Russell Lee “Yreka, California, seat of a county rich in mineral deposits” 1942

“The IMF looks to have abdicated all responsibility for fixing the mess.”

• The US Will Have To Bail Out Greece (MarketWatch)

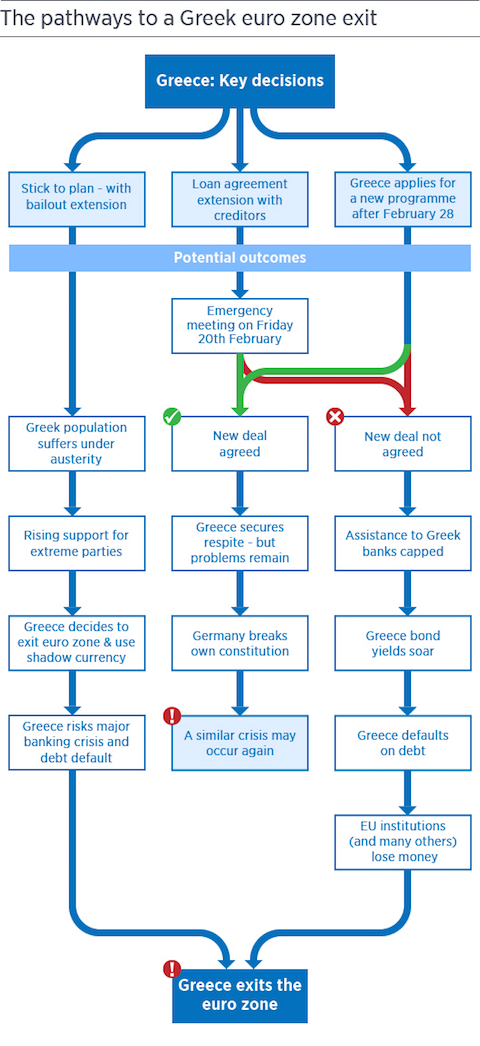

Fighting has flared up again in the Ukraine. The Egyptians are sending soldiers into Libya as another North African state collapses into chaos. The militants of Islamic State are spreading their influence across the region. You’d think Barack Obama might have bigger foreign policy issues to worry about than a small state of 10 million people on the eastern edges of the Mediterranean. But Greece may be about to turn from a European into an American problem. As the game of brinkmanship between the radical Syriza government elected last month and the European Union gets played out, it has become increasingly clear that both sides may have a strong interest in the talks failing. The IMF looks to have abdicated all responsibility for fixing the mess.

The worrying point is this: Both sides have an increasing interest in a catastrophic failure. But the U.S., with the U.K. perhaps in a subsidiary role, has an equally strong interest in a stable Greece. If a crunch comes, America will have no choice but to bail Greece out. How? It may well need to extend emergency loans, prop up its banks, and if necessary help it establish a new currency as well. On Monday, talks between Greece and the finance ministers of the eurozone ended chaotically. The Syriza government, led by the charismatic young Prime Minister Alexis Tsipras, is committed to ending the austerity regime imposed on Athens by the EU and the IMF and is refusing to borrow any more money under the terms of the bailout agreement.

The rest of the EU, led by Germany, is standing firm. It may be willing to make some minor concessions, such as rebranding the loans or extending their duration. But it does not look willing to compromise on the core issue — that Greece has to stick to the austerity plan, and keep tight controls on public spending. There may still be a deal to be struck. Greece after all only accounts for a small percentage of the total eurozone economy. Its debts amount to just 315 billion euros, hardly a massive sum in the context of an economic bloc with a total gross domestic product of €9.5 trillion. But the worrying point is this: Both sides have an increasing interest in a catastrophic failure.

“The German government has never wanted democratic reform in Greece..”

• Greece – It’s a Revolution, Stupid! (Mathew D. Rose)

I fear most people have become so fixated on the Greek debt and the fate of the Euro, that they have completely ignored the political dimensions of the current conflict in Europe, shich are no less dramatic. The ongoing dispute between the German and Greek governments is nothing less than a democratic revolution against German hegemony and the attempt of the Germans and their paladins in the EU to dictate Greek domestic policy. It is a struggle by the Greeks to re-establish national sovereignty. What is more, this is the first time in the history of the EU that a political party with true leftist credentials has led a member nation. For reactionary Germany, with its neoliberal agenda, that is intolerable. This conflict is profound, if not existential, and thus could well be intractable.

