G.G. Bain Pelham Park Railroad, City Island monorail, NY 1910

“I am an ordinary man, a comic, who has found his niche in this world and who woke up one day with a determination to dedicate a bit of his experience, wits and money to the cause of common good.”

• ‘EU Has Already Collapsed’– Beppe Grillo (RT)

RT: Is the Italian population ready to abandon euro and come back to the lira?

BG: Yes, the lira. Rather, a lira. Not the lira we used to have twenty years ago. But let’s call this new currency lira, with the lira-euro rate 1 to 1. For me, leaving the Eurozone means primarily launching a currency I call lira, which is not the lira we had 20 years ago, but let’s retain the name lira all the same. When we switch to the new lira its value will automatically decline by 20-30%. It will be an immediate shock. And what will happen next? We’ll have to pay more for commodities. But we do not market commodities, what we do is process them. We buy oil and refine it, we buy soybeans and grain and process them. We refine oil to produce petrol getting back the 30% in added value, and it won’t significantly affect the final petrol price – 5-10 cents per liter at most. And we’ll get a 30% export benefit. I think we’ll become number one in Europe, since we are absolute leaders in terms of industrial production.

Our foreign debt will be reduced by 30%, our credits too. What is there to be afraid of? They do their best to scare you as soon as you start considering the option of walking out. They start shouting, “Oooooh, what a catastrophe”. It is their problem, their catastrophe, not ours, it is unrelated to intelligent, hardworking people who are intent on doing this. It’s the catastrophe for those who earn money staying at home, abusing the financial system, receiving capital gains, who don’t work for real and are not part of the real economy. Yes, considering that the financial transaction volume, as it seems, exceeds global GDP by 10-15%. Take the German Bundesbank. If you inspect its balance you’ll find there 70 thousand billion dollars in derivatives, hedge funds, financial products etc.

And you want them to invest in real economy – in small factories and that sort of thing! But mind you, Germany is also having a hard time. We should treat this issue with utmost care and attention. The problem, as I see it, largely depends on you, my friends, on how you translate this interview, which parts you’ll choose to broadcast and what your audience will eventually be able to make out of what I said here. Here’s the real problem. We don’t have facts any more, reliable truthful facts. We know nothing about the situation in Afghanistan, or about Iran. We don’t have a slightest idea of what Putin says, because everything is delivered to us in translation made by some American or Israeli language services agency. We can’t have the truth.

So first we need to imagine what this truth may be like and go search for it, even if we have to sacrifice something. I appeal to you- go and look for information. Look at me. Dig for truth and don’t believe the journalists who stick labels calling me a rightist, a leftist, a homophobe, a racist and what not. They call me all kinds of names. And, in fact, I am an ordinary man, a comic, with 40 years of professional career under belt, who has found his niche in this world and who woke up one day with a determination to dedicate a bit of his experience, wits and money to the cause of common good. This is what scares people.

Buddy Steve takes you through it one more time.

• The Principal And Interest On Debt Myth (Steve Keen)

There are many ways that you can divide the world into two groups. Men and women, for example—with the former being about 50.2% of the population and the latter 49.8%. Or those that like math and those that don’t—where there are no accurate figures, but I’d hazard a guess at a 10% to 90% split. The (almost) binary grouping that motivated this post is between those who reckon that banks, debt and money are of no real consequence in capitalism, and those who believe that the mere mechanics of banking guarantee that capitalism is doomed. The former includes the vast majority of economists, who delusionally model the macroeconomy as if banks, debt and money don’t exist. The latter includes most of the general public, who know that banks create money when they create a loan, and think that because banks insist on interest on loans, the money supply has to grow indefinitely.

I reckon the split in this binary division is about 0.1% in the “banks don’t matter” camp, and 99.9% in the “debt can’t be paid” group. But there is also a statistically insignificant handful who reckon that both groups are wrong. I’m one of that handful, and both other groups exasperate the hell out of me, and my sprinkling of like-minded colleagues—hi Stephanie, Scott, Richard [both of you] and a few others. A tweet from one the 99.9% finally pushed me over the edge on Twitter this weekend—see Figure 1—and I promised that I’d devote my next column on Forbes to debunking this myth.

