NPC Fordson tractor exposition at Camp Meigs, Washington DC 1922

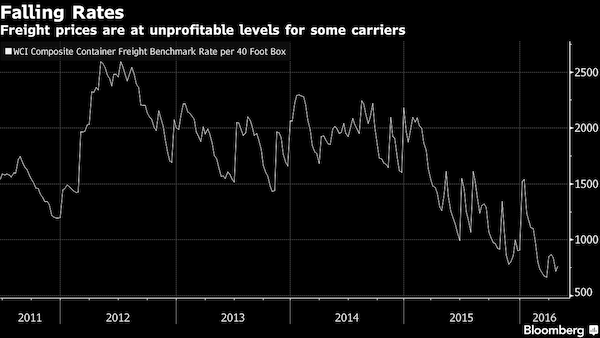

With trade growth goes globalization.

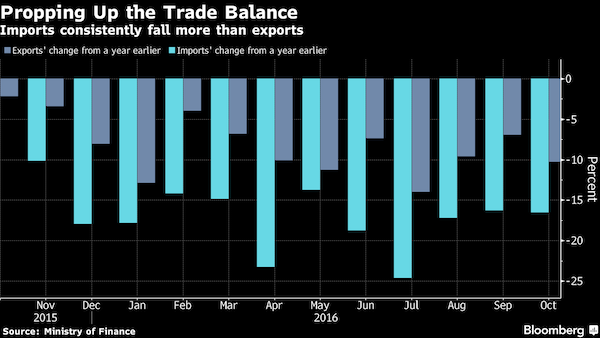

• Japan Exports Drop 13th Month By 10.3%, Imports Down 22nd Month By 16.5% (WSJ)

Japanese exports extended their losses to a 13th straight month in October, indicating that the world’s third-largest economy has yet to regain full fitness despite better-than-expected growth in the third quarter. Exports fell 10.3% from a year earlier in October to 5.870 trillion yen, figures released Monday by the Ministry of Finance showed. The reading came in worse than a 9.4% drop forecast by economists polled by WSJ. Exports decreased 6.9% in September. Despite the grim monthly figures, exports appear to be in better shape than in the spring, when Japan’s manufacturers were being buffeted by worries over a Chinese slowdown and other headwinds from abroad. Government estimates released last week showed that Japan’s economy grew 2.2% from the previous quarter in the July-September period, beating economists’ expectations.

Exports were stronger than in the previous three months. The near-term prospects for exports have also improved after Donald Trump’s victory of U.S. presidential election put the yen’s previous uptrend in reversal. The finance ministry said export volumes for October fell 1.4% from their year-earlier levels. That marked the first fall in three months. But seasonally adjusted month-on-month figures showed exports increased 1.6%. Imports declined 16.5% on year in October to Y5.374 trillion, the 22nd consecutive month of contraction, the ministry said. Japan’s trade balance came to Y496.2 billion in surplus, according to the data. Economists polled by the Nikkei expected a surplus of Y610.0 billion.

