Pablo Picasso Sleeping peasants 1919

“We are the first generation to know we are destroying the planet and the last to be able to do anything about it”

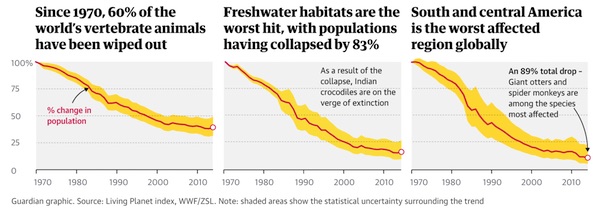

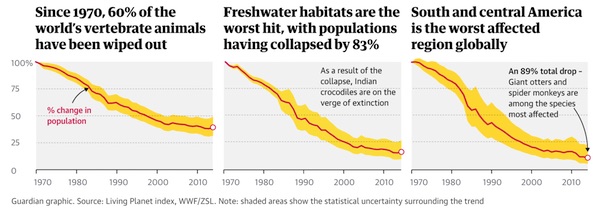

• Global Wildlife Populations Have Fallen By 60% Since 1970 (R.)

Global wildlife populations have fallen by 60% since 1970 as humans overuse natural resources, drive climate change and pollute the planet, a report warns. WWF has called for an ambitious “global deal” for nature and people, similar to the international Paris Agreement to tackle climate change, as the conservation charity’s new report spelled out the damage being done to the natural world. Only a quarter of the world’s land area is free from the impacts of human activity and by 2050 that will have fallen to just a tenth, the Living Planet Report 2018 says. The percentage of the world’s seabirds with plastic in their stomach is estimated to have increased from 5% in 1960 to 90% today, and the world has already lost around half its shallow water corals in just 30 years.

Overall, populations of more than 4,000 species of mammals, reptiles, birds, fish and amphibians have declined by an average of 60% between 1970 and 2014, the most recent year for which data is available. Tropical areas have seen the worst declines, with an 89% fall in populations monitored in Latin America and the Caribbean since 1970. Species which live in fresh water habitats, such as frogs and river fish, have seen global population falls of 83%, according to the living planet index by the Zoological Society of London (ZSL) which tracks the abundance of wildlife. From hedgehogs and puffins to elephants, rhinos and polar bears, wildlife is in decline, due to the loss of habitats, poaching, pollution of land and seas and rising global temperatures, the Living Planet report warns.

