William Henry Jackson Hand cart carry, Adirondacks, New York 1902

Mayhem foretold.

• European Union Predicts 3 Million More Refugees By End Of Next Year (WaPo)

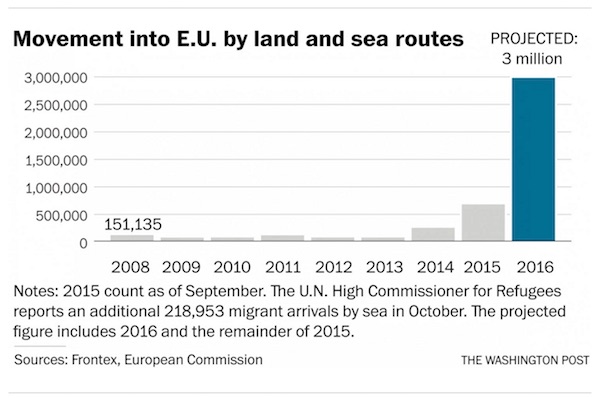

The European Union predicted Thursday that up to 3 million additional asylum seekers could enter the 28-member bloc by the end of next year, suggesting the staggering pace of new arrivals in recent months shows no sign of abating. The forecast, buried in a 204-page report on the future of the European economy, will add to an already burning debate in Europe about whether the continent can handle the influx, which has broken all modern records. So far this year, more than 760,000 people have entered the continent seeking refuge or jobs, according to the U.N.’s refugee agency. The new arrivals have badly strained government resources in countries all along the trail, which leads from the Mediterranean Sea in the south to richer nations in Europe’s north.

One of the more affluent countries, Sweden, said Thursday that it would apply for emergency E.U. aid, an admission that it is failing to cope. Sweden, which has taken the largest per capita share of refugees of any E.U. country, is expecting 190,000 asylum seekers this year — double its previous record. “The major problem today is that the number of asylum seekers is growing faster than we can arrange for accommodation,” Morgan Johansson, the minister for justice and migration, told reporters. “Sweden can no longer guarantee accommodation to everyone who comes. Those who are arriving could be met with the news that there isn’t anywhere to stay.” [..] Despite the unprecedented scale of the flows, the overall population of the European Union was forecast to rise only 0.4% as a result of the influx.

In a separate forecast, the U.N. High Commissioner for Refugees said it predicted that an average of up to 5,000 migrants a day would travel from Turkey to Greece over the next four months. That would mark a substantial departure from the migrant travel patterns in previous years, when winter’s harsh weather vastly reduced the numbers. The refugee agency appealed for nearly $100 million to winterize tents and sanitation systems while it warned of more deaths among refugees if adequate measures are not taken. Peter Sutherland, the U.N. secretary general’s special representative on migration issues, told the BBC that there was no sign that the flow of migrants was diminishing, despite a rising death toll from rougher autumn seas. He called for Europe to take collective action to deal with the crisis. “This is now a global responsibility, but it is a particular European responsibility”, he said. “And in Europe we can’t say simply that those who are the closest to the problem, and therefore receive most of the migrants, have to handle it themselves”.

At 5,000 a day, you don’t get to 3 million. Actually, you get to 1,825 million.

• UN Expects Daily Refugee Flow Of 5,000 To Europe This Winter (Reuters)

Refugees and migrants are likely to continue to arrive in Europe at a rate of up to 5,000 per day via Turkey this winter, the United Nations said on Thursday, appealing for more funds to avert tragedy in Greece and the Balkans in coming months. More than 760,000 people have already crossed the Mediterranean so far this year, mainly to Greece and Italy, after fleeing wars in Syria, Afghanistan and Iraq, as well as conflicts in Eritrea and other parts of Africa. “Harsh weather conditions in the region are likely to exacerbate the suffering of the thousands of refugees and migrants landing in Greece and travelling through the Balkans, and may result in further loss of life if adequate measures are not taken urgently,” the U.N. High Commissioner for Refugees (UNHCR) said.

“UNHCR’s new winter plan anticipates that there could be up to 5,000 arrivals per day from Turkey between November 2015 and February 2016,” it said. The agency is seeking an additional $96.15 million to support Croatia, Greece, Serbia, Slovenia and the former Republic of Macedonia, bringing the total amount that it is trying to raise for Europe’s refugee crisis to $172.7 million. The fresh funds will be used to upgrade shelter and reception facilities for winter conditions, and to supply family tents and housing units equipped with heating, the statement said. Sanitation and water supply systems will also be improved. “Winter clothing and blankets, as well as other essential items for protecting people from the elements, will be included in the aid packages to be distributed to individuals with specific needs,” it said.

He should be much more vocal on this.

• From Lesvos, Tsipras Says Greece Cannot Cope With Refugees (Reuters)

Greece’s prime minister conceded on Thursday that the country was unable to cope with the thousands of migrants arriving daily on its shores, just days after saying that he was shamed by Europe’s handling of the crisis. Alexis Tsipras was visiting Lesvos the Greek island which has received the bulk of arrivals and where aid groups condemned living conditions for refugees as dire. ”I think we are battling something which is beyond our abilities, and everyone should understand that,” he said, on a visit to a packed migrant registration center with Martin Schulz, head of the European Parliament. Cash-strapped Greece has been struggling to handle an influx of hundreds of thousands of migrants fleeing from war and hardship in the Middle East. Aid organisations estimate more than 601,000 have entered Europe through Greece this year.