The Greek people have made a decision to liberate themselves from a repressive regime of austerity and its incumbent humanitarian disaster. The Germans on the other hand refer to the developments of the past five years in Greece as a success. Yes, it has been a success in the sense that the Germans and French were able to rescue their banks and leave the Greek people to foot the bill. It was even more successful in that Greece was stripped of its political and economic autonomy – with the assistance of the quislings Antonis Samaras and Evangelos Venizelos. The German government has never wanted democratic reform in Greece, leaving the perpetrators of the Greek financial crisis, the political and financial elites, unscathed.

Success has meant Greece being reduced to a vassal state, raising the market above all other values, where multinational corporations, including German companies, could take over profitable state assets cheaply and German tourists could enjoy cut-rate holidays or buy holiday homes at bargain prices. What occurred in Greece with the bailout is an occupation, not with troops and panzers, but by financial means. Following the recent elections in Greece, Germany and its EU compradors are making it clear who is in charge. The Germans are currently not offering any compromise, but iterate the same blunt demand: Greece has to accept what is being dictated; in other words, capitulate or be annihilated. This time it will not be the Wehrmacht und Luftwaffe that are to force the Greek nation into submission, but a weapon just as lethal: national bankruptcy.

“The letter does not meet the criteria agreed by the Eurogroup on Monday..”

• Germany Rejects Greece’s Application To Extend Its Loan Agreement (CNBC)

Germany has rejected Greece’s application to extend its loan agreement and renegotiate the terms of its bailout, raising the very real threat of Athens running out of money in the coming weeks. The Berlin government Thursday said Greece’s application for a six-month extension of its loan and a renegotiation of some its terms was “no substantial solution.” “In truth it goes in the direction of a bridge financing, without fulfilling the demands of the program. The letter does not meet the criteria agreed by the Eurogroup on Monday,” German finance ministry spokesman Martin Jaeger said in a statement.

Earlier Thursday Athens had formally placed a request to prolong its “master financial assistance facility agreement.” In the proposal the left-leaning Syriza Party had offered a series of concessions to the previous hardline stance that it would unilaterally scrap the austerity measures imposed as part of the country’s €240 billion bailout. However, the Greek proposal Thursday had pledged to work with the EU and the IMF in reworking the terms of the bailout and to not make any unilateral decisions when it came to the terms of the austerity package.

The Eurogroup of finance ministers from the 19 countries that use the single currency is due to meet on Friday to discuss the Greek plan. There has to be unanimous agreement among the group for any policy decision to go ahea.d The current program – which included the EU and IMF as creditors – was due to expire in little more than a week. Without further funds, Greece would soon run out of money rasing the prospect of a default on its bonds and a possible exit from the euro zone.

“The EU is staking the future of its monetary union not on principles but on semantics.”

• Europe and Greece Are at War Over Nothing (Bloomberg ed.)

Even by the demanding standards of European dysfunction, the continuing standoff between Greece and the other euro countries is impressive. On substance, the distance between the two sides has narrowed almost to nothing — yet the stalemate and the risk of a new financial crisis drag on as if it were vast. The EU is staking the future of its monetary union not on principles but on semantics. Initially, the new Greek government was at fault for making reckless election promises and presenting these to its European Union partners as non-negotiable. It has since climbed down a long way – in particular, dropping its demand for big debt write-downs. Now it wants a new bailout with softer terms and a temporary arrangement to bridge the financing gap between the present deal and the new one.

Reportedly, it’s even willing to call this bridge an “extension.” With Germany’s government leading the demand for strict propriety, Europe’s response has been to say that the current program must be successfully concluded, perhaps with some flexibility, before anything else can be discussed. So here’s the puzzle. What’s the difference between an extension that’s a bridge to a new program and an extension with flexibility pending agreement on a new program? To the sane observer, too little to care. Yet because of this difference, whatever it may be, the euro system threatens to break apart. Funny, isn’t it, that Europe’s voters express growing disenchantment with the whole project?

