NPC Tank truck with plow clearing snow, Washington, DC 1922

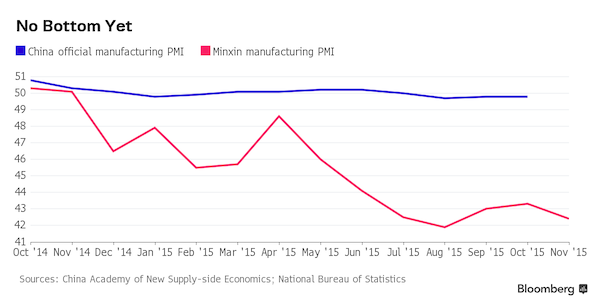

Huh? “Analysts were unsure if the numbers signalled a possible improvement in Chinese domestic demand..”

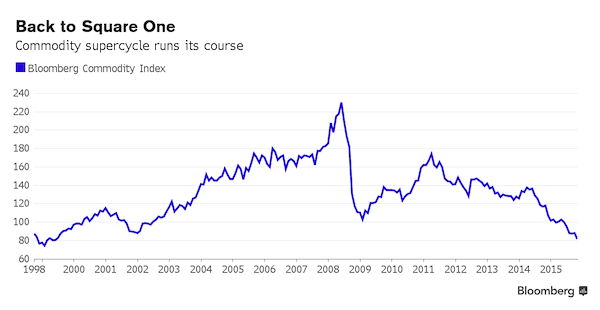

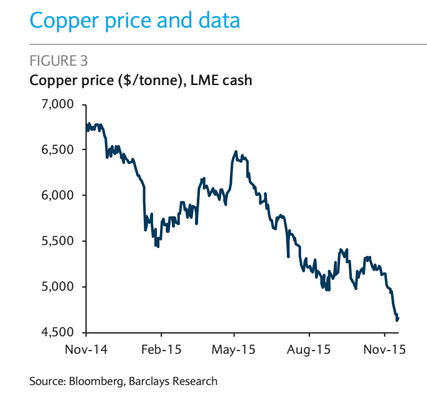

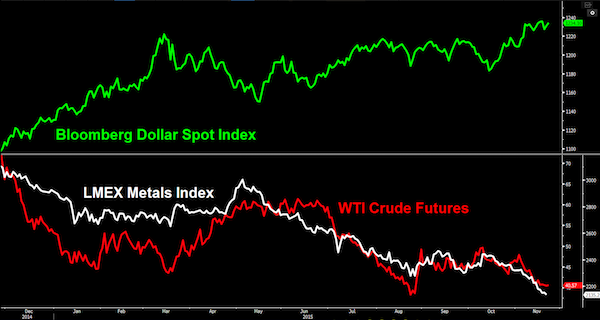

• Commodities Rout Deepens As Chinese Trade Data Signal Weaker Demand (Guardian)

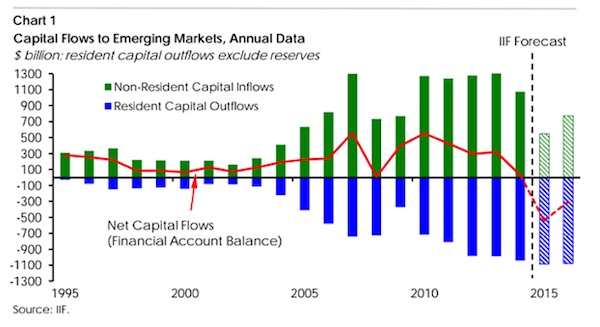

The accelerating rout in commodity prices has piled pressure on energy and resources shares in Asia Pacific amid more signs of slowing demand from China. Although oil prices pushed back on Tuesday from seven-year lows, stock markets around the region felt the pain from uncertainty about global growth and the likely rise in US interest rates later this month. The Nikkei index in Japan was down almost 1% on Tuesday and the Shanghai Composite and Hang Seng indices were down more 0.9% and 1.6% respectively. In resource-rich Australia, the ASX/S&P200 benchmark had a volaltile day but bears had the upper hand by the afternoon with the index off 0.91% at the close with the big oil and gas and mining companies bearing the brunt.

“Beyond the December hike, investors are concerned about the lack of Chinese demand which is acting as a millstone around the neck of risky assets and most investors will stay away until they see a clearer direction on rates,” said Cliff Tan, east Asian head of global markets at Bank of Tokyo-Mitsubishi UFJ in Hong Kong. Data showed on Tuesday that China’s exports fell by a more-than-expected 6.8% in November from a year earlier, their fifth straight month of decline. Imports fell 8.7%, which was not as much as expected but enough to signal continued weak demand from the world’s second biggest economy.

Analysts were unsure if the numbers signalled a possible improvement in Chinese domestic demand, which has been a key factor in driving world commodity prices to multi-year lows. “The big picture hasn’t really changed that much. The US is doing okay, but the problems with emerging markets are really quite big,” said Kevin Lai, chief economist Asia Ex-Japan at Daiwa Capital Markets in Hong Kong. “Imports have been slumping for more than a year now, so the year-on-year figures are benefiting from a much lower base, which statistically we should expect. But I’m not so sure the number today reflects a real fundamental change for the better in import demand.”

