Jack Delano Main street intersection, Norwich, Connecticut 1940

“..our internecine political conflicts prevent us from delivering on the braggadocio..”

• Peak America: Our Run Is Over (Paul B. Farrell)

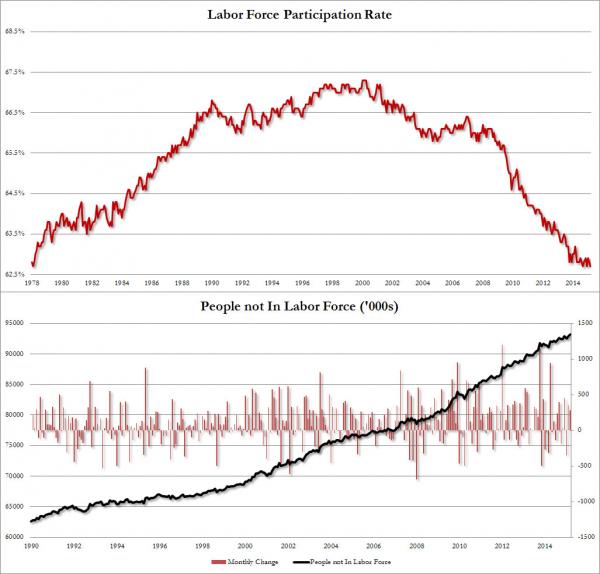

Peak America? Yes. We’re on the downside? Yes. Not exceptional? No. The questions come up a lot lately. In a Time magazine review of his new book “Superpower: Three Choices for America in the World,” foreign policy expert Ian Bremmer asks the blunt ones: “What role does President Barack Obama believe America should play in the world? His words and his actions tell different stories,” says Bremmer. Bottom line, “words aside, Obama’s deeds suggest he’s not acting so much as reacting to crises as they appear.” In his earlier best-seller, “Every Nation for Itself: What Happens When No One Leads the World?” Bremmer saw America’s spliting apart as a reflection of a global trend. He sees us living in a new “G-Zero, the new world order in which no single country or durable alliance of countries can meet the challenges of global leadership … What happens when the G-20 doesn’t work and the G-7 is history?”

The big question: “Have we hit Peak America?” asked the elite Foreign Policy magazine last year. Yes. The cover was a mess, total confusion, chaos, fragmentation. Yes, everything’s peaking. We talk a good game about exceptionalism. But our internecine political conflicts prevent us from delivering on the braggadocio. In “Superpower” Bremmer predicts even more fragmentation in America, reflecting our extreme political and cultural partisan conflict, plus Big Oil’s battle over climate science and carbon emissions. And across the world, it’s every nation for Itself. Prediction: America will peak with the 2016 election. Not just because of the insanity of 20 GOP presidential candidates. Truth is most are hustlers, not presidential timber.

Jeb Bush flip-flopping on his brother’s foreign policy was total incoherence. Rand Paul? Marco Rubio? Long shots. Hillary Clinton? Not incoherent, just running silent. The only coherent candidate is Bernie Sanders. Too good to be true. So special-interest billionaires will do everything possible to use him to destroy Clinton. No good news ahead. After the presidential election drama, no matter who’s elected, chaos, fragmentation and incoherence will accelerate. The delusional Federal Reserve and its bubble economy will finally collapse onto Wall Street’s overinflated stock market, confirming Jeremy Grantham’s forecast that the 2016 election will trigger a 50% drop, plunging America and the world into an economic recession, worse than 2007-08, with GDP near the flat line.

“Washington factions were blaming Germany for making the West lose Russia to China, while adult minds in the EU – away from the Bavarian Alps – blamed Washington.”

• American Dreaming, From G1 to Bilderberg (Pepe Escobar)

What’s the connection between the G7 summit in Germany, President Putin’s visit to Italy, the Bilderberg club meeting in Austria, and the TTIP – the US-EU free trade deal – negotiations in Washington? We start at the G7 in the Bavarian Alps – rather G1 with an added bunch of “junior partners” – as US President Barack Obama gloated about his neo-con induced feat; regiment the EU to soon extend sanctions on Russia even as the austerity-ravaged EU is arguably hurting even more than Russia. Predictably, German Chancellor Angela Merkel and French President Francois Hollande caved in – even after being forced by realpolitik to talk to Russia and jointly carve the Minsk-2 agreement.

The hypocrisy-meter in the Bavarian Alps had already exploded with a bang right at the pre-dinner speech by EU Council President Donald Tusk, former Prime Minister of Poland and certified Russophobe/warmonger: “All of us would have preferred to have Russia round the G7 table. But our group is not only a group (that shares) political or economic interests, but first of all this is a community of values. And that is why Russia is not among us.” So this was all about civilized “values” against “Russian aggression.” The “civilized” G1 + junior partners could not possibly argue whether they would collectively risk a nuclear war on European soil over a Kiev-installed ‘Banderastan’, sorry, “Russian aggression.” Instead, the real fun was happening behind the scenes.

