Francisco Goya Witches’ Sabbath 1797-98

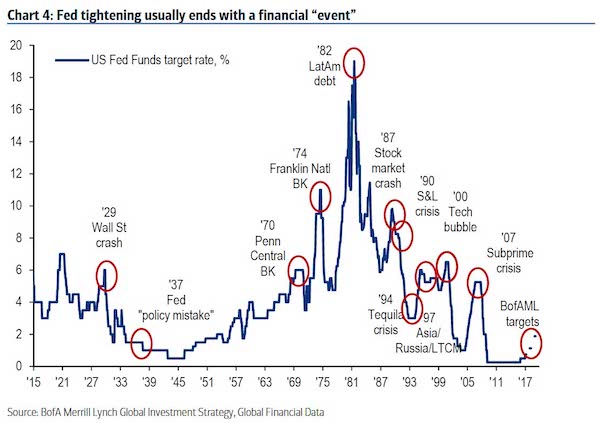

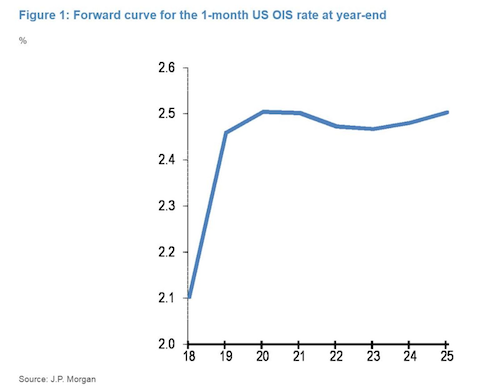

This means two things: 1) more fed rate hikes, and 2) ever slimmer chance of a blue wave in the midterms.

• US Wages And Salaries Jump By 3.1%, Highest Level In A Decade (CNBC)

Employment costs rose more than expected in the third quarter in a sign that more inflation could be brewing in the U.S. economy. The Labor Department’s employment cost index rose 0.8 percent for the period, ahead of the estimate of 0.7 percent from economists surveyed by Refinitiv. Wages and salaries rose 0.9 percent, well ahead of expectations for 0.5 percent. Benefit costs were up 0.4 percent. On a yearly basis, wages and salaries jumped 3.1 percent, the biggest increase in 10 years. Wage increases have been the missing link in the economy since the recovery began in mid-2008. Average hourly earnings have been rising steadily but have stayed below the 3 percent level as slack has remained in the labor market.

However the unemployment rate is now at 3.7 percent, the lowest since 1969, and wage pressures have begun to build. The Federal Reserve has been raising interest rates in an effort to stave off future inflationary pressures, though the central bank’s preferred gauge of inflation rose just 2.5 percent in the third quarter, including a 1.9 percent increase for health benefits. “The employment cost index data adds to the broader evidence that wage growth has continued to trend gradually higher over recent quarters,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note. “And with labor market conditions still tightening, we expect wage growth will accelerate further from here.”

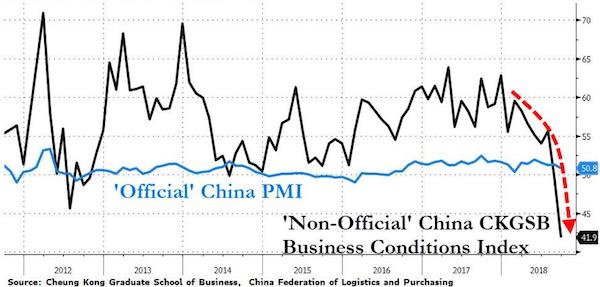

“2019 big year for China. centenary of founding of CCP [..] Being seen to succumb to Trump’s WH is just not on. Expect both sides to dig in further..”