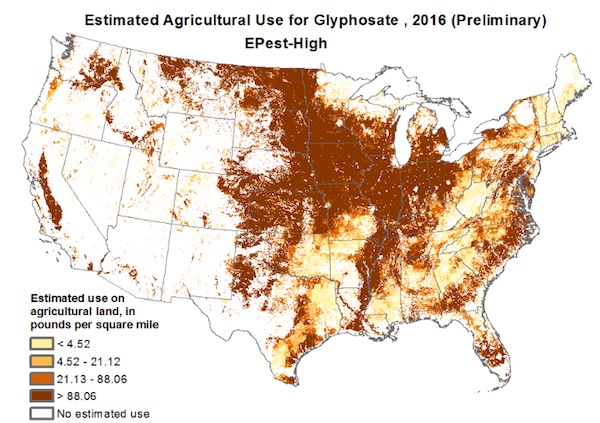

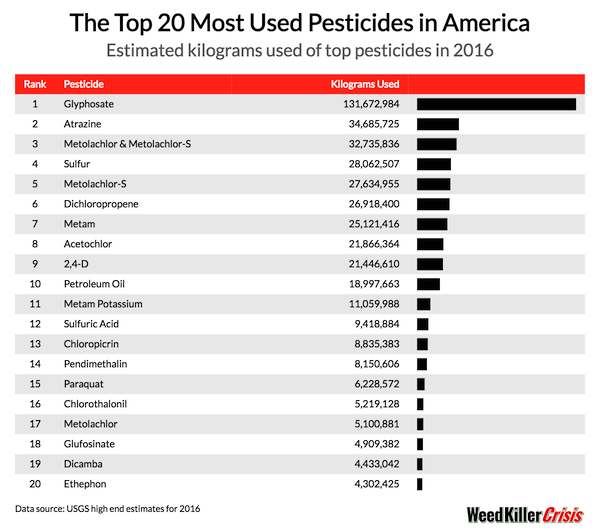

Current action to protect nature is failing because it is not enough to match the scale of the threat facing the planet, the conservationists claim. “Exploding” levels of human consumption are driving the impacts on nature, with over-exploitation of natural resources such as over-fishing, cutting down forests to grow crops such as soy and palm oil and the use of pesticides in agriculture. Climate change and plastic pollution are also significant and growing threats.

Read more …

We’re going to have to boycott trade with China because of this.

• Alarm As China Eases 25-Year Ban On Rhino And Tiger Parts (BBC)

Animal conservationists are alarmed over China’s decision to partially reverse a ban on the trade of tiger bones and rhino horn. Rhinos and tigers are both endangered in the wild and China prohibited their trade in 1993. But on Monday it said parts from captive animals would be authorised for scientific, medical and cultural use. Experts worry this will increase demand for the animals and jeopardise efforts to protect them. Rhino and tiger parts are highly valued in traditional Chinese medicine. They are prescribed to treat a large variety of ailments including fever, gout, insomnia and meningitis, thought any benefits have not been proven.

In a statement announcing the replacement of the 25-year old ban, the State Council said powdered forms of rhino horn and bones from dead tigers could be used in “qualified hospitals by qualified doctors”. The animal products can only be obtained from farms, it said. Parts from those animals classified as “antiques” could be used in cultural exchanges if approved by the cultural authorities, the statement adds. The World Wildlife Fund (WWF) said in a statement that the move would have “devastating consequences” and be an “enormous setback” to efforts to protect the animals in the wild.

Read more …

Species already living in the earth’s ‘extremes’ have nowhere to go.

• Climate Change Is ‘Escalator To Extinction’ For Mountain Birds (BBC)

Scientists have produced new evidence that climate change is driving tropical bird species who live near a mountain top to extinction. Researchers have long predicted many creatures will seek to escape a warmer world by moving towards higher ground. However, those living at the highest levels cannot go any higher, and have been forecast to decline. This study found that eight bird species that once lived near a Peruvian mountain peak have now disappeared. Researchers are particularly concerned about tropical mountain ranges and the impacts of climate change. “The tropical mountain areas are the hottest of biodiversity hotspots; they harbour more species than any other place on Earth,” lead author Dr Benjamin Freeman from the University of British Columbia told BBC News.

“It’s only got a little bit warmer in the tropics and tropical plants and animals seem to be living quite a bit higher now than they used to.” The species that live in these regions are also hugely vulnerable because the difference in temperatures between lower and higher elevations in tropical regions is not as great as it is in other parts of the world. This means that moving up the slopes may not be as much of a solution for species in the tropics as it is elsewhere. [..] scientists carried out a survey in 2017 of bird species that lived on a remote Peruvian mountain peak. The team covered the same ground, at the same time of year, and used the the same methods as a previous survey, carried out in 1985.

They found that on average, species’ ranges had shifted up the slope between the two surveys. Most of the species that had been found at the highest elevations declined significantly in both range and abundance. The researchers say that recent warming constitutes an “escalator to extinction” for some of these species with temperatures in the area increasing by almost half a degree Celsius between the two surveys. Of 16 species that were restricted to the very top of the ridge, eight had disappeared completely in the most recent survey.

A scarlet-breasted fruiteater which inhabits high elevations on the Cerro de Pantiacolla in Peru Photo: Graham Montgomery

Read more …

“We’re slated to lose 80% of the ice cover in the Rocky Mountains over the next 50 years.”

• Massive Canadian Glaciers Shrinking Rapidly (G.)