Washington factions were blaming Germany for making the West lose Russia to China, while adult minds in the EU – away from the Bavarian Alps – blamed Washington. Even juicier is a contrarian view circulating among powerful Masters of the Universe in the US corporate world, not politics. They fear that in the next two to three years France will eventually re-ally with Russia (plenty of historical precedents). And they – once again – identify Germany as the key problem, as in Berlin forcing Washington to get involved in a Prussian ‘Mitteleuropa’ Americans fought two wars to prevent. As for the Russians – from President Putin and Foreign Minister Lavrov downwards – a consensus has emerged; it’s pointless to discuss anything substantial considering the pitiful intellectual pedigree – or downright neo-con stupidity – of the self-described “Don’t Do Stupid Stuff” Obama administration policy makers and advisers. As for the “junior partners” – mostly EU minions – they are irrelevant, mere Washington vassals.

It’s all still propped up. In essence, market manipulation.

• US Is Still Drowning In Mortgage Debt (MarketWatch)

The percentage of homes underwater — where the home is worth less than the mortgage — has been dropping as the housing market has recovered, but more than 4 million U.S. homeowners owe the bank at least 20% more than their homes are worth, totaling $579 billion of so-called negative equity, according to real estate company Zillow. “Homeowners who remain underwater will likely be the toughest to free from negative equity,” says Zillow chief economist Stan Humphries. The rate of underwater homeowners is much higher among the homes with the least value, according to Zillow, which uses data from credit bureau TransUnion. More than 25% of those who own the least valuable third of homes were upside down, compared with about 8% of the most valuable third of homes.

In Atlanta, 46% of low-end homeowners were underwater, compared with 10% of high-end homeowners. In Baltimore, 32% of low-end homeowners were in negative equity, compared with 9% of those who own the highest-value homes. The good news: There were 15 million homes in negative equity at the peak of the housing crisis. The national negative equity rate dropped to 15.4% of all homes with mortgages in the first quarter, down from rate 18.8% the same period last year. The rate of negative equity improved in all of the 35 largest housing markets in the first quarter of 2015, “a sign that the country is continuing to recover from the lax lending rules and subsequent housing market bust of the last decade,” the report says.

Millions of Americans are so far underwater, it’s likely they may not re-gain equity for up to a decade or more at these rates,” Humphries says. Because negative equity is concentrated so heavily at the lower end of the market, it prevents potential first-time buyers from finding affordable homes for sale, he adds. “Owners of those homes can’t move up the chain because they’re stuck underwater in the entry-level home they bought years ago. The logjam at the bottom is having ripple effects.”

That $50 trillion zombie.

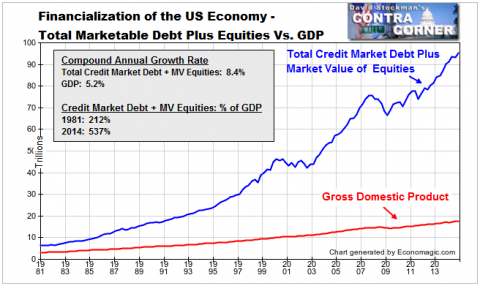

• The Warren Buffett Economy – Why Its Days Are Numbered-Part 3 (Stockman)

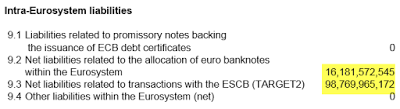

During the last 27 years the financial system has ballooned dramatically while the US economy has slowed to a crawl—–a divergent trend that has intensified with the passage of time. For instance, since Q4 2000, nominal GDP has expanded by just 70% compared to a 140% gain in market finance (i.e. the value of non-financial corporate equity plus credit market debt per the Fed’s Flow Of Funds report). As a consequence, and as we previously demonstrated, the ratio of finance to economic output has soared to nearly 540% of national income compared to a historic norm of about 200%. Had even the stabilized ratio of 240% that the Volcker sound money policy had put in place by 1986, for example, remained at the level, total credit market debt and equity finance would be $50 trillion lower than today’s gargantuan $93 trillion total.

Even when you purge the cumulative price inflation out of the above picture, the story does not remotely add-up. That is, while real median household income has not gained at all since the late 1980s, and thus currently stands at just 1.03X of its 1987 value, the GDP deflator-adjusted value of corporate equities and credit market debt outstanding stands at 8.0X and Warren Buffett’s real net worth at 19.0X. Needless to say, that’s not capitalism at work; its central bank driven bubble finance. So the question remains why did the Fed expand its balance sheet by 22X over the past 27 years (from $200 billion to $4.5 trillion)? After all, the empirical result was a sharp slowing of main street growth, a massive financialization of the US economy and monumental windfalls to financial speculators who surfed on the $50 trillion bubble.