“While some market watchers have pointed the blame squarely on China for this year’s global trade slowdown, the latest data highlighted weak demand globally..”

• China November Exports Down -6.8%, Imports -8.7% (Reuters)

China’s trade performance remained weak in November, casting doubt on hopes that the world’s second-largest economy would level off in the fourth quarter and spelling more pain for its major trading partners. The sluggish readings will reinforce expectations of economists and investors that the government will have to do more to stimulate domestic consumption in coming months given persistent weakness in global demand. Exports fell a worse-than-expected 6.8% from a year earlier, their fifth straight month of decline, while imports tumbled 8.7%, their 13th drop in a row. Imports did not slide as much as some economists had feared, but analysts were unsure if that signaled a possible improvement in soft Chinese domestic demand, which has been a key factor in driving world commodity prices to multi-year lows.

“The big picture hasn’t really changed that much. The U.S. is doing okay, but the problems with emerging markets are really quite big,” said Kevin Lai, chief economist Asia Ex-Japan at Daiwa Capital Markets in Hong Kong. “Imports have been slumping for more than a year now, so the year-on-year figures are benefiting from a much lower base, which statistically we should expect. But I’m not so sure the number today reflects a real fundamental change for the better in import demand.” To be sure, China imported more copper, iron ore, crude oil, coal and soybeans in November by volume than in the preceding month, preliminary data from the General Administration of Customs showed on Tuesday. But analysts said opportunistic Chinese buyers may have merely been taking advantage of a fresh slump in commodity prices, and will likely continue to export large quantities of finished products such as steel and diesel fuel because demand is not strong enough at home.

By value, China’s imports from the United States, the European Union and Japan all dropped, and in the case of Australia by a double-digit rate. While some market watchers have pointed the blame squarely on China for this year’s global trade slowdown, the latest data highlighted weak demand globally, with China’s shipments to every major destination, except South Korea, declining year-on-year. “China’s trade performance remains weak, as the trade value is likely to drop 8% for the whole year of 2015, versus an increase of 3.7% in 2014, clearly reflecting a de-leveraging process in the manufacturing sector that has dragged down demand for commodities,” Zhou Hao at Commerzbank in Singapore said.

Miners hurt.

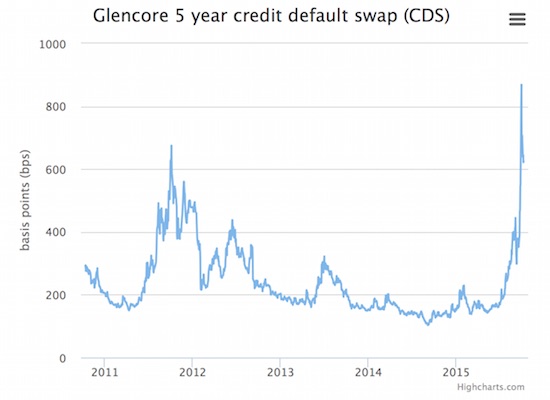

• Anglo American Scraps Dividend As Shares Fall 71% So Far This Year (BBG)

Anglo American scrapped its dividend for the first time since 2009, announced further spending reductions and plans to consolidate its business units to three from six as it accelerated a fight against a collapse in commodities. The company will suspend its payouts for the second half of 2015 and for 2016, it said in a statement Tuesday. Anglo is abandoning its practice of steadily increasing the dividend in favor of a system that allows the payment to rise and fall with the company’s profits, known as a dividend payout ratio. The producer reduced spending forecasts for 2015 to 2017 by $2.9 billion and increased the amount it plans to raise from asset sales to $4 billion from $3 billion, with its phosphates and niobium businesses confirmed for disposal, it said.

Anglo expects impairments of $3.7 billion to $4.7 billion because of weak prices and asset closures. “We will be consolidating our six business unit structures into three –De Beers, industrial metals and bulk commodities – providing further opportunity to reduce the cost burden on our business,” CEO Mark Cutifani said in the statement. Cutifani is seeking to turn around the company’s fortunes in the face of metal prices at the lowest in at least six years. It has sold assets and cut jobs to preserve cash as the shares tumbled 70% this year, the second-biggest decline in the U.K.’s FTSE 100 Index. The last time Anglo cut its dividend, during the depths of the global financial crisis in 2009, the shares plunged 17% in one day.

Downgrades for all.

• OPEC Forces Re-Rating Of Oil Majors (BBG)

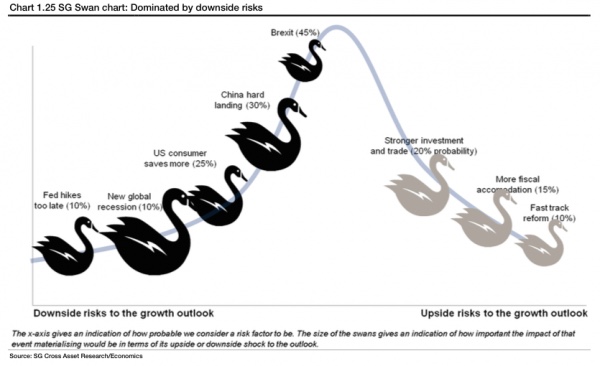

For months, many executives at the world’s largest oil producers have been talking about prices staying lower for longer. After OPEC’s decision to keep pumping full pelt that could become lower for even longer. Even before Friday, the prolonged slump in crude had forced analysts to cut their earnings-per-share estimates for the world’s 10 largest integrated oil companies in recent weeks. With oil dropping to the lowest in more than six years after the OPEC meeting on Friday, further downgrades are probably on the way. “A potential OPEC cut was the last source of hope for the bulls near term,” Aneek Haq with Exane BNP Paribas said Dec. 4.