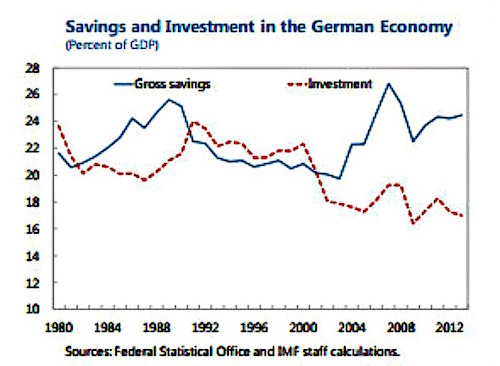

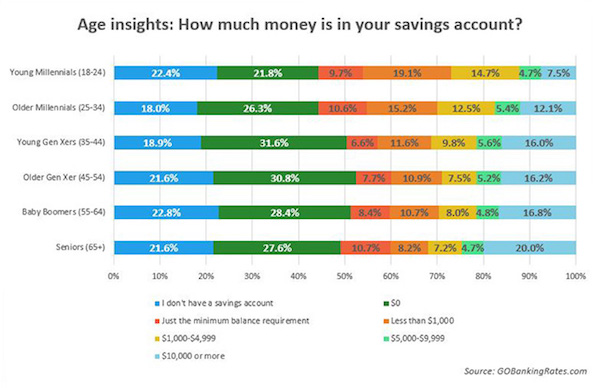

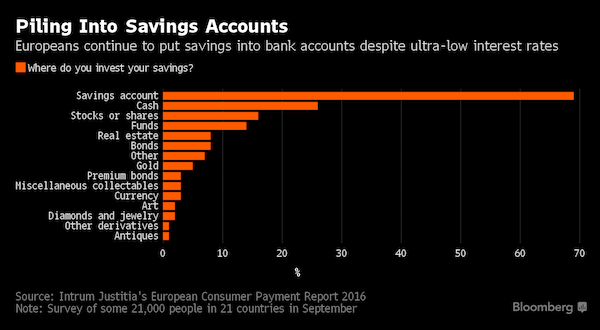

Anything reported as a ‘savings obsession’ can be filed under ‘fake news’. It takes this article a while to get to it, but then it does: “About 44% of all Europeans were unable to pay at least one bill on time during the last 12 months, mainly because of a lack of money..” Combine that with the accounting practice of filing ‘paying off debts’ under ‘saving’, and you know what’s really happening.

• Negative Rates Are Failing to Halt Savings Obsession in Europe (BBG)

After years of turbo-driven central bank stimulus, most Europeans still want to leave their spare cash in savings accounts, even if those accounts pay zero interest. That’s the finding of a survey by Europe’s biggest debt collector, Stockholm-based Intrum Justitia AB. “After the financial crisis, people have felt a need – even if they have small means – to create some kind of security,” CEO Mikael Ericson said in an interview in Stockholm on Nov. 16. “It can’t be that people save in a bank account because of the fantastic returns, so it must be about a sense of security, having money in the bank.” Some 69% of Europeans put their savings into bank accounts, according to Intrum Justitia’s European Consumer Payment Report.

The survey is based on feedback gathered in September and covers about 21,000 people in 21 countries. The survey also shows that 26% of Europeans prefer keeping their surplus funds in cash, while 16% hold stocks. Only 14% turn to investment funds, 8% invest in real estate and 8% in bonds. In Denmark and Sweden, where central bank benchmark rates are negative, almost 80% of people put their surplus cash in bank accounts. In France, the U.K. and the Netherlands, the figure is above 80%. [..] The survey also revealed how financially fragile many Europeans continue to be almost half a decade after the region’s debt crisis. About 44% of all Europeans were unable to pay at least one bill on time during the last 12 months, mainly because of a lack of money, the survey found. Greece was worst, with 76% of households failing to pay on time.

Yeah. Savings Obsession. Sure.

• More Than 1 in 3 European Workers Have Difficulty Making Ends Meet (ETUC)

According to the European Working Conditions Survey launched today more than one third of workers report some or great difficulty in making ends meet. This is the reality behind the rosier picture painted by the European Foundation for the Improvement of Living and Working Conditions which highlights an “increasingly skilled workforce, largely satisfied with work”. However, the study also reveals that • A shocking 1 in 5 workers “has a poor quality job with disadvantageous job quality features and job holders …. reporting an unsatisfactory experience of working life.” • Only 1 in 4 workers have “a smooth running job where most dimensions of job quality are satisfactory”.