“..when governors like Sam Brownback of Kansas or Scott Walker of Wisconsin slash spending on education and withhold infrastructure investment, they are serving the long-term interests of China rather than their own citizens”

• Myopic US Policies Pave Way For China’s Dominance (MarketWatch)

The Republican governors who are reducing taxes and slashing government spending are no doubt keeping their wealthy campaign donors happy. But when governors like Sam Brownback of Kansas or Scott Walker of Wisconsin slash spending on education and withhold infrastructure investment, they are serving the long-term interests of China rather than their own citizens. Trapped in the short-term objectives of their myopic ideology, these governors, as well as the Republican majorities in Congress, are hastening the decline of the U.S. as a world hegemon, and speeding the day when China will fashion a truly world empire.

Even as this country founders with a misguided fiscal retrenchment that will leave it ill-equipped to face global competition in coming decades, China is spending hundreds of billions on highways, rail lines, and pipelines to knit together a Eurasian landmass that a longstanding theory of geopolitics sees as the key to a genuine world empire. When the high-speed rail network and web of pipelines being feverishly constructed by China makes the land transport of resources more economical than sea transport, the containment policy followed by naval powers — first Britain, then the U.S.— will no longer work.

This is the daunting thesis advanced by University of Wisconsin historian Alfred McCoy, who sees China fulfilling the geopolitical destiny first described by British geographer Halford Mackinder in January 1904 in an impactful presentation to the Royal Geographical Society. “If China succeeds in linking its rising industries to the vast natural resources of the Eurasian heartland, then quite possibly, as Sir Halford Mackinder predicted on that cold London night in 1904, ‘the empire of the world would be in sight,’” McCoy wrote in a blog post this week. In Mackinder’s view — which has come to be known as the Pivot of History or Heartland Theory — it is the “world island” comprising Europe, Asia and Africa that is destined by geography to become the dominant world empire.

Though Mackinder’s forecast has taken longer than expected due to two world wars, the Russian Revolution and the Sino-Soviet split, China is now making good on the potential he described, McCoy says. “After decades of quiet preparation, Beijing has recently begun revealing its grand strategy for global power, move by careful move,” McCoy writes. “Its two-step plan is designed to build a transcontinental infrastructure for the economic integration of the world island from within, while mobilizing military forces to surgically slice through Washington’s encircling containment.”

The old dream of the big continent. But what happens when China’s economy halts?

• China’s Answer to Europe’s Needs (Bloomberg)

Although Budapest and Beijing are separated by 6,000 miles, they’ve just agreed to become much closer. In a quiet ceremony held last weekend, Hungary became the first European country to sign onto China’s New Silk Road initiative, a multi-billion dollar program to build up infrastructure and trade along the land and maritime routes of the ancient Silk Road that stretched across Asia and Europe. Right now, Hungary’s participation probably won’t have an impact beyond its own borders. But as others countries follow its lead, China’s economic and political relationship with Europe will likely undergo a dramatic shift – one that may not be to the European Union’s liking.

The Chinese government’s interest in Europe isn’t new. In recent years, it has made substantial investments in Greek port facilities, and agreed to help finance the development of high-speed rail service between Belgrade and Budapest. In both cases, China wanted to simplify the logistics of exporting to European markets. In return, it offered something to the countries in question: help building infrastructure, and easier access to Chinese markets (assuming they could figure out something to export back). The novelty of the New Silk Road initiative is that China is now pursuing far deeper partnerships as part of a comprehensive political strategy. Previously, policy makers in Beijing tended to treat, say, an investment in Tajikistan as a discrete exchange – you get a pipeline, we get gas.

Under the New Silk Road framework, it’s part of an explicit effort to expand Chinese influence across Eurasia – one step toward earning primacy for China on the global stage. Beijing hasn’t denied having vast ambitions for a program it expects to spur $2.5 trillion in annual trade by the end of the decade. In March, Xinhua, China’s official state news wire, announced the purpose of the program is nothing less than to “change the world political and economic landscape.” According to an analysis by Barclays, China’s economy will benefit enormously from opening up new markets for its excess capacity. For example, China’s massive state-owned sector currently earns an average return on investment of just over 4%. In contrast, Barclays estimates the average return for Chinese firms on New Silk Road infrastructure projects to be between 10 and 15%.

It’s like a vaudeville act: Xi and Li playing with fire.