The myth itself is clearly stated in Bernie King’s tweet: because banks lend principal, but insist that principal and interest be paid by the debtor, the money supply has to grow continuously to make this possible. The corollary is that since debt creates money, debt has to grow continuously too—faster than income—and that’s why capitalism has financial crises. So why is it wrong? In words, it’s because it confuses a stock (debt in dollars) with a flow (interest in dollars per year). But I’m not going to stick with mere words to try to explain this, because it’s fundamentally a mathematical proposition about accounting—that money must grow to allow interest to be paid on debt—and it’s best debunked using the maths of accounting, known as double-entry bookkeeping. So if you want to know why it’s a myth, brace yourself to do some intellectual work to follow the logic.

As brave as it is necessary.

• Greece Scraps Hospital Visit Fee, To Hire 4,500 Health Workers (Reuters)

Greek Prime Minister Alexis Tsipras said a €5 fee to access state hospitals had been scrapped and 4,500 healthcare workers would be hired, the latest move by his leftist government to ease what it calls a humanitarian crisis in the country. The move is likely to further endear Tsipras to austerity-weary Greeks but represents yet another potential outlay by the cash-strapped government at a time when its European and IMF lenders are demanding a commitment to fiscal rigour. Still, the abolition of the 5 euro fee for hospital visits would hurt the budget by less than €20 million annually and the health workers are expected to be hired without running afoul of Greece’s pledge to trim the public sector.

“We want to turn the health sector from a victim of the bailouts, a victim of austerity, into a fundamental right for every resident of this country and we commit to do so at any cost,” Tsipras said, adding he would fight “barbaric conditions” in public hospitals and corruption in the sector. His government would unify data systems as part of measures to boost transparency and save money, he said, in a nod to a longtime demand from international lenders. In a package of reforms sent to lenders on Wednesday, Greece said it planned comprehensive healthcare reform with the universal right to quality healthcare. It cited a fiscal impact of €2.1-2.7 billion without specifying if that represented outlays or potential revenues from tackling corruption.

Greece spends €11 billion a year on its public healthcare system – accounting for about 5% of its total economic output, which Tsipras said represented the lowest level of health spending among EU countries. Years of deep cuts in health spending have hurt standards of care in Greece’s state hospitals where there is often a shortage of basic supplies while fewer doctors and nurses look after more patients, an increasing number of whom are uninsured. About 2.5 million Greeks have no health insurance, Tsipras said. Health officials caution that despite the worsening conditions in the sector, most Greeks are able to access the health system without insurance. “All citizens, after this terrifying crisis, should have access to healthcare irrespective of whether they have insurance or not,” Tsipras said. “We will not tolerate the exploitation of human pain.”

“While it has cut government spending, Greece has also suffered from falling tax revenues, which means that its deficit figures are worse than its targets..”