Luca Visentini, General Secretary of the European Trade Union Confederation said “European workers are struggling to make ends meet. Work no longer assures a decent life. Is it any wonder that more and more voters are losing their faith in “the European Union and mainstream political parties? ”These results only strengthen the ETUC’s determination to fight for more public investment to create quality jobs, and for a pay rise for European workers to tackle poverty and drive economic recovery for all. Economic policies that result in 1 in 3 workers struggling to make ends meet are fundamentally wrong and must be radically changed.” “These are deeply worrying results that cannot be hidden by claiming that the world of work is increasingly complex. The survey actually shows that work is unsatisfactory or unrewarding for far too many workers.”

“The picture painted by the European Working Conditions Survey of widespread poverty in improving working conditions highlights the need for a comprehensive approach to tackle inequality across Europe. Improvements in labour markets and working conditions are modest and uneven at best; what’s more, these are being wiped out by spiralling costs of housing and austerity policies that drive insecurity for workers and their families.”

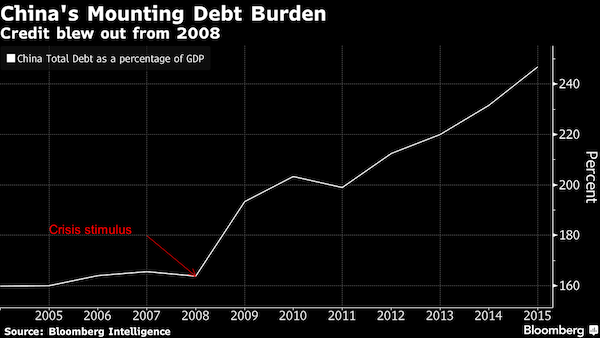

“Debt is good” is just another way of saying “Greed is good”.

• Now it Begins to Unravel (WS)

Debt is good. More debt is better. Funding consumer spending with debt is even better – that’s what economists have been preaching – because the consumed goods and services are gone after having been added to GDP, while the debt, which GDP ignores, remains until it is paid off with future earnings, or until it blows up. Corporations too have gone on a borrowing binge. Unlike consumers, they have no intention of paying off their debts. They issue new debt and use the proceeds to pay off maturing debts. Funding share-buybacks and dividends with debt is ideal. It’s called “unlocking value.” Debt must always grow. For that purpose, the Fed has manipulated interest rates to rock bottom. Actually paying off and reducing debt has the dreadful moniker, bandied about during the Financial Crisis, “deleveraging.”

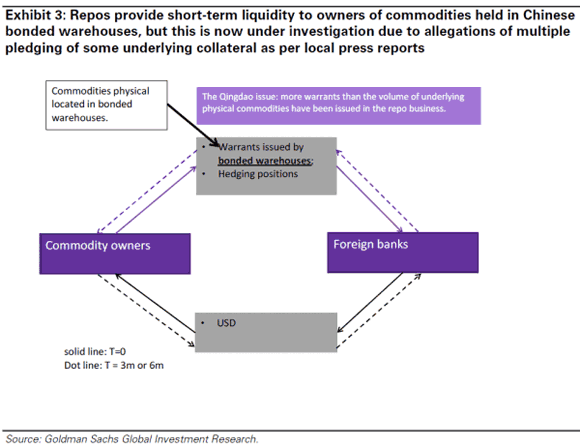

It’s synonymous with “The End of the World.” At the institutional level, “debt” is replaced with more politically correct “leverage.” More leverage is better. Particularly if you can borrow short-term at near zero cost and bet the proceeds on risky illiquid long-term assets, such as real estate, or on securities that become illiquid without notice. Derivatives are part of this institutional equation. The notional value of derivatives in the US banking system is $190 trillion, according to the Office of the Comptroller of the Currency. Four banks hold over 90% of them: JP Morgan ($53 trillion), Citibank ($52 trillion), Goldman ($44 trillion), and Bank of America ($26 trillion). Over 75% of those derivative contracts are interest rate products, such as swaps.

