Pablo Picasso Self portrait 1907

They can’t agree on anything. But they will keep trying, until they find something that can be accepted, by a narrow margin. And that narrow margin will be used to push through Brexit, which was voted for by narrow margin. A recipe for disaster. This can only end well if they put it off and talk first.

• UK MPs Vote Down All Alternative Brexit Options (G.)

A first attempt by MPs to find a consensus route forward for Brexit has ended in deadlock and confusion after the Commons rejected every option put forward, albeit with a near-even split on the idea of joining a customs union. Oliver Letwin, the veteran Conservative MP who led the process which allowed backbenchers to seize control of the order paper to hold a series of indicative votes, said the results were “disappointing” but he hoped a new round of votes would be held on Monday. The Speaker, John Bercow, said he would allow this to take place, prompting shouts of protests from many MPs. The Brexit secretary, Stephen Barclay, said the results strengthened the government’s view that Theresa May’s Brexit deal was the best and only way forward.

On the lack of a majority for any of the eight alternatives put to the vote on Wednesday, he said: “It demonstrates that there is not easy option here, that there is no easy way forward.” Groups of MPs had suggested 15 ideas, of which eight were selected by Bercow for votes. The closest result was a commitment for the government to negotiate a “permanent and comprehensive UK-wide customs union with the EU” in any Brexit deal. Put forward by the pro-EU Tory veteran Ken Clarke and others, it was voted down by 272 votes to 264. The only other relatively close vote was on a plan drawn up by the Labour MPs Peter Kyle and Phil Wilson, and tabled by the former foreign secretary Margaret Beckett, to require a referendum to confirm any Brexit deal. This was lost by 268 votes to 295.

But everything hangs on that vote.

• Speaker Issues Fresh Warning Over Third Vote On May’s Brexit Deal (G.)

Theresa May’s hopes of putting her Brexit deal to a third meaningful vote have hit another obstacle after John Bercow said parliamentary procedures could not be used to present it unchanged, even as more senior Eurosceptics seem to be getting behind the agreement. Amid speculation the prime minister is making a private pact to set a date to stand down when the deal goes through, more than 20 Conservative Eurosceptics have publicly suggested they will change their minds because they do not want a softer Brexit. Even if this many MPs in the European Research Group (ERG) switched, the vote would be extremely tight, but there was mounting speculation the government could table it on Thursday or Friday. This plan, however, could be scuppered after the Speaker told ministers he stood by his ruling that the twice-defeated motion could not be put to MPs again without significant change.

Bercow said he had instructed officials to block any attempts to put forward the same or similar plan using procedural rule changes, for example, by using a vote by MPs to instruct the Commons to overlook the rule behind his block. “I understand that the government may be thinking of bringing meaningful vote three before the house either tomorrow or even on Friday, if the house opts to sit that day,” Bercow told the Commons before the start of a debate on indicative votes on Brexit. “Therefore, in order that there should be no misunderstanding, I wish to make clear that I do expect the government to meet the test of change. They should not seek to circumvent my ruling by means of tabling either a notwithstanding motion or a tabling motion.

Is it too late to say she’s too late?

• May Vows To Resign Before Next Phase Of Brexit If Deal Is Passed (G.)

Theresa May has played her final desperate card to tame the Brexit rebels in her warring party, by promising to sacrifice her premiership if they back her twice-rejected Brexit deal. The beleaguered prime minister, whose authority has been shattered by the double rejection of her deal and the humiliation of a delay to Brexit day, made the offer to Tory backbenchers at a packed meeting in parliament. It came as MPs held backbench-led “indicative votes” on eight alternative Brexit options, including no deal, a referendum, a customs union and a Norway-style deal – none of which secured a majority.