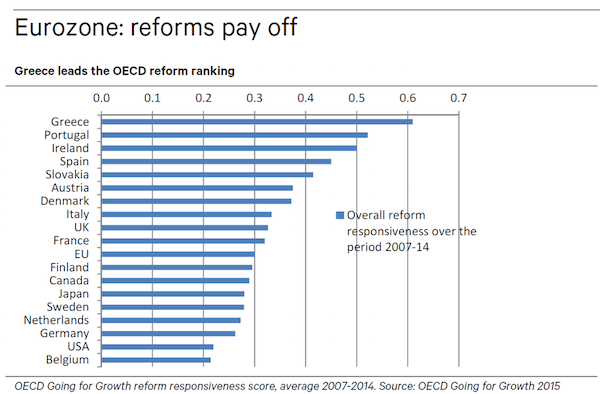

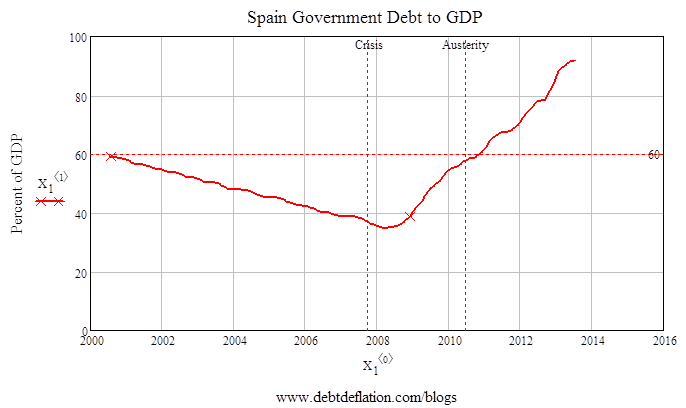

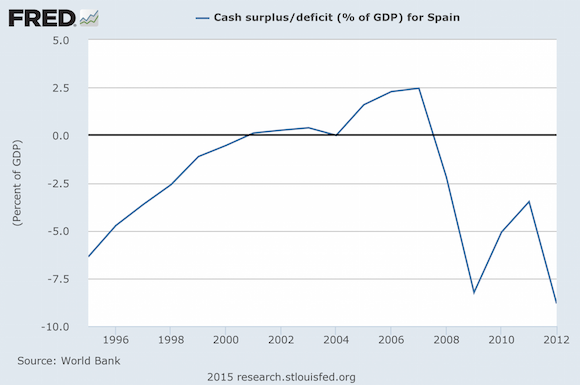

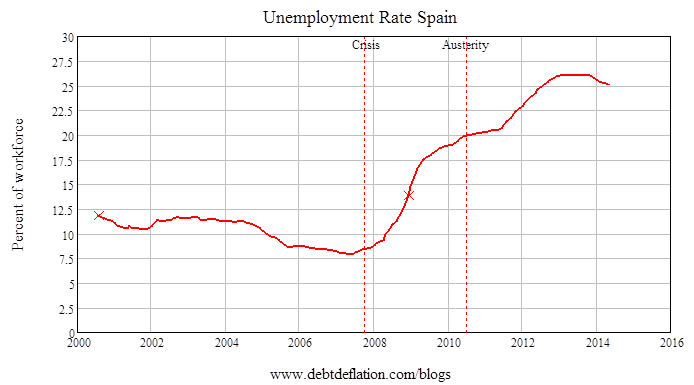

• Greek Reforms: Right Direction Or Road To Ruin? (CNBC)

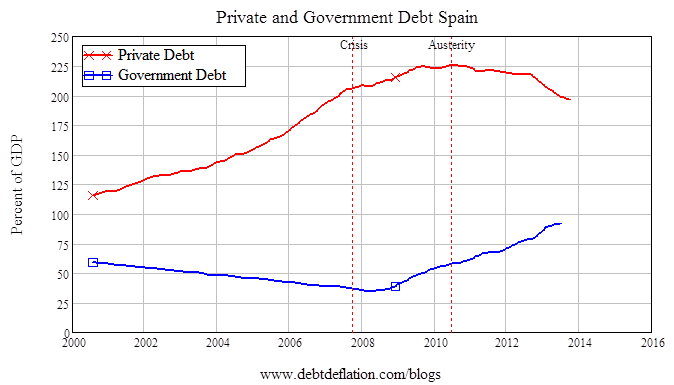

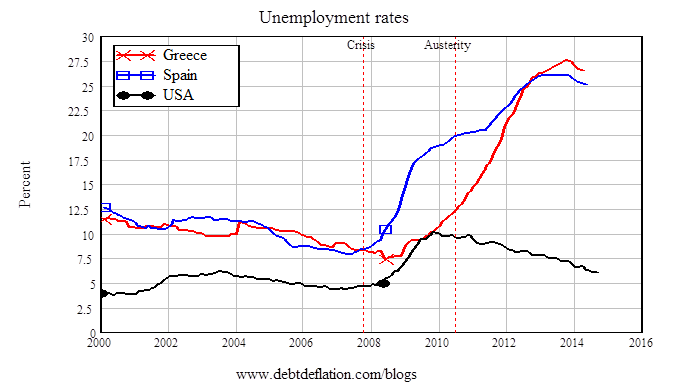

Greece may have put together an updated list of reform proposals, but as its new government finds it more difficult to secure concessions, there are still fears the country could crash out of the euro zone. The contents of the new reforms list, which has been published by the Greek press and involves raising an extra €4.7-6.1 billion in government revenues, represents “a clear step in the right direction” according to economists at Barclays Capital. This means that, in effect, the Greek government has offered some concession to European authorities on the continuing wrangles over the austerity measures imposed as part of its bailout. Since Greece elected a new government in January, led by the left-wing Syriza party, which promised to bring an end to austerity, the tone of its negotiations with international creditors has changed, raising fears that it may end up defaulting on its debt repayments and exiting the euro zone.

