Robert Campin Portrait of a woman 1430-35

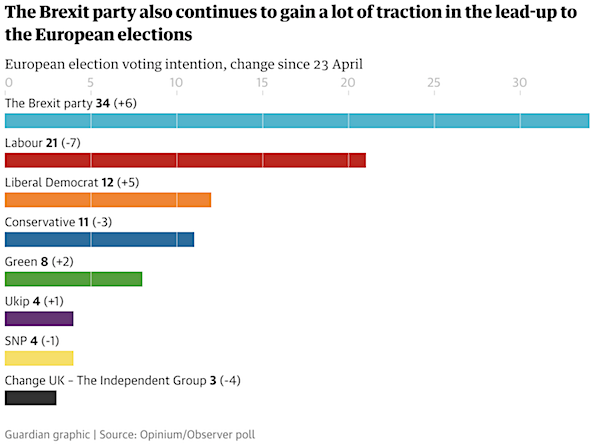

“Poll surge for Farage sparks panic among Tories and Labour..”

• Brexit Party May Get More EU Election Votes Than Tories, Labour Combined (G.)

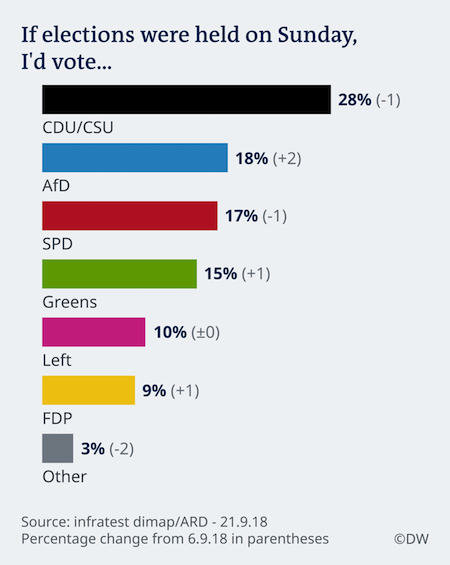

Nigel Farage’s Brexit party is on course to secure more support at the European elections than the Tories and Labour combined, according to the latest Opinium poll for the Observer. In the most striking sign to date of surging support for Farage, the poll suggests more than a third of voters will back him on 23 May. It puts his party on 34% of the vote, with less than a fortnight before the election takes place. The poll suggests support for the Conservatives has collapsed amid the Brexit uncertainty, with Theresa May’s party on just 11%. Labour is a distant second, on 21%. The Lib Dems perform the best of any of the openly anti-Brexit parties, one point ahead of the Tories on 12% of the vote.

With the Brexit party securing more than three times the level of support for the Tories, the poll confirms the concerns of senior Conservatives that it is haemorrhaging support as Brexit remains unresolved. Just a fortnight ago, the Brexit party was neck-and-neck with Labour on 28%. Now it has a 13-point lead over Jeremy Corbyn’s party. The Conservatives are now only narrowly ahead of the Brexit party when voters are asked who they would vote for at a general election. The Tories are on 22% support, down 4% on a fortnight ago, with the Brexit party on 21% backing. Labour leads on 28%, but is down five points on the last poll.

“The problem they have is that literally in front of us they will fall out,” he told the Sunday Mirror. “So the exercise here is holding themselves together. And that is proving impossible. The administration is falling apart.”

• Fight To Replace PM May Complicating Brexit Talks – Labour’s McDonnell (R.)

The battle among leading Conservatives to replace Theresa May as prime minister threatens to derail talks with the Labour Party and the bid to find a Brexit compromise, Labour’s John McDonnell said. May, who has offered to quit if MPs accept her Brexit deal, opened cross-party talks with Jeremy Corbyn’s Labour Party more than a month ago after parliament rejected her European Union withdrawal deal three times. The talks with Labour are a last resort for May, whose party’s deep divisions over Brexit have so far stopped her getting approval for an exit agreement and left the world’s fifth largest economy in prolonged political limbo.