May told her party’s backbench 1922 Committee: “I have heard very clearly the mood of the parliamentary party. I know there is a desire for a new approach – and new leadership – in the second phase of the Brexit negotiations, and I won’t stand in the way of that.” She added: “I am prepared to leave this job earlier than I intended in order to do what is right for our country and our party.” [..] The prime minister had hoped to remain in No 10 after exit day, and build a legacy that extended beyond the humiliations of the Brexit talks to domestic policy. But if the withdrawal agreement is passed and Britain leaves the EU in eight weeks’ time, she could now be gone before the summer – after just three years in the top job.

The fringe group she needed after her terrible election outcome now keeps her from pushing through her deal. Poetic justice?

• DUP Vows To Block May’s Brexit Deal After She Offers To Resign (Ind.)

Theresa May’s plan to secure Tory MPs’ backing for her Brexit deal by promising to resign has been blown apart after her DUP partners in government vowed to block it in a new vote. Ms May announced she will resign within weeks if Tory rebels desperate to see the back of her, allow the Brexit deal she struck with Brussels to pass through the House of Commons. The move did see Boris Johnson and other rebels finally fall into line, but within hours the boost was wiped out when DUP leader Arlene Foster branded the prime minister’s Brexit plan an “unacceptable threat” to the UK’s integrity.

With the success of Ms May’s final gambit now heavily in doubt, MPs held a series of votes to determine if any compromise can be found to break the parliamentary deadlock – but none of the eight options tested gained a majority. Earlier in the day cabinet ministers went on the airwaves to show support after Ms May’s pledge and to urge MPs to get behind her Brexit deal, but several will now ramp up preparations for a leadership contest with the PM looking fatally weakened. Several Conservatives told The Independent that with her Brexit plan on its last legs and parliament having so far failed to find an alternative, a new election now appears a very real possibility.

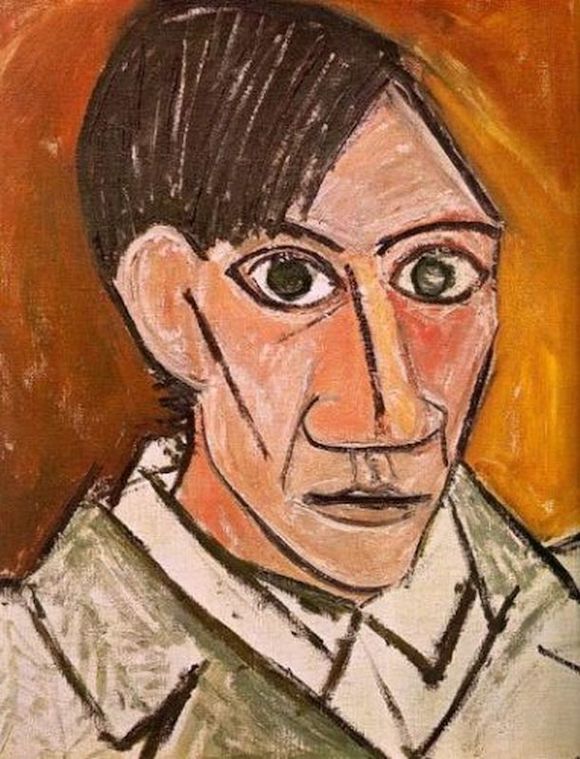

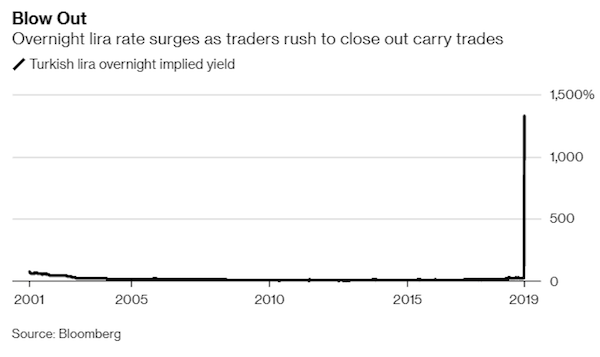

Erdogan is in full scale war with financial markets, even going up against JP Morgan. The classic failure of fighting against the shorts, which is like fighting windmills. But he thinks he has a right to be god in his own country.

