Georgia O’Keeffe Manhattan 1932

This really is the firefighter setting his own house on fire so he can play the hero. There’s often talk of central bankers taking away the punch bowl, but we need to take away the punch bowl from them. Urgently.

• Central Bankers Use Moment of Calm to Debate How to Fight the Next Crisis (DJ)

Central bankers, basking in a moment of synchronized growth and a global economy less dependent on easy-money policies, are thinking about what they will do when the next economic meltdown happens. ECB President Mario Draghi said Thursday that central banks might need to reuse some of the weapons employed to fight the last war, most notably negative interest rates. Federal Reserve and ECB officials, who are gathered in Washington for the fall meetings of the IMF and World Bank, are using a tranquil period to debate the type of monetary policies central banks might pursue. The world’s two most influential central banks signaled no shifts in strategy – in the Fed’s case, to raise rates gradually and shrink its bond portfolio, and in the ECB’s, to announce a slowdown of its bond-purchase program as soon as its next policy meeting on Oct. 26.

But while current policies are stepping away from the bond-purchase programs known as quantitative easing, central bankers are opening the door for a future that could include more negative interest rates and periods of higher inflation following recession. The discussions are still largely hypothetical. Ever since the global financial crisis of 2007-09, central bankers have wished for more moments when they could gather in calm and openly spitball monetary policy ideas without the risk of derailing recovery. That moment has finally arrived. Mr. Draghi said that negative interest rates, an untested policy for the ECB until 2014, had been a success, and that the decision to push the ECB’s target rate into negative territory hadn’t hurt bank profitability as critics suggested it would.

“We haven’t seen the distortions that people were foreseeing,” Mr. Draghi said at the Peterson Institute for International Economics in Washington. “We haven’t seen bank profitability going down; in fact, it is going up.” Mr. Draghi reiterated that the ECB would maintain its negative target rate “well past” the time it steps back from its bond-purchase program, underscoring growing comfort in the negative-rate strategy. And while Mr. Draghi endorsed negative rates, current and former Fed officials engaged in an unusually open discussion about changing the target for 2% inflation. That discussion was kicked off by former Federal Reserve Chairman Ben Bernanke, who presented a paper Thursday morning at the Peterson Institute arguing the Fed could overshoot its target for 2% inflation to make up for periods of recession in which inflation ran too low.

And this is just pure insanity.

• BOJ’s Kuroda Says No Signs Of Excesses Building In Markets (R.)

Bank of Japan Governor Haruhiko Kuroda said on Friday he did not see any signs of bubbles or excesses building up in U.S., European and Japanese markets as a result of heavy money printing by their central banks. Kuroda also dismissed some analysts’ criticism that the BOJ’s purchases of exchange-traded funds (ETF) were distorting financial markets or dominating Japan’s stock market. “I don’t think we have a very big share” of Japan’s total stock market capitalisation, he told reporters after attending the Group of 20 finance leaders’ gathering. The IMF painted a rosy picture of the global economy in its World Economic Outlook earlier this week, but warned that prolonged easy monetary policy could be sowing the seeds of excessive risk-taking.

Kuroda said that while policymakers should not be complacent about their economies, he did not see huge risks materializing as a result of their policies. Although major central banks deployed massive stimulus programmes to battle the global financial crisis, they have always scrutinized whether their policies were causing excessive risk-taking, he said. “I don’t think we’re seeing excesses building up and emerging as a big risk,” Kuroda said, adding that recent rises in global stock prices reflected strong corporate profits in Japan, the United States and Europe. He added that Japan’s economy was on track for a steady recovery that will likely gradually push up inflation and wages. “I don’t see any big risk for Japan’s economy. But there could be external risks, such as geopolitical ones, so we’re watching developments carefully,” he said.

Bubbles shape (distort) the space around them. It’s like a miniature version of Einstein’s gravitational waves.