What is certain is that Greece still needs external financial support, particularly the €7.2 billion in bailout funds which it hopes to unlock from its international lenders. To date, Greece has received two bailouts worth a total of €240 billion. Its lenders are keeping up the pressure on Greek politicians to reach a compromise. On Wednesday, the ECB raised Greece’s emergency liquidity by a modest €700 million to €71.8 billion, which Rabobank strategists argued continues “a strategy whereby Greece’s leeway in terms of liquidity is strictly rationed.” While it has cut government spending, Greece has also suffered from falling tax revenues, which means that its deficit figures are worse than its targets, and its deficit was still rising at the end of February. The other peripheral euro zone economies which were bailed out during the credit crisis are in various stages of recovery, but Greece has lagged behind. “Greece’s budget consolidation is unravelling,” Jessica Hinds at Capital Economics wrote in a research note.

That’s exactly what I wrote a few days ago: of course they’re preparing to leave. But that’s all you can read into this. Ambrose may count for more than me, but it’s the same message.

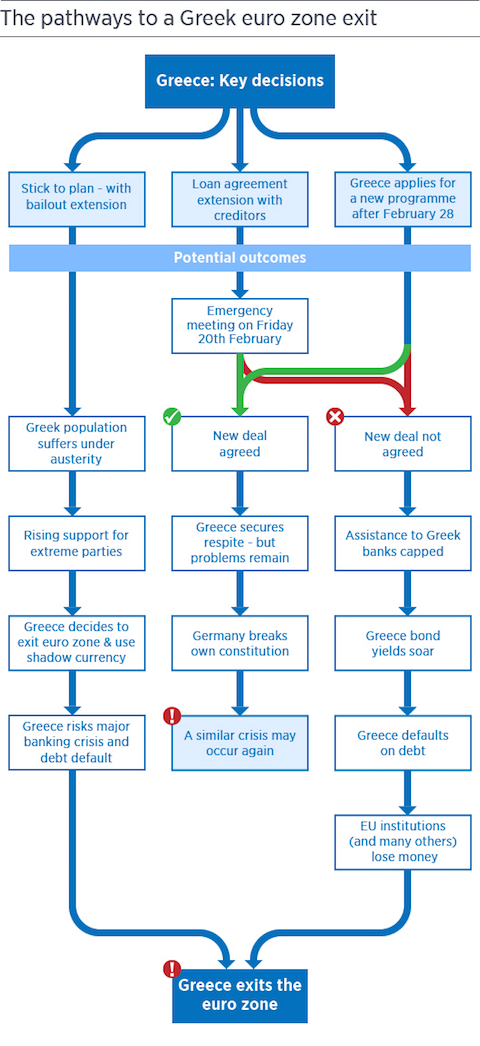

• Greece Draws Up Drachma Plans, Prepares To Miss IMF Payment (AEP)

Greece is drawing up drastic plans to nationalise the country’s banking system and introduce a parallel currency to pay bills unless the eurozone takes steps to defuse the simmering crisis and soften its demands. Sources close to the ruling Syriza party said the government is determined to keep public services running and pay pensions as funds run critically low. It may be forced to take the unprecedented step of missing a payment to the IMF next week. Greece no longer has enough money to pay the IMF €450 million on April 9 and also to cover payments for salaries and social security on April 14, unless the eurozone agrees to disburse the next tranche of its interim bail-out deal in time “We are a Left-wing government. If we have to choose between a default to the IMF or a default to our own people, it is a no-brainer,” said a senior official.

“We may have to go into a silent arrears process with the IMF. This will cause a furore in the markets and means that the clock will start to tick much faster,” the source told The Telegraph. Syriza’s radical-Left government would prefer to confine its dispute to EU creditors but the first payments to come due are owed to the IMF. While the party does not wish to trigger a formal IMF default, it increasingly views a slide into pre-default arrears as a necessary escalation in its showdown with Brussels and Frankfurt. The view in Athens is that the EU creditor powers have yet to grasp that the political landscape has changed dramatically since the election of Syriza in January and that they will have to make real concessions if they wish to prevent a disastrous rupture of monetary union, an outcome they have ruled out repeatedly as unthinkable.