• Turkey Is Unraveling Fast (Colombo)

This week, Turkey further roiled markets by preventing foreign banks from accessing the liras they need to close out their swap positions. That’s made it almost impossible for bankers to short the lira or exit carry trades, and forced the overnight lira rate up to about 1,000 percent from 23 percent.

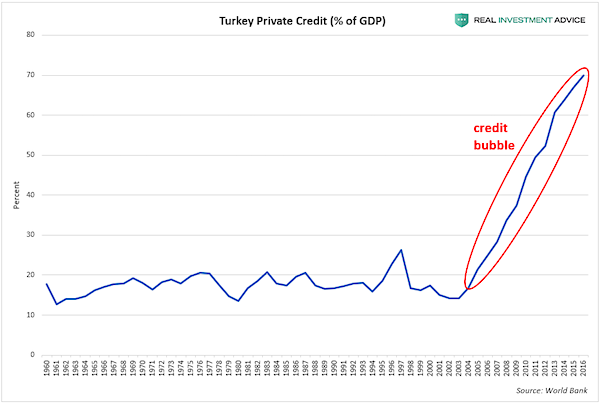

Turkey’s shocking intervention this week – which sought to punish speculators who were betting against the lira – is more confirmation that the country’s financial and economic situation is spiraling out of control. The primary reason for this turmoil is the bursting of Turkey’s 15 year old credit bubble. To summarize, a credit bubble formed in Turkey starting in the early-2000s, which led to an artificial economic boom. Private sector credit grew from roughly 15% of GDP in 2003 to 70% of GDP in 2016. Surging interest rates are now bursting the credit bubble and putting an end to the artificial economic boom.

Unfortunately, Turkey’s situation is only going to get worse – a 15 year-old credit bubble doesn’t resolve in a mere six months. This week’s currency intervention will only serve to scare away foreign investors, which will contribute to the downward spiral. Turkey is just one of many emerging economies that have experienced credit bubbles in the past decade due to the stimulative actions of global central banks. Bubbles – including the one in Turkey – have caused global debt to explode by $150 trillion in 15 years and $70 trillion in 10 years. Even if you do not invest directly in Turkey, you are still likely exposed to contagion risk – welcome to the downside of globalization.

Yup. Biggest airport in the world.

• Erdogan’s Big Turkish Ambitions Could Come Tumbling Down (BBC)

The crater is the size of a football pitch, dug 50 metres (165ft) deep into the earth. Mounds of rock line the surface. The only life here is the seagulls drinking from pools of stagnant water. It was supposed to be the site of Istanbul’s gleaming new development: a grandiose mix of apartments, malls and spas in the district of Fikirtepe. The promotional video from 2010 showed a symbol of Turkey’s newfound wealth. The houses of at least 15,000 people were demolished to make way for it. Many paid deposits to buy into the project. But as financial problems hit, investors pulled out – and most of the planned buildings never materialised. All that’s left is a gaping hole of bankrupt companies and broken promises.

It is symptomatic of a wider economic slump that poses the gravest threat to Recep Tayyip Erdogan in his 16 years in power. Polls before this weekend’s local elections suggest his governing AK Party could lose control of the capital, Ankara – and perhaps even Istanbul. Over the past 16 years, Mr Erdogan has championed construction as the engine of Turkey’s growth. His so-called “mega projects” – from airports to bridges to tunnels – have transformed the country’s infrastructure. And high-rise housing developments have changed city skylines, often to the horror of architects. Construction moguls close to the president have won state tenders through political support. The industry is mired in claims of corruption and cronyism.