• The World’s Worst Investment Bubble Will Burst Soon (MarketWatch)

Investment bubbles always look so obvious in hindsight. But when you’re in the middle of one, it’s hard to fight the crowd, even if that little voice in your head tells you to run for the hills. Why? Bubbles produce compelling narratives that give people reasons to believe. The Internet is changing everything. Housing prices never go down. Tulips are the most precious commodity on God’s green Earth, etc. Now the same thing is happening again in China, a market that has had one huge bubble burst only recently. The Shanghai Composite index briefly topped 6,000 in October 2007 only to plummet to just above 1,700, a sickening 70% plunge in only 12 months.

But a mere seven years later, Shanghai is above 5,000 again, and the bulls say more gains lie ahead, even though China’s economy is slowing dramatically and some valuations already are stratospheric. They’re counting on China’s central bank to keep cutting rates. It already has reduced them three times in the past six months. Sound familiar? Also, the Chinese government has eased trading restrictions on foreign investors. On Tuesday, index provider MSCI said it “expects to include China A shares in its global benchmarks” once it works out some issues with Chinese regulators.

A flood of institutional money would presumably follow. Indeed, mutual fund company Vanguard said last week it would gradually increase the number of mainland China-traded A shares in its Emerging Markets Stock Index Fund and ETF. This macro “story” has powered Shanghai 150% higher in the past 12 months. Shenzhen and other mainland markets with riskier, more speculative stocks have nearly tripled. With the animal spirits unleashed, average Chinese investors are piling in. In a reverse of what happened in the U.S. in the 2000s, Chinese investors fleeing a busted housing market have thrown their money into stocks. Talk about going from the wok to the fire!

“Other eurozone countries insisted that restructuring must not happen in 2010, and to the extent it was for their benefit, they should share the burden.”

• Demands On Greece Will Yield The Opposite Of What They Promise (FT)

The creditor demands and Greek counterproposals cover the primary (before interest) budget surplus, tax rates and pension payments, and a host of structural reforms. As you contemplate the list, it is worth shoving the details to one side and asking a more basic question: why do the creditors bother? What does it matter to Brussels, Frankfurt, Berlin and Washington whether the leftwing radicals in Athens adopt economic policies that the creditors claim are better for Greece? Why can’t the Greeks be left to sink or swim on their own? Of the answers that could be thought up to this question, many are illegitimate. They include the feeling that Greece need to be punished for being a deceitful troublemaker in Europe’s midst.

Also, the anti-democratic view that if the people make a bad choice the technocrats had better protect them against themselves. The only legitimate justification for the creditors’ insistence on specific policies is that these may be necessary for them to get their money back. Even there, the legitimacy is not clear-cut. Only 10% of the rescue loans financed Greek spending – the rest went to pay back outstanding debt that should have been restructured instead. Other eurozone countries insisted that restructuring must not happen in 2010, and to the extent it was for their benefit, they should share the burden. But for what it’s worth, the creditors’ interest in getting their money back makes the primary surplus by far the most important negotiation point.

The other demands can be justified only insofar as they are needed to reach a legitimate primary surplus target, otherwise not. But the creditors show a galling unwillingness to realise that by now, tightening Greece’s primary balance will make them less, not more, likely to get their money back. It is worth repeating the debt arithmetic we drew up last week. A plausible assumption is a fiscal multiplier (the effect of budget tightening on the economy) of 1.5 and a second-round effect of a GDP loss on the budget of one-third (it would be interesting to know which numbers the creditors use).

That means to achieve a given consolidation, measures twice as large have to be put in place, and the economy will shrink by three times the amount. Athens now seems to have accepted the creditors’ demand for a 1% of GDP primary surplus this year – from the 2/3% deficit the creditors’ currently expect. So to achieve that one-and-two-thirds percentage point improvement, fiscal measures have to be taken worth 3.33% of GDP – not, as many seem to think, one-and-two-thirds. And the economy will be 5% smaller than it would otherwise be.

There is no clearer sign of how the EU has deteriorated than having certified nut Tusk speak on its behalf.

• Varoufakis: ‘Contrary To Stubborn Rumours, We Never Gambled’ (Bloomberg)

Greece was told to stop fighting creditors’ demands and sign a deal that will avert a default as officials plan for a worsening of the crisis. Diplomatic niceties evaporated in Brussels on Thursday as European Union President Donald Tusk rebuked Greek Prime Minister Alexis Tsipras for dragging his feet on a debt agreement and the IMF’s team walked out of negotiations. Greek stocks tumbled. At a meeting of euro-area government staffers late Thursday, Greece was given less than 24 hours to come up with firm proposals to end the impasse, two officials present said. Policy makers are now examining all scenarios if Greece refuses to compromise, including the possibility that the country could eventually leave the currency, said the officials.

