G.G. Bain New York, suffragettes on way to Boston 1913

Another great explanation. Very simple to understand.

• Are Surpluses Normal? (Steve Keen)

England’s Chancellor George Osborne took the Conservative Party’s claim to fiscal responsibility one step higher last week when he announced that they will enact a law which will require British governments to run surpluses “in normal times”: “in normal times, governments of the left as well as the right should run a budget surplus to bear down on debt and prepare for an uncertain future.” (“Mansion House 2015: Speech by the Chancellor of the Exchequer”) This begs the question, “what is normal?” Can a word like “normal” even be applied to something as volatile as the economy? If we’re honest, when we say “why can’t you just be normal?” to someone or about something, what we really mean is “why can’t you be the way I’d like you to be?”

So by “normal times”, the Chancellor really means “when things are really good”. In that sense, the ultimate “normal times” for the Western world were the years from the end of the Korean War until just before the OPEC Oil crisis—from 1954 until 1973. These were the socially tumultuous years from Happy Days and The Fonz, to the Beatles, the Vietnam War and the death of Jim Morisson. But they were also the years when the economy boomed, with the real rate of growth in America averaging 4% a year (I use US data in this post rather than British since key UK data from that time period isn’t available). Can you imagine how happy George Osborne would be to report a real rate of growth of 4% today? So 1954 until 1973 is the yardstick for “normal times” in the modern, post-World-War era. And in those normal times, the annual change in US government debt was normally plus 1.72% of GDP.

Yes, that’s right, the “normal thing” for the government during those Happy Days was to run a deficit of just under 2% of GDP. As Figure 1 shows, only once—for about 6 months during 1956—did government debt actually fall. But at the same time, government debt as a percentage of GDP did fall—from almost 70% at the start of Happy Days to just under 40% by 1973. How did that happen? Because the rate of growth of the economy exceeded the rate of growth of government debt. In other words, the causation seems to run, not from the government deciding to “fix the roof while the sun is shining”, but from the sun shining so much that no roof was needed.

There is also little support in this data for Osborne’s mantra “that the people who suffer when governments run unsustainable deficits are not the richest but the poorest”—that is, unless we take his cue from the qualifier “unsustainable” to consider that there may in fact be “sustainable deficits”. The only problem for Osborne is that it appears that sustainable deficits apply even during “normal”—read “good”—economic times.

I suggest you read through this with care.

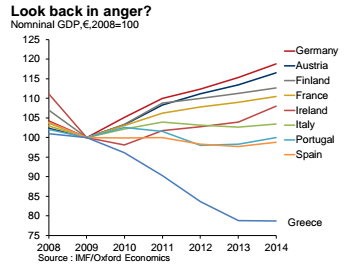

• Greece Is Literally Dying To Leave The Euro (Daily Mail)

How does a nation die? This week, in the beleaguered hospitals of Athens, I saw a glimpse of the shocking answer. It is when its own people die in their thousands simply because the state cannot afford to heal them. In the Reichstag in Berlin, it is now said openly that Angela Merkel is ready to discuss putting Greece out if its misery – to let it ‘Grexit’ and parachute free of its colossal European debt, which could have a huge impact across the globe. Yet to pay down this debt, Greeks have been battered by austerity measures that make Labour complaints about Osborne’s cutbacks utterly laughable.

There is no greater metaphor for a country’s health than its own healthcare system. And it is only when you see for yourself the horrors convulsing Greece’s NHS that you realise just how insane it is for this once-proud nation to continue as it is. If it was your country, it would make you weep with pain and shame. In its overloaded hospital wards, I either saw or heard first-hand accounts of babies held hostage for payments and dying patients left unattended; of porters sent out as paramedics, patients told to bring their own sheets, brakes failing on ancient ambulances travelling at high speed and hospitals running out of drugs and dressings. Operating theatres have been shut and staff numbers slashed because there simply is no money left.

Five years ago, Greece spent £13 billion on the health of its 11 million population – above the European average. It is now spending about half this. Worse still, in the first four months of this year the 140 state hospitals received just £31 million, a 94% fall on the previous year. And to make matters even blacker, any reserves have just been taken back by the government in its desperate scramble for cash to pay public servants and international debts. There are claims of an astonishing three-year fall in a Greek person’s life expectancy in just five years since the country’s economy crashed. If confirmed, this would be without precedent in modern Europe. And the individual human stories are pitiful, verging on the macabre.

These guts are nuts. They didn’t even discuss the latest Greek proposals on Thursday.