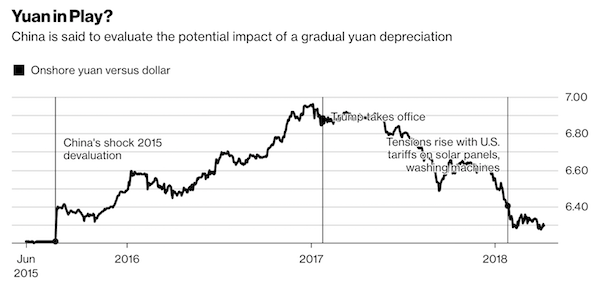

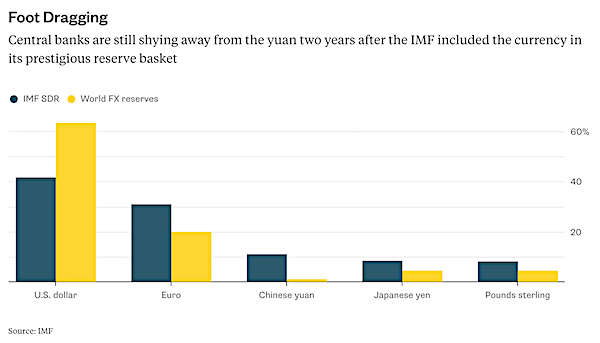

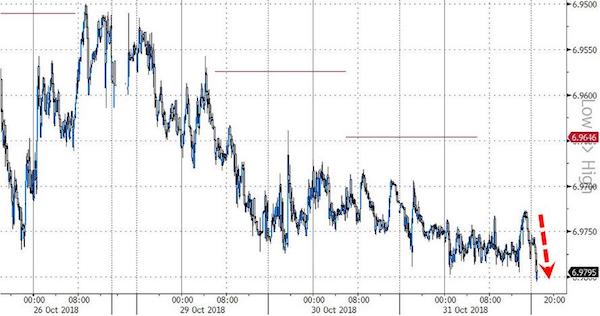

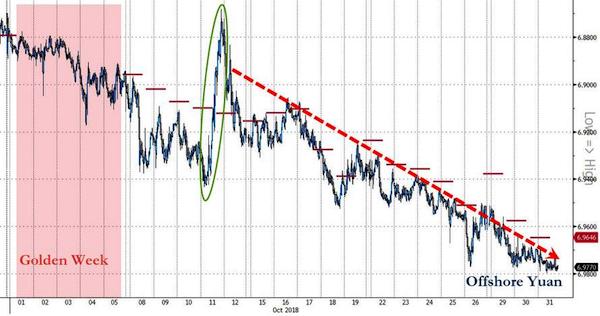

• Chinese Yuan Tumbles To New Cycle Low Amid Signs Of Capital Outflows (ZH)

As Chinese markets began to wake, yuan just broke below 6.98/USD for the first time in this downswing, despite PBOC liquidity withdrawals sending money market rates spiking (to squeeze yuan shorts). [..] if former UBS Chief Economist George Magnus is right, any hopes for the G20 meeting between Trump and Xi should be extinguished. In a series of tweets, Magnus warned… “Trump and Xi are supposed to meet at the G20 in Buenos Aires at end month. Will they talk trade? They need to cos Trump has already threatened to subject the other of 50% of imports from China to punitive tariffs. This is how he prepares the ground, telling Fox News: “I think that we will make a great deal with China and it has to be great, because they’ve drained our country,”.

Designed to turn XJP frostier, be even less inclined to bring something to the table, and more anxious not to be seen to be succumbing to foreign pressure. So I think, barring something going on in the background, these talks are set up to fail, assuming they happen. The 10% tariff rate is due to go to 25% on 200bn $ of goods on 1 Jan anyway, and we shd probably expect WHY to go for the remaining 250bn $ of imports in new year… 2019 big year for China. centenary of founding of CCP. and rivals Soviet CP’s 72 years in power. Xi’s Chinese Dream of Rejuvenation of Chinese Ppl isn’t just a slogan. Being seen to succumb to Trump’s WH is just not on. Expect both sides to dig in further

Begs question as what China will do next. Xant tit for tat any more, as they have run out of room. @davidjlynch in @washingtonpost reminds us that tourism cd be a target. Targeting US firms also could be cranked up. Yuan depreciation also poss tho v risky at home too … Much longer discussion and background written up in Red Flags, just out in the US this month….the details change with the news and announcements, but the substance is sadly all too clear.