• What Keeps Poor Americans From Moving (Atlantic)

Seccora Jaimes knows that she is not living in the land of opportunity. Her hometown has one of the highest unemployment rates in the nation, at 9.1%. Jaimes, 34, recently got laid off from the beauty school where she taught cosmetology, and hasn’t yet found another job. Her daughter, 17, wants the family to move to Los Angeles, so that she can attend one of the nation’s top police academies. Jaimes’s husband, who works in warehousing, would make much more money in Los Angeles, she told me. But one thing is stopping them: The cost of housing. “I don’t know if we could find a place out there that’s reasonable for us, that we could start any job and be okay,” she told me. Indeed, the average rent for a two-bedroom apartment in Merced, in California’s Central Valley, is $750. In Los Angeles, it’s $2,710.

America used to be a place where moving one’s family and one’s life in search of greater opportunities was common. During the Gold Rush, the Depression, and the postwar expansion West millions of Americans left their hometowns for places where they could earn more and provide a better life for their children. But mobility has fallen in recent years. While 3.6% of the population moved to a different state between 1952 and 1953, that number had fallen to 2.7% between 1992 and 1993, and to 1.5% between 2015 and 2016. (The share of people who move at all, even within the same county, has fallen too, from 20% in 1947 to 11.2% today.) Of course, it wasn’t simply “moving” that mattered—it was that they moved to specific areas that were growing.

When farming jobs were plentiful in the Midwest, for example, people moved there—in 1900, states including Iowa and Missouri were more populous than California. Black men who moved from to the North from the South earned at least 100% more than those who stayed, according to work by Leah Platt Boustan, an economist at Princeton. Additionally, for most of the 20th century, both janitors and lawyers could earn a lot more living in the tri-state area of New York, New Jersey, and Connecticut than they could living in the Deep South, so many people moved, according to Peter Ganong, an economist at the University of Chicago. With less labor supply in the regions that they left, wages would then increase there, and fall in the regions they were moving to, as the supply of workers increased.

As a result, for more than 100 years, the average incomes of different regions were getting closer and closer together, something economists call regional income convergence. Wages in poorer cities were growing 1.4% faster than wages in richer cities for much of the 20th century, according to Elisa Giannnone, a post-doctoral fellow at Princeton. But over the past 30 years, that regional income convergence has slowed. Economists say that is happening because net migration—the tendency of large numbers of people to move to a specific place—is waning, meaning that the supply of workers isn’t increasing fast enough in the rich areas to bring wages down, and isn’t falling fast enough in the poor areas to bring wages up.

Well argued.