With at least 430 people having died this year trying to make the short sea crossing along Greece’s border with Turkey, Tsipras said it was “imperative” to reach a deal with Ankara to stem the flow. About 15,000 refugees and migrants were effectively stranded on Lesvos on Thursday because a ferry strike had stopped reception centres forwarding arrivals onto the Greek mainland. “It’s an asphyxiating situation,” Tsipras said. International aid agency IRC, which has a unit on Lesbos, said conditions at one main centre were unacceptable and that Greece had struggled for years to cope with far fewer migrants. At Moria, an army camp converted into a refugee centre, Schulz and Tsipras got a taste of some of the frustration. “We are here three days. We are hungry. I have two children, my children are sick,” one man shouted at Tsipras.

Tsipras patted his arm. “We will do our best.” The United Nations refugee agency UNHCR launched a new funding appeal on Thursday, saying it needed $96.15 million in additional support for Greece and affected Balkan countries. Greece has had €5.9 million in EU aid so far this year. UNHCR forecasts up to 5,000 arrivals per day from Turkey between now and February. With a recent bout of bad weather, people smugglers have started offering discounts on journeys with flimsy inflatables and charging more for trips on boats. “We were unfortunate enough to see an improvised dinghy as we were heading in, full of refugees,” Tsipras said. “It’s criminal.” ”It is imperative that we reach an agreement with Turkey to stop the flows by targeting the smugglers.”

Far too late, and wrong meeting. What’s needed is something much higher up: UN.

• Tsipras To Hold Emergency Meeting On Refugees With Mayors And Governors (AP)

Greek Prime Minister Alexis Tsipras has invited mayors of eastern Aegean islands bearing the brunt of the current refugee influx to Athens for an emergency meeting on how to deal with the crisis. The meeting, scheduled for midday Friday, was also to be attended by the north and south Aegean regional governors as well as mayors and religious officials from the islands of Lesvos, Samos, Kos, Leros and Chios, and government officials.

Greece is the main gateway into the European Union for hundreds of thousands of people fleeing war and poverty at home. The vast majority arrive after a short but dangerous sea journey to Greek islands from the nearby Turkish coast and then head to the mainland and on to more prosperous northern EU countries through the Balkans. Hundreds have drowned, including many children, when their overcrowded and unseaworthy boats have sunk or capsized.

“Before the war, Syria had a population of 23ml, it was a middle income country and had one of the best education systems in the Arab world with 90% literacy rate. Today, more than half, 12.5ml people cannot survive without humanitarian aid..”

• A Hand in the Water is not Like a Hand in the Fire (Press Project)

The number of internally displaced people in Syria is estimated at 7.6ml while the number of those who fled to neighboring countries; Turkey, Lebanon, Jordan and Iraq is more that 4ml. Before the war, Syria had a population of 23ml, it was a middle income country and had one of the best education systems in the Arab world with 90% literacy rate. Today, more than half, 12.5ml people cannot survive without humanitarian aid. 50% of the children no longer attends school, half of the population has no access to running water and electricity-not simply because they have no money to pay for it but, mostly, because the war has destroyed 50% of the water and electricity infrastructure. Syria used to host 12 refugee camps which accommodated 560.000 Palestinians.

Today, after the war, 450.000 Palestinians are still in the country, scattered everywhere. Jordan closed its borders to Palestinians from Syria at the beginning of the war while Lebanon did the same on May, 2015. In all, 80.000 Palestinians from Syria have found refuge in Turkey, Lebanon, Jordan, and Egypt hoping to be able to cross over to Europe. Almost all of them fear extradition back to Syria due to their particular circumstances. As expected, the first Syrian refugees fled to the neighboring countries; Jordan, Lebanon, Turkey and, in smaller numbers, Iraq and Egypt. The Syrians who chose to move to those countries usually did it because they could not pay the trafficker’s fees for a passage to Europe- during the first years the prices were three times higher than today. Another reason was that some of them believed that the war would not last long and they would be able to return to their country relatively soon.

As Rome burns and babies drown…

• Merkel Hit By Refugee Crisis Setback As Berlin Drops Transit Zones Plan (Guar.)

Angela Merkel has suffered a setback in her attempt to stabilise the influx of refugees into Germany by setting up “transit zones” on the border with Austria. The zones, denounced as detention camps by the Social Democrats (SPD), the German chancellor’s junior coalition partner, were rejected at crisis talks in Berlin on Thursday. Instead, her government announced it would establish up to five reception centres inside Germany for the swifter processing of asylum claims and the prompt deportation of those with little chance of obtaining refugee status, mainly people from the Balkans. Merkel’s climbdown came as the European commission predicted the arrival of up to 3 million people in the EU by 2017.