Should we pity the fools who bought the overpriced crap? The entire westernworld is filled with people who grossly overpaid on the back of ultra-low rates. They’re all going to claim they’re victims, and there’s so many of them they may actually be bailed out, at the cost of those who haven’t been so stupid.

• Southern California Suffers Its Worst Housing Slump In Over A Decade (CNBC)

Higher mortgage rates and overheated home prices hit Southern California home sales hard in September. The number of new and existing houses and condominiums sold during the month plummeted nearly 18 percent compared with September 2017, according to CoreLogic. That was the slowest September pace since 2007, when the national housing and mortgage crisis was hitting. Sales have been falling on an annual basis for much of this year, but this was the biggest annual drop for any month in almost eight years. It was also more than twice the annual drop seen in August. “The double whammy of higher prices and rising mortgage rates has priced out some would-be buyers and prompted others to take a wait-and-see stance,” said Andrew LePage, a CoreLogic analyst, in the release.

“There was one caveat to last month’s sharp annual sales decline — this September had one less business day for recording transactions. Adjusting for that, the year-over-year decline would be about 13 percent, still the largest in four years.” On a monthly basis, sales fell 22 percent in September compared with August. Sales usually fall about 10 percent from August to September. Sales of newly built homes are suffering more than sales of existing homes, likely because fewer are being built compared with historical production levels. Newly built homes also come at a price premium. Sales of newly built homes were 47 percent below the September average dating back to 1988, while sales of existing homes were 22 percent below their long-term average.

The median price of Southern California homes sold in September, $505,000, was still 3.6 percent higher than it was a year ago. That was the lowest annual gain for any month in more than three years. “Price growth is moderating amid slower sales and more listings in many markets,” LePage said. “This is welcome news for potential homebuyers, but many still face a daunting hurdle – the monthly mortgage payment, which has been pushed up sharply by rising mortgage rates.”

They’re everywhere that debt is cheap.

• Rise In ‘Zombie Firms’ Is Fueling Fears For The Global Labor Market (CNBC)

A rise in so-called “zombie firms,” alongside higher interest rates, has led several experts to warn of the impact it could have on employment in developed nations. Zombie firms, as they are often called, are companies that would have defaulted in a normal economic cycle but continue to function due to an ultra-low interest rate environment. “Like the characters after which they are named, zombie firms are creatures that really should have shuffled off to the next realm some time ago. Instead of embracing death, they soldier on, usually wreaking havoc on the rest of society,” Eoin Murray, head of investment at Hermes Investment Management, said in a research note Wednesday.

Economists define a zombie firm as one which is at least 10 years old but is unable to cover its costs with its profits. Murray described collapsed facilities management and construction services company Carillion as one. Ever since the financial crisis, these firms have taken on huge pile of debts as borrowing became so cheap on the back of low interest rates. The numbers of such firms are currently on the rise, according to a report from the Bank of International Settlements (BIS) released last month. Decades of falling interest rates have led to a sharp increase in the number of zombie firms that are potentially threatening economic growth and preventing interest rates from rising, the report stated.

“Our analysis suggests that this increase is linked to reduced financial pressure, which in turn seems to reflect in part the effects of lower interest rates,” the research said, adding that these “zombies” weigh on economic performance because they are “less productive and because their presence lowers investment in and employment at more productive firms.”