“The oil majors have already started to underperform the market over the past few weeks, but this now coupled with earnings downgrades and valuations that imply $70 a barrel should put further pressure on share prices.” Mean adjusted 2016 EPS estimates for Exxon Mobil and Shell have been cut by more than 8 cents over the past month, according to data compiled by Bloomberg. EPS projections for Total, Europe’s second-biggest oil company, and Repsol are lower for 2016 than those for this year. Those estimates assume a much higher price than the $41.06 a barrel that Brent traded at as of 8:19 a.m. in London on Tuesday. Oswald Clint at Sanford C. Bernstein has based his EPS estimates for oil majors at a Brent price of $60 a barrel. Alexandre Andlauer at AlphaValue SAS has assumed a price of $63.

“The re-rating of the oil companies downwards will accelerate now,” Andlauer said Dec. 7 by phone from Paris. “Valuations will have to drop.” Shell’s B shares, the most actively traded, dropped 4.6% on Monday, the most in more than three months. BP dropped 3.4%, while the benchmark FTSE 100 Index declined 0.2%. “The lower-for-longer scenario that oil companies are predicting is going to become lower-for-even-longer,” said Philipp Chladek, a London-based oil sector analyst with Bloomberg Intelligence. “We will see some revisions in EPS forecasts in the near future because most forecasts are assuming an oil price recovery during 2016. Many will be taking that out now.”

“..we have to come to terms with paying the bill..”

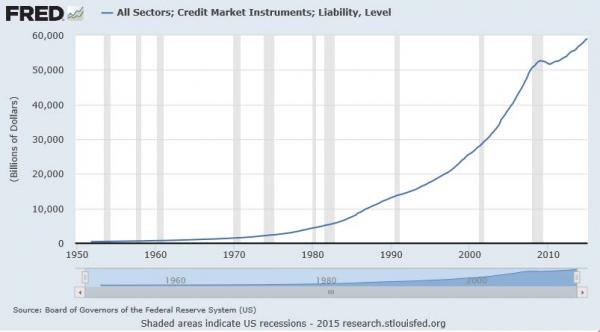

• Peter Schiff: ‘The Whole Economy Has Imploded; Collapse Is Coming’ (SHTF)

Peter Schiff continues to argue that the economy is on a downhill trajectory and this time there’ll be no stopping it. All of the emergency measures implemented by the government following the Crash of 2008 were merely temporary stop-gaps. The light at the end of the tunnel being touted by officials as recovery, Schiff has famously said, is actually an oncoming train. And if the forecast he laid out in his latest interview is as accurate as those he shared in 2007, then the the train is about to derail.

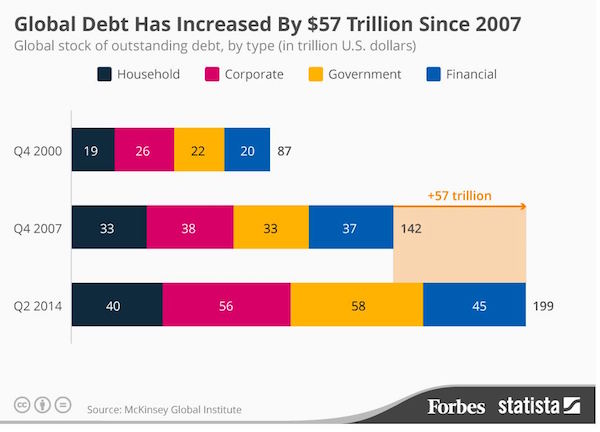

We’re broke. We’re basically living off of debt. We’ve had a huge transformation of the American economy. Look at all the Americans now on food stamps, on disability, on unemployment. The whole economy has imploded… the bottom hasn’t dropped out yet because we’re able to go deeper into debt. But the collapse is coming.

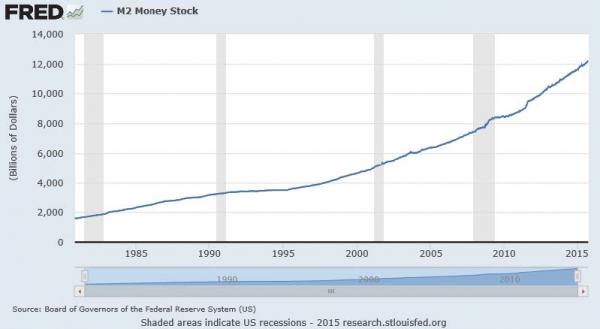

Fundamentally, America is worse off now than it was pre-crash. With the national debt rising unabated and money being printed out of thin air without reprieve, it is only a matter of time. Schiff notes that while government statistics claim Americans are saving again and consumers seem to be spending, the average Joe Sixpack actually has a negative net worth. But most people don’t even realize what’s happening:

I read a statistic… The average American has less than a $5000 net worth… it’s pathetic… we’re basically broke… but in fact it’s much less… If you actually took the national debt and broke it down per capita, the average American has a negative net worth because the government has borrowed in his name more than the average American is able to save.