The Berlin agreement – reached at crisis talks between Merkel’s Christian Democrats, its Bavarian sister party, the Christian Social Union, and the SPD – represented an unusual defeat for the centre-right and a victory for Sigmar Gabriel, the SPD leader and vice-chancellor. The German interior ministry indicated the massive scale of the movement of people towards Germany this year when it supplied the latest figures on Thursday for registered refugees – 758,000, a record-breaking figure that suggests the number will exceed 1 million this year. They mainly came from Syria and Iraq, Afghanistan, Albania and Kosovo. The migrants from the latter two places are likely to be deported promptly under the tighter regime Merkel is trying to create while remaining open to those viewed as bona fide refugees.

The Merkel’s climbdown on transit zones came as the EU prepares for a crucial week of summitry devoted for the fifth time in a matter of months to the migration emergency. EU interior and justice ministers are to meet on Monday to ponder their options amid growing evidence that their governments are failing to come up with coherent policies or to come good on repeated pledges of money, resources and refugee-sharing by quotas.

Economic models on 3 million extra refugees are completelyt useless: nobody has a clue.

• The Economic Impact of the European Refugee Crisis (Atlantic)

Three million refugees and migrants could arrive in Europe by the end of 2017, the European Commission says in its economic forecast for the fall of 2015. The report says the newcomers will have a relatively small economic impact in the medium term, with GDP rising between 0.2% and 0.3% above the baseline by 2020. But, the EC notes, that could vary by country with destination countries such as Germany seeing a more significant impact than transit countries. Here’s more:

“The impact from higher public spending and a larger labour force with a skillset similar to the existing one in the EU is expected to: “contribute to a small increase in the level of GDP this year and next, compared to a baseline scenario, rising to about 0.25% by 2017”. This however is less than the rise in the underlying population, implying a small, negative impact on GDP per capita throughout the period; and “strengthening the outlook for employment (which is expected to improve gradually to about 0.3% more employed persons by 2017), in part from a wage response.”

The EC reports points out that, typically, non-EU migrants typically receive less in individual benefits than they contribute in taxes and social contributions. And their employment is the most important factor of net fiscal contribution. The influx excluding failed asylum applications will increase the EU’s population by 0.4%, the forecast says. The report further says:

“For Member States with an ageing population and shrinking workforce, migration can alter the age distribution in a way that may strengthen fiscal sustainability yet, if the human potential is not used well, the inflow can also weaken fiscal sustainability. Moreover, while migration flows can partly offset unfavourable demographic developments, earlier studies have shown that immigration could not on its own solve the problems linked to ageing in the EU.”

Economic models examining the integration of 3 million extra people over the next two years notwithstanding, Europe is deeply divided over how to handle the most severe refugee crisis since World War II. More than 760,000 refugees and migrants have entered the EU in the first nine months of this year, but the bloc has only agreed on relocating 160,000 of them. Of these, as we reported Wednesday, 116 have been sent to their new homes. About 1.2 million people have sought asylum in the EU since the start of 2014. Many of them are people fleeing the Syrian civil war, and unrest in Afghanistan, Iraq, Eritrea, and elsewhere. Others, however, are economic migrants, and will likely be turned away by Europe.

The ECB should not be buying a single piece of paper.

• Is Europe’s Economy So Bad the ECB Will Run Out of Things to Buy? (Bloomberg)

With European Central Bank President Mario Draghi hinting at further easing by the central bank next month, markets are busy trying to work out whether the next move will be to lower deposit rates even further into negative territory or ramp up asset purchases. Or perhaps both. The terms of the ECB’s quantitative easing, or QE, program mean that it theoretically has a fixed universe of assets to purchase – a limit that could be hit earlier than its intended September 2016 deadline if the bank substantially increases the size of its purchases. Under its current rate of €60 billion a month, the ECB should be more than capable of purchasing the 893 billion euros of agency and government bonds with yields above the deposit rate planned through next September.

However, if the rate of purchases is ramped up then it could come close to running out of available assets, according to Bloomberg Intelligence economist David Powell. Instead, he said, the ECB could cut the deposit rate to increase the investible universe of assets, as well as significantly increasing QE purchases. “BI Economics calculates that a decline in bond yields of 25 basis points across the curve would shrink the universe of bonds to €1.3 trillion,” he said. “In that instance, a cut to the deposit rate would be required to implement asset purchases of €90 billion much beyond September 2016 – the total through September would be roughly €1.2 trillion of overall purchases of agency and government bonds.”

Rather than relying on a rate cut to free up assets, the ECB could simply shift the mix of purchases to agency debt, corporate debt, or even debt from other countries. In December last year, Draghi directly addressed the issue of eligible assets under the ECB’s QE program. Asked whether the board had discussed buying gold or U.S. Treasuries, he replied: “On what sort of assets should be included in QE, my sense and recollection is that we discussed all assets, but gold.” In other words, asset scarcity should not be a problem. However, lowering the deposit rate might be.

Only blatant nonsense spouts from Brussels. Europe is toast.

• EU Cuts Growth and Inflation Outlook as ECB Decision Looms (Bloomberg)

The European Commission cut its euro-area growth and inflation outlook for next year, citing more challenging global conditions and fading impetus from lower oil prices and a weaker euro. GDP in the 19-nation bloc is set to grow 1.8% in 2016, down from a previous projection of 1.9% in May, the Commission said in its autumn forecast published Thursday. Inflation is seen accelerating to 1.6% in 2017 from 0.1% this year. The economic recovery in the 19-nation region is resting on unprecedented stimulus by the European Central Bank. With a slowdown in emerging markets weighing on global trade, risks have increased that growth won’t be strong enough to sustain the decline in unemployment and bring inflation back in line with the ECB’s goal of just below 2%.