“There is no more time for gambling,” Tusk told reporters in Brussels on Thursday. “The day is coming, I am afraid, that someone says the game is over.” Greek banks fell as much as 8.1% and traded 7.1% lower at 11:30 a.m. in Athens. Greek bank stocks have lost more than 50% since the previous government of Antonis Samaras began to unravel in December. The Athens Stock Exchange Index, which has lost 24% since then, dropped as much as 4.2% on Friday. Standing on the brink of economic ruin, a reality check awaited Greece. The trio of lenders that hold the key to the country’s fate have run out of patience with what they see as delaying tactics and mixed messages of a leader elected to end an era of austerity.

“The ball is very much in Greece’s court,” IMF spokesman Gerry Rice told reporters in Washington. “There are major differences between us in most key areas. There has been no progress in narrowing these differences recently.” Greece is ready to speed up talks as its creditors have demanded and is aiming to reach an agreement in the next few days, government spokesman Gabriel Sakellaridis said in an e-mail on Thursday as Finance Minister Yanis Varoufakis pushed back against Tusk’s criticism. “Contrary to stubborn rumours, we never gambled,” Varoufakis said on Twitter.

It shows that no-one can be expected to overhaul the whole edifice in 5 months while they’re ordered to draft new troika plans every single day.

• Greek Pension Mess Shows There’s No Easy Way Out of Impasse (Bloomberg)

To find out why Greece’s pension system is tying negotiators up in knots, look no further than Maria Kounani, 59, a mother of two, single parent and early retiree. The maker of sewing patterns applied for a reduced pension last year, when the business where she’d worked for 20 years struggled with unpaid orders. To qualify for a full pension she needed to work another 10 years. She opted for early retirement, the only real choice she says she had, and one Greece’s creditors say is undermining the pension system. “I did it because no one is hiring me,” Kounani said. “They’re not even hiring my daughter who’s 39.” As Greek pensions remain a key sticking point in talks with creditors, cases like Kounani show why there are no simple ways out.

For creditors, the pension system is still too generous. For the Greek government, it’s a system struggling to cope after five years of recession and dwindling contributions in a nation with the European Union’s highest unemployment. In the first quarter, the rate was 26.6% overall and 30.6% for women. An aging population and an €8 billion hit to pension finances because of the largest sovereign debt restructuring in history in 2012 hasn’t helped. “If you have a new contribution system and a new system of calculating pensions and a person loses her job, she falls out of the system,” said Jens Bastian, an economist and a former member of the EC’s Greek task force. “That’s a macro issue that no number of pension system reforms can fix.” [..]

In parliament on June 5, Tsipras called the proposals from creditors “unrealistic” and said no lawmaker could agree to demands such as removing a stipend from the lowest-paid pensioners. Tsipras has agreed to merge funds to cut costs and close loopholes that allow early retirement. He blamed five years of austerity for weakening the system, saying fund reserves fell by €25 billion through the 2012 debt swap and high unemployment. In the last five years, pensions fell as much as 48%, Tsipras said, while 45% of recipients get pensions that are below the poverty threshold. Kounani gets a provisional payment of €420 a month and will get a final pension disclosed to her next year. She hopes it will be a little more than what she gets now, so that there’s a bit left over after paying her rent of €360 a month.

As of that’s news. All parties must do this.

• German Government Consulting On What To Do If Greece Goes Bankrupt (Reuters)

The German government is holding “concrete consultations” on what to do in the case of a bankruptcy of the Greek state, German newspaper Bild said, citing several people familiar with the matter. This includes discussions about introducing capital controls in Greece if the crisis-stricken country goes bankrupt, Bild said in an advance copy of an article due to be published on Friday. It said a debt haircut for Greece was also being discussed, adding that government officials were in close contact with the ECB on that.

The German government did not, however, have a concrete plan of how it would react if Greece goes bankrupt and much would have to be decided on an ad-hoc basis, Bild cited the sources as saying. Earlier on Thursday, the International Monetary Fund dramatically raised the stakes in Greece’s stalled debt talks, announcing that its delegation had left negotiations in Brussels and flown home because of major differences with Athens.

Obviously.

• Keeping Greece in the Euro May Have Nothing to Do With … Euros (Bloomberg)

The need to keep Greece firmly in the bosom of the West has always underpinned decisions about its European role. Greece became the 10th member of what’s now the EU in 1981 – joining before Spain and Austria. For 26 years, until Bulgaria joined in 2007, it shared no land border with another EU member. It adopted the euro in 2001, only then to reveal less than a decade later its finances weren’t in order. Merkel’s words were an echo of what Truman told Congress in 1947. That’s when he got approval for military and economic aid to prevent Greece from falling under the influence of the Soviet Union during its 1946-49 civil war. ‘‘Should we fail to aid Greece and Turkey in this fateful hour, the effect will be far-reaching to the west as well as to the east,” Truman said.