• Eurozone Ministers Insist On ‘New Proposals’ For Greece Summit (AFP)

Eurozone ministers Friday insisted that an emergency leaders summit called to solve the Greece debt crisis required firm proposals by Athens in advance of the meeting. “Calling a summit that will not be prepared if there is no arrangement this weekend, I don’t find that very constructive,” said Austrian Finance Minister Hans Jorg Schelling arriving for a meeting with his EU counterparts. “We don’t know if Greece is going to make a move and make new proposals. Taking this to the political level, as Greece does, is obviously a double-edged sword,” he added.

EU President Donald Tusk called a summit of the leaders of the 19 eurozone countries Monday in Brussels after finance ministers Thursday failed to break the five-month-old deadlock between the anti-austerity government in Athens and its EU-IMF creditors. “It’s very important that this is first prepared on the technical level because we need to have some kind of a proposal on the table for the euro summit,” Finnish Finance Minister Alex Stubb said Friday. Any deal between the Greek authorities and its creditors will first require an agreement on the technical details, negotiated by teams of experts from the institutions overseeing Greece’s bailout — the International Monetary Fund, the European Commission and the European Central Bank.

Several rounds of talks to strike a cash for reforms deal at this level have broken off in the five months since SYRIZA came to power, with the government insisting that any agreement be negotiated at the higher political level. But any deal “must be prepared by the institutions, then discussed in the Eurogroup [of euro finance ministers] and the heads, of course, have the right and responsibility to discuss political issues,” said Lithuanian Finance Minister Rimantas Sadzius.

These are those latest proposals.

• Greece’s Proposals to End the Crisis: My Eurogroup Intervention (Varoufakis)

The only antidote to propaganda and malicious ‘leaks’ is transparency. After so much disinformation on my presentation at the Eurogroup of the Greek government’s position, the only response is to post the precise words uttered within. Read them and judge for yourselves whether the Greek government’s proposals constitute a basis for agreement.

Colleagues,

Five months ago, in my very first Eurogroup intervention, I put it to you that the new Greek government faced a dual task: We had to earn a precious currency without depleting an important capital good. The precious currency we had to earn was a sense of trust, here, amongst our European partners and within the institutions. To mint that precious currency would necessitate a meaningful reform package and a credible fiscal consolidation plan. As for the important capital we could not afford to deplete, that was the trust of the Greek people who would have to swing behind any agreed reform program that will end the Greek crisis.

The prerequisite for that capital not to be depleted was, and remains, one: tangible hope that the agreement we bring back with us to Athens:

• is the last to be hammered out under conditions of crisis;

• comprises a reform package which ends the 6-year-long uninterrupted recession;

• does not hit the poor savagely like the previous reforms did;

• renders our debt sustainable thus creating genuine prospects of Greece’s return to the money markets, ending our undignified reliance on our partners to repay the loans we have received from them.Five months have gone by, the end of the road is nigh, but this finely balancing act has failed to materialise. Yes, at the Brussels Group we have come close. How close? On the fiscal side the positions are truly close, especially for 2015. For 2016 the remaining gap amounts to 0.5% of GDP. We have proposed parametric measures of 2% versus the 2.5% that the institutions insist upon. This 0.5% gap we propose to bridge over by administrative measures. It would be, I submit to you, a major error to allow such a minuscule difference to cause massive damage to the Eurozone’s integrity. Convergence had also been achieved on a wide range of issues. Nevertheless, I will not deny that our proposals have not instilled in you the trust that you need. And, at the same time, the institutions’ proposals that Mr Juncker conveyed to PM Tsipras cannot engender the hope that our citizens need. Thus, we have come close to an impasse.

Given the push for bank runs, hard to say what this will result in. More bullying?

• ECB Meeting To Decide On €3.5 Billion Greek Emergency Funding (Guardian)

The ECB is holding an emergency meeting on Friday morning to discuss whether to pump more funds into Greek banks to prevent a full-blown banking crisis. The meeting, starting at noon (11am UK time) via conference call, comes after the acrimonious breakdown of talks between finance ministers in Luxembourg on Thursday night raised the prospect of Greece’s exit from the eurozone. After the talks broke up with a war of words between Greece and its creditors, European leaders agreed to an emergency summit on Monday evening. The timing – just three days before a scheduled summit of all European Union leaders – was determined by fears of a run on the banks.