Scientists in Canada have warned that massive glaciers in the Yukon territory are shrinking even faster than would be expected from a warming climate – and bringing dramatic changes to the region. After a string of recent reports chronicling the demise of the ice fields, researchers hope that greater awareness will help the public better understand the rapid pace of climate change. The rate of warming in the north is double that of the average global temperature increase, concluded the US National Oceanic and Atmospheric Administration in its annual Arctic Report Card, which called the warming “unprecedented”. “The region is one of the hotspots for warming, which is something we’ve come to realize over the last 15 years,” said David Hik of Simon Fraser University. “The magnitude of the changes is dramatic.”

In their recent State of the Mountains report published earlier in the summer, the Canadian Alpine Club found that the Saint Elias mountains – which span British Columbia, the Yukon and Alaska – are losing ice faster than the rest of the country. Previous research found that between 1957 and 2007, the range lost 22% of its ice cover, enough to raise global seal levels by 1.1 millimetres. “When I first went to the St Elias range, it felt like time travel – into the past,” said Hik, who co-edited the report. “What we’re seeing now feels like time travel into the future. Because as the massive glaciers are retreating, they’re causing a complete reorganization of the environment.”

“We’re seeing a 20% difference in area coverage of the glaciers in Kluane national park and reserve and the rest of the Unesco world heritage site [over a 60-year period],” Diane Wilson, a field unit superintendent at Parks Canada, told the CBC. “We’ve never seen that. It’s outside the scope of normal.” In the St Elias range, researchers have found warming intensifies at higher altitudes – a phenomenon they are not quite able to explain. “These types of events aren’t isolated to glacial events in the St Elias,” said Zac Robinson, the report’s co-author and professor at the University of Alberta. “We’re slated to lose 80% of the ice cover in the Rocky Mountains over the next 50 years.”

Read more …

Take away their power.

• Fed May Have To Adjust The Way It’s Raising Rates (CNBC)

Along with an expected rate hike in December, some central bank watchers expect the Federal Reserve to approve another tweak to ensure that its current policy path, which has come under increasing pressure lately, proceeds smoothly. If the Fed is unable to manage the range where it keeps its benchmark interest rate, that could lead it to halt the unwinding of its balance sheet comprised of bonds it purchased to lower mortgage rates and stimulate the economy. The economic and market ramifications could be substantial, though there’s no indication now that the Fed is considering halting the balance sheet reduction.

The market has long been expecting the Fed to go through with a 25 basis point (0.25 percentage point) increase in its benchmark funds rate at the year’s final Federal Open Market Committee Meeting. Under normal circumstances, such a move would be accompanied by a commensurate quarter-point hike in the interest the Fed pays on excess reserves from banks, or the IOER. The current level is 2.2%, compared to the 2% to 2.25% range for the funds rate. However, the funds rate has risen near the top boundary of its range, to 2.2% to equal the IOER, and that presents a problem. The Fed uses the IOER to guide the funds rate, generally as a floor for where the funds rate should be.

The central bank manages its funds rate through the interest rate on reserves and its overnight repo facility, which also helps the Fed to set a floor on rates. This year, as government debt issuance has surged and rates have increased on the repo purchases in which the Fed has purchased, the funds rate has drifted to the upper end of its target range. Back in June, the Fed addressed the issue by raising the IOER just 20 basis points to try to push the funds rate more toward the center of the range. That worked for a few months, but the two rates have drifted closer together and on Oct. 23 met at 2.2%. The Fed has “lost control over rates” at the upper bounds of its target range, said Michael Pearce, senior U.S. economist at Capital Economics.

Read more …

Bezos lost 23% of his fortune in a month. That’s tens of billions.

• Amazon Shares Are Cratering – Down 6% Monday, 23% In The Past Month (CNBC)

Amazon shares closed down 6.3% on Monday suffered their steepest two-day tumble in more than four years, as investors continued to flee the stock following Thursday’s disappointing earnings report. The stock dropped $103.93 to $1,538.88 at the close, after losing $139.36, or 7.8%, on Friday, and is trading at its lowest price since April, down 23% over the past month. The 13.7-percent drop over two days is the biggest decline since February 2014, when the shares plummeted 14.1%. Amazon reported third-quarter revenue last week that trailed analysts’ estimates and also provided a fourth-quarter outlook that was below expectations.