The situation is all the more absurd because the details of any transitional provisions don’t much matter anyway. What’s crucial are the terms of the new longer-term agreement — which the EU is refusing to discuss until Greece capitulates. The need for a new deal isn’t seriously disputed. The existing bailout imposed too tight a fiscal squeeze, which held back growth. The country’s debt burden therefore failed to shrink as intended in relation to gross domestic product. The error has been widely acknowledged, including by the International Monetary Fund (one of the plan’s architects) and by other EU governments.

“Europe’s crisis is far less likely to give birth to a better alternative to capitalism than it is to unleash dangerously regressive forces..”Europe’s crisis is far less likely to give birth to a better alternative to capitalism than it is to unleash dangerously regressive forces

• How I Became An Erratic Marxist (Yanis Varoufakis)

In 2008, capitalism had its second global spasm. The financial crisis set off a chain reaction that pushed Europe into a downward spiral that continues to this day. Europe’s present situation is not merely a threat for workers, for the dispossessed, for the bankers, for social classes or, indeed, nations. No, Europe’s current posture poses a threat to civilisation as we know it. If my prognosis is correct, and we are not facing just another cyclical slump soon to be overcome, the question that arises for radicals is this: should we welcome this crisis of European capitalism as an opportunity to replace it with a better system? Or should we be so worried about it as to embark upon a campaign for stabilising European capitalism?

To me, the answer is clear. Europe’s crisis is far less likely to give birth to a better alternative to capitalism than it is to unleash dangerously regressive forces that have the capacity to cause a humanitarian bloodbath, while extinguishing the hope for any progressive moves for generations to come.For this view I have been accused, by well-meaning radical voices, of being “defeatist” and of trying to save an indefensible European socioeconomic system. This criticism, I confess, hurts. And it hurts because it contains more than a kernel of truth. I share the view that this European Union is typified by a large democratic deficit that, in combination with the denial of the faulty architecture of its monetary union, has put Europe’s peoples on a path to permanent recession.

And I also bow to the criticism that I have campaigned on an agenda founded on the assumption that the left was, and remains, squarely defeated. I confess I would much rather be promoting a radical agenda, the raison d’être of which is to replace European capitalism with a different system. Yet my aim here is to offer a window into my view of a repugnant European capitalism whose implosion, despite its many ills, should be avoided at all costs. It is a confession intended to convince radicals that we have a contradictory mission: to arrest the freefall of European capitalism in order to buy the time we need to formulate its alternative.

“I want you to bear this empirical reality in mind when you consider the pressure that is being applied to Greece to get it to “stick with the program..”

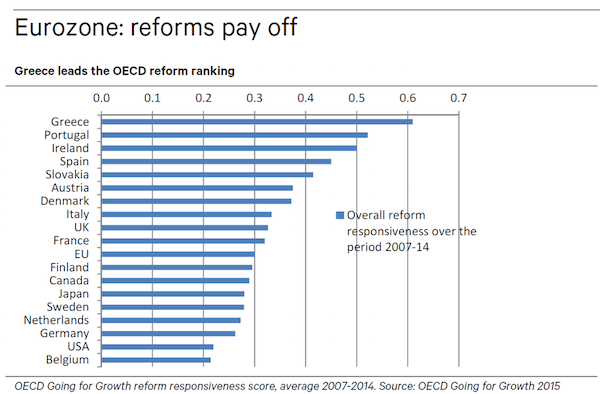

• For Greece And Many Others, Economic Reform Kills Economic Health (Steve Keen)

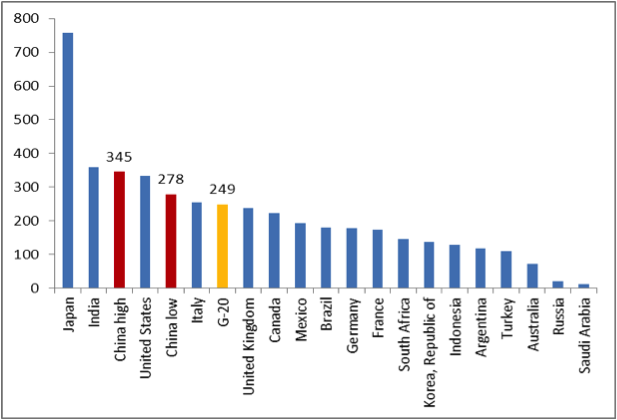

A quick quiz: which four countries do you think have done the most to reform their economies over the last seven years? OK, who said Greece, Portugal, Ireland and Spain? No one? Actually, someone did: the OECD. Yes, I kid you not, according to the OECD, the country that has done the most to reform its economy over the last seven years—that is, from before the 2008 economic crisis until well after it—is Greece. Followed at some distance by Portugal, Ireland and Spain. I saw this in a tweet, and even though I am a total sceptic on the value of what conventional economists call “economic reform”, I still couldn’t believe this graphic: surely it was an Onion spoof? I simply had to go searching to see for myself.