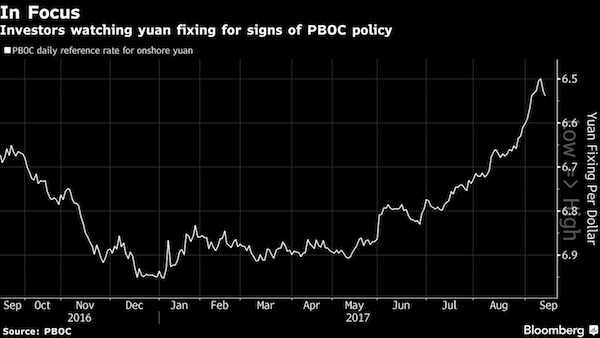

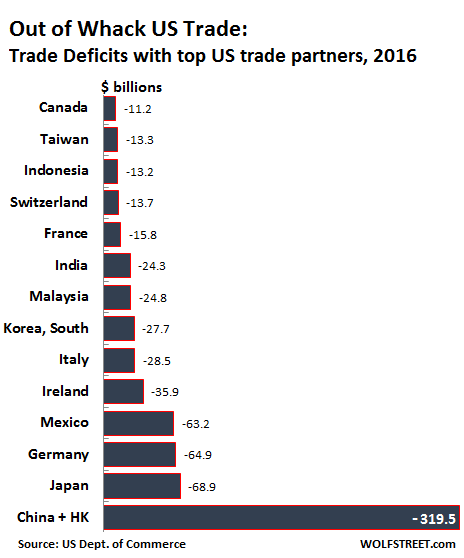

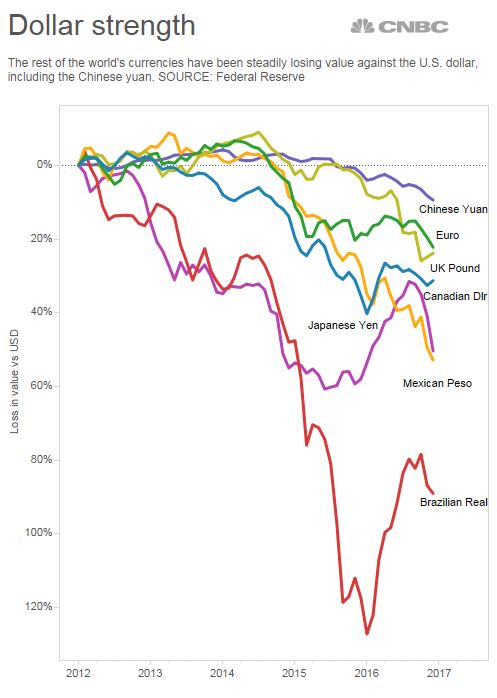

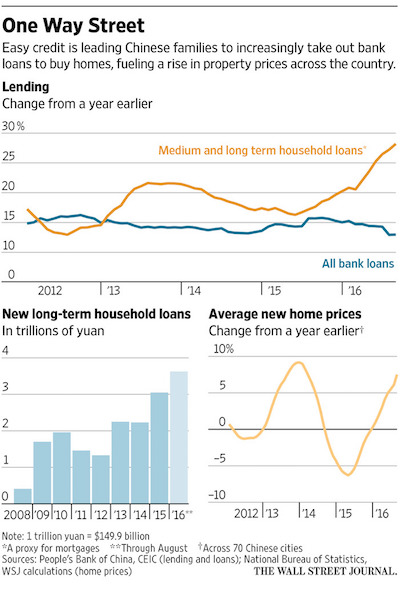

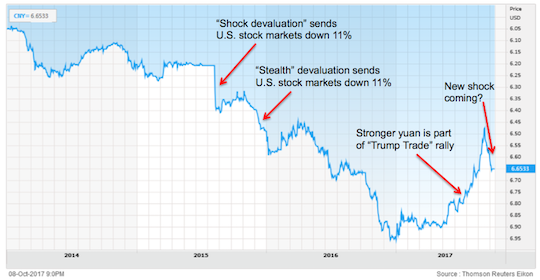

• Prepare for a Chinese Maxi-Devaluation (Rickards)