Greek depositors have withdrawn more than €3.2bn since Monday, including €1.2bn on Thursday, raising fears of a run on the banks. The ECB warned finance ministers on Thursday that Greek banks may not open on Monday. According to Reuters, when asked whether the banks would be open on Friday, ECB executive board member Benoit Coeure said: “Tomorrow yes. Monday I don’t know.” On Friday morning, the ECB’s decision-making governing council will discuss a request from the Bank of Greece for an increase in liquidity to Greek banks. According to newspaper Kathimerini, the Bank of Greece will ask for – and expects to get – €3.5bn of assistance via the Emergency Liquidity Assistance (ELA) facility. The request comes just two days after the ECB threw Greece a €1.1bn lifeline in ELA funds.

Used this for my article this morning. The quotes are insane.

• Greece Faces Banking Crisis After Eurozone Meeting Breaks Down (Guardian)

Greece is facing a full-blown banking crisis after a meeting of eurozone finance ministers broke down in acrimony and recrimination on Thursday evening, bringing the prospect of Greek exit from the eurozone a step nearer. Some €2bn of deposits have been withdrawn from Greek banks so far this week – including a record €1bn yesterday – triggering fears that a breakdown in talks would spark a further flight of funds. The German leader Angela Merkel, French president François Hollande and Greek prime minister Alexis Tsipras agreed to stage an emergency EU summit on Monday as a last critical attempt to prevent Greece going bankrupt. A representative of the ECB told the meeting it was unsure whether Greek banks would have the funds to be able to open on Monday.

As thousands of pro-EU protestors gathered outside the Athens parliament building, leaders of the eurozone and the IMF aimed bitter criticism at the leftwing Greek government, accusing it of lying to its own people, misrepresenting and misleading other EU leaders, refusing to negotiate seriously, and taking Greece to the brink of catastrophe. The Luxembourg talks broke down within an hour of discussions about the Greek crisis starting, indicating the bad blood between both sides. Christine Lagarde, the head of the IMF, said there was an urgent need for dialogue “with adults in the room”. She added: “We can only arrive at a resolution if there is a dialogue. Right now we’re short of a dialogue.”

Lagarde has taken a tough line on debt talks with Athens over the past four months, since the radical leftist Syriza government took control and insisted creditors drop proposals for further austerity as the price of releasing the last tranche of bailout funds. At the talks in Luxembourg she reportedly introduced herself to Greek finance minister Yanis Varoufakis as “the criminal in chief”, in reference to Tsipras’s claim earlier this week that the IMF bore “criminal responsibility” for the situation in Greece.

Pierre Moscovici, the European commissioner for economic affairs, who has been more sympathetic to the Greek case, said: “There’s not much time to avoid the worst.” He appealed to the Tsipras government to return to the negotiating table, making it plain that Athens has been treating its creditors and EU partners with contempt. He said Athens had made no credible counter-proposals on the bailout terms and said that Varoufakis tabled no new proposals on Thursday, despite the session of Eurogroup finance ministers being billed as the last chance to secure a deal sending Greece a financial lifeline and keeping it in the euro. He called on the Greek government “to avoid a fate that would be catastrophic”.

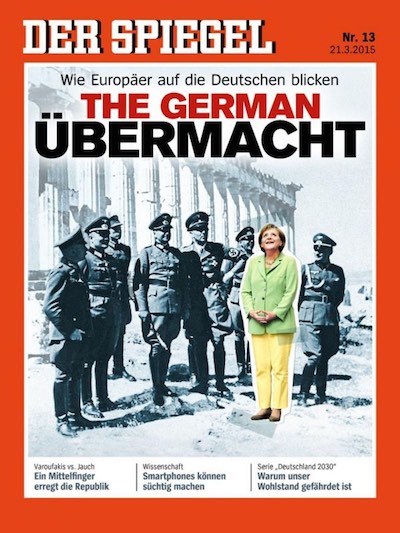

Merkel’s legacy?!

• Why Greece Might Now Have The Upper Hand In Crunch Talks (Guardian)

Greece knows it. The IMF knows it. Every European finance minister knows it. After the latest failure to secure a deal at the meeting of finance ministers in Luxembourg, the crisis is coming to a head. The unescapable facts are that between Monday and Wednesday, some €2bn (£1.43bn) left the Greek banking system – more than the €1.1bn in additional emergency financing provided by the European Central Bank this week. The banks are losing around 0.5% of their deposits each day and cannot sustain losses of this sort. They are on the brink of collapse. Greek public finances also look dire, with tax revenues 24% below target in May. The government is balancing the books – but only by not paying its bills.