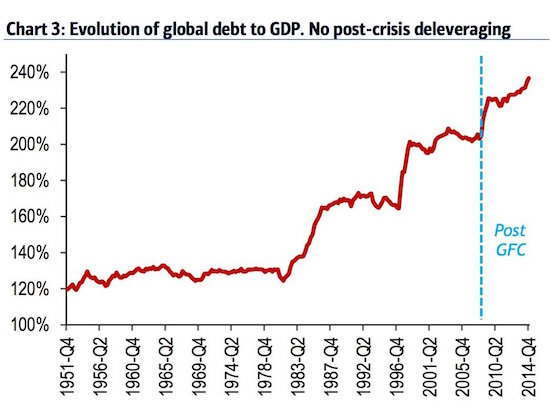

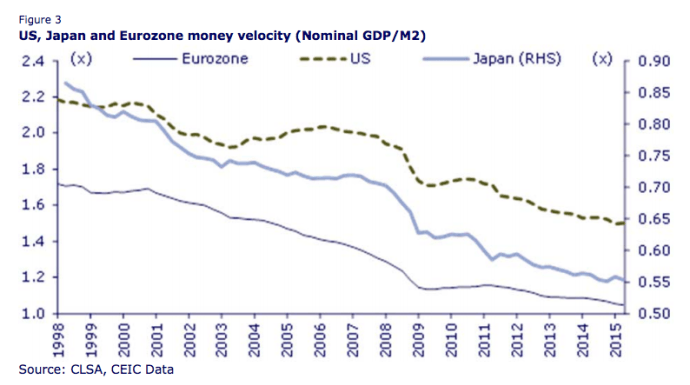

What’s happening is pretty much what we would anticipate. I don’t see from the data any real economic recovery, certainly not in the United States. We’re spending more money, but it’s not because we’re generating more wealth. We’re generating more debt. We’re using that borrowed money to consume and so temporarily it feels that we’re wealthier because we get to spend all that money… but we have to come to terms with paying the bill. The bills are going to come due. Right now interest rates are being kept at zero which makes it possible to service the debt even though it’s impossible to repay it… at least we can service it. But once interest rates go up then we can’t even service it let alone repay it. And then the party is going to come to an end.

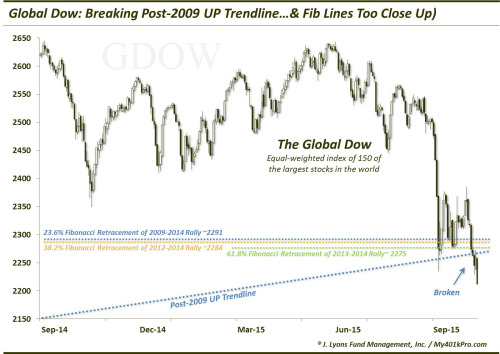

Its own data makes the IMF’s words look silly.

• We Are Shrinking! The Neglected Drop In Gross Planet Product (VoxEU)

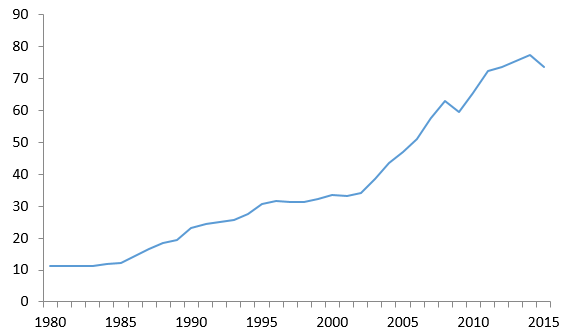

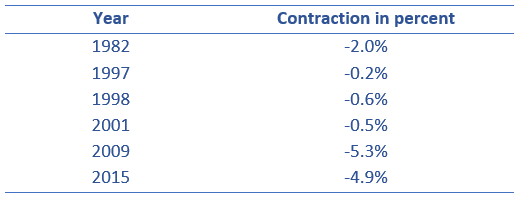

The analysis and forecasts of the IMF are well covered in the press. This column deals with a less noted development in the data provided by the IMF, namely the nominal decrease in Gross Planet Product. Since the IMF forecast both positive growth and positive inflation, the nominal shrinkage of GPP puts into question the consistency of the IMF World Economic Outlook data and forecasts. Presenting the October 2015 IMF World Economic Outlook, Maurice Obstfeld (2015) identified the fall of commodity prices as one of the powerful forces shaping the outlook for the world economy.

The strength of this force, however, is underestimated by the official forecasts in the IMF’s flagship publication. As illustrated in Figure 1 the IMF world economic outlook database reports a reduction of Gross Planet Product (GPP) for the year 2015 by -$3,8 trillion (-4.9%). A nominal reduction of GPP of this size has occurred only once since 1980 (the starting year of the IMF database), namely at the start of the Great Recession when GPP contracted by -5.3%. Table 1 illustrates that all previous contractions of nominal GPP are associated with major crises in the world economy.