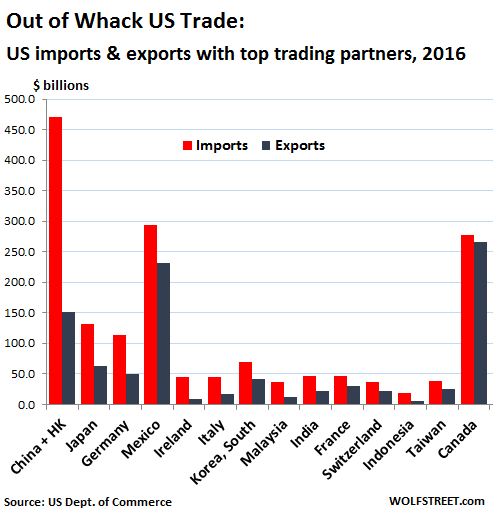

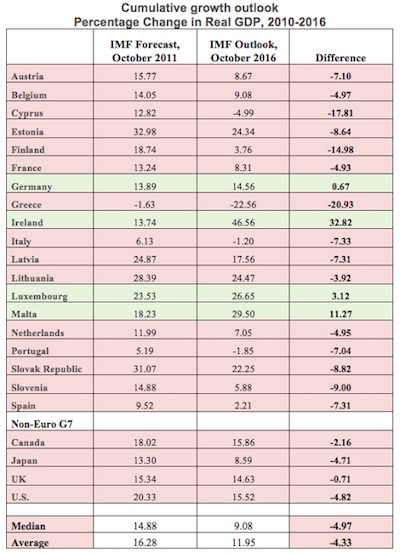

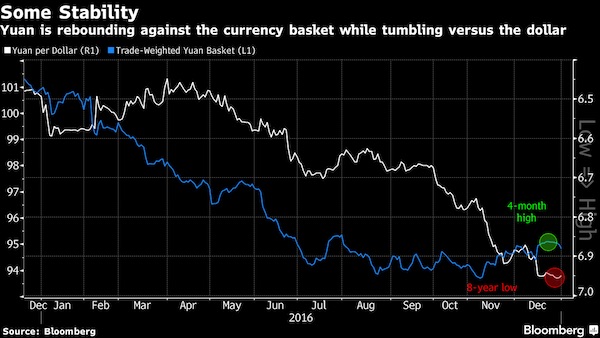

In August 2015, China engineered a sudden shock devaluation of the yuan. The dollar gained 3% against the yuan in two days as China devalued. The results were disastrous. U.S. stocks fell 11% in a few weeks. There was a real threat of global financial contagion and a full-blown liquidity crisis. A crisis was averted by Fed jawboning, and a decision to put off the “liftoff” in U.S. interest rates from September 2015 to the following December. China conducted another devaluation from November to December 2015. This time China did not execute a sneak attack, but did the devaluation in baby steps. This was stealth devaluation. The results were just as disastrous as the prior August. U.S. stocks fell 11% from January 1, 2016 to February 10. 2016. Again, a greater crisis was averted only by a Fed decision to delay planned U.S. interest rate hikes in March and June 2016. The impact these two prior devaluations had on the exchange rate is shown in the chart below.

Major moves in the dollar/yuan cross exchange rate (USD/CNY) have had powerful impacts on global markets. The August 2015 surprise yuan devaluation sent U.S. stocks reeling. Another slower devaluation did the same in early 2016. A stronger yuan in 2017 coincided with the Trump stock rally. A new devaluation is now underway and U.S. stocks may suffer again.

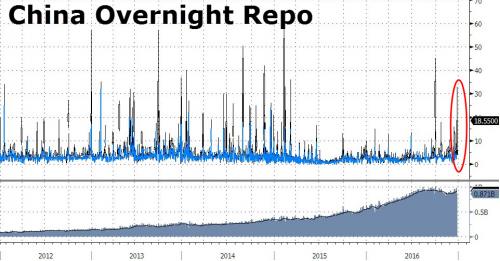

[..] China escaped the impossible trinity in 2015 by devaluing their currency. China escaped the impossible trinity again in 2017 using a hat trick of partially closing the capital account, raising interest rates, and allowing the yuan to appreciate against the dollar thereby breaking the exchange rate peg. The problem for China is that these solutions are all non-sustainable. China cannot keep the capital account closed without damaging badly needed capital inflows. Who will invest in China if you can’t get your money out? China also cannot maintain high interest rates because the interest costs will bankrupt insolvent state owned enterprises and lead to an increase in unemployment, which is socially destabilizing. China cannot maintain a strong yuan because that damages exports, hurts export-related jobs, and causes deflation to be imported through lower import prices. An artificially inflated currency also drains the foreign exchange reserves needed to maintain the peg.

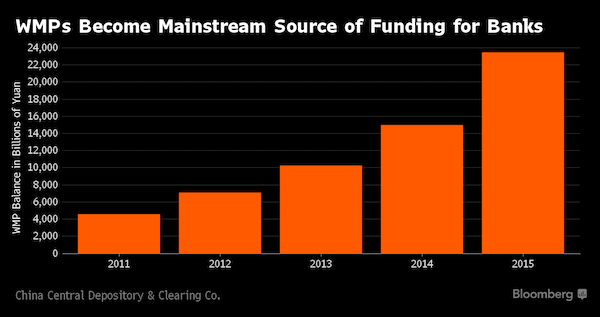

[..] Both Trump and Xi are readying a “gloves off” approach to a trade war and renewed currency war. A maxi-devaluation of the yuan is Xi’s most potent weapon. Finally, China’s internal contradictions are catching up with it. China has to confront an insolvent banking system, a real estate bubble, and a $1 trillion wealth management product Ponzi scheme that is starting to fall apart. A much weaker yuan would give China some policy space in terms of using its reserves to paper over some of these problems. Less dramatic devaluations of the yuan led to U.S. stock market crashes. What does a new maxi-devaluation portend for U.S. stocks?

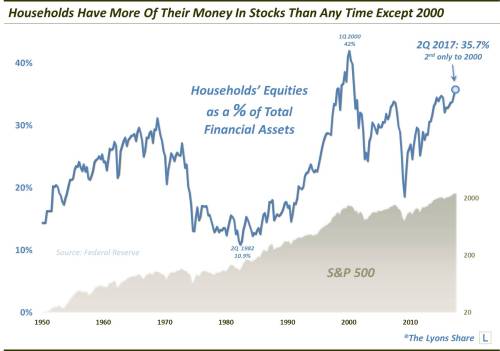

See my article yesterday: The Curious Case of Missing the Market Boom .