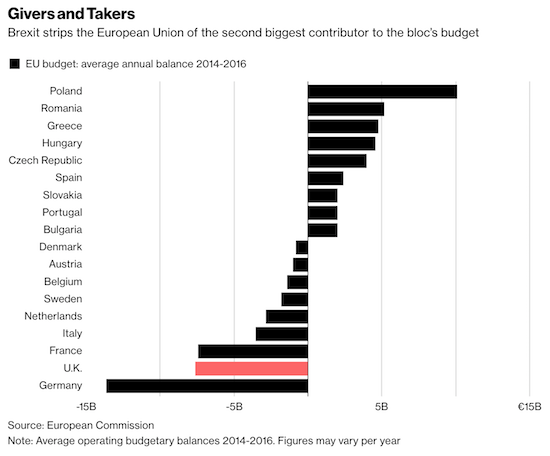

What’s the use without an Irish border deal?

• UK, EU Agree Tentative Brexit Deal On Financial Services (R.)

British Prime Minister Theresa May has struck a tentative deal with the European Union that would give UK financial services companies continued access to European markets after Brexit, the Times reported on Thursday. British and European negotiators have reached tentative agreement on all aspects of a future partnership on services, as well as the exchange of data, the British newspaper reported, citing government sources. The services deal would give UK companies access to European markets as long as British financial regulation remained broadly aligned with the EU’s, the Times reported. The British pound jumped as much as 0.5 percent against the dollar following the report.

Global banks operating in the UK have had to reorganize their operations around Britain’s departure from the European Union, due to take place in March next year. Many have set up new European hubs and begun to move operations, senior executives and staff to ensure they can continue to serve their continental clients if Britain leaves the bloc without a deal. According to the Times’ report, EU will accept that the UK has “equivalent” regulations to Brussels, and UK financial services companies will be allowed to operate as they now do in Europe. EU officials have said that the EU’s financial market access system, known as “equivalence,” under which Brussels grants access to foreign banks and insurers if their home rules converge with the bloc’s, is probably Britain’s best bet.

Yeah, let’s hand MbS some nukes.

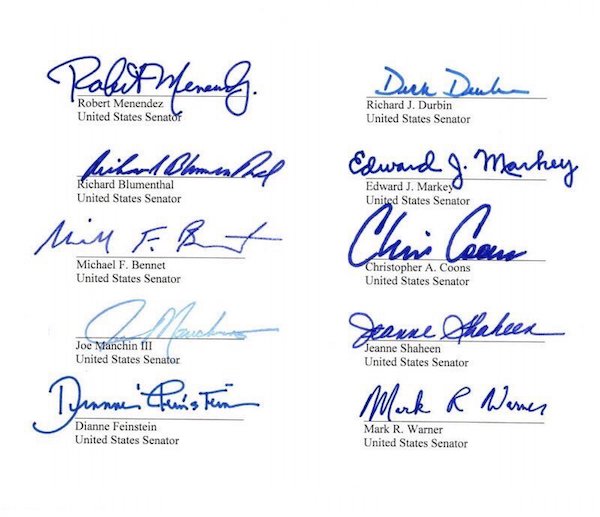

• GOP Senators Want Trump To Halt Nuclear Technology Talks With Saudis (CNBC)

Five Republican senators have asked the Trump administration to suspend talks to transfer U.S. nuclear technology to Saudi Arabia following the killing of journalist Jamal Khashoggi at the kingdom’s consulate in Turkey. The lawmakers, led by Senator Marco Rubio, threatened to block any agreement to export civilian nuclear technology to Saudi Arabia, potentially setting up a showdown with the White House. The Trump administration has courted the Saudis as they seek to build 16 nuclear power reactors over the next 25 years, an endeavor that would generate tens of billions of dollars in economic activity.

In a letter to President Donald Trump, the senators say the slaying of Khashoggi, as well as other foreign policy issues, raise questions about whether the Saudi leadership should be entrusted with U.S. nuclear technology and know-how. “The ongoing revelations about the murder of Saudi journalist Jamal Khashoggi, as well as certain Saudi actions related to Yemen and Lebanon, have raised further serious concerns about the transparency, accountability, and judgment of current decisionmakers in Saudi Arabia,” the lawmakers wrote in a letter to Trump. “We therefore request that you suspend any related negotiations for a U.S.-Saudi civil nuclear agreement for the foreseeable future.”