But with inflation now at 20% and the Turkish lira having plunged by around a third, the cost of importing raw materials and servicing foreign loans has soared – and construction companies are failing. Pana Yapi, the conglomerate running the Fikirtepe project, told the BBC “the whole country is going through an economic crisis”, arguing that it too is a victim. Cranes suspended in mid-air and half-built skyscrapers that now dot Istanbul are a sign of that crisis. Turkey entered recession last year, shrinking 3% in the final quarter. Many fear there is worse to come. “Turkey is heavily dependent on foreign-denominated debt and when that’s harder to service, that’s when you see the problems we’re in”, said Can Selcuki, general manager at Istanbul Economics Research.

The EU will split itself off the global internet because representatives didn’t understand procedures, and can’t correct their mistakes.

• MEPs Approved Controversial ‘Meme Ban’ EU Copyright Law By Accident (Ind.)

The most controversial “meme ban” part of new EU copyright law was voted through by MEPs by mistake, it has emerged. This week, the European Parliament voted to pass the new copyright regulations, which critics claim could fundamentally alter how the internet works. And one vote on those specifics of those rules appears to have been decided on the basis of MEPs who approved them by accident. During deliberations on the new regulations, MEPs were offered the chance to specifically debate the two most controversial pieces of the law: Article 11, which would stop search engines from showing snippets of text from other websites, and the renamed Article 13, which requires that tech companies ensure their users are not violating copyright and has been accused of leading to a “meme ban”.

The MEPs turned down an amendment that would have allowed them to specifically reject those parts of the law, by a very thin margin, in advance of the main vote. But now some of those politicians say they mistakenly voted the wrong way – and enough of them that it would have swung the vote. That amendment was rejected by just five votes. But at least ten MEPs said they had accidentally cast their vote the wrong way, and if they had voted it would have fallen the other way. Video taken during the vote shows the confusion among the politicians as they attempt to quickly vote on the amendments, which could have fundamentally changed the regulations that were eventually passed.

The voting records have now been fixed to show that a number of MEPs had cast the wrong votes, and registers the names of those who had intended to approve the amendment. But despte the fact that the voting records now show the corrected results, the original ones will still stand. There is no way for those MEPs to change the official vote, even though the records can be corrected.

How is it possible she was ever the no. 1 show?

• Rachel Maddow Sheds 500,000 Viewers In Post-Mueller Slump (RT)

After putting all its eggs in the Russiagate conspiracy-theory ‘basket’ only to be let down by the contents (or lack thereof) of the Mueller report, MSNBC – and its top attraction, Rachel Maddow – are hemorrhaging viewers.

Russian-collusion high priestess Rachel Maddow’s nightly news show has slipped from number one in cable news to number six since Special Counsel Robert Mueller turned in his report on Friday, hemorrhaging half a million viewers in the space of a week. An MSNBC insider spilled the beans to the Daily Beast, assuring them that no one at the network was panicking.“It was obviously a big couple of nights for Fox,” they said. MSNBC’s second-top-rated program, ‘The Last Word with Lawrence O’Donnell,’ was also down half a million pairs of eyes. #Resistance media reactions to Mueller’s “no more indictments” recommendation have varied wildly, from desperate pleas to “wait and see” what’s in the full report to claims that Mueller himself was compromised, or asking the wrong questions, all along. Maddow herself seems to have chosen the “denial” route:

“Can we expect President Trump and the Trump White House to finally accept the underlying factual record that Russia did in fact attack us?” she asked on Monday, interpreting the report summary of Attorney General William Barr, which found no evidence to suggest Russian collusion, as proof that the Russian menace was even more menacing than previously believed.

Maddow’s privileged status as Queen of the Russiagaters has largely insulated her from the standard journalistic responsibilities of telling the truth, fact-checking, and otherwise maintaining a reality-based narrative, but the Beast cited “many producers” at MSNBC who had noticeably backed away from other fiery preachers of the Russiagate gospel, like Malcolm “Russia has been plotting to invade the US for 20 years! Also memes are cruise missiles” Nance.

