Jack Delano Chicago, Illinois 1942

What does it say about our times, our Zeitgeist even, when a new record for global revenue is set by a movie named Infinity War?

Doublespeak in action. Rudd left because she lied, but is now lauded for being honorable, acting on principle.

• Ministers Rally Round Theresa May After Amber Rudd Resigns (G.)

Ministers have moved swiftly to try to protect Theresa May after the resignation of Amber Rudd, insisting the home secretary only stood down because she inadvertently misled MPs, not because of the wider Windrush migration scandal. With the prime minister set to announce a replacement for Rudd later on Monday, amid another forced cabinet reshuffle, the transport secretary, Chris Grayling, rejected the idea that May was facing pressure over her own position. “This is about sorting out a problem,” he told Sky News. “The prime minister has apologised to these people, and we’re going to get on with the job of fixing it.”

[..] Rudd was facing a bruising appearance in the House of Commons on Monday, having to explain again why she told the home affairs select committee last week that she did not know of any deportation targets. Grayling said Rudd had spoken “in good faith” and had stepped down because “she had inadvertently misled parliament, that she should have known a bit more about the issue of targets”. He added: “It doesn’t often happen in politics, and people criticise when it doesn’t happen. What we’ve got here is a former home secretary who acted on principle.”

Grayling insisted her departure had nothing to do with the wider issue of members of the Windrush generation of arrivals from the Caribbean being wrongly targeted by immigration authorities, or with the hostile environment immigration policy initiated by May when she was home secretary. “The Windrush issue is something we all regret,” he said. “It’s a mistake, the government’s apologised, the prime minister has apologised, the former home secretary apologised for it. That isn’t the issue that led to her resignation. The issue is about her inadvertently misleading the house in good faith.”

The shadow home secretary, Diane Abbott, disputed this, and said May also should come to the Commons to explain herself to MPs. “Fundamentally, the reason she had to resign was because of the Windrush fiasco,” Abbott told BBC Radio 4’s Today programme. “Somebody had to take responsibility. It happened on her watch, therefore I think it’s right she has resigned.” On May addressing MPs, Abbott said: “In the first instance we’d like to know if she herself knew about the targets and would therefore be in a position to say whether Amber Rudd misled the house. “More fundamentally, we want to talk to her about the aspects of the so-called hostile environment, which she was responsible for, and led to the Windrush fiasco.”

This is what this is about: indefinite detention for elderly ladies, taken from their families while awaiting deportation, in really bad conditions. It’s criminal.

• UK Home Office Charter Secret Removal Flight To Jamaica With Grandmothers (TLE)

After a week of repeated apologies to the victims of the Windrush scandal and assurances by Prime Minister Theresa May and Home Secretary Amber Rudd that they would not be facing any more deportations, we have discovered evidence of a special chartered removal flight to Jamaica next week. We know of at least three grandmothers with British families who were due to be removed on the secretive flight. One, Yvonne Williams, a 59-year old grandmother of seven, whose mother arrived from Jamaica in 1962, had been detained in the scandal-ridden Yarl’s Wood detention centre for OVER EIGHT MONTHS since last August. She had been given removal directions by the Home Office for next week’s flight despite all her family being based in Britain and having none in Jamaica.

Thankfully, on Friday, the Home Office told Yvonne after she had been incarcerated for months away from her elderly mother, 82, and from the grandchildren that she had been caring for, that she would not be removed on the flight and that she could finally be released from detention. [..] Another grandmother incarcerated at Yarl’s Wood detention centre has not been as fortunate. Yvonne Smith, 63, remembers waving to the Queen when she visited Jamaica. She was born a citizen of the UK and Colonies eight years before Jamaican independence. Yvonne’s father and mother came to the UK in the 1950’s. Yvonne stayed behind with her grandmother joining her British siblings and father in Birmingham after her mother and grandmother passed away.