With them, heavily leveraged institutional investors that borrow short-term to invest in illiquid long-term assets hedge against interest rate movements. But Treasury yields and mortgage rates have moved violently in recent weeks, and someone is out some big money. These credit bubbles always unravel to the greatest surprise of those institutions and their economists. When they unravel, the above “End-of-the-World” scenario of orderly deleveraging turns into forced deleveraging, which can get messy. Assets that had previously been taken for granted are either repriced or just evaporate. But they’d been pledged as collateral. Suddenly, the collateral no longer exists….

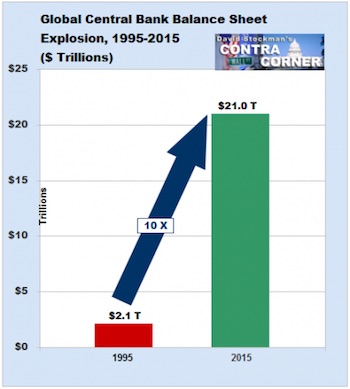

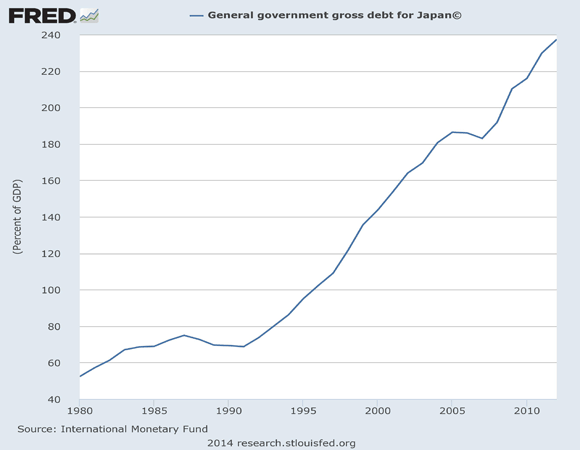

“..the Swiss National Bank’s balance sheet now accounts for 100% of GDP. Japan is also 100%, but mainly invested in its own state paper. The ECB and the Fed are 30%.”

• Former UBS, Credit Suisse CEO: “A Recession Is Sometimes Necessary” (ZH)

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary”, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their ‘supremacy over the markets and other banks’. He claimed that the use of negative interest rates and huge positive balance sheets represent ‘weapons of mass destruction’. He calls for an end to the use of negative interest rates. Sounding more like a “tinfoil” blog than the former CEO of the two largest Swiss banks, Grübel warned that central banks have “crossed the point of no return” which will ultimately “end in a crash.”

Joining Deutsche Bank in slamming NIRP, Grubel said that banks are losing hundreds of millions of francs each year to negative interest rates paid to central banks. Worse, he warned that central banks will eventually lose their credibility in the markets but that this could take 10 years or more, at which point it will “all end in a crash.” What happens then? The former CEO believes that the final outcome will be wholesale financial nationalization: “after that all banks could belong to the state” Grubel also the doubted the wisdom of the Swiss National Bank’s balance sheet: “the Swiss National Bank’s balance sheet now accounts for 100% of GDP. Japan is also 100%, but mainly invested in its own state paper. The ECB and the Fed are 30%. Switzerland is far, far, far ahead. Is that wise?”

Grübel also touched on a point we have made ever since 2010 when we said that in a world of unprecedented political polarity, politicians now control the world almost exclusively through monetary policy, to wit: “After the financial crisis, politics has taken power in the banking sector: It has bound the banks into a regulatory corset and now they can no longer move. Politicians have told central banks: now you determine what is going on with the economy.” What are the implications of this power shift? “Previously, the risk was distributed to thousands of banks. They had to pay for their mistakes. The risk lay with the shareholders. Today, more and more the state carries the risk.” Which, of course, is another word for taxpayers. In other words, the next crash will be one where central – not commercial – banks are failing, and the one left with the bill will once again be the ordinary person in the street.

In a tangent, Grübel gave his thoughts on what makes a man rich: “rich is a man when he goes to bed in a carefree manner and wakes up without care.” He is then asked if, by that definition, a billionaire is rich to which he replied: “No. Money has little to do with wealth. The real rich are carefree. Those who are healthy, are not dependent. The greatest wealth is independence.”