The stock dragged down the Nasdaq, which closed down 1.6% on Monday. Netflix, which like Amazon has been a favored stock for tech investors in recent years, is in the midst of a hefty two-day drop, down 9%. Monday was a tumultuous day for tech stocks broadly as markets opened to the news that IBM agreed to buy cloud software distributorRed Hat for $34 billion, a 63% premium. Red Hat surged on the news, while IBM was down 4.1%.

Read more …

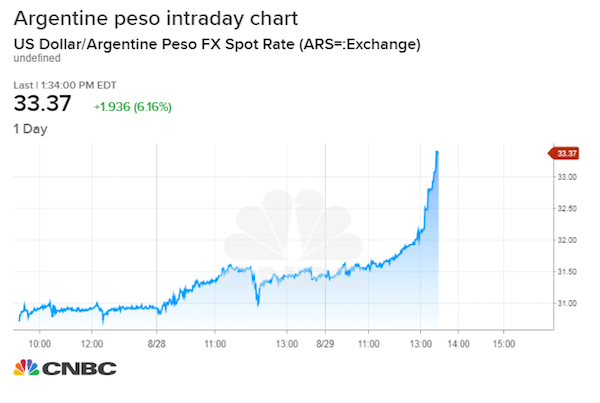

Nothing stabilizes.

• China’s Economic Slump Accelerated In October (ZH)

As corporate defaults surge, forcing a desperate PBOC to reverse its deleveraging efforts and threaten more interventions to stave off a more serious retrenchment in growth in the world’s second largest economy, it seems like not a day goes by without another warning sign that China’s economic precarious situation is even worse than we thought. The impact this has had on the mainland investors’ psyche has been obvious to all. Repeated interventions by China’s ‘National Team’ have done little to arrest the inexorable decline in mainland stocks in October, leaving the Shanghai Composite, the country’s main benchmark index, on track for one of its worst months since the financial crisis, and its worst year since 2011.

Meanwhile, a flood of FX outflows has pushed the Chinese yuan dangerously close to the 7 yuan-to-the dollar threshold which, if breached, could unleash another wave of chaos across global markets. And as Chinese policy makers are probably already scrambling to pad the official stats, Bloomberg has released its own proprietary preliminary gauge of Chinese GDP in October which showed that the slowdown unleashed by the US-China trade war worsened in October. The Bloomberg Economics gauge aggregates the earliest-available indicators on business conditions and market sentiment, and unequivocally affirmed that the Communist Party’s efforts to stabilize the country’s economy and markets – the party this month introduced a raft of measures to stabilize sentiment, including steps to boost liquidity in the financial system, new tax deductions for households and targeted measures aimed at helping exporters – haven’t been successful – at least not yet.

Read more …

Okay, well, get a deal then.

• 5 More Years Of Austerity In Event Of No-Deal Brexit – Chancellor (Ind.)

Austerity will continue for five more years if Britain crashes out of the EU with no deal, Philip Hammond signalled, in a Budget warning to MPs threatening to vote down Theresa May’s Brexit plans. The chancellor unveiled a Budget giveaway that cut income tax, announced a tax on the tech giants and conceded to pressure to help the victims of the bungled universal credit shake-up. But, most significantly, Mr Hammond made clear the prime minister’s promise that “austerity will be over” would only be met in full if Britain sidesteps economic damage from Brexit and the growing risk of leaving the EU with no agreement next March. pending would rise by 1.2% per year from next year, he announced – but immediately acknowledged the £20bn for the NHS would gobble up all the extra cash.

All other departments would only “keep pace with inflation”, a Treasury source said, before adding, tantalisingly: “If there’s a good deal, there’s an increase”. It appeared to be a clear warning to MPs that plunging Britain into the chaos and damage of a no-deal Brexit would prolong the pain of austerity for years to come. Some key departments – covering spending on the police, the courts and benefits – are still heading for cuts in day-to-day spending until 2022, the Budget book showed.