“We must take immediate and resolute action.” The Greeks joined NATO in 1952, three years before the Federal Republic of Germany and the same time as Turkey, uniting two traditional enemies under one umbrella. The aid Greece received under the Truman Doctrine and then the Marshall Plan bankrolled years of growth. Greek leftists chafed at the U.S. influence. The military regime, or junta, in 1967 to 1974 was seen as sponsored by the U.S. Truman’s statue, erected in 1963 by grateful Greek Americans, was defaced, attacked and toppled regularly over the years to protest U.S. policies in Greece and the region.

As Tsipras prepared to meet Merkel in Brussels on Wednesday evening, his foreign minister, Nikos Kotzias, told a gathering at Oxford University that now is the time to decide whether the pursuit of security, prosperity and freedom will prevail over the focus on numbers and profit margins. “Nowadays the role of geopolitics is more important than before,” Kotzias said. “Our world is in the midst of a conflict between its current needs and the future demands.” The EU “needs to learn to see beyond the end of its nose, as we say in Greece,” he said. “To manage our future not as a momentary action, nor as a shareholders’ meeting that thinks with an horizon of quarterly earnings.”

Debt restructuring is inevitable, so let’s get it done.

• EU Issues Final Warning To Greece As Last-Ditch Talks Achieve Nothing (AEP)

The European Union has warned Greece in the clearest language to date that its patience is exhausted and the country will be abandoned to its fate unless it accepts creditor demands in short order. Donald Tusk, the EU’s president, said the radical-Left Syriza government must stop spinning out the negotiations and face hard choices before Greece spirals irrevocably into default. “There is no more time for gambling. The day is coming, I’m afraid, that someone says that the game is over,” he said. The blunt language came as the International Monetary Fund pulled its officials out of the talks, citing a failure to break the deadlock after four months of wrangling. “There are major differences between us in most key areas. There has been no progress in narrowing these differences,” it said.

Greek prime minister Alexis Tsipras failed to secure any substantive concessions during two days of stormy talks with key power-brokers in Brussels, including German Chancellor Angela Merkel and French president Francois Hollande. Mrs Merkel tried to put the best gloss on events, insisting that Greece had agreed to work “full steam ahead” to break the impasse. Yet her assurances belie the reality that Syriza and Europe’s creditor powers are no closer to a deal as bankruptcy looms. The Greek interior ministry has ordered regional governors and mayors to transfer all cash reserves to the central bank as an emergency measure. The mounting worry is that the government may not be able to meet its bill for salaries and pensions this month. The economy is sliding deeper into recession and tax revenues are falling short.

Bizarrely, the Athens stock market soared 8.2pc in a wave of euphoria, swept by unsubstantiated rumours of a breakthrough that left Greek officials scratching their heads. The Piraeus Bank and Eurobank both jumped 19pc, while yields on two-year Greek debt plummeted 135 basis points to 23.8pc. Markets may have misjudged the political choreography of the talks in Brussels. It is understood that Mr Tsipras chose to acquiesce in what insiders deem to be a “negotiating charade” in order to show willingness and avoid blame at home if the showdown ends in rupture, and even in Greece’s ejection from the euro. It does not mean that Athens has ditched its fundamental demand for debt restructuring, an end to austerity and a comprehensive solution that puts Greece on a viable economic path.

“They tell us that there will be plenty of money for the next year or two if we sign on the dotted line and accept the Memorandum,” said one official. “The creditors are taking this to the wire because they think we are scared – and we are scared – but we cannot accept these terms because they solve nothing,” he said. Syriza has proposed a debt swap that would let it borrow from the eurozone bail-out find (ESM) to repay €27bn of liabilities to the ECB, a rotation from one creditor to another. This would have the effect of stretching maturities and averting a default to the ECB in July. The plan has so far been rejected out of hand by Brussels.

The extent to which the press shows any true insight in what’s going on is painfully limited. They see no fundamental difference between selling a second hand car and negotiating about abject poverty of half a country.

• IMF To Alexis Tsipras: ‘Do You Feel Lucky, Punk?’ (Guardian)

“You’ve got to ask yourself one question. Do I feel lucky? Well, do ya, punk?” The lines spoken by Clint Eastwood in Dirty Harry sprang to mind when the International Monetary Fund (IMF) announced that it had called its Greek negotiating team home from talks in Brussels. The IMF’s message was short and brutal. There were still major differences between Greece and its creditors. There was no progress in narrowing those differences. The two sides were well away from an agreement. So much, then, for the talk earlier this week that a deal is close. Shares across Europe surged on hopes that a resolution to the crisis was at hand, but that optimism was punctured by the news from Washington. The IMF, clearly, has had enough.