McDonnell, Labour’s financial spokesman and a member of the party’s negotiating team, said the situation was precarious. “The problem they have is that literally in front of us they will fall out,” he told the Sunday Mirror. “So the exercise here is holding themselves together. And that is proving impossible. The administration is falling apart.” In terms of progress, the second most powerful man in the Labour Party said nothing new had been put on the table, and in some cases the talks had gone backwards. “It’s so precarious. We’re dealing with an institution that might not be there in three weeks.” He said the talks had been made more difficult by May’s offer to resign because a new leader could rip up anything agreed by the current administration.

Universal in Sheffield?

• Labour Would Trial Universal Basic Income If Elected – McDonnell (G.)

Labour would trial universal basic income if it wins power, shadow chancellor John McDonnell has revealed. Pilot schemes would be held in Liverpool, Sheffield and the Midlands, McDonnell told the Mirror. The plan would do away with the need for welfare as every citizen would be given a fixed sum to cover the basics whether they are rich or poor, in work or unemployed. McDonnell said people can spend the money how they like, but it is intended for study, to set up a business or leave work to care for a loved one. “I’d like to see a northern and Midlands town in the pilot so we have a spread,” he said.

“I would like Liverpool – of course I would, I’m a Scouser – but Sheffield have really worked hard. I’ve been involved in their anti-poverty campaign and they’ve done a lot round the real living wage. I think those two cities would be ideal and somewhere in the Midlands.” Trials have been held elsewhere in the world, including Kenya, Finland and the US, as well as potentially being explored in four Scottish cities. The shadow chancellor was this week handed a feasibility report for different universal basic income (UBI) models for low-income areas, including one in which a whole community gets basic incomes.

All the means-tested benefits – apart from housing benefit – would be taken away and every adult would get a fixed amount per week, plus an additional amount for each child they have. “Of course it’s a radical idea,” McDonnell said. “But I can remember, when I was at the trade unions – campaigning for child benefit and that’s almost like UBI – you get a universal amount of money just based on having a child. “UBI shares that concept. It’s about winning the argument and getting the design right.” The concept has been around since at least the 1960s and was raised in the 1972 US presidential election, followed by the introduction of a UBI scheme called the Manitoba Basic Income Experiment in Canada in 1975.

[..] McDonnell is convinced of the benefits. “The reason we’re doing it is because the social security system has collapsed. We need a radical alternative and we’re going to examine that. “We’ll look at options, run the pilots and see if we can roll it out. If you look at the Finland pilot it says it didn’t do much in terms of employment but did in terms of wellbeing – things like health. It was quite remarkable. “The other thing it did was increase trust in politicians, which can’t be a bad thing.”

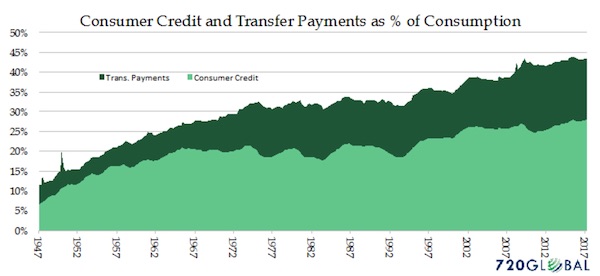

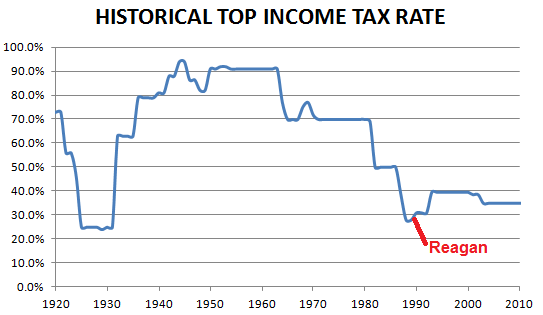

But the central banks has become the whole economy..