“They want to put us through the ritual of humiliation and force us into sequestration. They are trying to put us in a position where we either have to default to our own people or sign up to a deal that is politically toxic for us. If that is their objective, they will have to do it without us,” the source said. Going into arrears at the IMF – even for a few days – is an extremely risky strategy. No developed country has ever defaulted to the Bretton Woods institutions. While there would be a grace period of six weeks before the IMF board declared Greece to be in technical default, the process could spin out of control at various stages. Syriza sources say are they fully aware that a tough line with creditors risks setting off an unstoppable chain-reaction. They insist that they are willing to contemplate the worst rather than abandon their electoral pledges to the Greek people.

“Greece ‘will reassure the Russians, not the Westerners.'”

• Tsipras To Seek ‘Road Map’ During Russia Visit (Kathimerini)

The aides of Greek Prime Minister Alexis Tsipras and Russian President Vladimir Putin, and the Greek and Russian embassies in Moscow and Athens, are feverishly preparing for a scheduled visit by Tsipras to the Russian capital on April 8 and 9 which the Greek government hopes will serve to significantly upgrade bilateral ties. According to a well-informed source, Tsipras is expected to seek agreement for a “road map” of initiatives on the political and economic levels. Talks are expected to touch on several topics of bilateral interest, including “commercial and financial cooperation, investments, energy, tourism and cooperation in matters of education and culture,” according to Tsipras’s office.

Other topics on the agenda include “the relationship between Russia and the European Union, as well as regional and international issues.” Tsipras is expected to emphasize Greece’s respect for its commitments as a member of the EU and NATO on the one hand while underlining his conviction that the European Union’s “security architecture” should include Russia. Amid European concerns about Greece’s position vis-a-vis EU sanctions against Russia, Greek officials have sought to offer reassurances, suggesting that Athens will not actively oppose the EU line. But sources close to Tsipras said the government will continue to express its disagreement with sanctions as a policy.

As for a likely bilateral cooperation in the energy sector, a high-ranking government source told Kathimerini that Greece “will reassure the Russians, not the Westerners.” According to sources, Energy Minister Panayiotis Lafazanis has already agreed in principle to a proposal made by the head of Russian giant Gazprom, Alexey Miller, for a new gas pipeline through Turkey to be extended through Greek territory. The plan foresees the creation of a consortium in which Greece’s Public Gas Corporation (DEPA) would play a key role along with Russian funds and possibly also European clients of Gazprom, Kathimerini understands.

As the game continues, it inevitably becomes less transparent.

• Eurozone Officials: No Loan Tranches For Partial Greece Agreement (Kathimerini)

Greece is revisiting the possibility that it might be able to get some of the €7.2 billion remaining in bailout funding in return for part of the reforms being demanded by creditors but Kathimerini understands that the eurozone does not believe this option is available. Three European officials who spoke to Kathimerini on Thursday on condition of anonymity said there is no question of Athens receiving funding unless there is first an agreement on the entirety of the reform package. “There cannot be a partial agreement,” one of the three said. The next time Greece will be discussed is at a Euro Working Group (EWG) on April 8, a day ahead of Athens having to pay €450 million to the IMF.

Unnamed eurozone officials told Reuters that Greece expressed fears during the last EWG that it would run out of money on April 9. However, this claim was immediately denied by the government. “The Finance Ministry categorically denies an anonymous report by Reuters on issues which were supposedly discussed during the Euro Working Group on April 1,” the Finance Ministry said in a statement. Eurogroup chief Jeroen Dijsselbloem said negotiations with Athens are “improving” but that there is still much ground for Greece and its lenders to cover before an agreement on reforms could be reached. “They deliver more and more proposals that are more and more detailed.

On some parts, we will definitely reach an agreement,” he said, adding that he does not expect the Eurogroup to meet next week to discuss Greek reforms. “There must be a good package which can also be realized in the four months we’re talking about,” Dijsselbloem said. “The clock continues to tick.” The Finance Ministry insisted on Thursday that Greece’s primary surplus target for this year will be 1.2 to 1.5% despite the fact that the proposals it sent to lenders, which were leaked on Wednesday, indicated a goal of 3.1 to 3.9%.

Only fools and horses would volunteer to join the euro at this point.