Her brother, sisters, nephews, nieces, children, grandchildren are all British and she has no family left in Jamaica. Yvonne has been making attempts to regularise her stay since 2010 as the main carer for her 92 year old father. The Home Office insists that she has not got enough significant family ties and has incarcerated Yvonne since last August. She says it breaks her heart talking to her father on the phone: “He starts crying, he doesn’t want the NHS to look after him, he wants me, it’s too hard to hear him cry.” Being detained for over eight months has also taken its toll on Yvonne’s health. She has been diagnosed with Diabetes since being locked up, complains of pain and her eyes fading.

No, by lies. Her own.

• Amber Rudd: Felled By Claims, Counterclaims, Leaks And Denials (G.)

When Amber Rudd agreed to appear in front of political journalists at a Westminster lunch last week, it was an opportunity to demonstrate her leadership credentials. But by the time the event actually came around the fallout from the Guardian’s reporting on the Windrush scandal was in full flow and she was, as she put it, “just thinking about staying in the game”. She had already had a hellish week involving several appearances at the dispatch box, a brutal session at the hands of the home affairs select committee and what felt like countless apologies.

But while much of the anger directed at the home secretary over the preceding days had been a result of the mishandling of the Windrush generation of migrants, it was her confusion over the rather more arcane matter of targets for deporting illegal immigrants that eventually brought her down. The key moment in Rudd’s dramatic fall from grace was when she was summoned to explain herself – and her department – in front of the committee last Wednesday. Almost as an afterthought, committee chair Yvette Cooper asked about earlier evidence from the immigration officers’ union about targets for the number of people who should be deported from the UK. “We don’t have targets for removals,” Rudd replied, kicking off the series of claims and counterclaims, leaks and denials, that eventually led to her departure.

The next day it emerged that immigration officials in her own department had been given targets after all. She was summoned to the Commons to clarify. “I was not aware of them,” she insisted. By Friday, her claims were unravelling after a secret internal Home Office document boasting of the targets in 2017 was leaked to the Guardian. Damningly, Rudd had been copied in. More than eight hours after the Guardian approached the Home Office with details of the memo – as speculation swirled around Westminster about her future – she finally responded in a series of defiant late-night tweets. The home secretary insisted she had not seen the leaked memo, even though it had been sent to her office and that she wasn’t aware of the specific removal targets. “But I accept that I should have been and I’m sorry that I wasn’t.”

The longer May stays on, the more of a joke she becomes. And her office too, which is much worse.

• Theresa May Has Lost Her Human Shield (G.)

Beleaguered, embattled, hapless – as the Windrush scandal worsened over recent days, these doom-laden adjectives had begun attaching themselves irresistibly to Amber Rudd’s name. To the last, she and her allies continued to insist that she didn’t know about deportation targets – they maintain the government’s “ambition” for boosting the number of people sent home is not a “target”. But crucially in her resignation letter, Rudd admitted “information provided to my office”did “make mention of numerical targets”. She didn’t see that information, shesaid – but admitted she should have done.

[..] The second reason Rudd remained in post was that with fresh Windrush injustices still emerging almost daily, she was a lightning rod for public anger, more of which may now be directed at the prime minister. Rudd loyally made repeated public apologies without allowing the blame to fall on the prime minister and the tone and policies that May set in her six years at the Home Office. Rudd had been deemed a potential leadership rival. Allowing her to continue to take incoming fire, particularly as it undermined her reputation for brisk, well-briefed competence, must have been highly tempting. On Sunday night, May was left to turn her thoughts to who should replace her.

She may feel obliged to appoint another remainer, to avoid upsetting the delicate balance at the top table. But in the key arguments inside Cabinet, a newbie may lack the power base to be influential for some time – and Britain’s Brexit negotiating position is being fought over right now.

Thomas Fazi and Bill Mitchell.

• Why the Left Should Embrace Brexit (Jacobin)

Nothing better reflects the muddled thinking of the mainstream European left than its stance on Brexit. Each week seems to produce a new chapter for the Brexit scare story: withdrawing from the EU will be an economic disaster for the UK; tens of thousands of jobs will be lost; human rights will be eviscerated; the principles of fair trials, free speech, and decent labor standards will all be compromised. In short, Brexit will transform Britain into a dystopia, a failed state — or worse, an international pariah — cut off from the civilized world. Against this backdrop it’s easy to see why Labour Party leader Jeremy Corbyn is often criticized for his unwillingness to adopt a pro-Remain agenda.

