank would buy 300 billion yen ($2.5 billion) a year of ETFs, in addition to 3 trillion yen it already assigns each year to ETFs. It said the extra purchases would target funds whose underlying firms were “proactively making investment in physical and human capital”. Though he did not go into detail, the comment was an invitation for asset managers and index compilers to come up with some “Abenomics” ETFs which would be full of listed firms doing their bit to revive consumption and the broader economy. “We’ve already started trying to develop some kind of solution to the demand,” said Seiichiro Uchi, managing director for index compiler MSCI in Tokyo.

This is a policy thing, not some freak accident.

• UK Set For Worst Wage Growth Since 1920s, 3rd Worst Since 1860s (Guardian)

The 10 years between 2010 and 2020 are set to be the worst decade for pay growth in almost a century, and the third worst since the 1860s, according to new research. Research from the House of Commons Library shows that real-terms wage growth is forecast by the Office for Budget Responsibility to average at just 6.2% in this decade, compared with 12.7% between 2000 and 2010. The figures show that real-terms wage growth was lower only in the decades between 1920 and 1930 and between 1900 and 1910. Wage growth averaged at 1.5% in the 1920s and at 1.8% in the 1900s. Owen Smith, shadow work and pensions secretary, who commissioned the research, said that a “Tory decade of low pay” would see “workers’ pay packets squeezed to breaking point”.

“Even with this year’s increase in the minimum wage, the Tories will have overseen the slowest pay growth in a century and the third slowest since the 1860s,” he said. George Osborne has justified cuts to in-work benefits by arguing that the government is transitioning the UK from being “a low-wage, high-welfare economy to a high-wage, low-welfare economy”, a claim that Smith said was contradicted by wage-growth figures. In the autumn statement, the chancellor abandoned plans to cut £4bn from working tax credits, under pressure from the opposition and many backbench Tory MPs. However, Labour has pointed out there will be cuts to in-work benefit payments for new claimants put on the new universal credit system – championed by the work and pensions secretary, Iain Duncan Smith – which rolls at least six different benefits into one.

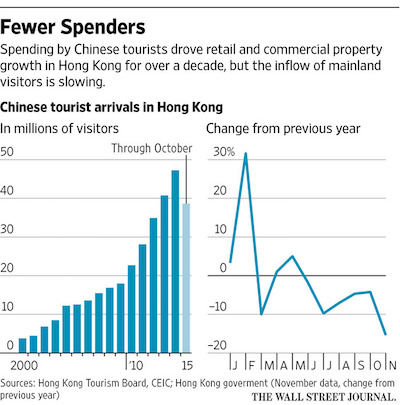

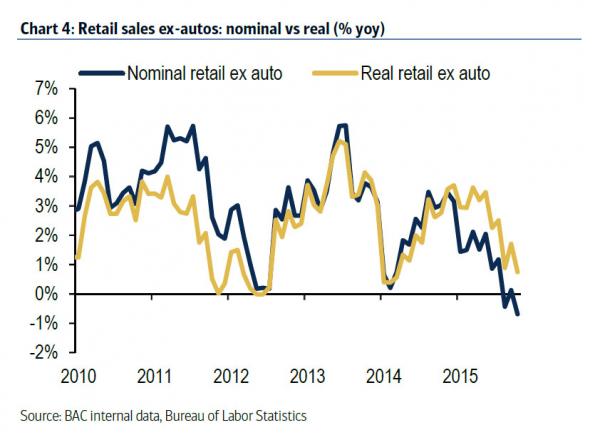

Reasons given: weather and terrorism. Couldn’t be lack of spending money, could it?

• UK High Street Retailers Feel The Pinch As Shoppers Stay At Home (Guardian)

Record-breaking discounts on offer in the post-Christmas sales have so far failed to attract a rush of bargain hunters to the high street, raising fears that Marks and Spencer, John Lewis and Next will be forced to report disappointing trading figures for the festive period. The number of high street shoppers from Monday 28 December to Friday 1 January was down 3% compared with the same period in 2014, according to research firm Springboard. A year ago, retailers had been celebrating a jump of 6.2%. Retail experts had predicted a stampede to the shops on Boxing day after retailers offered discounts topping last year’s average of more than 50%. They are desperate to clear cold-weather clothing that has remained on the shelves during record mild weather.