“Today’s economic forecast shows the euro-area economy continuing its moderate recovery,” Valdis Dombrovskis, vice president of the European Commission, said in a statement. “Sustaining and strengthening the recovery requires taking advantage of” temporary tailwinds including “low oil prices, a weaker euro exchange rate and the ECB’s accommodative monetary policy,” he said. While noting that the recovery has proved to be resilient to external shocks so far, uncertainty surrounding the economic outlook shows few signs of abating. Risks include a larger-than-anticipated slowdown in China and financial-market volatility triggered by a normalization of U.S. monetary policy, according to the report.

In Germany, factory orders dropped 2.8% in the third quarter from the previous one amid a slump in demand from outside the euro area, the Economy Ministry in Berlin said in a separate release on Thursday. Orders from within the country and the currency bloc are still supporting manufacturing, it said. The Commission upgraded its euro-area growth forecast for this year 1.6%, from a previous estimate of 1.5%. Output should accelerate to 1.9% in 2017, it said. Breaking down growth components, the Commission predicts domestic demand will pick up this year and continue to maintain its momentum over the near term, supported by a boost to nominal income, purchasing power and improving labor-market conditions.

Meanwhile, investment is forecast to strengthen “gradually,” albeit at a lower pace than in past recoveries, pointing to subdued demand expectations, credit-supply constraints and persistent corporate deleveraging pressures. Reacting to the report, EU Commissioner for Economic and Financial Affairs Pierre Moscovici said the recovery “remains on course,” but warned improvement is still unevenly spread across the euro area and major challenges remain going into next year. “These require bold and determined policy responses in 2016, especially in the face of an uncertain global outlook,” he said in a statement.

Cutting spending in a contracting economy. Who still thinks Greece is better off inside the EU?

• Brussels Demands More Austerity ‘Measures’ In Greece (Kath.)

The European Commission expects the recession that returned to Greece this year to continue into 2016 and is calling on the government to immediately draw up additional measures for 2017. Along with the release of its fall forecasts on Thursday, Brussels also criticized Athens for reversing the positive momentum recorded in the economy last year, which is attributed to the renewed uncertainty during 2015 and the introduction of capital controls. The Commission expects the Greek economy to contract 1.4% this year and 1.3% in 2016, before rebounding by 2.7% in 2017.

It blamed the loss of the 2014 momentum on the uncertainty created by the unsuccessful completion of the second bailout program, the referendum called by Prime Minister Alexis Tsipras in July, the three-week bank holiday and the capital controls, which came into effect on June 28. Despite the above constraints, the Greek economy expanded 1% in the first half of the year, although this was due to the rise in consumption as Greeks feared for their incomes and savings. It further reflected the decline in imports, while the very positive course of tourism for a second year in a row also helped. In the current second half of the year, Brussels believes that the Greek economy is burdened by the great volume of tax obligations that have to be paid out by the end of the year, the wait-and-see attitude of investors and the lack of credibility in the economy.

The Commission hopes that the stabilization of the credit sector after a successful recapitalization, the recovery of confidence and the return of investors through the privatizations program could lead the economy back to growth in the latter half of next year. It stressed that the application of the agreed reforms is key to a Greek recovery. Regarding the necessary primary budget surplus, the Commission says that besides the measures for 2015-17 already taken, amounting to 4% of gross domestic product, the government should take extra measures adding up to another 1.75% of GDP for 2017.

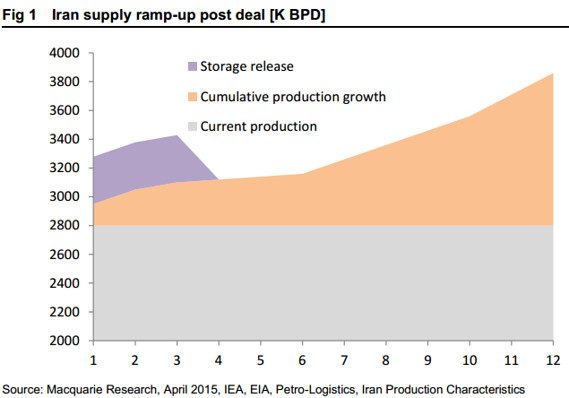

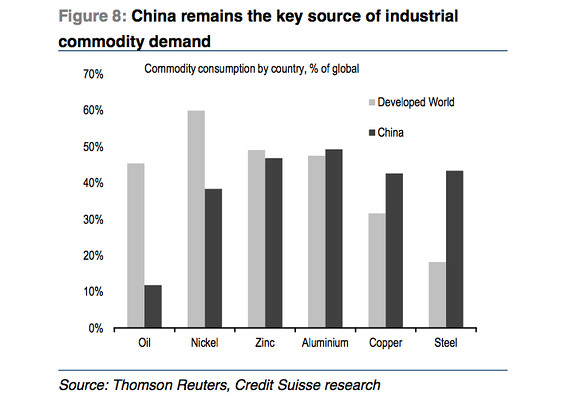

“Imports into China – mostly raw materials – are dropping at a double-digit rate. Exports are rolling over, too. There is nothing like easy money to cause people to make mistakes. Americans overspent. China overproduced. Now, Americans can’t step up their buying (they owe too much already)… and China has too much capacity.”