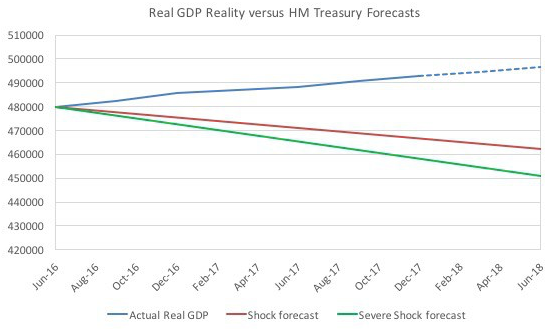

[..] In the months leading up to the referendum, the world was flooded with warnings — from the IMF, the OECD, and other bastions of contemporary economics — claiming that a Leave vote in the referendum would have immediate apocalyptic consequences for the UK, causing a financial meltdown and plunging the country into a deep recession. The most embarrassing forecast on “the immediate economic impact of a vote to leave the EU on the UK” was published by the Tory government. The aim of the “study” in question, released in May 2016 by the UK Treasury, was to quantify “the impact … over the immediate period of two years following a vote to leave.”

Within two years of a Leave vote, the Treasury predicted that GDP would be between 3.6 and 6 percent lower and the number of people unemployed would rise by as much as 820,000. The predictions in the May 2016 “study” sounded dire, and were clearly aimed at having the maximum impact on the vote, which would be held a month later. Just weeks before the referendum, the then-chancellor George Osborne cited the report to warn that “a vote to leave would represent an immediate and profound shock to our economy” and that “the shock would push our economy into recession and lead to an increase in unemployment of around 500,000.”

Nonetheless, the majority of voters opted for Brexit. In doing so, they proved economists wrong once again, since none of the catastrophic scenarios predicted in the run-up to the referendum have occurred. As Larry Elliott, Guardian economics editor, wrote: “Brexit Armageddon was a terrifying vision — but it simply hasn’t happened.” With almost two years having passed since the referendum, the economic data coming out of the UK makes a mockery of those doom-laden warnings — and of the aforementioned government report in particular. Data from the Office for National Statistics (ONS), shows that by the end of 2017, British GDP was already higher by 3.2 percent relative to its level at the time of the Brexit vote — a far cry from the deep recession we were told to expect.

How much longer?

• Tesla Doesn’t Burn Fuel, It Burns Cash (BBG)

The company that Elon Musk built to usher in the electric-car future might not have enough cash to make it through the calendar year. The anxieties that lurk beneath the tremendous ambition of Tesla Inc. moved into the forefront in recent weeks. The company again fell far short of its own production targets for the mass-market Model 3 sedan, another person died in a crash involving its assisted-driving feature and Musk entered into a public dispute with federal safety regulators. Tesla’s once high-flying stock, buffeted by a downgrade from credit analysts, has dropped 24 percent from its peak in September.

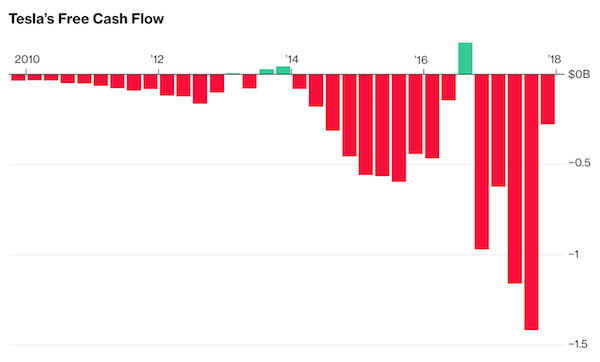

There’s a good reason to worry: No one has raised or spent money the way Elon Musk has. Nor has any other chief executive officer of a public company made a bankruptcy joke on Twitter at a time when so much seemed to be unraveling. Tesla is going through money so fast that, without additional financing, there is now a genuine risk that the 15-year-old company could run out of cash in 2018. The company burns through more than $6,500 every minute, according to data compiled by Bloomberg. Free cash flow—the amount of cash a company generates after accounting for capital expenditures—has been negative for five consecutive quarters. That will be a key figure to watch when Tesla reports earnings May 2.