“..the winner will be favorite to become president in May..”. Really? Then why am I thinking Le Pen is the favorite?

• Big Shock In France’s Presidential Election As Sarkozy Eliminated (BBG)

Former Prime Minister Francois Fillon, the new front-runner in France’s 2017 presidential election, is offering voters an economic-policy revolution inspired by Margaret Thatcher. Fillon, 62, vaulted from third position in most polls to win the first round of the Republican primary by 16 percentage points from the veteran Alain Juppe on Sunday with the most free-market platform among the seven candidates. They’ll face each other again in next Sunday’s runoff and the winner will be favorite to become president in May 2017. The lifelong politician is pledging to lengthen the work week to 39 hours from 35, to increase the retirement age to 65 and add immigration quotas. He’s vowed to eliminate half a million public-sector jobs and cut spending by €100 billion over his five years in office.

And he proposes a €40 billion tax-cut for companies and a constitutional ban on planned budget deficits. “Who is Fillon? The classic conservative, right-wing candidate,” Bruno Cautres, a political scientist at the Sciences Po Institute in Paris, said in an interview. “He wants a deep reform of the French model: shrinking the role of the state and cutting the welfare system.” Compared with the brash style of former boss, Nicolas Sarkozy, Fillon has a more low-key approach but he makes a virtue of telling it straight. When he took office as premier in 2007, he shocked even Sarkozy by announcing that France was a bankrupt state. Today he’s promising to reverse that, just like his role model when she became U.K. prime minister in 1979.

Europe and the scourge of direct democracy.

• The EU’s New Bomb Is Ticking in the Netherlands (WSJ)

If the European dream is to die, it may be the Netherlands that delivers the fatal blow. The Dutch general election in March is shaping up to be a defining moment for the European project. The risk to the EU doesn’t come from Geert Wilders, the leader of anti-EU, anti-immigration Party for Freedom. He is well ahead in the polls and looks destined to benefit from many of the social and economic factors that paved the way for the Brexit and Trump revolts. But the vagaries of the Dutch political system make it highly unlikely that Mr. Wilders will find his way into government. As things stand, he is predicted to win just 29 out of the 150 seats in the new parliament, and mainstream parties seem certain to shun him as a coalition partner. In an increasingly fragmented Dutch political landscape, most observers agree that the likely outcome of the election is a coalition of four or five center-right and center-left parties.

Instead, the risk to the EU comes instead from a new generation of Dutch euroskeptics who are less divisive and concerned about immigration but more focused on questions of sovereignty—and utterly committed to the destruction of the EU. Its leading figures are Thierry Baudet and Jan Roos, who have close links to British euroskeptics. They have already scored one significant success: In 2015, they persuaded the Dutch parliament to adopt a law that requires the government to hold a referendum on any law if 300,000 citizens request it. They then took advantage of this law at the first opportunity to secure a vote that rejected the EU’s proposed trade and economic pact with Ukraine, which Brussels saw as a vital step in supporting a strategically important neighbor. This referendum law is a potential bomb under the EU, as both Dutch politicians and Brussels officials are well aware.

Mr. Baudet believes he now has the means to block any steps the EU might seek to take to deepen European integration or stabilize the eurozone if they require Dutch legislation. This could potentially include aid to troubled Southern European countries such as Greece and Italy, rendering the eurozone unworkable. Indeed, the Dutch government gave a further boost to Mr. Baudet and his allies when it agreed to accept the outcome of the Ukraine referendum if turnout was above 30%, even though it was under no legal obligation to do so. This was a major concession to the euroskeptics, as became clear when strong turnout among their highly motivated supporters lifted overall turnout to 31%. With Mr. Wilders’s party, currently polling above 25%, and both Mr. Baudet and Mr. Roos having launched their own parties, Dutch euroskeptics are confident they will be able to reach the 30% threshold in future referendums.