• How China Broke the World’s ‘Bubble Machine’ (Bonner)

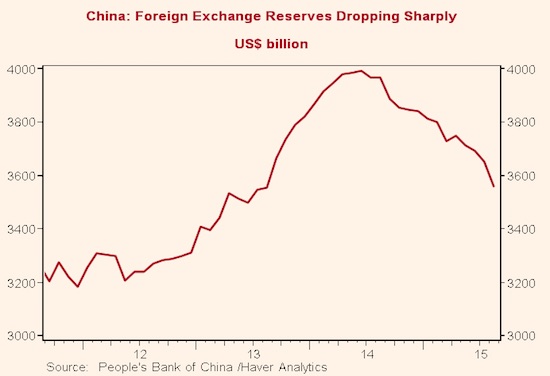

Here’s how it worked: Once the world’s money lost its golden anchor in 1971, things got a little funny. Americans spent money they never earned and never saved – dollars created “out of nothing” with nothing more than keystrokes on a computer. Much of this new money went overseas, where foreign nations – notably China – had to print their own currency to keep up with it. But you’ve heard this story before. China makes. The U.S. takes. In the process, a glut of dollars ends up in the hands of the Chinese feds as foreign exchange reserves. The buildup of these reserves is both the cause and the measure of the globalized boom the world has enjoyed since the early 1980s. As Americans bought more goods from China than they sold to China, they sent more dollars to the Middle Kingdom.

These dollars boosted the world’s money supply… and set heads a’spinning, wheels a’turning, and chimneys a’smokin’. China (and other countries) filled the orders and banked the dollar sales. Of course, you can’t easily spend dollars in China. So the Chinese central bank, the People’s Bank of China (PBoC) exchanged merchants’ and manufacturers’ dollars for renminbi at a fixed rate (otherwise, the demand for renminbi would push up its exchange value – something the Chinese have been keen to avoid). This left the PBoC with lots of dollars. What could it do with its stash? Buy U.S. Treasury bonds! As China recycled its export dollars into U.S. government debt, it lowered U.S. interest rates and increased the amount of money bidding for U.S. financial assets.

That – roughly – is how we got to where we are today. China’s supply of foreign currency reserves rose from zero in 1979 to $4 trillion in 2014. Worldwide, reserves grew by $12 trillion. Here, you can easily see the difference between this new credit-based system and the gold-backed system it replaced. You could never add $12 trillion to the world’s money supply in the same way if it was linked to gold. All the gold ever mined has a present value of only about $6 trillion. This big increase in the global money supply was what set off the booms and bubbles of the last 35 years. But now, what’s this? The bubble machine is broken? The PBoC is no longer adding to its dollar reserves. Instead, it is offloading them. About $400 billion has been clipped from China’s foreign exchange reserves since 2014.

This drop is a big change for China… and for the world’s financial system. Imports into China – mostly raw materials – are dropping at a double-digit rate. Exports are rolling over, too. There is nothing like easy money to cause people to make mistakes. Americans overspent. China overproduced. Now, Americans can’t step up their buying (they owe too much already)… and China has too much capacity. China’s growth, by the way, has been heavily concentrated on building factories and infrastructure – capital investment. China spent $4.3 trillion on fixed capital investment in 2013 – 10 times more than in 2000. But when you produce too much already, building more factories only makes the situation worse. Prices fall; on a year-over-year basis, producer prices in China haven fallen every month for the last three and half years.

Steve comes in at 13 minutes+.

• The Valeant Scandal and Steve Keen on China and Portugal (RT)

The European Union cuts its Eurozone growth forecast for 2016. Despite this being the third year of consecutive growth for the European Union, growth is slow and will slow even further. Ameera David weighs in. Ameera also highlights a new smart Gmail feature that will be able to scan your email and offer quick replies. Then, Ameera and RT correspondent Manuel Rapalo update their earlier discussion on Airbnb’s fight in to stay legal in San Francisco and discuss Expedia’s $3.9 billion deal to buy Airbnb competitor HomeAway. Afterwards, Paul Craig Roberts gives us his take on the elimination of two popular social security claiming measures, part of his interview with Boom Bust’s Bianca Facchinei that will air Friday.

After the break, Boom Bust’s Edward Harrison sits down with Steve Keen, head of economics, history, and politics at Kingston University to get his thoughts on the path forward for China, emerging markets, and the global economy, as well as to assess whether politics in Portugal are radicalizing. And in The Big Deal, Ameera and Edward Harrison talk about the scandal surrounding former stock darling Valeant Pharmaceuticals.

Casino.