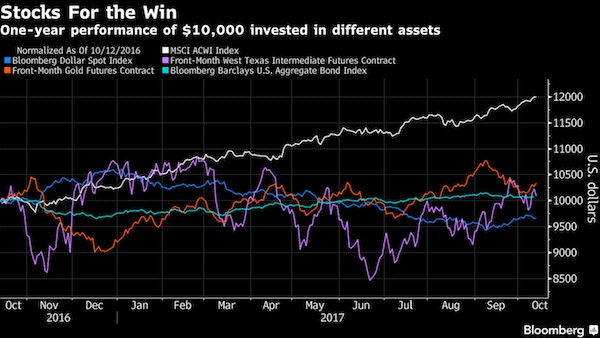

• The Cost of Missing the Market Boom Is Skyrocketing (BBG)

Skepticism in global equity markets is getting expensive. From Japan to Brazil and the U.S. as well as places like Greece and Ukraine, an epic year in equities is defying naysayers and rewarding anyone who staked a claim on corporate ownership. Records are falling, with about a quarter of national equity benchmarks at or within 2% of an all-time high. “You’ve heard people being bearish for eight years. They were wrong,” said Jeffrey Saut, chief investment strategist at St. Petersburg, Florida-based Raymond James Financial Inc., which oversees $500 billion. “The proof is in the returns.” To put this year’s gains in perspective, the value of global equities is now 3 1/2 times that at the financial crisis bottom in March 2009.

Aided by an 8% drop in the U.S. currency, the dollar-denominated capitalization of worldwide shares appreciated in 2017 by an amount – $20 trillion – that is comparable to the total value of all equities nine years ago. And yet skeptics still abound, pointing to stretched valuations or policy uncertainty from Washington to Brussels. Those concerns are nothing new, but heeding to them is proving an especially costly mistake. Clinging to such concerns means discounting a harmonized recovery in the global economy that’s virtually without precedent — and set to pick up steam, according to the IMF. At the same time, inflation remains tepid, enabling major central banks to maintain accommodative stances. “When policy is easy and growth is strong, this is an environment more conducive for people paying up for valuations,” said Andrew Sheets, chief cross-asset strategist at Morgan Stanley.

“The markets are up in line with what the earnings have done, and stronger earnings helped drive a higher level of enthusiasm and a higher level of risk taking.” The numbers are impressive: more than 85% of the 95 benchmark indexes tracked by Bloomberg worldwide are up this year, on course for the broadest gain since the bull market started. Emerging markets have surged 31%, developed nations are up 16%. Big companies are becoming huge, from Apple to Alibaba. Technology megacaps occupy all top six spots in the ranks of the world’s largest companies by market capitalization for the first time ever. Up 39% this year, the $1 trillion those firms added in value equals the combined worth of the world’s six-biggest companies at the bear market bottom in 2009. Apple, priced at $810 billion, is good for the total value of the 400 smallest companies in the S&P 500.

“If we define “winning the war” by counting dead bodies, then the dead bodies pile up like cordwood.”

• Are You Better Off Than You Were 17 Years Ago? (CH Smith)

If we use GDP as a broad measure of prosperity, we are 160% better off than we were in 1980 and 35% better off than we were in 2000. Other common metrics such as per capita (per person) income and total household wealth reflect similarly hefty gains. But are we really 35% better off than we were 17 years ago, or 160% better off than we were 37 years ago? Or do these statistics mask a pervasive erosion in our well-being? As I explained in my book Why Our Status Quo Failed and Is Beyond Reform, we optimize what we measure, meaning that once a metric and benchmark have been selected as meaningful, we strive to manage that metric to get the desired result. Optimizing what we measure has all sorts of perverse consequences. If we define “winning the war” by counting dead bodies, then the dead bodies pile up like cordwood.