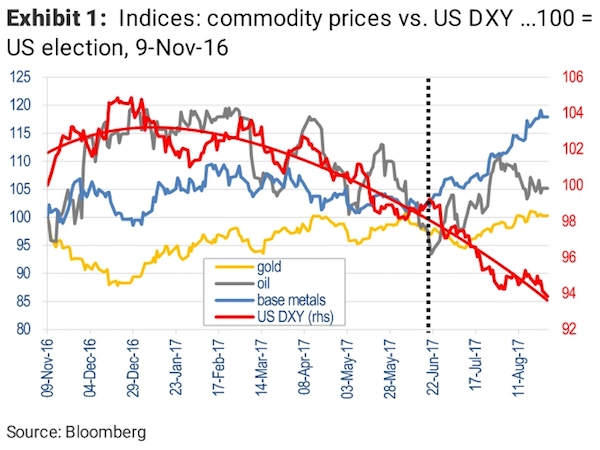

• QE Party Over, Bank of Japan Stealth-Tapers Further (WS)

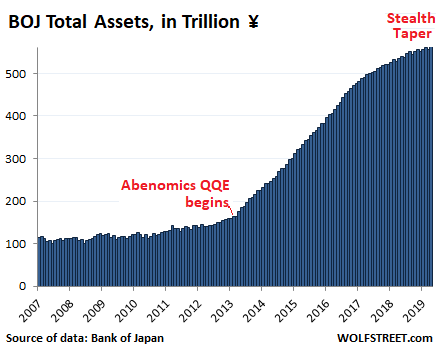

Total assets on the balance sheet of the Bank of Japan at the end of April ticked up from March but were flat with the record in February: ¥562 trillion ($5.1 trillion). This amounts to a gigantic 102.2% of nominal GDP. But the BOJ has been tapering its asset purchases since peak QE at the end of 2016, and the growth has slowed to a snail’s pace, by Abenomics QE standards. Despite the BOJs repeated promises of adding ¥85 trillion to its balance sheet every year, the BOJ hasn’t done that since peak QE in 2016 when it added ¥93 trillion. The additions have consistently decreased since then. Over the 12 months through April, it has added merely €27 trillion, the lowest 12-month increase since early days of ramping up Abenomics in March 2013. This amounts to a stealth taper:

Meanwhile, the government of Japan has been borrowing and issuing new debt with reckless abandon, and the gross national debt outstanding has ballooned to ¥1.12 quadrillion, or 203% of nominal GDP (measured in yen). But no problem: the BOJ started buying every Japanese government security that wasn’t nailed down, with the government selling new securities to the banks, and the banks selling them to the BOJ for a small profit. In addition the BOJ mopped up what was coming on the market. The BOJ now holds 43% of all outstanding Japanese government securities, up from 25% in January 2015. These massive purchases of Japanese government securities, and to a lesser extent, the purchases of corporate bonds, equity ETFs, and Japan REITS, have created this enormous balance sheet, but note the flattening spot at the top, a result of the stealth taper:

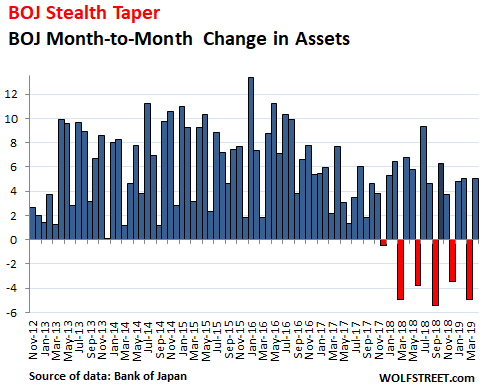

The stealth taper has reached a level to where the assets added to the balance sheet are small enough that every third month, as long-term securities mature and roll off the balance sheet, the balance sheet shrinks. Then the next two months, the balance sheet gains:

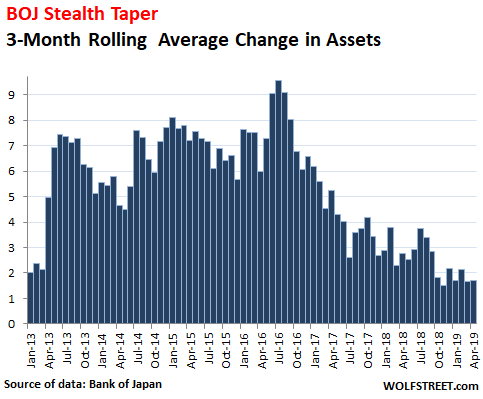

To smoothen out this volatility of the balance sheet and delineate the trend of the stealth taper more clearly, I converted that above data of month-to-month change into a rolling three-month average. The addition in assets over the past six months was ¥1.7 trillion a month on average:

John Quincy Adams. A bit wiser than Mike Pompeo.