Read more …

Ain’t that curious?

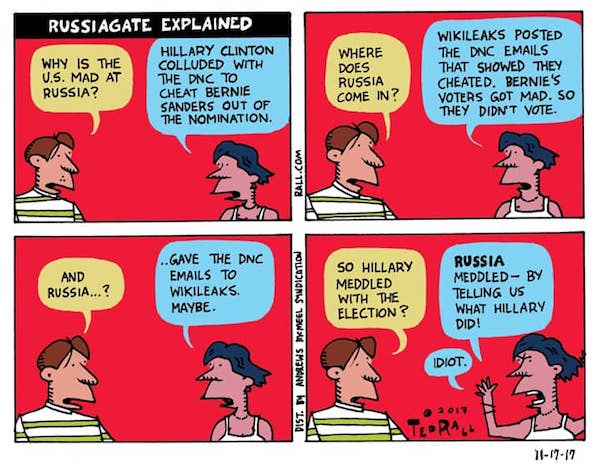

• With Just Days to the Midterms, Russiagate Is MIA (Maté)

The upcoming midterms are widely seen as a referendum on Donald Trump’s presidency, but its defining issue to date is notably MIA. “Campaign ads and debates are mostly avoiding the Russia investigation,” Politico reports, “in favor of other issues important to voters…like the economy, health care and taxes.” One study of political ads over a four-week period through mid-October found that 0.1% of ads aired in congressional races mentioned Russia; there were zero mentions of Russia in ads for Senate races.

On one level, it is unsurprising that the election has been focused on issues that impact voters’ lives, rather than the byzantine bureaucratic drama that has consumed Washington and elite media since Trump’s election. But after months of fearmongering about a sweeping Russian interference effort and a compromised, complicit president, perhaps we are also seeing the penny start to drop: Russiagate, for all its hype, has not gone as advertised.

Take the supposed Russian threat to the midterms. For months, intelligence officials and prominent media outlets have bombarded us with warnings about “a pervasive messaging campaign by Russia to try to weaken and divide the United States” (Director of National Intelligence Dan Coats), a threat so dire that we might as well dub the vote the “The Moscow Midterms” (FiveThirtyEight) and acknowledge that “we’re defenseless against Russian sabotage in the midterm elections,” (Washington Post columnist Jennifer Rubin). The New York Times informed readers in July that Coats had likened “the persistent danger of Russian cyberattacks today…to the warnings the United States had of stepped-up terror threats ahead of the Sept. 11, 2001, attacks.” “The warning lights are blinking red again,” he said.

Read more …

Pompeo didn’t want to listen b/c he didn’t want to make a statement on it: Fox

Saudi Prosecutor demanded but couldn’t get the tape: AJ

• Khashoggi Murder Tape Will Never Be Made Public: Turkish Source (MEE)

Turkey will never make its recordings of Jamal Khashoggi’s murder public, a government source told Middle East Eye, because they were made secretly and in contravention of international law. Instead, Turkey is placing the onus of officially revealing the details of the journalist’s assassination on Saudi Arabia’s Istanbul consulate on Riyadh. On Monday, as the Saudi prosecutor met with his Turkish counterpart in Istanbul, Foreign Minister Mevlut Cavusoglu called on Riyadh to release the “whole truth” behind Khashoggi’s killing. Khashoggi, a prominent Saudi journalist and critic of the kingdom’s crown prince, Mohammed bin Salman (MBS), was murdered on 2 October by a hit squad of 15 Saudis sent to kill him.

Turkish sources who have listened to the audio recording of Khashoggi’s death have told MEE that the Washington Post columnist was tortured, murdered and dismembered after entering the consulate to obtain divorce papers The existence of the audio recording of Khashoggi’s murder has long been touted as a crucial piece of evidence held by the Turkish government. However, a government source told MEE on Monday that the tape would never officially be made public because the recording was obtained through “intelligence work” and could therefore not be used as legal evidence. Diplomatic missions such as the Saudi consulate in Istanbul are protected under the Vienna Convention, meaning Turkish spying on the building would be unlawful.