There will be an emergency summit of eurozone leaders on Monday, but by then it may already be too late. Capital controls look inevitable to stem the outflow from the banks and could be needed before the weekend after the latest setback. Athens has already said it will be unable to pay the IMF at the end of the month unless it gets some immediate financial assistance. There was little evidence in Luxembourg of a deal, no sign even that either side was adopting a more emollient approach. The idea that Greece might be offered a grace period after its debts become due to the IMF was rejected by Christine Lagarde. The fund’s managing director could not have been clearer: “I have a deadline, which is 30 June, when a payment is due from Greece. If 1 July it’s not paid, it’s not paid.”

Meanwhile in Athens, the government said it was preparing for the return of the drachma. “If we are forced to say the big no, the difficulties will last for a few months”, said the social security minister, Dimitris Stratoulis. “But the consequences will be much worse for Europe.” This is a reasonable point. Throughout the crisis, the IMF, the ECB and the European commission have been negotiating from what they perceive as a position of strength. That’s because traditionally debtors do what creditors tell them. But not this time

There have been four big factors that have allowed Alexis Tsipras to run rings round Angela Merkel. The first is that being flat broke can sometimes help. When a country has suffered as much as Greece has in the past five years, telling it that life will be awfully bad outside the eurozone is not that much of a threat.

No doubt.

• Grexit Would Be ‘Beginning Of End’ For Eurozone, Greek PM Tsipras Says (AFP)

A Greek exit from the eurozone would be the beginning of the end of the single currency, Greek Prime Minister Alexis Tsipras was quoted as saying Friday in a newspaper interview. “The famous Grexit cannot be an option either for the Greeks or the European Union. This would be an irreversible step, it would be the beginning of the end of the eurozone,” Austrian daily Kurier quoted Tsipras as saying, in an interview published in German. “The Greek government cannot absorb the savings program forced upon it by the EU and the IMF. They would also not be positive for the Greek economy. Greece would not become more competitive and the debts would also not be reduced. The whole concept needs to be changed,” he said.

Many highly educated people on the Greek side that is constantly ridiculed by the troika.

• Euclid Tsakalotos: Greece’s Secret Weapon In Credit Negotiations (Guardian)

For those who thought the battle to save Greece was all about a rag tag bunch of leftists finally seeing the light, Euclid Tsakalotos has made many think again. At the eleventh hour, the Oxford-educated economist has emerged as Athens’ secret weapon, sounding every inch the man he was raised to be: a public school member of the British establishment. “It is rather surprising to the other side,” he says, the Greek parliament framed in the window of his eighth floor office. “But so, too, is the fact that I understand their economic arguments.” Phlegmatic, professorial, mild-mannered, Tsakalotos has spent the best part of 30 years in the ivory towers of Britain and Greece “engaging critically” with neoclassical economic thinking.

No other training could have prepared him better for his role as the point man in negotiations between Athens and the international creditors propping up its near-bankrupt economy. “The fact that he also sounds like an aristocrat helps too,” said an insider in the Syriza party. “He speaks their language better than they do. At times it’s been quite amusing to watch.” The son of a civil engineer who worked in the well-heeled world of Greek shipping, Tsakalotos was born in Rotterdam in 1960. When his family relocated to London, he was immediately enrolled at the exclusive London private school St Paul’s. A place at Oxford, where he studied PPE, ensued. The hurly burly world of radical left politics could not have been further away.

“My grandfather’s cousin was general Thrasyvoulos Tsakalotos who led the other side, the wrong side, in the Greek civil war,” he said of the bloody conflict that pitted communists against rightists between 1946-49. “He expressed the fear that I might end up as a liberal, certainly not anything further to the left.” Tsakalotos, who has written six books including The Crucible of Resistance, an analysis of Greece at the forefront of Europe’s economic crisis, embraced the left at Oxford when he joined the student wing of Greece’s euro communist party. What goaded him more than anything else was the treatment of the Greek left – who had led the resistance movement against Nazi occupation – after the second world war.

“Greeks have had a lot to resist, civil war, dictatorship, authoritarianism,” he said. “But perhaps the most terrible thing was the unfairness with which the left was treated in the postwar period. We were the only nation where people who had participated in what had been a very important resistance movement were treated like pariahs while those who had collaborated with the Germans had it good. It was just so wrong.”

Just one of a myriad of theories.

• Would An Argentina-Style Cure Work For Greece? Probably Not (Guardian)

There is a beguiling argument that life for Greece outside the eurozone wouldn’t be so bad. Sure, the immediate economic pain would be severe, but a new drachma, coupled with debt default, might deliver a whoosh of relief in time. Isn’t history full of countries that have devalued their way out of crisis by generating an export boom? Didn’t Argentina recover that way when it abandoned its currency peg to the US dollar in 2002? Taken to its logical extreme, this argument says the real threat to the survival of the eurozone is that Greece leaves and prospers. Come the next crisis, other strugglers might opt to quit, dumping their debts as they go. If this idea sounds far-fetched, Jim Leaviss on M&G’s bond team would agree. He makes an excellent case that Greece isn’t Argentina, not by any stretch.