• China’s Stock-Market Bulls Are Back, But Where Are the Earnings? (Bloomberg)

Hao Hong has seen this movie before, and it didn’t end well for China’s stock-market bulls. Five months after an equity boom built on weak corporate profits turned into a $5 trillion crash, a similar scenario is playing out in China today. The benchmark Shanghai Composite Index has surged 20% from its Aug. 26 low, despite third-quarter profits that trailed analyst estimates at 68% of companies in the index, the eighth straight quarter of disappointing results. The absence of a rebound in earnings is one reason why Hong at Bocom International says the latest surge in stocks is a “bear market rally.” Foreign investors seem to agree: they’ve been selling mainland equities through the Shanghai-Hong Kong exchange link for four straight weeks, cutting holdings by the most in two months on Thursday.

“It’s very difficult to see this rally sustaining without an earnings recovery,” said Tony Chu at RS Investment. Foreign investors “don’t have a very strong medium-to-longer-term view.” The rally in China follows an unprecedented government campaign to prop up share prices, along with increased monetary stimulus to combat the deepest economic slowdown in 25 years. The official support has helped revive confidence among local investors, spurring a pick-up in trading activity and sending the Shanghai Composite to an 11-week high on Thursday. The $1.6 trillion recovery in Chinese share prices is also boosting valuations as earnings shrink. Trailing 12-month profits at Shanghai Composite companies have dropped 10% so far this year, leaving the index with a price-to-earnings ratio of 18. While that’s still below the multiple of 25 reached at the height of the boom in June, it’s about 38% more expensive than the five-year average.

From bonds to stocks and back?

• China’s Bonds Set for Worst Week Since May as PBOC Seen on Hold (Bloomberg)

China’s 10-year sovereign bonds headed for the biggest weekly drop in five months on speculation investors are taking profits amid signs the central bank is done cutting borrowing costs for now. The People’s Bank of China has lowered benchmark deposit and lending rates six times since November and reduced lenders’ reserve ratios in an attempt to spur a slowing economy. The monetary authority will leave its policy rates unchanged through the end of next year, a Bloomberg survey showed last week. China’s local-currency sovereign debt rallied for five months through October and the 10-year yield fell to a six-year low last week. The yield on the notes due October 2025 climbed six basis points from Oct. 30 and two basis points on Friday to 3.14% as of 10 a.m. in Shanghai, according to National Interbank Funding Center prices.

That’s the biggest weekly increase for a benchmark of that maturity since May. “Profit-taking will probably continue to be the theme through to the end of the year, especially for active traders,” said Qu Qing at Huachuang Securities. “Given the slide in yields earlier, this may not be a good time to enter the market.” The cost of one-year interest-rate swaps, the fixed payment to receive the floating seven-day repurchase rate, rose three basis points this week to 2.35% and declined one basis point on Friday. The seven-day repo rate, a gauge of interbank funding availability, fell four basis points from Oct. 30 and three basis points on Friday to 2.26%, a weighted average from the National Interbank Funding Center shows.

What we have said for almost ten years now.

• Monetary Bazookas Or Not, “Global Crisis Is Inevitable” (Saxobank)

Until recently, the consensus assumed a strengthening of the global economy in 2016. It won’t happen. If the global economic growth manages to reach 3.1% next year, as forecast by the IMF, it will be a miracle. We haven’t realised that the global economic recovery is already here for over six years. This recovery phase is weaker than previous ones and much more disparate. Since the onset of the global financial crisis in 2007, the potential growth rate has been much lower everywhere: from 3% to 2% for the US, from 9.4% to 7.20% for China and from over 5% to below 4% for Poland. Many regions, such as the euro area, have remained on the sidelines and experienced stalling economic growth. Over the last two decades, economic cycles have been shortened due to the financialization of the economy, trade globalization, deregulation and the acceleration of innovation cycles.

Since the 1990s, the US went through three recessions: in 1991, 2001 and 2009. It is erroneous to believe that the recovery has just begun. We are close to the end of the current economic cycle. The outbreak of a new global crisis in the coming years is inevitable. The lack of economic momentum next year and short periods of deflation related to falling oil prices will certainly push central banks to pursue their disastrous “extend-and-pretend” strategy which will increase the price of financial assets and global debt. The ECB could push further interest rates into negative territory and could increase or lengthen the purchase program. Several options are on the table: the central bank could drop the 25% purchase limit on sovereign bonds with AAA rating or could add a program to help the corporate bond market.

Following the same path, China could take out the monetary bazooka in the first half of 2016 by launching its own version of QE-style bond buys. Along with a dovish monetary policy, China could implement a massive Keynesian stimulus programme, relying on the already-expected bond issue plan which could raise 1 billion yuan. This move could temporarily reassure world markets. The only central bank that has a leeway to hike rates is the US Federal Reserve. 52% of investors expect a tightening of US monetary policy in December. However, the speed and magnitude of tightening will remain low. It is unlikely the rates will be back anytime soon to where they were before the global financial crisis. Too high interest rates could cause a myriad of bankruptcies in heavily indebted industries, such as the shale oil sector in the US.

The Fed and other central banks are in a dead-end having fallen in the same trap as the Bank of Japan. If they increase rates too much, they will precipitate another financial crisis. It is impossible to stop the accommodative monetary policy.

Let’s get rid of the absurd idea that central banks can control economies. Not even the Soviet Union succeeded in that.