Turkish President Recep Tayyip Erdogan and the United Nations’ human rights chief have both said the extreme circumstances of the Khashoggi murder should be grounds enough to strip the consulate and its workers of diplomatic immunity, in order to facilitate the best possible investigation.

Read more …

They knew and didn’t tell anyone, not even the US.

• Britain ‘Knew Of Khashoggi Plot And Begged Saudi Arabia To Abort Plans’ (Exp.)

Murdered journalist Jamal Khashoggi was about to disclose details of Saudi Arabia’s use of chemical weapons in Yemen, sources close to him said last night. The revelations come as separate intelligence sources disclosed that Britain had first been made aware of a plot a full three weeks before he walked into the Saudi consulate in Istanbul. Intercepts by GCHQ of internal communications by the kingdom’s General Intelligence Directorate revealed orders by a “member of the royal circle” to abduct the troublesome journalist and take him back to Saudi Arabia.

[..] Speaking last night the intelligence source told the Sunday Express: “We were initially made aware that something was going in the first week of September, around three weeks before Mr Khashoggi walked into the consulate on October 2, though it took more time for other details to emerge. “These details included primary orders to capture Mr Khashoggi and bring him back to Saudi Arabia for questioning. However, the door seemed to be left open for alternative remedies to what was seen as a big problem. “We know the orders came from a member of the royal circle but have no direct information to link them to Crown Prince Mohammad bin Salman. “Whether this meant he was not the original issuer we cannot say.”

Read more …

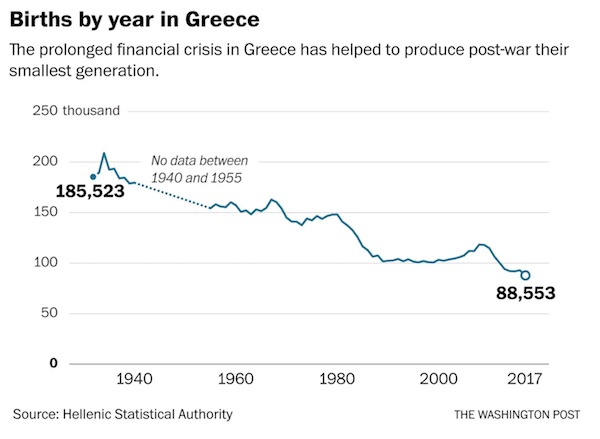

The entire country’s for sale. Athens will all be on Airbnb, and there’ll be no place left for Greeks.

• Seeking A Bargain, And Taste Of The Good Life, Chinese Buy Greek Homes (R.)

Three times a week, hundreds of Chinese investors arrive at Athens airport to be greeted by Greek real estate agents who drive them straight into the city to view apartments for sale. The visitors are drawn to Greece by rock-bottom property prices and one of Europe’s most generous “golden visa” schemes, offering a renewable five-year resident’s permit in return for a 250,000 euro ($285,000)investment in real estate. That’s enough to buy a three-bedroom apartment in the capital with a view to the Acropolis hill. It is also enough to bring the first glimmers of recovery to the market since the Greek economy started to collapse after the debt crisis in 2009, although prices are still down by about 40% from their peak.

One Athens resident, who gave his name only as Vassilis, had almost given up finding a buyer for his home last year when a minivan pulled up outside his maisonette and a Chinese family of four got out. A day later, he got an offer. “They didn’t see the house again. We went and got a down-payment, and everything was set in motion,” he said. Vassilis had bought the home in the up-and-coming suburb of Gerakas for 320,000 euros ($367,000) in 2007 and decided to sell in order to buy his two adult children their own apartments. He sold it to the Chinese family for 220,000 euros. Real estate prices rose 0.8% in the second quarter year-on-year after a 0.1% rise in the first – the first pick-up since 2008, according to Bank of Greece data.