• Euro Debate Ignites in East EU in Face of Public Skepticism (Bloomberg)

While Greece may have one foot out the door, policy makers in the European Union’s east are reopening the debate about whether to join the euro area after years of shunning the currency during the global financial crisis. In the Czech Republic, the prime minister said on Wednesday that joining the euro soon would help the economy after the president challenged the central bank’s long-standing resistance with a vow to appoint policy makers who favor the common currency. In Poland, the main divide between the top two candidates in the May 10 presidential election is whether the region’s biggest economy should ditch the zloty. “It’s quite interesting how the sentiment has shifted — I’m slightly surprised by this,” William Jackson at Capital Economics said.

“As the story coming from the euro zone in recent years has been negative, it’s very hard to imagine how the euro case for the public would be made now.” The obstacles are many. Romania, which has set 2019 as a potential target date, and Hungary don’t meet all the economic criteria. Poland faces legal hurdles and the Czech government has said it won’t set a date during its four-year term. As a standoff between Greece and euro-area leaders threatens to push the country into insolvency and potential exit, opinion polls show most Czechs and Poles oppose a switch.

The appeal of the euro, which all European Union members save Britain and Denmark are technically obliged to join, suffered when the area had to provide emergency loans to ailing members during the economic crisis. While five ex-communist countries that joined the trading bloc in 2004 – Slovakia, Slovenia, Estonia, Latvia, and Lithuania – have acceded, the Czech Republic, Poland and Hungary don’t have road maps. The region’s three biggest economies argued that floating currencies and control over monetary policy helps shield themselves against shocks like the euro crisis even if smaller countries may benefit from lower exchange-rate volatility and reduced trade costs. Facing weakening in their korunas, zlotys, and forints, some politicians in eastern Europe are questioning that logic.

The new US balance act make everybody wobble on their feet.

• Oil Falls Nearly 4% After Tentative Nuclear Deal For Iran (Reuters)

Brent oil fell nearly 4% on Thursday after a preliminary pact between Iran and global powers on Tehran’s nuclear program, even as officials set further talks in June and analysts questioned when the OPEC member will be allowed to export more crude. Traders had been fixated on the talks held in Lausanne, Switzerland for over a week as Iran tried to agree with six world powers on concessions to its nuclear program to remove U.S.-led sanctions that have halved its oil exports. The sanctions against Iran will come off under a “future comprehensive deal” to be agreed by June 30, after it complies with nuclear-related provisions, Iranian Foreign Minister Javad Zarif told a news conference. “If nothing is going to be signed until June, something could go wrong between now and then,” said Phil Flynn, analyst at Price Futures Group in Chicago.

Bob McNally, an adviser to former U.S. president George Bush who heads energy research firm Rapidan Group, noted Iran will need much patience as the “sanctions are not likely to be lifted until late 2015 or early 2016, though we could see slippage beforehand.” North Sea Brent crude futures, the more widely-used global benchmark for oil, settled down $2.15, or 3.8%, at $54.95 a barrel, almost $1 above the session low. U.S. crude futures settled down 95 cents, or 2%, at $49.14 a barrel, after falling nearly $2 earlier. “I think the market over reacted and is now sitting back a little to think there is a lot more work to be done,” said Dominick Chirichella at the Energy Management Institute. Under the preliminary deal, Iran would shut down more than two-thirds of its centrifuges producing uranium that could be used to build a bomb, dismantle a reactor that could produce plutonium and accept intrusive verification. Iran also needs to limit enrichment of uranium for 10 years.

“Prices pared losses on speculation no additional Iranian oil will flow into the global market in the short term.”

• Crude Oil Futures Retreat After Iran Nuclear Deal Reached (Bloomberg)

Crude oil futures declined after Iran and world powers said they reached an outline accord that keeps them on track to end a decade-long nuclear dispute. Brent slid 3.8% in London, while West Texas Intermediate crude dropped 1.9% in New York. The sides now have until the end of June to bridge gaps and draft a detailed technical agreement that would ease the international sanctions imposed on Iran, including oil exports. Prices pared losses on speculation no additional Iranian oil will flow into the global market in the short term. “This is mildly bearish,” Michael Lynch at Strategic Energy & Economic Research, said by phone. “We were expecting more Iranian oil to hit the market regardless of the outcome of the talks. They are not about to dump oil on the market.”