• Deflation Risks May Warrant Radical New Central-Bank Thinking: IMF (WSJ)

The Bank of Japan and other central banks around the world may need to try radical new easy-money policies to stave off the rising specter of deflation and revive sickly economic prospects, the IMF’s new chief economist warns. “I worry about deflation globally,” new IMF Economic Counselor Maurice Obstfeld said in an interview ahead of an annual IMF research conference that focuses this year on unconventional monetary policies and exchange rate regimes. “It may be time to start thinking outside the box.” Weak—and in some cases falling—price growth has plagued Japan, Europe, the U.S. and other major economies since the financial crisis. Plummeting commodity prices are exacerbating the so-called “lowflation” and deflation problems that curb investment, spending and growth.

Surveying several dozen of the largest economies around the world, Mr. Obstfeld said the number of countries experiencing low inflation is rising. Combined with slowing emerging market output, ballooning government debt and monetary policy constrained by the lower limits of interest rates, the deflation risk is fueling fears the global economy could be fast stuck into a deep low-growth mire. In the wake of the financial crisis, the Federal Reserve, the Bank of Japan and the ECB launched unprecedented easy-money stimulus programs to avert economic disaster and jumpstart growth. The Fed’s efforts have cut the unemployment rate but failed to sufficiently juice inflation. Tokyo has struggled to pull the long-listless economy out of the doldrums. And the ECB’s efforts have only narrowly avoided a triple-dip recession. Some economists argue the ECB’s actions have pumped up corporate cash reserves, but done little to boost employment or investment.

So, what would be thinking outside the box for Mr. Obstfeld? One option is a proposal by Adair Turner, a member of the Bank of England’s Financial Policy Committee, for central bankers to overtly finance increased budget stimulus with permanent increases in the money supply. By contrast, the increased money supply resulting from recent central bank bond-buying programs is meant to be temporary. In a paper prepared for the IMF conference, Mr. Turner contends Japan will be forced to use such “monetary financing” within the next five years and says the policy should become a normal central bank tool for all economies facing stagnation. Such an option would be highly provocative to fiscal hawks and those who fear giving central banks too much power, especially when many economists question both the returns and financial-turmoil side effects from existing easy-money policies.

2016 will be a very bad year for banks.

• Standard Chartered’s Shares Plunge 7% After Fitch Downgrade (Bloomberg)

Standard Chartered shares slumped in Hong Kong after Fitch Ratings downgraded the bank, citing the outlook for the lender’s profits and asset quality. The London-based bank this week unveiled plans to tap investors for $5.1 billion, eliminate thousands of jobs and cut risky assets across Asia. The bank’s shares fell as much as 7.1% Friday in Hong Kong. They were down 4.8% as of 11:30 a.m. local time, extending this year’s decline to 35%. The benchmark Hang Seng Index slipped 0.9%. Standard Chartered is now lagging behind the Bloomberg World Banks Index by the most since the gauge started in 2003. While Chief Executive Officer Bill Winters’s measures to restructure the lender and boost capital address some of Fitch’s concerns about the bank, implementing the plan could be challenging because of credit risks and high management and staff turnover, the ratings firm said in a statement.

Fitch on Thursday cut the lender’s credit rating one grade to A+ from AA-, with a negative outlook. Winters, who took over in June, on Tuesday unveiled 15,000 job losses to help save $2.9 billion by 2018, with the bank scrapping the second-half dividend. Standard Chartered will also restructure or exit $100 billion of assets and reduce its riskiest lending in Asia after loan impairments surged. The bank reported an unexpected third-quarter loss of $139 million, compared with a profit of $1.5 billion a year earlier. The bank’s impaired-loan ratios remain above its peers’ and appear to have become more volatile as a result of concentrated sector and country exposures, Fitch said. “Standard Chartered remains vulnerable to volatility from a difficult operating and regulatory environment.” The bank’s shares fell 6.3% in London on Thursday.

Apparently, the US army called the hospital prior to the attack to ask if there were any Taliban present.

• MSF Says US Planes Attacked Staff Fleeing Kunduz Hospital (Reuters)

Medical aid group Medicins Sans Frontieres (MSF) said Thursday it was hard to believe a U.S. strike on an Afghan hospital last month was a mistake, as it had reports of fleeing people being shot from an aircraft. “All the information that we’ve provided so far shows that a mistake is quite hard to understand and believe at this stage,” MSF General Director Christopher Stokes told reporters while presenting the group’s internal report on the incident. The report said many staff described “seeing people being shot, most likely from the plane” as they tried to flee the main hospital building, which was under attack by U.S. military aircraft. At least 30 people were killed when the hospital in Kunduz was hit by a powerful U.S. attack aircraft on Oct. 3 while Afghan government forces were battling to regain control of the northern city from Taliban forces who had seized it days earlier.

The United States has said the hospital was hit by accident and two separate investigations by the U.S. and NATO are underway. But the circumstances of the incident, one of the worst of its kind during the 14-year conflict, are still unclear. Stokes told reporters the organisation was still awaiting an explanation from the U.S. military. “From what we are seeing now, this action is illegal in the laws of war,” Stokes said. “There are still many unanswered questions, including who took the final decision, who gave the targeting instructions for the hospital.” Capt. Jeff Davis, a Pentagon spokesman, said MSF shared the report in advance with the U.S. Defence Department. “Since this tragic incident, we have worked closely with MSF to determine the facts surrounding it,” he said in a statement, which did not address the report’s specifics.