While Boxing Day had offered some hope of a pick-up in trade, the following week – which included a bank holiday – was poor. Shopper behaviour differed markedly in different parts of the country, with footfall down by almost 7% in Wales and by 5.8% in the West Midlands, but up in Scotland and the east of England by 11.3% and 4.5% respectively. In London and the south-east, the affluent engine of consumer spending, numbers were also in decline, dropping 4.5% and 3.3% respectively. But Springboard figures showed that some of this trade appeared to have migrated to shopping centres, where numbers were up 3.3% in Greater London and ahead by 8.8% in the south-east. As well as unexpectedly mild weather leaving little demand for winter clothing stock, shoppers are also thought to have been put off venturing out by heavy rainstorms and concerns about potential terrorist attacks.

Will M&A’s be 2016 story?

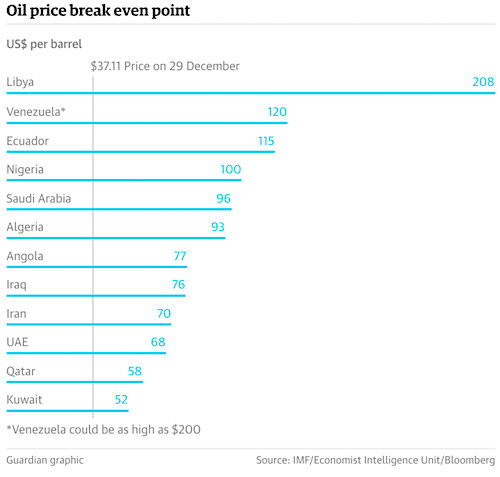

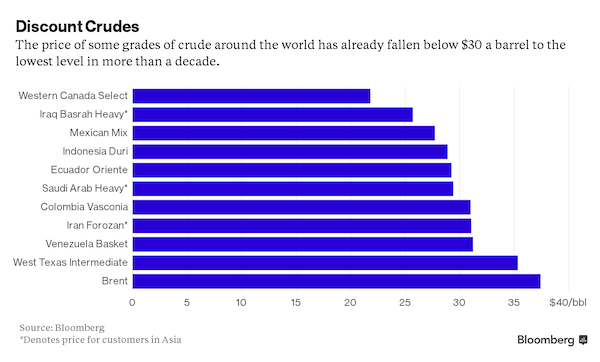

• Big Oil Faces Longest Period Of Investment Cuts In Decades (Reuters)

With crude prices at 11-year lows, the world’s biggest oil and gas producers are facing their longest period of investment cuts in decades, but are expected to borrow more to preserve the dividends demanded by investors. At around $37 a barrel, crude prices are well below the $60 firms such as Total, Statoil and BP need to balance their books, a level that has already been sharply reduced over the past 18 months. International oil companies are once again being forced to cut spending, sell assets, shed jobs and delay projects as the oil slump shows no sign of recovery. U.S. producers Chevron and ConocoPhillips have published plans to slash their 2016 budgets by a quarter. Shell has also announced a further $5 billion in spending cuts if its planned takeover of BG Group goes ahead.

Global oil and gas investments are expected to fall to their lowest in six years in 2016 to $522 billion, following a 22% fall to $595 billion in 2015, according to the Oslo-based consultancy Rystad Energy. “This will be the first time since the 1986 oil price downturn that we see two consecutive years of a decline in investments,” Bjoernar Tonhaugen, vice president of oil and gas markets at Rystad Energy, told Reuters. The activities that survive will be those that offer the best returns. But with the sector’s debt to equity ratio at a relatively low level of around 20% or below, industry sources say companies will take on even more borrowing to cover the shortfall in revenue in order to protect the level of dividend payouts.

Shell has not cut its dividend since 1945, a tradition its present management is not keen to break. The rest of the sector is also averse to reducing payouts to shareholders, which include the world’s biggest investment and pension funds, for fear investors might take flight. Exxon Mobil and Chevron benefit from the lowest debt ratios among the oil majors while Statoil and Repsol have the highest debt burden, according to Jefferies analyst Jason Gammel.

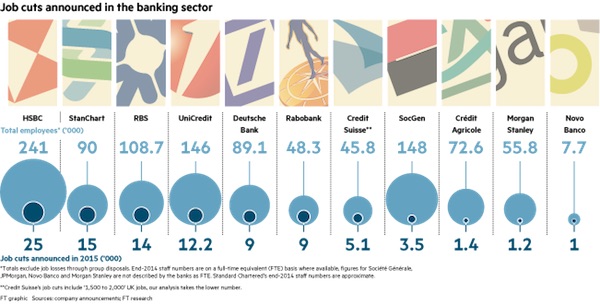

Amounts look utterly useless.