Number 1 in a list that includes UAE and Georgia. Nobody should want that. Nice going, Jacinda.

• New Zealand Is Best Place To Do Business – World Bank (G.)

New Zealand has topped the World Bank’s ranking of the best countries to start and run a business in 2018, ahead of Singapore, Denmark and Hong Kong. The World Bank said New Zealand had retained its position in its Doing Business report ahead of 190 other countries, despite not implementing any reforms in the last year. The UK slipped to ninth place while Norway climbed to seventh in a year when the World Bank said governments pressed ahead with a record number of reforms to business regulations and tax rules to support private businesses. Georgia, the former Soviet satellite state, retained its position at number six in the rankings, despite persistent criticism from aid agencies that the World Bank was rewarding a country with high levels of inequality, showing that a business-friendly environment is not in and of itself a means of alleviating poverty.

Macedonia, the United Arab Emirates, Malaysia and Mauritius are also among the business-friendly countries in the World Bank’s top 20 that rank among the highest in Oxfam’s list of unequal nations. The Organisation for Economic Cooperation and Development criticised Mauritius last year for acting as a tax haven and leaching tax revenues from mainland African nations. Singapore, often held up as a model for post-Brexit Britain, recently topped Oxfam’s list of unequal nations. The World Bank Group’s president, Jim Yong Kim, said the private sector played an important role in “creating sustainable economic growth and ending poverty around the world”.

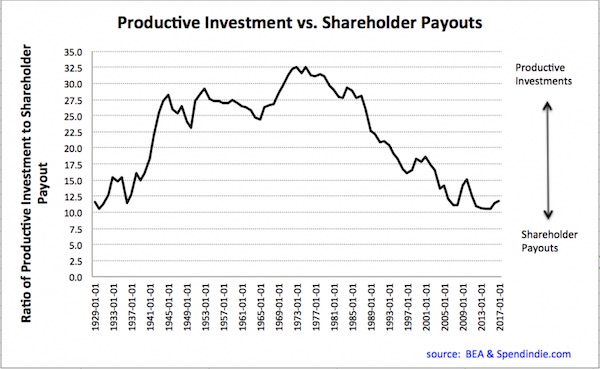

Even the US is ahead of Europe on this.

• Europe Torn Over Islamic State Children In Syria (R.)

For years, they heard little from daughters who went to join Islamic State. Now dozens of families across Europe have received messages from those same women, desperate to return home from detention in Syria. They are among 650 Europeans, many of them infants, held by U.S.-backed Kurdish militias in three camps since IS was routed last year, according to Kurdish sources. Unwanted by their Kurdish guards, they are also a headache for officials in Europe. In letters sent via the Red Cross and in phone messages, the women plead for their children to be allowed home to be raised in the countries they left behind. In one message played by a woman at a cafe in Antwerp, the chatter of her young grandchildren underscores their mother’s pleas.

Another woman in Paris wants to care for three grandchildren she has never met, born after her daughter left for Syria in 2014, at the age 18. “They are innocent,” she said. “They had no part in any of this.” Like other relatives of those held in Syria, the two mothers asked to remain anonymous – afraid of being linked to IS and worried their daughters may face reprisals. The United States has taken custody of some citizens, as have Russia and Indonesia, and wants Europe to do the same – fearing the camps may breed a new generation of militants. “We are telling European governments: ‘Take your people back, prosecute them. … They are more of a threat to you here than back home,’” a senior U.S. counterterrorism official said.

“If you put a drop of love into Twitter it seems to decay but if you put in a drop of hatred you feel it actually propagates much more strongly.”

• Tim Berners-Lee Says Tech Giants May Have To Be Split Up (R.)