Tesla makes three cars—the Model S and Model 3 sedans and the Model X SUV—at its only auto assembly plant, located in Fremont, California. There are aggressive plans to add an electric semi truck, a new roadster sports car and crossover to the production lineup in the next few years. While Musk’s vision for the future once called for extreme automation, the present day is all about manpower. Back in 2010, Tesla had just 899 employees. Today, the company has nearly 40,000 workers. The ongoing hiring binge is probably contributing to Tesla’s financial straits. Tesla has added employees faster than it has boosted revenue in three of the last four years. This includes more than doubling the workforce in 2017, when the company was scaling up for Model 3 production and took on employees from SolarCity.

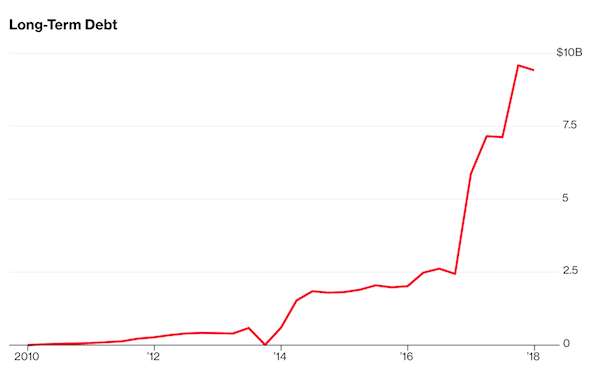

[..] Tesla ended 2017 with $3.4 billion in cash on hand and $9.4 billion in outstanding debt, a testament to Musk’s borrowing prowess. Many analysts believe that Tesla will need to raise money again—and soon. Bruce Clark of Moody’s Investors Service recently warned that Tesla will need an additional $2 billion this year, and he noted that $1.2 billion of existing debt will come due by 2019. Short sellers remain convinced that Tesla is on the verge of an epic meltdown. Famed investor Jim Chanos of Kynikos Associates has predicted the company is headed for a “brick wall.”

They want a piece of the action.

• JPMorgan, National Bank Of Canada, Others Test Debt Issuance On Blockchain (R.)

JPMorgan Chase has tested a new blockchain platform for issuing financial instruments with the National Bank of Canada and other large firms, they said on Friday, seeking to streamline origination, settlement, interest rate payments and other processes. The test on Wednesday mirrored the Canadian bank’s $150 million offering on the same day of a one-year floating-rate Yankee certificate of deposit, they said in a statement. The platform was built over more than a year using Quorum, a type of open-source blockchain that JPMorgan has developed inhouse and is in discussions to spin off. Participants in the experiment included Goldman Sachs Asset Management, the fund management arm of Goldman Sachs, Pfizer and Legg Mason’s Western Asset and other investors in the certificate of deposit.

Banks have poured millions of dollars to develop blockchain, the software first created to run cryptocurrency bitcoin, to streamline processes ranging from cross-border payments to securities settlement. “Blockchain-related technologies have the potential to bring about major change in the financial services industry,” David Furlong, senior vice president of artificial intelligence, venture capital and blockchain at National Bank of Canada, said in a statement.

A $26 billion deal, but it results in “a telecom giant with a $146 billion enterprise value which will serve some 127 million customers.”

• A T-Mobile-Sprint Merger Could Be ‘Devastating’ For Consumers (MW)

A merger between Sprint and T-Mobile US has been officially announced—and for consumers that is certainly something to phone home about. The two companies agreed to an all-stock merger on Sunday that, if allowed by antitrust enforcers, would leave the U.S. wireless market dominated by three national players, and comes after the telecommunication companies renewed M&A discussions earlier in April after thrice failing to complete a tie-up. Speculation had previously mounted about a potential merger in September, months after Bloomberg originally reported “informal contact” between the two companies last May. But Japanese telecommunications firm SoftBank, which owns more than 80% of Sprint’s shares, announced back in October that it would cease its efforts to merge the wireless carrier with T-Mobile.