If we define “health” as low cholesterol levels, then we pass statins out like candy. If test scores define “a good education,” then we teach to the tests. We tend to measure what’s easily measured (and supports the status quo) and ignore what isn’t easily measured (and calls the status quo into question). So we measure GDP, household wealth, median incomes, longevity, the number of students graduating with college diplomas, and so on, because all of these metrics are straightforward. We don’t measure well-being, our sense of security, our faith in a better future (i.e. hope), experiential knowledge that’s relevant to adapting to fast-changing circumstances, the social cohesion of our communities and similar difficult-to-quantify relationships. Relationships, well-being and internal states of awareness are not units of measurement.

While GDP has soared since 1980, many people feel that life has become much worse, not much better: many people feel less financially secure, more pressured at work, more stressed by not-enough-time-in-the-day, less healthy and less wealthy, regardless of their dollar-denominated “wealth.” Many people recall that a single paycheck could support an entire household in 1980, something that is no longer true for all but the most highly paid workers who also live in locales with a modest cost of living.

How on earth is it possible these people still have jobs?

• As Crisis At Kobe Steel Deepens, CEO Says Cheating Engulfs 500 Firms (R.)

The cheating crisis engulfing Kobe Steel just got bigger. Chief Executive Hiroya Kawasaki on Friday revealed that about 500 companies had received its falsely certified products, more than double its earlier count, confirming widespread wrongdoing at the steelmaker that has sent a chill along global supply chains. The scale of the misconduct at Japan’s third-largest steelmaker pummeled its shares as investors, worried about the financial impact and legal fallout, wiped about $1.8 billion off its market value this week. As the company revealed tampering of more products, the crisis has rippled through supply chains across the world in a body blow to Japan’s reputation as a high-quality manufacturing destination. A contrite Kawasaki told a briefing the firm plans to pay customers’ costs for any affected products.

“There has been no specific requests, but we are prepared to shoulder such costs after consultations,” he said, adding the products with tampered documentation account for about 4% of the sales in the affected businesses. Yoshihiko Katsukawa, a managing executive officer, told reporters that 500 companies were now known to be affected by the tampering. Kobe Steel initially said 200 firms were affected when it admitted at the weekend it had falsified data about the quality of aluminum and copper products used in cars, aircraft, space rockets and defense equipment. Asked if he plans to step down, Kawasaki said: “My biggest task right now is to help our customers make safety checks and to craft prevention measures.”

“The manufacturers can now exploit their monopoly positions, created by the patents, by marketing their drugs for conditions for which they never got regulatory approval.”

• Worse Than Big Tobacco: How Big Pharma Fuels the Opioid Epidemic (Parramore)

Once again, an out-of-control industry is threatening public health on a mammoth scale Over a 40-year career, Philadelphia attorney Daniel Berger has obtained millions in settlements for investors and consumers hurt by a rogues’ gallery of corporate wrongdoers, from Exxon to R.J. Reynolds Tobacco. But when it comes to what America’s prescription drug makers have done to drive one of the ghastliest addiction crises in the country’s history, he confesses amazement. “I used to think that there was nothing more reprehensible than what the tobacco industry did in suppressing what it knew about the adverse effects of an addictive and dangerous product,” says Berger. “But I was wrong. The drug makers are worse than Big Tobacco.”

The U.S. prescription drug industry has opened a new frontier in public havoc, manipulating markets and deceptively marketing opioid drugs that are known to addict and even kill. It’s a national emergency that claims 90 lives per day. Berger lays much of the blame at the feet of companies that have played every dirty trick imaginable to convince doctors to overprescribe medication that can transform fresh-faced teens and mild-mannered adults into zombified junkies. So how have they gotten away with it? The prescription drug industry is a strange beast, born of perverse thinking about markets and economics, explains Berger. In a normal market, you shop around to find the best price and quality on something you want or need—a toaster, a new car. Businesses then compete to supply what you’re looking for.

You’ve got choices: If the price is too high, you refuse to buy, or you wait until the market offers something better. It’s the supposed beauty of supply and demand. But the prescription drug “market” operates nothing like that. Drug makers game the patent and regulatory systems to create monopolies over every single one of their products. Berger explains that when drug makers get patent approval for brand-name pharmaceuticals, the patents create market exclusivity for those products—protecting them from competition from both generics and brand-name drugs that treat the same condition. The manufacturers can now exploit their monopoly positions, created by the patents, by marketing their drugs for conditions for which they never got regulatory approval. This dramatically increases sales. They can also charge very high prices because if you’re in pain or dying, you’ll pay virtually anything.