Silicon Valley technology giants such as Facebook and Google have grown so dominant they may need to be broken up, unless challengers or changes in taste reduce their clout, the inventor of the World Wide Web told Reuters. The digital revolution has spawned a handful of U.S.-based technology companies since the 1990s that now have a combined financial and cultural power greater than most sovereign states. Tim Berners-Lee, a London-born computer scientist who invented the Web in 1989, said he was disappointed with the current state of the internet, following scandals over the abuse of personal data and the use of social media to spread hate.

“What naturally happens is you end up with one company dominating the field so through history there is no alternative to really coming in and breaking things up,” Berners-Lee, 63, said in an interview. “There is a danger of concentration.” But he urged caution too, saying the speed of innovation in both technology and tastes could ultimately cut some of the biggest technology companies down to size. “Before breaking them up, we should see whether they are not just disrupted by a small player beating them out of the market, but by the market shifting, by the interest going somewhere else,” Berners-Lee said.

“I am disappointed with the current state of the Web,” he said. “We have lost the feeling of individual empowerment and to a certain extent also I think the optimism has cracked.” Facebook CEO Mark Zuckerberg apologized after the Cambridge Analytica scandal and pledged to do more to protect users’ data. But social media, Berners-Lee said, was still being used to propagate hate. “If you put a drop of love into Twitter it seems to decay but if you put in a drop of hatred you feel it actually propagates much more strongly. And you wonder: ‘Well is that because of the way that Twitter as a medium has been built?’”

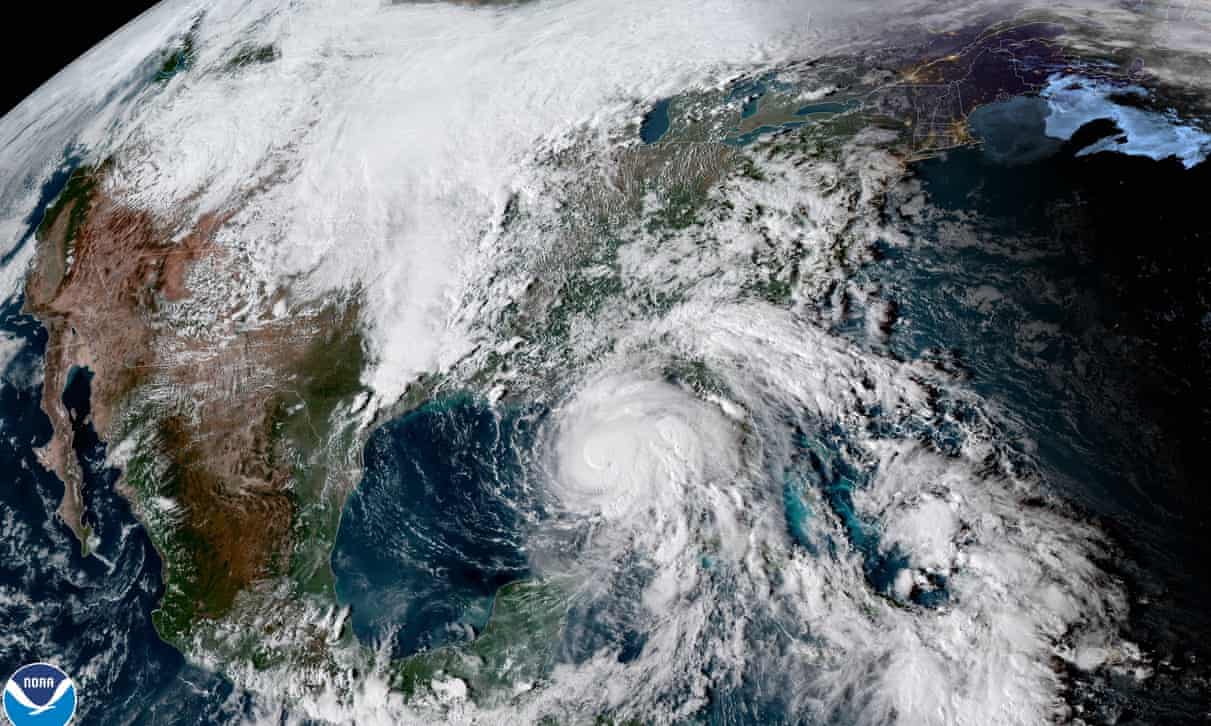

Not at all surprised, but I have some trouble with this sentence: “..we have put about 150 times the amount of energy used to generate electricity globally into the seas..”