And there it was, on page 111 of the OECD’s publication Going For Growth 2015, released on February 9 (in a slightly different form, and with New Zealand pipping in between Ireland and Spain—maybe this graphic was revised later). The top economic reformers were the basket cases of Europe and the world in general. Unemployment in Greece is 27%; in Portugal it’s 15%, Ireland 12%, and Spain 25%. Those are very, very sick economies. And yet they are also the OECD’s top reformers. You are, I hope, wondering “how come? Isn’t reform supposed to be good for you?” Well, that’s the fairy story—sorry, theory—purveyed and fervently believed in by mainstream economists: reform your economies according to our recommendations, and—whatever else happens—your economy will grow more rapidly and be more stable to boot.

Unfortunately for those purveying this fairytale, they also developed metrics by which the degree of reform could be measured, so that a decade later, we can compare the fairy story to the reality. And one quick look shows that we’ve been had. We were told to expect the beautiful Cinderella at the economic ball; instead we got one of her ugly step-sisters. I’ll cover at length someday soon why economic reform as recommended by mainstream economists will normally make your economy more dysfunctional and unstable. For now, I want you to bear this empirical reality in mind when you consider the pressure that is being applied to Greece to get it to “stick with the program” invented for it by the EU.

“Finance Ministry officials assure they have identified resources they could tap if a small extension on Greece’s bailout obligations, up to the first week of March, is granted from the eurozone.”

• February 24 To Be The First Crunch Day For Greek State Coffers (Kathimerini)

February 24 is expected to be the first crucial day for state finances, as projections of cash flows see state coffers starting to run dry on that date. Finance Ministry officials, however, assure they have identified resources they could tap if a small extension on Greece’s bailout obligations, up to the first week of March, is granted from the eurozone. The state of cash reserves – not robust before – has deteriorated further in recent days due to a shortfall in revenues, as a €1 billion hole in January revenues is putting the execution of the state budget in jeopardy and hampering the management of cash reserves. According to figures released yesterday by the Bank of Greece, in January the net cash result of the central administration posted a deficit of €217 million, against a surplus of €603 million in January 2014.

Budget revenues reached €3.1 billion, against 4.4 billion in January 2014, while expenditure dropped to €3.2 billion from €3.6 billion last year. Given these figures, the Finance Ministry estimates that cash reserves will run out next Tuesday. It has the option, however, of using the reserves of general government entities kept in commercial banks in order to cover short-term needs next week. However, the problem that cannot be addressed as things stand concerns needs for the first week of March. Unless something changes drastically to the country’s funding, Greece will not be able to fulfill all of its March obligations. Finance Minister Yanis Varoufakis had called on the ECB to increase the limit of treasury bills to €23 billion from the current 15 billion in a bid to address this shortfall.

The additional funds would have covered the state’s short-term obligations while also providing a cushion until the Greek government is able to strike a deal with its eurozone partners. The request, however, was rejected, as the ECB deemed it an act of direct monetary funding: In practical terms the European Central Bank would have been financing the obligations of a state, which contravenes its regulations.

“Depending on the number of installments, there will be a reduction to penalties and fines ranging from 30% to 90%..”

• Greek Debt Payment Plan Offers Huge Haircut (Kathimerini)

A new repayment plan for expired debts to the state and social security funds announced by the government on Wednesday provides for a reduction to the fines and penalties levied against debtors as well as for a writedown of the original debt, reaching as much as 50% rate in some cases. The new scheme, which has already generated concern among Greece’s international creditors but also among consistent taxpayers, foresees the repayment of debts in up to 100 monthly installments regardless of their size. The minimum installment will be set at €20, while for debts up to €5,000 there will be no interest attached. Depending on the number of installments, there will be a reduction to penalties and fines ranging from 30% to 90%, and in cases of repayment in a lump sum the penalties will be written off entirely.