Source: IMF World Economic Outlook Database, October 2015.

Source: IMF World Economic Outlook Database, October 2015.

The reduction at current prices is especially noteworthy in view of the official IMF forecasts that set real economic growth at 3.1% and planetary inflation at 3.3%. Taken at face value these forecasts imply a growth rate of GPP of + 6.5 %. By implication the IMF is either too optimistic about real growth, too optimistic about the avoidance of deflation or too optimistic about both these factors.

Close factories?!

• Beijing Issues First-Ever Red Alert for Hazardous Smog (WSJ)

Beijing’s residents have long wondered: Just how bad do the capital’s skies have to get before the government issues an emergency red alert? The serially ‘airpocalypse’-stricken city has in the past resisted issuing such an alert, which requires that authorities implement a series of smog-combating measures. Among other steps, under a red alert half of the city’s cars are ordered off the streets, the government recommends that schools be shuttered and outdoor construction must come to a halt. Such alerts are — in theory at least — to be issued when authorities forecast an air-quality index of above 300 for at least three consecutive days. China’s air-quality index has a maximum reading of 500, or what the government calls “severely polluted.”

On Monday, Beijing issued a red alert for the first time. The alert goes into effect Tuesday morning, with its environmental protection bureau saying that bad air was expected to last until Thursday, Dec. 10. According to an analysis released earlier this year, air pollution could prematurely kill more than 250,000 Chinese residents in major cities. Greenpeace campaigner Dong Liansai said that greater scrutiny from authorities, as well as public pressure, had likely helped spur Monday’s decision. “The cost of issuing a red alert is really high for the city, so officials weren’t willing to do it so easily,” Mr. Dong said. “But everyone has been talking about the issue lately and wondering why Beijing hasn’t issued it before, even during the really bad spells of smog.”

Last week, high concentrations of smog in Beijing at times made it seem like an eerie, artificial dusk had descended on the nation’s capital, with pollution across the city breaching the government’s official air quality index. Photos of the unnatural pall that swallowed up buildings across town went viral on social media, with even normally more restrained state media outlets such as national broadcaster China Central Television giving wide coverage to the spectacle.

“The Socialist Party was reduced to 15pc of what was once its core constituency, and can no longer make any plausible claim to be the voice of the French working class.”

• Euro Regime Is Working Like A Charm For France’s Marine Le Pen (AEP)

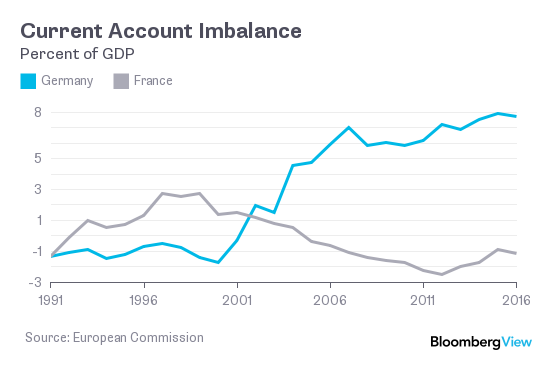

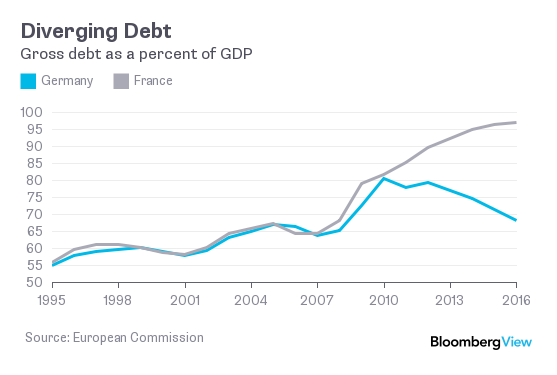

France is trapped in an economic slump that is hauntingly reminiscent of the inter-war years from 1929 to 1936 under the Gold Standard. Each tentative rebound proves to be a false dawn. The unemployment rate has continued to climb since the Lehman crisis, in stark contrast to Germany, Britain and the US. It jumped by 42,000 in October to an 18-year high of 10.6pc. The delayed political fuse has finally detonated. Marine Le Pen’s Front National – these days a blend of nationalist-Right and welfare-Left – swept half the communes of France in the first round of regional elections over the weekend. The Front won 55pc of voters classified as workers (ouvriers). The Socialist Party was reduced to 15pc of what was once its core constituency, and can no longer make any plausible claim to be the voice of the French working class.

“Nothing has been done about unemployment despite all the promises. Nobody has been listening to the distress,” said Professor Brigitte Granville, from Queen Mary University of London. Mrs Le Pen has filled the vacuum. She has abandoned the free-market views of her father, party founder Jean-Marie Le Pen, who once espoused “Reaganomics” and vowed to shrink the state. She is eating into the Socialist base from the Left, vowing to defend the French welfare model against the “neo-liberals” and to defeat the “dictatorship of the markets”. She calls globalisation the “law of the jungle” that allows multinationals to play off cheap labour in China against French labour Her plans include a national industrial strategy that swats aside EU competition law, as well as a cut in the retirement age to 60, and a “realignment of taxation against capital and in favour of workers”.