It’s the German government trying to create a situation in which the EU/ECB catches Deutsche’s fall.

• Deutsche Bank Seeking a “Guarantee of Existence” with Monster-Merger? (WS)

The chief executive of eternally troubled Too-Big-To-Fail Deutsche Bank, Christian Sewing, believes the time is ripe for a merger with its national rival, Commerzbank, combing Germany’s two biggest, most dangerous lenders. So, too does his counterpart at Commerzbank, as does US private equity firm Cerberus, which owns 3% of Deutsche Bank and 5% of Commerzbank. Germany’s Finance Minister and card-carrying social democrat Olaf Scholz is also firmly on board. Indeed, many say that he’s the one leading the charge despite the tens of thousands of job losses a merger between the two banks is guaranteed to produce. Scholz’s deputy, Joerg Kukies, has courted controversy for his previous role as co-chief executive of Goldman Sachs, which is reportedly advising Commerzbank on the proposed $28 billion tie-up.

But Kukies insists there are no conflicts of interest, which is a relief. For some time now, the German government has been exploring ways to lever a merger between the top two banks to add scale and slash expenses. As things currently stand, Deutsche Bank shows little sign of halting, let alone reversing, the “vicious cycle of declining revenues, sticky expenses, lowered ratings and rising funding costs” that the group’s CFO James von Motke says has been plaguing it. Whether lumping it together with a bank that has already been bailed out once in “a merger of weakquals,” as London-based brokerage Olivetree calls it, will help right the ship is highly debatable.

But right now, the big concern is that time is fast running out for one of Europe’s biggest and most hyper-connected lenders. Unless something drastic is done soon, the next downturn could prove fatal for an already gravely weakened Deutsche Bank whose stock has been in a death-spiral since 2007, having lost over 90% of its value, and whose price-to-book ratio — the equation often used to reflect the value that market participants attach to a company’s equity — is currently below 0.25%. Normally, when a company’s P/B ratio falls below 1, it means the market is either undervaluing it and thus it could be good value, or the company is in trouble. When the ratio slumps as low as 0.22%, as is the case with Deutsche Bank, it’s far more likely to be the latter than the former.

The Arab world can’t let this go.

• ‘Why Not Give Israel North & South Carolina?’ Syrian Envoy Asks US At UN (RT)

Syria’s UN ambassador has suggested the US hand “a couple” of its own states over to Israel instead of flaunting international law and selling others’ land for favors with the Israeli lobby, like it did with the Golan Heights.

Syria’s UN Ambassador Bashar Jaafari offered a stark rebuke to the US-backed Israeli claim to the occupied Golan Heights at the UN Security Council meeting on Wednesday. Jaafari said the Trump administration does the bidding of Israeli Prime Minister Benjamin Netanyahu at the UN to curry favor with the powerful Israeli lobby in the US. In a remark that elicited a chuckle and a head-shake from his Israeli counterpart, Jaafari suggested that Washington bargain away land that is actually its to give.

Trump’s decision to back the Israeli claim to the Golan Heights comes just ahead of the Israeli general elections on April, 6 and has been widely considered as an electoral boost for Netanyahu, who is facing charges of fraud, bribery and breach of trust at home. “Don’t be misguided by thinking that one day this land will be yours due to hypocrisy or due to being a pawn in the electoral game where you bring each other support, so the Israeli can succeed in their elections and the Americans can also get support from Israeli lobbying groups in the US,” Jaafari said. The Golan Heights, seized by Israel during the 1967 Six-Day war and formally annexed in 1981, will ultimately “come back” to Syria, the Syrian diplomat said.

“Trump upped the ante by warning Russia that “all options are open..”