Sure, there are parallels between the causes and symptoms of distress – an overvalued currency, unsustainable debts, shoddy tax collection, dodgy official statistics and high unemployment. But an Argentinian-style cure – massive devaluation and conversion of bank accounts – is unlikely to produce the same recovery in Greece, thinks Leaviss. Argentina was lucky with its timing of its devaluation, he argues. Global trade boomed after 2002 as the US Federal Reserve cut interest rates after the 9/11 terrorism attacks and China was welcomed into the world economy. A newly-competitive Argentina increased exports by 120% between 2002 and 2006. It’s hard to imagine Greece copying that performance. Tourism is already 18% of the economy, so probably can’t double as it almost did in Argentina.

The poorer quality of the land makes an agricultural boom harder. Greece’s biggest export (surprisingly) is refined petroleum, which is priced in dollars. And its biggest export market is Germany – “possibly problematic post a debt default”, notes Leaviss dryly. His common-sense conclusion is that countries that thrived after devaluation (Canada and Sweden are other examples) had trading partners that were growing strongly. “Greece does not have that luxury, nor an economy that can respond quickly to increased export competitiveness,” concludes Leaviss. Note, too, that the Argentinian revival looks less impressive these days with real growth at just 0.5%. They’re all good points, even if life inside the eurozone for Greece is also hellish.

Tell ‘em to grow a pair.

• What Greece Can Learn From Iceland’s Banking Crisis (Independent)

Greece is teetering on the brink of a financial crisis at the same time as Iceland is finally lifting controls imposed during one. The Icelandic finance minister has announced the end of capital controls – or limitations on what people there can do with their money – imposed after the 2008 crash. Iceland’s recovery has been celebrated. While other countries are still suffering from flat inflation and badly behaved bankers, Iceland has jailed those in charge when its banks were borrowing 20 times their worth. Unemployment is below 5 per cent, down from almost 10% at the height of the crisis in 2010.

Should Greece follow Iceland’s example? Iceland had its own currency, the krona, It could artificially devalue it relative to other currencies, reducing the real value of high wages by 50%, cutting spending, making exports more competitive and imports more expensive. The devalued currency also put Iceland on the map as a tourist destination. Greece can’t pull the same trick because it has the euro. The Icelandic prime minister Sigmundur David Gunnlaugsson told the BBC: “It can be difficult to leave the euro when you’re in. Since the Greeks are already within the Eurozone, this is a problem that must be solved not just by the Greeks but by the Eurozone as a whole.”

Many commentators watching the situation in Greece have raised fears about the possibility of the Greek government imposing capital controls if the country was unable to default on its debts. Iceland embraced capital controls, freezing foreign money in its banks, which stopped inflation. Now the government is relaxing these controls. It might be too late for capital controls to have the same impact in Greece. Around €30bn of capital has left Greek bank accounts since October.

Better get going then.

• Leaving Greece To Its Own Devices Is Not An Option (FT)

Spectators of the debt drama starring Greece and its eurozone creditors are shuffling uncomfortably in their seats. They do not know the ending, but every twist in the plot suggests that it is extremely unlikely to be happy. The Greek state is slipping closer to official default on its loans, and even exit from the eurozone. This creates an impression that the drama, which began in 2001 with the fatal decision to admit Greece into Europe’s monetary union, is approaching a sort of Act V dénouement. But real life is not a play, when the curtains come down after a fixed period of action. Some high-level eurozone politicians – by which I mean prime ministers and finance ministers – have made it clear for at least five weeks that they are ready to let Greece default and, if necessary, drop out of the 19-nation currency area.

Yet not all have thought hard enough about what might follow. To say “good riddance to the Greeks, they’ve been unreliable and irresponsible, we’ll be better off without them” does not amount to a serious policy. For the likely consequences would go beyond capital controls in Greece, or the issuance of scrip that ordinary Greeks would mark sharply down against the euro. This emergency is about more than money. It is about European security, especially in the Balkans, an area that for at least 140 years has repeatedly sucked in outside powers and left them licking their wounds afterwards. The economic, financial and political turmoil that would erupt in Greece after a debt default, let alone a eurozone exit, would be terrible for most Greeks – but it would also have repercussions beyond Greece’s borders.