It was unimpressed by Greece’s decision to bundle up all four of the debt repayments due this month and is frustrated by the unwillingness of Alexis Tsipras, the Greek prime minister, to cross its two “red line” issues – pensions and labour-market reform. This, then, is the IMF holding the gun to Alexis Tsipras’s head. It feels like a pivotal moment, the point where the creditors are saying “take it or leave it” and the Greeks have to decide whether the IMF really means it. Up until now, the view in Athens has been that the troika – made up of the IMF, the European Central Bank and the European commission – has been bluffing.

The view has been that there is always room for a bit more haggling, always time to cut a better deal that would avoid the need to make the changes to pensions, VAT and collective bargaining being demanded in exchange for fresh financial assistance. Greece has reached this conclusion for a number of reasons. It thinks European politicians will be wary of anything that might push Greece out of the single currency, because that would be a setback to the idea that Europe only ever moved forward. It believes that Angela Merkel will be willing to compromise for fear that a Grexit would push Tsipras into the willing arms of Vladimir Putin. And it is convinced that the reforms being demanded by the troika are wrong-headed and will impose more pain on a population that has suffered enough.

For their part, the creditors say Greece is not serious about reform, with the IMF noting that the Greek government is contributing 10% of GDP to pensions against an EU average of 2%. Put simply, they know Greece is running out of money and wants to stay in the euro. They are fed up with Tsipras acting like he is the one holding the .44 Magnum and they are threatening to pull the trigger. This movie climaxes next week.

“We are left with the conclusion that IMF leaders just don’t seem to be reading their own research.”

• The Slow Transformation Of The IMF (Rochon)

In recent years, the IMF research department has even espoused and given empirical support to a wide range of socially oriented economic policies, what many would call left-friendly. Today, there is no doubt the research department at the IMF has drifted somewhat away from its right-of-centre pulpit, in a series of important policy shifts. Of course, there remain important differences between what trained economists at the IMF are writing (the analysis) and what the political leaders of the IMF, like its director Christine Lagarde, are espousing publicly (the policies). Nowhere is this more evident for instance than the advice given to Greece. We are left with the conclusion that IMF leaders just don’t seem to be reading their own research. As economist Francesco Saraceno has clearly demonstrated, the IMF has gone on record with the following analytical conclusions:

1. Expansionary fiscal policy, with a focus on public investment, is basically a “free lunch.” Given the large impact of public expenditures, particularly in recessions, austerity programs are harmful and should be replaced by higher government spending. In fact, austerity the IMF argued, could not work. Concern over public debt is overrated;

2. Labor-market flexibility (for instance, reduction in wages; decreases in union participation) do not foster economic growth; they just are another element in a regressive income distributive regime, along with financial globalization;

3. Countries should actively manage their capital accounts, and even reverse the trend for even more deregulated financial flows;

4. Sustained and stable economic growth is achieved through a progressive income distribution, with redistributive efforts having no discernible negative impact on the economic performance. This argument is virtually a rejection of the efficiency-income egalitarianism trade-off behind the neoliberal discourse and “trickle-down” policies.

At first glance, these policies can appear to be quite progressive, and in many respects they are. Ignored by the mainstream of the profession and discarded by leaders and institutions around the globe, these policies have at one time or another, all been actively promoted by progressive economists, as well as by some progressive political parties and organizations.

Australia.

• Stupidity Is The Biggest Problem In The Housing Debate (Pickering)

Recent comments by Prime Minister Tony Abbott and Treasurer Joe Hockey highlight the biggest problem with Australia’s housing debate: pure unfettered stupidity. Faced with a social issue that requires real solutions and hard decisions; the federal government has instead stuck its head in the sand and hopes it will just go away. Reserve Bank governor Glenn Stevens was having none of it yesterday, declaring that the Sydney market had become “crazy” and a genuine “social problem”. It was strong language from a normally circumspect public servant. “What is happening in housing in Sydney I find acutely concerning for a host of reasons,” Stevens told the Economic Society of Australia yesterday. “I think some of what’s happening is crazy, but we [the RBA] have a national focus and so that just increases the complexity.”

If Stevens believes that a market has gone ‘crazy’ then there’s a good chance it went past that point long ago. It’s been well documented how slow the RBA was to endorse the use of macroprudential policies — particularly given the swift action of the Reserve Bank of New Zealand. The data itself suggests that current dynamics in the Sydney property market are unprecedented over the past few decades. The only comparable episode, in the early 2000s, resulted in real Sydney dwelling prices falling to such an extent that they didn’t pass their 2003 peak for another decade. Earlier this month, Treasury secretary John Fraser warned that the Sydney property market was “unequivocally” in a bubble. Nevertheless, Hockey and Abbott won’t have a bar of it.