Pierre Gattaz, head of the employers federation MEDEF, calls it a radical agenda stolen from the Left that would destroy France. Yet it clearly makes a heady brew for voters when mixed with nationalist identity politics. Mrs Le Pen once told The Telegraph that her first act in the Elysee Palace would be to order the treasury to draw up plans for a restoration of the French franc. “The euro ceases to exist the moment that France leaves. What are they going to do about it, send in tanks?” she said. Professor Jacques Sapir, from l’École des hautes études (EHESS) in Paris, says the Front National made its biggest strides in regions that have suffered the full force of de-industrialisation and the “globalisation shock”. Many of these areas are in the centre of the country, or in Burgundy and Lorraine, or parts of Normandy and Picardy, that are not key battlegrounds of France’s immigration and culture wars.

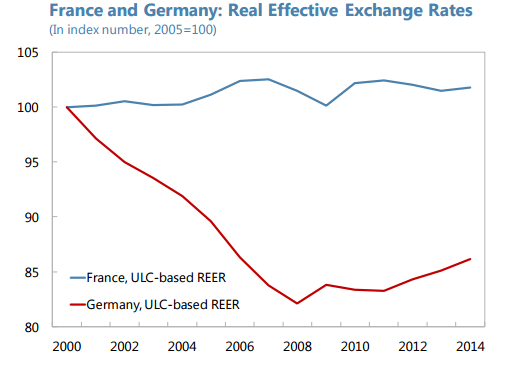

Prof Sapir said French industry is slowly being hollowed out. It is a drip-drip effect of closures – typically hitting 150 or 200 workers at a time – that slips below the radar screen of the national press. “These are the regions of rural misery,” he said. Prof Granville said there is no doubt that France’s problems are home-grown. It is entangled in a thicket of unworkable laws. There are 383 taxes, of which 50 cost more to enforce than they yield. The labour code is more than 3,000 pages, acting as a gale-force headwind against job creation. Yet monetary union has played its part, too. The eurozone’s twin policies of fiscal and monetary contraction from 2011 to 2014 aborted the recovery and led to a deep recession that went on long enough to cause lasting economic damage through labour “hysteresis”.

Prof Granville said there is another twist. France and Germany moved in radically different directions after the launch of the euro. While Paris introduced the 35-hour working week, Berlin pushed through the Hartz IV wage squeeze and an internal devaluation within EMU – a beggar-thy-neighbour strategy. The result is that France has lost 20pc in labour cost competitiveness. It had a current account surplus of 2.5pc of GDP at the start of the last decade. It is now bleeding national wealth slowly – as is Britain, for different reasons – with a cyclically-adjusted deficit of 1.5pc. She compared it to the slow torture France endured in the early 1930s under the Gold Standard, stoically accepting the “500 deflation decrees” of premier Pierre Laval. The dam broke in 1936 with the election of spurned outsiders, then the Front Populaire.

Reality bites.

• EU Is In Danger And Can Be Reversed: European Parliament’s Schulz (Reuters)

The European Union is at risk of falling apart and supporters must fight to keep it, the head of the European Parliament said in a German newspaper interview. Martin Schulz told Die Welt’s Tuesday edition that the EU was in danger and that there were forces trying to pull it apart. He was responding to a recent warning from Jean Asselborn, Luxembourg’s foreign affairs and migration minister, that the EU might break apart, “No one can say whether the EU will still exist in this form in 10 years’ time. If we want that then we need to fight very hard for it,” Schulz said. He was not specific about what was threatening the EU, but much of the interview was focused on the migrant crisis, which has stretched Europe’s unity and tolerance during the year.

Schulz said that the EU was not without alternatives and “could of course be reversed”, adding that other options including a Europe in which nationalism, borders and walls were prevalent. “That would be disastrous because that kind of Europe has repeatedly led our continent into catastrophe,” he added. Divisions in the EU over the migrant crisis are rife, notably between German Chancellor Angela Merkel, who has led efforts to take in more Syrians, and leaders in the formerly Communist East who oppose EU schemes to make them take in some asylum seekers. And Europe’s passport-free Schengen zone looks under threat too, with some countries re-introducing border controls.

Last Thursday Greece asked for European help to secure its borders and care for crowds of migrants, defusing threats from EU allies to bar it from Schengen if it failed to get control. Schulz said no country could single-handedly tackle challenges like migration, adding that this was only possible together as the EU.

And now debt relief is no longer important?!

• Tsipras Says IMF Behavior In Greek Crisis Not Constructive (Reuters)

Greek Prime Minister Alexis Tsipras said on Monday the IMF was not playing a constructive role in Greece’s bailout and should make up its mind whether it wants to stay in the program. He accused the Washington-based global lender of making unrealistic demands both on Greece for tough reforms and on its euro zone partners for debt relief beyond what they can accept. “This is a stance that cannot be called constructive in this process,” the leftist leader said in a television interview. “The Fund must decide if it wants to compromise, if it will stay in the program,” Tsipras said. “If it does not want that compromise, it should say so publicly.” The IMF has taken the hardest line in demanding pension reform with benefit cuts, and a far-reaching liberalization of Greece’s labor market.