Crucially, for debts generated up until December 31, 2013, a part of the original debt can be written off, by as much as 50% in certain cases. The plan further waives the limit of 1 million euros for debts that can be negotiated for settlement, making repayment easier for major state debtors. In presenting the new scheme yesterday, Alternate Finance Minister Nadia Valavani stressed that this will be the very last opportunity given to taxpayers to settle their debts to the state. She added that at a later stage there will be another, more favorable plan, concerning only those who find themselves in financial hardship. Ministry calculations show that out of the €76 billion of outstanding debts by taxpayers and corporations to the state, no more than €9 billion can actually be collected.

Social security funds are anticipating a total of €1.2 billion from debt repayments this year thanks to the new plan, from total arrears of €20 billion. The bill in Parliament, which Prime Minister Alexis Tsipras said on Tuesday would be put before Parliament on Thursday, has been postponed until next week. The official explanation cites a need for technical changes to be made to draft, though it has been suggested that the postponement of the process was decided in order to prevent a reaction from the country’s creditors in this week’s crucial negotiations.

“Whether “doing what is right” in this case means “doing what Varoufakis wants” is, of course, open to debate.”

• Greek Philosophy: Conflict Of Ideas Driving The Crisis (CNBC)

As European politicians ponder how to solve the current impasse over Greece’s debts to international creditors, some of the key players seem to be digging out their philosophy books.The country’s erudite Finance Minister, Yanis Varoufakis, cited German philosopher Immanuel Kant in a New York Times editorial published Tuesday – a nice reminder of Europe’s shared cultural history – as he pled with those reading to help the Greek people escape the bonds of austerity. Kant “taught us that the rational and the free escape the empire of expediency by doing what is right,” he argued.

Whether “doing what is right” in this case means “doing what Varoufakis wants” is, of course, open to debate. Wolfgang Schaueble, the German finance minister, seemed to be adopting a rather dogmatic philosophy, by contrast. When asked about the potential for changes to the existing programme by German state television channel ZDF Tuesday night, he said: “It’s not about extending a credit programme but about whether this bailout programme will be fulfilled, yes or no.”

I don’t think so.

• Greece Runs Up The Austerity White Flag In Brussels (Guardian)

The white flag has been raised over Athens. Greece has bowed to the intense pressure of its eurozone partners and will stick to austerity. After defiantly saying for the past three weeks that it will end the country’s fiscal waterboarding, the Syriza-led government is suing for peace. That, bluntly, is the only way to interpret news that Greece has formally asked for a six-month extension to its bailout agreement. There is no longer the pretence that the bailout is to be replaced by a loan agreement with no strings attached. The hated troika of the European Central Bank, the European Union and the International Monetary Fund will be monitoring Greece’s economy for the next six months, something that has been anathema to Syriza until now.

The Greek government has some demands of its own. It wants to negotiate a new growth deal for the four years until 2019. It is asking for debt relief under the terms of the bailout agreement signed in November 2012. And it wants to be able to take steps to deal with the humanitarian crisis caused by the 25% collapse in the size of the economy over the past five years. None of these demands are unreasonable. Indeed, they are all entirely sensible. As Dhaval Joshi of BCA Research has noted, for every euro the Greek government has saved through spending cuts or tax increases the economy has contracted by €1.2. Austerity has resulted in Greece’s debt to GDP ratio going up, not down. A change of tack is overdue. It is unlikely, though, that Syriza will get much of what it wants. The rest of Europe does not really want to negotiate with Alexis Tsipras and his finance minister, Yanis Varoufakis; it wants capitulation.

What’s more, it is in a position to get it. Tsipras has two big weaknesses. Firstly, Greece is suffering from capital flight and is dependent on emergency support from the ECB for its banks. This funding has just been increased by the ECB but not by as much as Greece would have liked. The life support could be cut off at any time. Secondly, and perhaps more significantly, Greece has failed to deploy its most potent weapon: a threat to leave the euro. For all the talk in Brussels and Berlin that the single currency could withstand a Greek departure from the single currency, the threat of withdrawal would have put the frighteners on. Would the euro group really want to risk chaos given the shaky state of the economy? Would Angela Merkel want to go down in history as the German chancellor responsible for rolling back more than half a century of European integration?