• Oceans ‘Soaking Up 60% More Heat Than Estimated’ (BBC)

The world has seriously underestimated the amount of heat soaked up by our oceans over the past 25 years, researchers say. Their study suggests that the seas have absorbed 60% more than previously thought. They say it means the Earth is more sensitive to fossil fuel emissions than estimated. This could make it much more difficult to to keep global warming within safe levels this century. According to the last major assessment by the Intergovernmental Panel on Climate Change (IPCC), the world’s oceans have taken up over 90% of the excess heat trapped by greenhouse gases.

But this new study says that every year, for the past 25 years, we have put about 150 times the amount of energy used to generate electricity globally into the seas – 60% more than previous estimates. That’s a big problem. Scientists base their predictions about how much the Earth is warming by adding up all the excess heat that is produced by the known amount of greenhouse gases that have been emitted by human activities. This new calculation shows that far more heat than we thought has been going into oceans. But it also means that far more heat than we thought has been generated by the warming gases we have emitted. Therefore more heat from the same amount of gas means the Earth is more sensitive to CO2.

More heat means less oxygen in the water which could have implications for many species. Photo Victor Huang

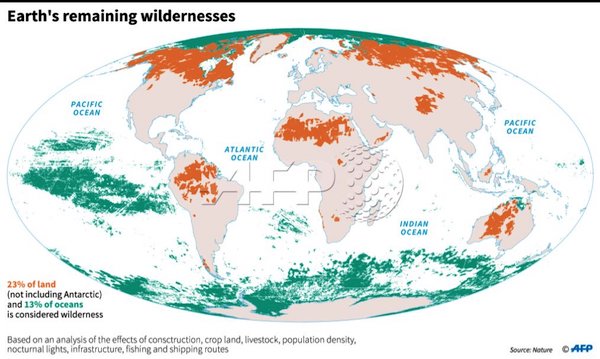

Well, and seas. “..more than 77 per cent of land – excluding Antarctica – and 87 per cent of the ocean has been modified by the direct effects of human activities..”

• 70% Of World’s Last Remaining Wilderness In Just Five Countries (Ind.)

More than 70 per cent of our planet’s remaining areas of wilderness are contained in just five countries and are at the mercy of political decisions regarding their future, new research has warned. Urgent international action is required to ensure the preservation of these last pockets of intact ecosystems, the study says, which calls for mandated conservation targets. The places where the greatest remaining tracts of wilderness containing mixes of species at near-natural levels of abundance were identified as being in Russia, Canada, Australia, the US and Brazil.

Produced by the University of Queensland (UQ) and the Wildlife Conservation Society (WCS), the study published in the journal Nature, says these areas are “increasingly important buffers against changing conditions… Yet they aren’t an explicit target in international policy frameworks.” The study also examines the huge future value these areas are likely to have for our planet. “They are also the only areas supporting the ecological processes that sustain biodiversity over evolutionary timescales,” it says. “As such, they are important reservoirs of genetic information, and act as reference areas for efforts to re-wild degraded land and seascapes.”

Professor James Watson, from UQ’s School of Earth and Environmental Sciences, said the work provides the first full global picture of how little wilderness remains, and he was alarmed at the results. “A century ago, only 15 per cent of the Earth’s surface was used by humans to grow crops and raise livestock,” he said. “Today, more than 77 per cent of land – excluding Antarctica – and 87 per cent of the ocean has been modified by the direct effects of human activities. It might be hard to believe, but between 1993 and 2009, an area of terrestrial wilderness larger than India – a staggering 3.3 million square kilometres – was lost to human settlement, farming, mining and other pressures.”