It has also said European governments need to grant Athens debt relief on a scale they have so far been unwilling to consider – including a possible 30-year debt service holiday – to make the public debt mountain sustainable. The IMF has not disbursed any aid to Greece since August 2014 under a previous program due to expire next March. Athens defaulted on an IMF loan repayment in June but has since made up the arrears after receiving a third bailout from euro zone creditors. An IMF spokesman said last week the Fund would decide whether to co-finance the new bailout after the first review of compliance with the program, expected early next year, and in light of how much debt relief Greece receives.

Tsipras acknowledged that it was important for creditor countries such as Germany and Finland for the IMF to stay in the program to ensure discipline. But he said Europe had the expertise to manage such programs on its own. The Fund was not being helpful by making reform demands that Greece’s political system and society could not bear, “and by going to the (EU) partners demanding solutions and proposals on debt sustainability which they know our partners cannot accept”.

“Rather than pushing to write off some of the face value of the debt – a “haircut,” in bond market jargon – Greece’s government is likely to accept delayed repayment of principal..”

• Greece’s Five Ticking Time Bombs (BBG)

Remember the Greek crisis? Last time we checked in, a newly mandated Greek government reached an agreement with creditors and the country was on its way to recovery, or at least stability. Well, not exactly. Several days in Athens spent talking with investors, business leaders and government officials last week made it clear to me that the chances of a fatal misstep remain high. While Prime Minister Alexis Tsipras got approval for his 2016 budget – narrowly, after 153 lawmakers backed the budget, with 145 parliamentarians voting against and two abstentions – the challenges ahead make his previous Houdini acts (especially ignoring the result of his own referendum) look easy. The budget calls for selling state-owned assets, reforming public-sector wages, dealing with bad loans at the nation’s banks and fixing a broken pensions system. Any one of these could prove unpalatable to the Greek parliament and trigger a renewed crisis. Trying to pin officials down on precise dates for implementing these reforms is an exercise in futility. So here are five ticking time bombs that lie ahead for Greece in the coming weeks.

1 ) NON-PERFORMING LOANS – The percentage of Greek loans that aren’t being repaid, including mortgages, consumer debt and company loans, is more than 48%, according to an October report by the European Central Bank. No wonder Greek bank stocks have lost 95% of their value this year.

2) PENSION REFORM – Everyone agrees that with Greek unemployment averaging more than 25% this year, the current pensions system is unsustainable. There aren’t enough people paying in, and a jobless rate that’s been above 20% for more than four years risks creating an underclass of people who’ve never contributed and will never qualify. Many households are currently dependent on the pension income of a single family member to stay financially afloat.

3) PRIVATIZATIONS – In July, the government promised a “significantly scaled-up privatization program” to generate 50 billion euros ($54 billion) of proceeds. Thus far, there’s little evidence of progress, although officials insist that agreements on selling ports and local airports are on the verge of completion.

4) CAPITAL CONTROLS AND THE BANKS – An American I met in Athens last week was joking about how many Greek bank shares he could buy for the price of a New York subway ticket. But if you’re a Greek taxpayer, it’s not funny; the money the government put into the banks has effectively disappeared. Shares of Piraeus Bank, for example, trade at 65 euro cents; a year ago, they were worth 134 euros apiece. Its market capitalization is 39 million euros, down from more than 8 billion euros.

5) DEBT RELIEF – The good news is that Greek officials are being pragmatic about what’s achievable on the debt-relief front. The not-so-good news is they’ll still want to come back from Brussels with something they can sell to their voters. Rather than pushing to write off some of the face value of the debt – a “haircut,” in bond market jargon – Greece’s government is likely to accept delayed repayment of principal, although it also wants even lower interest rates.

Too much time on their hands.

• New Zealand Named The World’s Most Ignorant Developed Country (NZH)

A new report shows New Zealanders have the wrong idea about the world around them. The Perils of Perception survey shows New Zealand is the most ignorant developed country, with most people misunderstanding the facts that make up our country’s society. The Ipsos-MORI poll showed inequality was one area where New Zealanders got it wrong. Kiwis hugely overestimated the proportion of wealth owned by the wealthiest 1% in the country. The average response on the percentage of wealth controlled by the wealthiest 1% in New Zealand was 50%. In reality, the wealthiest New Zealanders hold 18% of the country’s wealth. Most of the other countries believed the wealthiest 1% should own a smaller proportion of the country’s wealth than they currently do, but New Zealand responded the opposite.

In contrast, when asked what percentage of wealth the wealthiest New Zealanders should hold, Kiwis answered 27%, which is nearly 10 percentage points more than what they control currently. New Zealanders underestimated the rate of obesity or overweight people in the country, guessing 47% of the population was obese or overweight, when in fact 66% fall into those categories. Religion was another area where New Zealanders were off the mark. Asked how many people in 100 they believed did not affiliate with any religion, New Zealanders responded 49 people. In fact, 37 out of 100 people do not affiliate with any religion. New Zealanders overestimated the number of migrants living in the country, saying they believed 37% of the population are migrants. This was the third highest percentage answered to the question by any country. The correct answer was 25%.

The most ignorant country was Mexico, followed by India and Brazil taking second and third place respectively. New Zealand was the most ignorant developed country in fifth place overall.