Do they mean things would have been even worse without free trade? (if they do, let them say so): “..the benefits of trade and open markets need to be communicated to the wider public more effectively, emphasizing how trade promotes innovation, employment and higher living standards.”

• APEC Summit Closes With Call for More Globalization, Free Trade (AP)

Leaders of 21 Asia-Pacific nations ended their annual summit Sunday with a call to resist protectionism amid signs of increased free-trade skepticism, highlighted by the victory of Donald Trump in the U.S. presidential election. The Asia Pacific Economic Cooperation forum also closed with a joint pledge to work toward a sweeping new free trade agreement that would include all 21 members as a path to “sustainable, balanced and inclusive growth,” despite the political climate. “We reaffirm our commitment to keep our markets open and to fight against all forms of protectionism,” the leaders of the APEC nations said in a joint statement. APEC noted the “rising skepticism over trade” amid an uneven recovery since the financial crisis and said that “the benefits of trade and open markets need to be communicated to the wider public more effectively, emphasizing how trade promotes innovation, employment and higher living standards.”

Speaking to journalists at the conclusion of the summit, Peruvian President Pedro Pablo Kuczynski said the main obstacle to free trade agreements in Asia and around the world is the frustration felt by those left behind by globalization. “Protectionism in reality is a reflection of tough economic conditions,” said Kuczynski, the meeting’s host. Referring to Brexit and Trump’s election win in the U.S., he said those results highlighted the backlash against globalization in former industrial regions in the U.S. and Britain that contrasts with support for trade in more-prosperous urban areas and developing countries. “This is an important point in recent economic history because of the outcome of various elections in very important countries that have reflected an anti-trade, anti-openness feeling,” he said.

Fuhget about it.

• Obama Says World Leaders Want To Move Forward With TPP (AFP)

US President Barack Obama said Sunday that leaders from across the Asia-Pacific have decided to move ahead with a trade deal opposed by his successor Donald Trump. “Our partners made clear they want to move forward with TPP,” Obama said at a press conference after meeting leaders in Peru. “They would like to move forward with the United States.” It is unclear whether there is any future for the TPP, a vast, arduously negotiated agreement between 12 countries that are currently at different stages of ratifying it. It does not include China. Trump campaigned against the proposal as a “terrible deal” that would “rape” the United States by sending American jobs to countries with cheaper labor.

The agreement must by ratified in the US Congress – which will remain in the hands of Trump’s Republican allies when the billionaire mogul takes office on January 20. Without the United States, it cannot be implemented in its current form. However, some have suggested Trump could negotiate a number of changes and then claim credit for turning the deal around. Obama defended the increasing integration of the global economy at the close of his final foreign visit as president – a trade summit held against the backdrop of rising protectionist sentiment in the United States and Europe, seen in both Trump’s win and Britain’s “Brexit” vote. He said that “historic gains in prosperity” thanks to globalization had been muddied by a growing gap “between the rich and everyone else.” “That can reverberate through our politics,” he said.

Jim Quinn’s longtime series on the Fourth Turning continues. A problem might be that you can’t really know who’s who until afterwards. Maybe Mike Pence will turn out to be the real grey champion, or someone as yet unknown.

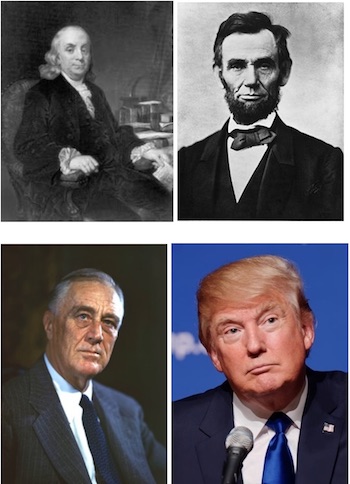

• The Grey Champion Assumes Command – Part 1 (Quinn)