Iran, a member of OPEC, could boost shipments by 1 million barrels a day if penalties are lifted, Oil Minister Bijan Namdar Zanganeh said March 16. Extra supplies would add to a worldwide glut that’s sent oil prices 50% lower since last year. WTI for May delivery settled down 95 cents to end at $49.14 a barrel on the New York Mercantile Exchange. The contract climbed $2.49 to $50.09 on Wednesday, the biggest gain since February. Brent for May settlement declined $2.15 to $54.95 a barrel on the ICE Futures Europe exchange. The European benchmark crude traded at a premium of $5.81 to WTI on the ICE. Both exchanges are closed April 3 for the Good Friday holiday. Sanctions against oil exports will be lifted upon the deal’s completion, Iran’s Tasnim news service reported.

Some criminals just negotiate, knowing they don’t risk any penaties thermselves, only their firm will get wrist-slapped. “Citigroup has countered with an offer that the plea come from a subsidiary that’s smaller than the Citibank NA unit..”

• US to Press for Guilty Plea From Citibank in Currency Probe (Bloomberg)

The U.S. Department of Justice is pressing for Citigroup’s main banking subsidiary to plead guilty to a felony tied to the rigging of foreign-exchange markets, according to two people briefed on the matter. Citigroup has countered with an offer that the plea come from a subsidiary that’s smaller than the Citibank NA unit, the people said, asking not to be identified discussing private negotiations. An agreement could come as soon as May and the related fine probably won’t exceed $1 billion, one of the people said. Two other people said the Justice Department is weighing all options and hasn’t decided on a particular entity. A guilty plea by its main banking unit might threaten Citigroup’s ability to operate certain types of businesses through that subsidiary, which accounted for more than 70% of the firm’s revenue last year.

The Justice Department has been investigating banks’ alleged manipulation of currency benchmarks for almost two years, and is pressing to resolve the probe with settlements that include guilty pleas, people familiar with the negotiations have told Bloomberg.

Authorities want the pleas to come from entities of greater importance within the banks, while the companies would prefer smaller units, according to two people briefed on the talks. JPMorgan, for example, would rather have its U.K.- based subsidiary plead guilty, arguing the behavior occurred there, the people said. Citibank reported $10.3 billion of net income in 2014 and at year-end it held assets of $1.36 trillion, or 74% of Citigroup’s total, according to Federal Deposit Insurance Corp. data.The parent company books the vast majority of its derivatives trades through the unit, which typically benefits from a higher credit rating and lower funding costs. A guilty plea by the nation’s third-biggest bank would set a new bar for criminal enforcement in the U.S. financial industry. While JPMorgan and Citigroup have paid billions of dollars in fines to resolve probes into their business practices since the 2008 financial crisis, neither has been convicted of a crime in the U.S. Settlements with the two New York-based firms would come around the same time as at least three other banks, one person said, declining to identify them. Another person familiar with the matter said last month that Citigroup and JPMorgan were in settlement talks along with UBS, Barclays and RBS.

“What’s toxic in one place is toxic everywhere, including Brazil.”

• Why Brazil Has A Big Appetite For Risky Pesticides (Reuters)

The farmers of Brazil have become the world’s top exporters of sugar, orange juice, coffee, beef, poultry and soybeans. They’ve also earned a more dubious distinction: In 2012, Brazil passed the United States as the largest buyer of pesticides. This rapid growth has made Brazil an enticing market for pesticides banned or phased out in richer nations because of health or environmental risks. At least four major pesticide makers – U.S.-based FMC, Denmark’s Cheminova, Helm of Germany and Swiss agribusiness giant Syngenta – sell products here that are no longer allowed in their domestic markets, a Reuters review of registered pesticides found. Among the compounds widely sold in Brazil: paraquat, which was branded as “highly poisonous” by U.S. regulators. Both Syngenta and Helm are licensed to sell it here.

Brazilian regulators warn that the government hasn’t been able to ensure the safe use of agrotóxicos, as herbicides, insecticides and fungicides are known in Portuguese. In 2013, a crop duster sprayed insecticide on a school in central Brazil. The incident, which put more than 30 schoolchildren and teachers in the hospital, is still being investigated. “We can’t keep up,” says Ana Maria Vekic, chief of toxicology at Anvisa, the federal agency in charge of evaluating pesticide health risks. FMC, Cheminova and Syngenta said the products they sell are safe if used properly. A ban in one country doesn’t necessarily mean a pesticide should be prohibited everywhere, they argue, because each market has different needs based on its crops, pests, illnesses and climate.