• The World’s Dictatress (Hornberger)

In his Fourth of July address to Congress in 1821, U.S. Secretary of State John Quincy Adams stated that if America were ever to abandon its founding foreign policy of non-interventionism, she would inevitably become the world’s “dictatress” and begin behaving accordingly. No can can deny that Adams’ prediction has come true. America has truly become the world’s dictatress — an arrogant, ruthless, brutal dictatress that brooks no dissent from anyone in the world. Now, I use the term “America” because that’s the term Adams used. In actuality, however, it’s not America that has become the world’s dictatress. It is the U.S. government that has become the world’s dictatress.

A good example of this phenomenon involves Meng Wanzhou, a Chinese citizen who serves as chief financial officer of the giant Chinese technology firm Huawei. Having been arrested by Canadian authorities and placed under house arrest, Meng is suffering the wrath of the world’s dictatress. What is her purported crime? That she violated U.S. sanctions against Iran. What do U.S. sanctions on Iran have to do with her? Exactly! She’s a Chinese citizen, not an American citizen. So, why is she being prosecuted by the U.S. government? Sanctions have become a standard tool of U.S. foreign policy. With the exception of libertarians, hardly anyone raises an eyebrow over their imposition and enforcement.

Their objective is to target foreign citizens with death, suffering, and economic privation as a way to bend their regime to the will of the U.S. dictratress and her brutal and ruthless agents. After all, what could be more brutal and ruthless than to target innocent people with death and impoverishment as a way to get to their government? Most foreign citizens have as little control over the actions of their government as individual American citizens have over the actions of their government. Where is the morality in targeting innocent people, especially as a way to achieve a political goal? Isn’t that why people condemn terrorism?

“.. it is John Bolton, not Iran, who poses the greatest threat to American national security today.”

• Is America Ready for John Bolton’s War With Iran? (Ritter)

The threat being promulgated by Bolton, CENTCOM, Pompeo, and the media ignores the reality that Iran has been preparing to strike American military forces in the Middle East for years as part of its efforts towards self-defense. Iran’s short-range ballistic missile capability is part of a larger missile threat that could, at a moment’s notice, blanket U.S. bases in the region with high explosives. Dispatching the Abraham Lincoln battle group and a B-52 task force to the Middle East is an act of theatrical bravado that will do nothing to change that. Iran’s missile force is, for the most part, mobile. The American experience in the Gulf War, and Saudi Arabia’s experience in Yemen, should underscore the reality that mobile relocatable targets such as Iran’s missile arsenal are virtually impossible to interdict through airpower.

By purposefully escalating tensions with Iran using manufactured intelligence about an all too real threat, Bolton is setting the country up for a war it is not prepared to fight and most likely cannot win. This point is driven home by the fact that Mike Pompeo has been recalled from his trip to participate in a National Security Council meeting where the Pentagon will lay out in stark detail the realities of a military conflict with Iran, including the high costs. (Hopefully, they’ll emphasize that Iran would win such a war simply by not losing—all they’d have to do is ride out any American attack.) That Israel is behind the scenes supplying the intelligence and motivation makes Bolton’s actions even more questionable. It shows that it is John Bolton, not Iran, who poses the greatest threat to American national security today.

The US must still be smart enough to understand it can only lose.

• Iran’s Rouhani Warns Of Greater Hardship Than War Years Of 1980s (R.)

Iran’s president, Hassan Rouhani, has called for unity among political factions to overcome conditions that he said may be harder than those during the 1980s war with Iraq, state media reported, as the country faces tightening US sanctions. Donald Trump on Thursday urged Iran’s leaders to talk with him about giving up their nuclear programme and said he could not rule out a military confrontation. The president increased economic and military pressure on Iran, moving to cut off all Iranian oil exports while beefing up the US navy and air force presence in the Gulf. Washington also approved a new deployment of Patriot missiles to the Middle East, a US official said on Friday.

“Today, it cannot be said whether conditions are better or worse than the (1980-88) war period,” Rouhani said, according to the state news agency IRNA. “But during the war we did not have a problem with our banks, oil sales or imports and exports, and there were only sanctions on arms purchases. “The pressures by enemies is a war unprecedented in the history of our Islamic revolution … but I do not despair and have great hope for the future and believe that we can move past these difficult conditions provided that we are united,” Rouhani told activists from various factions.