“The starting point for a first home buyer is to get a good job that pays good money,” Hockey said earlier this week. “Then you can go to the bank and borrow money.” “If housing were unaffordable in Sydney, no one would be buying it.” It’s a simplistic view of the world that suits the ideological foundations of a party famed for its usage of three-word slogans. If only life was that simple. In the Sydney property market it is no longer enough to simply find yourself a good job. An individual can earn between $80,000 and $90,000 in Sydney while renting and make minimal progress towards saving up for a housing deposit. Increasingly younger Australians are relying on their parents or grandparents for financial support either directly through rent-free living or via cash handouts. Misguided housing policy has created an intergenerational property market in which the wealth of one’s parents is the single best indicator of whether you can enter the market.

It’ll be an uphill battle.

• A Bitcoin Start-Up Has Made Exchanging Currency Free (CNBC)

A bitcoin start-up has launched a service that will allow people to carry out foreign exchange transactions for free, dodging the expensive commission often charged by major financial institutions. Bitreserve, a company founded last year by CNET and salesforce.com co-founder Halsey Minor, allows people to convert bitcoin into normal currencies and precious metals. The start-up used to charge a 0.45% commission for bitcoin-to-dollar transactions, but has now cut its fees entirely. The move is likely to give it an edge in the hotly contested “fintech” market where a number of companies such as U.K.-based Transferwise are contesting the currency transfer and mobile payments space.

Users of the platform will be able to make currency exchanges in eight major currencies: euros, dollars, pounds, yuan, yen, pesos, rupees, swiss francs. People will also have the ability to convert the currencies into gold, silver, platinum and palladium, depending on the market price. Bitreserve offers the mid-market rate for currencies. “Those in society who can least afford it have to spend so much for things that are so commonplace,” Anthony Watson, president and chief operating officer of Bitreserve, told CNBC by phone. “If you look at Mexican immigrants, they send approximately $30 billion home every year and they pay just under $3 billion for the privilege of sending that money home. That is 10% and that is disgusting.”

Bitreserve’s service comes with a catch however – you have to own bitcoin to use the service in order to make an initial deposit and then convert it to another asset. Plus, when users receive money, they can only spend it in bitcoin. This could put it at a disadvantage to other companies that allow people to sign up with bank accounts and send money for still a small commission.

Most of Europe -excluding, Italy, Greece- in effect have a citizens income already. So why not make it a European law?

• Italian Statistics Agency Validates Citizens Income Proposal (M5S)

The Citizens’ Income is the priority for ltaly. ISTAT, the Statistics Agency, has verified that the cost to implement this would be €14.9 billion. The M5S has found the resources to finance this – by cutting wasteful spending, and Europa is demanding that we implement this. The only thing missing is the willingness of the parties to discuss and approve it in Parliament. The Citizens’ Income is being discussed right now in the Senate Committee and we are callling on the President of the Senate, Grasso, to get together with the group leaders and Alberto Airola to get our Citizens’ Income draft law onto the agenda for the floor of the Senate as soon as possible (as set out in Art. 53 section 3 of the Senate Regulations). Each day that is lost is another slap in the face to each of the 10 million Italians living below the poverty line. No one must be left behind. Citizens’ Income now!

“This morning in the Senate’s Labour Committee, the President of ISTAT and various members of the Statistics Agency spoke to the Committee and presented a report containing an in-depth financial analysis about our proposed law for a Citizens’ Income. In the last few months we have been attacked in so many ways and we have heard unfounded criticism coming from people in different political parties stating that the cost of our proposal was more than 30 billion. But now it’s ISTAT that is confirming the validity of our proposal! According to the ISTAT report presented to the Senate, the income support in this package would cost €14.9 billion, which is €600 million less than the estimate we had in our initial model.

It’s worth noting that even ISTAT reckons that the M5S’s proposal for a Citizens’ Income turns out to be the most comprehensive proposal under discussion. This is because there is no distribution of resources to those who are not experiencing serious financial difficulties. In fact, the money is targeted at the 2,759,000 families (about 10 million people) with an income that is below the poverty line defined by Eurostat: €780. ISTAT adds that the Citizens’ Income is a measure that “tends to create a solid network of social protection, and fills in certain gaps that could be found in the welfare system. It highlights the difference between youth poverty and the situation of young people living on their own.“

Thanks to the savings verified by ISTAT, it is possible to free up further resources by taking additional actions like: strengthening the Job Shops, and promoting the creation of new enterprises and innovative start-ups. There are no longer any excuses. We are now calling on the President of the Senate, Grasso, to get together with the group leaders and Alberto Airola to get our Citizens’ Income draft law onto the agenda for the floor of the Senate as soon as possible (as set out in Art. 53 section 3 of the Senate Regulations). Thus let Pietro Grasso keep to his commitments, respect the regulations and take immediate steps. With the Citizens’ Income, nobody gets left behind.”