In September 2015 I wrote a five part article called Fourth Turning: Crisis of Trust. In Part 2 of that article I pondered who might emerge as the Grey Champion, leading the country during the second half of this Fourth Turning Crisis. I had the above pictures of Franklin, Lincoln, and FDR, along with a flaming question mark. The question has been answered. Donald J. Trump is the Grey Champion. When I wrote that article, only one GOP debate had taken place. There were eleven more to go. Trump was viewed by the establishment as a joke, ridiculed by the propaganda media, and disdained by the GOP and Democrats. I was still skeptical of his seriousness and desire to go the distance, but I attempted to view his candidacy through the lens of the Fourth Turning. I was convinced the mood of the country turning against the establishment could lead to his elevation to the presidency. I was definitely in the minority at the time:

“Until three months ago the 2016 presidential election was in control of the establishment. The Party was putting forth their chosen crony capitalist figureheads – Jeb Bush and Hillary Clinton. They are hand-picked known controllable entities who will not upset the existing corrupt system. They are equally acceptable to Goldman Sachs, the Federal Reserve, the military industrial complex, the sickcare industry, mega-corporate America, the moneyed interests, and the never changing government apparatchiks. The one party system is designed to give the appearance of choice, while in reality there is no difference between the policies of the two heads of one party and their candidate products. But now Donald Trump has stormed onto the scene from the reality TV world to tell the establishment – You’re Fired!!!”

Strauss and Howe wrote their prophetic tome two decades ago. [..] They did not know which events or which people would catalyze this Fourth Turning. But they knew the mood change in the country would be driven by the predictable generational alignment which occurs every eighty years. “Soon after the catalyst, a national election will produce a sweeping political realignment, as one faction or coalition capitalizes on a new public demand for decisive action. Republicans, Democrats, or perhaps a new party will decisively win the long partisan tug of war. This new regime will enthrone itself for the duration of the Crisis. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Where leaders had once been inclined to alleviate societal pressures, they will now aggravate them to command the nation’s attention. The regeneracy will be solidly under way.” – Strauss & Howe – The Fourth Turning

“This is a revolutionary moment. We must not allow them to shift the blame on to voters. This is their failure, decades in the making.”

• The Silver Lining In This Disaster: Clinton & Co Are Finally Gone (G.)

Hillary Clinton has given us back our freedom. Only such a crushing defeat could break the chains that bound us to the New Democrat elites. The defeat was the result of decades of moving the Democratic party – the party of FDR – away from what it once was and should have remained: a party that represents workers. All workers. For three decades they have kept us in line with threats of a Republican monster-president should we stay home on election day. Election day has come and passed, and many did stay home. And instead of bowing out gracefully and accepting responsibility for their defeat, they have already started blaming it largely on racist hordes of rural Americans. That explanation conveniently shifts blame away from themselves, and avoids any tough questions about where the party has failed.

In a capitalist democracy, the party of the left has one essential reason for existing: to speak for the working class. Capitalist democracies have tended towards two major parties. One, which acts in the interest of the capitalist class – the business owners, the entrepreneurs, the professionals – ensuring their efforts and the risks they took were fairly rewarded. The other party represented workers, unions and later on other groups that made up the working class, including women and oppressed minorities. This delicate balance ended in the 1990s. Many blame Reagan and Thatcher for destroying unions and unfettering corporations. I don’t. In the 1990s, a New Left arose in the English-speaking world: Bill Clinton’s New Democrats and Tony Blair’s New Labour. Instead of a balancing act, Clinton and Blair presided over an equally aggressive “new centrist” dismantling of the laws that protected workers and the poor.