Curiously left out of the ceasefire deal.

• Besieged Ukraine Town Debaltseve Falls (Reuters)

Ukraine pulled thousands of troops out of an encircled town on Wednesday after a massive assault by pro-Russian rebels, who ignored a new ceasefire to seize the strategic railway junction. The fall of the besieged town of Debaltseve was one of the worst defeats of the war for Ukraine’s troops, who proved unable to stop an advance by Moscow-backed rebels fighting for territory the Kremlin calls “New Russia”. President Petro Poroshenko told security chiefs on Wednesday night that six Ukrainian soldiers had been killed during the pullout from Debaltseve. “According to preliminary data, six Ukrainian heroes were killed during the withdrawal, more than 100 were wounded,” he said, according to Interfax news agency.

Twenty-two Ukrainian soldiers had earlier been killed in the town in the past few days, the Ukrainian military high command said, with more than 150 wounded. Poroshenko, who flew to the frontline, nevertheless tried to cast the battle in a positive light, saying that by holding out as long as they had, Ukraine’s troops had exposed “the true face of the bandits and separatists who are supported by Russia”. The Ukrainian troops had held out for three days beyond the start of a Europe-brokered ceasefire, forcing the rebels to disavow the truce to pursue their advance on the town. Ukrainian troops, their faces blackened, some in columns, some in cars, arrived in Artemivsk, about 30 km (20 miles) north of Debaltseve in government-held territory.

Fighting did not halt with the retreat. A Reuters correspondent near Debaltseve saw black smoke rising over the town and heard loud blasts hours after the withdrawal began. “One hundred and sixty-seven wounded have been taken to Artemivsk. They did not pick up a lot of bodies. I don’t know the total figure,” Semen Semenchenko, who heads the Donbass paramilitary battalion, said on Facebook.

Bet you never knew.

• ‘Guantanamo of the East’: Ukraine Locks Up Refugees at EU’s Behest (Spiegel)

Hasan Hirsi has been learning German for the last year and a half, and recently even enrolled in a class that meets for five hours a day, from 1 to 6 p.m. Nevertheless, he still has no words to describe what happened to him before his arrival in Germany. Hirsi, a 21-year-old refugee from Somalia, is huddled on a worn sofa in an apartment in Landau, a small town in southwestern Germany, which he shares with three other Somalian asylum-seekers. He is wearing a gray hoodie and has short, black hair. A retiree from Landau who has volunteered to assist the refugees is sitting next to him. He wants to help Hirsi adjust to his new life in Europe.

But Hirsi is finding it difficult to forget the past. Indeed, he still has nightmares about Ukraine, a place where he became stranded for a lengthy stay on his way to Europe. He now refers to the country as “hell.” Staring at the floor, Hirsi says: “It is difficult.” He repeats the same word, “difficult,” in different languages. After fleeing from Somalia in the summer of 2008, Hirsi tried several times to reach Europe through Ukraine. He was detained once each by Ukrainian and Hungarian border patrols, and twice by police in Slovakia. Ukrainian security forces robbed, beat and tortured him, he says. After being apprehended, he spent almost three years in four different Ukrainian prisons – for committing no crime other thanseeking shelter and protection in Europe.

Most migrants reach Europe through Italy or Greece and many of them die on the way. A broad coalition, ranging from Pope Francis to German President Joachim Gauck, is demanding better protection for refugees on Europe’s southern border and the United Nations refugee agency, UNHCR, describes the route across the Mediterranean as the world’s deadliest. But when it comes to the eastern route, and the fate of migrants like Hasan Hirsi, interest has thus far been limited. SPIEGEL and “Report Mainz,” a program on Germany’s ARD public television network, have now taken a closer look at the stories of refugees who were locked up in Ukrainian prisons for months during their journeys to Europe.

Bad smell.

• Ukraine Finance Minister’s American ‘Values’ (Robert Parry)

Ukraine’s new Finance Minister Natalie Jaresko, who has become the face of reform for the U.S.-backed regime in Kiev and will be a key figure handling billions of dollars in Western financial aid, was at the center of insider deals and other questionable activities when she ran a $150 million U.S.-taxpayer-financed investment fund. Prior to taking Ukrainian citizenship and becoming Finance Minister last December, Jaresko was a former U.S. diplomat who served as chief executive officer of the Western NIS Enterprise Fund (WNISEF), which was created by Congress in the 1990s and overseen by the U.S. Agency for International Development (U.S. AID) to help jumpstart an investment economy in Ukraine.