How much longer?

• Tesla Fired Hundreds Of Employees In Past Week (R.)

Luxury electric vehicle maker Tesla fired about 400 employees this week, including associates, team leaders and supervisors, a former employee told Reuters on Friday. The dismissals were a result of a company-wide annual review, Tesla said in an emailed statement, without confirming the number of employees leaving the company. “It’s about 400 people ranging from associates to team leaders to supervisors. We don’t know how high up it went,” said the former employee, who worked on the assembly line and did not want to be identified.

Though Tesla cited performance as the reason for the firings, the source told Reuters he was fired in spite of never having been given a bad review. The Palo Alto, California-based company said earlier in the month that “production bottlenecks” had left Tesla behind its planned ramp-up for the new Model 3 mass-market sedan. The company delivered 220 Model 3 sedans and produced 260 during the third quarter. In July, it began production of the Model 3, which starts at $35,000 – half the starting price of the Model S. Mercury News had earlier reported about the firing of hundreds of employees by Tesla in the past week.

Behind closed doors, the EU is already talking to Jeremy Corbyn. But that’s too late too.

• No-Deal Brexit: It’s Already Too Late (FCFT)

As things stand at the moment, eighteen months from now the UK will leave the EU without any agreement on trade regulation or tariffs, either with the EU or any of the other countries with which it currently has trade agreements. The arrangements which assure the smooth running of 60 percent of our goods trade will disappear. Once we are outside the regulatory framework, many products, particularly in highly regulated areas like agriculture and pharmaceuticals, will no longer be accredited for sale in Europe. Aeroplanes will be unable to fly to and from the EU to the UK. Those goods which can still legally be traded with the EU will face lengthy customs checks. Integrated supply chains and just-in-time manufacturing processes will be severely disrupted and, in some cases, damaged beyond repair. Unless politicians do something, that’s where we are heading.

International trade and commerce doesn’t just happen. It is facilitated by a framework of agreements on tariffs, quotas and regulations. Without these, trade is either very expensive or, in some cases, simply illegal. Therefore, if the UK were to leave the EU without concluding a trade deal, things wouldn’t simply stay the same. They would be very different and very damaging. Of course, it would be disruptive for the rest of the EU too, although it is much easier to find new suppliers and customers in a bloc of 27 countries than it is in a stand alone country with no trade deals. Even so, most of us have assumed that common sense will prevail at some point. No-one in their right mind would let such a thing happen so surely both sides will do what is necessary to between now and March 2019 to avoid it.

Incredibly, though, our government, egged on by ideologues on its own back benches, has been talking up the prospect of a no-deal Brexit, apparently as a negotiating ploy to make the EU realise that we are serious about walking away. Almost as soon as the no-deal idea was suggested, Phillip Hammond said that he was not willing to set aside any money to fund it. In any organisation, that’s a sure-fire sign of a project that’s going nowhere. If the finance director won’t even stump up the cash for the planning phase, you might as well forget the whole thing. Mr Hammond said that he would wait until “the very last moment” before committing any money to prepare for a no-deal scenario. Which means it’s not going to happen because the very last moment passed some time ago, most probably before we even had the referendum.

“They have to pay, they have to pay, not in an impossible way.”

• ‘They Have To Pay’, EU’s Juncker Says Of Britain (R.)

Britain must commit to paying what it owes to the European Union before talks can begin about a future relationship with the bloc after Brexit, European Commission President Jean-Claude Juncker said on Friday. “The British are discovering, as we are, day after day new problems. That’s the reason why this process will take longer than initially thought,” Juncker said in a speech to students in his native Luxembourg. “We cannot find for the time being a real compromise as far as the remaining financial commitments of the UK are concerned. As we are not able to do this we will not be able to say in the European Council in October that now we can move to the second phase of negotiations,” Juncker said. “They have to pay, they have to pay, not in an impossible way. I‘m not in a revenge mood. I‘m not hating the British.” The EU has told Britain that a summit next week will conclude that insufficient progress has been made in talks for Brussels to open negotiations on a future trade deal.