Sanity. The dignity of work. What should be obvious and normal has become left field. But we can still do it. Do the obvious. Give people pay for doing what they can see has an effect in their community. It’s not that hard.

• Albuquerque Revises Approach Toward Homeless, Offers Them Jobs (NY Times)

Will Cole steered an old Dodge van along a highway access road one recent Tuesday, searching for panhandlers willing to work. Four men waved him away dismissively at his first attempt, turning their backs on the van as it rolled past. By the third stop, though, nine men and one woman had hopped inside. They were homeless. But suddenly, as part of a novel attempt to deal with rising poverty and destitution here, they were city workers for the day. Donning gloves and fluorescent vests, they raked a piece of messy ground by some railroad tracks on the edge of downtown, cleaning up residues of lives that may well have been their own: a soiled burgundy blanket, two Bibles soaked by melting snow, a trail of crushed cans of Hurricane High Gravity Malt Liquor.

For participants, the toil paid off decently: $9 an hour and a lunch of sandwiches, chips and granola bars, enjoyed in a park. For the city, it represented a policy shift toward compassion and utility. “It’s about the dignity of work, which is kind of a hard thing to put a metric on, or a matrix,” Mayor Richard J. Berry said. “If we can get your confidence up a little, get a few dollars in your pocket, get you stabilized to the point where you want to reach out for services, whether the mental health services or substance abuse services — that’s the upward spiral that I’m looking for.”

After a schizophrenic homeless man, James Boyd, was fatally shot by the police last year — prompting protests and calls for reform of the Albuquerque Police Department, a force of 1,000 whose rate of deadly shootings was eight times that of New York’s — this city has sought to recalibrate its approach toward homelessness. While other cities, including New York, Baltimore, Los Angeles and Washington, have tried to clear out homeless camps or move the homeless further into the shadows, this city has decided to move away from the punitive approach that had defined strategies in the past.

It is, in part, the result of an agreement with the Justice Department, which released a blistering review of the use of force by police officers over the years, citing a pattern of violence and mistreatment that disproportionately affected mentally ill people, including many who were living on the streets. For example, training in crisis intervention has become a requirement for police cadets, who must try to find their way out of staged real-life scenarios — encounters with distressed drug addicts, rape victims or suicidal war veterans — without pulling out their guns.

“The proposal has been prepared in great haste,” the Council wrote, adding that meant the draft text had been poorly prepared. “This is particularly serious because the proposal is similar to martial law.”

• Swedish Legal Watchdog Rejects Proposal For Border Controls (Reuters)

The top legal watchdog in Sweden, a major destination for migrants flocking to Europe this year, on Monday rejected a government request for the right to impose tighter border controls and shut a bridge to Denmark. The Swedish Council on Legislation said the centre-left government’s plan resembled martial law and would violate refugees’ right to seek asylum in Sweden. Stockholm imposed temporary border controls in early November, the first in over two decades and a turn-around in its open-doors policy. The country has welcomed almost 160,000 refugees and migrants this year, more per capita than any other European Union country. Its latest step would fast-track a bill giving it the legal right to tighten the border controls and to close down the bridge between Sweden and Denmark if deemed necessary.

“The proposal has been prepared in great haste,” the Council wrote, adding that meant the draft text had been poorly prepared. “This is particularly serious because the proposal is similar to martial law.” The council has no legal mandate to disqualify proposed legislation but it is unusual for Swedish lawmakers to disregard its opinion. However, in a comment to local news agency TT, a government spokesman said it had no plans to withdraw the proposal. “The Council on Legislation makes a different assessment than the government regarding seriousness of the current refugee situation,” said Erik Brom Anderson, State Secretary to Infrastructure Minister Anna Johansson. “The government’s assessment has not changed.”

Good move.

• Escapism Magazine Devotes Whole Issue To Reality Of Refugee Crisis (Guardian)

Escapism magazine, which is distributed to commuters in central London, usually tells readers where they can enjoy exotic holiday destinations, the world’s best beaches and the coolest hotels. But the latest issue of the travel magazine is very different indeed. All 84 pages are dedicated to explaining the refugee crisis. And, in what must rank as a first for a giveaway title, it is entirely free from adverts. It highlights the various refugee crises across the world through a series of graphics, carries features written by refugees about their experiences, and there is a moving report from the Greek island of Lesbos where so many of the refugees from Syria and Afghanistan are currently living in camps.

Escapism’s associate editor, Hannah Summers, says: “For our readers, escapism has been a way to get away with family and friends, to relax on holiday. But, for many, it takes on a much more literal meaning – an escape from poverty and war.” In the magazine, Summers writes: “When I became a travel writer I never expected to cover an issue like this, but I’m grateful for an opportunity that has opened my eyes to an unjust and painful reality that’s also full of courage, humanity and, ultimately, hope. “This crisis affects us all, and we all have a part to play in how it unfolds. There are many ways you can get involved, but the most important thing is that you do get involved. Please, take action today.” A final page calls on readers to join “a kind and big-hearted group of volunteers” to help the refugees in the camp in Calais. For those who do not journey into the central zones of the London tube, much of the magazine’s content can be accessed on the magazine’s website.