Before all that, discussions were on hold due to the government’s spectrum auction (where the government sells the rights for companies to transmit signals over certain bands of the electromagnetic spectrum). The combined company, if the proposed $26 billion dollar deal is consummated, would have more than 127 million customers. Consequently, a combined T-Mobile-Sprint likely could usher in industrywide changes that would affect consumers of various carriers across the country, telecom analysts said. “It would be devastating for consumers in the long run,” said Chris Mills, news editor at BGR, a news website focused on mobile technology and consumer electronics.

It’s big merger time. While debt is still cheap.

• Marathon To Purchase Rival Refiner Andeavor For More Than $20 Billion (WSJ)

Marathon Petroleum plans to buy logistics and refining company Andeavor for more than $20 billion, according to people familiar with the matter. The cash-and stock deal, which values Andeavor at about $150 a share, is expected to be announced Monday. That would be a roughly 23% premium over Andeavor’s closing price Friday after the stock surged about 50% in the past year. Marathon, based in Findlay, Ohio, is the second-largest refiner in the U.S., according to its website. Marathon-branded gasoline is sold in 20 states, and its Speedway unit owns the nation’s second-largest convenience-store chain.

It also owns a midstream master limited partnership with about 11,000 miles of crude oil and light-product pipelines. Andeavor, based in San Antonio, operates 10 refineries in the western U.S. with total capacity of more than 1.2 million barrels a day. Part of the rationale of the deal centers on the companies’ complementary footprints; with Marathon in the East and Andeavor in the West, regulatory approval could be easier to win.

That should indeed be the question: who are these companies to censor us? Under what law is that possible?

• Facebook’s Censorship in Germany (Frank)

A court in Berlin has issued a temporary restraining order against Facebook. Under the threat of a fine of 250,000 euros (roughly $300,000 USD) or a jail term, Facebook was obliged to restore a user’s comment that it had deleted. Moreover, the ruling prohibited the company from banning the user because of this comment. This is the first time a German court has dealt with the consequences of Germany’s internet censorship law, which came into effect on October 1, 2017. The law stipulates that social media companies have to delete or block “apparent” criminal offenses, such as libel, slander, defamation or incitement, within 24 hours of receipt of a user complaint.

As many critics pointed out, this state censorship makes freedom of speech subject to the arbitrary decisions of corporate entities that are likely to censor more than absolutely necessary, rather than risk a crushing fine of up to 50 million euros ($65 million USD). According to a newspaper report, Facebook’s censors have just ten seconds to decide whether to delete a comment or not. The case with which the court in Berlin had to deal was that on January 8, 2018, the Swiss daily Basler Zeitung posted an article with the title “Viktor Orban speaks of Muslim ‘invasion'” on its Facebook site. The blurb read: “Viktor Orban wonders how in a country like Germany… chaos, anarchy and illegal crossing of borders can be celebrated as something good.”

Facebook user Gabor B. posted a comment: “Germans are becoming increasingly stupid. No wonder, since the left-wing media litters them every day with fake news about ‘skilled workers,’ declining unemployment figures or Trump.” This comment quickly received the most “likes”, until Facebook deleted it, due to an alleged infringement of Facebook’s “community standards.” In addition, Gabor B. was banned from Facebook for 30 days. “One may share the commenter’s opinion or may deem it polemic or unobjective”, Gabor B.’s attorney Joachim Nikolaus Steinhöfel told Gatestone. “The important thing is: The comment is covered by the right to freedom of speech.”

He added that before going to court, his law office had sent a written warning to Facebook. “Facebook partly gave in and lifted the ban but did not restore the comment. Facebook’s lawyers notified us that ‘a thorough reexamination came to the result that the community standards had been applied correctly and that therefore the content could not be restored’ – an assessment we cannot share.”

The land border does not fall under the EU/Turkey agreement.