Foreign direct investment in property jumped 91% to 287 million euros last year from 2016, the bank’s data showed. Meanwhile, taxes from property sales rose by an annual 41% in the seven months to July to 204.7 million euros, according to data from state revenue authority AADE. “We are getting much more phone calls,” said Lefteris Potamianos, head of the Real Estate Association of Athens, which represents about 3,000 brokers. “The overwhelming majority is foreigners and there are yet some Greeks. Certainly, Chinese are by far ahead of the game.”

Read more …

He’ll appeal.

• Assange’s Lawsuit Over Asylum Conditions Denied By Ecuador Judge (RT)

An Ecuadorian judge has thrown out the lawsuit by Julian Assange, who objected to the harshly revised terms of his asylum. The WikiLeaks co-founder has been trapped at the Embassy of Ecuador in London since 2012.

The judge made the decision following a lengthy hearing held by teleconference. Ecuador will maintain Assange’s asylum as long as he wants to keep it, but he must follow the rules laid out for him by the government, an unnamed government official told Reuters on Monday. The new rules, which were leaked earlier this month by an opposition politician, involve a list of restrictions Assange has argued violate his “fundamental rights and freedoms” as well as Ecuadorian and international law.

Among them are restrictions on discussing politics and receiving visitors, and demands of Assange to pay for his own food, medical care, laundry and related expenses of living at the embassy starting December 1. Ecuador has also threatened to seize Assange’s pet cat if he did not care for it properly, according to the leaked regulations. In the teleconference Monday, Assange accused Ecuador of using him as a “bargaining chip” in talks with the US and UK governments, and submitting to pressure from Washington and London. Ecuadorian Attorney General Inigo Salvador Crespo responded by calling those statements “malicious and perverse,” according to the newspaper El Comercio.

The new regulations and special protocols governing Assange’s visitations were put together for the purpose of making Assange’s continued stay at the embassy “harmonious,” Crespo argued. “It is a public building that was not intended for housing, so there must be regulation,” he told the judge.

Read more …

Canada is huge. We’re talking 10 hour bus trips. There’s nothing to replace them.

• Decline Of Greyhound Service Mirrors Rural Canada’s Plight (G.)

It’s 10 to midnight when the Winnipeg-bound Greyhound bus swings off of the empty highway and into a dirt lot illuminated by a single street lamp. Its headlights sweep across the only passenger waiting in this remote lumber town: Mary Reimer, 80, is bundled in a purple parka against the cold. “Since my husband passed away four years ago, this is how I get to my sister,” she says, before climbing aboard. It’s the last time she’ll make the journey this way. Amid cratering passenger figures, Greyhound will discontinue all service in Canada’s western provinces on 31 October. The cuts will eliminate routes that have existed for nearly a century and sever the only transit link for dozens of towns where the British-owned company has endured even as other businesses have trickled away.

Some analysts see it as yet another indicator that rural Canada is not only struggling, but slowly decoupling from the country’s thriving urban cores. Don Warkentin has witnessed these changes. After 34 years driving Greyhound buses between Winnipeg and the mining city of Flin Flon eleven hours north, he’ll retire next week along with his route. One of 415 employees phased out by the cuts, he remembers when Greyhound made three runs a day on this stretch, with 24-hour depots at each stop. Now there’s one bus nightly, and most stops are bare-bones roadside pull-offs like this one. “Not as many people are riding these days,” he says, pushing Reimer’s luggage into the undercarriage. “It’s an Uber culture now.”

For those that can’t afford an Uber or the high cost of gas, Greyhound’s decision to write off much of the Canadian frontier is more than an inconvenience. “Greyhound is a private company, but they were almost public transportation in terms of the service they provided,” says Cathy Sproule, a member of the New Democratic party congress in Saskatchewan. But Greyhound hasn’t turned a profit on some of those routes in over a decade. Since 2010, ridership has tumbled by 41%, hollowed out by urban migration, discount airlines and rising car ownership. After this month, its buses will no longer travel to points west of Sudbury, Ontario. [..] “We see a confluence of events happening,” says Laura Neidhart, spokesperson for the advocacy group Canada Without Poverty. “More and more people are leaving rural Canada, and the people who remain are often the ones who are unable to leave.”

Read more …