• New EU Authority Budgets For 10 Bank Failures In Four Years (FT)

The new EU authority that took over the job of winding up failing banks on January 1 has budgeted enough money to wind up 10 banks over the next four years, a tender sent to financial services firms shows. The tender, seen by the Financial Times, says the Single Resolution Board (SRB) is seeking €40m in “accounting advice, economic and financial valuation services and legal advice” to be used in the resolution of struggling eurozone banks from 2016-2020. Industry sources said such advice would cost between €4m and €5m per large case, so the SRB will be able to resolve eight to 10 banks. A spokeswoman for the SRB confirmed the tender’s details, but said the budget should not be interpreted as firm prediction of the number of banks the authority expects to resolve over the coming years.

“The SRB has made a reasonable estimation of the amount,” she said. “This estimation can be negotiated and adjusted.” In the aftermath of the 2008 financial crisis, which saw a series of chaotic and inconsistent collapses, eurozone leaders hammered out a complex protocol for handling bank failures. The goal is to be able to wind up even one of the region’s biggest banks over a single weekend under the guiding arm of the Brussels-based SRB and national resolution authorities. The authority is chaired by Elke König, a former president of the German regulator BaFin.

Many industry insiders and policy watchers are sceptical about whether an orderly wind-down in such a tight timeframe is really possible, especially in cases as complicated as the implosion of the Greek and Cypriot banking systems. As such, the first case the SRB handles will be closely watched. The SRB wants to have the best advice money can buy. The tender, which has not yet been awarded, is only open to large international firms; those offering accountancy or valuation advice must have annual sales of at least €5m the last three years, those offering legal advice must have at least €10m.

Yeah. What are the odds? Which markets? China’s?

• Fed’s Fischer Supports Higher Rates If Markets Overheat (BBG)

Federal Reserve Vice Chairman Stanley Fischer said it might be necessary for the central bank to increase interest rates if financial markets were overheating, though the first line of defense should be using regulatory tools to prevent bubbles from developing. “If asset prices across the economy – that is, taking all financial markets into account – are thought to be excessively high, raising the interest rate may be the appropriate step,” Fischer said in a speech at the annual American Economic Association meeting in San Francisco on Sunday. He suggested that might be particularly true in the U.S., where many of the so-called macro-prudential regulatory tools to tackle financial market excesses are either lacking or untested. Such tools would include, for example, adjusting lending rules to try to rein in borrowing.

Fischer did make clear that he thought “macro-prudential tools, rather than adjustments in short-term interest rates, should be the first line of defense” in tackling asset bubbles, while spelling out that “the real issue of whether adjustments in interest rates should be used to deal with problems of potential financial instability is macroeconomic.” Fischer didn’t address the current state of financial markets, although other policy makers, including Fed Chair Janet Yellen, have indicated that they do not see them, on the whole, as being overheated. Fischer was among three Fed policy makers who made public remarks at the AEA meeting on Sunday. San Francisco Fed President John Williams discussed estimates of long-run neutral rates, while Cleveland’s Loretta Mester delivered her outlook for the U.S. economy and explained why the Fed would not react to short-term swings in economic data.

Baltic Drier.

• Cash Burning Up For Shipowners As Finance Runs Dry (FT)

During stumbles in the market for shipping dry bulk commodities since the financial crisis, DryShips — the listed vehicle of George Economou, one of the industry’s best-known figures — has proved adept at dodging trouble. Diversification into owning oil-drilling rigs — through Ocean Rig, in which DryShips now holds only a minority stake — proved robustly profitable when oil prices were high. The company also diversified into oil tankers. However, slumps in earnings for dry bulk carriers and in oil prices have left the company scrabbling to stay afloat. On December 7, it announced an $820m loss for the third quarter after it was forced to take a $797m write-off for the value of its entire remaining fleet of dry bulk vessels, many of which it has been selling off. In October, the company announced that it was borrowing $60m from an entity controlled by Mr Economou.

The challenges facing DryShips are among the most acute of those facing nearly all dry bulk shipping companies after a slump in earnings drove most owners’ revenues well below their operating costs. Owners are haemorrhaging cash. Owners of Capesize ships — the largest kind — currently bring in around $3,000 a day less than the $8,000 they cost to operate. The losses for the many owners who have to service debts secured against vessels are far higher. Basil Karatzas, a New York-based corporate finance adviser, points out that in an industry that has already been making steady losses for 18 months, such substantial losses quickly mount up. “If you have 10 ships and you’re losing $3,000 to $4,000 per day per ship, that’s, let’s say, $40,000 per day, times 30 in a month, times 12 in a year,” he says. “You are losing some very serious money.” The question is how long dry bulk owners — and the private equity firms which have invested heavily in the companies — can survive the miserable market conditions.