Exxon knew it all. But that means so did everybody else.

• Exxon Mobil Investigated for Possible Climate Change Lies (NY Times)

The New York attorney general has begun an investigation of Exxon Mobil to determine whether the company lied to the public about the risks of climate change or to investors about how such risks might hurt the oil business. According to people with knowledge of the investigation, Attorney General Eric T. Schneiderman issued a subpoena Wednesday evening to Exxon Mobil, demanding extensive financial records, emails and other documents. The investigation focuses on whether statements the company made to investors about climate risks as recently as this year were consistent with the company’s own long-running scientific research.

The people said the inquiry would include a period of at least a decade during which Exxon Mobil funded outside groups that sought to undermine climate science, even as its in-house scientists were outlining the potential consequences — and uncertainties — to company executives. Kenneth P. Cohen, vice president for public affairs at Exxon Mobil, said on Thursday that the company had received the subpoena and was still deciding how to respond. “We unequivocally reject the allegations that Exxon Mobil has suppressed climate change research,” Mr. Cohen said, adding that the company had funded mainstream climate science since the 1970s, had published dozens of scientific papers on the topic and had disclosed climate risks to investors.

Mr. Schneiderman’s decision to scrutinize the fossil fuel companies may well open a new legal front in the climate change battle. The people with knowledge of the New York case also said on Thursday that, in a separate inquiry, Peabody Energy, the nation’s largest coal producer, had been under investigation by the attorney general for two years over whether it properly disclosed financial risks related to climate change. That investigation was not previously reported, and has not resulted in any charges or other legal action against Peabody. Vic Svec, a Peabody senior vice president, said in a statement, “Peabody continues to work with the New York attorney general’s office regarding our disclosures, which have evolved over the years.”

Here’s the only safe bet: nothing will happen that costs too much money.

• World Only Half Way To Meeting Emissions Target With Current Pledges (Guardian)

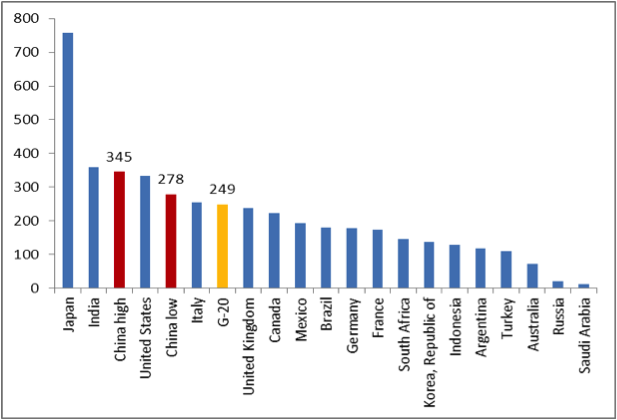

Current global efforts to cut greenhouse gas emissions leave about half of the reductions needed still to be found, according to a new analysis by the UN. The report suggests that governments will have to go much further in their pledges to limit future carbon dioxide emissions, which have been submitted to the UN ahead of the crunch conference on climate change taking place this December in Paris. Ways for governments to ramp up their commitments in future are one of the key components of the Paris talks. The UN Environment Programme (Unep) published a report showing that global emissions levels should not exceed 48 gigatonnes (GT) of carbon dioxide equivalent by 2025, and 42 GT in 2030, if the world is to have a good chance of holding global warming to no more than 2C on average above pre-industrial temperatures.

The 2C threshold is regarded by scientists as the limit of safety, beyond which the ravages of climate change – such as droughts, floods, heatwaves and sea level rises – are likely to become catastrophic and irreversible. But current pledges, known as Intended Nationally Determined Contributions (INDCs), are likely to lead to emissions of 53 to 58 GT of carbon dioxide equivalent in 2025, and between 54 and 59 GT in 2030. This means that emissions in 2030 are likely to be about 11GT lower than they would have been without the INDCs. But, according to Unep, they need to be about 12GT lower than that to give the world a two-thirds chance of avoiding more than 2C of warming. This leaves a large “emissions gap” to be made up.

Much work has gone into analysing the emissions pledges that countries have made, with branches of the UN, the International Energy Agency, the New Climate Economy group, and other independent organisations producing reports on what can be expected if the Paris pledges are fulfilled. There is broad consensus that the commitments that have so far been made are not yet adequate to meet the 2C limit. However, the commitments – which will come into force from 2020, when current international commitments on emissions, agreed at the Copenhagen summit in 2009, are scheduled to run out – represent a marked improvement on “business as usual”. The IEA has calculated that, if followed through, the emission plans would result in the growth of emissions from the energy sector slowing to near zero by the end of the next decade.

This would not be enough to meet scientific advice, but would be a remarkable reversal of the near-relentless upward trend of greenhouse gas emissions in modern times. Other analyses, endorsed by the UN, have suggested that warming would be limited to about 2.7C to 3C by the end of this century, under the current INDCs. While this would still not satisfy scientific advice, it would put the world on a much better footing than it is at present, as on current trends warming would reach as much as 5C above pre-industrial levels by 2100.