“You can’t compare Brazil to a temperate climate,” says Eduardo Daher, executive director of Andef, a Brazilian pesticide trade association. “We have more blights, more insects, more harvests.” Public-health specialists here reject that argument. “So what if the needs of crops or soils in Brazil are different?” says Victor Pelaez, a food engineer and economist at the Federal University of Paraná, in southern Brazil. “What’s toxic in one place is toxic everywhere, including Brazil.”

Who in the west will not think: oh, well, Turkey, isn’t that the third world?

• Turkey’s 10-Hour Blackout Shows World Power Grids Under Threat (Bloomberg)

A massive power failure that crippled life in Turkey for almost 10 hours on Tuesday highlights the threats facing grids worldwide. Turkey’s most extensive power failure in 15 years, which left people stranded in elevators and traffic snarled, wasn’t the result of a lack of electricity. The prime minister said all possible causes – including a cyber-attack – were being investigated. While the source of the problem is still unknown, recent revelations that a 2008 oil pipeline explosion in Turkey was orchestrated via computer and the high-profile attack last year on Sony Pictures Entertainment demonstrate the increasing ability of hackers to penetrate systems. For power grids, technology being added to make them more reliable and productive is also giving attackers an entry point into vital infrastructure.

“Every country, including the U.S., will be looking at it to see what the vulnerabilities were and learn some lessons about protection,” said Kit Konolige, a New York-based utility analyst for Bloomberg. “An electric grid is a complex system and it’s hard to ensure that it’s defended everywhere.” Several foreign governments have hacked into U.S. energy, water and fuel distribution systems and might damage essential services, the National Security Agency said in November. A report by California-based cybersecurity company SentinelOne predicts that such attacks will disrupt American electricity in 2015.

“More and more attacks are targeting the industrial control systems that run the production networks of critical infrastructure, stealing data and causing damage,” said David Emm, a principal researcher at Moscow-based security company Kaspersky Lab Inc., which advises governments and businesses. All power use was previously measured by mechanical meters, which were inspected and read by a utility worker. Now, utilities are turning to smart meters, which communicate live data to customers and the utility company. This opens up the systems to hackers.

“Nestlé may be bottling more than locals drink from the tap.”

• Nestlé Called Out For Bottling, Selling California Water During Drought (Reuters)

Nestlé is wading into what may be the purest form of water risk. A unit of the $243 billion Swiss food and drinks giant is facing populist protests for bottling and selling perfectly good water in Canada and drought-stricken California. Nestlé Waters says it does nothing harmful in the watersheds where it operates. Its parent company also signed and strongly supports the United Nations-sponsored CEO Water Mandate, which develops corporate sustainability policies. The company is under fire in British Columbia, though, for paying only $2.25 for every million liters of water it withdraws from local sources. Yet the provincial government sets the price and until this year charged nothing. The rates are also far higher in Quebec, which charges $70, and Nova Scotia, where the price is $140.

Nonetheless, 132,000 people have signed an online petition demanding the government stop allowing Nestlé to take water on the cheap. The company’s reputation may be at even greater risk in California, whose severe drought is in its fourth year. The Courage Campaign has organized an online petition, with more than 40,000 signatures so far, that demands Nestlé Waters stop bottling H2O during the drought. There are several local protests, too. The Swiss firm drew 50 million gallons from Sacramento sources last year, less than 0.5% of the Sacramento Suburban Water District’s total production. It amounts to about 12% of residential water use, though, and is just shy of how much water flows from home faucets in the United States, according to the U.S. Environmental Protection Agency.

In other words, Nestlé may be bottling more than locals drink from the tap. Consumers can only blame themselves, of course, for buying so much bottled water. The average price for a gallon is $1.21, according to the International Bottled Water Association. For just $1.60, Californians could purchase 1,000 gallons of tap water, according to the National Resources Defense Council. Moreover, Nestlé’s water business is its smallest and least profitable, generating a trading operating profit last year of 10.3% – less than half that of its powdered and liquid beverages unit. With California imposing a 25% cut on residential water use, Nestlé Waters may want to consider turning off its own taps.