“.. he reserves the right to invite foreign military actions in the way independence hero Simon Bolivar hired 5,000 British mercenaries to liberate South America from Spain. “:

• Guaido Seeks Pentagon Cooperation In Attempt To Take Power (AP)

Venezuelan opposition leader Juan Guaido on Saturday said he has instructed his political envoy in Washington to immediately open relations with the US military, in an attempt to put more pressure on President Nicolás Maduro to resign. Guiado said he had asked Carlos Vecchio, who the US recognizes as ambassador, to open “direct communications” toward possible military “coordination”. The remarks, at the end of a rally, were Guaido’s strongest public plea yet for greater US involvement in the country’s fast-escalating crisis. While Guaido has repeatedly echoed comments from the Trump administration that “all options” for removing Maduro are on the table, few in the US or Venezuelan opposition view military action as likely. Nor has the White House indicated it is seriously considering such a move.

[Guaido] announced on Saturday a forthcoming meeting with US military officials and said new actions will seek to “achieve the necessary pressure” to put an end to the Bolivarian revolution launched 20 years ago by the late socialist president Hugo Chávez. Guaido has said that as Venezuela’s rightful leader he reserves the right to invite foreign military actions in the way independence hero Simon Bolivar hired 5,000 British mercenaries to liberate South America from Spain. He says any such help should be considered “cooperation” instead of intervention, something he has accused Maduro of allowing in the form of military and intelligence support from Cuba and Russia. [..] Noticeably diminished crowds at opposition protests reflect demoralization that has permeated Guaido’s supporters after he led a failed military uprising on 30 April. In previous months, thousands heeded his calls to protest. On Saturday, a modest crowd of several hundred gathered in Caracas.

Lock ’em up.

• Boeing Altered Key Switches In 737 MAX Cockpit (ST)

In the middle of Boeing 737 cockpits, sitting between the pilot seats, are two toggle switches that can immediately shut off power to the systems that control the angle of the plane’s horizontal tail. Those switches are critical in the event a malfunction causes movements that the pilots don’t want. And Boeing sees the toggles as a vital backstop to a new safety system on the 737 MAX – the Maneuvering Characteristics Augmentation System (MCAS) – which is suspected of repeatedly moving the horizontal tails on the Lion Air and Ethiopian Airlines flights that crashed and killed a total of 346 people. But as Boeing was transitioning from its 737 NG model to the 737 MAX, the company altered the labeling and the purpose of those two switches.

The functionality of the switches became more restrictive on the MAX than on previous models, closing out an option that could conceivably have helped the pilots in the Ethiopian Airlines flight regain control. Boeing declined to detail the specific functionality of the two switches. But after obtaining and reviewing flight manual documents, The Seattle Times found that the left switch on the 737 NG model is capable of deactivating the buttons on the yoke that pilots regularly press with their thumb to control the horizontal stabilizer. The right switch on the 737 NG was labeled “AUTO PILOT” and is capable of deactivating just the automated controls of the stabilizer. On the newer 737 MAX, according to documents reviewed by The Times, those two switches were changed to perform the same function – flipping either one of them would turn off all electric controls of the stabilizer.

That means there is no longer an option to turn off automated functions – such as MCAS – without also turning off the thumb buttons the pilots would normally use to control the stabilizer. Peter Lemme, a former Boeing flight-controls engineer who has been closely scrutinizing the MAX design and first raised questions about the switches on his blog, said he doesn’t understand why Boeing abandoned the old setup. He said if the company had maintained the switch design from the 737 NG, Boeing could have instructed pilots after the Lion Air crash last year to simply flip the “AUTO PILOT” switch to deactivate MCAS and continue flying with the normal trim buttons on the control wheel.

He said that would have saved the Ethiopian Airlines plane and the 157 people on board. “There’s no doubt in my mind that they would have been fine,” Lemme said.

“..authorities have made clear to his visitors that, if they speak with the media about the conditions of Assange’s imprisonment, those conditions will only worsen.”