• ‘Leave Syria First’: Moscow Reacts To Trump’s Demand To Leave Venezuela (RT)

The Trump administration should make good on its own promise to pull troops out of Syria before telling others where they should or shouldn’t be, the Russian Foreign Ministry said in reply to Washington’s threat over Venezuela. “Before they have their say in the lawful interests of other nations, I would advise the US administration to fulfill the promises that it had given to the international community,” Russian Foreign Ministry spokeswoman Maria Zakharova said, referring to US President Donald Trump’s pledge to get American troops out of Syria. The US is behaving like a “cowboy in the Louvre,” undermining international order with its “chaotic moves and unpredictable behavior,” Zakharova said.

The Russian Foreign Ministry confirmed on Wednesday that two of its military planes arrived in Venezuela as part of a 2001 military cooperation deal that does not require further approval by the Venezuelan National Assembly, which has been taken over by the opposition and the self-proclaimed ‘interim president’ Juan Guaido. The planes carrying up to 100 Russian military specialists and cargo landed outside Caracas on Saturday, prompting wild guesses in the media. Washington was incensed over the arrival of the Russian troops and denounced it as “unnecessary provocation.” Trump upped the ante by warning Russia that “all options are open” when it comes to kicking Russia out.

They’ll just keep on appealing.

• Monsanto Ordered To Pay $80 Million In Damages To Cancer Victim (G.)

A federal jury ruled that Monsanto was liable for a California man’s cancer and ordered the Roundup manufacturer to pay $80m in damages. The ruling on Wednesday, which holds the company responsible for the cancer risks of its popular weedkiller, is the first of its kind in US federal court and a major blow to Monsanto and its parent company, Bayer. A spokesperson said Bayer would appeal. In a verdict during an earlier phase of the trial, the jury in San Francisco unanimously ruled that the herbicide was a “substantial factor” in causing the cancer of Edwin Hardeman. Hardeman, a 70-year-old Santa Rosa man, was the first person to challenge Monsanto’s herbicide in a federal trial, alleging that his exposure to the glyphosate weedkiller caused him to develop non-Hodgkin’s lymphoma (NHL), a cancer that affects the immune system.

The case has attracted international attention and raised new questions about the potential health hazards of Roundup. It also challenged the conduct of Monsanto, now owned by the German pharmaceutical company Bayer. The corporation is facing more than 9,000 similar lawsuits across the US that allege Roundup has caused cancer. The jury ruled that Roundup’s design was “defective”, that the product lacked sufficient cancer warnings, and that Monsanto was negligent in its failure to warn Hardeman of the NHL risk. The jurors ordered the company to pay Hardeman $75m in punitive damages, $200,000 for past economic losses and $5.6m in non-economic losses.

Another win for Monsanto.

• ‘Doomsday Vault’ Town Warming Quicker Than Any Other On Earth (Ind.)

The world’s northernmost settlement and home to what is known as the “Doomsday vault” – the subterranean Svalbard global seed vault which stores specimens of almost all the world’s seeds – is now believed to be the fastest-warming location on Earth, according to a new report. Longyearbyen, on the Norwegian island of Svalbard, had an average temperature in Svalbard was -7.8C in 1900 but since then, it has risen by 3.7C – more than three times the global average rise of about 1°C. Not only has it become significantly warmer, but wetter too, spelling trouble for the Doomsday vault as the seeds’ preservation depends on stable temperatures and bone-dry conditions.

“Svalbard is the ultimate failsafe for biodiversity of crops,” Marie Haga, the executive director of the Crop Trust told CNN. The vault was opened in 2008. Its construction was funded by the Norwegian government and built in partnership with the country’s Crop Trust and is now a secure storage unit for around a million seed samples, representing over 13,000 years of agricultural history. [..] Set deep within a mountain in a geologically inert area, there is a very low risk of earthquakes or volcanoes and similarly, Norway’s political system is also “very stable”, Ms Haga said. The seeds are stored at -18C. But the increasing likelihood of wet weather has already seen major upheaval at the site. Following heavy rainfall in October 2016, the entrance to the seed vault became half-flooded and ended up freezing into huge blocks of ice.