Summary: EU countries can use whatever force they want against their European citizens. Because anything else would threaten Brussels.

• EU Intervention In Catalonia Would Cause Chaos – Juncker (G.)

The president of the European commission has spoken of his regret at Spain’s failure to follow his advice and do more to head off the crisis in Catalonia, but claimed that any EU intervention on the issue now would only cause “a lot more chaos”. Speaking to students in Luxembourg on Friday, Jean-Claude Juncker said he had told the Spanish prime minister, Mariano Rajoy, that his government needed to act to stop the Catalan situation spinning out of control, but that the advice had gone unheeded. “For some time now I asked the Spanish prime minister to take initiatives so that Catalonia wouldn’t run amok,” he said. “A lot of things were not done.” Juncker said that while he wished to see Europe remain united, his hands were tied when it came to Catalan independence.

“People have to undertake their responsibility,” he said. “I would like to explain why the commission doesn’t get involved in that. A lot of people say: ‘Juncker should get involved in that.’ “We do not do it because if we do … it will create a lot more chaos in the EU. We cannot do anything. We cannot get involved in that.” Juncker said that while he often acted as a negotiator and facilitator between member states, the commission could not mediate if calls to do so came only from one side – in this case, the Catalan government. Rajoy has rejected calls for mediation, pointing out that the recent Catalan independence referendum was held in defiance of the Spanish constitution and the country’s constitutional court. “There is no possible mediation between democratic law and disobedience or illegality,” he said on Wednesday.

Despite his refusal to intervene, however, Juncker warned the international community that the political crisis in Spain could not be ignored. “OK, nobody is shooting anyone in Catalonia – not yet at least. But we shouldn’t understate that matter, though,” he added. he commission president also spoke more generally about the fragmentation of national identities within Europe, saying he feared that if Catalonia became independent, other regions would follow. “I am very concerned because the life in communities seems to be so difficult,” he said. “Everybody tries to find their own in their own way and they think that their identity cannot live in parallel to other people’s identity. “But if you allow – and it is not up to us of course – but if Catalonia is to become independent, other people will do the same. I don’t like that. I don’t like to have a euro in 15 years that will be 100 different states. It is difficult enough with 17 states. With many more states it will be impossible.”

“The people who deliver that way of life, and profit from it, are every bit as sincerely wishful about it as the underpaid and overfed schnooks moiling in the discount aisles. ”

• Blade Runner 2049: Not The Future (Kunstler)

The original Mad Max was little more than an extended car chase — though apparently all that people remember about it is the desolate desert landscape and Mel Gibson’s leather jumpsuit. As the series wore on, both the vehicles and the staged chases became more spectacularly grandiose, until, in the latest edition, the movie was solely about Charlize Theron driving a truck. I always wondered where Mel got new air filters and radiator hoses, not to mention where he gassed up. In a world that broken, of course, there would be no supply and manufacturing chains. So, of course, Blade Runner 2049 opens with a shot of the detective played by Ryan Gosling in his flying car, zooming over a landscape that looks more like a computer motherboard than actual earthly terrain.

As the movie goes on, he gets in and out of his flying car more often than a San Fernando soccer mom on her daily rounds. That actually tells us something more significant than all the grim monotone trappings of the production design, namely, that we can’t imagine any kind of future — or any human society for that matter — that is not centered on cars. But isn’t that exactly why we’ve invested so much hope and expectation (and public subsidies) in the activities of Elon Musk? After all, the Master Wish in this culture of wishful thinking is the wish to be able to keep driving to Wal Mart forever. It’s the ultimate fantasy of a shallow “consumer” society. The people who deliver that way of life, and profit from it, are every bit as sincerely wishful about it as the underpaid and overfed schnooks moiling in the discount aisles.

In the dark corners of so-called postmodern mythology, there really is no human life, or human future, without cars. This points to the central fallacy of this Sci-fi genre: that technology can defeat nature and still exist. This is where our techno-narcissism comes in fast and furious. The Blade Runner movies take place in and around a Los Angeles filled with mega-structures pulsating with holographic advertisements. Where does the energy come from to construct all this stuff? Supposedly from something Mr. Musk dreams up that we haven’t heard about yet. Frankly, I don’t believe that such a miracle is in the offing.