Odd take, but amusing.

• The 20% World: The Odds Of The Unthinkable Are Going Up (BBG)

If you want to pick a number for 2016, how about 20%? Look around the politics of the Western world, and you’ll see that a lot of once-unthinkable ideas and fringe candidates suddenly have a genuine chance of succeeding. The odds are usually somewhere around one in five – not probable, but possible. This “20% world” is going to set the tone in democracies on both sides of the Atlantic – not least because, as anybody who bets on horse racing will tell you, eventually one of these longshots is going to canter home. Start with President Donald Trump. Gamblers, who have been much better at predicting political results than pollsters, currently put the odds of the hard-to-pin-down-but-generally-right-wing billionaire reaching the White House at around 6-1, or 17%.

Interestingly, those are roughly the same odds as the ones offered on Jeremy Corbyn, the most left-wing leader of the Labour Party for a generation, becoming the next British prime minister. In France, gamblers put the likelihood of Marine Le Pen winning France’s presidency in 2017 at closer to 25%, partly because the right-wing populist stands an extremely good chance of reaching the runoff. Geert Wilders, another right-wing populist previously described as “fringe,” perhaps stands a similar chance of becoming the next Dutch prime minister. Other once-unthinkable possibilities could rapidly become realities. America’s version of Corbyn, Bernie Sanders, whom Trump recently described as a “wacko,” is currently trading around 5%, no worse than Jeb Bush.

Plus, Sanders has assembled the sort of Corbynite coalition of students, pensioners and public-sector workers that tends to outperform in primaries. If Hillary Clinton stumbles into another scandal, the Democrats could yet find themselves with a socialist contending for the national ticket. And it’s not just “wacko” candidates; some unthinkable events are also distinctly possible. This year, perhaps as early as June, Britain may vote to leave the European Union. Bookmakers still expect the country to go for the status quo, though most pundits are less certain about this than they were about the Scottish referendum in 2014, which turned out to be an uncomfortably close race for the British establishment.

Investors are used to the political world serving up surprises. These surprises, however, have usually involved one mainstream party doing much better or worse than expected – and things continuing as normal. Not this time. With Trump in charge, America would have a wall along the Rio Grande and could well be stuck in a trade war with China. Le Pen wants to take France out of the euro and renegotiate France’s membership in the EU. It’s hard to tell what would do more damage to the City of London: a Brexit that could lead to thousands of banking jobs moving to the continent; or a Corbyn premiership, which could include a maximum wage and the renationalization of Britain’s banks, railways and energy companies.

Moreover, in the 20% world, some nasty possibilities make others more likely. If Britain leaves the European Union, Scotland (which, unlike England, would probably have voted to stay in) might in turn try to leave Britain. If Le Pen manages to pull France out of the euro, the union’s chances of dissolution increase. And you can only guess what a President Trump would do to U.S. relations with Latin America and the Muslim world.

How much longer for Tsipras?

• Greece Warns Creditors On ‘Unreasonable Demands’ Over Pensions (FT)

Greek Prime Minister Alexis Tsipras has said his government “will not succumb to unreasonable demands” as it prepares to send the country’s creditors proposals on crucial reforms to the pension system this week. “The creditors have to know that we are going to respect the agreement,” Mr Tsipras said in an interview with Real News newspaper on Sunday, referring to reforms demanded in exchange for Greece’s €86bn bailout agreement last year. However, he pledged that Greece “won’t succumb to unreasonable and unfair demands” for more pension cuts. Mr Tsipras said that Greece will reform its pension system through measures targeting additional proceeds of about €600m in 2016, adding that “we have no commitment to find the money exclusively from pension cuts”.

On the contrary, “the agreement provides the option of equivalent measures”, he said, admitting however, that the pension system is “on the brink of collapse” and needs to be overhauled. Greece’s proposals are due to be sent to the creditors via email on Monday. The aim is to reach an agreement when the representatives of the creditors return to Athens later in January. The proposals include increases in employer insurance contributions by 1% and employee contributions by 0.5%. Taxes on banking transactions may also be introduced to secure the targeted €600m and avoid any further cuts. But creditors have indicated that further pension cuts are inevitable.