But Jaresko, who was limited to making $150,000 a year at WNISEF under the U.S. AID grant agreement, managed to earn more than that amount, reporting in 2004 that she was paid $383,259 along with $67,415 in expenses, according to WNISEF’s public filing with the Internal Revenue Service. Later, Jaresko’s compensation was removed from public disclosure altogether after she co-founded two entities in 2006: Horizon Capital Associates (HCA) to manage WNISEF’s investments (and collect around $1 million a year in fees) and Emerging Europe Growth Fund (EEGF) to collaborate with WNISEF on investment deals. Jaresko formed HCA and EEGF with two other WNISEF officers, Mark Iwashko and Lenna Koszarny. They also started a third firm, Horizon Capital Advisors, which “serves as a sub-advisor to the Investment Manager, HCA,” according to WNISEF’s IRS filing for 2006.

U.S. AID apparently found nothing suspicious about these tangled business relationships – and even allowed WNISEF to spend millions of dollars helping EEGF become a follow-on private investment firm – despite the potential conflicts of interest involving Jaresko, the other WNISEF officers and their affiliated companies. For instance, WNISEF’s 2012 annual report devoted two pages to “related party transactions,” including the management fees to Jaresko’s Horizon Capital ($1,037,603 in 2011 and $1,023,689 in 2012) and WNISEF’s co-investments in projects with the EEGF, where Jaresko was founding partner and chief executive officer. Jaresko’s Horizon Capital managed the investments of both WNISEF and EEGF.

Interesting lawsuit.

• Are the World’s Biggest Banks Moving Money for Terrorists? (Bloomberg)

Steven Vincent had just left a money exchange in the southern Iraqi city of Basra when a group of men in police uniforms drove up in a white truck and grabbed him and his translator. It was Aug. 2, 2005. Vincent, a freelance American journalist, had reported on the war for two-and-a-half years. British troops occupied Basra, but he operated without an embed arrangement. British and Iraqi authorities later found Vincent on the outskirts of the city shot dead. The Iraqi translator survived. Three days earlier the New York Times had published an op-ed article by Vincent, Switched Off in Basra, in which he described the infiltration of the local police by Iranian-backed Islamic extremists. Steven was executed for what he wrote, says his widow, Lisa Ramaci.

She’s set up a foundation in his name that donates money to the families of Iraqis injured or killed because of their work with U.S. journalists. And Ramaci did something else. In November she joined a lawsuit on behalf of relatives of U.S. soldiers and civilians who’ve died in Iraq as a result of violence linked to Iranian-backed militias and terrorist groups. The suit, filed in federal court in Brooklyn, seeks hundreds of millions of dollars not from death squads, whose members aren t likely to show up with lawyers in tow. Instead, it targets five of the largest banks in the world: HSBC, Credit Suisse, Barclays, Standard Chartered, and Royal Bank of Scotland. Defendants, the suit declares, committed acts of international terrorism. The suit, known as Freeman v. HSBC, takes its name from lead plaintiff Charlotte Freeman, whose husband, Brian, an Army captain, died in a Jan. 20, 2007, attack by Iranian-trained militants in Karbala, Iraq.

This far-fetched-seeming attempt to pin culpability for violent deaths on bankers relies on an intricate theory of causation: The European-based banks have handled hundreds of billions of dollars in international transfers for Iranian financial institutions. The Iranian financial institutions, in turn, have moved money for the Islamic Revolutionary Guard Corps (IRGC), an elite Iranian paramilitary organization, and for Hezbollah, the militant Shia movement based in Lebanon and backed by Iran. The Revolutionary Guard and Hezbollah have trained and armed Shia groups in Iraq that have kidnapped, shot, and blown up Americans, including Vincent and Freeman. Can the global banking industry be held liable for the detonation of improvised explosive devices and destruction of lives? It may sound wild-eyed or quixotic, but that s what we re trying to do, says Gary Osen, the New Jersey lawyer who recruited the 230 plaintiffs for Freeman v. HSBC.