It would add to the political disorder, economic distress, corruption, organised crime, irregular migration, great power manoeuvring and outright war that characterises an arc of countries stretching all the way from Bosnia-Herzegovina in the Balkans to Syria on the east Mediterranean coast. Now here is the point. As a matter of self-interest, European governments – and the US – would not want to let Greece slide into complete chaos, any more than they stood on the sidelines when armed conflicts erupted in nearby Kosovo in 1998-99 and in Macedonia in 2001. It is telling that, after 22 people were killed last month in political and ethnic violence in Macedonia, the Europeans and the US swung quickly into diplomatic action to broker early general elections in the former Yugoslav republic.

Sure.

• Portugal Says It Has Reserves to Face Financing Restrictions (Bloomberg)

Portuguese Prime Minister Pedro Passos Coelho said his country has cash reserves to weather developments that might come from Greece’s standoff with creditors. “If anything happens, we have reserves to face any more serious financing restriction that might occur in international markets,” Coelho said Tuesday night at an event in Oporto, northern Portugal. “And that’s the reason why if something more serious happens in Greece, Portugal won’t fall next because it doesn’t have any problem of financing in the markets.” His comments were broadcast by television station RTP.

The Portuguese government built up a cash buffer before the end of its aid program and the country’s debt agency forecast in a May 29 presentation that Portugal’s treasury cash position will be €9.8 billion at the end of 2015, compared with €12.4 billion at the end of 2014. Portugal has been selling longer-maturity bonds and easing debt repayments due in the next three years after exiting a bailout program provided by the European Union and the International Monetary Fund. Coelho’s government, which faces elections in September or October, in March made an early repayment of part of its IMF loan after the European Central Bank announced a bond-buying plan and borrowing costs fell.

The country’s 10-year bond yield is at 3.15%, after falling to 1.509% on March 12, the lowest since Bloomberg began collecting data in 1997. The yield climbed to more than 18% in 2012. The nation’s debt remains rated below investment grade by Fitch Ratings, Moody’s Investors Service and Standard & Poor’s. “Portugal’s treasury is able to face any volatility in external markets until the end of the year,” Coelho said. The debt agency said in the May 29 presentation that it had already sold 12.6 billion euros of bonds this year and planned to sell another 6.9 billion euros of the securities in 2015.

That’s not how Brussels sees things.

• If Greece And Russia Feel Humiliated, Europe Cannot Ignore That (Guardian)

Listening to the news these days, you’d assume that the politics of humiliation has taken over in Europe. Coming out of Greece and Russia, there is fiery rhetoric about nations being downtrodden, their pride trampled, their wellbeing attacked by hostile external forces. Greek prime minister Alexis Tsipras has accused his country’s creditors of attempting to “humiliate our people”, while Vladimir Putin has announced that 40 intercontinental missiles would be added to his country’s arsenal, as a retaliatory measure against what he claims are western attempts to humiliate and intimidate Russia. The grievances that Putin and Tsipras harbour against Europe are different, and translate into acts of varying degrees of gravity: military aggression on one hand, and the threat to the eurozone on the other.

But they share a notion that national feelings have been severely damaged, and that amends need to be made. That Tsipras felt the need to travel to St Petersburg and seek solace in a meeting with Putin says a lot about this alliance of the aggrieved. Of course, their comments need to be seen in a context of heightened diplomatic posturing. Greece’s negotiations with creditors have reached crunch time. Russia’s regime pursues a strategy aimed at rewriting post-cold war rules to its advantage, after having launched a war in Ukraine last year. But the perception of humiliation is real nonetheless, not least because the Greek and the Russian people seem to share it with their leaders. And in international relations, careless rhetorical flourishes can leave lasting damage.

As the language of humiliation is being ratcheted up to hysterical heights, it’s increasingly hard to see how the involved parties can climb down to a more diplomatic level. After so much energy has been spent on claiming victimhood and nursing grievances, talk of a compromise would suddenly sound too much like a retreat. To deflate the situation, it would be helpful to ask two questions. First: was there ever an intention to actually humiliate? Second, if a conciliatory gesture is really required, should it entail a full-blown mea culpa from the supposed humiliators? My answer to both of these questions would be no.

Russian Deputy PM reportedly said today the country is ready to help Greece with funds.