• Greece Reinforces Land Border With Turkey To Stem Flow Of Migrants (G.)

Greece has rushed to reinforce its land border with Turkey as fears mount over a sharp rise in the number of refugees and migrants crossing the frontier. Police patrols were augmented as local authorities said the increase in arrivals had become reminiscent of the influx of migrants on the Aegean islands close to the Turkish coast. About 2,900 people crossed the land border in April, by far surpassing the number who arrived by sea, the UN refugee agency (UNHCR) said. The figure represents half of the total number of crossings during the whole of 2017. Speaking from the frontier town of Orestiada, the local mayor, Dimitris Mavrides, told the Guardian: “Our reception facilities are overwhelmed and things are on the verge of spinning out of control. Far more are coming than are actually being registered.

“The government has just sent 120 extra police, but they are temporary and simply not enough. Frontex also has to intervene,” he added, referring to Europe’s border and coastguard agency. The area’s sole reception centre has capacity to process 240 people. In the absence of accommodation, authorities are placing newcomers, including children, in inappropriate police detention facilities where access to interpreters and other services are severely restricted. “Some of those in police detention have been held for more than three months,” UNHCR said in a statement. “Conditions are dismal … the hundreds of people kept include pregnant women, very young children and people in need of medical and psychosocial care.”

[..] The abrupt rise reflects a switch in tactics by people smugglers circumventing the controversial agreement the EU struck with Turkey in a bid to stem migration flows at the height of the crisis when more than a million people entered the bloc through Greece. [..] The land border does not fall under the agreement and is said to be easier to traverse. “In a boat it can take as little as three minutes to cross and is far cheaper,” said Mavrides. “They are coming precisely because it is not part of the deal and because word has got out the situation on the islands is dramatic. If they get here and are processed, they are free to go anywhere on the mainland. We have four buses a day to Athens and Thessaloniki and they are full.”

What a delight to read.

“It’s especially unusual because men and women speak different dialects..”

“Although the shark may not be seen much in these waters anymore, it is still spoken of with respect, as the giver of life and creator of this land.”

• Australia’s Ancient Language Shaped By Sharks (BBC)

The tiger shark was having a really bad day. Other sharks and fish were picking on him and he was fed up. After fighting them, he met up with the hammerhead shark and some stingrays at Vanderlin Rocks in the waters of Australia’s Gulf of Carpentaria to speak of their woes before they set out to find their own places to call home. This forms one of the oldest stories in the world, the tiger shark dreaming. The ‘dreaming’ is what Aboriginal people call their more than 40,000-year-old history and mythology; in this case, the dreaming describes how the Gulf of Carpentaria and rivers were created by the tiger shark. The story has been passed down by word of mouth through generations of the Aboriginal Yanyuwa people, who call themselves ‘li-antha wirriyara’ or ‘people of the salt water’.

As we sailed past the rocks and sandstone cliffs of Vanderlin Island, heading towards the mouth of the Wearyan River, dugongs and fish swam by. We were searching beneath the waves for a glimpse of shark fins, following in the path of the tiger shark in this creation story. The tiger shark’s journey was challenging as he forged his way through the Gulf, creating the water holes and rivers in the landscape. He was turned away by many other angry animals who did not want him to live with them. A wallaby even hurled rocks at him when he asked if he could stay with her. But as he swam, the dreaming story explains, the shark helped create the waters of the Gulf of Carpentaria that we see today.

“Tiger sharks are very important in our dreaming,” said Aboriginal elder Graham Friday, who is a sea ranger here and one of the few remaining speakers of Yanyuwa language. Some people here still believe the tiger shark is their ancestor, and the Yanyuwa are known for their ‘tiger shark language’, as they have so many words for the sea and shark. [..] today conservationists are concerned about tiger shark numbers, with them currently listed as ‘Near Threatened’ by the International Union for Conservation of Nature. “Not many sharks any more. But this dreaming story shows there were once,” Friday said. [..] Although the shark may not be seen much in these waters anymore, it is still spoken of with respect, as the giver of life and creator of this land.