• Assange’s Prison Conditions (Press Project)

ThePressProject has obtained exclusive information about Julian Assange’s prison conditions. According to that information, Assange appeared in court without having been granted prior counsel from an attorney. He has access to one book, the Bible, and is not permitted access to writing materials. He is being held in solitary confinement 23 hours a day and his visitors have been made aware that conditions will worsen if they are publicized. Assange has been held at Belmarsh Prison, a Category A (i.e. high security) facility since April 11.

Both Assange’s imprisonment at Belmarsh and his 50-week sentence have been condemned in a statement issued by the UN Working Group on Arbitrary Detention, which denounced the “disproportionate treatment imposed on Mr. Assange” and claimed that his “treatment appears to contravene the principles of necessity and proportionality envisaged by the human rights standards.” Following a visit to Assange in Belmarsh earlier this week, UN Special Rapporteur on torture Nils Melzer also expressed concerns that his rights were being violated. Assange is permitted one hour a day outside of solitary confinement, during which he is allowed to bathe, walk, and use a telephone. At this moment the attention of the international community is upon him, with calls being issued by the United Nations and expressions of support coming from all over the world.

Nevertheless, Assange was permitted to appear in court without prior counsel from an attorney; currently, his meetings with a lawyer are limited to three hours per week. Not only is he cut off from communication with the outside world, he is also not allowed access to books other than the Bible. Because he is not granted access to writing materials, he keeps notes in the margins of that Bible. Again, authorities have made clear to his visitors that, if they speak with the media about the conditions of Assange’s imprisonment, those conditions will only worsen. It is clear that, in this case of such an intense struggle against so unequal an opponent and with extradition to the United States a real possibility, the provision of a fair trial and access to adequate legal defense are a matter of life and death for the imprisoned Assange.

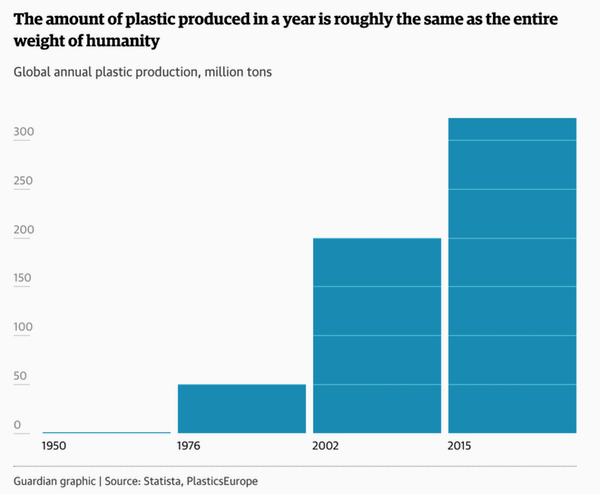

I see a headline like this, I immediately think: obesity. But there’s more tragedy behind this.

• American Mom Today 50% More Likely To Die In Childbirth Than Her Own Mother (AP)

Pregnancy-related deaths are rising in the United States and the main risk factor is being black, according to new reports that highlight racial disparities in care during and after childbirth. Black women, along with Native Americans and Alaska natives, are three times more likely to die before, during or after having a baby, and more than half of these deaths are preventable, Tuesday’s report from the Centers for Disease Control and Prevention concludes. Although these deaths are rare — about 700 a year — they have been rising for decades. “An American mom today is 50% more likely to die in childbirth than her own mother was,” said Dr. Neel Shah, a Harvard Medical School obstetrician.

Separately, the American College of Obstetricians and Gynecologists released new guidelines saying being black is the greatest risk factor for these deaths. The guidelines say women should have a comprehensive heart-risk evaluation 12 weeks after delivery, but up to 40% of women don’t return for that visit and payment issues may be one reason. Bleeding and infections used to cause most pregnancy-related deaths, but heart-related problems do now. The CDC report found that about one third of maternal deaths happened during pregnancy, a third were during or within a week of birth, and the rest were up to a year later. Globally, maternal mortality fell about 44% between 1990 and 2015, according to the World Health Organization. But the U.S. is out of step: Moms die in about 17 out of every 100,000 U.S. births each year, up from 12 per 100,000 a quarter century ago.