• Russia, Greece Sign Deal On Turkish Stream Gas Pipeline (RT)

Russia and Greece have signed a deal to create a joint enterprise for construction of the Turkish Stream pipeline across Greek territory, Russian Energy Minister Aleksandr Novak said. The pipeline will have a capacity of 47 billion cubic meters a year. The Greek extension of the Turkish Stream project is called the South European pipeline in the memorandum signed on Friday, Novak said at the St. Petersburg Economic Forum. Construction will start in 2016 and be completed by 2019. The two countries will have equal shares in the company, Novak added.Construction of the pipeline in Greece will be financed by Russia, and Athens will return the money afterward.

The Russian shareholder in the joint enterprise will be state-owned Vnesheconombank (VEB), Novak said. Greek Energy Minister Panagiotis Lafazanis said the Friday meeting was”historical”. “The pipeline will connect not only Greece and Russia, but also the peoples of Europe,” Lafazanis was quoted as saying by Sputnik news agency. “Our message is a message of stability and friendship… The pipeline we are beginning today is not against anyone in Europe or anyone else, it is a pipeline for peace, stability in the whole region.”

France is going the same route.

• Moscow Threatens Retaliation Over Belgian Seizure Of State Assets (RT)

Moscow has summoned the Belgian ambassador to lodge a protest over the freeze of its state assets. It said that Moscow may consider retaliatory measures against Belgium if the assets are seized, including against Belgium diplomatic property in Russia. This comes after Belgian bailiffs notified Belgian, Russian and other international companies of the seizure of assets belonging to Russia at the behest of the Isle of Man-based Yukos Universal Limited, a subsidiary of the Russian energy giant, which was dismantled in 2007. They have given the target companies a fortnight to comply.

“The frozen Russian assets include accounts of the Russian Embassy and Russia’s Permanent Mission to the UN. Even without any further analysis, this means a blatant violation of international law. We don’t yet know what the official position of our Belgian partners is, but at first sight, this seems to be an excessive act,” Russia’s Justice Minister Aleksandr Konovalov said. Russia will appeal the court’s arrest of Russian property, Russian presidential aide Andrey Belousov said. According to the official, “the situation with the arrest of the property is politicized, [and] Moscow hopes to avoid a new escalation in relations.”

On Thursday, Russia’s Foreign Ministry said it views Belgium’s actions as “an unfriendly act” and “a blatant violation” of the norms of international law, adding that it could consider retaliatory measures against Belgium if the assets are seized. “The Russian side will have to consider the adoption of adequate retaliatory measures against the property of Belgium located in the Russian Federation, including the property of the Embassy of Belgium in Moscow, as well as its legal entities,” the Russian Foreign Ministry said in a statement.

A low even for aburdist theater.

• ‘True Friend Of Ukraine’ Tony Blair Tapped To Join Kiev Advisory Council (RT)

Ukrainian President Petro Poroshenko has invited former British PM Tony Blair to “share his experience of public administration” on an international council of European public figures advising Kiev on government reforms. After meeting with Poroshenko in Kiev, the former UK leader told reporters that Ukraine faced “great challenges” from “Russian aggression” and “corruption.” Blair, who was prime minister from 1997 to 2007, also called on Ukrainian leaders to follow “not self-interest but values” such as “freedom, democracy and a desire to serve the people.” Poroshenko boasted that “despite the war, we are carrying out reforms,” and said that Blair asked him “exactly what help was needed from the international community.”

“This is the approach of a true friend of Ukraine,” said Poroshenko, who was elected in June 2014 in a controversial poll boycotted by rebellious regions in Eastern Ukraine. Ukraine’s International Advisory Council for Reforms started working last month. Leading it is former Georgian President Mikheil Saakashvili, who has since been appointed governor of the Odessa Region, in the south of the country. In Georgia, Saakashvili is wanted for crimes related to embezzlement during his time in office. Other members of the body, which has no executive or legislative powers, include former Swedish foreign minister Carl Bildt, Slovak reformer Mikulas Dzurinda and economist Anders Aslund. US Senator John McCain, a prominent supporter of the 2014 Maidan coup that deposed former Ukrainian President Viktor Yanukovich, said he was forced to decline a seat on the council, due to US Congress regulations.

A nation on crack.

• New Zealand Posts Weakest GDP Growth In Two Years (MarketWatch)

New Zealand’s economy continued to expand in the first quarter but growth was the weakest in two years, weighed by a fall in agriculture, forestry and mining. Gross domestic product rose 0.2% on the quarter in the three months to March 31, Statistics New Zealand said Thursday. On the year, GDP rose 2.6%. Both figures were below the median expectations in a Wall Street Journal poll of 14 economists, which had forecast growth of 0.6% on the quarter and 3.1% on the year. New Zealand’s agriculture-focused economy has started to flounder in recent months: global dairy prices are down more than 50% since early 2014 and New Zealand’s biggest trading partners, Australia and China, are experiencing slower growth.