They have already expressed their scepticism about increasing the contributions paid by employers and workers, stressing the potential wider economic impact on struggling businesses. Mr Tsipras’s comments were echoed by the finance minister Euclid Tsakalotos, who warned of forthcoming difficulties in negotiations with creditors. “There will be victories and defeats,” he said in an interview with Kathimerini newspaper. The government is rushing to finalise and submit the new pension bill to parliament for voting by January 15 so that the first review of the bailout package can be completed and discussion on debt relief can begin. Mr Tsipras’ governing majority is expected to be sorely tested by any pension reform legislation. The government’s majority has slid from 155 seats to 153, only two seats from the required minimum.

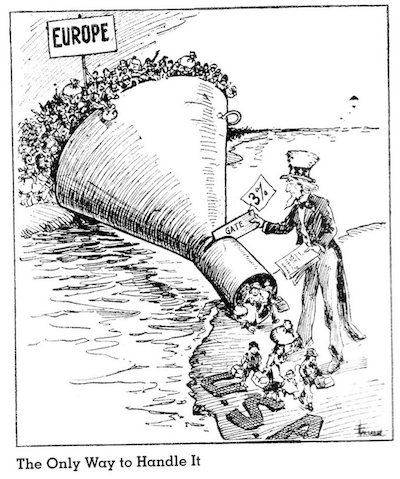

How much longer for the EU?

• Sweden To Impose ID Checks On Travellers From Denmark (Guardian)

Sweden is set to drastically reduce the flow of refugees into the country by imposing strict identity checks on all travellers from Denmark, as Scandinavian countries compete with each other to shed their reputations as havens for asylum seekers. For the first time since the 50s, from midnight on Sunday travellers by train, bus or boat will need to present a valid photo ID, such as a passport, to enter Sweden from its southern neighbour, with penalties for travel operators who fail to impose checks. Passengers who fail to present a satisfactory document will be turned back.

“The government now considers that the current situation, with a large number of people entering the country in a relatively short time, poses a serious threat to public order and national security,” the government said in a statement accompanying legislation enabling the border controls to take place. The move marks a turning point for the Swedish ruling coalition of Social Democrats and Greens, which earlier presented itself as a beacon to people fleeing conflict and terror in Asia and the Middle East. “My Europe takes in people fleeing from war, my Europe does not build walls,” Swedish prime minister Stefan Löfven told crowds in Stockholm on 6 September. But three months and about 80,000 asylum seekers later, the migration minister told parliament: “The system cannot cope.”

[..] Critics of Sweden’s refugee crackdown fear it will cause a “domino effect” as countries compete to outdo each other in their hostility to asylum seekers. “Traditionally, Sweden has been connected to humanitarian values, and we are very worried that the signals Sweden is sending out are that we are not that kind of country any more,” said Anna Carlstedt, president of the Red Cross in Sweden, whose staff and volunteers have often been the first line of support for new arrivals in the country. Other Scandinavian countries have recently announced their intention to stem the flow of refugees. In his new year address, Denmark’s liberal PM Lars Løkke Rasmussen said the country was prepared to impose similar controls on its border with Germany, if the Swedish passport checks left large numbers of asylum seekers stranded in Denmark.

The shame deepens still.

• Refugees Hold Terrified, Frozen Children Above The Waves Off Lesbos (DM)

Parents were forced to hold their children above freezing January waves as they struggled to reach shore on the Greek island of Lesbos on Sunday. The group of migrants and refugees were helped to disembark by volunteers, although several were forced to wade to the beach after falling overboard. Photographs show one father struggling to reach shore as he tried to hold his tiny, terrified daughter above the waves. Another image shows a group gathered around a woman in tears, while in another photograph, a little girl cries as she sits wrapped in a giant, silver thermal blanket after the harrowing crossing from Turkey. Once on shore, the group were handed thermal blankets stamped with the logo of the UNHCR as they sat on the beach near the town of Mytilene.

It comes the day after charity workers created a giant peace sign out of thousands of life-jackets on the hills of the Greek island, in honour of those who have died while making the perilous crossing in the hope of reaching Europe. The onset of winter and rougher sea conditions do not appear to have deterred the asylum-seekers, with boats still arriving on the Greek islands daily. Elsewhere, Turkish coastguards rescued a group of 57 migrants and refugees, including children, after they were left stranded on a rocky islet in the Aegean Sea. The group was trying to reach Greece by making the perilous journey across the sea, but they hit trouble after leaving the Turkish resort of Dikili, in Izmir province.