[..] .. let us be as clear about this electoral defeat as possible, because the New Democratic elite will try to pin their failure, and keep their jobs, by blaming this largely on racism, sexism – and FBI director Comey. This is an extremely dangerous conclusion to draw from this election. So here is our silver lining. This is a revolutionary moment. We must not allow them to shift the blame on to voters. This is their failure, decades in the making. And their failure is our chance to regroup. To clean house in the Democratic party, to retire the old elite and to empower a new generation of FDR Democrats, who look out for the working class – the whole working class.

What happens when you think the economy means the rich.

• Disaffected Rust Belt Voters Embraced Trump. They Had No Other Hope (G.)

The industrial midwest is the vast sweep, from western Pennsylvania through eastern Iowa, that drove the American economy for nearly a century. The great industrial cities, such as Chicago and Detroit, led the way, but it spread into hundreds of small towns and cities – from the steel mills of Ohio to the auto parts factories of Michigan and Wisconsin and the appliance makers of Iowa and Illinois. This was Hillary Clinton’s blue wall, the states she had to win to become president. Of the 11 swing states that decided the election, five – Pennsylvania, Ohio, Michigan, Wisconsin and Iowa – lie in this battered old industrial heartland. If, as expected, Trump’s lead in Michigan holds, she lost them all. How did it happen? There are many reasons. The Clinton team barely campaigned there and in Wisconsin until it was too late.

Misogyny played a role. So did Clinton’s personal unpopularity and the relatively low turnout. But the real reason is that the industrial era created this region and gave a good middle-class way of life to the people who worked there. That economy began to vanish 40 years ago, moving first to the sun belt and then Mexico, before finally China. The good jobs that were left increasingly went to robots. Factories closed. So did the stores and bars and schools around them. The brightest kids fled to universities and then to the cities – to New York or Chicago or the state capital. Those left behind worked two or three non-union jobs just to stay afloat. Families broke up. Drug use increased. Life spans shortened. And nobody seemed to care – until Trump. But does he really? Who knows? He said he did.

His tirades – against trade, against elites, against Obamacare, against immigrants, against the Clintons – sounded like unhinged rants in cities and on campuses, which never took him seriously. In the old industrial zones and withering farm towns, he echoed their own resentments. Mitt Romney couldn’t do this; neither could John McCain. But Trump did, and so they embraced him. Why was this such a surprise? It’s impossible to overstate the alienation between the two Americas, between the global citizens and the global left-behinds, between the great cities that run the nation’s economy and media, and the hinterland that feels not only cheated but, worse, disrespected.

Tsipras goes from one blunder to the next. Still, as long as he’s there, the streets are quiet, amazingly quiet for a society that’s under such economic fire. But he is soon going to be voted out in favor of someone, anyone, who will then see things get much worse in the streets. A smouldering powder keg.

• Tsipras Ready To Give In On Labor Reform To Ensure Debt Relief (Kath.)

Prime Minister Alexis Tsipras is prepared to make further concessions to Greece’s creditors in tough negotiations that are currently under way to ensure that there is no delay in launching crucial talks on relief for the country’s debt burden, Kathimerini understands. According to sources, Tsipras and his key ministers are ready to give in to calls by foreign auditors for more flexibility in the crucial area of labor laws. The government has already agreed to put off its demands for the restoration of collective wage bargaining, a key pledge of leftist SYRIZA before it came to power last year. It is unclear to what degree the Greek side is willing to concede on other issues – such as calls by foreign officials for facilitating mass layoffs for struggling employers and making it harder for unions to call strikes.

A source at the Labor Ministry said over the weekend that the Greek side has submitted its proposals for changes to labor laws and is awaiting the reaction of foreign officials. Tsipras is said to be set on a strategy of withdrawal despite the risks. The key danger is that cohesion in the ranks of leftist SYRIZA, which has already been tested by a series of concessions to foreign creditors, is further compromised, weakening the beleaguered coalition. The other risk is that the further concessions may boost the lead of conservative New Democracy over SYRIZA in opinion polls, which is already significant, thereby enhancing the sense that SYRIZA’s coalition with the right-wing Independent Greeks is on its way out.