“The lower growth reflected a 2.9% fall in primary industries–agriculture, forestry and mining–the largest fall since September 2010,” Statistics New Zealand said. Agricultural activity fell 2.3% in the March quarter on the back of decreased milk production in a quarter marked by drought conditions and lower dairy prices. However, Statistics New Zealand noted oil and gas were big factors in the lower GDP growth in the quarter. “There was less extraction and exploration, as international prices fall,” said national accounts manager Gary Dunnet. Mining activity was down 7.8%. Forestry production and exports of forestry products were also down, Statistics New Zealand said.

Wishful thinking.

• Pope Francis’s Climate Encyclical Will Launch A Revolution (Paul B. Farrell

Thursday is launch day for Pope Francis’s historic anticapitalist revolution, a multitargeted global revolution against out-of-control free-market capitalism driven by consumerism, against destruction of the planet’s environment, climate and natural resources for personal profits and against the greediest science deniers. Translated bluntly, stripped of all the euphemisms and his charm, that is the loud-and-clear message of Pope Francis’ historic encyclical released Thursday. Pope Francis has a grand mission here on Earth, and he gives no quarter, hammering home a very simple message with no wiggle room for compromise of his principles: ‘If we destroy God’s Creation, it will destroy us,” our human civilization here on Planet Earth.

Yes, he’s blunt, tough, he is a revolutionary. Pope Francis’s call-to-arms will be broadcast loud, clear and worldwide. Not just to 1.2 billion Catholics, but heard by seven billion humans all across the planet. And, yes, many will oppose him, be enraged to hear the message, because it is a call-to-arms, like Paul Revere’s ride, inspiring billions to join a people’s revolution. The fact is the pontiff is already building an army of billions, in the same spirit as Gandhi, King and Marx. These are revolutionary times. Deny it all you want, but the global zeitgeist has thrust the pope in front of a global movement, focusing, inspiring, leading billions. Future historians will call Pope Francis the “Great 21st Century Revolutionary.”

Yes, our upbeat, ever-smiling Pope Francis. As a former boxer, he loves a good match. And he’s going to get one. He is encouraging rebellion against super-rich capitalists, against fossil-fuel power-players, conservative politicians and the 67 billionaires who already own more than half the assets of the planet. That’s the biggest reason Pope Francis is scaring the hell out of the GOP, Big Oil, the Koch Empire, Massey Coal, every other fossil-fuel billionaire and more than a hundred million climate-denying capitalists and conservatives. Their biggest fear: They’re deeply afraid the pope has started the ball rolling and they can’t stop it. They had hoped the pope would just go away.

But he is not going away. And after June 18 his power will only accelerate, as his revolutionary encyclical will challenge everything on the GOP’s free-market capitalist agenda, exposing every one of the anti-environment, antipoor, antiscience, obstructionist policies in the conservative agenda.

Well, it sounds cute.

• The Green Pope: How Religion Can Do Economics A Favour (Guardian)

Small is Beautiful by EF Schumacher is probably the most influential text on green economics ever written. As a collection of essays by a former industrial economist, who for two decades after the second world war was chief economic adviser to the National Coal Board, it did more than anything else to reimagine economics as servant to a convivial society living in balance with the environment. But its most enduring idea from which the book’s title is derived, about the importance of scale, was taken straight from a papal encyclical. Schumacher took subsidiarity, the principle that things are always best done at the lowest practical level, from an encyclical of Pope Pius XII issued in 1931 in the wake of the economic catastrophe of the Great Depression.

It is an injustice and disturbance of right order to push power up rather than down, it said, insisting that nations which do the latter will be happier and more prosperous. Today local democracy, decentralised food and energy systems and local participatory budgeting are arguably better paths for progress. Following the Pope’s encyclical this week on the need for a more equal global economy that respects planetary boundaries, high-profile church figures from across the spectrum of faiths echoed his concerns.

The Christian faith has an honourable tradition of criticising capitalism and the excesses of the market, and of insisting on different ways of doing things, not least since the crash of 2007–08. Famously, medieval Christianity placed a prohibition on usury, the charging of punitive interest on loans. That was only relaxed with the emergence of an aggressive mercantile middle class. Islamic banking today, at least notionally, still operates without the charging of formal interest. There is also a debate in green economics about the degree to which interest-bearing loans are hard–wired to an environmentally destructive growth imperative.